Financial Risks, Slow Cyclical United States Growth with GDP Two Trillion Dollars below Trend, United States Commercial Banks Assets and Liabilities, United States Housing, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014

Executive Summary

I Mediocre Cyclical United States Economic Growth with GDP Two Trillion Dollars Below Trend

IA Mediocre Cyclical United States Economic Growth

IA1 Contracting Real Private Fixed Investment

IIA United States Commercial Banks Assets and Liabilities

IIA1 Transmission of Monetary Policy

IIB1 Functions of Banks

IIC United States Commercial Banks Assets and Liabilities

IID Theory and Reality of Economic History, Cyclical Slow Growth Not Secular Stagnation and Monetary Policy Based on Fear of Deflation

IIB United States Housing Collapse

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

Executive Summary

Contents of Executive Summary

ESI Increasing Interest Rate Risk, Tapering Quantitative Easing, Duration Dumping, Steepening

Yield Curve and Global Financial and Economic Risk

ESII Mediocre Cyclical United States Economic Growth with GDP Two Trillion Dollars Below Trend

ESIII Contracting Real Private Fixed Investment

ESIV United States Commercial Banks Assets and Liabilities

ESV United States Housing Collapse

ESI Increasing Interest Rate Risk, Tapering Quantitative Easing, Duration Dumping, Steepening Yield Curve and Global Financial and Economic Risk. The International Monetary Fund (IMF) provides an international safety net for prevention and resolution of international financial crises. The IMF’s Financial Sector Assessment Program (FSAP) provides analysis of the economic and financial sectors of countries (see Pelaez and Pelaez, International Financial Architecture (2005), 101-62, Globalization and the State, Vol. II (2008), 114-23). Relating economic and financial sectors is a challenging task for both theory and measurement. The International Monetary Fund (IMF) provides an international safety net for prevention and resolution of international financial crises. The IMF’s Financial Sector Assessment Program (FSAP) provides analysis of the economic and financial sectors of countries (see Pelaez and Pelaez, International Financial Architecture (2005), 101-62, Globalization and the State, Vol. II (2008), 114-23). Relating economic and financial sectors is a challenging task for both theory and measurement. The IMF (2013WEOOct) provides surveillance of the world economy with its Global Economic Outlook (WEO) (http://www.imf.org/external/pubs/ft/weo/2013/02/), of the world financial system with its Global Financial Stability Report (GFSR) (IMF 2013GFSROct) (http://www.imf.org/External/Pubs/FT/GFSR/2013/02/index.htm) and of fiscal affairs with the Fiscal Monitor (IMF 2013FMOct) (http://www.imf.org/external/pubs/ft/fm/2013/02/fmindex.htm). There appears to be a moment of transition in global economic and financial variables that may prove of difficult analysis and measurement. It is useful to consider a summary of global economic and financial risks, which are analyzed in detail in the comments of this blog in Section VI Valuation of Risk Financial Assets, Table VI-4.

Economic risks include the following:

- China’s Economic Growth. China is lowering its growth target to 7.5 percent per year. China’s GDP growth decelerated from 12.1 percent in IQ2010 and 11.2 percent in IIQ2010 to 7.7 percent in IQ2013, 7.5 percent in IIQ2013 and 7.8 percent in IIIQ2013. GDP grew 7.7 percent in IVQ2013 relative to a year earlier and 1.8 percent relative to IIIQ2013, which is equivalent to 7.4 percent per year (http://cmpassocregulationblog.blogspot.com/2014/01/capital-flows-exchange-rates-and.html and earlier http://cmpassocregulationblog.blogspot.com/2013/10/twenty-eight-million-unemployed-or.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/07/tapering-quantitative-easing-policy-and_7005.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/01/recovery-without-hiring-world-inflation.html and earlier at http://cmpassocregulationblog.blogspot.com/2012/10/world-inflation-waves-stagnating-united_21.html). There is also concern about indebtedness.

- United States Economic Growth, Labor Markets and Budget/Debt Quagmire. The US is growing slowly with 29.3 million in job stress, fewer 10 million full-time jobs, high youth unemployment, historically low hiring and declining/stagnating real wages. Actual GDP is about two trillion dollars lower than trend GDP.

- Economic Growth and Labor Markets in Advanced Economies. Advanced economies are growing slowly. There is still high unemployment in advanced economies.

- World Inflation Waves. Inflation continues in repetitive waves globally (http://cmpassocregulationblog.blogspot.com/2014/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/01/world-inflation-waves-interest-rate.html). There is growing concern on capital outflows and currency depreciation of emerging markets.

A list of financial uncertainties includes:

- Euro Area Survival Risk. The resilience of the euro to fiscal and financial doubts on larger member countries is still an unknown risk.

- Foreign Exchange Wars. Exchange rate struggles continue as zero interest rates in advanced economies induce devaluation of their currencies with alternating episodes of revaluation.

- Valuation of Risk Financial Assets. Valuations of risk financial assets have reached extremely high levels in markets with lower volumes.

- Duration Trap of the Zero Bound. The yield of the US 10-year Treasury rose from 2.031 percent on Mar 9, 2012, to 2.294 percent on Mar 16, 2012. Considering a 10-year Treasury with coupon of 2.625 percent and maturity in exactly 10 years, the price would fall from 105.3512 corresponding to yield of 2.031 percent to 102.9428 corresponding to yield of 2.294 percent, for loss in a week of 2.3 percent but far more in a position with leverage of 10:1. Min Zeng, writing on “Treasurys fall, ending brutal quarter,” published on Mar 30, 2012, in the Wall Street Journal (http://professional.wsj.com/article/SB10001424052702303816504577313400029412564.html?mod=WSJ_hps_sections_markets), informs that Treasury bonds maturing in more than 20 years lost 5.52 percent in the first quarter of 2012.

- Credibility and Commitment of Central Bank Policy. There is a credibility issue of the commitment of monetary policy (Sargent and Silber 2012Mar20).

- Carry Trades. Commodity prices driven by zero interest rates have resumed their increasing path with fluctuations caused by intermittent risk aversion

Chart VIII-1 of the Board of Governors of the Federal Reserve System provides the rate on the overnight fed funds rate and the yields of the 10-year constant maturity Treasury and the Baa seasoned corporate bond. Table VIII-3 provides the data for selected points in Chart VIII-1. There are two important economic and financial events, illustrating the ease of inducing carry trade with extremely low interest rates and the resulting financial crash and recession of abandoning extremely low interest rates.

- The Federal Open Market Committee (FOMC) lowered the target of the fed funds rate from 7.03 percent on Jul 3, 2000, to 1.00 percent on Jun 22, 2004, in pursuit of non-existing deflation (Pelaez and Pelaez, International Financial Architecture (2005), 18-28, The Global Recession Risk (2007), 83-85). Central bank commitment to maintain the fed funds rate at 1.00 percent induced adjustable-rate mortgages (ARMS) linked to the fed funds rate. Lowering the interest rate near the zero bound in 2003-2004 caused the illusion of permanent increases in wealth or net worth in the balance sheets of borrowers and also of lending institutions, securitized banking and every financial institution and investor in the world. The discipline of calculating risks and returns was seriously impaired. The objective of monetary policy was to encourage borrowing, consumption and investment. The exaggerated stimulus resulted in a financial crisis of major proportions as the securitization that had worked for a long period was shocked with policy-induced excessive risk, imprudent credit, high leverage and low liquidity by the incentive to finance everything overnight at interest rates close to zero, from adjustable rate mortgages (ARMS) to asset-backed commercial paper of structured investment vehicles (SIV). The consequences of inflating liquidity and net worth of borrowers were a global hunt for yields to protect own investments and money under management from the zero interest rates and unattractive long-term yields of Treasuries and other securities. Monetary policy distorted the calculations of risks and returns by households, business and government by providing central bank cheap money. Short-term zero interest rates encourage financing of everything with short-dated funds, explaining the SIVs created off-balance sheet to issue short-term commercial paper with the objective of purchasing default-prone mortgages that were financed in overnight or short-dated sale and repurchase agreements (Pelaez and Pelaez, Financial Regulation after the Global Recession, 50-1, Regulation of Banks and Finance, 59-60, Globalization and the State Vol. I, 89-92, Globalization and the State Vol. II, 198-9, Government Intervention in Globalization, 62-3, International Financial Architecture, 144-9). ARMS were created to lower monthly mortgage payments by benefitting from lower short-dated reference rates. Financial institutions economized in liquidity that was penalized with near zero interest rates. There was no perception of risk because the monetary authority guaranteed a minimum or floor price of all assets by maintaining low interest rates forever or equivalent to writing an illusory put option on wealth. Subprime mortgages were part of the put on wealth by an illusory put on house prices. The housing subsidy of $221 billion per year created the impression of ever-increasing house prices. The suspension of auctions of 30-year Treasuries was designed to increase demand for mortgage-backed securities, lowering their yield, which was equivalent to lowering the costs of housing finance and refinancing. Fannie and Freddie purchased or guaranteed $1.6 trillion of nonprime mortgages and worked with leverage of 75:1 under Congress-provided charters and lax oversight. The combination of these policies resulted in high risks because of the put option on wealth by near zero interest rates, excessive leverage because of cheap rates, low liquidity by the penalty in the form of low interest rates and unsound credit decisions. The put option on wealth by monetary policy created the illusion that nothing could ever go wrong, causing the credit/dollar crisis and global recession (Pelaez and Pelaez, Financial Regulation after the Global Recession, 157-66, Regulation of Banks, and Finance, 217-27, International Financial Architecture, 15-18, The Global Recession Risk, 221-5, Globalization and the State Vol. II, 197-213, Government Intervention in Globalization, 182-4). The FOMC implemented increments of 25 basis points of the fed funds target from Jun 2004 to Jun 2006, raising the fed funds rate to 5.25 percent on Jul 3, 2006, as shown in Chart VIII-1. The gradual exit from the first round of unconventional monetary policy from 1.00 percent in Jun 2004 (http://www.federalreserve.gov/boarddocs/press/monetary/2004/20040630/default.htm) to 5.25 percent in Jun 2006 (http://www.federalreserve.gov/newsevents/press/monetary/20060629a.htm) caused the financial crisis and global recession.

- On Dec 16, 2008, the policy determining committee of the Fed decided (http://www.federalreserve.gov/newsevents/press/monetary/20081216b.htm): “The Federal Open Market Committee decided today to establish a target range for the federal funds rate of 0 to 1/4 percent.” Policymakers emphasize frequently that there are tools to exit unconventional monetary policy at the right time. At the confirmation hearing on nomination for Chair of the Board of Governors of the Federal Reserve System, Vice Chair Yellen (2013Nov14 http://www.federalreserve.gov/newsevents/testimony/yellen20131114a.htm), states that: “The Federal Reserve is using its monetary policy tools to promote a more robust recovery. A strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy tools such as asset purchases. I believe that supporting the recovery today is the surest path to returning to a more normal approach to monetary policy.” Perception of withdrawal of $2611 billion, or $2.6 trillion, of bank reserves (http://www.federalreserve.gov/releases/h41/current/h41.htm#h41tab1), would cause Himalayan increase in interest rates that would provoke another recession. There is no painless gradual or sudden exit from zero interest rates because reversal of exposures created on the commitment of zero interest rates forever.

In his classic restatement of the Keynesian demand function in terms of “liquidity preference as behavior toward risk,” James Tobin (http://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/1981/tobin-bio.html) identifies the risks of low interest rates in terms of portfolio allocation (Tobin 1958, 86):

“The assumption that investors expect on balance no change in the rate of interest has been adopted for the theoretical reasons explained in section 2.6 rather than for reasons of realism. Clearly investors do form expectations of changes in interest rates and differ from each other in their expectations. For the purposes of dynamic theory and of analysis of specific market situations, the theories of sections 2 and 3 are complementary rather than competitive. The formal apparatus of section 3 will serve just as well for a non-zero expected capital gain or loss as for a zero expected value of g. Stickiness of interest rate expectations would mean that the expected value of g is a function of the rate of interest r, going down when r goes down and rising when r goes up. In addition to the rotation of the opportunity locus due to a change in r itself, there would be a further rotation in the same direction due to the accompanying change in the expected capital gain or loss. At low interest rates expectation of capital loss may push the opportunity locus into the negative quadrant, so that the optimal position is clearly no consols, all cash. At the other extreme, expectation of capital gain at high interest rates would increase sharply the slope of the opportunity locus and the frequency of no cash, all consols positions, like that of Figure 3.3. The stickier the investor's expectations, the more sensitive his demand for cash will be to changes in the rate of interest (emphasis added).”

Tobin (1969) provides more elegant, complete analysis of portfolio allocation in a general equilibrium model. The major point is equally clear in a portfolio consisting of only cash balances and a perpetuity or consol. Let g be the capital gain, r the rate of interest on the consol and re the expected rate of interest. The rates are expressed as proportions. The price of the consol is the inverse of the interest rate, (1+re). Thus, g = [(r/re) – 1]. The critical analysis of Tobin is that at extremely low interest rates there is only expectation of interest rate increases, that is, dre>0, such that there is expectation of capital losses on the consol, dg<0. Investors move into positions combining only cash and no consols. Valuations of risk financial assets would collapse in reversal of long positions in carry trades with short exposures in a flight to cash. There is no exit from a central bank created liquidity trap without risks of financial crash and another global recession. The net worth of the economy depends on interest rates. In theory, “income is generally defined as the amount a consumer unit could consume (or believe that it could) while maintaining its wealth intact” (Friedman 1957, 10). Income, Y, is a flow that is obtained by applying a rate of return, r, to a stock of wealth, W, or Y = rW (Friedman 1957). According to a subsequent statement: “The basic idea is simply that individuals live for many years and that therefore the appropriate constraint for consumption is the long-run expected yield from wealth r*W. This yield was named permanent income: Y* = r*W” (Darby 1974, 229), where * denotes permanent. The simplified relation of income and wealth can be restated as:

W = Y/r (1)

Equation (1) shows that as r goes to zero, r→0, W grows without bound, W→∞. Unconventional monetary policy lowers interest rates to increase the present value of cash flows derived from projects of firms, creating the impression of long-term increase in net worth. An attempt to reverse unconventional monetary policy necessarily causes increases in interest rates, creating the opposite perception of declining net worth. As r→∞, W = Y/r →0. There is no exit from unconventional monetary policy without increasing interest rates with resulting pain of financial crisis and adverse effects on production, investment and employment.

Chart VIII-1, Fed Funds Rate and Yields of Ten-year Treasury Constant Maturity and Baa Seasoned Corporate Bond, Jan 2, 2001 to Feb 27, 2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/

Table VIII-3, Selected Data Points in Chart VIII-1, % per Year

| Fed Funds Overnight Rate | 10-Year Treasury Constant Maturity | Seasoned Baa Corporate Bond | |

| 1/2/2001 | 6.67 | 4.92 | 7.91 |

| 10/1/2002 | 1.85 | 3.72 | 7.46 |

| 7/3/2003 | 0.96 | 3.67 | 6.39 |

| 6/22/2004 | 1.00 | 4.72 | 6.77 |

| 6/28/2006 | 5.06 | 5.25 | 6.94 |

| 9/17/2008 | 2.80 | 3.41 | 7.25 |

| 10/26/2008 | 0.09 | 2.16 | 8.00 |

| 10/31/2008 | 0.22 | 4.01 | 9.54 |

| 4/6/2009 | 0.14 | 2.95 | 8.63 |

| 4/5/2010 | 0.20 | 4.01 | 6.44 |

| 2/4/2011 | 0.17 | 3.68 | 6.25 |

| 7/25/2012 | 0.15 | 1.43 | 4.73 |

| 5/1/13 | 0.14 | 1.66 | 4.48 |

| 9/5/13 | 0.08 | 2.98 | 5.53 |

| 11/21/2013 | 0.09 | 2.79 | 5.44 |

| 11/27/13 | 0.09 | 2.74 | 5.34 (11/26/13) |

| 12/6/13 | 0.09 | 2.88 | 5.47 |

| 12/12/13 | 0.09 | 2.89 | 5.42 |

| 12/19/13 | 0.09 | 2.94 | 5.36 |

| 12/26/13 | 0.08 | 3.00 | 5.37 |

| 1/2/2014 | 0.08 | 3.00 | 5.34 |

| 1/9/2014 | 0.07 | 2.97 | 5.28 |

| 1/16/2014 | 0.07 | 2.86 | 5.18 |

| 1/23/2014 | 0.07 | 2.79 | 5.11 |

| 1/31/2014 | 0.07 | 2.72 | 5.08 |

| 2/7/2014 | 0.07 | 2.73 | 5.13 |

| 2/14/2014 | 0.06 | 2.73 | 5.12 |

| 2/21/14 | 0.07 | 2.76 | 5.15 |

| 2/28/14 | 0.07 | 2.65 | 5.01 |

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/

Professionals use a variety of techniques in measuring interest rate risk (Fabozzi, Buestow and Johnson, 2006, Chapter Nine, 183-226):

- Full valuation approach in which securities and portfolios are shocked by 50, 100, 200 and 300 basis points to measure their impact on asset values

- Stress tests requiring more complex analysis and translation of possible events with high impact even if with low probability of occurrence into effects on actual positions and capital

- Value at Risk (VaR) analysis of maximum losses that are likely in a time horizon

- Duration and convexity that are short-hand convenient measurement of changes in prices resulting from changes in yield captured by duration and convexity

- Yield volatility

Analysis of these methods is in Pelaez and Pelaez (International Financial Architecture (2005), 101-162) and Pelaez and Pelaez, Globalization and the State, Vol. (I) (2008a), 78-100). Frederick R. Macaulay (1938) introduced the concept of duration in contrast with maturity for analyzing bonds. Duration is the sensitivity of bond prices to changes in yields. In economic jargon, duration is the yield elasticity of bond price to changes in yield, or the percentage change in price after a percentage change in yield, typically expressed as the change in price resulting from change of 100 basis points in yield. The mathematical formula is the negative of the yield elasticity of the bond price or –[dB/d(1+y)]((1+y)/B), where d is the derivative operator of calculus, B the bond price, y the yield and the elasticity does not have dimension (Hallerbach 2001). The duration trap of unconventional monetary policy is that duration is higher the lower the coupon and higher the lower the yield, other things being constant. Coupons and yields are historically low because of unconventional monetary policy. Duration dumping during a rate increase may trigger the same crossfire selling of high duration positions that magnified the credit crisis. Traders reduced positions because capital losses in one segment, such as mortgage-backed securities, triggered haircuts and margin increases that reduced capital available for positioning in all segments, causing fire sales in multiple segments (Brunnermeier and Pedersen 2009; see Pelaez and Pelaez, Regulation of Banks and Finance (2008b), 217-24). Financial markets are currently experiencing fear of duration and riskier asset classes resulting from the debate within and outside the Fed on tapering quantitative easing. Table VIII-2 provides the yield curve of Treasury securities on Feb 28, 2014, Dec 31, 2013, May 1, 2013, Feb 28, 2013 and Feb 28, 2006. There is oscillating steepening of the yield curve for longer maturities, which are also the ones with highest duration. The 10-year yield increased from 1.45 percent on Jul 26, 2012 to 3.04 percent on Dec 31, 2013 and 2.66 percent on Feb 28, 2014, as measured by the United States Treasury. Assume that a bond with maturity in 10 years were issued on Dec 31, 2013, at par or price of 100 with coupon of 1.45 percent. The price of that bond would be 86.3778 with instantaneous increase of the yield to 3.04 percent for loss of 13.6 percent and far more with leverage. Assume that the yield of a bond with exactly ten years to maturity and coupon of 2.66 percent as occurred on Feb 28, 2013 would jump instantaneously from yield of 2.66 percent on Feb 28, 2014 to 4.55 percent as occurred on Feb 28, 2006 when the economy was closer to full employment. The price of the hypothetical bond issued with coupon of 2.66 percent would drop from 100 to 84.9502 after an instantaneous increase of the yield to 4.55 percent. The price loss would be 15.0 percent. Losses absorb capital available for positioning, triggering crossfire sales in multiple asset classes (Brunnermeier and Pedersen 2009). What is the path of adjustment of zero interest rates on fed funds and artificially low bond yields? There is no painless exit from unconventional monetary policy. Chris Dieterich, writing on “Bond investors turn to cash,” on Jul 25, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887323971204578625900935618178.html), uses data of the Investment Company Institute (http://www.ici.org/) in showing withdrawals of $43 billion in taxable mutual funds in Jun, which is the largest in history, with flows into cash investments such as $8.5 billion in the week of Jul 17 into money-market funds.

Table VIII-2, United States, Treasury Yields

| 2/28/14 | 12/31/13 | 5/01/13 | 2/28/13 | 2/28/06 | |

| 1 M | 0.04 | 0.01 | 0.03 | 0.07 | 4.47 |

| 3 M | 0.05 | 0.07 | 0.06 | 0.11 | 4.62 |

| 6 M | 0.08 | 0.10 | 0.08 | 0.13 | 4.74 |

| 1 Y | 0.12 | 0.13 | 0.11 | 0.17 | 4.73 |

| 2 Y | 0.33 | 0.38 | 0.20 | 0.25 | 4.69 |

| 3 Y | 0.69 | 0.78 | 0.30 | 0.36 | 4.67 |

| 5 Y | 1.51 | 1.75 | 0.65 | 0.77 | 4.61 |

| 7 Y | 2.13 | 2.45 | 1.07 | 1.26 | 4.57 |

| 10 Y | 2.66 | 3.04 | 1.66 | 1.89 | 4.55 |

| 20 Y | 3.31 | 3.72 | 2.44 | 2.71 | 4.70 |

| 30 Y | 3.59 | 3.96 | 2.83 | 3.10 | 4.51 |

M: Months; Y: Years

Source: United States Treasury

There is a false impression of the existence of a monetary policy “science,” measurements and forecasting with which to steer the economy into “prosperity without inflation.” Market participants are remembering the Great Bond Crash of 1994 shown in Table VI-7G when monetary policy pursued nonexistent inflation, causing trillions of dollars of losses in fixed income worldwide while increasing the fed funds rate from 3 percent in Jan 1994 to 6 percent in Dec. The exercise in Table VI-7G shows a drop of the price of the 30-year bond by 18.1 percent and of the 10-year bond by 14.1 percent. CPI inflation remained almost the same and there is no valid counterfactual that inflation would have been higher without monetary policy tightening because of the long lag in effect of monetary policy on inflation (see Culbertson 1960, 1961, Friedman 1961, Batini and Nelson 2002, Romer and Romer 2004). The pursuit of nonexistent deflation during the past ten years has resulted in the largest monetary policy accommodation in history that created the 2007 financial market crash and global recession and is currently preventing smoother recovery while creating another financial crash in the future. The issue is not whether there should be a central bank and monetary policy but rather whether policy accommodation in doses from zero interest rates to trillions of dollars in the fed balance sheet endangers economic stability.

Table VI-7G, Fed Funds Rates, Thirty and Ten Year Treasury Yields and Prices, 30-Year Mortgage Rates and 12-month CPI Inflation 1994

| 1994 | FF | 30Y | 30P | 10Y | 10P | MOR | CPI |

| Jan | 3.00 | 6.29 | 100 | 5.75 | 100 | 7.06 | 2.52 |

| Feb | 3.25 | 6.49 | 97.37 | 5.97 | 98.36 | 7.15 | 2.51 |

| Mar | 3.50 | 6.91 | 92.19 | 6.48 | 94.69 | 7.68 | 2.51 |

| Apr | 3.75 | 7.27 | 88.10 | 6.97 | 91.32 | 8.32 | 2.36 |

| May | 4.25 | 7.41 | 86.59 | 7.18 | 88.93 | 8.60 | 2.29 |

| Jun | 4.25 | 7.40 | 86.69 | 7.10 | 90.45 | 8.40 | 2.49 |

| Jul | 4.25 | 7.58 | 84.81 | 7.30 | 89.14 | 8.61 | 2.77 |

| Aug | 4.75 | 7.49 | 85.74 | 7.24 | 89.53 | 8.51 | 2.69 |

| Sep | 4.75 | 7.71 | 83.49 | 7.46 | 88.10 | 8.64 | 2.96 |

| Oct | 4.75 | 7.94 | 81.23 | 7.74 | 86.33 | 8.93 | 2.61 |

| Nov | 5.50 | 8.08 | 79.90 | 7.96 | 84.96 | 9.17 | 2.67 |

| Dec | 6.00 | 7.87 | 81.91 | 7.81 | 85.89 | 9.20 | 2.67 |

Notes: FF: fed funds rate; 30Y: yield of 30-year Treasury; 30P: price of 30-year Treasury assuming coupon equal to 6.29 percent and maturity in exactly 30 years; 10Y: yield of 10-year Treasury; 10P: price of 10-year Treasury assuming coupon equal to 5.75 percent and maturity in exactly 10 years; MOR: 30-year mortgage; CPI: percent change of CPI in 12 months

Sources: yields and mortgage rates http://www.federalreserve.gov/releases/h15/data.htm CPI ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.t

Chart VI-14 provides the overnight fed funds rate, the yield of the 10-year Treasury constant maturity bond, the yield of the 30-year constant maturity bond and the conventional mortgage rate from Jan 1991 to Dec 1996. In Jan 1991, the fed funds rate was 6.91 percent, the 10-year Treasury yield 8.09 percent, the 30-year Treasury yield 8.27 percent and the conventional mortgage rate 9.64 percent. Before monetary policy tightening in Oct 1993, the rates and yields were 2.99 percent for the fed funds, 5.33 percent for the 10-year Treasury, 5.94 for the 30-year Treasury and 6.83 percent for the conventional mortgage rate. After tightening in Nov 1994, the rates and yields were 5.29 percent for the fed funds rate, 7.96 percent for the 10-year Treasury, 8.08 percent for the 30-year Treasury and 9.17 percent for the conventional mortgage rate.

Chart VI-14, US, Overnight Fed Funds Rate, 10-Year Treasury Constant Maturity, 30-Year Treasury Constant Maturity and Conventional Mortgage Rate, Monthly, Jan 1991 to Dec 1996

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/update/

Chart VI-15 of the Bureau of Labor Statistics provides the all items consumer price index from Jan 1991 to Dec 1996. There does not appear acceleration of consumer prices requiring aggressive tightening.

Chart VI-15, US, Consumer Price Index All Items, Jan 1991 to Dec 1996

Source: Bureau of Labor Statistics

http://www.bls.gov/cpi/data.htm

Chart IV-16 of the Bureau of Labor Statistics provides 12-month percentage changes of the all items consumer price index from Jan 1991 to Dec 1996. Inflation collapsed during the recession from Jul 1990 (III) and Mar 1991 (I) and the end of the Kuwait War on Feb 25, 1991 that stabilized world oil markets. CPI inflation remained almost the same and there is no valid counterfactual that inflation would have been higher without monetary policy tightening because of the long lag in effect of monetary policy on inflation (see Culbertson 1960, 1961, Friedman 1961, Batini and Nelson 2002, Romer and Romer 2004). Policy tightening had adverse collateral effects in the form of emerging market crises in Mexico and Argentina and fixed income markets worldwide.

Chart VI-16, US, Consumer Price Index All Items, Twelve-Month Percentage Change, Jan 1991 to Dec 1996

Source: Bureau of Labor Statistics

http://www.bls.gov/cpi/data.htm

Interest rate risk is increasing in the US with amplifying fluctuations. Chart VI-13 of the Board of Governors provides the conventional mortgage rate for a fixed-rate 30-year mortgage. The rate stood at 5.87 percent on Jan 8, 2004, increasing to 6.79 percent on Jul 6, 2006. The rate bottomed at 3.35 percent on May 2, 2013. Fear of duration risk in longer maturities such as mortgage-backed securities caused continuing increases in the conventional mortgage rate that rose to 4.51 percent on Jul 11, 2013, 4.58 percent on Aug 22, 2013 and 4.37 percent on Feb 27, 2014, which is the last data point in Chart VI-13. Shayndi Raice and Nick Timiraos, writing on “Banks cut as mortgage boom ends,” on Jan 9, 2014, published in the Wall Street Journal (http://online.wsj.com/news/articles/SB10001424052702303754404579310940019239208), analyze the drop in mortgage applications to a 13-year low, as measured by the Mortgage Bankers Association.

Chart VI-13, US, Conventional Mortgage Rate, Jan 8, 2004 to Feb 27, 2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/update/

Chinese Yuan/Dollar (CNY/USD) exchange rate that reveal pursuit of exchange rate policies resulting from monetary policy in the US and capital control/exchange rate policy in China. The ultimate intentions are the same: promoting internal economic activity at the expense of the rest of the world. The easy money policy of the US was deliberately or not but effectively to devalue the dollar from USD 1.1423/EUR on Jun 26, 2003 to USD 1.5914/EUR on Jul 14, 2008, or by 39.3 percent. The flight into dollar assets after the global recession caused revaluation to USD 1.192/EUR on Jun 7, 2010, or by 25.1 percent. After the temporary interruption of the sovereign risk issues in Europe from Apr to Jul, 2010, shown in Table VI-4 below, the dollar has devalued again to USD 1.3801/EUR on Feb 28, 2014 or by 15.8 percent {[(1.3801/1.192)-1]100 = 15.8 %}. Yellen (2011AS, 6) admits that Fed monetary policy results in dollar devaluation with the objective of increasing net exports, which was the policy that Joan Robinson (1947) labeled as “beggar-my-neighbor” remedies for unemployment. Risk aversion erodes devaluation of the dollar. China fixed the CNY to the dollar for a long period at a highly undervalued level of around CNY 8.2765/USD subsequently revaluing to CNY 6.8211/USD until Jun 7, 2010, or by 17.6 percent. After fixing again the CNY to the dollar, China revalued to CNY 6.1481/USD on Fri Feb 28, 2014, or by an additional 9.9 percent, for cumulative revaluation of 25.7 percent. The final row of Table VI-2 shows: devaluation of 0.1 percent in the week of Feb 7, 2014; devaluation of 0.1 percent in the week of Feb 14, 2014; depreciation of 0.4 percent the week of Feb 21, 2013; and devaluation of 0.9 percent in the week of Feb 28, 2013. There could be reversal of revaluation to devalue the Yuan.

Table VI-2, Dollar/Euro (USD/EUR) Exchange Rate and Chinese Yuan/Dollar (CNY/USD) Exchange Rate

| USD/EUR | 12/26/03 | 7/14/08 | 6/07/10 | 2/28/14 |

| Rate | 1.1423 | 1.5914 | 1.192 | 1.3801 |

| CNY/USD | 01/03 | 07/21 | 7/15 | 2/28/ 2014 |

| Rate | 8.2798 | 8.2765 | 6.8211 | 6.1481 |

| Weekly Rates | 2/7/2014 | 2/14/2014 | 2/21/2014 | 2/28/ 2014 |

| CNY/USD | 6.0634 | 6.0670 | 6.0913 | 6.1481 |

| ∆% from Earlier Week* | -0.1 | -0.1 | -0.4 | -0.9 |

*Negative sign is depreciation; positive sign is appreciation

Source: http://professional.wsj.com/mdc/public/page/mdc_currencies.html?mod=mdc_topnav_2_3000

Professor Edward P Lazear (2013Jan7), writing on “Chinese ‘currency manipulation’ is not the problem,” on Jan 7, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887323320404578213203581231448.html), provides clear thought on the role of the yuan in trade between China and the United States and trade between China and Europe. There is conventional wisdom that Chinese exchange rate policy causes the loss of manufacturing jobs in the United States, which is shown by Lazear (2013Jan7) to be erroneous. The fact is that manipulation of the CNY/USD rate by China has only minor effects on US employment. Lazear (2013Jan7) shows that the movement of monthly exports of China to its major trading partners, United States and Europe, since 1995 cannot be explained by the fixing of the CNY/USD rate by China. The period is quite useful because it includes rapid growth before 2007, contraction until 2009 and weak subsequent expansion. Chart VI-1 of the Board of Governors of the Federal Reserve System provides the CNY/USD exchange rate from Jan 3, 1995 to Feb 21, 2014 together with US recession dates in shaded areas. China fixed the CNY/USD rate for a long period as shown in the horizontal segment from 1995 to 2005. There was systematic revaluation of 17.6 percent from CNY 8.2765 on Jul 21, 2005 to CNY 6.8211 on Jul 15, 2008. China fixed the CNY/USD rate until Jun 7, 2010, to avoid adverse effects on its economy from the global recession, which is shown as a horizontal segment from 2009 until mid 2010. China then continued the policy of appreciation of the CNY relative to the USD with oscillations until the beginning of 2012 when the rate began to move sideways followed by a final upward slope of devaluation that is measured in Table VI-2A but virtually disappeared in the rate of CNY 6.3589/USD on Aug 17, 2012 and was nearly unchanged at CNY 6.3558/USD on Aug 24, 2012. China then appreciated 0.2 percent in the week of Dec 21, 2012, to CNY 6.2352/USD for cumulative 1.9 percent revaluation from Oct 28, 2011 and left the rate virtually unchanged at CNY 6.2316/USD on Jan 11, 2013, appreciating to CNY 6.0912/USD on Feb 21, 2014, which is the last data point in Chart VI-1. Revaluation of the CNY relative to the USD by 25.7 percent by Feb 28, 2014 has not reduced the trade surplus of China but reversal of the policy of revaluation could result in international confrontation. The interruption with upward slope in the final segment on the right of Chart VI-I is measured as virtually stability in Table VI-2A followed with decrease or revaluation. There is concern if the policy of revaluation is changing to devaluation.

Chart VI-1, Chinese Yuan (CNY) per US Dollar (US), Business Days, Jan 3, 1995-Feb 21, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

Carry trades induced by zero interest rates increase capital flows into emerging markets that appreciate exchange rates. Portfolio reallocations away from emerging markets depreciate their exchange rates in reversals of capital flows. Chart VI-4A provides the exchange rate of the Mexican peso (MXN) per US dollar from Nov 8, 1993 to Feb 21, 2014. The first data point in Chart VI-4A is MXN 3.1520 on Nov 8, 1993. The rate devalued to 11.9760 on Nov 14, 1995 during emerging market crises in the 1990s and the increase of interest rates in the US in 1994 that stressed world financial markets (Pelaez and Pelaez, International Financial Architecture 2005, The Global Recession Risk 2007, 147-77). The MXN depreciated sharply to MXN 15.4060/USD on Mar 2, 2009, during the global recession. The rate moved to MXN 11.5050/USD on May 2, 2011, during the sovereign debt crisis in the euro area. The rate depreciated to 11.9760 on May 9, 2013. The final data point in the current flight from emerging markets is MXN 13.2710/USD on Feb 21, 2014.

Chart VI-4A, Mexican Peso (MXN) per US Dollar (USD), Nov 8, 1993 to Feb 21, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

There are collateral effects worldwide from unconventional monetary policy. In remarkable anticipation in 2005, Professor Raghuram G. Rajan (2005) warned of low liquidity and high risks of central bank policy rates approaching the zero bound (Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 218-9). Professor Rajan excelled in a distinguished career as an academic economist in finance and was chief economist of the International Monetary Fund (IMF). Shefali Anand and Jon Hilsenrath, writing on Oct 13, 2013, on “India’s central banker lobbies Fed,” published in the Wall Street Journal (http://online.wsj.com/news/articles/SB10001424052702304330904579133530766149484?KEYWORDS=Rajan), interviewed Raghuram G Rajan, who is the current Governor of the Reserve Bank of India, which is India’s central bank (http://www.rbi.org.in/scripts/AboutusDisplay.aspx). In this interview, Rajan argues that central banks should avoid unintended consequences on emerging market economies of inflows and outflows of capital triggered by monetary policy. Professor Rajan, in an interview with Kartik Goyal of Bloomberg (http://www.bloomberg.com/news/2014-01-30/rajan-warns-of-global-policy-breakdown-as-emerging-markets-slide.html), warns of breakdown of global policy coordination. Professor Willem Buiter (2014Feb4), a distinguished economist currently Global Chief Economist at Citigroup (http://www.willembuiter.com/resume.pdf), writing on “The Fed’s bad manners risk offending foreigners,” on Feb 4, 2014, published in the Financial Times (http://www.ft.com/intl/cms/s/0/fbb09572-8d8d-11e3-9dbb-00144feab7de.html#axzz2suwrwkFs), concurs with Raghuram Rajan. Buiter (2014Feb4) argues that international policy cooperation in monetary policy is both in the interest of the world and the United States. Portfolio reallocations induced by combination of zero interest rates and risk events stimulate carry trades that generate wide swings in world capital flows. Chart VI-4B provides the rate of the Indian rupee (INR) per US dollar (USD) from Jan 2, 1973 to Feb 21, 2014. The first data point is INR 8.0200 on Jan 2, 1973. The rate depreciated sharply to INR 51.9600 on Mar 3, 2009, during the global recession. The rate appreciated to INR 44.0300/USD on Jul 28, 2011 in the midst of the sovereign debt event in the euro area. The rate overshot to INR 68.8000 on Aug 28, 2013. The final data point if INR 62.1300/USD on Feb 21, 2014.

Chart VI-4B, Indian Rupee (INR) per US Dollar (USD), Jan 2, 1973 to Feb 21, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

ChVI-5 provides the exchange rate of JPY (Japan yen) per USD (US dollars). The first data point on the extreme left is JPY 357.7300/USD for Jan 4, 1971. The JPY has appreciated over the long term relative to the USD with fluctuations along an evident long-term appreciation. Before the global recession, the JPY stood at JPY 124.0900/USD on Jun 22, 2007. The use of the JPY as safe haven is evident by sharp appreciation during the global recession to JPY 110.48/USD on Aug 15, 2008, and to JPY 87.8000/USD on Jan 21, 2009. The final data point in Chart VI-5 is JPY 102.7100/USD on Feb 21, 2013 for appreciation of 17.2 percent relative to JPY 124.0900/USD on Jun 22, 2007 before the global recession and expansion characterized by recurring bouts of risk aversion. Takashi Nakamichi and Eleanor Warnock, writing on “Japan lashes out over dollar, euro,” on Dec 29, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887323530404578207440474874604.html?mod=WSJ_markets_liveupdate&mg=reno64-wsj), analyze the “war of words” launched by Japan’s new Prime Minister Shinzo Abe and his finance minister Taro Aso, arguing of deliberate devaluations of the USD and EUR relative to the JPY, which are hurting Japan’s economic activity. The data in Table VI-6 is obtained from closing dates in New York published by the Wall Street Journal (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata).

Chart VI-5, Japanese Yen JPY per US Dollars USD, Monthly, Jan 4, 1971-Feb 21, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

The financial crisis and global recession were caused by interest rate and housing subsidies and affordability policies that encouraged high leverage and risks, low liquidity and unsound credit (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 157-66, Regulation of Banks and Finance (2009b), 217-27, International Financial Architecture (2005), 15-18, The Global Recession Risk (2007), 221-5, Globalization and the State Vol. II (2008b), 197-213, Government Intervention in Globalization (2008c), 182-4). Several past comments of this blog elaborate on these arguments, among which: http://cmpassocregulationblog.blogspot.com/2011/07/causes-of-2007-creditdollar-crisis.html http://cmpassocregulationblog.blogspot.com/2011/01/professor-mckinnons-bubble-economy.html http://cmpassocregulationblog.blogspot.com/2011/01/world-inflation-quantitative-easing.html http://cmpassocregulationblog.blogspot.com/2011/01/treasury-yields-valuation-of-risk.html http://cmpassocregulationblog.blogspot.com/2010/11/quantitative-easing-theory-evidence-and.html http://cmpassocregulationblog.blogspot.com/2010/12/is-fed-printing-money-what-are.html

Zero interest rates in the United States forever tend to depreciate the dollar against every other currency if there is no risk aversion preventing portfolio rebalancing toward risk financial assets, which include the capital markets and exchange rates of emerging-market economies. The objective of unconventional monetary policy as argued by Yellen 2011AS) is to devalue the dollar to increase net exports that increase US economic growth. Increasing net exports and internal economic activity in the US is equivalent to decreasing net exports and internal economic activity in other countries.

Continental territory, rich endowment of natural resources, investment in human capital, teaching and research universities, motivated labor force and entrepreneurial initiative provide Brazil with comparative advantages in multiple economic opportunities. Exchange rate parity is critical in achieving Brazil’s potential but is difficult in a world of zero interest rates. Chart IV-6 of the Board of Governors of the Federal Reserve System provides the rate of Brazilian real (BRL) per US dollar (USD) from BRL 1.2074/USD on Jan 4, 1999 to BRL 2.3565/USD on Feb 21, 2013. The rate reached BRL 3.9450/USD on Oct 10, 2002 appreciating 60.5 percent to BRL 1.5580/USD on Aug 1, 2008. The rate depreciated 68.1 percent to BRL 2.6187/USD on Dec 5, 2008 during worldwide flight from risk. The rate appreciated again by 41.3 percent to BRL 1.5375/USD on Jul 26, 2011. The final data point in Chart VI-6 is BRL 2.3565/USD on Feb 21, 2014 for depreciation of 53.3 percent. The data in Table VI-6 is obtained from closing dates in New York published by the Wall Street Journal (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata).

Chart VI-6, Brazilian Real (BRL) per US Dollar (USD) Jan 4, 1999 to Feb 21, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

Chart VI-7 of the Board of Governors of the Federal Reserve System provides the history of the BRL beginning with the first data point of BRL 0.8440/USD on Jan 2, 1995. The rate jumped to BRL 2.0700/USD on Jan 29, 1999 after changes in exchange rate policy and then to BRL 2.2000/USD on Mar 3, 1999. The rate depreciated 26.7 percent to BRL 2.7880/USD on Sep 21, 2001 relative to Mar 3, 1999.

Chart VI-7, Brazilian Real (BRL) per US Dollar (USD), Jan 2, 1995 to Feb 21, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

The major reason and channel of transmission of unconventional monetary policy is through expectations of inflation. Fisher (1930) provided theoretical and historical relation of interest rates and inflation. Let in be the nominal interest rate, ir the real or inflation-adjusted interest rate and πe the expectation of inflation in the time term of the interest rate, which are all expressed as proportions. The following expression provides the relation of real and nominal interest rates and the expectation of inflation:

(1 + ir) = (1 + in)/(1 + πe) (1)

That is, the real interest rate equals the nominal interest rate discounted by the expectation of inflation in time term of the interest rate. Fisher (1933) analyzed the devastating effect of deflation on debts. Nominal debt contracts remained at original principal interest but net worth and income of debtors contracted during deflation. Real interest rates increase during declining inflation. For example, if the interest rate is 3 percent and prices decline 0.2 percent, equation (1) calculates the real interest rate as:

(1 +0.03)/(1 – 0.02) = 1.03/(0.998) = 1.032

That is, the real rate of interest is (1.032 – 1) 100 or 3.2 percent. If inflation were 2 percent, the real rate of interest would be 0.98 percent, or about 1.0 percent {[(1.03/1.02) -1]100 = 0.98%}.

The yield of the one-year Treasury security was quoted in the Wall Street Journal at 0.114 percent on Fri May 17, 2013 (http://online.wsj.com/mdc/page/marketsdata.html?mod=WSJ_topnav_marketdata_main). The expected rate of inflation πe in the next twelve months is not observed. Assume that it would be equal to the rate of inflation in the past twelve months estimated by the Bureau of Economic Analysis (BLS) at 1.1 percent (http://www.bls.gov/cpi/). The real rate of interest would be obtained as follows:

(1 + 0.00114)/(1 + 0.011) = (1 + rr) = 0.9902

That is, ir is equal to 1 – 0.9902 or minus 0.98 percent. Investing in a one-year Treasury security results in a loss of 0.98 percent relative to inflation. The objective of unconventional monetary policy of zero interest rates is to induce consumption and investment because of the loss to inflation of riskless financial assets. Policy would be truly irresponsible if it intended to increase inflationary expectations or πe. The result could be the same rate of unemployment with higher inflation (Kydland and Prescott 1977).

Current focus is on tapering quantitative easing by the Federal Open Market Committee (FOMC). There is sharp distinction between the two measures of unconventional monetary policy: (1) fixing of the overnight rate of fed funds at 0 to ¼ percent; and (2) outright purchase of Treasury and agency securities and mortgage-backed securities for the balance sheet of the Federal Reserve. Market are overreacting to the so-called “paring” of outright purchases of $85 billion of securities per month for the balance sheet of the Fed

(http://www.federalreserve.gov/newsevents/press/monetary/20140129a.htm):

“Taking into account the extent of federal fiscal retrenchment since the inception of its current asset progress toward maximum employment and the improvement in the outlook for labor market conditions, the Committee decided to make a further measured reduction in the pace of its asset purchases. Beginning in February, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $30 billion per month rather than $35 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $35 billion per month rather than $40 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.”

What is truly important is the fixing of the overnight fed funds at 0 to ¼ percent for which there is no end in sight as evident in the FOMC statement for Jan 29, 2014 (http://www.federalreserve.gov/newsevents/press/monetary/20140129a.htm):

“To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. The Committee also reaffirmed its expectation that the current exceptionally low target range for the federal funds rate of 0 to 1/4 percent will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal (emphasis added).”

There is a critical phrase in the statement of Sep 19, 2013 (http://www.federalreserve.gov/newsevents/press/monetary/20130918a.htm): “but mortgage rates have risen further.” Did the increase of mortgage rates influence the decision of the FOMC not to taper? Is FOMC “communication” and “guidance” successful? Will the FOMC increase purchases of mortgage-backed securities if mortgage rates increase?

At the confirmation hearing on nomination for Chair of the Board of Governors of the Federal Reserve System, Vice Chair Yellen (2013Nov14 http://www.federalreserve.gov/newsevents/testimony/yellen20131114a.htm), states needs and intentions of policy:

“We have made good progress, but we have farther to go to regain the ground lost in the crisis and the recession. Unemployment is down from a peak of 10 percent, but at 7.3 percent in October, it is still too high, reflecting a labor market and economy performing far short of their potential. At the same time, inflation has been running below the Federal Reserve's goal of 2 percent and is expected to continue to do so for some time.

For these reasons, the Federal Reserve is using its monetary policy tools to promote a more robust recovery. A strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy tools such as asset purchases. I believe that supporting the recovery today is the surest path to returning to a more normal approach to monetary policy.”

In testimony on the Semiannual Monetary Policy Report to the Congress before the Committee on Financial Services, US House of Representatives, on Feb 11, 2014, Chair Janet Yellen states (http://www.federalreserve.gov/newsevents/testimony/yellen20140211a.htm):

“Turning to monetary policy, let me emphasize that I expect a great deal of continuity in the FOMC's approach to monetary policy. I served on the Committee as we formulated our current policy strategy and I strongly support that strategy, which is designed to fulfill the Federal Reserve's statutory mandate of maximum employment and price stability. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. That said, purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on its outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases. In December of last year and again this January, the Committee said that its current expectation--based on its assessment of a broad range of measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments--is that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the 2 percent goal. I am committed to achieving both parts of our dual mandate: helping the economy return to full employment and returning inflation to 2 percent while ensuring that it does not run persistently above or below that level (emphasis added).”

In his classic restatement of the Keynesian demand function in terms of “liquidity preference as behavior toward risk,” James Tobin (http://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/1981/tobin-bio.html) identifies the risks of low interest rates in terms of portfolio allocation (Tobin 1958, 86):

“The assumption that investors expect on balance no change in the rate of interest has been adopted for the theoretical reasons explained in section 2.6 rather than for reasons of realism. Clearly investors do form expectations of changes in interest rates and differfrom each other in their expectations. For the purposes of dynamic theory and of analysis of specific market situations, the theories of sections 2 and 3 are complementary rather than competitive. The formal apparatus of section 3 will serve just as well for a non-zero expected capital gain or loss as for a zero expected value of g. Stickiness of interest rate expectations would mean that the expected value of g is a function of the rate of interest r, going down when r goes down and rising when r goes up. In addition to the rotation of the opportunity locus due to a change in r itself, there would be a further rotation in the same direction due to the accompanying change in the expected capital gain or loss. At low interest rates expectation of capital loss may push the opportunity locus into the negative quadrant, so that the optimal position is clearly no consols, all cash. At the other extreme, expectation of capital gain at high interest rates would increase sharply the slope of the opportunity locus and the frequency of no cash, all consols positions, like that of Figure 3.3. The stickier the investor's expectations, the more sensitive his demand for cash will be to changes in the rate of interest (emphasis added).”

Tobin (1969) provides more elegant, complete analysis of portfolio allocation in a general equilibrium model. The major point is equally clear in a portfolio consisting of only cash balances and a perpetuity or consol. Let g be the capital gain, r the rate of interest on the consol and re the expected rate of interest. The rates are expressed as proportions. The price of the consol is the inverse of the interest rate, (1+re). Thus, g = [(r/re) – 1]. The critical analysis of Tobin is that at extremely low interest rates there is only expectation of interest rate increases, that is, dre>0, such that there is expectation of capital losses on the consol, dg<0. Investors move into positions combining only cash and no consols. Valuations of risk financial assets would collapse in reversal of long positions in carry trades with short exposures in a flight to cash. There is no exit from a central bank created liquidity trap without risks of financial crash and another global recession. The net worth of the economy depends on interest rates. In theory, “income is generally defined as the amount a consumer unit could consume (or believe that it could) while maintaining its wealth intact” (Friedman 1957, 10). Income, Y, is a flow that is obtained by applying a rate of return, r, to a stock of wealth, W, or Y = rW (Ibid). According to a subsequent statement: “The basic idea is simply that individuals live for many years and that therefore the appropriate constraint for consumption is the long-run expected yield from wealth r*W. This yield was named permanent income: Y* = r*W” (Darby 1974, 229), where * denotes permanent. The simplified relation of income and wealth can be restated as:

W = Y/r (10

Equation (1) shows that as r goes to zero, r→0, W grows without bound, W→∞. Unconventional monetary policy lowers interest rates to increase the present value of cash flows derived from projects of firms, creating the impression of long-term increase in net worth. An attempt to reverse unconventional monetary policy necessarily causes increases in interest rates, creating the opposite perception of declining net worth. As r→∞, W = Y/r →0. There is no exit from unconventional monetary policy without increasing interest rates with resulting pain of financial crisis and adverse effects on production, investment and employment.

The argument that anemic population growth causes “secular stagnation” in the US (Hansen 1938, 1939, 1941) is as misplaced currently as in the late 1930s (for early dissent see Simons 1942). There is currently population growth in the ages of 16 to 24 years but not enough job creation and discouragement of job searches for all ages (http://cmpassocregulationblog.blogspot.com/2014/01/capital-flows-exchange-rates-and.htm and earlier http://cmpassocregulationblog.blogspot.com/2013/12/theory-and-reality-of-secular.html). This is merely another case of theory without reality with dubious policy proposals. The current reality is cyclical slow growth.

In delivering the biannual report on monetary policy (Board of Governors 2013Jul17), Chairman Bernanke (2013Jul17) advised Congress that:

“Instead, we are providing additional policy accommodation through two distinct yet complementary policy tools. The first tool is expanding the Federal Reserve's portfolio of longer-term Treasury securities and agency mortgage-backed securities (MBS); we are currently purchasing $40 billion per month in agency MBS and $45 billion per month in Treasuries. We are using asset purchases and the resulting expansion of the Federal Reserve's balance sheet primarily to increase the near-term momentum of the economy, with the specific goal of achieving a substantial improvement in the outlook for the labor market in a context of price stability. We have made some progress toward this goal, and, with inflation subdued, we intend to continue our purchases until a substantial improvement in the labor market outlook has been realized. We are relying on near-zero short-term interest rates, together with our forward guidance that rates will continue to be exceptionally low--our second tool--to help maintain a high degree of monetary accommodation for an extended period after asset purchases end, even as the economic recovery strengthens and unemployment declines toward more-normal levels. In appropriate combination, these two tools can provide the high level of policy accommodation needed to promote a stronger economic recovery with price stability.

The Committee's decisions regarding the asset purchase program (and the overall stance of monetary policy) depend on our assessment of the economic outlook and of the cumulative progress toward our objectives. Of course, economic forecasts must be revised when new information arrives and are thus necessarily provisional.”

Friedman (1953) argues there are three lags in effects of monetary policy: (1) between the need for action and recognition of the need; (2) the recognition of the need and taking of actions; and (3) taking of action and actual effects. Friedman (1953) finds that the combination of these lags with insufficient knowledge of the current and future behavior of the economy causes discretionary economic policy to increase instability of the economy or standard deviations of real income σy and prices σp. Policy attempts to circumvent the lags by policy impulses based on forecasts. We are all naïve about forecasting. Data are available with lags and revised to maintain high standards of estimation. Policy simulation models estimate economic relations with structures prevailing before simulations of policy impulses such that parameters change as discovered by Lucas (1977). Economic agents adjust their behavior in ways that cause opposite results from those intended by optimal control policy as discovered by Kydland and Prescott (1977). Advance guidance attempts to circumvent expectations by economic agents that could reverse policy impulses but is of dubious effectiveness. There is strong case for using rules instead of discretionary authorities in monetary policy (http://cmpassocregulationblog.blogspot.com/search?q=rules+versus+authorities). Jon Hilsenrath, writing on “New view into Fed’s response to crisis,” on Feb 21, 2014, published in the Wall Street Journal (http://online.wsj.com/news/articles/SB10001424052702303775504579396803024281322?mod=WSJ_hp_LEFTWhatsNewsCollection), analyzes 1865 pages of transcripts of eight formal and six emergency policy meetings at the Fed in 2008 (http://www.federalreserve.gov/monetarypolicy/fomchistorical2008.htm). If there were an infallible science of central banking, models and forecasts would provide accurate information to policymakers on the future course of the economy in advance. Such forewarning is essential to central bank science because of the long lag between the actual impulse of monetary policy and the actual full effects on income and prices many months and even years ahead (Romer and Romer 2004, Friedman 1961, 1953, Culbertson 1960, 1961, Batini and Nelson 2002). The transcripts of the Fed meetings in 2008 (http://www.federalreserve.gov/monetarypolicy/fomchistorical2008.htm) analyzed by Jon Hilsenrath demonstrate that Fed policymakers frequently did not understand the current state of the US economy in 2008 and much less the direction of income and prices. The conclusion of Friedman (1953) is that monetary impulses increase financial and economic instability because of lags in anticipating needs of policy, taking policy decisions and effects of decisions. This is a fortiori true when untested unconventional monetary policy in gargantuan doses shocks the economy and financial markets.

The key policy is maintaining fed funds rate between 0 and ¼ percent. An increase in fed funds rates could cause flight out of risk financial markets worldwide. There is no exit from this policy without major financial market repercussions. Indefinite financial repression induces carry trades with high leverage, risks and illiquidity. A competing event is the high level of valuations of risk financial assets (http://cmpassocregulationblog.blogspot.com/2013/01/peaking-valuation-of-risk-financial.html). Matt Jarzemsky, writing on “Dow industrials set record,” on Mar 5, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324156204578275560657416332.html), analyzes that the DJIA broke the closing high of 14,164.53 set on Oct 9, 2007, and subsequently also broke the intraday high of 14,198.10 reached on Oct 11, 2007. The DJIA closed at 16,321.71 on Fri Feb 28, 2014, which is higher by 15.2 percent than the value of 14,164.53 reached on Oct 9, 2007 and higher by 15.0 percent than the value of 14,198.10 reached on Oct 11, 2007. Values of risk financial are approaching or exceeding historical highs.

Jon Hilsenrath, writing on “Jobs upturn isn’t enough to satisfy Fed,” on Mar 8, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324582804578348293647760204.html), finds that much stronger labor market conditions are required for the Fed to end quantitative easing. Unconventional monetary policy with zero interest rates and quantitative easing is quite difficult to unwind because of the adverse effects of raising interest rates on valuations of risk financial assets and home prices, including the very own valuation of the securities held outright in the Fed balance sheet. Gradual unwinding of 1 percent fed funds rates from Jun 2003 to Jun 2004 by seventeen consecutive increases of 25 percentage points from Jun 2004 to Jun 2006 to reach 5.25 percent caused default of subprime mortgages and adjustable-rate mortgages linked to the overnight fed funds rate. The zero interest rate has penalized liquidity and increased risks by inducing carry trades from zero interest rates to speculative positions in risk financial assets. There is no exit from zero interest rates without provoking another financial crash.

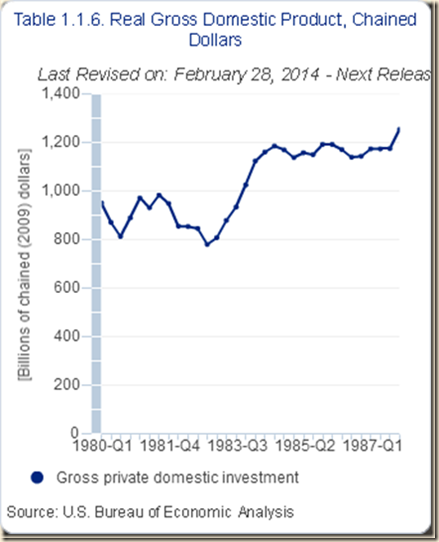

The carry trade from zero interest rates to leveraged positions in risk financial assets had proved strongest for commodity exposures but US equities have regained leadership. The DJIA has increased 68.5 percent since the trough of the sovereign debt crisis in Europe on Jul 2, 2010 to Feb 28, 2014; S&P 500 has gained 81.8 percent and DAX 70.9 percent. Before the current round of risk aversion, almost all assets in the column “∆% Trough to 2/28/14” had double digit gains relative to the trough around Jul 2, 2010 followed by negative performance but now some valuations of equity indexes show varying behavior. China’s Shanghai Composite is 13.7 percent below the trough. Japan’s Nikkei Average is 68.2 percent above the trough. DJ Asia Pacific TSM is 24.1 percent above the trough. Dow Global is 45.9 percent above the trough. STOXX 50 of 50 blue-chip European equities (http://www.stoxx.com/indices/index_information.html?symbol=sx5E) is 29.2 percent above the trough. NYSE Financial Index is 47.9 percent above the trough. DJ UBS Commodities is 8.1 percent above the trough. DAX index of German equities (http://www.bloomberg.com/quote/DAX:IND) is 70.9 percent above the trough. Japan’s Nikkei Average is 68.2 percent above the trough on Aug 31, 2010 and 30.3 percent above the peak on Apr 5, 2010. The Nikkei Average closed at 14,841.07 on Fri Feb 28, 2014 (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata), which is 44.7 percent higher than 10,254.43 on Mar 11, 2011, on the date of the Tōhoku or Great East Japan Earthquake/tsunami. Global risk aversion erased the earlier gains of the Nikkei. The dollar depreciated by 15.8 percent relative to the euro and even higher before the new bout of sovereign risk issues in Europe. The column “∆% week to 2/28/14” in Table VI-4 shows decrease of 2.7 percent in the week for China’s Shanghai Composite. DJ Asia Pacific increased 0.3 percent. NYSE Financial increased 0.9 percent in the week. DJ UBS Commodities increased 0.2 percent. Dow Global increased 0.8 percent in the week of Feb 28, 2014. The DJIA increased 1.4 percent and S&P 500 increased 1.3 percent. DAX of Germany increased 0.4 percent. STOXX 50 increased 0.2 percent. The USD depreciated 0.5 percent. There are still high uncertainties on European sovereign risks and banking soundness, US and world growth slowdown and China’s growth tradeoffs. Sovereign problems in the “periphery” of Europe and fears of slower growth in Asia and the US cause risk aversion with trading caution instead of more aggressive risk exposures. There is a fundamental change in Table VI-4 from the relatively upward trend with oscillations since the sovereign risk event of Apr-Jul 2010. Performance is best assessed in the column “∆% Peak to 2/28/14” that provides the percentage change from the peak in Apr 2010 before the sovereign risk event to Feb 28, 2014. Most risk financial assets had gained not only relative to the trough as shown in column “∆% Trough to 2/28/14” but also relative to the peak in column “∆% Peak to 2/28/14.” There are now several equity indexes above the peak in Table VI-4: DJIA 45.7 percent, S&P 500 52.8 percent, DAX 53.1 percent, Dow Global 19.0 percent, DJ Asia Pacific 8.6 percent, NYSE Financial Index (http://www.nyse.com/about/listed/nykid.shtml) 17.8 percent, Nikkei Average 30.3 percent and STOXX 9.4 percent. There is only one equity index below the peak: Shanghai Composite by 35.0 percent. DJ UBS Commodities Index is now 7.6 percent below the peak. The US dollar strengthened 8.8 percent relative to the peak. The factors of risk aversion have adversely affected the performance of risk financial assets. The performance relative to the peak in Apr 2010 is more important than the performance relative to the trough around early Jul 2010 because improvement could signal that conditions have returned to normal levels before European sovereign doubts in Apr 2010. Alexandra Scaggs, writing on “Tepid profits, roaring stocks,” on May 16, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887323398204578487460105747412.html), analyzes stabilization of earnings growth: 70 percent of 458 reporting companies in the S&P 500 stock index reported earnings above forecasts but sales fell 0.2 percent relative to forecasts of increase of 0.5 percent. Paul Vigna, writing on “Earnings are a margin story but for how long,” on May 17, 2013, published in the Wall Street Journal (http://blogs.wsj.com/moneybeat/2013/05/17/earnings-are-a-margin-story-but-for-how-long/), analyzes that corporate profits increase with stagnating sales while companies manage costs tightly. More than 90 percent of S&P components reported moderate increase of earnings of 3.7 percent in IQ2013 relative to IQ2012 with decline of sales of 0.2 percent. Earnings and sales have been in declining trend. In IVQ2009, growth of earnings reached 104 percent and sales jumped 13 percent. Net margins reached 8.92 percent in IQ2013, which is almost the same at 8.95 percent in IIIQ2006. Operating margins are 9.58 percent. There is concern by market participants that reversion of margins to the mean could exert pressure on earnings unless there is more accelerated growth of sales. Vigna (op. cit.) finds sales growth limited by weak economic growth. Kate Linebaugh, writing on “Falling revenue dings stocks,” on Oct 20, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390444592704578066933466076070.html?mod=WSJPRO_hpp_LEFTTopStories), identifies a key financial vulnerability: falling revenues across markets for United States reporting companies. Global economic slowdown is reducing corporate sales and squeezing corporate strategies. Linebaugh quotes data from Thomson Reuters that 100 companies of the S&P 500 index have reported declining revenue only 1 percent higher in Jun-Sep 2012 relative to Jun-Sep 2011 but about 60 percent of the companies are reporting lower sales than expected by analysts with expectation that revenue for the S&P 500 will be lower in Jun-Sep 2012 for the entities represented in the index. Results of US companies are likely repeated worldwide. Future company cash flows derive from investment projects. In IQ1980, gross private domestic investment in the US was $951.6 billion of 2009 dollars, growing to $1,173.8 billion in IQ1987 or 23.4 percent. Real gross private domestic investment in the US increased 2.0 percent from $2,605.2 billion of 2009 dollars in IVQ2007 to $2,656.2 billion in IVQ2013. As shown in Table IAI-2, real private fixed investment fell 2.7 percent from $2,586.3 billion of 2009 dollars in IVQ2007 to $2,517.5 billion in IVQ2013. Growth of real private investment in Table IA1-2 is mediocre for all but four quarters from IIQ2011 to IQ2012 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html). The investment decision of United States corporations has been fractured in the current economic cycle in preference of cash. Corporate profits with IVA and CCA fell $26.6 billion in IQ2013 after increasing $34.9 billion in IVQ2012 and $13.9 billion in IIIQ2012. Corporate profits with IVA and CCA rebounded with $66.8 billion in IIQ2013 and $39.2 billion in IIIQ2013. Profits after tax with IVA and CCA fell $1.7 billion in IQ2013 after increasing $40.8 billion in IVQ2012 and $4.5 billion in IIIQ2012. In IIQ2013, profits after tax with IVA and CCA increased $56.9 billion and $39.5 billion in IIIQ2013. Anticipation of higher taxes in the “fiscal cliff” episode caused increase of $120.9 billion in net dividends in IVQ2012 followed with adjustment in the form of decrease of net dividends by $103.8 billion in IQ2013, rebounding with $273.5 billion in IIQ2013. Net dividends fell at $179.0 billion in IIIQ2013. There is similar decrease of $80.1 billion in undistributed profits with IVA and CCA in IVQ2012 followed by increase of $102.1 billion in IQ2013 and decline of $216.6 billion in IIQ2013. Undistributed profits with IVA and CCA rose at $218.6 billion in IIIQ2013. Undistributed profits of US corporations swelled 382.4 percent from $107.7 billion IQ2007 to $519.5 billion in IIIQ2013 and changed signs from minus $55.9 billion in billion in IVQ2007 (Section IA2). In IQ2013, corporate profits with inventory valuation and capital consumption adjustment fell $26.6 billion relative to IVQ2012, from $2047.2 billion to $2020.6 billion at the quarterly rate of minus 1.3 percent. In IIQ2013, corporate profits with IVA and CCA increased $66.8 billion from $2020.6 billion in IQ2013 to $2087.4 billion at the quarterly rate of 3.3 percent. Corporate profits with IVA and CCA increased $39.2 billion from $2087.4 billion in IIQ2013 to $2126.6 billion in IIIQ2013 at the annual rate of 1.9 percent (http://www.bea.gov/newsreleases/national/gdp/2013/pdf/gdp3q13_3rd.pdf). Uncertainty originating in fiscal, regulatory and monetary policy causes wide swings in expectations and decisions by the private sector with adverse effects on investment, real economic activity and employment. Uncertainty originating in fiscal, regulatory and monetary policy causes wide swings in expectations and decisions by the private sector with adverse effects on investment, real economic activity and employment. The investment decision of US business is fractured. The basic valuation equation that is also used in capital budgeting postulates that the value of stocks or of an investment project is given by:

Where Rτ is expected revenue in the time horizon from τ =1 to T; Cτ denotes costs; and ρ is an appropriate rate of discount. In words, the value today of a stock or investment project is the net revenue, or revenue less costs, in the investment period from τ =1 to T discounted to the present by an appropriate rate of discount. In the current weak economy, revenues have been increasing more slowly than anticipated in investment plans. An increase in interest rates would affect discount rates used in calculations of present value, resulting in frustration of investment decisions. If V represents value of the stock or investment project, as ρ → ∞, meaning that interest rates increase without bound, then V → 0, or

declines. Equally, decline in expected revenue from the stock or project, Rτ, causes decline in valuation. An intriguing issue is the difference in performance of valuations of risk financial assets and economic growth and employment. Paul A. Samuelson (http://www.nobelprize.org/nobel_prizes/economics/laureates/1970/samuelson-bio.html) popularized the view of the elusive relation between stock markets and economic activity in an often-quoted phrase “the stock market has predicted nine of the last five recessions.” In the presence of zero interest rates forever, valuations of risk financial assets are likely to differ from the performance of the overall economy. The interrelations of financial and economic variables prove difficult to analyze and measure.

Table VI-4, Stock Indexes, Commodities, Dollar and 10-Year Treasury

| Peak | Trough | ∆% to Trough | ∆% Peak to 2/28/ /14 | ∆% Week 2/28/14 | ∆% Trough to 2/28/ 14 | |

| DJIA | 4/26/ | 7/2/10 | -13.6 | 45.7 | 1.4 | 68.5 |

| S&P 500 | 4/23/ | 7/20/ | -16.0 | 52.8 | 1.3 | 81.8 |

| NYSE Finance | 4/15/ | 7/2/10 | -20.3 | 17.8 | 0.9 | 47.9 |

| Dow Global | 4/15/ | 7/2/10 | -18.4 | 19.0 | 0.8 | 45.9 |

| Asia Pacific | 4/15/ | 7/2/10 | -12.5 | 8.6 | 0.3 | 24.1 |

| Japan Nikkei Aver. | 4/05/ | 8/31/ | -22.5 | 30.3 | -0.2 | 68.2 |

| China Shang. | 4/15/ | 7/02 | -24.7 | -35.0 | -2.7 | -13.7 |

| STOXX 50 | 4/15/10 | 7/2/10 | -15.3 | 9.4 | 0.2 | 29.2 |

| DAX | 4/26/ | 5/25/ | -10.5 | 53.1 | 0.4 | 70.9 |

| Dollar | 11/25 2009 | 6/7 | 21.2 | 8.8 | -0.5 | -15.8 |

| DJ UBS Comm. | 1/6/ | 7/2/10 | -14.5 | -7.6 | 0.2 | 8.1 |