Unconventional Monetary Policy and Valuations of Risk Financial Assets, Recovery without Hiring, Ten Million Fewer Full-time Jobs, Youth and Middle Age Unemployment, United States International Trade, United States Producer Prices, Collapse of United States Dynamism of Income Growth and Employment Creation, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017

IA Unconventional Monetary Policy and Valuations of Risk Financial Assets

I Recovery without Hiring

IA1 Hiring Collapse

IA2 Labor Underutilization

ICA3 Ten Million Fewer Full-time Jobs

IA4 Theory and Reality of Cyclical Slow Growth Not Secular Stagnation: Youth and Middle-Age Unemployment

II United States International Trade

IIB United States Producer Prices

II IB Collapse of United States Dynamism of Income Growth and Employment Creation

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

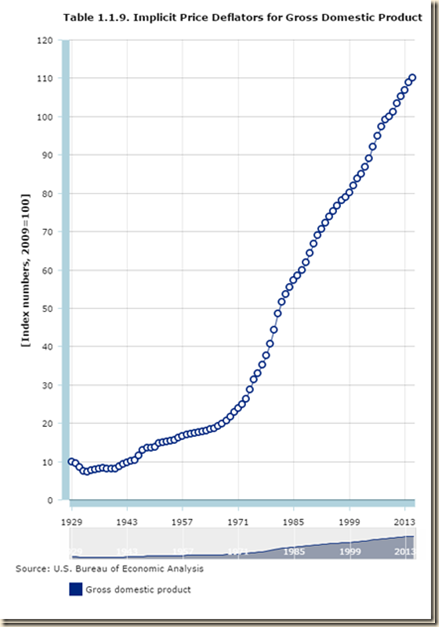

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

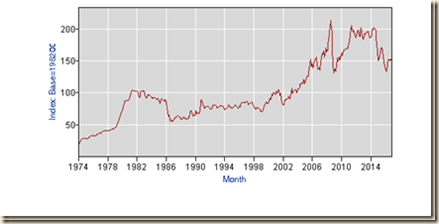

IIA United States International Trade. Table IIA-1 provides the trade balance of the US and monthly growth of exports and imports seasonally adjusted with the latest release and revisions (http://www.census.gov/foreign-trade/). Because of heavy dependence on imported oil, fluctuations in the US trade account originate largely in fluctuations of commodity futures prices caused by carry trades from zero interest rates into commodity futures exposures in a process similar to world inflation waves (http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html). The Census Bureau revised data for 2016, 2015, 2014 and 2013. Exports decreased 0.2 percent in Nov 2016 while imports increased 1.1 percent. The trade deficit increased from $42,360 million in Oct 2016 to $45,240 million in Nov 2016. The trade deficit deteriorated to $48,189 million in Mar 2015. The trade deficit improved to $40,885 million in Apr 2015 and $40,170 million in May 2015. The trade deficit deteriorated to $42,973 million in Jun 2015 and improved to $39,900 million in Jul 2015, deteriorating to $44,639 million in Aug 2015. The trade deficit improved to $41,072 million in Sep 2015, deteriorating to $41,600 million in Oct 2015 and improving to $41,122 million in Nov 2015. The trade deficit deteriorated to $45,259 million in Feb 2016, improving to $36,930 million in Mar 2016. The trade deficit deteriorated to $38,191 million in Apr 2016, deteriorating to $41,835 million in May 2016 and $44,719 million in Jun 2016. The trade deficit improved to $39,626 million in Jul 2016, deteriorating to $40,641 million in Aug 2016. The trade deficit improved to $36,166 million in Sep 2016, deteriorating to $42,360 million in Oct 2016. The trade deficit deteriorated to $45,240 million in Nov 2016.

Table IIA-1, US, Trade Balance of Goods and Services Seasonally Adjusted Millions of Dollars and ∆%

| Trade Balance | Exports | Month ∆% | Imports | Month ∆% | |

| Nov 2016 | -45.240 | 185,833 | -0.2 | 231,072 | 1.1 |

| Oct | -42,360 | 186,281 | -1.8 | 228,641 | 1.2 |

| Sep | -36,166 | 189,774 | 0.9 | 225,940 | -1.2 |

| Aug | -40,641 | 187,991 | 0.9 | 228,632 | 1.2 |

| Jul | 39,626 | 186,351 | 1.8 | 225,978 | -0.8 |

| Jun | -44,719 | 183,003 | 0.8 | 227,723 | 1.9 |

| May | -41,835 | 181,577 | -0.2 | 223,412 | 1.5 |

| Apr | -38,191 | 181,850 | 1.7 | 220,041 | 2.0 |

| Mar | -36,930 | 178,798 | -1.2 | 215,729 | -4.7 |

| Feb | -45,259 | 181,003 | 1.1 | 226,262 | 1.9 |

| Jan | -43,027 | 179,069 | -2.2 | 222,096 | -1.1 |

| Dec 2015 | -41,487 | 183,074 | -0.3 | 224,561 | -0.1 |

| Nov | -41,122 | 183,576 | -1.1 | 224,698 | -1.1 |

| Oct | -41,600 | 185,587 | -1.0 | 227,186 | -0.6 |

| Sep | -41,072 | 187,550 | 0.5 | 228,622 | -1.1 |

| Aug | -44,639 | 186,620 | -1.8 | 231,259 | 0.5 |

| Jul | -39,900 | 190,106 | -0.1 | 230,006 | -1.4 |

| Jun | -42,973 | 190,347 | 0.0 | 233,320 | 1.2 |

| May | -40,170 | 190,361 | -0.7 | 230,531 | -0.9 |

| Apr | -40,885 | 191,675 | 0.6 | 232,560 | -2.5 |

| Mar | -48,189 | 190,448 | 0.3 | 238,637 | 5.5 |

| Feb | -36,268 | 189,852 | -1.1 | 226,121 | -3.4 |

| Jan | -42,057 | 191,968 | -2.8 | 234,024 | -3.0 |

| Jan-Dec 2015 | -500,361 | 2,261,163 | -4.9 | 2,761,525 | -3.7 |

Note: Trade Balance of Goods = Exports of Goods less Imports of Goods. Trade balance may not add exactly because of errors of rounding and seasonality. Source: US Census Bureau, Foreign Trade Division

http://www.census.gov/foreign-trade/

Table IIA-1B provides US exports, imports and the trade balance of goods. The US has not shown a trade surplus in trade of goods since 1976. The deficit of trade in goods deteriorated sharply during the boom years from 2000 to 2007. The deficit improved during the contraction in 2009 but deteriorated in the expansion after 2009. The deficit could deteriorate sharply with growth at full employment.

Table IIA-1B, US, International Trade Balance of Goods, Exports and Imports of Goods, Millions of Dollars, Census Basis

| Balance | ∆% | Exports | ∆% | Imports | ∆% | |

| 1960 | 4,608 | (X) | 19,626 | (X) | 15,018 | (X) |

| 1961 | 5,476 | 18.8 | 20,190 | 2.9 | 14,714 | -2.0 |

| 1962 | 4,583 | -16.3 | 20,973 | 3.9 | 16,390 | 11.4 |

| 1963 | 5,289 | 15.4 | 22,427 | 6.9 | 17,138 | 4.6 |

| 1964 | 7,006 | 32.5 | 25,690 | 14.5 | 18,684 | 9.0 |

| 1965 | 5,333 | -23.9 | 26,699 | 3.9 | 21,366 | 14.4 |

| 1966 | 3,837 | -28.1 | 29,379 | 10.0 | 25,542 | 19.5 |

| 1967 | 4,122 | 7.4 | 30,934 | 5.3 | 26,812 | 5.0 |

| 1968 | 837 | -79.7 | 34,063 | 10.1 | 33,226 | 23.9 |

| 1969 | 1,289 | 54.0 | 37,332 | 9.6 | 36,043 | 8.5 |

| 1970 | 3,224 | 150.1 | 43,176 | 15.7 | 39,952 | 10.8 |

| 1971 | -1,476 | -145.8 | 44,087 | 2.1 | 45,563 | 14.0 |

| 1972 | -5,729 | 288.1 | 49,854 | 13.1 | 55,583 | 22.0 |

| 1973 | 2,389 | -141.7 | 71,865 | 44.2 | 69,476 | 25.0 |

| 1974 | -3,884 | -262.6 | 99,437 | 38.4 | 103,321 | 48.7 |

| 1975 | 9,551 | -345.9 | 108,856 | 9.5 | 99,305 | -3.9 |

| 1976 | -7,820 | -181.9 | 116,794 | 7.3 | 124,614 | 25.5 |

| 1977 | -28,352 | 262.6 | 123,182 | 5.5 | 151,534 | 21.6 |

| 1978 | -30,205 | 6.5 | 145,847 | 18.4 | 176,052 | 16.2 |

| 1979 | -23,922 | -20.8 | 186,363 | 27.8 | 210,285 | 19.4 |

| 1980 | -19,696 | -17.7 | 225,566 | 21.0 | 245,262 | 16.6 |

| 1981 | -22,267 | 13.1 | 238,715 | 5.8 | 260,982 | 6.4 |

| 1982 | -27,510 | 23.5 | 216,442 | -9.3 | 243,952 | -6.5 |

| 1983 | -52,409 | 90.5 | 205,639 | -5.0 | 258,048 | 5.8 |

| 1984 | -106,702 | 103.6 | 223,976 | 8.9 | 330,678 | 28.1 |

| 1985 | -117,711 | 10.3 | 218,815 | -2.3 | 336,526 | 1.8 |

| 1986 | -138,279 | 17.5 | 227,159 | 3.8 | 365,438 | 8.6 |

| 1987 | -152,119 | 10.0 | 254,122 | 11.9 | 406,241 | 11.2 |

| 1988 | -118,526 | -22.1 | 322,426 | 26.9 | 440,952 | 8.5 |

| 1989 | -109,399 | -7.7 | 363,812 | 12.8 | 473,211 | 7.3 |

| 1990 | -101,719 | -7.0 | 393,592 | 8.2 | 495,311 | 4.7 |

| 1991 | -66,723 | -34.4 | 421,730 | 7.1 | 488,453 | -1.4 |

| 1992 | -84,501 | 26.6 | 448,164 | 6.3 | 532,665 | 9.1 |

| 1993 | -115,568 | 36.8 | 465,091 | 3.8 | 580,659 | 9.0 |

| 1994 | -150,630 | 30.3 | 512,626 | 10.2 | 663,256 | 14.2 |

| 1995 | -158,801 | 5.4 | 584,742 | 14.1 | 743,543 | 12.1 |

| 1996 | -170,214 | 7.2 | 625,075 | 6.9 | 795,289 | 7.0 |

| 1997 | -180,522 | 6.1 | 689,182 | 10.3 | 869,704 | 9.4 |

| 1998 | -229,758 | 27.3 | 682,138 | -1.0 | 911,896 | 4.9 |

| 1999 | -328,821 | 43.1 | 695,797 | 2.0 | 1,024,618 | 12.4 |

| 2000 | -436,104 | 32.6 | 781,918 | 12.4 | 1,218,022 | 18.9 |

| 2001 | -411,899 | -5.6 | 729,100 | -6.8 | 1,140,999 | -6.3 |

| 2002 | -468,263 | 13.7 | 693,103 | -4.9 | 1,161,366 | 1.8 |

| 2003 | -532,350 | 13.7 | 724,771 | 4.6 | 1,257,121 | 8.2 |

| 2004 | -654,830 | 23.0 | 814,875 | 12.4 | 1,469,704 | 16.9 |

| 2005 | -772,373 | 18.0 | 901,082 | 10.6 | 1,673,455 | 13.9 |

| 2006 | -827,971 | 7.2 | 1,025,967 | 13.9 | 1,853,938 | 10.8 |

| 2007 | -808,763 | -2.3 | 1,148,199 | 11.9 | 1,956,962 | 5.6 |

| 2008 | -816,199 | 0.9 | 1,287,442 | 12.1 | 2,103,641 | 7.5 |

| 2009 | -503,582 | -38.3 | 1,056,043 | -18.0 | 1,559,625 | -25.9 |

| 2010 | -635,362 | 26.2 | 1,278,495 | 21.1 | 1,913,857 | 22.7 |

| 2011 | -725,447 | 14.2 | 1,482,508 | 16.0 | 2,207,954 | 15.4 |

| 2012 | -730,446 | 0.7 | 1,545,821 | 4.3 | 2,276,267 | 3.1 |

| 2013 | -689,470 | -5.6 | 1,578,517 | 2.1 | 2,267,987 | -0.4 |

| 2014 | -735,194 | 6.6 | 1,621,172 | 2.7 | 2,356,366 | 3.9 |

| 2015 | -745,660 | 1.4 | 1,502,572 | -7.3 | 2,248,232 | -4.6 |

Source: US Census Bureau, Foreign Trade Division

http://www.census.gov/foreign-trade/

Chart IIA-1 of the US Census Bureau of the Department of Commerce shows that the trade deficit (gap between exports and imports) fell during the economic contraction after 2007 but has grown again during the expansion. The low average rate of growth of GDP of 2.1 percent during the expansion beginning since IIIQ2009 does not deteriorate further the trade balance. Higher rates of growth may cause sharper deterioration.

Chart IIA-1, US, International Trade Balance, Exports and Imports of Goods and Services USD Billions

Source: US Census Bureau

http://www.census.gov/briefrm/esbr/www/esbr042.html

Table IIA-2B provides the US international trade balance, exports and imports of goods and services on an annual basis from 1992 to 2015. The trade balance deteriorated sharply over the long term. The US has a large deficit in goods or exports less imports of goods but it has a surplus in services that helps to reduce the trade account deficit or exports less imports of goods and services. The current account deficit of the US not seasonally adjusted decreased from $137.2 billion in IIIQ2015 to $133.2 billion in IIIQ2016 (http://www.bea.gov/international/index.htm). The current account deficit seasonally adjusted at annual rate increased from 2.7 percent of GDP in IIIQ2015 to 2.6 percent of GDP in IIQ2016, decreasing to 2.4 percent of GDP in IIIQ2016 (http://www.bea.gov/international/index.htm http://www.bea.gov/iTable/index_nipa.cfm). The ratio of the current account deficit to GDP has stabilized around 3 percent of GDP compared with much higher percentages before the recession (see Pelaez and Pelaez, The Global Recession Risk (2007), Globalization and the State, Vol. II (2008b), 183-94, Government Intervention in Globalization (2008c), 167-71). The last row of Table IIA-2B shows marginal improvement of the trade deficit from $548,625 million in 2011 to lower $536,773 million in 2012 with exports growing 4.3 percent and imports 3.0 percent. The trade balance improved further to deficit of $461,876 million in 2013 with growth of exports of 3.4 percent while imports virtually stagnated. The trade deficit deteriorated in 2014 to $490,176 million with growth of exports of 3.6 percent and of imports of 4.0 percent. The trade deficit deteriorated in 2015 to $500,361 million with decrease of exports of 4.9 percent and decrease of imports of 3.7 percent. Growth and commodity shocks under alternating inflation waves (http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html) have deteriorated the trade deficit from the low of $383,774 million in 2009.

Table IIA-2B, US, International Trade Balance of Goods and Services, Exports and Imports of Goods and Services, SA, Millions of Dollars, Balance of Payments Basis

| Balance | Exports | ∆% | Imports | ∆% | |

| 1960 | 3,508 | 25,940 | NA | 22,432 | NA |

| 1961 | 4,195 | 26,403 | 1.8 | 22,208 | -1.0 |

| 1962 | 3,370 | 27,722 | 5.0 | 24,352 | 9.7 |

| 1963 | 4,210 | 29,620 | 6.8 | 25,410 | 4.3 |

| 1964 | 6,022 | 33,341 | 12.6 | 27,319 | 7.5 |

| 1965 | 4,664 | 35,285 | 5.8 | 30,621 | 12.1 |

| 1966 | 2,939 | 38,926 | 10.3 | 35,987 | 17.5 |

| 1967 | 2,604 | 41,333 | 6.2 | 38,729 | 7.6 |

| 1968 | 250 | 45,543 | 10.2 | 45,293 | 16.9 |

| 1969 | 91 | 49,220 | 8.1 | 49,129 | 8.5 |

| 1970 | 2,254 | 56,640 | 15.1 | 54,386 | 10.7 |

| 1971 | -1,302 | 59,677 | 5.4 | 60,979 | 12.1 |

| 1972 | -5,443 | 67,222 | 12.6 | 72,665 | 19.2 |

| 1973 | 1,900 | 91,242 | 35.7 | 89,342 | 23.0 |

| 1974 | -4,293 | 120,897 | 32.5 | 125,190 | 40.1 |

| 1975 | 12,404 | 132,585 | 9.7 | 120,181 | -4.0 |

| 1976 | -6,082 | 142,716 | 7.6 | 148,798 | 23.8 |

| 1977 | -27,246 | 152,301 | 6.7 | 179,547 | 20.7 |

| 1978 | -29,763 | 178,428 | 17.2 | 208,191 | 16.0 |

| 1979 | -24,565 | 224,131 | 25.6 | 248,696 | 19.5 |

| 1980 | -19,407 | 271,834 | 21.3 | 291,241 | 17.1 |

| 1981 | -16,172 | 294,398 | 8.3 | 310,570 | 6.6 |

| 1982 | -24,156 | 275,236 | -6.5 | 299,391 | -3.6 |

| 1983 | -57,767 | 266,106 | -3.3 | 323,874 | 8.2 |

| 1984 | -109,072 | 291,094 | 9.4 | 400,166 | 23.6 |

| 1985 | -121,880 | 289,070 | -0.7 | 410,950 | 2.7 |

| 1986 | -138,538 | 310,033 | 7.3 | 448,572 | 9.2 |

| 1987 | -151,684 | 348,869 | 12.5 | 500,552 | 11.6 |

| 1988 | -114,566 | 431,149 | 23.6 | 545,715 | 9.0 |

| 1989 | -93,141 | 487,003 | 13.0 | 580,144 | 6.3 |

| 1990 | -80,864 | 535,233 | 9.9 | 616,097 | 6.2 |

| 1991 | -31,135 | 578,344 | 8.1 | 609,479 | -1.1 |

| 1992 | -39,212 | 616,882 | 6.7 | 656,094 | 7.6 |

| 1993 | -70,311 | 642,863 | 4.2 | 713,174 | 8.7 |

| 1994 | -98,493 | 703,254 | 9.4 | 801,747 | 12.4 |

| 1995 | -96,384 | 794,387 | 13.0 | 890,771 | 11.1 |

| 1996 | -104,065 | 851,602 | 7.2 | 955,667 | 7.3 |

| 1997 | -108,273 | 934,453 | 9.7 | 1,042,726 | 9.1 |

| 1998 | -166,140 | 933,174 | -0.1 | 1,099,314 | 5.4 |

| 1999 | -258,617 | 969,867 | 3.9 | 1,228,485 | 11.8 |

| 2000 | -372,517 | 1,075,321 | 10.9 | 1,447,837 | 17.9 |

| 2001 | -361,511 | 1,005,654 | -6.5 | 1,367,165 | -5.6 |

| 2002 | -418,955 | 978,706 | -2.7 | 1,397,660 | 2.2 |

| 2003 | -493,890 | 1,020,418 | 4.3 | 1,514,308 | 8.3 |

| 2004 | -609,883 | 1,161,549 | 13.8 | 1,771,433 | 17.0 |

| 2005 | -714,245 | 1,286,022 | 10.7 | 2,000,267 | 12.9 |

| 2006 | -761,716 | 1,457,642 | 13.3 | 2,219,358 | 11.0 |

| 2007 | -705,375 | 1,653,548 | 13.4 | 2,358,922 | 6.3 |

| 2008 | -708,726 | 1,841,612 | 11.4 | 2,550,339 | 8.1 |

| 2009 | -383,774 | 1,583,053 | -14.0 | 1,966,827 | -22.9 |

| 2010 | -494,658 | 1,853,606 | 17.1 | 2,348,263 | 19.4 |

| 2011 | -548,625 | 2,127,021 | 14.8 | 2,675,646 | 13.9 |

| 2012 | -536,773 | 2,218,989 | 4.3 | 2,755,762 | 3.0 |

| 2013 | -461,876 | 2,293,457 | 3.4 | 2,755,334 | 0.0 |

| 2014 | -490,176 | 2,376,577 | 3.6 | 2,866,754 | 4.0 |

| 2015 | -500,361 | 2,261,163 | -4.9 | 2,761,525 | -3.7 |

Source: US Census Bureau

http://www.census.gov/foreign-trade/

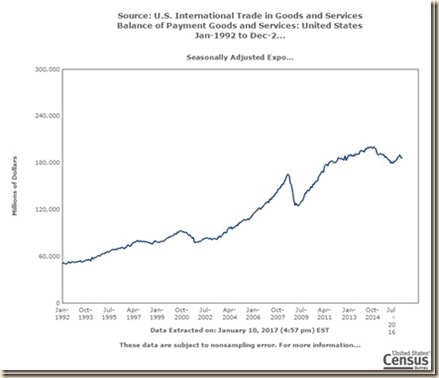

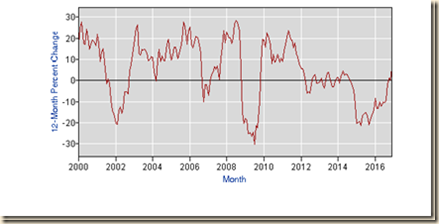

Chart IIA-2 of the US Census Bureau provides the US trade account in goods and services SA from Jan 1992 to Nov 2016. There is long-term trend of deterioration of the US trade deficit shown vividly by Chart IIA-2. The global recession from IVQ2007 to IIQ2009 reversed the trend of deterioration. Deterioration resumed together with incomplete recovery and was influenced significantly by the carry trade from zero interest rates to commodity futures exposures (these arguments are elaborated in Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 157-66, Regulation of Banks and Finance (2009b), 217-27, International Financial Architecture (2005), 15-18, The Global Recession Risk (2007), 221-5, Globalization and the State Vol. II (2008b), 197-213, Government Intervention in Globalization (2008c), 182-4 http://cmpassocregulationblog.blogspot.com/2011/07/causes-of-2007-creditdollar-crisis.html http://cmpassocregulationblog.blogspot.com/2011/01/professor-mckinnons-bubble-economy.html http://cmpassocregulationblog.blogspot.com/2011/01/world-inflation-quantitative-easing.html http://cmpassocregulationblog.blogspot.com/2011/01/treasury-yields-valuation-of-risk.html http://cmpassocregulationblog.blogspot.com/2010/11/quantitative-easing-theory-evidence-and.html http://cmpassocregulationblog.blogspot.com/2010/12/is-fed-printing-money-what-are.html). Earlier research focused on the long-term external imbalance of the US in the form of trade and current account deficits (Pelaez and Pelaez, The Global Recession Risk (2007), Globalization and the State Vol. II (2008b) 183-94, Government Intervention in Globalization (2008c), 167-71). US external imbalances have not been fully resolved and tend to widen together with improving world economic activity and commodity price shocks. There are additional effects for revaluation of the dollar with the Fed orienting interest rate increases while the European Central Bank and the Bank of Japan determine negative nominal interest rates.

Chart IIA-2, US, Balance of Trade SA, Monthly, Millions of Dollars, Jan 1992-Nov 2016

Source: US Census Bureau

http://www.census.gov/foreign-trade/

Chart IIA-3 of the US Census Bureau provides US exports SA from Jan 1992 to Nov 2016. There was sharp acceleration from 2003 to 2007 during worldwide economic boom and increasing inflation. Exports fell sharply during the financial crisis and global recession from IVQ2007 to IIQ2009. Growth picked up again together with world trade and inflation but stalled in the final segment with less rapid global growth and inflation.

Chart IIA-3, US, Exports SA, Monthly, Millions of Dollars Jan 1992-Nov 2016

Source: US Census Bureau

http://www.census.gov/foreign-trade/

Chart IIA-4 of the US Census Bureau provides US imports SA from Jan 1992 to Nov 2016. Growth was stronger between 2003 and 2007 with worldwide economic boom and inflation. There was sharp drop during the financial crisis and global recession. There is stalling import levels in the final segment resulting from weaker world economic growth and diminishing inflation because of risk aversion and portfolio reallocations from commodity exposures to equities.

Chart IIA-4, US, Imports SA, Monthly, Millions of Dollars Jan 1992-Nov 2016

Source: US Census Bureau

http://www.census.gov/foreign-trade/

There is deterioration of the US trade balance in goods in Table IIA-3 from deficit of $62,486 million in Nov 2015 to deficit of $66,627 million in Nov 2016. The nonpetroleum deficit increased by $3418 million while the petroleum deficit increased $811 million. Total exports of goods increased 0.9 percent in Nov 2016 relative to a year earlier while total imports increased 2.8 percent. Nonpetroleum exports changed 0.0 percent from Nov 2015 to Nov 2016 while nonpetroleum imports increased 2.0 percent. Petroleum imports increased 15.0 percent.

Table IIA-3, US, International Trade in Goods Balance, Exports and Imports $ Millions and ∆% SA

| Nov 2016 | Nov 2015 | ∆% | |

| Total Balance | -66,627 | -62,486 | |

| Petroleum | -6,021 | -5,210 | |

| Non Petroleum | -59,284 | -55,866 | |

| Total Exports | 122,351 | 121,286 | 0.9 |

| Petroleum | 8,243 | 7,193 | 14.6 |

| Non Petroleum | 113,603 | 113,598 | 0.0 |

| Total Imports | 188,978 | 183,772 | 2.8 |

| Petroleum | 14,264 | 12,402 | 15.0 |

| Non Petroleum | 172,886 | 169,463 | 2.0 |

Details may not add because of rounding and seasonal adjustment

Source: US Census Bureau

http://www.census.gov/foreign-trade/

US exports and imports of goods not seasonally adjusted in Jan-Nov 2016 and Jan-Nov 2015 are in Table IIA-4. The rate of growth of exports was minus 4.0 percent and minus 3.1 percent for imports. The US has partial hedge of commodity price increases in exports of agricultural commodities that increased 0.1 percent and of mineral fuels that decreased 11.9 percent both because prices of raw materials and commodities increase and fall recurrently as a result of shocks of risk aversion and portfolio reallocations. The US exports an insignificant but growing amount of crude oil, decreasing 13.3 percent in cumulative Jan-Nov 2016 relative to a year earlier. US exports and imports consist mostly of manufactured products, with less rapidly increasing prices. US manufactured exports decreased 6.1 percent while manufactured imports decreased 3.1 percent. Significant part of the US trade imbalance originates in imports of mineral fuels decreasing 21.5 percent and petroleum decreasing 22.6 percent with wide oscillations in oil prices. The limited hedge in exports of agricultural commodities and mineral fuels compared with substantial imports of mineral fuels and crude oil results in waves of deterioration of the terms of trade of the US, or export prices relative to import prices, originating in commodity price increases caused by carry trades from zero interest rates. These waves are similar to those in worldwide inflation.

Table IIA-4, US, Exports and Imports of Goods, Not Seasonally Adjusted Millions of Dollars and %, Census Basis

| Jan-Nov 2016 $ Millions | Jan-Nov 2015 $ Millions | ∆% | |

| Exports | 1,327,862 | 1,382,633 | -4.0 |

| Manufactured | 961,909 | 1,024,743 | -6.1 |

| Agricultural | 121,960 | 121,788 | 0.1 |

| Mineral Fuels | 84,005 | 95,366 | -11.9 |

| Petroleum | 68,452 | 78,963 | -13.3 |

| Imports | 2,004,953 | 2,068,507 | -3.1 |

| Manufactured | 1,754,211 | 1,790,206 | -2.0 |

| Agricultural | 104,871 | 104,379 | 0.5 |

| Mineral Fuels | 139,317 | 177,427 | -21.5 |

| Petroleum | 129,557 | 165,331 | -22.6 |

Source: US Census Bureau

http://www.census.gov/foreign-trade/

The current account of the US balance of payments is in Table VI-3A for IIIQ2015 and IIIQ2016. The Bureau of Economic Analysis analyzes as follows (https://www.bea.gov/newsreleases/international/transactions/2016/pdf/trans316.pdf):

“The U.S. current account deficit decreased to $113.0 billion (preliminary) in the third quarter of 2016 from $118.3 billion (revised) in the second quarter of 2016, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit decreased to 2.4 percent of current-dollar gross domestic product (GDP) from 2.6 percent in the second quarter.

The $5.3 billion decrease in the current account deficit reflected a $9.0 billion decrease in the deficit on goods that was partly offset by changes in the balances on secondary income, primary income, and services.”

The US has a large deficit in goods or exports less imports of goods but it has a surplus in services that helps to reduce the trade account deficit or exports less imports of goods and services. The current account deficit of the US not seasonally adjusted decreased from $137.2 billion in IIIQ2015 to $133.2 billion in IIIQ2016. The current account deficit seasonally adjusted at annual rate increased from 2.7 percent of GDP in IIIQ2015 to 2.6 percent of GDP in IIQ2016, decreasing to 2.4 percent of GDP in IIIQ2016. The ratio of the current account deficit to GDP has stabilized below 3 percent of GDP compared with much higher percentages before the recession but is combined now with much higher imbalance in the Treasury budget (see Pelaez and Pelaez, The Global Recession Risk (2007), Globalization and the State, Vol. II (2008b), 183-94, Government Intervention in Globalization (2008c), 167-71).

Table VI-3A, US, Balance of Payments, Millions of Dollars NSA

| IIIQ2015 | IIIQ2016 | Difference | |

| Goods Balance | -207,992 | -201,707 | 6,285 |

| X Goods | 373,337 | 365,767 | -2.0 ∆% |

| M Goods | -581,329 | -567,474 | -2.4 ∆% |

| Services Balance | 68,913 | 66,231 | -2,682 |

| X Services | 194,854 | 196,008 | 0.6 ∆% |

| M Services | -125,941 | -129,777 | 3.0 ∆% |

| Balance Goods and Services | -139,079 | -135,476 | 3,603 |

| Exports of Goods and Services and Income Receipts | 798,193 | 799,083 | |

| Imports of Goods and Services and Income Payments | -935,400 | -932,272 | |

| Current Account Balance | -137,207 | -133,188 | -4,019 |

| % GDP | IIIQ2015 | IIIQ2016 | IIQ2016 |

| 2.7 | 2.4 | 2.6 |

X: exports; M: imports

Balance on Current Account = Exports of Goods and Services – Imports of Goods and Services and Income Payments

Source: Bureau of Economic Analysis

http://www.bea.gov/international/index.htm#bop

In their classic work on “unpleasant monetarist arithmetic,” Sargent and Wallace (1981, 2) consider a regime of domination of monetary policy by fiscal policy (emphasis added):

“Imagine that fiscal policy dominates monetary policy. The fiscal authority independently sets its budgets, announcing all current and future deficits and surpluses and thus determining the amount of revenue that must be raised through bond sales and seignorage. Under this second coordination scheme, the monetary authority faces the constraints imposed by the demand for government bonds, for it must try to finance with seignorage any discrepancy between the revenue demanded by the fiscal authority and the amount of bonds that can be sold to the public. Suppose that the demand for government bonds implies an interest rate on bonds greater than the economy’s rate of growth. Then if the fiscal authority runs deficits, the monetary authority is unable to control either the growth rate of the monetary base or inflation forever. If the principal and interest due on these additional bonds are raised by selling still more bonds, so as to continue to hold down the growth of base money, then, because the interest rate on bonds is greater than the economy’s growth rate, the real stock of bonds will growth faster than the size of the economy. This cannot go on forever, since the demand for bonds places an upper limit on the stock of bonds relative to the size of the economy. Once that limit is reached, the principal and interest due on the bonds already sold to fight inflation must be financed, at least in part, by seignorage, requiring the creation of additional base money.”

The alternative fiscal scenario of the CBO (2012NovCDR, 2013Sep17) resembles an economic world in which eventually the placement of debt reaches a limit of what is proportionately desired of US debt in investment portfolios. This unpleasant environment is occurring in various European countries.

The current real value of government debt plus monetary liabilities depends on the expected discounted values of future primary surpluses or difference between tax revenue and government expenditure excluding interest payments (Cochrane 2011Jan, 27, equation (16)). There is a point when adverse expectations about the capacity of the government to generate primary surpluses to honor its obligations can result in increases in interest rates on government debt.

First, Unpleasant Monetarist Arithmetic. Fiscal policy is described by Sargent and Wallace (1981, 3, equation 1) as a time sequence of D(t), t = 1, 2,…t, …, where D is real government expenditures, excluding interest on government debt, less real tax receipts. D(t) is the real deficit excluding real interest payments measured in real time t goods. Monetary policy is described by a time sequence of H(t), t=1,2,…t, …, with H(t) being the stock of base money at time t. In order to simplify analysis, all government debt is considered as being only for one time period, in the form of a one-period bond B(t), issued at time t-1 and maturing at time t. Denote by R(t-1) the real rate of interest on the one-period bond B(t) between t-1 and t. The measurement of B(t-1) is in terms of t-1 goods and [1+R(t-1)] “is measured in time t goods per unit of time t-1 goods” (Sargent and Wallace 1981, 3). Thus, B(t-1)[1+R(t-1)] brings B(t-1) to maturing time t. B(t) represents borrowing by the government from the private sector from t to t+1 in terms of time t goods. The price level at t is denoted by p(t). The budget constraint of Sargent and Wallace (1981, 3, equation 1) is:

D(t) = {[H(t) – H(t-1)]/p(t)} + {B(t) – B(t-1)[1 + R(t-1)]} (1)

Equation (1) states that the government finances its real deficits into two portions. The first portion, {[H(t) – H(t-1)]/p(t)}, is seigniorage, or “printing money.” The second part,

{B(t) – B(t-1)[1 + R(t-1)]}, is borrowing from the public by issue of interest-bearing securities. Denote population at time t by N(t) and growing by assumption at the constant rate of n, such that:

N(t+1) = (1+n)N(t), n>-1 (2)

The per capita form of the budget constraint is obtained by dividing (1) by N(t) and rearranging:

B(t)/N(t) = {[1+R(t-1)]/(1+n)}x[B(t-1)/N(t-1)]+[D(t)/N(t)] – {[H(t)-H(t-1)]/[N(t)p(t)]} (3)

On the basis of the assumptions of equal constant rate of growth of population and real income, n, constant real rate of return on government securities exceeding growth of economic activity and quantity theory equation of demand for base money, Sargent and Wallace (1981) find that “tighter current monetary policy implies higher future inflation” under fiscal policy dominance of monetary policy. That is, the monetary authority does not permanently influence inflation, lowering inflation now with tighter policy but experiencing higher inflation in the future.

Second, Unpleasant Fiscal Arithmetic. The tool of analysis of Cochrane (2011Jan, 27, equation (16)) is the government debt valuation equation:

(Mt + Bt)/Pt = Et∫(1/Rt, t+τ)st+τdτ (4)

Equation (4) expresses the monetary, Mt, and debt, Bt, liabilities of the government, divided by the price level, Pt, in terms of the expected value discounted by the ex-post rate on government debt, Rt, t+τ, of the future primary surpluses st+τ, which are equal to Tt+τ – Gt+τ or difference between taxes, T, and government expenditures, G. Cochrane (2010A) provides the link to a web appendix demonstrating that it is possible to discount by the ex post Rt, t+τ. The second equation of Cochrane (2011Jan, 5) is:

MtV(it, ·) = PtYt (5)

Conventional analysis of monetary policy contends that fiscal authorities simply adjust primary surpluses, s, to sanction the price level determined by the monetary authority through equation (5), which deprives the debt valuation equation (4) of any role in price level determination. The simple explanation is (Cochrane 2011Jan, 5):

“We are here to think about what happens when [4] exerts more force on the price level. This change may happen by force, when debt, deficits and distorting taxes become large so the Treasury is unable or refuses to follow. Then [4] determines the price level; monetary policy must follow the fiscal lead and ‘passively’ adjust M to satisfy [5]. This change may also happen by choice; monetary policies may be deliberately passive, in which case there is nothing for the Treasury to follow and [4] determines the price level.”

An intuitive interpretation by Cochrane (2011Jan 4) is that when the current real value of government debt exceeds expected future surpluses, economic agents unload government debt to purchase private assets and goods, resulting in inflation. If the risk premium on government debt declines, government debt becomes more valuable, causing a deflationary effect. If the risk premium on government debt increases, government debt becomes less valuable, causing an inflationary effect.

There are multiple conclusions by Cochrane (2011Jan) on the debt/dollar crisis and Global recession, among which the following three:

(1) The flight to quality that magnified the recession was not from goods into money but from private-sector securities into government debt because of the risk premium on private-sector securities; monetary policy consisted of providing liquidity in private-sector markets suffering stress

(2) Increases in liquidity by open-market operations with short-term securities have no impact; quantitative easing can affect the timing but not the rate of inflation; and purchase of private debt can reverse part of the flight to quality

(3) The debt valuation equation has a similar role as the expectation shifting the Phillips curve such that a fiscal inflation can generate stagflation effects similar to those occurring from a loss of anchoring expectations.

This analysis suggests that there may be a point of saturation of demand for United States financial liabilities without an increase in interest rates on Treasury securities. A risk premium may develop on US debt. Such premium is not apparent currently because of distressed conditions in the world economy and international financial system. Risk premiums are observed in the spread of bonds of highly indebted countries in Europe relative to bonds of the government of Germany.

The issue of global imbalances centered on the possibility of a disorderly correction (Pelaez and Pelaez, The Global Recession Risk (2007), Globalization and the State Vol. II (2008b) 183-94, Government Intervention in Globalization (2008c), 167-71). Such a correction has not occurred historically but there is no argument proving that it could not occur. The need for a correction would originate in unsustainable large and growing United States current account deficits (CAD) and net international investment position (NIIP) or excess of financial liabilities of the US held by foreigners net relative to financial liabilities of foreigners held by US residents. The IMF estimated that the US could maintain a CAD of two to three percent of GDP without major problems (Rajan 2004). The threat of disorderly correction is summarized by Pelaez and Pelaez, The Global Recession Risk (2007), 15):

“It is possible that foreigners may be unwilling to increase their positions in US financial assets at prevailing interest rates. An exit out of the dollar could cause major devaluation of the dollar. The depreciation of the dollar would cause inflation in the US, leading to increases in American interest rates. There would be an increase in mortgage rates followed by deterioration of real estate values. The IMF has simulated that such an adjustment would cause a decline in the rate of growth of US GDP to 0.5 percent over several years. The decline of demand in the US by four percentage points over several years would result in a world recession because the weakness in Europe and Japan could not compensate for the collapse of American demand. The probability of occurrence of an abrupt adjustment is unknown. However, the adverse effects are quite high, at least hypothetically, to warrant concern.”

The United States could be moving toward a situation typical of heavily indebted countries, requiring fiscal adjustment and increases in productivity to become more competitive internationally. The CAD and NIIP of the United States are not observed in full deterioration because the economy is well below trend. There are two complications in the current environment relative to the concern with disorderly correction in the first half of the past decade. In the release of Jun 14, 2013, the Bureau of Economic Analysis (http://www.bea.gov/newsreleases/international/transactions/2013/pdf/trans113.pdf) informs of revisions of US data on US international transactions since 1999:

“The statistics of the U.S. international transactions accounts released today have been revised for the first quarter of 1999 to the fourth quarter of 2012 to incorporate newly available and revised source data, updated seasonal adjustments, changes in definitions and classifications, and improved estimating methodologies.”

The BEA introduced new concepts and methods (http://www.bea.gov/international/concepts_methods.htm) in comprehensive restructuring on Jun 18, 2014 (http://www.bea.gov/international/modern.htm):

“BEA introduced a new presentation of the International Transactions Accounts on June 18, 2014 and will introduce a new presentation of the International Investment Position on June 30, 2014. These new presentations reflect a comprehensive restructuring of the international accounts that enhances the quality and usefulness of the accounts for customers and bring the accounts into closer alignment with international guidelines.”

Table IIA2-3 provides data on the US fiscal and balance of payments imbalances incorporating all revisions and methods. In 2007, the federal deficit of the US was $161 billion corresponding to 1.1 percent of GDP while the Congressional Budget Office estimates the federal deficit in 2012 at $1087 billion or 6.8 percent of GDP. The estimate of the deficit for 2013 is $680 billion or 4.1 percent of GDP. The combined record federal deficits of the US from 2009 to 2012 are $5094 billion or 31.6 percent of the estimate of GDP for fiscal year 2012 implicit in the CBO (CBO 2013Sep11) estimate of debt/GDP. The deficits from 2009 to 2012 exceed one trillion dollars per year, adding to $5.094 trillion in four years, using the fiscal year deficit of $1087 billion for fiscal year 2012, which is the worst fiscal performance since World War II. Federal debt in 2007 was $5035 billion, slightly less than the combined deficits from 2009 to 2012 of $5094 billion. Federal debt in 2012 was 70.4 percent of GDP (CBO 2015Jan26) and 72.6 percent of GDP in 2013 (http://www.cbo.gov/). This situation may worsen in the future (CBO 2013Sep17):

“Between 2009 and 2012, the federal government recorded the largest budget deficits relative to the size of the economy since 1946, causing federal debt to soar. Federal debt held by the public is now about 73 percent of the economy’s annual output, or gross domestic product (GDP). That percentage is higher than at any point in U.S. history except a brief period around World War II, and it is twice the percentage at the end of 2007. If current laws generally remained in place, federal debt held by the public would decline slightly relative to GDP over the next several years, CBO projects. After that, however, growing deficits would ultimately push debt back above its current high level. CBO projects that federal debt held by the public would reach 100 percent of GDP in 2038, 25 years from now, even without accounting for the harmful effects that growing debt would have on the economy. Moreover, debt would be on an upward path relative to the size of the economy, a trend that could not be sustained indefinitely.

The gap between federal spending and revenues would widen steadily after 2015 under the assumptions of the extended baseline, CBO projects. By 2038, the deficit would be 6½ percent of GDP, larger than in any year between 1947 and 2008, and federal debt held by the public would reach 100 percent of GDP, more than in any year except 1945 and 1946. With such large deficits, federal debt would be growing faster than GDP, a path that would ultimately be unsustainable.

Incorporating the economic effects of the federal policies that underlie the extended baseline worsens the long-term budget outlook. The increase in debt relative to the size of the economy, combined with an increase in marginal tax rates (the rates that would apply to an additional dollar of income), would reduce output and raise interest rates relative to the benchmark economic projections that CBO used in producing the extended baseline. Those economic differences would lead to lower federal revenues and higher interest payments. With those effects included, debt under the extended baseline would rise to 108 percent of GDP in 2038.”

The most recent CBO long-term budget on Jul 12, 2016, projects US federal debt at 141.1 percent of GDP in 2046 (Congressional Budget Office, The 2016 long-term budget outlook. Washington, DC, Jul 12 https://www.cbo.gov/publication/51580).

Table VI-3B, US, Current Account, NIIP, Fiscal Balance, Nominal GDP, Federal Debt and Direct Investment, Dollar Billions and %

| 2007 | 2008 | 2009 | 2010 | 2011 | |

| Goods & | -705 | -709 | -384 | -495 | -549 |

| Primary Income | 101 | 146 | 124 | 178 | 221 |

| Secondary Income | -114 | -128 | -124 | -125 | -133 |

| Current Account | -719 | -691 | -384 | -442 | -460 |

| NGDP | 14478 | 14719 | 14419 | 14964 | 15518 |

| Current Account % GDP | -5.0 | -4.7 | -2.7 | -3.0 | -3.0 |

| NIIP | -1279 | -3995 | -2628 | -2512 | -4455 |

| US Owned Assets Abroad | 20705 | 19423 | 19426 | 21767 | 22209 |

| Foreign Owned Assets in US | 21984 | 23418 | 22054 | 24279 | 26664 |

| NIIP % GDP | -8.8 | -27.1 | -18.2 | -16.8 | -28.7 |

| Exports | 2569 | 2751 | 2286 | 2631 | 2988 |

| NIIP % | -50 | -145 | -115 | -95 | -149 |

| DIA MV | 5858 | 3707 | 4945 | 5486 | 5215 |

| DIUS MV | 4134 | 3091 | 3619 | 4099 | 4199 |

| Fiscal Balance | -161 | -459 | -1413 | -1294 | -1300 |

| Fiscal Balance % GDP | -1.1 | -3.1 | -9.8 | -8.7 | -8.5 |

| Federal Debt | 5035 | 5803 | 7545 | 9019 | 10128 |

| Federal Debt % GDP | 35.2 | 39.3 | 52.3 | 60.9 | 65.9 |

| Federal Outlays | 2729 | 2983 | 3518 | 3457 | 3603 |

| ∆% | 2.8 | 9.3 | 17.9 | -1.7 | 4.2 |

| % GDP | 19.1 | 20.2 | 24.4 | 23.4 | 23.4 |

| Federal Revenue | 2568 | 2524 | 2105 | 2163 | 2303 |

| ∆% | 6.7 | -1.7 | -16.6 | 2.7 | 6.5 |

| % GDP | 17.9 | 17.1 | 14.6 | 14.6 | 15.0 |

| 2012 | 2013 | 2014 | 2015 | |

| Goods & | -538 | -462 | -490 | -500 |

| Primary Income | 216 | 219 | 224 | 182 |

| Secondary Income | -126 | -124 | -126 | -145 |

| Current Account | -447 | -366 | -392 | -463 |

| NGDP | 16155 | 16692 | 17393 | 18037 |

| Current Account % GDP | -2.8 | -2.2 | -2.3 | -2.6 |

| NIIP | -4518 | -5373 | -7046 | -7281 |

| US Owned Assets Abroad | 22562 | 24145 | 24718 | 23341 |

| Foreign Owned Assets in US | 27080 | 29517 | 31764 | 30621 |

| NIIP % GDP | -28.0 | -32.2 | -40.5 | -40.4 |

| Exports | 3097 | 3215 | 3339 | 3173 |

| NIIP % | -146 | -167 | -211 | -229 |

| DIA MV | 5969 | 7121 | 7133 | 6978 |

| DIUS MV | 4662 | 5815 | 6350 | 6544 |

| Fiscal Balance | -1087 | -680 | -485 | -438 |

| Fiscal Balance % GDP | -6.8 | -4.1 | -2.8 | -2.5 |

| Federal Debt | 11281 | 11983 | 12780 | 13117 |

| Federal Debt % GDP | 70.4 | 72.6 | 74.4 | 73.6 |

| Federal Outlays | 3537 | 3455 | 3506 | 3688 |

| ∆% | -1.8 | -2.3 | 1.5 | 5.2 |

| % GDP | 22.1 | 20.9 | 20.4 | 20.7 |

| Federal Revenue | 2450 | 2775 | 3022 | 3250 |

| ∆% | 6.4 | 13.3 | 8.9 | 7.6 |

| % GDP | 15.3 | 16.8 | 17.6 | 18.2 |

Sources:

Notes: NGDP: nominal GDP or in current dollars; NIIP: Net International Investment Position; DIA MV: US Direct Investment Abroad at Market Value; DIUS MV: Direct Investment in the US at Market Value. There are minor discrepancies in the decimal point of percentages of GDP between the balance of payments data and federal debt, outlays, revenue and deficits in which the original number of the CBO source is maintained. See Bureau of Economic Analysis, US International Economic Accounts: Concepts and Methods. 2014. Washington, DC: BEA, Department of Commerce, Jun 2014 http://www.bea.gov/international/concepts_methods.htm These discrepancies do not alter conclusions. Budget http://www.cbo.gov/

https://www.cbo.gov/about/products/budget-economic-data#6

https://www.cbo.gov/about/products/budget_economic_data#3 https://www.cbo.gov/about/products/budget_economic_data#2 Balance of Payments and NIIP http://www.bea.gov/international/index.htm#bop Gross Domestic Product, Bureau of Economic Analysis (BEA) http://www.bea.gov/iTable/index_nipa.cfm

Table VI-3C provides quarterly estimates NSA of the external imbalance of the United States. The current account deficit seasonally adjusted decreases from 2.7 percent of GDP in IIIQ2015 to 2.5 percent in IVQ2015. The current account deficit increases to 2.9 percent of GDP in IQ2016. The deficit decreases to 2.6 percent in IIQ2016 and decreases to 2.4 percent in IIIQ2016. The net international investment position increases from minus $7.2 trillion in IIIQ2015 to minus $7.3 trillion in IVQ2015, increasing at minus $7.6 trillion in IQ2016. The net international investment position increases to minus $8.0 trillion in IIQ2016 and decreases to minus $7.8 trillion in IIIQ2016. The BEA explains as follows (https://www.bea.gov/newsreleases/international/intinv/2016/pdf/intinv316.pdf):

“The U.S. net international investment position increased to −$7,781.1 billion (preliminary) at the end of the third quarter of 2016 from −$8,026.9 billion (revised) at the end of the second quarter, according to statistics released today by the Bureau of Economic Analysis (BEA). The $245.8 billion increase in the net investment position reflected a $346.2 billion increase in U.S. assets and a $100.5 billion increase in U.S. liabilities. The net investment position increased 3.1 percent in the third quarter, compared with a decrease of 5.9 percent in the second quarter and an average quarterly decrease of 6.0 percent from the first quarter of 2011 through the first quarter of 2016.”

The BEA explains further (https://www.bea.gov/newsreleases/international/intinv/2016/pdf/intinv316.pdf): “U.S. assets increased $346.2 billion to $24,861.2 billion at the end of the third quarter, reflecting an increase in assets excluding financial derivatives that was partly offset by a decrease in financial derivatives. Assets excluding financial derivatives increased $794.9 billion to $22,086.1 billion, mostly reflecting increases in portfolio investment and direct investment assets due to increases in foreign equity prices. Financial derivatives decreased $448.7 billion to $2,775.1 billion, mostly in single-currency interest rate contracts and in foreign exchange contracts. U.S. liabilities increased $100.5 billion to $32,642.3 billion at the end of the third quarter, reflecting an increase in liabilities excluding financial derivatives that was partly offset by a decrease in financial derivatives. Liabilities excluding financial derivatives increased $546.3 billion to $29,922.5 billion, reflecting increases in portfolio investment and direct investment liabilities due to financial transactions and increases in U.S. equity prices. Financial derivatives decreased $445.8 billion to $2,719.9 billion, mostly in single-currency interest rate contracts and in foreign exchange contracts.”

Table VI-3C, US, Current Account, NIIP, Fiscal Balance, Nominal GDP, Federal Debt and Direct Investment, Dollar Billions and % NSA

| IIIQ2015 | IVQ2015 | IQ2016 | IIQ2016 | IIIQ2016 | |

| Goods & | -139 | -127 | -103 | -134 | -135 |

| Primary Income | 43 | 48 | 34 | 42 | 44 |

| Secondary Income | -41 | -36 | -41 | -36 | -42 |

| Current Account | -137 | -114 | -110 | -127 | -133 |

| Current Account % GDP | -2.7 | -2.5 | -2.9 | -2.6 | -2.4 |

| NIIP | -7240 | -7281 | -7582 | -8027 | -7781 |

| US Owned Assets Abroad | 23478 | 23341 | 24062 | 24515 | 24861 |

| Foreign Owned Assets in US | -30718 | -30621 | -31644 | -32542 | -32642 |

| DIA MV | 6785 | 6978 | 6993 | 6964 | 7384 |

| DIA MV Equity | 5640 | 5811 | 5838 | 5797 | 6161 |

| DIUS MV | 6260 | 6544 | 6665 | 6955 | 7194 |

| DIUS MV Equity | 4682 | 4979 | 5070 | 5272 | 5498 |

Notes: NIIP: Net International Investment Position; DIA MV: US Direct Investment Abroad at Market Value; DIUS MV: Direct Investment in the US at Market Value. See Bureau of Economic Analysis, US International Economic Accounts: Concepts and Methods. 2014. Washington, DC: BEA, Department of Commerce, Jun 2014 http://www.bea.gov/international/concepts_methods.htm

Chart VI-3C of the US Bureau of Economic Analysis provides the quarterly US net international investment position (NIIP) NSA in billion dollars. The NIIP deteriorated in 2008, improving in 2009-2011 followed by deterioration after 2012.

Chart VI-3C, US Net International Investment Positon, NSA, Billion US Dollars

Source: Bureau of Economic Analysis

http://www.bea.gov/newsreleases/international/intinv/intinvnewsrelease.htm

Chart VI-10 of the Board of Governors of the Federal Reserve System provides the overnight Fed funds rate on business days from Jul 1, 1954 at 1.13 percent through Jan 10, 1979, at 9.91 percent per year, to Jan 12, 2017, at 0.12 percent per year. US recessions are in shaded areas according to the reference dates of the NBER (http://www.nber.org/cycles.html). In the Fed effort to control the “Great Inflation” of the 1970s (see http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html http://cmpassocregulationblog.blogspot.com/2011/04/new-economics-of-rose-garden-turned.html http://cmpassocregulationblog.blogspot.com/2011/03/is-there-second-act-of-us-great.html and Appendix I The Great Inflation; see Taylor 1993, 1997, 1998LB, 1999, 2012FP, 2012Mar27, 2012Mar28, 2012JMCB and http://cmpassocregulationblog.blogspot.com/2017/01/rules-versus-discretionary-authorities.html and earlier http://cmpassocregulationblog.blogspot.com/2012/06/rules-versus-discretionary-authorities.html), the fed funds rate increased from 8.34 percent on Jan 3, 1979 to a high in Chart VI-10 of 22.36 percent per year on Jul 22, 1981 with collateral adverse effects in the form of impaired savings and loans associations in the United States, emerging market debt and money-center banks (see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 72-7; Pelaez 1986, 1987). Another episode in Chart VI-10 is the increase in the fed funds rate from 3.15 percent on Jan 3, 1994, to 6.56 percent on Dec 21, 1994, which also had collateral effects in impairing emerging market debt in Mexico and Argentina and bank balance sheets in a world bust of fixed income markets during pursuit by central banks of non-existing inflation (Pelaez and Pelaez, International Financial Architecture (2005), 113-5). Another interesting policy impulse is the reduction of the fed funds rate from 7.03 percent on Jul 3, 2000, to 1.00 percent on Jun 22, 2004, in pursuit of equally non-existing deflation (Pelaez and Pelaez, International Financial Architecture (2005), 18-28, The Global Recession Risk (2007), 83-85), followed by increments of 25 basis points from Jun 2004 to Jun 2006, raising the fed funds rate to 5.25 percent on Jul 3, 2006 in Chart VI-10. Central bank commitment to maintain the fed funds rate at 1.00 percent induced adjustable-rate mortgages (ARMS) linked to the fed funds rate. Lowering the interest rate near the zero bound in 2003-2004 caused the illusion of permanent increases in wealth or net worth in the balance sheets of borrowers and also of lending institutions, securitized banking and every financial institution and investor in the world. The discipline of calculating risks and returns was seriously impaired. The objective of monetary policy was to encourage borrowing, consumption and investment but the exaggerated stimulus resulted in a financial crisis of major proportions as the securitization that had worked for a long period was shocked with policy-induced excessive risk, imprudent credit, high leverage and low liquidity by the incentive to finance everything overnight at interest rates close to zero, from adjustable rate mortgages (ARMS) to asset-backed commercial paper of structured investment vehicles (SIV).

The consequences of inflating liquidity and net worth of borrowers were a global hunt for yields to protect own investments and money under management from the zero interest rates and unattractive long-term yields of Treasuries and other securities. Monetary policy distorted the calculations of risks and returns by households, business and government by providing central bank cheap money. Short-term zero interest rates encourage financing of everything with short-dated funds, explaining the SIVs created off-balance sheet to issue short-term commercial paper with the objective of purchasing default-prone mortgages that were financed in overnight or short-dated sale and repurchase agreements (Pelaez and Pelaez, Financial Regulation after the Global Recession, 50-1, Regulation of Banks and Finance, 59-60, Globalization and the State Vol. I, 89-92, Globalization and the State Vol. II, 198-9, Government Intervention in Globalization, 62-3, International Financial Architecture, 144-9). ARMS were created to lower monthly mortgage payments by benefitting from lower short-dated reference rates. Financial institutions economized in liquidity that was penalized with near zero interest rates. There was no perception of risk because the monetary authority guaranteed a minimum or floor price of all assets by maintaining low interest rates forever or equivalent to writing an illusory put option on wealth. Subprime mortgages were part of the put on wealth by an illusory put on house prices. The housing subsidy of $221 billion per year created the impression of ever-increasing house prices. The suspension of auctions of 30-year Treasuries was designed to increase demand for mortgage-backed securities, lowering their yield, which was equivalent to lowering the costs of housing finance and refinancing. Fannie and Freddie purchased or guaranteed $1.6 trillion of nonprime mortgages and worked with leverage of 75:1 under Congress-provided charters and lax oversight. The combination of these policies resulted in high risks because of the put option on wealth by near zero interest rates, excessive leverage because of cheap rates, low liquidity because of the penalty in the form of low interest rates and unsound credit decisions because the put option on wealth by monetary policy created the illusion that nothing could ever go wrong, causing the credit/dollar crisis and global recession (Pelaez and Pelaez, Financial Regulation after the Global Recession, 157-66, Regulation of Banks, and Finance, 217-27, International Financial Architecture, 15-18, The Global Recession Risk, 221-5, Globalization and the State Vol. II, 197-213, Government Intervention in Globalization, 182-4). A final episode in Chart VI-10 is the reduction of the fed funds rate from 5.41 percent on Aug 9, 2007, to 2.97 percent on October 7, 2008, to 0.12 percent on Dec 5, 2008 and close to zero throughout a long period with the final point at 0.66 percent on Jan 12, 2017. Evidently, this behavior of policy would not have occurred had there been theory, measurements and forecasts to avoid these violent oscillations that are clearly detrimental to economic growth and prosperity without inflation. The Chair of the Board of Governors of the Federal Reserve System, Janet L. Yellen, stated on Jul 10, 2015 that (http://www.federalreserve.gov/newsevents/speech/yellen20150710a.htm):

“Based on my outlook, I expect that it will be appropriate at some point later this year to take the first step to raise the federal funds rate and thus begin normalizing monetary policy. But I want to emphasize that the course of the economy and inflation remains highly uncertain, and unanticipated developments could delay or accelerate this first step. I currently anticipate that the appropriate pace of normalization will be gradual, and that monetary policy will need to be highly supportive of economic activity for quite some time. The projections of most of my FOMC colleagues indicate that they have similar expectations for the likely path of the federal funds rate. But, again, both the course of the economy and inflation are uncertain. If progress toward our employment and inflation goals is more rapid than expected, it may be appropriate to remove monetary policy accommodation more quickly. However, if progress toward our goals is slower than anticipated, then the Committee may move more slowly in normalizing policy.”

There is essentially the same view in the Testimony of Chair Yellen in delivering the Semiannual Monetary Policy Report to the Congress on Jul 15, 2015 (http://www.federalreserve.gov/newsevents/testimony/yellen20150715a.htm). The FOMC (Federal Open Market Committee) raised the fed funds rate to ¼ to ½ percent at its meeting on Dec 16, 2015 (http://www.federalreserve.gov/newsevents/press/monetary/20151216a.htm).

It is a forecast mandate because of the lags in effect of monetary policy impulses on income and prices (Romer and Romer 2004). The intention is to reduce unemployment close to the “natural rate” (Friedman 1968, Phelps 1968) of around 5 percent and inflation at or below 2.0 percent. If forecasts were reasonably accurate, there would not be policy errors. A commonly analyzed risk of zero interest rates is the occurrence of unintended inflation that could precipitate an increase in interest rates similar to the Himalayan rise of the fed funds rate from 9.91 percent on Jan 10, 1979, at the beginning in Chart VI-10, to 22.36 percent on Jul 22, 1981. There is a less commonly analyzed risk of the development of a risk premium on Treasury securities because of the unsustainable Treasury deficit/debt of the United States (http://cmpassocregulationblog.blogspot.com/2017/01/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html

and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html and earlier (http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html). There is not a fiscal cliff or debt limit issue ahead but rather free fall into a fiscal abyss. The combination of the fiscal abyss with zero interest rates could trigger the risk premium on Treasury debt or Himalayan hike in interest rates.

Chart VI-10, US, Fed Funds Rate, Business Days, Jul 1, 1954 to Jan 12, 2017, Percent per Year

Source: Board of Governors of the Federal Reserve System

https://www.federalreserve.gov/releases/h15/

There is a false impression of the existence of a monetary policy “science,” measurements and forecasting with which to steer the economy into “prosperity without inflation.” Market participants are remembering the Great Bond Crash of 1994 shown in Table VI-7G when monetary policy pursued nonexistent inflation, causing trillions of dollars of losses in fixed income worldwide while increasing the fed funds rate from 3 percent in Jan 1994 to 6 percent in Dec. The exercise in Table VI-7G shows a drop of the price of the 30-year bond by 18.1 percent and of the 10-year bond by 14.1 percent. CPI inflation remained almost the same and there is no valid counterfactual that inflation would have been higher without monetary policy tightening because of the long lag in effect of monetary policy on inflation (see Culbertson 1960, 1961, Friedman 1961, Batini and Nelson 2002, Romer and Romer 2004). The pursuit of nonexistent deflation during the past ten years has resulted in the largest monetary policy accommodation in history that created the 2007 financial market crash and global recession and is currently preventing smoother recovery while creating another financial crash in the future. The issue is not whether there should be a central bank and monetary policy but rather whether policy accommodation in doses from zero interest rates to trillions of dollars in the fed balance sheet endangers economic stability.

Table VI-7G, Fed Funds Rates, Thirty and Ten Year Treasury Yields and Prices, 30-Year Mortgage Rates and 12-month CPI Inflation 1994

| 1994 | FF | 30Y | 30P | 10Y | 10P | MOR | CPI |

| Jan | 3.00 | 6.29 | 100 | 5.75 | 100 | 7.06 | 2.52 |

| Feb | 3.25 | 6.49 | 97.37 | 5.97 | 98.36 | 7.15 | 2.51 |

| Mar | 3.50 | 6.91 | 92.19 | 6.48 | 94.69 | 7.68 | 2.51 |

| Apr | 3.75 | 7.27 | 88.10 | 6.97 | 91.32 | 8.32 | 2.36 |

| May | 4.25 | 7.41 | 86.59 | 7.18 | 88.93 | 8.60 | 2.29 |

| Jun | 4.25 | 7.40 | 86.69 | 7.10 | 90.45 | 8.40 | 2.49 |

| Jul | 4.25 | 7.58 | 84.81 | 7.30 | 89.14 | 8.61 | 2.77 |

| Aug | 4.75 | 7.49 | 85.74 | 7.24 | 89.53 | 8.51 | 2.69 |

| Sep | 4.75 | 7.71 | 83.49 | 7.46 | 88.10 | 8.64 | 2.96 |

| Oct | 4.75 | 7.94 | 81.23 | 7.74 | 86.33 | 8.93 | 2.61 |

| Nov | 5.50 | 8.08 | 79.90 | 7.96 | 84.96 | 9.17 | 2.67 |

| Dec | 6.00 | 7.87 | 81.91 | 7.81 | 85.89 | 9.20 | 2.67 |

Notes: FF: fed funds rate; 30Y: yield of 30-year Treasury; 30P: price of 30-year Treasury assuming coupon equal to 6.29 percent and maturity in exactly 30 years; 10Y: yield of 10-year Treasury; 10P: price of 10-year Treasury assuming coupon equal to 5.75 percent and maturity in exactly 10 years; MOR: 30-year mortgage; CPI: percent change of CPI in 12 months

Sources: yields and mortgage rates http://www.federalreserve.gov/releases/h15/data.htm CPI ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.t

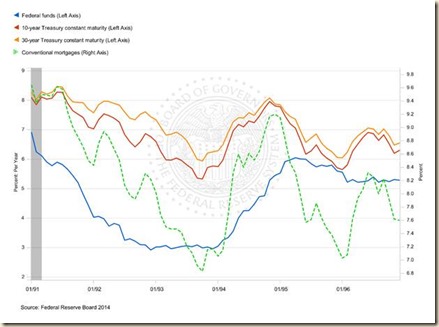

Chart VI-14 provides the overnight fed funds rate, the yield of the 10-year Treasury constant maturity bond, the yield of the 30-year constant maturity bond and the conventional mortgage rate from Jan 1991 to Dec 1996. In Jan 1991, the fed funds rate was 6.91 percent, the 10-year Treasury yield 8.09 percent, the 30-year Treasury yield 8.27 percent and the conventional mortgage rate 9.64 percent. Before monetary policy tightening in Oct 1993, the rates and yields were 2.99 percent for the fed funds, 5.33 percent for the 10-year Treasury, 5.94 for the 30-year Treasury and 6.83 percent for the conventional mortgage rate. After tightening in Nov 1994, the rates and yields were 5.29 percent for the fed funds rate, 7.96 percent for the 10-year Treasury, 8.08 percent for the 30-year Treasury and 9.17 percent for the conventional mortgage rate.

Chart VI-14, US, Overnight Fed Funds Rate, 10-Year Treasury Constant Maturity, 30-Year Treasury Constant Maturity and Conventional Mortgage Rate, Monthly, Jan 1991 to Dec 1996

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/update/

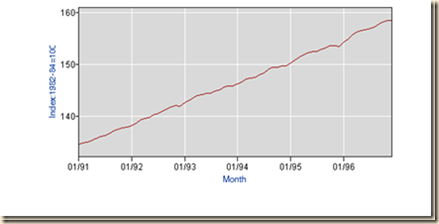

Chart VI-15 of the Bureau of Labor Statistics provides the all items consumer price index from Jan 1991 to Dec 1996. There does not appear acceleration of consumer prices requiring aggressive tightening.

Chart VI-15, US, Consumer Price Index All Items, Jan 1991 to Dec 1996

Source: Bureau of Labor Statistics

http://www.bls.gov/cpi/data.htm

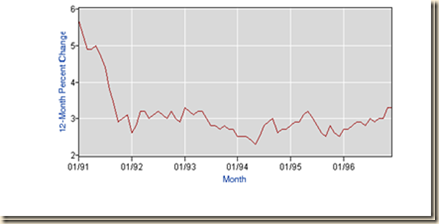

Chart IV-16 of the Bureau of Labor Statistics provides 12-month percentage changes of the all items consumer price index from Jan 1991 to Dec 1996. Inflation collapsed during the recession from Jul 1990 (III) and Mar 1991 (I) and the end of the Kuwait War on Feb 25, 1991 that stabilized world oil markets. CPI inflation remained almost the same and there is no valid counterfactual that inflation would have been higher without monetary policy tightening because of the long lag in effect of monetary policy on inflation (see Culbertson 1960, 1961, Friedman 1961, Batini and Nelson 2002, Romer and Romer 2004). Policy tightening had adverse collateral effects in the form of emerging market crises in Mexico and Argentina and fixed income markets worldwide.

Chart VI-16, US, Consumer Price Index All Items, Twelve-Month Percentage Change, Jan 1991 to Dec 1996

Source: Bureau of Labor Statistics

http://www.bls.gov/cpi/data.htm

The Congressional Budget Office (CBO 2014BEOFeb4) estimates potential GDP, potential labor force and potential labor productivity provided in Table IB-3. The CBO estimates average rate of growth of potential GDP from 1950 to 2014 at 3.3 percent per year. The projected path is significantly lower at 2.1 percent per year from 2015 to 2025. The legacy of the economic cycle expansion from IIIQ2009 to IIIQ2016 at 2.1 percent on average is in contrast with 4.8 percent on average in the expansion from IQ1983 to IQ1990 (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html).). Subpar economic growth may perpetuate unemployment and underemployment estimated at 24.2 million or 14.4 percent of the effective labor force in Nov 2016 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html) with much lower hiring than in the period before the current cycle (http://cmpassocregulationblog.blogspot.com/2016/12/rising-values-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/dollar-revaluation-and-valuations-of.html).

Table IB-3, US, Congressional Budget Office History and Projections of Potential GDP of US Overall Economy, ∆%

| Potential GDP | Potential Labor Force | Potential Labor Productivity* | |

| Average Annual ∆% | |||

| 1950-1973 | 4.0 | 1.6 | 2.4 |

| 1974-1981 | 3.2 | 2.5 | 0.7 |

| 1982-1990 | 3.2 | 1.6 | 1.6 |

| 1991-2001 | 3.2 | 1.2 | 2.0 |

| 2002-2007 | 2.5 | 1.0 | 1.5 |

| 2008-2015 | 1.5 | 0.5 | 0.9 |

| Total 1950-2015 | 3.2 | 1.5 | 1.7 |

| Projected Average Annual ∆% | |||

| 2016-2020 | 1.7 | 0.4 | 1.3 |

| 2021-2026 | 2.0 | 0.5 | 1.4 |

| 2016-2026 | 1.8 | 0.5 | 1.4 |

*Ratio of potential GDP to potential labor force

Source: CBO (2014BEOFeb4), CBO, Key assumptions in projecting potential GDP—February 2014 baseline. Washington, DC, Congressional Budget Office, Feb 4, 2014. CBO, The budget and economic outlook: 2015 to 2025. Washington, DC, Congressional Budget Office, Jan 26, 2015. Aug 2016

Chart IB-1A of the Congressional Budget Office provides historical and projected potential and actual US GDP. The gap between actual and potential output closes by 2017. Potential output expands at a lower rate than historically. Growth is even weaker relative to trend.

Chart IB-1A, Congressional Budget Office, Estimate of Potential GDP and Gap

Source: Congressional Budget Office

https://www.cbo.gov/publication/49890

Chart IB-1 of the Congressional Budget Office (CBO 2013BEOFeb5) provides actual and potential GDP of the United States from 2000 to 2011 and projected to 2024. Lucas (2011May) estimates trend of United States real GDP of 3.0 percent from 1870 to 2010 and 2.2 percent for per capita GDP. The United States successfully returned to trend growth of GDP by higher rates of growth during cyclical expansion as analyzed by Bordo (2012Sep27, 2012Oct21) and Bordo and Haubrich (2012DR). Growth in expansions following deeper contractions and financial crises was much higher in agreement with the plucking model of Friedman (1964, 1988). The unusual weakness of growth at 2.1 percent on average from IIIQ2009 to IIIQ2016 during the current economic expansion in contrast with 4.8 percent on average in the cyclical expansion from IQ1983 to IQ1990 (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html) cannot be explained by the contraction of 4.2 percent of GDP from IVQ2007 to IIQ2009 and the financial crisis. Weakness of growth in the expansion is perpetuating unemployment and underemployment of 24.2 million or 14.4 percent of the labor force as estimated for Dec 2016 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html). There is no exit from unemployment/underemployment and stagnating real wages because of the collapse of hiring (http://cmpassocregulationblog.blogspot.com/2016/12/rising-values-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/dollar-revaluation-and-valuations-of.html). The US economy and labor markets collapsed without recovery. Abrupt collapse of economic conditions can be explained only with cyclic factors (Lazear and Spletzer 2012Jul22) and not by secular stagnation (Hansen 1938, 1939, 1941 with early dissent by Simons 1942).

Chart IB-1, US, Congressional Budget Office, Actual and Projections of Potential GDP, 2000-2024, Trillions of Dollars

Source: Congressional Budget Office, CBO (2013BEOFeb5). The last year in common in both projections is 2017. The revision lowers potential output in 2017 by 7.3 percent relative to the projection in 2007.

Chart IB-2 provides differences in the projections of potential output by the CBO in 2007 and more recently on Feb 4, 2014, which the CBO explains in CBO (2014Feb28).

Chart IB-2, Congressional Budget Office, Revisions of Potential GDP

Source: Congressional Budget Office, 2014Feb 28. Revisions to CBO’s Projection of Potential Output since 2007. Washington, DC, CBO, Feb 28, 2014.

Chart IB-3 provides actual and projected potential GDP from 2000 to 2024. The gap between actual and potential GDP disappears at the end of 2017 (CBO2014Feb4). GDP increases in the projection at 2.5 percent per year.

Chart IB-3, Congressional Budget Office, GDP and Potential GDP

Source: CBO (2013BEOFeb5), CBO, Key assumptions in projecting potential GDP—February 2014 baseline. Washington, DC, Congressional Budget Office, Feb 4, 2014.

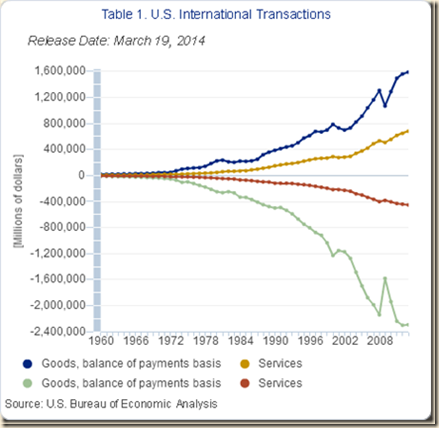

Chart IIA2-3 of the Bureau of Economic Analysis of the Department of Commerce shows on the lower negative panel the sharp increase in the deficit in goods and the deficits in goods and services from 1960 to 2012. The upper panel shows the increase in the surplus in services that was insufficient to contain the increase of the deficit in goods and services. The adjustment during the global recession has been in the form of contraction of economic activity that reduced demand for goods.

Chart IIA2-3, US, Balance of Goods, Balance on Services and Balance on Goods and Services, 1960-2013, Millions of Dollars

Source: Bureau of Economic Analysis http://www.bea.gov/iTable/index_ita.cfm

Chart IIA2-4 of the Bureau of Economic Analysis shows exports and imports of goods and services from 1960 to 2012. Exports of goods and services in the upper positive panel have been quite dynamic but have not compensated for the sharp increase in imports of goods. The US economy apparently has become less competitive in goods than in services.

Chart IIA2-4, US, Exports and Imports of Goods and Services, 1960-2013, Millions of Dollars

Source: Bureau of Economic Analysis http://www.bea.gov/iTable/index_ita.cfm

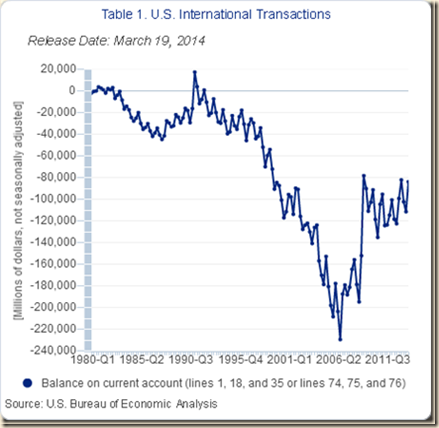

Chart IIA2-5 of the Bureau of Economic Analysis shows the US balance on current account from 1960 to 2012. The sharp devaluation of the dollar resulting from unconventional monetary policy of zero interest rates and elimination of auctions of 30-year Treasury bonds did not adjust the US balance of payments. Adjustment only occurred after the contraction of economic activity during the global recession.

Chart IIA2-5, US, Balance on Current Account, 1960-2013, Millions of Dollars

Source: Bureau of Economic Analysis http://www.bea.gov/iTable/index_ita.cfm

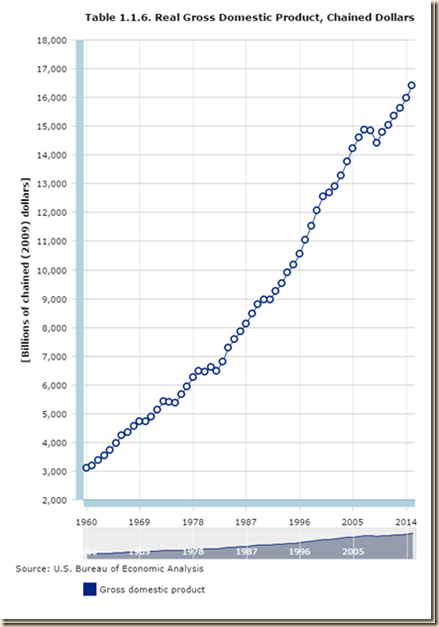

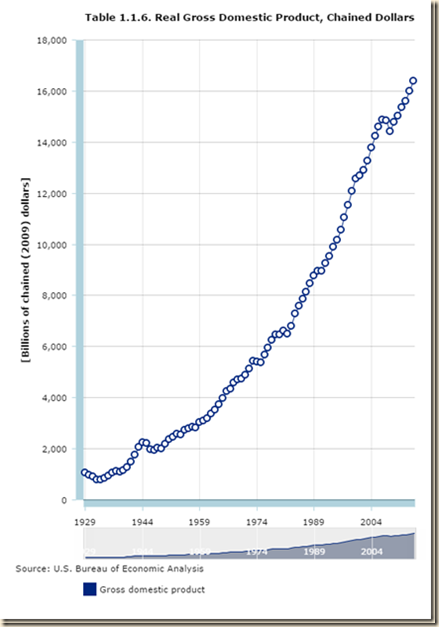

Chart IIA2-6 of the Bureau of Economic Analysis provides real GDP in the US from 1960 to 2014. The contraction of economic activity during the global recession was a major factor in the reduction of the current account deficit as percent of GDP.

Chart IIA2-6, US, Real GDP, 1960-2015, Billions of Chained 2009 Dollars

Source: Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IIA-7 provides the US current account deficit on a quarterly basis from 1980 to IQ1983. The deficit is at a lower level because of growth below potential not only in the US but worldwide. The combination of high government debt and deficit with external imbalance restricts potential prosperity in the US.

Chart IIA-7, US, Balance on Current Account, Quarterly, 1980-2013

Source: Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Risk aversion channels funds toward US long-term and short-term securities that finance the US balance of payments and fiscal deficits benefitting from risk flight to US dollar denominated assets. There are now temporary interruptions because of fear of rising interest rates that erode prices of US government securities because of mixed signals on monetary policy and exit from the Fed balance sheet of four trillion dollars of securities held outright. Net foreign purchases of US long-term securities (row C in Table VA-4) strengthened from minus $64.8 billion in Sep 2016 to minus $12.9 billion in Oct 2016. Foreign residents’ purchases minus sales of US long-term securities (row A in Table VA-4) in Sep 2016 of minus $46.6 billion strengthened to minus $6.0 billion in Oct 2016. Net US (residents) purchases of long-term foreign securities (row B in Table VA-4) weakened from $20.4 billion in Sep 2016 to $15.4 billion in Oct 2016. Other transactions (row C2 in Table VA-4) changed from minus $38.6 billion in Sep 2016 to minus $22.2 billion in Oct 2016. In Oct 2016,

C = A + B + C2 = -$6.0 billion + $15.4 billion -$22.2 billion = $12.8 billion

There are minor rounding errors. There is strengthening demand in Table VA-4 in Oct 2016 in A1 private purchases by residents overseas of US long-term securities of $32.8 billion of which strengthening in A11 Treasury securities of minus $18.3 billion, strengthening in A12 of $25.7 billion in agency securities, strengthening of $5.6 billion of corporate bonds and strengthening of $19.7 billion in equities. Worldwide risk aversion causes flight into US Treasury obligations with significant oscillations. Official purchases of securities in row A2 decreased $38.8 billion with decrease of Treasury securities of $45.3 billion in Oct 2016. Official purchases of agency securities increased $6.7 billion in Oct 2016. Row D shows decrease in Oct 2016 of $21.7 billion in purchases of short-term dollar denominated obligations. Foreign private holdings of US Treasury bills increased $41.3 billion (row D11) with foreign official holdings increasing $3.0 billion while the category “other” increased $16.6 billion. Foreign private holdings of US Treasury bills increased $41.3 billion in what could be arbitrage of duration exposures. Risk aversion of default losses in foreign securities dominates decisions to accept zero interest rates in Treasury securities with no perception of principal losses. In the case of long-term securities, investors prefer to sacrifice inflation and possible duration risk to avoid principal losses with significant oscillations in risk perceptions.

Table VA-4, Net Cross-Borders Flows of US Long-Term Securities, Billion Dollars, NSA

| Oct 2015 12 Months | Oct 2016 12 Months | Sep 2016 | Oct 2016 | |

| A Foreign Purchases less Sales of | 211.0 | 72.3 | -46.6 | -6.0 |

| A1 Private | 385.6 | 431.3 | -7.9 | 32.8 |

| A11 Treasury | 160.0 | 84.7 | -31.0 | -18.3 |

| A12 Agency | 136.3 | 244.5 | 23.9 | 25.7 |

| A13 Corporate Bonds | 157.8 | 122.4 | 2.1 | 5.6 |

| A14 Equities | -68.5 | -20.3 | -2.8 | 19.7 |

| A2 Official | -174.6 | -359.0 | -38.7 | -38.8 |

| A21 Treasury | -203.2 | -402.9 | -45.6 | -45.3 |

| A22 Agency | 39.3 | 50.1 | 8.2 | 6.7 |

| A23 Corporate Bonds | -1.7 | -4.9 | -1.0 | -1.1 |

| A24 Equities | -8.9 | -1.4 | -0.4 | 0.9 |

| B Net US Purchases of LT Foreign Securities | 173.8 | 172.4 | 20.4 | 15.4 |

| B1 Foreign Bonds | 309.7 | 229.5 | 22.4 | 20.6 |

| B2 Foreign Equities | -135.9 | -57.1 | -2.0 | -5.2 |

| C1 Net Transactions | 384.8 | 244.7 | -26.2 | 9.4 |

| C2 Other | -265.4 | -257.7 | -38.6 | -22.2 |

| C Net Foreign Purchases of US LT Securities | 119.3 | -13.0 | -64.8 | 12.9 |

| D Increase in Foreign Holdings of Dollar Denominated Short-term | -40.3 | 107.8 | 28.9 | -21.7 |

| D1 US Treasury Bills | -19.2 | 38.4 | 9.0 | -38.4 |

| D11 Private | 10.7 | 50.6 | -10.3 | 41.3 |

| D12 Official | -29.8 | -12.2 | 19.3 | 3.0 |

| D2 Other | -21.1 | 69.4 | 19.9 | 16.6 |

C1 = A + B; C = C1+C2

A = A1 + A2

A1 = A11 + A12 + A13 + A14

A2 = A21 + A22 + A23 + A24

B = B1 + B2

D = D1 + D2

Sources: United States Treasury

https://www.treasury.gov/resource-center/data-chart-center/tic/Pages/ticpress.aspx

http://www.treasury.gov/press-center/press-releases/Pages/jl2609.aspx