Fluctuation of Valuations of Risk Financial Assets, Twenty-One Million Unemployed or Underemployed in the Lost Economic Cycle of the Global Recession with Economic Growth Underperforming Below Trend Worldwide, Job Creation, Cyclically Stagnating Real Wages, Cyclically Stagnating Real Disposable Income Per Capita, Financial Repression, World Financial Turbulence, World Cyclical Slow Growth, Government Intervention in Globalization, and Global Recession Risk

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018

I Twenty-One Million Unemployed or Underemployed

IA1 Summary of the Employment Situation

IA2 Number of People in Job Stress

IA3 Long-term and Cyclical Comparison of Employment

IA4 Job Creation

II Stagnating Real Disposable Income and Consumption Expenditures

IIB1 Stagnating Real Disposable Income and Consumption Expenditures

IB2 Financial Repression

III World Financial Turbulence

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

I Twenty-One Million Unemployed or Underemployed in the Lost Economic Cycle of the Global Recession with Economic Growth Underperforming Below Trend Worldwide. Section IA1 Summary of the Employment Situation provides succinctly the major aspects of employment. Section IA2 Number of People in Job Stress analyzes alternative approaches to measuring job stress. Section IA3 Long-Term and Cyclical Comparison of Employment analyzes long-term and cyclical aspects of employment. Section IA4 Job Creation provides data and analysis on creation of jobs. Section IB Stagnating Real Wages analyzes cyclically stagnating real wages.

IA1 Summary of the Employment Situation. Table I-1 provides summary statistics of the employment situation report of the BLS. The first four rows provide the data from the establishment report of creation of nonfarm payroll jobs and remuneration of workers (for analysis of the differences in employment between the establishment report and the household survey see Abraham, Haltiwanger, Sandusky and Spletzer 2009). Total nonfarm payroll employment seasonally adjusted (SA) increased 155,000 in Nov 2018 and private payroll employment increased 161,000. The Bureau of Labor Statistics states (https://www.bls.gov/news.release/empsit.nr0.htm): “Our analysis suggests that the net effect of these hurricanes [Harvey and Irma] was to reduce the estimate of total nonfarm payroll employment for September. There was no discernible effect on the national unemployment rate. No changes were made to either the establishment or household survey estimation procedures for the September figures.” The average monthly number of nonfarm jobs created from Nov 2016 to Nov 2017 was 182,750 using seasonally adjusted data, while the average number of nonfarm jobs created from Nov 2017 to Nov 2018 was 203,583 or increase by 11.4 percent. The average number of private jobs created in the US from Nov 2016 to Nov 2017 was 180,083, using seasonally adjusted data, while the average from Nov 2017 to Nov 2018 was 199,583 or increase by 10.8 percent. This blog calculates the effective labor force of the US at 171.265 million in Nov 2018 and 169.438 million in Nov 2017 (Table I-4), for growth of 1.827 million at average 152,250 per month. The difference between the average increase of 199,583 new private nonfarm jobs per month in the US from Nov 2017 to Nov 2018 and the 152,250-average monthly increase in the labor force from Nov 2017 to Nov 2018 is 47,333 monthly new jobs net of absorption of new entrants in the labor force. There are 20,486 million in job stress in the US currently. Creation of 47,333 new jobs per month net of absorption of new entrants in the labor force would require 433 months to provide jobs for the unemployed and underemployed (20.486 million divided by 47,333) or 36 years (433 divided by 12). The civilian labor force of the US in Nov 2018 not seasonally adjusted stood at 162.665 million with 5.650 million unemployed or effectively 14.250 million unemployed in this blog’s calculation by inferring those who are not searching because they believe there is no job for them for effective labor force of 171.265 million. Reduction of one million unemployed at the current rate of job creation without adding more unemployment requires 1.76 years (1 million divided by product of 47,333 by 12, which is 567,996). Reduction of the rate of unemployment to 5 percent of the labor force would be equivalent to unemployment of only 8.133 million (0.05 times labor force of 162.665 million). New net job creation would be minus 2.483 million (5.650 million unemployed minus 8.133 million unemployed at rate of 5 percent) that at the current rate would take 0.0 years (-2.483 million divided by 0.568). Under the calculation in this blog, there are 14.250 million unemployed by including those who ceased searching because they believe there is no job for them and effective labor force of 171.265 million. Reduction of the rate of unemployment to 5 percent of the labor force would require creating 5.687 million jobs net of labor force growth that at the current rate would take 10.0 years (14.250 million minus 0.05

(171.265 million) = 5.687 million divided by 0.567996 using LF PART 66.2% and Total UEM in Table I-4). These calculations assume that there are no more recessions, defying United States economic history with periodic contractions of economic activity when unemployment increases sharply. The number employed in Nov 2018 was 157.015 million (NSA) or 9.700 million more people with jobs relative to the peak of 147.315 million in Aug 2007 while the civilian noninstitutional population of ages 16 years and over increased from 231.958 million in Jul 2007 to 258.708 million in Nov 2018 or by 26.750 million. The number employed increased 6.6 percent from Jul 2007 to Nov 2018 while the noninstitutional civilian population of ages of 16 years and over, or those available for work, increased 11.5 percent. The ratio of employment to population in Jul 2007 was 63.5 percent (147.315 million employed as percent of population of 231.958 million). The same ratio in Nov 2018 would result in 164.280 million jobs (0.635 multiplied by noninstitutional civilian population of 258.708 million). There are effectively 7.265 million fewer jobs in Nov 2018 than in Jul 2007, or 164.280 million minus 157.015 million. There is actually not sufficient job creation in merely absorbing new entrants in the labor force because of those dropping from job searches, worsening the stock of unemployed or underemployed in involuntary part-time jobs.

There is current interest in past theories of “secular stagnation.” Alvin H. Hansen (1939, 4, 7; see Hansen 1938, 1941; for an early critique see Simons 1942) argues:

“Not until the problem of full employment of our productive resources from the long-run, secular standpoint was upon us, were we compelled to give serious consideration to those factors and forces in our economy which tend to make business recoveries weak and anaemic (sic) and which tend to prolong and deepen the course of depressions. This is the essence of secular stagnation-sick recoveries which die in their infancy and depressions which feed on them-selves and leave a hard and seemingly immovable core of unemployment. Now the rate of population growth must necessarily play an important role in determining the character of the output; in other words, the com-position of the flow of final goods. Thus a rapidly growing population will demand a much larger per capita volume of new residential building construction than will a stationary population. A stationary population with its larger proportion of old people may perhaps demand more personal services; and the composition of consumer demand will have an important influence on the quantity of capital required. The demand for housing calls for large capital outlays, while the demand for personal services can be met without making large investment expenditures. It is therefore not unlikely that a shift from a rapidly growing population to a stationary or declining one may so alter the composition of the final flow of consumption goods that the ratio of capital to output as a whole will tend to decline.”

