Dollar Revaluation Squeezing Corporate Profits, Mediocre Cyclical United States Economic Growth with GDP Two Trillion Dollars below Trend, Stagnating Real Private Fixed Investment, Swelling Undistributed Corporate Profits, United States Housing Collapse, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015

I Mediocre Cyclical United States Economic Growth with GDP Two Trillion Dollars below Trend

IA Mediocre Cyclical United States Economic Growth

IA1 Stagnating Real Private Fixed Investment

IA2 Swelling Undistributed Corporate Profits

II United States Housing Collapse

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

V World Economic Slowdown. Table V-1 is constructed with the database of the IMF (http://www.imf.org/external/ns/cs.aspx?id=29) to show GDP in dollars in 2013 and the growth rate of real GDP of the world and selected regional countries from 2013 to 2017. The data illustrate the concept often repeated of “two-speed recovery” of the world economy from the recession of 2007 to 2009. The IMF has changed its forecast of the world economy to 3.4 percent in 2014 but accelerating to 3.5 percent in 2015, 3.8 percent in 2016 and 3.8 percent in 2016. Slow-speed recovery occurs in the “major advanced economies” of the G7 that account for $34,883 billion of world output of $75,471 billion, or 46.2 percent, but are projected to grow at much lower rates than world output, 2.1 percent on average from 2014 to 2017 in contrast with 3.6 percent for the world as a whole. While the world would grow 15.3 percent in the four years from 2014 to 2017, the G7 as a whole would grow 8.6 percent. The difference in dollars of 2013 is high: growing by 15.2 percent would add around $11.5 trillion of output to the world economy, or roughly, two times the output of the economy of Japan of $4,920 billion but growing by 8.6 percent would add $6.5 trillion of output to the world, or about the output of Japan in 2013. The “two speed” concept is in reference to the growth of the 150 countries labeled as emerging and developing economies (EMDE) with joint output in 2013 of $29,358 billion, or 38.9 percent of world output. The EMDEs would grow cumulatively 19.9 percent or at the average yearly rate of 4.7 percent, contributing $5.8 trillion from 2014 to 2017 or the equivalent of somewhat less than the GDP of $9,469 billion of China in 2013. The final four countries in Table V-1 often referred as BRIC (Brazil, Russia, India, China), are large, rapidly growing emerging economies. Their combined output in 2013 adds to $15,814 billion, or 21.0 percent of world output, which is equivalent to 45.3 percent of the combined output of the major advanced economies of the G7.

Table V-1, IMF World Economic Outlook Database Projections of Real GDP Growth

| GDP USD 2013 | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | |

| World | 75,471 | 3.4 | 3.5 | 3.8 | 3.8 |

| G7 | 34,883 | 1.7 | 2.3 | 2.3 | 2.0 |

| Canada | 1,839 | 2.5 | 2.2 | 2.0 | 2.0 |

| France | 2,807 | 0.4 | 1.2 | 1.5 | 1.7 |

| DE | 3,731 | 1.6 | 1.6 | 1.7 | 1.5 |

| Italy | 2,138 | -0.4 | 0.5 | 1.1 | 1.1 |

| Japan | 4,920 | -0.1 | 1.0 | 1.2 | 0.4 |

| UK | 2,680 | 2.6 | 2.7 | 2.3 | 2.2 |

| US | 16,768 | 2.4 | 3.1 | 3.1 | 2.7 |

| Euro Area | 13,143 | 0.9 | 1.5 | 1.7 | 1.6 |

| DE | 3,731 | 1.6 | 1.6 | 1.7 | 1.5 |

| France | 2,807 | 0.4 | 1.2 | 1.5 | 1.7 |

| Italy | 2,138 | -0.4 | 0.5 | 1.1 | 1.1 |

| POT | 225 | 0.9 | 1.6 | 1.5 | 1.4 |

| Ireland | 232 | 4.8 | 3.9 | 3.3 | 2.8 |

| Greece | 242 | 0.7 | 2.5 | 3.7 | 3.2 |

| Spain | 1,393 | 1.4 | 2.5 | 2.0 | 1.8 |

| EMDE | 29,358 | 4.6 | 4.3 | 4.7 | 5.0 |

| Brazil | 2,391 | 0.1 | -1.0 | 1.0 | 2.3 |

| Russia | 2,079 | 0.6 | -3.8 | -1.1 | 1.0 |

| India | 1,875 | 7.2 | 7.5 | 7.5 | 7.6 |

| China | 9,469 | 7.4 | 6.8 | 6.3 | 6.0 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries); POT: Portugal

Source: IMF World Economic Outlook databank

http://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx

Continuing high rates of unemployment in advanced economies constitute another characteristic of the database of the WEO (http://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx ). Table V-2 is constructed with the WEO database to provide rates of unemployment from 2013 to 2017 for major countries and regions. In fact, unemployment rates for 2014 in Table I-2 are high for all countries: unusually high for countries with high rates most of the time and unusually high for countries with low rates most of the time. The rates of unemployment are particularly high in 2014 for the countries with sovereign debt difficulties in Europe: 13.9 percent for Portugal (POT), 11.3 percent for Ireland, 26.5 percent for Greece, 24.5 percent for Spain and 12.8 percent for Italy, which is lower but still high. The G7 rate of unemployment is 7.1 percent. Unemployment rates are not likely to decrease substantially if slow growth persists in advanced economies.

Table I-2, IMF World Economic Outlook Database Projections of Unemployment Rate as Percent of Labor Force

| % Labor Force 2013 | % Labor Force 2014 | % Labor Force 2015 | % Labor Force 2016 | % Labor Force 2017 | |

| World | NA | NA | NA | NA | NA |

| G7 | 7.1 | 6.4 | 6.0 | 5.8 | 5.8 |

| Canada | 7.1 | 6.9 | 7.0 | 6.9 | 6.8 |

| France | 10.3 | 10.2 | 10.1 | 9.9 | 9.7 |

| DE | 5.2 | 5.0 | 4.9 | 4.8 | 4.8 |

| Italy | 12.2 | 12.8 | 12.6 | 12.3 | 12.0 |

| Japan | 4.0 | 3.6 | 3.7 | 3.7 | 3.8 |

| UK | 7.6 | 6.2 | 5.4 | 5.4 | 5.4 |

| US | 7.4 | 6.2 | 5.5 | 5.2 | 5.0 |

| Euro Area | 12.0 | 11.6 | 11.1 | 10.6 | 10.3 |

| DE | 5.2 | 5.0 | 4.9 | 4.8 | 4.8 |

| France | 10.3 | 10.2 | 10.1 | 9.9 | 9.7 |

| Italy | 12.2 | 12.8 | 12.6 | 12.3 | 12.0 |

| POT | 16.2 | 13.9 | 13.1 | 12.6 | 12.1 |

| Ireland | 13.0 | 11.3 | 9.8 | 8.8 | 8.3 |

| Greece | 27.5 | 26.5 | 24.8 | 22.1 | 20.0 |

| Spain | 26.1 | 24.5 | 22.6 | 21.1 | 19.9 |

| EMDE | NA | NA | NA | NA | NA |

| Brazil | 5.4 | 4.8 | 5.9 | 6.3 | 5.9 |

| Russia | 5.5 | 5.1 | 6.5 | 6.5 | 6.0 |

| India | NA | NA | NA | NA | NA |

| China | 4.1 | 4.1 | 4.1 | 4.1 | 4.1 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries)

Source: IMF World Economic Outlook

http://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx

Table V-3 provides the latest available estimates of GDP for the regions and countries followed in this blog from IQ2012 to IQ2015 available now for all countries. There are preliminary estimates for most countries for IQ2015. Growth is weak throughout most of the world.

- Japan. The GDP of Japan increased 1.1 percent in IQ2012, 4.3 percent at SAAR (seasonally adjusted annual rate) and 3.4 percent relative to a year earlier but part of the jump could be the low level a year earlier because of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan is experiencing difficulties with the overvalued yen because of worldwide capital flight originating in zero interest rates with risk aversion in an environment of softer growth of world trade. Japan’s GDP fell 0.5 percent in IIQ2012 at the seasonally adjusted annual rate (SAAR) of minus 1.9 percent, which is much lower than 4.3 percent in IQ2012. Growth of 3.5 percent in IIQ2012 in Japan relative to IIQ2011 has effects of the low level of output because of Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan’s GDP contracted 0.5 percent in IIIQ2012 at the SAAR of minus 1.8 percent and increased 0.2 percent relative to a year earlier. Japan’s GDP decreased 0.2 percent in IVQ2012 at the SAAR of minus 0.7 percent and changed 0.0 percent relative to a year earlier. Japan grew 1.4 percent in IQ2013 at the SAAR of 5.6 percent and increased 0.5 percent relative to a year earlier. Japan’s GDP increased 0.7 percent in IIQ2013 at the SAAR of 2.7 percent and increased 1.4 percent relative to a year earlier. Japan’s GDP grew 0.5 percent in IIIQ2013 at the SAAR of 1.9 percent and increased 2.2 percent relative to a year earlier. In IVQ2013, Japan’s GDP decreased 0.3 percent at the SAAR of minus 1.0 percent, increasing 2.3 percent relative to a year earlier. Japan’s GDP increased 1.2 percent in IQ2014 at the SAAR of 4.9 percent and increased 2.4 percent relative to a year earlier. In IIQ2014, Japan’s GDP fell 1.8 percent at the SAAR of minus 6.9 percent and fell 0.4 percent relative to a year earlier. Japan’s GDP contracted 0.5 percent in IIIQ2014 at the SAAR of minus 2.1 percent and fell 1.4 percent relative to a year earlier. In IVQ2014, Japan’s GDP grew 0.3 percent, at the SAAR of 1.1 percent, decreasing 0.9 percent relative to a year earlier. The GDP of Japan increased 0.6 percent in IQ2015 at the SAAR of 2.4 percent and decreased 1.4 percent relative to a year earlier.

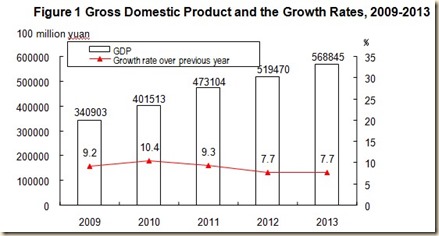

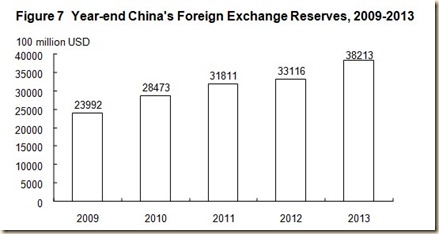

- China. China’s GDP grew 1.4 percent in IQ2012, annualizing to 5.7 percent, and 8.1 percent relative to a year earlier. The GDP of China grew at 2.1 percent in IIQ2012, which annualizes to 8.7 percent and 7.6 percent relative to a year earlier. China grew at 2.0 percent in IIIQ2012, which annualizes at 8.2 percent and 7.4 percent relative to a year earlier. In IVQ2012, China grew at 1.9 percent, which annualizes at 7.8 percent, and 7.9 percent in IVQ2012 relative to IVQ2011. In IQ2013, China grew at 1.7 percent, which annualizes at 7.0 percent and 7.8 percent relative to a year earlier. In IIQ2013, China grew at 1.8 percent, which annualizes at 7.4 percent and 7.5 percent relative to a year earlier. China grew at 2.3 percent in IIIQ2013, which annualizes at 9.5 percent and 7.9 percent relative to a year earlier. China grew at 1.8 percent in IVQ2013, which annualized to 7.4 percent and 7.6 percent relative to a year earlier. China’s GDP grew 1.6 percent in IQ2014, which annualizes to 6.6 percent, and 7.4 percent relative to a year earlier. China’s GDP grew 2.0 percent in IIQ2014, which annualizes at 8.2 percent, and 7.5 percent relative to a year earlier. China’s GDP grew 1.9 percent in IIIQ2014, which is equivalent to 7.8 percent in a year, and 7.3 percent relative to a year earlier. The GDP of China grew 1.5 percent in IVQ2014, which annualizes at 6.1 percent, and 7.3 percent relative to a year earlier. The GDP of China grew at 1.3 percent in IQ2015, which annualizes at 5.3 percent, and 7.0 percent relative to a year earlier. There is decennial change in leadership in China (http://www.xinhuanet.com/english/special/18cpcnc/index.htm). Growth rates of GDP of China in a quarter relative to the same quarter a year earlier have been declining from 2011 to 2015.

- Euro Area. GDP fell 0.1 percent in the euro area in IQ2012 and decreased 0.4 in IQ2012 relative to a year earlier. Euro area GDP contracted 0.3 percent IIQ2012 and fell 0.8 percent relative to a year earlier. In IIIQ2012, euro area GDP fell 0.1 percent and declined 0.8 percent relative to a year earlier. In IVQ2012, euro area GDP fell 0.4 percent relative to the prior quarter and fell 0.9 percent relative to a year earlier. In IQ2013, the GDP of the euro area fell 0.4 percent and decreased 1.2 percent relative to a year earlier. The GDP of the euro area increased 0.4 percent in IIQ2013 and fell 0.6 percent relative to a year earlier. In IIIQ2013, euro area GDP increased 0.2 percent and fell 0.3 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IVQ2013 and increased 0.4 percent relative to a year earlier. In IQ2014, the GDP of the euro area increased 0.3 percent and 1.1 percent relative to a year earlier. The GDP of the euro area increased 0.1 percent in IIQ2014 and increased 0.8 percent relative to a year earlier. The euro area’s GDP increased 0.2 percent in IIIQ2014 and increased 0.8 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IVQ2014 and increased 0.9 percent relative to a year earlier. Euro are GDP increased 0.4 percent in IQ2015 and increased 1.0 percent relative to a year earlier.

- Germany. The GDP of Germany increased 0.3 percent in IQ2012 and 1.5 percent relative to a year earlier. In IIQ2012, Germany’s GDP increased 0.1 percent and increased 0.3 percent relative to a year earlier but 0.8 percent relative to a year earlier when adjusted for calendar (CA) effects. In IIIQ2012, Germany’s GDP increased 0.1 percent and 0.1 percent relative to a year earlier. Germany’s GDP contracted 0.4 percent in IVQ2012 and decreased 0.3 percent relative to a year earlier. In IQ2013, Germany’s GDP decreased 0.4 percent and fell 1.8 percent relative to a year earlier. In IIQ2013, Germany’s GDP increased 0.8 percent and 0.5 percent relative to a year earlier. The GDP of Germany increased 0.3 percent in IIIQ2013 and 0.8 percent relative to a year earlier. In IVQ2013, Germany’s GDP increased 0.4 percent and 1.0 percent relative to a year earlier. The GDP of Germany increased 0.8 percent in IQ2014 and 2.6 percent relative to a year earlier. In IIQ2014, Germany’s GDP contracted 0.1 percent and increased 1.0 percent relative to a year earlier. The GDP of Germany increased 0.1 percent in IIIQ2014 and increased 1.2 percent relative to a year earlier. Germany’s GDP increased 0.7 percent in IVQ2014 and increased 1.6 percent relative to a year earlier. The GDP of Germany increased 0.3 percent in IQ2015 and increased 1.1 percent relative to a year earlier.

- United States. Growth of US GDP in IQ2012 was 0.6 percent, at SAAR of 2.3 percent and higher by 2.6 percent relative to IQ2011. US GDP increased 0.4 percent in IIQ2012, 1.6 percent at SAAR and 2.3 percent relative to a year earlier. In IIIQ2012, US GDP grew 0.6 percent, 2.5 percent at SAAR and 2.7 percent relative to IIIQ2011. In IVQ2012, US GDP grew 0.0 percent, 0.1 percent at SAAR and 1.6 percent relative to IVQ2011. In IQ2013, US GDP grew at 2.7 percent SAAR, 0.7 percent relative to the prior quarter and 1.7 percent relative to the same quarter in 2013. In IIQ2013, US GDP grew at 1.8 percent in SAAR, 0.4 percent relative to the prior quarter and 1.8 percent relative to IIQ2012. US GDP grew at 4.5 percent in SAAR in IIIQ2013, 1.1 percent relative to the prior quarter and 2.3 percent relative to the same quarter a year earlier (Section I and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html). In IVQ2013, US GDP grew 0.9 percent at 3.5 percent SAAR and 3.1 percent relative to a year earlier. In IQ2014, US GDP decreased 0.5 percent, increased 1.9 percent relative to a year earlier and fell 2.1 percent at SAAR. In IIQ2014, US GDP increased 1.1 percent at 4.6 percent SAAR and increased 2.6 percent relative to a year earlier. US GDP increased 1.2 percent in IIIQ2014 at 5.0 percent SAAR and increased 2.7 percent relative to a year earlier. In IVQ2014, US GDP increased 0.5 percent at SAAR of 2.2 percent and increased 2.4 percent relative to a year earlier. GDP decreased 0.2 percent in IQ2015 at SAAR of minus 0.7 percent and grew 2.7 percent relative to a year earlier.

- United Kingdom. In IQ2012, UK GDP increased 0.1 percent, increasing 1.0 percent relative to a year earlier. UK GDP fell 0.2 percent in IIQ2012 and increased 0.6 percent relative to a year earlier. UK GDP increased 0.8 percent in IIIQ2012 and increased 0.7 percent relative to a year earlier. UK GDP fell 0.3 percent in IVQ2012 relative to IIIQ2012 and increased 0.4 percent relative to a year earlier. UK GDP increased 0.6 percent in IQ2013 and 0.9 percent relative to a year earlier. UK GDP increased 0.6 percent in IIQ2013 and 1.7 percent relative to a year earlier. In IIIQ2013, UK GDP increased 0.7 percent and 1.6 percent relative to a year earlier. UK GDP increased 0.4 percent in IVQ2013 and 2.4 percent relative to a year earlier. In IQ2014, UK GDP increased 0.9 percent and 2.7 percent relative to a year earlier. UK GDP increased 0.8 percent in IIQ2014 and 2.9 percent relative to a year earlier. In IIIQ2014, UK GDP increased 0.6 percent and increased 2.8 percent relative to a year earlier. UK GDP increased 0.6 percent in IVQ2014 and increased 3.0 percent relative to a year earlier. In IQ2015, GDP increased 0.3 percent and 2.4 percent relative to a year earlier.

- Italy. Italy has experienced decline of GDP in seven consecutive quarters from IIIQ2011 to IQ2013 and in IQ2014, IIQ2014 and IIIQ2014. Italy’s GDP fell 1.0 percent in IQ2012 and declined 2.3 percent relative to IQ2011. Italy’s GDP fell 0.6 percent in IIQ2012 and declined 3.1 percent relative to a year earlier. In IIIQ2012, Italy’s GDP fell 0.5 percent and declined 3.1 percent relative to a year earlier. The GDP of Italy contracted 0.5 percent in IVQ2012 and fell 2.7 percent relative to a year earlier. In IQ2013, Italy’s GDP contracted 0.9 percent and fell 2.6 percent relative to a year earlier. Italy’s GDP changed 0.0 percent in IIQ2013 and fell 2.0 percent relative to a year earlier. The GDP of Italy increased 0.1 percent in IIIQ2013 and declined 1.4 percent relative to a year earlier. Italy’s GDP changed 0.0 percent in IVQ2013 and decreased 0.9 percent relative to a year earlier. In IQ2014, Italy’s GDP decreased 0.2 percent and fell 0.2 percent relative to a year earlier. The GDP of Italy fell 0.1 percent in IIQ2014 and declined 0.3 percent relative to a year earlier. In IIIQ2014, Italy’s GDP contracted 0.1 percent and fell 0.5 percent relative to a year earlier. The GDP of Italy changed 0.0 percent in IVQ20214 and declined 0.4 percent relative to a year earlier. In IQ2015, Italy’s GDP increased 0.3 percent and increased 0.1 percent relative to a year earlier

- France. France’s GDP changed 0.0 percent in IQ2012 and increased 0.4 percent relative to a year earlier. France’s GDP decreased 0.3 percent in IIQ2012 and increased 0.2 percent relative to a year earlier. In IIIQ2012, France’s GDP increased 0.3 percent and increased 0.3 percent relative to a year earlier. France’s GDP changed 0.0 percent in IVQ2012 and changed 0.0 percent relative to a year earlier. In IQ2013, France’s GDP increased 0.1 percent and increased 0.1 percent relative to a year earlier. The GDP of France increased 0.8 percent in IIQ2013 and increased 1.1 percent relative to a year earlier. France’s GDP decreased 0.1 percent in IIIQ2013 and increased 0.8 percent relative to a year earlier. The GDP of France increased 0.2 percent in IVQ2013 and increased 1.0 percent relative to a year earlier. In IQ2014, France’s GDP decreased 0.2 percent and increased 0.7 percent relative to a year earlier. In IIQ2014, France’s GDP contracted 0.1 percent and decreased 0.2 percent relative to a year earlier. France’s GDP increased 0.2 percent in IIIQ2014 and increased 0.2 percent relative to a year earlier. The GDP of France changed 0.0 percent in IVQ2014 and changed 0.0 percent relative to a year earlier. France’s GDP increased 0.6 percent in IQ2015 and increased 0.7 percent relative to a year earlier

Table V-3, Percentage Changes of GDP Quarter on Prior Quarter and on Same Quarter Year Earlier, ∆%

| IQ2012/IVQ2011 | IQ2012/IQ2011 | |

| United States | QOQ: 0.6 SAAR: 2.3 | 2.6 |

| Japan | QOQ: 1.1 SAAR: 4.3 | 3.4 |

| China | 1.4 | 8.1 |

| Euro Area | -0.1 | -0.4 |

| Germany | 0.3 | 1.5 |

| France | 0.0 | 0.4 |

| Italy | -1.0 | -2.3 |

| United Kingdom | 0.1 | 1.0 |

| IIQ2012/IQ2012 | IIQ2012/IIQ2011 | |

| United States | QOQ: 0.4 SAAR: 1.6 | 2.3 |

| Japan | QOQ: -0.5 | 3.5 |

| China | 2.1 | 7.6 |

| Euro Area | -0.3 | -0.8 |

| Germany | 0.1 | 0.3 0.8 CA |

| France | -0.3 | 0.2 |

| Italy | -0.6 | -3.1 |

| United Kingdom | -0.2 | 0.6 |

| IIIQ2012/ IIQ2012 | IIIQ2012/ IIIQ2011 | |

| United States | QOQ: 0.6 | 2.7 |

| Japan | QOQ: –0.5 | 0.2 |

| China | 2.0 | 7.4 |

| Euro Area | -0.1 | -0.8 |

| Germany | 0.1 | 0.1 |

| France | 0.3 | 0.3 |

| Italy | -0.5 | -3.1 |

| United Kingdom | 0.8 | 0.7 |

| IVQ2012/IIIQ2012 | IVQ2012/IVQ2011 | |

| United States | QOQ: 0.0 | 1.6 |

| Japan | QOQ: -0.2 SAAR: -0.7 | 0.0 |

| China | 1.9 | 7.9 |

| Euro Area | -0.4 | -0.9 |

| Germany | -0.4 | -0.3 |

| France | 0.0 | 0.0 |

| Italy | -0.5 | -2.7 |

| United Kingdom | -0.3 | 0.4 |

| IQ2013/IVQ2012 | IQ2013/IQ2012 | |

| United States | QOQ: 0.7 | 1.7 |

| Japan | QOQ: 1.4 SAAR: 5.6 | 0.5 |

| China | 1.7 | 7.8 |

| Euro Area | -0.4 | -1.2 |

| Germany | -0.4 | -1.8 |

| France | 0.1 | 0.1 |

| Italy | -0.9 | -2.6 |

| UK | 0.6 | 0.9 |

| IIQ2013/IQ2013 | IIQ2013/IIQ2012 | |

| United States | QOQ: 0.4 SAAR: 1.8 | 1.8 |

| Japan | QOQ: 0.7 SAAR: 2.7 | 1.4 |

| China | 1.8 | 7.5 |

| Euro Area | 0.4 | -0.6 |

| Germany | 0.8 | 0.5 |

| France | 0.8 | 1.1 |

| Italy | 0.0 | -2.0 |

| UK | 0.6 | 1.7 |

| IIIQ2013/IIQ2013 | III/Q2013/ IIIQ2012 | |

| USA | QOQ: 1.1 | 2.3 |

| Japan | QOQ: 0.5 SAAR: 1.9 | 2.2 |

| China | 2.3 | 7.9 |

| Euro Area | 0.2 | -0.3 |

| Germany | 0.3 | 0.8 |

| France | -0.1 | 0.8 |

| Italy | 0.1 | -1.4 |

| UK | 0.7 | 1.6 |

| IVQ2013/IIIQ2013 | IVQ2013/IVQ2012 | |

| USA | QOQ: 0.9 SAAR: 3.5 | 3.1 |

| Japan | QOQ: -0.3 SAAR: -1.0 | 2.3 |

| China | 1.8 | 7.6 |

| Euro Area | 0.3 | 0.4 |

| Germany | 0.4 | 1.0 |

| France | 0.2 | 1.0 |

| Italy | 0.0 | -0.9 |

| UK | 0.4 | 2.4 |

| IQ2014/IVQ2013 | IQ2014/IQ2013 | |

| USA | QOQ -0.5 SAAR -2.1 | 1.9 |

| Japan | QOQ: 1.2 SAAR: 4.9 | 2.4 |

| China | 1.6 | 7.4 |

| Euro Area | 0.3 | 1.1 |

| Germany | 0.8 | 2.6 |

| France | -0.2 | 0.7 |

| Italy | -0.2 | -0.2 |

| UK | 0.9 | 2.7 |

| IIQ2014/IQ2014 | IIQ2014/IIQ2013 | |

| USA | QOQ 1.1 SAAR 4.6 | 2.6 |

| Japan | QOQ: -1.8 SAAR: -6.9 | -0.4 |

| China | 2.0 | 7.5 |

| Euro Area | 0.1 | 0.8 |

| Germany | -0.1 | 1.0 |

| France | -0.1 | -0.2 |

| Italy | -0.1 | -0.3 |

| UK | 0.8 | 2.9 |

| IIIQ2014/IIQ2014 | IIIQ2014/IIIQ2013 | |

| USA | QOQ: 1.2 SAAR: 5.0 | 2.7 |

| Japan | QOQ: -0.5 SAAR: -2.1 | -1.4 |

| China | 1.9 | 7.3 |

| Euro Area | 0.2 | 0.8 |

| Germany | 0.1 | 1.2 |

| France | 0.2 | 0.2 |

| Italy | -0.1 | -0.5 |

| UK | 0.6 | 2.8 |

| IVQ2014/IIIQ2014 | IVQ2014/IVQ2013 | |

| USA | QOQ: 0.5 SAAR: 2.2 | 2.4 |

| Japan | QOQ: 0.3 SAAR: 1.1 | -0.9 |

| China | 1.5 | 7.3 |

| Euro Area | 0.3 | 0.9 |

| Germany | 0.7 | 1.6 |

| France | 0.0 | 0.0 |

| Italy | 0.0 | -0.4 |

| UK | 0.6 | 3.0 |

| IQ2015/IVQ2014 | IQ2015/IQ2014 | |

| USA | QOQ: -0.2 SAAR: -0.7 | 2.7 |

| Japan | QOQ: 0.6 SAAR: 2.4 | -1.4 |

| China | 1.3 | 7.0 |

| Euro Area | 0.4 | 1.0 |

| Germany | 0.3 | 1.1 |

| France | 0.6 | 0.7 |

| Italy | 0.3 | 0.1 |

| UK | 0.3 | 2.4 |

QOQ: Quarter relative to prior quarter; SAAR: seasonally adjusted annual rate

Source: Country Statistical Agencies http://www.census.gov/aboutus/stat_int.html

Table V-4 provides two types of data: growth of exports and imports in the latest available months and in the past 12 months; and contributions of net trade (exports less imports) to growth of real GDP.

- Japan. Japan provides the most worrisome data (Section VB and earlier http://cmpassocregulationblog.blogspot.com/2015/04/imf-view-of-economy-and-finance-united.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2014/07/world-inflation-waves-united-states.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html and earlier http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-zero-interest-rates-world.html http://cmpassocregulationblog.blogspot.com/2013/11/global-financial-risk-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations_8763.html http://cmpass ocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html and earlier http://cmpassocregulationblog.blogspot.com/2013/07/duration-dumping-steepening-yield-curve.html and earlier http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and_4699.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2013/03/united-states-commercial-banks-assets.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/world-inflation-waves-united-states.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/thirty-one-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2012/12/mediocre-and-decelerating-united-states_24.html and earlier http://cmpassocregulationblog.blogspot.com/2012/11/contraction-of-united-states-real_25.html and for GDP http://cmpassocregulationblog.blogspot.com/2013/09/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html and earlier http://cmpassocreulationblog.blogspot.com/2013/02/recovery-without-hiring-united-states.html). In Apr 2015, Japan’s exports increased 8.0 percent in 12 months while imports decreased 4.2 percent. The second part of Table V-4 shows that net trade deducted 1.4 percentage points from Japan’s growth of GDP in IIQ2012, deducted 1.9 percentage points from GDP growth in IIIQ2012 and deducted 0.4 percentage points from GDP growth in IVQ2012. Net trade added 0.3 percentage points to GDP growth in IQ2012, 1.6 percentage points in IQ2013 and 0.2 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.5 percentage points from GDP growth in Japan. Net trade ducted 2.1 percentage points from GDP growth in Japan in IVQ2013. Net trade deducted 1.2 percentage point from GDP growth of Japan in IQ2014. Net trade added 4.2 percentage points to GDP growth in IIQ2014. Net trade added 0.2 percentage points to GDP growth in IIIQ2014 and added 0.9 percentage points in IVQ2014.

- China. In Apr 2015, China exports decreased 6.4 percent relative to a year earlier and imports decreased 16.2 percent.

- Germany. Germany’s exports increased 1.2 percent in the month of Mar 2015 and increased 12.4 percent in the 12 months ending in Mar 2015. Germany’s imports increased 2.4 percent in the month of Mar 2015 and increased 7.1 percent in the 12 months ending in Mar. Net trade contributed 0.8 percentage points to growth of GDP in IQ2012, contributed 0.4 percentage points in IIQ2012, contributed 0.3 percentage points in IIIQ2012, deducted 0.5 percentage points in IVQ2012, deducted 0.3 percentage points in IQ2013 and added 0.1 percentage points in IIQ2013. Net traded deducted 0.5 percentage points from Germany’s GDP growth in IIIQ2013 and added 0.5 percentage points to GDP growth in IVQ2013. Net trade deducted 0.1 percentage points from GDP growth in IQ2014. Net trade added 0.2 percentage points to GDP growth in IIQ2014 and added 0.4 percentage points in IIIQ2014. Net trade deducted 0.3 percentage points to GDP growth in IVQ2014 and deducted 0.2 percentage points in IQ2015.

- United Kingdom. Net trade contributed 0.7 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.7 percentage points from UK growth. Net trade contributed 0.1 percentage points to UK value added in IVQ2013. Net trade contributed 0.1 percentage points to UK value added in IQ2014 and 0.2 percentage points in IIQ2014. Net trade deducted 0.5 percentage points to GDP growth in IIIQ2014 and added 0.8 percentage points in IVQ2014.

- France. France’s exports increased 0.9 percent in Mar 2015 while imports increased 3.1 percent. France’s exports increased 3.8 percent in the 12 months ending in Mar 2015 and imports increased 3.1 percent relative to a year earlier. Net traded added 0.1 percentage points to France’s GDP in IIIQ2012 and 0.1 percentage points in IVQ2012. Net trade deducted 0.1 percentage points from France’s GDP growth in IQ2013 and added 0.3 percentage points in IIQ2013, deducting 1.7 percentage points in IIIQ2013. Net trade added 0.1 percentage points to France’s GDP in IVQ2013 and deducted 0.1 percentage points in IQ2014. Net trade deducted 0.2 percentage points from France’s GDP growth in IIQ2014 and deducted 0.3 percentage points in IIIQ2014. Net trade added 0.2 percentage points to France’s GDP growth in IVQ2014 and deducted 0.5 percentage points in IQ2015

- United States. US exports increased 1.6 percent in Mar 2015 and goods exports decreased 5.1 percent in Jan-Mar 2015 relative to a year earlier. Imports increased 7.7 percent in Mar 2015 and goods imports decreased 1.4 percent in Jan-Mar 2015 relative to a year earlier. Net trade deducted 0.04 percentage points from GDP growth in IIQ2012 and added 0.39 percentage points in IIIQ2012 and 0.79 percentage points in IVQ2012. Net trade deducted 0.08 percentage points from US GDP growth in IQ2013 and deducted 0.54 percentage points in IIQ2013. Net traded added 0.59 percentage points to US GDP growth in IIIQ2013. Net trade added 1.08 percentage points to US GDP growth in IVQ2013. Net trade deducted 1.66 percentage points from US GDP growth in IQ2014 and deducted 0.34 percentage points in IIQ2014. Net trade added 0.78 percentage points to IIIQ2014. Net trade deducted 1.03 percentage points from GDP growth in IVQ2014 and deducted 1.90 percentage points from GDP growth in IQ2015. The Federal Reserve completed its annual revision of industrial production and capacity utilization on Mar 28, 2014 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm). The report of the Board of Governors of the Federal Reserve System states (http://www.federalreserve.gov/releases/g17/Current/default.htm):

“Industrial production decreased 0.3 percent in April for its fifth consecutive monthly loss. Manufacturing output was unchanged in April after recording an upwardly revised gain of 0.3 percent in March. In April, the index for mining moved down 0.8 percent, its fourth consecutive monthly decrease; a sharp fall in oil and gas well drilling has more than accounted for the overall decline in mining this year. The output of utilities fell 1.3 percent in April. At 105.2 percent of its 2007 average, total industrial production in April was 1.9 percent above its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in April to 78.2 percent, a rate that is 1.9 percentage points below its long-run (1972–2014) average.” In the six months ending in Apr 2015, United States national industrial production accumulated change of 0.0 percent at the annual equivalent rate of 0.0 percent, which is lower than growth of 1.9 percent in the 12 months ending in Apr 2015. Excluding growth of 1.1 percent in Nov 2014, growth in the remaining five months from Nov 2014 to Apr 2015 accumulated to minus 1.1 percent or minus 2.6 percent annual equivalent. Industrial production declined in five of the past six months. Industrial production contracted at annual equivalent 2.8 percent in the most recent quarter from Feb 2015 to Apr 2015 and expanded at 2.8 percent in the prior quarter Nov 2014 to Jan 2015. Business equipment accumulated growth of 0.0 percent in the six months from Nov 2014 to Apr 2015 at the annual equivalent rate of 0.0 percent, which is lower than growth of 2.2 percent in the 12 months ending in Apr 2015. The Fed analyzes capacity utilization of total industry in its report (http://www.federalreserve.gov/releases/g17/Current/default.htm): “Capacity utilization for the industrial sector decreased 0.4 percentage point in April to 78.2 percent, a rate that is 1.9 percentage points below its long-run (1972–2014) average.” United States industry apparently decelerated to a lower growth rate followed by possible acceleration and weakening growth in past months.

Manufacturing fell 21.9 from the peak in Jun 2007 to the trough in Apr 2009 and increased 25.1 percent from the trough in Apr 2009 to Dec 2014. Manufacturing grew 25.7 percent from the trough in Apr 2009 to Apr 2015. Manufacturing output in Apr 2015 is 1.9 percent below the peak in Jun 2007. The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. Growth at trend in the entire cycle from IVQ2007 to IQ2015 would have accumulated to 23.9 percent. GDP in IQ2015 would be $18,574.8 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2,270.0 billion than actual $16,304.8 billion. There are about two trillion dollars of GDP less than at trend, explaining the 25.6 million unemployed or underemployed equivalent to actual unemployment/underemployment of 15.4 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2015/05/quite-high-equity-valuations-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html). US GDP in IQ2015 is 12.2 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,304.8 billion in IQ2015 or 8.8 percent at the average annual equivalent rate of 1.2 percent. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth at average 3.3 percent per year from Apr 1919 to Apr 2015. Growth at 3.3 percent per year would raise the NSA index of manufacturing output from 99.2392 in Dec 2007 to 125.9172 in Apr 2015. The actual index NSA in Apr 2015 is 101.1122, which is 19.7 percent below trend. Manufacturing output grew at average 2.4 percent between Dec 1986 and Dec 2014. Using trend growth of 2.4 percent per year, the index would increase to 118.0899 in Apr 2015. The output of manufacturing at 101.1122 in Apr 2015 is 14.4 percent below trend under this alternative calculation.

Table V-4, Growth of Trade and Contributions of Net Trade to GDP Growth, ∆% and % Points

| Exports | Exports 12 M ∆% | Imports | Imports 12 M ∆% | |

| USA | 1.6 Mar | -5.1 Jan-Mar | 7.7 Jan | -1.4 Jan-Mar |

| Japan | Apr 2015 8.0 Mar 8.5 Feb 2.4 Jan 17.0 Dec 12.9 Nov 4.9 Oct 9.6 Sep 6.9 Aug -1.3 Jul 3.9 Jun -2.0 May 2014 -2.7 Apr 2014 5.1 Mar 2014 1.8 Feb 2014 9.5 Jan 2014 9.5 Dec 2013 15.3 Nov 2013 18.4 Oct 2013 18.6 Sep 2013 11.5 Aug 2013 14.7 Jul 2013 12.2 Jun 2013 7.4 May 2013 10.1 Apr 2013 3.8 Mar 2013 1.1 Feb 2013 -2.9 Jan 2013 6.4 Dec -5.8 Nov -4.1 Oct -6.5 Sep -10.3 Aug -5.8 Jul -8.1 | Apr 2015 -4.2 Mar -14.5 Feb -3.6 Jan -9.0 Dec 1.9 Nov -1.7 Oct 2.7 Sep 6.2 Aug -1.5 Jul 2.3 Jun 8.4 May 2014 -3.6 Apr 2013 3.4 Mar 2014 18.1 Feb 2014 9.0 Jan 2014 25.0 Dec 2013 24.7 Nov 2013 21.1 Oct 2013 26.1 Sep 2013 16.5 Aug 2013 16.0 Jul 2013 19.6 Jun 2013 11.8 May 2013 10.0 Apr 2013 9.4 Mar 2013 5.5 Feb 2013 7.3 Jan 2013 7.3 Dec 1.9 Nov 0.8 Oct -1.6 Sep 4.1 Aug -5.4 Jul 2.1 | ||

| China | 2015 -6.4 Apr -15.0 Mar 48.3 Feb -3.3 Jan 2014 9.7 Dec 4.7 Nov 11.6 Oct 15.3 Sep 9.4 Aug 14.5 Jul 7.2 Jun 7.0 May 0.9 Apr -6.6 Mar -18.1 Feb 10.6 Jan 2013 4.3 Dec 12.7 Nov 5.6 Oct -0.3 Sep 7.2 Aug 5.1 Jul -3.1 Jun 1.0 May 14.7 Apr 10.0 Mar 21.8 Feb 25.0 Jan | 2015 -16.2 Apr -12.7 Mar -20.5 Feb -19.9 Jan 2014 -2.4 Dec -6.7 Nov 4.6 Oct 7.0 Sep -2.4 Aug -1.6 Jul 5.5 Jun -1.6 May -0.8 Apr -11.3 Mar 10.1 Feb 10.0 Jan 2013 8.3 Dec 5.3 Nov 7.6 Oct 7.4 Sep 7.0 Aug 10.9 Jul -0.7 Jun -0.3 May 16.8 Apr 14.1 Mar -15.2 Feb 28.8 Jan | ||

| Euro Area | 2.2 12 M-Feb | 1.8 Jan-Feb | 0.1 12-M Feb | -2.8 Jan-Feb |

| Germany | 1.2 Mar CSA | 12.4 Mar | 2.4 Mar CSA | 7.1 Mar |

| France Mar | 0.9 | 3.8 | 3.1 | 3.1 |

| Italy Feb | 2.5 | 3.7 | 0.6 | 1.0 |

| UK | 0.7 Mar | 1.1 Jan 15-Mar 15 /Jan 14-Mar 14 | -0.4 Mar | -2.1 Jan 15-Mar 15 /Jan 14-Mar 14 |

| Net Trade % Points GDP Growth | % Points | |||

| USA | IQ2015 -1.90 IVQ2014 -1.03 IIIQ2014 0.78 IIQ2014 -0.34 IQ2014 -1.66 IVQ2013 1.08 IIIQ2013 0.59 IIQ2013 -0.54 IQ2013 -0.08 IVQ2012 +0.79 IIIQ2012 0.39 IIQ2012 -0.04 IQ2012 -0.11 | |||

| Japan | 0.3 IQ2012 -1.5 IIQ2012 -1.9 IIIQ2012 -0.6 IVQ2012 1.6 IQ2013 0.1 IIQ2013 -1.5 IIIQ2013 -2.1 IVQ2013 -1.3 IQ2014 4.3 IIQ2014 0.2 IIIQ2014 1.1 IVQ2014 -0.7 IQ2015 | |||

| Germany | IQ2012 0.8 IIQ2012 0.4 IIIQ2012 0.3 IVQ2012 -0.5 IQ2013 -0.3 IIQ2013 0.1 IIIQ2013 -0.5 IVQ2013 0.5 IQ2014 -0.1 IIQ2014 0.2 IIIQ2014 0.4 IVQ2014 -0.3 IQ2015 -0.2 | |||

| France | 0.1 IIIQ2012 0.1 IVQ2012 -0.1 IQ2013 0.3 IIQ2013 -1.7 IIIQ2013 0.1 IVQ2013 -0.1 IQ2014 -0.2 IIQ2014 -0.3 IIIQ2014 0.2 IVQ2014 -0.5 IQ2015 | |||

| UK | 0.7 IIQ2013 -1.7 IIIQ2013 0.1 IVQ2013 0.1 IQ2014 0.2 IIQ2214 -0.5 IIIQ2014 0.8 IVQ2014 -0.9 IQ2015 |

Sources: Country Statistical Agencies http://www.census.gov/foreign-trade/

The geographical breakdown of exports and imports of Japan with selected regions and countries is in Table V-5 for Apr 2015. The share of Asia in Japan’s trade is close to one-half for 52.8 percent of exports and 48.1 percent of imports. Within Asia, exports to China are 17.1 percent of total exports and imports from China 24.2 percent of total imports. While exports to China increased 2.4 percent in the 12 months ending in Apr 2015, imports from China increased 2.5 percent. The largest export market for Japan in Apr 2015 is the US with share of 20.8 percent of total exports, which is close to that of China, and share of imports from the US of 10.8 percent in total imports. Japan’s exports to the US increased 21.4 percent in the 12 months ending in Apr 2015 and imports from the US increased 23.9 percent. Western Europe has share of 10.0 percent in Japan’s exports and of 11.2 percent in imports. Rates of growth of exports of Japan in Apr 2015 are 21.4 percent for exports to the US, 13.3 percent for exports to Brazil and minus 6.9 percent for exports to Germany. Comparisons relative to 2011 may have some bias because of the effects of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Deceleration of growth in China and the US and threat of recession in Europe can reduce world trade and economic activity. Growth rates of imports in the 12 months ending in Apr 2015 are mixed. Imports from Asia increased 2.0 percent in the 12 months ending in Apr 2015 while imports from China increased 2.5 percent. Data are in millions of yen, which may have effects of recent depreciation of the yen relative to the United States dollar (USD).

Table V-5, Japan, Value and 12-Month Percentage Changes of Exports and Imports by Regions and Countries, ∆% and Millions of Yen

| Apr 2015 | Exports | 12 months ∆% | Imports Millions Yen | 12 months ∆% |

| Total | 6,551,467 | 8.0 | 6,604,907 | -4.2 |

| Asia | 3,458,704 % Total 52.8 | 6.0 | 3,174,261 % Total 48.1 | 2.0 |

| China | 1,121,254 % Total 17.1 | 2.4 | 1,597,187 % Total 24.2 | 2.5 |

| USA | 1,362,901 % Total 20.8 | 21.4 | 714,133 % Total 10.8 | 23.9 |

| Canada | 91,088 | 21.2 | 106,566 | 14.9 |

| Brazil | 50,497 | 13.3 | 72,010 | -1.7 |

| Mexico | 120,230 | 22.3 | 52,292 | 40.9 |

| Western Europe | 654,484 % Total 10.0 | 0.8 | 736,584 % Total 11.2 | 2.6 |

| Germany | 157,767 | -6.9 | 188,797 | -2.7 |

| France | 56,607 | 3.5 | 86,642 | -13.9 |

| UK | 96,797 | 6.3 | 56,467 | -15.2 |

| Middle East | 265,205 | 7.6 | 813,214 | -34.9 |

| Australia | 134,701 | 1.8 | 376,510 | -11.8 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

World trade projections of the IMF are in Table V-6. There is increasing growth of the volume of world trade of goods and services from 3.5 percent in 2013 to 3.7 percent in 2015 and 5.0 percent on average from 2016 to 2019. World trade would be slower for advanced economies while emerging and developing economies (EMDE) experience faster growth. World economic slowdown would be more challenging with lower growth of world trade.

Table V-6, IMF, Projections of World Trade, USD Billions, USD/Barrel and Annual ∆%

| 2013 | 2014 | 2015 | Average ∆% 2016-2019 | |

| World Trade Volume (Goods and Services) | 3.5 | 3.4 | 3.7 | 5.0 |

| Exports Goods & Services | 3.7 | 3.3 | 4.0 | 5.0 |

| Imports Goods & Services | 3.3 | 3.4 | 3.4 | 5.1 |

| World Trade Value of Exports Goods & Services USD Billion | 23,117 | 23,476 | 21,818 | Average ∆% 2007-2016 20,724 |

| Value of Exports of Goods USD Billion | 18,632 | 18,817 | 17,285 | Average ∆% 2007-2016 16,612 |

| Average Oil Price USD/Barrel | 104.07 | 96.25 | 58.14 | Average ∆% 2007-2016 84.21 |

| Average Annual ∆% Export Unit Value of Manufactures | -1.4 | -0.8 | -3.3 | Average ∆% 2007-2016 0.9 |

| Exports of Goods & Services | 2013 | 2014 | 2015 | Average ∆% 2016-2019 |

| Euro Area | 2.1 | 4.2 | 4.4 | 4.4 |

| EMDE | 4.6 | 3.4 | 5.3 | 6.0 |

| G7 | 2.0 | 3.7 | 4.1 | 4.1 |

| Imports Goods & Services | ||||

| Euro Area | 1.0 | 4.3 | 4.3 | 4.3 |

| EMDE | 5.5 | 3.7 | 3.5 | 6.0 |

| G7 | 1.6 | 3.7 | 4.1 | 4.6 |

| Terms of Trade of Goods & Services | ||||

| Euro Area | 0.9 | 0.8 | 1.4 | -0.5 |

| EMDE | -0.3 | -0.6 | -3.7 | -0.1 |

| G7 | 0.9 | 0.5 | 1.4 | 0.05 |

| Terms of Trade of Goods | ||||

| Euro Area | 1.2 | 1.0 | 1.7 | -0.6 |

| EMDE | -0.1 | 0.2 | -4.0 | 0.3 |

| G7 | 0.8 | 0.2 | 1.0 | 0.1 |

Notes: Commodity Price Index includes Fuel and Non-fuel Prices; Commodity Industrial Inputs Price includes agricultural raw materials and metal prices; Oil price is average of WTI, Brent and Dubai

Source: International Monetary Fund World Economic Outlook databank

http://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx

The JP Morgan Global All-Industry Output Index of the JP Morgan Manufacturing and Services PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, with high association with world GDP, decreased to 54.2 in Apr from 54.8 in Mar, indicating expansion at slower rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/8554b240eda74a019242005c06c2b843). This index has remained above the contraction territory of 50.0 during 69 consecutive months. The employment index increased from 52.0 in Mar to 52.5 in Apr with input prices rising at faster rate, new orders increasing at slower rate and output increasing at faster rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/8554b240eda74a019242005c06c2b843). Joseph Lupton, Senior Economist at JP Morgan, finds sound world growth (http://www.markiteconomics.com/Survey/PressRelease.mvc/8554b240eda74a019242005c06c2b843). The JP Morgan Global Manufacturing PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, decreased to 51.0 in Apr from 51.7 in Mar (http://www.markiteconomics.com/Survey/PressRelease.mvc/76478971e7cf4b029cab8fa1f12db82d). New export orders expanded for the twenty-first consecutive month. Joseph Lupton, Senior Economist at JP Morgan Chase, finds slowing growth in global manufacturing that could recover in the second half (http://www.markiteconomics.com/Survey/PressRelease.mvc/76478971e7cf4b029cab8fa1f12db82d). The HSBC Brazil Composite Output Index, compiled by Markit, decreased from 47.0 in Mar to 44.2 in Apr, indicating contraction in activity of Brazil’s private sector (http://www.markiteconomics.com/Survey/PressRelease.mvc/f89cfda3837d4c2da8a147b232648a45). The HSBC Brazil Services Business Activity index, compiled by Markit, decreased from 47.9 in Mar to 44.6 in Apr, indicating contracting services activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/f89cfda3837d4c2da8a147b232648a45). Pollyana De Lima, Economist at Markit, finds weaker private sector activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/f89cfda3837d4c2da8a147b232648a45). The HSBC Brazil Purchasing Managers’ IndexTM (PMI™) decreased from 46.2 in Mar to 46.0 in Apr, indicating deterioration in manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/4f2a7d5a203642648f3425beb3190e0b). Pollyanna De Lima, Economist at Markit, finds decline in output and new orders (http://www.markiteconomics.com/Survey/PressRelease.mvc/4f2a7d5a203642648f3425beb3190e0b).

VA United States. The Markit Flash US Manufacturing Purchasing Managers’ Index™ (PMI™) seasonally adjusted decreased to 53.8 in May from 54.1 in Apr (http://www.markiteconomics.com/Survey/PressRelease.mvc/a1972463970c4c208c7b400689223bf5). New export orders declined partly because of dollar revaluation. Chris Williamson, Chief Economist at Markit, finds that manufacturing expanding with challenges to competitiveness from the strong dollar (http://www.markiteconomics.com/Survey/PressRelease.mvc/a1972463970c4c208c7b400689223bf5). The Markit Flash US Services PMI™ Business Activity Index decreased from 59.2 in Mar to 57.8 in Apr (http://www.markiteconomics.com/Survey/PressRelease.mvc/abca94e77ba4442fa8a7a7549544852d). The Markit Flash US Composite PMI™ Output Index decreased from 59.2 in Mar to 57.4 in Apr. Chris Williamson, Chief Economist at Markit, finds that the surveys are consistent with slowing GDP growth that may accelerate to about 3.0 percent in the second quarter (http://www.markiteconomics.com/Survey/PressRelease.mvc/abca94e77ba4442fa8a7a7549544852d). The Markit US Composite PMI™ Output Index of Manufacturing and Services decreased to 59.2 in Mar from 57.0 in Apr (http://www.markiteconomics.com/Survey/PressRelease.mvc/8f79665402c84fd78e566add1d5183a0). The Markit US Services PMI™ Business Activity Index decreased from 59.2 in Mar to 57.4 in Apr (http://www.markiteconomics.com/Survey/PressRelease.mvc/8f79665402c84fd78e566add1d5183a0). Chris Williamson, Chief Economist at Markit, finds the indexes consistent with US growth at 3.0 percent in IIQ2015 (http://www.markiteconomics.com/Survey/PressRelease.mvc/8f79665402c84fd78e566add1d5183a0). The Markit US Manufacturing Purchasing Managers’ Index™ (PMI™) decreased to 54.1 in Apr from 55.7 in Mar, which indicates expansion at slower rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/53537500330a406db888ccdfe834f91b). New foreign orders decreased. Chris Williamson, Chief Economist at Markit, finds that the index suggests restrain of foreign orders because of dollar appreciation (http://www.markiteconomics.com/Survey/PressRelease.mvc/53537500330a406db888ccdfe834f91b). The purchasing managers’ index (PMI) of the Institute for Supply Management (ISM) Report on Business® changed 0.0 percentage points from 51.5 in Mar to 51.5 in Apr, which indicates growth at the same rate (https://www.instituteforsupplymanagement.org/ISMReport/MfgROB.cfm?navItemNumber=29317). The index of new orders increased 1.7 percentage points from 51.8 in Mar to 53.5 in Apr. The index of new export orders increased 4.0 percentage points from 47.5 in Mar to 51.5 in Apr, expanding at faster rate. The Non-Manufacturing ISM Report on Business® PMI increased 1.3 percentage points from 56.5 in Mar to 57.8 in Apr, indicating growth of business activity/production during 69 consecutive months, while the index of new orders increased 1.4 percentage points from 57.8 in Mar to 59.2 in Apr (https://www.instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?navItemNumber=29318). Table USA provides the country economic indicators for the US.

Table USA, US Economic Indicators

| Consumer Price Index | Apr 12 months NSA ∆%: minus 0.2; ex food and energy ∆%: 1.8 Apr month SA ∆%: 0.1; ex food and energy ∆%: 0.3 |

| Producer Price Index | Finished Goods Apr 12-month NSA ∆%: -4.4; ex food and energy ∆% 2.0 Final Demand Apr 12-month NSA ∆%: -1.3; ex food and energy ∆% 0.8 |

| PCE Inflation | Mar 12-month NSA ∆%: headline 0.3; ex food and energy ∆% 1.3 |

| Employment Situation | Household Survey: Apr Unemployment Rate SA 5.4% |

| Nonfarm Hiring | Nonfarm Hiring fell from 63.3 million in 2006 to 54.2 million in 2013 or by 9.1 million and to 58.7 million in 2014 or by 4.6 million |

| GDP Growth | BEA Revised National Income Accounts IIQ2012/IIQ2011 2.3 IIIQ2012/IIIQ2011 2.7 IVQ2012/IVQ2011 1.6 IQ2013/IQ2012 1.7 IIQ2013/IIQ2012 1.8 IIIQ2013/IIIQ2012 2.3 IVQ2013/IVQ2012 3.1 IQ2014/IQ2013 1.9 IIQ2014/IIQ2013 2.6 IIIQ2014/IIIQ2013 2.7 IVQ2014/IVQ2013 2.4 IQ2015/IVQ2014 3.0 IQ2012 SAAR 2.3 IIQ2012 SAAR 1.6 IIIQ2012 SAAR 2.5 IVQ2012 SAAR 0.1 IQ2013 SAAR 2.7 IIQ2013 SAAR 1.8 IIIQ2013 SAAR 4.5 IVQ2013 SAAR 3.5 IQ2014 SAAR -2.1 IIQ2014 SAAR 4.6 IIIQ2014 SAAR 5.0 IVQ2014 SAAR 2.2 IQ2015 SAAR 0.2 |

| Real Private Fixed Investment | SAAR IQ2015 ∆% minus 2.5 IVQ2007 to IQ2015: 2.7% Blog 5/3/15 |

| Corporate Profits | IQ2015 SAAR: Corporate Profits -5.9; Undistributed Profits -22.3 Blog 5/31/15 |

| Personal Income and Consumption | Mar month ∆% SA Real Disposable Personal Income (RDPI) SA ∆% -0.2 |

| Quarterly Services Report | IVQ14/IVQ13 NSA ∆%: Financial & Insurance 5.2 |

| Employment Cost Index | Compensation Private IVQ2014 SA ∆%: 0.6 |

| Industrial Production | Apr month SA ∆%: -0.3 Manufacturing Apr SA 0.0 ∆% Apr 12 months SA ∆% 2.3, NSA 2.3 |

| Productivity and Costs | Nonfarm Business Productivity IQ2015∆% SAAE -1.9; IQ2015/IQ2014 ∆% 0.6; Unit Labor Costs SAAE IQ2015 ∆% 5.0; IQ2015/IQ2014 ∆%: 1.1 Blog 5/10/15 |

| New York Fed Manufacturing Index | General Business Conditions From Apr -1.19 to May 3.09 |

| Philadelphia Fed Business Outlook Index | General Index from Apr 7.5 to May 6.7 |

| Manufacturing Shipments and Orders | New Orders SA Mar ∆% 2.1 Ex Transport 0.0 Jan-Mar NSA New Orders ∆% minus 4.8 Ex transport minus 5.9 Earlier data: |

| Durable Goods | Apr New Orders SA ∆%: -0.5; ex transport ∆%: minus 0.5 Earlier Data: |

| Sales of New Motor Vehicles | Apr 2015 5,409,495; Apr 2014 5,134,255. Apr 15 SAAR 16.50 million, Mar 15 SAAR 17.15 million, Apr 2014 SAAR 16.05 million Blog 5/3/15 |

| Sales of Merchant Wholesalers | Jan-Mar 2015/Jan-Mar 2014 NSA ∆%: Total -2.3; Durable Goods: 4.1; Nondurable EARLIER DATA: |

| Sales and Inventories of Manufacturers, Retailers and Merchant Wholesalers | Mar 15 12-M NSA ∆%: Sales Total Business -0.8; Manufacturers -2.1 |

| Sales for Retail and Food Services | Jan-Apr 2015/Jan-Apr 2014 ∆%: Retail and Food Services 1.9; Retail ∆% 1.0 |

| Value of Construction Put in Place | Feb SAAR month SA ∆%: minus 0.1 Feb 12-month NSA:3.1 |

| Case-Shiller Home Prices | Mar 2015/ Mar 2014 ∆% NSA: 10 Cities 4.7; 20 Cities: 5.0; National: 4.2 |

| FHFA House Price Index Purchases Only | Mar SA ∆% 0.3; |

| New House Sales | Apr 2015 month SAAR ∆%: 6.8 |

| Housing Starts and Permits | Apr Starts month SA ∆% 20.2; Permits ∆%: 10.1 Earlier Data: |

| Trade Balance | Balance Mar SA -$51,367 million versus Feb -$35,892 million |

| Export and Import Prices | Apr 12-month NSA ∆%: Imports -10.7; Exports -6.3 Earlier Data: |

| Consumer Credit | Mar ∆% annual rate: Total 7.4; Revolving 5.9; Nonrevolving 7.9 |

| Net Foreign Purchases of Long-term Treasury Securities | Mar Net Foreign Purchases of Long-term US Securities: minus $1.6 billion |

| Treasury Budget | Fiscal Year 2015/2014 ∆% Apr: Receipts 8.9; Outlays 6.4; Individual Income Taxes 12.9 Deficit Fiscal Year 2012 $1,087 billion Deficit Fiscal Year 2013 $680 billion Deficit Fiscal Year 2014 $483 billion Blog 5/17/2015 |

| CBO Budget and Economic Outlook | 2012 Deficit $1087 B 6.8% GDP Debt $11,281 B 70.4% GDP 2013 Deficit $680 B, 4.1% GDP Debt $11,983 B 72.3% GDP 2014 Deficit $483 B 2.8% GDP Debt $12,779 B 74.1% GDP 2025 Deficit $1,088B, 4.0% GDP Debt $21,605B 78.7% GDP 2039: Long-term Debt/GDP 106% Blog 8/26/12 11/18/12 2/10/13 9/22/13 2/16/14 8/24/14 9/14/14 3/1/15 |

| Commercial Banks Assets and Liabilities | Apr 2015 SAAR ∆%: Securities 7.3 Loans 9.8 Cash Assets minus 9.5 Deposits minus 3.0 Blog 5/24/15 |

| Flow of Funds Net Worth of Families and Nonprofits | IVQ2014 ∆ since 2007 Assets +$15,921.0 BN Nonfinancial $898.5 BN Real estate $172.1 BN Financial +15,022.4 BN Net Worth +$16,162.4 BN Blog 3/29/15 |

| Current Account Balance of Payments | IVQ2014 -111,222 MM % GDP 2.6 Blog 3/22/15 |

| Collapse of United States Dynamism of Income Growth and Employment Creation | Blog 5/24/15 |

| IMF View | World Real Economic Growth 2015 ∆% 3.5 Blog 4/26/15 |

Links to blog comments in Table USA:

5/24/15 http://cmpassocregulationblog.blogspot.com/2015/05/interest-rate-policy-and-dollar.html

5/17/15 http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html

5/10/15 http://cmpassocregulationblog.blogspot.com/2015/05/quite-high-equity-valuations-and.html

5/3/15 http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html

4/26/2015 http://cmpassocregulationblog.blogspot.com/2015/04/imf-view-of-economy-and-finance-united.html

4/19/2015 http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html

4/12/15 http://cmpassocregulationblog.blogspot.com/2015/04/dollar-revaluation-recovery-without.html

4/5/15 http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html

3/29/15 http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html

3/22/15 http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html

3/1/15 http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html

2/1/15 http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

8/24/14 http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

9/22/13 http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html

2/10/13 http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

VB Japan. The GDP of Japan grew at 1.0 percent per year on average from 1991 to 2002, with the GDP implicit deflator falling at 0.8 percent per year on average. The average growth rate of Japan’s GDP was 4 percent per year on average from the middle of the 1970s to 1992 (Ito 2004). Low growth in Japan in the 1990s is commonly labeled as “the lost decade” (see Pelaez and Pelaez, The Global Recession Risk (2007), 81-115). Table VB-GDP provides yearly growth rates of Japan’s GDP from 1995 to 2014. Growth weakened from 1.9 per cent in 1995 and 2.6 percent in 1996 to contractions of 2.0 percent in 1998 and 0.2 percent in 1999. Growth rates were below 2 percent with exception of 2.3 percent in 2000, 2.4 percent in 2004 and 2.2 percent in 2007. Japan’s GDP contracted sharply by 1.0 percent in 2008 and 5.5 percent in 2009. As in most advanced economies, growth was robust at 4.7 percent in 2010 but mediocre at minus 0.5 percent in 2011 because of the tsunami and 1.7 percent in 2012. Japan’s GDP grew 1.6 percent in 2013 and stagnated in 2014 at minus 0.1. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). Japan’s real GDP in calendar year 2014 is 0.6 percent higher than in calendar year 2007 (http://www.esri.cao.go.jp/index-e.html).

Table VB-GDP, Japan, Yearly Percentage Change of GDP ∆%

| Calendar Year | ∆% |

| 1995 | 1.9 |

| 1996 | 2.6 |

| 1997 | 1.6 |

| 1998 | -2.0 |

| 1999 | -0.2 |

| 2000 | 2.3 |

| 2001 | 0.4 |

| 2002 | 0.3 |

| 2003 | 1.7 |

| 2004 | 2.4 |

| 2005 | 1.3 |

| 2006 | 1.7 |

| 2007 | 2.2 |

| 2008 | -1.0 |

| 2009 | -5.5 |

| 2010 | 4.7 |

| 2011 | -0.5 |

| 2012 | 1.7 |

| 2013 | 1.6 |

| 2014 | -0.1 |

Source: Source: Japan Economic and Social Research Institute, Cabinet Office

http://www.esri.cao.go.jp/index-e.html

http://www.esri.cao.go.jp/en/sna/sokuhou/sokuhou_top.html

The Markit/JMMA Flash Japan Manufacturing PMI Index™ with the Flash Japan Manufacturing PMI™ increased from 49.9 in Apr to 50.9 in May and the Flash Japan Manufacturing Output Index™ increased from 49.3 in Apr to 51.7 in May (http://www.markiteconomics.com/Survey/PressRelease.mvc/00b8ed52e9154549b1e39c2d675b033b). New export orders increased at faster pace. Amy Brownbill, Economist at Markit, finds improvement in Japan’s manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/00b8ed52e9154549b1e39c2d675b033b). The Markit Composite Output PMI Index increased from 48.4 in Mar to 50.7 in Apr, indicating mildly improving business activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/256c1de800394daa9c16cfd21fc1da9a). The Markit Business Activity Index of Services increased to 51.3 in Apr from 48.4 in Mar (http://www.markiteconomics.com/Survey/PressRelease.mvc/256c1de800394daa9c16cfd21fc1da9a). Amy Brownbill, Ecoomist at Markit and author of the report, finds improved conditions with positive business expectations (http://www.markiteconomics.com/Survey/PressRelease.mvc/256c1de800394daa9c16cfd21fc1da9a). The Markit/JMMA Purchasing Managers’ Index™ (PMI™), seasonally adjusted, decreased from 50.3 in Mar to 49.9 in Apr (http://www.markiteconomics.com/Survey/PressRelease.mvc/5d78d5dab2e248818c2dd7292148740a). New orders declined while growth of foreign orders slowed. Amy Brownbill, Economist at Markit, finds manufacturing contracting with slowing growth foreign orders even with devaluation of the yen (http://www.markiteconomics.com/Survey/PressRelease.mvc/5d78d5dab2e248818c2dd7292148740a).Table JPY provides the country data table for Japan.

Table JPY, Japan, Economic Indicators

| Historical GDP and CPI | 1981-2010 Real GDP Growth and CPI Inflation 1981-2010 |

| Corporate Goods Prices | Apr ∆% 0.1 |

| Consumer Price Index | Apr NSA ∆% 0.4; Apr 12 months NSA ∆% 0.6 |

| Real GDP Growth | IQ2015 ∆%: 0.6 on IVQ2014; IVQ2014 SAAR 2.4; |

| Employment Report | Apr Unemployed 2.34 million Change in unemployed since last year: minus 200 thousand |

| All Industry Indices | Mar month SA ∆% -1/3 Earlier Data: Blog 4/26/15 |

| Industrial Production | Apr SA month ∆%: 1.0 Mar -0.8 Earlier Data: |

| Machine Orders | Total Mar ∆% 1.8 Private ∆%: 24.9 Mar ∆% Excluding Volatile Orders minus 2.9 Earlier Data: |

| Tertiary Index | Mar month SA ∆% -1.0 Earlier Data: |

| Wholesale and Retail Sales | Apr 12 months: Earlier Data: |

| Family Income and Expenditure Survey | Apr 12-month ∆% total nominal consumption -0.5, real -1.3 Earlier Data: Blog 3/29/15 |

| Trade Balance | Exports Apr 12 months ∆%: 8.0 Imports A[r 12 months ∆% -4.2 Earlier Data: Blog 4/26/15 |

Links to blog comments in Table JPY:

5/24/15 http://cmpassocregulationblog.blogspot.com/2015/05/interest-rate-policy-and-dollar.html

5/17/15 http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html

4/26/2015 http://cmpassocregulationblog.blogspot.com/2015/04/imf-view-of-economy-and-finance-united.html

4/19/2015 http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html

3/29/15 http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html

3/15/15 http://cmpassocregulationblog.blogspot.com/2015/03/global-exchange-rate-struggle-recovery.html

2/22/15 http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html

12/14/14 http://cmpassocregulationblog.blogspot.com/2014/12/global-financial-and-economic-risk.html

11/23/14 http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.htm

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

8/17/2014 http://cmpassocregulationblog.blogspot.com/2014/08/weakening-world-economic-growth.html

6/15/2014 http://cmpassocregulationblog.blogspot.com/2014/06/financialgeopolitical-risks-recovery.html

5/18/14 http://cmpassocregulationblog.blogspot.com/2014/05/world-inflation-waves-squeeze-of.html

3/16/2014 http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html

2/23/14 http://cmpassocregulationblog.blogspot.com/2014/02/squeeze-of-economic-activity-by-carry.html

12/15/13 http://cmpassocregulationblog.blogspot.com/2013/12/theory-and-reality-of-secular.html

11/17/13 http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-unwinding-monetary-policy.html

9/15/13 http://cmpassocregulationblog.blogspot.com/2013/09/recovery-without-hiring-ten-million.html

8/18/13 http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html

The employment report for Japan in Apr 2015 is in Table VB-1. The number unemployed reached 2.34 million in Apr 2015, declining 2000 thousand from a year earlier or 7.9 percent. The rate of unemployment not seasonally adjusted reached 3.5 percent, decreasing 0.3 percentage points from a year earlier. Population decreased 0.1 percent from a year earlier. The labor force decreased 0.2 percentage points from a year earlier and the labor participation rate stood at 59.4, decreasing 0.1 percentage points from a year earlier. The employment rate moved to 57.3 percent, which is higher by 0.1 percentage points relative to a year earlier.

Table VB-1, Japan, Employment Report Apr 2015

| Apr 2015 Unemployed | 2.34 million |

| Change since last year | -200 thousand; ∆% –7.9 |

| Unemployment rate | SA 3.3%, -0.1 from earlier month; NSA 3.5%, -0.3 from earlier year |

| Population ≥ 15 years | 110.73 million |

| Change since last year | ∆% -0.1 |

| Labor Force | 65.76 million |

| Change since last year | ∆% -0.2 |

| Employed | 63.42 million |

| Change since last year | ∆% 0.1 |

| Labor force participation rate | 59.4 |

| Change since last year | -0.1 |

| Employment rate | 57.3% |

| Change since last year | 0.1 |

Source: Japan, Statistics Bureau, Ministry of Internal Affairs and Communications

http://www.stat.go.jp/english/data/roudou/results/month/index.htm

Table VB-2 provides the rate of unemployment of Japan seasonally adjusted that decreased to 3.3 percent in Jan 2014 from 4.4 percent in May 2012. The rate of unemployment SA fell 0.1 percentage points from 3.5 percent in Mar 2014 to 3.3 percent in Apr 2015.

Table VB-2, Japan, Unemployment Rate, SA

| Unemployment Rate SA | |

| Apr 2015 | 3.3 |

| Mar | 3.4 |

| Feb | 3.5 |

| Jan | 3.6 |

| Dec 2014 | 3.4 |

| Nov | 3.5 |

| Oct | 3.5 |

| Sep | 3.6 |

| Aug | 3.5 |

| Jul | 3.7 |

| Jun | 3.7 |

| May | 3.6 |

| Apr | 3.6 |

| Mar | 3.6 |

| Feb | 3.6 |

| Jan | 3.7 |

| Dec 2013 | 3.7 |

| Nov | 3.9 |

| Oct | 4.0 |

| Sep | 4.0 |

| Aug | 4.1 |

| Jul | 3.8 |

| Jun | 3.9 |

| May | 4.1 |

| Apr | 4.1 |

| Mar | 4.1 |

| Feb | 4.3 |

| Jan | 4.2 |

| Dec 2012 | 4.3 |

| Nov | 4.1 |

| Oct | 4.1 |

| Sep | 4.3 |

| Aug | 4.2 |

| Jul | 4.4 |

| Jun | 4.3 |

| May | 4.4 |

Source: Source: Japan, Statistics Bureau, Ministry of Internal Affairs and Communications

http://www.stat.go.jp/english/data/roudou/results/month/index.htm

Chart VB-1 of Japan’s Statistics Bureau at the Ministry of Internal Affairs and Communications provides the unemployment rate of Japan from 2012 to 2014. There is clear trend of decline with multiple oscillations and increase in Jun-Jul 2014. The rate increased in Sep 2014 and fell in Oct 2014, stabilizing in Nov 2014 and declining in Dec 2014. The rate decreased in Feb-Apr 2015.

Chart VB-1, Japan, Unemployment Rate, Seasonally Adjusted

Source: Japan, Statistics Bureau, Ministry of Internal Affairs and Communications

http://www.stat.go.jp/english/data/roudou/results/month/index.htm

During the “lost decade” of the 1990s from 1991 to 2002 (Pelaez and Pelaez, The Global Recession Risk (2007), 82-3), Japan’s GDP grew at the average yearly rate of 1.0 percent, the CPI at 0.1 percent and the implicit deflator at minus 0.8 percent. Japan’s growth rate from the mid-1970s to 1992 was 4 percent (Ito 2004). Table VB-3 provides Japan’s rates of unemployment, participation in labor force and employment for selected years from 1953 to 1985 and yearly from 1990 to 2015. The rate of unemployment jumped from 2.1 percent in 1991 to 5.4 percent in 2002, which was a year of global economic weakness. The participation rate dropped from 64.0 percent in 1992 to 61.2 percent in 2002 and the employment rate fell from 62.6 percent in 1992 to 57.9 percent in 2002. The rate of unemployment rose from 3.9 percent in 2007 to 5.1 percent in 2010, falling to 4.6 percent in 2011, 4.3 percent in 2012 and 3.6 percent in 2014. The participation rate fell from 60.4 percent in 2007 to 59.6 percent in 2010, falling to 59.3 percent in 2011 and 59.1 in 2012 and increasing to 59.4 percent in 2014. The employment rate fell from 58.1 in percent in 2007 to 56.6 percent in 2010 and 56.5 percent in 2011 and 2012, increasing to 57.3 percent in 2014. The global recession adversely affected labor markets in advanced economies.

Table VB-3, Japan, Rates of Unemployment, Participation in Labor Force and Employment, %

| Participation | Employment Rate | Unemployment Rate | |

| 1953 | 70.0 | 68.6 | 1.9 |

| 1960 | 69.2 | 68.0 | 1.7 |

| 1965 | 65.7 | 64.9 | 1.2 |

| 1970 | 65.4 | 64.6 | 1.1 |

| 1975 | 63.0 | 61.9 | 1.9 |

| 1980 | 63.3 | 62.0 | 2.0 |

| 1985 | 63.0 | 61.4 | 2.6 |

| 1990 | 63.3 | 61.9 | 2.1 |

| 1991 | 63.8 | 62.4 | 2.1 |

| 1992 | 64.0 | 62.6 | 2.2 |

| 1993 | 63.8 | 62.2 | 2.5 |

| 1994 | 63.6 | 61.8 | 2.9 |

| 1995 | 63.4 | 61.4 | 3.2 |

| 1996 | 63.5 | 61.4 | 3.4 |

| 1997 | 63.7 | 61.5 | 3.4 |

| 1998 | 63.3 | 60.7 | 4.1 |

| 1999 | 62.9 | 59.9 | 4.7 |

| 2000 | 62.4 | 59.5 | 4.7 |

| 2001 | 62.0 | 58.9 | 5.0 |

| 2002 | 61.2 | 57.9 | 5.4 |

| 2003 | 60.8 | 57.6 | 5.3 |

| 2004 | 60.4 | 57.6 | 4.7 |

| 2005 | 60.4 | 57.7 | 4.4 |

| 2006 | 60.4 | 57.9 | 4.1 |

| 2007 | 60.4 | 58.1 | 3.9 |

| 2008 | 60.2 | 57.8 | 4.0 |

| 2009 | 59.9 | 56.9 | 5.1 |

| 2010 | 59.6 | 56.6 | 5.1 |

| 2011 | 59.3 | 56.5 | 4.6 |

| 2012 | 59.1 | 56.5 | 4.3 |

| 2013 | 59.3 | 56.9 | 4.0 |

| 2014 | 59.4 | 57.3 | 3.6 |

Source: Japan, Statistics Bureau, Ministry of Internal Affairs and Communications

http://www.stat.go.jp/english/data/roudou/results/month/index.htm

The geographical breakdown of exports and imports of Japan with selected regions and countries is in Table VB-4 for Apr 2015. The share of Asia in Japan’s trade is close to one-half for 52.8 percent of exports and 48.1 percent of imports. Within Asia, exports to China are 17.1 percent of total exports and imports from China 24.2 percent of total imports. While exports to China increased 2.4 percent in the 12 months ending in Apr 2015, imports from China increased 2.5 percent. The largest export market for Japan in Apr 2015 is the US with share of 20.8 percent of total exports, which is close to that of China, and share of imports from the US of 10.8 percent in total imports. Japan’s exports to the US increased 21.4 percent in the 12 months ending in Apr 2015 and imports from the US increased 23.9 percent. Western Europe has share of 10.0 percent in Japan’s exports and of 11.2 percent in imports. Rates of growth of exports of Japan in Apr 2015 are 21.4 percent for exports to the US, 13.3 percent for exports to Brazil and minus 6.9 percent for exports to Germany. Comparisons relative to 2011 may have some bias because of the effects of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Deceleration of growth in China and the US and threat of recession in Europe can reduce world trade and economic activity. Growth rates of imports in the 12 months ending in Apr 2015 are mixed. Imports from Asia increased 2.0 percent in the 12 months ending in Apr 2015 while imports from China increased 2.5 percent. Data are in millions of yen, which may have effects of recent depreciation of the yen relative to the United States dollar (USD).

Table VB-4, Japan, Value and 12-Month Percentage Changes of Exports and Imports by Regions and Countries, ∆% and Millions of Yen

| Apr 2015 | Exports | 12 months ∆% | Imports Millions Yen | 12 months ∆% |

| Total | 6,551,467 | 8.0 | 6,604,907 | -4.2 |

| Asia | 3,458,704 % Total 52.8 | 6.0 | 3,174,261 % Total 48.1 | 2.0 |

| China | 1,121,254 % Total 17.1 | 2.4 | 1,597,187 % Total 24.2 | 2.5 |

| USA | 1,362,901 % Total 20.8 | 21.4 | 714,133 % Total 10.8 | 23.9 |

| Canada | 91,088 | 21.2 | 106,566 | 14.9 |

| Brazil | 50,497 | 13.3 | 72,010 | -1.7 |

| Mexico | 120,230 | 22.3 | 52,292 | 40.9 |

| Western Europe | 654,484 % Total 10.0 | 0.8 | 736,584 % Total 11.2 | 2.6 |

| Germany | 157,767 | -6.9 | 188,797 | -2.7 |

| France | 56,607 | 3.5 | 86,642 | -13.9 |

| UK | 96,797 | 6.3 | 56,467 | -15.2 |

| Middle East | 265,205 | 7.6 | 813,214 | -34.9 |

| Australia | 134,701 | 1.8 | 376,510 | -11.8 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

VC China. China estimates an index of nonmanufacturing purchasing managers based on a sample of 1200 nonmanufacturing enterprises across the country (http://www.stats.gov.cn/english/pressrelease/t20121009_402841094.htm). Table CIPMNM provides this index and components. The total index increased from 55.7 in Jan 2011 to 58.0 in Mar 2012, decreasing to 53.9 in Aug 2013. The index decreased from 56.0 in Nov 2013 to 54.6 in Dec 2013, easing to 53.4 in Jan 2014. The index moved to 53.7 in Mar 2015. The index of new orders increased from 52.2 in Jan 2012 to 54.3 in Dec 2012 but fell to 50.1 in May 2013, barely above the neutral frontier of 50.0. The index of new orders stabilized at 51.0 in Nov-Dec 2013, easing to 50.9 in Jan 2014. The index of new orders moved to 50.3 in Mar 2015.

Table CIPMNM, China, Nonmanufacturing Index of Purchasing Managers, %, Seasonally Adjusted

| Total Index | New Orders | Interm. | Subs Prices | Exp | |

| Mar 2015 | 53.7 | 50.3 | 50.0 | 48.4 | 58.8 |

| Feb | 53.9 | 51.2 | 52.5 | 51.2 | 58.7 |

| Jan | 53.7 | 50.2 | 47.6 | 46.9 | 59.6 |

| Dec 2014 | 54.1 | 50.5 | 50.1 | 47.3 | 59.5 |

| Nov | 53.9 | 50.1 | 50.6 | 47.7 | 59.7 |

| Oct | 53.8 | 51.0 | 52.0 | 48.8 | 59.9 |

| Sep | 54.0 | 49.5 | 49.8 | 47.3 | 60.9 |

| Aug | 54.4 | 50.0 | 52.2 | 48.3 | 61.2 |

| Jul | 54.2 | 50.7 | 53.4 | 49.5 | 61.5 |

| Jun | 55.0 | 50.7 | 56.0 | 50.8 | 60.4 |

| May | 55.5 | 52.7 | 54.5 | 49.0 | 60.7 |

| Apr | 54.8 | 50.8 | 52.4 | 49.4 | 61.5 |

| Mar | 54.5 | 50.8 | 52.8 | 49.5 | 61.5 |

| Feb | 55.0 | 51.4 | 52.1 | 49.0 | 59.9 |

| Jan | 53.4 | 50.9 | 54.5 | 50.1 | 58.1 |

| Dec 2013 | 54.6 | 51.0 | 56.9 | 52.0 | 58.7 |

| Nov | 56.0 | 51.0 | 54.8 | 49.5 | 61.3 |

| Oct | 56.3 | 51.6 | 56.1 | 51.4 | 60.5 |

| Sep | 55.4 | 53.4 | 56.7 | 50.6 | 60.1 |

| Aug | 53.9 | 50.9 | 57.1 | 51.2 | 62.9 |

| Jul | 54.1 | 50.3 | 58.2 | 52.4 | 63.9 |

| Jun | 53.9 | 50.3 | 55.0 | 50.6 | 61.8 |

| May | 54.3 | 50.1 | 54.4 | 50.7 | 62.9 |

| Apr | 54.5 | 50.9 | 51.1 | 47.6 | 62.5 |

| Mar | 55.6 | 52.0 | 55.3 | 50.0 | 62.4 |

| Feb | 54.5 | 51.8 | 56.2 | 51.1 | 62.7 |

| Jan | 56.2 | 53.7 | 58.2 | 50.9 | 61.4 |

| Dec 2012 | 56.1 | 54.3 | 53.8 | 50.0 | 64.6 |

| Nov | 55.6 | 53.2 | 52.5 | 48.4 | 64.6 |

| Oct | 55.5 | 51.6 | 58.1 | 50.5 | 63.4 |

| Sep | 53.7 | 51.8 | 57.5 | 51.3 | 60.9 |

| Aug | 56.3 | 52.7 | 57.6 | 51.2 | 63.2 |

| Jul | 55.6 | 53.2 | 49.7 | 48.7 | 63.9 |

| Jun | 56.7 | 53.7 | 52.1 | 48.6 | 65.5 |

| May | 55.2 | 52.5 | 53.6 | 48.5 | 65.4 |

| Apr | 56.1 | 52.7 | 57.9 | 50.3 | 66.1 |

| Mar | 58.0 | 53.5 | 60.2 | 52.0 | 66.6 |

| Feb | 57.3 | 52.7 | 59.0 | 51.2 | 63.8 |

| Jan | 55.7 | 52.2 | 58.2 | 51.1 | 65.3 |

Notes: Interm.: Intermediate; Subs: Subscription; Exp: Business Expectations

Source: National Bureau of Statistics of China

http://www.stats.gov.cn/english/

Chart CIPMNM provides China’s nonmanufacturing purchasing managers’ index. The index fell from 56.0 in Oct 2013 to 53.7 in Mar 2015.

Chart CIPMNM, China, Nonmanufacturing Index of Purchasing Managers, Seasonally Adjusted

Source: National Bureau of Statistics of China

http://www.stats.gov.cn/english

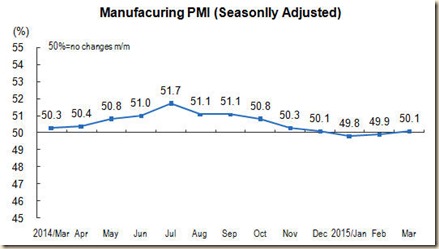

Table CIPMMFG provides the index of purchasing managers of manufacturing seasonally adjusted of the National Bureau of Statistics of China. The general index (IPM) rose from 50.5 in Jan 2012 to 53.3 in Apr 2012, falling to 49.2 in Aug 2012, rebounding to 50.6 in Dec 2012. The index fell to 50.1 in Jun 2013, barely above the neutral frontier at 50.0, recovering to 51.4 in Nov 2013 but falling to 51.0 in Dec 2013. The index fell to 50.5 in Jan 2014, 50.1 in Dec 2014 and 50.1 in Mar 2015. The index of new orders fell from 54.5 in Apr 2012 to 51.2 in Dec 2012. The index of new orders fell from 52.3 in Nov 2013 to 52.0 in Dec 2013. The index fell to 50.9 in Jan 2014 and moved to 50.4 in Dec 2014. The index moved to 50.2 in Mar 2015.

Table CIPMMFG, China, Manufacturing Index of Purchasing Managers, %, Seasonally Adjusted

| IPM | PI | NOI | INV | EMP | SDEL | |

| 2015 | ||||||

| Mar | 50.1 | 52.1 | 50.2 | 48.0 | 48.4 | 50.1 |

| Feb | 49.9 | 51.4 | 50.4 | 48.2 | 47.8 | 49.9 |

| Jan | 49.8 | 51.7 | 50.2 | 47.3 | 47.9 | 50.2 |

| 2014 | ||||||

| Dec | 50.1 | 52.2 | 50.4 | 47.5 | 48.1 | 49.9 |

| Nov | 50.3 | 52.5 | 50.9 | 47.7 | 48.2 | 50.3 |

| Oct | 50.8 | 53.1 | 51.6 | 48.4 | 48.4 | 50.1 |

| Sep | 51.1 | 53.6 | 52.2 | 48.8 | 48.2 | 50.1 |

| Aug | 51.1 | 53.2 | 52.5 | 48.6 | 48.2 | 50.0 |

| Jul | 51.7 | 54.2 | 53.6 | 49.0 | 48.3 | 50.2 |

| Jun | 51.0 | 53.0 | 52.8 | 48.0 | 48.6 | 50.5 |

| May | 50.8 | 52.8 | 52.3 | 48.0 | 48.2 | 50.3 |

| Apr | 50.4 | 52.5 | 51.2 | 48.1 | 48.3 | 50.1 |

| Mar | 50.3 | 52.7 | 50.6 | 47.8 | 48.3 | 49.8 |

| Feb | 50.2 | 52.6 | 50.5 | 47.4 | 48.0 | 49.9 |

| Jan | 50.5 | 53.0 | 50.9 | 47.8 | 48.2 | 49.8 |

| Dec 2013 | 51.0 | 53.9 | 52.0 | 47.6 | 48.7 | 50.5 |

| Nov | 51.4 | 54.5 | 52.3 | 47.8 | 49.6 | 50.6 |

| Oct | 51.4 | 54.4 | 52.5 | 48.6 | 49.2 | 50.8 |

| Sep | 51.1 | 52.9 | 52.8 | 48.5 | 49.1 | 50.8 |

| Aug | 51.0 | 52.6 | 52.4 | 48.0 | 49.3 | 50.4 |

| Jul | 50.3 | 52.4 | 50.6 | 47.6 | 49.1 | 50.1 |

| Jun | 50.1 | 52.0 | 50.4 | 47.4 | 48.7 | 50.3 |

| May | 50.8 | 53.3 | 51.8 | 47.6 | 48.8 | 50.8 |

| Apr | 50.6 | 52.6 | 51.7 | 47.5 | 49.0 | 50.8 |

| Mar | 50.9 | 52.7 | 52.3 | 47.5 | 49.8 | 51.1 |

| Feb | 50.1 | 51.2 | 50.1 | 49.5 | 47.6 | 48.3 |

| Jan | 50.4 | 51.3 | 51.6 | 50.1 | 47.8 | 50.0 |

| Dec 2012 | 50.6 | 52.0 | 51.2 | 47.3 | 49.0 | 48.8 |

| Nov | 50.6 | 52.5 | 51.2 | 47.9 | 48.7 | 49.9 |

| Oct | 50.2 | 52.1 | 50.4 | 47.3 | 49.2 | 50.1 |

| Sep | 49.8 | 51.3 | 49.8 | 47.0 | 48.9 | 49.5 |

| Aug | 49.2 | 50.9 | 48.7 | 45.1 | 49.1 | 50.0 |