Turbulence of Financial Asset Valuations, Twenty-five Million Unemployed or Underemployed, Job Creation, Stagnating Real Wages, Collapse of United States Dynamism of Income Growth and Employment Creation, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015

I Twenty Five Million Unemployed or Underemployed

IA1 Summary of the Employment Situation

IA2 Number of People in Job Stress

IA3 Long-term and Cyclical Comparison of Employment

IA4 Job Creation

IB Stagnating Real Wages

II IB Collapse of United States Dynamism of Income Growth and Employment Creation

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

V World Economic Slowdown. Table V-1 is constructed with the database of the IMF (http://www.imf.org/external/ns/cs.aspx?id=29) to show GDP in dollars in 2013 and the growth rate of real GDP of the world and selected regional countries from 2013 to 2017. The data illustrate the concept often repeated of “two-speed recovery” of the world economy from the recession of 2007 to 2009. The IMF has changed its forecast of the world economy to 3.4 percent in 2014 but accelerating to 3.5 percent in 2015, 3.8 percent in 2016 and 3.8 percent in 2016. Slow-speed recovery occurs in the “major advanced economies” of the G7 that account for $34,883 billion of world output of $75,471 billion, or 46.2 percent, but are projected to grow at much lower rates than world output, 2.1 percent on average from 2014 to 2017 in contrast with 3.6 percent for the world as a whole. While the world would grow 15.3 percent in the four years from 2014 to 2017, the G7 as a whole would grow 8.6 percent. The difference in dollars of 2013 is high: growing by 15.2 percent would add around $11.5 trillion of output to the world economy, or roughly, two times the output of the economy of Japan of $4,920 billion but growing by 8.6 percent would add $6.5 trillion of output to the world, or about the output of Japan in 2013. The “two speed” concept is in reference to the growth of the 150 countries labeled as emerging and developing economies (EMDE) with joint output in 2013 of $29,358 billion, or 38.9 percent of world output. The EMDEs would grow cumulatively 19.9 percent or at the average yearly rate of 4.7 percent, contributing $5.8 trillion from 2014 to 2017 or the equivalent of somewhat less than the GDP of $9,469 billion of China in 2013. The final four countries in Table V-1 often referred as BRIC (Brazil, Russia, India, China), are large, rapidly growing emerging economies. Their combined output in 2013 adds to $15,814 billion, or 21.0 percent of world output, which is equivalent to 45.3 percent of the combined output of the major advanced economies of the G7.

Table V-1, IMF World Economic Outlook Database Projections of Real GDP Growth

| GDP USD 2013 | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | |

| World | 75,471 | 3.4 | 3.5 | 3.8 | 3.8 |

| G7 | 34,883 | 1.7 | 2.3 | 2.3 | 2.0 |

| Canada | 1,839 | 2.5 | 2.2 | 2.0 | 2.0 |

| France | 2,807 | 0.4 | 1.2 | 1.5 | 1.7 |

| DE | 3,731 | 1.6 | 1.6 | 1.7 | 1.5 |

| Italy | 2,138 | -0.4 | 0.5 | 1.1 | 1.1 |

| Japan | 4,920 | -0.1 | 1.0 | 1.2 | 0.4 |

| UK | 2,680 | 2.6 | 2.7 | 2.3 | 2.2 |

| US | 16,768 | 2.4 | 3.1 | 3.1 | 2.7 |

| Euro Area | 13,143 | 0.9 | 1.5 | 1.7 | 1.6 |

| DE | 3,731 | 1.6 | 1.6 | 1.7 | 1.5 |

| France | 2,807 | 0.4 | 1.2 | 1.5 | 1.7 |

| Italy | 2,138 | -0.4 | 0.5 | 1.1 | 1.1 |

| POT | 225 | 0.9 | 1.6 | 1.5 | 1.4 |

| Ireland | 232 | 4.8 | 3.9 | 3.3 | 2.8 |

| Greece | 242 | 0.7 | 2.5 | 3.7 | 3.2 |

| Spain | 1,393 | 1.4 | 2.5 | 2.0 | 1.8 |

| EMDE | 29,358 | 4.6 | 4.3 | 4.7 | 5.0 |

| Brazil | 2,391 | 0.1 | -1.0 | 1.0 | 2.3 |

| Russia | 2,079 | 0.6 | -3.8 | -1.1 | 1.0 |

| India | 1,875 | 7.2 | 7.5 | 7.5 | 7.6 |

| China | 9,469 | 7.4 | 6.8 | 6.3 | 6.0 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries); POT: Portugal

Source: IMF World Economic Outlook databank

http://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx

Continuing high rates of unemployment in advanced economies constitute another characteristic of the database of the WEO (http://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx ). Table V-2 is constructed with the WEO database to provide rates of unemployment from 2013 to 2017 for major countries and regions. In fact, unemployment rates for 2014 in Table I-2 are high for all countries: unusually high for countries with high rates most of the time and unusually high for countries with low rates most of the time. The rates of unemployment are particularly high in 2014 for the countries with sovereign debt difficulties in Europe: 13.9 percent for Portugal (POT), 11.3 percent for Ireland, 26.5 percent for Greece, 24.5 percent for Spain and 12.8 percent for Italy, which is lower but still high. The G7 rate of unemployment is 7.1 percent. Unemployment rates are not likely to decrease substantially if slow growth persists in advanced economies.

Table I-2, IMF World Economic Outlook Database Projections of Unemployment Rate as Percent of Labor Force

| % Labor Force 2013 | % Labor Force 2014 | % Labor Force 2015 | % Labor Force 2016 | % Labor Force 2017 | |

| World | NA | NA | NA | NA | NA |

| G7 | 7.1 | 6.4 | 6.0 | 5.8 | 5.8 |

| Canada | 7.1 | 6.9 | 7.0 | 6.9 | 6.8 |

| France | 10.3 | 10.2 | 10.1 | 9.9 | 9.7 |

| DE | 5.2 | 5.0 | 4.9 | 4.8 | 4.8 |

| Italy | 12.2 | 12.8 | 12.6 | 12.3 | 12.0 |

| Japan | 4.0 | 3.6 | 3.7 | 3.7 | 3.8 |

| UK | 7.6 | 6.2 | 5.4 | 5.4 | 5.4 |

| US | 7.4 | 6.2 | 5.5 | 5.2 | 5.0 |

| Euro Area | 12.0 | 11.6 | 11.1 | 10.6 | 10.3 |

| DE | 5.2 | 5.0 | 4.9 | 4.8 | 4.8 |

| France | 10.3 | 10.2 | 10.1 | 9.9 | 9.7 |

| Italy | 12.2 | 12.8 | 12.6 | 12.3 | 12.0 |

| POT | 16.2 | 13.9 | 13.1 | 12.6 | 12.1 |

| Ireland | 13.0 | 11.3 | 9.8 | 8.8 | 8.3 |

| Greece | 27.5 | 26.5 | 24.8 | 22.1 | 20.0 |

| Spain | 26.1 | 24.5 | 22.6 | 21.1 | 19.9 |

| EMDE | NA | NA | NA | NA | NA |

| Brazil | 5.4 | 4.8 | 5.9 | 6.3 | 5.9 |

| Russia | 5.5 | 5.1 | 6.5 | 6.5 | 6.0 |

| India | NA | NA | NA | NA | NA |

| China | 4.1 | 4.1 | 4.1 | 4.1 | 4.1 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries)

Source: IMF World Economic Outlook

http://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx

Table V-3 provides the latest available estimates of GDP for the regions and countries followed in this blog from IQ2012 to IQ2015 available now for all countries. There are preliminary estimates for most countries for IQ2015. Growth is weak throughout most of the world.

- Japan. The GDP of Japan increased 1.0 percent in IQ2012, 4.1 percent at SAAR (seasonally adjusted annual rate) and 3.5 percent relative to a year earlier but part of the jump could be the low level a year earlier because of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan is experiencing difficulties with the overvalued yen because of worldwide capital flight originating in zero interest rates with risk aversion in an environment of softer growth of world trade. Japan’s GDP fell 0.5 percent in IIQ2012 at the seasonally adjusted annual rate (SAAR) of minus 1.8 percent, which is much lower than 4.1 percent in IQ2012. Growth of 3.5 percent in IIQ2012 in Japan relative to IIQ2011 has effects of the low level of output because of Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan’s GDP contracted 0.4 percent in IIIQ2012 at the SAAR of minus 1.8 percent and increased 0.2 percent relative to a year earlier. Japan’s GDP decreased 0.1 percent in IVQ2012 at the SAAR of minus 0.6 percent and changed 0.0 percent relative to a year earlier. Japan grew 1.3 percent in IQ2013 at the SAAR of 5.3 percent and increased 0.4 percent relative to a year earlier. Japan’s GDP increased 0.7 percent in IIQ2013 at the SAAR of 2.9 percent and increased 1.4 percent relative to a year earlier. Japan’s GDP grew 0.5 percent in IIIQ2013 at the SAAR of 2.0 percent and increased 2.2 percent relative to a year earlier. In IVQ2013, Japan’s GDP decreased 0.2 percent at the SAAR of minus 0.9 percent, increasing 2.3 percent relative to a year earlier. Japan’s GDP increased 1.1 percent in IQ2014 at the SAAR of 4.4 percent and increased 2.4 percent relative to a year earlier. In IIQ2014, Japan’s GDP fell 1.7 percent at the SAAR of minus 6.8 percent and fell 0.4 percent relative to a year earlier. Japan’s GDP contracted 0.5 percent in IIIQ2014 at the SAAR of minus 2.0 percent and fell 1.4 percent relative to a year earlier. In IVQ2014, Japan’s GDP grew 0.3 percent, at the SAAR of 1.2 percent, decreasing 1.0 percent relative to a year earlier. The GDP of Japan increased 1.0 percent in IQ2015 at the SAAR of 3.9 percent and decreased 0.9 percent relative to a year earlier.

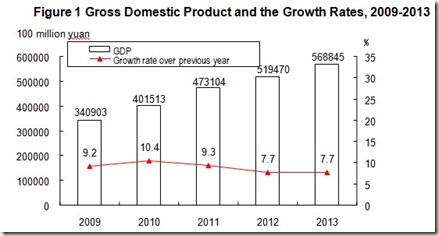

- China. China’s GDP grew 1.4 percent in IQ2012, annualizing to 5.7 percent, and 8.1 percent relative to a year earlier. The GDP of China grew at 2.1 percent in IIQ2012, which annualizes to 8.7 percent and 7.6 percent relative to a year earlier. China grew at 2.0 percent in IIIQ2012, which annualizes at 8.2 percent and 7.4 percent relative to a year earlier. In IVQ2012, China grew at 1.9 percent, which annualizes at 7.8 percent, and 7.9 percent in IVQ2012 relative to IVQ2011. In IQ2013, China grew at 1.7 percent, which annualizes at 7.0 percent and 7.8 percent relative to a year earlier. In IIQ2013, China grew at 1.8 percent, which annualizes at 7.4 percent and 7.5 percent relative to a year earlier. China grew at 2.3 percent in IIIQ2013, which annualizes at 9.5 percent and 7.9 percent relative to a year earlier. China grew at 1.8 percent in IVQ2013, which annualized to 7.4 percent and 7.6 percent relative to a year earlier. China’s GDP grew 1.6 percent in IQ2014, which annualizes to 6.6 percent, and 7.4 percent relative to a year earlier. China’s GDP grew 2.0 percent in IIQ2014, which annualizes at 8.2 percent, and 7.5 percent relative to a year earlier. China’s GDP grew 1.9 percent in IIIQ2014, which is equivalent to 7.8 percent in a year, and 7.3 percent relative to a year earlier. The GDP of China grew 1.5 percent in IVQ2014, which annualizes at 6.1 percent, and 7.3 percent relative to a year earlier. The GDP of China grew at 1.3 percent in IQ2015, which annualizes at 5.3 percent, and 7.0 percent relative to a year earlier. There is decennial change in leadership in China (http://www.xinhuanet.com/english/special/18cpcnc/index.htm). Growth rates of GDP of China in a quarter relative to the same quarter a year earlier have been declining from 2011 to 2015.

- Euro Area. GDP fell 0.2 percent in the euro area in IQ2012 and decreased 0.5 in IQ2012 relative to a year earlier. Euro area GDP contracted 0.3 percent IIQ2012 and fell 0.8 percent relative to a year earlier. In IIIQ2012, euro area GDP fell 0.1 percent and declined 0.9 percent relative to a year earlier. In IVQ2012, euro area GDP fell 0.3 percent relative to the prior quarter and fell 0.9 percent relative to a year earlier. In IQ2013, the GDP of the euro area fell 0.4 percent and decreased 1.1 percent relative to a year earlier. The GDP of the euro area increased 0.4 percent in IIQ2013 and fell 0.5 percent relative to a year earlier. In IIIQ2013, euro area GDP increased 0.2 percent and fell 0.2 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IVQ2013 and increased 0.5 percent relative to a year earlier. In IQ2014, the GDP of the euro area increased 0.2 percent and 1.1 percent relative to a year earlier. The GDP of the euro area increased 0.1 percent in IIQ2014 and increased 0.8 percent relative to a year earlier. The euro area’s GDP increased 0.2 percent in IIIQ2014 and increased 0.8 percent relative to a year earlier. The GDP of the euro area increased 0.4 percent in IVQ2014 and increased 0.9 percent relative to a year earlier. Euro are GDP increased 0.4 percent in IQ2015 and increased 1.0 percent relative to a year earlier.

- Germany. The GDP of Germany increased 0.3 percent in IQ2012 and 1.5 percent relative to a year earlier. In IIQ2012, Germany’s GDP increased 0.1 percent and increased 0.3 percent relative to a year earlier but 0.8 percent relative to a year earlier when adjusted for calendar (CA) effects. In IIIQ2012, Germany’s GDP increased 0.1 percent and 0.1 percent relative to a year earlier. Germany’s GDP contracted 0.4 percent in IVQ2012 and decreased 0.3 percent relative to a year earlier. In IQ2013, Germany’s GDP decreased 0.4 percent and fell 1.8 percent relative to a year earlier. In IIQ2013, Germany’s GDP increased 0.8 percent and 0.5 percent relative to a year earlier. The GDP of Germany increased 0.3 percent in IIIQ2013 and 0.8 percent relative to a year earlier. In IVQ2013, Germany’s GDP increased 0.4 percent and 1.0 percent relative to a year earlier. The GDP of Germany increased 0.8 percent in IQ2014 and 2.6 percent relative to a year earlier. In IIQ2014, Germany’s GDP contracted 0.1 percent and increased 1.0 percent relative to a year earlier. The GDP of Germany increased 0.1 percent in IIIQ2014 and increased 1.2 percent relative to a year earlier. Germany’s GDP increased 0.7 percent in IVQ2014 and increased 1.6 percent relative to a year earlier. The GDP of Germany increased 0.3 percent in IQ2015 and increased 1.1 percent relative to a year earlier.

- United States. Growth of US GDP in IQ2012 was 0.6 percent, at SAAR of 2.3 percent and higher by 2.6 percent relative to IQ2011. US GDP increased 0.4 percent in IIQ2012, 1.6 percent at SAAR and 2.3 percent relative to a year earlier. In IIIQ2012, US GDP grew 0.6 percent, 2.5 percent at SAAR and 2.7 percent relative to IIIQ2011. In IVQ2012, US GDP grew 0.0 percent, 0.1 percent at SAAR and 1.6 percent relative to IVQ2011. In IQ2013, US GDP grew at 2.7 percent SAAR, 0.7 percent relative to the prior quarter and 1.7 percent relative to the same quarter in 2013. In IIQ2013, US GDP grew at 1.8 percent in SAAR, 0.4 percent relative to the prior quarter and 1.8 percent relative to IIQ2012. US GDP grew at 4.5 percent in SAAR in IIIQ2013, 1.1 percent relative to the prior quarter and 2.3 percent relative to the same quarter a year earlier (Section I and earlier http://cmpassocregulationblog.blogspot.com/2015/06/dollar-revaluation-squeezing-corporate.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html). In IVQ2013, US GDP grew 0.9 percent at 3.5 percent SAAR and 3.1 percent relative to a year earlier. In IQ2014, US GDP decreased 0.5 percent, increased 1.9 percent relative to a year earlier and fell 2.1 percent at SAAR. In IIQ2014, US GDP increased 1.1 percent at 4.6 percent SAAR and increased 2.6 percent relative to a year earlier. US GDP increased 1.2 percent in IIIQ2014 at 5.0 percent SAAR and increased 2.7 percent relative to a year earlier. In IVQ2014, US GDP increased 0.5 percent at SAAR of 2.2 percent and increased 2.4 percent relative to a year earlier. GDP changed 0.0 percent in IQ2015 at SAAR of minus 0.2 percent and grew 2.9 percent relative to a year earlier.

- United Kingdom. In IQ2012, UK GDP increased 0.1 percent, increasing 1.0 percent relative to a year earlier. UK GDP fell 0.2 percent in IIQ2012 and increased 0.6 percent relative to a year earlier. UK GDP increased 0.8 percent in IIIQ2012 and increased 0.7 percent relative to a year earlier. UK GDP fell 0.3 percent in IVQ2012 relative to IIIQ2012 and increased 0.4 percent relative to a year earlier. UK GDP increased 0.6 percent in IQ2013 and 0.9 percent relative to a year earlier. UK GDP increased 0.6 percent in IIQ2013 and 1.7 percent relative to a year earlier. In IIIQ2013, UK GDP increased 0.7 percent and 1.6 percent relative to a year earlier. UK GDP increased 0.4 percent in IVQ2013 and 2.4 percent relative to a year earlier. In IQ2014, UK GDP increased 0.9 percent and 2.7 percent relative to a year earlier. UK GDP increased 0.9 percent in IIQ2014 and 3.0 percent relative to a year earlier. In IIIQ2014, UK GDP increased 0.7 percent and increased 3.0 percent relative to a year earlier. UK GDP increased 0.8 percent in IVQ2014 and increased 3.4 percent relative to a year earlier. In IQ2015, GDP increased 0.4 percent and 2.9 percent relative to a year earlier.

- Italy. Italy has experienced decline of GDP in seven consecutive quarters from IIIQ2011 to IQ2013 and in IQ2014, IIQ2014 and IIIQ2014. Italy’s GDP fell 1.0 percent in IQ2012 and declined 2.3 percent relative to IQ2011. Italy’s GDP fell 0.6 percent in IIQ2012 and declined 3.1 percent relative to a year earlier. In IIIQ2012, Italy’s GDP fell 0.5 percent and declined 3.1 percent relative to a year earlier. The GDP of Italy contracted 0.5 percent in IVQ2012 and fell 2.7 percent relative to a year earlier. In IQ2013, Italy’s GDP contracted 0.9 percent and fell 2.6 percent relative to a year earlier. Italy’s GDP changed 0.0 percent in IIQ2013 and fell 2.0 percent relative to a year earlier. The GDP of Italy increased 0.1 percent in IIIQ2013 and declined 1.4 percent relative to a year earlier. Italy’s GDP changed 0.0 percent in IVQ2013 and decreased 0.9 percent relative to a year earlier. In IQ2014, Italy’s GDP decreased 0.2 percent and fell 0.2 percent relative to a year earlier. The GDP of Italy fell 0.1 percent in IIQ2014 and declined 0.3 percent relative to a year earlier. In IIIQ2014, Italy’s GDP contracted 0.1 percent and fell 0.5 percent relative to a year earlier. The GDP of Italy changed 0.0 percent in IVQ20214 and declined 0.4 percent relative to a year earlier. In IQ2015, Italy’s GDP increased 0.3 percent and increased 0.1 percent relative to a year earlier

- France. France’s GDP changed 0.0 percent in IQ2012 and increased 0.4 percent relative to a year earlier. France’s GDP decreased 0.3 percent in IIQ2012 and increased 0.2 percent relative to a year earlier. In IIIQ2012, France’s GDP increased 0.3 percent and increased 0.3 percent relative to a year earlier. France’s GDP changed 0.0 percent in IVQ2012 and changed 0.0 percent relative to a year earlier. In IQ2013, France’s GDP increased 0.1 percent and increased 0.1 percent relative to a year earlier. The GDP of France increased 0.8 percent in IIQ2013 and increased 1.2 percent relative to a year earlier. France’s GDP decreased 0.1 percent in IIIQ2013 and increased 0.8 percent relative to a year earlier. The GDP of France increased 0.2 percent in IVQ2013 and increased 1.0 percent relative to a year earlier. In IQ2014, France’s GDP decreased 0.2 percent and increased 0.7 percent relative to a year earlier. In IIQ2014, France’s GDP contracted 0.1 percent and decreased 0.2 percent relative to a year earlier. France’s GDP increased 0.2 percent in IIIQ2014 and increased 0.2 percent relative to a year earlier. The GDP of France increased 0.1 percent in IVQ2014 and changed 0.0 percent relative to a year earlier. France’s GDP increased 0.6 percent in IQ2015 and increased 0.8 percent relative to a year earlier

Table V-3, Percentage Changes of GDP Quarter on Prior Quarter and on Same Quarter Year Earlier, ∆%

| IQ2012/IVQ2011 | IQ2012/IQ2011 | |

| United States | QOQ: 0.6 SAAR: 2.3 | 2.6 |

| Japan | QOQ: 1.0 SAAR: 4.1 | 3.5 |

| China | 1.4 | 8.1 |

| Euro Area | -0.2 | -0.5 |

| Germany | 0.3 | 1.5 |

| France | 0.0 | 0.4 |

| Italy | -1.0 | -2.3 |

| United Kingdom | 0.1 | 1.0 |

| IIQ2012/IQ2012 | IIQ2012/IIQ2011 | |

| United States | QOQ: 0.4 SAAR: 1.6 | 2.3 |

| Japan | QOQ: -0.5 | 3.5 |

| China | 2.1 | 7.6 |

| Euro Area | -0.3 | -0.8 |

| Germany | 0.1 | 0.3 0.8 CA |

| France | -0.3 | 0.2 |

| Italy | -0.6 | -3.1 |

| United Kingdom | -0.2 | 0.6 |

| IIIQ2012/ IIQ2012 | IIIQ2012/ IIIQ2011 | |

| United States | QOQ: 0.6 | 2.7 |

| Japan | QOQ: –0.4 | 0.2 |

| China | 2.0 | 7.4 |

| Euro Area | -0.1 | -0.9 |

| Germany | 0.1 | 0.1 |

| France | 0.3 | 0.3 |

| Italy | -0.5 | -3.1 |

| United Kingdom | 0.8 | 0.7 |

| IVQ2012/IIIQ2012 | IVQ2012/IVQ2011 | |

| United States | QOQ: 0.0 | 1.6 |

| Japan | QOQ: -0.1 SAAR: -0.6 | 0.0 |

| China | 1.9 | 7.9 |

| Euro Area | -0.3 | -0.9 |

| Germany | -0.4 | -0.3 |

| France | 0.0 | 0.0 |

| Italy | -0.5 | -2.7 |

| United Kingdom | -0.3 | 0.4 |

| IQ2013/IVQ2012 | IQ2013/IQ2012 | |

| United States | QOQ: 0.7 | 1.7 |

| Japan | QOQ: 1.3 SAAR: 5.3 | 0.4 |

| China | 1.7 | 7.8 |

| Euro Area | -0.4 | -1.1 |

| Germany | -0.4 | -1.8 |

| France | 0.1 | 0.1 |

| Italy | -0.9 | -2.6 |

| UK | 0.6 | 0.9 |

| IIQ2013/IQ2013 | IIQ2013/IIQ2012 | |

| United States | QOQ: 0.4 SAAR: 1.8 | 1.8 |

| Japan | QOQ: 0.7 SAAR: 2.9 | 1.4 |

| China | 1.8 | 7.5 |

| Euro Area | 0.4 | -0.5 |

| Germany | 0.8 | 0.5 |

| France | 0.8 | 1.2 |

| Italy | 0.0 | -2.0 |

| UK | 0.6 | 1.7 |

| IIIQ2013/IIQ2013 | III/Q2013/ IIIQ2012 | |

| USA | QOQ: 1.1 | 2.3 |

| Japan | QOQ: 0.5 SAAR: 2.0 | 2.2 |

| China | 2.3 | 7.9 |

| Euro Area | 0.2 | -0.2 |

| Germany | 0.3 | 0.8 |

| France | -0.1 | 0.8 |

| Italy | 0.1 | -1.4 |

| UK | 0.7 | 1.6 |

| IVQ2013/IIIQ2013 | IVQ2013/IVQ2012 | |

| USA | QOQ: 0.9 SAAR: 3.5 | 3.1 |

| Japan | QOQ: -0.2 SAAR: -0.9 | 2.3 |

| China | 1.8 | 7.6 |

| Euro Area | 0.3 | 0.5 |

| Germany | 0.4 | 1.0 |

| France | 0.2 | 1.0 |

| Italy | 0.0 | -0.9 |

| UK | 0.4 | 2.4 |

| IQ2014/IVQ2013 | IQ2014/IQ2013 | |

| USA | QOQ -0.5 SAAR -2.1 | 1.9 |

| Japan | QOQ: 1.1 SAAR: 4.4 | 2.4 |

| China | 1.6 | 7.4 |

| Euro Area | 0.2 | 1.1 |

| Germany | 0.8 | 2.6 |

| France | -0.2 | 0.7 |

| Italy | -0.2 | -0.2 |

| UK | 0.9 | 2.7 |

| IIQ2014/IQ2014 | IIQ2014/IIQ2013 | |

| USA | QOQ 1.1 SAAR 4.6 | 2.6 |

| Japan | QOQ: -1.7 SAAR: -6.8 | -0.4 |

| China | 2.0 | 7.5 |

| Euro Area | 0.1 | 0.8 |

| Germany | -0.1 | 1.0 |

| France | -0.1 | -0.2 |

| Italy | -0.1 | -0.3 |

| UK | 0.9 | 3.0 |

| IIIQ2014/IIQ2014 | IIIQ2014/IIIQ2013 | |

| USA | QOQ: 1.2 SAAR: 5.0 | 2.7 |

| Japan | QOQ: -0.5 SAAR: -2.0 | -1.4 |

| China | 1.9 | 7.3 |

| Euro Area | 0.2 | 0.8 |

| Germany | 0.1 | 1.2 |

| France | 0.2 | 0.2 |

| Italy | -0.1 | -0.5 |

| UK | 0.7 | 3.0 |

| IVQ2014/IIIQ2014 | IVQ2014/IVQ2013 | |

| USA | QOQ: 0.5 SAAR: 2.2 | 2.4 |

| Japan | QOQ: 0.3 SAAR: 1.2 | -1.0 |

| China | 1.5 | 7.3 |

| Euro Area | 0.4 | 0.9 |

| Germany | 0.7 | 1.6 |

| France | 0.1 | 0.0 |

| Italy | 0.0 | -0.4 |

| UK | 0.8 | 3.4 |

| IQ2015/IVQ2014 | IQ2015/IQ2014 | |

| USA | QOQ: 0.0 SAAR: -0.2 | 2.9 |

| Japan | QOQ: 1.0 SAAR: 3.9 | -0.9 |

| China | 1.3 | 7.0 |

| Euro Area | 0.4 | 1.0 |

| Germany | 0.3 | 1.1 |

| France | 0.6 | 0.8 |

| Italy | 0.3 | 0.1 |

| UK | 0.4 | 2.9 |

QOQ: Quarter relative to prior quarter; SAAR: seasonally adjusted annual rate

Source: Country Statistical Agencies http://www.census.gov/aboutus/stat_int.html

Table V-4 provides two types of data: growth of exports and imports in the latest available months and in the past 12 months; and contributions of net trade (exports less imports) to growth of real GDP.

- Japan. Japan provides the most worrisome data (http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/dollar-revaluation-squeezing-corporate.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/imf-view-of-economy-and-finance-united.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2014/07/world-inflation-waves-united-states.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html and earlier http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-zero-interest-rates-world.html http://cmpassocregulationblog.blogspot.com/2013/11/global-financial-risk-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations_8763.html http://cmpass ocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html and earlier http://cmpassocregulationblog.blogspot.com/2013/07/duration-dumping-steepening-yield-curve.html and earlier http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and_4699.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2013/03/united-states-commercial-banks-assets.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/world-inflation-waves-united-states.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/thirty-one-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2012/12/mediocre-and-decelerating-united-states_24.html and earlier http://cmpassocregulationblog.blogspot.com/2012/11/contraction-of-united-states-real_25.html and for GDP http://cmpassocregulationblog.blogspot.com/2013/09/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html and earlier http://cmpassocreulationblog.blogspot.com/2013/02/recovery-without-hiring-united-states.html). In May 2015, Japan’s exports increased 2.4 percent in 12 months while imports decreased 8.7 percent. The second part of Table V-4 shows that net trade deducted 1.4 percentage points from Japan’s growth of GDP in IIQ2012, deducted 1.9 percentage points from GDP growth in IIIQ2012 and deducted 0.4 percentage points from GDP growth in IVQ2012. Net trade added 0.3 percentage points to GDP growth in IQ2012, 1.6 percentage points in IQ2013 and 0.2 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.5 percentage points from GDP growth in Japan. Net trade ducted 2.1 percentage points from GDP growth in Japan in IVQ2013. Net trade deducted 1.2 percentage point from GDP growth of Japan in IQ2014. Net trade added 4.2 percentage points to GDP growth in IIQ2014. Net trade added 0.2 percentage points to GDP growth in IIIQ2014 and added 0.9 percentage points in IVQ2014.

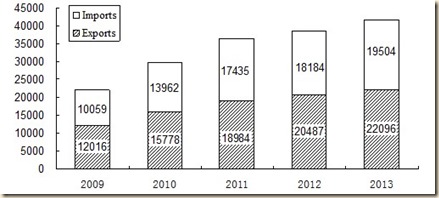

- China. In May 2015, China exports decreased 2.5 percent relative to a year earlier and imports decreased 17.6 percent.

- Germany. Germany’s exports increased 1.9 percent in the month of Apr 2015 and increased 7.5 percent in the 12 months ending in Apr 2015. Germany’s imports decreased 1.3 percent in the month of Apr 2015 and increased 2.8 percent in the 12 months ending in Apr. Net trade contributed 0.8 percentage points to growth of GDP in IQ2012, contributed 0.4 percentage points in IIQ2012, contributed 0.3 percentage points in IIIQ2012, deducted 0.5 percentage points in IVQ2012, deducted 0.3 percentage points in IQ2013 and added 0.1 percentage points in IIQ2013. Net traded deducted 0.5 percentage points from Germany’s GDP growth in IIIQ2013 and added 0.5 percentage points to GDP growth in IVQ2013. Net trade deducted 0.1 percentage points from GDP growth in IQ2014. Net trade added 0.2 percentage points to GDP growth in IIQ2014 and added 0.4 percentage points in IIIQ2014. Net trade deducted 0.3 percentage points to GDP growth in IVQ2014 and deducted 0.2 percentage points in IQ2015.

- United Kingdom. Net trade contributed 0.7 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.7 percentage points from UK growth. Net trade contributed 0.1 percentage points to UK value added in IVQ2013. Net trade contributed 0.2 percentage points to UK value added in IQ2014 and 0.1 percentage points in IIQ2014. Net trade deducted 0.7 percentage points to GDP growth in IIIQ2014 and added 0.8 percentage points in IVQ2014. Net traded deducted 0.6 percentage points from growth in IQ2015.

- France. France’s exports increased 1.4 percent in Apr 2015 while imports decreased 2.1 percent. France’s exports increased 6.5 percent in the 12 months ending in Apr 2015 and imports increased 2.6 percent relative to a year earlier. Net traded added 0.1 percentage points to France’s GDP in IIIQ2012 and 0.1 percentage points in IVQ2012. Net trade deducted 0.1 percentage points from France’s GDP growth in IQ2013 and added 0.3 percentage points in IIQ2013, deducting 1.7 percentage points in IIIQ2013. Net trade added 0.1 percentage points to France’s GDP in IVQ2013 and deducted 0.1 percentage points in IQ2014. Net trade deducted 0.2 percentage points from France’s GDP growth in IIQ2014 and deducted 0.3 percentage points in IIIQ2014. Net trade added 0.2 percentage points to France’s GDP growth in IVQ2014 and deducted 0.5 percentage points in IQ2015

- United States. US exports increased 1.0 percent in Apr 2015 and goods exports decreased 4.6 percent in Jan-Apr 2015 relative to a year earlier. Imports decreased 3.7 percent in Apr 2015 and goods imports decreased 3.0 percent in Jan-Apr 2015 relative to a year earlier. Net trade deducted 0.04 percentage points from GDP growth in IIQ2012 and added 0.39 percentage points in IIIQ2012 and 0.79 percentage points in IVQ2012. Net trade deducted 0.08 percentage points from US GDP growth in IQ2013 and deducted 0.54 percentage points in IIQ2013. Net traded added 0.59 percentage points to US GDP growth in IIIQ2013. Net trade added 1.08 percentage points to US GDP growth in IVQ2013. Net trade deducted 1.66 percentage points from US GDP growth in IQ2014 and deducted 0.34 percentage points in IIQ2014. Net trade added 0.78 percentage points to IIIQ2014. Net trade deducted 1.03 percentage points from GDP growth in IVQ2014 and deducted 1.90 percentage points from GDP growth in IQ2015. The Federal Reserve completed its annual revision of industrial production and capacity utilization on Mar 28, 2014 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm). The report of the Board of Governors of the Federal Reserve System states (http://www.federalreserve.gov/releases/g17/Current/default.htm): “Industrial production decreased 0.2 percent in May after falling 0.5 percent in April. The decline in April was larger than previously reported, but the rates of change for previous months were generally revised higher, leaving the level of the index in April slightly above its initial estimate. Manufacturing output decreased 0.2 percent in May and was little changed, on net, from its level in January. In May, the index for mining moved down 0.3 percent after declining more than 1 percent per month, on average, in the previous four months. The slower rate of decrease for mining output last month was due in part to a reduced pace of decline in the index for oil and gas well drilling and servicing. The output of utilities increased 0.2 percent in May. At 105.1 percent of its 2007 average, total industrial production in May was 1.4 percent above its year-earlier level. Capacity utilization for the industrial sector decreased 0.2 percentage point in May to 78.1 percent, a rate that is 2.0 percentage points below its long-run (1972–2014) average.” In the six months ending in May 2015, United States national industrial production accumulated change of minus 1.1 percent at the annual equivalent rate of minus 2.2 percent, which is lower than growth of 1.4 percent in the 12 months ending in May 2015. Excluding growth of 1.1 percent in Nov 2014, growth in the remaining five months from Nov 2014 to May 2015 accumulated to minus 1.1 percent or minus 2.6 percent annual equivalent. Industrial production declined in three of the past six months and changed 0.0 percent in three months. Industrial production contracted at annual equivalent 2.8 percent in the most recent quarter from Mar 2015 to May 2015 and contracted at 1.6 percent in the prior quarter Dec 2014 to Feb 2015. Business equipment accumulated contraction of 1.0 percent in the six months from Dec 2014 to May 2015 at the annual equivalent rate of minus 2.0 percent, which is lower than growth of 1.9 percent in the 12 months ending in May 2015. The Fed analyzes capacity utilization of total industry in its report (http://www.federalreserve.gov/releases/g17/Current/default.htm): “Capacity utilization for the industrial sector decreased 0.2 percentage point in May to 78.1 percent, a rate that is 2.0 percentage points below its long-run (1972–2014) average.” United States industry apparently decelerated to a lower growth rate followed by possible acceleration and weakening growth in past months.

Manufacturing fell 21.9 from the peak in Jun 2007 to the trough in Apr 2009 and increased by 25.1 percent from the trough in Apr 2009 to Dec 2014. Manufacturing grew 26.3 percent from the trough in Apr 2009 to May 2015. Manufacturing output in May 2015 is 1.4 percent below the peak in Jun 2007. The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. Growth at trend in the entire cycle from IVQ2007 to IQ2015 would have accumulated to 23.9 percent. GDP in IQ2015 would be $18,574.8 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2,287.1 billion than actual $16,287.7 billion. There are about two trillion dollars of GDP less than at trend, explaining the 24.7 million unemployed or underemployed equivalent to actual unemployment/underemployment of 15.1 percent of the effective labor force (Section I and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/quite-high-equity-valuations-and.html). US GDP in IQ2015 is 12.3 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,287.7 billion in IQ2015 or 8.6 percent at the average annual equivalent rate of 1.2 percent. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth at average 3.3 percent per year from May 1919 to May 2015. Growth at 3.3 percent per year would raise the NSA index of manufacturing output from 99.2392 in Dec 2007 to 126.2585 in May 2015. The actual index NSA in May 2015 is 101.5858, which is 19.5 percent below trend. Manufacturing output grew at average 2.4 percent between Dec 1986 and Dec 2014. Using trend growth of 2.4 percent per year, the index would increase to 118.3245 in May 2015. The output of manufacturing at 101.5858 in May 2015 is 14.1 percent below trend under this alternative calculation.

Table V-4, Growth of Trade and Contributions of Net Trade to GDP Growth, ∆% and % Points

| Exports | Exports 12 M ∆% | Imports | Imports 12 M ∆% | |

| USA | 1.0 Apr | -4.6 Jan-Apr | -3.7 Jan | -3.0 Jan-Mar |

| Japan | May 2015 2.4 Apr 8.0 Mar 8.5 Feb 2.4 Jan 17.0 Dec 12.9 Nov 4.9 Oct 9.6 Sep 6.9 Aug -1.3 Jul 3.9 Jun -2.0 May 2014 -2.7 Apr 2014 5.1 Mar 2014 1.8 Feb 2014 9.5 Jan 2014 9.5 Dec 2013 15.3 Nov 2013 18.4 Oct 2013 18.6 Sep 2013 11.5 Aug 2013 14.7 Jul 2013 12.2 Jun 2013 7.4 May 2013 10.1 Apr 2013 3.8 Mar 2013 1.1 Feb 2013 -2.9 Jan 2013 6.4 Dec -5.8 Nov -4.1 Oct -6.5 Sep -10.3 Aug -5.8 Jul -8.1 | May 2015 -8.7 Apr -4.2 Mar -14.5 Feb -3.6 Jan -9.0 Dec 1.9 Nov -1.7 Oct 2.7 Sep 6.2 Aug -1.5 Jul 2.3 Jun 8.4 May 2014 -3.6 Apr 2013 3.4 Mar 2014 18.1 Feb 2014 9.0 Jan 2014 25.0 Dec 2013 24.7 Nov 2013 21.1 Oct 2013 26.1 Sep 2013 16.5 Aug 2013 16.0 Jul 2013 19.6 Jun 2013 11.8 May 2013 10.0 Apr 2013 9.4 Mar 2013 5.5 Feb 2013 7.3 Jan 2013 7.3 Dec 1.9 Nov 0.8 Oct -1.6 Sep 4.1 Aug -5.4 Jul 2.1 | ||

| China | 2015 -2.5 May -6.4 Apr -15.0 Mar 48.3 Feb -3.3 Jan 2014 9.7 Dec 4.7 Nov 11.6 Oct 15.3 Sep 9.4 Aug 14.5 Jul 7.2 Jun 7.0 May 0.9 Apr -6.6 Mar -18.1 Feb 10.6 Jan 2013 4.3 Dec 12.7 Nov 5.6 Oct -0.3 Sep 7.2 Aug 5.1 Jul -3.1 Jun 1.0 May 14.7 Apr 10.0 Mar 21.8 Feb 25.0 Jan | 2015 -17.6 May -12.7 Mar -20.5 Feb -19.9 Jan 2014 -2.4 Dec -6.7 Nov 4.6 Oct 7.0 Sep -2.4 Aug -1.6 Jul 5.5 Jun -1.6 May -0.8 Apr -11.3 Mar 10.1 Feb 10.0 Jan 2013 8.3 Dec 5.3 Nov 7.6 Oct 7.4 Sep 7.0 Aug 10.9 Jul -0.7 Jun -0.3 May 16.8 Apr 14.1 Mar -15.2 Feb 28.8 Jan | ||

| Euro Area | 8.8 12 M-Apr | 6.0 Jan-Apr | 3.0 12-M Apr | 1.0 Jan-Apr |

| Germany | 1.9 Apr CSA | 7.5 Apr | -1.3 Apr CSA | 2.8 Apr |

| France Apr | 1.4 | 6.5 | -2.1 | 2.6 |

| Italy Apr | -0.8 | 4.6 | 0.0 | 4.0 |

| UK | 1.2 Apr | -1.6 Jan 15-Apr 15 /Jan 14-Apr 14 | -3.1 Apr | -1.1 Jan 15-Apr 15 /Jan 14-Apr 14 |

| Net Trade % Points GDP Growth | Points | |||

| USA | IQ2015 -1.90 IVQ2014 -1.03 IIIQ2014 0.78 IIQ2014 -0.34 IQ2014 -1.66 IVQ2013 1.08 IIIQ2013 0.59 IIQ2013 -0.54 IQ2013 -0.08 IVQ2012 +0.79 IIIQ2012 0.39 IIQ2012 -0.04 IQ2012 -0.11 | |||

| Japan | 0.3 IQ2012 -1.5 IIQ2012 -1.9 IIIQ2012 -0.6 IVQ2012 1.6 IQ2013 0.1 IIQ2013 -1.5 IIIQ2013 -2.1 IVQ2013 -1.3 IQ2014 4.3 IIQ2014 0.2 IIIQ2014 1.1 IVQ2014 -0.7 IQ2015 | |||

| Germany | IQ2012 0.8 IIQ2012 0.4 IIIQ2012 0.3 IVQ2012 -0.5 IQ2013 -0.3 IIQ2013 0.1 IIIQ2013 -0.5 IVQ2013 0.5 IQ2014 -0.1 IIQ2014 0.2 IIIQ2014 0.4 IVQ2014 -0.3 IQ2015 -0.2 | |||

| France | 0.1 IIIQ2012 0.1 IVQ2012 -0.1 IQ2013 0.3 IIQ2013 -1.7 IIIQ2013 0.1 IVQ2013 -0.1 IQ2014 -0.2 IIQ2014 -0.3 IIIQ2014 0.2 IVQ2014 -0.5 IQ2015 | |||

| UK | 0.7 IIQ2013 -1.7 IIIQ2013 0.1 IVQ2013 0.2 IQ2014 0.1 IIQ2214 -0.7 IIIQ2014 0.8 IVQ2014 -0.6 IQ2015 |

Sources: Country Statistical Agencies http://www.census.gov/foreign-trade/

The geographical breakdown of exports and imports of Japan with selected regions and countries is in Table V-5 for May 2015. The share of Asia in Japan’s trade is close to one-half for 55.5 percent of exports and 48.0 percent of imports. Within Asia, exports to China are 18.5 percent of total exports and imports from China 24.2 percent of total imports. While exports to China increased 1.1 percent in the 12 months ending in May 2015, imports from China increased 1.5 percent. The largest export market for Japan in May 2015 is the US with share of 18.9 percent of total exports, which is close to that of China, and share of imports from the US of 11.5 percent in total imports. Japan’s exports to the US increased 7.4 percent in the 12 months ending in May 2015 and imports from the US increased 11.5 percent. Western Europe has share of 10.6 percent in Japan’s exports and of 12.2 percent in imports. Rates of growth of exports of Japan in May 2015 are 7.4 percent for exports to the US, minus 17.0 percent for exports to Brazil and minus 9.9 percent for exports to Germany. Comparisons relative to 2011 may have some bias because of the effects of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Deceleration of growth in China and the US and threat of recession in Europe can reduce world trade and economic activity. Growth rates of imports in the 12 months ending in May 2015 are mixed. Imports from Asia decreased 3.0 percent in the 12 months ending in May 2015 while imports from China increased 1.5 percent. Data are in millions of yen, which may have effects of recent depreciation of the yen relative to the United States dollar (USD).

Table V-5, Japan, Value and 12-Month Percentage Changes of Exports and Imports by Regions and Countries, ∆% and Millions of Yen

| May 2015 | Exports | 12 months ∆% | Imports Millions Yen | 12 months ∆% |

| Total | 5,740,473 | 2.4 | 5,956,447 | -8.7 |

| Asia | 3,186,813 % Total 55.5 | 3.3 | 2,857,793 % Total 48.0 | -3.0 |

| China | 1,060,662 % Total 18.5 | 1.1 | 1,442,301 % Total 24.2 | 1.5 |

| USA | 1,086,085 % Total 18.9 | 7.4 | 682,351 % Total 11.5 | 11.5 |

| Canada | 70,987 | 19.5 | 85,017 | -16.3 |

| Brazil | 34,331 | -17.0 | 63,961 | -14.9 |

| Mexico | 81,544 | -0.6 | 41,526 | -12.8 |

| Western Europe | 609,376 % Total 10.6 | -2.1 | 725,632 % Total 12.2 | 2.1 |

| Germany | 149,118 | -9.9 | 178,411 | -7.6 |

| France | 49,445 | 3.7 | 96,643 | 8.7 |

| UK | 109,575 | 19.1 | 56,900 | 8.8 |

| Middle East | 201,464 | -6.3 | 715,497 | -35.1 |

| Australia | 125,847 | 20.6 | 302,066 | -22.9 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

World trade projections of the IMF are in Table V-6. There is increasing growth of the volume of world trade of goods and services from 3.5 percent in 2013 to 3.7 percent in 2015 and 5.0 percent on average from 2016 to 2019. World trade would be slower for advanced economies while emerging and developing economies (EMDE) experience faster growth. World economic slowdown would be more challenging with lower growth of world trade.

Table V-6, IMF, Projections of World Trade, USD Billions, USD/Barrel and Annual ∆%

| 2013 | 2014 | 2015 | Average ∆% 2016-2019 | |

| World Trade Volume (Goods and Services) | 3.5 | 3.4 | 3.7 | 5.0 |

| Exports Goods & Services | 3.7 | 3.3 | 4.0 | 5.0 |

| Imports Goods & Services | 3.3 | 3.4 | 3.4 | 5.1 |

| World Trade Value of Exports Goods & Services USD Billion | 23,117 | 23,476 | 21,818 | Average ∆% 2007-2016 20,724 |

| Value of Exports of Goods USD Billion | 18,632 | 18,817 | 17,285 | Average ∆% 2007-2016 16,612 |

| Average Oil Price USD/Barrel | 104.07 | 96.25 | 58.14 | Average ∆% 2007-2016 84.21 |

| Average Annual ∆% Export Unit Value of Manufactures | -1.4 | -0.8 | -3.3 | Average ∆% 2007-2016 0.9 |

| Exports of Goods & Services | 2013 | 2014 | 2015 | Average ∆% 2016-2019 |

| Euro Area | 2.1 | 4.2 | 4.4 | 4.4 |

| EMDE | 4.6 | 3.4 | 5.3 | 6.0 |

| G7 | 2.0 | 3.7 | 4.1 | 4.1 |

| Imports Goods & Services | ||||

| Euro Area | 1.0 | 4.3 | 4.3 | 4.3 |

| EMDE | 5.5 | 3.7 | 3.5 | 6.0 |

| G7 | 1.6 | 3.7 | 4.1 | 4.6 |

| Terms of Trade of Goods & Services | ||||

| Euro Area | 0.9 | 0.8 | 1.4 | -0.5 |

| EMDE | -0.3 | -0.6 | -3.7 | -0.1 |

| G7 | 0.9 | 0.5 | 1.4 | 0.05 |

| Terms of Trade of Goods | ||||

| Euro Area | 1.2 | 1.0 | 1.7 | -0.6 |

| EMDE | -0.1 | 0.2 | -4.0 | 0.3 |

| G7 | 0.8 | 0.2 | 1.0 | 0.1 |

Notes: Commodity Price Index includes Fuel and Non-fuel Prices; Commodity Industrial Inputs Price includes agricultural raw materials and metal prices; Oil price is average of WTI, Brent and Dubai

Source: International Monetary Fund World Economic Outlook databank

http://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx

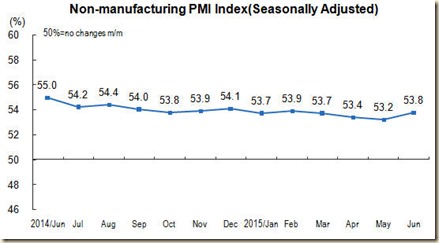

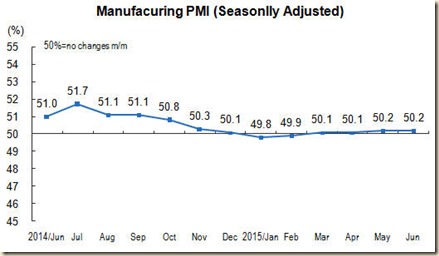

The JP Morgan Global All-Industry Output Index of the JP Morgan Manufacturing and Services PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, with high association with world GDP, decreased to 53.6 in mAY from 54.9 in Apr, indicating expansion at slower rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/c690870f3b0d41f5bcc2647ff00ce73f). This index has remained above the contraction territory of 50.0 during 32 consecutive months. The employment index increased from 52.6 in Apr to 52.9 in May with input prices rising at faster rate, new orders increasing at slower rate and output increasing at slower rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/c690870f3b0d41f5bcc2647ff00ce73f). David Hensley, Director of Global Economic Coordination at JP Morgan, finds slowing world growth with potential acceleration in IIIQ2015 (http://www.markiteconomics.com/Survey/PressRelease.mvc/c690870f3b0d41f5bcc2647ff00ce73f). The JP Morgan Global Manufacturing PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, decreased to 51.0 in Jun from 51.3 in May (http://www.markiteconomics.com/Survey/PressRelease.mvc/189b1000739a404d9f423941fa328347). New export orders changed to expanding from falling. David Hensley, Director of Global Economic Coordination at JP Morgan Chase, finds mild growth in global manufacturing that could recover in the second half (http://www.markiteconomics.com/Survey/PressRelease.mvc/189b1000739a404d9f423941fa328347). The HSBC Brazil Composite Output Index, compiled by Markit, decreased from 42.9 in May to 41.0 in Jun, indicating contraction in activity of Brazil’s private sector (http://www.markiteconomics.com/Survey/PressRelease.mvc/f57ab317b67c43f283938cce9e852131). The HSBC Brazil Services Business Activity index, compiled by Markit, decreased from 42.5 in May to 39.9 in Jun, indicating contracting services activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/f57ab317b67c43f283938cce9e852131). Pollyana De Lima, Economist at Markit, finds probable contraction of GDP in IIQ2015 (http://www.markiteconomics.com/Survey/PressRelease.mvc/f57ab317b67c43f283938cce9e852131). The HSBC Brazil Purchasing Managers’ IndexTM (PMI™) increased from 45.9 in May to 46.5 in Jun, indicating deterioration in manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/bb072eebf7294ac0a3e61d08f127c78a). Pollyanna De Lima, Economist at Markit, finds decline in output and new orders (http://www.markiteconomics.com/Survey/PressRelease.mvc/bb072eebf7294ac0a3e61d08f127c78a).

VA United States. The Markit Flash US Manufacturing Purchasing Managers’ Index™ (PMI™) seasonally adjusted decreased to 53.4 in Jun from 54.0 in May (http://www.markiteconomics.com/Survey/PressRelease.mvc/1e3df27e44c443bfbef289b16452bc4d). New export orders stabilized partly under pressure because of dollar revaluation. Chris Williamson, Chief Economist at Markit, finds that manufacturing expanding with challenges to competitiveness from the strong dollar (http://www.markiteconomics.com/Survey/PressRelease.mvc/1e3df27e44c443bfbef289b16452bc4d). The Markit Flash US Services PMI™ Business Activity Index decreased from 56.2 in May to 54.8 in Jun (http://www.markiteconomics.com/Survey/PressRelease.mvc/bf7741e29e5a427f9717073c9b72d185). The Markit Flash US Composite PMI™ Output Index decreased from 56.0 in May to 54.6 in Jun. Chris Williamson, Chief Economist at Markit, finds that the surveys are consistent with slowing GDP growth that may accelerate to about 3.0 percent in the second quarter (http://www.markiteconomics.com/Survey/PressRelease.mvc/bf7741e29e5a427f9717073c9b72d185). The Markit US Composite PMI™ Output Index of Manufacturing and Services decreased to 56.0 in May from 57.0 in Apr (http://www.markiteconomics.com/Survey/PressRelease.mvc/e66ed08a14684077a3da1d250160966c). The Markit US Services PMI™ Business Activity Index decreased from 57.4 in Apr to 56.2 in May (http://www.markiteconomics.com/Survey/PressRelease.mvc/e66ed08a14684077a3da1d250160966c). Chris Williamson, Chief Economist at Markit, finds the indexes suggesting the slowest growth of the US since Jan 2015 (http://www.markiteconomics.com/Survey/PressRelease.mvc/e66ed08a14684077a3da1d250160966c). The Markit US Manufacturing Purchasing Managers’ Index™ (PMI™) decreased to 53.6 in Jun from 54.0 in May, which indicates expansion at slower rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/25ce0a99fabb4e0c90907a2a5b7ef6b3). New foreign orders decreased. Chris Williamson, Chief Economist at Markit, finds that the index suggests restrain of foreign orders and corporate profits because of dollar appreciation (http://www.markiteconomics.com/Survey/PressRelease.mvc/25ce0a99fabb4e0c90907a2a5b7ef6b3). The purchasing managers’ index (PMI) of the Institute for Supply Management (ISM) Report on Business® increased 0.7 percentage points from 52.8 in May to 53.5 in Jun, which indicates growth at the faster rate (https://www.instituteforsupplymanagement.org/ISMReport/MfgROB.cfm?navItemNumber=29393). The index of new orders increased 0.2 percentage points from 55.8 in May to 56.0 in Jun. The index of new exports decreased 0.5 percentage points from 50.0 in May to 49.5 in Jun, contracting from unchanged. The Non-Manufacturing ISM Report on Business® PMI decreased 2.1 percentage points from 57.8 in Apr to 55.7 in May, indicating growth of business activity/production during 70 consecutive months, while the index of new orders decreased 1.3 percentage points from 59.2 in Apr to 57.9 in May (https://www.instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?navItemNumber=29348). Table USA provides the country economic indicators for the US.

Table USA, US Economic Indicators

| Consumer Price Index | May 12 months NSA ∆%: 0.0; ex food and energy ∆%: 1.7 May month SA ∆%: 0.4; ex food and energy ∆%: 0.1 |

| Producer Price Index | Finished Goods May 12-month NSA ∆%: -3.0; ex food and energy ∆% 2.0 Final Demand May 12-month NSA ∆%: -1.1; ex food and energy ∆% 0.6 |

| PCE Inflation | May 12-month NSA ∆%: headline 0.2; ex food and energy ∆% 1.2 |

| Employment Situation | Household Survey: Jun Unemployment Rate SA 5.3% |

| Nonfarm Hiring | Nonfarm Hiring fell from 63.3 million in 2006 to 54.2 million in 2013 or by 9.1 million and to 58.7 million in 2014 or by 4.6 million |

| GDP Growth | BEA Revised National Income Accounts IIQ2012/IIQ2011 2.3 IIIQ2012/IIIQ2011 2.7 IVQ2012/IVQ2011 1.6 IQ2013/IQ2012 1.7 IIQ2013/IIQ2012 1.8 IIIQ2013/IIIQ2012 2.3 IVQ2013/IVQ2012 3.1 IQ2014/IQ2013 1.9 IIQ2014/IIQ2013 2.6 IIIQ2014/IIIQ2013 2.7 IVQ2014/IVQ2013 2.4 IQ2015/IVQ2014 2.9 IQ2012 SAAR 2.3 IIQ2012 SAAR 1.6 IIIQ2012 SAAR 2.5 IVQ2012 SAAR 0.1 IQ2013 SAAR 2.7 IIQ2013 SAAR 1.8 IIIQ2013 SAAR 4.5 IVQ2013 SAAR 3.5 IQ2014 SAAR -2.1 IIQ2014 SAAR 4.6 IIIQ2014 SAAR 5.0 IVQ2014 SAAR 2.2 IQ2015 SAAR -0.2 |

| Real Private Fixed Investment | SAAR IQ2015 ∆% minus 0.3 IVQ2007 to IQ2015: 3.3% Blog 6/28/15 |

| Corporate Profits | IQ2015 SAAR: Corporate Profits -5.2; Undistributed Profits -22.7 Blog 6/28/15 |

| Personal Income and Consumption | May month ∆% SA Real Disposable Personal Income (RDPI) SA ∆% 0.2 |

| Quarterly Services Report | IQ15/IQ14 NSA ∆%: Financial & Insurance 3.7 Earlier Data: |

| Employment Cost Index | Compensation Private IVQ2014 SA ∆%: 0.6 |

| Industrial Production | May month SA ∆%: -0.2 Manufacturing May SA -0.2 ∆% May 12 months SA ∆% 1.8, NSA 2.0 |

| Productivity and Costs | Nonfarm Business Productivity IQ2015∆% SAAE -3.1; IQ2015/IQ2014 ∆% 0.3; Unit Labor Costs SAAE IQ2015 ∆% 6.7; IQ2015/IQ2014 ∆%: 1.8 Blog 6/7/15 |

| New York Fed Manufacturing Index | General Business Conditions From May 3.09 to Jun -1.98 |

| Philadelphia Fed Business Outlook Index | General Index from May 6.7 to Jun 15.2 |

| Manufacturing Shipments and Orders | New Orders SA May ∆% -1.0 Ex Transport 0.1 Jan-May NSA New Orders ∆% minus 6.1 Ex transport minus 6.5 Earlier data: |

| Durable Goods | May New Orders SA ∆%: -1.8; ex transport ∆%: 0.5 Earlier Data: |

| Sales of New Motor Vehicles | Jun 2015 8,521,260; Jun 2014 8,163,942. Jun 15 SAAR 17.16 million, May 15 SAAR 17.79 million, Jun 2014 SAAR 16.90 million Blog 7/5/15 |

| Sales of Merchant Wholesalers | Jan-Apr 2015/Jan-Apr 2014 NSA ∆%: Total -2.7; Durable Goods: 3.5; Nondurable EARLIER DATA: |

| Sales and Inventories of Manufacturers, Retailers and Merchant Wholesalers | Apr 15 12-M NSA ∆%: Sales Total Business -2.5; Manufacturers -3.7 |

| Sales for Retail and Food Services | Jan-May 2015/Jan-May 2014 ∆%: Retail and Food Services 1.9; Retail ∆% 1.0 |

| Value of Construction Put in Place | May SAAR month SA ∆%: 0.8 Jan-May NSA: 5.9 Earlier Data: |

| Case-Shiller Home Prices | Apr 2015/ Apr 2014 ∆% NSA: 10 Cities 4.6; 20 Cities: 4.9; National: 4.2 |

| FHFA House Price Index Purchases Only | Apr SA ∆% 0.3; |

| New House Sales | May 2015 month SAAR ∆%: 2.2 |

| Housing Starts and Permits | May Starts month SA ∆% 11.8; Permits ∆%: 10.1 Earlier Data: |

| Trade Balance | Balance Apr SA -$40,879 million versus Mar -$50,566 million |

| Export and Import Prices | May 12-month NSA ∆%: Imports -9.6; Exports -5.9 Earlier Data: |

| Consumer Credit | Apr ∆% annual rate: Total 7.3; Revolving 11.6; Nonrevolving 5.8 Earlier Data: |

| Net Foreign Purchases of Long-term Treasury Securities | Apr Net Foreign Purchases of Long-term US Securities: minus $38.1 billion |

| Treasury Budget | Fiscal Year 2015/2014 ∆% May: Receipts 8.6; Outlays 4.0; Individual Income Taxes 12.4 Deficit Fiscal Year 2012 $1,087 billion Deficit Fiscal Year 2013 $680 billion Deficit Fiscal Year 2014 $483 billion Blog 6/14/2015 |

| CBO Budget and Economic Outlook | 2012 Deficit $1087 B 6.8% GDP Debt $11,281 B 70.4% GDP 2013 Deficit $680 B, 4.1% GDP Debt $11,983 B 72.3% GDP 2014 Deficit $483 B 2.8% GDP Debt $12,779 B 74.1% GDP 2025 Deficit $1,088B, 4.0% GDP Debt $21,605B 78.7% GDP 2040: Long-term Debt/GDP 103% Blog 8/26/12 11/18/12 2/10/13 9/22/13 2/16/14 8/24/14 9/14/14 3/1/15 6/21/14 |

| Commercial Banks Assets and Liabilities | May 2015 SAAR ∆%: Securities 12.8 Loans 3.3 Cash Assets minus 39.0 Deposits minus 4.3 Blog 6/14/15 |

| Flow of Funds Net Worth of Families and Nonprofits | IQ2015 ∆ since 2007 Assets +$17,964.6 BN Nonfinancial 1544 BN Real estate $778.5 BN Financial +16,415.2 BN Net Worth +$18,202.8 BN Blog 6/21/15 |

| Current Account Balance of Payments | IQ2015 -88,648 MM % GDP 2.6 Blog 6/21/15 |

| Collapse of United States Dynamism of Income Growth and Employment Creation | Blog 6/14/15 |

| IMF View | World Real Economic Growth 2015 ∆% 3.5 Blog 4/26/15 |

Links to blog comments in Table USA:

6/28/2015 http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial.html

6/21/15 http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html

6/14/15 http://cmpassocregulationblog.blogspot.com/2015/06/volatility-of-financial-asset.html

6/7/15 http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html

5/31/15 http://cmpassocregulationblog.blogspot.com/2015/06/dollar-revaluation-squeezing-corporate.html

5/10/15 http://cmpassocregulationblog.blogspot.com/2015/05/quite-high-equity-valuations-and.html

4/26/2015 http://cmpassocregulationblog.blogspot.com/2015/04/imf-view-of-economy-and-finance-united.html

4/19/2015 http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html

4/12/15 http://cmpassocregulationblog.blogspot.com/2015/04/dollar-revaluation-recovery-without.html

4/5/15 http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html

3/1/15 http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html

2/1/15 http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

8/24/14 http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

9/22/13 http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html

2/10/13 http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

Motor vehicle sales and production in the US have been in long-term structural change. Table VA-1 provides the data on new motor vehicle sales and domestic car production in the US from 1990 to 2010. New motor vehicle sales grew from 14,137 thousand in 1990 to the peak of 17,806 thousand in 2000 or 29.5 percent. In that same period, domestic car production fell from 6,231 thousand in 1990 to 5,542 thousand in 2000 or -11.1 percent. New motor vehicle sales fell from 17,445 thousand in 2005 to 11,772 in 2010 or 32.5 percent while domestic car production fell from 4,321 thousand in 2005 to 2,840 thousand in 2010 or 34.3 percent. In Jun 2015, light vehicle sales accumulated to 8,521,260, which is higher by 4.4 percent relative to 8,163,942 a year earlier (http://motorintelligence.com/m_frameset.html). The seasonally adjusted annual rate of light vehicle sales in the US reached 17.16 million in Jun 2015, lower than 17.79 million in May 2015 and higher than 16.90 million in Jun 2014 (http://motorintelligence.com/m_frameset.html).

Table VA-1, US, New Motor Vehicle Sales and Car Production, Thousand Units

| New Motor Vehicle Sales | New Car Sales and Leases | New Truck Sales and Leases | Domestic Car Production | |

| 1990 | 14,137 | 9,300 | 4,837 | 6,231 |

| 1991 | 12,725 | 8,589 | 4,136 | 5,454 |

| 1992 | 13,093 | 8,215 | 4,878 | 5,979 |

| 1993 | 14,172 | 8,518 | 5,654 | 5,979 |

| 1994 | 15,397 | 8,990 | 6,407 | 6,614 |

| 1995 | 15,106 | 8,536 | 6,470 | 6,340 |

| 1996 | 15,449 | 8,527 | 6,922 | 6,081 |

| 1997 | 15,490 | 8,273 | 7,218 | 5,934 |

| 1998 | 15,958 | 8,142 | 7,816 | 5,554 |

| 1999 | 17,401 | 8,697 | 8,704 | 5,638 |

| 2000 | 17,806 | 8,852 | 8,954 | 5,542 |

| 2001 | 17,468 | 8,422 | 9,046 | 4,878 |

| 2002 | 17,144 | 8,109 | 9,036 | 5,019 |

| 2003 | 16,968 | 7,611 | 9,357 | 4,510 |

| 2004 | 17,298 | 7,545 | 9,753 | 4,230 |

| 2005 | 17,445 | 7,720 | 9,725 | 4,321 |

| 2006 | 17,049 | 7,821 | 9,228 | 4,367 |

| 2007 | 16,460 | 7,618 | 8,683 | 3,924 |

| 2008 | 13,494 | 6,814 | 6.680 | 3,777 |

| 2009 | 10,601 | 5,456 | 5,154 | 2,247 |

| 2010 | 11,772 | 5,729 | 6,044 | 2,840 |

Source: US Census Bureau

http://www.census.gov/compendia/statab/cats/wholesale_retail_trade/motor_vehicle_sales.html

Chart VA-1 of the Board of Governors of the Federal Reserve provides output of motor vehicles and parts in the United States from 1972 to 2015. Output virtually stagnated since the late 1990s.

Chart VA-1, US, Motor Vehicles and Parts Output, 1972-2015

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/default.htm

The valuable report on Financial Accounts of the United States formerly Flow of Funds Accounts of the United States provided by the Board of Governors of the Federal Reserve System (http://www.federalreserve.gov/releases/z1/Current/ http://www.federalreserve.gov/apps/fof/) is rich in important information and analysis. Table IIA-1, updated in this blog for every new quarterly release, shows the balance sheet of US households combined with nonprofit organizations in 2007, 2011, 2014 and IQ2015. The data show the strong shock to US wealth during the contraction. Assets fell from $81.1 trillion in 2007 to $77.4 trillion in 2011 even after nine consecutive quarters of growth beginning in IIIQ2009 (http://cmpassocregulationblog.blogspot.com/2015/06/dollar-revaluation-squeezing-corporate.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html), for decline of $3.7 trillion or 4.5 percent. Assets stood at $97.5 trillion in 2014 for gain of $16.4 trillion relative to $81.1 trillion in 2007 or increase by 20.2 percent. Assets increased to $99.1 trillion in IQ2015 by $18.0 trillion relative to 2007 or 22.1 percent. Liabilities declined from $14.4 trillion in 2007 to $13.6 trillion in 2011 or by $824.4 billion equivalent to decline by 5.7 percent. Liabilities declined $226.4 billion or 1.6 percent from 2007 to 2014. Liabilities fell from $14.4 trillion in 2007 to $14.1 trillion in IQ2015, by $243.7 billion or decline of 1.7 percent. Net worth shrank from $66.7 trillion in 2007 to $63.9 trillion in 2011, that is, $2.8 trillion equivalent to decline of 4.3 percent. Net worth increased from $66,721.8 billion in 2007 to $84,924.6 billion in IQ2015 by $18,202.8 billion or 27.3 percent. The US consumer price index for all items increased from 210.036 in Dec 2007 to 236.119 in Mar 2015 (http://www.bls.gov/cpi/data.htm) or 12.4 percent. Net worth adjusted by CPI inflation increased 13.2 percent from 2007 to IQ2015. Nonfinancial assets increased $898.5 billion from $28,149.7 billion in 2007 to $29,693.7 billion in IQ2015 or 5.5 percent. There was increase from 2007 to IQ2015 of $778.5 billion in real estate assets or by 3.3 percent. Real estate assets adjusted for CPI inflation fell 8.1 percent between 2007 and IQ2015. The National Association of Realtors estimated that the gains in net worth in homes by Americans were about $4 trillion between 2000 and 2005 (quoted in Pelaez and Pelaez, The Global Recession Risk (2007), 224-5).

Table IIA-1, US, Balance Sheet of Households and Nonprofit Organizations, Billions of Dollars Outstanding End of Period, NSA

| 2007 | 2011 | 2014 | IQ2015 | |

| Assets | 81,117.1 | 77,449.5 | 97,464.9 | 99,076.3 |

| Nonfinancial | 28,149.7 | 23,378.2 | 29,150.2 | 29,693.7 |

| Real Estate | 23,340.2 | 18,252.6 | 23,615.4 | 24,118.7 |

| Durable Goods | 4,476.0 | 4,723.3 | 5,085.5 | 5,121.1 |

| Financial | 52,967.4 | 54,071.3 | 68,314.7 | 69,382.6 |

| Deposits | 7,560.4 | 8,716.1 | 10,144.1 | 10,287.2 |

| Credit Market | 3,997.0 | 4,395.5 | 3,314.5 | 3,271.4 |

| Mutual Fund Shares | 4,591.5 | 4,622.5 | 7,695.3 | 7,918.8 |

| Equities Corporate | 9,912.5 | 8,498.4 | 13,360.7 | 13,640.8 |

| Equity Noncorporate | 8,933.1 | 7,587.0 | 9,924.7 | 10,156.2 |

| Pension | 15,267.2 | 17,447.7 | 20,783.7 | 20,991.9 |

| Liabilities | 14,395.3 | 13,570.9 | 14,168.9 | 14,151.6 |

| Home Mortgages | 10,613.3 | 9,695.9 | 9,403.1 | 9,370.5 |

| Consumer Credit | 2,615.1 | 2,755.4 | 3,317.2 | 3,321.6 |

| Net Worth | 66,721.8 | 63,878.6 | 83,296.0 | 84,924.6 |

Net Worth = Assets – Liabilities

Source: Board of Governors of the Federal Reserve System. 2015. Flow of funds, balance sheets and integrated macroeconomic accounts: first quarter 2015. Washington, DC, Federal Reserve System, Jun 11. http://www.federalreserve.gov/releases/z1/.

The explanation of the sharp contraction of household wealth can probably be found in the origins of the financial crisis and global recession. Let V(T) represent the value of the firm’s equity at time T and B stand for the promised debt of the firm to bondholders and assume that corporate management, elected by equity owners, is acting on the interests of equity owners. Robert C. Merton (1974, 453) states:

“On the maturity date T, the firm must either pay the promised payment of B to the debtholders or else the current equity will be valueless. Clearly, if at time T, V(T) > B, the firm should pay the bondholders because the value of equity will be V(T) – B > 0 whereas if they do not, the value of equity would be zero. If V(T) ≤ B, then the firm will not make the payment and default the firm to the bondholders because otherwise the equity holders would have to pay in additional money and the (formal) value of equity prior to such payments would be (V(T)- B) < 0.”

Pelaez and Pelaez (The Global Recession Risk (2007), 208-9) apply this analysis to the US housing market in 2005-2006 concluding:

“The house market [in 2006] is probably operating with low historical levels of individual equity. There is an application of structural models [Duffie and Singleton 2003] to the individual decisions on whether or not to continue paying a mortgage. The costs of sale would include realtor and legal fees. There could be a point where the expected net sale value of the real estate may be just lower than the value of the mortgage. At that point, there would be an incentive to default. The default vulnerability of securitization is unknown.”

There are multiple important determinants of the interest rate: “aggregate wealth, the distribution of wealth among investors, expected rate of return on physical investment, taxes, government policy and inflation” (Ingersoll 1987, 405). Aggregate wealth is a major driver of interest rates (Ibid, 406). Unconventional monetary policy, with zero fed funds rates and flattening of long-term yields by quantitative easing, causes uncontrollable effects on risk taking that can have profound undesirable effects on financial stability. Excessively aggressive and exotic monetary policy is the main culprit and not the inadequacy of financial management and risk controls.

The net worth of the economy depends on interest rates. In theory, “income is generally defined as the amount a consumer unit could consume (or believe that it could) while maintaining its wealth intact” (Friedman 1957, 10). Income, Y, is a flow that is obtained by applying a rate of return, r, to a stock of wealth, W, or Y = rW (Ibid). According to a subsequent restatement: “The basic idea is simply that individuals live for many years and that therefore the appropriate constraint for consumption decisions is the long-run expected yield from wealth r*W. This yield was named permanent income: Y* = r*W” (Darby 1974, 229), where * denotes permanent. The simplified relation of income and wealth can be restated as:

W = Y/r (1)

Equation (1) shows that as r goes to zero, r →0, W grows without bound, W→∞.

Lowering the interest rate near the zero bound in 2003-2004 caused the illusion of permanent increases in wealth or net worth in the balance sheets of borrowers and also of lending institutions, securitized banking and every financial institution and investor in the world. The discipline of calculating risks and returns was seriously impaired. The objective of monetary policy was to encourage borrowing, consumption and investment but the exaggerated stimulus resulted in a financial crisis of major proportions as the securitization that had worked for a long period was shocked with policy-induced excessive risk, imprudent credit, high leverage and low liquidity by the incentive to finance everything overnight at close to zero interest rates, from adjustable rate mortgages (ARMS) to asset-backed commercial paper of structured investment vehicles (SIV).

The consequences of inflating liquidity and net worth of borrowers were a global hunt for yields to protect own investments and money under management from the zero interest rates and unattractive long-term yields of Treasuries and other securities. Monetary policy distorted the calculations of risks and returns by households, business and government by providing central bank cheap money. Short-term zero interest rates encourage financing of everything with short-dated funds, explaining the SIVs created off-balance sheet to issue short-term commercial paper to purchase default-prone mortgages that were financed in overnight or short-dated sale and repurchase agreements (Pelaez and Pelaez, Financial Regulation after the Global Recession, 50-1, Regulation of Banks and Finance, 59-60, Globalization and the State Vol. I, 89-92, Globalization and the State Vol. II, 198-9, Government Intervention in Globalization, 62-3, International Financial Architecture, 144-9). ARMS were created to lower monthly mortgage payments by benefitting from lower short-dated reference rates. Financial institutions economized in liquidity that was penalized with near zero interest rates. There was no perception of risk because the monetary authority guaranteed a minimum or floor price of all assets by maintaining low interest rates forever or equivalent to writing an illusory put option on wealth. Subprime mortgages were part of the put on wealth by an illusory put on house prices. The housing subsidy of $221 billion per year created the impression of ever increasing house prices. The suspension of auctions of 30-year Treasuries was designed to increase demand for mortgage-backed securities, lowering their yield, which was equivalent to lowering the costs of housing finance and refinancing. Fannie and Freddie purchased or guaranteed $1.6 trillion of nonprime mortgages and worked with leverage of 75:1 under Congress-provided charters and lax oversight. The combination of these policies resulted in high risks because of the put option on wealth by near zero interest rates, excessive leverage because of cheap rates, low liquidity because of the penalty in the form of low interest rates and unsound credit decisions because the put option on wealth by monetary policy created the illusion that nothing could ever go wrong, causing the credit/dollar crisis and global recession (Pelaez and Pelaez, Financial Regulation after the Global Recession, 157-66, Regulation of Banks, and Finance, 217-27, International Financial Architecture, 15-18, The Global Recession Risk, 221-5, Globalization and the State Vol. II, 197-213, Government Intervention in Globalization, 182-4).

There are significant elements of the theory of bank financial fragility of Diamond and Dybvig (1983) and Diamond and Rajan (2000, 2001a, 2001b) that help to explain the financial fragility of banks during the credit/dollar crisis (see also Diamond 2007). The theory of Diamond and Dybvig (1983) as exposed by Diamond (2007) is that banks funding with demand deposits have a mismatch of liquidity (see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 58-66). A run occurs when too many depositors attempt to withdraw cash at the same time. All that is needed is an expectation of failure of the bank. Three important functions of banks are providing evaluation, monitoring and liquidity transformation. Banks invest in human capital to evaluate projects of borrowers in deciding if they merit credit. The evaluation function reduces adverse selection or financing projects with low present value. Banks also provide important monitoring services of following the implementation of projects, avoiding moral hazard that funds be used for, say, real estate speculation instead of the original project of factory construction. The transformation function of banks involves both assets and liabilities of bank balance sheets. Banks convert an illiquid asset or loan for a project with cash flows in the distant future into a liquid liability in the form of demand deposits that can be withdrawn immediately.

In the theory of banking of Diamond and Rajan (2000, 2001a, 2001b), the bank creates liquidity by tying human assets to capital. The collection skills of the relationship banker convert an illiquid project of an entrepreneur into liquid demand deposits that are immediately available for withdrawal. The deposit/capital structure is fragile because of the threat of bank runs. In these days of online banking, the run on Washington Mutual was through withdrawals online. A bank run can be triggered by the decline of the value of bank assets below the value of demand deposits.

Pelaez and Pelaez (Regulation of Banks and Finance 2009b, 60, 64-5) find immediate application of the theories of banking of Diamond, Dybvig and Rajan to the credit/dollar crisis after 2007. It is a credit crisis because the main issue was the deterioration of the credit portfolios of securitized banks as a result of default of subprime mortgages. It is a dollar crisis because of the weakening dollar resulting from relatively low interest rate policies of the US. It caused systemic effects that converted into a global recession not only because of the huge weight of the US economy in the world economy but also because the credit crisis transferred to the UK and Europe. Management skills or human capital of banks are illustrated by the financial engineering of complex products. The increasing importance of human relative to inanimate capital (Rajan and Zingales 2000) is revolutionizing the theory of the firm (Zingales 2000) and corporate governance (Rajan and Zingales 2001). Finance is one of the most important examples of this transformation. Profits were derived from the charter in the original banking institution. Pricing and structuring financial instruments was revolutionized with option pricing formulas developed by Black and Scholes (1973) and Merton (1973, 1974, 1998) that permitted the development of complex products with fair pricing. The successful financial company must attract and retain finance professionals who have invested in human capital, which is a sunk cost to them and not of the institution where they work.

The complex financial products created for securitized banking with high investments in human capital are based on houses, which are as illiquid as the projects of entrepreneurs in the theory of banking. The liquidity fragility of the securitized bank is equivalent to that of the commercial bank in the theory of banking (Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 65). Banks created off-balance sheet structured investment vehicles (SIV) that issued commercial paper receiving AAA rating because of letters of liquidity guarantee by the banks. The commercial paper was converted into liquidity by its use as collateral in SRPs at the lowest rates and minimal haircuts because of the AAA rating of the guarantor bank. In the theory of banking, default can be triggered when the value of assets is perceived as lower than the value of the deposits. Commercial paper issued by SIVs, securitized mortgages and derivatives all obtained SRP liquidity on the basis of illiquid home mortgage loans at the bottom of the pyramid. The run on the securitized bank had a clear origin (Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 65):

“The increasing default of mortgages resulted in an increase in counterparty risk. Banks were hit by the liquidity demands of their counterparties. The liquidity shock extended to many segments of the financial markets—interbank loans, asset-backed commercial paper (ABCP), high-yield bonds and many others—when counterparties preferred lower returns of highly liquid safe havens, such as Treasury securities, than the risk of having to sell the collateral in SRPs at deep discounts or holding an illiquid asset. The price of an illiquid asset is near zero.”

Gorton and Metrick (2010H, 507) provide a revealing quote to the work in 1908 of Edwin R. A. Seligman, professor of political economy at Columbia University, founding member of the American Economic Association and one of its presidents and successful advocate of progressive income taxation. The intention of the quote is to bring forth the important argument that financial crises are explained in terms of “confidence” but as Professor Seligman states in reference to historical banking crises in the US the important task is to explain what caused the lack of confidence. It is instructive to repeat the more extended quote of Seligman (1908, xi) on the explanations of banking crises:

“The current explanations may be divided into two categories. Of these the first includes what might be termed the superficial theories. Thus it is commonly stated that the outbreak of a crisis is due to lack of confidence,--as if the lack of confidence was not in itself the very thing which needs to be explained. Of still slighter value is the attempt to associate a crisis with some particular governmental policy, or with some action of a country’s executive. Such puerile interpretations have commonly been confined to countries like the United States, where the political passions of democracy have had the fullest way. Thus the crisis of 1893 was ascribed by the Republicans to the impending Democratic tariff of 1894; and the crisis of 1907 has by some been termed the ‘[Theodore] Roosevelt panic,” utterly oblivious of the fact that from the time of President Jackson, who was held responsible for the troubles of 1837, every successive crisis had had its presidential scapegoat, and has been followed by a political revulsion. Opposed to these popular, but wholly unfounded interpretations, is the second class of explanations, which seek to burrow beneath the surface and to discover the more occult and fundamental causes of the periodicity of crises.”