World Financial Turbulence, Squeeze of Economic Activity by Carry Trades Induced by Zero Interest Rates, United States Industrial Production, United States Producer Prices, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015

I United States Industrial Production

II United States Producer Prices

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIGB Adjustment during the Debt Crisis of the 1980s

V World Economic Slowdown. Table V-1 is constructed with the database of the IMF (http://www.imf.org/external/ns/cs.aspx?id=28) to show GDP in dollars in 2012 and the growth rate of real GDP of the world and selected regional countries from 2013 to 2016. The data illustrate the concept often repeated of “two-speed recovery” of the world economy from the recession of 2007 to 2009. The IMF has changed its forecast of the world economy to 3.3 percent in 2013 but accelerating to 3.3 percent in 2014, 3.8 percent in 2015 and 4.0 percent in 2016. Slow-speed recovery occurs in the “major advanced economies” of the G7 that account for $34,523 billion of world output of $72,688 billion, or 47.5 percent, but are projected to grow at much lower rates than world output, 1.9 percent on average from 2013 to 2016 in contrast with 3.6 percent for the world as a whole. While the world would grow 15.2 percent in the four years from 2013 to 2016, the G7 as a whole would grow 8.5 percent. The difference in dollars of 2012 is rather high: growing by 15.2 percent would add around $11.0 trillion of output to the world economy, or roughly, two times the output of the economy of Japan of $5,938 billion but growing by 8.0 percent would add $5.8 trillion of output to the world, or about the output of Japan in 2012. The “two speed” concept is in reference to the growth of the 150 countries labeled as emerging and developing economies (EMDE) with joint output in 2012 of $27,512 billion, or 37.8 percent of world output. The EMDEs would grow cumulatively 20.7 percent or at the average yearly rate of 4.8 percent, contributing $5.7 trillion from 2013 to 2016 or the equivalent of somewhat less than the GDP of $8,387 billion of China in 2012. The final four countries in Table V-1 often referred as BRIC (Brazil, Russia, India, China), are large, rapidly growing emerging economies. Their combined output in 2012 adds to $14,511 billion, or 19.9 percent of world output, which is equivalent to 42.0 percent of the combined output of the major advanced economies of the G7.

Table V-1, IMF World Economic Outlook Database Projections of Real GDP Growth

| GDP USD 2012 | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | |

| World | 72,688 | 3.3 | 3.3 | 3.8 | 4.0 |

| G7 | 34,523 | 1.5 | 1.7 | 2.3 | 2.3 |

| Canada | 1,709 | 2.0 | 2.3 | 2.4 | 2.4 |

| France | 2,688 | 0.3 | 0.4 | 1.0 | 1.6 |

| DE | 3,428 | 0.5 | 1.4 | 1.5 | 1.8 |

| Italy | 2,014 | -1.9 | -0.2 | 0.9 | 1.3 |

| Japan | 5,938 | 1.5 | 0.9 | 0.8 | 0.8 |

| UK | 2,471 | 1.7 | 3.2 | 2.7 | 2.4 |

| US | 16,163 | 2.2 | 2.2 | 3.1 | 3.0 |

| Euro Area | 12,220 | -0.4 | 0.8 | 1.3 | 1.7 |

| DE | 3,428 | 0.5 | 1.4 | 1.5 | 1.8 |

| France | 2,688 | 0.3 | 0.4 | 1.0 | 1.6 |

| Italy | 2,014 | -1.9 | -0.2 | 0.9 | 1.3 |

| POT | 212 | -1.4 | 1.0 | 1.5 | 1.7 |

| Ireland | 211 | -0.3 | 1.7 | 2.5 | 2.5 |

| Greece | 249 | -3.9 | 0.6 | 2.9 | 3.7 |

| Spain | 1,323 | -1.2 | 1.3 | 1.7 | 1.8 |

| EMDE | 27,512 | 4.7 | 4.4 | 5.0 | 5.2 |

| Brazil | 2,248 | 2.5 | 0.3 | 1.4 | 2.2 |

| Russia | 2,017 | 1.3 | 0.2 | 0.5 | 1.5 |

| India | 1,859 | 5.0 | 5.6 | 6.4 | 6.5 |

| China | 8,387 | 7.7 | 7.4 | 7.1 | 6.8 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries); POT: Portugal

Source: IMF World Economic Outlook databank http://www.imf.org/external/ns/cs.aspx?id=28

Continuing high rates of unemployment in advanced economies constitute another characteristic of the database of the WEO (http://www.imf.org/external/ns/cs.aspx?id=28). Table V-2 is constructed with the WEO database to provide rates of unemployment from 2012 to 2016 for major countries and regions. In fact, unemployment rates for 2013 in Table I-2 are high for all countries: unusually high for countries with high rates most of the time and unusually high for countries with low rates most of the time. The rates of unemployment are particularly high in 2013 for the countries with sovereign debt difficulties in Europe: 16.2 percent for Portugal (POT), 13.0 percent for Ireland, 27.3 percent for Greece, 26.1 percent for Spain and 12.2 percent for Italy, which is lower but still high. The G7 rate of unemployment is 7.1 percent. Unemployment rates are not likely to decrease substantially if slow growth persists in advanced economies.

Table V-2, IMF World Economic Outlook Database Projections of Unemployment Rate as Percent of Labor Force

| % Labor Force 2012 | % Labor Force 2013 | % Labor Force 2014 | % Labor Force 2015 | % Labor Force 2016 | |

| World | NA | NA | NA | NA | NA |

| G7 | 7.4 | 7.1 | 6.5 | 6.3 | 6.1 |

| Canada | 7.3 | 7.1 | 7.0 | 6.9 | 6.8 |

| France | 9.8 | 10.3 | 10.0 | 10.0 | 9.9 |

| DE | 5.5 | 5.3 | 5.3 | 5.3 | 5.3 |

| Italy | 10.7 | 12.2 | 12.6 | 12.0 | 11.3 |

| Japan | 4.3 | 4.0 | 3.7 | 3.8 | 3.8 |

| UK | 8.0 | 7.6 | 6.3 | 5.8 | 5.5 |

| US | 8.1 | 7.4 | 6.3 | 5.9 | 5.8 |

| Euro Area | 11.3 | 11.9 | 11.6 | 11.2 | 10.7 |

| DE | 5.5 | 5.3 | 5.3 | 5.3 | 5.3 |

| France | 9.8 | 10.3 | 10.0 | 10.0 | 9.9 |

| Italy | 10.7 | 12.2 | 12.6 | 12.0 | 11.3 |

| POT | 15.5 | 16.2 | 14.2 | 13.5 | 13.0 |

| Ireland | 14.7 | 13.0 | 11.2 | 10.5 | 10.1 |

| Greece | 24.2 | 27.3 | 25.8 | 23.8 | 20.9 |

| Spain | 24.8 | 26.1 | 24.6 | 23.5 | 22.4 |

| EMDE | NA | NA | NA | NA | NA |

| Brazil | 5.5 | 5.4 | 5.5 | 6.1 | 5.9 |

| Russia | 5.5 | 5.5 | 5.6 | 6.5 | 6.0 |

| India | NA | NA | NA | NA | NA |

| China | 4.1 | 4.1 | 4.1 | 4.1 | 4.1 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries)

Source: IMF World Economic Outlook databank http://www.imf.org/external/ns/cs.aspx?id=28

Table V-3 provides the latest available estimates of GDP for the regions and countries followed in this blog from IQ2012 to IIIQ2014 available now for all countries. There are preliminary estimates for most countries for IVQ2014. Growth is weak throughout most of the world.

- Japan. The GDP of Japan increased 1.1 percent in IQ2012, 4.4 percent at SAAR (seasonally adjusted annual rate) and 3.5 percent relative to a year earlier but part of the jump could be the low level a year earlier because of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan is experiencing difficulties with the overvalued yen because of worldwide capital flight originating in zero interest rates with risk aversion in an environment of softer growth of world trade. Japan’s GDP fell 0.4 percent in IIQ2012 at the seasonally adjusted annual rate (SAAR) of minus 1.5 percent, which is much lower than 4.4 percent in IQ2012. Growth of 3.5 percent in IIQ2012 in Japan relative to IIQ2011 has effects of the low level of output because of Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan’s GDP contracted 0.6 percent in IIIQ2012 at the SAAR of minus 2.2 percent and increased 0.2 percent relative to a year earlier. Japan’s GDP decreased 0.2 percent in IVQ2012 at the SAAR of minus 0.7 percent and changed 0.0 percent relative to a year earlier. Japan grew 1.4 percent in IQ2013 at the SAAR of 5.7 percent and increased 0.5 percent relative to a year earlier. Japan’s GDP increased 0.8 percent in IIQ2013 at the SAAR of 3.2 percent and increased 1.4 percent relative to a year earlier. Japan’s GDP grew 0.4 percent in IIIQ2013 at the SAAR of 1.5 percent and increased 2.2 percent relative to a year earlier. In IVQ2013, Japan’s GDP decreased 0.4 percent at the SAAR of minus 1.4 percent, increasing 2.3 percent relative to a year earlier. Japan’s GDP increased 1.3 percent in IQ2014 at the SAAR of 5.5 percent and increased 2.4 percent relative to a year earlier. In IIQ2014, Japan’s GDP fell 1.7 percent at the SAAR of minus 6.7 percent and fell 0.4 percent relative to a year earlier. Japan’s GDP contracted 0.6 percent in IIIQ2014 at the SAAR of minus 2.3 percent and fell 1.4 percent relative to a year earlier. In IVQ2014, Japan’s GDP grew 0.6 percent, at the SAAR of 2.2 percent, decreasing 0.5 percent relative to a year earlier.

- China. China’s GDP grew 1.4 percent in IQ2012, annualizing to 5.7 percent, and 8.1 percent relative to a year earlier. The GDP of China grew at 2.1 percent in IIQ2012, which annualizes to 8.7 percent and 7.6 percent relative to a year earlier. China grew at 2.0 percent in IIIQ2012, which annualizes at 8.2 percent and 7.4 percent relative to a year earlier. In IVQ2012, China grew at 1.9 percent, which annualizes at 7.8 percent, and 7.9 percent in IVQ2012 relative to IVQ2011. In IQ2013, China grew at 1.7 percent, which annualizes at 7.0 percent and 7.8 percent relative to a year earlier. In IIQ2013, China grew at 1.8 percent, which annualizes at 7.4 percent and 7.5 percent relative to a year earlier. China grew at 2.3 percent in IIIQ2013, which annualizes at 9.5 percent and 7.9 percent relative to a year earlier. China grew at 1.8 percent in IVQ2013, which annualized to 7.4 percent and 7.6 percent relative to a year earlier. China’s GDP grew 1.6 percent in IQ2014, which annualizes to 6.6 percent, and 7.4 percent relative to a year earlier. China’s GDP grew 1.9 percent in IIQ2014, which annualizes at 7.8 percent, and 7.5 percent relative to a year earlier. China’s GDP grew 1.9 percent in IIIQ2014, which is equivalent to 7.8 percent in a year, and 7.3 percent relative to a year earlier. The GDP of China grew 1.5 percent in IVQ2014, which annualizes at 6.1 percent, and 7.3 percent relative to a year earlier. There is decennial change in leadership in China (http://www.xinhuanet.com/english/special/18cpcnc/index.htm). Growth rates of GDP of China in a quarter relative to the same quarter a year earlier have been declining from 2011 to 2014.

- Euro Area. GDP fell 0.1 percent in the euro area in IQ2012 and decreased 0.3 in IQ2012 relative to a year earlier. Euro area GDP contracted 0.3 percent IIQ2012 and fell 0.6 percent relative to a year earlier. In IIIQ2012, euro area GDP fell 0.1 percent and declined 0.8 percent relative to a year earlier. In IVQ2012, euro area GDP fell 0.4 percent relative to the prior quarter and fell 0.9 percent relative to a year earlier. In IQ2013, the GDP of the euro area fell 0.4 percent and decreased 1.2 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IIQ2013 and fell 0.6 percent relative to a year earlier. In IIIQ2013, euro area GDP increased 0.2 percent and fell 0.3 percent relative to a year earlier. The GDP of the euro area increased 0.2 percent in IVQ2013 and increased 0.4 percent relative to a year earlier. In IQ2014, the GDP of the euro area increased 0.3 percent and 1.1 percent relative to a year earlier. The GDP of the euro area increased 0.1 percent in IIQ2014 and increased 0.8 percent relative to a year earlier. The euro area’s GDP increased 0.2 percent in IIIQ2014 and increased 0.8 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IVQ2014 and increased 0.9 percent relative to a year earlier.

- Germany. The GDP of Germany increased 0.3 percent in IQ2012 and 1.5 percent relative to a year earlier. In IIQ2012, Germany’s GDP increased 0.1 percent and increased 0.3 percent relative to a year earlier but 0.8 percent relative to a year earlier when adjusted for calendar (CA) effects. In IIIQ2012, Germany’s GDP increased 0.1 percent and 0.1 percent relative to a year earlier. Germany’s GDP contracted 0.4 percent in IVQ2012 and decreased 0.3 percent relative to a year earlier. In IQ2013, Germany’s GDP decreased 0.4 percent and fell 1.8 percent relative to a year earlier. In IIQ2013, Germany’s GDP increased 0.8 percent and 0.5 percent relative to a year earlier. The GDP of Germany increased 0.3 percent in IIIQ2013 and 0.8 percent relative to a year earlier. In IVQ2013, Germany’s GDP increased 0.4 percent and 1.0 percent relative to a year earlier. The GDP of Germany increased 0.8 percent in IQ2014 and 2.6 percent relative to a year earlier. In IIQ2014, Germany’s GDP contracted 0.1 percent and increased 1.0 percent relative to a year earlier. The GDP of Germany increased 0.1 percent in IIIQ2014 and increased 1.2 percent relative to a year earlier. Germany’s GDP increased 0.7 percent in IVQ2014 and increased 1.6 percent relative to a year earlier.

- United States. Growth of US GDP in IQ2012 was 0.6 percent, at SAAR of 2.3 percent and higher by 2.6 percent relative to IQ2011. US GDP increased 0.4 percent in IIQ2012, 1.6 percent at SAAR and 2.3 percent relative to a year earlier. In IIIQ2012, US GDP grew 0.6 percent, 2.5 percent at SAAR and 2.7 percent relative to IIIQ2011. In IVQ2012, US GDP grew 0.0 percent, 0.1 percent at SAAR and 1.6 percent relative to IVQ2011. In IQ2013, US GDP grew at 2.7 percent SAAR, 0.7 percent relative to the prior quarter and 1.7 percent relative to the same quarter in 2013. In IIQ2013, US GDP grew at 1.8 percent in SAAR, 0.4 percent relative to the prior quarter and 1.8 percent relative to IIQ2012. US GDP grew at 4.5 percent in SAAR in IIIQ2013, 1.1 percent relative to the prior quarter and 2.3 percent relative to the same quarter a year earlier (http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/growth-uncertainties-mediocre-cyclical.html) with weak hiring (http://cmpassocregulationblog.blogspot.com/2015/02/g20-monetary-policy-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/global-financial-and-economic-risk.html). In IVQ2013, US GDP grew 0.9 percent at 3.5 percent SAAR and 3.1 percent relative to a year earlier. In IQ2014, US GDP decreased 0.5 percent, increased 1.9 percent relative to a year earlier and fell 2.1 percent at SAAR. In IIQ2014, US GDP increased 1.1 percent at 4.6 percent SAAR and increased 2.6 percent relative to a year earlier. US GDP increased 1.2 percent in IIIQ2014 at 5.0 percent SAAR and increased 2.7 percent relative to a year earlier. In IVQ2014, US GDP increased 0.7 percent at SAAR of 2.6 percent and increased 2.5 percent relative to a year earlier.

- United Kingdom. In IQ2012, UK GDP increased 0.1 percent, increasing 1.0 percent relative to a year earlier. UK GDP fell 0.2 percent in IIQ2012 and increased 0.6 percent relative to a year earlier. UK GDP increased 0.8 percent in IIIQ2012 and increased 0.7 percent relative to a year earlier. UK GDP fell 0.3 percent in IVQ2012 relative to IIIQ2012 and increased 0.4 percent relative to a year earlier. UK GDP increased 0.6 percent in IQ2013 and 0.9 percent relative to a year earlier. UK GDP increased 0.6 percent in IIQ2013 and 1.7 percent relative to a year earlier. In IIIQ2013, UK GDP increased 0.7 percent and 1.6 percent relative to a year earlier. UK GDP increased 0.4 percent in IVQ2013 and 2.4 percent relative to a year earlier. In IQ2014, UK GDP increased 0.6 percent and 2.4 percent relative to a year earlier. UK GDP increased 0.8 percent in IIQ2014 and 2.6 percent relative to a year earlier. In IIIQ2014, UK GDP increased 0.7 percent and increased 2.6 percent relative to a year earlier. UK GDP increased 0.5 percent in IVQ2014 and increased 2.7 percent relative to a year earlier.

- Italy. Italy has experienced decline of GDP in nine consecutive quarters from IIIQ2011 to IIIQ2013 and in IIQ2014 and IIIQ2014. Italy’s GDP fell 0.9 percent in IQ2012 and declined 1.9 percent relative to IQ2011. Italy’s GDP fell 0.4 percent in IIQ2012 and declined 2.4 percent relative to a year earlier. In IIIQ2012, Italy’s GDP fell 0.4 percent and declined 2.5 percent relative to a year earlier. The GDP of Italy contracted 0.8 percent in IVQ2012 and fell 2.5 percent relative to a year earlier. In IQ2013, Italy’s GDP contracted 0.9 percent and fell 2.5 percent relative to a year earlier. Italy’s GDP fell 0.2 percent in IIQ2013 and 2.2 percent relative to a year earlier. The GDP of Italy changed 0.0 percent in IIIQ2013 and declined 1.8 percent relative to a year earlier. Italy’s GDP decreased 0.1 percent in IVQ2013 and decreased 1.2 percent relative to a year earlier. In IQ2014, Italy’s GDP changed 0.0 percent and fell 0.3 percent relative to a year earlier. The GDP of Italy fell 0.2 percent in IIQ2014 and declined 0.4 percent relative to a year earlier. In IIIQ2014, Italy’s GDP contracted 0.1 percent and fell 0.5 percent relative to a year earlier. The GDP of Italy changed 0.0 percent in IVQ20214 and declined 0.3 percent relative to a year earlier

- France. France’s GDP increased 0.2 percent in IQ2012 and increased 0.6 percent relative to a year earlier. France’s GDP decreased 0.3 percent in IIQ2012 and increased 0.4 percent relative to a year earlier. In IIIQ2012, France’s GDP increased 0.2 percent and increased 0.4 percent relative to a year earlier. France’s GDP fell 0.2 percent in IVQ2012 and changed 0.0 percent relative to a year earlier. In IQ2013, France’s GDP changed 0.0 percent and declined 0.2 percent relative to a year earlier. The GDP of France increased 0.7 percent in IIQ2013 and 0.7 percent relative to a year earlier. France’s GDP decreased 0.1 percent in IIIQ2013 and increased 0.3 percent relative to a year earlier. The GDP of France increased 0.3 percent in IVQ2013 and 0.8 percent relative to a year earlier. In IQ2014, France’s GDP changed 0.0 percent and increased 0.8 percent relative to a year earlier. In IIQ2014, France’s GDP contracted 0.1 percent and changed 0.0 percent relative to a year earlier. France’s GDP increased 0.3 percent in IIIQ2014 and increased 0.4 percent relative to a year earlier. The GDP of France increased 0.1 percent in IVQ2014 and increased 0.2 percent relative to a year earlier

Table V-3, Percentage Changes of GDP Quarter on Prior Quarter and on Same Quarter Year Earlier, ∆%

| IQ2012/IVQ2011 | IQ2012/IQ2011 | |

| United States | QOQ: 0.6 SAAR: 2.3 | 2.6 |

| Japan | QOQ: 1.1 SAAR: 4.4 | 3.5 |

| China | 1.4 | 8.1 |

| Euro Area | -0.1 | -0.3 |

| Germany | 0.3 | 1.5 |

| France | 0.2 | 0.6 |

| Italy | -0.9 | -1.9 |

| United Kingdom | 0.1 | 1.0 |

| IIQ2012/IQ2012 | IIQ2012/IIQ2011 | |

| United States | QOQ: 0.4 SAAR: 1.6 | 2.3 |

| Japan | QOQ: -0.4 | 3.5 |

| China | 2.1 | 7.6 |

| Euro Area | -0.3 | -0.6 |

| Germany | 0.1 | 0.3 0.8 CA |

| France | -0.3 | 0.4 |

| Italy | -0.4 | -2.4 |

| United Kingdom | -0.2 | 0.6 |

| IIIQ2012/ IIQ2012 | IIIQ2012/ IIIQ2011 | |

| United States | QOQ: 0.6 | 2.7 |

| Japan | QOQ: –0.6 | 0.2 |

| China | 2.0 | 7.4 |

| Euro Area | -0.1 | -0.8 |

| Germany | 0.1 | 0.1 |

| France | 0.2 | 0.4 |

| Italy | -0.4 | -2.5 |

| United Kingdom | 0.8 | 0.7 |

| IVQ2012/IIIQ2012 | IVQ2012/IVQ2011 | |

| United States | QOQ: 0.0 | 1.6 |

| Japan | QOQ: -0.2 SAAR: -0.7 | 0.0 |

| China | 1.9 | 7.9 |

| Euro Area | -0.4 | -0.9 |

| Germany | -0.4 | -0.3 |

| France | -0.2 | 0.0 |

| Italy | -0.8 | -2.5 |

| United Kingdom | -0.3 | 0.4 |

| IQ2013/IVQ2012 | IQ2013/IQ2012 | |

| United States | QOQ: 0.7 | 1.7 |

| Japan | QOQ: 1.4 SAAR: 5.7 | 0.5 |

| China | 1.7 | 7.8 |

| Euro Area | -0.4 | -1.2 |

| Germany | -0.4 | -1.8 |

| France | 0.0 | -0.2 |

| Italy | -0.9 | -2.5 |

| UK | 0.6 | 0.9 |

| IIQ2013/IQ2013 | IIQ2013/IIQ2012 | |

| United States | QOQ: 0.4 SAAR: 1.8 | 1.8 |

| Japan | QOQ: 0.8 SAAR: 3.2 | 1.4 |

| China | 1.8 | 7.5 |

| Euro Area | 0.3 | -0.6 |

| Germany | 0.8 | 0.5 |

| France | 0.7 | 0.7 |

| Italy | -0.2 | -2.2 |

| UK | 0.6 | 1.7 |

| IIIQ2013/IIQ2013 | III/Q2013/ IIIQ2012 | |

| USA | QOQ: 1.1 | 2.3 |

| Japan | QOQ: 0.4 SAAR: 1.5 | 2.2 |

| China | 2.3 | 7.9 |

| Euro Area | 0.2 | -0.3 |

| Germany | 0.3 | 0.8 |

| France | -0.1 | 0.3 |

| Italy | 0.0 | -1.8 |

| UK | 0.7 | 1.6 |

| IVQ2013/IIIQ2013 | IVQ2013/IVQ2012 | |

| USA | QOQ: 0.9 SAAR: 3.5 | 3.1 |

| Japan | QOQ: -0.4 SAAR: -1.4 | 2.3 |

| China | 1.8 | 7.6 |

| Euro Area | 0.2 | 0.4 |

| Germany | 0.4 | 1.0 |

| France | 0.3 | 0.8 |

| Italy | -0.1 | -1.2 |

| UK | 0.4 | 2.4 |

| IQ2014/IVQ2013 | IQ2014/IQ2013 | |

| USA | QOQ -0.5 SAAR -2.1 | 1.9 |

| Japan | QOQ: 1.3 SAAR: 5.5 | 2.4 |

| China | 1.6 | 7.4 |

| Euro Area | 0.3 | 1.1 |

| Germany | 0.8 | 2.6 |

| France | 0.0 | 0.8 |

| Italy | 0.0 | -0.3 |

| UK | 0.6 | 2.4 |

| IIQ2014/IQ2014 | IIQ2014/IIQ2013 | |

| USA | QOQ 1.1 SAAR 4.6 | 2.6 |

| Japan | QOQ: -1.7 SAAR: -6.7 | -0.4 |

| China | 1.9 | 7.5 |

| Euro Area | 0.1 | 0.8 |

| Germany | -0.1 | 1.0 |

| France | -0.1 | 0.0 |

| Italy | -0.2 | -0.4 |

| UK | 0.8 | 2.6 |

| IIIQ2014/IIQ2014 | IIIQ2014/IIIQ2013 | |

| USA | QOQ: 1.2 SAAR: 5.0 | 2.7 |

| Japan | QOQ: -0.6 SAAR: -2.3 | -1.4 |

| China | 1.9 | 7.3 |

| Euro Area | 0.2 | 0.8 |

| Germany | 0.1 | 1.2 |

| France | 0.3 | 0.4 |

| Italy | -0.1 | -0.4 |

| UK | 0.7 | 2.6 |

| IVQ2014/IIIQ2014 | IVQ2014/IVQ2013 | |

| USA | QOQ: 0.7 SAAR: 2.6 | 2.5 |

| Japan | QOQ: 0.6 SAAR: 2.2 | -0.5 |

| China | 1.5 | 7.3 |

| Euro Area | 0.3 | 0.9 |

| Germany | 0.7 | 1.6 |

| France | 0.1 | 0.2 |

| Italy | 0.0 | -0.3 |

| UK | 0.5 | 2.7 |

QOQ: Quarter relative to prior quarter; SAAR: seasonally adjusted annual rate

Source: Country Statistical Agencies http://www.census.gov/aboutus/stat_int.html

Table V-4 provides two types of data: growth of exports and imports in the latest available months and in the past 12 months; and contributions of net trade (exports less imports) to growth of real GDP.

- Japan. Japan provides the most worrisome data (Section VB and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2014/07/world-inflation-waves-united-states.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html and earlier http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-zero-interest-rates-world.html http://cmpassocregulationblog.blogspot.com/2013/11/global-financial-risk-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations_8763.html http://cmpass ocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html and earlier http://cmpassocregulationblog.blogspot.com/2013/07/duration-dumping-steepening-yield-curve.html and earlier http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and_4699.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2013/03/united-states-commercial-banks-assets.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/world-inflation-waves-united-states.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/thirty-one-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2012/12/mediocre-and-decelerating-united-states_24.html and earlier http://cmpassocregulationblog.blogspot.com/2012/11/contraction-of-united-states-real_25.html and for GDP http://cmpassocregulationblog.blogspot.com/2013/09/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html and earlier http://cmpassocreulationblog.blogspot.com/2013/02/recovery-without-hiring-united-states.html). In Jan 2015, Japan’s exports increased 17.0 percent in 12 months while imports decreased 9.0 percent. The second part of Table V-4 shows that net trade deducted 1.4 percentage points from Japan’s growth of GDP in IIQ2012, deducted 1.9 percentage points from GDP growth in IIIQ2012 and deducted 0.4 percentage points from GDP growth in IVQ2012. Net trade added 0.3 percentage points to GDP growth in IQ2012, 1.6 percentage points in IQ2013 and 0.2 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.5 percentage points from GDP growth in Japan. Net trade ducted 2.1 percentage points from GDP growth in Japan in IVQ2013. Net trade deducted 1.2 percentage point from GDP growth of Japan in IQ2014. Net trade added 4.2 percentage points to GDP growth in IIQ2014. Net trade added 0.2 percentage points to GDP growth in IIIQ2014 and added 0.9 percentage points in IVQ2014.

- China. In Jan 2015, China exports decreased 3.3 percent relative to a year earlier and imports decreased 19.9 percent.

- Germany. Germany’s exports increased 3.4 percent in the month of Dec 2014 and increased 10.0 percent in the 12 months ending in Dec 2014. Germany’s imports decreased 0.8 percent in the month of Dec 2014 and increased 4.0 percent in the 12 months ending in Dec. Net trade contributed 0.8 percentage points to growth of GDP in IQ2012, contributed 0.4 percentage points in IIQ2012, contributed 0.3 percentage points in IIIQ2012, deducted 0.5 percentage points in IVQ2012, deducted 0.3 percentage points in IQ2013 and added 0.1 percentage points in IIQ2013. Net traded deducted 0.5 percentage points from Germany’s GDP growth in IIIQ2013 and added 0.5 percentage points to GDP growth in IVQ2013. Net trade deducted 0.1 percentage points from GDP growth in IQ2014. Net trade added 0.1 percentage points to GDP growth in IIQ2014 and added 0.2 percentage points in IIIQ2014.

- United Kingdom. Net trade contributed 0.7 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.7 percentage points from UK growth. Net trade contributed 0.1 percentage points to UK value added in IVQ2013. Net trade contributed 0.6 percentage points to UK value added in IQ2014 and 0.3 percentage points in IIQ2014. Net trade deducted 0.2 percentage points to GDP growth in IIIQ2014.

- France. France’s exports increased 1.8 percent in Dec 2014 while imports increased 2.6 percent. France’s exports increased 3.7 percent in the 12 months ending in Dec 2014 and imports decreased 1.4 percent relative to a year earlier. Net traded added 0.1 percentage points to France’s GDP in IIIQ2012 and 0.1 percentage points in IVQ2012. Net trade deducted 0.1 percentage points from France’s GDP growth in IQ2013 and added 0.3 percentage points in IIQ2013, deducting 1.7 percentage points in IIIQ2013. Net trade added 0.1 percentage points to France’s GDP in IVQ2013 and deducted 0.1 percentage points in IQ2014. Net trade deducted 0.2 percentage points from France’s GDP growth in IIQ2014 and deducted 0.2 percentage points in IIIQ2014. Net trade added 0.1 percentage points to France’s GDP growth in IVQ2014.

United States. US exports increased 0.8 percent in Dec 2014 and goods exports increased 2.8 percent in Jan-Dec 2014 relative to a year earlier. Imports increased 2.2 percent in Dec 2014 and goods imports increased 3.04 percent in Jan-Dec 2014 relative to a year earlier. Net trade deducted 0.04 percentage points from GDP growth in IIQ2012 and added 0.39 percentage points in IIIQ2012 and 0.79 percentage points in IVQ2012. Net trade deducted 0.08 percentage points from US GDP growth in IQ2013 and deducted 0.54 percentage points in IIQ2013. Net traded added 0.59 percentage points to US GDP growth in IIIQ2013. Net trade added 1.08 percentage points to US GDP growth in IVQ2013. Net trade deducted 1.66 percentage points from US GDP growth in IQ2014 and deducted 0.34 percentage points in IIQ2014. Net trade added 0.78 percentage points to IIIQ2014. . Industrial production increased 0.2 percent in Jan 2015 and decreased 0.3 percent in Dec 2014 after increasing 1.1 percent in Nov 2014. The Federal Reserve completed its annual revision of industrial production and capacity utilization on Mar 28, 2014 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm). The report of the Board of Governors of the Federal Reserve System states (http://www.federalreserve.gov/releases/g17/Current/default.htm):

“Industrial production increased 0.2 percent in January after decreasing 0.3 percent in December. The rates of change in output for September through December are all slightly lower than previously published; even so, production is estimated to have advanced at an annual rate of 4.3 percent in the fourth quarter of last year. In January, manufacturing output moved up 0.2 percent and was 5.6 percent above its year-earlier level. The index for mining decreased 1.0 percent, with the decline more than accounted for by a substantial drop in the index for oil and gas well drilling and related support activities. The output of utilities increased 2.3 percent. At 106.2 percent of its 2007 average, total industrial production in January was 4.8 percent above its level of a year earlier. Capacity utilization for the industrial sector was unchanged in January at 79.4 percent, a rate that is 0.7 percentage point below its long-run (1972–2014) average.”

In the six months ending in Jan 2015, United States national industrial production accumulated increase of 1.6 percent at the annual equivalent rate of 3.2 percent, which is lower than growth of 4.8 percent in the 12 months ending in Jan 2015. Excluding growth of 1.1 percent in Nov 2014, growth in the remaining five months from Aug 2014 to Jan 2015 accumulated to 0.5 percent or 1.2 percent annual equivalent. Industrial production declined in two of the past six months. Industrial production expanded at annual equivalent 4.1 percent in the most recent quarter from Nov 2014 to Jan 2015 and at 2.4 percent in the prior quarter Aug to Oct 2014. Business equipment accumulated growth of 1.4 percent in the six months from Aug 2014 to Jan 2015 at the annual equivalent rate of 2.8 percent, which is lower than growth of 7.3 percent in the 12 months ending in Jan 2015. The Fed analyzes capacity utilization of total industry in its report (http://www.federalreserve.gov/releases/g17/Current/default.htm): “Capacity utilization for the industrial sector was unchanged in January at 79.4 percent, a rate that is 0.7 percentage point below its long-run (1972–2014) average.” United States industry apparently decelerated to a lower growth rate followed by possible acceleration and oscillating growth in past months.

Manufacturing fell 21.9 from the peak in Jun 2007 to the trough in Apr 2009 and increased by 25.2 percent from the trough in Apr 2009 to Dec 2014. Manufacturing grew 24.2 percent from the trough in Apr 2009 to Jan 2015. Manufacturing output in Jan 2015 is 3.1 percent below the peak in Jun 2007. Growth at trend in the entire cycle from IVQ2007 to IVQ2014 would have accumulated to 23.0 percent. GDP in IVQ2014 would be $18,438.0 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2,126.4 billion than actual $16,311.6 billion. There are about two trillion dollars of GDP less than at trend, explaining the 28.3 million unemployed or underemployed equivalent to actual unemployment of 17.1 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html and earlier http://cmpassocregulationblog.blogspot.com/2015/01/fluctuating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/financial-risks-twenty-six-million.html). US GDP in IVQ2014 is 11.5 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,311.6 billion in IVQ2014 or 8.8 percent at the average annual equivalent rate of 1.2 percent. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth at average 3.3 percent per year from Jan 1919 to Jan 2015. Growth at 3.3 percent per year would raise the NSA index of manufacturing output from 99.2392 in Dec 2007 to 124.8993 in Jan 2015. The actual index NSA in Jan 2015 is 99.8883, which is 20.0 percent below trend. Manufacturing output grew at average 2.4 percent between Dec 1986 and Dec 2014, raising the index at trend to 117.3927 in Jan 2015. The output of manufacturing at 99.8883 in Jan 2015 is 14.9 percent below trend under this alternative calculation.

Table V-4, Growth of Trade and Contributions of Net Trade to GDP Growth, ∆% and % Points

| Exports | Exports 12 M ∆% | Imports | Imports 12 M ∆% | |

| USA | 0.8 Dec | 2.8 Jan-Dec | 2.2 Nov | 3.4 Jan-Dec |

| Japan | Jan 2015 17.0 Dec 12.9 Nov 4.9 Oct 9.6 Sep 6.9 Aug -1.3 Jul 3.9 Jun -2.0 May 2014 -2.7 Apr 2014 5.1 Mar 2014 1.8 Feb 2014 9.5 Jan 2014 9.5 Dec 2013 15.3 Nov 2013 18.4 Oct 2013 18.6 Sep 2013 11.5 Aug 2013 14.7 Jul 2013 12.2 Jun 2013 7.4 May 2013 10.1 Apr 2013 3.8 Mar 2013 1.1 Feb 2013 -2.9 Jan 2013 6.4 Dec -5.8 Nov -4.1 Oct -6.5 Sep -10.3 Aug -5.8 Jul -8.1 | Jan 2015 -9.0 Dec 1.9 Nov -1.7 Oct 2.7 Sep 6.2 Aug -1.5 Jul 2.3 Jun 8.4 May 2014 -3.6 Apr 2013 3.4 Mar 2014 18.1 Feb 2014 9.0 Jan 2014 25.0 Dec 2013 24.7 Nov 2013 21.1 Oct 2013 26.1 Sep 2013 16.5 Aug 2013 16.0 Jul 2013 19.6 Jun 2013 11.8 May 2013 10.0 Apr 2013 9.4 Mar 2013 5.5 Feb 2013 7.3 Jan 2013 7.3 Dec 1.9 Nov 0.8 Oct -1.6 Sep 4.1 Aug -5.4 Jul 2.1 | ||

| China | 2015 -3.3 Jan 2014 9.7 Dec 4.7 Nov 11.6 Oct 15.3 Sep 9.4 Aug 14.5 Jul 7.2 Jun 7.0 May 0.9 Apr -6.6 Mar -18.1 Feb 10.6 Jan 2013 4.3 Dec 12.7 Nov 5.6 Oct -0.3 Sep 7.2 Aug 5.1 Jul -3.1 Jun 1.0 May 14.7 Apr 10.0 Mar 21.8 Feb 25.0 Jan | 2015 -19.9 Jan 2014 -2.4 Dec -6.7 Nov 4.6 Oct 7.0 Sep -2.4 Aug -1.6 Jul 5.5 Jun -1.6 May -0.8 Apr -11.3 Mar 10.1 Feb 10.0 Jan 2013 8.3 Dec 5.3 Nov 7.6 Oct 7.4 Sep 7.0 Aug 10.9 Jul -0.7 Jun -0.3 May 16.8 Apr 14.1 Mar -15.2 Feb 28.8 Jan | ||

| Euro Area | 8.0 12-M Dec | 2.4 Jan-Dec | 1.0 12-M Dec | 0.1 Jan-Dec |

| Germany | 3.4 Dec CSA | 10.0 Dec | -0.8 Dec CSA | 4.0 Nov |

| France Dec | 1.8 | 3.7 | 2.6 | -1.4 |

| Italy Dec | 2.6 | 6.3 | -1.6 | -1.3 |

| UK | -0.2 Dec | -0.1 Oct-Dec 14 /Oct-Dec 13 | -2.2 Dec | -2.2 Oct-Dec 14/Oct-Dec 13 |

| Net Trade % Points GDP Growth | % Points | |||

| USA | IIIQ2014 0.78 IIQ2014 -0.34 IQ2014 -1.66 IVQ2013 1.08 IIIQ2013 0.59 IIQ2013 -0.54 IQ2013 -0.08 IVQ2012 +0.79 IIIQ2012 0.39 IIQ2012 -0.04 IQ2012 -0.11 | |||

| Japan | 0.3 IQ2012 -1.4 IIQ2012 -1.9 IIIQ2012 -0.4 IVQ2012 1.6 IQ2013 0.2 IIQ2013 -1.5 IIIQ2013 -2.1 IVQ2013 -1.2 IQ2014 4.2 IIQ2014 0.2 IIIQ2014 0.9 IVQ2014 | |||

| Germany | IQ2012 0.8 IIQ2012 0.4 IIIQ2012 0.3 IVQ2012 -0.5 IQ2013 -0.3 IIQ2013 0.1 IIIQ2013 -0.5 IVQ2013 0.5 IQ2014 -0.1 IIQ2014 0.1 IIIQ2014 0.2 | |||

| France | 0.1 IIIQ2012 0.1 IVQ2012 -0.1 IQ2013 0.3 IIQ2013 -1.7 IIIQ2013 0.1 IVQ2013 -0.1 IQ2014 -0.2 IIQ2014 -0.2 IIIQ2014 0.1 IVQ2014 | |||

| UK | 0.7 IIQ2013 -1.7 IIIQ2013 0.1 IVQ2013 0.6 IQ2014 0.3 IIQ2014 -0.2 IIIQ2014 |

Sources: Country Statistical Agencies http://www.census.gov/foreign-trade/

The geographical breakdown of exports and imports of Japan with selected regions and countries is in Table VB-5 for Jan 2015. The share of Asia in Japan’s trade is close to one-half for 53.9 percent of exports and 48.7 percent of imports. Within Asia, exports to China are 17.0 percent of total exports and imports from China 24.3 percent of total imports. While exports to China increased 20.8 percent in the 12 months ending in Jan 2015, imports from China decreased 6.9 percent. The largest export market for Japan in Jan 2015 is the US with share of 19.4 percent of total exports, which is close to that of China, and share of imports from the US of 8.8 percent in total imports. Japan’s exports to the US increased 16.5 percent in the 12 months ending in Jan 2015 and imports from the US decreased 1.4 percent. Western Europe has share of 10.9 percent in Japan’s exports and of 10.1 percent in imports. Rates of growth of exports of Japan in Jan 2015 are 16.5 percent for exports to the US, 6.6 percent for exports to Brazil and 0.4 percent for exports to Germany. Comparisons relative to 2011 may have some bias because of the effects of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Deceleration of growth in China and the US and threat of recession in Europe can reduce world trade and economic activity. Growth rates of imports in the 12 months ending in Jan 2015 are mixed. Imports from Asia decreased 3.0 percent in the 12 months ending in Jan 2015 while imports from China decreased 3.0 percent. Data are in millions of yen, which may have effects of recent depreciation of the yen relative to the United States dollar (USD).

Table VB-5, Japan, Value and 12-Month Percentage Changes of Exports and Imports by Regions and Countries, ∆% and Millions of Yen

| Jan 2015 | Exports | 12 months ∆% | Imports Millions Yen | 12 months ∆% |

| Total | 6,144,713 | 17.0 | 7,322,176 | -9.0 |

| Asia | 3,314,119 % Total 53.9 | 22.7 | 3,562,992 % Total 48.7 | -3.0 |

| China | 1,041,905 % Total 17.0 | 20.8 | 1,778,299 % Total 24.3 | -6.9 |

| USA | 1,192,663 % Total 19.4 | 16.5 | 647,255 % Total 8.8 | -1.4 |

| Canada | 78,303 | 20.8 | 93,241 | 5.2 |

| Brazil | 40,584 | 6.6 | 86,272 | -14.3 |

| Mexico | 87,868 | 21.2 | 38,506 | 7.0 |

| Western Europe | 671,916 % Total 10.9 | 8.2 | 741,708 % Total 10.1 | -3.3 |

| Germany | 160,392 | 0.4 | 208,587 | -8.8 |

| France | 48,630 | -0.4 | 98,481 | -0.5 |

| UK | 115,715 | 31.7 | 59,238 | 10.2 |

| Middle East | 216,735 | 6.1 | 1,022,772 | -38.3 |

| Australia | 115,777 | 5.1 | 467,520 | -1.9 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

World trade projections of the IMF are in Table V-6. There is increasing growth of the volume of world trade of goods and services from 3.0 percent in 2013 to 5.0 percent in 2015 and 5.6 percent on average from 2016 to 2019. World trade would be slower for advanced economies while emerging and developing economies (EMDE) experience faster growth. World economic slowdown would be more challenging with lower growth of world trade.

Table V-6, IMF, Projections of World Trade, USD Billions, USD/Barrel and Annual ∆%

| 2013 | 2014 | 2015 | Average ∆% 2016-2019 | |

| World Trade Volume (Goods and Services) | 3.0 | 3.8 | 5.0 | 5.6 |

| Exports Goods & Services | 3.2 | 3.7 | 5.0 | 5.5 |

| Imports Goods & Services | 2.8 | 3.9 | 5.0 | 5.6 |

| World Trade Value of Exports Goods & Services USD Billion | 23,114 | 23,928 | 24,948 | Average ∆% 2006-2015 20,259 |

| Value of Exports of Goods USD Billion | 18,671 | 19,299 | 20,107 | Average ∆% 2006-2015 16,312 |

| Average Oil Price USD/Barrel | 104.07 | 102.76 | 99.36 | Average ∆% 2006-2015 88.85 |

| Average Annual ∆% Export Unit Value of Manufactures | -1.1 | -0.2 | -0.5 | Average ∆% 2006-2015 -0.6 |

| Exports of Goods & Services | 2013 | 2014 | 2015 | Average ∆% 2016-2019 |

| Euro Area | 1.8 | 3.5 | 4.3 | 4.7 |

| EMDE | 4.4 | 3.9 | 5.8 | 6.1 |

| G7 | 1.8 | 2.9 | 4.2 | 4.9 |

| Imports Goods & Services | ||||

| Euro Area | 0.5 | 3.4 | 3.9 | 4.7 |

| EMDE | 5.3 | 4.4 | 6.1 | 6.3 |

| G7 | 1.2 | 3.6 | 4.1 | 4.9 |

| Terms of Trade of Goods & Services | ||||

| Euro Area | 0.8 | -0.4 | -0.3 | -0.1 |

| EMDE | -0.2 | -0.02 | -0.6 | -0.4 |

| G7 | 0.8 | 0.7 | -0.2 | 0.0 |

| Terms of Trade of Goods | ||||

| Euro Area | 1.2 | 0.03 | -0.02 | -0.2 |

| EMDE | -0.2 | 0.2 | -0.4 | -0.3 |

| G7 | 0.9 | 0.3 | -0.1 | -0.1 |

Notes: Commodity Price Index includes Fuel and Non-fuel Prices; Commodity Industrial Inputs Price includes agricultural raw materials and metal prices; Oil price is average of WTI, Brent and Dubai

Source: International Monetary Fund World Economic Outlook databank

http://www.imf.org/external/ns/cs.aspx?id=28

The JP Morgan Global All-Industry Output Index of the JP Morgan Manufacturing and Services PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, with high association with world GDP, increased to 52.8 in Jan from 52.4 in Dec, indicating expansion at slightly higher rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/aa9e75bbcfac4fea8622b22632b5d42c). This index has remained above the contraction territory of 50.0 during 66 consecutive months. The employment index increased from 51.1 in Dec to 51.6 in Jan with input prices rising at slower rate, new orders increasing at slower rate and output increasing at faster rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/aa9e75bbcfac4fea8622b22632b5d42c). David Hensley, Director of Global Economic Coordination at JP Morgan, finds moderate world economic growth (http://www.markiteconomics.com/Survey/PressRelease.mvc/aa9e75bbcfac4fea8622b22632b5d42c). The JP Morgan Global Manufacturing PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, increased to 51.7 in Jan from 51.5 in Dec (http://www.markiteconomics.com/Survey/PressRelease.mvc/52b184024a1446779fe747f37d5df0ef). New export orders expanded for the eighteenth consecutive month. David Hensley, Director of Global Economics Coordination at JP Morgan Chase, finds continuing growth in global manufacturing with output increasing at around annual 3.5 percent (http://www.markiteconomics.com/Survey/PressRelease.mvc/52b184024a1446779fe747f37d5df0ef). The HSBC Brazil Composite Output Index, compiled by Markit, was unchanged from 49.2 in Dec to 49.2 in Jan, indicating moderate contraction in activity of Brazil’s private sector (http://www.markiteconomics.com/Survey/PressRelease.mvc/480418ba2f0d48e0a716f5737527d8d8). The HSBC Brazil Services Business Activity index, compiled by Markit, decreased from 49.1 in Dec to 48.4 in Jan, indicating marginally contracting services activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/480418ba2f0d48e0a716f5737527d8d8). André Loes, Chief Economist, Brazil, at HSBC, finds faster pace of contraction (http://www.markiteconomics.com/Survey/PressRelease.mvc/480418ba2f0d48e0a716f5737527d8d8). The HSBC Brazil Purchasing Managers’ IndexTM (PMI™) increased from 50.2 in Dec to 50.7 in Jan, indicating moderate improvement in manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/76ee5ab696c44271ac7eaa6e6da02cea). André Loes, Chief Economist, Brazil at HSBC, finds increasing output and cost-push pressures perhaps because of currency depreciation (http://www.markiteconomics.com/Survey/PressRelease.mvc/76ee5ab696c44271ac7eaa6e6da02cea).

VA United States. The Markit Flash US Manufacturing Purchasing Managers’ Index™ (PMI™) seasonally adjusted increased to 54.3 in Feb from 53.9 in Jan (http://www.markiteconomics.com/Survey/PressRelease.mvc/76d54ef7fac944e6a41abf20258b097f). New export orders softened. Chris Williamson, Chief Economist at Markit, finds that manufacturing provides strong contribution to economic growth (http://www.markiteconomics.com/Survey/PressRelease.mvc/76d54ef7fac944e6a41abf20258b097f). The Markit Flash US Services PMI™ Business Activity Index increased from 53.3 in Dec to 54.0 in Jan (http://www.markiteconomics.com/Survey/PressRelease.mvc/3b941f12d3724e4cb923968e1f814a36). The Markit Flash US Composite PMI™ Output Index in from 53.5 in Dec to 54.2 in Jan. Chris Williamson, Chief Economist at Markit, finds that the surveys are consistent with growth of GDP around 2.5 percent (http://www.markiteconomics.com/Survey/PressRelease.mvc/3b941f12d3724e4cb923968e1f814a36). The Markit US Composite PMI™ Output Index of Manufacturing and Services increased to 54.4 in Jan from 53.5 in Dec (http://www.markiteconomics.com/Survey/PressRelease.mvc/4df1e15f72dc47a89ba23d0f062c1360). The Markit US Services PMI™ Business Activity Index increased from 53.3 in Dec to 54.2 in Jan (http://www.markiteconomics.com/Survey/PressRelease.mvc/4df1e15f72dc47a89ba23d0f062c1360). Chris Williamson, Chief Economist at Markit, finds the indexes consistent with US growth at around 2.0 percent annual in IQ2015 (http://www.markiteconomics.com/Survey/PressRelease.mvc/4df1e15f72dc47a89ba23d0f062c1360). The Markit US Manufacturing Purchasing Managers’ Index™ (PMI™) did not change to 53.9 in Jan from 53.9 in Dec, which indicates expansion at the same rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/dce95357995b45edbcf2bd17561b8f94). New foreign orders expanded at moderate rate. Chris Williamson, Chief Economist at Markit, finds that the index suggests slowing but strong manufacturing with GDP growth possibly lower in IQ2015 than 2.6 percent SAAR in IVQ2014 (http://www.markiteconomics.com/Survey/PressRelease.mvc/dce95357995b45edbcf2bd17561b8f94). The purchasing managers’ index (PMI) of the Institute for Supply Management (ISM) Report on Business® decreased 1.6 percentage points from 55.1 in Dec to 53.5 in Jan, which indicates growth at slower rate (http://www.ism.ws/ISMReport/MfgROB.cfm?navItemNumber=12942). The index of new orders decreased 4.9 percentage points from 57.8 in Dec to 52.9 in Jan. The index of new export orders decreased 2.5 percentage points from 52.0 in Dec to 49.5 in Jan, contracting at moderate rate. The Non-Manufacturing ISM Report on Business® PMI increased 0.2 percentage points from 56.5 in Dec to 56.7 in Jan, indicating growth of business activity/production during 66 consecutive months, while the index of new orders increased 0.3 percentage points from 59.2 in Dec to 59.5 in Jan (http://www.ism.ws/ISMReport/NonMfgROB.cfm?navItemNumber=28744). Table USA provides the country economic indicators for the US.

Table USA, US Economic Indicators

| Consumer Price Index | Dec 12 months NSA ∆%: 0.8; ex food and energy ∆%: 1.6 Dec month SA ∆%: -0.4; ex food and energy ∆%: 0.0 |

| Producer Price Index | Finished Goods Jan 12-month NSA ∆%: -3.1; ex food and energy ∆% 1.5 Final Demand Jan 12-month NSA ∆%: 0.0; ex food and energy ∆% 1.6 |

| PCE Inflation | Dec 12-month NSA ∆%: headline 0.7; ex food and energy ∆% 1.3 |

| Employment Situation | Household Survey: Jan Unemployment Rate SA 5.7% |

| Nonfarm Hiring | Nonfarm Hiring fell from 63.3 million in 2006 to 54.2 million in 2013 or by 9.1 million |

| GDP Growth | BEA Revised National Income Accounts IIQ2012/IIQ2011 2.3 IIIQ2012/IIIQ2011 2.7 IVQ2012/IVQ2011 1.6 IQ2013/IQ2012 1.7 IIQ2013/IIQ2012 1.8 IIIQ2013/IIIQ2012 2.3 IVQ2013/IVQ2012 3.1 IQ2014/IQ2013 1.9 IIQ2014/IIQ2013 2.6 IIIQ2014/IIIQ2013 2.7 IVQ2014/IVQ2013 2.5 IQ2012 SAAR 2.3 IIQ2012 SAAR 1.6 IIIQ2012 SAAR 2.5 IVQ2012 SAAR 0.1 IQ2013 SAAR 2.7 IIQ2013 SAAR 1.8 IIIQ2013 SAAR 4.5 IVQ2013 SAAR 3.5 IQ2014 SAAR -2.1 IIQ2014 SAAR 4.6 IIIQ2014 SAAR 5.0 IVQ2014 SAAR 2.6 |

| Real Private Fixed Investment | SAAR IVQ2014 2.3 ∆% IVQ2007 to IVQ2014: 2.8% Blog 2/1/15 |

| Corporate Profits | IIIQ2014 SAAR: Corporate Profits 3.1; Undistributed Profits 12.4 Blog 12/28/14 |

| Personal Income and Consumption | Dec month ∆% SA Real Disposable Personal Income (RDPI) SA ∆% 0.5 |

| Quarterly Services Report | IIIQ14/IIIQ13 NSA ∆%: Financial & Insurance 4.8 |

| Employment Cost Index | Compensation Private IVQ2014 SA ∆%: 0.6 |

| Industrial Production | Jan month SA ∆%: 0.2 Manufacturing Jan SA 0.2 ∆% Jan 12 months SA ∆% 5.6, NSA 5.5 |

| Productivity and Costs | Nonfarm Business Productivity IVQ2014∆% SAAE -1.8; IVQ2014/IVQ2013 ∆% 0.0; Unit Labor Costs SAAE IVQ2014 ∆% 2.7; IVQ2014/IVQ2013 ∆%: 1.9 Blog 2/8/15 |

| New York Fed Manufacturing Index | General Business Conditions From Jan 9.95 to Feb 7.78 |

| Philadelphia Fed Business Outlook Index | General Index from Jan 6.3 to Feb 5.2 |

| Manufacturing Shipments and Orders | New Orders SA Dec ∆% -3.4 Ex Transport -2.3 Jan-Dec NSA New Orders ∆% 2.8 Ex transport 1.9 |

| Durable Goods | Dec New Orders SA ∆%: minus 3.4; ex transport ∆%: minus 0.8 |

| Sales of New Motor Vehicles | Jan 2015 1,151.123; Jan 2014 1,012,582. Jan 15 SAAR 16.66 million, Dec 14 SAAR 16.92 million, Jan 2014 SAAR 15.29 million Blog 2/8/15 |

| Sales of Merchant Wholesalers | Jan-Dec 2014/Jan-Dec 2013 NSA ∆%: Total 5.1; Durable Goods: 5.8; Nondurable |

| Sales and Inventories of Manufacturers, Retailers and Merchant Wholesalers | Dec 14 12-M NSA ∆%: Sales Total Business 2.8; Manufacturers 0.1 |

| Sales for Retail and Food Services | Jan 2015/Jan 2014 ∆%: Retail and Food Services 2.8; Retail ∆% 1.6 |

| Value of Construction Put in Place | Dec SAAR month SA ∆%: minus 0.4 Dec 12-month NSA: 3.3 |

| Case-Shiller Home Prices | Nov 2014/Nov 2013 ∆% NSA: 10 Cities 4.7; 20 Cities: 4.3; National: 4.7 |

| FHFA House Price Index Purchases Only | Nov SA ∆% 0.8; |

| New House Sales | Dec 2014 month SAAR ∆%: minus 11.6 |

| Housing Starts and Permits | Jan Starts month SA ∆% -2.0; Permits ∆%: -0.7 |

| Trade Balance | Balance Dec SA -$46,557 million versus Nov -$39,751 million |

| Export and Import Prices | Jan 12-month NSA ∆%: Imports -8.0; Exports -5.4 |

| Consumer Credit | Dec ∆% annual rate: Total 5.4; Revolving 7.9; Nonrevolving 4.5 |

| Net Foreign Purchases of Long-term Treasury Securities | Dec Net Foreign Purchases of Long-term US Securities: $35.4 billion |

| Treasury Budget | Fiscal Year 2015/2014 ∆% Jan: Receipts 8.7; Outlays 8.3; Individual Income Taxes 8.2 Deficit Fiscal Year 2012 $1,087 billion Deficit Fiscal Year 2013 $680 billion Deficit Fiscal Year 2014 $483 billion Blog 2/15/2015 |

| CBO Budget and Economic Outlook | 2012 Deficit $1087 B 6.8% GDP Debt $11,281 B 70.1% GDP 2013 Deficit $680 B, 4.1% GDP Debt $11,983 B 72.0% GDP 2024 Deficit $960B, 3.6% GDP Debt $20,554B 77.2% GDP 2039: Long-term Debt/GDP 106% Blog 8/26/12 11/18/12 2/10/13 9/22/13 2/16/14 8/24/14 9/14/14 |

| Commercial Banks Assets and Liabilities | Dec 2014 SAAR ∆%: Securities 24.2 Loans 7.1 Cash Assets -52.4 Deposits 7.6 Blog 1/25/15 |

| Flow of Funds Net Worth of Families and Nonprofits | IIIQ2014 ∆ since 2007 Assets +$14,260.8 BN Nonfinancial $477.8 BN Real estate -$1,215.2 BN Financial +13,783.0 BN Net Worth +$14,595.3 BN Blog 12/28/14 |

| Current Account Balance of Payments | IIIQ2014 -202,280 MM % GDP 2.3 Blog 12/21/14 |

| Collapse of United States Dynamism of Income Growth and Employment Creation | Blog 1/25/15 |

Links to blog comments in Table USA:

2/15/15 http://cmpassocregulationblog.blogspot.com/2015/02/g20-monetary-policy-recovery-without.html

2/8/15 http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html

2/1/15 http://cmpassocregulationblog.blogspot.com/2015/02/financial-and-international.html

1/25/15 http://cmpassocregulationblog.blogspot.com/2015/01/competitive-currency-conflicts-world.html

12/28/14 http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html

12/21/14 http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html

12/14/14 http://cmpassocregulationblog.blogspot.com/2014/12/global-financial-and-economic-risk.html

12/7/14 http://cmpassocregulationblog.blogspot.com/2014/12/financial-risks-twenty-six-million.html

9/14/14 http://cmpassocregulationblog.blogspot.com/2014/09/geopolitics-monetary-policy-and.html

8/24/14 http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html

8/3/14 http://cmpassocregulationblog.blogspot.com/2014/08/fluctuating-financial-valuations.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

9/22/13 http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html

2/10/13 http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

Seasonally adjusted annual rates (SAAR) of housing starts and permits are shown in Table VA-1. Housing starts decreased 2.0 percent in Jan 2015 after wide oscillations that included increases of 7.1 percent in Dec, 20.8 percent in Jul, 11.9 percent in Apr, 2.4 percent in Mar, 3.5 percent in Feb. There were decreases of 7.1 percent in Nov, 12.3 percent in Aug, 7.6 percent in Jun, 7.4 percent in May and 13.2 percent in Jan. There were increases of 18.1 percent in Nov 2013 and declines of 14.7 percent in Apr 2013 and 9.2 percent in Jun 2013. Housing starts increased 18.7 percent from the SAAR of 897 in Jan 2014 to the SAAR of 1065 in Jan 2015. Housing permits, indicating future activity, decreased 0.7 percent in Jan 2015, changed 0.0 percent in Dec 2014 and decreased 3.8 percent in Nov 2014, 1.4 percent in Aug 2014 and 1.0 percent in Jun 2014. There were significant oscillations with increase of 6.1 percent in Oct 2014 and 4.5 percent in Jul 2014. Housing permits increased 8.1 percent from 974 SSAR in Jan 2014 to SSAR of 1053 in Jan 2015. While single unit houses starts decreased 6.7 percent in Jan 2015, seasonally adjusted, structures with five units or more increased 12.1 percent. Multifamily residential construction is increasing at a faster rate than single-family construction with wide monthly oscillations. Monthly rates in starts and permits fluctuate significantly as shown in Table VA-1.

Table VA-1, US, Housing Starts and Permits SSAR Month ∆%

| Housing | Month ∆% | Housing | Month ∆% | |

| Jan 2015 | 1065 | -2.0 | 1053 | -0.7 |

| Dec 2014 | 1087 | 7.1 | 1060 | 0.0 |

| Nov | 1015 | -7.1 | 1060 | -3.8 |

| Oct | 1092 | 6.2 | 1102 | 6.1 |

| Sep | 1028 | 6.7 | 1039 | 1.7 |

| Aug | 963 | -12.3 | 1022 | -1.4 |

| Jul | 1098 | 20.8 | 1037 | 4.5 |

| Jun | 909 | -7.6 | 992 | -1.0 |

| May | 984 | -7.4 | 1002 | -7.9 |

| Apr | 1063 | 11.9 | 1088 | 7.7 |

| Mar | 950 | 2.4 | 1010 | -0.4 |

| Feb | 928 | 3.5 | 1014 | 4.1 |

| Jan | 897 | -13.2 | 974 | -1.7 |

| Dec 2013 | 1034 | -6.4 | 991 | -2.6 |

| Nov | 1105 | 18.1 | 1017 | -2.1 |

| Oct | 936 | 8.5 | 1039 | 6.7 |

| Sep | 863 | -2.5 | 974 | 5.2 |

| Aug | 885 | -1.4 | 926 | -2.9 |

| Jul | 898 | 8.1 | 954 | 3.9 |

| Jun | 831 | -9.2 | 918 | -6.8 |

| May | 915 | 7.9 | 985 | -2.0 |

| Apr | 848 | -14.7 | 1005 | 12.9 |

| Mar | 994 | 4.5 | 890 | -6.5 |

| Feb | 951 | 6.1 | 952 | 4.0 |

| Jan | 896 | -8.2 | 915 | -3.0 |

| Dec 2012 | 976 | 17.2 | 943 | 1.1 |

| Nov | 833 | -9.0 | 933 | 2.8 |

| Oct | 915 | 8.0 | 908 | -1.4 |

| Sep | 847 | 12.3 | 921 | 11.4 |

| Aug | 754 | 1.9 | 827 | -1.4 |

| Jul | 740 | -2.2 | 839 | 6.9 |

| Jun | 757 | 6.9 | 785 | -2.6 |

| May | 708 | -6.0 | 806 | 7.6 |

| Apr | 753 | 8.3 | 749 | -4.6 |

| Mar | 695 | -1.3 | 785 | 6.2 |

| Feb | 704 | -2.6 | 739 | 3.5 |

| Jan | 723 | 4.2 | 714 | 2.4 |

| Dec 2011 | 694 | -2.4 | 697 | -1.3 |

| Nov | 711 | 16.6 | 706 | 5.2 |

| Oct | 610 | -6.2 | 671 | 10.0 |

| Sep | 650 | 11.1 | 610 | -5.7 |

| Aug | 585 | -6.1 | 647 | 4.2 |

| Jul | 623 | 2.5 | 621 | -2.4 |

| Jun | 608 | 8.4 | 636 | 2.9 |

| May | 561 | 1.3 | 618 | 6.4 |

| Apr | 554 | -7.7 | 581 | -0.3 |

| Mar | 600 | 16.1 | 583 | 7.6 |

| Feb | 517 | -17.9 | 542 | -5.9 |

| Jan | 630 | 16.9 | 576 | -8.9 |

| Dec 2010 | 539 | -1.1 | 632 | 12.9 |

| Nov | 545 | 0.4 | 560 | 0.4 |

| Oct | 543 | -8.6 | 558 | -0.9 |

| Sep | 594 | -0.8 | 563 | -2.9 |

SAAR: Seasonally Adjusted Annual Rate

Source: US Census Bureau http://www.census.gov/construction/nrc/

Housing starts and permits in Jan not-seasonally adjusted are in Table VA-2. Housing starts increased 18.3 percent in Jan 2015 relative to Jan 2014 and new permits increased 4.2 percent. Construction of new houses in the US remains at very depressed levels. Housing starts fell 53.1 percent in Jan 2015 relative to Jan 2006 and fell 49.8 percent relative to Jan 2005. Housing permits fell 43.8 percent in Jan 2015 relative to Jan 2006 and fell 52.1 percent relative to Jan 2005.

Table VA-2, US, Housing Starts and New Permits, Thousands of Units, NSA, and %

| Housing Starts | New Permits | |

| Jan 2015 | 71.8 | 1032.9 |

| Jan 2014 | 60.7 | 990.9 |

| ∆% Jan 2015/Jan 2014 | 18.3 | 4.2 |

| Jan 2006 | 153.0 | 1838.9 |

| ∆% Jan 2015/Jan-Dec 2006 | -53.1 | -43.8 |

| Jan 2005 | 142.9 | 2155.2 |

| ∆% Jan 2015/Jan-Dec 2005 | -49.8 | -52.1 |

Source: US Census Bureau http://www.census.gov/construction/nrc/

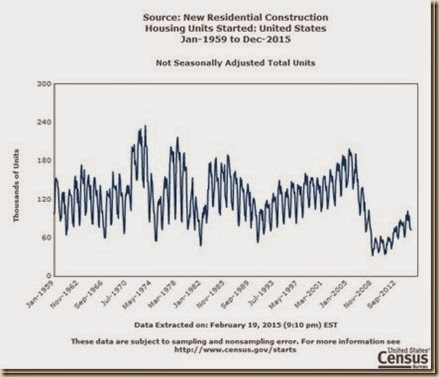

Chart VA-1 of the US Census Bureau shows the sharp increase in construction of new houses from 2000 to 2006. Housing construction fell sharply through the recession, recovering from the trough around IIQ2009. The right-hand side of Chart VA-1 shows a mild downward trend or stagnation from mid-2010 to the present in single-family houses with a recent mild upward trend in recent months in the category of two or more units but marginal decline in some recent months. While single unit houses starts increased 8.8 percent in Jan-Dec 2014 relative to a year earlier, not seasonally adjusted, structures with two to four units increased 2.1 percent and with five units or more increased 17.1 percent. Single unit houses were 64.5 percent of total housing starts in 2014, increasing 4.9 percent relative to 2013, while construction of five units of more were 34.1 percent, increasing 17.1 percent, and construction of two to four units were 1.4 percent of the total, increasing 2.1 percent.

Chart VA-1, US, Total and Single-Family New Housing Units Started in the US, SAAR (Seasonally Adjusted Annual Rate)

Source: US Census Bureau

http://www.census.gov/briefrm/esbr/www/esbr020.html

Table VA-3 provides new housing units that started in the US at seasonally adjusted annual rates (SAAR) in Jan and from Jul to Dec of the years from 2000 to 2015. SAARs have dropped from high levels around 2 million in 2005-2006 to the range of 848,000 in Apr 2013 to 1,034,000 in Dec 2013 and 1,098,000 in Jul 2014, which is an improvement over the range of 517,000 in Feb 2011 to 711,000 in Nov 2011. Improvement continued with 1,034,000 in Dec 2013 relative to 976,000 in Dec 2012. The rate of housing starts moved to 1,065,000 in Jan 2015 relative to 897 in Jan 2014.

Table VA-3, US, New Housing United Started at Seasonally Adjusted Rates, Thousand Units

| Year | Jan | Jul | Aug | Sep | Oct | Nov | Dec |

| 2000 | 1,636 | 1,463 | 1,541 | 1,507 | 1,549 | 1,551 | 1,532 |

| 2001 | 1,600 | 1,670 | 1,567 | 1,562 | 1,540 | 1,602 | 1,568 |

| 2002 | 1,698 | 1,655 | 1,633 | 1,804 | 1,648 | 1,753 | 1,788 |

| 2003 | 1,853 | 1,897 | 1,833 | 1,939 | 1,967 | 2,083 | 2,057 |

| 2004 | 1,911 | 2,002 | 2,024 | 1,905 | 2,072 | 1,782 | 2,042 |

| 2005 | 2,144 | 2,054 | 2,095 | 2,151 | 2,065 | 2,147 | 1,994 |

| 2006 | 2,273 | 1,737 | 1,650 | 1,720 | 1,491 | 1,570 | 1,649 |

| 2007 | 1,409 | 1,354 | 1,330 | 1,183 | 1,264 | 1,197 | 1,037 |

| 2008 | 1,084 | 923 | 844 | 820 | 777 | 652 | 560 |

| 2009 | 490 | 594 | 586 | 585 | 534 | 588 | 581 |

| 2010 | 614 | 546 | 599 | 594 | 543 | 545 | 539 |

| 2011 | 630 | 623 | 585 | 650 | 610 | 711 | 694 |

| 2012 | 723 | 740 | 754 | 847 | 915 | 833 | 976 |

| 2013 | 896 | 898 | 885 | 863 | 936 | 1,105 | 1,034 |

| 2014 | 897 | 1,098 | 963 | 1,028 | 1,092 | 1,015 | 1,087 |

| 2015 | 1,065 | NA | NA | NA | NA | NA | NA |

Source: US Census Bureau http://www.census.gov/construction/nrc

Table VA-4 provides new housing united starts NSA in Jan and from Jun to Dec in the years from 2000 to 2015. The number of units started NSA decreased 53.1 percent from 153.0 thousand in Jan 2006 to 71.8 thousand in Jan 2015. The number of units started increased 18.3 percent from 60.7 thousand in Jan 2014 to 71.8 thousand in Jan 2015.

Table VA-4, New Housing Units Started in the US, Not Seasonally Adjusted, Thousands of Units

| Year | Jan | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| 2000 | 104.0 | 146.3 | 135.0 | 141.4 | 128.9 | 139.7 | 117.1 | 100.7 |

| 2001 | 106.4 | 155.2 | 154.6 | 141.5 | 133.1 | 139.8 | 121.0 | 104.6 |

| 2002 | 110.4 | 160.3 | 155.9 | 147.0 | 155.6 | 146.8 | 133.0 | 123.1 |

| 2003 | 117.8 | 174.5 | 175.8 | 163.8 | 171.3 | 173.5 | 153.7 | 144.2 |

| 2004 | 124.5 | 172.3 | 182.0 | 185.9 | 164.0 | 181.3 | 138.1 | 140.2 |

| 2005 | 142.9 | 192.8 | 187.6 | 192.0 | 187.9 | 180.4 | 160.7 | 136.0 |

| 2006 | 153.0 | 170.2 | 160.9 | 146.8 | 150.1 | 130.6 | 115.2 | 112.4 |

| 2007 | 95.0 | 137.8 | 127.9 | 121.2 | 101.5 | 115.0 | 88.8 | 68.9 |

| 2008 | 70.8 | 102.5 | 86.7 | 76.4 | 73.9 | 68.2 | 47.5 | 37.7 |

| 2009 | 31.9 | 59.1 | 56.8 | 52.9 | 52.6 | 44.5 | 42.3 | 36.6 |

| 2010 | 38.9 | 53.8 | 51.5 | 56.3 | 53.0 | 45.4 | 40.6 | 33.8 |

| 2011 | 40.2 | 60.5 | 57.6 | 54.5 | 58.8 | 53.2 | 53.0 | 42.7 |

| 2012 | 47.2 | 74.7 | 69.2 | 69.0 | 75.8 | 77.0 | 62.2 | 63.2 |

| 2013 | 58.7 | 80.7 | 84.0 | 80.4 | 78.4 | 78.4 | 83.8 | 67.6 |

| 2014 | 60.7 | 87.3 | 101.0 | 86.2 | 94.2 | 92.0 | 75.8 | 73.0 |

| 2015 | 71.8 | NA | NA | NA | NA | NA | NA | NA |

Source: US Census Bureau http://www.census.gov/construction/nrc/

Chart VA-2 of the US Census Bureau provides construction of new housing units started in the US at seasonally adjusted annual rate (SAAR) from Jan 1959 to Jan 2015 that helps to analyze in historical perspective the debacle of US new house construction. There are three periods in the series. (1) There is stationary behavior with wide fluctuations from 1959 to the beginning of the decade of the 1970s. (2) There is sharp upward trend from the 1990s to 2006 propelled by the US housing subsidy, politics of Fannie Mae and Freddie Mac and unconventional monetary policy of near zero interest rates from Jun 2003 to Jun 2004 and suspension of the auction of 30-year Treasury bonds intended to lower mortgage rates. The financial crisis and global recession were caused by interest rate and housing subsidies and affordability policies that encouraged high leverage and risks, low liquidity and unsound credit (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 157-66, Regulation of Banks and Finance (2009b), 217-27, International Financial Architecture (2005), 15-18, The Global Recession Risk (2007), 221-5, Globalization and the State Vol. II (2008b), 197-213, Government Intervention in Globalization (2008c), 182-4). Several past comments of this blog elaborate on these arguments, among which: http://cmpassocregulationblog.blogspot.com/2011/07/causes-of-2007-creditdollar-crisis.html http://cmpassocregulationblog.blogspot.com/2011/01/professor-mckinnons-bubble-economy.html http://cmpassocregulationblog.blogspot.com/2011/01/world-inflation-quantitative-easing.html http://cmpassocregulationblog.blogspot.com/2011/01/treasury-yields-valuation-of-risk.html http://cmpassocregulationblog.blogspot.com/2010/11/quantitative-easing-theory-evidence-and.html http://cmpassocregulationblog.blogspot.com/2010/12/is-fed-printing-money-what-are.html. (3) There is insufficient recovery during the weak expansion after IIIQ2009.

Chart VA-2, US, New Housing Units Started in the US, Not Seasonally Adjusted, Thousands of Units, Jan 1959-Jan 2015

Source: US Census Bureau http://www.census.gov/construction/nrc/

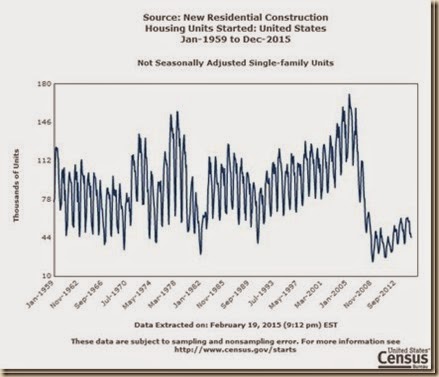

Chart VA-3 of the US Census Bureau provides single-family houses started without seasonal adjustment. There was sharp increase from 1992 to 2007 followed by sharp decline. The recovery is sluggish.

Chart VA-3, US, Single-family Houses Started, Thousands of Units, Jan-1959-Jan 2015, NSA

Source: US Census Bureau http://www.census.gov/construction/nrc

Chart VA-4 of the US Census Bureau provides housing units started with five units or more. Construction was stagnant before the drop in the global recession. Recovery is stronger than in the case of single-family units.

Chart VA-4, US, Housing Units Stated in Buildings with Five Units or More, Thousands of Units, Jan-1959-Nov 2015, NSA

Source: US Census Bureau http://www.census.gov/construction/nrc/

A longer perspective on residential construction in the US is provided by Table VA-5 with annual data from 1960 to 2014. Housing starts fell 51.5 percent from 2005 to 2014, 36.1 percent from 2000 to 2014 and 29.8 percent relative to the average from 1959 to 1963. Housing permits fell 51.8 percent from 2005 to 2014, 34.7 percent from 2000 to 2014 and 10.2 percent from the average of 1969-1963 to 2014. Housing starts rose 31.8 from 2000 to 2005 while housing permits grew 35.4 percent. From 1990 to 2000, housing starts increased 31.5 percent while permits increased 43.3 percent.

Table VA-5, US, Annual New Privately Owned Housing Units Authorized by Building Permits in Permit-Issuing Places and New Privately Owned Housing Units Started, Thousands

| Starts | Permits | |

| 2014 | 1003.0 | 1039.6 |

| 2013 | 924.9 | 990.8 |

| 2012 | 780.6 | 829.7 |

| ∆% 2014/2013 | 8.4 | 4.9 |

| ∆% 2014/2012 | 28.5 | 25.3 |

| ∆% 2014/2011 | 64.8 | 66.6 |

| ∆% 2014/2010 | 70.9 | 71.9 |

| ∆% 2014/2006 | -44.3 | -43.5 |

| ∆% 2014/2005 | -51.5 | -51.8 |

| ∆% 2014/2000 | -36.1 | -34.7 |

| ∆% 2014/Av 1959-1963 | -29.8 | -10.2 |

| 2011 | 608.8 | 624.1 |

| ∆% 2012/2005 | -62.3 | -61.5 |

| ∆% 2012/2000 | -50.2 | -47.9 |

| ∆% 2012/Av 1959-1963 | -45.4 | -28.4 |

| 2011 | 608.8 | 624.1 |

| 2010 | 586.9 | 604.6 |

| 2009 | 554.0 | 583.0 |

| 2008 | 905.5 | 905.4 |

| 2007 | 1,355,0 | 1,398.4 |

| 2006 | 1,800.9 | 1,838.9 |

| 2005 | 2,068.3 | 2,155.3 |

| ∆% 2005/2000 | 31.8 | 35.4 |

| 2004 | 1,955.8 | 2,070.1 |

| 2003 | 1,847.7 | 1,889.2 |

| 2002 | 1,704.9 | 1,747.7 |

| 2001 | 1,602.7 | 1,636.7 |

| 2000 | 1,568.7 | 1,592.3 |

| ∆% 2000/1990 | 31.5 | 43.3 |

| 1990 | 1,192,7 | 1,110.8 |

| 1980 | 1,292.2 | 1,190.6 |

| 1970 | 1,433.6 | 1,351.5 |

| Average 1959-63 | 1,429.7 | 1,158.2 |

Source: US Census Bureau

http://www.census.gov/construction/nrc/

Risk aversion channels funds toward US long-term and short-term securities that finance the US balance of payments and fiscal deficits benefitting from risk flight to US dollar denominated assets. There are now temporary interruptions because of fear of rising interest rates that erode prices of US government securities because of mixed signals on monetary policy and exit from the Fed balance sheet of four trillion dollars of securities held outright. Net foreign purchases of US long-term securities (row C in Table VA-6) increased from minus $25.7 billion in Nov 2014 to $35.4 billion in Dec 2014. Foreign (residents) purchases minus sales of US long-term securities (row A in Table VA-6) in Nov 2014 of $59.2 billion decreased to minus $5.8 billion in Dec 2014. Net US (residents) purchases of long-term foreign securities (row B in Table VA-6) increased from minus $25.7 billion in Nov 2014 to $41.2 billion in Dec 2014. In Dec 2014,

C = A + B = -$5.8 billion +$41.2 billion = $35.4 billion

There are minor rounding errors. There is weakening demand in Table VA-6 in Dec in A1 private purchases by residents overseas of US long-term securities of $14.5 billion of which deterioration in A11 Treasury securities of $5.6 billion, improvement in A12 of $4.8 billion in agency securities, improvement of $5.7 billion of corporate bonds and improvement of $9.6 billion in equities. Worldwide risk aversion causes flight into US Treasury obligations with significant oscillations. Official purchases of securities in row A2 decreased $20.3 billion with decrease of Treasury securities of $16.6 billion in Dec 2014. Official purchases of agency securities decreased $4.8 billion in Dec. Row D shows increase in Dec 2014 of $4.0 billion in purchases of short-term dollar denominated obligations. Foreign private holdings of US Treasury bills increased $31.5 billion (row D11) with foreign official holdings decreasing $6.7 billion while the category “other” decreased $14.7 billion. Foreign private holdings of US Treasury bills increased $31.5 billion in what could be arbitrage of duration exposures. Risk aversion of default losses in foreign securities dominates decisions to accept zero interest rates in Treasury securities with no perception of principal losses. In the case of long-term securities, investors prefer to sacrifice inflation and possible duration risk to avoid principal losses with significant oscillations in risk perceptions.

Table VA-6, Net Cross-Borders Flows of US Long-Term Securities, Billion Dollars, NSA

| Dec 2013 12 Months | Dec 2014 12 Months | Nov 2014 | Dec 2014 | |

| A Foreign Purchases less Sales of | 79.4 | 246.5 | 59.2 | -5.8 |

| A1 Private | 0.7 | 168.5 | 53.0 | 14.5 |

| A11 Treasury | 49.3 | 113.5 | 2.7 | -5.6 |

| A12 Agency | -3.7 | 42.8 | 18.7 | 4.8 |

| A13 Corporate Bonds | -5.8 | 18.4 | 25.5 | 5.7 |

| A14 Equities | -39.1 | -6.2 | 6.0 | 9.6 |

| A2 Official | 78.8 | 77.9 | 6.2 | -20.3 |

| A21 Treasury | -8.4 | 45.4 | -7.5 | -16.6 |

| A22 Agency | 75.2 | 30.6 | 14.6 | -4.8 |

| A23 Corporate Bonds | 16.2 | 7.4 | -0.5 | 1.2 |

| A24 Equities | -4.1 | -5.4 | -0.3 | -0.2 |

| B Net US Purchases of LT Foreign Securities | -221.0 | 28.5 | -25.7 | 41.2 |

| B1 Foreign Bonds | -46.8 | 135.3 | 3.6 | 37.9 |

| B2 Foreign Equities | -174.2 | -106.8 | -29.3 | 3.3 |

| C Net Foreign Purchases of US LT Securities | -141.5 | 275.0 | 33.5 | 35.4 |

| D Increase in Foreign Holdings of Dollar Denominated Short-term | -34.1 | 24.3 | 4.0 | 10.1 |

| D1 US Treasury Bills | 21.6 | -13.9 | 8.8 | 24.8 |

| D11 Private | -4.1 | 49.2 | 3.9 | 31.5 |

| D12 Official | 25.7 | -63.1 | 4.9 | -6.7 |

| D2 Other | -55.7 | 38.2 | -4.8 | -14.7 |

C = A + B;

A = A1 + A2

A1 = A11 + A12 + A13 + A14

A2 = A21 + A22 + A23 + A24

B = B1 + B2

D = D1 + D2

Sources: United States Treasury

http://www.treasury.gov/resource-center/data-chart-center/tic/Pages/ticpress.aspx

http://www.treasury.gov/press-center/press-releases/Pages/jl2609.aspx

Table VA-7 provides major foreign holders of US Treasury securities. China is the largest holder with $1244.3 billion in Dec 2014, decreasing 2.0 percent from $1270.1 billion in Dec 2013 while decreasing $6.1 billion from Nov 2014 or 0.5 percent. The United States Treasury estimates US government debt held by private investors at $9829 billion in Sep 2014. China’s holding of US Treasury securities represent 12.7 percent of US government marketable interest-bearing debt held by private investors (http://www.fms.treas.gov/bulletin/index.html). Min Zeng, writing on “China plays a big role as US Treasury yields fall,” on Jul 16, 2004, published in the Wall Street Journal (http://online.wsj.com/articles/china-plays-a-big-role-as-u-s-treasury-yields-fall-1405545034?tesla=y&mg=reno64-wsj), finds that acceleration in purchases of US Treasury securities by China has been an important factor in the decline of Treasury yields in 2014. Japan increased its holdings from $1182.5 billion in Dec 2013 to $1230.9 billion in Dec 2014 or 4.1 percent. The combined holdings of China and Japan in Dec 2014 add to $2475 billion, which is equivalent to 25.2 percent of US government marketable interest-bearing securities held by investors of $9829 billion in Sep 2014 (http://www.fms.treas.gov/bulletin/index.html). Total foreign holdings of Treasury securities rose from $5792.6 billion in Dec 2013 to $6153.7 billion in Dec 2014, or 6.2 percent. The US continues to finance its fiscal and balance of payments deficits with foreign savings (see Pelaez and Pelaez, The Global Recession Risk (2007)). A point of saturation of holdings of US Treasury debt may be reached as foreign holders evaluate the threat of reduction of principal by dollar devaluation and reduction of prices by increases in yield, including possibly risk premium. Shultz et al (2012) find that the Fed financed three-quarters of the US deficit in fiscal year 2011, with foreign governments financing significant part of the remainder of the US deficit while the Fed owns one in six dollars of US national debt. Concentrations of debt in few holders are perilous because of sudden exodus in fear of devaluation and yield increases and the limit of refinancing old debt and placing new debt. In their classic work on “unpleasant monetarist arithmetic,” Sargent and Wallace (1981, 2) consider a regime of domination of monetary policy by fiscal policy (emphasis added):

“Imagine that fiscal policy dominates monetary policy. The fiscal authority independently sets its budgets, announcing all current and future deficits and surpluses and thus determining the amount of revenue that must be raised through bond sales and seignorage. Under this second coordination scheme, the monetary authority faces the constraints imposed by the demand for government bonds, for it must try to finance with seignorage any discrepancy between the revenue demanded by the fiscal authority and the amount of bonds that can be sold to the public. Suppose that the demand for government bonds implies an interest rate on bonds greater than the economy’s rate of growth. Then if the fiscal authority runs deficits, the monetary authority is unable to control either the growth rate of the monetary base or inflation forever. If the principal and interest due on these additional bonds are raised by selling still more bonds, so as to continue to hold down the growth of base money, then, because the interest rate on bonds is greater than the economy’s growth rate, the real stock of bonds will growth faster than the size of the economy. This cannot go on forever, since the demand for bonds places an upper limit on the stock of bonds relative to the size of the economy. Once that limit is reached, the principal and interest due on the bonds already sold to fight inflation must be financed, at least in part, by seignorage, requiring the creation of additional base money.”

Table VA-7, US, Major Foreign Holders of Treasury Securities $ Billions at End of Period

| Dec 2014 | Nov 2014 | Dec 2013 | |

| Total | 6153.7 | 6112.4 | 5792.6 |

| China | 1244.3 | 1250.4 | 1270.1 |

| Japan | 1230.9 | 1241.5 | 1182.5 |

| Belgium | 335.4 | 335.7 | 256.8 |

| Caribbean Banking Centers | 333.2 | 331.5 | 294.2 |

| Oil Exporters | 285.9 | 278.9 | 238.3 |

| Brazil | 255.8 | 264.2 | 245.4 |

| Switzerland | 190.1 | 183.8 | 176.7 |

| United Kingdom | 189.2 | 174.5 | 163.7 |

| Taiwan | 174.4 | 170.6 | 182.2 |

| Hong Kong | 172.6 | 165.6 | 158.8 |

| Luxembourg | 171.8 | 167.3 | 134.6 |

| Ireland | 138.6 | 127.4 | 125.5 |

| Singapore | 110.0 | 110.1 | 86.2 |

| Foreign Official Holdings | 4113.1 | 4133.5 | 4054.6 |

| A. Treasury Bills | 335.3 | 342.0 | 398.4 |

| B. Treasury Bonds and Notes | 3777.8 | 3791.5 | 3656.2 |

Source: United States Treasury

http://www.treasury.gov/resource-center/data-chart-center/tic/Pages/ticpress.aspx

http://www.treasury.gov/resource-center/data-chart-center/tic/Pages/index.aspx

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015.

No comments:

Post a Comment