Tapering Quantitative Easing Policy and Peaking Valuations of Risk Financial Assets, Mediocre United States Economic Growth, Stagnating Real Disposable Income, Financial Repression, Swelling Undistributed Corporate Profits, United States Housing Collapse, World Economic Slowdown and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013

Executive Summary

I Mediocre and Decelerating United States Economic Growth

IA Mediocre and Decelerating United States Economic Growth

IA1 Contracting Real Private Fixed Investment

IA2 Swelling Undistributed Corporate Profits

II Stagnating Real Disposable Income and Consumption Expenditures

IIA1 Stagnating Real Disposable Income and Consumption Expenditures

IIA2 Financial Repression

IIB United States Housing Collapse

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

Executive Summary

Executive Summary Contents

ESI Tapering Quantitative Easing and Global Financial and Economic Risk

ESII Mediocre and Decelerating United States Economic Growth

ESIII Contracting Real Private Fixed Investment.

ESIV Swelling Undistributed Corporate Profits

ESV Contracting Corporate Profits.

ESVI Stagnating Real Disposable Income.

ESVII Financial Repression.

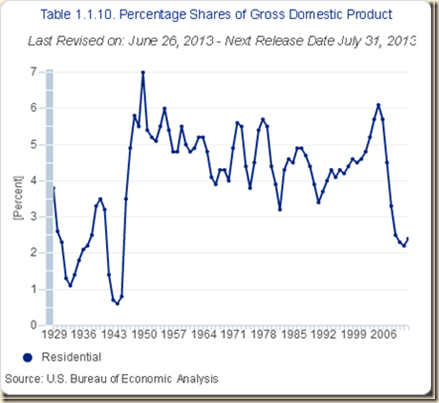

ESVIII United States Housing Collapse

ESI Tapering Quantitative Easing and Global Financial and Economic Risk. The International Monetary Fund (IMF) provides an international safety net for prevention and resolution of international financial crises. The IMF’s Financial Sector Assessment Program (FSAP) provides analysis of the economic and financial sectors of countries (see Pelaez and Pelaez, International Financial Architecture (2005), 101-62, Globalization and the State, Vol. II (2008), 114-23). Relating economic and financial sectors is a challenging task for both theory and measurement. The IMF (2012WEOOct) provides surveillance of the world economy with its Global Economic Outlook (WEO) (http://www.imf.org/external/pubs/ft/weo/2012/02/index.htm), of the world financial system with its Global Financial Stability Report (GFSR) (IMF 2012GFSROct) (http://www.imf.org/external/pubs/ft/gfsr/2012/02/index.htm) and of fiscal affairs with the Fiscal Monitor (IMF 2012FMOct) (http://www.imf.org/external/pubs/ft/fm/2012/02/fmindex.htm). There appears to be a moment of transition in global economic and financial variables that may prove of difficult analysis and measurement. It is useful to consider a summary of global economic and financial risks, which are analyzed in detail in the comments of this blog in Section VI Valuation of Risk Financial Assets, Table VI-4.

Economic risks include the following:

- China’s Economic Growth. China is lowering its growth target to 7.5 percent per year. China’s GDP growth decelerated significantly from annual equivalent 9.9 percent in IIQ2011 to 7.4 percent in IVQ2011 and 6.6 percent in IQ2012, rebounding to 7.8 percent in IIQ2012, 8.7 percent in IIIQ2012 and 8.2 percent in IVQ2012. Annual equivalent growth in IQ2013 fell to 6.6 percent. (See Subsection VC and earlier at http://cmpassocregulationblog.blogspot.com/2013/01/recovery-without-hiring-world-inflation.html and earlier at http://cmpassocregulationblog.blogspot.com/2012/10/world-inflation-waves-stagnating-united_21.html).

- United States Economic Growth, Labor Markets and Budget/Debt Quagmire. The US is growing slowly with 27.8 million in job stress, fewer 10 million full-time jobs, high youth unemployment, historically low hiring and declining real wages.

- Economic Growth and Labor Markets in Advanced Economies. Advanced economies are growing slowly. There is still high unemployment in advanced economies.

- World Inflation Waves. Inflation continues in repetitive waves globally (http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and.html).

A list of financial uncertainties includes:

- Euro Area Survival Risk. The resilience of the euro to fiscal and financial doubts on larger member countries is still an unknown risk.

- Foreign Exchange Wars. Exchange rate struggles continue as zero interest rates in advanced economies induce devaluation of their currencies.

- Valuation of Risk Financial Assets. Valuations of risk financial assets have reached extremely high levels in markets with lower volumes.

- Duration Trap of the Zero Bound. The yield of the US 10-year Treasury rose from 2.031 percent on Mar 9, 2012, to 2.294 percent on Mar 16, 2012. Considering a 10-year Treasury with coupon of 2.625 percent and maturity in exactly 10 years, the price would fall from 105.3512 corresponding to yield of 2.031 percent to 102.9428 corresponding to yield of 2.294 percent, for loss in a week of 2.3 percent but far more in a position with leverage of 10:1. Min Zeng, writing on “Treasurys fall, ending brutal quarter,” published on Mar 30, 2012, in the Wall Street Journal (http://professional.wsj.com/article/SB10001424052702303816504577313400029412564.html?mod=WSJ_hps_sections_markets), informs that Treasury bonds maturing in more than 20 years lost 5.52 percent in the first quarter of 2012.

- Credibility and Commitment of Central Bank Policy. There is a credibility issue of the commitment of monetary policy (Sargent and Silber 2012Mar20).

- Carry Trades. Commodity prices driven by zero interest rates have resumed their increasing path with fluctuations caused by intermittent risk aversion

The major reason and channel of transmission of unconventional monetary policy is through expectations of inflation. Fisher (1930) provided theoretical and historical relation of interest rates and inflation. Let in be the nominal interest rate, ir the real or inflation-adjusted interest rate and πe the expectation of inflation in the time term of the interest rate, which are all expressed as proportions. The following expression provides the relation of real and nominal interest rates and the expectation of inflation:

(1 + ir) = (1 + in)/(1 + πe) (1)

That is, the real interest rate equals the nominal interest rate discounted by the expectation of inflation in time term of the interest rate. Fisher (1933) analyzed the devastating effect of deflation on debts. Nominal debt contracts remained at original principal interest but net worth and income of debtors contracted during deflation. Real interest rates increase during declining inflation. For example, if the interest rate is 3 percent and prices decline 0.2 percent, equation (1) calculates the real interest rate as:

(1 +0.03)/(1 – 0.02) = 1.03/(0.998) = 1.032

That is, the real rate of interest is (1.032 – 1) 100 or 3.2 percent. If inflation were 2 percent, the real rate of interest would be 0.98 percent, or about 1.0 percent {[(1.03/1.02) -1]100 = 0.98%}.

The yield of the one-year Treasury security was quoted in the Wall Street Journal at 0.114 percent on Fri May 17, 2013 (http://online.wsj.com/mdc/page/marketsdata.html?mod=WSJ_topnav_marketdata_main). The expected rate of inflation πe in the next twelve months is not observed. Assume that it would be equal to the rate of inflation in the past twelve months estimated by the Bureau of Economic Analysis (BLS) at 1.1 percent (http://www.bls.gov/cpi/). The real rate of interest would be obtained as follows:

(1 + 0.00114)/(1 + 0.011) = (1 + rr) = 0.9902

That is, ir is equal to 1 – 0.9902 or minus 0.98 percent. Investing in a one-year Treasury security results in a loss of 0.98 percent relative to inflation. The objective of unconventional monetary policy of zero interest rates is to induce consumption and investment because of the loss to inflation of riskless financial assets. Policy would be truly irresponsible if it intended to increase inflationary expectations or πe. The result could be the same rate of unemployment with higher inflation (Kydland and Prescott 1977).

Current focus is on “tapering” quantitative easing by the Federal Open Market Committee (FOMC). There is sharp distinction between the two measures of unconventional monetary policy: (1) fixing of the overnight rate of fed funds at 0 to ¼ percent; and (2) outright purchase of Treasury and agency securities and mortgage-backed securities for the balance sheet of the Federal Reserve. Market are overreacting to the so-called “tapering” of outright purchases of $85 billion of securities per month for the balance sheet of the Fed. What is truly important is the fixing of the overnight fed funds at 0 to ¼ percent for which there is no end in sight as evident in the FOMC statement for Jun 19, 2013 (http://www.federalreserve.gov/newsevents/press/monetary/20130619a.htm):

“To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent” (emphasis added).

The key policy is maintaining fed funds rate between 0 and ¼ percent. An increase in fed funds rates could cause flight out of risk financial markets worldwide. There is no exit from this policy without major financial market repercussions. Indefinite financial repression induces carry trades with high leverage, risks and illiquidity.

A competing event is the high level of valuations of risk financial assets (http://cmpassocregulationblog.blogspot.com/2013/01/peaking-valuation-of-risk-financial.html). Matt Jarzemsky, writing on Dow industrials set record,” on Mar 5, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324156204578275560657416332.html), analyzes that the DJIA broke the closing high of 14,164.53 set on Oct 9, 2007, and subsequently also broke the intraday high of 14,198.10 reached on Oct 11, 2007. The DJIA closed at 14,909.60

on Fri Jun 28, 2013, which is higher by 5.3 percent than the value of 14,164.53 reached on Oct 9, 2007 and higher by 5.0 percent than the value of 14,198.10 reached on Oct 11, 2007. Values of risk financial are approaching or exceeding historical highs

Jon Hilsenrath, writing on “Jobs upturn isn’t enough to satisfy Fed,” on Mar 8, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324582804578348293647760204.html), finds that much stronger labor market conditions are required for the Fed to end quantitative easing. Unconventional monetary policy with zero interest rates and quantitative easing is quite difficult to unwind because of the adverse effects of raising interest rates on valuations of risk financial assets and home prices, including the very own valuation of the securities held outright in the Fed balance sheet. Gradual unwinding of 1 percent fed funds rates from Jun 2003 to Jun 2004 by seventeen consecutive increases of 25 percentage points from Jun 2004 to Jun 2006 to reach 5.25 percent caused default of subprime mortgages and adjustable-rate mortgages linked to the overnight fed funds rate. The zero interest rate has penalized liquidity and increased risks by inducing carry trades from zero interest rates to speculative positions in risk financial assets. There is no exit from zero interest rates without provoking another financial crash.

The carry trade from zero interest rates to leveraged positions in risk financial assets had proved strongest for commodity exposures but US equities have regained leadership. The DJIA has increased 53.9 percent since the trough of the sovereign debt crisis in Europe on Jul 2, 2010 to Jun 28, 2013; S&P 500 has gained 57.1 percent; and DAX 40.4 percent. Before the current round of risk aversion, almost all assets in the column “∆% Trough to 6/28/13” had double digit gains relative to the trough around Jul 2, 2010 followed by negative performance but now some valuations of equity indexes show varying behavior: China’s Shanghai Composite is 16.9 percent below the trough; Japan’s Nikkei Average is 55.0 percent above the trough; DJ Asia Pacific TSM is 16.4 percent above the trough; Dow Global is 23.9 percent above the trough; STOXX 50 of 50 blue-chip European equities (http://www.stoxx.com/indices/index_information.html?symbol=sx5E) is 13.4 percent above the trough; and NYSE Financial Index is 33.1 percent above the trough. DJ UBS Commodities is 0.4 percent above the trough. DAX index of German equities (http://www.bloomberg.com/quote/DAX:IND) is 40.4 percent above the trough. Japan’s Nikkei Average is 55.0 percent above the trough on Aug 31, 2010 and 20.0 percent above the peak on Apr 5, 2010. The Nikkei Average closed at 13,677.32 on Fri Jun 28, 2013 (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata), which is 33.4 percent higher than 10,254.43 on Mar 11, 2011, on the date of the Tōhoku or Great East Japan Earthquake/tsunami. Global risk aversion erased the earlier gains of the Nikkei. The dollar depreciated by 9.1 percent relative to the euro and even higher before the new bout of sovereign risk issues in Europe. The column “∆% week to 6/28/13” in Table VI-4 shows decrease of 4.5 percent in the week for China’s Shanghai Composite. DJ Asia Pacific increased 1.8 percent. NYSE Financial increased 1.7 percent in the week. DJ UBS Commodities decreased 2.2 percent. Dow Global increased 1.1 percent in the week of Jun 28, 2013. The DJIA increased 0.7 percent and S&P 500 increased 0.9 percent. DAX of Germany increased 2.2 percent. STOXX 50 increased 2.1 percent. The USD appreciated 0.9 percent. There are still high uncertainties on European sovereign risks and banking soundness, US and world growth slowdown and China’s growth tradeoffs. Sovereign problems in the “periphery” of Europe and fears of slower growth in Asia and the US cause risk aversion with trading caution instead of more aggressive risk exposures. There is a fundamental change in Table VI-4 from the relatively upward trend with oscillations since the sovereign risk event of Apr-Jul 2010. Performance is best assessed in the column “∆% Peak to 6/28/13” that provides the percentage change from the peak in Apr 2010 before the sovereign risk event to Jun 28, 2013. Most risk financial assets had gained not only relative to the trough as shown in column “∆% Trough to 6/28/13” but also relative to the peak in column “∆% Peak to 6/28/13.” There are now several equity indexes above the peak in Table VI-4: DJIA 33.1 percent, S&P 500 31.9 percent, DAX 25.7 percent, Dow Global 1.1 percent, DJ Asia Pacific 1.9 percent, NYSE Financial Index (http://www.nyse.com/about/listed/nykid.shtml) 6.0 percent and Nikkei Average 20.0 percent. There are only two equity indexes below the peak: Shanghai Composite by 37.5 percent and STOXX 50 by 3.9 percent. DJ UBS Commodities Index is now 14.2 percent below the peak. The US dollar strengthened 14.0 percent relative to the peak. The factors of risk aversion have adversely affected the performance of risk financial assets. The performance relative to the peak in Apr 2010 is more important than the performance relative to the trough around early Jul 2010 because improvement could signal that conditions have returned to normal levels before European sovereign doubts in Apr 2010. Alexandra Scaggs, writing on “Tepid profits, roaring stocks,” on May 16, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887323398204578487460105747412.html), analyzes stabilization of earnings growth: 70 percent of 458 reporting companies in the S&P 500 stock index reported earnings above forecasts but sales fell 0.2 percent relative to forecasts of increase of 0.5 percent. Paul Vigna, writing on “Earnings are a margin story but for how long,” on May 17, 2013, published in the Wall Street Journal (http://blogs.wsj.com/moneybeat/2013/05/17/earnings-are-a-margin-story-but-for-how-long/), analyzes that corporate profits increase with stagnating sales while companies manage costs tightly. More than 90 percent of S&P components reported moderate increase of earnings of 3.7 percent in IQ2013 relative to IQ2012 with decline of sales of 0.2 percent. Earnings and sales have been in declining trend. In IVQ2009, growth of earnings reached 104 percent and sales jumped 13 percent. Net margins reached 8.92 percent in IQ2013, which is almost the same at 8.95 percent in IIIQ2006. Operating margins are 9.58 percent. There is concern by market participants that reversion of margins to the mean could exert pressure on earnings unless there is more accelerated growth of sales. Vigna (op. cit.) finds sales growth limited by weak economic growth. Kate Linebaugh, writing on “Falling revenue dings stocks,” on Oct 20, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390444592704578066933466076070.html?mod=WSJPRO_hpp_LEFTTopStories), identifies a key financial vulnerability: falling revenues across markets for United States reporting companies. Global economic slowdown is reducing corporate sales and squeezing corporate strategies. Linebaugh quotes data from Thomson Reuters that 100 companies of the S&P 500 index have reported declining revenue only 1 percent higher in Jun-Sep 2012 relative to Jun-Sep 2011 but about 60 percent of the companies are reporting lower sales than expected by analysts with expectation that revenue for the S&P 500 will be lower in Jun-Sep 2012 for the entities represented in the index. Results of US companies are likely repeated worldwide. Future company cash flows derive from investment projects. Real private fixed investment fell from $2,111.5 billion in IVQ2007 to $1920.4 billion in IQ2013 or by 9.1 percent compared with growth of 24.1 percent of gross private domestic investment from IQ1980 to IVQ1985 (Section IA1). Undistributed profits of US corporations swelled 306.9 percent from $118.0 billion IQ2007 to $480.2 billion in IQ2013 and changed signs from minus $22.1 billion in IVQ2007 (Section IA2). In IQ2013, corporate profits with inventory valuation and capital consumption adjustment fell $27.8 billion relative to IVQ2012 (http://www.bea.gov/newsreleases/national/gdp/2013/pdf/gdp1q13_3rd.pdf), from $2013.0 billion to $1985.2 billion at the quarterly rate of minus 1.4 percent. Uncertainty originating in fiscal, regulatory and monetary policy causes wide swings in expectations and decisions by the private sector with adverse effects on investment, real economic activity and employment. The investment decision of US business is fractured.

It may be quite painful to exit QE→∞ or use of the balance sheet of the central together with zero interest rates forever. The basic valuation equation that is also used in capital budgeting postulates that the value of stocks or of an investment project is given by:

Where Rτ is expected revenue in the time horizon from τ =1 to T; Cτ denotes costs; and ρ is an appropriate rate of discount. In words, the value today of a stock or investment project is the net revenue, or revenue less costs, in the investment period from τ =1 to T discounted to the present by an appropriate rate of discount. In the current weak economy, revenues have been increasing more slowly than anticipated in investment plans. An increase in interest rates would affect discount rates used in calculations of present value, resulting in frustration of investment decisions. If V represents value of the stock or investment project, as ρ → ∞, meaning that interest rates increase without bound, then V → 0, or

declines. Equally, decline in expected revenue from the stock or project, Rτ, causes decline in valuation. An intriguing issue is the difference in performance of valuations of risk financial assets and economic growth and employment. Paul A. Samuelson (http://www.nobelprize.org/nobel_prizes/economics/laureates/1970/samuelson-bio.html) popularized the view of the elusive relation between stock markets and economic activity in an often-quoted phrase “the stock market has predicted nine of the last five recessions.” In the presence of zero interest rates forever, valuations of risk financial assets are likely to differ from the performance of the overall economy. The interrelations of financial and economic variables prove difficult to analyze and measure.

Table VI-4, Stock Indexes, Commodities, Dollar and 10-Year Treasury

| Peak | Trough | ∆% to Trough | ∆% Peak to 6/28/ /13 | ∆% Week 6/28/13 | ∆% Trough to 6/28/ 13 | |

| DJIA | 4/26/ | 7/2/10 | -13.6 | 33.1 | 0.7 | 53.9 |

| S&P 500 | 4/23/ | 7/20/ | -16.0 | 31.9 | 0.9 | 57.1 |

| NYSE Finance | 4/15/ | 7/2/10 | -20.3 | 6.0 | 1.7 | 33.1 |

| Dow Global | 4/15/ | 7/2/10 | -18.4 | 1.1 | 1.1 | 23.9 |

| Asia Pacific | 4/15/ | 7/2/10 | -12.5 | 1.9 | 1.8 | 16.4 |

| Japan Nikkei Aver. | 4/05/ | 8/31/ | -22.5 | 20.0 | 3.4 | 55.0 |

| China Shang. | 4/15/ | 7/02 | -24.7 | -37.5 | -4.5 | -16.9 |

| STOXX 50 | 4/15/10 | 7/2/10 | -15.3 | -3.9 | 2.1 | 13.4 |

| DAX | 4/26/ | 5/25/ | -10.5 | 25.7 | 2.2 | 40.4 |

| Dollar | 11/25 2009 | 6/7 | 21.2 | 14.0 | 0.9 | -9.1 |

| DJ UBS Comm. | 1/6/ | 7/2/10 | -14.5 | -14.2 | -2.2 | 0.4 |

| 10-Year T Note | 4/5/ | 4/6/10 | 3.986 | 2.486 |

T: trough; Dollar: positive sign appreciation relative to euro (less dollars paid per euro), negative sign depreciation relative to euro (more dollars paid per euro)

