Increase of Interest Rates by Monetary Policy Dependent on Forecasting Accuracy of Future Economic Conditions and Behavior of Financial Markets, World Inflation Waves, Theory and Reality of Monetary Policy Based on Fear of Deflation, United Sates Industrial Production, Squeeze of Economic Activity by Carry Trades Induced by Zero Interest Rates, Rules, Discretionary Authorities and Slow Productivity Growth, Collapse of United States Dynamism of Income Growth and Employment Creation in the Lost Economic Cycle of the Global Recession with Economic Growth Underperforming Below Trend Worldwide, World Financial Turbulence, World Cyclical Slow Growth, Government Intervention in Globalization, and Global Recession Risk

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018

I World Inflation Waves

IA Appendix: Transmission of Unconventional Monetary Policy

IB1 Theory

IB2 Policy

IB3 Evidence

IB4 Unwinding Strategy

IC United States Inflation

IC Long-term US Inflation

ID Current US Inflation

IE Theory and Reality of Economic History, Cyclical Slow Growth Not Secular Stagnation and Monetary Policy Based on Fear of Deflation

II United States Industrial Production

IIB Squeeze of Economic Activity by Carry Trades Induced by Zero Interest Rates

II Rules, Discretionary Authorities and Slow Productivity Growth

II 1B Collapse of United States Dynamism of Income Growth and Employment Creation in the Lost Economic Cycle of the Global Recession with Economic Growth Underperforming Below Trend Worldwide

III World Financial Turbulence

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IID Squeeze of Economic Activity by Carry Trades Induced by Zero Interest Rates. Long-term economic growth in Japan significantly improved by increasing competitiveness in world markets. Net trade of exports and imports is an important component of the GDP accounts of Japan. Table VB-3 provides quarterly data for net trade, exports and imports of Japan. Net trade had strong positive contributions to GDP growth in Japan in all quarters from IQ2007 to IIQ2009 with exception of IVQ2008, IIIQ2008 and IQ2009. The US recession is dated by the National Bureau of Economic Research (NBER) as beginning in IVQ2007 (Dec) and ending in IIQ2009 (Jun) (http://www.nber.org/cycles/cyclesmain.html). Net trade contributions helped to cushion the economy of Japan from the global recession. Net trade deducted from GDP growth in six of the nine quarters from IVQ2010 to IQ2012. The only strong contribution of net trade was 3.6 percent in IIIQ2011. Net trade added 1.4 percentage points to GDP growth in IQ2013 but deducted 0.1 percentage points in IIQ2013, deducting 1.3 percentage points in IIIQ2013 and 2.2 percentage points in IVQ2013. Net trade deducted 0.9 percentage points from GDP growth in IQ2014. Net trade added 3.9 percentage points to GDP growth in IIQ2014 and deducted 0.0 percentage points in IIIQ2014. Net trade added 1.5 percentage points to GDP growth in IVQ2014. Net trade contributed 0.0 percentage points to GDP growth in IQ2015 and deducted 0.7-percentage points in IIQ2015. Net trade deducted 0.2 percentage points from GDP growth in IIIQ2015. Net trade subtracted 0.1 percentage points from GDP growth in IVQ2015 and added 1.3 percentage points in IQ2016. Net trade contributed 0.2 percentage points to GDP growth in IIQ2016. Net trade added 1.7 percentage points to GDP growth in IIIQ2016 and contributed 1.3 percentage points in IVQ2016. Net trade contributed 0.3 percentage points to GDP growth in IQ2017 and deducted 1.2 percentage points in IIQ2017. Net trade contributed 2.4 percentage points to GDP growth in IIIQ2017 and deducted 0.4 percentage-point in IVQ2017. Net trade contributed 0.2 percentage points to GDP growth in IQ2018 and deducted 0.4 percentage points in IIQ2018. Net trade deducted 0.3 percentage points from GDP growth in IIIQ2018. Private consumption assumed the role of driver of Japan’s economic growth but should moderate as in most mature economies.

There was milder increase in Japan’s export corporate goods price index during the global recession in 2008 but similar sharp decline during the bank balance sheets effect in late 2008, as shown in Chart IV-5 of the Bank of Japan. Japan exports industrial goods whose prices have been less dynamic than those of commodities and raw materials. As a result, the export CGPI on the yen basis in Chart IV-5 trends down with oscillations after a brief rise in the final part of the recession in 2009. The export corporate goods price index on the yen basis fell from 93.9 in Jun 2009 to 84.1 in Jan 2012 or minus 10.4 percent and increased to 97.9 in Nov 2018 for gain of 16.4 percent relative to Jan 2012 and increase of 4.3 percent relative to Jun 2009. The choice of Jun 2009 is designed to capture the reversal of risk aversion beginning in Sep 2008 with the announcement of toxic assets in banks that would be withdrawn with the Troubled Asset Relief Program (TARP) (Cochrane and Zingales 2009). Reversal of risk aversion in the form of flight to the USD and obligations of the US government opened the way to renewed carry trades from zero interest rates to exposures in risk financial assets such as commodities. Japan exports industrial products and imports commodities and raw materials. The recovery from the global recession began in the third quarter of 2009.

Chart IV-5, Japan, Export Corporate Goods Price Index, Monthly, Yen Basis, 2008-2018

Source: Bank of Japan

http://www.stat-search.boj.or.jp/index_en.html

Chart IV-5A provides the export corporate goods price index on the basis of the contract currency. The export corporate goods price index on the basis of the contract currency increased from 105.9 in Jun 2009 to 111.5 in Apr 2012 or 5.3 percent but dropped to 102.1 in Nov 2018 or minus 8.4 percent relative to Apr 2012 and fell 3.6 percent to 102.1 in Nov 2018 relative to Jun 2009.

Chart IV-5A, Japan, Export Corporate Goods Price Index, Monthly, Contract Currency Basis, 2008-2018

Source: Bank of Japan

http://www.stat-search.boj.or.jp/index_en.html

Japan imports primary commodities and raw materials. As a result, the import corporate goods price index on the yen basis in Chart IV-6 shows an upward trend after declining from the increase during the global recession in 2008 driven by carry trades from fed funds rates. The index increases with carry trades from zero interest rates into commodity futures and declines during risk aversion from late 2008 into beginning of 2008 originating in doubts about soundness of US bank balance sheets. Measurement that is more careful should show that the terms of trade of Japan, export prices relative to import prices, declined during the commodity shocks originating in unconventional monetary policy. The decline of the terms of trade restricted potential growth of income in Japan (for the relation of terms of trade and growth see Pelaez 1979, 1976a). The import corporate goods price index on the yen basis increased from 82.4 in Jun 2009 to 99.6 in Apr 2012 or 20.9 percent and to 104.4 in Nov 2018 or increase of 4.8 percent relative to Apr 2012 and increase of 26.7 percent relative to Jun 2009.

Chart IV-6, Japan, Import Corporate Goods Price Index, Monthly, Yen Basis, 2008-2018

Source: Bank of Japan

http://www.stat-search.boj.or.jp/index_en.html

Chart IV-6A provides the import corporate goods price index on the contract currency basis. The import corporate goods price index on the basis of the contract currency increased from 95.0 in Jun 2009 to 131.6 in Apr 2012 or 38.5 percent and to 109.9 in Nov 2018 or minus 16.5 percent relative to Apr 2012 and increase of 15.7 percent relative to Jun 2009. There is evident deterioration of the terms of trade of Japan: the export corporate goods price index on the basis of the contract currency decreased 3.6 percent from Jun 2009 to Nov 2018 while the import corporate goods price index increased 15.7 percent. Prices of Japan’s exports of corporate goods, mostly industrial products, increased only 5.3 percent from Jun 2009 to Apr 2012, while imports of corporate goods, mostly commodities and raw materials increased 38.5 percent. Unconventional monetary policy induces carry trades from zero interest rates to exposures in commodities that squeeze economic activity of industrial countries by increases in prices of imported commodities and raw materials during periods without risk aversion. Reversals of carry trades during periods of risk aversion decrease prices of exported commodities and raw materials that squeeze economic activity in economies exporting commodities and raw materials. Devaluation of the dollar by unconventional monetary policy could increase US competitiveness in world markets but economic activity is squeezed by increases in prices of imported commodities and raw materials. Unconventional monetary policy causes instability worldwide instead of the mission of central banks of promoting financial and economic stability.

Chart IV-6A, Japan, Import Corporate Goods Price Index, Monthly, Contract Currency Basis, 2008-2018

Source: Bank of Japan

http://www.stat-search.boj.or.jp/index_en.html

Table IV-6B provides the Bank of Japan’s Corporate Goods Price indexes of exports and imports on the yen and contract bases from Jan 2008 to Nov 2018. There are oscillations of the indexes that are shown vividly in the four charts above. For the entire period from Jan 2008 to Nov 2018, the export index on the contract currency basis decreased 4.8 percent and decreased 5.2 percent on the yen basis. For the entire period from Jan 2008 to Nov 2018, the import price index decreased 0.9 percent on the contract currency basis and decreased 0.4 percent on the yen basis. During significant part of the expansion period, prices of Japan’s exports of corporate goods on the contract currency, mostly industrial products, increased only 5.3 percent from Jun 2009 to Apr 2012, while prices of imports of corporate goods on the contract currency, mostly commodities and raw materials, increased 38.5 percent. The charts show sharp deteriorations in relative prices of exports to prices of imports during multiple periods. Price margins of Japan’s producers are subject to periodic squeezes resulting from carry trades from zero interest rates of monetary policy to exposures in commodities.

Table IV-6B, Japan, Exports and Imports Corporate Goods Price Index, Contract Currency Basis and Yen Basis

