World Inflation Waves, Squeeze of Economic Activity by Carry Trades Induced by Zero Interest Rates, United States Industrial Production, Peaking Valuations of Risk Financial Assets, World Economic Slowdown and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011, 2012, 2013

Executive Summary

I World Inflation Waves

IA Appendix: Transmission of Unconventional Monetary Policy

IA1 Theory

IA2 Policy

IA3 Evidence

IA4 Unwinding Strategy

IB United States Inflation

IC Long-term US Inflation

ID Current US Inflation

IE Theory and Reality of Economic History and Monetary Policy Based on Fear of Deflation

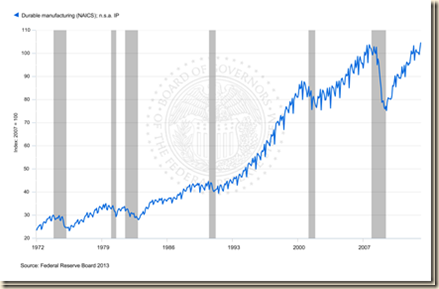

II United States Industrial Production

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

Executive Summary

ESI World Inflation Waves. The major reason and channel of transmission of unconventional monetary policy is through expectations of inflation. Fisher (1930) provided theoretical and historical relation of interest rates and inflation. Let in be the nominal interest rate, ir the real or inflation-adjusted interest rate and πe the expectation of inflation in the time term of the interest rate, which are all expressed as proportions. The following expression provides the relation of real and nominal interest rates and the expectation of inflation:

(1 + ir) = (1 + in)/(1 + πe) (1)

That is, the nominal interest rate equals the real interest rate discounted by the expectation of inflation in time term of the interest rate. Fisher (1933) observed the devastating effect of deflation on debts. Nominal debt contracts remained at original principal interest but net worth and income of debtors contracted during deflation. Real interest rates increase during declining inflation. For example, if the interest rate is 3 percent and prices decline 0.2 percent, equation (1) calculates the real interest rate as:

(1 +0.03)/(1 – 0.02) = 1.03/(0.998) = 1.032

That is, the real rate of interest is (1.032 – 1) 100 or 3.2 percent. If inflation were 2 percent, the real rate of interest would be 0.98 percent, or about 1.0 percent {[(1.03/1.02) -1]100 = 0.98%}.

The yield of the one-year Treasury security was quoted in the Wall Street Journal at 0.114 percent on Fri Apr 19, 2013 (http://online.wsj.com/mdc/page/marketsdata.html?mod=WSJ_topnav_marketdata_main). The expected rate of inflation πe in the next twelve months is not observed. Assume that it would be equal to the rate of inflation in the past twelve months estimated by the Bureau of Economic Analysis (BLS) at 1.5 percent (http://www.bls.gov/cpi/). The real rate of interest would be obtained as follows:

(1 + 0.00114)/(1 + 0.015) = (1 + ir) = 0.9863

That is, ir is equal to 1 – 0.9863 or minus 1.37 percent. Investing in a one-year Treasury security results in a loss of 1.37 percent relative to inflation. The objective of unconventional monetary policy of zero interest rates is to induce consumption and investment because of the loss to inflation of riskless financial assets. Policy would be truly irresponsible if it intended to increase inflationary expectations or πe. The result could be the same rate of unemployment with higher inflation (Kydland and Prescott 1977).

Friedman (1953) analyzed the effects of full-employment economic policy on economic stability. There are two critical issues. First, there are lags in effect of monetary policy on aggregate income and prices (Friedman 1961, Culbertson 1960, 1961, Batini and Nelson 2002, Romer and Romer 2004). Second, concrete knowledge on the functioning of the economy is inadequate. The result of shocking the economy with policies at the wrong time could be an increase in instability in the form of higher volatility of prices, or σp (standard deviation of prices), and higher volatility of real income, or σy (standard deviation of real income.

Carry trades from zero interest rates to highly leveraged exposures in risk financial assets characterize the current environment. Some analytical aspects of the carry trade are instructive (Pelaez and Pelaez, Globalization and the State, Vol. I (2008a), 101-5, Pelaez and Pelaez, Globalization and the State, Vol. II (2008b), 202-4), Government Intervention in Globalization: Regulation, Trade and Devaluation Wars (2008c), 70-4). Consider the following symbols: Rt is the exchange rate of a country receiving carry trade denoted in units of domestic currency per dollars at time t of initiation of the carry trade; Rt+τ is the exchange of the country receiving carry trade denoted in units of domestic currency per dollars at time t+τ when the carry trade is unwound; if is the domestic interest rate of the high-yielding country where investment will be made; iusd is the interest rate on short-term dollar debt assumed to be 0.5 percent per year; if >iusd, which expresses the fact that the interest rate on the foreign country is much higher than that in short-term USD (US dollars); St is the dollar value of the investment principal; and π is the dollar profit from the carry trade. The investment of the principal St in the local currency debt of the foreign country provides a profit of:

π = (1 + if)(RtSt)(1/Rt+τ) – (1 + iusd)St (2)

The profit from the carry trade, π, is nonnegative when:

(1 + if)/ (1 + iusd) ≥ Rt+τ/Rt (3)

In words, the difference in interest rate differentials, left-hand side of inequality (3), must exceed the percentage devaluation of the currency of the host country of the carry trade, right hand side of inequality (3). The carry trade must earn enough in the host-country interest rate to compensate for depreciation of the host-country at the time of return to USD. A simple example explains the vulnerability of the carry trade in fixed-income. Let if be 0.10 (10 percent), iusd 0.005 (0.5 percent), St USD100 and Rt CUR 1.00/USD. Adopt the fixed-income rule of months of 30 days and years of 360 days. Consider a strategy of investing USD 100 at 10 percent for 30 days with borrowing of USD 100 at 0.5 percent for 30 days. At time t, the USD 100 are converted into CUR 100 and invested at [(30/360)10] equal to 0.833 percent for thirty days. At the end of the 30 days, assume that the rate Rt+30 is still CUR 1/USD such that the return amount from the carry trade is USD 0.833. There is still a loan to be paid [(0.005)(30/360)USD100] equal to USD 0.042. The investor receives the net amount of USD 0.833 minus USD 0.042 or US 0.791. The rate of return on the investment of the USD 100 is 0.791 percent, which is equivalent to the annual rate of return of 9.49 percent {(0.791)(360/30)}. This is incomparably better than earning 0.5 percent. There are alternatives of hedging by buying forward the exchange for conversion back into USD.

Carry trades induced by zero interest rates increase the volatility of inflation σp and real income σy. World inflation waves originating in carry trades from zero interest rates to commodity futures and options deteriorate the sales prices of producing and investing companies and real income of consumers. The main objective of monetary policy is providing for financial stability. Unconventional monetary policy creates economic instability with higher volatilities of prices and real income as well as financial stability with major oscillations of risk financial assets. Carry trades induced by zero interest rates cause improvements and deteriorations of net margins of sales prices less costs of raw materials and real income of consumers disrupting decisions on production, investment and consumption.

Table ESI-1 provides annual equivalent rates of inflation for producer price indexes followed in this blog of countries and regions that account for close to three quarters of world output. The behavior of the US producer price index in 2011 and into 2012-2013 shows neatly multiple waves. (1) In Jan-Apr 2011, without risk aversion, US producer prices rose at the annual equivalent rate of 10.0 percent. (2) After risk aversion, producer prices increased in the US at the annual equivalent rate of 1.8 percent in May-Jun 2011. (3) From Jul to Sep 2011, under alternating episodes of risk aversion, producer prices increased at the annual equivalent rate of 4.9 percent. (4) Under the pressure of risk aversion because of the European debt crisis, US producer prices increased at the annual equivalent rate of 0.6 percent in Oct-Nov 2011. (5) From Dec 2011 to Jan 2012, US producer were flat at the annual equivalent rate of 0.0 percent. (6) Inflation of producer prices returned with 2.4 percent annual equivalent in Feb-Mar 2012. (7) With return of risk aversion from the European debt crisis, producer prices fell at the annual equivalent rate of 4.7 percent in Apr-May 2012. (8) New positions in commodity futures even with continuing risk aversion caused annual equivalent inflation of 3.0 percent in Jun-Jul 2012. (9) Relaxed risk aversion because of announcement of sovereign bond buying by the European Central Bank induced carry trades that resulted in annual equivalent producer price inflation in the US of 12.7 percent in Aug-Sep 2012. (10) Renewed risk aversion caused unwinding of carry trades of zero interest rates to commodity futures exposures with annual equivalent inflation of minus 3.5 percent in Oct-Dec 2012. (10) In Jan-Feb 2013, producer prices rose at the annual equivalent rate of 5.5 percent with more relaxed risk aversion at the margin. (11) Return of risk aversion resulted in annual equivalent inflation of minus 7.0 percent in Mar 2013. Resolution of the European debt crisis if there is not an unfavorable growth event with political development in China would result in jumps of valuations of risk financial assets. Increases in commodity prices would cause the same high producer price inflation experienced in Jan-Apr 2011 and Aug-Sep 2012. An episode of exploding commodity prices could ignite inflationary expectations that would result in an inflation phenomenon of costly resolution. There are nine producer-price indexes in Table ESI-1 for seven countries (two for the UK) and one region (euro area) showing very similar behavior. Zero interest rates without risk aversion cause increases in commodity prices that in turn increase input and output prices. Producer price inflation rose at very high rates during the first part of 2011 for the US, Japan, China, Euro Area, Germany, France, Italy and the UK when risk aversion was contained. With the increase in risk aversion in May and Jun 2011, inflation moderated because carry trades were unwound. Producer price inflation returned after Jul 2011, with alternating bouts of risk aversion. In the final months of the year producer price inflation collapsed because of the disincentive to exposures in commodity futures resulting from fears of resolution of the European debt crisis. There is renewed worldwide inflation in the early part of 2012 with subsequent collapse because of another round of sharp risk aversion. Sharp worldwide jump in producer prices occurred recently because of the combination of zero interest rates forever or QE→∞ with temporarily relaxed risk aversion. Producer prices were moderating or falling in the final months of 2012 because of renewed risk aversion that causes unwinding of carry trades from zero interest rates to commodity futures exposures. In the first months of 2013, new carry trades caused higher worldwide inflation. Unconventional monetary policy fails in stimulating the overall real economy, merely introducing undesirable instability because monetary authorities cannot control allocation of floods of money at zero interest rates to carry trades into risk financial assets. The economy is constrained in a suboptimal allocation of resources that is perpetuated along a continuum of short-term periods results in long-term or dynamic inefficiency in the form of a trajectory of economic activity that is lower than what would be attained with rules instead of discretionary authorities in monetary policy (http://cmpassocregulationblog.blogspot.com/2012/06/rules-versus-discretionary-authorities.html).

Table ESI-1, Annual Equivalent Rates of Producer Price Indexes

| INDEX 2011-2013 | AE ∆% |

| US Producer Price Index | |

| AE ∆% Mar | -7.0 |

| AE ∆% Jan-Feb 2013 | 5.5 |

| AE ∆% Oct-Dec 2012 | -3.5 |

| AE ∆% Aug-Sep 2012 | 12.7 |

| AE ∆% Jun-Jul 2012 | 3.0 |

| AE ∆% Apr-May 2012 | -4.7 |

| AE ∆% Feb-Mar 2012 | 2.4 |

| AE ∆% Dec 2011-Jan-2012 | 0.0 |

| AE ∆% Oct-Nov 2011 | 0.6 |

| AE ∆% Jul-Sep 2011 | 4.9 |

| AE ∆% May-Jun 2011 | 1.8 |

| AE ∆% Jan-Apr 2011 | 10.0 |

| Japan Corporate Goods Price Index | |

| AE ∆% Dec 2012-Mar 2013 | 3.7 |

| AE ∆% Oct-Nov 2012 | -3.0 |

| AE ∆% Aug-Sep 2012 | 3.0 |

| AE ∆% May-Jul 2012 | -5.8 |

| AE ∆% Feb-Apr 2012 | 2.0 |

| AE ∆% Dec 2011-Jan 2012 | -0.6 |

| AE ∆% Jul-Nov 2011 | -2.2 |

| AE ∆% May-Jun 2011 | -1.2 |

| AE ∆% Jan-Apr 2011 | 5.9 |

| China Producer Price Index | |

| AE ∆% Jan-Mar 2013 | 1.6 |

| AE ∆% Nov-Dec 2012 | -1.2 |

| AE ∆% Oct 2012 | 2.4 |

| AE ∆% May-Sep 2012 | -5.8 |

| AE ∆% Feb-Apr 2012 | 2.4 |

| AE ∆% Dec 2011-Jan 2012 | -2.4 |

| AE ∆% Jul-Nov 2011 | -3.1 |

| AE ∆% Jan-Jun 2011 | 6.4 |

| Euro Zone Industrial Producer Prices | |

| AE ∆% Jan-Feb 2013 | 3.7 |

| AE ∆% Nov-Dec 2012 | -2.4 |

| AE ∆% Sep-Oct 2012 | 1.2 |

| AE ∆% Jul-Aug 2012 | 7.4 |

| AE ∆% Apr-Jun 2012 | -3.2 |

| AE ∆% Jan-Mar 2012 | 8.3 |

| AE ∆% Oct-Dec 2011 | 0.4 |

| AE ∆% Jul-Sep 2011 | 2.4 |

| AE ∆% May-Jun 2011 | -1.2 |

| AE ∆% Jan-Apr 2011 | 11.4 |

| Germany Producer Price Index | |

| AE ∆% Feb-Mar 2013 | -1.8 NSA –3.0 SA |

| AE ∆% Jan 2013 | 10.0 NSA 1.2 SA |

| AE ∆% Oct-Dec 2012 | -1.6 NSA 1.6 SA |

| AE ∆% Aug-Sep 2012 | 4.9 NSA 4.9 SA |

| AE ∆% May-Jul 2012 | -2.8 NSA –0.4 SA |

| AE ∆% Feb-Apr 2012 | 4.9 NSA 1.6 SA |

| AE ∆% Dec 2011-Jan 2012 | 1.2 NSA –0.6 SA |

| AE ∆% Oct-Nov 2011 | 1.8 NSA 3.7 SA |

| AE ∆% Jul-Sep 2011 | 2.8 NSA 3.2 SA |

| AE ∆% May-Jun 2011 | 0.6 NSA 4.3 SA |

| AE ∆% Jan-Apr 2011 | 10.4 NSA 6.5 SA |

| France Producer Price Index for the French Market | |

| AE ∆% Jan-Feb 2013 | 6.2 |

| AE ∆% Nov-Dec 2012 | -4.1 |

| AE ∆% Jul-Oct 2012 | 7.1 |

| AE ∆% Apr-Jun 2012 | -5.1 |

| AE ∆% Jan-Mar 2012 | 6.2 |

| AE ∆% Oct-Dec 2011 | 2.8 |

| AE ∆% Jul-Sep 2011 | 3.7 |

| AE ∆% May-Jun 2011 | -1.8 |

| AE ∆% Jan-Apr 2011 | 10.4 |

| Italy Producer Price Index | |

| AE ∆% Feb 2013 | 2.4 |

| AE ∆% Sep 2012-Jan 2013 | -5.2 |

| AE ∆% Jul-Aug 2012 | 9.4 |

| AE ∆% May-Jun 2012 | -0.6 |

| AE ∆% Mar-Apr 2012 | 6.8 |

| AE ∆% Jan-Feb 2012 | 8.1 |

| AE ∆% Oct-Dec 2011 | 2.0 |

| AE ∆% Jul-Sep 2011 | 4.9 |

| AE ∆% May-Jun 2011 | 1.8 |

| AE ∆% Jan-April 2011 | 10.7 |

| UK Output Prices | |

| AE ∆% Jan-Mar 2013 | 5.3 |

| AE ∆% Nov-Dec 2012 | -2.4 |

| AE ∆% Jul-Oct 2012 | 4.0 |

| AE ∆% May-Jun 2012 | -5.3 |

| AE ∆% Feb-Apr 2012 | 7.9 |

| AE ∆% Nov 2011-Jan-2012 | 1.6 |

| AE ∆% May-Oct 2011 | 2.0 |

| AE ∆% Jan-Apr 2011 | 12.0 |

| UK Input Prices | |

| AE ∆% Mar 2013 | -1.2 |

| AE ∆% Jan-Feb 2013 | 30.5 |

| AE ∆% Sep-Dec 2012 | 1.5 |

| AE ∆% Jul-Aug 2012 | 14.0 |

| AE ∆% Apr-Jun 2012 | -21.9 |

| AE ∆% Jan-Mar 2012 | 18.1 |

| AE ∆% Nov-Dec 2011 | -1.2 |

| AE ∆% May-Oct 2011 | -3.1 |

| AE ∆% Jan-Apr 2011 | 35.6 |

AE: Annual Equivalent

Sources:

http://www.stats.gov.cn/enGliSH/

http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/search_database

https://www.destatis.de/EN/Homepage.html

http://www.insee.fr/en/default.asp

http://www.ons.gov.uk/ons/index.html

Similar world inflation waves are in the behavior of consumer price indexes of six countries and the euro zone in Table ESI-2. US consumer price inflation shows similar waves. (1) Under risk appetite in Jan-Apr 2011, consumer prices increased at the annual equivalent rate of 4.6 percent. (2) Risk aversion caused the collapse of inflation to annual equivalent 3.0 percent in May-Jun 2011. (3) Risk appetite drove the rate of consumer price inflation in the US to 3.3 percent in Jul-Sep 2011. (4) Gloomier views of carry trades caused the collapse of inflation in Oct-Nov 2011 to annual equivalent 0.6 percent. (5) Consumer price inflation resuscitated with increased risk appetite at annual equivalent of 1.2 percent in Dec 2011 to Jan 2012. (6) Consumer price inflation returned at 2.4 percent annual equivalent in Feb-Apr 2012. (7) Under renewed risk aversion, annual equivalent consumer price inflation in the US was 0.0 percent in May-Jul 2012. (8) Inflation jumped to annual equivalent 4.9 percent in Aug-Oct 2012. (9) Unwinding of carry trades caused negative annual equivalent inflation of 0.8 percent in Nov 2012-Jan 2013 but some countries experienced higher inflation in Dec 2012 and Jan 2013. (10) Inflation jumped again with annual equivalent inflation of 8.7 percent in Feb 2013 in a mood of relaxed risk aversion. (11) Inflation fell at 2.4 percent annual equivalent in Mar 2013. Inflationary expectations can be triggered in one of these episodes of accelerating inflation because of commodity carry trades induced by unconventional monetary policy of zero interest rates in perpetuity or QE→∞ or almost continuous time. Alternating episodes of increase and decrease of inflation introduce uncertainty in household planning that frustrates consumption and home buying. Announcement of purchases of impaired sovereign bonds by the European Central Bank relaxed risk aversion that induced carry trades into commodity exposures, increasing prices of food, raw materials and energy. There is similar behavior in all the other consumer price indexes in Table ESI-2. China’s CPI increased at annual equivalent 8.3 percent in Jan-Mar 2011, 2.0 percent in Apr-Jun, 2.9 percent in Jul-Dec and resuscitated at 5.8 percent annual equivalent in Dec 2011 to Mar 2012, declining to minus 3.9 percent in Apr-Jun 2012 but resuscitating at 4.1 percent in Jul-Sep 2012, declining to minus 1.2 percent in Oct 2012 and 0.0 percent in Oct-Nov 2012. High inflation in China at annual equivalent 5.5 percent in Nov-Dec 2012 is attributed to inclement winter weather that caused increases in food prices. Continuing pressure of food prices caused annual equivalent inflation of 12.2 percent in China in Dec 2012 to Feb 2013. Inflation in China fell at annual equivalent 10.3 percent in Mar 2013. The euro zone harmonized index of consumer prices (HICP) increased at annual equivalent 5.2 percent in Jan-Apr 2011, minus 2.4 percent in May-Jul 2011, 4.3 percent in Aug-Dec 2011, minus 3.0 percent in Dec 2011-Jan 2012 and then 9.6 percent in Feb-Apr 2012, falling to minus 2.8 percent annual equivalent in May-Jul 2012 but resuscitating at 5.3 percent in Aug-Oct 2012. The recent shock of risk aversion forced minus 2.4 percent annual equivalent in Nov 2012. As in several European countries, annual equivalent inflation jumped to 4.9 percent in the euro area in Dec 2012. The HICP price index fell at annual equivalent 11.4 percent in Jan 2013 and increased at 10.9 percent in Feb-Mar 2013. The price indexes of the largest members of the euro zone, Germany, France and Italy, and the euro zone as a whole, exhibit the same inflation waves. The United Kingdom CPI increased at annual equivalent 6.5 percent in Jan-Apr 2011, falling to only 0.4 percent in May-Jul 2011 and then increasing at 4.6 percent in Aug-Nov 2011. UK consumer prices fell at 0.6 percent annual equivalent in Dec 2011 to Jan 2012 but increased at 6.2 percent annual equivalent from Feb to Apr 2012. In May-Jun 2012, with renewed risk aversion, UK consumer prices fell at the annual equivalent rate of minus 3.0 percent. Inflation returned in the UK at average annual equivalent of 4.5 percent in Jul-Dec 2012 with inflation in Oct 2012 caused mostly by increases of university tuition fees. Inflation returned at 4.5 percent annual equivalent in Jul-Dec 2012 and was higher in annual equivalent producer price inflation in the UK in Jul-Oct 2012 at 4.0 percent for output prices and 14.0 percent for input prices in Jul-Aug 2012 (see Table ESI-1). Consumer prices in the UK fell at annual equivalent 5.8 percent in Jan 2013, rebounding at 6.2 percent in Feb-Mar 2013.

Table ESI-2, Annual Equivalent Rates of Consumer Price Indexes

| Index 2011-2013 | AE ∆% |

| US Consumer Price Index | |

| AE ∆% Mar 2013 | -2.4 |

| AE ∆% Feb 2013 | 8.7 |

| AE ∆% Nov 2012-Jan 2013 | -0.8 |

| AE ∆% Aug-Oct 2012 | 4.9 |

| AE ∆% May-Jul 2012 | 0.0 |

| AE ∆% Feb-Apr 2012 | 2.4 |

| AE ∆% Dec 2011-Jan 2012 | 1.2 |

| AE ∆% Oct-Nov 2011 | 0.6 |

| AE ∆% Jul-Sep 2011 | 3.3 |

| AE ∆% May-Jun 2011 | 3.0 |

| AE ∆% Jan-Apr 2011 | 4.6 |

| China Consumer Price Index | |

| AE ∆% Mar 2013 | -10.3 |

| AE ∆% Dec 2012-Feb 2013 | 12.2 |

| AE ∆% Oct-Nov 2012 | 0.0 |

| AE ∆% Jul-Sep 2012 | 4.1 |

| AE ∆% Apr-Jun 2012 | -3.9 |

| AE ∆% Dec 2011-Mar 2012 | 5.8 |

| AE ∆% Jul-Nov 2011 | 2.9 |

| AE ∆% Apr-Jun 2011 | 2.0 |

| AE ∆% Jan-Mar 2011 | 8.3 |

| Euro Zone Harmonized Index of Consumer Prices | |

| AE ∆% Feb-Mar 2013 | 10.0 |

| AE ∆% Jan 2013 | -11.4 |

| AE ∆% Dec 2012 | 4.9 |

| AE ∆% Nov 2012 | -2.4 |

| AE ∆% Aug-Oct 2012 | 5.3 |

| AE ∆% May-Jul 2012 | -2.8 |

| AE ∆% Feb-Apr 2012 | 9.6 |

| AE ∆% Dec 2011-Jan 2012 | -3.0 |

| AE ∆% Aug-Nov 2011 | 4.3 |

| AE ∆% May-Jul 2011 | -2.4 |

| AE ∆% Jan-Apr 2011 | 5.2 |

| Germany Consumer Price Index | |

| AE ∆% Feb-Mar 2013 | 6.8 NSA 1.2 SA |

| AE ∆% Jan 2013 | -5.8 NSA –1.2 SA |

| AE ∆% Sep-Dec 2012 | 1.5 NSA 1.5 SA |

| AE ∆% Jul-Aug 2012 | 4.9 NSA 3.7 SA |

| AE ∆% May-Jun 2012 | -1.2 NSA 1.2 SA |

| AE ∆% Feb-Apr 2012 | 4.5 NSA 2.0 SA |

| AE ∆% Dec 2011-Jan 2012 | 0.6 NSA 1.8 SA |

| AE ∆% Jul-Nov 2011 | 1.7 NSA 1.9 SA |

| AE ∆% May-Jun 2011 | 0.6 NSA 3.0 SA |

| AE ∆% Feb-Apr 2011 | 3.0 NSA 2.4 SA |

| France Consumer Price Index | |

| AE ∆% Feb-Mar 2013 | 6.8 |

| AE ∆% Nov 2012-Jan 2013 | -1.6 |

| AE ∆% Aug-Oct 2012 | 2.8 |

| AE ∆% May-Jul 2012 | -2.4 |

| AE ∆% Feb-Apr 2012 | 5.3 |

| AE ∆% Dec 2011-Jan 2012 | 0.0 |

| AE ∆% Aug-Nov 2011 | 3.0 |

| AE ∆% May-Jul 2011 | -1.2 |

| AE ∆% Jan-Apr 2011 | 4.3 |

| Italy Consumer Price Index | |

| AE ∆% Dec 2012-Mar 2013 | 2.4 |

| AE ∆% Sep-Nov 2012 | -0.8 |

| AE ∆% Jul-Aug 2012 | 3.0 |

| AE ∆% May-Jun 2012 | 1.2 |

| AE ∆% Feb-Apr 2012 | 5.7 |

| AE ∆% Dec 2011-Jan 2012 | 4.3 |

| AE ∆% Oct-Nov 2011 | 3.0 |

| AE ∆% Jul-Sep 2011 | 2.4 |

| AE ∆% May-Jun 2011 | 1.2 |

| AE ∆% Jan-Apr 2011 | 4.9 |

| UK Consumer Price Index | |

| AE ∆% Feb-Mar 2013 | 6.2 |

| AE ∆% Jan 2013 | -5.8 |

| AE ∆% Jul-Dec 2012 | 4.5 |

| AE ∆% May-Jun 2012 | -3.0 |

| AE ∆% Feb-Apr 2012 | 6.2 |

| AE ∆% Dec 2011-Jan 2012 | -0.6 |

| AE ∆% Aug-Nov 2011 | 4.6 |

| AE ∆% May-Jul 2011 | 0.4 |

| AE ∆% Jan-Apr 2011 | 6.5 |

AE: Annual Equivalent

Sources:

http://www.stats.gov.cn/enGliSH/

http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/search_database

https://www.destatis.de/EN/Homepage.html

http://www.insee.fr/en/default.asp

http://www.ons.gov.uk/ons/index.html

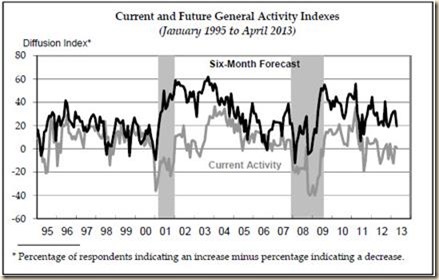

ESII Squeeze of Economic Activity by Carry Trades Induced by Zero Interest Rates I. There are two categories of responses in the Empire State Manufacturing Survey of the Federal Reserve Bank of New York (http://www.newyorkfed.org/survey/empire/empiresurvey_overview.html): current conditions and expectations for the next six months. There are responses in the survey for two types of prices: prices received or inputs of production and prices paid or sales prices of products. Table ESII-1 provides indexes for the two categories and within them for the two types of prices from Jan 2011 to Apr 2013. There are two categories of responses in the Empire State Manufacturing Survey of the Federal Reserve Bank of New York (http://www.newyorkfed.org/survey/empire/empiresurvey_overview.html): current conditions and expectations for the next six months. There are responses in the survey for two types of prices: prices received or inputs of production and prices paid or sales prices of products. The index of current prices paid or costs of inputs increased from 14.61 in Dec 2012 while the index of current prices received or sales prices increased from 1.08 in Dec 2012 to 5.68 in Apr 2013. The index of future prices paid or expectations of costs of inputs in the next six months fell from 51.61 in Dec 2012 to 44.32 in Apr 2013 while the index of future prices received or expectation of sales prices in the next six months fell from 25.81 in Dec 2012 to 14.77 in Apr 2013. Prices of sales of finished products are less dynamic than prices of costs of inputs during waves of increases. Prices of costs of costs of inputs fall less rapidly than prices of sales of finished products during waves of price decreases. As a result, margins of prices of sales less costs of inputs oscillate with typical deterioration against producers.

Table ESII-1, US, FRBNY Empire State Manufacturing Survey, Diffusion Indexes, Prices Paid and Prices Received, SA

| Current Prices Paid | Current Prices Received | Six Months Prices Paid | Six Months Prices Received | |

| Apr 2013 | 28.41 | 5.68 | 44.32 | 14.77 |

| Mar | 25.81 | 2.15 | 50.54 | 23.66 |

| Feb | 26.26 | 8.08 | 44.44 | 13.13 |

| Jan | 22.58 | 10.75 | 38.71 | 21.51 |

| Dec 2012 | 16.13 | 1.08 | 51.61 | 25.81 |

| Nov | 14.61 | 5.62 | 39.33 | 15.73 |

| Oct | 17.20 | 4.30 | 44.09 | 24.73 |

| Sep | 19.15 | 5.32 | 40.43 | 23.40 |

| Aug | 16.47 | 2.35 | 31.76 | 14.12 |

| Jul | 7.41 | 3.70 | 35.80 | 16.05 |

| Jun | 19.59 | 1.03 | 34.02 | 17.53 |

| May | 37.35 | 12.05 | 57.83 | 22.89 |

| Apr | 45.78 | 19.28 | 50.60 | 22.89 |

| Mar | 50.62 | 13.58 | 66.67 | 32.10 |

| Feb | 25.88 | 15.29 | 62.35 | 34.12 |

| Jan | 26.37 | 23.08 | 53.85 | 30.77 |

| Dec 2011 | 24.42 | 3.49 | 56.98 | 36.05 |

| Nov | 18.29 | 6.10 | 36.59 | 25.61 |

| Oct | 22.47 | 4.49 | 40.45 | 17.98 |

| Sep | 32.61 | 8.70 | 53.26 | 22.83 |

| Aug | 28.26 | 2.17 | 42.39 | 15.22 |

| Jul | 43.33 | 5.56 | 51.11 | 30.00 |

| Jun | 56.12 | 11.22 | 55.10 | 19.39 |

| May | 69.89 | 27.96 | 68.82 | 35.48 |

| Apr | 57.69 | 26.92 | 56.41 | 38.46 |

| Mar | 53.25 | 20.78 | 71.43 | 36.36 |

| Feb | 45.78 | 16.87 | 55.42 | 27.71 |

| Jan | 35.79 | 15.79 | 60.00 | 42.11 |

Source: http://www.newyorkfed.org/survey/empire/empiresurvey_overview.html

Price indexes of the Federal Reserve Bank of Philadelphia Outlook Survey are provided in Table ESII-2. As inflation waves throughout the world (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/03/recovery-without-hiring-ten-million.html), indexes of both current and expectations of future prices paid and received were quite high until May 2011. Prices paid, or inputs, were more dynamic, reflecting carry trades from zero interest rates to commodity futures. All indexes softened after May 2011 with even decline of prices received in Aug 2011 during the first round of risk aversion. Current and future price indexes have increased again but not back to the levels in the beginning of 2011 because of risk aversion frustrating carry trades even under zero interest rates. The index of prices paid or prices of inputs fell from 23.5 in Dec 2012 to 3/1 in Apr 2013. The index of current prices received was minus 7.5 in Apr 2013, indicating decrease of prices received. The index of future prices paid fell to 26.6 in Apr 2013 from 45.8 in Dec 2012, indicating expectation of lower pressure of increases of input prices, while the index of future prices received fell marginally from 25.6 in Dec 2012 to 8.3 in Apr 2013. Expectations are incorporating faster increases in prices of inputs or costs of production than of sales of produced goods.

Table ESII-2, US, Federal Reserve Bank of Philadelphia Business Outlook Survey, Current and Future Prices Paid and Prices Received, SA

| Current Prices Paid | Current Prices Received | Future Prices Paid | Future Prices Paid | |

| Dec-10 | 44.3 | 6.6 | 59.6 | 25.3 |

| Jan-11 | 48.9 | 11.9 | 58.3 | 34.4 |

| Feb-11 | 58.9 | 13.1 | 62.1 | 33.3 |

| Mar-11 | 57.5 | 16.8 | 60.2 | 31.8 |

| Apr-11 | 49.4 | 19.8 | 54.2 | 32.4 |

| May-11 | 47.7 | 18.5 | 52.7 | 27.6 |

| Jun-11 | 38.9 | 8.1 | 38.3 | 6.8 |

| Jul-11 | 35.6 | 6 | 49.6 | 16.7 |

| Aug-11 | 23.3 | -4.7 | 44.3 | 22.7 |

| Sep-11 | 31.6 | 7.6 | 41.8 | 21.8 |

| Oct-11 | 25.4 | 4.1 | 44.5 | 28.4 |

| Nov-11 | 26.3 | 7.6 | 39 | 29.1 |

| Dec-11 | 27.5 | 8.2 | 46.7 | 23.5 |

| Jan-12 | 27.1 | 7.9 | 47.2 | 21.9 |

| Feb-12 | 30.2 | 9.7 | 43.5 | 28.6 |

| Mar-12 | 14.3 | 5.4 | 35.9 | 22 |

| Apr-12 | 16 | 5.3 | 33.3 | 18.6 |

| May-12 | 5.4 | -2.2 | 37.2 | 8.3 |

| Jun-12 | 5.4 | -3.4 | 29.6 | 16.6 |

| Jul-12 | 10.3 | 4.2 | 29.3 | 19.6 |

| Aug-12 | 15.7 | 4.7 | 38 | 23.9 |

| Sep-12 | 15.4 | 4 | 42.8 | 27.4 |

| Oct-12 | 20.6 | 8.4 | 48.1 | 16.1 |

| Nov-12 | 27.9 | 7.5 | 50.7 | 14 |

| Dec-12 | 23.5 | 12.4 | 45.8 | 25.6 |

| Jan-13 | 14.7 | -1.1 | 34.3 | 21.7 |

| Feb-13 | 8.9 | -0.5 | 26.4 | 25.4 |

| Mar-13 | 8.5 | -0.8 | 30.9 | 16.6 |

| Apr-13 | 3.1 | -7.5 | 26.6 | 8.3 |

Source: Federal Reserve Bank of Philadelphia http://www.philadelphiafed.org/index.cfm

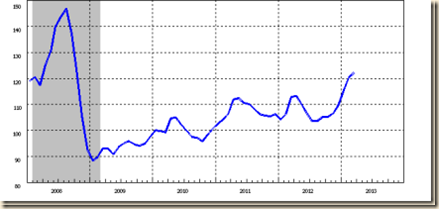

Chart ESII-1 of the Business Outlook Survey of the Federal Reserve Bank of Philadelphia Outlook Survey provides the diffusion index of current prices paid or prices of inputs from 2006 to 2013. Recession dates are in shaded areas. In the middle of deep global contraction after IVQ2007, input prices continued to increase in speculative carry trades from central bank policy rates falling toward zero into commodities futures. The index peaked above 70 in the second half of 2008. Inflation of inputs moderated significantly during the shock of risk aversion in late 2008, even falling briefly into contraction territory below zero during several months in 2009 in the flight away from risk financial assets into US government securities (Cochrane and Zingales 2009) that unwound carry trades. Return of risk appetite induced carry trade with significant increase until return of risk aversion in the first round of the European sovereign debt crisis in Apr 2010. Carry trades returned during risk appetite in expectation that the European sovereign debt crisis was resolved. The various inflation waves originating in carry trades induced by zero interest rates with alternating episodes of risk aversion are mirrored in the prices of inputs after 2011, in particular after Aug 2012 with the announcement of the Outright Monetary Transactions Program of the European Central Bank (http://www.ecb.int/press/pr/date/2012/html/pr120906_1.en.html). Subsequent risk aversion caused sharp decline in the index of prices paid.

Chart ESII-1, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Paid Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

http://www.philadelphiafed.org/index.cfm

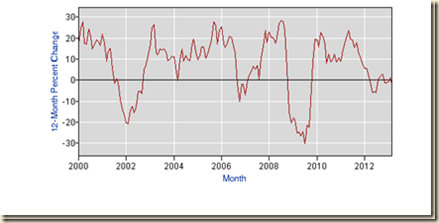

Chart ESII-2 of the Federal Reserve Bank of Philadelphia Outlook Survey provides the diffusion index of current prices received from 2006 to 2013. The significant difference between the index of current prices paid in Chart ESII-1 and the index of current prices paid in Chart ESII-2 is that increases in prices paid are significantly sharper than increases in prices received. There were several periods of negative readings of prices received from 2010 to 2013 but none of prices paid. Prices paid relative to prices received deteriorate most of the time largely because of the carry trades from zero interest rates to commodity futures. Profit margins of business are compressed intermittently by fluctuations of commodity prices induced by unconventional monetary policy of zero interest rates, frustrating production, investment and hiring decisions of business, which is precisely the opposite outcome desired by unconventional monetary policy.

Chart ESII-2, Federal Reserve Bank of Philadelphia Business Outlook Survey Current Prices Received Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

http://www.philadelphiafed.org/index.cfm

ESIII Squeeze of Economy Activity by Carry Trades Induced by Zero Interest Rates II. The geographical breakdown of exports and imports of Japan with selected regions and countries is provided in Table ESIII-3 for Mar 2013. The share of Asia in Japan’s trade is more than one half, 54.2 percent of exports and 43.2 percent of imports. Within Asia, exports to China are 17.7 percent of total exports and imports from China 20.2 percent of total imports. While exports to China fell 2.5 percent in the 12 months ending in Mar 2013, imports from China increased 1.0 percent. The second largest export market for Japan in Mar 2013 is the US with share of 17.5 percent of total exports and share of imports from the US of 8.1 percent in total imports. Western Europe has share of 9.8 percent in Japan’s exports and of 10.5 percent in imports. Rates of growth of exports of Japan in Mar 2013 are negative for several countries and regions with the exception of growth of 7.0 percent for exports to the US, 22.3 for exports to Mexico, 3.6 percent for exports to Brazil and 1.0 percent for exports to Australia. Comparisons relative to 2011 may have some bias because of the effects of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Deceleration of growth in China and the US and threat of recession in Europe can reduce world trade and economic activity, which could be part of the explanation for the increase of Japan’s exports by 1.1 percent in Mar 2013 while imports increased 5.5 percent but higher levels after the earthquake and declining prices may be another factor. Growth rates of imports in the 12 months ending in Mar 2013 are positive for most trading partners. Imports from Asia increased 3.8 percent in the 12 months ending in Mar 2013 while imports from China increased 1.0 percent. Data are in millions of yen, which has effects of recent depreciation of the yen relative to the United States dollar (USD).

Table ESIII-3, Japan, Value and 12-Month Percentage Changes of Exports and Imports by Regions and Countries, ∆% and Millions of Yens

| Mar 2013 | Exports | 12 months ∆% | Imports Millions Yen | 12 months ∆% |

| Total | 6,271,355 | 1.1 | 6,633,776 | 5.5 |

| Asia | 3,399,786 | 0.3 | 2,863,414 | 3.8 |

| China | 1,108,606 | -2.5 | 1,342,491 | 1.0 |

| USA | 1,096,769 | 7.0 | 535,136 | -0.4 |

| Canada | 78,247 | -7.9 | 91,097 | 5.0 |

| Brazil | 50,166 | 3.6 | 86,684 | 10.4 |

| Mexico | 88,090 | 22.3 | 31,335 | -6.8 |

| Western Europe | 615,009 | -4.7 | 696,019 | 10.8 |

| Germany | 153,886 | -1.4 | 185,366 | 0.4 |

| France | 49,858 | -16.6 | 103,961 | 30.1 |

| UK | 80,750 | -12.4 | 47,673 | -14.4 |

| Middle East | 224,218 | -7.1 | 1,313,653 | 2.7 |

| Australia | 150,352 | 1.0 | 399,424 | 6.1 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

Japan registered another deficit in the trade balance of JPY 362,421 million, as shown in Table ESIII-2. The significantly large deficits of JPY 1,089,435 million with the Middle East, JPY 233,372 million with China, JPY 249,072 with China and JPY 81,010 with Western Europe are not compensated by surpluses of JPY 536,372 with Asia and JPY 561,633 with the US

Table ESIII-2, Japan, Trade Balance, Millions of Yen

| Mar 2013 | Millions of Yen |

| Total | -362,421 |

| Asia | 536,372 |

| China | -233,885 |

| USA | 561,633 |

| Canada | -12,850 |

| Brazil | -36,518 |

| Mexico | 56,755 |

| Western Europe | -81,010 |

| Germany | -31,480 |

| France | -54,103 |

| UK | 33,077 |

| Middle East | -1,089,435 |

| Australia | -249,072 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

There was milder increase in Japan’s export corporate goods price index during the global recession in 2008 but similar sharp decline during the bank balance sheets effect in late 2008, as shown in Chart ESIII-1 of the Bank of Japan. Japan exports industrial goods whose prices have been less dynamic than those of commodities and raw materials. As a result, the export CGPI on the yen basis in Chart ESIII-1 trends down with oscillations after a brief rise in the final part of the recession in 2009. The export corporate goods price index fell from 104.9 in Jun 2009 to 94 in Jan 2012 or minus 10.4 percent and increased to 106.6 in Mar 2013 for a gain of 13.4 percent relative to Jan 2012 and 1.6 percent relative to Jun 2009. The choice of Jun 2009 is designed to capture the reversal of risk aversion beginning in Sep 2008 with the announcement of toxic assets in banks that would be withdrawn with the Troubled Asset Relief Program (TARP) (Cochrane and Zingales 2009). Reversal of risk aversion in the form of flight to the USD and obligations of the US government opened the way to renewed carry trades from zero interest rates to exposures in risk financial assets such as commodities. Japan exports industrial products and imports commodities and raw materials.

Chart ESIII-1, Japan, Export Corporate Goods Price Index, Monthly, Yen Basis, 2008-2013

Source: Bank of Japan

http://www.stat-search.boj.or.jp/index_en.html

Chart ESIII-2 provides the export corporate goods price index on the basis of the contract currency. The export corporate goods price index on the basis of the contract currency increased from 97.9 in Jun 2009 to 102.4 in Feb 2012 or 4.6 percent but dropped to 101.3 in Mar 2013 or minus 1.1 percent relative to Feb 2012 and gained 3.5 percent relative to Jun 2009.

Chart ESIII-2, Japan, Export Corporate Goods Price Index, Monthly, Contract Currency Basis, 2008-2013

http://www.stat-search.boj.or.jp/index_en.html

Japan imports primary commodities and raw materials. As a result, the import corporate goods price index on the yen basis in Chart ESIII-3 shows an upward trend after the rise during the global recession in 2008 driven by carry trades from fed funds rates collapsing to zero into commodity futures and decline during risk aversion from late 2008 into beginning of 2008 originating in doubts about soundness of US bank balance sheets. More careful measurement should show that the terms of trade of Japan, export prices relative to import prices, declined during the commodity shocks originating in unconventional monetary policy. The decline of the terms of trade restricted potential growth of income in Japan. The import corporate goods price index on the yen basis increased from 93.5 in Jun 2009 to 106.4 in Feb 2012 or 13.8 percent and to 122.2 in Mar 2013 or gain of 14.8 percent relative to Feb 2012 and 30.7 percent relative to Jun 2009.

Chart VB-3, Japan, Import Corporate Goods Price Index, Monthly, Yen Basis, 2008-2013

Source: Bank of Japan

http://www.stat-search.boj.or.jp/index_en.html

Chart ESIII-4 provides the import corporate goods price index on the contract currency basis. The import corporate goods price index on the basis of the contract currency increased from 86.2 in Jun 2009 to 115.8 in Feb 2012 or 34.3 percent and to 115.3 in Mar 2013 or minus 0.4 percent relative to Feb 2012 and gain of 33.8 percent relative to Jun 2009. There is evident deterioration of the terms of trade of Japan: the export corporate goods price index on the basis of the contract currency increased 4.6 percent from Jun 2009 to Feb 2012 while the import corporate goods price index increased 34.3 percent. Prices of Japan’s exports of corporate goods, mostly industrial products, increased only 3.5 percent from Jun 2009 to Mar 2013, while imports of corporate goods, mostly commodities and raw materials increased 33.8 percent. Unconventional monetary policy induces carry trades from zero interest rates to exposures in commodities that squeeze economic activity of industrial countries by increases in prices of imported commodities and raw materials during periods without risk aversion. Reversals of carry trades during periods of risk aversion decrease prices of exported commodities and raw materials that squeeze economic activity in economies exporting commodities and raw materials. Devaluation of the dollar by unconventional monetary policy could increase US competitiveness in world markets but economic activity is squeezed by increases in prices of imported commodities and raw materials. Devaluation of the dollar by unconventional monetary policy could increase US competitiveness in world markets but economic activity is squeezed by increases in prices of imported commodities and raw materials. Unconventional monetary policy causes instability worldwide instead of the mission of central banks of promoting financial and economic stability.

materials. Unconventional monetary policy causes instability worldwide instead of the mission of central banks of promoting financial and economic stability.

Chart ESIII-4, Japan, Import Corporate Goods Price Index, Monthly, Contract Currency Basis, 2008-2013

http://www.stat-search.boj.or.jp/index_en.html

Table ESIII-3 provides the Bank of Japan’s Corporate Goods Price indexes of exports and imports on the yen and contract bases from Jan 2008 to Mar 2013. There are oscillations of the indexes that are shown vividly in the four charts above. For the entire period from Jan 2008 to Mar 2013, the export index on the contract currency basis increased 2.1 percent and fell 7.7 percent on the yen basis. For the entire period from Jan 2008 to Mar 2013, the import index increased 14.5 percent on the contract currency basis and increased 2.7 percent on the yen basis. The charts show sharp deteriorations in relative prices of exports to prices of imports during multiple periods. Price margins of Japan’s producers are subject to periodic squeezes resulting from carry trades from zero interest rates of monetary policy to exposures in commodities.

Table ESIII-3, Japan, Exports and Imports Corporate Goods Price Index, Contract Currency Basis and Yen Basis

| Month | Exports Contract | Exports Yen | Imports Contract Currency | Imports Yen |

| 2008/01 | 99.2 | 115.5 | 100.7 | 119.0 |

| 2008/02 | 99.8 | 116.1 | 102.4 | 120.6 |

| 2008/03 | 100.5 | 112.6 | 104.5 | 117.4 |

| 2008/04 | 101.6 | 115.3 | 110.1 | 125.2 |

| 2008/05 | 102.4 | 117.4 | 113.4 | 130.4 |

| 2008/06 | 103.5 | 120.7 | 119.5 | 140.3 |

| 2008/07 | 104.7 | 122.1 | 122.6 | 143.9 |

| 2008/08 | 103.7 | 122.1 | 123.1 | 147.0 |

| 2008/09 | 102.7 | 118.3 | 117.1 | 137.1 |

| 2008/10 | 100.2 | 109.6 | 109.1 | 121.5 |

| 2008/11 | 98.6 | 104.5 | 97.8 | 105.8 |

| 2008/12 | 97.9 | 100.6 | 89.3 | 93.0 |

| 2009/01 | 98.0 | 99.5 | 85.6 | 88.4 |

| 2009/02 | 97.5 | 100.1 | 85.7 | 89.7 |

| 2009/03 | 97.3 | 104.2 | 85.2 | 93.0 |

| 2009/04 | 97.6 | 105.6 | 84.4 | 93.0 |

| 2009/05 | 97.5 | 103.8 | 84.0 | 90.8 |

| 2009/06 | 97.9 | 104.9 | 86.2 | 93.5 |

| 2009/07 | 97.5 | 103.1 | 89.2 | 95.0 |

| 2009/08 | 98.3 | 104.4 | 89.6 | 95.8 |

| 2009/09 | 98.3 | 102.1 | 91.0 | 94.7 |

| 2009/10 | 98.0 | 101.2 | 91.0 | 94.0 |

| 2009/11 | 98.4 | 100.8 | 92.8 | 94.8 |

| 2009/12 | 98.3 | 100.7 | 95.4 | 97.5 |

| 2010/01 | 99.4 | 102.2 | 97.0 | 100.0 |

| 2010/02 | 99.7 | 101.6 | 97.6 | 99.8 |

| 2010/03 | 99.7 | 101.8 | 97.0 | 99.2 |

| 2010/04 | 100.5 | 104.6 | 99.9 | 104.6 |

| 2010/05 | 100.7 | 102.9 | 101.7 | 104.9 |

| 2010/06 | 100.1 | 101.6 | 100.0 | 102.3 |

| 2010/07 | 99.4 | 99 | 99.9 | 99.8 |

| 2010/08 | 99.1 | 97.3 | 99.5 | 97.5 |

| 2010/09 | 99.4 | 97 | 100.0 | 97.2 |

| 2010/10 | 100.1 | 96.4 | 100.5 | 95.8 |

| 2010/11 | 100.7 | 97.4 | 102.6 | 98.2 |

| 2010/12 | 101.2 | 98.3 | 104.4 | 100.6 |

| 2011/01 | 102.1 | 98.6 | 107.2 | 102.6 |

| 2011/02 | 102.9 | 99.5 | 109.0 | 104.3 |

| 2011/03 | 103.5 | 99.6 | 111.8 | 106.3 |

| 2011/04 | 104.1 | 101.7 | 115.9 | 111.9 |

| 2011/05 | 103.9 | 99.9 | 118.8 | 112.4 |

| 2011/06 | 103.8 | 99.3 | 117.5 | 110.5 |

| 2011/07 | 103.6 | 98.3 | 118.3 | 110.2 |

| 2011/08 | 103.6 | 96.6 | 118.6 | 108.1 |

| 2011/09 | 103.7 | 96.1 | 117.0 | 106.2 |

| 2011/10 | 103.0 | 95.2 | 116.6 | 105.6 |

| 2011/11 | 101.9 | 94.8 | 115.4 | 105.4 |

| 2011/12 | 101.5 | 94.5 | 116.1 | 106.2 |

| 2012/01 | 101.8 | 94 | 115.0 | 104.2 |

| 2012/02 | 102.4 | 95.8 | 115.8 | 106.4 |

| 2012/03 | 102.9 | 99.2 | 118.3 | 112.9 |

| 2012/04 | 103.1 | 98.6 | 119.5 | 113.1 |

| 2012/05 | 102.2 | 96.3 | 118.1 | 109.9 |

| 2012/06 | 101.4 | 95.0 | 115.2 | 106.7 |

| 2012/07 | 100.6 | 94.0 | 112.0 | 103.6 |

| 2012/08 | 100.8 | 94.1 | 112.4 | 103.6 |

| 2012/09 | 100.9 | 94.0 | 114.7 | 105.2 |

| 2012/10 | 101.0 | 94.7 | 113.8 | 105.2 |

| 2012/11 | 100.9 | 95.9 | 113.3 | 106.6 |

| 2012/12 | 100.7 | 98.0 | 113.6 | 109.7 |

| 2013/01 | 101.0 | 102.5 | 114.0 | 115.5 |

| 2013/02 | 101.5 | 105.9 | 114.9 | 120.4 |

| 2013/03 | 101.3 | 106.6 | 115.3 | 122.2 |

Source: Bank of Japan

http://www.stat-search.boj.or.jp/index_en.html

Further insight into inflation of the corporate goods price index (CGPI) of Japan is provided in Table ESIII-4. Petroleum and coal with weight of 5.7 percent increased 0.6 percent in Mar 2013 and increased 1.6 percent in 12 months. Japan exports manufactured products and imports raw materials and commodities such that the country’s terms of trade, or export prices relative to import prices, deteriorate during commodity price increases. In contrast, prices of production machinery, with weight of 3.1 percent, increased 0.4 percent in Mar 2013 and increased 0.2 percent in 12 months. In general, most manufactured products have been experiencing negative or low increases in prices while inflation rates have been high in 12 months for products originating in raw materials and commodities. Ironically, unconventional monetary policy of zero interest rates and quantitative easing that intended to increase aggregate demand and GDP growth deteriorated the terms of trade of advanced economies with adverse effects on real income.

Table ESIII-4, Japan, Corporate Goods Prices and Selected Components, % Weights, Month and 12 Months ∆%

| Mar 2013 | Weight | Month ∆% | 12 Month ∆% |

| Total | 1000.0 | 0.1 | -0.5 |

| Food, Beverages, Tobacco, Feedstuffs | 137.5 | -0.1 | 0.4 |

| Petroleum & Coal | 57.4 | 0.6 | 1.6 |

| Production Machinery | 30.8 | 0.4 | 0.2 |

| Electronic Components | 31.0 | -0.3 | -1.9 |

| Electric Power, Gas & Water | 52.7 | 0.4 | 4.2 |

| Iron & Steel | 56.6 | 0.3 | -7.5 |

| Chemicals | 92.1 | 0.3 | 0.9 |

| Transport | 136.4 | 0.0 | -2.2 |

Source: Bank of Japan http://www.boj.or.jp/en/statistics/pi/cgpi_release/cgpi1303.pdf

Percentage point contributions to change of the corporate goods price index (CGPI) in Mar 2013 are provided in Table ESIII-5 divided into domestic, export and import segments. In the domestic CGPI, increasing 0.1 percent in Mar 2013, the energy shock resulting from carry trades is evident in the contribution of 0.04 percentage points by petroleum and coal products in new carry trades of exposures in commodity futures. The exports CGPI decreased 0.2 percent on the basis of the contract currency with deduction of 0.08 percentage points by general purpose, production & business oriented machinery. The imports CGPI increased 0.3 percent on the contract currency basis. Petroleum, coal & natural gas added 0.45 percentage points because of new carry trades into energy commodity exposures. Shocks of risk aversion cause unwinding carry trades that result in declining commodity prices with resulting downward pressure on price indexes. The volatility of inflation adversely affects financial and economic decisions worldwide.

Table ESIII-5, Japan, Percentage Point Contributions to Change of Corporate Goods Price Index

| Groups Mar 2013 | Contribution to Change Percentage Points |

| A. Domestic Corporate Goods Price Index | Monthly Change: |

| Petroleum & Coal Products | 0.04 |

| Scrap & Waste | 0.03 |

| Chemicals & Related Products | 0.02 |

| Electric Power, Gas & Water | 0.02 |

| Iron & Steel | 0.02 |

| Nonferrous Metals | -0.02 |

| B. Export Price Index | Monthly Change: |

| General Purpose, Production & Business Oriented Machinery | -0.08 |

| Textiles | -0.07 |

| Metals & Related Products | -0.06 |

| Chemicals & Related Products | 0.07 |

| C. Import Price Index | Monthly Change: 0.3 % contract currency basis |

| Petroleum, Coal & Natural Gas | 0.45 |

| Metals & Related Products | -0.09 |

Source: Bank of Japan

http://www.boj.or.jp/en/statistics/pi/cgpi_release/cgpi1303.pdf

ESIV Global Financial and Economic Risk. The International Monetary Fund (IMF) provides an international safety net for prevention and resolution of international financial crises. The IMF’s Financial Sector Assessment Program (FSAP) provides analysis of the economic and financial sectors of countries (see Pelaez and Pelaez, International Financial Architecture (2005), 101-62, Globalization and the State, Vol. II (2008), 114-23). Relating economic and financial sectors is a challenging task both for theory and measurement. The IMF (2012WEOOct) provides surveillance of the world economy with its Global Economic Outlook (WEO) (http://www.imf.org/external/pubs/ft/weo/2012/02/index.htm), of the world financial system with its Global Financial Stability Report (GFSR) (IMF 2012GFSROct) (http://www.imf.org/external/pubs/ft/gfsr/2012/02/index.htm) and of fiscal affairs with the Fiscal Monitor (IMF 2012FMOct) (http://www.imf.org/external/pubs/ft/fm/2012/02/fmindex.htm). There appears to be a moment of transition in global economic and financial variables that may prove of difficult analysis and measurement. It is useful to consider a summary of global economic and financial risks, which are analyzed in detail in the comments of this blog in Section VI Valuation of Risk Financial Assets, Table VI-4.

Economic risks include the following:

- China’s Economic Growth. China is lowering its growth target to 7.5 percent per year. China’s GDP growth decelerated significantly from annual equivalent 9.9 percent in IIQ2011 to 7.4 percent in IVQ2011 and 6.6 percent in IQ2012, rebounding to 7.8 percent in IIQ2012, 8.7 percent in IIIQ2012 and 8.2 percent in IVQ2012. Annual equivalent growth in IQ2013 fell to 6.6 percent. (See Subsection VC and earlier at http://cmpassocregulationblog.blogspot.com/2013/01/recovery-without-hiring-world-inflation.html and earlier at http://cmpassocregulationblog.blogspot.com/2012/10/world-inflation-waves-stagnating-united_21.html).

- United States Economic Growth, Labor Markets and Budget/Debt Quagmire. The US is growing slowly with 30.8 million in job stress, fewer 10 million full-time jobs, high youth unemployment, historically low hiring and declining real wages.

- Economic Growth and Labor Markets in Advanced Economies. Advanced economies are growing slowly. There is still high unemployment in advanced economies.

- World Inflation Waves. Inflation continues in repetitive waves globally (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/03/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2013/02/world-inflation-waves-united-states.html).

A list of financial uncertainties includes:

- Euro Area Survival Risk. The resilience of the euro to fiscal and financial doubts on larger member countries is still an unknown risk.

- Foreign Exchange Wars. Exchange rate struggles continue as zero interest rates in advanced economies induce devaluation of their currencies.

- Valuation of Risk Financial Assets. Valuations of risk financial assets have reached extremely high levels in markets with lower volumes.

- Duration Trap of the Zero Bound. The yield of the US 10-year Treasury rose from 2.031 percent on Mar 9, 2012, to 2.294 percent on Mar 16, 2012. Considering a 10-year Treasury with coupon of 2.625 percent and maturity in exactly 10 years, the price would fall from 105.3512 corresponding to yield of 2.031 percent to 102.9428 corresponding to yield of 2.294 percent, for loss in a week of 2.3 percent but far more in a position with leverage of 10:1. Min Zeng, writing on “Treasurys fall, ending brutal quarter,” published on Mar 30, 2012, in the Wall Street Journal (http://professional.wsj.com/article/SB10001424052702303816504577313400029412564.html?mod=WSJ_hps_sections_markets), informs that Treasury bonds maturing in more than 20 years lost 5.52 percent in the first quarter of 2012.

- Credibility and Commitment of Central Bank Policy. There is a credibility issue of the commitment of monetary policy (Sargent and Silber 2012Mar20).

- Carry Trades. Commodity prices driven by zero interest rates have resumed their increasing path with fluctuations caused by intermittent risk aversion

A competing event is the high level of valuations of risk financial assets (http://cmpassocregulationblog.blogspot.com/2013/01/peaking-valuation-of-risk-financial.html). Matt Jarzemsky, writing on Dow industrials set record,” on Mar 5, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324156204578275560657416332.html), analyzes that the DJIA broke the closing high of 14164.53 set on Oct 9, 2007, and subsequently also broke the intraday high of 14,198.10 reached on Oct 11, 2007. The DJIA closed at 14,547.51

on Fri Apr 19, 2013, which is higher by 2.7 percent than the value of 14,164.53 reached on Oct 9, 2007 and higher by 2.5 percent than the value of 14,198.10 reached on Oct 11, 2007.

Jon Hilsenrath, writing on “Jobs upturn isn’t enough to satisfy Fed,” on Mar 8, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324582804578348293647760204.html), finds that much stronger labor market conditions are required for the Fed to end quantitative easing. Unconventional monetary policy with zero interest rates and quantitative easing is quite difficult to unwind because of the adverse effects of raising interest rates on valuations of risk financial assets and home prices, including the very own valuation of the securities held outright in the Fed balance sheet. Gradual unwinding of 1 percent fed funds rates from Jun 2003 to Jun 2004 by seventeen consecutive increases of 25 percentage points from Jun 2004 to Jun 2006 to reach 5.25 percent caused default of subprime mortgages and adjustable-rate mortgages linked to the overnight fed funds rate. The zero interest rate has penalized liquidity and increased risks by inducing carry trades from zero interest rates to speculative positions in risk financial assets. There is no exit from zero interest rates without provoking another financial crash.

The carry trade from zero interest rates to leveraged positions in risk financial assets had proved strongest for commodity exposures but US equities have regained leadership. The DJIA has increased 50.2 percent since the trough of the sovereign debt crisis in Europe on Jul 2, 2010 to Apr 19, 2013, S&P 500 has gained 52.1 percent and DAX 31.6 percent. Before the current round of risk aversion, almost all assets in the column “∆% Trough to 4/19/13” in Table ESIV-1 had double digit gains relative to the trough around Jul 2, 2010 followed by negative performance but now some valuations of equity indexes show varying behavior: China’s Shanghai Composite is 5.8 percent below the trough; Japan’s Nikkei Average is 50.9 percent above the trough; DJ Asia Pacific TSM is 21.5 percent above the trough; Dow Global is 23.3 percent above the trough; STOXX 50 of 50 blue-chip European equities (http://www.stoxx.com/indices/index_information.html?symbol=sx5E) is 14.3 percent above the trough; and NYSE Financial Index is 28.7 percent above the trough. DJ UBS Commodities is 6.1 percent above the trough. DAX index of German equities (http://www.bloomberg.com/quote/DAX:IND) is 31.6 percent above the trough. Japan’s Nikkei Average is 50.9 percent above the trough on Aug 31, 2010 and 16.9 percent above the peak on Apr 5, 2010. The Nikkei Average closed at 13,316.48

on Fri Apr 12, 2013 (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata), which is 29.9 percent higher than 10,254.43 on Mar 11, 2011, on the date of the Tōhoku or Great East Japan Earthquake/tsunami. Global risk aversion erased the earlier gains of the Nikkei. The dollar depreciated by 9.5 percent relative to the euro and even higher before the new bout of sovereign risk issues in Europe. The column “∆% week to 4/19/13” in Table ESIV-1 shows that there were increases of valuations of risk financial assets in the week of Apr 19, 2013 such as 1.7 percent for China’s Shanghai Composite. DJ Asia Pacific decreased 1.2 percent. NYSE Financial decreased 2.0 percent in the week. DJ UBS Commodities decreased 1.7 percent. Dow Global decreased 2.1 percent in the week of Apr 19, 2013. The DJIA decreased 2.1 percent and S&P 500 decreased 2.1 percent. DAX of Germany decreased 3.7 percent. STOXX 50 decreased 2.1 percent. The USD appreciated 0.5 percent. There are still high uncertainties on European sovereign risks and banking soundness, US and world growth slowdown and China’s growth tradeoffs. Sovereign problems in the “periphery” of Europe and fears of slower growth in Asia and the US cause risk aversion with trading caution instead of more aggressive risk exposures. There is a fundamental change in Table ESIV-1 from the relatively upward trend with oscillations since the sovereign risk event of Apr-Jul 2010. Performance is best assessed in the column “∆% Peak to 4/19/13” that provides the percentage change from the peak in Apr 2010 before the sovereign risk event to Apr 19, 2013. Most risk financial assets had gained not only relative to the trough as shown in column “∆% Trough to 4/19/13” but also relative to the peak in column “∆% Peak to 4/19/13.” There are now several equity indexes above the peak in Table ESIV-1: DJIA 29.8 percent, S&P 500 27.8 percent, DAX 17.8 percent, Dow Global 0.6 percent, DJ Asia Pacific 6.4 percent, NYSE Financial Index (http://www.nyse.com/about/listed/nykid.shtml) 2.5 percent and Nikkei Average 16.9 percent. There are two equity indexes below the peak: Shanghai Composite by 29.1 percent and STOXX 50 by 3.2 percent. DJ UBS Commodities Index is now 9.3 percent below the peak. The US dollar strengthened 13.7 percent relative to the peak. The factors of risk aversion have adversely affected the performance of risk financial assets. The performance relative to the peak in Apr 2010 is more important than the performance relative to the trough around early Jul 2010 because improvement could signal that conditions have returned to normal levels before European sovereign doubts in Apr 2010. Kate Linebaugh, writing on “Falling revenue dings stocks,” on Oct 20, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390444592704578066933466076070.html?mod=WSJPRO_hpp_LEFTTopStories), identifies a key financial vulnerability: falling revenues across markets for United States reporting companies. Global economic slowdown is reducing corporate sales and squeezing corporate strategies. Linebaugh quotes data from Thomson Reuters that 100 companies of the S&P 500 index have reported declining revenue only 1 percent higher in Jun-Sep 2012 relative to Jun-Sep 2011 but about 60 percent of the companies are reporting lower sales than expected by analysts with expectation that revenue for the S&P 500 will be lower in Jun-Sep 2012 for the entities represented in the index. Results of US companies are likely repeated worldwide. It may be quite painful to exit QE→∞ or use of the balance sheet of the central together with zero interest rates forever. The basic valuation equation that is also used in capital budgeting postulates that the value of stocks or of an investment project is given by:

Where Rτ is expected revenue in the time horizon from τ =1 to T; Cτ denotes costs; and ρ is an appropriate rate of discount. In words, the value today of a stock or investment project is the net revenue, or revenue less costs, in the investment period from τ =1 to T discounted to the present by an appropriate rate of discount. In the current weak economy, revenues have been increasing more slowly than anticipated in investment plans. An increase in interest rates would affect discount rates used in calculations of present value, resulting in frustration of investment decisions. If V represents value of the stock or investment project, as ρ → ∞, meaning that interest rates increase without bound, then V → 0, or

declines. Equally, decline in expected revenue from the stock or project, Rτ, causes decline in valuation. An intriguing issue is the difference in performance of valuations of risk financial assets and economic growth and employment. Paul A. Samuelson (http://www.nobelprize.org/nobel_prizes/economics/laureates/1970/samuelson-bio.html).

Table ESIV-1, Stock Indexes, Commodities, Dollar and 10-Year Treasury

| Peak | Trough | ∆% to Trough | ∆% Peak to 4/19/ /13 | ∆% Week 4/19/13 | ∆% Trough to 4/19/ 13 | |

| DJIA | 4/26/ | 7/2/10 | -13.6 | 29.8 | -2.1 | 50.2 |

| S&P 500 | 4/23/ | 7/20/ | -16.0 | 27.8 | -2.1 | 52.1 |

| NYSE Finance | 4/15/ | 7/2/10 | -20.3 | 2.5 | -2.0 | 28.7 |

| Dow Global | 4/15/ | 7/2/10 | -18.4 | 0.6 | -2.1 | 23.3 |

| Asia Pacific | 4/15/ | 7/2/10 | -12.5 | 6.4 | -1.2 | 21.5 |

| Japan Nikkei Aver. | 4/05/ | 8/31/ | -22.5 | 16.9 | -1.3 | 50.9 |

| China Shang. | 4/15/ | 7/02 | -24.7 | -29.1 | 1.7 | -5.8 |

| STOXX 50 | 4/15/10 | 7/2/10 | -15.3 | -3.2 | -2.1 | 14.3 |

| DAX | 4/26/ | 5/25/ | -10.5 | 17.8 | -3.7 | 31.6 |

| Dollar | 11/25 2009 | 6/7 | 21.2 | 13.7 | 0.5 | -9.5 |

| DJ UBS Comm. | 1/6/ | 7/2/10 | -14.5 | -9.3 | -1.7 | 6.1 |

| 10-Year T Note | 4/5/ | 4/6/10 | 3.986 | 1.702 |

T: trough; Dollar: positive sign appreciation relative to euro (less dollars paid per euro), negative sign depreciation relative to euro (more dollars paid per euro)

Source: http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

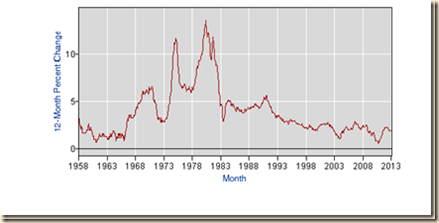

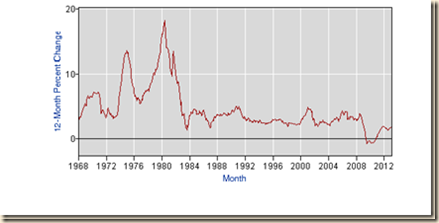

I World Inflation Waves. This section provides analysis and data on world inflation waves. IA Appendix: Transmission of Unconventional Monetary Policy provides more technical analysis. Section IB United States Inflation analyzes inflation in the United States in two subsections: IC Long-term US Inflation and ID Current US Inflation. There is similar lack of reality in economic history as in monetary policy based on fear of deflation as analyzed in Subsection IAE Theory and Reality of Economic History and Monetary Policy Based on Fear of Deflation

The critical fact of current world financial markets is the combination of “unconventional” monetary policy with intermittent shocks of financial risk aversion. There are two interrelated unconventional monetary policies. First, unconventional monetary policy consists of (1) reducing short-term policy interest rates toward the “zero bound” such as fixing the fed funds rate at 0 to ¼ percent by decision of the Federal Open Market Committee (FOMC) since Dec 16, 2008 (http://www.federalreserve.gov/newsevents/press/monetary/20081216b.htm). Second, unconventional monetary policy also includes a battery of measures in also reducing long-term interest rates of government securities and asset-backed securities such as mortgage-backed securities.

When inflation is low, the central bank lowers interest rates to stimulate aggregate demand in the economy, which consists of consumption and investment. When inflation is subdued and unemployment high, monetary policy would lower interest rates to stimulate aggregate demand, reducing unemployment. When interest rates decline to zero, unconventional monetary policy would consist of policies such as large-scale purchases of long-term securities to lower their yields. A major portion of credit in the economy is financed with long-term asset-backed securities. Loans for purchasing houses, automobiles and other consumer products are bundled in securities that in turn are sold to investors. Corporations borrow funds for investment by issuing corporate bonds. Loans to small businesses are also financed by bundling them in long-term bonds. Securities markets bridge the needs of higher returns by savers obtaining funds from investors that are channeled to consumers and business for consumption and investment. Lowering the yields of these long-term bonds could lower costs of financing purchases of consumer durables and investment by business. The essential mechanism of transmission from lower interest rates to increases in aggregate demand is portfolio rebalancing. Withdrawal of bonds in a specific maturity segment or directly in a bond category such as currently mortgage-backed securities causes reductions in yield that are equivalent to increases in the prices of the bonds. There can be secondary increases in purchases of those bonds in private portfolios in pursuit of their increasing prices. Lower yields translate into lower costs of buying homes and consumer durables such as automobiles and also lower costs of investment for business. There are two additional intended routes of transmission.

1. Unconventional monetary policy or its expectation can increase stock market valuations (Bernanke 2010WP). Increases in equities traded in stock markets can augment perceptions of the wealth of consumers inducing increases in consumption.

2. Unconventional monetary policy causes devaluation of the dollar relative to other currencies, which can cause increases in net exports of the US that increase aggregate economic activity (Yellen 2011AS).

Monetary policy can lower short-term interest rates quite effectively. Lowering long-term yields is somewhat more difficult. The critical issue is that monetary policy cannot ensure that increasing credit at low interest cost increases consumption and investment. There is a large variety of possible allocation of funds at low interest rates from consumption and investment to multiple risk financial assets. Monetary policy does not control how investors will allocate asset categories. A critical financial practice is to borrow at low short-term interest rates to invest in high-risk, leveraged financial assets. Investors may increase in their portfolios asset categories such as equities, emerging market equities, high-yield bonds, currencies, commodity futures and options and multiple other risk financial assets including structured products. If there is risk appetite, the carry trade from zero interest rates to risk financial assets will consist of short positions at short-term interest rates (or borrowing) and short dollar assets with simultaneous long positions in high-risk, leveraged financial assets such as equities, commodities and high-yield bonds. Low interest rates may induce increases in valuations of risk financial assets that may fluctuate in accordance with perceptions of risk aversion by investors and the public. During periods of muted risk aversion, carry trades from zero interest rates to exposures in risk financial assets cause temporary waves of inflation that may foster instead of preventing financial instability. During periods of risk aversion such as fears of disruption of world financial markets and the global economy resulting from events such as collapse of the European Monetary Union, carry trades are unwound with sharp deterioration of valuations of risk financial assets. More technical discussion is in IA Appendix: Transmission of Unconventional Monetary Policy.

Symmetric inflation targets appear to have been abandoned in favor of a self-imposed single jobs mandate of easing monetary policy even with the economy growing at or close to potential output. Monetary easing by unconventional measures is now open ended in perpetuity, or QE→∞, as provided in the statement of the meeting of the Federal Open Market Committee (FOMC) on Sep 13, 2012 (http://www.federalreserve.gov/newsevents/press/monetary/20120913a.htm):

“To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.”

Charles Evans, President of the Federal Reserve Bank of Chicago, proposed an “economic state-contingent policy” or “7/3” approach (Evans 2012 Aug 27):

“I think the best way to provide forward guidance is by tying our policy actions to explicit measures of economic performance. There are many ways of doing this, including setting a target for the level of nominal GDP. But recognizing the difficult nature of that policy approach, I have a more modest proposal: I think the Fed should make it clear that the federal funds rate will not be increased until the unemployment rate falls below 7 percent. Knowing that rates would stay low until significant progress is made in reducing unemployment would reassure markets and the public that the Fed would not prematurely reduce its accommodation.

Based on the work I have seen, I do not expect that such policy would lead to a major problem with inflation. But I recognize that there is a chance that the models and other analysis supporting this approach could be wrong. Accordingly, I believe that the commitment to low rates should be dropped if the outlook for inflation over the medium term rises above 3 percent.

The economic conditionality in this 7/3 threshold policy would clarify our forward policy intentions greatly and provide a more meaningful guide on how long the federal funds rate will remain low. In addition, I would indicate that clear and steady progress toward stronger growth is essential.”

Evans (2012Nov27) modified the “7/3” approach to a “6.5/2.5” approach:

“I have reassessed my previous 7/3 proposal. I now think a threshold of 6-1/2 percent for the unemployment rate and an inflation safeguard of 2-1/2 percent, measured in terms of the outlook for total PCE (Personal Consumption Expenditures Price Index) inflation over the next two to three years, would be appropriate.”

The Federal Open Market Committee (FOMC) decided at its meeting on Dec 12, 2012 to implement the “6.5/2.5” approach (http://www.federalreserve.gov/newsevents/press/monetary/20121212a.htm):

“To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.”

The actual objective is attempting to bring the unemployment rate to 5.2 percent but because of the lag in effect of monetary policy impulses on income and prices policy uses “projections” such that the target of monetary policy is a forecast of unemployment and inflation. Unconventional monetary policy will remain in perpetuity, or QE→∞, changing to a “growth mandate.” There are two reasons explaining unconventional monetary policy of QE→∞: insufficiency of job creation to reduce unemployment/underemployment at current rates of job creation; and growth of GDP at 1.6 to 2.1 percent, which is well below 3.0 percent estimated by Lucas (2011May) from 1870 to 2010. Unconventional monetary policy interprets the dual mandate of low inflation and maximum employment as mainly a “growth mandate” of forcing economic growth in the US at a rate that generates full employment. A hurdle to this “growth mandate” is that the US economy grew at 6.2 percent on average during cyclical expansions in the postwar period while growth has been at only 2.1 percent on average in the cyclical expansion in the 14 quarters from IIIQ2009 to IVQ2012. Zero interest rates and quantitative easing have not provided the impulse for growth and were not required in past successful cyclical expansions.