Source: http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

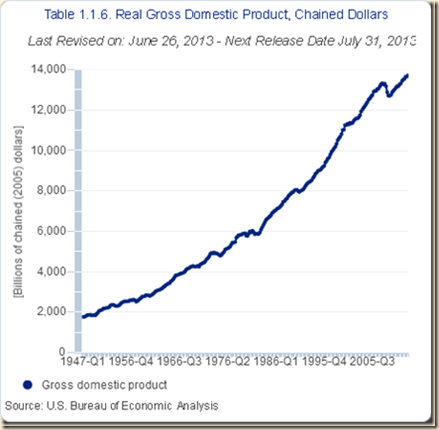

ESII Mediocre and Decelerating United States Economic Growth. The US is experiencing the first expansion from a recession after World War II without growth, jobs (http://cmpassocregulationblog.blogspot.com/2013/06/twenty-eight-million-unemployed-or.html) and hiring (http://cmpassocregulationblog.blogspot.com/2013/06/recovery-without-hiring-seven-million.html), unsustainable government deficit/debt (http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

http://cmpassocregulationblog.blogspot.com/2012/11/united-states-unsustainable-fiscal.html), waves of inflation (http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and.html) and deteriorating terms of trade and net revenue margins in squeeze of economic activity by carry trades induced by zero interest rates

(http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and.html) while valuations of risk financial assets approach historical highs. Long-term economic performance in the United States consisted of trend growth of GDP at 3 percent per year and of per capita GDP at 2 percent per year as measured for 1870 to 2010 by Robert E Lucas (2011May). The economy returned to trend growth after adverse events such as wars and recessions. The key characteristic of adversities such as recessions was much higher rates of growth in expansion periods that permitted the economy to recover output, income and employment losses that occurred during the contractions. Over the business cycle, the economy compensated the losses of contractions with higher growth in expansions to maintain trend growth of GDP of 3 percent and of GDP per capita of 2 percent. US economic growth has been at only 2.1 percent on average in the cyclical expansion in the 15 quarters from IIIQ2009 to IQ2013. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). The average of 7.8 percent in the first four quarters of major cyclical expansions is in contrast with the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 of only 3.2 percent obtained by diving GDP of $13,103.5 billion in IIIQ2010 by GDP of $12,701.0 billion in IIQ2009 {[$13,103.5/$12,701.0 -1]100 = 3.2%], or accumulating the quarter on quarter growth rates (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/06/mediocre-united-states-economic-growth.html). The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.7 percent and at 7.7 percent from IQ1983 to IVQ1983 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/06/mediocre-united-states-economic-growth.html). As a result, there are 27.8 million unemployed or underemployed in the United States for an effective unemployment rate of 17.1 percent (http://cmpassocregulationblog.blogspot.com/2013/06/twenty-eight-million-unemployed-or.html).

The economy of the US can be summarized in growth of economic activity or GDP as decelerating from mediocre growth of 2.4 percent on an annual basis in 2010 and 1.8 percent in 2011 to 2.2 percent in 2012. Calculations below show that actual growth is around 1.8 percent per year. This rate is well below 3 percent per year in trend from 1870 to 2010, which has been always recovered after events such as wars and recessions (Lucas 2011May). United States real GDP grew at the rate of 3.2 percent between 1929 and 2012 and at 3.2 percent between 1947 and 2012 (http://www.bea.gov/iTable/index_nipa.cfm see http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.html). Growth is not only mediocre but also sharply decelerating to a rhythm that is not consistent with reduction of unemployment and underemployment of 28.6 million people corresponding to 17.6 percent of the effective labor force of the United States (http://cmpassocregulationblog.blogspot.com/2013/05/twenty-nine-million-unemployed-or.html). In the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013, US real GDP grew at the seasonally-adjusted annual equivalent rates of 0.1 percent in the first quarter of 2011 (IQ2011), 2.5 percent in IIQ2011, 1.3 percent in IIIQ2011, 4.1 percent in IVQ2011, 2.0 percent in IQ2012, 1.3 percent in IIQ2012, revised 3.1 percent in IIIQ2012, 0.4 percent in IVQ2012 and revised 1.8 percent in IQ2013. The annual equivalent rate of growth of GDP for the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 is 1.9 percent, obtained as follows. Discounting 0.1 percent to one quarter is 0.025 percent {[(1.001)1/4 -1]100 = 0.025}; discounting 2.5 percent to one quarter is 0.62 percent {[(1.025)1/4 – 1]100}; discounting 1.3 percent to one quarter is 0.32 percent {[(1.013)1/4 – 1]100}; discounting 4.1 percent to one quarter is 1.0 percent {[(1.04)1/4 -1]100; discounting 2.0 percent to one quarter is 0.50 percent {[(1.020)1/4 -1]100); discounting 1.3 percent to one quarter is 0.32 percent {[(1.013)1/4 -1]100}; discounting 3.1 percent to one quarter is 0.77 {[(1.031)1/4 -1]100); discounting 0.4 percent to one quarter is 0.1 percent {[(1.004)1/4 – 1]100}; and discounting 1.8 percent to one quarter is 0.44 percent {[(1.018)1/4 -1}100}. Real GDP growth in the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 accumulated to 4.3 percent {[(1.00025 x 1.0062 x 1.0032 x 1.010 x 1.005 x 1.0032 x 1.0077 x 1.001 x 1.0044) - 1]100 = 4.2%}. This is equivalent to growth from IQ2011 to IQ2013 obtained by dividing the seasonally-adjusted annual rate (SAAR) of IQ2013 of $13,725.7 billion by the SAAR of IVQ2010 of $13,181.2 (http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1 and Table I-6 below) and expressing as percentage {[($13,746.2/$13,181.2) - 1]100 = 4.1%}. The growth rate in annual equivalent for the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 is 1.8 percent {[(1.00025 x 1.0062 x 1.0032 x 1.010 x 1.005 x 1.0032 x 1.0077 x 1.001 x 1.0044)4/9 -1]100 = 1.8%], or {[($13,725.7/$13,181.2)]4/9-1]100 = 1.8%} dividing the SAAR of IVQ2012 by the SAAR of IVQ2010 in Table I-6 below, obtaining the average for nine quarters and the annual average for one year of four quarters. Growth in the four quarters of 2012 accumulates to 1.7 percent {[(1.02)1/4(1.013)1/4(1.031)1/4(1.004)1/4 -1]100 = 1.7%}. This is equivalent to dividing the SAAR of $13,665.4 billion for IVQ2012 in Table I-6 by the SAAR of $13,441.0 billion in IVQ2011 except for a rounding discrepancy to obtain 1.7 percent {[($13,665.4/$13,441.0) – 1]100 = 1.7%}. The US economy is still close to a standstill especially considering the GDP report in detail.

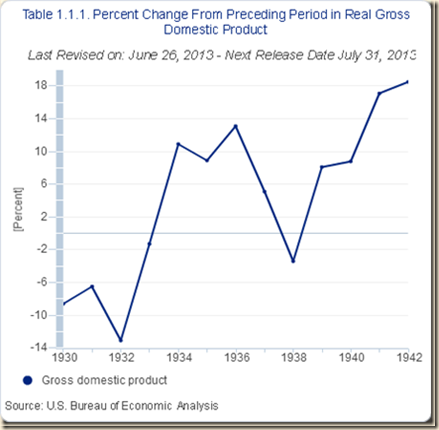

The NBER dates another recession in 1980 that lasted about half a year. If the two recessions from IQ1980s to IIIQ1980 and IIIQ1981 to IVQ1982 are combined, the impact of lost GDP of 4.8 percent is more comparable to the latest revised 4.7 percent drop of the recession from IVQ2007 to IIQ2009. The recession in 1981-1982 is quite similar on its own to the 2007-2009 recession. In contrast, during the Great Depression in the four years of 1930 to 1933, GDP in constant dollars fell 26.5 percent cumulatively and fell 45.6 percent in current dollars (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 150-2, Pelaez and Pelaez, Globalization and the State, Vol. II (2009b), 205-7). Table I-2 provides the Bureau of Economic Analysis (BEA) quarterly growth rates of GDP in SA yearly equivalents for the recessions of 1981 to 1982 and 2007 to 2009, using the latest major revision published on Jul 29, 2011 (http://www.bea.gov/newsreleases/national/gdp/2011/pdf/gdp2q11_adv.pdf) and the revision back to 2009 (http://www.bea.gov/newsreleases/national/gdp/2012/pdf/gdp2q12_adv.pdf) and the third estimate for IQ2013 (http://www.bea.gov/newsreleases/national/gdp/2013/pdf/gdp1q13_3rd.pdf), which are available in the dataset of the US Bureau of Economic Analysis (http://www.bea.gov/iTable/index_nipa.cfm). There were four quarters of contraction in 1981-1982 ranging in rate from -1.5 percent to -6.4 percent and five quarters of contraction in 2007-2009 ranging in rate from -0.3 percent to -8.9 percent. The striking difference is that in the first fifteen quarters of expansion from IQ1983 to IIIQ1986, shown in Table I-2 in relief, GDP grew at the high quarterly percentage growth rates of 5.1, 9.3, 8.1, 8.5, 8.0, 7.1, 3.9, 3.3, 3.8, 3.4, 6.4, 3.1, 3.9, 1.6 and 3.9 while the percentage growth rates in the first fifteen quarters of expansion from IIIQ2009 to IQ2013 shown in relief in Table I-2, were mediocre: 1.4, 4.0, 2.3, 2.2, 2.6, 2.4, 0.1, 2.5, 1.3, 4.1, 2.0, 1.3, 3.1, 0.4 and 1.8. Asterisks denote the estimates that have been revised by the BEA in the first round of Jul 29, 2011 and double asterisks the revisions released on Jul 27, 2012. During the four quarters of 2011 GDP grew at annual equivalent rates of 0.1 percent in IQ2011, 2.5 percent in IIQ2011, 1.3 percent in IIIQ2011 and 4.1 percent in IVQ2011. The rate of growth of the US economy decelerated from seasonally-adjusted annual equivalent of 4.1 percent in IVQ2011 to 2.0 percent in IQ2012, 1.3 percent in IIQ2012, 3.1 percent in IIIQ2012, which is more like 1.73 percent without contributions of 0.73 percentage points by inventory change and 0.64 percentage points by one-time expenditures in national defense and 0.4 percent in IVQ2012, which is more like 3.2 percent without deductions of 1.52 percentage points of inventory divestment and 1.27 percentage points of reductions of one-time national defense expenditures. Inventory change contributed to initial growth but was rapidly replaced by growth in investment and demand in 1983. Inventory accumulation contributed 2.53 percentage points to the rate of growth of 4.1 percent in IVQ2011, which is the only relatively high rate from IQ2011 to IIIQ2012, and 0.73 percentage points to the rate of 3.1 percent in IIIQ2012. Economic growth and employment creation decelerated rapidly during 2012 and in 2013 as would be required from movement to full employment.

