Rising Valuations of Risk Financial Assets, Mediocre Cyclical United States Economic Growth with GDP Two Trillion Dollars below Trend, Stagnating Real Private Fixed Investment, United States Commercial Banks Assets and Liabilities, United States Housing, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017

I Mediocre Cyclical United States Economic Growth with GDP Two Trillion Dollars below Trend

IA Mediocre Cyclical United States Economic Growth

IA1 Stagnating Real Private Fixed Investment

IIA United States Commercial Banks Assets and Liabilities

IA Transmission of Monetary Policy

IB Functions of Banking

IC United States Commercial Banks Assets and Liabilities

ID Theory and Reality of Economic History, Cyclical Slow Growth Not Secular Stagnation and Monetary Policy Based on Fear of Deflation

IIB United States Housing Collapse

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

I Mediocre Cyclical United States Economic Growth with GDP Two Trillion Dollars below Trend. Section IA Mediocre Cyclical United States Economic Growth provides the analysis of long-term and cyclical growth of GDP in the US with GDP two trillion dollars or 13.8 percent below trend. Section IA1 Stagnating Real Private Fixed Investment analyzes weakness in investment. There is socio-economic stress in the combination of adverse events and cyclical performance:

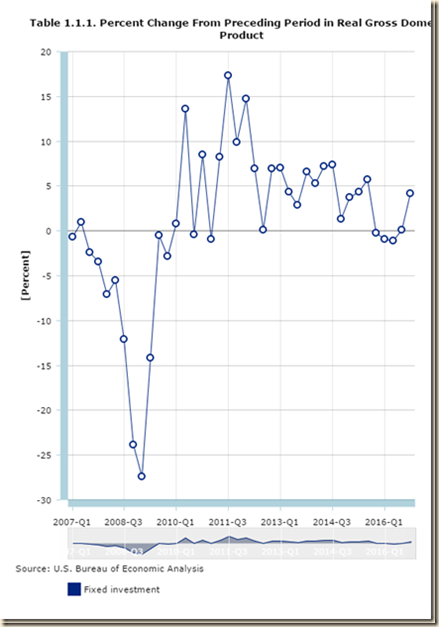

- Mediocre economic growth below potential and long-term trend, resulting in idle productive resources with GDP two trillion dollars below trend (Section I and earlier (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html). US GDP grew at the average rate of 3.2 percent per year from 1929 to 2015, with similar performance in whole cycles of contractions and expansions, but only at 1.3 percent per year on average from 2007 to 2016. GDP in IVQ2016 is 14.1 percent lower than what it would have been had it grown at trend of 3.0 percent

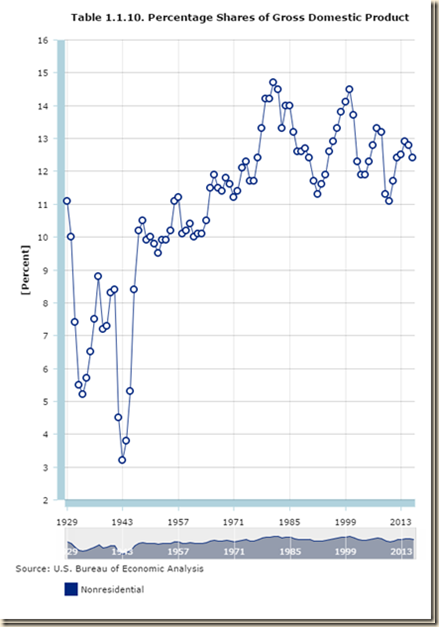

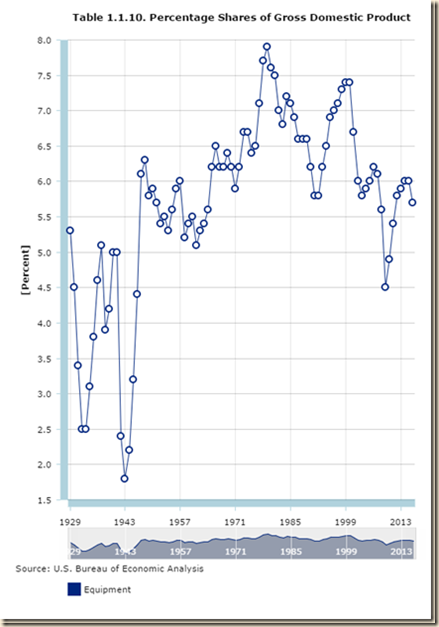

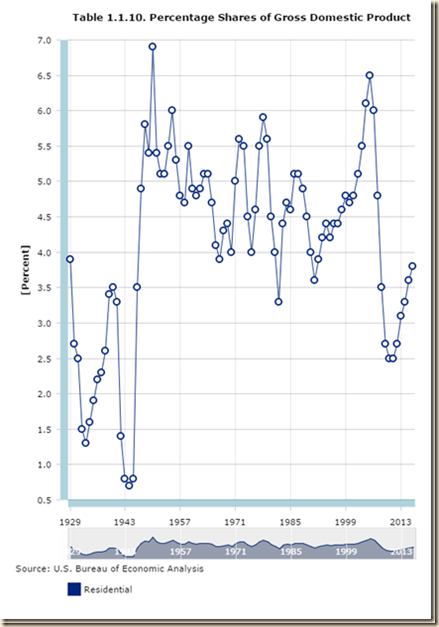

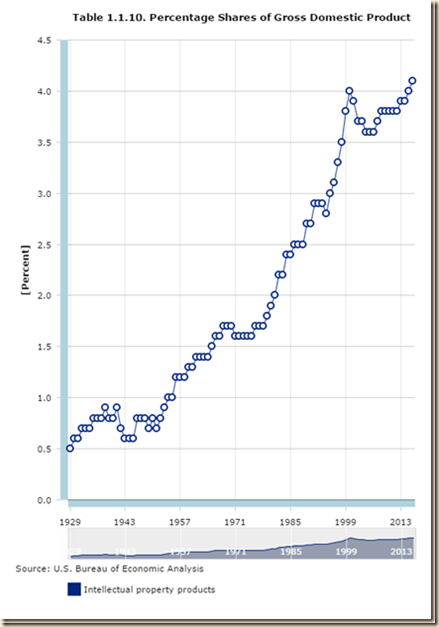

- Private fixed investment stagnating at increase of 8.6 percent in the entire cycle from IVQ2007 to IVQ2016 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html)

- Twenty four million or 14.4 percent of the effective labor force unemployed or underemployed in involuntary part-time jobs with stagnating or declining real wages (http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/global-competitive-easing-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/fluctuating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/fluctuating-risk-financial-assets-in.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-with-exchange-rate.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-fed-funds-rate-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/turbulence-of-financial-asset.html)

- Stagnating real disposable income per person or income per person after inflation and taxes (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/global-competitive-easing-or.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/fluctuating-risk-financial-assets-in.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/dollar-revaluation-and-decreasing.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html)

- Depressed hiring that does not afford an opportunity for reducing unemployment/underemployment and moving to better-paid jobs (http://cmpassocregulationblog.blogspot.com/2017/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-values-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/dollar-revaluation-and-valuations-of.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/imf-view-of-world-economy-and-finance.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rate-uncertainty-and-valuation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/rising-valuations-of-risk-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/considerable-uncertainty-about-economic.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/contraction-of-united-states-corporate.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/subdued-foreign-growth-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-volatile_17.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-policy-conundrum-recovery.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/impact-of-monetary-policy-on-exchange.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what_13.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/volatility-of-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/volatility-of-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/dollar-revaluation-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-exchange-rate-struggle-recovery.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/g20-monetary-policy-recovery-without.html)

- Productivity growth fell from 2.2 percent per year on average from 1947 to 2015 and average 2.3 percent per year from 1947 to 2007 to 1.3 percent per year on average from 2007 to 2015, deteriorating future growth and prosperity (http://cmpassocregulationblog.blogspot.com/2016/12/rising-values-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/rising-valuations-of-risk-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/considerable-uncertainty-about-economic.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-fed-funds-rate-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/quite-high-equity-valuations-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-competitive-devaluation-rules.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/financial-risks-twenty-six-million.html)

- Output of manufacturing in Dec 2016 at 28.8 percent below long-term trend since 1919 and at 22.3 percent below trend since 1986 (http://cmpassocregulationblog.blogspot.com/2017/01/world-inflation-waves-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/interest-rate-increase-could-well.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/dollar-revaluation-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-volatility-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/interest-rate-policy-uncertainty-and.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/04/contracting-united-states-industrial.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/imf-view-squeeze-of-economic-activity.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html)

- Unsustainable government deficit/debt and balance of payments deficit (http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html)

- Worldwide waves of inflation (http://cmpassocregulationblog.blogspot.com/2017/01/world-inflation-waves-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/interest-rate-increase-could-well.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/dollar-revaluation-world-inflation.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-volatility-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/interest-rate-policy-uncertainty-and.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/contracting-united-states-industrial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/uncertainty-of-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/global-decline-of-values-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/interest-rate-policy-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2015/01/competitive-currency-conflicts-world.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/financial-oscillations-world-inflation.html http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/07/world-inflation-waves-united-states.html)

- Deteriorating terms of trade and net revenue margins of production across countries in squeeze of economic activity by carry trades induced by zero interest rates (http://cmpassocregulationblog.blogspot.com/2017/01/world-inflation-waves-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/interest-rate-increase-could-well.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/dollar-revaluation-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-volatility-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/imf-view-of-world-economy-and-finance.html and earlier) (http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/uncertainty-of-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/global-decline-of-values-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/imf-view-squeeze-of-economic-activity.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html

- Financial repression of interest rates and credit affecting the most people without means and access to sophisticated financial investments with likely adverse effects on income distribution and wealth disparity (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/global-competitive-easing-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/dollar-revaluation-and-decreasing.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-competitive-devaluation-rules.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/growth-uncertainties-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/world-financial-turbulence-twenty-seven.html)

- 43 million in poverty and 29 million without health insurance with family income adjusted for inflation regressing to 1999 levels (http://cmpassocregulationblog.blogspot.com/2016/09/the-economic-outlook-is-inherently.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-uncertainty-imf.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html)

- Net worth of households and nonprofits organizations increasing by 18.1 percent after adjusting for inflation in the entire cycle from IVQ2007 to IIQ2016 when it would have grown over 30.6 percent at trend of 3.1 percent per year in real terms from IVQ1945 to IIIQ2016 (http://cmpassocregulationblog.blogspot.com/2017/01/rules-versus-discretionary-authorities.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/the-economic-outlook-is-inherently.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/of-course-considerable-uncertainty.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-fluctuations-of_13.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/06/financial-indecision-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/collapse-of-united-states-dynamism-of.html). Financial assets increased $20.4 trillion while nonfinancial assets increased $3.9 trillion with likely concentration of wealth in those with access to sophisticated financial investments. Real estate assets adjusted for inflation fell 2.4 percent.

Long-term economic performance in the United States consisted of trend growth of GDP at 3 percent per year and of per capita GDP at 2 percent per year as measured for 1870 to 2010 by Robert E Lucas (2011May). The economy returned to trend growth after adverse events such as wars and recessions. The key characteristic of adversities such as recessions was much higher rates of growth in expansion periods that permitted the economy to recover output, income and employment losses that occurred during the contractions. Over the business cycle, the economy compensated the losses of contractions with higher growth in expansions to maintain trend growth of GDP of 3 percent and of GDP per capita of 2 percent. The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. US economic growth has been at only 2.1 percent on average in the cyclical expansion in the 30 quarters from IIIQ2009 to IVQ2016. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). There are new calculations using the revision of US GDP and personal income data since 1929 by the Bureau of Economic Analysis (BEA) (http://bea.gov/iTable/index_nipa.cfm) and the first estimate of GDP for IVQ2016 (https://www.bea.gov/newsreleases/national/gdp/2017/pdf/gdp4q16_adv.pdf). The average of 7.7 percent in the first four quarters of major cyclical expansions is in contrast with the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 of only 2.7 percent obtained by diving GDP of $14,745.9 billion in IIQ2010 by GDP of $14,355.6 billion in IIQ2009 {[$14,745.9/$14,355.6 -1]100 = 2.7%], or accumulating the quarter on quarter growth rates (Section I and earlier (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html). The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.9 percent, 5.4 percent from IQ1983 to IIIQ1986, 5.2 percent from IQ1983 to IVQ1986, 5.0 percent from IQ1983 to IQ1987, 5.0 percent from IQ1983 to IIQ1987, 4.9 percent from IQ1983 to IIIQ1987, 5.0 percent from IQ1983 to IVQ1987, 4.9 percent from IQ1983 to IIQ1988, 4.8 percent from IQ1983 to IIIQ1988, 4.8 percent from IQ1983 to IVQ1988, 4.8 percent from IQ1983 to IQ1989, 4.7 percent from IQ1983 to IIQ1989, 4.7 percent from IQ1983 to IIIQ1989, 4.5 percent from IQ1983 to IVQ1989. 4.5 percent from IQ1983 to IQ1990, 4.4 percent from IQ1983 to IIQ1990 and at 7.8 percent from IQ1983 to IVQ1983 (Section I and earlier (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html). The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. Growth at trend in the entire cycle from IVQ2007 to IVQ2016 would have accumulated to 30.5 percent. GDP in IVQ2016 would be $19,564.3 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2759.5 billion than actual $16,804.8 billion. There are about two trillion dollars of GDP less than at trend, explaining the 24.2 million unemployed or underemployed equivalent to actual unemployment/underemployment of 14.4 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html). US GDP in IVQ2016 is 14.1 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,804.8 billion in IVQ2016 or 12.1 percent at the average annual equivalent rate of 1.3 percent. Professor John H. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. Cochrane (2016May02) measures GDP growth in the US at average 3.5 percent per year from 1950 to 2000 and only at 1.76 percent per year from 2000 to 2015 with only at 2.0 percent annual equivalent in the current expansion. Cochrane (2016May02) proposes drastic changes in regulation and legal obstacles to private economic activity. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth of manufacturing at average 3.1 percent per year from Dec 1919 to Dec 2016. Growth at 3.1 percent per year would raise the NSA index of manufacturing output from 108.2316 in Dec 2007 to 142.4328 in Dec 2016. The actual index NSA in Dec 2016 is 101.4769, which is 28.8 percent below trend. Manufacturing output grew at average 2.1 percent between Dec 1986 and Dec 2015. Using trend growth of 2.1 percent per year, the index would increase to 130.5273 in Dec 2016. The output of manufacturing at 101.4769 in Dec 2016 is 22.3 percent below trend under this alternative calculation.

The economy of the US can be summarized in growth of economic activity or GDP as fluctuating from mediocre growth of 2.5 percent on an annual basis in 2010 to 1.6 percent in 2011, 2.2 percent in 2012, 1.7 percent in 2013, 2.4 percent in 2014 and 2.6 percent in 2015. GDP growth was 1.6 percent in 2016. The following calculations show that actual growth is around 2.1 percent per year. The rate of growth of 1.3 percent in the entire cycle from 2007 to 2016 is well below 3 percent per year in trend from 1870 to 2010, which the economy of the US always attained for entire cycles in expansions after events such as wars and recessions (Lucas 2011May). Revisions and enhancements of United States GDP and personal income accounts by the Bureau of Economic Analysis (BEA) (http://bea.gov/iTable/index_nipa.cfm) provide important information on long-term growth and cyclical behavior. Table Summary provides relevant data.

Table Summary, Long-term and Cyclical Growth of GDP, Real Disposable Income and Real Disposable Income per Capita

| GDP | ||

| Long-Term | ||

| 1929-2016 | 3.2 | |

| 1947-2016 | 3.2 | |

| Whole Cycles | ||

| 1980-1989 | 3.5 | |

| 2006-2016 | 1.3 | |

| 2007-2016 | 1.3 | |

| Cyclical Contractions ∆% | ||

| IQ1980 to IIIQ1980, IIIQ1981 to IVQ1982 | -4.7 | |

| IVQ2007 to IIQ2009 | -4.2 | |

| Cyclical Expansions Average Annual Equivalent ∆% | ||

| IQ1983 to IVQ1985 IQ1983-IQ1986 IQ1983-IIIQ1986 IQ1983-IVQ1986 IQ1983-IQ1987 IQ1983-IIQ1987 IQ1983-IIIQ1987 IQ1983 to IVQ1987 IQ1983 to IQ1988 IQ1983 to IIQ1988 IQ1983 to IIIQ1988 IQ1983 to IVQ1988 IQ1983 to IQ1989 IQ1983 to IIQ1989 IQ1983 to IIIQ1989 IQ1983 to IVQ1989 IQ1983 to IQ1990 IQ1983 to IIQ1990 | 5.9 5.7 5.4 5.2 5.0 5.0 4.9 5.0 4.9 4.9 4.8 4.8 4.8 4.7 4.7 4.5 4.5 4.4 | |

| First Four Quarters IQ1983 to IVQ1983 | 7.8 | |

| IIIQ2009 to IVQ2016 | 2.1 | |

| First Four Quarters IIIQ2009 to IIQ2010 | 2.7 | |

| Real Disposable Income | Real Disposable Income per Capita | |

| Long-Term | ||

| 1929-2015 | 3.2 | 2.0 |

| 1947-1999 | 3.7 | 2.3 |

| Whole Cycles | ||

| 1980-1989 | 3.5 | 2.6 |

| 2006-2015 | 1.6 | 0.8 |

Source: Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

The revisions and enhancements of United States GDP and personal income accounts by the Bureau of Economic Analysis (BEA) (http://bea.gov/iTable/index_nipa.cfm) also provide critical information in assessing the current rhythm of US economic growth. The economy appears to be moving at a pace around 2.1 percent per year. Table Summary GDP provides the data.

1. Average Annual Growth in the Past Nineteen Quarters. GDP growth in the four quarters of 2012, the four quarters of 2013, the four quarters of 2014, the four quarters of Q2015 and the four quarters of 2016 accumulated to 10.6 percent. This growth is equivalent to 2.0 percent per year, obtained by dividing GDP in IVQ2016 of $16,804.8 billion by GDP in IVQ2011 of $15,190.3 billion and compounding by 4/20: {[($16,804.8/$15,190.3)4/20 -1]100 = 2.0 percent}.

2. Average Annual Growth in the Past Four Quarters. GDP growth in the four quarters of IVQ2015 to IVQ2016 accumulated to 1.9 percent that is equivalent to 1.9 percent in a year. This is obtained by dividing GDP in IVQ2016 of $16,804.8 billion by GDP in IVQ2015 of $16,490.7 billion and compounding by 4/4: {[($16,804.8.0/$16,490.7)4/4 -1]100 = 1.9%}. The US economy grew 1.9 percent in IVQ2016 relative to the same quarter a year earlier in IVQ2015. Growth was at annual equivalent 4.0 percent in IIQ2014 and 5.0 percent IIIQ2014 and only at 2.3 percent in IVQ2014. GDP grew at annual equivalent 2.0 percent in IQ2015, 2.6 percent in IIQ2015, 2.0 percent in IIIQ2015 and 0.9 percent in IVQ2015. GDP grew at annual equivalent 0.8 percent in IQ2016 and at 1.4 percent annual equivalent in IIQ2016. GDP increased at 3.5 percent annual equivalent in IIIQ2016 and at 1.9 percent in IVQ2016. Another important revelation of the revisions and enhancements is that GDP was flat in IVQ2012, which is in the borderline of contraction, and negative in IQ2014. US GDP fell 0.3 percent in IQ2014. The rate of growth of GDP in the revision of IIIQ2013 is 3.1 percent in seasonally adjusted annual rate (SAAR).

Table Summary GDP, US, Real GDP and Percentage Change Relative to IVQ2007 and Prior Quarter, Billions Chained 2005 Dollars and ∆%

| Real GDP, Billions Chained 2009 Dollars | ∆% Relative to IVQ2007 | ∆% Relative to Prior Quarter | ∆% | |

| IVQ2007 | 14,991.8 | NA | 0.4 | 1.9 |

| IVQ2011 | 15,190.3 | 1.3 | 1.1 | 1.7 |

| IQ2012 | 15,291.0 | 2.0 | 0.7 | 2.8 |

| IIQ2012 | 15,362.4 | 2.5 | 0.5 | 2.5 |

| IIIQ2012 | 15,380.8 | 2.6 | 0.1 | 2.4 |

| IVQ2012 | 15,384.3 | 2.6 | 0.0 | 1.3 |

| IQ2013 | 15,491.9 | 3.3 | 0.7 | 1.3 |

| IIQ2013 | 15,521.6 | 3.5 | 0.2 | 1.0 |

| IIIQ2013 | 15,641.3 | 4.3 | 0.8 | 1.7 |

| IVQ2013 | 15,793.9 | 5.4 | 1.0 | 2.7 |

| IQ2014 | 15,747.0 | 5.0 | -0.3 | 1.6 |

| IIQ2014 | 15,900.8 | 6.1 | 1.0 | 2.4 |

| IIIQ2014 | 16,094.5 | 7.4 | 1.2 | 2.9 |

| IVQ2014 | 16,186.7 | 8.0 | 0.6 | 2.5 |

| IQ2015 | 16,269.0 | 8.5 | 0.5 | 3.3 |

| IIQ2015 | 16,374.2 | 9.2 | 0.6 | 3.0 |

| IIIQ2015 | 16,454.9 | 9.8 | 0.5 | 2.2 |

| IVQ2015 | 16,490.7 | 10.0 | 0.2 | 1.9 |

| IQ2016 | 16,525.0 | 10.2 | 0.2 | 1.6 |

| IIQ2016 | 16,583.1 | 10.6 | 0.4 | 1.3 |

| IIIQ2016 | 16,727.0 | 11.6 | 0.9 | 1.7 |

| IVQ2016 | 16,804.8 | 12.1 | 0.5 | 1.9 |

| Cumulative ∆% IQ2012 to IVQ2016 | 10.6 | 10.8 | ||

| Annual Equivalent ∆% | 2.0 | 2.1 |

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart GDP of the US Bureau of Economic Analysis provides the rates of growth of GDP at SAAR (seasonally adjusted annual rate) in the 16 quarters from IVQ2012 to IIIQ2016. Growth has been fluctuating.

Chart GDP, Seasonally Adjusted Quarterly Rates of Growth of United States GDP, ∆%

Source: US Bureau of Economic Analysis

http://www.bea.gov/newsreleases/national/gdp/gdp_glance.htm

Historical parallels are instructive but have all the limitations of empirical research in economics. The more instructive comparisons are not with the Great Depression of the 1930s but rather with the recessions in the 1950s, 1970s and 1980s. The growth rates and job creation in the expansion of the economy away from recession are subpar in the current expansion compared to others in the past. Four recessions are initially considered, following the reference dates of the National Bureau of Economic Research (NBER) (http://www.nber.org/cycles/cyclesmain.html ): IIQ1953-IIQ1954, IIIQ1957-IIQ1958, IIIQ1973-IQ1975 and IQ1980-IIIQ1980. The data for the earlier contractions illustrate that the growth rate and job creation in the current expansion are inferior. The sharp contractions of the 1950s and 1970s are considered in Table I-1, showing the Bureau of Economic Analysis (BEA) quarter-to-quarter, seasonally adjusted (SA), yearly-equivalent growth rates of GDP. The recovery from the recession of 1953 consisted of four consecutive quarters of high percentage growth rates from IIIQ1954 to IIIQ1955: 4.6, 8.0, 11.9 and 6.7. The recession of 1957 was followed by four consecutive high percentage growth rates from IIIQ1958 to IIQ1959: 9.6, 9.7, 7.7 and 10.1. The recession of 1973-1975 was followed by high percentage growth rates from IIQ1975 to IQ1976: 3.1, 6.8, 5.5 and 9.3. The disaster of the Great Inflation and Unemployment of the 1970s, which made stagflation notorious, is even better in growth rates during the expansion phase in comparison with the current slow-growth recession.

Table I-1, US, Seasonally Adjusted Quarterly Percentage Growth Rates in Annual Equivalent of GDP in Cyclical Recessions and Following Four Quarter Expansions ∆%

| IQ | IIQ | IIIQ | IV | |

| R IIQ1953-IIQ1954 | ||||

| 1953 | -2.2 | -5.9 | ||

| 1954 | -1.8 | |||

| E IIIQ1954-IIQ1955 | ||||

| 1954 | 4.6 | 8.0 | ||

| 1955 | 11.9 | 6.7 | ||

| R IIIQ1957-IIQ1958 | ||||

| 1957 | -4.0 | |||

| 1958 | -10.0 | |||

| E IIIQ1958-IIQ1959 | ||||

| 1958 | 9.6 | 9.7 | ||

| 1959 | 7.7 | 10.1 | ||

| R IVQ1969-IV1970 | ||||

| 1969 | -1.7 | |||

| 1970 | -0.7 | |||

| E IIQ1970-IQ1971 | ||||

| 1970 | 0.7 | 3.6 | -4.0 | |

| 1971 | 11.1 | |||

| R IVQ1973-IQ1975 | ||||

| 1973 | 3.8 | |||

| 1974 | -3.3 | 1.1 | -3.8 | -1.6 |

| 1975 | -4.7 | |||

| E IIQ1975-IQ1976 | ||||

| 1975 | 3.1 | 6.8 | 5.5 | |

| 1976 | 9.3 | |||

| R IQ1980-IIIQ1980 | ||||

| 1980 | 1.3 | -7.9 | -0.6 | |

| R IQ1981-IVQ1982 | ||||

| 1981 | 8.5 | -2.9 | 4.7 | -4.6 |

| 1982 | -6.5 | 2.2 | -1.4 | 0.4 |

| E IQ1983-IVQ1983 | ||||

| 1983 | 5.3 | 9.4 | 8.1 | 8.5 |

| R IVQ2007-IIQ2009 | ||||

| 2008 | -2.7 | 2.0 | -1.9 | -8.2 |

| 2009 | -5.4 | -0.5 | ||

| E IIIQ2009-IIQ2010 | ||||

| 2009 | 1.3 | 3.9 | ||

| 2010 | 1.7 | 3.9 |

Source: Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

The NBER dates another recession in 1980 that lasted about half a year. If the two recessions from IQ1980s to IIIQ1980 and IIIQ1981 to IVQ1982 are combined, the impact of lost GDP of 4.7 percent is more comparable to the latest revised 4.2 percent drop of the recession from IVQ2007 to IIQ2009. The recession in 1981-1982 is quite similar on its own to the 2007-2009 recession. In contrast, during the Great Depression in the four years of 1930 to 1933, GDP in constant dollars fell 26.4 percent cumulatively and fell 45.3 percent in current dollars (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 150-2, Pelaez and Pelaez, Globalization and the State, Vol. II (2009b), 205-7 and revisions in http://bea.gov/iTable/index_nipa.cfm). Table I-2 provides the Bureau of Economic Analysis (BEA) quarterly growth rates of GDP in SA yearly equivalents for the recessions of 1981 to 1982 and 2007 to 2009, using the latest major revision published on Jul 27, 2016 and the third estimate for IIIQ2016 GDP (https://www.bea.gov/newsreleases/national/gdp/2016/pdf/gdp3q16_3rd.pdf), which are available in the dataset of the US Bureau of Economic Analysis (http://www.bea.gov/iTable/index_nipa.cfm). There were four quarters of contraction in 1981-1982 ranging in rate from -1.4 percent to -6.5 percent and five quarters of contraction in 2007-2009 ranging in rate from -0.5 percent to -8.2 percent. The striking difference is that in the first twenty-nine quarters of expansion from IQ1983 to IVQ1989, shown in Table I-2 in relief, GDP grew at the high quarterly percentage growth rates of 5.3, 9.4, 8.1, 8.5, 8.2, 7.2, 4.0, 3.2, 4.0, 3.7, 6.4, 3.0, 3.8, 1.9, 4.1, 2.1, 2.8, 4.6, 3.7, 6.8, 2.3, 5.4, 2.3, 5.4, 4.1, 3.2, 3.0, 0.9, 4.5, 1.6, 0.1 and minus 3.4. The National Bureau of Economic Research dates another cycle from Jul 1990 (IIIQ1981) to Mar 1991 (IQ1991) (http://www.nber.org/cycles.html), showing in Table III-1 with weaker performance in IIQ1990 and IIIQ1990 and contraction of 3.4 percent in IVQ1990. In contrast, the percentage growth rates in the first twenty-eight quarters of expansion from IIIQ2009 to IIQ2016 shown in relief in Table I-2 were mediocre: 1.3, 3.9, 1.7, 3.9, 2.7, 2.5, -1.5, 2.9, 0.8, 4.6, 2.7, 1.9, 0.5, 0.1, 2.8, 0.8, 3.1, 4.0, minus 1.2, 4.0, 5.0, 2.3, 2.0, 2.6, 2.0, 0.9, 0.8, 1.4, 3.5 and 1.9. Economic growth and employment creation continued at slow rhythm during 2012 and in 2013-2016 while much stronger growth would be required in movement to full employment. The cycle is now long by historical standards and growth rates are typically weaker in the final periods of cyclical expansions.

Table I-2, US, Quarterly Growth Rates of GDP, % Annual Equivalent SA

| Q | 1981 | 1982 | 1983 | 1984 | 2008 | 2009 | 2010 |

| I | 8.5 | -6.5 | 5.3 | 8.2 | -2.7 | -5.4 | 1.7 |

| II | -2.9 | 2.2 | 9.4 | 7.2 | 2.0 | -0.5 | 3.9 |

| III | 4.7 | -1.4 | 8.1 | 4.0 | -1.9 | 1.3 | 2.7 |

| IV | -4.6 | 0.4 | 8.5 | 3.2 | -8.2 | 3.9 | 2.5 |

| 1985 | 2011 | ||||||

| I | 4.0 | -1.5 | |||||

| II | 3.7 | 2.9 | |||||

| III | 6.4 | 0.8 | |||||

| IV | 3.0 | 4.6 | |||||

| 1986 | 2012 | ||||||

| I | 3.8 | 2.7 | |||||

| II | 1.9 | 1.9 | |||||

| III | 4.1 | 0.5 | |||||

| IV | 2.1 | 0.1 | |||||

| 1987 | 2013 | ||||||

| I | 2.8 | 2.8 | |||||

| II | 4.6 | 0.8 | |||||

| III | 3.7 | 3.1 | |||||

| IV | 6.8 | 4.0 | |||||

| 1988 | 2014 | ||||||

| I | 2.3 | -1.2 | |||||

| II | 5.4 | 4.0 | |||||

| III | 2.3 | 5.0 | |||||

| IV | 5.4 | 2.3 | |||||

| 1989 | 2015 | ||||||

| I | 4.1 | 2.0 | |||||

| II | 3.2 | 2.6 | |||||

| III | 3.0 | 2.0 | |||||

| IV | 0.9 | 0.9 | |||||

| 1990 | 2016 | ||||||

| I | 4.5 | 0.8 | |||||

| II | 1.6 | 1.4 | |||||

| III | 0.1 | 3.5 | |||||

| IV | -3.4 | 1.9 |

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

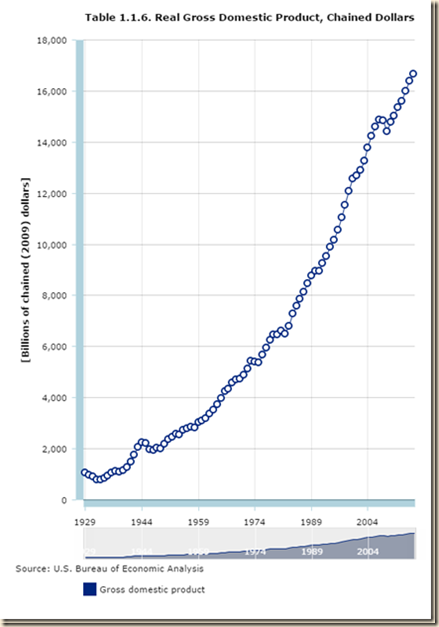

Chart I-1 of the Bureau of Economic Analysis (BEA) provides strong growth of real GDP in the US between 1929 and 1999 at the yearly average rate of 3.5 percent. There is an evident acceleration of the rate of GDP growth in the 1990s as shown by a much sharper slope of the growth curve. Cobet and Wilson (2002) define labor productivity as the value of manufacturing output produced per unit of labor input used (see Pelaez and Pelaez, The Global Recession Risk (2007), 137-44). Between 1950 and 2000, labor productivity in the US grew less rapidly than in Germany and Japan. The major part of the increase in productivity in Germany and Japan occurred between 1950 and 1973 while the rate of productivity growth in the US was relatively subdued in several periods. While Germany and Japan reached their highest growth rates of productivity before 1973, the US accelerated its rate of productivity growth in the second half of the 1990s. Between 1950 and 2000, the rate of productivity growth in the US of 2.9 percent per year was much lower than 6.3 percent in Japan and 4.7 percent in Germany. Between 1995 and 2000, the rate of productivity growth of the US of 4.6 percent exceeded that of Japan of 3.9 percent and the rate of Germany of 2.6 percent.

Chart I-1, US, Real GDP 1929-1999

Source: US Bureau of Economic Analysis http://bea.gov/iTable/index_nipa.cfm

Chart I-1A provides real GDP annually from 1929 to 2015. Growth after the global recession from IVQ2007 to IIQ2009 has not been sufficiently high to compensate for the contraction as it had in past economic cycles. The drop of output in the recession from IVQ2007 to IIQ2009 has been followed by anemic recovery compared with return to trend at 3.0 percent from 1870 to 2010 after events such as wars and recessions (Lucas 2011May) and a standstill that can lead to growth recession, or low rates of economic growth. The expansion is relatively long compared to earlier expansion and there could be even another contraction or conventional recession in the future. The average rate of growth from 1947 to 2016 is 3.2 percent. The average growth rate from IV2007 to IVQ2016 is only 1.3 percent with 2.8 percent annual equivalent from the end of the recession in IVQ2001 to the end of the expansion in IVQ2007. There are about two trillion dollars of GDP less than at trend, explaining the 24.2 million unemployed or underemployed equivalent to actual unemployment/underemployment of 14.4 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html). US GDP in IVQ2016 is 14.1 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,804.8 billion in IVQ2016 or 12.1 percent at the average annual equivalent rate of 1.3 percent. Professor John H. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. Cochrane (2016May02) measures GDP growth in the US at average 3.5 percent per year from 1950 to 2000 and only at 1.76 percent per year from 2000 to 2015 with only at 2.0 percent annual equivalent in the current expansion. Cochrane (2016May02) proposes drastic changes in regulation and legal obstacles to private economic activity. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth of manufacturing at average 3.1 percent per year from Dec 1919 to Dec 2016. Growth at 3.1 percent per year would raise the NSA index of manufacturing output from 108.2316 in Dec 2007 to 142.4328 in Dec 2016. The actual index NSA in Dec 2016 is 101.4769, which is 28.8 percent below trend. Manufacturing output grew at average 2.1 percent between Dec 1986 and Dec 2015. Using trend growth of 2.1 percent per year, the index would increase to 130.5273 in Dec 2016. The output of manufacturing at 101.4769 in Dec 2016 is 22.3 percent below trend under this alternative calculation.

Chart I-1A, US, Real GDP 1929-2016

Source: US Bureau of Economic Analysis http://bea.gov/iTable/index_nipa.cfm

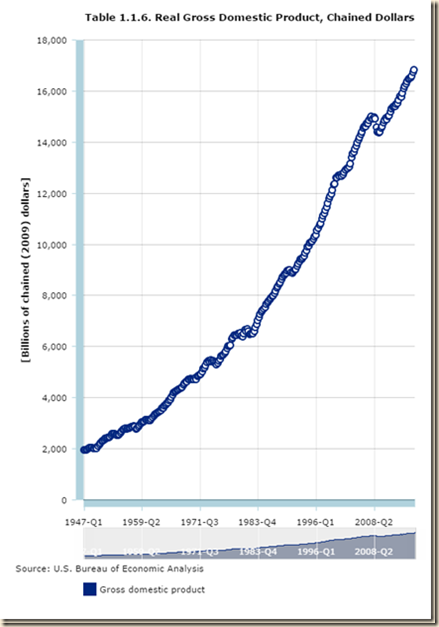

Chart I-2 provides the growth of real quarterly GDP in the US between 1947 and 2016. The drop of output in the recession from IVQ2007 to IIQ2009 has been followed by anemic recovery compared with return to trend at 3.0 percent from 1870 to 2010 after events such as wars and recessions (Lucas 2011May) and a standstill that can lead to growth recession, or low rates of economic growth. The expansion is relatively long compared to earlier expansions and there could be another contraction or conventional recession in the future. The average rate of growth from 1947 to 2016 is 3.2 percent. The average growth rate from IVQ2007 to IVQ2016 is only 1.3 percent with 2.8 percent from the end of the recession in IVQ2001 to the end of the expansion in IVQ2007.

Chart I-2, US, Real GDP, Quarterly, 1947-2016

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

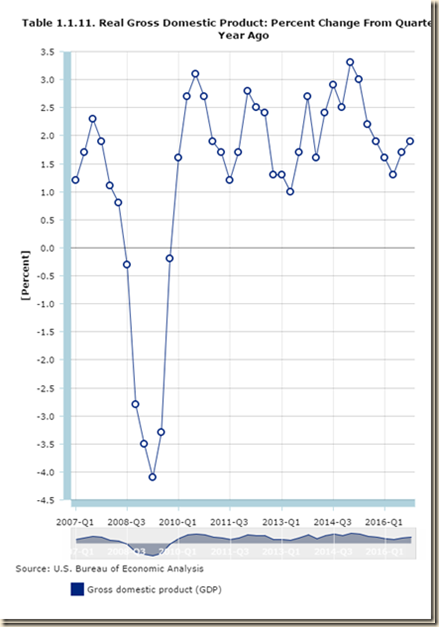

Chart I-3 provides real GDP percentage change on the quarter a year earlier for 1983-1989. The objective is simply to compare expansion in two recoveries from sharp contractions as shown in Table I-5. Growth rates in the early phase of the recovery in 1983 and 1984 were very high, which is the opportunity to reduce unemployment that has characterized cyclical expansion in the postwar US economy.

Chart I-3, Real GDP Percentage Change on Quarter a Year Earlier 1983-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

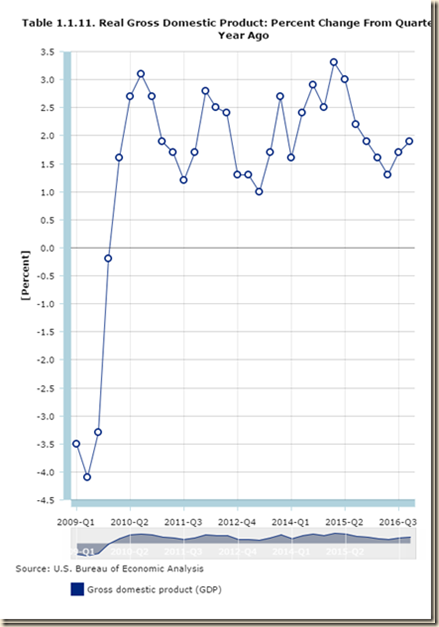

In contrast, growth rates in the comparable first twenty-nine quarters of expansion from 2009 to 2016 in Chart I-4 have been mediocre. As a result, growth has not provided the exit from unemployment and underemployment as in other cyclical expansions in the postwar period. Growth rates did not rise in V shape as in earlier expansions and then declined close to the standstill of growth recessions.

Chart I-4, US, Real GDP Percentage Change on Quarter a Year Earlier 2009-2016

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Table I-3 provides percentage change of real GDP in the United States in the 1930s, 1980s and 2000s. The recession in 1981-1982 is quite similar on its own to the 2007-2009 recession. In contrast, during the Great Depression in the four years of 1930 to 1933, GDP in constant dollars fell 26.4 percent cumulatively and fell 45.3 percent in current dollars (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 150-2, Pelaez and Pelaez, Globalization and the State, Vol. II (2009b), 205-7 and revisions in http://bea.gov/iTable/index_nipa.cfm). Data are available for the 1930s only on a yearly basis. US GDP fell 4.7 percent in the two recessions (1) from IQ1980 to IIIQ1980 and (2) from III1981 to IVQ1982 and 4.2 percent cumulatively in the recession from IVQ2007 to IIQ2009. It is instructive to compare the first years of the expansions in the 1980s and the current expansion. GDP grew at 4.6 percent in 1983, 7.3 percent in 1984, 4.2 percent in 1985, 3.5 percent in 1986, 3.5 percent in 1987, 4.2 percent in 1988 and 3.7 percent in 1989. In contrast, GDP grew 2.5 percent in 2010, 1.6 percent in 2011, 2.2 percent in 2012, 1.7 percent in 2013, 2.4 percent in 2014 and 2.6 percent in 2015. GDP grew 1.6 percent in 2016. Actual annual equivalent GDP growth in the twenty quarters from 2012 to 2016 is 2.0 percent and 1.9 percent in the four quarters ending in IVQ2016. GDP grew at 4.2 percent in 1985, 3.5 percent in 1986, 3.5 percent in 1987, 4.2 percent in 1988 and 3.7 percent in 1989. The forecasts of the central tendency of participants of the Federal Open Market Committee (FOMC) are in the range of 1.9 to 2.3 percent in 2017 (https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20161214.pdf) with less reliable forecast of 1.8 to 2.2 percent in 2017 (https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20161214.pdf). Growth of GDP in the expansion from IIIQ2009 to IIIQ2016 has been at average 2.1 percent in annual equivalent.

Table I-3, US, Percentage Change of GDP in the 1930s, 1980s and 2000s, ∆%

| Year | GDP ∆% | Year | GDP ∆% | Year | GDP ∆% |

| 1930 | -8.5 | 1980 | -0.2 | 2000 | 4.1 |

| 1931 | -6.4 | 1981 | 2.6 | 2001 | 1.0 |

| 1932 | -12.9 | 1982 | -1.9 | 2002 | 1.8 |

| 1933 | -1.3 | 1983 | 4.6 | 2003 | 2.8 |

| 1934 | 10.8 | 1984 | 7.3 | 2004 | 3.8 |

| 1935 | 8.9 | 1985 | 4.2 | 2005 | 3.3 |

| 1936 | 12.9 | 1986 | 3.5 | 2006 | 2.7 |

| 1937 | 5.1 | 1987 | 3.5 | 2007 | 1.8 |

| 1938 | -3.3 | 1988 | 4.2 | 2008 | -0.3 |

| 1939 | 8.0 | 1989 | 3.7 | 2009 | -2.8 |

| 1940 | 8.8 | 1990 | 1.9 | 2010 | 2.5 |

| 1941 | 17.7 | 1991 | -0.1 | 2011 | 1.6 |

| 1942 | 18.9 | 1992 | 3.6 | 2012 | 2.2 |

| 1943 | 17.0 | 1993 | 2.7 | 2013 | 1.7 |

| 1944 | 8.0 | 1994 | 4.0 | 2014 | 2.4 |

| 1945 | -1.0 | 1995 | 2.7 | 2015 | 2.6 |

| 1946 | -11.6 | 1996 | 3.8 | 2016 | 1.6 |

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart I-5 provides percentage change of GDP in the US during the 1930s. There is vast literature analyzing the Great Depression (Pelaez and Pelaez, Regulation of Banks and Finance (2009), 198-217). Cole and Ohanian (1999) find that US real per capita output was lower by 11 percent in 1939 than in 1929 while the typical expansion of real per capita output in the US during a decade is 31 percent. Private hours worked in the US were 25 percent lower in 1939 relative to 1929.

Chart I-5, US, Percentage Change of GDP in the 1930s

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

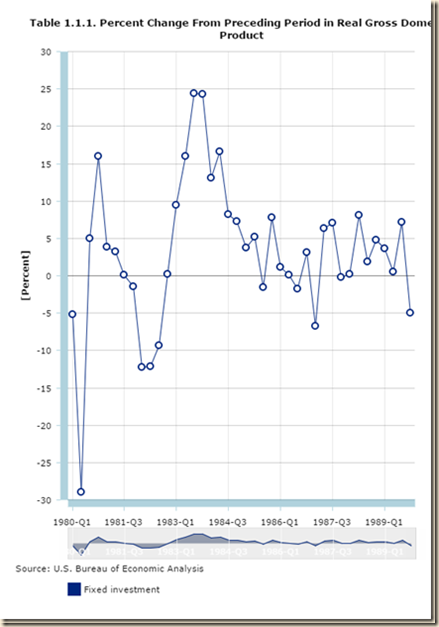

In contrast, Chart I-6 shows rapid recovery from the recessions in the 1980s. High growth rates in the initial quarters of expansion eliminated the unemployment and underemployment created during the contraction. The economy then returned to grow at the trend of expansion, interrupted by another contraction in 1991.

Chart I-6, US, Percentage Change of GDP in the 1980s

Source: US Bureau of Economic Analysis9

http://www.bea.gov/iTable/index_nipa.cfm

Chart I-7 provides the rates of growth during the 2000s. Growth rates in the initial twenty-nine quarters of expansion have been relatively lower than during recessions after World War II. As a result, unemployment and underemployment continue at the rate of 14.4 percent of the effective US labor force (http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html).

Chart I-7, US, Percentage Change of GDP in the 2000s

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Characteristics of the four cyclical contractions are in Table I-4 with the first column showing the number of quarters of contraction; the second column the cumulative percentage contraction; and the final column the average quarterly rate of contraction. There were two contractions from IQ1980 to IIIQ1980 and from IIIQ1981 to IVQ1982 separated by three quarters of expansion. The drop of output combining the declines in these two contractions is 4.7 percent, which is almost equal to the decline of 4.2 percent in the contraction from IVQ2007 to IIQ2009. In contrast, during the Great Depression in the four years of 1930 to 1933, GDP in constant dollars fell 26.4 percent cumulatively and fell 45.3 percent in current dollars (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 150-2, Pelaez and Pelaez, Globalization and the State, Vol. II (2009b), 205-7 and revisions in http://bea.gov/iTable/index_nipa.cfm). The comparison of the global recession after 2007 with the Great Depression is entirely misleading.

Table I-4, US, Number of Quarters, GDP Cumulative Percentage Contraction and Average Percentage Annual Equivalent Rate in Cyclical Contractions

| Number of Quarters | Cumulative Percentage Contraction | Average Percentage Rate | |

| IIQ1953 to IIQ1954 | 3 | -2.4 | -0.8 |

| IIIQ1957 to IIQ1958 | 3 | -3.0 | -1.0 |

| IVQ1973 to IQ1975 | 5 | -3.1 | -0.6 |

| IQ1980 to IIIQ1980 | 2 | -2.2 | -1.1 |

| IIIQ1981 to IVQ1982 | 4 | -2.5 | -0.64 |

| IVQ2007 to IIQ2009 | 6 | -4.2 | -0.72 |

Sources: Source: Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Table I-5 shows the mediocre average annual equivalent growth rate of 2.1 percent of the US economy in the thirty quarters of the current cyclical expansion from IIIQ2009 to IVQ2016. In sharp contrast, the average growth rate of GDP was:

- 5.7 percent in the first thirteen quarters of expansion from IQ1983 to IQ1986

- 5.4 percent in the first fifteen quarters of expansion from IQ1983 to IIIQ1986

- 5.2 percent in the first sixteen quarters of expansion from IQ1983 to IVQ1986

- 5.0 percent in the first seventeen quarters of expansion from IQ1983 to IQ1987

- 5.0 percent in the first eighteen quarters of expansion from IQ1983 to IIQ1987

- 4.9 percent in the first nineteen quarters of expansion from IQ1983 to IIIQ1987

- 5.0 percent in the first twenty quarters of expansion from IQ1983 to IVQ1987

- 4.9 percent in the first twenty-first quarters of expansion from IQ1983 to IQ1988

- 4.9 percent in the first twenty-two quarters of expansion from IQ1983 to IIQ1988

- 4.8 percent in the first twenty-three quarters of expansion from IQ1983 to IIIQ1988

- 4.8 percent in the first twenty-four quarters of expansion from IQ1983 to IVQ1988

- 4.8 percent in the first twenty-five quarters of expansion from IQ1983 to IQ1989

- 4.7 percent in the first twenty-six quarters of expansion from IQ1983 to IIQ1989

- 4.7 percent in the first twenty-seven quarters of expansion from IQ1983 to IIIQ1989

- 4.5 percent in the first twenty-eight quarters of expansion from IQ1983 to IVQ1989

- 4.5 percent in the first twenty-nine quarters of expansion from IQ1983 to IQ1990

- 4.4 percent in the first thirty quarters of expansion from IQ1983 to IIQ1990

The line “average first four quarters in four expansions” provides the average growth rate of 7.7 percent with 7.8 percent from IIIQ1954 to IIQ1955, 9.2 percent from IIIQ1958 to IIQ1959, 6.1 percent from IIIQ1975 to IIQ1976 and 7.8 percent from IQ1983 to IVQ1983. The United States missed this opportunity of high growth in the initial phase of recovery. BEA data show the US economy in standstill with annual growth of 2.5 percent in 2010 decelerating to 1.6 percent annual growth in 2011, 2.2 percent in 2012, 1.7 percent in 2013, 2.4 percent in 2014, 2.6 percent in 2015 and 1.6 percent in 2016 (http://www.bea.gov/iTable/index_nipa.cfm). The expansion from IQ1983 to IQ1986 was at the average annual growth rate of 5.7 percent, 5.2 percent from IQ1983 to IVQ1986, 4.9 percent from IQ1983 to IIIQ1987, 5.0 percent from IQ1983 to IVQ1987, 4.9 percent from IQ1983 to IQ1988, 4.9 percent from IQ1983 to IIQ1988, 4.8 percent from IQ1983 to IIIQ1988. 4.8 percent from IQ1983 to IVQ1988, 4.8 percent from IQ1983 to IQ1989, 4.7 percent from IQ1983 to IIQ1989, 4.7 percent from IQ1983 to IIIQ1989. 4.5 percent from IQ1983 to IVQ1989, 4.5 percent from IQ1983 to IQ1990, 4.4 percent from IQ1983 to IIQ1990 and at 7.8 percent from IQ1983 to IVQ1983. GDP grew 2.7 percent in the first four quarters of the expansion from IIIQ2009 to IIQ2010. GDP growth in the twenty quarters from 2012 to 2016 accumulated to 10.6 percent. This growth is equivalent to 2.0 percent per year, obtained by dividing GDP in IVQ2016 of $16,804.8 billion by GDP in IVQ2011 of $15,190.3 billion and compounding by 4/20: {[($16,804.8/$15,190.3)4/20 -1]100 = 2.0 percent}.