The argument that anemic population growth causes “secular stagnation” in the US (Hansen 1938, 1939, 1941) is as misplaced currently as in the late 1930s (for early dissent see Simons 1942). There is currently population growth in the ages of 16 to 24 years but not enough job creation and discouragement of job searches for all ages (https://cmpassocregulationblog.blogspot.com/2018/11/oscillation-of-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2018/10/oscillation-of-valuations-of-risk.html). The proper explanation is not in secular stagnation but in cyclically slow growth. Secular stagnation is merely another case of theory without reality with dubious policy proposals. Subsection IA4 Job Creation analyzes the types of jobs created, which are lower paying than earlier. Average hourly earnings in Nov 2018 were $27.35 seasonally adjusted (SA), increasing 3.1 percent not seasonally adjusted (NSA) relative to Nov 2017 and increasing 0.2 percent relative to Oct 2018 seasonally adjusted. In Oct 2018, average hourly earnings seasonally adjusted were $27.29, increasing 2.4 percent relative to Oct 2017 not seasonally adjusted, and increasing 0.1 percent seasonally adjusted relative to Sep 2018. These are nominal changes in workers’ wages. The following row “average hourly earnings in constant dollars” provides hourly wages in constant dollars calculated by the BLS or what is called “real wages” adjusted for inflation. Data are not available for Nov 2018 because the prices indexes of the BLS for Nov 2018 will only be released on Dec 12, 2018 (http://www.bls.gov/cpi/), which will be covered in this blog’s comment on Dec 16, 2018 together with world inflation. The third column provides changes in real wages for Oct and Sep 2018. Average hourly earnings adjusted for inflation or in constant dollars decreased 0.1 percent in Oct 2018 relative to Oct 2017 and increased 1.2 percent from Sep 2017 to Sep 2018 but have been decreasing/stagnating during multiple months. World inflation waves in bouts of risk aversion (https://cmpassocregulationblog.blogspot.com/2018/11/weakening-gdp-growth-in-major-economies.html and earlier https://cmpassocregulationblog.blogspot.com/2018/10/oscillation-of-valuations-of-risk.html) mask declining trend of real wages. The fractured labor market of the US is characterized by high levels of unemployment and underemployment together with cyclically stagnating real wages or wages adjusted for inflation (Section I and earlier https://cmpassocregulationblog.blogspot.com/2018/11/fluctuations-of-valuations-of-risk.html). The following section IB Stagnating Real Wages provides more detailed analysis. Average weekly hours of US workers seasonally adjusted had remained virtually unchanged, increasing from 34.4 in Sep 2018 to 34.5 in Oct 2018 and decreasing to 34.4 in Nov 2018, which could affect additional work on a labor force of 162.770 million SA in Nov 2018. Another headline number widely followed is the unemployment rate or number of people unemployed as percent of the labor force. The unemployment rate calculated in the household survey did not change from 3.7 percent in Sep 2018 to 3.7 percent in Oct 2018, seasonally adjusted, not changing to 3.7 percent in Nov 2018. This blog provides with every employment situation report the number of people in the US in job stress or unemployed plus underemployed calculated without seasonal adjustment (NSA) at 20.5 million in Nov 2018, 19.9 million in Oct 2018 and 20.7 million in Sep 2018. The final row in Table I-1 provides the number in job stress as percent of the actual labor force calculated at 12.1 percent in Sep 2018, 11.6 percent in Oct 2018 and 12.0 percent in Nov 2018.

There is socio-economic stress in the combination of adverse events and cyclical performance:

- Mediocre economic growth below potential and long-term trend, resulting in idle productive resources with GDP two trillion dollars below trend (https://cmpassocregulationblog.blogspot.com/2018/12/monetary-policy-rates-near-normal.html and earlier https://cmpassocregulationblog.blogspot.com/2018/10/contraction-of-valuations-of-risk.html). US GDP grew at the average rate of 3.2 percent per year from 1929 to 2017, with similar performance in whole cycles of contractions and expansions, but only at 1.5 percent per year on average from 2007 to 2017. GDP in IIIQ2018 is 13.8 percent lower than what it would have been had it grown at trend of 3.0 percent

- Private fixed investment stagnating initially followed by cumulative increase of 26.8 percent in the entire cycle from IVQ2007 to IIIQ2018 (https://cmpassocregulationblog.blogspot.com/2018/12/monetary-policy-rates-near-normal.html and earlier https://cmpassocregulationblog.blogspot.com/2018/10/contraction-of-valuations-of-risk.html).

- Twenty-one million or 12.0 percent of the effective labor force unemployed or underemployed in involuntary part-time jobs with stagnating or declining real wages (Section I and earlier https://cmpassocregulationblog.blogspot.com/2018/11/fluctuations-of-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2018/10/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/08/fomc-policy-rate-unchanged-competitive.html and earlier https://cmpassocregulationblog.blogspot.com/2018/07/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/06/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/05/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/04/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/twenty-three-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/02/twenty-four-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/01/twenty-three-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/12/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/11/unchanged-fomc-policy-rate-gradual.html and earlier https://cmpassocregulationblog.blogspot.com/2017/10/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/09/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/08/data-dependent-monetary-policy-with.html and earlier https://cmpassocregulationblog.blogspot.com/2017/07/rising-yields-twenty-two-million.html and earlier https://cmpassocregulationblog.blogspot.com/2017/06/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/05/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/04/twenty-three-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/03/increasing-interest-rates-twenty-four.html and earlier https://cmpassocregulationblog.blogspot.com/2017/02/twenty-six-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/global-competitive-easing-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/fluctuating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/fluctuating-risk-financial-assets-in.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-with-exchange-rate.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-fed-funds-rate-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/turbulence-of-financial-asset.html)

- Stagnating real disposable income per person or income per person after inflation and taxes (Section II and earlier https://cmpassocregulationblog.blogspot.com/2018/11/fluctuations-of-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/fomc-increases-policy-interest-rate.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/revision-of-united-states-national.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/08/revision-of-united-states-national.html and earlier https://cmpassocregulationblog.blogspot.com/2018/08/fomc-policy-rate-unchanged-competitive.html and earlier https://cmpassocregulationblog.blogspot.com/2018/07/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/06/stronger-dollar-mediocre-cyclical.html and earlier https://cmpassocregulationblog.blogspot.com/2018/05/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/04/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/04/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/twenty-three-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/02/twenty-four-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/12/dollar-devaluation-cyclically.html and earlier https://cmpassocregulationblog.blogspot.com/2017/12/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/11/unchanged-fomc-policy-rate-gradual.html and earlier https://cmpassocregulationblog.blogspot.com/2017/10/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/09/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/08/data-dependent-monetary-policy-with.html and earlier https://cmpassocregulationblog.blogspot.com/2017/07/rising-yields-twenty-two-million.html and earlier https://cmpassocregulationblog.blogspot.com/2017/06/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/05/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/04/twenty-three-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/03/rising-valuations-of-risk-financial.html and earlier https://cmpassocregulationblog.blogspot.com/2017/02/twenty-six-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/global-competitive-easing-or.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/fluctuating-risk-financial-assets-in.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/dollar-revaluation-and-decreasing.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html)

- Depressed hiring that does not afford an opportunity for reducing unemployment/underemployment and moving to better-paid jobs (https://cmpassocregulationblog.blogspot.com/2018/11/oscillation-of-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2018/10/oscillation-of-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/recovery-without-hiring-in-lost.html and earlier https://cmpassocregulationblog.blogspot.com/2018/08/dollar-revaluation-recovery-without.html and earlier https://cmpassocregulationblog.blogspot.com/2018/07/recovery-without-hiring-ten-million.html and earlier https://cmpassocregulationblog.blogspot.com/2018/06/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/05/recovery-without-hiring-ten-million.html and earlier https://cmpassocregulationblog.blogspot.com/2018/04/rising-yields-world-inflation-waves.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/decreasing-valuations-of-risk-financial.html and earlier https://cmpassocregulationblog.blogspot.com/2018/02/collateral-effects-of-unwinding.html and earlier https://cmpassocregulationblog.blogspot.com/2018/01/dollar-devaluation-and-rising.html and earlier https://cmpassocregulationblog.blogspot.com/2017/12/fomc-increases-interest-rates-with.html and earlier https://cmpassocregulationblog.blogspot.com/2017/11/recovery-without-hiring-ten-million.html and earlier https://cmpassocregulationblog.blogspot.com/2017/10/increasing-valuations-of-risk-financial.html and earlier https://cmpassocregulationblog.blogspot.com/2017/09/dollar-devaluation-world-inflation.html and earlier https://cmpassocregulationblog.blogspot.com/2017/08/recovery-without-hiring-ten-million_40.html and earlier https://cmpassocregulationblog.blogspot.com/2017/07/dollar-devaluation-and-valuation-of.html and earlier https://cmpassocregulationblog.blogspot.com/2017/06/flattening-us-treasury-yield-curve.html and earlier https://cmpassocregulationblog.blogspot.com/2017/05/recovery-without-hiring-ten-million_14.html and earlier https://cmpassocregulationblog.blogspot.com/2017/04/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2017/03/recovery-without-hiring-ten-million.html and earlier https://cmpassocregulationblog.blogspot.com/2017/02/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2017/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-values-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/dollar-revaluation-and-valuations-of.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/imf-view-of-world-economy-and-finance.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rate-uncertainty-and-valuation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/rising-valuations-of-risk-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/considerable-uncertainty-about-economic.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/contraction-of-united-states-corporate.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/subdued-foreign-growth-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-volatile_17.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-policy-conundrum-recovery.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/impact-of-monetary-policy-on-exchange.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what_13.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/volatility-of-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/volatility-of-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/dollar-revaluation-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-exchange-rate-struggle-recovery.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/g20-monetary-policy-recovery-without.html)

- Productivity growth fell from 2.1 percent per year on average from 1947 to 2017 and average 2.3 percent per year from 1947 to 2007 to 1.3 percent per year on average from 2007 to 2017, deteriorating future growth and prosperity (https://cmpassocregulationblog.blogspot.com/2018/11/weaker-world-economic-growth-with.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/recovery-without-hiring-in-lost.html and earlier https://cmpassocregulationblog.blogspot.com/2018/08/revision-of-united-states-national.html and earlier https://cmpassocregulationblog.blogspot.com/2018/06/fomc-increases-interest-rates-with.html and earlier (https://cmpassocregulationblog.blogspot.com/2018/05/recovery-without-hiring-ten-million.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/united-states-inflation-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/02/collateral-effects-of-unwinding.html and earlier (https://cmpassocregulationblog.blogspot.com/2017/12/fomc-increases-interest-rates-with.html and earlier (https://cmpassocregulationblog.blogspot.com/2017/11/recovery-without-hiring-ten-million.html and earlier https://cmpassocregulationblog.blogspot.com/2017/09/ii-rules-discretionary-authorities-and.html and earlier https://cmpassocregulationblog.blogspot.com/2017/08/recovery-without-hiring-ten-million_40.html and earlier https://cmpassocregulationblog.blogspot.com/2017/06/flattening-us-treasury-yield-curve.html and earlier https://cmpassocregulationblog.blogspot.com/2017/05/recovery-without-hiring-ten-million_14.html and earlier https://cmpassocregulationblog.blogspot.com/2017/03/increasing-interest-rates-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-values-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/rising-valuations-of-risk-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/considerable-uncertainty-about-economic.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-fed-funds-rate-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/quite-high-equity-valuations-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-competitive-devaluation-rules.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/financial-risks-twenty-six-million.html)

- Output of manufacturing in Oct 2018 at 29.1 percent below long-term trend since 1919 and at 21.2 percent below trend since 1986 (https://cmpassocregulationblog.blogspot.com/2018/11/weaker-world-economic-growth-with.html and earlier https://cmpassocregulationblog.blogspot.com/2018/10/oscillation-of-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/08/world-inflation-waves-lost-economic.html and earlier https://cmpassocregulationblog.blogspot.com/2018/07/continuing-gradual-increases-in-fed.html and earlier (https://cmpassocregulationblog.blogspot.com/2018/06/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/05/dollar-revaluation-united-states_24.html and earlier (https://cmpassocregulationblog.blogspot.com/2018/04/rising-yields-world-inflation-waves.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/united-states-inflation-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/02/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/01/dollar-devaluation-and-increasing.html and earlier https://cmpassocregulationblog.blogspot.com/2017/12/mediocre-cyclical-united-states_23.html and earlier https://cmpassocregulationblog.blogspot.com/2017/11/the-lost-economic-cycle-of-global_25.html and earlier https://cmpassocregulationblog.blogspot.com/2017/10/world-inflation-waves-long-term-and.html and earlier) (https://cmpassocregulationblog.blogspot.com/2017/09/monetary-policy-of-reducing-central.html and earlier https://cmpassocregulationblog.blogspot.com/2017/08/fluctuating-valuations-of-risk.html and earlier (https://cmpassocregulationblog.blogspot.com/2017/07/rising-valuations-of-risk-financial.html and earlier https://cmpassocregulationblog.blogspot.com/2017/06/fomc-interest-rate-increase-planned.html and earlier https://cmpassocregulationblog.blogspot.com/2017/05/dollar-devaluation-world-inflation.html and earlier https://cmpassocregulationblog.blogspot.com/2017/04/united-states-commercial-banks-assets.html and earlier https://cmpassocregulationblog.blogspot.com/2017/03/fomc-increases-interest-rates-world.html and earlier https://cmpassocregulationblog.blogspot.com/2017/02/world-inflation-waves-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2017/01/world-inflation-waves-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/interest-rate-increase-could-well.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/dollar-revaluation-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-volatility-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/interest-rate-policy-uncertainty-and.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/04/contracting-united-states-industrial.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html

and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/imf-view-squeeze-of-economic-activity.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html)

- Unsustainable government deficit/debt and balance of payments deficit (https://cmpassocregulationblog.blogspot.com/2018/10/global-contraction-of-valuations-of.html and earlier https://cmpassocregulationblog.blogspot.com/2017/04/mediocre-cyclical-economic-growth-with.html and earlier http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html)

- Worldwide waves of inflation (https://cmpassocregulationblog.blogspot.com/2018/11/weakening-gdp-growth-in-major-economies.html and earlier https://cmpassocregulationblog.blogspot.com/2018/10/oscillation-of-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/08/world-inflation-waves-lost-economic.html and earlier https://cmpassocregulationblog.blogspot.com/2018/07/continuing-gradual-increases-in-fed.html and earlier https://cmpassocregulationblog.blogspot.com/2018/06/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/05/dollar-strengthening-world-inflation.htm and earlier https://cmpassocregulationblog.blogspot.com/2018/04/rising-yields-world-inflation-waves.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/decreasing-valuations-of-risk-financial.html and earlier https://cmpassocregulationblog.blogspot.com/2018/02/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/01/dollar-devaluation-and-increasing.html and earlier https://cmpassocregulationblog.blogspot.com/2017/12/fomc-increases-interest-rates-with.html and earlier https://cmpassocregulationblog.blogspot.com/2017/11/dollar-devaluation-and-decline-of.html and earlier https://cmpassocregulationblog.blogspot.com/2017/10/world-inflation-waves-long-term-and.html and earlier https://cmpassocregulationblog.blogspot.com/2017/09/dollar-devaluation-world-inflation.html and earlier https://cmpassocregulationblog.blogspot.com/2017/08/fluctuating-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2017/07/dollar-devaluation-and-valuation-of.html and earlier https://cmpassocregulationblog.blogspot.com/2017/06/fomc-interest-rate-increase-planned.html and earlier https://cmpassocregulationblog.blogspot.com/2017/05/dollar-devaluation-world-inflation.html and earlier https://cmpassocregulationblog.blogspot.com/2017/04/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2017/03/fomc-increases-interest-rates-world.html and earlier https://cmpassocregulationblog.blogspot.com/2017/02/world-inflation-waves-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2017/01/world-inflation-waves-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/interest-rate-increase-could-well.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/dollar-revaluation-world-inflation.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-volatility-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/interest-rate-policy-uncertainty-and.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/contracting-united-states-industrial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/uncertainty-of-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/global-decline-of-values-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/interest-rate-policy-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2015/01/competitive-currency-conflicts-world.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/financial-oscillations-world-inflation.html http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/07/world-inflation-waves-united-states.html)

- Deteriorating terms of trade and net revenue margins of production across countries in squeeze of economic activity by carry trades induced by zero interest rates (https://cmpassocregulationblog.blogspot.com/2018/11/weaker-world-economic-growth-with.html and earlier https://cmpassocregulationblog.blogspot.com/2018/10/oscillation-of-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/08/world-inflation-waves-lost-economic.html and earlier https://cmpassocregulationblog.blogspot.com/2018/07/continuing-gradual-increases-in-fed.html and earlier https://cmpassocregulationblog.blogspot.com/2018/06/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/05/dollar-revaluation-united-states_24.html and earlier https://cmpassocregulationblog.blogspot.com/2018/04/rising-yields-world-inflation-waves.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/decreasing-valuations-of-risk-financial.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/united-states-inflation-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/02/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/01/dollar-devaluation-and-increasing.html and earlier https://cmpassocregulationblog.blogspot.com/2017/12/mediocre-cyclical-united-states_23.html and earlier https://cmpassocregulationblog.blogspot.com/2017/11/the-lost-economic-cycle-of-global_25.html and earlier https://cmpassocregulationblog.blogspot.com/2017/10/world-inflation-waves-long-term-and.html and earlier https://cmpassocregulationblog.blogspot.com/2017/09/monetary-policy-of-reducing-central.html and earlier https://cmpassocregulationblog.blogspot.com/2017/08/fluctuating-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2017/07/dollar-devaluation-and-valuation-of.html and earlier https://cmpassocregulationblog.blogspot.com/2017/06/fomc-interest-rate-increase-planned.html and earlier https://cmpassocregulationblog.blogspot.com/2017/05/dollar-devaluation-world-inflation.html and earlier https://cmpassocregulationblog.blogspot.com/2017/04/united-states-commercial-banks-assets.html and earlier https://cmpassocregulationblog.blogspot.com/2017/03/fomc-increases-interest-rates-world.html and earlier http://cmpassocregulationblog.blogspot.com/2017/01/world-inflation-waves-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/interest-rate-increase-could-well.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/dollar-revaluation-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-volatility-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/imf-view-of-world-economy-and-finance.html and earlier) (http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/uncertainty-of-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/global-decline-of-values-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/imf-view-squeeze-of-economic-activity.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html

- Financial repression of interest rates and credit affecting the most people without means and access to sophisticated financial investments with likely adverse effects on income distribution and wealth disparity (Section II and earlier https://cmpassocregulationblog.blogspot.com/2018/11/fluctuations-of-valuations-of-risk.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/fomc-increases-policy-interest-rate.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/revision-of-united-states-national.html and earlier https://cmpassocregulationblog.blogspot.com/2018/09/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/08/revision-of-united-states-national.html and earlier https://cmpassocregulationblog.blogspot.com/2018/07/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/06/stronger-dollar-mediocre-cyclical.html and earlier https://cmpassocregulationblog.blogspot.com/2018/05/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/04/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/04/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/twenty-three-million-unemployed-or.html and earlier (https://cmpassocregulationblog.blogspot.com/2018/02/twenty-four-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/12/dollar-devaluation-cyclically.html and earlier (https://cmpassocregulationblog.blogspot.com/2017/12/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/11/unchanged-fomc-policy-rate-gradual.html and earlier https://cmpassocregulationblog.blogspot.com/2017/10/twenty-one-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/09/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/08/data-dependent-monetary-policy-with.html and earlier https://cmpassocregulationblog.blogspot.com/2017/07/rising-yields-twenty-two-million.html and earlier https://cmpassocregulationblog.blogspot.com/2017/06/twenty-two-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/05/twenty-two-million-unemployed-or.html and earlier (https://cmpassocregulationblog.blogspot.com/2017/04/twenty-three-million-unemployed-or.html and earlier https://cmpassocregulationblog.blogspot.com/2017/03/rising-valuations-of-risk-financial.html and earlier https://cmpassocregulationblog.blogspot.com/2017/02/twenty-six-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/global-competitive-easing-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/dollar-revaluation-and-decreasing.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-competitive-devaluation-rules.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/growth-uncertainties-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/world-financial-turbulence-twenty-seven.html)

- 43 million in poverty and 29 million without health insurance with family income adjusted for inflation regressing to 1999 levels (http://cmpassocregulationblog.blogspot.com/2016/09/the-economic-outlook-is-inherently.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-uncertainty-imf.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html)

- Net worth of households and nonprofits organizations increasing by 30.3 percent after adjusting for inflation in the entire cycle from IVQ2007 to IIQ2018 when it would have grown over 39.2 percent at trend of 3.2 percent per year in real terms from IVQ1945 to IIQ2018 (https://cmpassocregulationblog.blogspot.com/2018/09/fomc-increases-policy-interest-rate.html and earlier https://cmpassocregulationblog.blogspot.com/2018/06/world-inflation-waves-united-states.html and earlier https://cmpassocregulationblog.blogspot.com/2018/03/mediocre-cyclical-united-states_31.html and earlier https://cmpassocregulationblog.blogspot.com/2017/12/dollar-devaluation-cyclically.html and earlier https://cmpassocregulationblog.blogspot.com/2017/10/destruction-of-household-nonfinancial.html and earlier https://cmpassocregulationblog.blogspot.com/2017/06/united-states-commercial-banks-united.html and earlier (https://cmpassocregulationblog.blogspot.com/2017/03/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2017/01/rules-versus-discretionary-authorities.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/the-economic-outlook-is-inherently.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/of-course-considerable-uncertainty.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-fluctuations-of_13.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/06/financial-indecision-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/collapse-of-united-states-dynamism-of.html). Financial assets increased $32.9 trillion while nonfinancial assets increased $6.9 trillion with likely concentration of wealth in those with access to sophisticated financial investments. Real estate assets adjusted for inflation increased 3.6 percent.

Table I-1, US, Summary of the Employment Situation Report SA

| Nov 2018 | Oct 2018 | Sep 2018 | |

| New Nonfarm Payroll Jobs | 155 | 237 | 119 |

| New Private Payroll Jobs | 161 | 251 | 117 |

| Average Hourly Earnings | Nov $27.35 ∆% Nov 18/Nov 17 NSA: 3.1 ∆% Nov 18/Oct 18 SA: 0.2 | Oct $27.29 ∆% Oct 18/Oct 17 NSA: 2.4 ∆% Oct 18/Sep 18 SA: 0.1 | Sep $27.25 ∆% Sep 18/Sep 17 NSA: 3.6 ∆% Sep 18/Aug 18 SA: 0.3 |

| Average Hourly Earnings in Constant Dollars | ∆% Oct 18/Oct 17 NSA: -0.1 | ∆% Sep 18/Sep 17 NSA: 1.2 | |

| Average Weekly Hours | 34.4 SA NSA 34.4 | 34.5 SA NSA 34.4 | 34.4 SA NSA: 34.8 |

| Unemployment Rate Household Survey % of Labor Force SA | 3.7 | 3.7 | 3.7 |

| Number in Job Stress Unemployed and Underemployed Blog Calculation | 20.5 | 19.9 | 20.7 |

| In Job Stress as % Labor Force | 12.0 | 11.6 | 12.1 |

Source: US Bureau of Labor Statistics

“Most series published by the Current Employment Statistics program reflect a regularly recurring seasonal movement that can be measured from past experience. By eliminating that part of the change attributable to the normal seasonal variation, it is possible to observe the cyclical and other nonseasonal movements in these series. Seasonally adjusted series are published monthly for selected employment, hours, and earnings estimates.”

Requirements of using best available information and updating seasonality factors affect the comparability over time of United States employment data. In the first month of the year, the BLS revises data for several years by adjusting benchmarks and seasonal factors (page 4 at http://www.bls.gov/news.release/pdf/empsit.pdf release of Jan 2015 at http://www.bls.gov/schedule/archives/empsit_nr.htm#2015), which is the case of the data for Jan 2015 released on Feb 6, 2015:

“In accordance with annual practice, the establishment survey data released today have been benchmarked to reflect comprehensive counts of payroll jobs for March 2014. These counts are derived principally from the Quarterly Census of Employment and Wages (QCEW), which enumerates jobs covered by the unemployment insurance tax system. The benchmark process results in revisions to not seasonally adjusted data from April 2013 forward.

Seasonally adjusted data from January 2010 forward are subject to revision. In addition, data for some series prior to 2010, both seasonally adjusted and unadjusted, incorporate revisions. The total nonfarm employment level for March 2014 was revised upward by 91,000 (+67,000 on a not seasonally adjusted basis, or less than 0.05 percent). The average benchmark revision over the past 10 years was plus or minus 0.3 percent. Table A presents revised total nonfarm employment data on a seasonally adjusted basis for January through

December 2014.

An article that discusses the benchmark and post-benchmark revisions and other technical issues can be accessed through the BLS website at www.bls.gov/web/empsit/cesbmart.pdf.

Information on the data released today also may be obtained by calling (202) 691-6555.”

There are also adjustments of population that affect comparability of labor statistics over time (page 5 at http://www.bls.gov/news.release/pdf/empsit.pdf release of Jan 2015 at http://www.bls.gov/schedule/archives/empsit_nr.htm#2015):

“Effective with data for January 2015, updated population estimates have been used in the household survey. Population estimates for the household survey are developed by the U.S. Census Bureau. Each year, the Census Bureau updates the estimates to reflect new information and assumptions about the growth of the population since the previous decennial census. The change in population reflected in the new estimates results from adjustments for net international migration, updated vital statistics and other information, and some methodological changes in the estimation process. In accordance with usual practice, BLS will not revise the official household survey estimates for December 2014 and earlier months. To show the impact of the population adjustments, however, differences in selected December 2014 labor force series based on the old and new population estimates are shown in table B.”

There are also adjustments of benchmarks and seasonality factors for establishment data that affect comparability over time (page 4 at http://www.bls.gov/news.release/pdf/empsit.pdf release of Jan 2015 at http://www.bls.gov/schedule/archives/empsit_nr.htm#2015):

“In accordance with annual practice, the establishment survey data released today [Feb 6, 2015] have been benchmarked to reflect comprehensive counts of payroll jobs for March 2014. These counts are derived principally from the Quarterly Census of Employment and Wages (QCEW), which enumerates jobs covered by the unemployment insurance tax system. The benchmark process results in revisions to not seasonally adjusted data from April 2013 forward. Seasonally adjusted data from January 2010 forward are subject to revision. In addition, data for some series prior to 2010, both seasonally adjusted and unadjusted, incorporate revisions.”

The Bureau of Labor Statistics (BLS) revised household data for seasonal factors in the release for Dec 2015 (http://www.bls.gov/news.release/pdf/empsit.pdf):

“Seasonally adjusted household survey data have been revised using updated seasonal adjustment factors, a procedure done at the end of each calendar year. Seasonally adjusted estimates back to January 2011 were subject to revision. The unemployment rates for January 2015 through November 2015 (as originally published and as revised) appear in table A on page 5, along with additional information about the revisions.”

The Bureau of Labor Statistics (BLS) revised household data for seasonal factors in the release for Dec 2016 (https://www.bls.gov/news.release/pdf/empsit.pdf):

“Seasonally adjusted household survey data have been revised using updated seasonal adjustment factors, a procedure done at the end of each calendar year. Seasonally adjusted estimates back to January 2012 were subject to revision. The unemployment rates for January 2016 through November 2016 (as originally published and as revised) appear in table A on page 5, along with additional information about the revisions.”

The Bureau of Labor Statistics (BLS) revised establishment data for seasonal and benchmarks in the release for Jan 2016 (http://www.bls.gov/news.release/pdf/empsit.pdf): “Establishment survey data have been revised as a result of the annual benchmarking process and the updating of seasonal adjustment factors. Also, household survey data for January 2016 reflect updated population estimates. See the notes beginning on page 4 for more information about these changes.”

The Bureau of Labor Statistics (BLS) revised establishment data for seasonal and benchmarks in the release for Jan 2017 (https://www.bls.gov/news.release/pdf/empsit.pdf): “Establishment survey data have been revised as a result of the annual benchmarking process and the updating of seasonal adjustment factors using an improved methodology to select models. Also, household survey data for January 2017 reflect updated population estimates. See the notes beginning on page 4 for more information about these changes.”

The Bureau of Labor Statistics (BLS) revised household data for seasonal adjustment in the release for Dec 2017 (https://www.bls.gov/news.release/pdf/empsit.pdf): “Seasonally adjusted household survey data have been revised using updated seasonal adjustment factors, a procedure done at the end of each calendar year. Seasonally adjusted estimates back to January 2013 were subject to revision. The unemployment rates for January 2017 through November 2017 (as originally published and as revised) appear in table A on page 6, along with additional information about the revisions.”

All comparisons over time are affected by yearly adjustments of benchmarks and seasonality factors. All data in this blog comment use revised data released by the BLS (http://www.bls.gov/).

The Bureau of Labor Statistics (BLS) revised the Establishment Survey Data with the release of estimates for Jan 2018 on Feb 20, 2018 (https://www.bls.gov/news.release/pdf/empsit.pdf): “In accordance with annual practice, the establishment survey data released today have been benchmarked to reflect comprehensive counts of payroll jobs for March 2017. These counts are derived principally from the Quarterly Census of Employment and Wages (QCEW), which counts jobs covered by the Unemployment Insurance (UI) tax system. In addition, the data were updated to the 2017 North American Industry Classification System (NAICS) from the 2012 NAICS. This update resulted in minor changes to several detailed industries. The normal benchmark process revises not seasonally adjusted data from April 2016 forward and seasonally adjusted data from January 2013 forward. However, some data were also revised further back in their history than normal due to the implementation of 2017 NAICS and other minor technical changes related to rounding and re-aggregation of some series. The total nonfarm employment level for March 2017 was revised upward by 146,000 (+138,000 on a not seasonally adjusted basis, or +0.1 percent). On a not seasonally adjusted basis, the average absolute benchmark revision over the past 10 years is 0.2 percent. The effect of these revisions on the underlying trend in nonfarm payroll employment was minor. For example, the over-the-year change in total nonfarm employment for 2017 was revised from +2,055,000 to +2,173,000 (seasonally adjusted). Table A presents revised total nonfarm employment data on a seasonally adjusted basis from January to December 2017. All revised historical establishment survey data are available on the BLS website at www.bls.gov/ces/data.htm. In addition, an article that discusses the benchmark and post-benchmark revisions and other technical issues is available at www.bls.gov/web/empsit/cesbmart.htm.”

IA2 Number of People in Job Stress. There are two approaches to calculating the number of people in job stress. The first approach consists of calculating the number of people in job stress unemployed or underemployed with the raw data of the employment situation report as in Table I-2. The data are seasonally adjusted (SA). The first three rows provide the labor force and unemployed in millions and the unemployment rate of unemployed as percent of the labor force. There is increase in the number unemployed from 5.964 million in Sep 2018 to 6.075 million in Oct 2018 and decrease to 5.975 million in Nov 2018. The rate of unemployment did not change from 3.7 percent in Sep 2018 to 3.7 percent in Oct 2018 and did not change to 3.7 percent in Nov 2018. An important aspect of unemployment is its persistence for more than 27 weeks with 1.253 million in Oct 2018 corresponding to 21.0 percent of the unemployed. The longer the period of unemployment the lower are the chances of finding another job with many long-term unemployed ceasing to search for a job. Another key characteristic of the current labor market is the high number of people trying to subsist with part-time jobs because they cannot find full-time employment or part-time for economic reasons. The BLS explains as follows: “these individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or because they were unable to find full-time jobs” (http://www.bls.gov/news.release/pdf/empsit.pdf 2). The number of part-time for economic reasons decreased from 4.642 million in Sep 2018 to 4.621 million in Oct 2018 and increased to 4.802 million in Nov 2018. Another important fact is the marginally attached to the labor force. The BLS explains as follows: “these individuals were not in the labor force, wanted and were available for work, and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey” (http://www.bls.gov/news.release/pdf/empsit.pdf 2). The number in job stress unemployed or underemployed of 12.445 million in Nov 2018 consists of:

· 5.975 million unemployed (of whom 1.253 million, or 21.0 percent, unemployed for 27 weeks or more) compared with 6.075 million unemployed in Oct 2018 (of whom 1.373 million, or 22.6 percent, unemployed for 27 weeks or more).

· 4.802 million employed part-time for economic reasons in Nov 2018 (who suffered reductions in their work hours or could not find full-time employment) compared with 4.621 million in Oct 2018

· 1.678 million who were marginally attached to the labor force in Nov 2018 (who were not in the labor force but wanted and were available for work) compared with 1.491 million in Oct 2018

Table I-2, US, People in Job Stress, Millions and % SA

| Nov 2018 | Oct 2018 | Sep 2018 | |

| Labor Force Millions | 162.770 | 162.637 | 161.926 |

| Unemployed | 5.975 | 6.075 | 5.964 |

| Unemployment Rate (unemployed as % labor force) | 3.7 | 3.7 | 3.7 |

| Unemployed ≥27 weeks | 1.253 | 1.373 | 1.384 |

| Unemployed ≥27 weeks % | 21.0 | 22.6 | 23.2 |

| Part Time for Economic Reasons | 4.802 | 4.621 | 4.642 |

| Marginally | 1.678 | 1.491 | 1.577 |

| Job Stress | 12.455 | 12.187 | 12.183 |

| In Job Stress as % Labor Force | 7.7 | 7.5 | 7.5 |

Job Stress = Unemployed + Part Time Economic Reasons + Marginally Attached Labor Force

Source: US Bureau of Labor Statistics

Table I-3, US, Unemployment and Underemployment, SA, Millions and Percent

| Nov 2018 | Oct 2018 | Sep 2018 | Aug | |

| Labor Force | 162.770 | 162.637 | 161.926 | 161.776 |

| Participation Rate | 62.9 | 62.9 | 62.7 | 62.7 |

| Unemployed | 5.975 | 6.075 | 5.964 | 6.234 |

| UNE Rate % | 3.7 | 3.7 | 3.7 | 3.9 |

| Part Time Economic Reasons | 4.802 | 4.621 | 4.642 | 4.379 |

| Marginally Attached to Labor Force | 1.678 | 1.491 | 1.577 | 1.443 |

| In Job Stress | 12.455 | 12.187 | 12.183 | 12.056 |

| In Job Stress % Labor Force | 7.7 | 7.5 | 7.5 | 7.5 |

| Employed | 156.795 | 156.562 | 155.962 | 155.542 |

| Employment % Population | 60.6 | 60.6 | 60.4 | 60.3 |

Job Stress = Unemployed + Part Time Economic Reasons + Marginally Attached Labor Force

Source: US Bureau of Labor Statistics

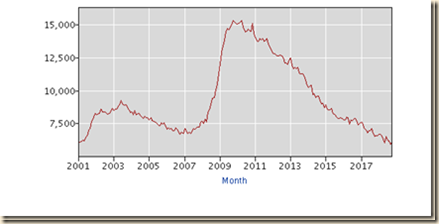

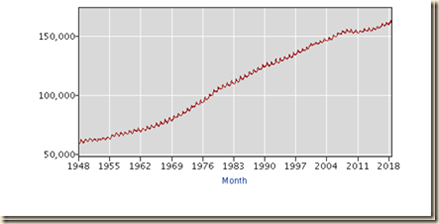

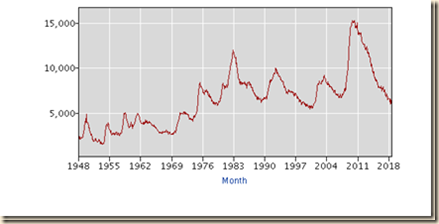

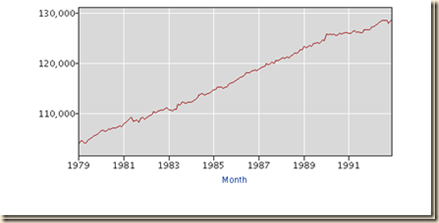

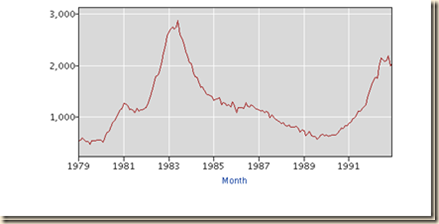

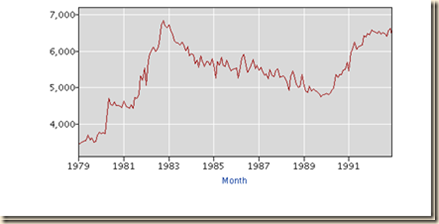

The balance of this section considers the second approach. Charts I-1 to I-12 explain the reasons for considering another approach to calculating job stress in the US. Chart I-1 of the Bureau of Labor Statistics provides the level of employment in the US from 2001 to 2018. There was a big drop of the number of people employed from 147.315 million at the peak in Jul 2007 (NSA) to 136.809 million at the trough in Jan 2010 (NSA) with 10.506 million fewer people employed. Recovery has been anemic compared with the shallow recession of 2001 that was followed by nearly vertical growth in jobs. The number employed in Nov 2018 was 157.015 million (NSA) or 9.700 million more people with jobs relative to the peak of 147.315 million in Aug 2007 while the civilian noninstitutional population of ages 16 years and over increased from 231.958 million in Jul 2007 to 258.708 million in Nov 2018 or by 26.750 million. The number employed increased 6.6 percent from Jul 2007 to Nov 2018 while the noninstitutional civilian population of ages of 16 years and over, or those available for work, increased 11.5 percent. The ratio of employment to population in Jul 2007 was 63.5 percent (147.315 million employed as percent of population of 231.958 million). The same ratio in Nov 2018 would result in 164.280 million jobs (0.635 multiplied by noninstitutional civilian population of 258.708 million). There are effectively 7.265 million fewer jobs in Nov 2018 than in Jul 2007, or 164.280 million minus 157.015 million. There is actually not sufficient job creation in merely absorbing new entrants in the labor force because of those dropping from job searches, worsening the stock of unemployed or underemployed in involuntary part-time jobs.

Chart I-1, US, Employed, Thousands, SA, 2001-2018

Source: Bureau of Labor Statistics

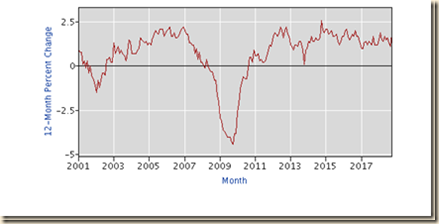

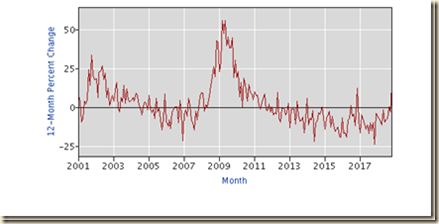

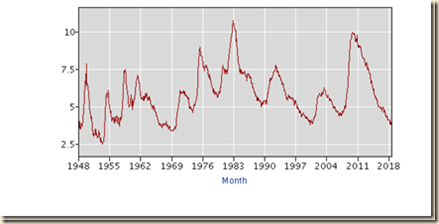

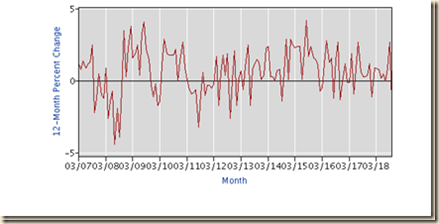

Chart I-2 of the Bureau of Labor Statistics provides 12-month percentage changes of the number of people employed in the US from 2001 to 2018. There was recovery since 2010 but not sufficient to recover lost jobs. Many people in the US who had jobs before the global recession are not working now and many who entered the labor force cannot find employment.

Chart I-2, US, Employed, 12-Month Percentage Change NSA, 2001-2018

Source: Bureau of Labor Statistics

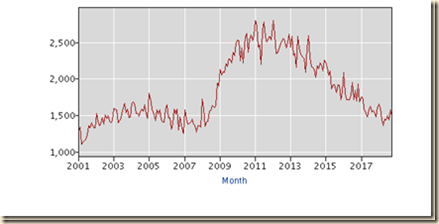

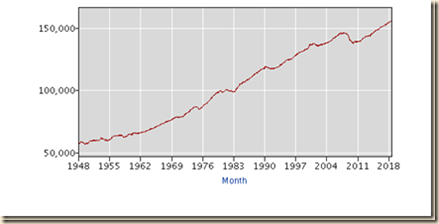

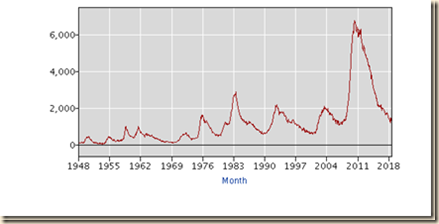

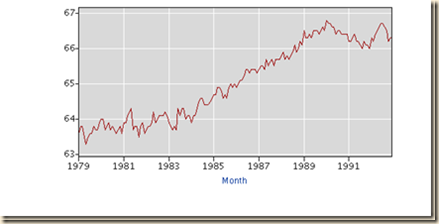

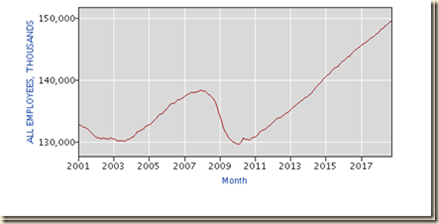

The foundation of the second approach derives from Chart I-3 of the Bureau of Labor Statistics providing the level of the civilian labor force in the US. The civilian labor force consists of people who are available and willing to work and who have searched for employment recently. The labor force of the US NSA grew 9.4 percent from 142.828 million in Jan 2001 to 156.255 million in Jul 2009. The civilian labor force is 4.1 percent higher at 162.665 million in Nov 2018 than in Jul 2009, all numbers not seasonally adjusted. Chart I-3 shows the flattening of the curve of expansion of the labor force and its decline in 2010 and 2011. The ratio of the labor force of 154.871 million in Jul 2007 to the noninstitutional population of 231.958 million in Jul 2007 was 66.8 percent while the ratio of the labor force of 162.665 million in Nov 2018 to the noninstitutional population of 258.708 million in Nov 2018 was 62.9 percent. The labor force of the US in Nov 2018 corresponding to 66.8 percent of participation in the population would be 172.817 million (0.668 x 258.708). The difference between the measured labor force in Nov 2018 of 162.665 million and the labor force in Nov 2018 with participation rate of 66.8 percent (as in Jul 2007) of 172.817 million is 9.964 million. The level of the labor force in the US has stagnated and is 10.152 million lower than what it would have been had the same participation rate been maintained. Millions of people have abandoned their search for employment because they believe there are no jobs available for them. The key issue is whether the decline in participation of the population in the labor force is the result of people giving up on finding another job.

Chart I-3, US, Civilian Labor Force, Thousands, SA, 2001-2018

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

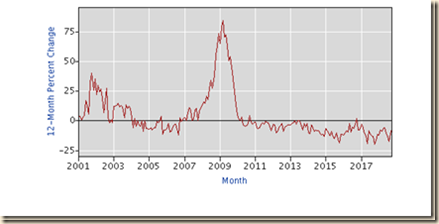

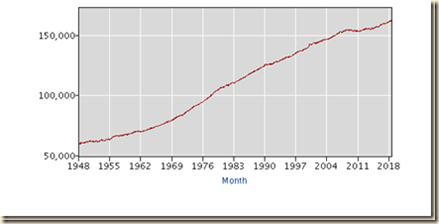

Chart I-4 of the Bureau of Labor Statistics provides 12-month percentage changes of the level of the labor force in the US. The rate of growth fell almost instantaneously with the global recession and became negative from 2009 to 2011. The labor force of the US collapsed and did not recover. Growth in the beginning of the summer originates in younger people looking for jobs in the summer after graduation or during school recess.

Chart I-4, US, Civilian Labor Force, Thousands, NSA, 12-month Percentage Change, 2001-2018

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

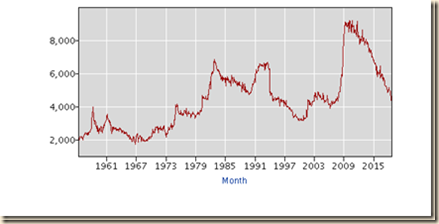

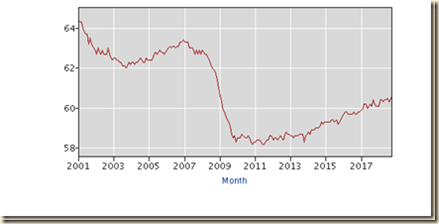

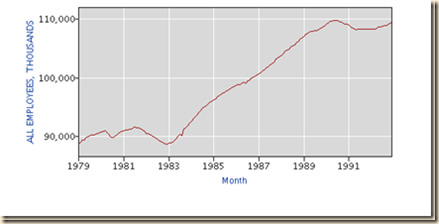

Chart I-5 of the Bureau of Labor Statistics provides the labor force participation rate in the US or labor force as percent of the population. The labor force participation rate of the US fell from 66.8 percent in Jan 2001 to 62.9 percent NSA in Nov 2018, all numbers not seasonally adjusted. The annual labor force participation rate for 1979 was 63.7 percent and also 63.7 percent in Nov 1980 during sharp economic contraction. This comparison is further elaborated below. Chart I-5 shows an evident downward trend beginning with the global recession that has continued throughout the recovery beginning in IIIQ2009. The critical issue is whether people left the workforce of the US because they believe there is no longer a job for them.

Chart I-5, Civilian Labor Force Participation Rate, Percent of Population in Labor Force SA, 2001-2018

Source: US Bureau of Labor Statistics http://www.bls.gov/data/