Table I-2, US, Quarterly Growth Rates of GDP, % Annual Equivalent SA

| Q | 1981 | 1982 | 1983 | 1984 | 2008 | 2009 | 2010 |

| I | 8.6 | -6.4 | 5.1 | 8.0 | -1.8* | -5.3** | 2.3** |

| II | -3.2 | 2.2 | 9.3 | 7.1 | 1.3* | -0.3** | 2.2** |

| III | 4.9 | -1.5 | 8.1 | 3.9 | -3.7* | 1.4** | 2.6** |

| IV | -4.9 | 0.3 | 8.5 | 3.3 | -8.9* | 4.0** | 2.4** |

| 1985 | 2011 | ||||||

| I | 3.8 | 0.1** | |||||

| II | 3.4 | 2.5** | |||||

| III | 6.4 | 1.3** | |||||

| IV | 3.1 | 4.1** | |||||

| 1986 | 2012 | ||||||

| I | 3.9 | 2.0** | |||||

| II | 1.6 | 1.3 | |||||

| III | 3.9 | 3.1 | |||||

| IV | 1.9 | 0.4 | |||||

| 1987 | 2013 | ||||||

| I | 2.2 | 1.8 | |||||

| II | 4.3 | ||||||

| III | 3.5 | ||||||

| IV | 7.0 |

*Revision of Jul 29, 2011 **Revision of Jul 27, 2012

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Characteristics of the four cyclical contractions are provided in Table I-4 with the first column showing the number of quarters of contraction; the second column the cumulative percentage contraction; and the final column the average quarterly rate of contraction. There were two contractions from IQ1980 to IIIQ1980 and from IIIQ1981 to IVQ1982 separated by three quarters of expansion. The drop of output combining the declines in these two contractions is 4.8 percent, which is almost equal to the decline of 4.7 percent in the contraction from IVQ2007 to IIQ2009. In contrast, during the Great Depression in the four years of 1930 to 1933, GDP in constant dollars fell 26.7 percent cumulatively and fell 45.6 percent in current dollars (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 150-2, Pelaez and Pelaez, Globalization and the State, Vol. II (2009b), 205-7). The comparison of the global recession after 2007 with the Great Depression is entirely misleading.

Table I-4, US, Number of Quarters, Cumulative Percentage Contraction and Average Percentage Annual Equivalent Rate in Cyclical Contractions

| Number of Quarters | Cumulative Percentage Contraction | Average Percentage Rate | |

| IIQ1953 to IIQ1954 | 3 | -2.6 | -0.7 |

| IIIQ1957 to IIQ1958 | 3 | -3.1 | -1.1 |

| IVQ1973 to IQ1975 | 5 | -3.2 | -0.6 |

| IQ1980 to IIIQ1980 | 2 | -2.2 | -1.1 |

| IIIQ1981 to IVQ1982 | 4 | -2.7 | -0.69 |

| IVQ2007 to IIQ2009 | 6 | -4.7 | -0.80 |

Sources: Business Cycle Reference Dates; US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Table I-5 shows the extraordinary contrast between the mediocre average annual equivalent growth rate of 2.1 percent of the US economy in the fifteen quarters of the current cyclical expansion from IIIQ2009 to IQ2013 and the average of 5.7 percent in the first thirteen quarters of expansion from IQ1983 to IQ1986 and 5.3 percent in the first fifteen quarters of expansion from IQ1983 to IIIQ1986. The line “average first four quarters in four expansions” provides the average growth rate of 7.8 percent with 7.9 percent from IIIQ1954 to IIQ1955, 9.5 percent from IIIQ1958 to IIQ1959, 6.1 percent from IIIQ1975 to IIQ1976 and 7.7 percent from IQ1983 to IVQ1983. The United States missed this opportunity of high growth in the initial phase of recovery. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). Table I-5 provides an average of 7.8 percent in the first four quarters of major cyclical expansions while the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 is only 3.2 percent obtained by diving GDP of $13,103.5 billion in IIIQ2010 by GDP of $12,701.0 billion in IIQ2009 {[$13.103.5/$12,701.0 -1]100 = 3.2%], or accumulating the quarter on quarter growth rates. As a result, there are 27.8 million unemployed or underemployed in the United States for an effective unemployment rate of 17.1 percent (http://cmpassocregulationblog.blogspot.com/2013/06/twenty-eight-million-unemployed-or.html). BEA data show the US economy in standstill with annual growth of 2.4 percent in 2010 decelerating to 1.8 percent annual growth in 2011, 2.2 percent in 2012 (http://www.bea.gov/iTable/index_nipa.cfm) and cumulative 1.7 percent in the four quarters of 2012 {[(1.02)1/4(1.013)1/4(1.031)1/4(1.004)1/4 – 1]100 = 1.7%} with minor rounding discrepancy using the SSAR of $13,665.4 billion in IVQ2012 relative to the SAAR of $13,441.0 billion in IVQ2011 {[($13665.4/$13441.00-1]100 = 1.7%}. %}. The growth rate in annual equivalent for the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 is 1.8 percent {[(1.00025 x 1.0062 x 1.0032 x 1.010 x 1.005 x 1.0032 x 1.0077 x 1.001 x 1.0044)4/9 -1]100 = 1.8%], or {[($13,725.7/$13,181.2)]4/9-1]100 = 1.8%} dividing the SAAR of IVQ2012 by the SAAR of IVQ2010 in Table I-6 below, obtaining the average for nine quarters and the annual average for one year of four quarters. The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.7 percent and at 7.7 percent from IQ1983 to IVQ1983.

Table I-5, US, Number of Quarters, Cumulative Growth and Average Annual Equivalent Growth Rate in Cyclical Expansions

| Number | Cumulative Growth ∆% | Average Annual Equivalent Growth Rate | |

| IIIQ 1954 to IQ1957 | 11 | 12.6 | 4.4 |

| First Four Quarters IIIQ1954 to IIQ1955 | 4 | 7.9 | |

| IIQ1958 to IIQ1959 | 5 | 10.2 | 8.1 |

| First Four Quarters IIIQ1958 to IIQ1959 | 4 | 9.5 | |

| IIQ1975 to IVQ1976 | 8 | 9.5 | 4.6 |

| First Four Quarters IIIQ1975 to IIQ1976 | 4 | 6.1 | |

| IQ1983 to IQ1986 IQ1983 to IIIQ1986 | 13 15 | 19.6 21.3 | 5.7 5.3 |

| First Four Quarters IQ1983 to IVQ1983 | 4 | 7.7 | |

| Average First Four Quarters in Four Expansions* | 7.8 | ||

| IIIQ2009 to IQ2013 | 15 | 8.1 | 2.1 |

| First Four Quarters IIIQ2009 to IIIQ2010 | 3.2 |

*First Four Quarters: 7.9% IIIQ1954-IIQ1955; 9.6% IIIQ1958-IIQ1959; 6.1% IIIQ1975-IIQ1976; 7.7% IQ1983-IVQ1983

Sources: Business Cycle Reference Dates: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart I-8 shows US real quarterly GDP growth from 1980 to 1989. The economy contracted during the recession and then expanded vigorously throughout the 1980s, rapidly eliminating the unemployment caused by the contraction.

Chart I-8, US, Real GDP, 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

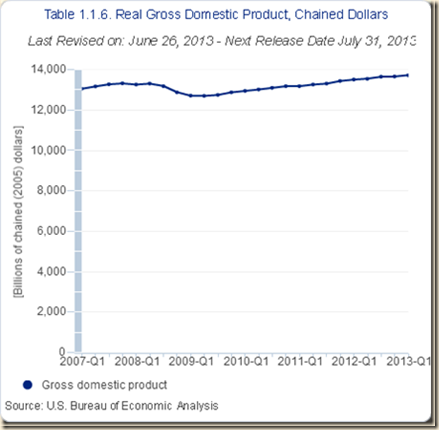

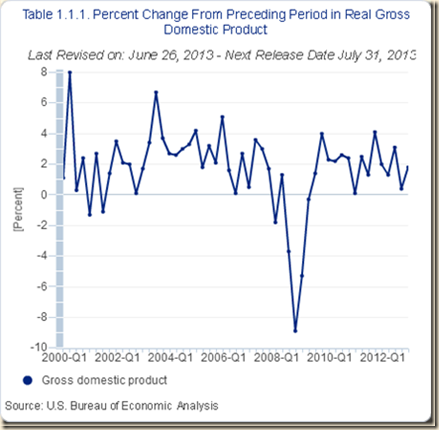

Chart I-9 shows the entirely different situation of real quarterly GDP in the US between 2007 and 2012. The economy has underperformed during the first fifteen quarters of expansion for the first time in the comparable contractions since the 1950s. The US economy is now in a perilous standstill.

