Interest Rate Risks, World Inflation Waves, Squeeze of Economic Activity by Carry Trades Induced by Zero Interest Rates, Collapse of United States Dynamism of Income Growth and Employment Creation, Unresolved US Balance of Payments Deficits and Fiscal Imbalance Threatening Risk Premium on Treasury Securities, United States Industrial Production, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014

Executive Summary

I World Inflation Waves

IA Appendix: Transmission of Unconventional Monetary Policy

IB1 Theory

IB2 Policy

IB3 Evidence

IB4 Unwinding Strategy

IB United States Inflation

IC Long-term US Inflation

ID Current US Inflation

IE Theory and Reality of Economic History, Cyclical Slow Growth Not Secular Stagnation and Monetary Policy Based on Fear of Deflation

IB Collapse of United States Dynamism of Income Growth and Employment Creation

IIA Unresolved US Balance of Payments Deficits and Fiscal Imbalance Threatening Risk

Premium on Treasury Securities

IIA1 United States Unsustainable Deficit/Debt

IIA2 Unresolved US Balance of Payments Deficits

IIB United States Industrial Production

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

V World Economic Slowdown. Table V-1 is constructed with the database of the IMF http://www.imf.org/external/pubs/ft/weo/2013/02/weodata/index.aspx) to show GDP in dollars in 2012 and the growth rate of real GDP of the world and selected regional countries from 2013 to 2016. The data illustrate the concept often repeated of “two-speed recovery” of the world economy from the recession of 2007 to 2009. The IMF has lowered its forecast of the world economy to 2.9 percent in 2013 but accelerating to 3.6 percent in 2014, 4.0 percent in 2015 and 4.1 percent in 2016. Slow-speed recovery occurs in the “major advanced economies” of the G7 that account for $34,560 billion of world output of $72,216 billion, or 47.9 percent, but are projected to grow at much lower rates than world output, 2.1 percent on average from 2013 to 2016 in contrast with 3.6 percent for the world as a whole. While the world would grow 15.4 percent in the four years from 2013 to 2016, the G7 as a whole would grow 8.6 percent. The difference in dollars of 2012 is rather high: growing by 15.4 percent would add $11.1 trillion of output to the world economy, or roughly, two times the output of the economy of Japan of $5,960 billion but growing by 8.6 percent would add $6.2 trillion of output to the world, or about the output of Japan in 2012. The “two speed” concept is in reference to the growth of the 150 countries labeled as emerging and developing economies (EMDE) with joint output in 2012 of $27,221 billion, or 37.7 percent of world output. The EMDEs would grow cumulatively 21.9 percent or at the average yearly rate of 5.1 percent, contributing $6.0 trillion from 2013 to 2016 or the equivalent of somewhat less than the GDP of $8,221 billion of China in 2012. The final four countries in Table V-1 often referred as BRIC (Brazil, Russia, India, China), are large, rapidly growing emerging economies. Their combined output in 2012 adds to $14,346 billion, or 19.9 percent of world output, which is equivalent to 41.5 percent of the combined output of the major advanced economies of the G7.

Table V-1, IMF World Economic Outlook Database Projections of Real GDP Growth

| GDP USD 2012 | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | |

| World | 72,216 | 2.9 | 3.6 | 4.0 | 4.1 |

| G7 | 34,560 | 1.2 | 2.0 | 2.5 | 2.6 |

| Canada | 1,821 | 1.6 | 2.2 | 2.4 | 2.5 |

| France | 2,614 | 0.2 | 1.0 | 1.5 | 1.7 |

| DE | 3,430 | 0.5 | 1.4 | 1.4 | 1.3 |

| Italy | 2,014 | -1.8 | 0.7 | 1.1 | 1.4 |

| Japan | 5,960 | 1.9 | 1.2 | 1.1 | 1.2 |

| UK | 2,477 | 1.4 | 1.9 | 2.0 | 2.0 |

| US | 16,245 | 1.6 | 2.6 | 3.4 | 3.5 |

| Euro Area | 12,199 | -0.4 | 1.0 | 1.4 | 1.5 |

| DE | 3,430 | 0.5 | 1.4 | 1.4 | 1.3 |

| France | 2,614 | 0.2 | 1.0 | 1.5 | 1.7 |

| Italy | 2,014 | -1.8 | 0.7 | 1.1 | 1.4 |

| POT | 212 | -1.8 | 0.8 | 1.5 | 1.8 |

| Ireland | 211 | 0.6 | 1.8 | 2.5 | 2.5 |

| Greece | 249 | -4.2 | 0.6 | 2.9 | 3.7 |

| Spain | 1,324 | -1.3 | 0.2 | 0.5 | 0.7 |

| EMDE | 27,221 | 4.5 | 5.1 | 5.3 | 5.4 |

| Brazil | 2,253 | 2.5 | 2.5 | 3.2 | 3.3 |

| Russia | 2,030 | 1.5 | 3.0 | 3.5 | 3.5 |

| India | 1,842 | 3.8 | 5.1 | 6.3 | 6.5 |

| China | 8,221 | 7.6 | 7.3 | 7.0 | 7.0 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries); POT: Portugal

Source: IMF World Economic Outlook databank http://www.imf.org/external/pubs/ft/weo/2013/02/weodata/index.aspx

Continuing high rates of unemployment in advanced economies constitute another characteristic of the database of the WEO (http://www.imf.org/external/pubs/ft/weo/2013/02/weodata/index.aspx). Table V-2 is constructed with the WEO database to provide rates of unemployment from 2012 to 2016 for major countries and regions. In fact, unemployment rates for 2012 in Table V-2 are high for all countries: unusually high for countries with high rates most of the time and unusually high for countries with low rates most of the time. The rates of unemployment are particularly high for the countries with sovereign debt difficulties in Europe: 15.7 percent for Portugal (POT), 14.7 percent for Ireland, 24.2 percent for Greece, 25.0 percent for Spain and 10.6 percent for Italy, which is lower but still high. The G7 rate of unemployment is 7.4 percent. Unemployment rates are not likely to decrease substantially if slow growth persists in advanced economies.

Table V-2, IMF World Economic Outlook Database Projections of Unemployment Rate as Percent of Labor Force

| % Labor Force 2012 | % Labor Force 2013 | % Labor Force 2014 | % Labor Force 2015 | % Labor Force 2016 | |

| World | NA | NA | NA | NA | NA |

| G7 | 7.4 | 7.3 | 7.3 | 7.0 | 6.6 |

| Canada | 7.3 | 7.2 | 7.1 | 7.0 | 6.9 |

| France | 10.3 | 11.0 | 11.1 | 10.9 | 10.5 |

| DE | 5.5 | 5.6 | 5.5 | 5.5 | 5.5 |

| Italy | 10.7 | 12.5 | 12.4 | 12.0 | 11.2 |

| Japan | 4.4 | 4.2 | 4.3 | 4.3 | 4.3 |

| UK | 8.0 | 7.7 | 7.5 | 7.3 | 7.0 |

| US | 8.1 | 7.6 | 7.4 | 6.9 | 6.4 |

| Euro Area | 11.4 | 12.3 | 12.2 | 12.0 | 11.5 |

| DE | 5.5 | 5.6 | 5.5 | 5.5 | 5.5 |

| France | 10.3 | 11.0 | 11.1 | 10.9 | 10.5 |

| Italy | 10.7 | 12.5 | 12.4 | 12.0 | 11.2 |

| POT | 15.7 | 17.4 | 17.7 | 17.3 | 16.8 |

| Ireland | 14.7 | 13.7 | 13.3 | 12.8 | 12.4 |

| Greece | 24.2 | 27.0 | 26.1 | 24.0 | 21.0 |

| Spain | 25.0 | 26.9 | 26.7 | 26.5 | 26.2 |

| EMDE | NA | NA | NA | NA | NA |

| Brazil | 5.5 | 5.8 | 6.0 | 6.5 | 6.5 |

| Russia | 6.0 | 5.7 | 5.7 | 5.5 | 5.5 |

| India | NA | NA | NA | NA | NA |

| China | 4.1 | 4.1 | 4.1 | 4.1 | 4.1 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries)

Source: IMF World Economic Outlook databank http://www.imf.org/external/pubs/ft/weo/2013/02/weodata/index.aspx

Table V-3 provides the latest available estimates of GDP for the regions and countries followed in this blog from IQ2012 to IIQ2013 available now for all countries. There are preliminary estimates for all countries for IVQ2013. Growth is weak throughout most of the world.

- Japan. The GDP of Japan increased 0.9 percent in IQ2012 and 3.2 percent relative to a year earlier but part of the jump could be the low level a year earlier because of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan is experiencing difficulties with the overvalued yen because of worldwide capital flight originating in zero interest rates with risk aversion in an environment of softer growth of world trade. Japan’s GDP fell 0.4 percent in IIQ2012 at the seasonally adjusted annual rate (SAAR) of minus 1.7 percent, which is much lower than 3.5 percent in IQ2012. Growth of 3.2 percent in IIQ2012 in Japan relative to IIQ2011 has effects of the low level of output because of Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan’s GDP contracted 0.8 percent in IIIQ2012 at the SAAR of minus 3.2 percent and decreased 0.2 percent relative to a year earlier. Japan’s GDP changed 0.0 percent in IVQ2012 at the SAAR of minus 0.1 percent and decreased 0.3 percent relative to a year earlier. Japan grew 1.1 percent in IQ2013 at the SAAR of 4.5 percent and changed 0.0 percent relative to a year earlier. Japan’s GDP increased 1.1 percent in IIQ2013 at the SAAR of 4.1 percent and increased 1.2 percent relative to a year earlier. Japan’s GDP grew 0.2 percent in IIIQ2013 at the SAAR of 0.9 percent and increased 2.3 percent relative to a year earlier. In IVQ2013, Japan’s GDP increased 0.2 percent at the SAAR of 0.7 percent, increasing 2.6 percent relative to a year earlier.

- China. The GDP of China grew at 2.1 percent in IIQ2012, which annualizes to 8.7 percent and 7.6 percent relative to a year earlier. China grew at 2.0 percent in IIIQ2012, which annualizes at 8.2 percent and 7.4 percent relative to a year earlier. In IVQ2012, China grew at 1.9 percent, which annualizes at 7.8 percent, and 7.9 percent in IVQ2012 relative to IVQ2011. In IQ2013, China grew at 1.5 percent, which annualizes at 6.1 percent and 7.7 percent relative to a year earlier. In IIQ2013, China grew at 1.8 percent, which annualizes at 7.4 percent and 7.5 percent relative to a year earlier. China grew at 2.2 percent in IIIQ2013, which annualizes at 9.1 percent and 7.8 percent relative to a year earlier. China grew at 1.8 percent in IVQ2013, which annualized to 7.4 percent and 7.7 percent relative to a year earlier. There is decennial change in leadership in China (http://www.xinhuanet.com/english/special/18cpcnc/index.htm). Growth rates of GDP of China in a quarter relative to the same quarter a year earlier have been declining from 2011 to 2013.

- Euro Area. GDP fell 0.1 percent in the euro area in IQ2012 and decreased 0.2 in IQ2012 relative to a year earlier. Euro area GDP contracted 0.3 percent IIQ2012 and fell 0.5 percent relative to a year earlier. In IIIQ2012, euro area GDP fell 0.2 percent and declined 0.7 percent relative to a year earlier. In IVQ2012, euro area GDP fell 0.5 percent relative to the prior quarter and fell 1.0 percent relative to a year earlier. In IQ2013, the GDP of the euro area fell 0.2 percent and decreased 1.2 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IIQ2013 and fell 0.6 percent relative to a year earlier. In IIIQ2013, euro area GDP increased 0.1 percent and fell 0.3 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IVQ2013 and increased 0.5 percent relative to a year earlier.

- Germany. The GDP of Germany increased 0.7 percent in IQ2012 and 1.8 percent relative to a year earlier. In IIQ2012, Germany’s GDP decreased 0.1 percent and increased 0.6 percent relative to a year earlier but 1.1 percent relative to a year earlier when adjusted for calendar (CA) effects. In IIIQ2012, Germany’s GDP increased 0.2 percent and 0.4 percent relative to a year earlier. Germany’s GDP contracted 0.5 percent in IVQ2012 and increased 0.0 percent relative to a year earlier. In IQ2013, Germany’s GDP increased 0.0 percent and fell 1.6 percent relative to a year earlier. In IIQ2013, Germany’s GDP increased 0.7 percent and 0.9 percent relative to a year earlier. The GDP of Germany increased 0.3 percent in IIIQ2013 and 1.1 percent relative to a year earlier. In IVQ2013, Germany’s GDP increased 0.4 percent and 1.3 percent relative to a year earlier.

- United States. Growth of US GDP in IQ2012 was 0.9 percent, at SAAR of 3.7 percent and higher by 3.3 percent relative to IQ2011. US GDP increased 0.3 percent in IIQ2012, 1.2 percent at SAAR and 2.8 percent relative to a year earlier. In IIIQ2012, US GDP grew 0.7 percent, 2.8 percent at SAAR and 3.1 percent relative to IIIQ2011. In IVQ2012, US GDP grew 0.0 percent, 0.1 percent at SAAR and 2.0 percent relative to IVQ2011. In IQ2013, US GDP grew at 1.1 percent SAAR, 0.3 percent relative to the prior quarter and 1.3 percent relative to the same quarter in 2013. In IIQ2013, US GDP grew at 2.5 percent in SAAR, 0.6 percent relative to the prior quarter and 1.6 percent relative to IIQ2012. US GDP grew at 4.1 percent in SAAR in IIIQ2013, 1.0 percent relative to the prior quarter and 2.0 percent relative to the same quarter a year earlier (http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html and earlier http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html) with weak hiring (Section I and earlier http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html). In IVQ2013, US GDP grew 0.6 percent at 2.4 percent SAAR and 2.5 percent relative to a year earlier.

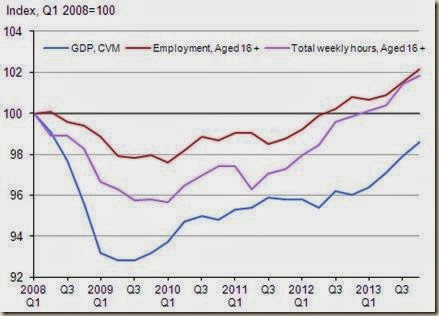

- United Kingdom. In IQ2012, UK GDP changed 0.0 percent, increasing 0.6 percent relative to a year earlier. UK GDP fell 0.4 percent in IIQ2012 and changed 0.0 percent relative to a year earlier. UK GDP increased 0.8 percent in IIIQ2012 and increased 0.2 percent relative to a year earlier. UK GDP fell 0.1 percent in IVQ2012 relative to IIIQ2012 and increased 0.2 percent relative to a year earlier. UK GDP increased 0.4 percent in IQ2013 and 0.6 percent relative to a year earlier. UK GDP increased 0.7 percent in IIQ2013 and 1.8 percent relative to a year earlier. In IIIQ2013, UK GDP increased 0.8 percent and 1.9 percent relative to a year earlier. UK GDP increased 0.7 percent in IVQ2013 and 2.7 percent relative to a year earlier.

- Italy. Italy has experienced decline of GDP in nine consecutive quarters from IIIQ2011 to IIIQ2013. Italy’s GDP fell 1.1 percent in IQ2012 and declined 1.7 percent relative to IQ2011. Italy’s GDP fell 0.5 percent in IIQ2012 and declined 2.4 percent relative to a year earlier. In IIIQ2012, Italy’s GDP fell 0.4 percent and declined 2.6 percent relative to a year earlier. The GDP of Italy contracted 0.9 percent in IVQ2012 and fell 2.8 percent relative to a year earlier. In IQ2013, Italy’s GDP contracted 0.6 percent and fell 2.4 percent relative to a year earlier. Italy’s GDP fell 0.3 percent in IIQ2013 and 2.1 percent relative to a year earlier. The GDP of Italy decreased 0.1 percent in IIIQ2013 and declined 1.9 percent relative to a year earlier. Italy’s GDP increased 0.1 percent in IVQ2013 and decreased 0.9 percent relative to a year earlier.

- France. France’s GDP changed 0.0 percent in IQ2012 and increased 0.4 percent relative to a year earlier. France’s GDP decreased 0.3 percent in IIQ2012 and increased 0.1 percent relative to a year earlier. In IIIQ2012, France’s GDP increased 0.2 percent and changed 0.0 percent relative to a year earlier. France’s GDP fell 0.2 percent in IVQ2012 and declined 0.3 percent relative to a year earlier. In IQ2013, France GDP changed 0.0 percent and declined 0.4 percent relative to a year earlier. The GDP of France increased 0.6 percent in IIQ2013 and 0.5 percent relative to a year earlier. France’s GDP changed 0.0 percent in IIIQ2013 and increased 0.3 percent relative to a year earlier. The GDP of France increased 0.3 percent in IVQ2013 and 0.8 percent relative to a year earlier.

Table V-3, Percentage Changes of GDP Quarter on Prior Quarter and on Same Quarter Year Earlier, ∆%

| IQ2012/IVQ2011 | IQ2012/IQ2011 | |

| United States | QOQ: 0.9 SAAR: 3.7 | 3.3 |

| Japan | QOQ: 0.9 SAAR: 3.5 | 3.2 |

| China | 1.4 | 8.1 |

| Euro Area | -0.1 | -0.2 |

| Germany | 0.7 | 1.8 |

| France | 0.0 | 0.4 |

| Italy | -1.1 | -1.7 |

| United Kingdom | 0.0 | 0.6 |

| IIQ2012/IQ2012 | IIQ2012/IIQ2011 | |

| United States | QOQ: 0.3 SAAR: 1.2 | 2.8 |

| Japan | QOQ: -0.4 | 3.2 |

| China | 2.1 | 7.6 |

| Euro Area | -0.3 | -0.5 |

| Germany | -0.1 | 0.6 1.1 CA |

| France | -0.3 | 0.1 |

| Italy | -0.5 | -2.4 |

| United Kingdom | -0.4 | 0.0 |

| IIIQ2012/ IIQ2012 | IIIQ2012/ IIIQ2011 | |

| United States | QOQ: 0.7 | 3.1 |

| Japan | QOQ: –0.8 | -0.2 |

| China | 2.0 | 7.4 |

| Euro Area | -0.2 | -0.7 |

| Germany | 0.2 | 0.4 |

| France | 0.2 | 0.0 |

| Italy | -0.4 | -2.6 |

| United Kingdom | 0.8 | 0.2 |

| IVQ2012/IIIQ2012 | IVQ2012/IVQ2011 | |

| United States | QOQ: 0.0 | 2.0 |

| Japan | QOQ: 0.0 SAAR: 0.1 | -0.3 |

| China | 1.9 | 7.9 |

| Euro Area | -0.5 | -1.0 |

| Germany | -0.5 | 0.0 |

| France | -0.2 | -0.3 |

| Italy | -0.9 | -2.8 |

| United Kingdom | -0.1 | 0.2 |

| IQ2013/IVQ2012 | IQ2013/IQ2012 | |

| United States | QOQ: 0.3 | 1.3 |

| Japan | QOQ: 1.1 SAAR: 4.5 | 0.0 |

| China | 1.5 | 7.7 |

| Euro Area | -0.2 | -1.2 |

| Germany | 0.0 | -1.6 |

| France | 0.0 | -0.4 |

| Italy | -0.6 | -2.4 |

| UK | 0.4 | 0.6 |

| IIQ2013/IQ2013 | IIQ2013/IIQ2012 | |

| United States | QOQ: 0.6 SAAR: 2.5 | 1.6 |

| Japan | QOQ: 1.1 SAAR: 4.1 | 1.2 |

| China | 1.8 | 7.5 |

| Euro Area | 0.3 | -0.6 |

| Germany | 0.7 | 0.9 |

| France | 0.6 | 0.5 |

| Italy | -0.3 | -2.1 |

| UK | 0.7 | 1.8 |

| IIIQ2013/IIQ2013 | III/Q2013/ IIIQ2012 | |

| USA | QOQ: 1.0 | 2.0 |

| Japan | QOQ: 0.2 SAAR: 0.9 | 2.3 |

| China | 2.2 | 7.8 |

| Euro Area | 0.1 | -0.3 |

| Germany | 0.3 | 1.1 |

| France | 0.0 | 0.3 |

| Italy | -0.1 | -1.9 |

| UK | 0.8 | 1.9 |

| IVQ2013/IIIQ2013 | IVQ2013/IVQ2012 | |

| USA | QOQ: 0.6 SAAR: 2.4 | 2.5 |

| Japan | QOQ: 0.2 SAAR: 0.7 | 2.6 |

| China | 1.8 | 7.7 |

| Euro Area | 0.3 | 0.5 |

| Germany | 0.4 | 1.3 |

| France | 0.3 | 0.8 |

| Italy | 0.1 | -0.9 |

| UK | 0.7 | 2.7 |

QOQ: Quarter relative to prior quarter; SAAR: seasonally adjusted annual rate

Source: Country Statistical Agencies http://www.census.gov/aboutus/stat_int.html

Table V-4 provides two types of data: growth of exports and imports in the latest available months and in the past 12 months; and contributions of net trade (exports less imports) to growth of real GDP.

- Japan. Japan provides the most worrisome data (Section VB and earlier http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html and earlier http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-zero-interest-rates-world.html http://cmpassocregulationblog.blogspot.com/2013/11/global-financial-risk-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations_8763.html http://cmpass ocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html and earlier http://cmpassocregulationblog.blogspot.com/2013/07/duration-dumping-steepening-yield-curve.html and earlier http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and_4699.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2013/03/united-states-commercial-banks-assets.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/world-inflation-waves-united-states.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/thirty-one-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2012/12/mediocre-and-decelerating-united-states_24.html and earlier http://cmpassocregulationblog.blogspot.com/2012/11/contraction-of-united-states-real_25.html and for GDP http://cmpassocregulationblog.blogspot.com/2013/09/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html and earlier http://cmpassocreulationblog.blogspot.com/2013/02/recovery-without-hiring-united-states.html). In Feb 2014, Japan’s exports grew 9.0 percent in 12 months while imports increased 9.0 percent. The second part of Table V-4 shows that net trade deducted 1.3 percentage points from Japan’s growth of GDP in IIQ2012, deducted 2.2 percentage points from GDP growth in IIIQ2012 and deducted 0.5 percentage points from GDP growth in IVQ2012. Net trade added 0.4 percentage points to GDP growth in IQ2012, 1.7 percentage points in IQ2013 and 0.5 percentage points in IIQ2013. In IIIQ2013, net trade deducted 2.0 percentage points from GDP growth in Japan. Net trade ducted 2.2 percentage points from GDP growth in Japan in IVQ2013.

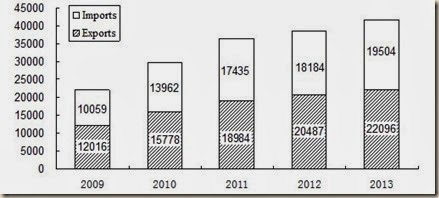

- China. In Feb 2014, China exports decreased 18.1 percent relative to a year earlier and imports increased 10.1 percent.

- Germany. Germany’s exports increased 2.2 percent in the month of Jan 2014 and increased 2.9 percent in the 12 months ending in Jan 2014. Germany’s imports increased 4.1 percent in the month of Jan and increased 1.5 percent in the 12 months ending in Dec. Net trade contributed 0.8 percentage points to growth of GDP in IQ2012, contributed 0.4 percentage points in IIQ2012, contributed 0.3 percentage points in IIIQ2012, deducted 0.5 percentage points in IVQ2012, deducted 0.3 percentage points in IQ2013 and added 0.3 percentage points in IIQ2013. Net traded deducted 0.3 percentage points from Germany’s GDP growth in IIIQ2013 and added 1.1 percentage points to GDP growth in IVQ2013.

- United Kingdom. Net trade deducted 0.8 percentage points from UK value added in IQ2012, deducted 0.8 percentage points in IIQ2012, added 0.7 percentage points in IIIQ2012 and subtracted 0.5 percentage points in IVQ2012. In IQ2013, net trade added 0.8 percentage points to UK’s growth of value added and contributed 0.0 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.1 percentage points from UK growth. Net trade contributed 0.4 percentage points to UK value added in IVQ2013.

- France. France’s exports decreased 1.8 percent in Jan 2013 while imports decreased 0.3 percent. Net traded added 0.1 percentage points to France’s GDP in IIIQ2012 and 0.1 percentage points in IVQ2012. Net trade deducted 0.1 percentage points from France’s GDP growth in IQ2013 and added 0.2 percentage points in IIQ2013, deducting 0.7 percentage points in IIIQ2013. Net trade added 0.2 percentage points to France’s GDP in IVQ2013.

- United States. US exports decreased 1.8 percent in Dec 2013 and goods exports increased 2.1 percent in Jan-Dec 2013 relative to a year earlier but net trade deducted 0.03 percentage points from GDP growth in IIIQ2012 and added 0.68 percentage points in IVQ2012. Net trade deducted 0.28 percentage points from US GDP growth in IQ2013 and deducted 0.07 percentage points in IIQ2013. Net traded added 0.14 percentage points to US GDP growth in IIIQ2013. Net trade added 0.99 percentage points to US GDP growth in IVQ2013. Industrial production increased 0.6 percent in Feb 2014 after decreasing 0.2 percent in Jan 2013 and changing 0.0 percent in Dec 2013, as shown in Table I-1, with all data seasonally adjusted. The report of the Board of Governors of the Federal Reserve System states (http://www.federalreserve.gov/releases/g17/Current/default.htm):

“Industrial production increased 0.6 percent in February after having declined 0.2 percent in January. In February, manufacturing output rose 0.8 percent and nearly reversed its decline of 0.9 percent in January, which resulted, in part, from extreme weather. The gain in factory production in February was the largest since last August. The output of utilities edged down 0.2 percent following a jump of 3.8 percent in January, and the production at mines moved up 0.3 percent. At 101.6 percent of its 2007 average, total industrial production in February was 2.8 percent above its level of a year earlier. The capacity utilization rate for total industry increased in February to 78.8 percent, a rate that is 1.3 percentage points below its long-run (1972–2013) average.”

In the six months ending in Feb 2014, United States national industrial production accumulated increase of 2.0 percent at the annual equivalent rate of 4.1 percent, which is higher than growth of 2.9 percent in the 12 months ending in Jan 2014. Excluding growth of -0.2 percent in Jan 2014, growth in the remaining five months from Sep to Feb 2013 accumulated to 2.2 percent or 5.4 percent annual equivalent. Industrial production fell in one of the past six months. Business equipment accumulated growth of 2.3 percent in the six months from Sep 2013 to Feb 2014 at the annual equivalent rate of 4.7 percent, which is lower than growth of 2.8 percent in the 12 months ending in Feb 2014. The Fed analyzes capacity utilization of total industry in its report (http://www.federalreserve.gov/releases/g17/Current/default.htm): “The capacity utilization rate for total industry increased in February to 78.8 percent, a rate that is 1.3 percentage points below its long-run (1972–2013) average.” United States industry apparently decelerated to a lower growth rate with possible acceleration in the past few months. Manufacturing increased 0.8 percent in Feb 2014 after decreasing 0.9 percent in Jan 2014 and increasing 0.2 percent in Dec 2013 seasonally adjusted, increasing 1.9 percent not seasonally adjusted in 12 months ending in Feb 2014, as shown in Table I-2. Manufacturing grew cumulatively 1.2 percent in the six months ending in Jan 2014 or at the annual equivalent rate of 2.4 percent. Excluding the decrease of 0.9 percent in Jan 2014, manufacturing accumulated growth of 2.1 percent from Sep 2013 to Feb 2013 or at the annual equivalent rate of 5.2 percent. Table I-2 provides a longer perspective of manufacturing in the US. There has been evident deceleration of manufacturing growth in the US from 2010 and the first three months of 2011 into more recent months as shown by 12 months rates of growth. Growth rates appeared to be increasing again closer to 5 percent in Apr-Jun 2012 but deteriorated. The rates of decline of manufacturing in 2009 are quite high with a drop of 18.2 percent in the 12 months ending in Apr 2009. Manufacturing recovered from this decline and led the recovery from the recession. Rates of growth appeared to be returning to the levels at 3 percent or higher in the annual rates before the recession but the pace of manufacturing fell steadily in the past six months with some strength at the margin. The Manufacturing fell 21.9 from the peak in Jun 2007 to the trough in Apr 2009 and increased by 19.1 percent from the trough in Apr 2009 to Dec 2013. Manufacturing grew 19.1 percent from the trough in Apr 2009 to Feb 2014. Manufacturing output in Feb 2014 is 6.9 percent below the peak in Jun 2007.

Table V-4, Growth of Trade and Contributions of Net Trade to GDP Growth, ∆% and % Points

| Exports | Exports 12 M ∆% | Imports | Imports 12 M ∆% | |

| USA | 0.6 Jan | 3.3 Jan | 0.6 Jan | -0.3 Jan |

| Japan | Feb 2014 9.5 Jan 2014 9.5 Dec 2013 15.3 Nov 2013 18.4 Oct 2013 18.6 Sep 2013 11.5 Aug 2013 14.7 Jul 2013 12.2 Jun 2013 7.4 May 2013 10.1 Apr 2013 3.8 Mar 2013 1.1 Feb 2013 -2.9 Jan 2013 6.4 Dec -5.8 Nov -4.1 Oct -6.5 Sep -10.3 Aug -5.8 Jul -8.1 | Feb 2014 9.0 Jan 2014 25.0 Dec 2013 24.7 Nov 2013 21.1 Oct 2013 26.1 Sep 2013 16.5 Aug 2013 16.0 Jul 2013 19.6 Jun 2013 11.8 May 2013 10.0 Apr 2013 9.4 Mar 2013 5.5 Feb 2013 7.3 Jan 2013 7.3 Dec 1.9 Nov 0.8 Oct -1.6 Sep 4.1 Aug -5.4 Jul 2.1 | ||

| China | 2014 -18.1 Feb 10.6 Jan 2013 4.3 Dec 12.7 Nov 5.6 Oct -0.3 Sep 7.2 Aug 5.1 Jul -3.1 Jun 1.0 May 14.7 Apr 10.0 Mar 21.8 Feb 25.0 Jan | 2014 10.1 Feb 10.0 Jan 2013 8.3 Dec 5.3 Nov 7.6 Oct 7.4 Sep 7.0 Aug 10.9 Jul -0.7 Jun -0.3 May 16.8 Apr 14.1 Mar -15.2 Feb 28.8 Jan | ||

| Euro Area | 1.0 12-M Jan | 0.8 Jan-Dec | -3.2 12-M Dec | -3.3 Jan-Dec |

| Germany | 2.2 Jan CSA | 2.9 Jan | 4.1 Jan CSA | 1.5 Jan |

| France Dec | -1.8 | -0.8 | -0.3 | 0.1 |

| Italy Jan | -1.5 | 0.2 | -1.6 | -6.6 |

| UK | -2.2 Feb | 0.1 Dec-Feb 14 /Dec-Feb 13 | 2.3 Dec | -0.4 Dec-Feb 14 13/Dec-Feb 13 |

| Net Trade % Points GDP Growth | % Points | |||

| USA | IVQ2013 0.99 IIIQ2013 0.14 IIQ2013 -0.07 IQ2013 -0.28 IVQ2012 +0.68 IIIQ2012 -0.03 IIQ2012 +0.10 IQ2012 +0.44 | |||

| Japan | 0.4 IQ2012 -1.3 IIQ2012 -2.2 IIIQ2012 -0.5 IVQ2012 1.7 IQ2013 0.6 IIQ2013 -2.0 IIIQ2013 -2.1 IVQ2013 | |||

| Germany | IQ2012 0.8 IIQ2012 0.4 IIIQ2012 0.3 IVQ2012 -0.5 IQ2013 -0.3 IIQ2013 0.3 IIIQ2013 -0.3 IVQ2013 1.1 | |||

| France | 0.1 IIIQ2012 0.1 IVQ2012 -0.1 IQ2013 0.2 IIQ2013 -0.7 IIIQ2013 0.2 IVQ2013 | |||

| UK | -0.8 IQ2012 -0.8 IIQ2012 +0.7 IIIQ2012 -0.5 IVQ2012 0.8 IQ2013 0.0 IIQ2013 -1.1 IIIQ2013 0.4 IVQ2013 |

Sources: Country Statistical Agencies http://www.census.gov/foreign-trade/ http://www.bea.gov/iTable/index_nipa.cfm

The geographical breakdown of exports and imports of Japan with selected regions and countries is provided in Table V-5 for Feb 2014. The share of Asia in Japan’s trade is more than one-half for 53.5 percent of exports and 41.7 percent of imports. Within Asia, exports to China are 18.5 percent of total exports and imports from China 18.0 percent of total imports. While exports to China increased 27.7 percent in the 12 months ending in Feb 2014, imports from China increased 5.7 percent. The largest export market for Japan in Feb 2014 is the US with share of 18.3 percent of total exports, which is close to that of China, and share of imports from the US of 8.8 percent in total imports. Japan’s exports to the US grew 5.6 percent in the 12 months ending in Feb 2014 and imports from the US grew 20.8 percent. Western Europe has share of 10.8 percent in Japan’s exports and of 10.7 percent in imports. Rates of growth of exports of Japan in Jan 2014 are 5.6 percent for exports to the US, minus 0.6 percent for exports to Brazil and 21.1 percent for exports to Germany. Comparisons relative to 2011 may have some bias because of the effects of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Deceleration of growth in China and the US and threat of recession in Europe can reduce world trade and economic activity. Growth rates of imports in the 12 months ending in Feb 2014 are positive for all trading partners except for declines from France and the Middle East. Imports from Asia increased 7.7 percent in the 12 months ending in Feb 2014 while imports from China increased 5.7 percent. Data are in millions of yen, which may have effects of recent depreciation of the yen relative to the United States dollar (USD).

Table V-5, Japan, Value and 12-Month Percentage Changes of Exports and Imports by Regions and Countries, ∆% and Millions of Yen

| Feb 2014 | Exports | 12 months ∆% | Imports Millions Yen | 12 months ∆% |

| Total | 5,799,966 | 9.8 | 6,600,275 | 9.0 |

| Asia | 3,102,072 | 12.5 | 2,749,544 | 7.7 |

| China | 1,074,853 | 27.7 | 1,185,620 | 5.7 |

| USA | 1,063,575 | 5.6 | 579,923 | 20.8 |

| Canada | 68,826 | -5.8 | 85,997 | 11.8 |

| Brazil | 38,879 | -0.6 | 96,705 | 1.2 |

| Mexico | 83,036 | 16.4 | 36,199 | 24.5 |

| Western Europe | 623,929 | 11.7 | 707,309 | 17.6 |

| Germany | 165,864 | 21.1 | 214,308 | 33.0 |

| France | 50,842 | 13.8 | 80,196 | -1.0 |

| UK | 87,878 | -0.6 | 52,547 | 5.1 |

| Middle East | 230,990 | 18.7 | 1,328,897 | -2.2 |

| Australia | 126,279 | -7.3 | 373,453 | 6.3 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

World trade projections of the IMF are in Table V-6. There is increasing growth of the volume of world trade of goods and services from 2.9 percent in 2013 to 5.4 percent in 2015 and 5.1 percent on average from 2013 to 2018. World trade would be slower for advanced economies while emerging and developing economies (EMDE) experience faster growth. World economic slowdown would more challenging with lower growth of world trade.

Table V-6, IMF, Projections of World Trade, USD Billions, USD/Barrel and ∆%

| 2013 | 2014 | 2015 | Average ∆% 2013-2018 | |

| World Trade Volume (Goods and Services) | 2.9 | 4.9 | 5.4 | 5.1 |

| Exports Goods & Services | 3.0 | 5.1 | 5.4 | 5.1 |

| Imports Goods & Services | 2.8 | 4.7 | 5.4 | 5.0 |

| Oil Price USD/Barrel | 104.49 | 101.35 | NA | NA |

| Value of World Exports Goods & Services $B | 23,164 | 24,367 | NA | NA |

| Value of World Exports Goods $B | 18,709 | 19,632 | NA | NA |

| Exports Goods & Services | ||||

| EMDE | 3.5 | 5.8 | 6.3 | 5.9 |

| G7 | 2.3 | 4.6 | 4.4 | 4.4 |

| Imports Goods & Services | ||||

| EMDE | 5.0 | 5.9 | 6.7 | 6.2 |

| G7 | 1.3 | 3.9 | 4.2 | 4.0 |

| Terms of Trade of Goods & Services | ||||

| EMDE | -0.5 | -0.4 | -0.6 | -0.5 |

| G7 | 0.1 | -0.1 | 0.1 | 0.1 |

| Terms of Trade of Goods | ||||

| EMDE | -0.6 | -0.9 | -0.9 | -0.8 |

| G7 | -0.5 | 0.2 | 0.2 | -0.007 |

Notes: Commodity Price Index includes Fuel and Non-fuel Prices; Commodity Industrial Inputs Price includes agricultural raw materials and metal prices; Oil price is average of WTI, Brent and Dubai

Source: International Monetary Fund World Economic Outlook databank

http://www.imf.org/external/pubs/ft/weo/2013/02/weodata/index.aspx

The JP Morgan Global All-Industry Output Index of the JP Morgan Manufacturing and Services PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, with high association with world GDP, decreased to 53.0 in Feb from 54.0 in Jan, indicating expansion at slower rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/90d6571ed14f442d8ac0a59d7592a77f). This index has remained above the contraction territory of 50.0 during 55 consecutive months. The employment index decreased from 51.9 in Jan to 51.4 in Feb with input prices rising at slower rate, new orders increasing at faster rate and output increasing at slower rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/90d6571ed14f442d8ac0a59d7592a77f). David Hensley, Director of Global Economics Coordination at JP Morgan finds temporary effects of services and weather with expectation of resumption of the growth impulse (http://www.markiteconomics.com/Survey/PressRelease.mvc/90d6571ed14f442d8ac0a59d7592a77f). The JP Morgan Global Manufacturing PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, increased at 53.3 in Feb from 53.0 in Jan (http://www.markiteconomics.com/Survey/PressRelease.mvc/24962c60b7d34a84a661c0c2cb0ab8b8). New export orders expanded for the eighth consecutive month at a faster rate than in Jn (http://www.markiteconomics.com/Survey/PressRelease.mvc/24962c60b7d34a84a661c0c2cb0ab8b8). David Hensley, Director of Global Economic Coordination at JP Morgan finds slowing of the index from the strength at the end of 2013 even excluding the US with weather effects (http://www.markiteconomics.com/Survey/PressRelease.mvc/24962c60b7d34a84a661c0c2cb0ab8b8). The HSBC Brazil Composite Output Index, compiled by Markit, increased from 49.9 in Jan to 50.8 in Feb, indicating expanding activity of Brazil’s private sector (http://www.markiteconomics.com/Survey/PressRelease.mvc/71ab794bc85841cf85d5c0b70a6692a2). The HSBC Brazil Services Business Activity index, compiled by Markit, increased from 49.6 in Jan to 50.8 in Feb, indicating expanding services activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/71ab794bc85841cf85d5c0b70a6692a2). André Loes, Chief Economist, Brazil, at HSBC, finds improving economy in Feb with more data required to assess conditions (http://www.markiteconomics.com/Survey/PressRelease.mvc/71ab794bc85841cf85d5c0b70a6692a2). The HSBC Brazil Purchasing Managers’ IndexTM (PMI™) decreased marginally from 50.8 in Jan to 50.4 in Feb, indicating marginal improvement in manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/46aa9d753c9f4f25b7fb307a8fa92821). André Loes, Chief Economist, Brazil at HSBC, finds slower growth of manufacturing with input prices increasing at the fastest rhythm since Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/46aa9d753c9f4f25b7fb307a8fa92821).

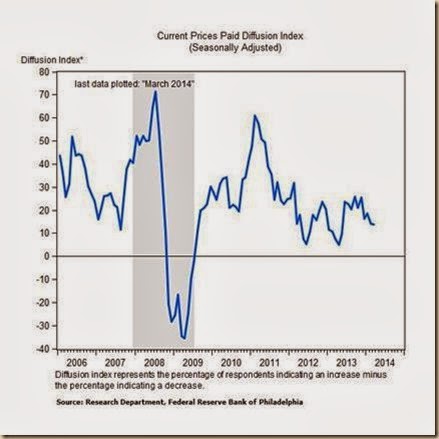

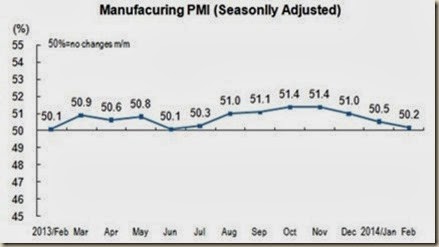

VA United States. The Markit Flash US Manufacturing Purchasing Managers’ Index™ (PMI™) seasonally adjusted increased to 56.7 in Feb from 53.7 in Jan, which is the highest rate of improvement since May 2010 (http://www.markiteconomics.com/Survey/PressRelease.mvc/c7542a2e11a34e0eb2dc6d0da06fef6e). New export orders registered 50.9 in Feb, increasing from 48.4 in Jan, indicating marginal expansion. Chris Williamson, Chief Economist at Markit, finds that manufacturing hiring is growing with creation of about 15,000 jobs in Feb (http://www.markiteconomics.com/Survey/PressRelease.mvc/c7542a2e11a34e0eb2dc6d0da06fef6e). The Markit Flash US Services PMI™ Business Activity Index increased from 55.7 in Dec to 56.6 in Jan (http://www.markiteconomics.com/Survey/PressRelease.mvc/979201249645452086dde674d0d375e0). Chris Williamson, Chief Economist at Markit, finds that the surveys are consistent with growth of jobs at monthly rate of 200,000 (http://www.markiteconomics.com/Survey/PressRelease.mvc/979201249645452086dde674d0d375e0). The Markit US Composite PMI™ Output Index of Manufacturing and Services decreased to 54.1 in Feb from 56.2 in Jan (http://www.markiteconomics.com/Survey/PressRelease.mvc/d041468211fe42bdad220ac2d97e2972). The Markit US Services PMI™ Business Activity Index decreased from 56.7 in Jan to 53.3 in Feb (http://www.markiteconomics.com/Survey/PressRelease.mvc/d041468211fe42bdad220ac2d97e2972). Chris Williamson, Chief Economist at Markit, finds weather effects with the indexes suggesting 1.7 percent annual growth in IQ2014 relative to 2.4 percent in IVQ2013 (http://www.markiteconomics.com/Survey/PressRelease.mvc/d041468211fe42bdad220ac2d97e2972). The Markit US Manufacturing Purchasing Managers’ Index™ (PMI™) increased to 57.1 in Feb from 53.7 in Jan, which indicates expansion at faster rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/84b031abddba4c3e829492e8c6209db6). The index of new exports orders increased from 48.5 in Jan to 51.6 in Feb while total new orders increased from 53.9 in Jan to 59.6 in Feb. Chris Williamson, Chief Economist at Markit, finds that the index suggests the fastest improvement in US manufacturing in nearly four years (http://www.markiteconomics.com/Survey/PressRelease.mvc/84b031abddba4c3e829492e8c6209db6). The purchasing managers’ index (PMI) of the Institute for Supply Management (ISM) Report on Business® increased 1.9 percentage points from 51.3 in Jan to 53.2 in Feb, which indicates growth at a faster rate (http://www.ism.ws/ISMReport/MfgROB.cfm?navItemNumber=12942). The index of new orders increased 3.0 percentage points from 60.6 in Oct to 63.6 in Nov. The index of exports decreased 13.2 percentage point from 64.4 in Dec to 51.2 in Nov, growing at a slower rate. The Non-Manufacturing ISM Report on Business® PMI decreased 2.4 percentage points from 54.0 in Jan to 51.6 in Feb, indicating growth of business activity/production during 55 consecutive months, while the index of new orders increased 0.4 percentage points from 50.9 in Jan to 51.3 in Feb (http://www.ism.ws/ISMReport/NonMfgROB.cfm?navItemNumber=12943). Table USA provides the country economic indicators for the US.

Table USA, US Economic Indicators

| Consumer Price Index | Feb 12 months NSA ∆%: 1.1; ex food and energy ∆%: 1.6 Feb month SA ∆%: 0.1; ex food and energy ∆%: 0.1 |

| Producer Price Index | Finished Goods Feb 12-month NSA ∆%: 1.3; ex food and energy ∆% 1.7 Final Demand Feb 12-month NSA ∆%: 0.9; ex food and energy ∆% 1.1 |

| PCE Inflation | Jan 12-month NSA ∆%: headline 1.2; ex food and energy ∆% 1.1 |

| Employment Situation | Household Survey: Feb Unemployment Rate SA 6.7% |

| Nonfarm Hiring | Nonfarm Hiring fell from 63.3 million in 2006 to 54.2 million in 2013 or by 9.1 million |

| GDP Growth | BEA Revised National Income Accounts IIQ2012/IIQ2011 2.8 IIIQ2012/IIIQ2011 3.1 IVQ2012/IVQ2011 2.0 IQ2013/IQ2012 1.3 IIQ2013/IIQ2012 1.6 IIIQ2013/IIIQ2012 2.0 IVQ2013/IVQ2012 2.5 IQ2012 SAAR 3.7 IIQ2012 SAAR 1.2 IIIQ2012 SAAR 2.8 IVQ2012 SAAR 0.1 IQ2013 SAAR 1.1 IIQ2013 SAAR 2.5 IIIQ2013 SAAR 4.1 IVQ2013 SAAR 2.4 |

| Real Private Fixed Investment | SAAR IVQ2013 3.8 ∆% IVQ2007 to IVQ2013: minus 2.7% Blog 3/2/14 |

| Personal Income and Consumption | Jan month ∆% SA Real Disposable Personal Income (RDPI) SA ∆% 0.3 |

| Quarterly Services Report | IVQ13/IVQ12 NSA ∆%: Financial & Insurance 5.6 |

| Employment Cost Index | Compensation Private IVQ2013 SA ∆%: 0.5 |

| Industrial Production | Feb month SA ∆%: 0.6 Manufacturing Feb SA ∆% 0.8 Feb 12 months SA ∆% 1.5, NSA 1.9 |

| Productivity and Costs | Nonfarm Business Productivity IVQ2013∆% SAAE 1.8; IVQ2013/IVQ2012 ∆% 1.3; Unit Labor Costs SAAE IVQ2013 ∆% -0.1; IVQ2013/IVQ2012 ∆%: -0.9 Blog 3/9/2014 |

| New York Fed Manufacturing Index | General Business Conditions From Feb 4.48 to Mar 5.61 |

| Philadelphia Fed Business Outlook Index | General Index from Feb -6.3 to Mar 9.0 |

| Manufacturing Shipments and Orders | New Orders SA Jan ∆% -0.7 Ex Transport 0.2 Jan NSA New Orders ∆% 1.2 Ex transport 0.4 |

| Durable Goods | Jan New Orders SA ∆%: minus 1.0; ex transport ∆%: 1.1 |

| Sales of New Motor Vehicles | Jan-Feb 2014 2,206,454; Feb 2013 2,238,820. Feb 14 SAAR 15.34 million, Jan 14 SAAR 15.34 million, Feb 2013 SAAR 15.34 million Blog 3/9/14 |

| Sales of Merchant Wholesalers | Jan 2014/Jan 2013 NSA ∆%: Total 3.5; Durable Goods: 5.0; Nondurable |

| Sales and Inventories of Manufacturers, Retailers and Merchant Wholesalers | Jan 14 12-M NSA ∆%: Sales Total Business 2.6; Manufacturers 1.8 |

| Sales for Retail and Food Services | Jan-Feb 2014/Jan-Feb 2013 ∆%: Retail and Food Services 1.9; Retail ∆% 1.8 |

| Value of Construction Put in Place | Jan SAAR month SA ∆%: 0.1 Jan 12-month NSA: 9.4 |

| Case-Shiller Home Prices | Dec 2013/Dec 2012 ∆% NSA: 10 Cities 13.6; 20 Cities: 13.4 |

| FHFA House Price Index Purchases Only | Dec SA ∆% 0.8; |

| New House Sales | Jan 2014 month SAAR ∆%: 9.6 |

| Housing Starts and Permits | Feb Starts month SA ∆% minus 0.2; Permits ∆%: 7.7 |

| Trade Balance | Balance Jan SA -$39,095 million versus Dec -$38,975 million |

| Export and Import Prices | Feb 12-month NSA ∆%: Imports -1.2; Exports -1.3 |

| Consumer Credit | Jan ∆% annual rate: Total 5.3; Revolving -0.3; Nonrevolving 7.5 |

| Net Foreign Purchases of Long-term Treasury Securities | Jan Net Foreign Purchases of Long-term US Securities: $7.3 billion |

| Treasury Budget | Fiscal Year 2014/2013 ∆% Feb: Receipts 9.3; Outlays minus 1.5; Individual Income Taxes 2.6 Deficit Fiscal Year 2012 $1,087 billion Deficit Fiscal Year 2013 $680 billion Blog 3/16/2014 |

| CBO Budget and Economic Outlook | 2012 Deficit $1087 B 6.8% GDP Debt 11,281 B 70.1% GDP 2013 Deficit $680 B, 4.1% GDP Debt 11,982 B 72.1% GDP Blog 8/26/12 11/18/12 2/10/13 9/22/13 2/16/14 |

| Commercial Banks Assets and Liabilities | Jan 2014 SAAR ∆%: Securities 1.7 Loans 3.7 Cash Assets 24.9 Deposits 8.9 Blog 3/2/14 |

| Flow of Funds | IVQ2013 ∆ since 2007 Assets +$12,272.6 BN Nonfinancial -$729.2 BN Real estate -$1380.6 BN Financial +13,001.7 BN Net Worth +$12,910.9 BN Blog 3/16/14 |

| Current Account Balance of Payments | IVQ2013 -83,739 MM %GDP 2.2 Blog 3/23/14 |

Links to blog comments in Table USA:

3/16/2014 http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html

3/9/14 http://cmpassocregulationblog.blogspot.com/2014/03/rules-discretionary-authorities-and.html

3/2/14 http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html

2/23/14 http://cmpassocregulationblog.blogspot.com/2014/02/squeeze-of-economic-activity-by-carry.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

2/9/14 http://cmpassocregulationblog.blogspot.com/2014/02/financial-instability-rules.html

9/22/13 http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html

2/10/13 http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

Seasonally adjusted annual rates (SAAR) of housing starts and permits are shown in Table VA-1. Housing starts fell 0.2 percent in Feb 2014 after wide oscillations in 2013 that included decrease of 11.2 percent in Jan, increase of 22.5 percent in Nov, decline of 15.2 percent in Apr 2013 and 9.1 percent in Jun 2013. Housing starts decreased 6.4 percent from the SAAR of 969 in Feb 2013 to the SAAR of 907 in Feb 2014. Housing permits, indicating future activity, increased 7.7 percent in Feb 2014 also after significant oscillations in 2013 with increase of 6.9 percent from 952 SSAR in Jan 2013 to SSAR of 1018 in Feb 2014. While single unit houses starts decreased 1.8 percent in Feb 2014, seasonally adjusted, structures with five units or more increased 27.6 percent. Multifamily residential construction is increasing at a faster rate than single-family construction with wide monthly oscillations. Monthly rates in starts and permits fluctuate significantly as shown in Table VA-1.

Table VA-1, US, Housing Starts and Permits SSAR Month ∆%

| Housing | Month ∆% | Housing | Month ∆% | |

| Feb 2014 | 907 | -0.2 | 1018 | 7.7 |

| Jan | 909 | -11.2 | 945 | -4.6 |

| Dec 2013 | 1024 | -7.0 | 991 | -2.6 |

| Nov | 1101 | 22.5 | 1017 | -2.1 |

| Oct | 899 | 3.0 | 1039 | 6.7 |

| Sep | 873 | -1.1 | 974 | 5.2 |

| Aug | 883 | -0.9 | 926 | -2.9 |

| Jul | 891 | 6.7 | 954 | 3.9 |

| Jun | 835 | -9.1 | 918 | -6.8 |

| May | 919 | 7.9 | 985 | -2.0 |

| Apr | 852 | -15.2 | 1005 | 12.9 |

| Mar | 1005 | 3.7 | 890 | -6.5 |

| Feb | 969 | 7.9 | 952 | 4.0 |

| Jan | 898 | -8.6 | 915 | -3.0 |

| Dec 2012 | 983 | 16.7 | 943 | 1.1 |

| Nov | 842 | -2.5 | 933 | 2.8 |

| Oct | 864 | 1.2 | 908 | -1.4 |

| Sep | 854 | 14.0 | 921 | 11.4 |

| Aug | 749 | 1.1 | 827 | -1.4 |

| Jul | 741 | -2.1 | 839 | 6.9 |

| Jun | 757 | 6.5 | 785 | -2.6 |

| May | 711 | -5.7 | 806 | 7.6 |

| Apr | 754 | 6.6 | 749 | -4.6 |

| Mar | 707 | -0.8 | 785 | 6.2 |

| Feb | 713 | -1.4 | 739 | 3.5 |

| Jan | 723 | 4.2 | 714 | 2.4 |

| Dec 2011 | 694 | -2.4 | 697 | -1.3 |

| Nov | 711 | 16.6 | 706 | 5.2 |

| Oct | 610 | -6.2 | 671 | 10.0 |

| Sep | 650 | 11.1 | 610 | -5.7 |

| Aug | 585 | -6.1 | 647 | 4.2 |

| Jul | 623 | 2.5 | 621 | -2.4 |

| Jun | 608 | 8.4 | 636 | 2.9 |

| May | 561 | 1.3 | 618 | 6.4 |

| Apr | 554 | -7.7 | 581 | -0.3 |

| Mar | 600 | 16.1 | 583 | 7.6 |

| Feb | 517 | -17.9 | 542 | -5.9 |

| Jan | 630 | 16.9 | 576 | -8.9 |

| Dec 2010 | 539 | -1.1 | 632 | 12.9 |

| Nov | 545 | 0.4 | 560 | 0.4 |

| Oct | 543 | -8.6 | 558 | -0.9 |

| Sep | 594 | -0.8 | 563 | -2.9 |

SAAR: Seasonally Adjusted Annual Rate

Source: US Census Bureau http://www.census.gov/construction/nrc/

Housing starts and permits in Jan-Feb not-seasonally adjusted are in Table VA-2. Housing starts decreased 4.4 percent in Jan-Feb 2014 relative to Jan-Feb 2013 and new permits increased 4.4 percent. Construction of new houses in the US remains at very depressed levels. Housing starts fell 58.6 percent in Jan-Feb 2014 relative to Jan-Feb 2006 and fell 57.7 percent relative to Jan-Feb 2005. Housing permits fell 55.4 percent in Jan-Feb 2014 relative to Jan-Feb 2006 and fell 52.4 percent relative to Jan-Feb 2005.

Table VA-2, US, Housing Starts and New Permits, Thousands of Units, NSA, and %

| Housing Starts | New Permits | |

| Jan-Feb 2014 | 123.5 | 135.7 |

| Jan-Feb 2013 | 124.7 | 130.0 |

| ∆% Jan-Feb 2014/Jan-Feb 2013 | -1.0 | 4.4 |

| Jan-Feb 2006 | 298.2 | 304.2 |

| ∆% Jan-Feb 2014/Jan-Feb 2006 | -58.6 | -55.4 |

| Jan-Feb 2005 | 292.0 | 285.3 |

| ∆% Jan-Feb 2014/Jan-Feb 2005 | -57.7 | -52.4 |

Source: US Census Bureau http://www.census.gov/construction/nrc/

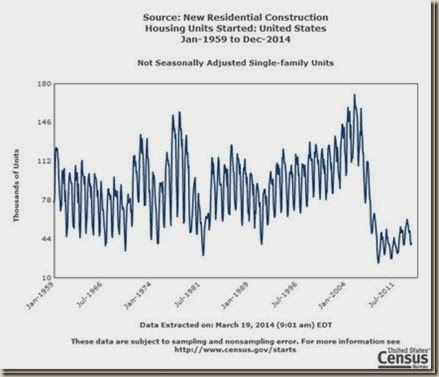

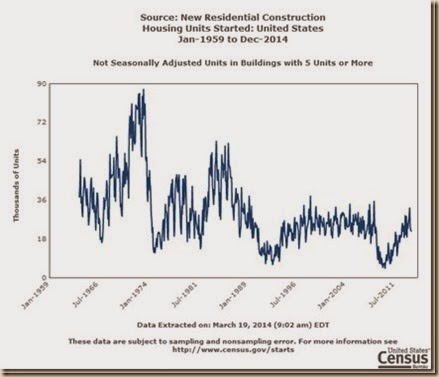

Chart VA-1 of the US Census Bureau shows the sharp increase in construction of new houses from 2000 to 2006. Housing construction fell sharply through the recession, recovering from the trough around IIQ2009. The right-hand side of Chart VA-4 shows a mild downward trend or stagnation from mid-2010 to the present in single-family houses with a recent mild upward trend in recent months in the category of two or more units but marginal decline in recent months. While single unit houses starts decreased 0.5 percent in Jan-Feb 2014 relative to a year earlier, not seasonally adjusted, structures with two to four units decreased 12.8 percent and with five units or more increased 15.4 percent. Single unit houses were 63.2 percent of total housing starts in 2013, increasing 19.0 percent relative to 2012, while construction of five units of more were 34.0 percent, increasing 16.6 percent, and construction of two to four units were 2.8 percent of the total, increasing 2.7 percent.

Chart VA-1, US, Total and Single-Family New Housing Units Started in the US, SAAR (Seasonally Adjusted Annual Rate)

Source: US Census Bureau

http://www.census.gov/briefrm/esbr/www/esbr020.html

Table VA-3 provides new housing units that started in the US at seasonally adjusted annual rates (SAAR) from Aug to Dec and from Jan to Feb of the years from 2000 to 2014. SAARs have dropped from high levels around 2 million in 2005-2006 to the range of 707,000 in Mar 2012 to 983,000 in Dec 2012 and 1,005,000 in Mar 2013, which is an improvement over the range of 517,000 in Feb 2011 to 711,000 in Nov 2011. There is improvement in Jul 2013 with SAAR of 891,000 relative to 741,000 in Jul 2012 and in Aug 2013 with 883,000 relative to 749,000 in Aug 2012. Improvement continued with 1,024,000 in Dec 2013 relative to 983,000 in Dec 2012. Housing starts remained at a relatively high level of 1,024,000 in Dec 2013 compared with 983,000 in Dec 2012. The rate of housing starts fell to 907,000 in Feb 2014 relative to 979,000 in Feb 2013.

Table VA-3, US, New Housing United Started at Seasonally Adjusted Rates, Thousand Units

| Jan | Feb | Aug | Sep | Oct | Nov | Dec | |

| 2000 | 1,636 | 1,737 | 1,541 | 1,507 | 1,549 | 1,551 | 1,532 |

| 2001 | 1,600 | 1,625 | 1,567 | 1,562 | 1,540 | 1,602 | 1,568 |

| 2002 | 1,698 | 1,829 | 1,633 | 1,804 | 1,648 | 1,753 | 1,788 |

| 2003 | 1,853 | 1,629 | 1,833 | 1,939 | 1,967 | 2,083 | 2,057 |

| 2004 | 1,911 | 1,846 | 2,024 | 1,905 | 2,072 | 1,782 | 2,042 |

| 2005 | 2,144 | 2,207 | 2,095 | 2,151 | 2,065 | 2,147 | 1,994 |

| 2006 | 2,273 | 2,119 | 1,650 | 1,720 | 1,491 | 1,570 | 1,649 |

| 2007 | 1,409 | 1,480 | 1,330 | 1,183 | 1,264 | 1,197 | 1,037 |

| 2008 | 1,084 | 1,103 | 844 | 820 | 777 | 652 | 560 |

| 2009 | 490 | 582 | 586 | 585 | 534 | 588 | 581 |

| 2010 | 614 | 604 | 599 | 594 | 543 | 545 | 539 |

| 2011 | 630 | 517 | 585 | 650 | 610 | 711 | 694 |

| 2012 | 723 | 713 | 749 | 854 | 864 | 842 | 983 |

| 2013 | 898 | 969 | 883 | 873 | 899 | 1,101 | 1,024 |

| 2014 | 909 | 907 | NA | NA | NA | NA | NA |

Source: US Census Bureau http://www.census.gov/construction/nrc/

Chart VA-2 of the US Census Bureau provides construction of new housing units started in the US at seasonally adjusted annual rate (SAAR) from Jan 1959 to Feb 2014 that helps to analyze in historical perspective the debacle of US new house construction. There are three periods in the series. (1) There is stationary behavior with wide fluctuations from 1959 to the beginning of the decade of the 1970s. (2) There is sharp upward trend from the 1990s to 2006 propelled by the US housing subsidy, politics of Fannie Mae and Freddie Mac and unconventional monetary policy of near zero interest rates from Jun 2003 to Jun 2004 and suspension of the auction of 30-year Treasury bonds intended to lower mortgage rates. The financial crisis and global recession were caused by interest rate and housing subsidies and affordability policies that encouraged high leverage and risks, low liquidity and unsound credit (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 157-66, Regulation of Banks and Finance (2009b), 217-27, International Financial Architecture (2005), 15-18, The Global Recession Risk (2007), 221-5, Globalization and the State Vol. II (2008b), 197-213, Government Intervention in Globalization (2008c), 182-4). Several past comments of this blog elaborate on these arguments, among which: http://cmpassocregulationblog.blogspot.com/2011/07/causes-of-2007-creditdollar-crisis.html http://cmpassocregulationblog.blogspot.com/2011/01/professor-mckinnons-bubble-economy.html http://cmpassocregulationblog.blogspot.com/2011/01/world-inflation-quantitative-easing.html http://cmpassocregulationblog.blogspot.com/2011/01/treasury-yields-valuation-of-risk.html http://cmpassocregulationblog.blogspot.com/2010/11/quantitative-easing-theory-evidence-and.html http://cmpassocregulationblog.blogspot.com/2010/12/is-fed-printing-money-what-are.html .

Chart VA-2, US, New Housing Units Started in the US, SAAR (Seasonally Adjusted Annual Rate), Thousands of Units, Jan 1959-Feb 2014

Source: US Census Bureau http://www.census.gov/construction/nrc/

Table VA-4 provides actual new housing units started in the US, not seasonally adjusted, from Aug to Dec and from Jan to Feb in the years from 2000 to 2014. The number of housing units started fell from the peak of 197.9 thousand in May 2005 to 67.6 thousand in Dec 2013 or decline of 65.8 percent in large part because of lower seasonal activity at the end of the year. The number of housing units started jumped increased from 49.7 thousand in Jan 2012 to 62.4 thousand in Feb 2014 or by 25.5 percent and increased 53.3 percent from 40.7 thousand in Feb 2010.

Table VA-4, New Housing Units Started in the US, Not Seasonally Adjusted, Thousands of Units

| Jan | Feb | Aug | Sep | Oct | Nov | Dec | |

| 2000 | 104.0 | 119.7 | 141.4 | 128.9 | 139.7 | 117.1 | 100.7 |

| 2001 | 106.4 | 108.2 | 141.5 | 133.1 | 139.8 | 121.0 | 104.6 |

| 2002 | 110.4 | 120.4 | 147.0 | 155.6 | 146.8 | 133.0 | 123.1 |

| 2003 | 117.8 | 109.7 | 163.8 | 171.3 | 173.5 | 153.7 | 144.2 |

| 2004 | 124.5 | 126.4 | 185.9 | 164.0 | 181.3 | 138.1 | 140.2 |

| 2005 | 142.9 | 149.1 | 192.0 | 187.9 | 180.4 | 160.7 | 136.0 |

| 2006 | 153.0 | 145.1 | 146.8 | 150.1 | 130.6 | 115.2 | 112.4 |

| 2007 | 95.0 | 103.1 | 121.2 | 101.5 | 115.0 | 88.8 | 68.9 |

| 2008 | 70.8 | 78.4 | 76.4 | 73.9 | 68.2 | 47.5 | 37.7 |

| 2009 | 31.9 | 39.8 | 52.9 | 52.6 | 44.5 | 42.3 | 36.6 |

| 2010 | 38.9 | 40.7 | 56.3 | 53.0 | 45.4 | 40.6 | 33.8 |

| 2011 | 40.2 | 35.4 | 54.5 | 58.8 | 53.2 | 53.0 | 42.7 |

| 2012 | 47.2 | 49.7 | 69.0 | 75.8 | 77.0 | 62.2 | 63.2 |

| 2013 | 58.7 | 66.1 | 80.4 | 78.4 | 78.4 | 83.8 | 67.6 |

| 2014 | 61.1 | 62.4 | NA | NA | NA | NA | NA |

Source: US Census Bureau http://www.census.gov/construction/nrc/

Chart VA-3 of the US Census Bureau provides new housing units started in the US not seasonally adjusted (NSA) from Jan 1959 to Feb 2014. There is the same behavior as in Chart VA-2 SA but with sharper fluctuations in the original series without seasonal adjustment. There are the same three periods. (1) The series is virtually stationary with wide fluctuations from 1959 to the late 1980s. (2) There is downward trend during the savings and loans crisis of the 1980s. Benston and Kaufman (1997, 139) find that there was failure of 1150 US commercial and savings banks between 1983 and 1990, or about 8 percent of the industry in 1980, which is nearly twice more than between the establishment of the Federal Deposit Insurance Corporation in 1934 through 1983. More than 900 savings and loans associations, representing 25 percent of the industry, were closed, merged or placed in conservatorships (see Pelaez and Pelaez, Regulation of Banks and Finance (2008b), 74-7). The Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA) created the Resolution Trust Corporation (RTC) and the Savings Association Insurance Fund (SAIF) that received $150 billion of taxpayer funds to resolve insolvent savings and loans. The GDP of the US in 1989 was $4346.7 billion (http://www.bea.gov/iTable/index_nipa.cfm), such that the partial cost to taxpayers of that bailout was around 3.45 percent of GDP in a year. US GDP in 2013 is estimated at $16,797.5 billion, such that the bailout would be equivalent to cost to taxpayers of about $579.5 billion in current GDP terms. A major difference with the Troubled Asset Relief Program (TARP) for private-sector banks is that most of the costs were recovered with interest gains whereas in the case of savings and loans there was no recovery. (3) There is vertical drop of new housing construction in the US during the global recession from (Dec) IVQ2007 to (Jun) IIQ2009 (http://www.nber.org/cycles/cyclesmain.html). The final segment shows upward trend but it could be simply part of yet another fluctuation. Marginal improvement in housing in the US should not obscure the current depressed levels relative to earlier periods.

Chart VA-3, US, New Housing Units Started in the US, Not Seasonally Adjusted, Thousands of Units, Jan 1959-Feb 2014

Source: US Census Bureau http://www.census.gov/construction/nrc/

Chart VA-4 of the US Census Bureau provides single-family houses started without seasonal adjustment. There was sharp increase from 1992 to 2007 followed by sharp decline. The recovery is sluggish.

Chart VA-4, US, Single-family Houses Started, Thousands of Units, Jan-1959-Feb 2014, NSA

Source: US Census Bureau http://www.census.gov/construction/nrc

Chart VA-5 of the US Census Bureau provides housing units started with five units or more. Construction was stagnant before the drop in the global recession. Recovery is stronger than in the case of single-family units.

Chart VA-5, US, Housing Units Stated in Buildings with Five Units or More, Thousands of Units, Jan-1959-Feb 2014, NSA

Source: US Census Bureau http://www.census.gov/construction/nrc/

A longer perspective on residential construction in the US is provided by Table VA-5 with annual data from 1960 to 2013. Housing starts fell 55.3 percent from 2005 to 2013, 41.0 percent from 2000 to 2013 and 35.3 percent relative to the average from 1959 to 1963. Housing permits fell 54.7 percent from 2005 to 2013, 38.7 percent from 2000 to 2013 and 15.7 percent from the average of 1969-1963 to 2013. Housing starts rose 31.8 from 2000 to 2005 while housing permits grew 35.4 percent. From 1990 to 2000, housing starts increased 31.5 percent while permits increased 43.3 percent.

Table VA-5, US, Annual New Privately Owned Housing Units Authorized by Building Permits in Permit-Issuing Places and New Privately Owned Housing Units Started, Thousands

| Starts | Permits | |

| 2013 | 924.9 | 976.4 |

| 2012 | 780.6 | 829.7 |

| ∆% 2013/2012 | 18.5 | 17.7 |

| ∆% 2013/2011 | 51.9 | 56.4 |

| ∆% 2013/2010 | 57.6 | 61.5 |

| ∆% 2013/2006 | -48.6 | -46.9 |

| ∆% 2013/2005 | -55.3 | -54.7 |

| ∆% 2013/2000 | -41.0 | -38.7 |

| ∆% 2013/Av 1959-1963 | -35.3 | -15.7 |

| 2011 | 608.8 | 624.1 |

| ∆% 2012/2005 | -62.3 | -61.5 |

| ∆% 2012/2000 | -50.2 | -47.9 |

| ∆% 2012/Av 1959-1963 | -45.4 | -28.4 |

| 2011 | 608.8 | 624.1 |

| 2010 | 586.9 | 604.6 |

| 2009 | 554.0 | 583.0 |

| 2008 | 905.5 | 905.4 |

| 2007 | 1,355,0 | 1,398.4 |

| 2006 | 1,800.9 | 1,838.9 |

| 2005 | 2,068.3 | 2,155.3 |

| ∆% 2005/2000 | 31.8 | 35.4 |

| 2004 | 1,955.8 | 2,070.1 |

| 2003 | 1,847.7 | 1,889.2 |

| 2002 | 1,704.9 | 1,747.7 |

| 2001 | 1,602.7 | 1,636.7 |

| 2000 | 1,568.7 | 1,592.3 |

| ∆% 2000/1990 | 31.5 | 43.3 |

| 1990 | 1,192,7 | 1,110.8 |

| 1980 | 1,292.2 | 1,190.6 |

| 1970 | 1,433.6 | 1,351.5 |

| Average 1959-63 | 1,429.7 | 1,158.2 |

Source: US Census Bureau

http://www.census.gov/construction/nrc/

VB Japan. Table VB-BOJF provides the forecasts of economic activity and inflation in Japan by the majority of members of the Policy Board of the Bank of Japan, which is part of their Outlook for Economic Activity and Prices (http://www.boj.or.jp/en/announcements/release_2013/k130711a.pdf). For fiscal 2013, the forecast is of growth of GDP between 2.5 and 2.9 percent, with the all items CPI less fresh food of 0.7 to 0.9 percent (http://www.boj.or.jp/en/announcements/release_2014/k140122a.pdf). The critical difference is forecast of the CPI excluding fresh food of 2.9 to 3.6 percent in 2014 and 1.7 to 2.9 percent in 2015. Consumer price inflation in Japan excluding fresh food was 0.0 percent in Nov 2013 and 1.2 percent in 12 months (http://www.stat.go.jp/english/data/cpi/1581.htm). The new monetary policy of the Bank of Japan aims to increase inflation to 2 percent. These forecasts are biannual in Apr and Oct. The Cabinet Office, Ministry of Finance and Bank of Japan released on Jan 22, 2013, a “Joint Statement of the Government and the Bank of Japan on Overcoming Deflation and Achieving Sustainable Economic Growth” (http://www.boj.or.jp/en/announcements/release_2013/k130122c.pdf) with the important change of increasing the inflation target of monetary policy from 1 percent to 2 percent:

“The Bank of Japan conducts monetary policy based on the principle that the policy shall be aimed at achieving price stability, thereby contributing to the sound development of the national economy, and is responsible for maintaining financial system stability. The Bank aims to achieve price stability on a sustainable basis, given that there are various factors that affect prices in the short run.

The Bank recognizes that the inflation rate consistent with price stability on a sustainable basis will rise as efforts by a wide range of entities toward strengthening competitiveness and growth potential of Japan's economy make progress. Based on this recognition, the Bank sets the price stability target at 2 percent in terms of the year-on-year rate of change in the consumer price index.

Under the price stability target specified above, the Bank will pursue monetary easing and aim to achieve this target at the earliest possible time. Taking into consideration that it will take considerable time before the effects of monetary policy permeate the economy, the Bank will ascertain whether there is any significant risk to the sustainability of economic growth, including from the accumulation of financial imbalances.”

The Bank of Japan also provided explicit analysis of its view on price stability in a “Background note regarding the Bank’s thinking on price stability” (http://www.boj.or.jp/en/announcements/release_2013/data/rel130123a1.pdf http://www.boj.or.jp/en/announcements/release_2013/rel130123a.htm/). The Bank of Japan also amended “Principal terms and conditions for the Asset Purchase Program” (http://www.boj.or.jp/en/announcements/release_2013/rel130122a.pdf): “Asset purchases and loan provision shall be conducted up to the maximum outstanding amounts by the end of 2013. From January 2014, the Bank shall purchase financial assets and provide loans every month, the amount of which shall be determined pursuant to the relevant rules of the Bank.”

Financial markets in Japan and worldwide were shocked by new bold measures of “quantitative and qualitative monetary easing” by the Bank of Japan (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf). The objective of policy is to “achieve the price stability target of 2 percent in terms of the year-on-year rate of change in the consumer price index (CPI) at the earliest possible time, with a time horizon of about two years” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf). The main elements of the new policy are as follows:

- Monetary Base Control. Most central banks in the world pursue interest rates instead of monetary aggregates, injecting bank reserves to lower interest rates to desired levels. The Bank of Japan (BOJ) has shifted back to monetary aggregates, conducting money market operations with the objective of increasing base money, or monetary liabilities of the government, at the annual rate of 60 to 70 trillion yen. The BOJ estimates base money outstanding at “138 trillion yen at end-2012) and plans to increase it to “200 trillion yen at end-2012 and 270 trillion yen at end 2014” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf).

- Maturity Extension of Purchases of Japanese Government Bonds. Purchases of bonds will be extended even up to bonds with maturity of 40 years with the guideline of extending the average maturity of BOJ bond purchases from three to seven years. The BOJ estimates the current average maturity of Japanese government bonds (JGB) at around seven years. The BOJ plans to purchase about 7.5 trillion yen per month (http://www.boj.or.jp/en/announcements/release_2013/rel130404d.pdf). Takashi Nakamichi, Tatsuo Ito and Phred Dvorak, wiring on “Bank of Japan mounts bid for revival,” on Apr 4, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887323646604578401633067110420.html ), find that the limit of maturities of three years on purchases of JGBs was designed to avoid views that the BOJ would finance uncontrolled government deficits.

- Seigniorage. The BOJ is pursuing coordination with the government that will take measures to establish “sustainable fiscal structure with a view to ensuring the credibility of fiscal management” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf).

- Diversification of Asset Purchases. The BOJ will engage in transactions of exchange traded funds (ETF) and real estate investment trusts (REITS) and not solely on purchases of JGBs. Purchases of ETFs will be at an annual rate of increase of one trillion yen and purchases of REITS at 30 billion yen.

- Bank Lending Facility and Growth Supporting Funding Facility. At the meeting on Feb 18, the Bank of Japan doubled the scale of these lending facilities to prevent their expiration in the near future (http://www.boj.or.jp/en/announcements/release_2014/k140218a.pdf).

Table VB-BOJF, Bank of Japan, Forecasts of the Majority of Members of the Policy Board, % Year on Year

| Fiscal Year | Real GDP | CPI All Items Less Fresh Food | Excluding Effects of Consumption Tax Hikes |

| 2013 | |||

| Jan 2014 | +2.5 to +2.9 [+2.7] | +0.7 to +0.9 [+0.7] | |

| Oct 2013 | +2.6 to +3.0 [+2.7] | +0.6 to +1.0 [+0.7] | |

| Jul 2013 | +2.5 to +3.0 [+2.8] | +0.5 to +0.8 [+0.6] | |

| 2014 | |||

| Jan 2014 | +0.9 to 1.5 [+1.4] | +2.9 to +3.6 [+3.3] | +0.9 to +1.6 [+1.3] |

| Oct 2013 | +0.9 to +1.5 [+1.5] | +2.8 to +3.6 [+3.3] | +0.8 to +1.6 [+1.3] |

| Jul 2013 | +0.8 to +1.5 [+1.3] | +2.7 to +3.6 [+3.3] | +0.7 to +1.6 [+1.3] |

| 2015 | |||

| Jan 2014 | +1.2 to +1.8 [+1.5] | +1.7 to +2.9 [+2.6] | +1.0 to +2.2 [+1.9] |

| Oct 2013 | +1.3 to +1.8 [+1.5] | +1.6 to +2.9 [+2.6] | +0.9 to +2.2 [+1.9] |

| Jul 2013 | +1.3 to +1.9 [+1.5] | +1.6 to +2.9 [+2.6] | +0.9 to +2.2 [+1.9] |

Figures in brackets are the median of forecasts of Policy Board members

Source: Policy Board, Bank of Japan

http://www.boj.or.jp/en/mopo/outlook/gor1310b.pdf

Private-sector activity in Japan expanded with the Markit Composite Output PMI™ Index decreasing from 54.1 in Jan to 52.0 in Feb, indicating slower growth (http://www.markiteconomics.com/Survey/PressRelease.mvc/6d69e0d951cf45b4a3f0e45809ba5b4c). Paul Smith, Director at Markit and author of the report, finds that the survey data suggest weakening conditions because of weather effects (http://www.markiteconomics.com/Survey/PressRelease.mvc/6d69e0d951cf45b4a3f0e45809ba5b4c). The Markit Business Activity Index of Services decreased from the record of 51.8 in Nov to 52.1 in Dec, 51.2 in Jan and 49.3 in Feb (http://www.markiteconomics.com/Survey/PressRelease.mvc/6d69e0d951cf45b4a3f0e45809ba5b4c). Paul Smith, Director at Markit and author of the report, finds concerns with the increase in sales taxes (http://www.markiteconomics.com/Survey/PressRelease.mvc/6d69e0d951cf45b4a3f0e45809ba5b4c). The Markit/JMMA Purchasing Managers’ Index™ (PMI™), seasonally adjusted, decreased from 56.6 in Jan, which is the highest level since Feb 2006, to 55.5 in Feb (http://www.markiteconomics.com/Survey/PressRelease.mvc/18431136559044cfbbe099e870c915b5). New orders grew at a high rate for the twelfth consecutive month. New export orders increased for the sixth consecutive month at slow pace. Paul Smith, Economist at Markit and author of the report, finds improving manufacturing conditions with some concerns about the sales tax increase in Apr with price increases providing some compensation (http://www.markiteconomics.com/Survey/PressRelease.mvc/18431136559044cfbbe099e870c915b5).Table JPY provides the country data table for Japan.

Table JPY, Japan, Economic Indicators

| Historical GDP and CPI | 1981-2010 Real GDP Growth and CPI Inflation 1981-2010 |

| Corporate Goods Prices | Feb ∆% -0.2 |

| Consumer Price Index | Jan NSA ∆% -0.2; Jan 12 months NSA ∆% 1.4 |

| Real GDP Growth | IVQ2013 ∆%: 0.2 on IIIQ2013; IVQ2013 SAAR 0.7; |

| Employment Report | Jan Unemployed 2.38 million Change in unemployed since last year: minus 350 thousand |

| All Industry Indices | Jan month SA ∆% 1.0 Blog 3/23/14 |

| Industrial Production | Jan SA month ∆%: 4.0 |

| Machine Orders | Total Jan ∆% 12.6 Private ∆%: 18.3 Jan ∆% Excluding Volatile Orders 13.4 |

| Tertiary Index | Jan month SA ∆% 0.9 |

| Wholesale and Retail Sales | Jan 12 months: |

| Family Income and Expenditure Survey | Jan 12-month ∆% total nominal consumption 2.8, real 1.1 Blog 3/2/14 |

| Trade Balance | Exports Feb 12 months ∆%: 9.8 Imports Feb 12 months ∆% 9.0 Blog 3/23/14 |

Links to blog comments in Table JPY:

3/16/2014 http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html

3/2/14 http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html

2/23/14 http://cmpassocregulationblog.blogspot.com/2014/02/squeeze-of-economic-activity-by-carry.html

12/15/13 http://cmpassocregulationblog.blogspot.com/2013/12/theory-and-reality-of-secular.html

11/17/13 http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-unwinding-monetary-policy.html

9/15/13 http://cmpassocregulationblog.blogspot.com/2013/09/recovery-without-hiring-ten-million.html

8/18/13 http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html

The indices of all industry activity of Japan, which approximates GDP or economic activity, fell to levels close to the worst point of the recession, showing the brutal impact of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Table VB-1 with the latest revisions shows the quarterly index, which permits comparison with the movement of real GDP. The first row provides weights of the various components of the index: AG (agriculture) 1.4 percent (not shown), CON (construction) 5.7 percent, IND (industrial production) 18.3 percent, TERT (services) 63.2 percent, and GOVT (government) 11.4 percent. GDP increased 0.2 percent in IVQ2013 (Table VB-1 at http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/theory-and-reality-of-secular.html), industry increased 1.7 percent, the tertiary sector decreased 0.3 percent, government increased 0.1 percent and construction increased 3.3 percent. The report shows that the all industry index increased 0.2 percent in IVQ2013. Industry added 0.30 percentage points to growth of the all industry index and the tertiary index deducted 0.20 percentage points. Japan had already experienced a very weak quarter in IVQ2010, with decline of GDP of 0.5 percent (Table VB-1 at http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/theory-and-reality-of-secular.html), when it was unexpectedly hit by the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. GDP fell 1.9 percent in IQ2011 and 0.6 percent in IIQ2011. GDP changed 0.0 percent in IQ2011 relative to a year earlier and fell 1.5 percent in IIQ2011 relative to a year earlier (Tables VB-1 and VB-4 at http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/theory-and-reality-of-secular.html). The all industry activity index fell in all quarters of 2012 with exception of growth of 0.1 percent in IQ2012. Weakness in industry was the driver of decline.

Table VB-1, Japan, Indices of All Industry Activity Percentage Change from Prior Quarter SA ∆%

| CON | IND | TERT | GOVT | ALL IND | REAL | |

| Weight | 5.7 | 18.3 | 63.2 | 11.4 | 100.0 | |

| 2013 | ||||||

| IVQ2013 | 3.3 | 1.7 | -0.3 | 0.1 | 0.2 | 0.2 |

| Cont to IVQ % Change | 0.17 | 0.30 | -0.20 | 0.01 | ||

| IIIQ2013 | 5.4 | 1.8 | -0.1 | -0.4 | 0.6 | 0.2 |

| IIQ2013 | 4.7 | 1.5 | 0.7 | -0.5 | 1.0 | 1.0 |

| IQ2013 | -0.5 | 0.6 | 0.2 | 0.1 | 0.0 | 1.1 |

| 2012 | ||||||

| IVQ2012 | 3.0 | -1.8 | 0.3 | 0.1 | -0.1 | 0.0 |

| IIIQ | 1.6 | -3.3 | 0.0 | 0.0 | -0.4 | -0.8 |

| IIQ | 1.3 | -2.1 | 0.0 | 0.0 | -0.2 | -0.4 |

| IQ | 2.0 | 1.6 | 0.0 | 0.2 | 0.1 | 0.9 |

AG: indices of agriculture, forestry and fisheries has weight of 1.4% and is not included in official report or in this table; CON: indices of construction industry activity; IND: indices of industrial production; TERT: indices of tertiary industry activity; GOVT: indices of government services, etc.; ALL IND: indices of all industry activity

Source: Japan, Ministry of Economy, Trade and Industry (METI)

http://www.meti.go.jp/english/statistics/index.html

http://www.esri.cao.go.jp/index-e.html

http://www.esri.cao.go.jp/en/sna/sokuhou/sokuhou_top.html

There are more details in Table VB-2. In Jan 2014, the all industry activity index decreased 1.0 percent with industry increasing 3.8 percent and services increasing 0.9 percent while construction decreased 3.2 percent and government decreased 0.4 percent. Industry added 0.68 percentage points and services added 0.59 percentage points while construction deducted 0.17 percentage points and government deducted 0.05 percentage points. The all industry activity index is stronger in 2013 with growth of 0.5 percent in Dec 2012, 0.4 percent in Feb 2013, 0.4 percent in Mar 2013, 0.1 percent in Apr 2013 and 1.1 percent in May 2013. After decline of 0.8 percent in Jun 2013, the all industry index rose 0.4 percent in Jul 2013, 0.3 percent in Aug 2013 and 0.5 percent in Sep 2013. The index fell 0.4 percent in Oct 2013 but increased 0.5 percent in Nov 2013. The index fell 0.3 percent in Dec 2013. Industry is recovering with growth of 1.4 percent in Dec 2012, 0.9 percent in Feb 2013, 0.1 percent in Mar 2013, 0.9 percent in Apr 2013 and 1.9 percent in May 2013. After decline of 3.0 percent in Jun 2003, industry grew 3.4 percent in Jul 2013 and declined 0.9 percent in Aug 2013. Industry rebounded with 1.3 percent in Sep 2013 and 1.0 percent in Oct 2013. Industry fell 0.1 percent in Nov 2013 and increased 1.0 percent in Dec 2013. The highest risk to Japan is if weakening world growth would affect Japanese exports.

Table VB-2, Japan, Indices of All Industry Activity Percentage Change from Prior Month SA ∆%

| CON | IND | TERT | GOVT | ALL IND | |

| Jan 2014 | -3.2 | 3.8 | 0.9 | -0.4 | 1.0 |

| Cont to Dec % Change | -0.17 | 0.68 | 0.59 | -0.05 | |

| Dec 2013 | -1.2 | 1.0 | -0.5 | 0.5 | -0.3 |

| Nov | 2.6 | -0.1 | 0.8 | -1.1 | 0.5 |

| Oct | 1.1 | 1.0 | -1.0 | 1.0 | -0.4 |

| Sep | 1.3 | 1.3 | 0.1 | -0.3 | 0.5 |

| Aug | 0.0 | -0.9 | 0.6 | -0.2 | 0.3 |

| Jul | 0.7 | 3.4 | -0.4 | -0.2 | 0.4 |

| Jun | 3.9 | -3.0 | -0.7 | 0.1 | -0.8 |

| May | 5.2 | 1.9 | 1.2 | -0.1 | 1.1 |

| Apr | -0.1 | 0.9 | -0.5 | 0.2 | 0.1 |

| Mar | 0.6 | 0.1 | 0.2 | -0.9 | 0.4 |

| Feb | -1.3 | 0.9 | 1.3 | -0.2 | 0.4 |

| Jan | -1.4 | -0.7 | -0.8 | 0.6 | -0.7 |

| Dec 2012 | 0.9 | 1.4 | 0.2 | -0.3 | 0.5 |

| Nov | 3.0 | -0.9 | -0.1 | 0.3 | -0.2 |

| Oct | -0.1 | 0.3 | 0.2 | 0.2 | 0.2 |

| Sep | 1.2 | -2.2 | 0.0 | -0.3 | -0.4 |

| Aug | 0.1 | -1.4 | 0.2 | 0.1 | 0.0 |

| Jul | -1.0 | -0.5 | -0.3 | -0.1 | -0.3 |

| Jun | 1.7 | -0.9 | 0.0 | 0.1 | 0.1 |

| May | 3.0 | -1.8 | 0.5 | 0.0 | -0.1 |

| Apr | -1.1 | -0.4 | -0.2 | 0.0 | -0.1 |

| Mar | -0.5 | -0.2 | -0.3 | 0.1 | -0.2 |

| Feb | 0.7 | -0.2 | 0.2 | -0.2 | 0.1 |

| Jan | 2.6 | 0.8 | -0.8 | 0.4 | -0.7 |

AG: indices of agriculture, forestry and fisheries has weight of 1.4% and is not included in official report or in this table; CON: indices of construction industry activity; IND: indices of industrial production; TERT: indices of tertiary industry activity; GOVT: indices of government services, etc.; ALL IND: indices of all industry activity

Sources: Japan, Ministry of Economy, Trade and Industry (METI)

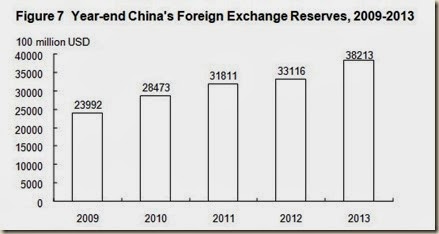

http://www.meti.go.jp/english/statistics/index.html