World Inflation Waves, Squeeze of Economic Activity by Carry Trades Induced by Zero Interest Rates, United States Industrial Production, Unresolved US Balance of Payments Deficits and Fiscal Imbalance Threatening Risk Premium on Treasury Securities, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014

I World Inflation Waves

IA Appendix: Transmission of Unconventional Monetary Policy

IB1 Theory

IB2 Policy

IB3 Evidence

IB4 Unwinding Strategy

IC United States Inflation

IC Long-term US Inflation

ID Current US Inflation

IE Theory and Reality of Economic History, Cyclical Slow Growth Not Secular Stagnation and Monetary Policy Based on Fear of Deflation

IIA Unresolved US Balance of Payments Deficits and Fiscal Imbalance Threatening Risk Premium on Treasury Securities

IIB United States Industrial Production

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

VD Euro Area. Table VD-EUR provides yearly growth rates of the combined GDP of the members of the European Monetary Union (EMU) or euro area since 1996. Growth was very strong at 3.3 percent in 2006 and 3.0 percent in 2007. The global recession had strong impact with growth of only 0.4 percent in 2008 and decline of 4.4 percent in 2009. Recovery was at lower growth rates of 2.0 percent in 2010 and 1.6 percent in 2011. EUROSTAT estimates growth of GDP of the euro area of minus 0.7 percent in 2012 and minus 0.4 percent in 2013 but 1.1 percent in 2014 and 1.7 percent in 2015.

Table VD-EUR, Euro Area, Yearly Percentage Change of Harmonized Index of Consumer Prices, Unemployment and GDP ∆%

| Year | HICP ∆% | Unemployment | GDP ∆% |

| 1999 | 1.2 | 9.6 | 2.9 |

| 2000 | 2.2 | 8.8 | 3.8 |

| 2001 | 2.4 | 8.2 | 2.0 |

| 2002 | 2.3 | 8.5 | 0.9 |

| 2003 | 2.1 | 9.0 | 0.7 |

| 2004 | 2.2 | 9.2 | 2.2 |

| 2005 | 2.2 | 9.1 | 1.7 |

| 2006 | 2.2 | 8.4 | 3.3 |

| 2007 | 2.2 | 7.5 | 3.0 |

| 2008 | 3.3 | 7.6 | 0.4 |

| 2009 | 0.3 | 9.6 | -4.5 |

| 2010 | 1.6 | 10.1 | 1.9 |

| 2011 | 2.7 | 10.1 | 1.6 |

| 2012 | 2.5 | 11.3 | -0.7 |

| 2013* | 1.3 | 12.0 | -0.4 |

| 2014* | 1.1 | ||

| 2015* | 1.7 |

*EUROSTAT forecast Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/

http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/search_database

The GDP of the euro area in 2012 in current US dollars in the dataset of the World Economic Outlook (WEO) of the International Monetary Fund (IMF) is $12,199.1 billion or 16.9 percent of world GDP of $72,216.4 billion (http://www.imf.org/external/pubs/ft/weo/2012/02/weodata/index.aspx). The sum of the GDP of France $2613.9 billion with the GDP of Germany of $3429.5 billion, Italy of $2014.1 billion and Spain $1323.5 billion is $9381.0 billion or 76.9 percent of total euro area GDP and 13.0 percent of World GDP. The four largest economies account for slightly more than three quarters of economic activity of the euro area. Table VD-EUR1 is constructed with the dataset of EUROSTAT, providing growth rates of the euro area as a whole and of the largest four economies of Germany, France, Italy and Spain annually from 1996 to 2011 with the estimate of 2012 and forecasts for 2013, 2014 and 2015 by EUROSTAT. The impact of the global recession on the overall euro area economy and on the four largest economies was quite strong. There was sharp contraction in 2009 and growth rates have not rebounded to earlier growth with exception of Germany in 2010 and 2011.

Table VD-EUR1, Euro Area, Real GDP Growth Rate, ∆%

| Euro Area | Germany | France | Italy | Spain | |

| 2015* | 1.7 | 1.9 | 1.7 | 1.2 | 1.7 |

| 2014* | 1.1 | 1.7 | 0.9 | 0.7 | 0.5 |

| 2013* | -0.4 | 0.4 | 0.2 | -1.9 | -1.2 |

| 2012 | -0.7 | 0.7 | 0.0 | -2.4 | -1.6 |

| 2011 | 1.6 | 3.3 | 2.0 | 0.4 | 0.1 |

| 2010 | 1.9 | 4.0 | 1.7 | 1.7 | -0.2 |

| 2009 | -4.5 | -5.1 | -3.1 | -5.5 | -3.8 |

| 2008 | 0.4 | 1.1 | -0.1 | -1.2 | 0.9 |

| 2007 | 3.0 | 3.3 | 2.3 | 1.7 | 3.5 |

| 2006 | 3.3 | 3.7 | 2.5 | 2.2 | 4.1 |

| 2005 | 1.7 | 0.7 | 1.8 | 0.9 | 3.6 |

| 2004 | 2.2 | 1.2 | 2.5 | 1.7 | 3.3 |

| 2003 | 0.7 | -0.4 | 0.9 | 0.0 | 3.1 |

| 2002 | 0.9 | 0.0 | 0.9 | 0.5 | 2.7 |

| 2001 | 2.0 | 1.5 | 1.8 | 1.9 | 3.7 |

| 2000 | 3.8 | 3.1 | 3.7 | 3.7 | 5.0 |

| 1999 | 2.9 | 1.9 | 3.3 | 1.5 | 4.7 |

| 1998 | 2.8 | 1.9 | 3.4 | 1.4 | 4.5 |

| 1997 | 2.6 | 1.7 | 2.2 | 1.9 | 3.9 |

| 1996 | 1.5 | 0.8 | 1.1 | 1.1 | 2.5 |

Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/

http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/search_database

The Flash Eurozone PMI Composite Output Index of the Markit Flash Eurozone PMI®, combining activity in manufacturing and services, decreased from 53.8 in Jun to 52.8 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/df839e9df3334511bc07ff6b990e4ce6). Rob Dobson, Chief Economist at Markit, finds that the Markit Flash Eurozone PMI index suggests that the index is consistent with growth of GDP about 0.3 to 0.4 percent in IIIQ2014 (http://www.markiteconomics.com/Survey/PressRelease.mvc/df839e9df3334511bc07ff6b990e4ce6). The Markit Eurozone PMI® Composite Output Index, combining services and manufacturing activity with close association with GDP decreased from 53.8 in Jul to 52.5 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/0bdd0b3b190a4eee9180e1180d572ce5). Chris Williamson, Chief Economist at Markit, finds slowing growth of GDP (http://www.markiteconomics.com/Survey/PressRelease.mvc/0bdd0b3b190a4eee9180e1180d572ce5). The Markit Eurozone Services Business Activity Index decreased from 54.2 in Jul to 52.5 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/0bdd0b3b190a4eee9180e1180d572ce5). The Markit Eurozone Manufacturing PMI® decreased to 50.7 in Aug from 51.8 in Jul (http://www.markiteconomics.com/Survey/PressRelease.mvc/057f1e9c278b4c53baae13c9bd9e9ceb). New orders and export orders increased for the fourteenth consecutive month. Rob Dobson, Senior Economist at Markit, finds slowing industrial growth in the euro area (http://www.markiteconomics.com/Survey/PressRelease.mvc/057f1e9c278b4c53baae13c9bd9e9ceb). Table EUR provides the data table for the euro area.

Table EUR, Euro Area Economic Indicators

| GDP | IIQ2014 ∆% 0.0; IIQ2014/IIQ2013 ∆% 0.7 Blog 9/7/14 |

| Unemployment | Jul 2014: 11.5 % unemployment rate; Jul 2014: 18.409 million unemployed Blog 8/31/14 |

| HICP | Aug month ∆%: 0.1 12 months Aug ∆%: 0.4 |

| Producer Prices | Euro Zone industrial producer prices Jul ∆%: -0.1 |

| Industrial Production | Jul month ∆%: 1.0; Jul 12 months ∆%: 2.2 |

| Retail Sales | Jul month ∆%: -0.4 |

| Confidence and Economic Sentiment Indicator | Sentiment 100.6 Aug 2014 Consumer minus 10.0 Aug 2014 Blog 8/31/14 |

| Trade | Jan-Jul 2014/Jan-Jul 2013 Exports ∆%: 1.2 Jul 2014 12-month Exports ∆% 2.6 Imports ∆% 0.8 |

Links to blog comments in Table EUR:

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

9/7/14 http://cmpassocregulationblog.blogspot.com/2014/09/competitive-monetary-policy-and.html

8/31/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitical-and-financial-risks.html

Growth of euro zone trade continues to be relatively resilient as shown in Table VD-1 but with deceleration at the margin. Exports grew 1.2 percent and imports increased 0.3 percent in Jan-Jul 2014 relative to Jan-Jul 2013. The 12-month rate of growth of exports was 2.6 percent in Jul 2014 while imports increased 0.8 percent. In Jun 2014, exports increased 2.9 percent in 12 months and imports increased 2.5 percent. At the margin, rates of growth of trade are declining in part because of moderation of commodity prices.

Table VD-1, Euro Zone, Exports, Imports and Trade Balance, Billions of Euros and Percent, NSA

| Exports | Imports | |

| Jan-Jul 2014 | 1,120.9 | 1,021.5 |

| Jan-Jul 2013 | 1,108.0 | 1,018.8 |

| ∆% | 1.2 | 0.3 |

| Jul 2014 | 172.4 | 151.2 |

| Jul 2013 | 168.0 | 150.0 |

| ∆% | 2.6% | 0.8 |

| Jun 2014 | 162.2 | 145.5 |

| Jun 2013 | 157.6 | 141.9 |

| ∆% | 2.9 | 2.5 |

| Trade Balance | Jan-Jul 2014 | Jan-Jul 2013 |

| € Billions | 99.5 | 89.2 |

Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/

http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/search_database

The structure of trade of the euro zone in Jun 2014 is provided in Table VD-2. Data are still not available for trade structure for Jul 2014. Manufactured exports increased 2.1 percent in Jan-Jun 2014 relative to Jan-Jun 2013 while imports increased 4.0 percent. The trade surplus in manufactured products was higher than the trade deficit in primary products in Jan-Jun 2014 but not by as much in Jan-Jun 2013 partly because of the commodity shock caused by carry trades.

Table VD-2, Euro Zone, Structure of Exports, Imports and Trade Balance, € Billions, NSA, ∆%

| Primary | Manufactured | Other | Total | |

| Exports | ||||

| Jan-Jun 2014 € B | 147.5 | 776.8 | 24.3 | 948.5 |

| Jan-Jun 2013 € B | 151.7 | 760.5 | 27.8 | 940.0 |

| ∆% | -2.8 | 2.1 | -12.6 | 0.9 |

| Imports | ||||

| Jan-Jun 2014 € B | 295.9 | 558.7 | 15.6 | 870.2 |

| Jan-Jun 2013 € B | 315.0 | 537.0 | 16.8 | 868.8 |

| ∆% | -6.1 | 4.0 | -7.1 | 0.2 |

| Trade Balance € B | ||||

| Jan-Jun 2014 | -148.5 | 218.0 | 8.7 | 78.3 |

| Jan-Jun 2013 | -163.3 | 223.5 | 11.0 | 71.2 |

Note: there are minor rounding errors

Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/

http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/search_database

VE Germany. Table VE-DE provides yearly growth rates of the German economy from 1971 to 2013, price adjusted chain-linked and price and calendar-adjusted chain-linked. Germany’s GDP fell 5.6 percent in 2009 after growing below trend at 1.1 percent in 2008. Recovery has been robust in contrast with other advanced economies. The German economy grew at 4.1 percent in 2010, 3.6 percent in 2011 and 0.4 percent in 2012. Growth decelerated to 0.1 percent in 2013.

The Federal Statistical Agency of Germany analyzes the fall and recovery of the German economy (http://www.destatis.de/jetspeed/portal/cms/Sites/destatis/Internet/EN/Content/Statistics/VolkswirtschaftlicheGesamtrechnungen/Inlandsprodukt/Aktuell,templateId=renderPrint.psml):

“The German economy again grew strongly in 2011. The price-adjusted gross domestic product (GDP) increased by 3.0% compared with the previous year. Accordingly, the catching-up process of the German economy continued during the second year after the economic crisis. In the course of 2011, the price-adjusted GDP again exceeded its pre-crisis level. The economic recovery occurred mainly in the first half of 2011. In 2009, Germany experienced the most serious post-war recession, when GDP suffered a historic decline of 5.1%. The year 2010 was characterised by a rapid economic recovery (+3.7%).”

Table VE-4 provides annual growth rates of the German economy from 1970 to 2013, price adjusted chain-linked and price and calendar-adjusted chain-linked. Germany’s GDP fell 5.6 percent in 2009 after growing below trend at 1.1 percent in 2008. Recovery has been robust in contrast with other advanced economies. The German economy grew at 4.1 percent in 2010, 3.6 percent in 2011 and 0.4 percent in 2012. Growth in 2013 was 0.1 percent.

Table VE-DE, Germany, GDP ∆% on Prior Year

| Price Adjusted Chain-Linked | Price- and Calendar-Adjusted Chain Linked | |

| Average ∆% 1991-2013 | 1.3 | |

| Average ∆% 1991-1999 | 1.5 | |

| Average ∆% 2000-2007 | 1.4 | |

| Average ∆% 2003-2007 | 2.2 | |

| Average ∆% 2007-2013 | 0.5 | |

| Average ∆% 2009-2013 | 2.0 | |

| 2013 | 0.1 | 0.2 |

| 2012 | 0.4 | 0.6 |

| 2011 | 3.6 | 3.7 |

| 2010 | 4.1 | 3.9 |

| 2009 | -5.6 | -5.6 |

| 2008 | 1.1 | 0.8 |

| 2007 | 3.3 | 3.4 |

| 2006 | 3.7 | 3.9 |

| 2005 | 0.7 | 0.9 |

| 2004 | 1.2 | 0.7 |

| 2003 | -0.7 | -0.7 |

| 2002 | 0.0 | 0.0 |

| 2001 | 1.7 | 1.8 |

| 2000 | 3.0 | 3.2 |

| 1999 | 2.0 | 1.9 |

| 1998 | 2.0 | 1.7 |

| 1997 | 1.8 | 1.9 |

| 1996 | 0.8 | 0.8 |

| 1995 | 1.7 | 1.8 |

| 1994 | 2.5 | 2.5 |

| 1993 | -1.0 | -1.0 |

| 1992 | 1.9 | 1.5 |

| 1991 | 5.1 | 5.2 |

| 1990 | 5.3 | 5.5 |

| 1989 | 3.9 | 4.0 |

| 1988 | 3.7 | 3.4 |

| 1987 | 1.4 | 1.3 |

| 1986 | 2.3 | 2.3 |

| 1985 | 2.3 | 2.3 |

| 1984 | 2.8 | 2.9 |

| 1983 | 1.6 | 1.5 |

| 1982 | -0.4 | -0.5 |

| 1981 | 0.5 | 0.6 |

| 1980 | 1.4 | 1.3 |

| 1979 | 4.2 | 4.3 |

| 1978 | 3.0 | 3.1 |

| 1977 | 3.3 | 3.5 |

| 1976 | 4.9 | 4.5 |

| 1975 | -0.9 | -0.9 |

| 1974 | 0.9 | 1.0 |

| 1973 | 4.8 | 5.0 |

| 1972 | 4.3 | 4.3 |

| 1971 | 3.1 | 3.0 |

| 1970 | NA | NA |

Source: Statistisches Bundesamt Deutschland (Destatis)

https://www.destatis.de/EN/PressServices/Press/pr/2014/02/PE14_048_811.html

https://www.destatis.de/EN/PressServices/Press/pr/2013/08/PE13_278_811.html https://www.destatis.de/EN/PressServices/Press/pr/2013/11/PE13_381_811.html

https://www.destatis.de/EN/PressServices/Press/pr/2014/01/PE14_016_811.html

https://www.destatis.de/EN/PressServices/Press/pr/2014/05/PE14_167_811.html

https://www.destatis.de/EN/PressServices/Press/pr/2014/09/PE14_306_811.html

The Flash Germany Composite Output Index of the Markit Flash Germany PMI®, combining manufacturing and services, decreased from 55.7 in Jul to 54.9 in Aug. The index of manufacturing output reached 51.9 in Aug, decreasing from 53.8 in Jul, while the index of services decreased to 56.4 in Aug from 56.4 in Jul. The overall Flash Germany Manufacturing PMI® decreased from 52.4 in Jul to 52.0 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/a2f4ac116982481f8ce1820b6658581d). New export work volumes increased. Oliver Kolodseike, Economist at Markit, finds continuing expansion of Germany’s private sector with strength in new orders and output (http://www.markiteconomics.com/Survey/PressRelease.mvc/a2f4ac116982481f8ce1820b6658581d). The Markit Germany Composite Output Index of the Markit Germany Services PMI®, combining manufacturing and services with close association with Germany’s GDP, decreased from 55.7 in Jul to 53.7 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/9b02b77969fb43eea3d19b1500330fc0). Oliver Kolodseike, Senior Economist at Markit and author of the report, finds slowing private output (http://www.markiteconomics.com/Survey/PressRelease.mvc/9b02b77969fb43eea3d19b1500330fc0). The Germany Services Business Activity Index decreased from 56.7 in Jul to 54.9 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/9b02b77969fb43eea3d19b1500330fc0). The Markit/BME Germany Purchasing Managers’ Index® (PMI®), showing close association with Germany’s manufacturing conditions, decreased from 52.4 in Jul to 51.4 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/d2b45f292bc14215a67c279a2a5d13b1). New export orders increased for the thirteenth consecutive month. Oliver Kolodseike, Senior Economist at Markit and author of the report, finds slowing output and new orders (http://www.markiteconomics.com/Survey/PressRelease.mvc/d2b45f292bc14215a67c279a2a5d13b1).Table DE provides the country data table for Germany.

Table DE, Germany, Economic Indicators

| GDP | IIQ2014 -0.2 ∆%; II/Q2014/IIQ2013 ∆% 0.8 2013/2012: 0.1% GDP ∆% 1970-2013 Blog 8/26/12 5/27/12 11/25/12 2/24/13 5/19/13 5/26/13 8/18/13 8/25/13 11/17/13 11/24/13 1/26/14 2/16/14 3/2/14 5/18/14 5/25/14 8/17/14 9/7/14 |

| Consumer Price Index | Aug month NSA ∆%: 0.0 |

| Producer Price Index | Aug month ∆%: -0.1 NSA, minus 0.1 CSA |

| Industrial Production | MFG Jul month CSA ∆%: 2.6 |

| Machine Orders | MFG Jul month ∆%: 4.6 |

| Retail Sales | Jul Month ∆% 0.7 12-Month ∆% -1.4 Blog 8/31/14 |

| Employment Report | Unemployment Rate SA Jul 4.9% |

| Trade Balance | Exports Jul 12-month NSA ∆%: 8.5 Blog 9/14/14 |

Links to blog comments in Table DE:

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

9/7/14 http://cmpassocregulationblog.blogspot.com/2014/09/competitive-monetary-policy-and.html

8/31/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitical-and-financial-risks.html

8/17/2014 http://cmpassocregulationblog.blogspot.com/2014/08/weakening-world-economic-growth.html

5/25/14 http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html

5/18/14 http://cmpassocregulationblog.blogspot.com/2014/05/world-inflation-waves-squeeze-of.html

3/2/14 http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

1/26/14 http://cmpassocregulationblog.blogspot.com/2014/01/capital-flows-exchange-rates-and.html

11/24/13 http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-zero-interest-rates-world.html

11/17/13 http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-unwinding-monetary-policy.html

8/25/13 http://cmpassocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html

8/18/13 http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html

VF France. Table VF-FR provides growth rates of GDP of France with the estimates of Institut National de la Statistique et des Études Économiques (INSEE). The long-term rate of GDP growth of France from IVQ1949 to IVQ2012 is quite high at 3.2 percent. France’s growth rates were quite high in the four decades of the 1950s, 1960, 1970s and 1980s with an average growth rate of 4.0 percent compounding the average rates in the decades and discounting to one decade. The growth impulse diminished with 2.0 percent in the 1990s and 1.8 percent from 2000 to 2007. The average growth rate from 2000 to 2012, using fourth quarter data, is 1.1 percent because of the sharp impact of the global recession from IVQ2007 to IIQ2009. The growth rate from 2000 to 2012 is 1.1 percent. Cobet and Wilson (2002) provide estimates of output per hour and unit labor costs in national currency and US dollars for the US, Japan and Germany from 1950 to 2000 (see Pelaez and Pelaez, The Global Recession Risk (2007), 137-44). The average yearly rate of productivity change from 1950 to 2000 was 2.9 percent in the US, 6.3 percent for Japan and 4.7 percent for Germany while unit labor costs in USD increased at 2.6 percent in the US, 4.7 percent in Japan and 4.3 percent in Germany. From 1995 to 2000, output per hour increased at the average yearly rate of 4.6 percent in the US, 3.9 percent in Japan and 2.6 percent in Germany while unit labor costs in US fell at minus 0.7 percent in the US, 4.3 percent in Japan and 7.5 percent in Germany. There was increase in productivity growth in the G7 in Japan and France in the second half of the 1990s but significantly lower than the acceleration of 1.3 percentage points per year in the US. Lucas (2011May) compares growth of the G7 economies (US, UK, Japan, Germany, France, Italy and Canada) and Spain, finding that catch-up growth with earlier rates for the US and UK stalled in the 1970s.

Table VF-FR, France, Average Growth Rates of GDP Fourth Quarter, 1949-2013

| Period | Average ∆% |

| 1949-2013 | 3.2 |

| 2007-2013 | 0.3 |

| 2000-2013 | 1.1 |

| 2000-2012 | 1.1 |

| 2000-2007 | 1.8 |

| 1990-1999 | 2.0 |

| 1980-1989 | 2.6 |

| 1970-1979 | 3.7 |

| 1960-1969 | 5.7 |

| 1950-1959 | 4.2 |

Source: Institut National de la Statistique et des Études Économiques

http://www.insee.fr/en/themes/info-rapide.asp?id=26&date=20140814

The Markit Flash France Composite Output Index increased from 49.4 in Jul to 50.0 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/0fc100060e304796884a24175e8066c0). Jack Kennedy, Senior Economist at Markit and author of the report, finds continuing weak performance (http://www.markiteconomics.com/Survey/PressRelease.mvc/0fc100060e304796884a24175e8066c0). The Markit France Composite Output Index, combining services and manufacturing with close association with French GDP, increased from 49.4 in Jul to 49.5 in Aug, indicating marginal contraction (http://www.markiteconomics.com/Survey/PressRelease.mvc/72adfd6d1e164ed2900cda30dff94717). Jack Kennedy, Senior Economist at Markit and author of the France Services PMI®, finds weak demand (http://www.markiteconomics.com/Survey/PressRelease.mvc/72adfd6d1e164ed2900cda30dff94717). The Markit France Services Activity index decreased from 50.4 in Jul to 50.3 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/72adfd6d1e164ed2900cda30dff94717). The Markit France Manufacturing Purchasing Managers’ Index® decreased to 46.9 in Aug from 47.8 in Jul (http://www.markiteconomics.com/Survey/PressRelease.mvc/45f4c75be3eb49f6a552c9a33232cabd). Jack Kennedy, Senior Economist at Markit and author of the France Manufacturing PMI®, finds deteriorating conditions because of weakness in new orders (http://www.markiteconomics.com/Survey/PressRelease.mvc/45f4c75be3eb49f6a552c9a33232cabd). Table FR provides the country data table for France.

Table FR, France, Economic Indicators

| CPI | Aug month ∆% 0.4 |

| PPI | Jul month ∆%: -0.3 Blog 8/31/14 |

| GDP Growth | IIQ2014/IQ2014 ∆%:0.0 |

| Industrial Production | Jul ∆%: |

| Consumer Spending | Manufactured Goods |

| Employment | Unemployment Rate: IIQ2014 9.7% |

| Trade Balance | Jul Exports ∆%: month -1.5, 12 months -1.3 Jul Imports ∆%: month -1.3, 12 months 0.0 Blog 9/14/14 |

| Confidence Indicators | Historical average 100 Aug Mfg Business Climate 96.0 Blog 8/31/14 |

Links to blog comments in Table FR:

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

9/7/14 http://cmpassocregulationblog.blogspot.com/2014/09/competitive-monetary-policy-and.html

8/31/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitical-and-financial-risks.html

8/17/2014 http://cmpassocregulationblog.blogspot.com/2014/08/weakening-world-economic-growth.html

8/3/14 http://cmpassocregulationblog.blogspot.com/2014/08/fluctuating-financial-valuations.html

6/29/14 http://cmpassocregulationblog.blogspot.com/2014/06/financial-indecision-mediocre-cyclical.html

5/18/14 http://cmpassocregulationblog.blogspot.com/2014/05/world-inflation-waves-squeeze-of.html

4/6/14 http://cmpassocregulationblog.blogspot.com/2014/04/interest-rate-risks-twenty-eight.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

12/29/13 http://cmpassocregulationblog.blogspot.com/2013/12/collapse-of-united-states-dynamism-of.html

11/17/13 http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-unwinding-monetary-policy.html

9/29/13 http://cmpassocregulationblog.blogspot.com/2013/09/mediocre-and-decelerating-united-states.html

6/30/13 http://cmpassocregulationblog.blogspot.com/2013/06/tapering-quantitative-easing-policy-and.html

5/19/13 http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.html

VG Italy. Table VG-IT provides percentage changes in a quarter relative to the same quarter a year earlier of Italy’s expenditure components in chained volume measures. GDP has been declining at sharper rates from minus 0.6 percent in IVQ2011 to minus 2.9 percent in IVQ2012, minus 2.4 percent in IQ2013, minus 2.2 percent in IIQ2013 and minus 1.9 percent in IIIQ2013. GDP fell 0.9 percent in IVQ2013 relative to a year earlier. GDP fell 0.4 percent in IQ2014 relative to a year earlier and decreased 0.2 percent in IIQ2014 relative to a year earlier. The aggregate demand components of consumption and gross fixed capital formation (GFCF) have been declining at faster rates. The rates of decline of GDP, consumption and GFCF were somewhat milder in IIIQ2013 and IVQ2013 than in IQ2013 and the final three quarters of 2012. Consumption fell 0.3 percent in IQ2014 and GFCF fell 2.1 percent. In IIQ2014, consumption increased 0.2 percent relative to a year earlier and GFCF fell 2.1 percent.

Table VG-IT, Italy, GDP and Expenditure Components, Chained Volume Measures, Quarter ∆% on Same Quarter Year Earlier

| GDP | Imports | Consumption | GFCF | Exports | |

| 2014 | |||||

| IIQ | -0.2 | 2.0 | 0.2 | -2.1 | 1.9 |

| IQ | -0.4 | 0.9 | -0.3 | -1.2 | 2.5 |

| 2013 | |||||

| IVQ | -0.9 | -0.1 | -1.1 | -2.8 | 1.0 |

| IIIQ | -1.9 | -2.0 | -1.7 | -4.6 | -0.4 |

| IIQ | -2.2 | -4.4 | -2.9 | -4.8 | 0.1 |

| IQ | -2.4 | -5.0 | -3.0 | -6.1 | -0.8 |

| 2012 | |||||

| IVQ | -2.9 | -6.5 | -4.0 | -7.3 | 0.9 |

| IIIQ | -2.6 | -7.1 | -4.0 | -8.3 | 2.0 |

| IIQ | -2.4 | -7.0 | -3.4 | -8.5 | 2.3 |

| IQ | -1.7 | -7.9 | -3.2 | -8.1 | 3.0 |

| 2011 | |||||

| IVQ | -0.6 | -6.8 | -1.9 | -3.8 | 3.5 |

| IIIQ | 0.4 | 0.6 | -1.1 | -2.4 | 6.1 |

| IIQ | 1.1 | 3.6 | 0.3 | -1.0 | 7.5 |

| IQ | 1.4 | 9.1 | 0.6 | 0.6 | 11.0 |

| 2010 | |||||

| IVQ | 2.2 | 15.6 | 1.0 | 1.3 | 13.4 |

| IIIQ | 1.8 | 13.2 | 1.2 | 2.3 | 12.1 |

| IIQ | 1.8 | 13.4 | 0.8 | 1.0 | 12.0 |

| IQ | 0.9 | 7.0 | 1.0 | -2.4 | 7.1 |

| 2009 | |||||

| IVQ | -3.5 | -6.3 | 0.2 | -8.2 | -9.3 |

| IIIQ | -5.0 | -12.2 | -0.8 | -12.6 | -16.4 |

| IIQ | -6.6 | -17.9 | -1.4 | -13.6 | -21.4 |

| IQ | -6.9 | -17.2 | -1.8 | -12.4 | -22.8 |

| 2008 | |||||

| IVQ | -3.0 | -8.2 | -0.9 | -8.3 | -10.3 |

| IIIQ | -1.9 | -5.0 | -0.8 | -4.5 | -3.9 |

| IIQ | -0.2 | -0.1 | -0.3 | -1.5 | 0.4 |

| IQ | 0.5 | 1.7 | 0.1 | -1.0 | 2.9 |

GFCF: Gross Fixed Capital Formation

Source: Istituto Nazionale di Statistica

http://www.istat.it/it/archivio/130505

The Markit/ADACI Business Activity Index decreased from 52.8 in Jul to 49.8 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/4eb69c87a1504ec58672dbdbda1c4eb1). Phil Smith, Economist at Markit and author of the Italy Services PMI®, finds services with contracting with slowing manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/4eb69c87a1504ec58672dbdbda1c4eb1). The Markit/ADACI Purchasing Managers’ Index® (PMI®), decreased from 51.9 in Jul to 49.8 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/23313b9fd48142e89e95bf5cf3eae536). Growth of new export orders was strong at slower rate. Phil Smith, Economist at Markit and author of the Italian Manufacturing PMI®, finds deteriorating conditions in manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/23313b9fd48142e89e95bf5cf3eae536). Table IT provides the country data table for Italy.

Table IT, Italy, Economic Indicators

| Consumer Price Index | Aug month ∆%: 0.2 |

| Producer Price Index | Jun month ∆%: 0.1 Blog 8/3/14 |

| GDP Growth | IIQ2014/IQ2014 SA ∆%: minus 0.2 |

| Labor Report | Jul 2014 Participation rate 63.7% Employment ratio 55.6% Unemployment rate 12.6% Youth Unemployment 42.9% Blog 8/31/14 |

| Industrial Production | Jul month ∆%: -1.0 |

| Retail Sales | Jun month ∆%: -0.7 Jun 12-month ∆%: -0.5 Blog 8/31/14 |

| Business Confidence | Mfg Aug 95.7, Apr 99.6 Construction Aug 77.0, Apr 75.1 Blog 8/31/14 |

| Trade Balance | Balance Jul SA €2821 million versus Jun €2596 |

Links to blog comments in Table IT:

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

8/31/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitical-and-financial-risks.html

8/10/14 http://cmpassocregulationblog.blogspot.com/2014/08/volatility-of-valuations-of-risk_10.html

8/3/14 http://cmpassocregulationblog.blogspot.com/2014/08/fluctuating-financial-valuations.html

7/20/14 http://cmpassocregulationblog.blogspot.com/2014/07/financial-irrational-exuberance.html

6/15/2014 http://cmpassocregulationblog.blogspot.com/2014/06/financialgeopolitical-risks-recovery.html

5/18/14 http://cmpassocregulationblog.blogspot.com/2014/05/world-inflation-waves-squeeze-of.html

3/16/2014 http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

12/15/13 http://cmpassocregulationblog.blogspot.com/2013/12/theory-and-reality-of-secular.html

11/17/13 http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-unwinding-monetary-policy.html

9/15/13 http://cmpassocregulationblog.blogspot.com/2013/09/recovery-without-hiring-ten-million.html

8/11/13 http://cmpassocregulationblog.blogspot.com/2013/08/recovery-without-hiring-loss-of-full.html

6/16/13 http://cmpassocregulationblog.blogspot.com/2013/06/recovery-without-hiring-seven-million.html

3/17/13 http://cmpassocregulationblog.blogspot.com/2013/03/recovery-without-hiring-ten-million.html

Exports and imports of Italy and monthly growth rates SA are in Table VG-1. There have been significant fluctuations. Seasonally adjusted exports decreased 1.6 percent in Jul 2014 while imports decreased 2.5 percent. The SA trade balance improved from surplus of €2596 million in Jun 2014 to surplus of €2821 million in Jul 2014.

Table VG-1, Italy, Exports, Imports and Trade Balance SA Million Euros and Month SA ∆%

| Exports | ∆% | Imports | ∆% | Balance | |

| 2012 | |||||

| IQ | 96,295 | 1.0 | 97,029 | -0.7 | -734 |

| IIQ | 97,761 | 1.5 | 96,127 | -0.9 | 1,634 |

| IIIQ | 99,247 | 1.5 | 96,091 | 0.0 | 3,156 |

| IVQ | 98,002 | -1.3 | 92,835 | -3.4 | 5,167 |

| 2013 | |||||

| IQ | 97,691 | -0.3 | 91,576 | -1.4 | 6,115 |

| 2Q | 97,825 | 0.1 | 89,167 | -2.6 | 8,658 |

| 3Q | 98,069 | 0.2 | 91,158 | 2.2 | 6,911 |

| 4Q | 98,705 | 0.6 | 89,132 | -2.2 | 9,573 |

| 2014 | |||||

| IQ | 98,956 | 0.3 | 88,325 | -0.9 | 10,631 |

| 2Q | 99,497 | 0.5 | 89,479 | 1.3 | 10,018 |

| 2012 | |||||

| Jun | 33,029 | 2.4 | 31,951 | 4.4 | 1,078 |

| Aug | 33,561 | 1.6 | 33,027 | 3.4 | 534 |

| Sep | 32,657 | -2.7 | 31,113 | -5.8 | 1,544 |

| Oct | 32,815 | 0.5 | 31,404 | 0.9 | 1,411 |

| Nov | 32,961 | 0.4 | 31,008 | -1.3 | 1,953 |

| Dec | 32,226 | -2.2 | 30,423 | -1.9 | 1,803 |

| 2013 | |||||

| Jan | 33,060 | 2.6 | 31,234 | 2.7 | 1,826 |

| Feb | 32,096 | -2.9 | 30,112 | -3.6 | 1,984 |

| Mar | 32,535 | 1.4 | 30,230 | 0.4 | 2,305 |

| Apr | 32,409 | -0.4 | 29,831 | -1.3 | 2,578 |

| May | 32,538 | 0.4 | 29,553 | -0.9 | 2,985 |

| Jun | 32,878 | 1.0 | 29,783 | 0.8 | 3,095 |

| Jul | 32,422 | -1.4 | 30,090 | 1.0 | 2,332 |

| Aug | 32,715 | 0.9 | 30,463 | 1.2 | 2,252 |

| Sep | 32,932 | 0.7 | 30,605 | 0.5 | 2,327 |

| Oct | 32,737 | -0.6 | 29,793 | -2.7 | 2,944 |

| Nov | 32,161 | -1.8 | 29,113 | -2.3 | 3,048 |

| Dec | 33,807 | 5.1 | 30,226 | 3.8 | 3,581 |

| 2014 | |||||

| Jan | 33,284 | -1.5 | 29,609 | -2.0 | 3,675 |

| Feb | 32,960 | -1.0 | 29,469 | -0.5 | 3,491 |

| Mar | 32,712 | -0.8 | 29,247 | -0.8 | 3,465 |

| Apr | 32,823 | 0.3 | 29,134 | -0.4 | 3,689 |

| May | 33,577 | 2.3 | 29,844 | 2.4 | 3,733 |

| Jun | 33,097 | -1.4 | 30,501 | 2.2 | 2,596 |

| Jul | 32,553 | -1.6 | 29,732 | -2.5 | 2,821 |

Source: Istituto Nazionale di Statistica

http://www.istat.it/it/archivio/131450

Italy’s trade account not seasonally adjusted is in Table VG-2. Values are different because the data are original and not adjusted. Exports increased 1.1 percent in the 12 months ending in Jul 2014 while imports decreased 1.4 percent with actual trade surplus of €6857 million. Twelve-month rates of growth picked up again in Aug 2011 with 15.2 percent for exports and 12.6 percent for imports. In Sep 2011, exports grew 10.2 percent relative to a year earlier while imports grew only 3.6 percent. In Oct 2011, exports grew 4.5 percent while imports fell 0.2 percent. In Nov 2011, exports grew 6.5 percent in 12 months while imports grew 0.5 percent. Exports continued to growth of 7.9 percent in the 12 months ending in Aug 2012 while imports fell 1.8 percent. The actual or not seasonally adjusted trade balance deficit fell from €2948 million in Aug 2011 to surplus of €1407 million in Dec 2011 but turned into deficit of €4691 million in Jan 2012. The deficit improved to lower deficit of €1311 million in Feb 2012 and surplus of €1831 million in Mar 2012, returning to deficit of €421 million in Apr and surplus of €833 million in May. In Jun 2012, the actual surplus was €2681 million and then €4673 million in Jul 2012, which was the highest in 2012, but deteriorated to actual deficit of €535 million in Aug 2012. Exports fell 20.9 percent and imports 22.1 percent during the global recession in 2009. Growth of exports was 12.2 percent in the 12 months ending in Oct 2012 while imports increased 1.4 percent, increasing the trade surplus to €2337 million. The trade surplus was €2314 million in Dec 2012 with growth of exports of minus 4.5 percent in 12 months while imports fell 7.8 percent. The trade balance deteriorated to deficit of €1810 million in Jan 2013 even with growth of exports of 8.9 percent in 12 months while imports fell 1.4 percent. The trade balance returned to surplus of €1045 million in Feb 2013 with decline of exports by 2.9 percent and decrease of imports by 9.9 percent. The surplus widened to €3081 million in Mar 2013 with exports declining 6.1 percent and imports falling 10.1 percent. The surplus shrank to €2006 million in Apr 2013 with growth of exports of 4.4 and decline of imports of 3.5 percent. The surplus increased to €3893 million in May 2013 with declines of exports of 1.9 percent and of imports of 10.8 percent. The surplus declined to €3542 million in Jun 2013 with decline of exports of 3.3 percent in 12 months and of imports of 6.3 percent.

Table VG-2, Italy, Exports, Imports and Trade Balance NSA Million Euros and Year-on-Year ∆%

| Exports | ∆% | Imports | ∆% | Balance | |

| 2011 | 375,904 | 11.4 | 401,428 | 9.3 | -25,524 |

| 2012 | 390,182 | 3.8 | 380,292 | -5.3 | 9,890 |

| 2013 | 389,854 | -0.1 | 359,454 | -5.5 | 30,400 |

| 2011 | |||||

| IQ | 90,128 | 18.1 | 103,760 | 21.7 | -13,632 |

| IIQ | 97,274 | 13.4 | 104,303 | 22.4 | -7,029 |

| IIIQ | 92,567 | 9.8 | 96,138 | 12.8 | -3,571 |

| IVQ | 95,935 | 5.5 | 97,227 | -2.7 | -1,292 |

| 2012 | |||||

| IQ | 95,398 | 5.8 | 99,568 | -4.0 | -4,170 |

| IIQ | 100,172 | 3.0 | 97,079 | -6.9 | 3,093 |

| IIIQ | 94,938 | 2.6 | 90,670 | -5.7 | 4,268 |

| IVQ | 99,674 | 3.9 | 92,975 | -4.4 | 6,699 |

| 2013 | |||||

| IQ | 94,695 | -0.7 | 92,379 | -7.2 | 2,316 |

| IIQ | 99,724 | -0.4 | 90,283 | -7.0 | 9,441 |

| IIIQ | 95,094 | 0.2 | 87,209 | -3.8 | 7,885 |

| IVQ | 100,341 | 0.7 | 89,584 | -3.6 | 10,758 |

| 2014 | |||||

| IQ | 96,105 | 1.5 | 89,228 | -3.4 | 6,877 |

| IIQ | 100,815 | 1.1 | 90,344 | 0.1 | 10,471 |

| 2012 | |||||

| Jul | 37,190 | 5.3 | 32,517 | -4.5 | 4,673 |

| Aug | 26,166 | 7.9 | 26,701 | -1.8 | -535 |

| Sep | 31,583 | -4.3 | 31,452 | -9.8 | 131 |

| Oct | 36,037 | 12.2 | 33,700 | 1.4 | 2,337 |

| Nov | 33,688 | 3.8 | 31,641 | -7.0 | 2,047 |

| Dec | 29,948 | -4.5 | 27,634 | -7.8 | 2,314 |

| 2013 | |||||

| Jan | 29,913 | 8.9 | 31,723 | -1.4 | -1,810 |

| Feb | 30,884 | -2.9 | 29,839 | -9.9 | 1,045 |

| Mar | 33,897 | -6.1 | 30,816 | -10.1 | 3,081 |

| Apr | 31,878 | 4.4 | 29,873 | -3.5 | 2,006 |

| May | 34,576 | -1.9 | 30,682 | -10.8 | 3,893 |

| Jun | 33,270 | -3.3 | 29,728 | -6.3 | 3,542 |

| Jul | 38,136 | 2.5 | 32,156 | -1.1 | 5,980 |

| Aug | 24,741 | -5.4 | 23,667 | -11.4 | 1,074 |

| Sep | 32,217 | 2.0 | 31,386 | -0.2 | 831 |

| Oct | 36,330 | 0.8 | 32,271 | -4.2 | 4,060 |

| Nov | 32,538 | -3.4 | 29,450 | -6.9 | 3,088 |

| Dec | 31,473 | 5.1 | 27,863 | 0.8 | 3,610 |

| 2014 | |||||

| Jan | 29,988 | 0.2 | 29,626 | -6.6 | 362 |

| Feb | 31,815 | 3.0 | 29,186 | -2.2 | 2,629 |

| Mar | 34,302 | 1.2 | 30,417 | -1.3 | 3,886 |

| Apr | 32,512 | 2.0 | 28,995 | -2.9 | 3,517 |

| May | 34,676 | 0.3 | 30,958 | 0.9 | 3,718 |

| Jun | 33,626 | 1.1 | 30,390 | 2.2 | 3,236 |

| Jul | 38,555 | 1.1 | 31,698 | -1.4 | 6,857 |

Source: Istituto Nazionale di Statistica

http://www.istat.it/it/archivio/131450

Growth rates of Italy’s trade and major products are in Table VG-3 for the period Jan-Jul 2014 relative to Jan-Jul 2013. Growth rates of cumulative imports relative to a year earlier are negative for energy with minus 17.6 percent. Exports of durable goods grew 2.5 percent and exports of capital goods increased 3.3 percent. The higher rate of growth of exports of 1.3 percent in Jan-Jul 2014/Jan-Jul 2013 relative to that of imports of minus 1.7 percent may reflect weak demand in Italy with GDP declining during nine consecutive quarters from IIIQ2011 through IIIQ2013 together with softening commodity prices. GDP increased marginally 0.1 percent in IVQ2013 and fell 0.2 percent in IIQ2014.

Table VG-3, Italy, Exports and Imports % Share of Products in Total and ∆%

| Exports | Exports | Imports | Imports | |

| Consumer | 31.0 | 3.3 | 27.3 | 2.2 |

| Durable | 6.0 | 2.5 | 2.9 | 7.6 |

| Non-Durable | 25.1 | 3.5 | 24.4 | 1.5 |

| Capital Goods | 32.3 | 3.3 | 20.3 | 4.7 |

| Inter- | 32.3 | -0.5 | 32.5 | 0.9 |

| Energy | 4.4 | -15.6 | 19.9 | -17.6 |

| Total ex Energy | 95.6 | 2.0 | 80.1 | 2.3 |

| Total | 100.0 | 1.3 | 100.0 | -1.7 |

Note: % Share for 2012 total trade.

Source: Istituto Nazionale di Statistica

http://www.istat.it/it/archivio/131450

Table VG-4 provides Italy’s trade balance by product categories in Jul 2014 and cumulative Jan-Jul 2014. Italy’s trade balance excluding energy, generated surplus of 10,845 million in Jul 2014 and €50,883 million cumulative in Jan-Jul 2014 but the energy trade balance created deficit of €3988 million in Jul 2014 and cumulative €26,679 million in Jan-Jul 2014. The overall surplus in Jul 2014 was €6857 million with cumulative surplus of €24,205 million in Jan-Jul 2014. Italy has significant competitiveness in various economic activities in contrast with some other countries with debt difficulties.

Table VG-4, Italy, Trade Balance by Product Categories, € Millions

| Jul 2014 | Cumulative Jan-Jul 2014 | |

| Consumer Goods | 3,271 | 14,126 |

| Durable | 1,346 | 7,560 |

| Nondurable | 1,925 | 6,566 |

| Capital Goods | 5,946 | 32,193 |

| Intermediate Goods | 1,628 | 4,564 |

| Energy | -3,988 | -26,679 |

| Total ex Energy | 10,845 | 50,883 |

| Total | 6,857 | 24,205 |

Source: Istituto Nazionale di Statistica

http://www.istat.it/it/archivio/131450

Professors Ricardo Caballero and Francesco Giavazzi (2012Jan15) find that the resolution of the European sovereign crisis with survival of the euro area would require success in the restructuring of Italy. Growth of the Italian economy would ensure that success. A critical problem is that the common euro currency prevents Italy from devaluing the exchange rate to parity or the exchange rate that would permit export growth to promote internal economic activity, which could generate fiscal revenues for primary fiscal surpluses that ensure creditworthiness. Fiscal consolidation and restructuring are important but of long-term gestation. Immediate growth of the Italian economy would consolidate the resolution of the sovereign debt crisis. Caballero and Giavazzi (2012Jan15) argue that 55 percent of the exports of Italy are to countries outside the euro area such that devaluation of 15 percent would be effective in increasing export revenue. Newly available data in Table VG-5 providing Italy’s trade with regions and countries supports the argument of Caballero and Giavazzi (2012Jan15). Italy’s exports to the European Monetary Union (EMU), or euro area, are only 39.8 percent of the total in Jul 2014. Exports to the non-European Union area with share of 46.3 percent in Italy’s total exports are growing at minus 1.9 percent in Jan-Jul 2014 relative to Jan-Jul 2013 while those to EMU are growing at 2.8 percent.

Table VG-5, Italy, Exports and Imports by Regions and Countries, % Share and 12-Month ∆%

| Jul 2014 | Exports | ∆% Jan-Jul 2014/ Jan-Jul 2013 | Imports | ∆% Jan-Jul 2014/ Jan-Jul 2013 |

| EU | 53.7 | 3.9 | 55.3 | 0.9 |

| EMU 18 | 39.8 | 2.8 | 44.3 | -0.1 |

| France | 10.8 | -0.9 | 8.4 | 0.5 |

| Germany | 12.4 | 4.5 | 14.7 | 2.7 |

| Spain | 4.4 | 4.7 | 4.5 | 3.2 |

| UK | 5.0 | 5.5 | 2.7 | 2.4 |

| Non EU | 46.3 | -1.9 | 44.7 | -4.7 |

| Europe non EU | 13.0 | -9.0 | 12.1 | -4.6 |

| USA | 6.9 | 9.5 | 3.2 | 7.6 |

| China | 2.5 | 7.9 | 6.4 | 5.0 |

| OPEC | 6.0 | -7.9 | 8.1 | -33.3 |

| Total | 100.0 | 1.3 | 100.0 | -1.7 |

Notes: EU: European Union; EMU: European Monetary Union (euro zone)

Source: Istituto Nazionale di Statistica

http://www.istat.it/it/archivio/131450

Table VG-6 provides Italy’s trade balance by regions and countries. Italy had trade surplus of €1312 million with the 17 countries of the euro zone (EMU 17) in Jul 2014 and cumulative surplus of €1657 million in Jan-Jul 2014. Depreciation to parity could permit greater competitiveness in improving the trade surplus of €3087 million in Jan-Jul 2014 with Europe non-European Union, the trade surplus of €9891 million with the US and the trade surplus with non-European Union of €7279 million in Jan-Jul 2014. There is significant rigidity in the trade deficit in Jan-Jul 2014 of €8253 million with China. There is a trade surplus of €626 million with members of the Organization of Petroleum Exporting Countries (OPEC). Higher exports could drive economic growth in the economy of Italy that would permit less onerous adjustment of the country’s fiscal imbalances, raising the country’s credit rating.

Table VG-6, Italy, Trade Balance by Regions and Countries, Millions of Euro

| Regions and Countries | Trade Balance Jul 2014 Millions of Euro | Trade Balance Cumulative Jan-Jul 2014 Millions of Euro |

| EU | 3,312 | 11,209 |

| EMU 18 | 1,312 | 1,657 |

| France | 1,245 | 7,473 |

| Germany | 100 | -1,850 |

| Spain | 266 | 767 |

| UK | 1,208 | 6,234 |

| Non EU | 3,545 | 12,995 |

| Europe non EU | 1,317 | 3,087 |

| USA | 1,885 | 9,891 |

| China | -1,510 | -8,253 |

| OPEC | 163 | 626 |

| Total | 6,857 | 24,205 |

Notes: EU: European Union; EMU: European Monetary Union (euro zone)

Source: Istituto Nazionale di Statistica

http://www.istat.it/it/archivio/131450

VH United Kingdom. Annual data in Table VH-UK show the strong impact of the global recession in the UK with decline of GDP of 5.2 percent in 2009 after dropping 0.8 percent in 2008. Recovery of 1.7 percent in 2010 is relatively low in comparison with annual growth rates in 2007 and earlier years. Growth was only 1.1 percent in 2011 and 0.3 percent in 2012. Growth increased to 1.7 percent in 2013. The bottom part of Table VH-UK provides average growth rates of UK GDP since 1948. The UK economy grew at 2.6 percent per year on average between 1948 and 2013, which is relatively high for an advanced economy. The growth rate of GDP between 2000 and 2007 is higher at 3.0 percent. Growth in the current cyclical expansion has been only at 1.2 percent as advanced economies struggle with weak internal demand and world trade. GDP in 2013 was lower by 1.4 percent relative to 2007.

Table VH-UK, UK, Gross Domestic Product, ∆%

| ∆% on Prior Year | |

| 1998 | 3.6 |

| 1999 | 2.9 |

| 2000 | 4.4 |

| 2001 | 2.2 |

| 2002 | 2.3 |

| 2003 | 3.9 |

| 2004 | 3.2 |

| 2005 | 3.2 |

| 2006 | 2.8 |

| 2007 | 3.4 |

| 2008 | -0.8 |

| 2009 | -5.2 |

| 2010 | 1.7 |

| 2011 | 1.1 |

| 2012 | 0.3 |

| 2013 | 1.7 |

| Average Growth Rates ∆% per Year | |

| 1948-2013 | 2.6 |

| 1950-1959 | 2.7 |

| 1960-1969 | 3.3 |

| 1970-1979 | 2.5 |

| 1980-1989 | 3.2 |

| 1990-1999 | 2.9 |

| 2000-2007 | 3.0 |

| 2007-2012* | -3.0 |

| 2007-2013* | -1.3 |

| 2000-2013 | 1.5 |

*Absolute change from 2007 to 2012 an from 2007 to 2013

Source: UK Office for National Statistics

http://www.ons.gov.uk/ons/rel/naa2/quarterly-national-accounts/q1-2014/index.html

The Business Activity Index of the Markit/CIPS UK Services PMI® increased from 59.1 in Jul to 60.5 in Aug (http://www.markiteconomics.com/Survey/PressRelease.mvc/c376e02b9014499a8c402bdadf5f7451). Chris Williamson, Chief Economist at Markit, finds the combined indices consistent with the UK economy growing at around 0.8 percent in IIIQ2014 if activity continues at current rates (http://www.markiteconomics.com/Survey/PressRelease.mvc/c376e02b9014499a8c402bdadf5f7451). The Markit/CIPS UK Manufacturing Purchasing Managers’ Index® (PMI®) decreased to 52.5 in Aug from 54.8 in Jul (http://www.markiteconomics.com/Survey/PressRelease.mvc/491cc76cd6bf47f7b8f99e39c5be6fe1). New export orders increased for the seventeenth consecutive month from the US, Canada, Asia and the Middle East. Rob Dobson, Senior Economist at Markit that compiles the Markit/CIPS Manufacturing PMI®, finds that manufacturing conditions are slowing (http://www.markiteconomics.com/Survey/PressRelease.mvc/491cc76cd6bf47f7b8f99e39c5be6fe1). Table UK provides the economic indicators for the United Kingdom.

Table UK, UK Economic Indicators

| CPI | Aug month ∆%: 0.4 |

| Output/Input Prices | Output Prices: Aug 12-month NSA ∆%: -0.3; excluding food, petroleum ∆%: 0.9 |

| GDP Growth | IIQ2014 prior quarter ∆% 0.8; year earlier same quarter ∆%: 3.2 |

| Industrial Production | Jul 2014/Jul 2013 ∆%: Production Industries 1.7; Manufacturing 2.2 |

| Retail Sales | Aug month ∆%: 0.4 |

| Labor Market | May-Jul Unemployment Rate: 6.2%; Claimant Count 2.9%; Earnings Growth 0.6% |

| GDP and the Labor Market | IIQ2014 Weekly Hours 103.8, GDP 100.2, Employment 103.7 IQ2008 =100 GDP IIQ14 100.2 IQ2008=100 Blog 8/17/14 |

| Trade Balance | Balance SA Jul minus ₤3348 million |

Links to blog comments in Table UK:

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

8/17/2014 http://cmpassocregulationblog.blogspot.com/2014/08/weakening-world-economic-growth.html

7/27/14 http://cmpassocregulationblog.blogspot.com/2014/07/world-inflation-waves-united-states.html

6/29/14 http://cmpassocregulationblog.blogspot.com/2014/06/financial-indecision-mediocre-cyclical.html

5/25/14 http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html

5/4/2014 http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html

4/6/14 http://cmpassocregulationblog.blogspot.com/2014/04/interest-rate-risks-twenty-eight.html

3/2/14 http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html

2/2/14 http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html

12/22/13 http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html

12/1/13 http://cmpassocregulationblog.blogspot.com/2013/12/exit-risks-of-zero-interest-rates-world.html

10/27/13 http://cmpassocregulationblog.blogspot.com/2013/10/twenty-eight-million-unemployed-or.html

9/29/13 http://cmpassocregulationblog.blogspot.com/2013/09/mediocre-and-decelerating-united-states.html

8/25/13 http://cmpassocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html

7/28/13 http://cmpassocregulationblog.blogspot.com/2013/07/duration-dumping-steepening-yield-curve.html

5/26/13 http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html

4/28/13 http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html

03/31/13 http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states.html

The UK Office for National Statistics provides important analysis of the relation of GDP and the labor market (http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q2-2014--august-quarterly-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q1-2014--may-gdp-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q1-2014--april-gdp-update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q4--march-gdp-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q4-2013--january-gdp-update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q3-2013--december-gdp-update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q3-2013--november-gdp-update/sum-nov-gdp.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q3-2013--october-gdp-update/sum-october-gdp.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q2--august-labour-market-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q1--may-labour-market-update/sum-may13-labour.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q1--may-labour-market-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2012-q4--january-gdp-update/sum-jan13.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2012-q4--february-labour-market-update/sum-2012-q4---february-labour-update.html). The UK economy grew 0.8 percent in IIQ2014 with output 0.2 percent above the level before the global recession in IQ2008 (http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q2-2014--august-quarterly-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q1-2014--april-gdp-update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q4--march-gdp-update/index.html

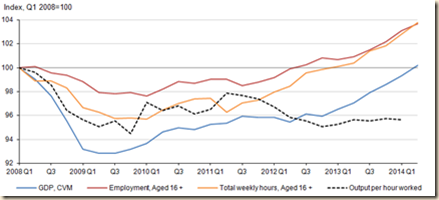

(http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q4-2013--january-gdp-update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q3-2013--december-gdp-update/sum-dec-gdp.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q3-2013--october-gdp-update/sum-october-gdp.html). Chart VH-1 of the UK Office for National Statistics (http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q1-2014--may-gdp-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q1-2014--april-gdp-update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q3-2013--october-gdp-update/sum-october-gdp.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q1--may-labour-market-update/sum-may13-labour.html) shows weakening output but relatively faster increases in employment and hours worked. Output growth and labor market improvement are converging.

Chart VH-1, UK, Employment Level Ages 16 and Over, Total Weekly Hours, GDP and Output per Hour, 2008-2014

Source: UK Office for National Statistics

Table VH-L1 of the UK Office for national Statistics provides the data for GDP and the labor market (http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q2-2014--august-quarterly-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q1-2014--may-gdp-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q1-2014--april-gdp-update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q4--march-gdp-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q4-2013--february-gdp-update/index.html

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q4-2013--january-gdp-update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q3-2013--december-gdp-update/sum-dec-gdp.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q3-2013--november-gdp-update/sum-nov-gdp.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q3-2013--october-gdp-update/sum-october-gdp.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q2--august-labour-market update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q1--may-gdp-update/index.html http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/2013-q1--may-labour-market-update/sum-may13-labour.html) provides total weekly hours, output and employment quarterly from 2008 to 2013. Improving output has been accompanied recently by improvements in hours worked and employment. From IQ2008 to IIQ2014, employment increased 3.7 percent and hours worked 3.8 percent while GDP was 0.2 percent higher. In IIQ2014, GDP grew 0.8 percent relative to IQ2012 and 3.3 percent relative to IIQ2013 and is now 0.2 percent above the peak in IIQ2008 (http://www.ons.gov.uk/ons/rel/naa2/second-estimate-of-gdp/q2-2014/index.html).

Table VH-L1, UK, Indices of Quarterly Employment Ages 16 and Over, Total Hours Worked, GDP and Output per Hour, 2008-2014

| Index, Q1 2008 =100 | ||||

| GDP, CVM | Employment, Aged 16 + | Total weekly hours, Aged 16 + | Output per hour worked | |

| YBEZ | MGRZ | YBUS | LZVB | |

| 2008 Q1 | 100.0 | 100.0 | 100.0 | 100.0 |

| Q2 | 99.1 | 100.1 | 98.9 | 99.6 |

| Q3 | 97.6 | 99.6 | 98.9 | 98.6 |

| Q4 | 95.6 | 99.4 | 98.3 | 96.4 |

| 2009 Q1 | 93.2 | 98.9 | 96.7 | 95.7 |

| Q2 | 92.8 | 97.9 | 96.3 | 95.1 |

| Q3 | 92.8 | 97.8 | 95.8 | 95.6 |

| Q4 | 93.2 | 97.9 | 95.8 | 94.5 |

| 2010 Q1 | 93.7 | 97.6 | 95.7 | 97.1 |

| Q2 | 94.6 | 98.2 | 96.5 | 96.4 |

| Q3 | 95.0 | 98.9 | 97.0 | 96.8 |

| Q4 | 94.8 | 98.7 | 97.4 | 96.1 |

| 2011 Q1 | 95.3 | 99.0 | 97.4 | 96.5 |

| Q2 | 95.4 | 99.0 | 96.3 | 97.9 |

| Q3 | 95.9 | 98.5 | 97.1 | 97.7 |

| Q4 | 95.8 | 98.8 | 97.3 | 97.4 |

| 2012 Q1 | 95.8 | 99.2 | 98.0 | 96.7 |

| Q2 | 95.5 | 99.9 | 98.5 | 95.8 |

| Q3 | 96.1 | 100.2 | 99.6 | 95.6 |

| Q4 | 95.9 | 100.8 | 99.8 | 95.1 |

| 2013 Q1 | 96.5 | 100.7 | 100.1 | 95.3 |

| Q2 | 97.1 | 100.9 | 100.4 | 95.7 |

| Q2 | 97.9 | 101.5 | 101.4 | 95.6 |

| Q4 | 98.6 | 102.2 | 101.8 | 95.7 |

| 2014 Q1 | 99.3 | 103.1 | 102.8 | 95.7 |

| Q2 | 100.2 | 103.7 | 103.8 |

Source: UK Office for National Statistics

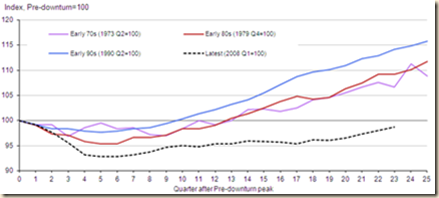

Chart VH-2 of the UK Office for National Statistics provides comparison of output performance during four cycles in the 1970s, 1980s, 1990s and 2000s. Output is indexed to the pre-recession peak. For example, the index for the current economic cycles is 100 for IQ2008. Output performance was stronger in the earlier economic cycles.

Chart VH-2, UK, Index of Output in Economic Cycles

UK Office for National Statistics

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q4-2013--january-gdp-update/index.html

Table VH-L2 provides output in the four economic cycles. Output increased 8.8 percent in the cycle of the early 1970s, 11.7 percent in the cycle of the 1980s and 15.8 percent in the cycle of the 1990s. Output is 1.3 percent below the pre-recession peak in IQ2008.

Table VH-L2, Index of Output in Economic Cycles, Pre-Contraction = 100

| Early 70s (1973 Q2=100) | Early 80s (1979 Q4=100) | Early 90s (1990 Q2=100) | Latest (2008 Q1=100) |

| ABMI | ABMI | ABMI | ABMI |

| 100.0 | 100.0 | 100.0 | 100.0 |

| 99.1 | 99.0 | 99.1 | 99.1 |

| 99.1 | 97.3 | 98.4 | 97.6 |

| 96.8 | 97.1 | 98.3 | 95.6 |

| 98.6 | 95.8 | 97.9 | 93.2 |

| 99.5 | 95.4 | 97.6 | 92.8 |

| 98.4 | 95.4 | 97.9 | 92.8 |

| 98.6 | 96.6 | 98.4 | 93.2 |

| 97.2 | 96.6 | 98.6 | 93.7 |

| 97.0 | 97.1 | 99.4 | 94.6 |

| 98.4 | 98.3 | 100.3 | 95.0 |

| 100.0 | 98.3 | 101.4 | 94.8 |

| 99.1 | 99.0 | 102.1 | 95.3 |

| 100.0 | 100.4 | 103.2 | 95.4 |

| 102.1 | 101.3 | 104.1 | 95.9 |

| 102.3 | 102.5 | 105.5 | 95.8 |

| 101.8 | 103.8 | 107.1 | 95.7 |

| 102.5 | 104.8 | 108.7 | 95.4 |

| 104.1 | 104.2 | 109.6 | 96.1 |

| 104.6 | 104.6 | 110.1 | 96.0 |

| 105.5 | 106.3 | 110.9 | 96.5 |

| 106.7 | 107.5 | 112.3 | 97.3 |

| 107.6 | 109.2 | 112.9 | 98.0 |

| 106.7 | 109.2 | 114.2 | 98.7 |

| 111.3 | 110.1 | 114.8 | |

| 108.8 | 111.7 | 115.8 |

UK Office for National Statistics

http://www.ons.gov.uk/ons/rel/elmr/gdp-and-the-labour-market/q4-2013--january-gdp-update/index.html

Labor market statistics of the UK for the quarter May 2014-Jul 2014 are provided in Table VH-L2. The unemployment rate fell to 6.2 percent and the number unemployed decreased 468,000 in the year, reaching 2.019 million. The employment rate is 73.0 percent. Earnings growth including bonuses increased 0.6 percent over the earlier year. The claimant count or those receiving unemployment benefits stands at 2.9 percent, down 0.1 percentage points on the month and down 1.2 percentage points on the year.

Table VH-L2, UK, Labor Market Statistics

| Quarter May 2014-Jul 2014 | |

| Unemployment Rate | 6.2 %, 6.8% prior quarter and 7.8% year earlier |

| Number Unemployed | (1) Down 146,000 on quarter and down 468,000 from year earlier to reach 2.019 million (2) Unemployment rate 16 to 24 years of age 16.6% of that age group (3) Unemployed 16 to 24 years excluding those in full-time education 489,000 (258,000 in full-time education); unemployment rate 16.6% down 1.9% Points |

| Number Unemployed > one and two years | (1) Number unemployed over one year: 718,000, down 64,000 on quarter, down 173,000 on year (2) Number unemployed over two years: 392,000, down 33,000 on quarter, down 70,000 on year |

| Inactivity Rate 16-64 Years of Age (Definition: Not in employment but have not been seeking employment in the past four weeks or are unable to start work in two weeks) | (1) 22.1%, 21.8% prior quarter, 22.3% year earlier (2) Economically inactive 16-64 years up 114,000 on quarter and down 31,000 on year to 8.930 million |

| Employment Rate | 73.0%, 72.9% prior quarter, 71.6% year earlier |

| Number Employed | (1) Up 74,000 on quarter, +774,000 on year to 30.609 million (2) Number of employees up 424,000 on year to 25.816 million (3) Self-employed rose 368,000 on year to 4.541 million (4) Full-time 19.056 million, up 371,000 on year (5) 6.760 million working part-time, up 52,000 on year |

| Earnings Growth Rates Year on Year | (1) Total 0.6% (including bonuses) over year earlier; regular 0.7%; private sector 0.8% on year earlier, public sector 0.5% on year earlier (2) Regular private 1.0% (excluding bonuses); regular public 0.5% on year earlier |

| Full-time and Part-time | (1) Number employees full-time 19.056 million, up 440,000 on year; self-employed full-time 3.263 million up 252,000 on year (2) Number employees part-time 6.710 million, up 6,000 on year; self-employed part-time 1.327 million, up 156,000 in year |

| Claimant Count (Jobseeker’s Allowance, JSA) | (1) Latest estimate: 966,500; down 37,200 in month, down 423,600 on year earlier (2) Claimant count 2.9%, down 0.1 on month and down 1.2 % points on year |

Note: Labor Force Survey does not measure monthly changes. Comparisons on quarter are on quarter before prior quarter

Source: UK Office for National Statistics

http://www.ons.gov.uk/ons/rel/lms/labour-market-statistics/september-2014/index.html

Table VH-L3 provides indicators of the labor force survey of the UK for May 2014-Jul 2014 and earlier quarters. There has been improvement in UK labor markets with the rate of unemployment decreasing from 7.7 percent in May-Jul 2013 to 6.2 percent in May-Jul 2014.

Table VH-L3, UK, Labor Force Survey Indicators

| LFHP | EMP | PART | UNE | RATE | |

| May-Jul 2012 | 40,187 | 29,560 | 71.2 | 2,592 | 8.1 |

| May-Jul 2013 | 40,253 | 29,836 | 71.6 | 2,487 | 7.7 |

| Aug-Oct 2013 | 40,299 | 30,086 | 72.0 | 2,388 | 7.4 |

| Nov-Jan 2014 | 40,344 | 30,191 | 72.3 | 2,326 | 7.2 |

| Feb-Apr 2014 | 40,389 | 30,535 | 72.9 | 2,165 | 6.6 |

| May-Jul 2014 | 40,434 | 30,609 | 73.0 | 2,019 | 6.2 |

Notes: LFHP: Labor Force Household Population Ages 16 to 64 in thousands; EMP: Employed Ages 16 and over in thousands; PART: Employment as % of Population Ages 16 to 64; UNE: Unemployed Ages 16 and over in thousands; Rate: Number Unemployed Ages 16 and over as % of Employed plus Unemployed

Source: UK Office for National Statistics

http://www.ons.gov.uk/ons/rel/lms/labour-market-statistics/september-2014/index.html

The volume of retail sales in the UK increased 0.4 percent in Aug 2014 and increased 3.9 percent in the 12 months ending in Aug 2014, as shown in Table VH-1. Percentage changes of retail sales in 12 months had been positive in several months since Sep 2011 with exceptions, such as declines of 2.3 percent in Apr 2012 and 1.1 percent in Mar 2013. The quarter ending in Jul 2013 is quite strong with growth of 2.4 percent in May, 0.5 percent in Jun and 0.7 percent in Jul, interrupted by decline of 1.0 percent in Aug 2013 followed by increase of 0.9 percent in Sep 2013. The volume of retail sales fell 0.8 percent in Oct 2013, increasing 0.2 percent in Nov 2013 and jumping 2.5 percent in Dec 2013. Retail sales decreased 1.9 percent in Jan 2014 and increased 0.8 percent in Apr 2014. Retail sales increased 3.9 percent in the 12 months ending in Aug 2014.

Table VH-1, UK, Volume of Retail Sales ∆%

| 2011 | Oct | 1.2 | 0.5 |

| Nov | -0.1 | 0.2 | |

| Dec | -0.3 | 2.4 | |

| 2012 | Jan | 0.8 | 0.6 |

| Feb | -1.1 | 0.4 | |

| Mar | 1.9 | 2.6 | |

| Apr | -2.3 | -1.9 | |

| May | 1.2 | 1.6 | |

| Jun | 0.4 | 1.9 | |

| Jul | 0.1 | 1.7 | |

| Aug | -0.1 | 2.1 | |

| Sep | 0.2 | 1.9 | |

| Oct | -0.4 | 0.3 | |

| Nov | 0.1 | 0.5 | |

| Dec | -0.8 | - | |

| 2013 | Jan | -0.3 | -1.1 |

| Feb | 1.9 | 2.0 | |

| Mar | -1.1 | -1.0 | |

| Apr | -0.8 | 0.5 | |

| May | 2.4 | 1.6 | |

| Jun | 0.5 | 1.7 | |

| Jul | 0.7 | 2.3 | |

| Aug | -1.0 | 1.4 | |

| Sep | 0.9 | 2.1 | |

| Oct | -0.8 | 1.7 | |

| Nov | 0.2 | 1.9 | |

| Dec | 2.5 | 5.2 | |

| 2014 | Jan | -1.9 | 3.5 |

| Feb | 1.4 | 3.0 | |

| Mar | 0.3 | 4.5 | |

| Apr | 0.8 | 6.2 | |

| May | -0.1 | 3.6 | |

| Jun | 0.1 | 3.2 | |

| Jul | - | 2.5 | |

| Aug | 0.4 | 3.9 |

Source: UK Office for National Statistics

http://www.ons.gov.uk/ons/rel/rsi/retail-sales/august-2014/index.html

Retail sales in the UK struggle with oscillating and relatively high inflation, declining recently. Table VH-2 provides 12-month percentage changes of the implied deflator of UK retail sales. The implied deflator of all retail sales declined 1.2 percent in the 12 months ending in Aug 2014 while that of sales excluding auto fuel decreased 0.7 percent. The 12-month increase of the implied deflator of auto fuel in Aug 2014 was minus 5.0 percent. The 12-month increase of the implied deflator of auto fuel sales rose to 17.0 percent in Sep 2011, which is the highest 12-month increase in 2011, but then declined to 0.3 percent in Dec 2012 and minus 0.2 percent in Jan 2013. The 12-month implied deflator of auto fuel sales decreased 2.2 percent in May 2013, increasing 1.3 percent in Jun 2013 and 2.6 percent in Jul 2013. The percentage change of the implied deflator of sales of food stores at 2.3 percent in Dec 2013 is higher than for total retail sales of 0.5 percent. Increases in fuel prices at the retail level have occurred throughout most years since 2005 with exception of the decline of 9.7 percent in Dec 2008 when commodity carry trades were reversed in the panic of the financial crisis. UK inflation is particularly sensitive to changes in commodity prices.

Table VH-2, UK, Implied Deflator of Retail Sales, 12-Month Percentage Changes

| All Retail | All Retail ex Auto Fuel | Mostly Food Stores | Mostly Nonfood Stores | Mostly Automotive Fuel Stores | ||

| 2008 | Sep | 5.1 | 3.5 | 8.3 | -0.3 | 18.6 |

| Oct | 3.6 | 2.9 | 7.4 | -0.7 | 9.2 | |

| Nov | 2.2 | 2.7 | 7.5 | -1.1 | -2.6 | |

| Dec | -0.2 | 0.5 | 7.1 | -3.9 | -9.7 | |

| 2009 | Jan | -0.2 | 1.6 | 7.3 | -2.9 | -13.4 |

| Feb | 1.0 | 2.6 | 8.4 | -2.1 | -11.0 | |

| Mar | 0.6 | 2.4 | 7.9 | -2.0 | -12.4 | |

| Apr | 0.2 | 1.7 | 6.2 | -2.0 | -11.1 | |

| May | - | 1.6 | 5.7 | -1.9 | -12.4 | |

| Jun | -1.1 | 0.7 | 4.2 | -2.4 | -13.2 | |

| Jul | -1.4 | 0.3 | 3.5 | -2.4 | -13.6 | |

| Aug | -0.9 | 0.2 | 2.3 | -1.8 | -8.9 | |

| Sep | -0.8 | - | 1.9 | -1.5 | -5.8 | |

| Oct | 0.3 | 0.5 | 2.5 | -1.2 | -0.8 | |

| Nov | 1.4 | 0.5 | 1.8 | -0.8 | 10.0 | |

| Dec | 3.7 | 2.4 | 2.2 | 1.8 | 17.0 | |

| 2010 | Jan | 4.1 | 2.0 | 2.7 | 1.2 | 23.3 |

| Feb | 3.0 | 1.0 | 1.5 | 0.8 | 20.5 | |

| Mar | 3.6 | 1.4 | 2.2 | 0.9 | 22.7 | |

| Apr | 4.0 | 2.0 | 2.9 | 1.3 | 23.3 | |

| May | 3.4 | 1.5 | 2.0 | 1.1 | 20.9 | |

| Jun | 2.6 | 1.3 | 2.1 | 0.8 | 14.7 | |

| Jul | 2.7 | 1.6 | 3.0 | 0.5 | 13.5 | |

| Aug | 2.6 | 1.7 | 3.4 | 0.4 | 11.4 | |

| Sep | 3.1 | 2.6 | 4.3 | 1.2 | 8.3 | |

| Oct | 3.3 | 2.5 | 4.1 | 1.1 | 10.8 | |

| Nov | 3.6 | 3.0 | 4.9 | 1.3 | 9.8 | |

| Dec | 3.7 | 3.2 | 5.2 | 1.4 | 12.4 | |

| 2011 | Jan | 4.4 | 3.3 | 5.4 | 1.4 | 14.5 |

| Feb | 4.9 | 3.8 | 5.6 | 2.2 | 15.1 | |

| Mar | 4.3 | 3.0 | 4.3 | 1.9 | 14.9 | |

| Apr | 4.2 | 3.3 | 4.8 | 1.9 | 12.3 | |

| May | 4.6 | 3.5 | 5.6 | 1.8 | 13.2 | |

| Jun | 4.7 | 3.4 | 6.2 | 1.2 | 14.5 | |

| Jul | 5.1 | 3.9 | 6.0 | 2.2 | 14.5 | |

| Aug | 5.4 | 4.0 | 6.0 | 2.4 | 16.2 | |

| Sep | 5.1 | 3.7 | 6.2 | 1.7 | 17.0 | |

| Oct | 4.7 | 3.5 | 5.1 | 2.3 | 14.8 | |

| Nov | 4.0 | 3.0 | 4.7 | 1.7 | 12.6 | |

| Dec | 3.3 | 2.4 | 4.3 | 1.0 | 9.1 | |

| 2012 | Jan | 2.6 | 2.2 | 3.6 | 1.1 | 5.3 |

| Feb | 2.8 | 2.4 | 4.0 | 0.9 | 5.4 | |

| Mar | 3.0 | 2.7 | 4.5 | 1.1 | 4.9 | |

| Apr | 2.3 | 2.0 | 3.8 | 0.4 | 5.2 | |

| May | 1.4 | 1.5 | 3.1 | 0.2 | 1.2 | |

| Jun | 0.6 | 0.9 | 2.3 | -0.2 | -1.2 | |

| Jul | 0.4 | 0.7 | 2.0 | -0.2 | -1.4 | |

| Aug | 0.5 | 0.6 | 2.1 | -0.8 | 0.4 | |

| Sep | 0.9 | 0.7 | 2.1 | -0.4 | 2.9 | |

| Oct | 1.1 | 1.0 | 2.8 | -0.4 | 2.6 | |

| Nov | 0.7 | 0.7 | 3.1 | -1.0 | 1.3 | |

| Dec | 0.9 | 1.0 | 3.0 | -0.3 | 0.3 | |

| 2013 | Jan | 1.1 | 1.4 | 3.8 | -0.7 | -0.2 |

| Feb | 1.0 | 1.0 | 3.2 | -0.7 | 1.1 | |

| Mar | 0.9 | 1.2 | 3.1 | -0.7 | 0.5 | |

| Apr | 0.6 | 1.1 | 3.4 | -0.7 | -3.0 | |

| May | 1.0 | 1.5 | 3.5 | -0.1 | -2.2 | |

| Jun | 1.7 | 1.8 | 3.4 | 0.6 | 1.3 | |

| Jul | 1.8 | 1.8 | 3.4 | 0.3 | 2.6 | |

| Aug | 1.6 | 1.6 | 3.4 | 0.3 | 1.5 | |

| Sep | 0.9 | 1.3 | 3.4 | -0.2 | -1.2 | |

| Oct | 0.7 | 1.3 | 3.3 | -0.2 | -3.5 | |

| Nov | 0.6 | 1.0 | 2.7 | -0.1 | -3.0 | |

| Dec | 0.5 | 0.6 | 2.3 | -0.3 | -1.0 | |

| 2014 | Jan | 0.2 | 0.4 | 1.8 | -0.5 | -1.4 |

| Feb | -0.2 | 0.4 | 1.6 | -0.4 | -4.4 | |

| Mar | -0.5 | 0.2 | 1.8 | -0.7 | -5.8 | |

| Apr | -0.5 | 0.1 | 0.9 | -0.6 | -4.4 | |

| May | -0.7 | -0.4 | 0.4 | -0.8 | -2.2 | |

| Jun | - | 0.3 | 0.8 | 0.2 | -2.5 | |

| Jul | -0.9 | -0.6 | 0.2 | -0.8 | -2.5 | |

| Aug | -1.2 | -0.7 | -0.1 | -0.7 | -5.0 |

Source: UK Office for National Statistics

http://www.ons.gov.uk/ons/rel/rsi/retail-sales/august-2014/index.html

UK monthly retail volume of sales is quite volatile, as shown in Table VH-3. Total volume of sales decreased 0.8 percent in Apr 2013 and increased 2.4 percent in May 2013, 0.5 percent in Jun 2013 and 0.7 percent in Jul 2013 but declined 1.0 percent in Aug 2013. Retail sales increased 0.9 percent in Sep 2013 and fell 0.8 percent in Oct 2013. Retail sales increased 0.2 percent in Nov 2013 and 2.5 percent in Dec 2013. Total volume of retail sales fell 1.9 percent in Jan 2014 and increased 1.4 percent in Feb 2014. Total volume of retail sales increased 0.3 percent in Mar 2014 and 0.8 percent in Apr 2014. Retail sales fell 0.1 percent in May 2014. Retail sales increased 0.1 percent in Jun 2014 and changed 0.0 percent in Jul 2014. Retail sales increased 0.4 percent in Aug 2014. There was increase of 0.2 percent in retail sales excluding auto fuels in Aug 2014 and increase of 0.2 percent in food stores, decrease of 0.7 percent in nonfood stores and increase of 1.7 percent in auto fuel stores. Multiple positive and negative variations and changes in magnitudes confirm high volatility.

Table VH-3, UK, Growth of Retail Sales Volume by Component Groups Month SA ∆%

| All Retail | All Retail ex Auto Fuel | Mostly Food Stores | Mostly Nonfood Stores | Mostly Automotive Fuel Stores | ||

| 2011 | Oct | 1.2 | 1.2 | 0.9 | 1.6 | 1.6 |

| Nov | -0.1 | -0.5 | -0.5 | -1.2 | 3.2 | |

| Dec | -0.3 | -0.1 | -0.1 | 0.4 | -1.7 | |

| 2012 | Jan | 0.8 | 0.8 | 0.7 | 0.7 | 0.9 |

| Feb | -1.1 | -0.9 | -0.5 | -1.2 | -2.9 | |

| Mar | 1.9 | 1.5 | -0.6 | 3.3 | 5.6 | |

| Apr | -2.3 | -1.1 | -0.5 | -2.0 | -12.4 | |

| May | 1.2 | 0.8 | 0.9 | 0.7 | 5.3 | |

| Jun | 0.4 | 0.8 | 0.1 | 1.6 | -3.3 | |

| Jul | 0.1 | -0.2 | -0.1 | -0.9 | 2.8 | |

| Aug | -0.1 | -0.1 | 0.5 | 0.3 | 0.1 | |

| Sep | 0.2 | 0.1 | -0.2 | -0.4 | 1.2 | |

| Oct | -0.4 | -0.1 | -0.8 | 0.1 | -2.5 | |

| Nov | 0.1 | 0.3 | -0.3 | 0.7 | -1.6 | |

| Dec | -0.8 | -1.0 | -0.1 | -2.1 | 1.6 | |

| 2013 | Jan | -0.3 | -0.1 | -0.4 | -0.4 | -2.0 |

| Feb | 1.9 | 2.0 | 0.3 | 3.7 | 1.8 | |

| Mar | -1.1 | -1.1 | 1.7 | -4.6 | -0.5 | |

| Apr | -0.8 | -0.9 | -5.0 | 3.8 | 0.3 | |

| May | 2.4 | 2.4 | 4.3 | 0.4 | 1.6 | |

| Jun | 0.5 | 0.6 | - | 1.0 | -0.9 | |

| Jul | 0.7 | 0.6 | 2.5 | -1.3 | 1.7 | |

| Aug | -1.0 | -0.9 | -2.3 | -0.3 | -1.4 | |

| Sep | 0.9 | 1.2 | -0.3 | 3.3 | -1.1 | |

| Oct | -0.8 | -0.6 | -0.1 | -1.3 | -2.0 | |

| Nov | 0.2 | 0.3 | 0.2 | 0.2 | - | |

| Dec | 2.5 | 2.6 | 2.4 | 2.5 | 0.9 | |

| 2014 | Jan | -1.9 | -2.0 | -3.4 | 0.1 | -1.5 |

| Feb | 1.4 | 1.4 | 1.8 | -0.2 | 1.4 | |

| Mar | 0.3 | -0.2 | -1.6 | 1.5 | 5.4 | |

| Apr | 0.8 | 1.5 | 2.6 | -0.2 | -4.8 | |

| May | -0.1 | -0.1 | -1.0 | 0.7 | -0.8 | |

| Jun | 0.1 | -0.1 | 0.1 | -0.1 | 2.5 | |

| Jul | - | 0.4 | 0.1 | 0.8 | -2.9 | |

| Aug | 0.4 | 0.2 | -0.7 | 1.6 | 1.7 |

Source: UK Office for National Statistics

http://www.ons.gov.uk/ons/rel/rsi/retail-sales/august-2014/index.html

Percentage growth in 12 months of retail sales volume by component groups in the UK is provided in Table VH-4. Total retail sales increased 3.9 percent in the 12 months ending in Aug 2014 with increase of 4.5 percent in sales excluding auto fuel. Sales of food stores decreased 0.2 percent in the 12 months ending in Aug 2014 while sales of nonfood stores increased 9.0 percent. Sales of auto fuel stores decreased 1.5 percent in Aug 2014 relative to a year earlier.

Table VH-4, UK, Growth of Retail Sales Volume by Component Groups 12-Month ∆%

| All Retail | All Retail ex Auto Fuel | Mostly Food Stores | Mostly Nonfood Stores | Mostly Automotive Fuel Stores | ||

| 2011 | Oct | 0.5 | 0.3 | 0.4 | -1.1 | 2.7 |

| Nov | 0.2 | -0.4 | -1.1 | -1.9 | 5.3 | |

| Dec | 2.4 | 1.2 | 1.0 | 0.4 | 13.8 | |

| 2012 | Jan | 0.6 | 0.3 | 0.9 | -1.3 | 3.4 |

| Feb | 0.4 | 0.3 | 1.0 | -1.2 | 1.0 | |

| Mar | 2.6 | 2.0 | -0.3 | 3.0 | 7.5 | |

| Apr | -1.9 | -1.2 | -3.6 | -0.5 | -7.5 | |

| May | 1.6 | 2.0 | 1.0 | 1.8 | -2.2 | |

| Jun | 1.9 | 2.7 | 1.3 | 3.5 | -5.3 | |

| Jul | 1.7 | 2.2 | 0.5 | 2.4 | -2.5 | |

| Aug | 2.1 | 2.5 | 0.9 | 4.0 | -1.7 | |

| Sep | 1.9 | 2.3 | 0.6 | 2.9 | -0.9 | |

| Oct | 0.3 | 0.9 | -1.1 | 1.4 | -4.9 | |

| Nov | 0.5 | 1.7 | -0.8 | 3.4 | -9.3 | |

| Dec | - | 0.8 | -0.8 | 0.8 | -6.3 | |

| 2013 | Jan | -1.1 | -0.1 | -2.0 | -0.3 | -9.0 |

| Feb | 2.0 | 2.8 | -1.2 | 4.6 | -4.5 | |

| Mar | -1.0 | 0.1 | 1.1 | -3.5 | -10.1 | |

| Apr | 0.5 | 0.3 | -3.6 | 2.2 | 2.9 | |

| May | 1.6 | 1.9 | -0.3 | 1.8 | -0.7 | |

| Jun | 1.7 | 1.7 | -0.3 | 1.3 | 1.8 | |

| Jul | 2.3 | 2.5 | 2.2 | 0.8 | 0.7 | |

| Aug | 1.4 | 1.7 | -0.6 | 0.2 | -0.8 | |

| Sep | 2.1 | 2.7 | -0.8 | 3.9 | -3.1 | |

| Oct | 1.7 | 2.2 | -0.1 | 2.5 | -2.6 | |

| Nov | 1.9 | 2.2 | 0.4 | 2.0 | -1.0 | |

| Dec | 5.2 | 6.0 | 2.9 | 6.8 | -1.6 | |

| 2014 | Jan | 3.5 | 4.1 | -0.1 | 7.3 | -1.1 |

| Feb | 3.0 | 3.5 | 1.4 | 3.3 | -1.5 | |

| Mar | 4.5 | 4.5 | -1.9 | 9.9 | 4.3 | |

| Apr | 6.2 | 7.0 | 6.0 | 5.6 | -1.0 | |

| May | 3.6 | 4.4 | 0.6 | 6.0 | -3.3 | |

| Jun | 3.2 | 3.6 | 0.7 | 4.7 | - | |

| Jul | 2.5 | 3.3 | -1.7 | 7.0 | -4.5 | |

| Aug | 3.9 | 4.5 | -0.2 | 9.0 | -1.5 |

Source: UK Office for National

http://www.ons.gov.uk/ons/rel/rsi/retail-sales/august-2014/index.html

Table VH-5 provides the analysis of the UK Office for National Statistics of contributions to 12-month percentage changes of value and volume of retail sales in the UK. The volume of retail sales seasonally adjusted increased 3.9 percent in the 12 months ending in Aug 2014. Sales of predominantly food stores with weight of 41.5 percent decreased 0.2 percent in the 12 months ending in Aug 2014, subtracting 0.1 percentage points. Mostly nonfood stores with weight of 41.3 percent increased 9.0 percent with contribution of 3.8 percentage points. Positive contribution to 12-month percentage changes of volume was made by non-store retailing with weight of 5.7 percent, growth of 4.4 percent and positive contribution of 0.3 percentage points. Automotive fuel with weight of 11.5 percent and growth of minus 1.5 percent deducted 0.1 percentage points. The value of retail sales increased 2.7 percent in the 12 months ending in Aug 2014. There were positive contributions: 3.3 percentage points for predominantly nonfood stores and 0.2 percentage points for non-store retailing. Automotive fuel stores deducted 0.7 percentage points while food stores deducted 0.1 percentage points.

Table VH-9, UK, Volume and Value of Retail Sales 12-month ∆% and Percentage Points Contributions by Sectors

| Aug 2014 | Weight | Volume SA | PP Cont. | Value SA | PP Cont. |

| All Retailing | 100.0 | 3.9 | 2.7 | ||

| Mostly | 41.5 | -0.2 | -0.1 | -0.2 | -0.1 |

| Mostly Nonfood Stores | 41.3 | 9.0 | 3.8 | 8.1 | 3.3 |

| Non-store Retailing | 5.7 | 4.4 | 0.3 | 3.5 | 0.2 |

| Automotive Fuel | 11.5 | -1.5 | -0.1 | -6.4 | -0.7 |

Cont.: Contribution

Source: UK Office for National Statistics

http://www.ons.gov.uk/ons/rel/rsi/retail-sales/august-2014/index.html

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014.

No comments:

Post a Comment