Chart I-9, US, Real GDP, 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

As shown in Tables I-4 and I-5 above the loss of real GDP in the US during the contraction was 4.7 percent but the gain in the cyclical expansion has been only 8.1 percent (last row in Table I-5), using all latest revisions. As a result, the level of real GDP in IQ2013 with the second estimate and revisions is only higher by 3.0 percent than the level of real GDP in IVQ2007. Table I-6 provides in the second column real GDP in billions of chained 2005 dollars. The third column provides the percentage change of the quarter relative to IVQ2007; the fourth column provides the percentage change relative to the prior quarter; and the final fifth column provides the percentage change relative to the same quarter a year earlier. The contraction actually concentrated in two quarters: decline of 2.3 percent in IVQ2008 relative to the prior quarter and decline of 1.3 percent in IQ2009 relative to IVQ2008. The combined fall of GDP in IVQ2008 and IQ2009 was 3.6 percent {[(1-0.023) x (1-0.013) -1]100 = -3.6%}, or {[(IQ2009 $12,711.0)/(IIIQ2008 $13,186.9) – 1]100 = -3.6%}. Those two quarters coincided with the worst effects of the financial crisis. GDP fell 0.1 percent in IIQ2009 but grew 0.4 percent in IIIQ2009, which is the beginning of recovery in the cyclical dates of the NBER. Most of the recovery occurred in five successive quarters from IVQ2009 to IVQ2010 of growth of 1.0 percent in IVQ2009 and equal growth at 0.6 percent in IQ2010, IIQ2010, IIIQ2010 and IVQ2010 for cumulative growth in those five quarters of 3.4 percent, obtained by accumulating the quarterly rates {[(1.01 x 1.006 x 1.006 x 1.006 x 1.006) – 1]100 = 3.4%} or {[(IVQ2010 $13,181.2)/(IIIQ2009 $12,746.7) – 1]100 = 3.4%}. The economy lost momentum already in 2010 growing at 0.6 percent in each quarter, or annual equivalent 2.4 per cent {[(1.006)4 – 1]100 = 2.4%}, compared with annual equivalent 4.1 percent in IV2009 {[(1.01)4 – 1]100 = 4.1%}. The economy then stalled during the first half of 2011 with growth of 0.0025 percent in IQ2011 and 0.6 percent in IIQ2011 for combined annual equivalent rate of 1.2 percent {(1.00025 x 1.006)2}. The economy grew 0.3 percent in IIIQ2011 for annual equivalent growth of 1.2 percent in the first three quarters {[(1.00025 x 1.006 x 1.003)4/3 -1]100 = 1.2%}. Growth picked up in IVQ2011 with 1.0 percent relative to IIIQ2011. Growth in a quarter relative to a year earlier in Table I-6 slows from over 2.4 percent during three consecutive quarters from IIQ2010 to IVQ2010 to 1.8 percent in IQ2011, 1.9 percent in IIQ2011, 1.6 percent in IIIQ2011 and 2.0 percent in IVQ2011. As shown below, growth of 1.0 percent in IVQ2011 was partly driven by inventory accumulation. In IQ2012, GDP grew 0.5 percent relative to IVQ2011 and 2.4 percent relative to IQ2011, decelerating to 0.3 percent in IIQ2012 and 2.1 percent relative to IIQ2011 and 0.8 percent in IIIQ2012 and 2.6 percent relative to IIIQ2011 largely because of inventory accumulation and national defense expenditures. Growth was 0.1 percent in IVQ2012 with 1.7 percent relative to a year earlier but mostly because of 1.52 percentage points of inventory divestment and 1.27 percentage points of reduction of one-time national defense expenditures. Growth was 0.4 percent in IQ2013 and 1.6 percent relative to IQ2012 in large part because of burning savings to consume caused by financial repression of zero interest rates. Rates of a quarter relative to the prior quarter capture better deceleration of the economy than rates on a quarter relative to the same quarter a year earlier. The critical question for which there is not yet definitive solution is whether what lies ahead is continuing growth recession with the economy crawling and unemployment/underemployment at extremely high levels or another contraction or conventional recession. Forecasts of various sources continued to maintain high growth in 2011 without taking into consideration the continuous slowing of the economy in late 2010 and the first half of 2011. The sovereign debt crisis in the euro area is one of the common sources of doubts on the rate and direction of economic growth in the US but there is weak internal demand in the US with almost no investment and spikes of consumption driven by burning saving because of financial repression forever in the form of zero interest rates.

Table I-6, US, Real GDP and Percentage Change Relative to IVQ2007 and Prior Quarter, Billions Chained 2005 Dollars and ∆%

| Real GDP, Billions Chained 2005 Dollars | ∆% Relative to IVQ2007 | ∆% Relative to Prior Quarter | ∆% | |

| IVQ2007 | 13,326.0 | NA | NA | 2.2 |

| IQ2008 | 13,266.8 | -0.4 | -0.4 | 1.6 |

| IIQ2008 | 13,310.5 | -0.1 | 0.3 | 1.0 |

| IIIQ2008 | 13,186.9 | -1.0 | -0.9 | -0.6 |

| IVQ2008 | 12,883.5 | -3.3 | -2.3 | -3.3 |

| IQ2009 | 12,711.0 | -4.6 | -1.3 | -4.2 |

| IIQ2009 | 12,701.0 | -4.7 | -0.1 | -4.6 |

| IIIQ2009 | 12,746.7 | -4.3 | 0.4 | -3.3 |

| IV2009 | 12,873.1 | -3.4 | 1.0 | -0.1 |

| IQ2010 | 12,947.6 | -2.8 | 0.6 | 1.9 |

| IIQ2010 | 13,019.6 | -2.3 | 0.6 | 2.5 |

| IIIQ2010 | 13,103.5 | -1.7 | 0.6 | 2.8 |

| IVQ2010 | 13,181.2 | -1.1 | 0.6 | 2.4 |

| IQ2011 | 13,183.8 | -1.1 | 0.0 | 1.8 |

| IIQ2011 | 13,264.7 | -0.5 | 0.6 | 1.9 |

| IIIQ2011 | 13,306.9 | -0.1 | 0.3 | 1.6 |

| IV2011 | 13,441.0 | 0.9 | 1.0 | 2.0 |

| IQ2012 | 13,506.4 | 1.4 | 0.5 | 2.4 |

| IIQ2012 | 13,548.5 | 1.7 | 0.3 | 2.1 |

| IIIQ2012 | 13,652.5 | 2.5 | 0.8 | 2.6 |

| IVQ2012 | 13,665.4 | 2.5 | 0.1 | 1.7 |

| IQ2013 | 13,725.7 | 3.0 | 0.4 | 1.6 |

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart I-10 provides the percentage change of real GDP from the same quarter a year earlier from 1980 to 1989. There were two contractions almost in succession in 1980 and from 1981 to 1983. The expansion was marked by initial high rates of growth as in other recession in the postwar US period during which employment lost in the contraction was recovered. Growth rates continued to be high after the initial phase of expansion.

Chart I-10, Percentage Change of Real Gross Domestic Product from Quarter a Year Earlier 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

The experience of recovery after 2009 is not as complete as during the 1980s. Chart I-11 shows the much lower rates of growth in the early phase of the current expansion and how they have sharply declined from an early peak. The US missed the initial high growth rates in cyclical expansions during which unemployment and underemployment are eliminated.

Chart I-11, Percentage Change of Real Gross Domestic Product from Quarter a Year Earlier 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart I-12 provides growth rates from a quarter relative to the prior quarter during the 1980s. There is the same strong initial growth followed by a long period of sustained growth.

Chart I-12, Percentage Change of Real Gross Domestic Product from Prior Quarter 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart I-13 provides growth rates in a quarter relative to the prior quarter from 2007 to 2013. Growth in the current expansion after IIIQ2009 has not been as strong as in other postwar cyclical expansions.

Chart I-13, Percentage Change of Real Gross Domestic Product from Prior Quarter 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

ESIII Contracting Real Private Fixed Investment. The United States economy has grown at the average yearly rate of 3 percent per year and 2 percent per year in per capita terms from 1870 to 2010, as measured by Lucas (2011May). An important characteristic of the economic cycle in the US has been rapid growth in the initial phase of expansion after recessions. In cyclical expansions since 1950, US GDP has grown at the average rate of 7.8 percent in the first four quarters after the trough, moving the economy back to long-term trend. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). As a result, there are 27.8 million unemployed or underemployed in the United States for an effective unemployment rate of 17.1 percent (http://cmpassocregulationblog.blogspot.com/2013/06/twenty-eight-million-unemployed-or.html).

Growth of GDP has been only 2.1 percent on average during the current cyclical expansion from IIIQ2009 to IQ2013. Weakness in the current cyclical expansion has occurred in growth, labor markets and wealth, as analyzed in IB Collapse of United States Dynamism of Income Growth and Employment Creation (http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and.html) incorporating additional data on private investment (IX Conclusion and extended analysis at http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and.html). Inferior performance of the US economy and labor markets is the critical current issue of analysis and policy design. Table IA1-1 provides quarterly seasonally adjusted annual rates (SAAR) of growth of private fixed investment for the recessions of the 1980s and the current economic cycle. In the cyclical expansion beginning in IQ1983 (http://www.nber.org/cycles.html), real private fixed investment in the United States grew at the average annual rate of 15.3 percent in the first eight quarters from IQ1983 to IVQ1984. Growth rates fell to an average of 1.6 percent in the following eight quarters from IQ1985 to IVQ1986. There were only four quarters of contraction of private fixed investment from IQ1983 to IVQ1986. There is quite different behavior of private fixed investment in the fifteen quarters of cyclical expansion from IIIQ2009 to IQ2013. The average annual growth rate in the first eight quarters of expansion from IIIQ2009 to IIQ2011 was 2.5 percent, which is significantly lower than 15.3 percent in the first eight quarters of expansion from IQ1983 to IVQ1984. There is only strong growth of private fixed investment in the four quarters of expansion from IIQ2011 to IQ2012 at the average annual rate of 11.9 percent. Growth has fallen from the SAAR of 15.5 percent in IIIQ2011 to 0.9 percent in IIIQ2012, recovering to 14.0 percent in IVQ2012 and falling to 3.0 percent in IQ2013. Sudeep Reddy and Scott Thurm, writing on “Investment falls off a cliff,” on Nov 18, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324595904578123593211825394.html?mod=WSJPRO_hpp_LEFTTopStories) analyze the decline of private investment in the US and inform that a review by the Wall Street Journal of filing and conference calls finds that 40 of the largest publicly traded corporations in the US have announced intentions to reduce capital expenditures in 2012. The SAAR of real private fixed investment jumped to 14.0 percent in IVQ2012 but declined to 3.0 percent in IQ2013.

Table IA1-1, US, Quarterly Growth Rates of Real Private Fixed Investment, % Annual Equivalent SA

| Q | 1981 | 1982 | 1983 | 1984 | 2008 | 2009 | 2010 |

| I | 3.0 | -11.6 | 9.0 | 13.1 | -8.3 | -30.2 | -0.9 |

| II | 2.7 | -13.3 | 16.4 | 17.5 | -5.2 | -18.5 | 14.5 |

| III | 0.0 | -10.7 | 26.1 | 8.8 | -12.3 | -3.1 | -1.0 |

| IV | -1.4 | 0.6 | 25.6 | 7.4 | -25.2 | -6.0 | 7.6 |

| 1985 | 2011 | ||||||

| I | 3.1 | -1.3 | |||||

| II | 5.1 | 12.4 | |||||

| III | -3.2 | 15.5 | |||||

| IV | 7.8 | 10.0 | |||||

| 1986 | 2012 | ||||||

| I | 0.6 | 9.8 | |||||

| II | -1.0 | 4.5 | |||||

| III | -2.2 | 0.9 | |||||

| IV | 2.7 | 14.0 | |||||

| 1987 | 2013 | ||||||

| I | -7.7 | 3.0 | |||||

| II | 7.4 | ||||||

| III | 8.8 | ||||||

| IV | -0.1 |

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart IA1-1 of the US Bureau of Economic Analysis (BEA) provides seasonally adjusted annual rates of growth of real private fixed investment from 1981 to 1986. Growth rates recovered sharply during the first eight quarters, which was essential in returning the economy to trend growth and eliminating unemployment and underemployment accumulated during the contractions.

Chart IA1-1, US, Real Private Fixed Investment, Seasonally-Adjusted Annual Rates Percent Change from Prior Quarter, 1981-1986

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Weak behavior of real private fixed investment from 2007 to 2012 is shown in Chart IA1-2. Growth rates of real private fixed investment were much lower during the initial phase of expansion in the current economic cycle and have entered sharp trend of decline.

Chart IA1-2, US, Real Private Fixed Investment, Seasonally-Adjusted Annual Rates Percent Change from Prior Quarter, 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Table IA1-2 provides real private fixed investment at seasonally adjusted annual rates from IVQ2007 to IQ2013 or for the complete economic cycle. The first column provides the quarter, the second column percentage change relative to IVQ2007, the third column the quarter percentage change in the quarter relative to the prior quarter and the final column percentage change in a quarter relative to the same quarter a year earlier. In IQ1980, gross private domestic investment in the US was $778.3 billion of 2005 dollars, growing to $965.9 billion in IVQ1985 or 24.1 percent, as shown in Table IB-2 of IB Collapse of Dynamism of United States Income Growth and Employment Creation (IX Conclusion and extended analysis at http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and.html). Real gross private domestic investment in the US decreased 7.2 percent from $2,123.6 billion of 2005 dollars in IVQ2007 to $1,970.1 billion in IQ2013. As shown in Table IAI-2, real private fixed investment fell 9.1 percent from $2111.5 billion of 2005 dollars in IVQ2007 to $1920.4 billion in IQ2014. Growth of real private investment in Table IA1-2 is mediocre for all but four quarters from IIQ2011 to IQ2012.

Table IA1-2, US, Real Private Fixed Investment and Percentage Change Relative to IVQ2007 and Prior Quarter, Billions of Chained 2005 Dollars and ∆%

| Real PFI, Billions Chained 2005 Dollars | ∆% Relative to IVQ2007 | ∆% Relative to Prior Quarter | ∆% | |

| IVQ2007 | 2111.5 | NA | -1.2 | -1.0 |

| IQ2008 | 2066.4 | -2.1 | -2.1 | -2.9 |

| IIQ2008 | 2039.1 | -3.4 | -1.3 | -5.0 |

| IIIQ2008 | 1973.5 | -6.5 | -3.2 | -7.7 |

| IV2008 | 1835.4 | -13.1 | -7.0 | -13.1 |

| IQ2009 | 1677.3 | -20.6 | -8.6 | -18.8 |

| IIQ2009 | 1593.7 | -24.5 | -5.0 | -21.8 |

| IIIQ2009 | 1581.2 | -25.1 | -0.8 | -19.9 |

| IVQ2009 | 1556.8 | -26.3 | -1.5 | -15.2 |

| IQ2010 | 1553.1 | -26.4 | -0.2 | -7.4 |

| IIQ2010 | 1606.5 | -23.9 | 3.4 | 0.8 |

| IIIQ2010 | 1602.7 | -24.1 | -0.2 | 1.4 |

| IVQ2010 | 1632.3 | -22.7 | 1.8 | 4.8 |

| IQ2011 | 1627.0 | -22.9 | -0.3 | 4.8 |

| IIQ2011 | 1675.4 | -20.7 | 3.0 | 4.3 |

| IIIQ2011 | 1736.8 | -17.7 | 3.7 | 8.4 |

| IVQ2011 | 1778.7 | -15.8 | 2.4 | 9.0 |

| IQ2012 | 1820.6 | -13.8 | 2.4 | 11.9 |

| IIQ2012 | 1840.6 | -12.8 | 1.1 | 9.9 |

| IIIQ2012 | 1844.8 | -12.6 | 0.2 | 6.2 |

| IVQ2012 | 1906.3 | -9.7 | 3.3 | 7.2 |

| IQ2013 | 1920.4 | -9.1 | 0.7 | 5.5 |

PFI: Private Fixed Investment

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart IA1-3 provides real private fixed investment in billions of chained 2005 dollars from IV2007 to IQ2013. Real private fixed investment has not recovered, stabilizing at a level in IQ2013 that is 9.1 percent below the level in IVQ2007.

Chart IA1-3, US, Real Private Fixed Investment, Billions of Chained 2005 Dollars, IQ2007 to IQ2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

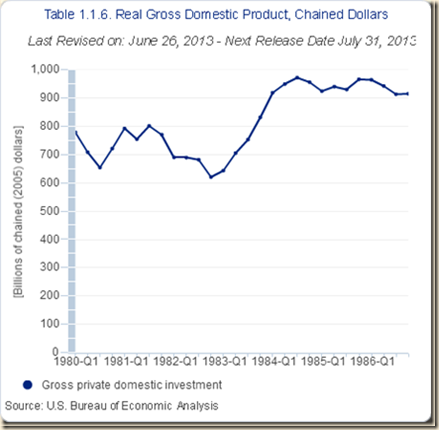

Chart IA1-4 provides real gross private domestic investment in chained dollars of 2005 from 1980 to 1986. Real gross private domestic investment climbed 24.1 percent in IVQ1985 above the level in IQ1980.

Chart IA1-4, US, Real Gross Private Domestic Investment, Billions of Chained 2005 Dollars at Seasonally Adjusted Annual Rate, 1980-1986

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IA1-5 provides real gross private domestic investment in the United States in billions of dollars of 2005 from 2006 to 2013. Gross private domestic investment reached a level in IQ2013 that was 7.2 percent lower than the level in IVQ2007 (http://www.bea.gov/iTable/index_nipa.cfm).

Chart IA1-5, US, Real Gross Private Domestic Investment, Billions of Chained 2005 Dollars at Seasonally Adjusted Annual Rate, 2007-2013

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

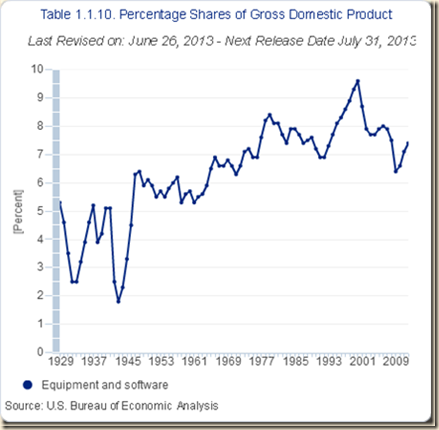

ESIV Swelling Undistributed Corporate Profits. Table IA1-5 provides value added of corporate business, dividends and corporate profits in billions of current dollars at seasonally adjusted annual rates (SAAR) in IVQ2007 and IQ2013 together with percentage changes. The last three rows of Table IA1-5 provide gross value added of nonfinancial corporate business, consumption of fixed capital and net value added in billions of chained 2005 dollars at SAARs. Deductions from gross value added of corporate profits down the rows of Table IA1-5 end with undistributed corporate profits. Profits after taxes with inventory valuation adjustment (IVA) and capital consumption adjustment (CCA) increased by 79.0 percent in nominal terms from IVQ2007 to IQ2013 while net dividends decreased 1.6 percent and undistributed corporate profits swelled 306.9 percent from $118.0 billion in IQ2007 to $480.2 billion in IQ2013 and changed signs from minus $22.1 billion in current dollars in IVQ2007. The investment decision of United States corporations has been fractured in the current economic cycle in preference of cash. Gross value added of nonfinancial corporate business adjusted for inflation increased 4.2 percent from IVQ2007 to IQ2013, which is much lower than nominal increase of 14.2 percent in the same period for gross value added of total corporate business.

Table IA1-5, US, Value Added of Corporate Business, Corporate Profits and Dividends, IVQ2007-IQ2013

| IVQ2007 | IQ2013 | ∆% | |

| Current Billions of Dollars Seasonally Adjusted Annual Rates (SAAR) | |||

| Gross Value Added of Corporate Business | 7,975.6 | 9,108.6 | 14.2 |

| Consumption of Fixed Capital | 988.0 | 1,135.4 | 14.9 |

| Net Value Added | 6,987.6 | 7,973.2 | 14.1 |

| Compensation of Employees | 5,020.7 | 5,391.5 | 7.4 |

| Taxes on Production and Imports Less Subsidies | 659.7 | 717.0 | 8.7 |

| Net Operating Surplus | 1,307.2 | 1,864.6 | 42.6 |

| Net Interest and Misc | 202.4 | 187.3 | -7.5 |

| Business Current Transfer Payment Net | 73.1 | 125.2 | 71.3 |

| Corporate Profits with IVA and CCA Adjustments | 1,031.6 | 1,552.2 | 50.5 |

| Taxes on Corporate Income | 408.8 | 437.5 | 7.0 |

| Profits after Tax with IVA and CCA Adjustment | 622.9 | 1,114.7 | 79.0 |

| Net Dividends | 645.0 | 634.4 | -1.6 |

| Undistributed Profits with IVA and CCA Adjustment | -22.1 | 480.2 | NA |

| Billions of Chained USD 2005 SAAR | |||

| Gross Value Added of Nonfinancial Corporate Business | 6,642.5 | 6,920.9 | 4.2 |

| Consumption of Fixed Capital | 801.6 | 860.0 | 7.3 |

| Net Value Added | 5,840.9 | 6,016.1 | 3.0 |

IVA: Inventory Valuation Adjustment; CCA: Capital Consumption Adjustment

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

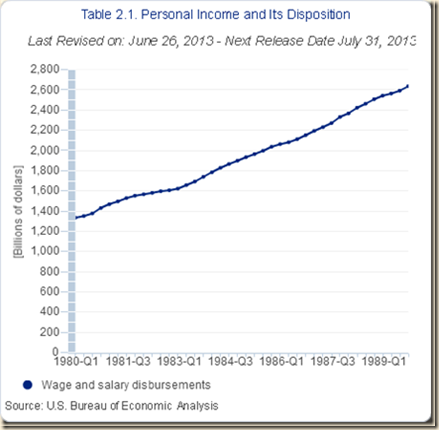

Table IA1-6 provides comparable United States value added of corporate business, corporate profits and dividends from IQ1980 to IVQ1985. There is significant difference both in nominal and inflation-adjusted data. Between IQ1980 and IVQ1985, profits after tax with IVA and CCA increased 140.3 percent with dividends growing 112.7 percent and undistributed profits jumping 169.7 percent. There was much higher inflation in the 1980s than in the current cycle. For example, the consumer price index for all items not seasonally adjusted increased 36.5 percent between Mar 1980 and Dec 1985 but only 9.3 percent between Dec 2007 and Dec 2012 (http://www.bls.gov/cpi/data.htm). The comparison is still valid in terms of inflation-adjusted data: gross value added of nonfinancial corporate business adjusted for inflation increased 21.2 percent between IQ1980 and IVQ1985 but only 4.2 percent between IVQ2007 and IQ2013 while net value added adjusted for inflation increased 20.6 percent between IQ1980 and IVQ1985 but only 3.0 percent between IVQ2007 and IQ2013.

Table IA1-6, US, Value Added of Corporate Business, Corporate Profits and Dividends, IQ1980-IVQ1985

| IQ1980 | IVQ1985 | ∆% | |

| Current Billions of Dollars Seasonally Adjusted Annual Rates (SAAR) | |||

| Gross Value Added of Corporate Business | 1,619.3 | 2,576.1 | 59.1 |

| Consumption of Fixed Capital | 169.9 | 278.9 | 64.2 |

| Net Value Added | 1,449.4 | 2,297.1 | 58.5 |

| Compensation of Employees | 1,090.6 | 1,667.0 | 52.9 |

| Taxes on Production and Imports Less Subsidies | 121.5 | 213.3 | 75.6 |

| Net Operating Surplus | 237.3 | 416.9 | 75.7 |

| Net Interest and Misc | 49.0 | 96.8 | 97.6 |

| Business Current Transfer Payment Net | 12.1 | 30.0 | 147.9 |

| Corporate Profits with IVA and CCA Adjustments | 176.3 | 290.0 | 64.5 |

| Taxes on Corporate Income | 97.0 | 99.7 | 2.8 |

| Profits after Tax with IVA and CCA Adjustment | 79.2 | 190.3 | 140.3 |

| Net Dividends | 40.9 | 87.0 | 112.7 |

| Undistributed Profits with IVA and CCA Adjustment | 38.3 | 103.3 | 169.7 |

| Billions of Chained USD 2005 SAAR | |||

| Gross Value Added of Nonfinancial Corporate Business | 2,642.8 | 3,203.9 | 21.2 |

| Consumption of Fixed Capital | 223.2 | 286.6 | 28.4 |

| Net Value Added | 2,419.6 | 2,917.3 | 20.6 |

IVA: Inventory Valuation Adjustment; CCA: Capital Consumption Adjustment

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

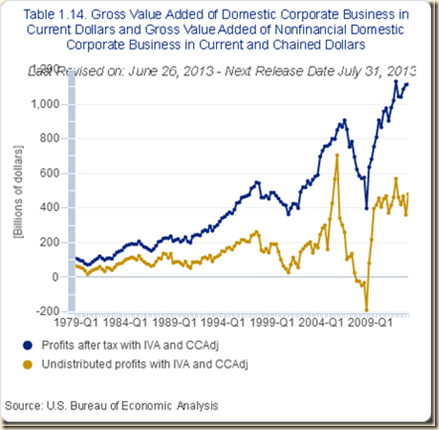

Chart IA1-12 of the US Bureau of Economic Analysis provides quarterly corporate profits after tax and undistributed profits with IVA and CCA from 1979 to 2012. There is tightness between the series of quarterly corporate profits and undistributed profits in the 1980s with significant gap developing from 1988 and to the present with the closest approximation peaking in IVQ2005 and surrounding quarters. These gaps widened during all recessions including in 1991 and 2001 and recovered in expansions with exceptionally weak performance in the current expansion.

Chart IA1-12, US, Corporate Profits after Tax and Undistributed Profits with Inventory Valuation Adjustment and Capital Consumption Adjustment, Quarterly, 1979-2012

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Table IA1-7 provides price, costs and profit per unit of gross value added of nonfinancial domestic corporate income for IVQ2007 and IQ2013 in the upper block and for IQ1980 and IVQ1985 in the lower block. Compensation of employees or labor costs per unit of gross value added of nonfinancial domestic corporate income hardly changed from 0.667 in IVQ2007 to 0.693 in IQ2013 in a fractured labor market but increased from 0.386 in IQ1980 to 0.480 in IVQ1985 in a more vibrant labor market. Unit nonlabor costs increased mildly from 0.271 per unit of gross value added in IVQ2007 to 0.287 in IQ2013 but increased from 0.127 in IQ1980 to 0.175 in IVQ1985 in an economy closer to full employment of resources. Profits after tax with IVA and CCA per unit of gross value added of nonfinancial domestic corporate income increased from 0.076 in IVQ2007 to 0.114 in IQ2013 and from 0.025 in IQ1980 to 0.053 in IVQ1985.

Table IA1-7, US, Price, Costs and Profit per Unit of Gross Value Added of Nonfinancial Domestic Corporate Income

| IVQ2007 | IQ2013 | |

| Price per Unit of Real Gross Value Added of Nonfinancial Corporate Business | 1.056 | 1.140 |

| Compensation of Employees (Unit Labor Cost) | 0.667 | 0.693 |

| Unit Nonlabor Cost | 0.271 | 0.287 |

| Consumption of Fixed Capital | 0.128 | 0.138 |

| Taxes on Production and Imports less Subsidies plus Business Current Transfer Payments (net) | 0.103 | 0.110 |

| Net Interest and Misc. Payments | 0.040 | 0.039 |

| Corporate Profits with IVA and CCA Adjustment (Unit Profits from Current Production) | 0.118 | 0.159 |

| Taxes on Corporate Income | 0.043 | 0.045 |

| Profits after Tax with IVA and CCA Adjustment | 0.076 | 0.114 |

| IQ1980 | IVQ1985 | |

| Price per Unit of Real Gross Value Added of Nonfinancial Corporate Business | 0.566 | 0.730 |

| Compensation of Employees (Unit Labor Cost) | 0.386 | 0.480 |

| Unit Nonlabor Cost | 0.127 | 0.175 |

| Consumption of Fixed Capital | 0.060 | 0.078 |

| Taxes on Production and Imports less Subsidies plus Business Current Transfer Payments (net) | 0.047 | 0.068 |

| Net Interest and Misc. Payments | 0.020 | 0.029 |

| Corporate Profits with IVA and CCA Adjustment (Unit Profits from Current Production) | 0.054 | 0.075 |

| Taxes on Corporate Income | 0.029 | 0.022 |

| Profits after Tax with IVA and CCA Adjustment | 0.025 | 0.053 |

IVA: Inventory Valuation Adjustment; CCA: Capital Consumption Adjustment

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart IA1-13 provides quarterly profits after tax with IVA and CCA per unit of gross value added of nonfinancial domestic corporate income from 1980 to 2013. In an environment of idle labor and other productive resources nonfinancial corporate income increased after tax profits with IVA and CCA per unit of gross value added at a faster pace in the weak economy from IVQ2007 to IQ2013 than in the vibrant expansion of the cyclical contractions of the 1980s. Part of the profits was distributed as dividends and significant part was retained as undistributed profits in the current economic cycle with frustrated investment decision.

Chart IA1-13, US, Profits after Tax with Inventory Valuation Adjustment and Capital Consumption Adjustment per Unit of Gross Value Added of Nonfinancial Domestic Corporate Income, 1980-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

ESV Contracting Corporate Profits. Table IA1-8 provides seasonally adjusted annual rates of change of corporate profits from IIQ2012 to IQ2013. US corporate profits with inventory valuation adjustment (IVA) and capital consumption adjustment (CCA) fell 1.4 percent in IQ2013 and 1.1 percent after taxes. Net dividends jumped 16.3 percent in IVQ2012 in generalized anticipation of income because of fear of the so-called “fiscal cliff,” or increases in taxes in 2013, and fell 11.7 percent in IQ2013 in adjustment to normal levels. Undistributed profits fell 9.9 percent in IVQ2012 in anticipation of tax increases and adjusted by increasing 12.6 percent in IQ2013.

Table IA1-8, Quarterly Seasonally Adjusted Annual Equivalent Percentage Rates of Change of Corporate Profits, ∆%

| IIQ2012 | IIIQ2012 | IVQ2012 | IQ2013 | |

| Corporate Profits with IVA and CCA | 1.1 | 2.4 | 2.3 | -1.4 |

| Corporate Income Taxes | -2.3 | 2.0 | -1.0 | -2.3 |

| After Tax Profits with IVA and CCA | 2.2 | 2.5 | 3.3 | -1.1 |

| Net Dividends | 2.8 | 1.7 | 16.3 | -11.7 |

| Und Profits with IVA and CCA | 1.6 | 3.3 | -9.9 | 12.6 |

Source: Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Table IA1-9 provides change from prior quarter of the level of seasonally adjusted annual rates of US corporate profits. Corporate profits with IVA and CCA fell $28 billion in IQ2013 after increasing $45.4 billion in IVQ2012 and $45.7 billion in IIIQ2012. Profits after tax with IVA and CCA fell $17.5 billion in IQ2013 after increasing $49.8 billion in IVQ2012 and $36.7 billion in IIIQ2012. Anticipation of higher taxes in the “fiscal cliff” episode caused increase of $124.3 billion in net dividends in IVQ2012 followed with adjustment in the form of decrease of net dividends by $103.5 billion in IQ2013. There is similar decrease of $74.3 billion in undistributed profits with IVA and CCA in IVQ2012 followed by increase of $85.8 billion in IQ2013. Undistributed profits of US corporations swelled 306.9 percent from $118.0 billion IQ2007 to $480.2 billion in IQ2013 and changed signs from minus $22.1 billion in billion in IVQ2007 (Section IA2). In IQ2013, corporate profits with inventory valuation and capital consumption adjustment fell $27.8 billion relative to IVQ2012 (http://www.bea.gov/newsreleases/national/gdp/2013/pdf/gdp1q13_3rd.pdf), from $2013.0 billion to $1985.2 billion at the quarterly rate of minus 1.4 percent. Uncertainty originating in fiscal, regulatory and monetary policy causes wide swings in expectations and decisions by the private sector with adverse effects on investment, real economic activity and employment.

Table IA1-9, Change from Prior Quarter of Level of Seasonally Adjusted Annual Equivalent Rates of Corporate Profits, Billions of Dollars

| IIQ2012 | IIIQ2012 | IVQ2012 | IQ2013 | |

| Corporate Profits with IVA and CCA | 21.8 | 45.7 | 45.4 | -28.0 |

| Corporate Income Taxes | -10.3 | 9.1 | -4.4 | -10.5 |

| After Tax Profits with IVA and CCA | 31.9 | 36.7 | 49.8 | -17.5 |

| Net Dividends | 20.4 | 12.8 | 124.3 | -103.5 |

| Und Profits with IVA and CCA | 11.6 | 23.8 | -74.3 | 85.8 |

Source: Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

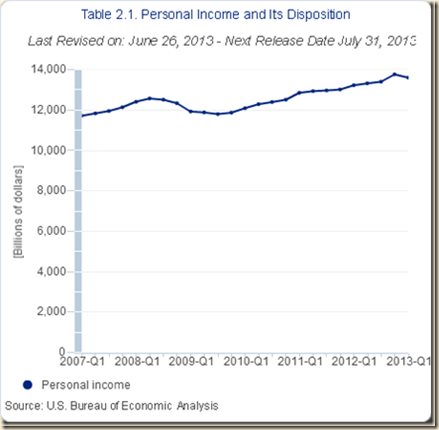

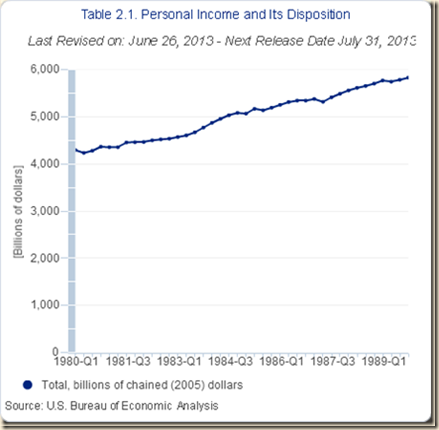

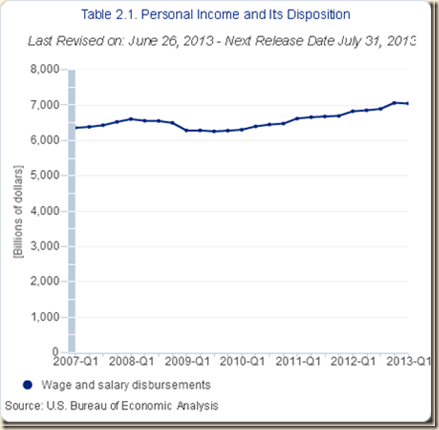

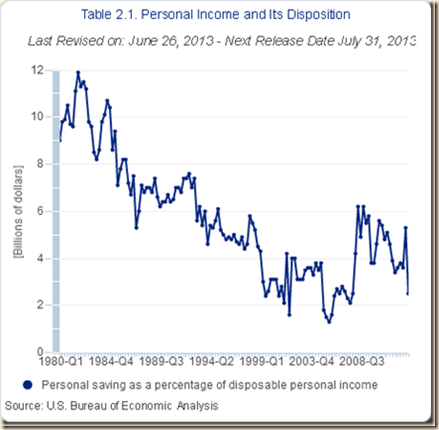

ESVI Stagnating Real Disposable Income. Chart IIA-3 provides personal income in the US between 1980 and 1989. These data are not adjusted for inflation that was still high in the 1980s in the exit from the Great Inflation of the 1960s and 1970s. Personal income grew steadily during the 1980s after recovery from two recessions from Jan IQ1980 to Jul IIIQ1980 and from Jul IIIQ1981 to Nov IVQ1982.

Chart IIA-3, US, Personal Income, Billion Dollars, Quarterly Seasonally Adjusted at Annual Rates, 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

A different evolution of personal income is shown in Chart IIA-4. Personal income also fell during the recession from Dec IVQ2007 to Jun IIQ2009 (http://www.nber.org/cycles.html). Growth of personal income during the expansion has been tepid even with the new revisions. In IVQ2012, nominal disposable personal income grew at the SAAR of 11.1 percent and real disposable personal income at 8.9 percent (http://www.bea.gov/iTable/index_nipa.cfm http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0513.pdf), which the BEA explains as: “Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf pages 1-2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0113.pdf). The Bureau of Economic Analysis explains as (http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0213.pdf 2-3): “The January estimate of employee contributions for government social insurance reflected the expiration of the “payroll tax holiday,” that increased the social security contribution rate for employees and self-employed workers by 2.0 percentage points, or $114.1 billion at an annual rate. For additional information, see FAQ on “How did the expiration of the payroll tax holiday affect personal income for January 2013?” at www.bea.gov. The January estimate of employee contributions for government social insurance also reflected an increase in the monthly premiums paid by participants in the supplementary medical insurance program, in the hospital insurance provisions of the Patient Protection and Affordable Care Act, and in the social security taxable wage base.”

The increase was provided in the “fiscal cliff” law H.R. 8 American Taxpayer Relief Act of 2012 (http://www.gpo.gov/fdsys/pkg/BILLS-112hr8eas/pdf/BILLS-112hr8eas.pdf).

In IQ2013, personal income fell at the SAAR of minus 4.7 percent; real personal income excluding current transfer receipts at minus 7.7 percent; and real disposable personal income at minus 8.6 percent (Table 6 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0513.pdf). The BEA explains as follows (page 3 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf):

“The February and January changes in disposable personal income (DPI) mainly reflected the effect of special factors in January, such as the expiration of the “payroll tax holiday” and the acceleration of bonuses and personal dividends to November and to December in anticipation of changes in individual tax rates.”

Chart IIA-4, US, Personal Income, Current Billions of Dollars, Quarterly Seasonally Adjusted at Annual Rates, 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

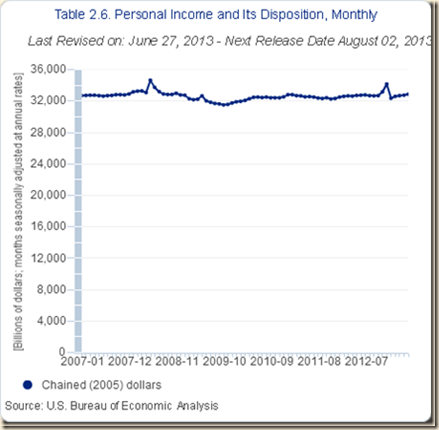

Real or inflation-adjusted disposable personal income is provided in Chart IIA-5 from 1980 to 1989. Real disposable income after allowing for taxes and inflation grew steadily at high rates during the entire decade.

Chart IIA-5, US, Real Disposable Income, Billions of Chained 2005 Dollars, Quarterly Seasonally Adjusted at Annual Rates 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

In IQ2013, personal income fell at the SAAR of minus 4.7 percent; real personal income excluding current transfer receipts at minus 7.7 percent; and real disposable personal income at minus 8.6 percent (Table 6 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0513.pdf). The BEA explains as follows (page 3 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf):

“The February and January changes in disposable personal income (DPI) mainly reflected the effect of special factors in January, such as the expiration of the “payroll tax holiday” and the acceleration of bonuses and personal dividends to November and to December in anticipation of changes in individual tax rates.”

This is the explanation for the decline in IQ2013 in Chart IIA-6.

Chart IIA-6, US, Real Disposable Income, Billions of Chained 2005 Dollars, Seasonally Adjusted at Annual Rates, 2007-2013

http://www.bea.gov/iTable/index_nipa.cfm

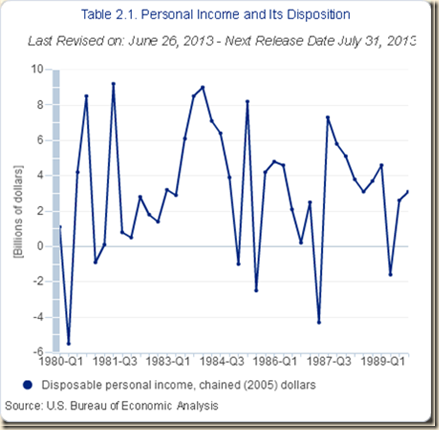

Chart IIA-7 provides percentage quarterly changes in real disposable income from the preceding period at seasonally adjusted annual rates from 1980 to 1989. Rates of changes were high during the decade with few negative changes.

Chart IIA-7, US, Real Disposable Income Percentage Change from Preceding Period at Quarterly Seasonally-Adjusted Annual Rates, 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

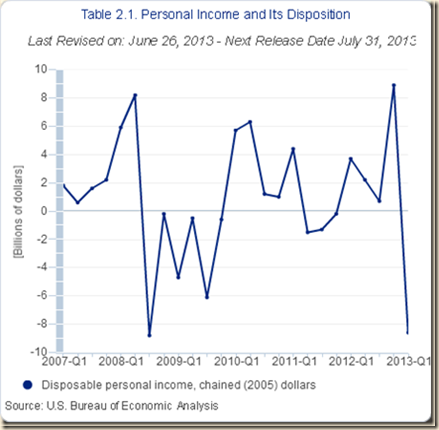

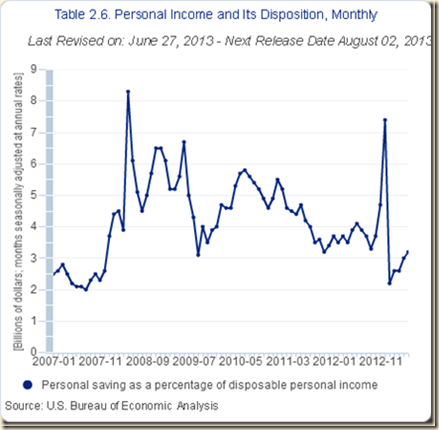

Chart IIA-8 provides percentage quarterly changes in real disposable income from the preceding period at seasonally adjusted annual rates from 2007 to 2013. There has been a period of positive rates followed by decline of rates and then negative and low rates in 2011. Recovery in 2012 has not reproduced the dynamism of the brief early phase of expansion. In IVQ2012, nominal disposable personal income grew at the SAAR of 10.6 percent and real disposable personal income at 8.9 percent, which the BEA explains as: “Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf). In IQ2013, personal income fell at the SAAR of minus 4.7 percent; real personal income excluding current transfer receipts at minus 7.7 percent; and real disposable personal income at minus 8.6 percent (Table 6 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0513.pdf). The BEA explains as follows (page 3 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf):

“The February and January changes in disposable personal income (DPI) mainly reflected the effect of special factors in January, such as the expiration of the “payroll tax holiday” and the acceleration of bonuses and personal dividends to November and to December in anticipation of changes in individual tax rates.”

Chart, IIA-8, US, Real Disposable Income, Percentage Change from Preceding Period at Seasonally-Adjusted Annual Rates, 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm