“Economic Activity Appears to Have Slowed,” Mediocre Cyclical United States Economic Growth with GDP Two Trillion Dollars below Trend, Stagnating Real Private Fixed Investment, United States Housing Collapse, Decline of United States Homeownership, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016

I Mediocre Cyclical United States Economic Growth with GDP Two Trillion Dollars below Trend

IA Mediocre Cyclical United States Economic Growth

IA1 Stagnating Real Private Fixed Investment

IIA United States Housing Collapse

IIB United States House Prices

IIC Decline of United States Homeownership

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

V World Economic Slowdown. Table V-1 is constructed with the database of the IMF (http://www.imf.org/external/ns/cs.aspx?id=29) to show GDP in dollars in 2014 and the growth rate of real GDP of the world and selected regional countries from 2014 to 2017. The data illustrate the concept often repeated of “two-speed recovery” of the world economy from the recession of 2007 to 2009. The IMF has changed its forecast of the world economy to 3.4 percent in 2014 and 3.1 percent in 2015 but accelerating to 3.2 percent in 2016 and 3.5 percent in 2017. Slow-speed recovery occurs in the “major advanced economies” of the G7 that account for $35,570 billion of world output of $77,825 billion, or 45.7 percent, but are projected to grow at much lower rates than world output, 1.8 percent on average from 2014 to 2017 in contrast with 3.3 percent for the world as a whole. While the world would grow 13.9 percent in the four years from 2014 to 2017, the G7 as a whole would grow 7.4 percent. The difference in dollars of 2014 is high: growing by 13.9 percent would add around $10.8 trillion of output to the world economy, or roughly, two times the output of the economy of Japan of $4,596 billion but growing by 7.4 percent would add $5.8 trillion of output to the world, or about the output of Japan in 2014. The “two speed” concept is in reference to the growth of the 150 countries labeled as emerging and developing economies (EMDE) with joint output in 2014 of $30,690 billion, or 39.4 percent of world output. The EMDEs would grow cumulatively 18.6 percent or at the average yearly rate of 4.4 percent, contributing $5.7 trillion from 2014 to 2017 or the equivalent of somewhat more than one half the GDP of $10,431 billion of China in 2014. The final four countries in Table V-1 often referred as BRIC (Brazil, Russia, India, China), are large, rapidly growing emerging economies. Their combined output in 2014 adds to $16,921 billion, or 21.7 percent of world output, which is equivalent to 47.5 percent of the combined output of the major advanced economies of the G7.

Table V-1, IMF World Economic Outlook Database Projections of Real GDP Growth

| GDP USD 2014 | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | |

| World | 77,825 | 3.4 | 3.1 | 3.2 | 3.5 |

| G7 | 35,570 | 1.7 | 1.8 | 1.8 | 1.9 |

| Canada | 1,784 | 2.5 | 1.2 | 1.5 | 1.9 |

| France | 2,834 | 0.2 | 1.1 | 1.1 | 1.3 |

| DE | 3,874 | 1.6 | 1.5 | 1.5 | 1.6 |

| Italy | 2,142 | -0.3 | 0.8 | 1.0 | 1.2 |

| Japan | 4,596 | 0.0 | 0.5 | 0.5 | -0.1 |

| UK | 2,992 | 2.9 | 2.2 | 1.9 | 2.2 |

| US | 17,348 | 2.4 | 2.4 | 2.4 | 2.5 |

| Euro Area | 13,430 | 0.9 | 1.6 | 1.5 | 1.6 |

| DE | 3,874 | 1.6 | 1.5 | 1.5 | 1.6 |

| France | 2,834 | 0.2 | 1.1 | 1.1 | 1.3 |

| Italy | 2,142 | -0.3 | 0.8 | 1.0 | 1.2 |

| POT | 230 | 0.9 | 1.5 | 1.4 | 1.3 |

| Ireland | 251 | 5.2 | 7.8 | 5.0 | 3.6 |

| Greece | 236 | 0.7 | -0.2 | -0.6 | 2.7 |

| Spain | 1,384 | 1.4 | 3.2 | 2.6 | 2.3 |

| EMDE | 30,690 | 4.6 | 4.0 | 4.1 | 4.7 |

| Brazil | 2,417 | 0.1 | -3.8 | -3.8 | 0.0 |

| Russia | 2,030 | 0.7 | -3.7 | -1.8 | 0.8 |

| India | 2,043 | 7.2 | 7.3 | 7.5 | 7.5 |

| China | 10,431 | 7.3 | 6.9 | 6.5 | 6.2 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries); POT: Portugal

Source: IMF World Economic Outlook databank

http://www.imf.org/external/pubs/ft/weo/2016/01/weodata/index.aspx

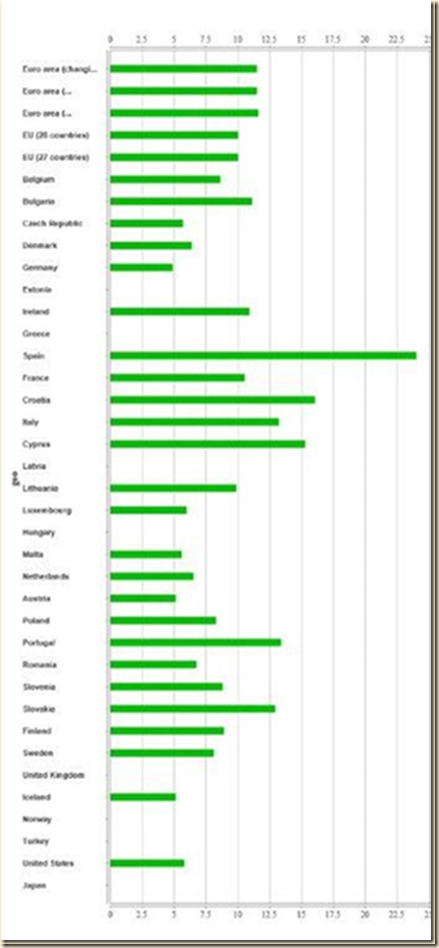

Continuing high rates of unemployment in advanced economies constitute another characteristic of the database of the WEO (http://www.imf.org/external/pubs/ft/weo/2016/01/weodata/index.aspx). Table V-2 is constructed with the WEO database to provide rates of unemployment from 2013 to 2017 for major countries and regions. In fact, unemployment rates for 2014 in Table I-2 are high for all countries: unusually high for countries with high rates most of the time and unusually high for countries with low rates most of the time. The rates of unemployment are particularly high in 2014 for the countries with sovereign debt difficulties in Europe: 13.9 percent for Portugal (POT), 11.3 percent for Ireland, 26.5 percent for Greece, 24.5 percent for Spain and 12.6 percent for Italy, which is lower but still high. The G7 rate of unemployment is 6.4 percent. Unemployment rates are not likely to decrease substantially if slow growth persists in advanced economies.

Table V-2, IMF World Economic Outlook Database Projections of Unemployment Rate as Percent of Labor Force

| % Labor Force 2013 | % Labor Force 2014 | % Labor Force 2015 | % Labor Force 2016 | % Labor Force 2017 | |

| World | NA | NA | NA | NA | NA |

| G7 | 7.1 | 6.4 | 5.8 | 5.5 | 5.5 |

| Canada | 7.1 | 6.9 | 6.9 | 7.3 | 7.4 |

| France | 10.3 | 10.3 | 10.4 | 10.1 | 10.0 |

| DE | 5.2 | 5.0 | 4.6 | 4.6 | 4.8 |

| Italy | 12.2 | 12.6 | 11.9 | 11.4 | 10.9 |

| Japan | 4.0 | 3.6 | 3.4 | 3.3 | 3.3 |

| UK | 7.6 | 6.2 | 5.4 | 5.0 | 5.0 |

| US | 7.4 | 6.2 | 5.3 | 4.9 | 4.8 |

| Euro Area | 12.0 | 11.6 | 10.9 | 10.3 | 9.9 |

| DE | 5.2 | 5.0 | 4.6 | 4.6 | 4.8 |

| France | 10.3 | 10.3 | 10.4 | 10.1 | 10.0 |

| Italy | 12.2 | 12.6 | 11.9 | 11.4 | 10.9 |

| POT | 16.2 | 13.9 | 12.4 | 11.6 | 11.1 |

| Ireland | 13.0 | 11.3 | 9.4 | 8.3 | 7.5 |

| Greece | 27.5 | 26.5 | 25.0 | 25.0 | 23.4 |

| Spain | 26.1 | 24.5 | 22.1 | 19.7 | 18.3 |

| EMDE | NA | NA | NA | NA | NA |

| Brazil | 5.4 | 4.8 | 6.8 | 9.2 | 10.2 |

| Russia | 5.5 | 5.2 | 5.6 | 6.5 | 6.3 |

| India | NA | NA | NA | NA | NA |

| China | 4.1 | 4.1 | 4.1 | 4.1 | 4.1 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries)

Source: IMF World Economic Outlook

http://www.imf.org/external/pubs/ft/weo/2016/01/weodata/index.aspx

Table V-3 provides the latest available estimates of GDP for the regions and countries followed in this blog from IQ2012 to IIIQ2015 available now for all countries. There are preliminary estimates for all countries for IVQ2015. Growth is weak throughout most of the world.

- Japan. The GDP of Japan increased 0.9 percent in IQ2012, 3.7 percent at SAAR (seasonally adjusted annual rate) and 3.5 percent relative to a year earlier but part of the jump could be the low level a year earlier because of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan is experiencing difficulties with the overvalued yen because of worldwide capital flight originating in zero interest rates with risk aversion in an environment of softer growth of world trade. Japan’s GDP fell 0.4 percent in IIQ2012 at the seasonally adjusted annual rate (SAAR) of minus 1.6 percent, which is much lower than 3.7 percent in IQ2012. Growth of 3.5 percent in IIQ2012 in Japan relative to IIQ2011 has effects of the low level of output because of Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan’s GDP contracted 0.5 percent in IIIQ2012 at the SAAR of minus 1.8 percent and increased 0.2 percent relative to a year earlier. Japan’s GDP decreased 0.1 percent in IVQ2012 at the SAAR of minus 0.3 percent and changed 0.0 percent relative to a year earlier. Japan grew 1.0 percent in IQ2013 at the SAAR of 4.1 percent and increased 0.3 percent relative to a year earlier. Japan’s GDP increased 0.7 percent in IIQ2013 at the SAAR of 2.7 percent and increased 1.1 percent relative to a year earlier. Japan’s GDP grew 0.5 percent in IIIQ2013 at the SAAR of 2.1 percent and increased 2.0 percent relative to a year earlier. In IVQ2013, Japan’s GDP decreased 0.1 percent at the SAAR of minus 0.4 percent, increasing 2.1 percent relative to a year earlier. Japan’s GDP increased 1.3 percent in IQ2014 at the SAAR of 5.2 percent and increased 2.7 percent relative to a year earlier. In IIQ2014, Japan’s GDP fell 2.0 percent at the SAAR of minus 7.9 percent and fell 0.3 percent relative to a year earlier. Japan’s GDP contracted 0.6 percent in IIIQ2014 at the SAAR of minus 2.5 percent and fell 1.5 percent relative to a year earlier. In IVQ2014, Japan’s GDP grew 0.5 percent, at the SAAR of 2.2 percent, decreasing 1.0 percent relative to a year earlier. The GDP of Japan increased 1.1 percent in IQ2015 at the SAAR of 4.6 percent and decreased 1.0 percent relative to a year earlier. Japan’s GDP decreased 0.4 percent in IIQ2015 at the SAAR of minus 1.4 percent and increased 0.7 percent relative to a year earlier. The GDP of Japan increased 0.3 percent in IIIQ2015 at the SAAR of 1.4 percent and increased 1.7 percent relative to a year earlier. Japan’s GDP contracted 0.3 percent in IVQ2015 at the SAAR of minus 1.1 percent and grew 0.7 percent relative to a year earlier

- China. China’s GDP grew 1.8 percent in IQ2012, annualizing to 7.4 percent, and 8.0 percent relative to a year earlier. The GDP of China grew at 2.1 percent in IIQ2012, which annualizes to 8.7 percent and 7.5 percent relative to a year earlier. China grew at 1.8 percent in IIIQ2012, which annualizes at 7.4 percent and 7.4 percent relative to a year earlier. In IVQ2012, China grew at 1.9 percent, which annualizes at 7.8 percent, and 8.0 percent in IVQ2012 relative to IVQ2011. In IQ2013, China grew at 1.8 percent, which annualizes at 7.4 percent and 7.8 percent relative to a year earlier. In IIQ2013, China grew at 1.7 percent, which annualizes at 7.0 percent and 7.5 percent relative to a year earlier. China grew at 2.2 percent in IIIQ2013, which annualizes at 9.1 percent, and increased 7.9 percent relative to a year earlier. China grew at 1.6 percent in IVQ2013, which annualized to 6.6 percent and 7.6 percent relative to a year earlier. China’s GDP grew 1.7 percent in IQ2014, which annualizes to 7.0 percent, and 7.3 percent relative to a year earlier. China’s GDP grew 1.8 percent in IIQ2014, which annualizes at 7.4 percent, and 7.4 percent relative to a year earlier. China’s GDP grew 1.9 percent in IIIQ2014, which is equivalent to 7.8 percent in a year, and 7.1 percent relative to a year earlier. The GDP of China grew 1.7 percent in IVQ2014, which annualizes at 7.0 percent, and 7.2 percent relative to a year earlier. The GDP of China grew at 1.4 percent in IQ2015, which annualizes at 5.7 percent, and 7.0 percent relative to a year earlier. The GDP of China grew 1.8 percent in IIQ2015, which annualizes at 7.4 percent, and increased 7.0 percent relative to a year earlier. In IIIQ2015, China’s GDP grew at 1.8 percent, which annualizes at 7.4 percent and increased 6.9 percent relative to a year earlier. The GDP of China grew at 1.5 percent in IVQ2015, which annualizes at 6.1 percent and increased 6.8 percent relative to a year earlier. The GDP of China grew 1.1 percent in IQ2016, which annualizes at 4.5 percent and increased 6.7 percent relative to a year earlier. There is decennial change in leadership in China (http://www.xinhuanet.com/english/special/18cpcnc/index.htm). Growth rates of GDP of China in a quarter relative to the same quarter a year earlier have been declining from 2011 to 2015.

- Euro Area. GDP fell 0.2 percent in the euro area in IQ2012 and decreased 0.5 in IQ2012 relative to a year earlier. Euro area GDP contracted 0.3 percent IIQ2012 and fell 0.8 percent relative to a year earlier. In IIIQ2012, euro area GDP fell 0.1 percent and declined 0.9 percent relative to a year earlier. In IVQ2012, euro area GDP fell 0.5 percent relative to the prior quarter and fell 1.1 percent relative to a year earlier. In IQ2013, the GDP of the euro area fell 0.2 percent and decreased 1.2 percent relative to a year earlier. The GDP of the euro area increased 0.4 percent in IIQ2013 and fell 0.4 percent relative to a year earlier. In IIIQ2013, euro area GDP increased 0.3 percent and changed 0.0 percent relative to a year earlier. The GDP of the euro area increased 0.2 percent in IVQ2013 and increased 0.6 percent relative to a year earlier. In IQ2014, the GDP of the euro area increased 0.2 percent and increased 1.1 percent relative to a year earlier. The GDP of the euro area increased 0.1 percent in IIQ2014 and increased 0.8 percent relative to a year earlier. The euro area’s GDP increased 0.3 percent in IIIQ2014 and increased 0.8 percent relative to a year earlier. The GDP of the euro area increased 0.4 percent in IVQ2014 and increased 1.0 percent relative to a year earlier. Euro area GDP increased 0.6 percent in IQ2015 and increased 1.3 percent relative to a year earlier. The GDP of the euro area increased 0.4 percent in IIQ2015 and increased 1.6 percent relative to a year earlier. The euro area’s GDP increased 0.3 percent in IIIQ2015 and increased 1.6 percent relative to a year earlier. Euro area GDP increased 0.3 percent in IVQ2015 and increased 1.6 percent relative to a year earlier. Euro area’s GDP increased 0.6 percent in IQ2016 and increased 1.6 percent relative to a year earlier.

- Germany. The GDP of Germany increased 0.4 percent in IQ2012 and increased 1.5 percent relative to a year earlier. In IIQ2012, Germany’s GDP increased 0.1 percent and increased 0.3 percent relative to a year earlier but 0.8 percent relative to a year earlier when adjusted for calendar (CA) effects. In IIIQ2012, Germany’s GDP increased 0.2 percent and 0.1 percent relative to a year earlier. Germany’s GDP contracted 0.5 percent in IVQ2012 and decreased 0.3 percent relative to a year earlier. In IQ2013, Germany’s GDP decreased 0.3 percent and fell 1.7 percent relative to a year earlier. In IIQ2013, Germany’s GDP increased 0.9 percent and grew 0.7 percent relative to a year earlier. The GDP of Germany increased 0.4 percent in IIIQ2013 and grew 1.0 percent relative to a year earlier. In IVQ2013, Germany’s GDP increased 0.3 percent and increased 1.2 percent relative to a year earlier. The GDP of Germany increased 0.7 percent in IQ2014 and grew 2.6 percent relative to a year earlier. In IIQ2014, Germany’s GDP contracted 0.1 percent and increased 1.0 percent relative to a year earlier. The GDP of Germany increased 0.2 percent in IIIQ2014 and increased 1.2 percent relative to a year earlier. Germany’s GDP increased 0.6 percent in IVQ2014 and increased 1.6 percent relative to a year earlier. The GDP of Germany increased 0.4 percent in IQ2015 and increased 1.3 percent relative to a year earlier. Germany’s GDP increased 0.4 percent in IIQ2015 and grew 1.6 percent relative to a year earlier. The GDP of Germany increased 0.3 percent in IIIQ2015 and grew 1.7 percent relative to a year earlier. Germany’s GDP increased 0.3 percent in IVQ2015 and grew 2.1 percent relative to a year earlier.

- United States. Growth of US GDP in IQ2012 was 0.7 percent, at SAAR of 2.7 percent and higher by 2.8 percent relative to IQ2011. US GDP increased 0.5 percent in IIQ2012, 1.9 percent at SAAR and 2.5 percent relative to a year earlier. In IIIQ2012, US GDP grew 0.1 percent, 0.5 percent at SAAR and 2.4 percent relative to IIIQ2011. In IVQ2012, US GDP grew 0.0 percent, 0.1 percent at SAAR and 1.3 percent relative to IVQ2011. In IQ2013, US GDP grew at 1.9 percent SAAR, 0.5 percent relative to the prior quarter and 1.1 percent relative to the same quarter in 2013. In IIQ2013, US GDP grew at 1.1 percent in SAAR, 0.3 percent relative to the prior quarter and 0.9 percent relative to IIQ2012. US GDP grew at 3.0 percent in SAAR in IIIQ2013, 0.7 percent relative to the prior quarter and 1.5 percent relative to the same quarter a year earlier (Section I and earlier http://cmpassocregulationblog.blogspot.com/2016/03/contraction-of-united-states-corporate.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/mediocre-cyclical-united-states.html). In IVQ2013, US GDP grew 0.9 percent at 3.8 percent SAAR and 2.5 percent relative to a year earlier. In IQ2014, US GDP decreased 0.2 percent, increased 1.7 percent relative to a year earlier and fell 0.9 percent at SAAR. In IIQ2014, US GDP increased 1.1 percent at 4.6 percent SAAR and increased 2.6 percent relative to a year earlier. US GDP increased 1.1 percent in IIIQ2014 at 4.3 percent SAAR and increased 2.9 percent relative to a year earlier. In IVQ2014, US GDP increased 0.5 percent at SAAR of 2.1 percent and increased 2.5 percent relative to a year earlier. GDP increased 0.2 percent in IQ2015 at SAAR of 0.6 percent and grew 2.9 percent relative to a year earlier. US GDP grew at SAAR 3.9 percent in IIQ2015, increasing 1.0 percent in the quarter and 2.7 percent relative to a year earlier. GDP increased 0.5 percent in IIIQ2015 at SAAR of 2.0 percent and grew 2.1 percent in IIIQ2015 relative to a year earlier. US GDP grew at SAAR of 1.4 percent in IVQ2015, increasing 0.3 percent in the quarter and 2.0 percent relative to a year earlier. In IQ2016, US GDP grew 0.1 percent at SAAR of 0.5 percent and increased 2.0 percent relative to a year earlier.

- United Kingdom. In IQ2012, UK GDP increased 0.2 percent and increased 1.5 percent relative to a year earlier. In IIQ2012, GDP fell 0.2 percent relative to IQ2012 and increased 1.0 percent relative to a year earlier. In IIIQ2012, GDP increased 1.0 percent and increased 1.2 percent relative to the same quarter a year earlier. In IVQ2012, GDP fell 0.1 percent and increased 1.0 percent relative to a year earlier. Fiscal consolidation in an environment of weakening economic growth is much more challenging. Growth increased to 1.4 percent in IQ2013 relative to a year earlier and 0.7 percent in IQ2013 relative to IVQ2012. In IIQ2013, GDP increased 0.6 percent and 2.2 percent relative to a year earlier. GDP increased 0.9 percent in IIIQ2013 and 2.1 percent relative to a year earlier. GDP increased 0.6 percent in IVQ2013 and 2.8 percent relative to a year earlier. In IQ2014, GDP increased 0.6 percent and 2.8 percent relative to a year earlier. GDP increased 0.8 percent in IIQ2014 and 3.0 percent relative to a year earlier. GDP increased 0.7 percent in IIIQ2013 and 2.8 percent relative to a year earlier. In IVQ2014, GDP increased 0.7 percent and 2.8 percent relative to a year earlier. GDP increased 0.5 percent in IQ2015 and increased 2.6 percent relative to a year earlier. GDP increased 0.6 percent in IIQ2015 and increased 2.4 percent relative to a year earlier. UK GDP increased 0.4 percent in IIIQ2015 and increased 2.2 percent relative to a year earlier. GDP increased 0.6 percent in IVQ2015 and increased 2.1 percent relative to a year earlier. GDP increased 0.4 percent in IQ2016 and increased 2.1 percent relative to a year earlier.

- Italy. GDP increased 0.1 percent in IVQ2015 and increased 1.0 percent relative to a year earlier. In IIIQ2015, GDP increased 0.2 percent and increased 0.8 percent relative to a year earlier. GDP increased 0.3 percent in IIQ2015 and 0.6 percent relative to a year earlier. GDP increased 0.4 percent in IQ2015 and increased 0.2 percent relative to a year earlier. GDP decreased 0.1 percent in IVQ2014 and fell 0.3 percent relative to a year earlier. GDP changed 0.0 percent in IIIQ2014 and fell 0.4 percent relative to a year earlier. Italy’s GDP fell 0.1 percent in IIQ2014 and declined 0.2 percent relative to a year earlier. The GDP of Italy decreased 0.1 percent in IQ2014 and fell 0.2 percent relative to a year earlier. Italy’s GDP decreased 0.1 percent in IVQ2013 and fell 0.9 percent relative to a year earlier. The GDP of Italy increased 0.2 percent in IIIQ2013 and fell 1.4 percent relative to a year earlier. Italy’s GDP decreased 0.1 percent in IIQ2013, continuing eight consecutive quarterly declines, and fell 2.0 percent relative to a year earlier. Italy’s GDP fell 0.8 percent in IQ2013 and declined 2.6 percent relative to IQ2012. GDP had been growing during six consecutive quarters but at very low rates from IQ2010 to IIQ2011. Italy’s GDP fell in eight consecutive quarters from IIIQ2011 to IIQ2013 at increasingly higher rates of contraction from 0.5 percent in IIIQ2011 to 1.0 percent in IVQ2011, 0.9 percent in IQ2012, 0.7 percent in IIQ2012 and 0.5 percent in IIIQ2012. The pace of decline accelerated to minus 0.5 percent in IVQ2012 and minus 0.8 percent in IQ2013. GDP contracted cumulatively 4.9 percent in eight consecutive quarterly contractions from IIIQ2011 to IIQ2013 at the annual equivalent rate of minus 2.5 percent. The total contraction in the 12 quarters including IVQ2013, IQ2014, IIQ2014, IIIQ2014 and IVQ2014 accumulates to 5.3 percent. The yearly rate has fallen from 2.3 percent in IVQ2010 to minus 2.7 percent in IVQ2012, minus 2.6 percent in IQ2013, minus 2.0 percent in IIQ2013 and minus 1.4 percent in IIIQ2013. GDP fell 0.9 percent in IVQ2013 relative to a year earlier. GDP fell 0.2 percent in IQ2014 relative to a year earlier and fell 0.2 percent in IIQ2014 relative to a year earlier. GDP fell 0.4 percent in IIIQ2014 relative to a year earlier and fell 0.3 percent in IVQ2014 relative to a year earlier. GDP increased 0.2 percent in IQ2015 relative to a year earlier and increased 0.6 percent in IIQ2015 relative to a year earlier. GDP increased 0.8 percent in IIIQ2015 relative to a year earlier and increased 1.0 percent in IVQ2015 relative to a year earlier. Using seasonally and calendar adjusted chained volumes in the dataset of EUROSTAT (http://ec.europa.eu/eurostat), the GDP of Italy in IVQ2015 is lower by 8.8 percent relative to IQ2008. The fiscal adjustment of Italy is significantly more difficult with the economy not growing especially on the prospects of increasing government revenue. The strategy is for reforms to improve productivity, facilitating future fiscal consolidation.

- France. France’s GDP changed 0.0 percent in IQ2012 and increased 0.4 percent relative to a year earlier. France’s GDP decreased 0.3 percent in IIQ2012 and increased 0.2 percent relative to a year earlier. In IIIQ2012, France’s GDP increased 0.3 percent and increased 0.3 percent relative to a year earlier. France’s GDP decreased 0.1 percent in IVQ2012 and changed 0.0 percent relative to a year earlier. In IQ2013, France’s GDP increased 0.1 percent and increased 0.1 percent relative to a year earlier. The GDP of France increased 0.7 percent in IIQ2013 and increased 1.1 percent relative to a year earlier. France’s GDP changed 0.0 percent in IIIQ2013 and increased 0.8 percent relative to a year earlier. The GDP of France increased 0.2 percent in IVQ2013 and increased 1.0 percent relative to a year earlier. In IQ2014, France’s GDP decreased 0.2 percent and increased 0.7 percent relative to a year earlier. In IIQ2014, France’s GDP contracted 0.1 percent and decreased 0.2 percent relative to a year earlier. France’s GDP increased 0.3 percent in IIIQ2014 and increased 0.1 percent relative to a year earlier. The GDP of France increased 0.2 percent in IVQ2014 and increased 0.1 percent relative to a year earlier. France’s GDP increased 0.7 percent in IQ2015 and increased 1.0 percent relative to a year earlier. In IIQ2015, France’s GDP changed 0.0 percent and increased 1.1 percent relative to a year earlier. France’s GDP increased 0.4 percent in IIIQ2015 and increased 1.2 percent relative to a year earlier. In IVQ2015, the GDP of France increased 0.3 percent and increased 1.4 percent relative to a year earlier. France’s GDP increased 0.5 percent in IQ2016 and increased 1.3 percent relative to a year earlier.

Table V-3, Percentage Changes of GDP Quarter on Prior Quarter and on Same Quarter Year Earlier, ∆%

| IQ2012/IVQ2011 | IQ2012/IQ2011 | |

| United States | QOQ: 0.7 SAAR: 2.7 | 2.8 |

| Japan | QOQ: 0.9 SAAR: 3.7 | 3.5 |

| China | 1.8 | 8.0 |

| Euro Area | -0.2 | -0.5 |

| Germany | 0.4 | 1.5 |

| France | 0.0 | 0.4 |

| Italy | -0.9 | -2.3 |

| United Kingdom | 0.2 | 1.5 |

| IIQ2012/IQ2012 | IIQ2012/IIQ2011 | |

| United States | QOQ: 0.5 SAAR: 1.9 | 2.5 |

| Japan | QOQ: -0.4 | 3.5 |

| China | 2.1 | 7.5 |

| Euro Area | -0.3 | -0.8 |

| Germany | 0.1 | 0.3 0.8 CA |

| France | -0.3 | 0.2 |

| Italy | -0.7 | -3.2 |

| United Kingdom | -0.2 | 1.0 |

| IIIQ2012/ IIQ2012 | IIIQ2012/ IIIQ2011 | |

| United States | QOQ: 0.1 | 2.4 |

| Japan | QOQ: –0.5 | 0.2 |

| China | 1.8 | 7.4 |

| Euro Area | -0.1 | -0.9 |

| Germany | 0.2 | 0.1 |

| France | 0.3 | 0.3 |

| Italy | -0.5 | -3.2 |

| United Kingdom | 1.0 | 1.2 |

| IVQ2012/IIIQ2012 | IVQ2012/IVQ2011 | |

| United States | QOQ: 0.0 | 1.3 |

| Japan | QOQ: -0.1 SAAR: -0.3 | 0.0 |

| China | 1.9 | 8.0 |

| Euro Area | -0.5 | -1.1 |

| Germany | -0.5 | -0.3 |

| France | -0.1 | 0.0 |

| Italy | -0.5 | -2.7 |

| United Kingdom | -0.1 | 1.0 |

| IQ2013/IVQ2012 | IQ2013/IQ2012 | |

| United States | QOQ: 0.5 | 1.1 |

| Japan | QOQ: 1.0 SAAR: 4.1 | 0.3 |

| China | 1.8 | 7.8 |

| Euro Area | -0.2 | -1.2 |

| Germany | -0.3 | -1.7 |

| France | 0.1 | 0.1 |

| Italy | -0.8 | -2.6 |

| UK | 0.7 | 1.4 |

| IIQ2013/IQ2013 | IIQ2013/IIQ2012 | |

| United States | QOQ: 0.3 SAAR: 1.1 | 0.9 |

| Japan | QOQ: 0.7 SAAR: 2.7 | 1.1 |

| China | 1.7 | 7.5 |

| Euro Area | 0.4 | -0.4 |

| Germany | 0.9 | 0.7 |

| France | 0.7 | 1.1 |

| Italy | -0.1 | -2.0 |

| UK | 0.6 | 2.2 |

| IIIQ2013/IIQ2013 | III/Q2013/ IIIQ2012 | |

| USA | QOQ: 0.7 | 1.5 |

| Japan | QOQ: 0.5 SAAR: 2.1 | 2.0 |

| China | 2.2 | 7.9 |

| Euro Area | 0.3 | 0.0 |

| Germany | 0.4 | 1.0 |

| France | 0.0 | 0.8 |

| Italy | 0.2 | -1.4 |

| UK | 0.9 | 2.1 |

| IVQ2013/IIIQ2013 | IVQ2013/IVQ2012 | |

| USA | QOQ: 0.9 SAAR: 3.8 | 2.5 |

| Japan | QOQ: -0.1 SAAR: -0.4 | 2.1 |

| China | 1.6 | 7.6 |

| Euro Area | 0.2 | 0.6 |

| Germany | 0.3 | 1.2 |

| France | 0.2 | 1.0 |

| Italy | -0.1 | -0.9 |

| UK | 0.6 | 2.8 |

| IQ2014/IVQ2013 | IQ2014/IQ2013 | |

| USA | QOQ -0.2 SAAR -0.9 | 1.7 |

| Japan | QOQ: 1.3 SAAR: 5.2 | 2.7 |

| China | 1.7 | 7.3 |

| Euro Area | 0.2 | 1.1 |

| Germany | 0.7 | 2.6 |

| France | -0.2 | 0.7 |

| Italy | -0.1 | -0.2 |

| UK | 0.6 | 2.8 |

| IIQ2014/IQ2014 | IIQ2014/IIQ2013 | |

| USA | QOQ 1.1 SAAR 4.6 | 2.6 |

| Japan | QOQ: -2.0 SAAR: -7.9 | -0.3 |

| China | 1.8 | 7.4 |

| Euro Area | 0.1 | 0.8 |

| Germany | -0.1 | 1.0 |

| France | -0.1 | -0.2 |

| Italy | -0.1 | -0.2 |

| UK | 0.8 | 3.0 |

| IIIQ2014/IIQ2014 | IIIQ2014/IIIQ2013 | |

| USA | QOQ: 1.1 SAAR: 4.3 | 2.9 |

| Japan | QOQ: -0.6 SAAR: -2.5 | -1.5 |

| China | 1.9 | 7.1 |

| Euro Area | 0.3 | 0.8 |

| Germany | 0.2 | 1.2 |

| France | 0.3 | 0.1 |

| Italy | 0.0 | -0.4 |

| UK | 0.7 | 2.8 |

| IVQ2014/IIIQ2014 | IVQ2014/IVQ2013 | |

| USA | QOQ: 0.5 SAAR: 2.1 | 2.5 |

| Japan | QOQ: 0.5 SAAR: 2.2 | -1.0 |

| China | 1.7 | 7.2 |

| Euro Area | 0.4 | 1.0 |

| Germany | 0.6 | 1.6 |

| France | 0.2 | 0.1 |

| Italy | -0.1 | -0.3 |

| UK | 0.7 | 2.8 |

| IQ2015/IVQ2014 | IQ2015/IQ2014 | |

| USA | QOQ: 0.2 SAAR: 0.6 | 2.9 |

| Japan | QOQ: 1.1 SAAR: 4.6 | -1.0 |

| China | 1.4 | 7.0 |

| Euro Area | 0.6 | 1.3 |

| Germany | 0.4 | 1.3 |

| France | 0.7 | 1.0 |

| Italy | 0.4 | 0.2 |

| UK | 0.5 | 2.6 |

| IIQ2015/IQ2015 | IIQ2015/IIQ2014 | |

| USA | QOQ: 1.0 SAAR: 3.9 | 2.7 |

| Japan | QOQ: -0.4 SAAR: -1.4 | 0.7 |

| China | 1.8 | 7.0 |

| Euro Area | 0.4 | 1.6 |

| Germany | 0.4 | 1.6 |

| France | 0.0 | 1.1 |

| Italy | 0.3 | 0.6 |

| UK | 0.6 | 2.4 |

| IIIQ2015/IIQ2015 | IIIQ2015/IIIQ2014 | |

| USA | QOQ: 0.5 SAAR: 2.0 | 2.1 |

| Japan | QOQ: 0.3 SAAR: 1.4 | 1.7 |

| China | 1.8 | 6.9 |

| Euro Area | 0.3 | 1.6 |

| Germany | 0.3 | 1.7 |

| France | 0.4 | 1.2 |

| Italy | 0.2 | 0.8 |

| UK | 0.4 | 2.2 |

| IVQ2015/IIIQ2015 | IVQ2015/IVQ2014 | |

| USA | QOQ: 0.3 SAAR: 1.4 | 2.0 |

| Japan | QOQ: -0.3 SAAR: -1.1 | 0.7 |

| China | 1.5 | 6.8 |

| Euro Area | 0.3 | 1.6 |

| Germany | 0.3 | 2.1 |

| France | 0.3 | 1.4 |

| Italy | 0.1 | 1.0 |

| UK | 0.6 | 2.1 |

| IQ2016/IVQ2015 | IQ2016/IQ2015 | |

| USA | QOQ: 0.1 SAAR: 0.5 | 2.0 |

| China | 1.1 | 6.7 |

| Euro Area | 0.6 | 1.6 |

| France | 0.5 | 1.3 |

| UK | 0.4 | 2.1 |

QOQ: Quarter relative to prior quarter; SAAR: seasonally adjusted annual rate

Source: Country Statistical Agencies http://www.census.gov/aboutus/stat_int.html

Table V-4 provides two types of data: growth of exports and imports in the latest available months and in the past 12 months; and contributions of net trade (exports less imports) to growth of real GDP.

- Japan. Japan provides the most worrisome data (http://cmpassocregulationblog.blogspot.com/2015/08/global-decline-of-values-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/valuation-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/dollar-revaluation-squeezing-corporate.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/imf-view-of-economy-and-finance-united.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2014/07/world-inflation-waves-united-states.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html and earlier http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-zero-interest-rates-world.html http://cmpassocregulationblog.blogspot.com/2013/11/global-financial-risk-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations_8763.html http://cmpass ocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html and earlier http://cmpassocregulationblog.blogspot.com/2013/07/duration-dumping-steepening-yield-curve.html and earlier http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and_4699.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2013/03/united-states-commercial-banks-assets.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/world-inflation-waves-united-states.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/thirty-one-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2012/12/mediocre-and-decelerating-united-states_24.html and earlier http://cmpassocregulationblog.blogspot.com/2012/11/contraction-of-united-states-real_25.html and for GDP http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what_13.html). In Mar 2016, Japan’s exports decreased 6.8 percent in 12 months while imports decreased 14.9 percent. The second part of Table V-4 shows that net trade deducted 1.6 percentage points from Japan’s growth of GDP in IIQ2012, deducted 1.8 percentage points from GDP growth in IIIQ2012 and deducted 0.6 percentage points from GDP growth in IVQ2012. Net trade added 0.4 percentage points to GDP growth in IQ2012, 1.8 percentage points in IQ2013 and deducted 0.3 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.3 percentage points from GDP growth in Japan. Net trade ducted 2.0 percentage points from GDP growth in Japan in IVQ2013. Net trade deducted 0.9 percentage points from GDP growth of Japan in IQ2014. Net trade added 3.6 percentage points to GDP growth in IIQ2014. Net trade added 0.5 percentage points to GDP growth in IIIQ2014 and added 1.4 percentage points in IVQ2014. Net trade deducted 0.0 percentage points from GDP growth in IQ2015 and deducted 1.3 percentage points in IIQ2015. Net trade added 0.8 percentage points to GDP growth in IIIQ2015 and added 0.6 percentage points in IVQ2015

- China. In Mar 2016, China exports increased 11.5 percent relative to a year earlier and imports decreased 7.6 percent.

- Germany. Germany’s exports increased 1.3 percent in the month of Feb 2016 and increased 4.1 percent in the 12 months ending in Feb 2016. Germany’s imports increased 0.4 percent in the month of Feb 2016 and increased 4.0 percent in the 12 months ending in Feb 2016. Net trade contributed 0.8 percentage points to growth of GDP in IQ2012, contributed 0.4 percentage points in IIQ2012, contributed 0.3 percentage points in IIIQ2012, deducted 0.5 percentage points in IVQ2012, deducted 0.3 percentage points in IQ2013 and added 0.1 percentage points in IIQ2013. Net traded deducted 0.5 percentage points from Germany’s GDP growth in IIIQ2013 and added 0.5 percentage points to GDP growth in IVQ2013. Net trade contributed 0.0 percentage points to GDP growth in IQ2014. Net trade added 0.2 percentage points to GDP growth in IIQ2014 and added 0.5 percentage points in IIIQ2014. Net trade deducted 0.3 percentage points from GDP growth in IVQ2014 and deducted 0.2 percentage points in IQ2015. Net trade added 0.6 percentage points to GDP growth in IIQ2015 and deducted 0.3 percentage points in IIIQ2015. Net trade deducted 0.5 percentage points in IVQ2015.

- United Kingdom. Net trade contributed 0.7 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.7 percentage points from UK growth. Net trade contributed 0.1 percentage points to UK value added in IVQ2013. Net trade contributed 0.2 percentage points to UK value added in IQ2014 and 0.5 percentage points in IIQ2014. Net trade deducted 0.5 percentage points to GDP growth in IIIQ2014 and added 0.2 percentage points in IVQ2014. Net traded deducted 1.2 percentage points from growth in IQ2015. Net trade added 1.7 percentage points to GDP growth in IIQ2015 and deducted 1.1 percentage points in IIIQ2015. Net trade deducted 0.3 percentage points from GDP growth in IVQ2015.

- France. France’s exports decreased 0.2 percent in Feb 2016 while imports increased 2.8 percent. France’s exports increased 1.5 percent in the 12 months ending in Feb 2016 and imports increased 5.9 percent relative to a year earlier. Net traded added 0.1 percentage points to France’s GDP in IIIQ2012 and 0.1 percentage points in IVQ2012. Net trade deducted 0.1 percentage points from France’s GDP growth in IQ2013 and added 0.3 percentage points in IIQ2013, deducting 1.7 percentage points in IIIQ2013. Net trade added 0.1 percentage points to France’s GDP in IVQ2013 and deducted 0.1 percentage points in IQ2014. Net trade deducted 0.2 percentage points from France’s GDP growth in IIQ2014 and deducted 0.2 percentage points in IIIQ2014. Net trade added 0.2 percentage points to France’s GDP growth in IVQ2014 and deducted 0.2 percentage points in IQ2015. Net trade added 0.3 percentage points to GDP growth in IIQ2015 and deducted 0.6 percentage points in IIIQ2015. Net trade deducted 0.4 percentage points from GDP growth in IVQ2015 and deducted 0.2 percentage points from GDP growth in IQ2016

- United States. US exports increased 1.0 percent in Feb 2016 and goods exports decreased 7.4 percent in Feb 2016 relative to a year earlier. Imports increased 1.3 percent in Feb 2016 and goods imports decreased 2.4 percent in Feb 2016 relative to a year earlier. Net trade added 0.28 percentage points to GDP growth in IIQ2012 and added 0.16 percentage points in IIIQ2012 and 0.58 percentage points in IVQ2012. Net trade deducted 0.01 percentage points from US GDP growth in IQ2013 and deducted 0.24 percentage points in IIQ2013. Net traded added 0.16 percentage points to US GDP growth in IIIQ2013. Net trade added 1.26 percentage points to US GDP growth in IVQ2013. Net trade deducted 1.39 percentage points from US GDP growth in IQ2014 and deducted 0.24 percentage points in IIQ2014. Net trade added 0.39 percentage points to GDP growth in IIIQ2014. Net trade deducted 0.89 percentage points from GDP growth in IVQ2014 and deducted 1.92 percentage points from GDP growth in IQ2015. Net trade added 0.18 percentage points to GDP growth in IIQ2015. Net trade deducted 0.26 percentage points from GDP growth in IIIQ2015. Net trade deducted 0.14 percentage points from GDP growth in IVQ2015. Net trade deducted 0.34 pecentage points from GDP growth in IQ2016. Industrial production decreased 0.6 percent in Mar 2016 and decreased 0.6 percent in Feb 2016 after increasing 0.5 percent in Jan 2016, with all data seasonally adjusted. The Board of Governors of the Federal Reserve System conducted the annual revision of industrial production released on Apr 1, 2016 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm):

“The Federal Reserve has revised its index of industrial production (IP) and the related measures of capacity and capacity utilization.[1] Total IP is now reported to have increased about 2 1/2 percent per year, on average, from 2011 through 2014 before falling 1 1/2 percent in 2015.[2] Relative to earlier reports, the current rates of change are lower, especially for 2014 and 2015. Total IP is now estimated to have returned to its pre-recession peak in November 2014, six months later than previously estimated. Capacity for total industry is now reported to have increased about 2 percent in 2014 and 2015 after having increased only 1 percent in 2013. Compared with the previously reported estimates, the gain in 2015 is 1/2 percentage point higher, and the gain in 2013 is 1/2 percentage point lower. Industrial capacity is expected to increase 1/2 percent in 2016.”

Manufacturing declined 22.3 from the peak in Jun 2007 to the trough in Apr 2009 and increased of 16.1 percent from the trough in Apr 2009 to Dec 2015. Manufacturing grew 18.1 percent from the trough in Apr 2009 to Mar 2016. Manufacturing in Mar 2016 is lower by 8.3 percent relative to the peak in Jun 2007. The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. Growth at trend in the entire cycle from IVQ2007 to IVQ2015 would have accumulated to 26.7 percent. GDP in IVQ2015 would be $18,994.6 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2524.0 billion than actual $16,470.6 billion. There are about two trillion dollars of GDP less than at trend, explaining the 24.5 million unemployed or underemployed equivalent to actual unemployment/underemployment of 14.6 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html). US GDP in IVQ2015 is 13.3 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,470.6 billion in IVQ2015 or 9.9 percent at the average annual equivalent rate of 1.2 percent. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth of manufacturing at average 3.2 percent per year from Mar 1919 to Mar 2016. Growth at 3.2 percent per year would raise the NSA index of manufacturing output from 108.2316 in Dec 2007 to 140.3764 in Mar 2016. The actual index NSA in Mar 2016 is 103.2208, which is 26.5 percent below trend. Manufacturing output grew at average 2.1 percent between Dec 1986 and Dec 2015. Using trend growth of 2.1 percent per year, the index would increase to 128.4709 in Mar 2016. The output of manufacturing at 103.2208 in Mar 2016 is 19.7 percent below trend under this alternative calculation.

Table V-4, Growth of Trade and Contributions of Net Trade to GDP Growth, ∆% and % Points

| Exports | Exports 12 M ∆% | Imports | Imports 12 M ∆% | |

| USA | 1.0 Feb | -7.4 Jan-Feb | 1.3 Feb | -2.4 Jan-Feb |

| Japan | Mar 2016 -6.8 Feb 2016 -4.0 Jan 2016 -12.9 Dec 2015 -8.0 Nov 2015 -3.3 Oct 2015 -2.1 Sep 2015 0.6 Aug 3.1 Jul 2015 7.6 Jun 2015 9.5 May 2015 2.4 Apr 8.0 Mar 8.5 Feb 2.4 Jan 17.0 Dec 12.9 Nov 4.9 Oct 9.6 Sep 6.9 Aug -1.3 Jul 3.9 Jun -2.0 May 2014 -2.7 Apr 2014 5.1 Mar 2014 1.8 Feb 2014 9.5 Jan 2014 9.5 Dec 2013 15.3 Nov 2013 18.4 Oct 2013 18.6 Sep 2013 11.5 Aug 2013 14.7 Jul 2013 12.2 Jun 2013 7.4 May 2013 10.1 Apr 2013 3.8 Mar 2013 1.1 Feb 2013 -2.9 Jan 2013 6.4 Dec -5.8 Nov -4.1 Oct -6.5 Sep -10.3 Aug -5.8 Jul -8.1 | Mar 2016 -14.9 Feb 2016 -14.2 Jan 2016 -18.0 Dec 2015 -18.0 Nov 2015 -10.2 Oct 2015 -13.4 Sep 2015 -11.1 Aug -3.1 Jul 2015 -3.2 Jun 2015 -2.9 May 2015 -8.7 Apr -4.2 Mar -14.5 Feb -3.6 Jan -9.0 Dec 1.9 Nov -1.7 Oct 2.7 Sep 6.2 Aug -1.5 Jul 2.3 Jun 8.4 May 2014 -3.6 Apr 2013 3.4 Mar 2014 18.1 Feb 2014 9.0 Jan 2014 25.0 Dec 2013 24.7 Nov 2013 21.1 Oct 2013 26.1 Sep 2013 16.5 Aug 2013 16.0 Jul 2013 19.6 Jun 2013 11.8 May 2013 10.0 Apr 2013 9.4 Mar 2013 5.5 Feb 2013 7.3 Jan 2013 7.3 Dec 1.9 Nov 0.8 Oct -1.6 Sep 4.1 Aug -5.4 Jul 2.1 | ||

| China | Jan-Dec 2015 -2.8 | 2016 Mar 11.5 Feb -25.4 Jan -11.2 2015 -1.4 Dec -6.8 Nov -6.9 Oct -3.7 Sep -5.5 Aug -8.3 Jul 2.8 Jun -2.5 May -6.4 Apr -15.0 Mar 48.3 Feb -3.3 Jan 2014 9.7 Dec 4.7 Nov 11.6 Oct 15.3 Sep 9.4 Aug 14.5 Jul 7.2 Jun 7.0 May 0.9 Apr -6.6 Mar -18.1 Feb 10.6 Jan 2013 4.3 Dec 12.7 Nov 5.6 Oct -0.3 Sep 7.2 Aug 5.1 Jul -3.1 Jun 1.0 May 14.7 Apr 10.0 Mar 21.8 Feb 25.0 Jan | Jan-Dec 2015 -14.1 | 2016 Mar -7.6 Feb -13.8 Jan -18.8 2015 -7.6 Dec -8.7 Nov -18.8 Oct -20.4 Sep -13.8 Aug -8.1 Jul -6.1 Jun -17.6 May -12.7 Mar -20.5 Feb -19.9 Jan 2014 -2.4 Dec -6.7 Nov 4.6 Oct 7.0 Sep -2.4 Aug -1.6 Jul 5.5 Jun -1.6 May -0.8 Apr -11.3 Mar 10.1 Feb 10.0 Jan 2013 8.3 Dec 5.3 Nov 7.6 Oct 7.4 Sep 7.0 Aug 10.9 Jul -0.7 Jun -0.3 May 16.8 Apr 14.1 Mar -15.2 Feb 28.8 Jan |

| Euro Area | 1.3 12-M Feb | -0.3 Jan-Feb | 2.0 12-M Feb | -0.3 Jan-Feb |

| Germany | 1.3 Feb CSA | 4.1 Feb | 0.4 Feb CSA | 4.0 Feb |

| France Feb | -0.2 | 1.5 | 2.8 | 5.9 |

| Italy Feb | 2.5 | 3.3 | 0.6 | 2.4 |

| UK | 0.9 Feb | -2.5 Dec 15-Feb 16 /Dec 14-Feb 15 | 0.0 Jan | -1.2 Dec 15-Feb 16 /Dec 14-Feb 15 |

| Net Trade % Points GDP Growth | Points | |||

| USA | IQ2016 -0.34 IVQ2015 -0.14 IIIQ2015 -0.26 IIQ2015 0.18 IQ2015 -1.92 IVQ2014 -0.89 IIIQ2014 0.39 IIQ2014 -0.24 IQ2014 -1.39 IVQ2013 1.26 IIIQ2013 0.16 IIQ2013 -0.24 IQ2013 -0.01 IVQ2012 +0.58 IIIQ2012 0.16 IIQ2012 0.28 IQ2012 -0.02 | |||

| Japan | 0.4 IQ2012 -1.6 IIQ2012 -1.8 IIIQ2012 -0.6 IVQ2012 1.8 IQ2013 -0.3 IIQ2013 -1.3 IIIQ2013 -2.0 IVQ2013 -0.9 IQ2014 3.6 IIQ2014 0.5 IIIQ2014 1.4 IVQ2014 0.0 IQ2015 -1.3 IIQ2015 0.8 IIIQ2015 0.6 IVQ2015 | |||

| Germany | IQ2012 0.8 IIQ2012 0.4 IIIQ2012 0.3 IVQ2012 -0.5 IQ2013 -0.3 IIQ2013 0.1 IIIQ2013 -0.5 IVQ2013 0.5 IQ2014 0.0 IIQ2014 0.2 IIIQ2014 0.5 IVQ2014 -0.3 IQ2015 -0.2 IIQ2015 0.6 IIIQ2015 -0.3 IVQ2015 -0.5 | |||

| France | 0.1 IIIQ2012 0.1 IVQ2012 -0.1 IQ2013 0.3 IIQ2013 -1.7 IIIQ2013 0.1 IVQ2013 -0.1 IQ2014 -0.2 IIQ2014 -0.2 IIIQ2014 0.2 IVQ2014 -0.2 IQ2015 0.3 IIQ2015 -0.6 IIIQ2015 -0.4 IVQ2015 -0.2 IQ2016 | |||

| UK | 0.7 IIQ2013 -1.7 IIIQ2013 0.1 IVQ2013 0.2 IQ2014 0.5 IIQ2014 -0.5 IIIQ2014 0.2 IVQ2014 -1.2 IQ2015 1.7 IIQ2015 -1.1 IIIQ2015 -0.3 IVQ2015 |

Sources: Country Statistical Agencies http://www.census.gov/foreign-trade/

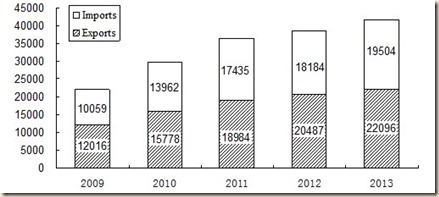

The geographical breakdown of exports and imports of Japan with selected regions and countries is in Table V-5 for Mar 2016. The share of Asia in Japan’s trade is close to one-half for 51.4 percent of exports and 51.0 percent of imports. Within Asia, exports to China are 17.3 percent of total exports and imports from China 25.7 percent of total imports. While exports to China decreased 7.1 percent in the 12 months ending in Mar 2016, imports from China increased 6.3 percent. The largest export market for Japan in Mar 2016 is the US with share of 20.2 percent of total exports, which is close to that of China, and share of imports from the US of 10.9 percent in total imports. Japan’s exports to the US decreased 5.1 percent in the 12 months ending in Mar 2016 and imports from the US decreased 20.0 percent. Western Europe has share of 12.6 percent in Japan’s exports and of 12.9 percent in imports. Rates of growth of exports of Japan in Mar 2016 are minus 5.1 percent for exports to the US, minus 37.0 percent for exports to Brazil and minus 3.6 percent for exports to Germany. Comparisons relative to 2011 may have some bias because of the effects of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Deceleration of growth in China and the US and threat of recession in Europe can reduce world trade and economic activity. Growth rates of imports in the 12 months ending in Mar 2016 are mixed. Imports from Asia decreased 5.3 percent in the 12 months ending in Mar 2016 while imports from China increased 6.3 percent. Data are in millions of yen, which may have effects of recent depreciation of the yen relative to the United States dollar (USD) and revaluation of the dollar relative to the euro.

Table V-5, Japan, Value and 12-Month Percentage Changes of Exports and Imports by Regions and Countries, ∆% and Millions of Yen

| Mar 2016 | Exports | 12 months ∆% | Imports Millions Yen | 12 months ∆% |

| Total | 6,456,599 | -6.8 | 5,701,614 | -14.9 |

| Asia | 3,318,583 % Total 51.4 | -9.7 | 2,909,164 % Total 51.0 | -5.3 |

| China | 1,116,069 % Total 17.3 | -7.1 | 1,467,142 % Total 25.7 | 6.3 |

| USA | 1,307,213 % Total 20.2 | -5.1 | 621,430 % Total 10.9 | -20.0 |

| Canada | 85,941 | -8.7 | 86,271 | -13.4 |

| Brazil | 31,982 | -37.0 | 73,391 | -15.9 |

| Mexico | 96,090 | -19.4 | 45,566 | -0.8 |

| Western Europe | 812,446 % Total 12.6 | 13.3 | 732,807 % Total 12.9 | -6.4 |

| Germany | 167,012 | -3.6 | 208,315 | -14.7 |

| France | 60,488 | 10.4 | 92,083 | 4.6 |

| UK | 161,773 | 67.6 | 69,324 | 6.8 |

| Middle East | 254,504 | -17.8 | 558,076 | -39.4 |

| Australia | 119,174 | -3.4 | 274,899 | -25.8 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

World trade projections of the IMF are in Table V-6. There is decreasing growth of the volume of world trade of goods and services from 3.5 percent in 2014 to 2.8 percent in 2015 and 3.1 percent in 2016. Growth improves to 4.2 percent on average from 2017 to 2019. World trade would be slower for advanced economies while emerging and developing economies (EMDE) experience faster growth. World economic slowdown would be more challenging with lower growth of world trade.

Table V-6, IMF, Projections of World Trade, USD Billions, USD/Barrel and Annual ∆%

| 2014 | 2015 | 2016 | Average ∆% 2017-2021 | |

| World Trade Volume (Goods and Services) | 3.5 | 2.8 | 3.1 | 4.2 |

| Exports Goods & Services | 3.4 | 2.8 | 3.0 | 4.0 |

| Imports Goods & Services | 3.6 | 2.9 | 3.3 | 4.3 |

| Average Oil Price USD/Barrel | 96.25 | 50.79 | 34.75 | Average ∆% 2008-2017 77.37 |

| Average Annual ∆% Export Unit Value of Manufactures | -0.7 | -4.0 | -2.7 | Average ∆% 2008-2017 0.1 |

| Exports of Goods & Services | 2014 | 2015 | 2016 | Average ∆% 2008-2017 |

| EMDE | 3.1 | 1.7 | 3.8 | 3.9 |

| G7 | 3.5 | 3.4 | 2.5 | 2.5 |

| Imports Goods & Services | ||||

| EMDE | 3.7 | 0.5 | 3.0 | 4.6 |

| G7 | 3.5 | 4.3 | 3.4 | 2.2 |

| Terms of Trade of Goods & Services | ||||

| EMDE | -0.4 | -3.9 | -2.3 | -0.2 |

| G7 | 0.3 | 1.9 | 1.1 | 0.1 |

| Terms of Trade of Goods | ||||

| EMDE | -0.4 | -4.1 | -1.9 | -0.2 |

| G7 | 0.1 | 1.8 | 1.2 | -0.1 |

Notes: Commodity Price Index includes Fuel and Non-fuel Prices; Commodity Industrial Inputs Price includes agricultural raw materials and metal prices; Oil price is average of WTI, Brent and Dubai

Source: International Monetary Fund World Economic Outlook databank

http://www.imf.org/external/pubs/ft/weo/2016/01/weodata/index.aspx

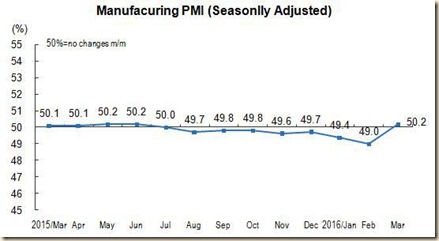

The JP Morgan Global All-Industry Output Index of the JP Morgan Manufacturing and Services PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, with high association with world GDP, increased to 51.3 in Mar from 50.8 in Feb, indicating expansion at faster rate (https://www.markiteconomics.com/Survey//PressRelease.mvc/dcaf0a9b1dc54693831a9e30c1562cfb). This index has remained above the contraction territory of 50.0 during 41 consecutive months. The employment index decreased from 51.5 in Feb to 51.4 in Mar with input prices rising at faster rate, new orders increasing at slower rate and output increasing at faster rate (https://www.markiteconomics.com/Survey//PressRelease.mvc/dcaf0a9b1dc54693831a9e30c1562cfb). David Hensley, Director of Global Economic Coordination at JP Morgan, finds slowing growth at the beginning of 2016 with potential recovery in the middle of the year (https://www.markiteconomics.com/Survey//PressRelease.mvc/dcaf0a9b1dc54693831a9e30c1562cfb). The JP Morgan Global Manufacturing PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, increased to 50.5 in Mar from 50.0 in Feb (https://www.markiteconomics.com/Survey//PressRelease.mvc/6dca312245734f8daf9488dd7e1088a9). New export orders decrease at slower rate. Senior Economist at JP Morgan, finds the index suggesting fragile conditions (https://www.markiteconomics.com/Survey//PressRelease.mvc/6dca312245734f8daf9488dd7e1088a9). The Markit Brazil Composite Output Index increased from 39.0 in Feb to 40.8 in Mar, indicating contraction in activity of Brazil’s private sector (https://www.markiteconomics.com/Survey//PressRelease.mvc/cf70fd75c7384d5b98afd7676b849413). The Markit Brazil Services Business Activity index, compiled by Markit, increased from 36.9 in Feb to 38.6 in Mar, indicating contracting services activity (https://www.markiteconomics.com/Survey//PressRelease.mvc/cf70fd75c7384d5b98afd7676b849413). Pollyanna de Lima, Economist at Markit, finds deteriorating conditions (https://www.markiteconomics.com/Survey//PressRelease.mvc/cf70fd75c7384d5b98afd7676b849413). The Markit Brazil Purchasing Managers’ IndexTM (PMI™) increased from 44.5 in Feb to 46.0 in Mar, indicating deterioration in manufacturing (https://www.markiteconomics.com/Survey//PressRelease.mvc/93a6863fecb84f3daca0b0a3ec8e40b5). Pollyanna De Lima, Economist at Markit, finds stress in manufacturing (https://www.markiteconomics.com/Survey//PressRelease.mvc/93a6863fecb84f3daca0b0a3ec8e40b5).

VA United States. The Markit Flash US Manufacturing Purchasing Managers’ Index™ (PMI™) seasonally adjusted decreased to 50.8 in Apr from 51.5 in Mar (https://www.markiteconomics.com/Survey//PressRelease.mvc/923b3dc0f4314b259e101c31f406a676). New export orders decreased because of the strong US dollar and weak world economy. Chris Williamson, Chief Economist at Markit, finds the weakest business environment in more than three years (https://www.markiteconomics.com/Survey//PressRelease.mvc/923b3dc0f4314b259e101c31f406a676). The Markit Flash US Services PMI™ Business Activity Index increased from 51.3 in Mar to 52.1 in Apr (https://www.markiteconomics.com/Survey//PressRelease.mvc/2b996d460af44f33b833bd6d3efef41c). The Markit Flash US Composite PMI™ Output Index increased from 51.3 in Mar to 51.7 in Apr. Chris Williamson, Chief Economist at Markit, finds that the surveys are consistent with growth weaker in IIQ2016 than a year earlier (https://www.markiteconomics.com/Survey//PressRelease.mvc/2b996d460af44f33b833bd6d3efef41c). The Markit US Composite PMI™ Output Index of Manufacturing and Services increased to 51.3 in Mar from 50.0 in Feb (https://www.markiteconomics.com/Survey//PressRelease.mvc/5cfd7e03fa634394b497dbf0cd5620c7). The Markit US Services PMI™ Business Activity Index increased from 49.7 in Feb to 51.3 in Mar (https://www.markiteconomics.com/Survey//PressRelease.mvc/5cfd7e03fa634394b497dbf0cd5620c7). Chris Williamson, Chief Economist at Markit, finds the indexes suggesting stagnating growth with annual growth at 0.7 percent in IQ2016 (https://www.markiteconomics.com/Survey//PressRelease.mvc/5cfd7e03fa634394b497dbf0cd5620c7). The Markit US Manufacturing Purchasing Managers’ Index™ (PMI™) increased to 51.5 in Mar from 51.3 in Feb, which indicates expansion at faster rate (https://www.markiteconomics.com/Survey//PressRelease.mvc/abbe8801546e464fafd899bcd405acb2). New foreign orders stabilized. Tim Moore, Senior Economist at Markit, finds slow growth (https://www.markiteconomics.com/Survey//PressRelease.mvc/abbe8801546e464fafd899bcd405acb2). The purchasing managers’ index (PMI) of the Institute for Supply Management (ISM) Report on Business® increased 2.3 percentage points from 49.5 in Feb to 51.8 in Mar, which indicates change to expansion (https://www.instituteforsupplymanagement.org/ISMReport/MfgROB.cfm?). The index of new orders increased 6.8 percentage points from 51.5 in Feb to 58.3 in Mar. The index of new exports increased 5.5 percentage points from 46.5 in Feb to 52.0 in Mar, expanding. The Non-Manufacturing ISM Report on Business® PMI increased 1.1 percentage points from 53.4 in Feb to 54.5 in Mar, indicating growth of business activity/production during 80 consecutive months, while the index of new orders increased 1.2 percentage points from 55.5 in Feb to 56.7 in Mar (https://www.instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?). Table USA provides the country economic indicators for the US.

Table USA, US Economic Indicators

| Consumer Price Index | Mar 12 months NSA ∆%: 0.9; ex food and energy ∆%: 2.2 Mar month SA ∆%: 0.1; ex food and energy ∆%: 0.1 |

| Producer Price Index | Finished Goods Mar 12-month NSA ∆%: -1.9; ex food and energy ∆% 1.5 Final Demand Mar 12-month NSA ∆%: -0.1; ex food and energy ∆% 1.0 |

| PCE Inflation | Feb 12-month NSA ∆%: headline 1.0; ex food and energy ∆% 1.7 |

| Employment Situation | Household Survey: Mar Unemployment Rate SA 5.0% |

| Nonfarm Hiring | Nonfarm Hiring fell from 63.5 million in 2006 to 58.6 million in 2014 or by 4.9 million and to 61.7 million in 2015 or by 1.8 million |

| GDP Growth | BEA Revised National Income Accounts IIQ2012/IIQ2011 2.5 IIIQ2012/IIIQ2011 2.4 IVQ2012/IVQ2011 1.3 IQ2013/IQ2012 1.1 IIQ2013/IIQ2012 0.9 IIIQ2013/IIIQ2012 1.5 IVQ2013/IVQ2012 2.5 IQ2014/IQ2013 1.7 IIQ2014/IIQ2013 2.6 IIIQ2014/IIIQ2013 2.9 IVQ2014/IVQ2013 2.5 IQ2015/IQ2014 2.9 IIQ2015/IIQ2014 2.7 IIIQ2015/IIIQ2014 2.1 IVQ2015/IVQ2014 2.0 IQ2016/IQ2015 2.0 IQ2012 SAAR 2.7 IIQ2012 SAAR 1.9 IIIQ2012 SAAR 0.5 IVQ2012 SAAR 0.1 IQ2013 SAAR 1.9 IIQ2013 SAAR 1.1 IIIQ2013 SAAR 3.0 IVQ2013 SAAR 3.8 IQ2014 SAAR -0.9 IIQ2014 SAAR 4.6 IIIQ2014 SAAR 4.3 IVQ2014 SAAR 2.1 IQ2015 SAAR 0.6 IIQ2015 SAAR: 3.9 IIIQ2015 SAAR: 2.0 IVQ2015 SAAR: 1.4 IQ2016 SAAR: 0.5 |

| Real Private Fixed Investment | SAAR IQ2016 ∆% -1.6 IVQ2007 to IQ2016: 6.4% Blog 5/1/16 |

| Corporate Profits | IVQ2015 SAAR: Corporate Profits -7.8; Undistributed Profits -18.6 Blog 3/27/16 |

| Personal Income and Consumption | Feb month ∆% SA Real Disposable Personal Income (RDPI) SA ∆% 0.3 |

| Quarterly Services Report | IVQ15/IVQ14 NSA ∆%: Financial & Insurance 1.8 Earlier Data: |

| Employment Cost Index | Compensation Private IQ2016 SA ∆%: 0.6 Earlier Data: |

| Industrial Production | Mar month SA ∆%: -0.6 Manufacturing Mar SA -0.3 ∆% Mar 12 months SA ∆% 0.4, NSA -0.2 |

| Productivity and Costs | Nonfarm Business Productivity IVQ2015∆% SAAE -2.2; IVQ2015/IVQ2014 ∆% 0.5; Unit Labor Costs SAAE IVQ2015 ∆% 3.3; IVQ2015/IVQ2014 ∆%: 2.1 Blog 3/6/16 |

| New York Fed Manufacturing Index | General Business Conditions From Mar 0.62 to Apr 9.56 |

| Philadelphia Fed Business Outlook Index | General Index from Mar 12.4 to Apr -1.6 |

| Manufacturing Shipments and Orders | Feb Orders SA Feb ∆% -1.7 Ex Transport -0.8 Feb 16/Feb 15 NSA New Orders ∆% minus 1.7 Ex transport minus 3.4 Earlier data: |

| Durable Goods | Mar New Orders SA ∆%: 0.8; ex transport ∆%: -0.2 Earlier Data: |

| Sales of New Motor Vehicles | Mar 2016 4,087,765; Mar 2015 3,954,544. Mar 16 SAAR 16.57 million, Feb 16 SAAR 17.54 million, Mar 2015 SAAR 17.14 million Blog 4/3/16 |

| Sales of Merchant Wholesalers | Jan-Feb 2016/Jan-Feb 2015 NSA ∆%: Total -3.2; Durable Goods: minus 1.7; Nondurable EARLIER DATA: |

| Sales and Inventories of Manufacturers, Retailers and Merchant Wholesalers | Feb 16 12-M NSA ∆%: Sales Total Business 2.0; Manufacturers -0.1 |

| Sales for Retail and Food Services | Jan-Mar 2016/Jan-Mar 2015 ∆%: Retail and Food Services 3.8; Retail ∆% 3.4 |

| Value of Construction Put in Place | SAAR month SA Jan ∆%: 1.5 Jan 16/Jan 15 NSA: 9.5 Earlier Data: |

| Case-Shiller Home Prices | Feb 2016/ Feb 2015 ∆% NSA: 10 Cities 4.6; 20 Cities: 5.4; National: 5.3 |

| FHFA House Price Index Purchases Only | Mar SA ∆% 0.4; |

| New House Sales | Mar 2016 month SAAR ∆%: minus 1.5 |

| Housing Starts and Permits | Feb Starts month SA ∆% 5.2; Permits ∆%: -3.1 Earlier Data: |

| Rate of Homeownership | IQ2016: 63.5 Blog 5/1/16 |

| Trade Balance | Balance Feb SA -$47,060 million versus Jan -$45,882 million |

| Export and Import Prices | Mar 12-month NSA ∆%: Imports -6.2; Exports -6.1 Earlier Data: |

| Consumer Credit | Feb ∆% annual rate: Total 5.8; Revolving 3.7; Nonrevolving 6.6 Earlier Data: |

| Net Foreign Purchases of Long-term Treasury Securities | Feb Net Foreign Purchases of Long-term US Securities: $60.9 billion |

| Treasury Budget | Fiscal Year 2016/2015 ∆% Mar: Receipts 4.0; Outlays 4.2; Individual Income Taxes 5.2 Deficit Fiscal Year 2012 $1,087 billion Deficit Fiscal Year 2013 $680 billion Deficit Fiscal Year 2014 $485 billion Deficit Fiscal Year 2015 $438 billion Blog 4/17/2016 |

| CBO Budget and Economic Outlook | 2012 Deficit $1087 B 6.8% GDP Debt $11,281 B 70.4% GDP 2013 Deficit $680 B, 4.1% GDP Debt $11,983 B 72.6% GDP 2014 Deficit $485 B 2.8% GDP Debt $12,780 B 74.4% GDP 2015 Deficit $438 B 2.5% GDP Debt $13,117 B 73.6% GDP 2026 Deficit $1,343B, 4.9% GDP Debt $23,672B 85.6% GDP 2040: Long-term Debt/GDP 103% Blog 8/26/12 11/18/12 2/10/13 9/22/13 2/16/14 8/24/14 9/14/14 3/1/15 6/21/15 1/3/16 4/10/16 |

| Commercial Banks Assets and Liabilities | Mar 2016 SAAR ∆%: Securities 0.2 Loans 5.0 Cash Assets -11.1 Deposits 8.4 Blog 4/24/16 |

| Flow of Funds Net Worth of Families and Nonprofits | IVQ2015 ∆ since 2007 Assets +$20,374.8 BN Nonfinancial 2790.0 BN Real estate $1897.1 BN Financial +17,853.9 BN Net Worth +$20,260.0 BN Blog 3/13/16 |

| Current Account Balance of Payments | IVQ2015 -127,927 MM % GDP 2.8 Blog 4/10/16 |

| Collapse of United States Dynamism of Income Growth and Employment Creation | Blog 4/24/16 |

| IMF View | World Real Economic Growth 2016 ∆% 3.2 Blog 4/24/16 |

| Income, Poverty and Health Insurance in the United States | 46.657 Million Below Poverty in 2014, 14.8% of Population Median Family Income CPI-2014 Adjusted $53,657 in 2014 back to 1996 Levels Uncovered by Health Insurance 32.968 Million in 2014 Blog 10/11/15 |

| Monetary Policy and Cyclical Valuation of Risk Financial Assets | Blog 1/17/2016 |

Links to blog comments in Table USA: 4/24/16 http://cmpassocregulationblog.blogspot.com/2016/04/imf-view-of-world-economy-and-finance.html

4/17/16 http://cmpassocregulationblog.blogspot.com/2016/04/contracting-united-states-industrial.html

4/10/16 http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html

4/3/16 http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html

3/27/16 http://cmpassocregulationblog.blogspot.com/2016/03/contraction-of-united-states-corporate.html

3/13/16 http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-fluctuations-of_13.html

3/6/16 http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html

2/28/16 http://cmpassocregulationblog.blogspot.com/2016/02/mediocre-cyclical-united-states.html

1/31/16 http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html

1/17/16 http://cmpassocregulationblog.blogspot.com/2016/01/unconventional-monetary-policy-and.html

1/3/16 http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html

10/11/15 http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-uncertainty-imf.html

6/21/15 http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html

5/10/15 http://cmpassocregulationblog.blogspot.com/2015/05/quite-high-equity-valuations-and.html

4/26/2015 http://cmpassocregulationblog.blogspot.com/2015/04/imf-view-of-economy-and-finance-united.html

4/19/2015 http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html

4/12/15 http://cmpassocregulationblog.blogspot.com/2015/04/dollar-revaluation-recovery-without.html

4/5/15 http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html

3/22/15 http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html

3/1/15 http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html

2/1/15 http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

8/24/14 http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

9/22/13 http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html

2/10/13 http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

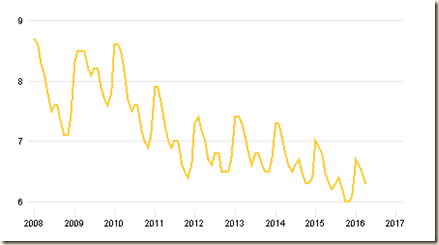

VB Japan. The GDP of Japan grew at 1.0 percent per year on average from 1991 to 2002, with the GDP implicit deflator falling at 0.8 percent per year on average. The average growth rate of Japan’s GDP was 4 percent per year on average from the middle of the 1970s to 1992 (Ito 2004). Low growth in Japan in the 1990s is commonly labeled as “the lost decade” (see Pelaez and Pelaez, The Global Recession Risk (2007), 81-115). Table VB-GDP provides yearly growth rates of Japan’s GDP from 1995 to 2014. Growth weakened from 1.9 per cent in 1995 and 2.6 percent in 1996 to contractions of 2.0 percent in 1998 and 0.2 percent in 1999. Growth rates were below 2 percent with exception of 2.3 percent in 2000, 2.4 percent in 2004 and 2.2 percent in 2007. Japan’s GDP contracted sharply by 1.0 percent in 2008 and 5.5 percent in 2009. As in most advanced economies, growth was robust at 4.7 percent in 2010 but mediocre at minus 0.5 percent in 2011 because of the tsunami and 1.7 percent in 2012. Japan’s GDP grew 1.7 percent in 2013 and stagnated in 2014 at 0.0. The GDP of Japan increased 0.5 percent in 2015. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). Japan’s real GDP in calendar year 2015 is 0.9 percent higher than in calendar year 2007 (http://www.esri.cao.go.jp/index-e.html).

Table VB-GDP, Japan, Yearly Percentage Change of GDP ∆%

| Calendar Year | ∆% |

| 1995 | 1.9 |

| 1996 | 2.6 |

| 1997 | 1.6 |

| 1998 | -2.0 |

| 1999 | -0.2 |

| 2000 | 2.3 |

| 2001 | 0.4 |

| 2002 | 0.3 |

| 2003 | 1.7 |

| 2004 | 2.4 |

| 2005 | 1.3 |

| 2006 | 1.7 |

| 2007 | 2.2 |

| 2008 | -1.0 |

| 2009 | -5.5 |

| 2010 | 4.7 |

| 2011 | -0.5 |

| 2012 | 1.7 |

| 2013 | 1.4 |

| 2014 | 0.0 |

| 2015 | 0.5 |

Source: Source: Japan Economic and Social Research Institute, Cabinet Office

http://www.esri.cao.go.jp/index-e.html

http://www.esri.cao.go.jp/en/sna/sokuhou/sokuhou_top.html

Table VB-BOJF provides the forecasts of economic activity and inflation in Japan by the majority of members of the Policy Board of the Bank of Japan, which is part of their Outlook for Economic Activity and Prices (https://www.boj.or.jp/en/mopo/outlook/gor1504b.pdf) with changes on Jul 21, 2015 (https://www.boj.or.jp/en/announcements/release_2015/k150121a.pdf). For fiscal 2015, the forecast is of growth of GDP between 1.5 to 2.1 percent, with the all items CPI less fresh food 0.2 to 1.2 to 3.3 percent (https://www.boj.or.jp/en/mopo/outlook/gor1504b.pdf). The critical difference is forecast of the CPI excluding fresh food of 0.2 to 1.2 percent in 2015 and 1.2 to 2.2 percent in 2016 (https://www.boj.or.jp/en/mopo/outlook/gor1504b.pdf). Consumer price inflation in Japan excluding fresh food was minus 0.4 percent in Mar 2014 and 2.2 percent in 12 months (http://www.stat.go.jp/english/data/cpi/1581.htm), significantly because of the increase of the tax on value added of consumption in Apr 2014. The new monetary policy of the Bank of Japan aims to increase inflation to 2 percent. These forecasts are biannual in Apr and Oct. The Cabinet Office, Ministry of Finance and Bank of Japan released on Jan 22, 2013, a “Joint Statement of the Government and the Bank of Japan on Overcoming Deflation and Achieving Sustainable Economic Growth” (http://www.boj.or.jp/en/announcements/release_2013/k130122c.pdf) with the important change of increasing the inflation target of monetary policy from 1 percent to 2 percent:

“The Bank of Japan conducts monetary policy based on the principle that the policy shall be aimed at achieving price stability, thereby contributing to the sound development of the national economy, and is responsible for maintaining financial system stability. The Bank aims to achieve price stability on a sustainable basis, given that there are various factors that affect prices in the short run.

The Bank recognizes that the inflation rate consistent with price stability on a sustainable basis will rise as efforts by a wide range of entities toward strengthening competitiveness and growth potential of Japan's economy make progress. Based on this recognition, the Bank sets the price stability target at 2 percent in terms of the year-on-year rate of change in the consumer price index.

Under the price stability target specified above, the Bank will pursue monetary easing and aim to achieve this target at the earliest possible time. Taking into consideration that it will take considerable time before the effects of monetary policy permeate the economy, the Bank will ascertain whether there is any significant risk to the sustainability of economic growth, including from the accumulation of financial imbalances.”

The Bank of Japan also provided explicit analysis of its view on price stability in a “Background note regarding the Bank’s thinking on price stability” (http://www.boj.or.jp/en/announcements/release_2013/data/rel130123a1.pdf http://www.boj.or.jp/en/announcements/release_2013/rel130123a.htm/). The Bank of Japan also amended “Principal terms and conditions for the Asset Purchase Program” (http://www.boj.or.jp/en/announcements/release_2013/rel130122a.pdf): “Asset purchases and loan provision shall be conducted up to the maximum outstanding amounts by the end of 2013. From January 2014, the Bank shall purchase financial assets and provide loans every month, the amount of which shall be determined pursuant to the relevant rules of the Bank.”

Financial markets in Japan and worldwide were shocked by new bold measures of “quantitative and qualitative monetary easing” by the Bank of Japan (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf). The objective of policy is to “achieve the price stability target of 2 percent in terms of the year-on-year rate of change in the consumer price index (CPI) at the earliest possible time, with a time horizon of about two years” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf). The main elements of the new policy are as follows:

- Monetary Base Control. Most central banks in the world pursue interest rates instead of monetary aggregates, injecting bank reserves to lower interest rates to desired levels. The Bank of Japan (BOJ) has shifted back to monetary aggregates, conducting money market operations with the objective of increasing base money, or monetary liabilities of the government, at the annual rate of 60 to 70 trillion yen. The BOJ estimates base money outstanding at “138 trillion yen at end-2012) and plans to increase it to “200 trillion yen at end-2012 and 270 trillion yen at end 2014” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf).

- Maturity Extension of Purchases of Japanese Government Bonds. Purchases of bonds will be extended even up to bonds with maturity of 40 years with the guideline of extending the average maturity of BOJ bond purchases from three to seven years. The BOJ estimates the current average maturity of Japanese government bonds (JGB) at around seven years. The BOJ plans to purchase about 7.5 trillion yen per month (http://www.boj.or.jp/en/announcements/release_2013/rel130404d.pdf). Takashi Nakamichi, Tatsuo Ito and Phred Dvorak, wiring on “Bank of Japan mounts bid for revival,” on Apr 4, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887323646604578401633067110420.html), find that the limit of maturities of three years on purchases of JGBs was designed to avoid views that the BOJ would finance uncontrolled government deficits.

- Seigniorage. The BOJ is pursuing coordination with the government that will take measures to establish “sustainable fiscal structure with a view to ensuring the credibility of fiscal management” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf).

- Diversification of Asset Purchases. The BOJ will engage in transactions of exchange traded funds (ETF) and real estate investment trusts (REITS) and not solely on purchases of JGBs. Purchases of ETFs will be at an annual rate of increase of one trillion yen and purchases of REITS at 30 billion yen.

- Bank Lending Facility and Growth Supporting Funding Facility. At the meeting on Feb 18, the Bank of Japan doubled the scale of these lending facilities to prevent their expiration in the near future (http://www.boj.or.jp/en/announcements/release_2014/k140218a.pdf).

Table VB-BOJF provides the forecasts of economic activity and inflation in Japan by the majority of members of the Policy Board of the Bank of Japan, which is part of their Outlook for Economic Activity and Prices (https://www.boj.or.jp/en/mopo/outlook/gor1510b.pdf) with changes on Apr 29, 2016 (https://www.boj.or.jp/en/mopo/outlook/gor1604b.pdf). On Jun 19, 2015, the Bank of Japan announced a “New Framework for Monetary Policy Meetings,” which provides for quarterly release of the forecasts of the economy and prices beginning in Jan 2016 (https://www.boj.or.jp/en/announcements/release_2015/rel150619a.pdf). For fiscal 2015, the forecast is of growth of GDP between 0.7 to 0.7 percent, with the all items CPI less fresh food of 0.0 percent (https://www.boj.or.jp/en/mopo/outlook/gor1604b.pdf). The critical difference is forecast of the CPI excluding fresh food of 0.0 to 0.2 percent in 2016 and 1.8 to 3.0 percent in 2017 (https://www.boj.or.jp/en/mopo/outlook/gor1604b.pdf). Consumer price inflation in Japan excluding fresh food was 0.1 percent in Mar 2016 and minus 0.3 percent in 12 months (http://www.stat.go.jp/english/data/cpi/1581.htm). The CPI increased significantly because of the increase of the tax on value added of consumption in Apr 2014. The new monetary policy of the Bank of Japan aims to increase inflation to 2 percent. These forecasts are biannual in Apr and Oct. The Cabinet Office, Ministry of Finance and Bank of Japan released on Jan 22, 2013, a “Joint Statement of the Government and the Bank of Japan on Overcoming Deflation and Achieving Sustainable Economic Growth” (http://www.boj.or.jp/en/announcements/release_2013/k130122c.pdf) with the important change of increasing the inflation target of monetary policy from 1 percent to 2 percent:

“The Bank of Japan conducts monetary policy based on the principle that the policy shall be aimed at achieving price stability, thereby contributing to the sound development of the national economy, and is responsible for maintaining financial system stability. The Bank aims to achieve price stability on a sustainable basis, given that there are various factors that affect prices in the short run.

The Bank recognizes that the inflation rate consistent with price stability on a sustainable basis will rise as efforts by a wide range of entities toward strengthening competitiveness and growth potential of Japan's economy make progress. Based on this recognition, the Bank sets the price stability target at 2 percent in terms of the year-on-year rate of change in the consumer price index.

Under the price stability target specified above, the Bank will pursue monetary easing and aim to achieve this target at the earliest possible time. Taking into consideration that it will take considerable time before the effects of monetary policy permeate the economy, the Bank will ascertain whether there is any significant risk to the sustainability of economic growth, including from the accumulation of financial imbalances.”

The Bank of Japan also provided explicit analysis of its view on price stability in a “Background note regarding the Bank’s thinking on price stability” (http://www.boj.or.jp/en/announcements/release_2013/data/rel130123a1.pdf http://www.boj.or.jp/en/announcements/release_2013/rel130123a.htm/). The Bank of Japan also amended “Principal terms and conditions for the Asset Purchase Program” (http://www.boj.or.jp/en/announcements/release_2013/rel130122a.pdf): “Asset purchases and loan provision shall be conducted up to the maximum outstanding amounts by the end of 2013. From January 2014, the Bank shall purchase financial assets and provide loans every month, the amount of which shall be determined pursuant to the relevant rules of the Bank.”

Financial markets in Japan and worldwide were shocked by new bold measures of “quantitative and qualitative monetary easing” by the Bank of Japan (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf). The objective of policy is to “achieve the price stability target of 2 percent in terms of the year-on-year rate of change in the consumer price index (CPI) at the earliest possible time, with a time horizon of about two years” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf). The main elements of the new policy are as follows:

- Monetary Base Control. Most central banks in the world pursue interest rates instead of monetary aggregates, injecting bank reserves to lower interest rates to desired levels. The Bank of Japan (BOJ) has shifted back to monetary aggregates, conducting money market operations with the objective of increasing base money, or monetary liabilities of the government, at the annual rate of 60 to 70 trillion yen. The BOJ estimates base money outstanding at “138 trillion yen at end-2012) and plans to increase it to “200 trillion yen at end-2012 and 270 trillion yen at end 2014” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf).