Rules versus Discretionary Authorities in Monetary Policy, Destruction of Household Nonfinancial Wealth with Stagnating Total Real Wealth, United States Housing, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017

I Rules versus Discretionary Authorities in Monetary Policy

IA Monetary Policy Rules

IA1 Origins of Rules versus Discretion

IA2 Monetary Policy Rules

IA3 The Taylor Rule

IB Unconventional Monetary Policy

IC Counterfactual of Policies Causing the Financial Crisis and Global Recession

ID Appendix on the Monetary History of Brazil

II Destruction of Household Nonfinancial Wealth with Stagnating Total Real Wealth

IIA United States Housing Collapse

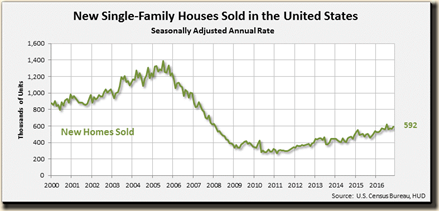

IIA1 Sales of New Houses

IIA2 United States House Prices

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

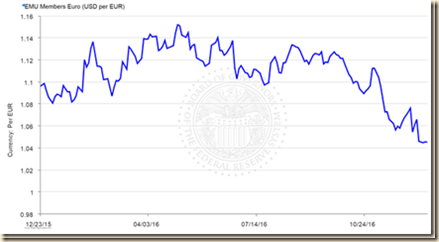

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

I Rules versus Discretionary Authorities in Monetary Policy. The objective of this section is to place the alternatives of monetary policy into two perspectives of (1) emphasis on long-term policy in contrast with (2) current emphasis on short-term impulses of unusual magnitude to respond immediately to deviations perceived with significant lags and measurement errors because of the deficiencies of the state of the art.

Unconventional monetary policy since 2003 has consisted of near zero nominal interest rates, negative real rates of interest, massive purchases of securities for the balance sheet of the Fed and intervention in allocation of credit. Professor John B. Taylor (2016Dec 7, 2016Dec20), in Testimony to the Subcommittee on Monetary Policy and Trade Committee on Financial Services, on Dec 7, 2016, analyzes the adverse effects of unconventional monetary policy:

“My research and that of others over the years shows that these policies were not effective, and may have been counterproductive. Economic growth was consistently below the Fed’s forecasts with the policies, and was much weaker than in earlier U.S. recoveries from deep recessions. Job growth has been insufficient to raise the percentage of the population that is working above pre-recession levels. There is a growing consensus that the extra low interest rates and unconventional monetary policy have reached diminishing or negative returns. Many have argued that these policies widen the income distribution, adversely affect savers, and increase the volatility of the dollar exchange rate. Experienced market participants have expressed concerns about bubbles, imbalances, and distortions caused by the policies. The unconventional policies have also raised public policy concerns about the Fed being transformed into a multipurpose institution, intervening in particular sectors and allocating credit, areas where Congress may have a role, but not a limited-purpose independent agency of government.”

Long-term economic performance in the United States consisted of trend growth of GDP at 3 percent per year and of per capita GDP at 2 percent per year as measured for 1870 to 2010 by Robert E Lucas (2011May). The economy returned to trend growth after adverse events such as wars and recessions. The key characteristic of adversities such as recessions was much higher rates of growth in expansion periods that permitted the economy to recover output, income and employment losses that occurred during the contractions. Over the business cycle, the economy compensated the losses of contractions with higher growth in expansions to maintain trend growth of GDP of 3 percent and of GDP per capita of 2 percent. The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. US economic growth has been at only 2.1 percent on average in the cyclical expansion in the 29 quarters from IIIQ2009 to IIIQ2016. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). There are new calculations using the revision of US GDP and personal income data since 1929 by the Bureau of Economic Analysis (BEA) (http://bea.gov/iTable/index_nipa.cfm) and the third estimate of GDP for IIIQ2016 (https://www.bea.gov/newsreleases/national/gdp/2016/pdf/gdp3q16_3rd.pdf). The average of 7.7 percent in the first four quarters of major cyclical expansions is in contrast with the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 of only 2.7 percent obtained by diving GDP of $14,745.9 billion in IIQ2010 by GDP of $14,355.6 billion in IIQ2009 {[$14,745.9/$14,355.6 -1]100 = 2.7%], or accumulating the quarter on quarter growth rates (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html). The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.9 percent, 5.4 percent from IQ1983 to IIIQ1986, 5.2 percent from IQ1983 to IVQ1986, 5.0 percent from IQ1983 to IQ1987, 5.0 percent from IQ1983 to IIQ1987, 4.9 percent from IQ1983 to IIIQ1987, 5.0 percent from IQ1983 to IVQ1987, 4.9 percent from IQ1983 to IIQ1988, 4.8 percent from IQ1983 to IIIQ1988, 4.8 percent from IQ1983 to IVQ1988, 4.8 percent from IQ1983 to IQ1989, 4.7 percent from IQ1983 to IIQ1989, 4.7 percent from IQ1983 to IIIQ1989, 4.5 percent from IQ1983 to IVQ1989. 4.5 percent from IQ1983 to IQ1990 and at 7.8 percent from IQ1983 to IVQ1983 (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html). The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. Growth at trend in the entire cycle from IVQ2007 to IIIQ2016 would have accumulated to 29.5 percent. GDP in IIIQ2016 would be $19,414.4 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2687.4 billion than actual $16,727.0 billion. There are about two trillion dollars of GDP less than at trend, explaining the 23.6 million unemployed or underemployed equivalent to actual unemployment/underemployment of 14.0 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html). US GDP in IIIQ2016 is 13.8 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,727.0 billion in IIIQ2016 or 11.6 percent at the average annual equivalent rate of 1.3 percent. Professor John H. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. Cochrane (2016May02) measures GDP growth in the US at average 3.5 percent per year from 1950 to 2000 and only at 1.76 percent per year from 2000 to 2015 with only at 2.0 percent annual equivalent in the current expansion. Cochrane (2016May02) proposes drastic changes in regulation and legal obstacles to private economic activity. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth of manufacturing at average 3.1 percent per year from Nov 1919 to Nov 2016. Growth at 3.1 percent per year would raise the NSA index of manufacturing output from 108.2316 in Dec 2007 to 142.1081 in Nov 2016. The actual index NSA in Nov 2016 is 103.0759, which is 27.5 percent below trend. Manufacturing output grew at average 2.1 percent between Dec 1986 and Dec 2015. Using trend growth of 2.1 percent per year, the index would increase to 130.3109 in Nov 2016. The output of manufacturing at 103.0759 in Nov 2016 is 20.9 percent below trend under this alternative calculation.

There is socio-economic stress in the combination of adverse events and cyclical performance:

- Mediocre economic growth below potential and long-term trend, resulting in idle productive resources with GDP two trillion dollars below trend (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html). US GDP grew at the average rate of 3.2 percent per year from 1929 to 2015, with similar performance in whole cycles of contractions and expansions, but only at 1.2 percent per year on average from 2007 to 2015. GDP in IIIQ2016 is 13.8 percent lower than what it would have been had it grown at trend of 3.0 percent

- Private fixed investment stagnating at increase of 7.5 percent in the entire cycle from IVQ2007 to IIIQ2016 (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html)

- Twenty four million or 14.0 percent of the effective labor force unemployed or underemployed in involuntary part-time jobs with stagnating or declining real wages (http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/global-competitive-easing-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/fluctuating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/fluctuating-risk-financial-assets-in.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-with-exchange-rate.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-fed-funds-rate-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/turbulence-of-financial-asset.html)

- Stagnating real disposable income per person or income per person after inflation and taxes (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/global-competitive-easing-or.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/fluctuating-risk-financial-assets-in.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/dollar-revaluation-and-decreasing.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html)

- Depressed hiring that does not afford an opportunity for reducing unemployment/underemployment and moving to better-paid jobs (http://cmpassocregulationblog.blogspot.com/2016/12/rising-values-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/dollar-revaluation-and-valuations-of.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/imf-view-of-world-economy-and-finance.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rate-uncertainty-and-valuation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/rising-valuations-of-risk-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/considerable-uncertainty-about-economic.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/contraction-of-united-states-corporate.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/subdued-foreign-growth-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-volatile_17.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-policy-conundrum-recovery.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/impact-of-monetary-policy-on-exchange.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what_13.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/volatility-of-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/volatility-of-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/dollar-revaluation-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-exchange-rate-struggle-recovery.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/g20-monetary-policy-recovery-without.html)

- Productivity growth fell from 2.2 percent per year on average from 1947 to 2015 and average 2.3 percent per year from 1947 to 2007 to 1.3 percent per year on average from 2007 to 2015, deteriorating future growth and prosperity (http://cmpassocregulationblog.blogspot.com/2016/12/rising-values-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/rising-valuations-of-risk-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/considerable-uncertainty-about-economic.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-fed-funds-rate-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/quite-high-equity-valuations-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-competitive-devaluation-rules.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/financial-risks-twenty-six-million.html)

- Output of manufacturing in Nov 2016 at 27.5 percent below long-term trend since 1919 and at 20.9 percent below trend since 1986 (http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/interest-rate-increase-could-well.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/dollar-revaluation-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-volatility-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/interest-rate-policy-uncertainty-and.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/04/contracting-united-states-industrial.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/imf-view-squeeze-of-economic-activity.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html)

- Unsustainable government deficit/debt and balance of payments deficit (http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html)

- Worldwide waves of inflation (http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/interest-rate-increase-could-well.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/dollar-revaluation-world-inflation.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-volatility-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/interest-rate-policy-uncertainty-and.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/contracting-united-states-industrial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/uncertainty-of-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/global-decline-of-values-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/interest-rate-policy-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2015/01/competitive-currency-conflicts-world.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/financial-oscillations-world-inflation.html http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/07/world-inflation-waves-united-states.html)

- Deteriorating terms of trade and net revenue margins of production across countries in squeeze of economic activity by carry trades induced by zero interest rates (http://cmpassocregulationblog.blogspot.com/2016/12/of-course-economic-outlook-is-highly.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/interest-rate-increase-could-well.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/dollar-revaluation-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-volatility-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/unresolved-us-balance-of-payments.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/imf-view-of-world-economy-and-finance.html and earlier) (http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/uncertainty-of-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/global-decline-of-values-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/imf-view-squeeze-of-economic-activity.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html

- Financial repression of interest rates and credit affecting the most people without means and access to sophisticated financial investments with likely adverse effects on income distribution and wealth disparity (http://cmpassocregulationblog.blogspot.com/2016/12/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2016/12/rising-yields-and-dollar-revaluation.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/11/the-case-for-increase-in-federal-funds.html and earlier http://cmpassocregulationblog.blogspot.com/2016/10/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/09/interest-rates-and-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/08/global-competitive-easing-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/dollar-revaluation-and-decreasing.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-competitive-devaluation-rules.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/growth-uncertainties-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/world-financial-turbulence-twenty-seven.html)

- 43 million in poverty and 29 million without health insurance with family income adjusted for inflation regressing to 1999 levels (http://cmpassocregulationblog.blogspot.com/2016/09/the-economic-outlook-is-inherently.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-uncertainty-imf.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html)

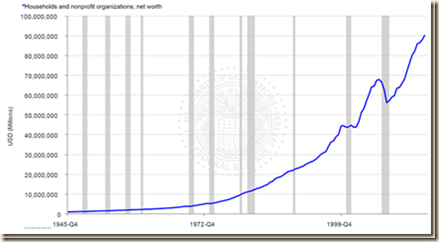

- Net worth of households and nonprofits organizations increasing by 18.1 percent after adjusting for inflation in the entire cycle from IVQ2007 to IIIQ2016 when it would have grown over 30.6 percent at trend of 3.1 percent per year in real terms from IVQ1945 to IIIQ2016 (Section II and earlier http://cmpassocregulationblog.blogspot.com/2016/09/the-economic-outlook-is-inherently.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/of-course-considerable-uncertainty.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-fluctuations-of_13.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/06/financial-indecision-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/collapse-of-united-states-dynamism-of.html). Financial assets increased $20.4 trillion while nonfinancial assets increased $3.9 trillion with likely concentration of wealth in those with access to sophisticated financial investments. Real estate assets adjusted for inflation fell 2.4 percent.

IA Monetary Policy Rules considers the use of long-term rules or guidance for optimization of policy over many periods in contrast with discretion or immediate optimization of every perceived deviation from desired paths by policymakers. Section IB Unconventional Monetary Policy raises the issue if excessive short-term impulses cause instability instead of the prime objective of monetary policy of fostering stability. There are adverse effects on resource allocation that prevent an efficient dynamic path of the economy at the time when real disposable income per capita, or what is left per person after taxes and inflation, has stagnated. IC Counterfactual of Policies Causing the Financial Crisis and Global Recession identifies the critical issue of research that economic conditions would have been less unfavorable under alternative monetary policy rules. ID Appendix on the Monetary History of Brazil provides some evidence on the history of Brazil that is of relevance to monetary policy rules. The data in the appendix were part of a research project on the monetary history of Brazil using the NBER framework of Friedman and Schwartz (1963, 1970) and Cagan (1965) as well as the institutional framework of Rondo E. Cameron (1967, 1972) who inspired the research (Pelaez 1974, 1975, 1976a,b, 1977, 1979, Pelaez and Suzigan 1978, 1981). The data were also used to test the correct specification of money and income following Sims (1972; see also Williams et al. 1976) as well as another test of orthogonality of money demand and supply using covariance analysis. Sims (1972, 541) finds that: “If and only if causality runs one way from current and past values of some list of exogenous variables to a given endogenous variable, then in a regression of the endogenous variable on past, current, and future values of the exogenous variables, the future values of the exogenous variables should have zero coefficients.” The objective of research was to verify the quantity theory of money of Friedman and Schwartz (1963, 1970) for the economy of Brazil from 1862 to 1976. The Granger-Sims test postulates that causality runs from money into nominal income if and only if in a regression of nominal income on past, current and future values of money, future coefficients are zero. The results show that the Sims F coefficients are zero for the regressions of nominal income on money and 38 for the coefficients of money on income (Pelaez and Suzigan 1978, Pelaez 1979, 106). There are also covariance tests verifying orthogonality of money demand and money supply and orthogonality of base money and the money multiplier. The quantity theory of money explains money, income and prices in the historical period of Brazil 1862 to 1976. There are two important conclusions.

- Models of Keynesian multipliers in historical Brazil are inconsistent with these findings

- Pelaez (1979, 121) concludes following Friedman and Schwartz (1963, 1970) that for the case of Brazil “in historical perspective, it appears that a system of rules, instead of authorities, would have best promoted the interests of the Nation.”

Hill (2007, 763) develops “a simple parametric recursion for VAR coefficients that, for trivariate processes with one scalar auxiliary variable, always allows for sequential linear parametric conditions for non-causality up to horizon h ≥ 1. An empirical analysis of the money-income relationship reveals significant evidence in favor of linear causation of money to income, either directly when we control for cointegration, or indirectly after a delay of 1-3 months in models of first differences.” Shikida, Araujo Jr. e Figueiredo (2014) apply Hill (2007) to the historical experience of Brazil. They conclude that base money influences nominal output but not real output. Their results are consistent with the unpleasant monetarist arithmetic of Sargent and Wallace (1981) that uses base money instead of the stock of money. Because of restrictions on banking and finance (Summerhill 2015, Pelaez 1975), base money should have been more important in influencing nominal income in historical Brazil. It is valid to conclude that monetary policy rules instead of discretionary authorities would have best promoted national interests in historical Brazil.

IA Monetary Policy Rules. The discussion of monetary policy rules is divided into three subsections: IA1 Origins of Rules versus Discretion, IA2 Monetary Policy Rules and IA3 The Taylor Rule.

IA1 Origins of Rules versus Discretion. A classic proposal for rules instead of “authorities” in monetary policy is by Simons (1936, 29-30):

“A democratic, free-enterprise system implies, and requires for its effective functioning and survival, a stable framework of definite rules, laid down in legislation and subject to change only gradually and with careful regard for the vested interests of participants in the economic game. It is peculiarly essential economically that there should be a minimum of uncertainty for enterprisers and investors as to monetary conditions in the future and, politically, that the plausible expedient of setting up "authorities" instead of rules, with respect to matters of such fundamental importance, be avoided, or accepted only as a very temporary arrangement. The most important objective of a sound liberal policy, apart from the establishment of highly competitive conditions in industry and the narrow limitation of political control over relative prices, should be that of securing a monetary system governed by definite rule. The responsibility for carrying out the monetary rules should be lodged in a federal authority, endowed with large administrative powers but closely controlled in their exercise by a sharply defined policy. The powers of the monetary authority should have to do primarily or exclusively with fiscal arrangements with the issue and retirement of paper money (open-market operations in government securities) and perhaps with the relation between government revenues and expenditures; in other words, the monetary rules should be implemented entirely by, and in turn should largely determine, fiscal policy. A monetary rule of maintaining the constancy of some price-index, preferably an index of prices of competitively produced commodities, appears to afford the only promising escape from present monetary chaos and uncertainties.”

The working system of Simons (1936, 1948) consisted of 100 percent reserve requirements on banks (see Allen 1993, Fisher 1936, Graham 1936) to avoid fluctuations from bank runs and fixed quantity of money. Friedman (1967) finds that the monetary reforms proposed by Simons (1948) were not required and moving against desired directions by restricting financial intermediation that would raise costs of capital, inhibiting capital formation. The value in the proposals of Simons (1948) as viewed by Friedman (1967) would be in providing more flexibility for banks that were restricted in the 1960s by regulation inherited from the Great Depression. There are contemporary proposals that resemble the 100 percent reserve requirement in what is known as “narrow banking” (see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 71-72).

Historical evolution of monetary policy rules is analyzed by Asso, Khan and Leeson (2007, 2010). In the United States, Irving Fisher and Milton Friedman proposed price and monetary rules (see Bordo and Rockoff 2011). An important departure for considering rules is the existence of three lags of macroeconomic policy (Friedman 1953):

- The lag between the need for action and the recognition of the need

- The lag between recognition of the need and taking action

- The lag between taking action and effects on prices and income

There is not “one hundred percent” confidence in controlling inflation because of the lags in effects of monetary policy impulses and the equally important lags in realization of the need for action and taking of action in addition to the inability to forecast any economic variable. Romer and Romer (2004) find that a one-percentage point tightening of monetary policy is associated with a 4.3 percent decline in industrial production. There is no change in inflation in the first 22 months after monetary policy tightening when it begins to decline steadily, with decrease by 6 percent after 48 months (see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 102). Even if there were one hundred percent confidence in reducing inflation by monetary policy, it could take a prolonged period with adverse effects on economic activity. Certainty does not occur in economic policy, in which there are costs that cannot be anticipated.

Friedman (1968) restated his proposal for fixed setting of monetary policy in terms of a fixed rate of increase of the money stock:

“My own prescription is still that the monetary authority go all the way in avoiding such swings by adopting publicly the policy of achieving a steady rate of growth in a specified monetary total. The precise rate of growth, like the precise monetary total, is less important than the adoption of some stated and known rate. I myself have argued for a rate that would on the average achieve rough stability in the level of prices of final products, which I have estimated would call for something like a 3 to 5 per cent per year rate of growth in currency plus all commercial bank deposits or a slightly lower rate of growth in currency plus demand deposits only. But it would be better to have a fixed rate that would on the average produce moderate inflation or moderate deflation, provided it was steady, than to suffer the wide and erratic perturbations we have experienced. Short of the adoption of such a publicly stated policy of a steady rate of monetary growth, it would constitute a major improvement if the monetary authority followed the self-denying ordinance of avoiding wide swings. It is a matter of record that periods of relative stability in the rate of monetary growth have also been periods of relative stability in economic activity, both in the United States and other countries. Periods of wide swings in the rate of monetary growth have also been periods of wide swings in economic activity.”

This was Friedman’s presidential address to the American Economic Association at the onset of wide swings in monetary policy, output and employment in the period of United States economic history known as “the Great Inflation.”

There are three “tactics” in monetary policy identified by Friedman (1982, 100-1):

- Interest rates as both targets and instruments

- Monetary targets as instruments and interest rates as targets

- Base money as instrument and monetary aggregates as targets

The specific policy proposal of Friedman (1982, 101) consists of five ingredients:

“A monetarist policy has five points: first, the target should be growth in some monetary aggregate just which monetary aggregate is a separate question; second, monetary authorities should adopt long-run targets for monetary growth that are consistent with no inflation; third, present rates of growth of monetary aggregates should be modified to achieve the long-run target in a gradual, systematic, and preannounced fashion; fourth, monetary authorities should avoid fine-tuning; fifth, monetary authorities should avoid trying to manipulate either interest rates or exchange rates. Internationally, those countries that have broadly followed the five-point monetarist policy have succeeded in controlling inflation and have done so while achieving relatively satisfactory economic growth.”

The fourth of eight specific proposals for Fed monetary policy at the time states (Friedman, 1982, 117): “set a target path for several years ahead for a single aggregate—for example, M2 or the base. It is less important which aggregate is chosen than that a single aggregate be designated as the target.”

IA2 Monetary Policy Rules. The essence of rules versus discretion monetary policy is posed by McCallum (1999) as follows:

- Rules attempt to optimize by using a policy-contingent rule or formula that is implemented every period and is designed such as to apply indefinitely

- Discretion consist of re-optimization in every period in accordance with existing conditions assessed by monetary authorities

A rules-based policy optimizes over a long-term period while discretionary policy optimizes individually in every period in accordance with short-term information. A practical definition of monetary policy rule by McCallum (1999) is systematic policy that does not use expectations to cause temporary gains in output.

McCallum (1999) finds that Barro and Gordon (1983b) opened the inclusion of activist policy within a monetary policy rule. The rule provides a reaction function of the central bank that depends on available information. Barro and Gordon (1983b, 606) differentiate as follows: “the presence or absence of precomitment is the most important distinction between rules and discretion.” The reaction function of the central bank h(It-1) depends on information available in the past period, It-1, that would be more restrictive under rules-based policy than under discretion, would include many more variables in the argument. As McCallum (1999) argues, a rule could specify the conditions for activism instead of fixed settings for policy. For example, constant rate of growth of the money stock would be a fixed setting that the central bank would implement indefinitely. A policy in which the interest rate depends on inflation and the divergence of actual and potential output would be activist but under certain guidance.

Current distinction between rules and discretion is provided by Taylor (2012JMCB, 2). There are characteristics of both rules and discretion.

- Characteristics of rules

· More predictable and systematic decisions by the central bank on policy instruments

· Dynamic analysis of effects of current decisions on future outcomes

· Decisions based or guided by formulas and equations

· Use of stable relation of policy instruments to outcomes such as inflation and growth

- Characteristics of discretion

· Decisions on monetary policy instruments are “less predictable,” focusing on short-term events such as “fine tuning” or policy actions in response to ad hoc movements in economic and financial variables

· Little or no interest by policymakers in agreeing on alternative strategies for fixing magnitudes of instruments of policy

· Evolution of policy instruments over time cannot be captured by equations

IA3 The Taylor Rule. The definition of policy rule by Taylor (1993, 199) is: “Technically, a policy rule is a contingency plan that lasts forever unless there is an explicit cancellation clause.” “Forever” means here “a reasonably long period of time” (Taylor 1993, 1999). The departing theory of Taylor (1993, 1999) is the quantity theory of money equation:

MV = PY (1)

Where M is the money stock, V is income velocity of money, P the price level and Y real output. Velocity depends on the interest rate r and real output or income Y with functional form V(r, Y). The substitution of V(r, Y) in equation (1) yields a relation between the interest rate, r, the price level, P, and real output Y. Taylor (1999) assumes a linear relation of interest rates and the logarithms of the price level P and real output Y. Assuming no lags, deviation of output from stochastic trend and the inflation rate as the first difference of the logarithms of the price level, Taylor (1999) obtains:

r = π + gy + h(π – π*) + rr = (rf – hπ*) + (1 + h)π + gy (2)

Where r is the short-term interest rate, π the inflation rate or percent change in the price level P, y the percentage difference of real output Y from trend and g, h, π* and rf are constants. The settings of monetary policy are the response coefficients g of the deviation of actual output from potential output and (1+h), the response to inflation.

Taylor (1993, 202) provides the simple formula, known as the Taylor Rule, as follows:

r = p + .5y + .5(p-2) + 2 (3)

Where r is the federal funds rate or policy rate of the Fed, p is the rate of inflation in the past four quarters and y is the percentage deviation of actual output from potential output. The fed funds rate increases if the gap between actual and potential output y increases to prevent lower growth below potential and resulting unemployment, and increases if inflation p increases above maximum tolerable inflation of 2 percent. Thus, the policy is guidance on fixing the fed funds rate in response to growth and inflation. Taylor (1993, 202) states: “if both the inflation rate and real GDP are on target, then the federal funds rate would equal 4 percent, or 2 percent in real terms.” If real economic growth is around trend, y is zero, and inflation is around the maximum desired of 2 percent, (p-2) is zero, such that the fed funds rate r is equal to 4 or 2 percent by deducting inflation of 2 percent.

IB Unconventional Monetary Policy. Taylor (1998LB, 1999, 2012JMCB) argues that economic performance has been enhanced during periods of long-term focus of monetary policy in the form of guidance under monetary policy rules. Periods of discretion such as the Great Inflation from the second half of the 1960s to the beginning of the 1980s and the past decade since 2003 have been characterized by instability and mediocre economic performance.

The objective of Levin and Taylor (2009) is to reveal the primary cause of the persistence of inflation drift during the Great Inflation by focusing on the path of inflationary expectations to model monetary policy from 1965 to 1980. They derive three stylized facts by use of measurements of inflation expectations. (1) Inflation began in the mid 1960 while it had been contained since the late 1950s at around 1 percent but inflation expectations accelerate beginning in 1965. (2) Long-term inflation expectations stabilized at a high level in the first half of the 1970s but catapulted toward the end of the decade. (3) Long-run inflation expectations only began to decline at the end of 1980. The central bank reaction function analyzed by Taylor (1993, 202, equation (1)) based on prior research is:

r = p +0.5y + 0.5(p-2) + 2 (3)

In equation (3), the federal funds rate, r, is expressed in terms of the rate of inflation over the previous four quarters, the percentage output gap, y, defined as 100(Y-Y*)/Y*, where Y is actual GDP, Y* is trend real GDP (2.2 percent from IQ1984 to IIIQ1992), and the deviation of inflation from the target of 2 percent, 0.5(p-2). The Taylor policy rule in equation (3) triggers an increase in the fed funds rate when inflation exceeds 2 percent or when GDP exceeds trend GDP. If GDP is equal to target, y = 0, and inflation is also equal to target, p = 2, then the real rate of interest as measured by prior inflation, r-p, equal 2 percent. The fed funds rate calculated with this simple policy rule fits remarkably well the actual fed funds rate in 1987-1992 (Taylor 1993, 204, Figure 1).

The simple rule is restated by Levin and Taylor (2010, 16, equation (1)) to account for discrete shifts in the intercept:

rt = r’ + γπ(πt – π*) + γy(yt – y*t) (5)

Equation (5) expresses the short-term real interest rate, rt, in terms of an effect, γπ(πt – π*), of the difference between actual inflation, πt, and the central’s bank objective for inflation, π*, and an effect, γy(yt – y*t), of the deviation of actual output, yt, from trend or steady-state output, y*t, and r’ stands for the steady-state value of the real rate of interest.

Equation (5) is shown by Levy and Taylor (2009) to provide a good fit of experience during the Great Inflation by allowing for shifts in the central bank’s inflation objective π*. Monetary policy during the Great Inflation can be interpreted by three stop-start events occurring in 1968-70, 1974-76 and 1979-80. Levy and Taylor (2009) conclude that in all three “stop and go” episodes monetary policy “fell behind the curve,” permitting rising inflation before belated tightening and abandoning tightening because of the contraction before inflation was reduced to the level before the event. Lags in effect of monetary policy have been amply discussed in the literature and may have proved important in falling behind the curve (see Culbertson 1960, Friedman 1961, Culbertson 1961, Batini and Nelson 2002 and Romer and Romer 2004).

Detailed discussion of the analysis of the Great Inflation is provided in past comments of this blog (http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html http://cmpassocregulationblog.blogspot.com/2011/04/new-economics-of-rose-garden-turned.html http://cmpassocregulationblog.blogspot.com/2011/03/is-there-second-act-of-us-great.html). Unconventional monetary policy played a major role in the financial crisis and global recession as discussed in the balance of this section.

IC. Counterfactual of Policies Causing the Financial Crisis and Global Recession. A counterfactual consists of theory and measurements of what would have occurred otherwise if economic policies or institutional arrangements had been different. This task is quite difficult because economic data are observed with all effects as they actually occurred while the counterfactual attempts to evaluate how data would differ had policies and institutional arrangements been different (see Pelaez and Pelaez, Globalization and the State, Vol. I (2008b), 125, 136; Pelaez 1979, 26-8). Counterfactual data are unobserved and must be calculated using theory and measurement methods. The measurement of costs and benefits of projects or applied welfare economics (Harberger 1971, 1997) specifies and attempts to measure projects such as what would be economic welfare with or without a bridge or whether markets would be more or less competitive in the absence of antitrust and regulation laws (Winston 2006). The “new economic history” of the United States used counterfactuals to measure the economy with or without railroads (Fishlow 1965, Fogel 1964) and in analyzing slavery (Fogel and Engerman 1974). A critical counterfactual in economic history is how Britain surged ahead of France (North and Weingast 1989). There is similarly path-breaking research on railroads in Latin America by Coastworth (1981) and Summerhill (1997, 1998, 2003). Coastworth (2006, 176) argues that: “We already have so many history books that tells us so much about what really occurred in the past, that what we need now are books about what did not happen—but might have, or perhaps even should have happened: Counterfactual History, that is, history that is contrary to fact.”

The counterfactual of avoidance of deeper and more prolonged contraction by fiscal and monetary policies is not the critical issue. As Professor John B. Taylor (2012Oct25) argues, the critically important counterfactual is that the financial crisis and global recession would have not occurred in the first place if different economic policies had been followed. The counterfactual intends to verify that a combination of housing policies and discretionary monetary policies instead of rules (Taylor 1993) caused, deepened and prolonged the financial crisis (Taylor 2007, 2008Nov, 2009, 2012FP, 2012Mar27, 2012Mar28, 2012JMCB, 2015, 2012 Oct 25; 2013Oct28, 2014 Jan01, 2014Jan3, 2014Jun26, 2014Jul15, 2015, 2016Dec7, 2016Dec20 http://www.johnbtaylor.com/; see http://cmpassocregulationblog.blogspot.com/2012/06/rules-versus-discretionary-authorities.html). The experience resembles that of the Great Inflation of the 1960s and 1970s with stop-and-go growth/inflation that coined the term stagflation (http://cmpassocregulationblog.blogspot.com/2012/06/rules-versus-discretionary-authorities.html http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html http://cmpassocregulationblog.blogspot.com/2011/04/new-economics-of-rose-garden-turned.html http://cmpassocregulationblog.blogspot.com/2011/03/is-there-second-act-of-us-great.html and Appendix I).

The answer to these arguments can probably be found in the origins of the financial crisis and global recession. Let V(T) represent the value of the firm’s equity at time T and B stand for the promised debt of the firm to bondholders and assume that corporate management, elected by equity owners, is acting on the interests of equity owners. Robert C. Merton (1974, 453) states:

“On the maturity date T, the firm must either pay the promised payment of B to the debtholders or else the current equity will be valueless. Clearly, if at time T, V(T) > B, the firm should pay the bondholders because the value of equity will be V(T) – B > 0 whereas if they do not, the value of equity would be zero. If V(T) ≤ B, then the firm will not make the payment and default the firm to the bondholders because otherwise the equity holders would have to pay in additional money and the (formal) value of equity prior to such payments would be (V(T)- B) < 0.”

Pelaez and Pelaez (The Global Recession Risk (2007), 208-9) apply this analysis to the US housing market in 2005-2006 concluding:

“The house market [in 2006] is probably operating with low historical levels of individual equity. There is an application of structural models [Duffie and Singleton 2003] to the individual decisions on whether or not to continue paying a mortgage. The costs of sale would include realtor and legal fees. There could be a point where the expected net sale value of the real estate may be just lower than the value of the mortgage. At that point, there would be an incentive to default. The default vulnerability of securitization is unknown.”

There are multiple important determinants of the interest rate: “aggregate wealth, the distribution of wealth among investors, expected rate of return on physical investment, taxes, government policy and inflation” (Ingersoll 1987, 405). Aggregate wealth is a major driver of interest rates (Ibid, 406). Unconventional monetary policy, with zero fed funds rates and flattening of long-term yields by quantitative easing, causes uncontrollable effects on risk taking that can have profound undesirable effects on financial stability. Excessively aggressive and exotic monetary policy is the main culprit and not the inadequacy of financial management and risk controls.

The net worth of the economy depends on interest rates. In theory, “income is generally defined as the amount a consumer unit could consume (or believe that it could) while maintaining its wealth intact” (Friedman 1957, 10). Income, Y, is a flow that is obtained by applying a rate of return, r, to a stock of wealth, W, or Y = rW (Ibid). According to a subsequent restatement: “The basic idea is simply that individuals live for many years and that therefore the appropriate constraint for consumption decisions is the long-run expected yield from wealth r*W. This yield was named permanent income: Y* = r*W” (Darby 1974, 229), where * denotes permanent. The simplified relation of income and wealth can be restated as:

W = Y/r (1)

Equation (1) shows that as r goes to zero, r →0, W grows without bound, W→∞.

Lowering the interest rate near the zero bound in 2003-2004 caused the illusion of permanent increases in wealth or net worth in the balance sheets of borrowers and also of lending institutions, securitized banking and every financial institution and investor in the world. The discipline of calculating risks and returns was seriously impaired. The objective of monetary policy was to encourage borrowing, consumption and investment but the exaggerated stimulus resulted in a financial crisis of major proportions as the securitization that had worked for a long period was shocked with policy-induced excessive risk, imprudent credit, high leverage and low liquidity by the incentive to finance everything overnight at close to zero interest rates, from adjustable rate mortgages (ARMS) to asset-backed commercial paper of structured investment vehicles (SIV).

The consequences of inflating liquidity and net worth of borrowers were a global hunt for yields to protect own investments and money under management from the zero interest rates and unattractive long-term yields of Treasuries and other securities. Monetary policy distorted the calculations of risks and returns by households, business and government by providing central bank cheap money. Short-term zero interest rates encourage financing of everything with short-dated funds, explaining the SIVs created off-balance sheet to issue short-term commercial paper to purchase default-prone mortgages that were financed in overnight or short-dated sale and repurchase agreements (Pelaez and Pelaez, Financial Regulation after the Global Recession, 50-1, Regulation of Banks and Finance, 59-60, Globalization and the State Vol. I, 89-92, Globalization and the State Vol. II, 198-9, Government Intervention in Globalization, 62-3, International Financial Architecture, 144-9). ARMS were created to lower monthly mortgage payments by benefitting from lower short-dated reference rates. Financial institutions economized in liquidity that was penalized with near zero interest rates. There was no perception of risk because the monetary authority guaranteed a minimum or floor price of all assets by maintaining low interest rates forever or equivalent to writing an illusory put option on wealth. Subprime mortgages were part of the put on wealth by an illusory put on house prices. The housing subsidy of $221 billion per year created the impression of ever increasing house prices. The suspension of auctions of 30-year Treasuries was designed to increase demand for mortgage-backed securities, lowering their yield, which was equivalent to lowering the costs of housing finance and refinancing. Fannie and Freddie purchased or guaranteed $1.6 trillion of nonprime mortgages and worked with leverage of 75:1 under Congress-provided charters and lax oversight. The combination of these policies resulted in high risks because of the put option on wealth by near zero interest rates, excessive leverage because of cheap rates, low liquidity because of the penalty in the form of low interest rates and unsound credit decisions because the put option on wealth by monetary policy created the illusion that nothing could ever go wrong, causing the credit/dollar crisis and global recession (Pelaez and Pelaez, Financial Regulation after the Global Recession, 157-66, Regulation of Banks, and Finance, 217-27, International Financial Architecture, 15-18, The Global Recession Risk, 221-5, Globalization and the State Vol. II, 197-213, Government Intervention in Globalization, 182-4).

There are significant elements of the theory of bank financial fragility of Diamond and Dybvig (1983) and Diamond and Rajan (2000, 2001a, 2001b) that help to explain the financial fragility of banks during the credit/dollar crisis (see also Diamond 2007). The theory of Diamond and Dybvig (1983) as exposed by Diamond (2007) is that banks funding with demand deposits have a mismatch of liquidity (see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 58-66). A run occurs when too many depositors attempt to withdraw cash at the same time. All that is needed is an expectation of failure of the bank. Three important functions of banks are providing evaluation, monitoring and liquidity transformation. Banks invest in human capital to evaluate projects of borrowers in deciding if they merit credit. The evaluation function reduces adverse selection or financing projects with low present value. Banks also provide important monitoring services of following the implementation of projects, avoiding moral hazard that funds be used for, say, real estate speculation instead of the original project of factory construction. The transformation function of banks involves both assets and liabilities of bank balance sheets. Banks convert an illiquid asset or loan for a project with cash flows in the distant future into a liquid liability in the form of demand deposits that can be withdrawn immediately.

In the theory of banking of Diamond and Rajan (2000, 2001a, 2001b), the bank creates liquidity by tying human assets to capital. The collection skills of the relationship banker convert an illiquid project of an entrepreneur into liquid demand deposits that are immediately available for withdrawal. The deposit/capital structure is fragile because of the threat of bank runs. In these days of online banking, the run on Washington Mutual was through withdrawals online. A bank run can be triggered by the decline of the value of bank assets below the value of demand deposits.

Pelaez and Pelaez (Regulation of Banks and Finance 2009b, 60, 64-5) find immediate application of the theories of banking of Diamond, Dybvig and Rajan to the credit/dollar crisis after 2007. It is a credit crisis because the main issue was the deterioration of the credit portfolios of securitized banks as a result of default of subprime mortgages. It is a dollar crisis because of the weakening dollar resulting from relatively low interest rate policies of the US. It caused systemic effects that converted into a global recession not only because of the huge weight of the US economy in the world economy but also because the credit crisis transferred to the UK and Europe. Management skills or human capital of banks are illustrated by the financial engineering of complex products. The increasing importance of human relative to inanimate capital (Rajan and Zingales 2000) is revolutionizing the theory of the firm (Zingales 2000) and corporate governance (Rajan and Zingales 2001). Finance is one of the most important examples of this transformation. Profits were derived from the charter in the original banking institution. Pricing and structuring financial instruments was revolutionized with option pricing formulas developed by Black and Scholes (1973) and Merton (1973, 1974, 1998) that permitted the development of complex products with fair pricing. The successful financial company must attract and retain finance professionals who have invested in human capital, which is a sunk cost to them and not of the institution where they work.

The complex financial products created for securitized banking with high investments in human capital are based on houses, which are as illiquid as the projects of entrepreneurs in the theory of banking. The liquidity fragility of the securitized bank is equivalent to that of the commercial bank in the theory of banking (Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 65). Banks created off-balance sheet structured investment vehicles (SIV) that issued commercial paper receiving AAA rating because of letters of liquidity guarantee by the banks. The commercial paper was converted into liquidity by its use as collateral in SRPs at the lowest rates and minimal haircuts because of the AAA rating of the guarantor bank. In the theory of banking, default can be triggered when the value of assets is perceived as lower than the value of the deposits. Commercial paper issued by SIVs, securitized mortgages and derivatives all obtained SRP liquidity on the basis of illiquid home mortgage loans at the bottom of the pyramid. The run on the securitized bank had a clear origin (Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 65):

“The increasing default of mortgages resulted in an increase in counterparty risk. Banks were hit by the liquidity demands of their counterparties. The liquidity shock extended to many segments of the financial markets—interbank loans, asset-backed commercial paper (ABCP), high-yield bonds and many others—when counterparties preferred lower returns of highly liquid safe havens, such as Treasury securities, than the risk of having to sell the collateral in SRPs at deep discounts or holding an illiquid asset. The price of an illiquid asset is near zero.”

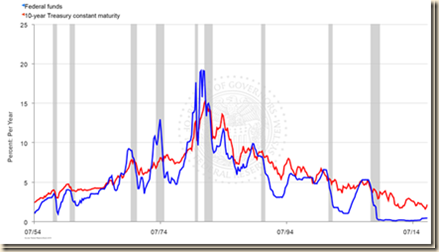

There are collateral effects of unconventional monetary policy. Chart VIII-1 of the Board of Governors of the Federal Reserve System provides the rate on the overnight fed funds rate and the yields of the 10-year constant maturity Treasury and the Baa seasoned corporate bond. Table VIII-3 provides the data for selected points in Chart VIII-1. There are two important economic and financial events, illustrating the ease of inducing carry trade with extremely low interest rates and the resulting financial crash and recession of abandoning extremely low interest rates.

- The Federal Open Market Committee (FOMC) lowered the target of the fed funds rate from 7.03 percent on Jul 3, 2000, to 1.00 percent on Jun 22, 2004, in pursuit of non-existing deflation (Pelaez and Pelaez, International Financial Architecture (2005), 18-28, The Global Recession Risk (2007), 83-85). Central bank commitment to maintain the fed funds rate at 1.00 percent induced adjustable-rate mortgages (ARMS) linked to the fed funds rate. Lowering the interest rate near the zero bound in 2003-2004 caused the illusion of permanent increases in wealth or net worth in the balance sheets of borrowers and also of lending institutions, securitized banking and every financial institution and investor in the world. The discipline of calculating risks and returns was seriously impaired. The objective of monetary policy was to encourage borrowing, consumption and investment. The exaggerated stimulus resulted in a financial crisis of major proportions as the securitization that had worked for a long period was shocked with policy-induced excessive risk, imprudent credit, high leverage and low liquidity by the incentive to finance everything overnight at interest rates close to zero, from adjustable rate mortgages (ARMS) to asset-backed commercial paper of structured investment vehicles (SIV). The consequences of inflating liquidity and net worth of borrowers were a global hunt for yields to protect own investments and money under management from the zero interest rates and unattractive long-term yields of Treasuries and other securities. Monetary policy distorted the calculations of risks and returns by households, business and government by providing central bank cheap money. Short-term zero interest rates encourage financing of everything with short-dated funds, explaining the SIVs created off-balance sheet to issue short-term commercial paper with the objective of purchasing default-prone mortgages that were financed in overnight or short-dated sale and repurchase agreements (Pelaez and Pelaez, Financial Regulation after the Global Recession, 50-1, Regulation of Banks and Finance, 59-60, Globalization and the State Vol. I, 89-92, Globalization and the State Vol. II, 198-9, Government Intervention in Globalization, 62-3, International Financial Architecture, 144-9). ARMS were created to lower monthly mortgage payments by benefitting from lower short-dated reference rates. Financial institutions economized in liquidity that was penalized with near zero interest rates. There was no perception of risk because the monetary authority guaranteed a minimum or floor price of all assets by maintaining low interest rates forever or equivalent to writing an illusory put option on wealth. Subprime mortgages were part of the put on wealth by an illusory put on house prices. The housing subsidy of $221 billion per year created the impression of ever-increasing house prices. The suspension of auctions of 30-year Treasuries was designed to increase demand for mortgage-backed securities, lowering their yield, which was equivalent to lowering the costs of housing finance and refinancing. Fannie and Freddie purchased or guaranteed $1.6 trillion of nonprime mortgages and worked with leverage of 75:1 under Congress-provided charters and lax oversight. The combination of these policies resulted in high risks because of the put option on wealth by near zero interest rates, excessive leverage because of cheap rates, low liquidity by the penalty in the form of low interest rates and unsound credit decisions. The put option on wealth by monetary policy created the illusion that nothing could ever go wrong, causing the credit/dollar crisis and global recession (Pelaez and Pelaez, Financial Regulation after the Global Recession, 157-66, Regulation of Banks, and Finance, 217-27, International Financial Architecture, 15-18, The Global Recession Risk, 221-5, Globalization and the State Vol. II, 197-213, Government Intervention in Globalization, 182-4). The FOMC implemented increments of 25 basis points of the fed funds target from Jun 2004 to Jun 2006, raising the fed funds rate to 5.25 percent on Jul 3, 2006, as shown in Chart VIII-1. The gradual exit from the first round of unconventional monetary policy from 1.00 percent in Jun 2004 (http://www.federalreserve.gov/boarddocs/press/monetary/2004/20040630/default.htm) to 5.25 percent in Jun 2006 (http://www.federalreserve.gov/newsevents/press/monetary/20060629a.htm) caused the financial crisis and global recession.

- On Dec 16, 2008, the policy determining committee of the Fed decided (http://www.federalreserve.gov/newsevents/press/monetary/20081216b.htm): “The Federal Open Market Committee decided today to establish a target range for the federal funds rate of 0 to 1/4 percent.” Policymakers emphasize frequently that there are tools to exit unconventional monetary policy at the right time. At the confirmation hearing on nomination for Chair of the Board of Governors of the Federal Reserve System, Vice Chair Yellen (2013Nov14 http://www.federalreserve.gov/newsevents/testimony/yellen20131114a.htm), states that: “The Federal Reserve is using its monetary policy tools to promote a more robust recovery. A strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy tools such as asset purchases. I believe that supporting the recovery today is the surest path to returning to a more normal approach to monetary policy.” Perception of withdrawal of $2671 billion, or $2.7 trillion, of bank reserves (http://www.federalreserve.gov/releases/h41/current/h41.htm#h41tab1), would cause Himalayan increase in interest rates that would provoke another recession. There is no painless gradual or sudden exit from zero interest rates because reversal of exposures created on the commitment of zero interest rates forever.

In his classic restatement of the Keynesian demand function in terms of “liquidity preference as behavior toward risk,” James Tobin (http://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/1981/tobin-bio.html) identifies the risks of low interest rates in terms of portfolio allocation (Tobin 1958, 86):