| X-CC | X-Y | M-CC | M-Y | |

| 2008/01 | 107.3 | 103.3 | 110.9 | 104.8 |

| 2008/02 | 107.9 | 103.9 | 112.8 | 106.2 |

| 2008/03 | 108.7 | 100.7 | 115.1 | 103.4 |

| 2008/04 | 109.9 | 103.2 | 121.3 | 110.3 |

| 2008/05 | 110.7 | 105 | 124.9 | 114.9 |

| 2008/06 | 111.9 | 108 | 131.6 | 123.6 |

| 2008/07 | 113.2 | 109.2 | 135 | 126.8 |

| 2008/08 | 112.1 | 109.2 | 135.6 | 129.5 |

| 2008/09 | 111 | 105.8 | 129 | 120.8 |

| 2008/10 | 108.3 | 98.1 | 120.2 | 107 |

| 2008/11 | 106.6 | 93.5 | 107.7 | 93.2 |

| 2008/12 | 105.9 | 90 | 98.4 | 81.9 |

| 2009/01 | 106 | 89 | 94.3 | 77.9 |

| 2009/02 | 105.4 | 89.6 | 94.4 | 79 |

| 2009/03 | 105.2 | 93.2 | 93.8 | 81.9 |

| 2009/04 | 105.5 | 94.5 | 93 | 81.9 |

| 2009/05 | 105.4 | 92.9 | 92.5 | 80 |

| 2009/06 | 105.9 | 93.9 | 95 | 82.4 |

| 2009/07 | 105.4 | 92.2 | 98.3 | 83.7 |

| 2009/08 | 106.3 | 93.4 | 98.7 | 84.4 |

| 2009/09 | 106.3 | 91.4 | 100.2 | 83.4 |

| 2009/10 | 106 | 90.5 | 100.2 | 82.8 |

| 2009/11 | 106.4 | 90.2 | 102.2 | 83.5 |

| 2009/12 | 106.3 | 90.1 | 105.1 | 85.9 |

| 2010/01 | 107.5 | 91.4 | 106.8 | 88.1 |

| 2010/02 | 107.8 | 90.9 | 107.5 | 87.9 |

| 2010/03 | 107.8 | 91.1 | 106.8 | 87.4 |

| 2010/04 | 108.7 | 93.6 | 110 | 92.1 |

| 2010/05 | 108.9 | 92.1 | 112 | 92.4 |

| 2010/06 | 108.2 | 90.9 | 110.2 | 90.1 |

| 2010/07 | 107.5 | 88.6 | 110 | 87.9 |

| 2010/08 | 107.2 | 87.1 | 109.6 | 85.9 |

| 2010/09 | 107.5 | 86.8 | 110.2 | 85.6 |

| 2010/10 | 108.2 | 86.3 | 110.7 | 84.4 |

| 2010/11 | 108.9 | 87.1 | 113 | 86.5 |

| 2010/12 | 109.4 | 88 | 115 | 88.6 |

| 2011/01 | 110.4 | 88.2 | 118.1 | 90.4 |

| 2011/02 | 111.3 | 89 | 120.1 | 91.9 |

| 2011/03 | 111.9 | 89.1 | 123.2 | 93.6 |

| 2011/04 | 112.6 | 91 | 127.7 | 98.6 |

| 2011/05 | 112.3 | 89.4 | 130.9 | 99 |

| 2011/06 | 112.2 | 88.8 | 129.4 | 97.3 |

| 2011/07 | 112 | 88 | 130.3 | 97.1 |

| 2011/08 | 112 | 86.4 | 130.6 | 95.2 |

| 2011/09 | 112.1 | 86 | 128.9 | 93.6 |

| 2011/10 | 111.4 | 85.2 | 128.4 | 93 |

| 2011/11 | 110.2 | 84.8 | 127.1 | 92.8 |

| 2011/12 | 109.7 | 84.6 | 127.9 | 93.6 |

| 2012/01 | 110.1 | 84.1 | 126.7 | 91.8 |

| 2012/02 | 110.7 | 85.7 | 127.6 | 93.7 |

| 2012/03 | 111.3 | 88.8 | 130.3 | 99.5 |

| 2012/04 | 111.5 | 88.3 | 131.6 | 99.6 |

| 2012/05 | 110.6 | 86.2 | 130.1 | 96.7 |

| 2012/06 | 109.6 | 85 | 126.9 | 94 |

| 2012/07 | 108.8 | 84.1 | 123.4 | 91.2 |

| 2012/08 | 109.1 | 84.2 | 123.8 | 91.3 |

| 2012/09 | 109.2 | 84.2 | 126.3 | 92.7 |

| 2012/10 | 109.3 | 84.7 | 125.4 | 92.7 |

| 2012/11 | 109.1 | 85.8 | 124.7 | 93.8 |

| 2012/12 | 108.9 | 87.7 | 124.9 | 96.5 |

| 2013/01 | 109.2 | 91.6 | 125.4 | 101.7 |

| 2013/02 | 109.7 | 94.8 | 126.5 | 105.9 |

| 2013/03 | 109.5 | 95.4 | 126.8 | 107.5 |

| 2013/04 | 108.3 | 96.2 | 125.7 | 109.1 |

| 2013/05 | 107.7 | 97.6 | 124 | 110.4 |

| 2013/06 | 107.3 | 94.9 | 123.4 | 106.8 |

| 2013/07 | 107.2 | 96.2 | 122.9 | 108.2 |

| 2013/08 | 107 | 94.9 | 123.2 | 106.9 |

| 2013/09 | 107 | 95.9 | 124.5 | 109.2 |

| 2013/10 | 107.3 | 95.5 | 124.6 | 108.3 |

| 2013/11 | 107.2 | 96.6 | 124.6 | 110 |

| 2013/12 | 107.2 | 98.8 | 125.4 | 113.6 |

| 2014/01 | 107.3 | 99 | 126 | 114.6 |

| 2014/02 | 106.9 | 97.7 | 125.4 | 112.5 |

| 2014/03 | 106.6 | 97.6 | 124.9 | 112.2 |

| 2014/04 | 106.3 | 97.5 | 124.1 | 111.8 |

| 2014/05 | 106.2 | 96.8 | 123.8 | 110.9 |

| 2014/06 | 105.9 | 96.7 | 123.9 | 111.2 |

| 2014/07 | 106 | 96.5 | 123.9 | 110.9 |

| 2014/08 | 106.1 | 97.3 | 123.7 | 111.6 |

| 2014/09 | 105.9 | 99.3 | 122.8 | 114 |

| 2014/10 | 105.2 | 99.1 | 120.7 | 112.7 |

| 2014/11 | 104.8 | 103.4 | 117.8 | 115.9 |

| 2014/12 | 103.8 | 104.1 | 113.8 | 114 |

| 2015/01 | 102.2 | 101.2 | 108.2 | 106.6 |

| 2015/02 | 101.2 | 100.1 | 102.1 | 100.7 |

| 2015/03 | 101.3 | 100.9 | 103.1 | 102.6 |

| 2015/04 | 101.1 | 100.2 | 102 | 101 |

| 2015/05 | 101.4 | 101.4 | 101.6 | 101.5 |

| 2015/06 | 101.3 | 102.9 | 102.5 | 104.3 |

| 2015/07 | 100.6 | 101.7 | 101.5 | 102.9 |

| 2015/08 | 99.8 | 100.9 | 99 | 100.4 |

| 2015/09 | 98.6 | 98.2 | 96.6 | 96.2 |

| 2015/10 | 97.9 | 97.3 | 95.5 | 95 |

| 2015/11 | 97.5 | 98 | 94.9 | 95.7 |

| 2015/12 | 97.1 | 97.3 | 92.9 | 93.2 |

| 2016/01 | 96.4 | 94.7 | 89.9 | 88.3 |

| 2016/02 | 95.9 | 92.7 | 87.5 | 84.4 |

| 2016/03 | 96.1 | 92 | 87.3 | 83.2 |

| 2016/04 | 96.4 | 91 | 88.2 | 82.4 |

| 2016/05 | 96.5 | 90.6 | 88.6 | 82.4 |

| 2016/06 | 96.5 | 88.8 | 89.9 | 81.6 |

| 2016/07 | 96.9 | 88.2 | 90.8 | 81.5 |

| 2016/08 | 96.9 | 87.1 | 90.7 | 79.9 |

| 2016/09 | 97 | 87.5 | 91.1 | 80.7 |

| 2016/10 | 97.4 | 88.6 | 91.1 | 81.6 |

| 2016/11 | 98.1 | 91.2 | 93.8 | 86.3 |

| 2016/12 | 98.7 | 95.5 | 93.7 | 90.5 |

| 2017/01 | 99.4 | 95.6 | 96.1 | 92.1 |

| 2017/02 | 99.8 | 95.3 | 97.6 | 92.5 |

| 2017/03 | 100.3 | 95.7 | 98.4 | 93.3 |

| 2017/04 | 99.8 | 93.7 | 98.3 | 91.4 |

| 2017/05 | 99.4 | 94.6 | 98.1 | 92.6 |

| 2017/06 | 99.2 | 93.9 | 97.1 | 91 |

| 2017/07 | 99.3 | 94.9 | 96.3 | 91.2 |

| 2017/08 | 99.9 | 94.4 | 96.5 | 90.1 |

| 2017/09 | 100.5 | 95.5 | 97.8 | 91.8 |

| 2017/10 | 101.2 | 97.2 | 99.2 | 94.3 |

| 2017/11 | 101.5 | 97.4 | 100.3 | 95.3 |

| 2017/12 | 101.7 | 97.7 | 102.1 | 97.1 |

| 2018/01 | 101.9 | 97.1 | 103 | 96.7 |

| 2018/02 | 102.4 | 96.1 | 104.9 | 96.6 |

| 2018/03 | 102.7 | 95.2 | 104.4 | 94.9 |

| 2018/04 | 102.2 | 95.5 | 104.7 | 96.1 |

| 2018/05 | 102.7 | 96.9 | 106.3 | 98.9 |

| 2018/06 | 102.7 | 97 | 108.3 | 100.8 |

| 2018/07 | 102.5 | 97.4 | 108.3 | 101.7 |

| 2018/08 | 102.3 | 97 | 107.9 | 101.1 |

| 2018/09 | 102.3 | 97.5 | 107.9 | 101.7 |

| 2018/10 | 102.5 | 98 | 109.2 | 103.5 |

| 2018/11 | 102.1 | 97.9 | 109.9 | 104.4 |

Note: X-CC: Exports Contract Currency; X-Y: Exports Yen; M-CC: Imports Contract; M-Y: Imports Yen

Source: Bank of Japan

http://www.boj.or.jp/en/statistics/index.htm/

Japan also experienced sharp increase in inflation during the 1970s as in the episode of the Great Inflation in the US. Monetary policy focused on accommodating higher inflation, with emphasis solely on the mandate of promoting employment, has been blamed as deliberate or because of model error or imperfect measurement for creating the Great Inflation (http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html http://cmpassocregulationblog.blogspot.com/2011/04/new-economics-of-rose-garden-turned.html http://cmpassocregulationblog.blogspot.com/2011/03/is-there-second-act-of-us-great.html and Appendix I The Great Inflation; see Taylor 1993, 1997, 1998LB, 1999, 2012FP, 2012Mar27, 2012Mar28, 2012JMCB and http://cmpassocregulationblog.blogspot.com/2017/01/rules-versus-discretionary-authorities.html and earlier http://cmpassocregulationblog.blogspot.com/2012/06/rules-versus-discretionary-authorities.html). A remarkable similarity with US experience is the sharp rise of the CGPI of Japan in 2008 driven by carry trades from policy interest rates rapidly falling to zero to exposures in commodity futures during a global recession. Japan had the same sharp waves of consumer price inflation during the 1970s as in the US (see Chart IV-5A and associated table at: 11/25/18 https://cmpassocregulationblog.blogspot.com/2018/11/weaker-world-economic-growth-with.html https://cmpassocregulationblog.blogspot.com/2018/10/contraction-of-valuations-of-risk.html https://cmpassocregulationblog.blogspot.com/2018/09/world-inflation-waves-united-states.html https://cmpassocregulationblog.blogspot.com/2018/08/revision-of-united-states-national.html https://cmpassocregulationblog.blogspot.com/2018/07/continuing-gradual-increases-in-fed.html https://cmpassocregulationblog.blogspot.com/2018/06/world-inflation-waves-united-states.html https://cmpassocregulationblog.blogspot.com/2018/05/dollar-strengthening-world-inflation.html https://cmpassocregulationblog.blogspot.com/2018/04/dollar-appreciation-mediocre-cyclical.html https://cmpassocregulationblog.blogspot.com/2018/03/mediocre-cyclical-united-states_31.html https://cmpassocregulationblog.blogspot.com/2018/03/mediocre-cyclical-united-states.html https://cmpassocregulationblog.blogspot.com/2018/02/twenty-four-million-unemployed-or.html https://cmpassocregulationblog.blogspot.com/2017/12/dollar-devaluation-cyclically.html https://cmpassocregulationblog.blogspot.com/2017/12/twenty-one-million-unemployed-or.html https://cmpassocregulationblog.blogspot.com/2017/10/dollar-revaluation-and-increase-of.html https://cmpassocregulationblog.blogspot.com/2017/10/destruction-of-household-nonfinancial.html https://cmpassocregulationblog.blogspot.com/2017/08/dollar-devaluation-and-interest-rate.html https://cmpassocregulationblog.blogspot.com/2017/07/data-dependent-monetary-policy-with_30.html https://cmpassocregulationblog.blogspot.com/2017/07/dollar-devaluation-and-rising-yields.html https://cmpassocregulationblog.blogspot.com/2017/05/mediocre-cyclical-united-states.html https://cmpassocregulationblog.blogspot.com/2017/04/dollar-devaluation-mediocre-cyclical.html https://cmpassocregulationblog.blogspot.com/2017/04/mediocre-cyclical-economic-growth-with.html https://cmpassocregulationblog.blogspot.com/2017/03/rising-valuations-of-risk-financial.html http://cmpassocregulationblog.blogspot.com/2017/01/rising-valuations-of-risk-financial.html http://cmpassocregulationblog.blogspot.com/2017/01/rules-versus-discretionary-authorities.html http://cmpassocregulationblog.blogspot.com/2016/11/dollar-revaluation-rising-yields-and.html http://cmpassocregulationblog.blogspot.com/2016/10/mediocre-cyclical-united-states_30.html http://cmpassocregulationblog.blogspot.com/2016/10/mediocre-cyclical-united-states.html http://cmpassocregulationblog.blogspot.com/2016/08/and-as-ever-economic-outlook-is.html http://cmpassocregulationblog.blogspot.com/2016/07/business-fixed-investment-has-been-soft.html http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html http://cmpassocregulationblog.blogspot.com/2016/05/appropriate-for-fed-to-increase.html http://cmpassocregulationblog.blogspot.com/2016/03/contraction-of-united-states-corporate.html http://cmpassocregulationblog.blogspot.com/2016/02/mediocre-cyclical-united-states.html http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html http://cmpassocregulationblog.blogspot.com/2015/12/dollar-revaluation-and-decreasing.html http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-increase-considered.html http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-increase-considered.htmlhttp://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html

http://cmpassocregulationblog.blogspot.com/2015/08/fluctuations-of-global-financial.html http://cmpassocregulationblog.blogspot.com/2015/08/turbulence-of-valuations-of-financial_77.html http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial_29.html http://cmpassocregulationblog.blogspot.com/2015/06/dollar-revaluation-squeezing-corporate_97.html http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html http://cmpassocregulationblog.blogspot.com/2014/09/financial-volatility-mediocre-cyclical.html http://cmpassocregulationblog.blogspot.com/2014/09/geopolitical-and-financial-risks_71.html http://cmpassocregulationblog.blogspot.com/2014/03/financial-uncertainty-mediocre-cyclical_8145.html http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html http://cmpassocregulationblog.blogspot.com/2013/12/collapse-of-united-states-dynamism-of.html http://cmpassocregulationblog.blogspot.com/2013/12/exit-risks-of-zero-interest-rates-world_1.html and earlier http://cmpassocregulationblog.blogspot.com/2013/10/twenty-eight-million-unemployed-or_561.html and at http://cmpassocregulationblog.blogspot.com/2013/09/increasing-interest-rate-risk_1.html http://cmpassocregulationblog.blogspot.com/2012/07/recovery-without-jobs-stagnating-real_09.html).

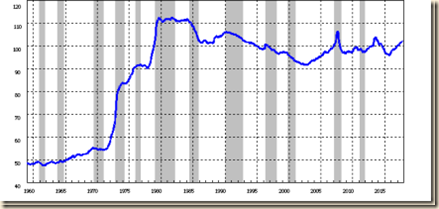

Chart IV-7, Japan, Domestic Corporate Goods Price Index, Monthly, 1960-2018

Source: Bank of Japan

http://www.stat-search.boj.or.jp/index_en.html

The producer price index of the US from 1970 to 2018 in Chart IV-8 shows various periods of more rapid or less rapid inflation but no bumps. The major event is the decline in 2008 when risk aversion because of the global recession caused the collapse of oil prices from $148/barrel to less than $80/barrel with most other commodity prices also collapsing. The event had nothing in common with explanations of deflation but rather with the concentration of risk exposures in commodities after the decline of stock market indexes. Eventually, there was a flight to government securities because of the fears of insolvency of banks caused by statements supporting proposals for withdrawal of toxic assets from bank balance sheets in the Troubled Asset Relief Program (TARP), as explained by Cochrane and Zingales (2009). The bump in 2008 with decline in 2009 is consistent with the view that zero interest rates with subdued risk aversion induce carry trades into commodity futures.

Chart IV-8, US, Producer Price Index Finished Goods, Monthly, 1960-2018

Source: US Bureau of Labor Statistics

Table IV-7, Japan, Corporate Goods Prices and Selected Components, % Weights, Month and 12 Months ∆%

| Nov 2018 | Weight | Month ∆% | 12 Month ∆% |

| Total | 1000.0 | -0.3 | 2.3 |

| Food, Beverages | 141.6 | 0.0 | 1.3 |

| Petroleum & Coal | 59.5 | -4.3 | 14.8 |

| Production Machinery | 41.1 | 0.2 | 0.4 |

| Electronic Components | 24.5 | 0.0 | -0.5 |

| Electric Power, Gas & Water | 67.1 | 0.7 | 8.1 |

| Iron & Steel | 51.7 | 0.1 | 4.6 |

| Chemicals | 89.2 | -0.8 | 2.7 |

| Transport | 140.7 | 0.0 | -0.3 |

Source: Bank of Japan

http://www.boj.or.jp/en/statistics/index.htm/

Table IV-8, Japan, Percentage Point Contributions to Change of Corporate Goods Price Index

| Groups Nov 2018 | Contribution to Change Percentage Points |

| A. Domestic Corporate Goods Price Index | Monthly Change: |

| Petroleum & Coal Products | -0.31 |

| Chemicals & Related Products | -0.07 |

| Scrap & Waste | -0.04 |

| Electrical Machinery & Equipment | -0.02 |

| Electric Power, Gas & Water | 0.05 |

| Agriculture, Forestry & Fishery Products | 0.03 |

| Pulp, Paper & Related Products | 0.02 |

| General Purpose Machinery | 0.01 |

| B. Export Price Index | Monthly Change: |

| Chemicals & Related Products | -0.28 |

| Metals & Related Products | -0.15 |

| Electric & Electronic Products | -0.06 |

| General Purpose, Production & Business Oriented Machinery | 0.09 |

| Other Primary Products & Manufactured Goods | 003% |

| C. Import Price Index | Monthly Change: 0.6% contract currency basis |

| Petroleum, Coal & Natural Gas | 0.65 |

| Chemicals & Related Products | 0.03 |

| Electric & Electronic Products | -0.07 |

| Metals & Related Products | -0.03 |

| Lumber & Wood Products and Forest Products | -0.01 |

Source: Bank of Japan

http://www.boj.or.jp/en/statistics/index.htm/

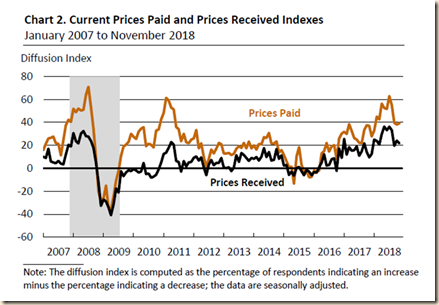

There are two categories of responses in the Empire State Manufacturing Survey of the Federal Reserve Bank of New York (https://www.newyorkfed.org/survey/empire/empiresurvey_overview.html): current conditions and expectations for the next six months. There are responses in the survey for two types of prices: prices received or inputs of production and prices paid or sales prices of products. Table IV-5 provides indexes for the two categories and within them for the two types of prices from Dec 2010 to Dec 2018. The index of current prices paid or costs of inputs moved from 16.1 in Dec 2012 to 39.7 in Dec 2018 while the index of current prices received or sales prices moved from 1.1 in Dec 2012 to 12.8 in Dec 2018. The farther the index is from the area of no change at zero, the faster the rate of change. Prices paid or costs of inputs at 39.7 in Dec 2018 are expanding at faster pace than prices received or of sales of products at 12.8. The index of future prices paid or expectations of costs of inputs in the next six months moved from 51.6 in Dec 2012 to 51.9 in Dec 2018 while the index of future prices received or expectation of sales prices in the next six months moved from 25.8 in Dec 2012 to 27.6 in Dec 2018. Prices paid or of inputs at 51.9 in Dec 2018 are expected to increase at a faster pace in the next six months than prices received or prices of sales products at 27.6 in Dec 2018. Prices of sales of finished products are less dynamic than prices of costs of inputs during waves of increases. Prices of costs of costs of inputs fall less rapidly than prices of sales of finished products during waves of price decreases. As a result, margins of prices of sales less costs of inputs oscillate with typical deterioration against producers, forcing companies to manage tightly costs and labor inputs. Instability of sales/costs margins discourages investment and hiring.

Table IV-5, US, FRBNY Empire State Manufacturing Survey, Diffusion Indexes, Prices Paid and Prices Received, SA

| Current Prices Paid | Current Prices Received | Future Prices Paid | Future Prices Received | |

| 12/31/2010 | 28.4 | 3.4 | 58 | 38.6 |

| 1/31/2011 | 35.8 | 15.8 | 60 | 42.1 |

| 2/28/2011 | 45.8 | 16.9 | 55.4 | 27.7 |

| 3/31/2011 | 53.2 | 20.8 | 71.4 | 36.4 |

| 4/30/2011 | 57.7 | 26.9 | 56.4 | 38.5 |

| 5/31/2011 | 69.9 | 28 | 68.8 | 35.5 |

| 6/30/2011 | 56.1 | 11.2 | 55.1 | 19.4 |

| 7/31/2011 | 43.3 | 5.6 | 51.1 | 30 |

| 8/31/2011 | 28.3 | 2.2 | 42.4 | 15.2 |

| 9/30/2011 | 32.6 | 8.7 | 53.3 | 22.8 |

| 10/31/2011 | 22.5 | 4.5 | 40.4 | 18 |

| 11/30/2011 | 18.3 | 6.1 | 36.6 | 25.6 |

| 12/31/2011 | 24.4 | 3.5 | 57 | 36 |

| 1/31/2012 | 26.4 | 23.1 | 53.8 | 30.8 |

| 2/29/2012 | 25.9 | 15.3 | 62.4 | 34.1 |

| 3/31/2012 | 50.6 | 13.6 | 66.7 | 32.1 |

| 4/30/2012 | 45.8 | 19.3 | 50.6 | 22.9 |

| 5/31/2012 | 37.3 | 12 | 57.8 | 22.9 |

| 6/30/2012 | 19.6 | 1 | 34 | 17.5 |

| 7/31/2012 | 7.4 | 3.7 | 35.8 | 16 |

| 8/31/2012 | 16.5 | 2.4 | 31.8 | 14.1 |

| 9/30/2012 | 19.1 | 5.3 | 40.4 | 23.4 |

| 10/31/2012 | 17.2 | 4.3 | 44.1 | 24.7 |

| 11/30/2012 | 14.6 | 5.6 | 39.3 | 15.7 |

| 12/31/2012 | 16.1 | 1.1 | 51.6 | 25.8 |

| 1/31/2013 | 22.6 | 10.8 | 38.7 | 21.5 |

| 2/28/2013 | 26.3 | 8.1 | 44.4 | 13.1 |

| 3/31/2013 | 25.8 | 2.2 | 50.5 | 23.7 |

| 4/30/2013 | 28.4 | 5.7 | 44.3 | 14.8 |

| 5/31/2013 | 20.5 | 4.5 | 29.5 | 14.8 |

| 6/30/2013 | 21 | 11.3 | 45.2 | 17.7 |

| 7/31/2013 | 17.4 | 1.1 | 28.3 | 12 |

| 8/31/2013 | 20.5 | 3.6 | 41 | 19.3 |

| 9/30/2013 | 21.5 | 8.6 | 39.8 | 24.7 |

| 10/31/2013 | 21.7 | 2.4 | 45.8 | 25.3 |

| 11/30/2013 | 17.1 | -3.9 | 42.1 | 17.1 |

| 12/31/2013 | 15.7 | 3.6 | 48.2 | 27.7 |

| 1/31/2014 | 36.6 | 13.4 | 45.1 | 23.2 |

| 2/28/2014 | 25 | 15 | 40 | 23.8 |

| 3/31/2014 | 21.2 | 2.4 | 43.5 | 25.9 |

| 4/30/2014 | 22.4 | 10.2 | 33.7 | 14.3 |

| 5/31/2014 | 19.8 | 6.6 | 31.9 | 14.3 |

| 6/30/2014 | 17.2 | 4.3 | 36.6 | 16.1 |

| 7/31/2014 | 25 | 6.8 | 37.5 | 18.2 |

| 8/31/2014 | 27.3 | 8 | 42 | 21.6 |

| 9/30/2014 | 23.9 | 17.4 | 43.5 | 32.6 |

| 10/31/2014 | 11.4 | 6.8 | 42 | 26.1 |

| 11/30/2014 | 10.6 | 0 | 41.5 | 25.5 |

| 12/31/2014 | 10.4 | 6.3 | 40.6 | 32.3 |

| 1/31/2015 | 12.6 | 12.6 | 33.7 | 15.8 |

| 2/28/2015 | 14.6 | 3.4 | 27 | 5.6 |

| 3/31/2015 | 12.4 | 8.2 | 32 | 12.4 |

| 4/30/2015 | 19.1 | 4.3 | 38.3 | 13.8 |

| 5/31/2015 | 9.4 | 1 | 26 | 7.3 |

| 6/30/2015 | 9.6 | 1 | 24 | 5.8 |

| 7/31/2015 | 7.4 | 5.3 | 27.7 | 6.4 |

| 8/31/2015 | 7.3 | 0.9 | 34.5 | 10.9 |

| 9/30/2015 | 4.1 | -5.2 | 28.9 | 7.2 |

| 10/31/2015 | 0.9 | -8.5 | 27.4 | 7.5 |

| 11/30/2015 | 4.5 | -4.5 | 29.1 | 11.8 |

| 12/31/2015 | 4 | -4 | 27.3 | 20.2 |

| 1/31/2016 | 16 | 4 | 31 | 12 |

| 2/29/2016 | 3 | -5 | 14.9 | 4 |

| 3/31/2016 | 3 | -5.9 | 19.8 | 7.9 |

| 4/30/2016 | 19.2 | 2.9 | 27.9 | 5.8 |

| 5/31/2016 | 16.7 | -3.1 | 28.1 | 6.3 |

| 6/30/2016 | 18.4 | -1 | 29.6 | 7.1 |

| 7/31/2016 | 18.7 | 1.1 | 26.4 | 7.7 |

| 8/31/2016 | 15.5 | 2.1 | 25.8 | 9.3 |

| 9/30/2016 | 17 | 1.8 | 41.1 | 20.5 |

| 10/31/2016 | 22.6 | 4.7 | 35.8 | 30.2 |

| 11/30/2016 | 15.5 | 2.7 | 39.1 | 20.9 |

| 12/31/2016 | 22.6 | 3.5 | 42.6 | 22.6 |

| 1/31/2017 | 36.1 | 17.6 | 50.4 | 27.7 |

| 2/28/2017 | 37.8 | 19.4 | 38.8 | 25.5 |

| 3/31/2017 | 31 | 8.8 | 41.6 | 19.5 |

| 4/30/2017 | 32.8 | 12.4 | 37.2 | 25.5 |

| 5/31/2017 | 20.9 | 4.5 | 38.1 | 22.4 |

| 6/30/2017 | 20 | 10.8 | 33.1 | 13.8 |

| 7/31/2017 | 21.3 | 11 | 30.7 | 15.7 |

| 8/31/2017 | 31 | 6.2 | 33.3 | 21.7 |

| 9/30/2017 | 35.8 | 13.8 | 42.3 | 18.7 |

| 10/31/2017 | 27.3 | 7 | 41.4 | 25 |

| 11/30/2017 | 24.6 | 9.2 | 48.5 | 23.8 |

| 12/31/2017 | 29.7 | 11.6 | 50 | 27.5 |

| 1/31/2018 | 36.2 | 21.7 | 52.9 | 31.2 |

| 2/28/2018 | 48.6 | 21.5 | 52.1 | 25.7 |

| 3/31/2018 | 50.3 | 22.4 | 55.9 | 28 |

| 4/30/2018 | 47.4 | 20.7 | 54.8 | 31.1 |

| 5/31/2018 | 54 | 23 | 54 | 29.5 |

| 6/30/2018 | 52.7 | 23.3 | 51.2 | 27.1 |

| 7/31/2018 | 42.7 | 22.2 | 48.7 | 28.2 |

| 8/31/2018 | 45.2 | 20 | 53.3 | 26.7 |

| 9/30/2018 | 46.3 | 16.3 | 56.1 | 30.9 |

| 10/31/2018 | 42 | 14.3 | 52.9 | 23.5 |

| 11/30/2018 | 44.5 | 13.1 | 59.1 | 31.4 |

| 12/31/2018 | 39.7 | 12.8 | 51.9 | 27.6 |

Source:

http://www.ny.frb.org/survey/empire/empiresurvey_overview.html

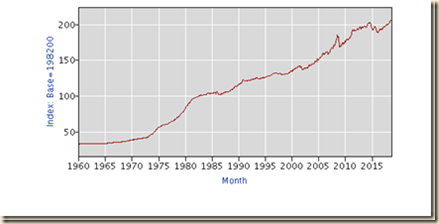

Price indexes of the Federal Reserve Bank of Philadelphia Outlook Survey are in Table IV-5A. As in inflation waves throughout the world (Section I and earlier https://cmpassocregulationblog.blogspot.com/2018/11/weakening-gdp-growth-in-major-economies.html) indexes of both current and expectations of future prices paid and received were quite high until May 2011. Prices paid, or inputs, were more dynamic, reflecting carry trades from zero interest rates to commodity futures. All indexes softened after May 2011 with even decline of prices received in Aug 2011 during the first round of risk aversion. Current and future price indexes have increased again but not back to the intensity in the beginning of 2011 because of risk aversion frustrating carry trades even induced by zero interest rates. The index of prices paid or prices of inputs moved from 21.0 in Dec 2012 to 38.0 in Dec 2018. The index of current prices received was minus 2.4 in Apr 2013, indicating decrease of prices received. The index of current prices received decreased from 9.0 in Dec 2012 to minus 6.0 in Sep 2015, decreasing to minus 3.9 in Feb 2016. The index of current prices received was 26.2 in Dec 2018. The farther the index is from the area of no change at zero, the faster the rate of change. The index of current prices paid or costs of inputs at 38.0 in Dec 2018 indicates faster expansion than the index of current prices received or sales prices of production in Dec 2018, showing 26.2. Prices paid indicate faster expansion than prices received during most of the history of the index. The index of future prices paid increased to 60.2 in Dec 2018 from 41.9 in Dec 2012 while the index of future prices received increased from 21.7 in Dec 2012 to 45.0 in Dec 2018. Expectations are incorporating faster increases in prices of inputs or costs of production, 60.2 in Dec 2018, than of sales prices of produced goods, 45.0 in Dec 2018, forcing companies to manage tightly costs and labor inputs. Volatility of margins of sales/costs discourages investment and hiring.

Table IV-5A, US, Federal Reserve Bank of Philadelphia Business Outlook Survey, Current and Future Prices Paid and Prices Received, SA

| Current Prices Pai | Current Prices Received | Future Prices Paid | Future Prices Received | |

| Dec-10 | 42.7 | 5.2 | 56.3 | 24.2 |

| Jan-11 | 48.2 | 12.6 | 58.9 | 34.6 |

| Feb-11 | 61.4 | 13.6 | 68.7 | 31.6 |

| Mar-11 | 59.2 | 17.8 | 61.5 | 33.5 |

| Apr-11 | 52.8 | 22.9 | 56.4 | 36.4 |

| May-11 | 51.3 | 20.6 | 54.8 | 28.5 |

| Jun-11 | 36 | 6.3 | 40.7 | 6.8 |

| Jul-11 | 34.1 | 5.6 | 48.1 | 17.2 |

| Aug-11 | 23.6 | -2.9 | 42.7 | 22.8 |

| Sep-11 | 30.1 | 6.4 | 38.2 | 20.5 |

| Oct-11 | 22.7 | 1.6 | 41.4 | 27.7 |

| Nov-11 | 21.8 | 5.1 | 34.3 | 26.2 |

| Dec-11 | 25 | 5.5 | 42.7 | 21.1 |

| Jan-12 | 26.1 | 9.2 | 47.9 | 21.8 |

| Feb-12 | 33.4 | 10.4 | 51.6 | 26.5 |

| Mar-12 | 17.4 | 6.8 | 38.7 | 24.9 |

| Apr-12 | 21.8 | 9.6 | 37 | 25.2 |

| May-12 | 10.2 | 1.1 | 40.4 | 9.1 |

| Jun-12 | 1.2 | -6.1 | 32.9 | 16.9 |

| Jul-12 | 8.3 | 3.3 | 27.1 | 20.3 |

| Aug-12 | 16.3 | 7.3 | 35 | 23.9 |

| Sep-12 | 12.9 | 2.7 | 38.3 | 24.6 |

| Oct-12 | 17.2 | 4.7 | 44.2 | 15 |

| Nov-12 | 22.1 | 4.7 | 45.6 | 10.5 |

| Dec-12 | 21 | 9 | 41.9 | 21.7 |

| Jan-13 | 12.9 | 0.7 | 35.2 | 21.7 |

| Feb-13 | 12.9 | 0.1 | 35.6 | 23.2 |

| Mar-13 | 13.3 | 1 | 35.2 | 20.5 |

| Apr-13 | 11.6 | -2.4 | 31.3 | 17.1 |

| May-13 | 12.7 | 0.6 | 35.4 | 19.2 |

| Jun-13 | 17 | 11.5 | 29.7 | 24.1 |

| Jul-13 | 19.3 | 5.5 | 40 | 24.7 |

| Aug-13 | 17.8 | 13.3 | 34.1 | 23 |

| Sep-13 | 22.1 | 11.6 | 37.3 | 27.1 |

| Oct-13 | 17.4 | 9 | 41.5 | 34.2 |

| Nov-13 | 23.3 | 6.5 | 40.8 | 36 |

| Dec-13 | 17.4 | 9 | 40.1 | 28 |

| Jan-14 | 19.9 | 8.3 | 37.6 | 13.7 |

| Feb-14 | 16.3 | 9.9 | 29.3 | 20 |

| Mar-14 | 21.2 | 6.8 | 33.6 | 20.7 |

| Apr-14 | 21.1 | 10.3 | 38.4 | 22 |

| May-14 | 27.1 | 17.7 | 39.2 | 29 |

| Jun-14 | 26.4 | 9.7 | 42.4 | 30 |

| Jul-14 | 30.9 | 14.3 | 36.5 | 21.7 |

| Aug-14 | 21.6 | 6.8 | 44.9 | 27.6 |

| Sep-14 | 21.6 | 7.4 | 39.1 | 25.9 |

| Oct-14 | 23.5 | 16.9 | 30.7 | 21.2 |

| Nov-14 | 13.9 | 8.2 | 32.6 | 17.9 |

| Dec-14 | 15.9 | 11.4 | 25.2 | 19.5 |

| Jan-15 | 11.6 | 2.4 | 30.6 | 20.9 |

| Feb-15 | 6.1 | 2.8 | 35 | 23 |

| Mar-15 | 1 | -5.8 | 30 | 10 |

| Apr-15 | 1.3 | -2.8 | 20.2 | 14.9 |

| May-15 | -13.2 | -6.4 | 24.1 | 19.2 |

| Jun-15 | 10.5 | 0.3 | 39.3 | 12.5 |

| Jul-15 | 18.5 | 1.2 | 33.7 | 16 |

| Aug-15 | 3.1 | -2.5 | 34.9 | 7.9 |

| Sep-15 | -3.1 | -6 | 25.5 | 5.3 |

| Oct-15 | -2 | -1.4 | 16.9 | 7.9 |

| Nov-15 | -7.8 | -2.8 | 23.3 | 9.5 |

| Dec-15 | -7.6 | -6 | 24.2 | 13.1 |

| Jan-16 | -2 | -3.2 | 18.9 | 11.3 |

| Feb-16 | -2.8 | -3.9 | 13.4 | 5.2 |

| Mar-16 | -2 | 1.1 | 23.7 | 14.9 |

| Apr-16 | 13 | 5 | 35.8 | 22.9 |

| May-16 | 15 | 12.3 | 26.2 | 12.8 |

| Jun-16 | 22.1 | 2.5 | 36.3 | 18.4 |

| Jul-16 | 14.6 | 2.9 | 28.2 | 22.6 |

| Aug-16 | 19.2 | 7.9 | 31.8 | 12.8 |

| Sep-16 | 20.2 | 8.8 | 41.1 | 32.9 |

| Oct-16 | 8.4 | -2.2 | 39.9 | 26.7 |

| Nov-16 | 25.9 | 17.3 | 38 | 29 |

| Dec-16 | 30.4 | 9.1 | 44.7 | 28.3 |

| Jan-17 | 31.8 | 25.5 | 47.6 | 27.5 |

| Feb-17 | 30 | 11.9 | 47.9 | 25.3 |

| Mar-17 | 38.6 | 18.5 | 53.8 | 39.3 |

| Apr-17 | 32.7 | 15.4 | 35.9 | 29.8 |

| May-17 | 26.3 | 15.8 | 44.9 | 24.1 |

| Jun-17 | 25.1 | 19.1 | 43 | 30.1 |

| Jul-17 | 22.3 | 10.9 | 47.7 | 30.1 |

| Aug-17 | 21.9 | 14.7 | 37.4 | 37 |

| Sep-17 | 33.5 | 21.9 | 47.8 | 33.9 |

| Oct-17 | 37.6 | 14.1 | 57.8 | 39.4 |

| Nov-17 | 36.9 | 9.6 | 53.9 | 42.9 |

| Dec-17 | 27.8 | 12.6 | 56 | 39.4 |

| Jan-18 | 32.9 | 25.1 | 54.2 | 44.1 |

| Feb-18 | 45 | 23.9 | 65.2 | 49.5 |

| Mar-18 | 42.6 | 20.7 | 62.8 | 51.3 |

| Apr-18 | 56.4 | 29.8 | 66.8 | 47.9 |

| May-18 | 52.6 | 36.4 | 63.4 | 33.6 |

| Jun-18 | 51.8 | 33.2 | 62.6 | 56.6 |

| Jul-18 | 62.9 | 36.3 | 59.7 | 50.6 |

| Aug-18 | 55 | 33.2 | 60.2 | 58.9 |

| Sep-18 | 39.6 | 19.6 | 49.6 | 44.2 |

| Oct-18 | 38.2 | 24.1 | 54.1 | 51.1 |

| Nov-18 | 39.3 | 21.9 | 59.5 | 58.6 |

| Dec-18 | 38 | 26.2 | 60.2 | 45 |

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

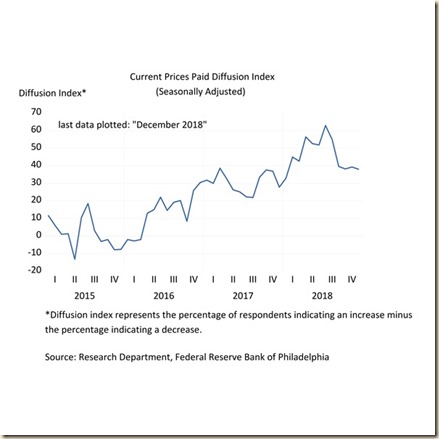

Chart IV-1 of the Business Outlook Survey of the Federal Reserve Bank of Philadelphia Outlook Survey provides the diffusion index of current prices paid or prices of inputs from 2006 to 2018. Recession dates are in shaded areas. In the middle of deep global contraction after IVQ2007, input prices continued to increase in speculative carry trades from central bank policy rates falling toward zero into commodities futures. The index peaked above 70 in the second half of 2008. Inflation of inputs moderated significantly during the shock of risk aversion in late 2008, even falling briefly into contraction territory below zero during several months in 2009 in the flight away from risk financial assets into US government securities (Cochrane and Zingales 2009) that unwound carry trades. Return of risk appetite induced carry trade with significant increase until return of risk aversion in the first round of the European sovereign debt crisis in Apr 2010. Carry trades returned during risk appetite in expectation that the European sovereign debt crisis was resolved. The various inflation waves originating in carry trades induced by zero interest rates with alternating episodes of risk aversion are mirrored in the prices of inputs after 2011, in particular after Aug 2012 with the announcement of the Outright Monetary Transactions Program of the European Central Bank (http://www.ecb.int/press/pr/date/2012/html/pr120906_1.en.html). Subsequent risk aversion and flows of capital away from commodities into stocks and high-yield bonds caused sharp decline in the index of prices paid followed by another recent rebound with marginal decline and new increase. The index falls, rebounds and falls again in the final segment but there are no episodes of contraction after 2009 with exception of minus 13.2 in May 2015, minus 3.1 in Sep 2015, minus 2.0 in Oct 2015, minus 7.8 in Nov 2015 and minus 7.6 in Dec 2015. The reading for the index in Jan 2016 is minus 2.0 and minus 2.8 for Feb 2016. The index is minus 2.0 in Mar 2016 and 13.0 in Apr 2016, increasing at 15.0 in May 2016 and 22.1 in Jun 2016. The index reached 14.6 in Jul 2016, 19.2 in Aug 2016 and 20.2 in Sep 2016. The index was 8.4 in Oct 2016 and 38.0 in Dec 2018.

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

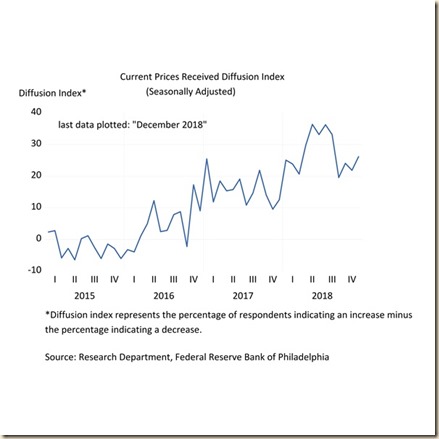

Chart IV-2 of the Federal Reserve Bank of Philadelphia Outlook Survey provides the diffusion index of current prices received from 2006 to 2018. The significant difference between the index of current prices paid in Chart IV-1 and the index of current prices received in Chart IV-2 is that increases in prices paid are significantly sharper than increases in prices received. There were several periods of negative readings of prices received from 2010 to 2016. Prices paid increased at 1.0 in Mar 2015 while prices received contracted at 5.8. There were several contractions of prices paid: 6.4 in May 2015 for prices received with faster contraction of 13.2 of prices paid; minus 3.1 for prices paid in Sep 2015 with minus 6.0 for prices received; and minus 2.0 for prices paid in Oct 2015 with minus 1.4 for prices received. The index of prices received fell to minus 2.8 in Nov 2015 with minus 7.8 for prices paid and to minus 6.0 in Dec 2015 with minus 7.6 for prices paid. The index of prices received fell to minus 3.9 in Feb 2016 with minus 2.8 for prices paid. The index of prices paid decreased at 2.0 in Mar 2016 with increase at 1.1 for prices received. Prices paid moved to 38.0 in Dec 2018 while prices received moved to 26.2. Prices received relative to prices paid deteriorate most of the time largely because of the carry trades from zero interest rates to commodity futures. Profit margins of business are compressed intermittently by fluctuations of commodity prices induced by unconventional monetary policy of zero interest rates, frustrating production, investment and hiring decisions of business, which is precisely the opposite outcome pursued by unconventional monetary policy.

Chart IV-2, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

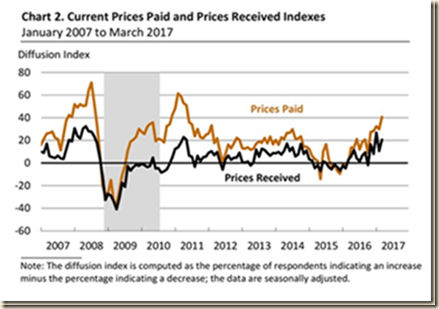

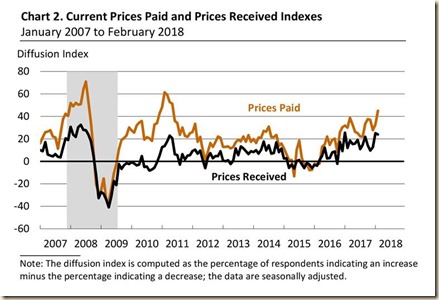

Chart IV-2A of the Federal Reserve Bank of Philadelphia shows current prices paid and current prices received from Jan 2007 to Mar 2017. Current prices paid jumped ahead of current prices received during the contraction from IVQ2007 to IIQ2009 through the carry trade from zero interest rates to exposures in commodity derivatives. There is the same behavior during most of the cyclical expansion after IIIQ2009. Rebalancing of financial investment portfolios away from commodities into equities explains the recent weakness of prices paid. There is a new ongoing carry trade into commodity futures.

Chart IV-2A, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Current Prices Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

Chart IV-2B of the Federal Reserve Bank of Philadelphia shows Current and Future Prices Received of the Business Outlook Survey from 2007 to Jun 2017. There is correlation in the direction of the indexes. The six-month forecast is typically above current prices received. There is upward trend in both indexes in the final segment with wide fluctuations.

Chart IV-2B, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Received and Future Prices Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

Chart IV-2C of the Federal Reserve Bank of Philadelphia shows Current and Future Prices Received of the Business Outlook Survey from 2007 to Jul 2017. There is correlation in the direction of the indexes. The six-month forecast is typically above current prices received. There is upward trend in both indexes in the final segment with wide fluctuations.

Chart IV-2c, Federal Reserve Bank of Philadelphia Business Outlook Survey Current and Future Prices Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

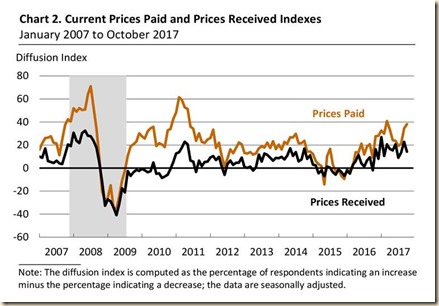

Chart IV-2D of the Federal Reserve Bank of Philadelphia shows Current Prices Paid and Current Prices Received of the Business Outlook Survey from 2007 to Sep 2017. Current prices paid are typically above prices received.

Chart IV-2d, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Current Prices Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

Chart IV-2DE of the Federal Reserve Bank of Philadelphia shows Current Prices Paid and Current Prices Received of the Business Outlook Survey from 2007 to Oct 2017. Current prices paid are typically above prices received.

Chart IV-2de, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

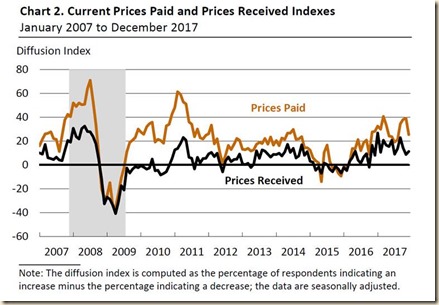

Chart IV-2DEf of the Federal Reserve Bank of Philadelphia shows current prices paid and received of the Business Outlook Survey from 2007 to Dec 2017.Current prices paid are mostly above current prices received. There is upward trend in both indexes in the final segment with wide fluctuations.

Chart IV-2DEf, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices and Future Prices Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

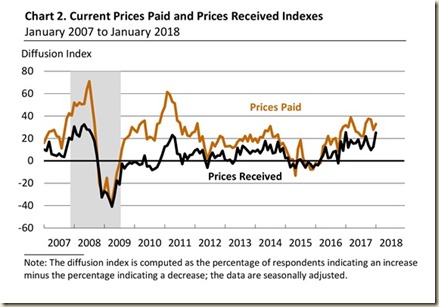

Chart IV-2Def1 of the Federal Reserve Bank of Philadelphia shows current prices paid and received of the Business Outlook Survey from 2007 to Jan 2018. There is correlation in the direction of the indexes. The six-month forecast is typically above current prices received. There is upward trend in both indexes in the final segment with wide fluctuations.

Chart IV-2dEf1, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices and Future Prices Paid Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

Chart IV-2Def2 of the Federal Reserve Bank of Philadelphia shows current prices paid and received of the Business Outlook Survey from 2007 to Feb 2018. There is correlation in the direction of the indexes. Prices paid are typically above prices received.

Chart IV-2df2, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Piad and Future Prices Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

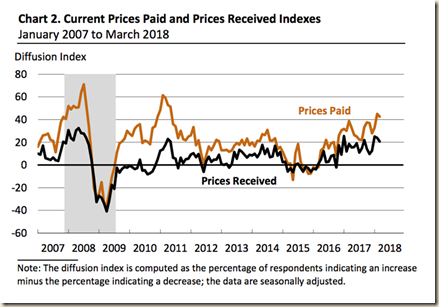

Chart IV-2DEF3 of the Federal Reserve Bank of Philadelphia Business Outlook survey provides current prices paid and received from 2007 to Mar 2018 with prices paid typically above prices received. The Business Outlook survey of the FRB of Philadelphia states: “Price increases for purchased inputs were reported by 44 percent of the manufacturers this month. The prices paid diffusion index fell 2 points to 42.6 but remains near last month’s reading, which was the highest since 2011 (see Chart 2). The current prices received index, reflecting the manufacturers own prices, declined 3 points to a reading of 20.7” (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos0318).

Chart IV-2dEf3, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

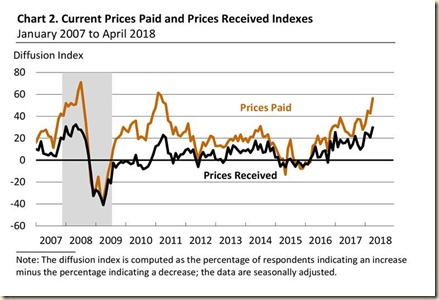

Chart IV-2DEF4 of the Federal Reserve Bank of Philadelphia Business Outlook survey provides current prices paid and received from 2007 to Apr 2018 with prices paid typically above prices received. The Business Outlook survey of the FRB of Philadelphia states: “Price increases for purchased inputs were reported by 59 percent of the manufacturers this month, up notably from 44 percent in March. The prices paid diffusion index increased 14 points to the highest reading since Mar 2011 (see Chart 2). The current prices received index, reflecting the manufacturers own prices, increased 9 points to a reading of 29.8, its highest reading since May 2008” (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos0418).

Chart IV-2dEf4, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

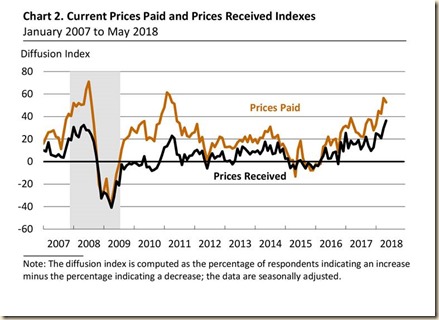

Chart IV-2DEF5 of the Federal Reserve Bank of Philadelphia Business Outlook survey provides current prices paid and received from 2007 to May 2018 with prices paid typically above prices received. The Business Outlook survey of the FRB of Philadelphia states: “Price increases for purchased inputs were reported by 55 percent of the manufacturers this month, down slightly from 59 percent in April. The prices paid diffusion index fell 4 points but remains at an elevated level (see Chart 2). The current prices received index, reflecting the manufacturers’ own prices, increased 7 points to a reading of 36.4, its second consecutive month of increase and highest reading since February 1989.” (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos0518).

Chart IV-2dEf5, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

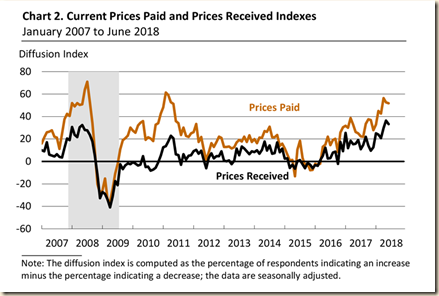

Chart IV-2DEF5 of the Federal Reserve Bank of Philadelphia Business Outlook survey provides current prices paid and received from 2007 to Jun 2018 with prices paid typically above prices received. The Business Outlook survey of the FRB of Philadelphia states: “The firms continued to report higher prices for both purchased inputs and their own manufactured goods, although the survey’s price indicators fell modestly from their May readings. Price increases for purchased inputs were reported by 54 percent of the manufacturers this month, but the prices paid diffusion index edged 1 point lower (see Chart 2). The current prices received index, reflecting the manufacturers’ own prices, decreased 3 points but remains at a high reading of 33.2. Nearly 34 percent of the firms reported higher prices for their manufactured goods.” (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos0618).

Chart IV-2dEf5, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

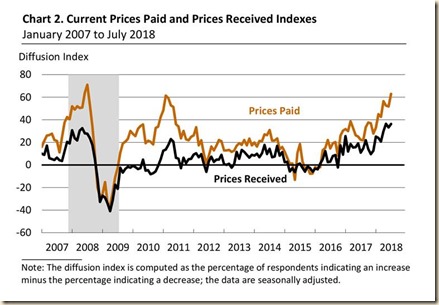

Chart IV-2DEF5 of the Federal Reserve Bank of Philadelphia Business Outlook survey provides current prices paid and received from 2007 to Jul 2018 with prices paid typically above prices received. The Business Outlook survey of the FRB of Philadelphia states: “The manufacturers continued to report higher prices for both purchased inputs and their own manufactured goods. Price increases for purchased inputs were reported by 63 percent of the manufacturers this month, up from 54 percent last month. The index has now risen 30 points since January (see Chart 2). The current prices received index, reflecting the manufacturers’ own prices, increased 3 points. Over 36 percent of the firms reported higher prices for their manufactured goods this month.” (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos0718).

Chart IV-2dEf6, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

The Business Outlook survey of the FRB of Philadelphia for Aug 2018 states (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos0818): “The survey’s current price measures moderated slightly but remain elevated, indicating that price increases for both purchased inputs and the firms’ own manufactured goods remain widespread. The prices paid index fell 8 points. Price increases for purchased inputs were reported by 63 percent of the manufacturers this month. Nearly 35 percent of the firms reported higher prices for their own manufactured goods this month, although the prices received index fell 3 points. In this month’s special questions, the firms were asked to forecast the changes in the prices of their own products and for U.S. consumers over the next four quarters. Regarding their own prices, the firms’ median forecast was for an increase of 3.0 percent, the same as when the same question was last asked in May. The firms expect their employee compensation costs (wages plus benefits on a per employee basis) to rise 3.0 percent over the next four quarters, the same as the previous forecast. When asked about the rate of inflation for U.S. consumers over the next year, the firms’ median forecast was 3.0 percent, slightly higher than the 2.5 percent projected in the previous survey. The firms’ forecast for the long-run (10-year average) inflation rate was also 3.0 percent.”

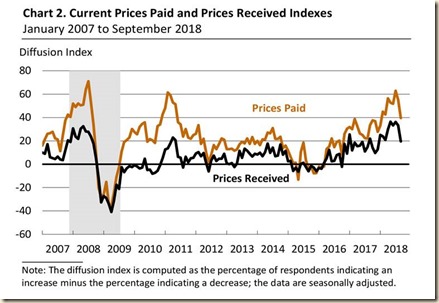

The Business Outlook survey of the FRB of Philadelphia for Sep 2018 states (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos0918): “The survey’s diffusion indexes for prices remained positive but decreased from their readings in August (see Chart 2). On the cost side, 44 percent of the firms reported increases in the prices paid for inputs, down from 63 percent in August, and the prices paid index decreased 15 points to 39.6. With respect to prices received for firms’ own manufactured goods, 25 percent of the firms reported higher prices compared with 35 percent last month. The prices received index decreased 14 points.”

Chart IV-2dEf6, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

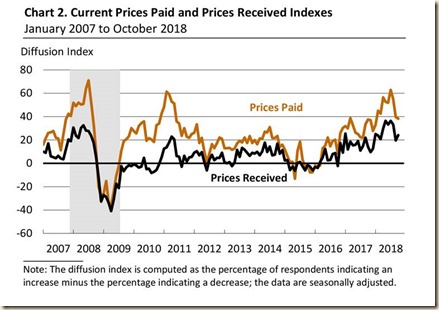

The Business Outlook survey of the FRB of Philadelphia for Oct 2018 states (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos1018): “The survey’s diffusion indexes for prices remained positive but lower than their readings for most of this year (see Chart 2). On the cost side, 42 percent of the firms reported increases in the prices paid for inputs, and the prices paid index, which had fallen 15 points last month, decreased 1 point to 38.2. With respect to prices received for firms’ own manufactured goods, 27 percent of the firms reported higher prices compared with 3 percent that reported decreases. The prices received index increased 5 points.”

Chart IV-2Oct18, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

The Business Outlook survey of the FRB of Philadelphia for Nov 2018 states (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos1118): “The survey’s diffusion indexes for prices remained positive but lower than their readings for most of this year (see Chart 2). With respect to prices received for firms’ own manufactured goods, 24 percent of the firms reported higher prices compared with 2 percent that reported decreases. The prices received index decreased 2 points. On the cost side, 41 percent of the firms reported increases in the prices paid for inputs. The prices paid index edged up 1 point but remains 24 points lower than its peak in July.”

Chart IV-2Nov18, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

The Business Outlook survey of the FRB of Philadelphia for Dec 2018 states (https://www.philadelphiafed.org/research-and-data/regional-economy/business-outlook-survey/2018/bos1218): “The survey’s diffusion indexes for prices remained positive, suggesting continued increases in firms’ input prices and the prices for their own manufactured goods. On the cost side, 42 percent of the firms reported increases in the prices paid for inputs. The prices paid index edged down 1 point and remains 25 points below its peak in July (see Chart 2). The prices received index increased 4 points to 26.2, its highest reading in four months, but 10 points below its peak in May.”

Chart IV-2Dec18, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid and Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

https://www.philadelphiafed.org/

II Rules, Discretionary Authorities and Slow Productivity Growth. The Bureau of Labor Statistics (BLS) of the Department of Labor provides the quarterly report on productivity and costs. The operational definition of productivity used by the BLS is (https://www.bls.gov/news.release/pdf/prod2.pdf 1): “Labor productivity, or output per hour, is calculated by dividing an index of real output by an index of hours worked of all persons, including employees, proprietors, and unpaid family workers.” The BLS has revised the estimates for productivity and unit costs. Table II-1 provides the third estimate for IIIQ2018 and revision of the estimates for IIQ2018 and IQ2018 together with data for nonfarm business sector productivity and unit labor costs in seasonally adjusted annual equivalent (SAAE) rate and the percentage change from the same quarter a year earlier. Reflecting increase in output at 4.1 percent and increase at 1.8 percent in hours worked, nonfarm business sector labor productivity changed at the SAAE rate of 2.3 percent in IIIQ2018, as shown in column 2 “IIIQ2018 SAEE.” The increase of labor productivity from IIIQ2017 to IIIQ2018 was 1.3 percent, reflecting increases in output of 3.7 percent and of hours worked of 2.3 percent, as shown in column 3 “IIIQ2018 YoY.” Hours worked decreased from 2.3 percent in IQ2018 at SAAE to 2.0 percent in IIQ2018 and decreased to 1.8 percent in IIIQ2018 while output growth increased from 2.6 percent in IQ2018 at SAAE to 5.0 percent in IIQ2018, decreasing to 4.1 percent in IIQ2018. The BLS defines unit labor costs as (https://www.bls.gov/news.release/pdf/prod2.pdf 1): “BLS calculates unit labor costs as the ratio of hourly compensation to labor productivity. Increases in hourly compensation tend to increase unit labor costs and increases in output per hour tend to reduce them.” Unit labor costs increased at the SAAE rate of 0.9 percent in IIIQ2018 and increased 0.9 percent in IIIQ2018 relative to IIIQ2017. Hourly compensation increased at the SAAE rate of 3.1 percent in IIIQ2018, which deflating by the estimated consumer price increase SAAE rate in IIIQ2018 results in increase of real hourly compensation at 1.1 percent. Real hourly compensation decreased 0.4 percent in IIIQ2018 relative to IIIQ2017.

Table II-1, US, Nonfarm Business Sector Productivity and Costs %

| IIIQ2018 SAAE | IIIQ2018 YOY | IIQ2018 SAAE | IIQ2018 YOY | IQ2018 SAAE | IQ2018 YOY | |

| Productivity | 2.3 | 1.3 | 3.0 | 1.3 | 0.3 | 1.0 |

| Output | 4.1 | 3.7 | 5.0 | 3.5 | 2.6 | 3.2 |

| Hours | 1.8 | 2.3 | 2.0 | 2.2 | 2.3 | 2.3 |

| Hourly | 3.1 | 2.2 | 0.0 | 2.7 | 3.8 | 3.0 |

| Real Hourly Comp. | 1.1 | -0.4 | -1.6 | 0.0 | 0.2 | 0.7 |

| Unit Labor Costs | 0.9 | 0.9 | -2.8 | 1.4 | 3.4 | 2.0 |

| Unit Nonlabor Payments | 1.8 | 4.3 | 12.7 | 4.2 | -0.3 | 1.7 |

| Implicit Price Deflator | 1.3 | 2.4 | 3.6 | 2.6 | 1.8 | 1.9 |

Notes: SAAE: seasonally adjusted annual equivalent; Comp.: compensation; YoY: Quarter on Same Quarter Year Earlier

The analysis by Kydland (http://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/2004/kydland-bio.html) and Prescott (http://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/2004/prescott-bio.html) (1977, 447-80, equation 5) uses the “expectation augmented” Phillips curve with the natural rate of unemployment of Friedman (1968) and Phelps (1968), which in the notation of Barro and Gordon (1983, 592, equation 1) is:

Ut = Unt – α(πt – πe) α > 0 (1)

Where Ut is the rate of unemployment at current time t, Unt is the natural rate of unemployment, πt is the current rate of inflation and πe is the expected rate of inflation by economic agents based on current information. Equation (1) expresses unemployment net of the natural rate of unemployment as a decreasing function of the gap between actual and expected rates of inflation. The system is completed by a social objective function, W, depending on inflation, π, and unemployment, U:

W = W(πt, Ut) (2)

The policymaker maximizes the preferences of the public, (2), subject to the constraint of the tradeoff of inflation and unemployment, (1). The total differential of W set equal to zero provides an indifference map in the Cartesian plane with ordered pairs (πt, Ut - Un) such that the consistent equilibrium is found at the tangency of an indifference curve and the Phillips curve in (1). The indifference curves are concave to the origin. The consistent policy is not optimal. Policymakers without discretionary powers following a rule of price stability would attain equilibrium with unemployment not higher than with the consistent policy. The optimal outcome is obtained by the rule of price stability, or zero inflation, and no more unemployment than under the consistent policy with nonzero inflation and the same unemployment. Taylor (1998LB) attributes the sustained boom of the US economy after the stagflation of the 1970s to following a monetary policy rule instead of discretion (see Taylor 1993, 1999). Professor John B. Taylor (2014Jul15, 2014Jun26) building on advanced research (Taylor 2007, 2008Nov, 2009, 2012FP, 2012Mar27, 2012Mar28, 2012JMCB, 2015, 2012 Oct 25; 2013Oct28, 2014 Jan01, 2014Jan3, 2014Jun26, 2014Jul15, 2015, 2016Dec7, 2016Dec20 http://www.johnbtaylor.com/) finds that a monetary policy rule would function best in promoting an environment of low inflation and strong economic growth with stability of financial markets. There is strong case for using rules instead of discretionary authorities in monetary policy (http://cmpassocregulationblog.blogspot.com/2017/01/rules-versus-discretionary-authorities.html and earlier http://cmpassocregulationblog.blogspot.com/2012/06/rules-versus-discretionary-authorities.html). It is not uncommon for effects of regulation differing from those intended by policy. Professors Edward C. Prescott and Lee E. Ohanian (2014Feb), writing on “US productivity growth has taken a dive,” on Feb 3, 2014, published in the Wall Street Journal (http://online.wsj.com/news/articles/SB10001424052702303942404579362462611843696?KEYWORDS=Prescott), argue that impressive productivity growth over the long-term constructed US prosperity and wellbeing. Prescott and Ohanian (2014Feb) measure US productivity growth at 2.5 percent per year since 1948. Average US productivity growth has been only 1.1 percent since 2011. Prescott and Ohanian (2014Feb) argue that living standards in the US increased at 28 percent in a decade but with current slow growth of productivity will only increase 12 percent by 2024. There may be collateral effects on productivity growth from policy design similar to those in Kydland and Prescott (1977). Professor Edward P. Lazear (2017Feb27), writing in the Wall Street Journal, on Feb 27, 2017 (https://www.wsj.com/articles/how-trump-can-hit-3-growthmaybe-1488239746), finds that productivity growth was 7 percent between 2009 and 2016 at annual equivalent 1 percent. Lazear measures productivity growth at 2.3 percent per year from 2001 to 2008. Herkenhoff, Ohanian and Prescott (2017) and Ohanian and Prescott (2017Dec) analyze how restriction of land use by states in the United States have been depressing economic activity. Professor Edmund S. Phelps (https://www.nobelprize.org/prizes/economic-sciences/2006/phelps/auto-biography/) argues that there is failed analysis that fiscal stimulus in the form of higher government expenditures and tax reductions caused the recovery of the economy to normal levels by 2017 (Phelps, Edmund S. 2018. The fantasy of fiscal stimulus. The Wall Street Journal Oct 29, 2018 https://www.wsj.com/articles/the-fantasy-of-fiscal-stimulus-1540852299?mod=searchresults&page=1&pos=2). The evidence analyzed by Phelps leads to the conclusion that countries with disorderly government finance grew less rapidly than those with sounder fiscal performance. Phelps concludes convincingly that “there is a strong relationship between the speed of recovery and a proxy of its dynamism—the long-term growth rate of total factor productivity from 1990 to 2007. Some countries have preexisting social institutions and cultural capital that enables them to bounce back from an economic downturn. Much credit of the U.S.’s relatively speedy recovery is owed to this country’s endemic culture of innovation and enterprise.” The Bureau of Labor Statistics important report on productivity and costs released Aug 15, 2018 (http://www.bls.gov/lpc/) and revised on Dec 6, 2018, supports the argument of decline of productivity growth in the US analyzed by Prescott and Ohanian (2014Feb), Lazear (2017Feb27) and Phelps (2018). Table II-2 provides the annual percentage changes of productivity, real hourly compensation and unit labor costs for the entire economic cycle from 2007 to 2017. The estimates incorporate the yearly revision of the US national accounts (https://www.bea.gov/scb/pdf/2017/08-August/0817-2017-annual-nipa-update.pdf) and the comprehensive revisions since 1929 (https://apps.bea.gov/national/pdf/2018-ComprehensiveUpdate-Results.pdf). The data confirm the argument of Prescott and Ohanian (2014Feb) and Lazear (2017Feb27): productivity increased cumulatively 4.8 percent from 2011 to 2017 at the average annual rate of 0.7 percent. The situation is direr by excluding growth of 1.3 percent in 2015, which leaves an average of 0.6 percent for 2011-2017. Average productivity growth for the entire economic cycle from 2007 to 2017 is only 1.3 percent. The argument by Prescott and Ohanian (2014Feb) is proper in choosing the tail of the business cycle because the increase in productivity in 2009 of 3.5 percent and 3.4 percent in 2010 consisted of reducing labor hours.

Table II-2, US, Revised Nonfarm Business Sector Productivity and Costs Annual Average, ∆% Annual Average

| 2017 ∆% | ||||||

| Productivity | 1.1 | |||||

| Real Hourly Compensation | 1.2 | |||||

| Unit Labor Costs | 2.2 | |||||

| 2016 ∆% | 2015 ∆% | 2014 ∆% | 2013 ∆% | 2012 ∆% | 2011 ∆% | |

| Productivity | 0.1 | 1.3 | 0.8 | 0.5 | 0.9 | 0.0 |

| Real Hourly Compensation | -0.2 | 2.9 | 1.1 | -0.2 | 0.5 | -0.9 |

| Unit Labor Costs | 0.9 | 1.8 | 2.0 | 0.8 | 1.8 | 2.2 |

| 2010 ∆% | 2009 ∆% | 2008 ∆% | 2007∆% | |

| Productivity | 3.4 | 3.5 | 1.1 | 1.7 |

| Real Hourly Compensation | 0.2 | 1.3 | -1.0 | 1.5 |

| Unit Labor Costs | -1.5 | -2.5 | 1.7 | 2.6 |

Source: US Bureau of Labor Statistics

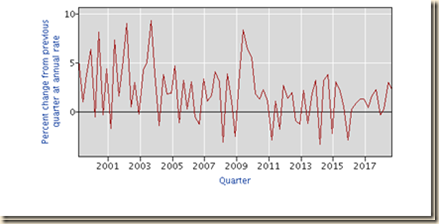

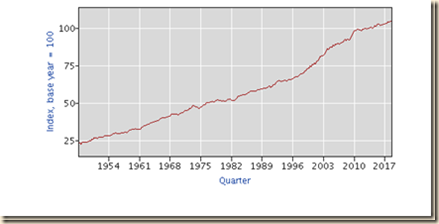

Productivity jumped in the recovery after the recession from Mar IQ2001 to Nov IVQ2001 (http://www.nber.org/cycles.html) Table II-3 provides quarter on quarter and annual percentage changes in nonfarm business output per hour, or productivity, from 1999 to 2018. The annual average jumped from 2.7 percent in 2001 to 4.3 percent in 2002. Nonfarm business productivity increased at the SAAE rate of 9.1 percent in the first quarter after the recession in IQ2002. Productivity increases decline later in the expansion period. Productivity increases were mediocre during the recession from Dec IVQ2007 to Jun IIIQ2009 (http://www.nber.org/cycles.html) and increased during the first phase of expansion from IIQ2009 to IQ2010, trended lower and collapsed in 2011 and 2012 with sporadic jumps and declines. Productivity increased at 3.2 percent in IVQ2013 and contracted at 3.3 percent in IQ2014. Productivity increased at 3.2 percent in IIQ2014 and at 3.8 percent in IIIQ2014. Productivity contracted at 2.2 percent in IVQ2014 and increased at 3.1 percent in IQ2015. Productivity grew at 2.1 percent in IIQ2015 and increased at 0.5 percent in IIIQ2015. Productivity contracted at 2.9 percent in IVQ2015 and increased at 0.3 percent in IQ2016. Productivity increased at 0.9 percent in IIQ2016 and expanded at 1.3 percent in IIIQ2016. Productivity grew at 1.3 percent in IVQ2016 and increased at 0.4 percent in IQ2017. Productivity increased at 1.6 percent in IIQ2017 and increased at 2.3 percent in IIIQ2017. Productivity decreased at 0.3 percent in IVQ2017 and increased at 0.3 percent in IQ2018. Productivity increased at 3.0 percent in IIQ2018 and increased at 2.3 percent in IIIQ2018.

Table II-3, US, Nonfarm Business Output per Hour, Percent Change from Prior Quarter at Annual Rate, 1999-2018

| Year | Qtr1 | Qtr2 | Qtr3 | Qtr4 | Annual |

| 1999 | 5.3 | 1.0 | 3.8 | 6.4 | 3.8 |

| 2000 | -0.5 | 8.2 | -0.3 | 4.4 | 3.3 |

| 2001 | -1.7 | 7.4 | 1.6 | 5.3 | 2.7 |

| 2002 | 9.1 | 0.5 | 3.0 | -0.2 | 4.3 |

| 2003 | 4.3 | 5.1 | 9.4 | 3.9 | 3.8 |

| 2004 | -1.4 | 3.8 | 1.8 | 1.9 | 2.9 |

| 2005 | 4.7 | -1.1 | 3.2 | 0.3 | 2.2 |

| 2006 | 3.1 | -0.5 | -1.3 | 3.4 | 1.1 |

| 2007 | 1.1 | 1.7 | 4.1 | 3.1 | 1.7 |

| 2008 | -3.1 | 3.9 | 1.0 | -2.5 | 1.1 |

| 2009 | 4.0 | 8.4 | 6.4 | 5.6 | 3.5 |

| 2010 | 1.8 | 1.3 | 2.3 | 1.1 | 3.4 |

| 2011 | -2.9 | 1.1 | -1.8 | 2.7 | 0.0 |

| 2012 | 1.4 | 2.0 | -0.9 | -1.3 | 0.9 |

| 2013 | 2.2 | -1.2 | 1.9 | 3.2 | 0.5 |

| 2014 | -3.3 | 3.2 | 3.8 | -2.2 | 0.8 |

| 2015 | 3.1 | 2.1 | 0.5 | -2.9 | 1.3 |

| 2016 | 0.3 | 0.9 | 1.3 | 1.3 | 0.1 |

| 2017 | 0.4 | 1.6 | 2.3 | -0.3 | 1.1 |

| 2018 | 0.3 | 3.0 | 2.3 |

Source: US Bureau of Labor Statistics: http://www.bls.gov/lpc/

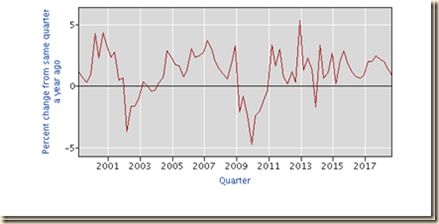

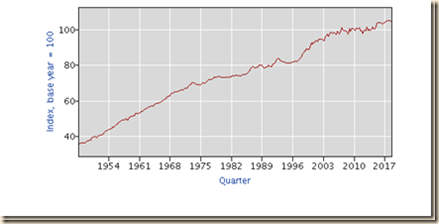

Chart II-1, US, Nonfarm Business Output per Hour, Percent Change from Prior Quarter at Annual Rate, 1999-2018

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/

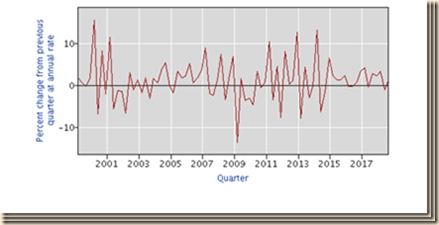

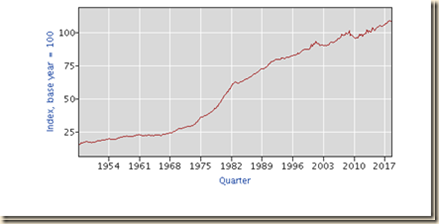

Percentage changes from prior quarter at SAAE rates and annual average percentage changes of nonfarm business unit labor costs are provided in Table II-4. Unit labor costs fell during the contractions with continuing negative percentage changes in the early phases of the recovery. Weak labor markets partly explain the decline in unit labor costs. As the economy moves toward full employment, labor markets tighten with increase in unit labor costs. The expansion beginning in IIIQ2009 has been characterized by high unemployment and underemployment. Table II-4 shows continuing subdued increases in unit labor costs in 2011 but with increase at 8.1 percent in IQ2012 followed by increase at 0.3 percent in IIQ2012, increase at 1.2 percent in IIIQ2012 and increase at 12.6 percent in IVQ2012. Unit labor costs decreased at 7.8 percent in IQ2013 and increased at 4.4 percent in IIQ2013. Unit labor costs decreased at 2.9 percent in IIIQ2013 and decreased at 0.1 percent in IVQ2013. Unit labor costs increased at 13.1 percent in IQ2014 and at minus 6.2 percent in IIQ2014. Unit labor costs decreased at 1.5 percent in IIIQ2014 and increased at 6.5 percent in IVQ2014. Unit labor costs increased at 2.3 percent in IQ2015 and increased at 1.4 percent in IIQ2015. Unit labor costs increased at 1.4 percent in IIIQ2015 and increased at 2.3 percent in IVQ2015. Unit labor costs decreased at 0.2 percent in IQ2016 and decreased at 0.2 percent in IIQ2016. Unit labor costs increased at 0.9 percent in IIIQ2016 and increased at 3.4 percent in IVQ2016. Unit labor costs increased at 4.2 percent in IQ2017 and decreased at 0.3 percent in IIQ2017. United labor costs increased at 2.8 percent in IIIQ2017 and increased at 2.3 percent in IVQ2017. Unit labor costs increased at 3.4 percent in IQ2018 and decreased at 2.8 percent in IIQ2018. Unit labor costs increased at 0.9 percent in IIIQ2018.

Table II-4, US, Nonfarm Business Unit Labor Costs, Percent Change from Prior Quarter at Annual Rate 1999-2018

| Year | Qtr1 | Qtr2 | Qtr3 | Qtr4 | Annual |

| 1999 | 1.8 | 0.6 | -0.2 | 1.9 | 0.8 |

| 2000 | 15.6 | -6.8 | 8.3 | -2.1 | 3.6 |

| 2001 | 11.4 | -5.5 | -1.1 | -1.4 | 1.6 |

| 2002 | -6.5 | 3.0 | -1.0 | 1.3 | -1.9 |

| 2003 | -1.7 | 1.9 | -3.0 | 1.7 | -0.1 |

| 2004 | 0.7 | 4.0 | 5.4 | -0.2 | 1.6 |

| 2005 | -1.6 | 3.3 | 1.8 | 2.2 | 1.4 |

| 2006 | 5.2 | 0.6 | 1.9 | 3.7 | 2.7 |

| 2007 | 8.9 | -1.9 | -2.3 | 1.3 | 2.6 |

| 2008 | 7.4 | -3.4 | 2.6 | 7.0 | 1.7 |

| 2009 | -13.4 | 1.7 | -3.6 | -3.1 | -2.5 |

| 2010 | -4.5 | 3.3 | -0.5 | 0.8 | -1.5 |

| 2011 | 10.5 | -3.3 | 4.5 | -7.6 | 2.2 |

| 2012 | 8.1 | 0.3 | 1.2 | 12.6 | 1.8 |

| 2013 | -7.8 | 4.4 | -2.9 | -0.1 | 0.8 |

| 2014 | 13.1 | -6.2 | -1.5 | 6.5 | 2.0 |

| 2015 | 2.3 | 1.4 | 1.4 | 2.3 | 1.8 |

| 2016 | -0.2 | -0.2 | 0.9 | 3.4 | 0.9 |

| 2017 | 4.2 | -0.3 | 2.8 | 2.3 | 2.2 |

| 2018 | 3.4 | -2.8 | 0.9 |

Source: US Bureau of Labor Statistics: http://www.bls.gov/lpc/

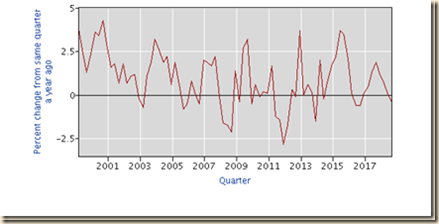

Chart II-2 provides change of unit labor costs at SAAE from 1999 to 2018. There are multiple oscillations recently with negative changes alternating with positive changes.

Chart II-2, US, Nonfarm Business Unit Labor Costs, Percent Change from Prior Quarter at Annual Rate 1999-2018

Source: US Bureau of Labor Statistics: http://www.bls.gov/lpc/

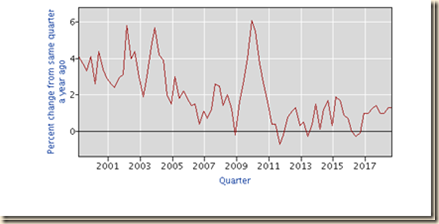

Table II-5 provides percentage change from prior quarter at annual rates for nonfarm business real hourly worker compensation. The expansion after the contraction of 2001 was followed by strong recovery of real hourly compensation. Real hourly compensation increased at the rate of 2.8 percent in IQ2011 but fell at annual rates of 6.6 percent in IIQ2011 and 6.8 percent in IVQ2011. Real hourly compensation increased at 7.1 percent in IQ2012, increasing at 1.4 percent in IIQ2012, declining at 1.6 percent in IIIQ2012 and increasing at 8.3 percent in IVQ2012. Real hourly compensation fell at 0.9 percent in 2011 and increased at 0.5 percent in 2012. Real hourly compensation fell at 7.4 percent in IQ2013 and increased at 3.6 percent in IIQ2013, falling at 3.2 percent in IIIQ2013. Real hourly compensation increased at 1.5 percent in IVQ2013 and at 6.6 percent in IQ2014. Real hourly compensation decreased at 5.2 percent in IIQ2014. Real hourly compensation increased at 1.1 percent in IIIQ2014. The annual rate of increase of real hourly compensation for 2013 is minus 0.2 percent. Real hourly compensation increased at 5.1 percent in IVQ2014. The annual rate of increase of real hourly compensation in 2014 is 1.1 percent. Real hourly compensation increased at 8.2 percent in IQ2015 and increased at 0.8 percent in IIQ2015. Real hourly compensation increased at 0.3 percent in IIIQ2015 and decreased at 0.8 percent in IVQ2015. Real hourly compensation increased at 2.9 percent in 2015. Real hourly compensation increased at 0.1 percent in IQ2016 and decreased at 2.0 percent in IIQ2016. Real hourly compensation increased at 0.3 percent in IIIQ2016 and increased at 1.9 percent in IVQ2016. Real hourly compensation decreased 0.2 percent in 2016. Real hourly compensation increased at 1.6 percent in IQ2017 and increased at 1.2 percent in IIQ2017. Real hourly compensation increased at 2.9 percent in IIIQ2017. Real hourly compensation decreased at 1.3 percent in IVQ2017. Real hourly compensation increased 1.2 percent in 2017. Real hourly compensation increased at 0.2 percent in IQ2018 and decreased at 1.6 percent in IIQ2018. Real hourly compensation increased at 1.1 percent in IIIQ2018.

Table II-5, Nonfarm Business Real Hourly Compensation, Percent Change from Prior Quarter at Annual Rate, 1999, 2018

| Year | Qtr1 | Qtr2 | Qtr3 | Qtr4 | Annual |

| 1999 | 5.8 | -1.4 | 0.5 | 5.1 | 2.5 |

| 2000 | 10.5 | -2.2 | 4.1 | -0.5 | 3.5 |

| 2001 | 5.4 | -1.5 | -0.6 | 4.2 | 1.5 |

| 2002 | 0.6 | 0.3 | -0.2 | -1.2 | 0.7 |

| 2003 | -1.6 | 7.7 | 3.0 | 4.0 | 1.4 |

| 2004 | -4.0 | 4.7 | 4.6 | -2.6 | 1.8 |

| 2005 | 1.0 | -0.6 | -1.0 | -1.2 | 0.3 |

| 2006 | 6.2 | -3.5 | -3.0 | 9.0 | 0.6 |

| 2007 | 5.9 | -4.5 | -0.9 | -0.5 | 1.5 |

| 2008 | -0.4 | -4.7 | -2.5 | 14.4 | -1.0 |

| 2009 | -7.4 | 7.9 | -0.8 | -0.8 | 1.3 |

| 2010 | -3.4 | 4.8 | 0.6 | -1.4 | 0.2 |