Table I-5 shows that GDP grew 17.1 percent in the first twenty-nine quarters of expansion from IIIQ2009 to IVQ2016 at the annual equivalent rate of 2.1 percent.

Table I-5, US, Number of Quarters, Cumulative Growth and Average Annual Equivalent Growth Rate in Cyclical Expansions

| Number | Cumulative Growth ∆% | Average Annual Equivalent Growth Rate | |

| IIIQ 1954 to IQ1957 | 11 | 12.8 | 4.5 |

| First Four Quarters IIIQ1954 to IIQ1955 | 4 | 7.8 | |

| IIQ1958 to IIQ1959 | 5 | 10.0 | 7.9 |

| First Four Quarters IIIQ1958 to IIQ1959 | 4 | 9.2 | |

| IIQ1975 to IVQ1976 | 8 | 8.3 | 4.1 |

| First Four Quarters IIIQ1975 to IIQ1976 | 4 | 6.1 | |

| IQ1983-IQ1986 IQ1983-IIIQ1986 IQ1983-IVQ1986 IQ1983-IQ1987 IQ1983-IIQ1987 IQ1983 to IIIQ1987 IQ1983 to IVQ1987 IQ1983 to IQ1988 IQ1983 to IIQ1988 IQ1983 to IIIQ1988 IQ1983 to IVQ1988 IQ1983 to IQ1989 IQ1983 to IIQ1989 IQ1983 to IIIQ1989 IQ1983 to IVQ1989 IQ1983 to IQ1990 IQ1983 to IIQ1990 | 13 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 | 19.9 21.6 22.3 23.1 24.5 25.6 27.7 28.4 30.1 30.9 32.6 34.0 35.0 36.0 36.3 37.8 38.3 | 5.7 5.4 5.2 5.0 5.0 4.9 5.0 4.9 4.9 4.8 4.8 4.8 4.7 4.7 4.5 4.5 4.4 |

| First Four Quarters IQ1983 to IVQ1983 | 4 | 7.8 | |

| Average First Four Quarters in Four Expansions* | 7.7 | ||

| IIIQ2009 to IVQ2016 | 30 | 17.1 | 2.1 |

| First Four Quarters IIIQ2009 to IIQ2010 | 2.7 |

*First Four Quarters: 7.8% IIIQ1954-IIQ1955; 9.2% IIIQ1958-IIQ1959; 6.1% IIIQ1975-IQ1976; 7.8% IQ1983-IVQ1983

Source: Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

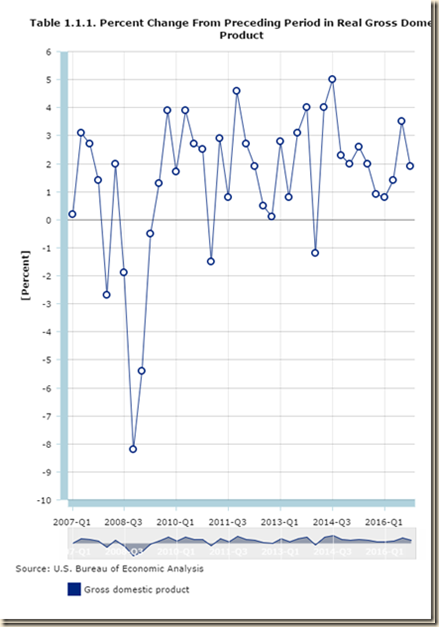

Chart I-8 shows US real quarterly GDP growth from 1980 to 1989. The economy contracted during the recession and then expanded vigorously throughout the 1980s, rapidly eliminating the unemployment caused by the contraction.

Chart I-8, US, Real GDP, 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

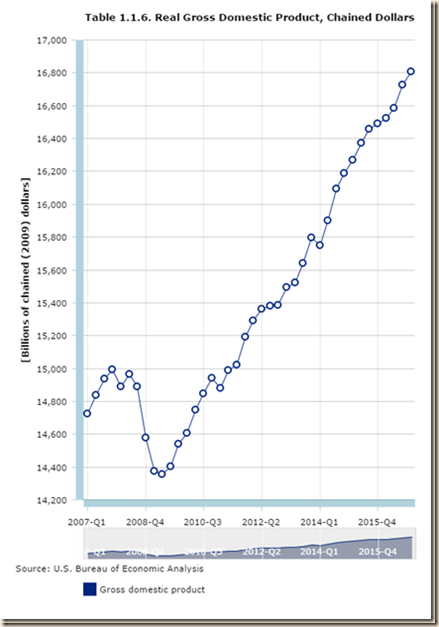

Chart I-9 shows the entirely different situation of real quarterly GDP in the US between 2007 and 2016. The economy has underperformed during the first twenty-nine quarters of expansion for the first time in the comparable contractions since the 1950s. The US economy is now in a perilous standstill.

Chart I-9, US, Real GDP, 2007-2016

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

As shown in Tables I-4 and I-5 above the loss of real GDP in the US during the contraction was 4.2 percent but the gain in the cyclical expansion has been only 17.1 percent (first to the last row in Table I-5), using all latest revisions. As a result, the level of real GDP in IIIQ2016 with the second estimate and revisions is higher by only 12.1 percent than the level of real GDP in IVQ2007.

The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. Growth at trend in the entire cycle from IVQ2007 to IVQ2016 would have accumulated to 30.5 percent. GDP in IVQ2016 would be $19,564.3 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2759.5 billion than actual $16,804.8 billion. There are about two trillion dollars of GDP less than at trend, explaining the 24.2 million unemployed or underemployed equivalent to actual unemployment/underemployment of 14.4 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html). US GDP in IVQ2016 is 14.1 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,804.8 billion in IVQ2016 or 12.1 percent at the average annual equivalent rate of 1.3 percent. Professor John H. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. Cochrane (2016May02) measures GDP growth in the US at average 3.5 percent per year from 1950 to 2000 and only at 1.76 percent per year from 2000 to 2015 with only at 2.0 percent annual equivalent in the current expansion. Cochrane (2016May02) proposes drastic changes in regulation and legal obstacles to private economic activity. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth of manufacturing at average 3.1 percent per year from Dec 1919 to Dec 2016. Growth at 3.1 percent per year would raise the NSA index of manufacturing output from 108.2316 in Dec 2007 to 142.4328 in Dec 2016. The actual index NSA in Dec 2016 is 101.4769, which is 28.8 percent below trend. Manufacturing output grew at average 2.1 percent between Dec 1986 and Dec 2015. Using trend growth of 2.1 percent per year, the index would increase to 130.5273 in Dec 2016. The output of manufacturing at 101.4769 in Dec 2016 is 22.3 percent below trend under this alternative calculation.

Table I-6 shows that the contraction actually concentrated in two quarters: decline of 2.1 percent in IVQ2008 relative to the prior quarter and decline of 1.4 percent in IQ2009 relative to IVQ2008. The combined fall of GDP in IVQ2008 and IQ2009 was 3.5 percent {[(1-0.021) x (1-0.014) -1]100 = -3.5%}, or {[(IQ2009 $14,375.0)/(IIIQ2008 $14,891.6) – 1]100 = -3.5%} except for rounding. Those two quarters coincided with the worst effects of the financial crisis (Cochrane and Zingales 2009). GDP fell 0.1 percent in IIQ2009 but grew 0.3 percent in IIIQ2009, which is the beginning of recovery in the cyclical dates of the NBER. Most of the recovery occurred in five successive quarters from IVQ2009 to IVQ2010 of growth of 1.0 percent in IVQ2009, 0.4 percent in IQ2010, 1.0 percent in IIQ2010 and nearly equal growth at 0.7 percent in IIIQ2010 and 0.6 percent in IVQ2010 for cumulative growth in those five quarters of 3.8 percent, obtained by accumulating the quarterly rates {[(1.01 x 1.004 x 1.01 x 1.007 x 1.006) – 1]100 = 3.8%} or {[(IVQ2010 $14,939.0)/(IIIQ2009 $14,402.5) – 1]100 = 3.7%} with minor rounding difference. The economy then stalled during the first half of 2011 with decline of 0.4 percent in IQ2011 and growth of 0.7 percent in IIQ2011 for combined annual equivalent rate of 0.6 percent {(0.996 x 1.007)2}. The economy grew 0.2 percent in IIIQ2011 for annual equivalent growth of 0.7 percent in the first three quarters {[(0.996 x 1.007 x 1.002)4/3 -1]100 = 0.7%}. Growth picked up in IVQ2011 with 1.1 percent relative to IIIQ2011. Growth in a quarter relative to a year earlier in Table I-6 slows from over 2.7 percent during three consecutive quarters from IIQ2010 to IVQ2010 to 1.9 percent in IQ2011, 1.7 percent in IIQ2011, 1.2 percent in IIIQ2011 and 1.7 percent in IVQ2011. As shown below, growth of 1.1 percent in IVQ2011 was partly driven by inventory accumulation. In IQ2012, GDP grew 0.7 percent relative to IVQ2011 and 2.8 percent relative to IQ2011, decelerating to 0.5 percent in IIQ2012 and 2.5 percent relative to IIQ2011 and 0.1 percent in IIIQ2012 and 2.4 percent relative to IIIQ2011. Growth was 0.0 percent in IVQ2012 with 1.3 percent relative to a year earlier but mostly because of deduction of 1.54 percentage points of inventory divestment and 0.42 percentage points of reduction of one-time national defense expenditures. Growth was 0.7 percent in IQ2013 and 1.3 percent relative to IQ2012 in large part because of burning savings to consume caused by financial repression of zero interest rates. There is similar growth of 0.2 percent in IIQ2013 and 1.0 percent relative to a year earlier. In IIIQ2013, GDP grew 0.8 percent relative to the prior quarter and 1.7 percent relative to the same quarter a year earlier with inventory accumulation contributing 1.60 percentage points to growth at 3.1 percent SAAR in IIIQ2013. GDP increased 1.0 percent in IVQ2013 and 2.7 percent relative to a year earlier. GDP fell 0.3 percent in IQ2014 and grew 1.6 percent relative to a year earlier. Inventory divestment deducted 1.89 percentage points from GDP growth in IQ2014. GDP grew 1.0 percent in IIQ2014, 2.4 percent relative to a year earlier and at 4.0 SAAR with inventory change contributing 0.67 percentage points. GDP grew 1.2 percent in IIIQ2014 and 2.9 percent relative to a year earlier. GDP grew 0.6 percent in IVQ2014 and 2.5 percent relative to a year earlier. GDP increased 0.5 percent in IQ2015 and increased 3.3 percent relative to a year earlier partly because of low level during contraction of 0.3 percent in IQ2014. GDP grew 0.6 percent in IIQ2015 and 3.0 percent relative to a year earlier. GDP grew 0.5 percent in IIIQ2015 and 2.2 percent relative to a year earlier. GDP grew 0.2 percent in IVQ2015 and increased 1.9 percent relative to a year earlier. GDP grew 0.2 percent in IQ2016 and increased 1.6 percent relative to a year earlier. GDP grew 0.4 percent in IIQ2016 and increased 1.3 percent relative to a year earlier. GDP grew 0.9 percent in IIIQ2016 and increased 1.7 percent relative to a year earlier. GDP grew 0.5 percent in IVQ2016 and increased 1.9 percent relative to a year earlier. Rates of a quarter relative to the prior quarter capture better deceleration of the economy than rates on a quarter relative to the same quarter a year earlier. The critical question for which there is not yet definitive solution is whether what lies ahead is continuing growth recession with the economy crawling and unemployment/underemployment at extremely high levels or another contraction or conventional recession. Forecasts of various sources continued to maintain high growth in 2011 without taking into consideration the continuous slowing of the economy in late 2010 and the first half of 2011. The sovereign debt crisis in the euro area and growth in China are common sources of doubts on the rate and direction of economic growth in the US. There is weak internal demand in the US with almost no investment and spikes of consumption driven by burning saving because of financial repression in the form of zero interest rates and bloated balance sheet of the Fed.

Table I-6, US, Real GDP and Percentage Change Relative to IVQ2007 and Prior Quarter, Billions Chained 2009 Dollars and ∆%

| Real GDP, Billions Chained 2009 Dollars | ∆% Relative to IVQ2007 | ∆% Relative to Prior Quarter | ∆% | |

| IVQ2007 | 14,991.8 | NA | 0.4 | 1.9 |

| IQ2008 | 14,889.5 | -0.7 | -0.7 | 1.1 |

| IIQ2008 | 14,963.4 | -0.2 | 0.5 | 0.8 |

| IIIQ2008 | 14,891.6 | -0.7 | -0.5 | -0.3 |

| IVQ2008 | 14,577.0 | -2.8 | -2.1 | -2.8 |

| IQ2009 | 14,375.0 | -4.1 | -1.4 | -3.5 |

| IIQ2009 | 14,355.6 | -4.2 | -0.1 | -4.1 |

| IIIQ2009 | 14,402.5 | -3.9 | 0.3 | -3.3 |

| IV2009 | 14,541.9 | -3.0 | 1.0 | -0.2 |

| IQ2010 | 14,604.8 | -2.6 | 0.4 | 1.6 |

| IIQ2010 | 14,745.9 | -1.6 | 1.0 | 2.7 |

| IIIQ2010 | 14,845.5 | -1.0 | 0.7 | 3.1 |

| IVQ2010 | 14,939.0 | -0.4 | 0.6 | 2.7 |

| IQ2011 | 14,881.3 | -0.7 | -0.4 | 1.9 |

| IIQ2011 | 14,989.6 | 0.0 | 0.7 | 1.7 |

| IIIQ2011 | 15,021.1 | 0.2 | 0.2 | 1.2 |

| IVQ2011 | 15,190.3 | 1.3 | 1.1 | 1.7 |

| IQ2012 | 15,291.0 | 2.0 | 0.7 | 2.8 |

| IIQ2012 | 15,362.4 | 2.5 | 0.5 | 2.5 |

| IIIQ2012 | 15,380.8 | 2.6 | 0.1 | 2.4 |

| IVQ2012 | 15,384.3 | 2.6 | 0.0 | 1.3 |

| IQ2013 | 15,491.9 | 3.3 | 0.7 | 1.3 |

| IIQ2013 | 15,521.6 | 3.5 | 0.2 | 1.0 |

| IIIQ2013 | 15,641.3 | 4.3 | 0.8 | 1.7 |

| IVQ2013 | 15,793.9 | 5.4 | 1.0 | 2.7 |

| IQ2014 | 15,747.0 | 5.0 | -0.3 | 1.6 |

| IIQ2014 | 15,900.8 | 6.1 | 1.0 | 2.4 |

| IIIQ2014 | 16,094.5 | 7.4 | 1.2 | 2.9 |

| IVQ2014 | 16,186.7 | 8.0 | 0.6 | 2.5 |

| IQ2015 | 16,269.0 | 8.5 | 0.5 | 3.3 |

| IIQ2015 | 16,374.2 | 9.2 | 0.6 | 3.0 |

| IIIQ2015 | 16,454.9 | 9.8 | 0.5 | 2.2 |

| IVQ2015 | 16,490.7 | 10.0 | 0.2 | 1.9 |

| IQ2016 | 16,525.0 | 10.2 | 0.2 | 1.6 |

| IIQ2016 | 16,583.1 | 10.6 | 0.4 | 1.3 |

| IIIQ2016 | 16,727.0 | 11.6 | 0.9 | 1.7 |

| IV 2016 | 16,804.8 | 12.1 | 0.5 | 1.9 |

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart I-10 provides the percentage change of real GDP from the same quarter a year earlier from 1980 to 1989. There were two contractions almost in succession in 1980 and from 1981 to 1983. The expansion was marked by initial high rates of growth as in other recession in the postwar US period during which employment lost in the contraction was recovered. Growth rates continued to be high after the initial phase of expansion.

Chart I-10, Percentage Change of Real Gross Domestic Product from Quarter a Year Earlier 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm