Financial “Irrational Exuberance,” “Stretched Valuations,” “Brisk Issuance” and Monetary Policy Rules Instead of Discretionary Authorities, Squeeze of Economic Activity by Carry Trades Induced by Zero Interest Rates, United States Industrial Production, United States Commercial Banks Assets and Liabilities, Collapse of United States Dynamism of Income Growth and Employment Creation, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014

Executive Summary

References

I United States Industrial Production

IB Collapse of United States Dynamism of Income Growth and Employment Creation

IIA United States Commercial Banks Assets and Liabilities

IA Transmission of Monetary Policy

IB Functions of Banking

Appendix on Monetary Policy

IA1 Theory

IA2 Policy

IA3 Evidence

IA4 Unwinding Strategy

IC United States Commercial Banks Assets and Liabilities

ID Theory and Reality of Economic History, Cyclical Slow Growth not Secular Stagnation and Monetary Policy Based on Fear of Deflation

IIB United States Producer Prices

IIC United States Import and Export Prices

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

V World Economic Slowdown. Table V-1 is constructed with the database of the IMF (http://www.imf.org/external/ns/cs.aspx?id=28) to show GDP in dollars in 2012 and the growth rate of real GDP of the world and selected regional countries from 2013 to 2016. The data illustrate the concept often repeated of “two-speed recovery” of the world economy from the recession of 2007 to 2009. The IMF has changed its forecast of the world economy to 3.0 percent in 2013 but accelerating to 3.6 percent in 2014, 3.9 percent in 2015 and 3.9 percent in 2016. Slow-speed recovery occurs in the “major advanced economies” of the G7 that account for $34,543 billion of world output of $72,106 billion, or 47.9 percent, but are projected to grow at much lower rates than world output, 2.0 percent on average from 2013 to 2016 in contrast with 3.6 percent for the world as a whole. While the world would grow 15.2 percent in the four years from 2013 to 2016, the G7 as a whole would grow 8.5 percent. The difference in dollars of 2012 is rather high: growing by 15.2 percent would add around $11.0 trillion of output to the world economy, or roughly, two times the output of the economy of Japan of $5,938 billion but growing by 8.5 percent would add $6.1 trillion of output to the world, or about the output of Japan in 2012. The “two speed” concept is in reference to the growth of the 150 countries labeled as emerging and developing economies (EMDE) with joint output in 2012 of $27,080 billion, or 37.6 percent of world output. The EMDEs would grow cumulatively 21.9 percent or at the average yearly rate of 5.1 percent, contributing $5.9 trillion from 2013 to 2016 or the equivalent of somewhat less than the GDP of $8,229 billion of China in 2012. The final four countries in Table V-1 often referred as BRIC (Brazil, Russia, India, China), are large, rapidly growing emerging economies. Their combined output in 2012 adds to $14,340 billion, or 19.9 percent of world output, which is equivalent to 41.5 percent of the combined output of the major advanced economies of the G7.

Table V-1, IMF World Economic Outlook Database Projections of Real GDP Growth

| GDP USD 2012 | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | |

| World | 72,106 | 3.0 | 3.6 | 3.9 | 3.9 |

| G7 | 34,543 | 1.4 | 2.2 | 2.3 | 2.3 |

| Canada | 1,821 | 2.0 | 2.3 | 2.4 | 2.4 |

| France | 2,613 | 0.3 | 1.0 | 1.5 | 1.7 |

| DE | 3,428 | 0.5 | 1.7 | 1.6 | 1.4 |

| Italy | 2,014 | -1.8 | 0.6 | 1.1 | 1.3 |

| Japan | 5,938 | 1.5 | 1.4 | 1.0 | 0.7 |

| UK | 2,484 | 1.8 | 2.9 | 2.5 | 2.4 |

| US | 16,245 | 1.9 | 2.8 | 3.0 | 3.0 |

| Euro Area | 12,192 | -0.5 | 1.2 | 1.5 | 1.5 |

| DE | 3,428 | 0.5 | 1.7 | 1.6 | 1.4 |

| France | 2,613 | 0.3 | 1.0 | 1.5 | 1.7 |

| Italy | 2,014 | -1.8 | 0.6 | 1.1 | 1.3 |

| POT | 212 | -1.4 | 1.2 | 1.5 | 1.7 |

| Ireland | 211 | -0.3 | 1.7 | 2.5 | 2.5 |

| Greece | 249 | -3.9 | 0.6 | 2.9 | 3.7 |

| Spain | 1,323 | -1.2 | 0.9 | 1.0 | 1.1 |

| EMDE | 27,080 | 4.7 | 4.9 | 5.3 | 5.4 |

| Brazil | 2,248 | 2.3 | 1.8 | 2.7 | 3.0 |

| Russia | 2,004 | 1.3 | 1.3 | 2.3 | 2.5 |

| India | 1,859 | 4.4 | 5.4 | 6.4 | 6.5 |

| China | 8,229 | 7.7 | 7.5 | 7.3 | 7.0 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries); POT: Portugal

Source: IMF World Economic Outlook databank http://www.imf.org/external/ns/cs.aspx?id=28

Continuing high rates of unemployment in advanced economies constitute another characteristic of the database of the WEO (http://www.imf.org/external/ns/cs.aspx?id=28). Table V-2 is constructed with the WEO database to provide rates of unemployment from 2012 to 2016 for major countries and regions. In fact, unemployment rates for 2013 in Table V-2 are high for all countries: unusually high for countries with high rates most of the time and unusually high for countries with low rates most of the time. The rates of unemployment are particularly high in 2013 for the countries with sovereign debt difficulties in Europe: 16.3 percent for Portugal (POT), 13.1 percent for Ireland, 27.3 percent for Greece, 26.4 percent for Spain and 12.2 percent for Italy, which is lower but still high. The G7 rate of unemployment is 7.1 percent. Unemployment rates are not likely to decrease substantially if slow growth persists in advanced economies.

Table V-2, IMF World Economic Outlook Database Projections of Unemployment Rate as Percent of Labor Force

| % Labor Force 2012 | % Labor Force 2013 | % Labor Force 2014 | % Labor Force 2015 | % Labor Force 2016 | |

| World | NA | NA | NA | NA | NA |

| G7 | 7.4 | 7.1 | 6.7 | 6.5 | 6.3 |

| Canada | 7.3 | 7.0 | 7.0 | 6.9 | 6.8 |

| France | 10.2 | 10.8 | 11.0 | 10.7 | 10.3 |

| DE | 5.5 | 5.3 | 5.2 | 5.2 | 5.2 |

| Italy | 10.7 | 12.2 | 12.4 | 11.9 | 11.1 |

| Japan | 4.3 | 4.0 | 3.9 | 3.9 | 3.9 |

| UK | 8.0 | 7.6 | 6.9 | 6.6 | 6.3 |

| US | 8.1 | 7.4 | 6.4 | 6.2 | 6.1 |

| Euro Area | 11.4 | 12.1 | 11.9 | 11.6 | 11.1 |

| DE | 5.5 | 5.3 | 5.2 | 5.2 | 5.2 |

| France | 10.2 | 10.8 | 11.0 | 10.7 | 10.3 |

| Italy | 10.7 | 12.2 | 12.4 | 11.9 | 11.1 |

| POT | 15.7 | 16.3 | 15.7 | 15.1 | 14.5 |

| Ireland | 14.7 | 13.1 | 11.2 | 10.5 | 10.1 |

| Greece | 24.2 | 27.3 | 26.3 | 24.4 | 21.4 |

| Spain | 25.0 | 26.4 | 25.5 | 24.9 | 24.2 |

| EMDE | NA | NA | NA | NA | NA |

| Brazil | 5.5 | 5.4 | 5.6 | 5.8 | 6.0 |

| Russia | 5.5 | 5.5 | 6.2 | 6.2 | 6.0 |

| India | NA | NA | NA | NA | NA |

| China | 4.1 | 4.1 | 4.1 | 4.1 | 4.1 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries)

Source: IMF World Economic Outlook databank http://www.imf.org/external/ns/cs.aspx?id=28

Table V-3 provides the latest available estimates of GDP for the regions and countries followed in this blog from IQ2012 to IVQ2013 available now for all countries. There are preliminary estimates for all countries for IQ2014. Growth is weak throughout most of the world.

- Japan. The GDP of Japan increased 1.0 percent in IQ2012, 4.1 percent at SAAR (seasonally adjusted annual rate) and 3.2 percent relative to a year earlier but part of the jump could be the low level a year earlier because of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan is experiencing difficulties with the overvalued yen because of worldwide capital flight originating in zero interest rates with risk aversion in an environment of softer growth of world trade. Japan’s GDP fell 0.6 percent in IIQ2012 at the seasonally adjusted annual rate (SAAR) of minus 2.5 percent, which is much lower than 4.1 percent in IQ2012. Growth of 3.2 percent in IIQ2012 in Japan relative to IIQ2011 has effects of the low level of output because of Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan’s GDP contracted 0.8 percent in IIIQ2012 at the SAAR of minus 3.0 percent and decreased 0.2 percent relative to a year earlier. Japan’s GDP increased 0.1 percent in IVQ2012 at the SAAR of 0.2 percent and decreased 0.3 percent relative to a year earlier. Japan grew 1.3 percent in IQ2013 at the SAAR of 5.3 percent and increased 0.1 percent relative to a year earlier. Japan’s GDP increased 0.7 percent in IIQ2013 at the SAAR of 2.9 percent and increased 1.2 percent relative to a year earlier. Japan’s GDP grew 0.3 percent in IIIQ2013 at the SAAR of 1.3 percent and increased 2.3 percent relative to a year earlier. In IVQ2013, Japan’s GDP increased 0.1 percent at the SAAR of 0.3 percent, increasing 2.5 percent relative to a year earlier. Japan’s GDP increased 1.6 percent in IQ2014 at the SAAR of 6.7 percent and increased 3.0 percent relative to a year earlier.

- China. China’s GDP grew 1.4 percent in IQ2012, annualizing to 5.7 percent, and 8.1 percent relative to a year earlier. The GDP of China grew at 2.1 percent in IIQ2012, which annualizes to 8.7 percent and 7.6 percent relative to a year earlier. China grew at 2.0 percent in IIIQ2012, which annualizes at 8.2 percent and 7.4 percent relative to a year earlier. In IVQ2012, China grew at 1.9 percent, which annualizes at 7.8 percent, and 7.9 percent in IVQ2012 relative to IVQ2011. In IQ2013, China grew at 1.6 percent, which annualizes at 6.6 percent and 7.7 percent relative to a year earlier. In IIQ2013, China grew at 1.8 percent, which annualizes at 7.4 percent and 7.5 percent relative to a year earlier. China grew at 2.3 percent in IIIQ2013, which annualizes at 9.5 percent and 7.8 percent relative to a year earlier. China grew at 1.7 percent in IVQ2013, which annualized to 7.0 percent and 7.7 percent relative to a year earlier. China’s GDP grew 1.5 percent in IQ2014, which annualizes to 6.1 percent, and 7.4 percent relative to a year earlier. China’s GDP grew 2.0 percent in IIQ2014, which annualizes at 8.2 percent, and 7.5 percent relative to a year earlier. There is decennial change in leadership in China (http://www.xinhuanet.com/english/special/18cpcnc/index.htm). Growth rates of GDP of China in a quarter relative to the same quarter a year earlier have been declining from 2011 to 2014.

- Euro Area. GDP fell 0.1 percent in the euro area in IQ2012 and decreased 0.2 in IQ2012 relative to a year earlier. Euro area GDP contracted 0.3 percent IIQ2012 and fell 0.5 percent relative to a year earlier. In IIIQ2012, euro area GDP fell 0.2 percent and declined 0.7 percent relative to a year earlier. In IVQ2012, euro area GDP fell 0.5 percent relative to the prior quarter and fell 1.0 percent relative to a year earlier. In IQ2013, the GDP of the euro area fell 0.2 percent and decreased 1.1 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IIQ2013 and fell 0.6 percent relative to a year earlier. In IIIQ2013, euro area GDP increased 0.1 percent and fell 0.3 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IVQ2013 and increased 0.5 percent relative to a year earlier. In IQ2014, the GDP of the euro area increased 0.2 percent and 0.9 percent relative to a year earlier.

- Germany. The GDP of Germany increased 0.7 percent in IQ2012 and 1.8 percent relative to a year earlier. In IIQ2012, Germany’s GDP decreased 0.1 percent and increased 0.6 percent relative to a year earlier but 1.1 percent relative to a year earlier when adjusted for calendar (CA) effects. In IIIQ2012, Germany’s GDP increased 0.2 percent and 0.4 percent relative to a year earlier. Germany’s GDP contracted 0.5 percent in IVQ2012 and changed 0.0 percent relative to a year earlier. In IQ2013, Germany’s GDP changed 0.0 percent and fell 1.6 percent relative to a year earlier. In IIQ2013, Germany’s GDP increased 0.7 percent and 0.9 percent relative to a year earlier. The GDP of Germany increased 0.3 percent in IIIQ2013 and 1.1 percent relative to a year earlier. In IVQ2013, Germany’s GDP increased 0.4 percent and 1.3 percent relative to a year earlier. The GDP of Germany increased 0.8 percent in IQ2014 and 2.5 percent relative to a year earlier.

- United States. Growth of US GDP in IQ2012 was 0.9 percent, at SAAR of 3.7 percent and higher by 3.3 percent relative to IQ2011. US GDP increased 0.3 percent in IIQ2012, 1.2 percent at SAAR and 2.8 percent relative to a year earlier. In IIIQ2012, US GDP grew 0.7 percent, 2.8 percent at SAAR and 3.1 percent relative to IIIQ2011. In IVQ2012, US GDP grew 0.0 percent, 0.1 percent at SAAR and 2.0 percent relative to IVQ2011. In IQ2013, US GDP grew at 1.1 percent SAAR, 0.3 percent relative to the prior quarter and 1.3 percent relative to the same quarter in 2013. In IIQ2013, US GDP grew at 2.5 percent in SAAR, 0.6 percent relative to the prior quarter and 1.6 percent relative to IIQ2012. US GDP grew at 4.1 percent in SAAR in IIIQ2013, 1.0 percent relative to the prior quarter and 2.0 percent relative to the same quarter a year earlier (http://cmpassocregulationblog.blogspot.com/2014/06/financial-indecision-mediocre-cyclical.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/06/financial-instability-mediocre-cyclical.html) with weak hiring (http://cmpassocregulationblog.blogspot.com/2014/05/rules-discretionary-authorities-and.html). In IVQ2013, US GDP grew 0.7 percent at 2.6 percent SAAR and 2.6 percent relative to a year earlier. In IQ2014, US GDP decreased 0.7 percent, increased 1.5 percent relative to a year earlier and fell 2.9 percent at SAAR.

- United Kingdom. In IQ2012, UK GDP changed 0.0 percent, increasing 0.6 percent relative to a year earlier. UK GDP fell 0.4 percent in IIQ2012 and increased 0.1 percent relative to a year earlier. UK GDP increased 0.8 percent in IIIQ2012 and increased 0.3 percent relative to a year earlier. UK GDP fell 0.2 percent in IVQ2012 relative to IIIQ2012 and increased 0.2 percent relative to a year earlier. UK GDP increased 0.5 percent in IQ2013 and 0.7 percent relative to a year earlier. UK GDP increased 0.7 percent in IIQ2013 and 1.8 percent relative to a year earlier. In IIIQ2013, UK GDP increased 0.8 percent and 1.8 percent relative to a year earlier. UK GDP increased 0.7 percent in IVQ2013 and 2.7 percent relative to a year earlier. In IQ2014, UK GDP increased 0.8 percent and 3.0 percent relative to a year earlier.

- Italy. Italy has experienced decline of GDP in nine consecutive quarters from IIIQ2011 to IIIQ2013. Italy’s GDP fell 1.1 percent in IQ2012 and declined 1.7 percent relative to IQ2011. Italy’s GDP fell 0.5 percent in IIQ2012 and declined 2.4 percent relative to a year earlier. In IIIQ2012, Italy’s GDP fell 0.4 percent and declined 2.6 percent relative to a year earlier. The GDP of Italy contracted 0.9 percent in IVQ2012 and fell 2.8 percent relative to a year earlier. In IQ2013, Italy’s GDP contracted 0.6 percent and fell 2.4 percent relative to a year earlier. Italy’s GDP fell 0.3 percent in IIQ2013 and 2.2 percent relative to a year earlier. The GDP of Italy decreased 0.1 percent in IIIQ2013 and declined 1.9 percent relative to a year earlier. Italy’s GDP increased 0.1 percent in IVQ2013 and decreased 0.9 percent relative to a year earlier. In IQ2014, Italy’s GDP decreased 0.1 percent and fell 0.5 percent relative to a year earlier.

- France. France’s GDP increased 0.2 percent in IQ2012 and increased 0.6 percent relative to a year earlier. France’s GDP decreased 0.3 percent in IIQ2012 and increased 0.4 percent relative to a year earlier. In IIIQ2012, France’s GDP increased 0.3 percent and increased 0.5 percent relative to a year earlier. France’s GDP fell 0.3 percent in IVQ2012 and changed 0.0 percent relative to a year earlier. In IQ2013, France GDP changed 0.0 percent and declined 0.2 percent relative to a year earlier. The GDP of France increased 0.6 percent in IIQ2013 and 0.7 percent relative to a year earlier. France’s GDP decreased 0.1 percent in IIIQ2013 and increased 0.3 percent relative to a year earlier. The GDP of France increased 0.2 percent in IVQ2013 and 0.7 percent relative to a year earlier. In IVQ2014, France’s GDP changed 0.0 percent and increased 0.7 percent relative to a year earlier.

Table V-3, Percentage Changes of GDP Quarter on Prior Quarter and on Same Quarter Year Earlier, ∆%

| IQ2012/IVQ2011 | IQ2012/IQ2011 | |

| United States | QOQ: 0.9 SAAR: 3.7 | 3.3 |

| Japan | QOQ: 1.0 SAAR: 4.1 | 3.2 |

| China | 1.4 | 8.1 |

| Euro Area | -0.1 | -0.2 |

| Germany | 0.7 | 1.8 |

| France | 0.2 | 0.6 |

| Italy | -1.1 | -1.7 |

| United Kingdom | 0.0 | 0.6 |

| IIQ2012/IQ2012 | IIQ2012/IIQ2011 | |

| United States | QOQ: 0.3 SAAR: 1.2 | 2.8 |

| Japan | QOQ: -0.6 | 3.2 |

| China | 2.1 | 7.6 |

| Euro Area | -0.3 | -0.5 |

| Germany | -0.1 | 0.6 1.1 CA |

| France | -0.3 | 0.4 |

| Italy | -0.5 | -2.4 |

| United Kingdom | -0.4 | 0.1 |

| IIIQ2012/ IIQ2012 | IIIQ2012/ IIIQ2011 | |

| United States | QOQ: 0.7 | 3.1 |

| Japan | QOQ: –0.8 | -0.2 |

| China | 2.0 | 7.4 |

| Euro Area | -0.2 | -0.7 |

| Germany | 0.2 | 0.4 |

| France | 0.3 | 0.5 |

| Italy | -0.4 | -2.6 |

| United Kingdom | 0.8 | 0.3 |

| IVQ2012/IIIQ2012 | IVQ2012/IVQ2011 | |

| United States | QOQ: 0.0 | 2.0 |

| Japan | QOQ: 0.1 SAAR: 0.2 | -0.3 |

| China | 1.9 | 7.9 |

| Euro Area | -0.5 | -1.0 |

| Germany | -0.5 | 0.0 |

| France | -0.3 | 0.0 |

| Italy | -0.9 | -2.8 |

| United Kingdom | -0.2 | 0.2 |

| IQ2013/IVQ2012 | IQ2013/IQ2012 | |

| United States | QOQ: 0.3 | 1.3 |

| Japan | QOQ: 1.3 SAAR: 5.3 | 0.1 |

| China | 1.6 | 7.7 |

| Euro Area | -0.2 | -1.1 |

| Germany | 0.0 | -1.6 |

| France | 0.0 | -0.2 |

| Italy | -0.6 | -2.4 |

| UK | 0.5 | 0.7 |

| IIQ2013/IQ2013 | IIQ2013/IIQ2012 | |

| United States | QOQ: 0.6 SAAR: 2.5 | 1.6 |

| Japan | QOQ: 0.7 SAAR: 2.9 | 1.2 |

| China | 1.8 | 7.5 |

| Euro Area | 0.3 | -0.6 |

| Germany | 0.7 | 0.9 |

| France | 0.6 | 0.7 |

| Italy | -0.3 | -2.2 |

| UK | 0.7 | 1.8 |

| IIIQ2013/IIQ2013 | III/Q2013/ IIIQ2012 | |

| USA | QOQ: 1.0 | 2.0 |

| Japan | QOQ: 0.3 SAAR: 1.3 | 2.3 |

| China | 2.3 | 7.8 |

| Euro Area | 0.1 | -0.3 |

| Germany | 0.3 | 1.1 |

| France | -0.1 | 0.3 |

| Italy | -0.1 | -1.9 |

| UK | 0.8 | 1.8 |

| IVQ2013/IIIQ2013 | IVQ2013/IVQ2012 | |

| USA | QOQ: 0.7 SAAR: 2.6 | 2.6 |

| Japan | QOQ: 0.1 SAAR: 0.3 | 2.5 |

| China | 1.7 | 7.7 |

| Euro Area | 0.3 | 0.5 |

| Germany | 0.4 | 1.3 |

| France | 0.2 | 0.7 |

| Italy | 0.1 | -0.9 |

| UK | 0.7 | 2.7 |

| IQ2014/IVQ2013 | IQ2014/IQ2013 | |

| USA | QOQ -0.7 SAAR -2.9 | 1.5 |

| Japan | QOQ: 1.6 SAAR: 6.7 | 3.0 |

| China | 1.5 | 7.4 |

| Euro Area | 0.2 | 0.9 |

| Germany | 0.8 | 2.5 |

| France | 0.0 | 0.7 |

| Italy | -0.1 | -0.5 |

| UK | 0.8 | 3.0 |

| IIQ2014/IQ2014 | IIQ2014/IIQ2013 | |

| China | 2.0 | 7.5 |

QOQ: Quarter relative to prior quarter; SAAR: seasonally adjusted annual rate

Source: Country Statistical Agencies http://www.census.gov/aboutus/stat_int.html

Table V-4 provides two types of data: growth of exports and imports in the latest available months and in the past 12 months; and contributions of net trade (exports less imports) to growth of real GDP.

- Japan. Japan provides the most worrisome data (http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html and earlier http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-zero-interest-rates-world.html http://cmpassocregulationblog.blogspot.com/2013/11/global-financial-risk-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations_8763.html http://cmpass ocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html and earlier http://cmpassocregulationblog.blogspot.com/2013/07/duration-dumping-steepening-yield-curve.html and earlier http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and_4699.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2013/03/united-states-commercial-banks-assets.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/world-inflation-waves-united-states.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/thirty-one-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2012/12/mediocre-and-decelerating-united-states_24.html and earlier http://cmpassocregulationblog.blogspot.com/2012/11/contraction-of-united-states-real_25.html and for GDP http://cmpassocregulationblog.blogspot.com/2013/09/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html and earlier http://cmpassocreulationblog.blogspot.com/2013/02/recovery-without-hiring-united-states.html). In May 2014, Japan’s exports fell 2.7 percent in 12 months while imports decreased 3.6 percent. The second part of Table V-4 shows that net trade deducted 1.3 percentage points from Japan’s growth of GDP in IIQ2012, deducted 2.2 percentage points from GDP growth in IIIQ2012 and deducted 0.5 percentage points from GDP growth in IVQ2012. Net trade added 0.4 percentage points to GDP growth in IQ2012, 1.7 percentage points in IQ2013 and 0.5 percentage points in IIQ2013. In IIIQ2013, net trade deducted 2.0 percentage points from GDP growth in Japan. Net trade ducted 2.2 percentage points from GDP growth in Japan in IVQ2013. Net trade deducted 1.1 percentage point from GDP growth of Japan in IQ2014.

- China. In May 2014, China exports increased 7.0 percent relative to a year earlier and imports decreased 1.6 percent.

- Germany. Germany’s exports decreased 1.1 percent in the month of May 2014 and increased 4.3 percent in the 12 months ending in May 2014. Germany’s imports decreased 3.4 percent in the month of May and decreased 0.4 percent in the 12 months ending in Apr. Net trade contributed 0.8 percentage points to growth of GDP in IQ2012, contributed 0.3 percentage points in IIQ2012, contributed 0.3 percentage points in IIIQ2012, deducted 0.5 percentage points in IVQ2012, deducted 0.3 percentage points in IQ2013 and added 0.1 percentage points in IIQ2013. Net traded deducted 0.5 percentage points from Germany’s GDP growth in IIIQ2013 and added 0.4 percentage points to GDP growth in IVQ2013. Net trade added 0.1 percentage points to GDP growth in IQ2014.

- United Kingdom. Net trade deducted 0.7 percentage points from UK value added in IQ2012, deducted 0.8 percentage points in IIQ2012, added 0.9 percentage points in IIIQ2012 and subtracted 0.4 percentage points in IVQ2012. In IQ2013, net trade added 0.6 percentage points to UK’s growth of value added and contributed 0.0 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.2 percentage points from UK growth. Net trade contributed 0.7 percentage points to UK value added in IVQ2013. Net trade contributed 0.3 percentage points to UK value added in IQ2014.

- France. France’s exports increased 0.3 percent in May 2014 while imports increased 2.2 percent. Net traded added 0.1 percentage points to France’s GDP in IIIQ2012 and 0.1 percentage points in IVQ2012. Net trade deducted 0.1 percentage points from France’s GDP growth in IQ2013 and added 0.3 percentage points in IIQ2013, deducting 0.5 percentage points in IIIQ2013. Net trade added 0.3 percentage points to France’s GDP in IVQ2013 and deducted 0.1 percentage points in IQ2014.

- United States. US exports increased 1.0 percent in May 2014 and goods exports increased 3.0 percent in Jan-May 2014 relative to a year earlier. Net trade deducted 0.03 percentage points from GDP growth in IIIQ2012 and added 0.68 percentage points in IVQ2012. Net trade deducted 0.28 percentage points from US GDP growth in IQ2013 and deducted 0.07 percentage points in IIQ2013. Net traded added 0.14 percentage points to US GDP growth in IIIQ2013. Net trade added 0.99 percentage points to US GDP growth in IVQ2013. Net trade deducted 1.53 percentage points from US GDP growth in IQ2014. Industrial production increased 0.2 percent in Jun 2014 after increasing 0.5 percent in May 2014 and changing 0.0 percent in Apr 2014 with all data seasonally adjusted. The Federal Reserve completed its annual revision of industrial production and capacity utilization on Mar 28, 2014 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm). The report of the Board of Governors of the Federal Reserve System states (http://www.federalreserve.gov/releases/g17/Current/default.htm):

“Industrial production increased 0.2 percent in June and advanced at an annual rate of 5.5 percent for the second quarter of 2014. In June, manufacturing output edged up 0.1 percent for its fifth consecutive monthly gain, while the production at mines moved up 0.8 percent and the output of utilities declined 0.3 percent. For the second quarter as a whole, manufacturing production rose at an annual rate of 6.7 percent, while mining output increased at an annual rate of 18.8 percent because of gains in the extraction of oil and gas; by contrast, the output of utilities fell at an annual rate of 21.4 percent following a weather-related increase of 15.6 percent in the first quarter. At 103.9 percent of its 2007 average, total industrial production in June was 4.3 percent above its level of a year earlier. The capacity utilization rate for total industry was unchanged in June at 79.1 percent, a rate that is 1.0 percentage point below its long-run (1972–2013) average.”

In the six months ending in Jun 2014, United States national industrial production accumulated increase of 2.3 percent at the annual equivalent rate of 4.7 percent, which is higher than growth of 4.3 percent in the 12 months ending in Jun 2014. Excluding growth of 0.9 percent in Feb 2014, growth in the remaining five months from Jan to Jun 2014 accumulated to 1.4 percent or 3.4 percent annual equivalent. Industrial production fell in one of the past six months and stagnated in another. Industrial production expanded at annual equivalent 2.8 percent in the most recent quarter from Apr to Jun 2014 and at 6.6 percent in the prior quarter Jan-Mar 2014. Business equipment accumulated growth of 4.1 percent in the six months from Jan 2013 to Jun 2014 at the annual equivalent rate of 8.5 percent, which is higher than growth of 4.7 percent in the 12 months ending in Jun 2014. The Fed analyzes capacity utilization of total industry in its report (http://www.federalreserve.gov/releases/g17/Current/default.htm): “The capacity utilization rate for total industry was unchanged in June at 79.1 percent, a rate that is 1.0 percentage point below its long-run (1972–2013) average.” United States industry apparently decelerated to a lower growth rate with possible acceleration in past months. The bottom part of Manufacturing fell 21.9 from the peak in Jun 2007 to the trough in Apr 2009 and increase by 19.9 percent from the trough in Apr 2009 to Dec 2013. Manufacturing grew 26.7 percent from the trough in Apr 2009 to Jun 2014. Manufacturing output in May 2014 is 1.1 percent below the peak in Jun 2007. Growth at trend in the entire cycle from IVQ2007 to IQ2014 would have accumulated to 21.2 percent. GDP in IQ2014 would be $18,172.7 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2,348.5 billion than actual $15,824.2 billion. There are about two trillion dollars of GDP less than at trend, explaining the 26.8 million unemployed or underemployed equivalent to actual unemployment of 16.3 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2014/07/financial-valuations-twenty-seven.html and earlier http://cmpassocregulationblog.blogspot.com/2014/06/financial-risks-rules-discretionary.html). US GDP in IQ2014 is 12.9 percent lower than at trend. US GDP grew from $14,996.1 billion in IVQ2007 in constant dollars to $15,842.2 billion in IQ2014 or 5.5 percent at the average annual equivalent rate of 0.8 percent. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. The long-term trend is growth at average 3.3 percent per year from Jan 1919 to Jun 2014. Growth at 3.3 percent per year would raise the NSA index of manufacturing output from 111.7242 in Dec 2007 to 120.3775 in Jun 2014. The actual index NSA in Jun 2014 is 101.9337, which is 15.3 percent below trend. Manufacturing output grew at average 2.3 percent between Dec 1986 and Dec 2013, raising the index at trend to 113.0017 in Jun 2014. The output of manufacturing at 101.9337 in Jun 2014 is 9.8 percent below trend under this alternative calculation.

Table V-4, Growth of Trade and Contributions of Net Trade to GDP Growth, ∆% and % Points

| Exports | Exports 12 M ∆% | Imports | Imports 12 M ∆% | |

| USA | 1.0 May | 3.0 Jan-May | -0.3 May | 2.6 Jan-May |

| Japan | May 2014 -2.7 Apr 2014 5.1 Mar 2014 1.8 Feb 2014 9.5 Jan 2014 9.5 Dec 2013 15.3 Nov 2013 18.4 Oct 2013 18.6 Sep 2013 11.5 Aug 2013 14.7 Jul 2013 12.2 Jun 2013 7.4 May 2013 10.1 Apr 2013 3.8 Mar 2013 1.1 Feb 2013 -2.9 Jan 2013 6.4 Dec -5.8 Nov -4.1 Oct -6.5 Sep -10.3 Aug -5.8 Jul -8.1 | May 2014 -3.6 Apr 2013 3.4 Mar 2014 18.1 Feb 2014 9.0 Jan 2014 25.0 Dec 2013 24.7 Nov 2013 21.1 Oct 2013 26.1 Sep 2013 16.5 Aug 2013 16.0 Jul 2013 19.6 Jun 2013 11.8 May 2013 10.0 Apr 2013 9.4 Mar 2013 5.5 Feb 2013 7.3 Jan 2013 7.3 Dec 1.9 Nov 0.8 Oct -1.6 Sep 4.1 Aug -5.4 Jul 2.1 | ||

| China | 2014 7.0 May 0.9 Apr -6.6 Mar -18.1 Feb 10.6 Jan 2013 4.3 Dec 12.7 Nov 5.6 Oct -0.3 Sep 7.2 Aug 5.1 Jul -3.1 Jun 1.0 May 14.7 Apr 10.0 Mar 21.8 Feb 25.0 Jan | 2014 -1.6 May -0.8 Apr -11.3 Mar 10.1 Feb 10.0 Jan 2013 8.3 Dec 5.3 Nov 7.6 Oct 7.4 Sep 7.0 Aug 10.9 Jul -0.7 Jun -0.3 May 16.8 Apr 14.1 Mar -15.2 Feb 28.8 Jan | ||

| Euro Area | 0.2 12-M May | 0.4 Jan-May | -0.3 12-M May | -0.5 Jan-May |

| Germany | -1.1 May CSA | 4.3 May | -3.4 May CSA | -0.4 May |

| France May | 0.3 | 0.3 | 2.2 | -1.5 |

| Italy May | 2.2 | 0.2 | 3.2 | 0.9 |

| UK | -2.9 Apr | -2.9 Feb-Apr 14 /Feb-Apr 13 | 0.6 Apr | -3.7 Feb-Apr 14 13/Feb-Apr 13 |

| Net Trade % Points GDP Growth | % Points | |||

| USA | IQ2014 -1.53 IVQ2013 0.99 IIIQ2013 0.14 IIQ2013 -0.07 IQ2013 -0.28 IVQ2012 +0.68 IIIQ2012 -0.03 IIQ2012 +0.10 IQ2012 +0.44 | |||

| Japan | 0.4 IQ2012 -1.3 IIQ2012 -2.2 IIIQ2012 -0.5 IVQ2012 1.7 IQ2013 0.5 IIQ2013 -2.0 IIIQ2013 -2.2 IVQ2013 -1.1 IQ2014 | |||

| Germany | IQ2012 0.8 IIQ2012 0.4 IIIQ2012 0.3 IVQ2012 -0.5 IQ2013 -0.3 IIQ2013 0.1 IIIQ2013 -0.5 IVQ2013 0.4 IQ2014 0.1 | |||

| France | 0.1 IIIQ2012 0.1 IVQ2012 -0.1 IQ2013 0.3 IIQ2013 -0.5 IIIQ2013 0.3 IVQ2013 -0.1 IQ2014 | |||

| UK | -0.7 IQ2012 -0.8 IIQ2012 +0.9 IIIQ2012 -0.4 IVQ2012 0.6 IQ2013 0.0 IIQ2013 -1.2 IIIQ2013 0.7 IVQ2013 0.3 IQ2014 |

Sources: Country Statistical Agencies http://www.census.gov/foreign-trade/ http://www.bea.gov/iTable/index_nipa.cfm

The geographical breakdown of exports and imports of Japan with selected regions and countries is provided in Table V-4 for May 2014. The share of Asia in Japan’s trade is more than one-half for 55.1 percent of exports and 45.2 percent of imports. Within Asia, exports to China are 18.7 percent of total exports and imports from China 21.8 percent of total imports. While exports to China increased 0.4 percent in the 12 months ending in May 2014, imports from China decreased 0.5 percent. The second largest export market for Japan in May 2014 is the US with share of 18.0 percent of total exports, which is close to that of China, and share of imports from the US of 9.4 percent in total imports. Japan’s exports to the US fell 2.8 percent in the 12 months ending in May 2014 and imports from the US fell 0.5 percent. Western Europe has share of 11.1 percent in Japan’s exports and of 10.9 percent in imports. Rates of growth of exports of Japan in May 2014 are minus 2.8 percent for exports to the US, minus 10.7 percent for exports to Brazil and 22.5 percent for exports to Germany. Comparisons relative to 2011 may have some bias because of the effects of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Deceleration of growth in China and the US and threat of recession in Europe can reduce world trade and economic activity. Growth rates of imports in the 12 months ending in May 2014 are mixed. Imports from Asia decreased 1.2 percent in the 12 months ending in May 2014 while imports from China decreased 2.7 percent. Data are in millions of yen, which may have effects of recent depreciation of the yen relative to the United States dollar (USD).

Table V-4, Japan, Value and 12-Month Percentage Changes of Exports and Imports by Regions and Countries, ∆% and Millions of Yen

| May 2014 | Exports | 12 months ∆% | Imports Millions Yen | 12 months ∆% |

| Total | 5,607,581 | -2.7 | 6,516,544 | -3.6 |

| Asia | 3,087,914 % Total 55.1 | -3.4 | 2,945,032 % Total 45.2 | -1.2 |

| China | 1,049,696 % Total 18.7 | 0.4 | 1,419,105 % Total 21.8 | -2.7 |

| USA | 1,010,694 % Total 18.0 | -2.8 | 611,193 % Total 9.4 | -0.5 |

| Canada | 59,414 | -14.2 | 101,133 | -9.3 |

| Brazil | 41,339 | -10.7 | 75,075 | -28.9 |

| Mexico | 81,962 | 3.3 | 47,485 | 22.4 |

| Western Europe | 622,770 % Total 11.1 | 15.2 | 709,880 % Total 10.9 | 6.1 |

| Germany | 165,641 | 22.5 | 192,516 | 7.1 |

| France | 47,659 | -1.7 | 88,854 | 1.2 |

| UK | 92,016 | 3.6 | 52,249 | -13.6 |

| Middle East | 215,002 | 10.9 | 1,102,296 | -10.5 |

| Australia | 104,308 | -30.4 | 391,700 | -12.8 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

World trade projections of the IMF are in Table V-6. There is increasing growth of the volume of world trade of goods and services from 3.0 percent in 2013 to 5.3 percent in 2015 and 5.7 percent on average from 2016 to 2019. World trade would be slower for advanced economies while emerging and developing economies (EMDE) experience faster growth. World economic slowdown would be more challenging with lower growth of world trade.

Table V-6, IMF, Projections of World Trade, USD Billions, USD/Barrel and Annual ∆%

| 2013 | 2014 | 2015 | Average ∆% 2016-2019 | |

| World Trade Volume (Goods and Services) | 3.0 | 4.3 | 5.3 | 5.7 |

| Exports Goods & Services | 3.1 | 4.5 | 5.3 | 5.7 |

| Imports Goods & Services | 2.9 | 4.2 | 5.2 | 5.7 |

| World Trade Value of Exports Goods & Services USD Billion | 23,083 | 23,990 | 25,123 | Average ∆% 2006-2015 20,390 |

| Value of Exports of Goods USD Billion | 18,591 | 19,281 | 20,132 | Average ∆% 2006-2015 16,396 |

| Average Oil Price USD/Barrel | 104.07 | 104.17 | 97.92 | Average ∆% 2006-2015 88.84 |

| Average Annual ∆% Export Unit Value of Manufactures | -1.1 | -0.3 | -0.4 | Average ∆% 2006-2015 1.4 |

| Exports of Goods & Services | 2013 | 2014 | 2015 | Average ∆% 2016-2019 |

| Euro Area | 1.4 | 3.4 | 4.2 | 4.7 |

| EMDE | 4.4 | 5.0 | 6.2 | 6.2 |

| G7 | 1.4 | 3.9 | 4.5 | 4.9 |

| Imports Goods & Services | ||||

| Euro Area | 0.3 | 2.8 | 3.5 | 4.7 |

| EMDE | 5.6 | 5.2 | 6.3 | 6.4 |

| G7 | 1.1 | 3.2 | 4.2 | 4.9 |

| Terms of Trade of Goods & Services | ||||

| Euro Area | -0.3 | -0.2 | -0.7 | -0.1 |

| EMDE | 0.7 | -0.4 | -0.6 | -0.4 |

| G7 | 0.7 | -0.044 | 0.3 | 0.0 |

| Terms of Trade of Goods | ||||

| Euro Area | 0.8 | -0.044 | 0.1 | -0.2 |

| EMDE | -0.6 | -0.9 | -0.9 | -0.8 |

| G7 | -0.1 | -0.3 | -0.9 | -0.7 |

Notes: Commodity Price Index includes Fuel and Non-fuel Prices; Commodity Industrial Inputs Price includes agricultural raw materials and metal prices; Oil price is average of WTI, Brent and Dubai

Source: International Monetary Fund World Economic Outlook databank

http://www.imf.org/external/ns/cs.aspx?id=28

The JP Morgan Global All-Industry Output Index of the JP Morgan Manufacturing and Services PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, with high association with world GDP, increased to 55.4 in Jun from 54.2 in May, indicating expansion at faster rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/f4caa5bd611d4a568ab1a28c8f2816a5). This index has remained above the contraction territory of 50.0 during 59 consecutive months. The employment index increased from 51.6 in May to 52.7 in Jun with input prices rising at faster rate, new orders increasing at faster rate and output increasing at faster rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/f4caa5bd611d4a568ab1a28c8f2816a5). David Hensley, Director of Global Economics Coordination at JP Morgan finds possible higher growth than trend in the second half of the year (http://www.markiteconomics.com/Survey/PressRelease.mvc/f4caa5bd611d4a568ab1a28c8f2816a5). The JP Morgan Global Manufacturing PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, increased to 52.7 in Jun from 52.1 in Mat (http://www.markiteconomics.com/Survey/PressRelease.mvc/ce22ed75fd824bb2a6de0856a5049151). New export orders expanded for the twelfth consecutive month (http://www.markiteconomics.com/Survey/PressRelease.mvc/ce22ed75fd824bb2a6de0856a5049151). David Hensley, Director of Global Economic Coordination at JP Morgan finds improvement of the index with above-trend growth at 4.5 percent annual equivalent (http://www.markiteconomics.com/Survey/PressRelease.mvc/ce22ed75fd824bb2a6de0856a5049151). The HSBC Brazil Composite Output Index, compiled by Markit, increased from 49.9 in Apr to 49.9 in Jun, indicating unchanged activity of Brazil’s private sector (http://www.markiteconomics.com/Survey/PressRelease.mvc/eb41cd65ef7342758ff5e778a4548620). The HSBC Brazil Services Business Activity index, compiled by Markit, increased from 50.6 in May to 51.4 in Jun, indicating expanding services activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/1b1eac66368b4c93b0488de12835096a). André Loes, Chief Economist, Brazil, at HSBC, finds risks of weak economic activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/1b1eac66368b4c93b0488de12835096a). The HSBC Brazil Purchasing Managers’ IndexTM (PMI™) decreased marginally from 48.8 in May to 48.7 in Jun, indicating moderate deterioration in manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/35d4c5e2b0af4e9b9d535d5979613a1b). André Loes, Chief Economist, Brazil at HSBC, finds weakening industrial activity in Brazil (http://www.markiteconomics.com/Survey/PressRelease.mvc/35d4c5e2b0af4e9b9d535d5979613a1b).

VA United States. The Markit Flash US Manufacturing Purchasing Managers’ Index™ (PMI™) seasonally adjusted increased to 57.5 in Jun from 56.4 in May (http://www.markiteconomics.com/Survey/PressRelease.mvc/eaa9c08442964117981ead1ac971a652). New export orders registered 50.9 in Jun, decreasing from 52.2 in May, indicating expansion at a slower rate. Chris Williamson, Chief Economist at Markit, finds that manufacturing hiring is growing with creation of about 12,000 jobs, 200.000 new nonfarm payroll jobs and 3.0 percent GDP growth (http://www.markiteconomics.com/Survey/PressRelease.mvc/eaa9c08442964117981ead1ac971a652). The Markit Flash US Services PMI™ Business Activity Index increased from 58.1 in May to 61.2 in Jun (http://www.markiteconomics.com/Survey/PressRelease.mvc/f1b973b6faa84a18bfb1ce9eb4538725). Chris Williamson, Senior Economist at Markit, finds that the surveys are consistent with the highest rate of economic activity since before the global recession (http://www.markiteconomics.com/Survey/PressRelease.mvc/f1b973b6faa84a18bfb1ce9eb4538725). The Markit US Composite PMI™ Output Index of Manufacturing and Services increased to 61.0 in Jun from 58.4 in May (http://www.markiteconomics.com/Survey/PressRelease.mvc/a0ce20b0b3d544f1b2e1c97acbc94e0d). The Markit US Services PMI™ Business Activity Index increased from 58.1 in May to 61.0 in Jun (http://www.markiteconomics.com/Survey/PressRelease.mvc/a0ce20b0b3d544f1b2e1c97acbc94e0d). Chris Williamson, Chief Economist at Markit, finds the indexes consistent with US growth at annual rate of 4.0 percent in IIQ2014 (http://www.markiteconomics.com/Survey/PressRelease.mvc/a0ce20b0b3d544f1b2e1c97acbc94e0d). The Markit US Manufacturing Purchasing Managers’ Index™ (PMI™) increased to 57.3 in Jun from 56.4 in May, which indicates expansion at faster rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/a5254670de854235b620ac5824418514). The index of new exports orders decreased from 52.2 in May to 50.6 in Jun while total new orders increased from 58.8 in May to 61.2 in Jun. Chris Williamson, Chief Economist at Markit, finds that the index suggests output growth at aroun the fastest pace since the Global Recession (http://www.markiteconomics.com/Survey/PressRelease.mvc/a5254670de854235b620ac5824418514). The purchasing managers’ index (PMI) of the Institute for Supply Management (ISM) Report on Business® decreased 0.1 percentage points from 55.4 in May to 55.3 in Jun, which indicates growth at almost unchaged rate (http://www.ism.ws/ISMReport/MfgROB.cfm?navItemNumber=12942). The index of new orders increased 2.0 percentage points from 56.9 in May to 58.9 in Jun. The index of exports decreased 2.0 percentage point from 56.5 in May to 54.5 in Jun, growing at a slower rate. The Non-Manufacturing ISM Report on Business® PMI decreased 0.3 percentage points from 56.3 in May to 56.0 in Jun, indicating growth of business activity/production during 59 consecutive months, while the index of new orders increased 0.7 percentage points from 60.5 in May to 61.2 in Jun (http://www.ism.ws/ISMReport/NonMfgROB.cfm?navItemNumber=12943). Table USA provides the country economic indicators for the US.

Table USA, US Economic Indicators

| Consumer Price Index | May 12 months NSA ∆%: 2.0; ex food and energy ∆%: 2.0 May month SA ∆%: 0.4; ex food and energy ∆%: 0.3 |

| Producer Price Index | Finished Goods Jun 12-month NSA ∆%: 2.7; ex food and energy ∆% 1.9 Final Demand Jun 12-month NSA ∆%: 1.9; ex food and energy ∆% 1.8 |

| PCE Inflation | May 12-month NSA ∆%: headline 1.8; ex food and energy ∆% 1.5 |

| Employment Situation | Household Survey: Jun Unemployment Rate SA 6.1% |

| Nonfarm Hiring | Nonfarm Hiring fell from 63.3 million in 2006 to 54.2 million in 2013 or by 9.1 million |

| GDP Growth | BEA Revised National Income Accounts IIQ2012/IIQ2011 2.8 IIIQ2012/IIIQ2011 3.1 IVQ2012/IVQ2011 2.0 IQ2013/IQ2012 1.3 IIQ2013/IIQ2012 1.6 IIIQ2013/IIIQ2012 2.0 IVQ2013/IVQ2012 2.6 IQ2014/IQ2013 1.5 IQ2012 SAAR 3.7 IIQ2012 SAAR 1.2 IIIQ2012 SAAR 2.8 IVQ2012 SAAR 0.1 IQ2013 SAAR 1.1 IIQ2013 SAAR 2.5 IIIQ2013 SAAR 4.1 IVQ2013 SAAR 2.6 IQ2014 SAAR -2.9 |

| Real Private Fixed Investment | SAAR IQ2014 minus 1.8 ∆% IVQ2007 to IQ2014: minus 3.3% Blog 6/29/14 |

| Corporate Profits | IQ2014 SAAR: Corporate Profits -9.1; Undistributed Profits -17.5 Blog 6/29/14 |

| Personal Income and Consumption | May month ∆% SA Real Disposable Personal Income (RDPI) SA ∆% 0.2 |

| Quarterly Services Report | IQ14/IQ13 NSA ∆%: Financial & Insurance 5.3 |

| Employment Cost Index | Compensation Private IQ2014 SA ∆%: 0.3 |

| Industrial Production | Jun month SA ∆%: 0.2 Manufacturing Jun SA ∆% 0.1 Jun 12 months SA ∆% 3.4, NSA 3.6 |

| Productivity and Costs | Nonfarm Business Productivity IQ2014∆% SAAE -3.2; IQ2014/IQ2013 ∆% 1.0; Unit Labor Costs SAAE IQ2014 ∆% 5.7; IQ2014/IQ2013 ∆%: 1.2 Blog 6/8/2014 |

| New York Fed Manufacturing Index | General Business Conditions From Jun 19.28 to Jul 25.60 |

| Philadelphia Fed Business Outlook Index | General Index from May 17.8 to Jul 23.9 |

| Manufacturing Shipments and Orders | New Orders SA May ∆% -0.5 Ex Transport -0.1 Jan-May NSA New Orders ∆% 2.5 Ex transport 1.9 |

| Durable Goods | May New Orders SA ∆%: minus 1.0; ex transport ∆%: minus 0.1 |

| Sales of New Motor Vehicles | Jan-Jun 2014 8,163,942; Jan-Jun 2013 7,829,141. Jun 14 SAAR 16.98 million, May 14 SAAR 16.77 million, Jun 2013 SAAR 15.88 million Blog 7/6/14 |

| Sales of Merchant Wholesalers | Jan-May 2014/Jan-May 2013 NSA ∆%: Total 4.9; Durable Goods: 3.8; Nondurable |

| Sales and Inventories of Manufacturers, Retailers and Merchant Wholesalers | May 14 12-M NSA ∆%: Sales Total Business 3.3; Manufacturers 1.8 |

| Sales for Retail and Food Services | Jan-Jun 2014/Jan-Jun 2013 ∆%: Retail and Food Services 3.6; Retail ∆% 3.5 |

| Value of Construction Put in Place | May SAAR month SA ∆%: 0.1 May 12-month NSA: 5.7 |

| Case-Shiller Home Prices | Apr 2014/Apr 2013 ∆% NSA: 10 Cities 10.8; 20 Cities: 10.8 |

| FHFA House Price Index Purchases Only | Apr SA ∆% 0.0; |

| New House Sales | May 2014 month SAAR ∆%: 18.6 |

| Housing Starts and Permits | Jun Starts month SA ∆% minus -9.3; Permits ∆%: minus 4.2 |

| Trade Balance | Balance May SA -$44,392 million versus Apr -$47,037 million |

| Export and Import Prices | Jun 12-month NSA ∆%: Imports 1.2; Exports 0.2 |

| Consumer Credit | May ∆% annual rate: Total 7/4; Revolving 2.5; Nonrevolving 9.3 |

| Net Foreign Purchases of Long-term Treasury Securities | May Net Foreign Purchases of Long-term US Securities: $19.4 billion |

| Treasury Budget | Fiscal Year 2014/2013 ∆% Jun: Receipts 8.2; Outlays 1.1; Individual Income Taxes 5.4 Deficit Fiscal Year 2012 $1,087 billion Deficit Fiscal Year 2013 $680 billion Blog 7/13/2014 |

| CBO Budget and Economic Outlook | 2012 Deficit $1087 B 6.8% GDP Debt 11,281 B 70.1% GDP 2013 Deficit $680 B, 4.1% GDP Debt 11,982 B 72.1% GDP Blog 8/26/12 11/18/12 2/10/13 9/22/13 2/16/14 |

| Commercial Banks Assets and Liabilities | Jun 2014 SAAR ∆%: Securities 9.4 Loans 9.8 Cash Assets 35.2 Deposits 3.5 Blog 7/20/14 |

| Flow of Funds | IQ2014 ∆ since 2007 Assets +$13,322.5 BN Nonfinancial $120.8 BN Real estate -$565.4 BN Financial +13,201.7 BN Net Worth +$13,931.7 BN Blog 6/29/14 |

| Current Account Balance of Payments | IQ2014 -86,131 MM % GDP 2.6 Blog 6/22/14 |

Links to blog comments in Table USA:

7/13/14 http://cmpassocregulationblog.blogspot.com/2014/07/financial-risk-recovery-without-hiring.html

7/6/14 http://cmpassocregulationblog.blogspot.com/2014/07/financial-valuations-twenty-seven.html

6/29/14 http://cmpassocregulationblog.blogspot.com/2014/06/financial-indecision-mediocre-cyclical.html

6/22/14 http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html

6/15/2014 http://cmpassocregulationblog.blogspot.com/2014/06/financialgeopolitical-risks-recovery.html

6/8/14 http://cmpassocregulationblog.blogspot.com/2014/06/financial-risks-rules-discretionary.html

5/4/2014 http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

9/22/13 http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html

2/10/13 http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

Sales of manufacturers increased 0.1 percent in May 2014 after increasing 0.4 percent in Apr and increased 1.8 percent in the 12 months ending in May, as shown in Table VA-1. Retailers’ sales increased 0.4 percent in May 2014 after increasing 0.7 percent in Apr and increased 4.6 percent in 12 months ending in May 2014. Sales of merchant wholesalers increased 0.7 percent in May, increased 1.3 percent in Apr and increased 3.9 percent in 12 months ending in May. Sales of total business increased 0.4 percent in May after increasing 0.8 percent in Apr and increased 3.3 percent in 12 months.

Table VA-1, US, Percentage Changes for Sales of Manufacturers, Retailers and Merchant Wholesalers

| May 14/Apr 14 | May 2014 | Apr 14/ Mar 14 ∆% SA | May 14/ May 13 | |

| Total Business | 0.4 | 1,391,751 | 0.8 | 3.3 |

| .Manufacturers | 0.1 | 511,869 | 0.4 | 1.8 |

| Retailers | 0.4 | 413,915 | 0.7 | 4.6 |

| Merchant Wholesalers | 0.7 | 465,967 | 1.3 | 3.9 |

Source: US Census Bureau http://www.census.gov/mtis/

Chart VA-1 of the US Census Bureau provides total US sales of manufacturing, retailers and wholesalers seasonally adjusted (SA) in millions of dollars. Seasonal adjustment softens adjacent changes for purposes of comparing short-term variations free of seasonal factors. There was sharp drop in the global recession followed by sharp recovery with decline and recovery in the final segment above the peak before the global recession. Data are not adjusted for price changes.

Chart VA-1, US, Total Business Sales of Manufacturers, Retailers and Merchant Wholesalers, SA, Millions of Dollars, Jan 1992-May 2014

US Census Bureau

Chart VA-2 of the US Census Bureau provides total US sales of manufacturing, retailers and wholesalers not seasonally adjusted (NSA) in millions of dollars. The series without adjustment shows sharp jagged behavior because of monthly fluctuations following seasonal patterns. There is sharp recovery from the global recession in a robust trend, which is mixture of price and quantity effects because data are not adjusted for price changes. There is stability in the final segment with monthly marginal strength.

Chart VA-2, US, Total Business Sales of Manufacturers, Retailers and Merchant Wholesalers, NSA, Millions of Dollars, Jan 1992-May 2014

US Census Bureau

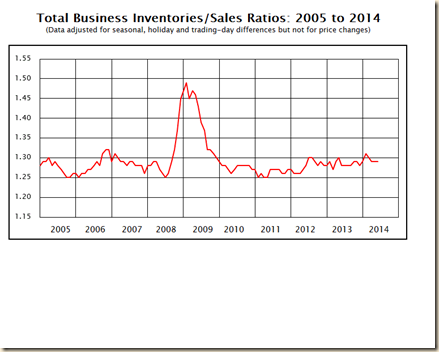

Businesses added cautiously to inventories to replenish stocks. Retailers’ inventories added 0.2 percent in May 2014 and 0.5 percent in Apr with growth of 5.6 percent in 12 months, as shown in Table VA-2. Total business increased inventories by 0.5 percent in May, 0.6 percent in Apr and 5.7 percent in 12 months. Inventories sales/ratios of total business continued at a level close to 1.30 under careful management to avoid costs and risks. Inventory/sales ratios of manufacturers and retailers are higher than for merchant wholesalers. There is stability in inventory/sales ratios in individual months and relative to a year earlier.

Table VA-2, US, Percentage Changes for Inventories of Manufacturers, Retailers and Merchant Wholesalers and Inventory/Sales Ratios

| Inventory Change | May 14 | May 14/ Apr 14 ∆% SA | Apr 14/ Mar 14 ∆% SA | May 14/ May 13 ∆% NSA |

| Total Business | 1,732,814 | 0.5 | 0.6 | 5.7 |

| Manufacturers | 656,822 | 0.8 | 0.5 | 4.0 |

| Retailers | 548,243 | 0.2 | 0.5 | 5.6 |

| Merchant | 527,749 | 0.5 | 1.0 | 7.8 |

| Inventory/ | May 14 | May 2014 SA | Apr 2014 SA | May 2013 SA |

| Total Business | 1,732,814 | 1.29 | 1.29 | 1.28 |

| Manufacturers | 656,822 | 1.31 | 1.30 | 1.30 |

| Retailers | 548,243 | 1.41 | 1.41 | 1.40 |

| Merchant Wholesalers | 527,749 | 1.18 | 1.18 | 1.16 |

Source: US Census Bureau http://www.census.gov/mtis/

Chart VA-3 of the US Census Bureau provides total business inventories of manufacturers, retailers and merchant wholesalers seasonally adjusted (SA) in millions of dollars from Jan 1992 to May 2014. The impact of the two recessions of 2001 and IVQ2007 to IIQ2009 is evident in the form of sharp reductions in inventories. Inventories have surpassed the peak before the global recession. Data are not adjusted for price changes.

Chart VA-3, US, Total Business Inventories of Manufacturers, Retailers and Merchant Wholesalers, SA, Millions of Dollars, Jan 1992-May 2014

US Census Bureau

Chart VA-4 provides total business inventories of manufacturers, retailers and merchant wholesalers not seasonally adjusted (NSA) from Jan 1992 to May 2014 in millions of dollars. The recessions of 2001 and IVQ2007 to IIQ2009 are evident in the form of sharp reductions of inventories. There is sharp upward trend of inventory accumulation after both recessions. Total business inventories are higher than in the peak before the global recession.

Chart VA-4, US, Total Business Inventories of Manufacturers, Retailers and Merchant Wholesalers, NSA, Millions of Dollars, Jan 1992-May 2014

US Census Bureau

Inventories follow business cycles. When recession hits sales inventories pile up, declining with expansion of the economy. In a fascinating classic opus, Lloyd Meltzer (1941, 129) concludes:

“The dynamic sequences (i) through (6) were intended to show what types of behavior are possible for a system containing a sales output lag. The following conclusions seem to be the most important:

(i) An economy in which business men attempt to recoup inventory losses will always undergo cyclical fluctuations when equilibrium is disturbed, provided the economy is stable.

This is the pure inventory cycle.

(2) The assumption of stability imposes severe limitations upon the possible size of the marginal propensity to consume, particularly if the coefficient of expectation is positive.

(3) The inventory accelerator is a more powerful de-stabilizer than the ordinary acceleration principle. The difference in stability conditions is due to the fact that the former allows for replacement demand whereas the usual analytical formulation of the latter does not. Thus, for inventories, replacement demand acts as a de-stabilizer. Whether it does so for all types of capital goods is a moot question, but I believe cases may occur in which it does not.

(4) Investment for inventory purposes cannot alter the equilibrium of income, which depends only upon the propensity to consume and the amount of non-induced investment.

(5) The apparent instability of a system containing both an accelerator and a coefficient of expectation makes further investigation of possible stabilizers highly desirable.”

Chart VA-5 shows the increase in the inventory/sales ratios during the recession of 2007-2009. The inventory/sales ratio fell during the expansions. The inventory/sales ratio declined to a trough in 2011, climbed and then stabilized at current levels in 2012, 2013 and 2014.

Chart VA-5, Total Business Inventories/Sales Ratios 2005 to 2014

Source: US Census Bureau

http://www2.census.gov/retail/releases/historical/mtis/img/mtisbrf.gif

Sales of retail and food services increased 0.2 percent in Jun 2014 after increasing 0.5 percent in May 2014 seasonally adjusted (SA), growing 3.6 percent in Jan-Jun 2014 relative to Jan-Jun 2013 not seasonally adjusted (NSA), as shown in Table VA-3. Excluding motor vehicles and parts, retail sales increased 0.4 percent in Jun 2014, increasing 0.4 percent in May 2014 SA and increasing 2.6 percent NSA in Jan-Jun 2014 relative to a year earlier. Sales of motor vehicles and parts decreased 0.3 percent in Jun 2014 after increasing 0.8 percent in May 2014 SA and increasing 7.8 percent NSA in Jan-Jun 2014 relative to a year earlier. Gasoline station sales increased 0.3 percent SA in Jun 2014 after increasing 0.7 percent in May 2014 in oscillating prices of gasoline that are moderating, decreasing 1.0 percent in Jan-Jun 2014 relative to a year earlier.

Table VA-3, US, Percentage Change in Monthly Sales for Retail and Food Services, ∆%

| Jun/May ∆% SA | May/Apr ∆% SA | Jan-Jun 2014 Million Dollars NSA | Jan-Jun 2014 from Jan-Jun 2013 ∆% NSA | |

| Retail and Food Services | 0.2 | 0.5 | 2,552,036 | 3.6 |

| Excluding Motor Vehicles and Parts | 0.4 | 0.4 | 2,029,888 | 2.6 |

| Motor Vehicles & Parts Dealers | -0.3 | 0.8 | 522,148 | 7.8 |

| Retail | 0.3 | 0.4 | 2,273,172 | 3.5 |

| Building Materials | -1.0 | 0.6 | 162,833 | 3.8 |

| Food and Beverage | 0.4 | 0.3 | 325,479 | 2.6 |

| Grocery | 0.1 | 0.2 | 291,096 | 2.0 |

| Health & Personal Care Stores | 0.9 | 1.1 | 145,376 | 5.5 |

| Clothing & Clothing Accessories Stores | 0.8 | -0.5 | 115,386 | 1.5 |

| Gasoline Stations | 0.3 | 0.7 | 271,880 | -1.0 |

| General Merchandise Stores | 1.1 | -0.1 | 312,864 | 1.4 |

| Food Services & Drinking Places | -0.3 | 0.9 | 278,864 | 4.0 |

Source: US Census Bureau http://www.census.gov/retail/

Chart VA-6 provides monthly percentage changes of sales of retail and food services. There is significant monthly volatility that prevents identification of clear trends.

Chart VA-6, US, Monthly Percentage Change of Retail and Food Services Sales, Jan 1992-Jun 2014

Source: US Census Bureau

Chart VA-7 of the US Census Bureau provides total sales of retail trade and food services seasonally adjusted (SA) from Jan 1992 to Jun 2014 in millions of dollars. The impact on sales of the shallow recession of 2001 was much milder than the sharp contraction in the global recession from IVQ2007 to IIQ2009. There is flattening in the final segment of the series followed by another increase. Data are not adjusted for price changes.

Chart VA-7, US, Total Sales of Retail Trade and Food Services, SA, Jan 1992-Jun 2014, Millions of Dollars

Source: US Census Bureau

Chart VA-8 of the US Census Bureau provides total sales of retail trade and food services not seasonally adjusted (NSA) in millions of dollars from Jan 1992 to Jun 2014. Data are not adjusted for seasonality, which explains sharp jagged behavior, or price changes. There was contraction during the global recession from IVQ2007 to IIQ2009 with strong rebound to a higher level and stability followed by strong increase in the final segment.

Chart VA-8, US, Total Sales of Retail Trade and Food Services, NSA, Jan 1992-Jun 2014, Millions of Dollars

Source: US Census Bureau

Seasonally adjusted annual rates (SAAR) of housing starts and permits are shown in Table VA-4. Housing starts decreased 9.3 percent in Jun 2014 after wide oscillations that included increases of 11.9 percent in Apr, 2.4 percent in Mar, 3.5 percent in Feb, decreases of 7.3 percent in May and 13.2 percent in Jan, increase of 18.1 percent in Nov, decline of 14.7 percent in Apr 2013 and 9.2 percent in Jun 2013. Housing starts increased 9.4 percent from the SAAR of 915 in May 2013 to the SAAR of 1001 in May 2014. Housing permits, indicating future activity, decreased 4.2 percent in Jun 2014 and 5.1 percent in May 2014 also after significant oscillations in 2013 with decrease of 5.8 percent from 1022 SSAR in Dec 2013 to SSAR of 963 in Jun 2014. While single unit houses starts decreased 9.0 percent in Jun 2014, seasonally adjusted, structures with five units or more decreased 11.3 percent. Multifamily residential construction is increasing at a faster rate than single-family construction with wide monthly oscillations. Monthly rates in starts and permits fluctuate significantly as shown in Table VA-4.

Table VA-4, US, Housing Starts and Permits SSAR Month ∆%

| Housing | Month ∆% | Housing | Month ∆% | |

| Jun 2014 | 893 | -9.3 | 963 | -4.2 |

| May | 985 | -7.3 | 1005 | -5.1 |

| Apr | 1063 | 11.9 | 1059 | 5.9 |

| Mar | 950 | 2.4 | 1000 | -1.1 |

| Feb | 928 | 3.5 | 1011 | 7.7 |

| Jan | 897 | -13.2 | 939 | -8.1 |

| Dec 2013 | 1034 | -6.4 | 1022 | -1.4 |

| Nov | 1105 | 18.1 | 1037 | -2.8 |

| Oct | 936 | 8.5 | 1067 | 7.5 |

| Sep | 863 | -2.5 | 993 | 4.7 |

| Aug | 885 | -1.4 | 948 | -3.0 |

| Jul | 898 | 8.1 | 977 | 4.2 |

| Jun | 831 | -9.2 | 938 | -7.1 |

| May | 915 | 7.9 | 1010 | -2.9 |

| Apr | 848 | -14.7 | 1040 | 12.3 |

| Mar | 994 | 4.5 | 926 | -5.1 |

| Feb | 951 | 6.1 | 976 | 3.1 |

| Jan | 896 | -8.2 | 947 | 1.0 |

| Dec 2012 | 976 | 17.2 | 938 | 0.9 |

| Nov | 833 | -9.0 | 930 | 3.9 |

| Oct | 915 | 8.0 | 895 | -2.8 |

| Sep | 847 | 12.3 | 921 | 10.7 |

| Aug | 754 | 1.9 | 832 | -0.9 |

| Jul | 740 | -2.2 | 840 | 6.3 |

| Jun | 757 | 6.9 | 790 | -2.1 |

| May | 708 | -6.0 | 807 | 8.0 |

| Apr | 753 | 8.3 | 747 | -6.3 |

| Mar | 695 | -1.3 | 797 | 8.7 |

| Feb | 704 | -2.6 | 733 | 2.5 |

| Jan | 723 | 4.2 | 715 | 2.6 |

| Dec 2011 | 694 | -2.4 | 697 | -1.3 |

| Nov | 711 | 16.6 | 706 | 5.2 |

| Oct | 610 | -6.2 | 671 | 10.0 |

| Sep | 650 | 11.1 | 610 | -5.7 |

| Aug | 585 | -6.1 | 647 | 4.2 |

| Jul | 623 | 2.5 | 621 | -2.4 |

| Jun | 608 | 8.4 | 636 | 2.9 |

| May | 561 | 1.3 | 618 | 6.4 |

| Apr | 554 | -7.7 | 581 | -0.3 |

| Mar | 600 | 16.1 | 583 | 7.6 |

| Feb | 517 | -17.9 | 542 | -5.9 |

| Jan | 630 | 16.9 | 576 | -8.9 |

| Dec 2010 | 539 | -1.1 | 632 | 12.9 |

| Nov | 545 | 0.4 | 560 | 0.4 |

| Oct | 543 | -8.6 | 558 | -0.9 |

| Sep | 594 | -0.8 | 563 | -2.9 |

SAAR: Seasonally Adjusted Annual Rate

Source: US Census Bureau http://www.census.gov/construction/nrc/

Housing starts and permits in Jan-Jun not-seasonally adjusted are in Table VA-5. Housing starts increased 6.0 percent in Jan-Jun 2014 relative to Jan-Jun 2013 and new permits increased 2.2 percent. Construction of new houses in the US remains at very depressed levels. Housing starts fell 51.3 percent in Jan-Jun 2014 relative to Jan-Jun 2006 and fell 53.2 percent relative to Jan-Jun 2005. Housing permits fell 53.0 percent in Jan-Jun 2014 relative to Jan-Jun 2006 and fell 53.8 percent relative to Jan-Jun 2005.

Table VA-5, US, Housing Starts and New Permits, Thousands of Units, NSA, and %

| Housing Starts | New Permits | |

| Jan-Jun 2014 | 479.3 | 497.5 |

| Jan-Jun 2013 | 452.3 | 486.7 |

| ∆% Jan-Jun 2014/Jan-Jun 2013 | 6.0 | 2.2 |

| Jan-Jun 2006 | 984.9 | 1035.0 |

| ∆% Jan-Jun 2014/Jan-Jun 2006 | -51.3 | -53.0 |

| Jan-Jun 2005 | 1023.5 | 1077.8 |

| ∆% Jan-Jun 2014/Jan-Jun 2005 | -53.2 | -53.8 |

Source: US Census Bureau http://www.census.gov/construction/nrc/

Chart VA-9 of the US Census Bureau shows the sharp increase in construction of new houses from 2000 to 2006. Housing construction fell sharply through the recession, recovering from the trough around IIQ2009. The right-hand side of Chart VA-9 shows a mild downward trend or stagnation from mid-2010 to the present in single-family houses with a recent mild upward trend in recent months in the category of two or more units but marginal decline in some recent months. While single unit houses starts increased 1.3 percent in Jan-Jun 2014 relative to a year earlier, not seasonally adjusted, structures with two to four units decreased 22.4 percent and with five units or more increased 18.3 percent. Single unit houses were 66.8 percent of total housing starts in 2013, increasing 15.4 percent relative to 2012, while construction of five units of more were 31.8 percent, increasing 25.6 percent, and construction of two to four units were 1.5 percent of the total, increasing 19.3 percent.

Chart VA-9, US, Total and Single-Family New Housing Units Started in the US, SAAR (Seasonally Adjusted Annual Rate)

Source: US Census Bureau

http://www.census.gov/briefrm/esbr/www/esbr020.html

Table VA-6 provides new housing units that started in the US at seasonally adjusted annual rates (SAAR) from Nov to Dec and from Jan to Jun of the years from 2000 to 2014. SAARs have dropped from high levels around 2 million in 2005-2006 to the range of 848,000 in Apr 2013 to 1,034,000 in Dec 2013 and 893,000 in Jun 2014, which is an improvement over the range of 517,000 in Feb 2011 to 711,000 in Nov 2011. Improvement continued with 1,034,000 in Dec 2013 relative to 976,000 in Dec 2012. The rate of housing starts increased to 893,000 in Jun 2014 relative to 831,000 in Jun 2013.

Table VA-6, US, New Housing United Started at Seasonally Adjusted Rates, Thousand Units

| Year | Jan | Feb | Mar | Apr | May | Jun | Nov | Dec |

| 2000 | 1,636 | 1,737 | 1,604 | 1,626 | 1,575 | 1,559 | 1,551 | 1,532 |

| 2001 | 1,600 | 1,625 | 1,590 | 1,649 | 1,605 | 1,636 | 1,602 | 1,568 |

| 2002 | 1,698 | 1,829 | 1,642 | 1,592 | 1,764 | 1,717 | 1,753 | 1,788 |

| 2003 | 1,853 | 1,629 | 1,726 | 1,643 | 1,751 | 1,867 | 2,083 | 2,057 |

| 2004 | 1,911 | 1,846 | 1,998 | 2,003 | 1,981 | 1,828 | 1,782 | 2,042 |

| 2005 | 2,144 | 2,207 | 1,864 | 2,061 | 2,025 | 2,068 | 2,147 | 1,994 |

| 2006 | 2,273 | 2,119 | 1,969 | 1,821 | 1,942 | 1,802 | 1,570 | 1,649 |

| 2007 | 1,409 | 1,480 | 1,495 | 1,490 | 1,415 | 1,448 | 1,197 | 1,037 |

| 2008 | 1,084 | 1,103 | 1,005 | 1,013 | 973 | 1,046 | 652 | 560 |

| 2009 | 490 | 582 | 505 | 478 | 540 | 585 | 588 | 581 |

| 2010 | 614 | 604 | 636 | 687 | 583 | 536 | 545 | 539 |

| 2011 | 630 | 517 | 600 | 554 | 561 | 608 | 711 | 694 |

| 2012 | 723 | 704 | 695 | 753 | 708 | 757 | 833 | 976 |

| 2013 | 896 | 951 | 994 | 848 | 915 | 831 | 1,105 | 1,034 |

| 2014 | 897 | 928 | 950 | 1,063 | 985 | 893 | NA | NA |

Source: US Census Bureau http://www.census.gov/construction/nrc/

Chart VA-10 of the US Census Bureau provides construction of new housing units started in the US at seasonally adjusted annual rate (SAAR) from Jan 1959 to May 2014 that helps to analyze in historical perspective the debacle of US new house construction. There are three periods in the series. (1) There is stationary behavior with wide fluctuations from 1959 to the beginning of the decade of the 1970s. (2) There is sharp upward trend from the 1990s to 2006 propelled by the US housing subsidy, politics of Fannie Mae and Freddie Mac and unconventional monetary policy of near zero interest rates from Jun 2003 to Jun 2004 and suspension of the auction of 30-year Treasury bonds intended to lower mortgage rates. The financial crisis and global recession were caused by interest rate and housing subsidies and affordability policies that encouraged high leverage and risks, low liquidity and unsound credit (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 157-66, Regulation of Banks and Finance (2009b), 217-27, International Financial Architecture (2005), 15-18, The Global Recession Risk (2007), 221-5, Globalization and the State Vol. II (2008b), 197-213, Government Intervention in Globalization (2008c), 182-4). Several past comments of this blog elaborate on these arguments, among which: http://cmpassocregulationblog.blogspot.com/2011/07/causes-of-2007-creditdollar-crisis.html http://cmpassocregulationblog.blogspot.com/2011/01/professor-mckinnons-bubble-economy.html http://cmpassocregulationblog.blogspot.com/2011/01/world-inflation-quantitative-easing.html http://cmpassocregulationblog.blogspot.com/2011/01/treasury-yields-valuation-of-risk.html http://cmpassocregulationblog.blogspot.com/2010/11/quantitative-easing-theory-evidence-and.html http://cmpassocregulationblog.blogspot.com/2010/12/is-fed-printing-money-what-are.html. (3) There is insufficient recovery during the weak expansion after IIIQ2009.

Chart VA-10, US, New Housing Units Started in the US, SAAR (Seasonally Adjusted Annual Rate), Thousands of Units, Jan 1959-Jun 2014

Source: US Census Bureau http://www.census.gov/construction/nrc/

Table VA-4 provides actual new housing units started in the US, not seasonally adjusted, from Oct to Dec and from Jan to Jun in the years from 2000 to 2014. The number of housing units started fell from the peak of 192.8 thousand in Jun 2005 to 67.6 thousand in Dec 2013 or decline of 64.9 percent in large part because of lower seasonal activity at the end of the year. The number of housing units started jumped from 74.7 thousand in Jun 2012 to 85.2 thousand in Jun 2014 or by 14.1 percent and increased 40.8 percent from 60.5 thousand in May 2011. The number of housing units started increased from 80.7 thousand in Jun 2013 to 85.2 thousand in Jun 2014 or 5.6 percent.

Table VA-6, New Housing Units Started in the US, Not Seasonally Adjusted, Thousands of Units

| Year | Jan | Feb | Mar | Apr | May | Jun | Oct | Nov | Dec |

| 2000 | 104.0 | 119.7 | 133.4 | 149.5 | 152.9 | 146.3 | 139.7 | 117.1 | 100.7 |

| 2001 | 106.4 | 108.2 | 133.2 | 151.3 | 154.0 | 155.2 | 139.8 | 121.0 | 104.6 |

| 2002 | 110.4 | 120.4 | 138.2 | 148.8 | 165.5 | 160.3 | 146.8 | 133.0 | 123.1 |

| 2003 | 117.8 | 109.7 | 147.2 | 151.2 | 165.0 | 174.5 | 173.5 | 153.7 | 144.2 |

| 2004 | 124.5 | 126.4 | 173.8 | 179.5 | 187.6 | 172.3 | 181.3 | 138.1 | 140.2 |

| 2005 | 142.9 | 149.1 | 156.2 | 184.6 | 197.9 | 192.8 | 180.4 | 160.7 | 136.0 |

| 2006 | 153.0 | 145.1 | 165.9 | 160.5 | 190.2 | 170.2 | 130.6 | 115.2 | 112.4 |

| 2007 | 95.0 | 103.1 | 123.8 | 135.6 | 136.5 | 137.8 | 115.0 | 88.8 | 68.9 |

| 2008 | 70.8 | 78.4 | 82.2 | 89.5 | 91.7 | 102.5 | 68.2 | 47.5 | 37.7 |

| 2009 | 31.9 | 39.8 | 42.7 | 42.5 | 52.2 | 59.1 | 44.5 | 42.3 | 36.6 |

| 2010 | 38.9 | 40.7 | 54.7 | 62.0 | 56.2 | 53.8 | 45.4 | 40.6 | 33.8 |

| 2011 | 40.2 | 35.4 | 49.9 | 49.0 | 54.0 | 60.5 | 53.2 | 53.0 | 42.7 |

| 2012 | 47.2 | 49.7 | 58.0 | 66.8 | 67.8 | 74.7 | 77.0 | 62.2 | 63.2 |

| 2013 | 58.7 | 66.1 | 83.3 | 76.3 | 87.2 | 80.7 | 78.4 | 83.8 | 67.6 |

| 2014 | 60.7 | 65.1 | 80.2 | 94.9 | 93.2 | 85.2 | NA | NA | NA |

Source: US Census Bureau http://www.census.gov/construction/nrc/

Chart VA-11 of the US Census Bureau provides new housing units started in the US not seasonally adjusted (NSA) from Jan 1959 to Apr 2014. There is the same behavior as in Chart VA-10 SA but with sharper fluctuations in the original series without seasonal adjustment. There are the same three periods. (1) The series is virtually stationary with wide fluctuations from 1959 to the late 1980s. (2) There is downward trend during the savings and loans crisis of the 1980s. Benston and Kaufman (1997, 139) find that there was failure of 1150 US commercial and savings banks between 1983 and 1990, or about 8 percent of the industry in 1980, which is nearly twice more than between the establishment of the Federal Deposit Insurance Corporation in 1934 through 1983. More than 900 savings and loans associations, representing 25 percent of the industry, were closed, merged or placed in conservatorships (see Pelaez and Pelaez, Regulation of Banks and Finance (2008b), 74-7). The Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA) created the Resolution Trust Corporation (RTC) and the Savings Association Insurance Fund (SAIF) that received $150 billion of taxpayer funds to resolve insolvent savings and loans. The GDP of the US in 1989 was $4346.7 billion (http://www.bea.gov/iTable/index_nipa.cfm), such that the partial cost to taxpayers of that bailout was around 3.45 percent of GDP in a year. US GDP in 2013 is estimated at $16,799.7 billion, such that the bailout would be equivalent to cost to taxpayers of about $579.6 billion in current GDP terms. A major difference with the Troubled Asset Relief Program (TARP) for private-sector banks is that most of the costs were recovered with interest gains whereas in the case of savings and loans there was no recovery. (3) There is vertical drop of new housing construction in the US during the global recession from (Dec) IVQ2007 to (Jun) IIQ2009 (http://www.nber.org/cycles/cyclesmain.html). The final segment shows upward trend but it could be simply part of yet another fluctuation. Marginal improvement in housing in the US should not obscure the current depressed levels relative to earlier periods.

Chart VA-11, US, New Housing Units Started in the US, Not Seasonally Adjusted, Thousands of Units, Jan 1959-Jun 2014

Source: US Census Bureau http://www.census.gov/construction/nrc/

Chart VA-12 of the US Census Bureau provides single-family houses started without seasonal adjustment. There was sharp increase from 1992 to 2007 followed by sharp decline. The recovery is sluggish.

Chart VA-12, US, Single-family Houses Started, Thousands of Units, Jan-1959-Jun 2014, NSA

Source: US Census Bureau http://www.census.gov/construction/nrc

Chart VA-13 of the US Census Bureau provides housing units started with five units or more. Construction was stagnant before the drop in the global recession. Recovery is stronger than in the case of single-family units.

Chart VA-13, US, Housing Units Stated in Buildings with Five Units or More, Thousands of Units, Jan-1959-Jun 2014, NSA

Source: US Census Bureau http://www.census.gov/construction/nrc/

A longer perspective on residential construction in the US is provided by Table VA-7 with annual data from 1960 to 2013. Housing starts fell 55.3 percent from 2005 to 2013, 41.0 percent from 2000 to 2013 and 35.3 percent relative to the average from 1959 to 1963. Housing permits fell 54.0 percent from 2005 to 2013, 37.8 percent from 2000 to 2013 and 14.5 percent from the average of 1969-1963 to 2013. Housing starts rose 31.8 from 2000 to 2005 while housing permits grew 35.4 percent. From 1990 to 2000, housing starts increased 31.5 percent while permits increased 43.3 percent.

Table VA-7, US, Annual New Privately Owned Housing Units Authorized by Building Permits in Permit-Issuing Places and New Privately Owned Housing Units Started, Thousands

| Starts | Permits | |

| 2013 | 924.9 | 990.8 |

| 2012 | 780.6 | 829.7 |

| ∆% 2013/2012 | 18.5 | 19.4 |

| ∆% 2013/2011 | 51.9 | 58.8 |

| ∆% 2013/2010 | 57.6 | 63.9 |

| ∆% 2013/2006 | -48.6 | -46.1 |

| ∆% 2013/2005 | -55.3 | -54.0 |

| ∆% 2013/2000 | -41.0 | -37.8 |

| ∆% 2013/Av 1959-1963 | -35.3 | -14.5 |

| 2011 | 608.8 | 624.1 |

| ∆% 2012/2005 | -62.3 | -61.5 |

| ∆% 2012/2000 | -50.2 | -47.9 |

| ∆% 2012/Av 1959-1963 | -45.4 | -28.4 |

| 2011 | 608.8 | 624.1 |

| 2010 | 586.9 | 604.6 |

| 2009 | 554.0 | 583.0 |

| 2008 | 905.5 | 905.4 |

| 2007 | 1,355,0 | 1,398.4 |

| 2006 | 1,800.9 | 1,838.9 |

| 2005 | 2,068.3 | 2,155.3 |

| ∆% 2005/2000 | 31.8 | 35.4 |

| 2004 | 1,955.8 | 2,070.1 |

| 2003 | 1,847.7 | 1,889.2 |

| 2002 | 1,704.9 | 1,747.7 |

| 2001 | 1,602.7 | 1,636.7 |

| 2000 | 1,568.7 | 1,592.3 |

| ∆% 2000/1990 | 31.5 | 43.3 |

| 1990 | 1,192,7 | 1,110.8 |

| 1980 | 1,292.2 | 1,190.6 |

| 1970 | 1,433.6 | 1,351.5 |

| Average 1959-63 | 1,429.7 | 1,158.2 |

Source: US Census Bureau

http://www.census.gov/construction/nrc/

Risk aversion channels funds toward US long-term and short-term securities that finance the US balance of payments and fiscal deficits benefitting from risk flight to US dollar denominated assets. There are now temporary interruptions because of fear of rising interest rates that erode prices of US government securities because of mixed signals on monetary policy and exit from the Fed balance sheet of four trillion dollars of securities held outright. Net foreign purchases of US long-term securities (row C in Table VA-8) increased from minus $41.2 billion in Apr 2014 to $19.4 billion in May 2014. Foreign (residents) purchases minus sales of US long-term securities (row A in Table VA-8) in Apr 2014 of minus $14.0 billion increased to $34.6 billion in May 2014. Net US (residents) purchases of long-term foreign securities (row B in Table VA-8) improved from minus $27.2 billion in Apr 2014 to minus $15.2 billion in May 2014. In May 2014,

C = A + B = $34.6 billion - $15.2 billion = $19.4 billion