G20 Monetary Policy, Recovery without Hiring, Ten Million Fewer Full-time Jobs, Youth and Middle Age Unemployment, Import and Export Prices, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015

I Recovery without Hiring

IA1 Hiring Collapse

IA2 Labor Underutilization

ICA3 Ten Million Fewer Full-time Jobs

IA4 Theory and Reality of Cyclical Slow Growth Not Secular Stagnation: Youth and

Middle-Age Unemployment

IIB Import and Export Prices

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

IX Conclusion. Lucas (2011May) estimates US economic growth in the long-term at 3 percent per year and about 2 percent per year in per capita terms. There are displacements from this trend caused by events such as wars and recessions but the economy grows much faster during the expansion, compensating for the contraction and maintaining trend growth over the entire cycle. Historical US GDP data exhibit remarkable growth: Lucas (2011May) estimates an increase of US real income per person by a factor of 12 in the period from 1870 to 2010. The explanation by Lucas (2011May) of this remarkable growth experience is that government provided stability and education while elements of “free-market capitalism” were an important driver of long-term growth and prosperity. Lucas sharpens this analysis by comparison with the long-term growth experience of G7 countries (US, UK, France, Germany, Canada, Italy and Japan) and Spain from 1870 to 2010. Countries benefitted from “common civilization” and “technology” to “catch up” with the early growth leaders of the US and UK, eventually growing at a faster rate. Significant part of this catch up occurred after World War II. Lucas (2011May) finds that the catch up stalled in the 1970s. The analysis of Lucas (2011May) is that the 20-40 percent gap that developed originated in differences in relative taxation and regulation that discouraged savings and work incentives in comparison with the US. A larger welfare and regulatory state, according to Lucas (2011May), could be the cause of the 20-40 percent gap. Cobet and Wilson (2002) provide estimates of output per hour and unit labor costs in national currency and US dollars for the US, Japan and Germany from 1950 to 2000 (see Pelaez and Pelaez, The Global Recession Risk (2007), 137-44). The average yearly rate of productivity change from 1950 to 2000 was 2.9 percent in the US, 6.3 percent for Japan and 4.7 percent for Germany while unit labor costs in USD increased at 2.6 percent in the US, 4.7 percent in Japan and 4.3 percent in Germany. From 1995 to 2000, output per hour increased at the average yearly rate of 4.6 percent in the US, 3.9 percent in Japan and 2.6 percent in Germany while unit labor costs in USD fell at minus 0.7 percent in the US, 4.3 percent in Japan and 7.5 percent in Germany. There was increase in productivity growth in Japan and France within the G7 in the second half of the 1990s but significantly lower than the acceleration of 1.3 percentage points per year in the US. The key indicator of growth of real income per capita, which is what a person earns after inflation, measures long-term economic growth and prosperity. A refined concept would include real disposable income per capita, which is what a person earns after inflation and taxes.

Table IB-1 provides the data required for broader comparison of long-term and cyclical performance of the United States economy. Revisions and enhancements of United States GDP and personal income accounts by the Bureau of Economic Analysis (BEA) (http://bea.gov/iTable/index_nipa.cfm) provide important information on long-term growth and cyclical behavior. First, Long-term performance. Using annual data, US GDP grew at the average rate of 3.3 percent per year from 1929 to 2013 and at 3.2 percent per year from 1947 to 2013. Real disposable income grew at the average yearly rate of 3.2 percent from 1929 to 2013 and at 3.7 percent from 1947 to 1999. Real disposable income per capita grew at the average yearly rate of 2.0 percent from 1929 to 2013 and at 2.3 percent from 1947 to 1999. US economic growth was much faster during expansions, compensating contractions in maintaining trend growth for whole cycles. Using annual data, US real disposable income grew at the average yearly rate of 3.5 percent from 1980 to 1989 and real disposable income per capita at 2.6 percent. The US economy has lost its dynamism in the current cycle: real disposable income grew at the yearly average rate of 1.4 percent from 2006 to 2013 and real disposable income per capita at 0.5 percent. Real disposable income grew at the average rate of 1.2 percent from 2007 to 2013 and real disposable income per capita at 0.4 percent. Table IB-1 illustrates the contradiction of long-term growth with the proposition of secular stagnation (Hansen 1938, 1938, 1941 with early critique by Simons (1942). Secular stagnation would occur over long periods. Table IB-1 also provides the corresponding rates of population growth that is only marginally lower at 0.8 to 0.9 percent recently from 1.1 percent over the long-term. GDP growth fell abruptly from 2.6 percent on average from 2000 to 2006 to 1.0 percent from 2006 to 2013 and 0.9 percent from 2007 to 2013 and real disposable income growth fell from 2.9 percent on average from 2000 to 2006 to 1.4 percent from 2006 to 2013. The decline of growth of real per capita disposable income is even sharper from average 2.0 percent from 2000 to 2006 to 0.5 percent from 2006 to 2013 and 0.4 percent from 2007 to 2013 while population growth was 0.8 percent on average. Lazear and Spletzer (2012JHJul122) provide theory and measurements showing that cyclic factors explain currently depressed labor markets. This is also the case of the overall economy. Second, first four quarters of expansion. Growth in the first four quarters of expansion is critical in recovering loss of output and employment occurring during the contraction. In the first four quarters of expansion from IQ1983 to IVQ1983: GDP increased 7.8 percent, real disposable personal income 5.3 percent and real disposable income per capita 4.4 percent. In the first four quarters of expansion from IIIQ2009 to IIQ2010: GDP increased 2.7 percent, real disposable personal income 0.2 percent and real disposable income per capita decreased 0.7 percent. Third, first 21 quarters of expansion. In the expansion from IQ1983 to IQ1988: GDP grew 28.4 percent at the annual equivalent rate of 4.9 percent; real disposable income grew 23.8 percent at the annual equivalent rate of 4.2 percent; and real disposable income per capita grew 18.2 percent at the annual equivalent rate of 3.2 percent. In the expansion from IIIQ2009 to IIIQ2014: GDP grew 12.9 percent at the annual equivalent rate of 2.3 percent; real disposable income grew 8.5 percent at the annual equivalent rate of 1.6 percent; and real disposable personal income per capita grew 4.4 percent at the annual equivalent rate of 0.8 percent. Fourth, entire quarterly cycle. In the entire cycle combining contraction and expansion from IQ1980 to IQ1988: GDP grew 28.2 percent at the annual equivalent rate of 3.0 percent; real disposable personal income grew 31.0 percent at the annual equivalent rate of 3.2 percent; and real disposable personal income per capita 21.3 percent at the annual equivalent rate of 2.3 percent. In the entire cycle combining contraction and expansion from IVQ2007 to IIIQ2014: GDP grew 8.1 percent at the annual equivalent rate of 1.1 percent; real disposable personal income 10.3 percent at the annual equivalent rate of 1.4 percent; and real disposable personal income per capita 4.7 percent at the annual equivalent rate of 0.7 percent. The United States grew during its history at high rates of per capita income that made its economy the largest in the world. That dynamism is disappearing. Bordo (2012 Sep27) and Bordo and Haubrich (2012DR) provide strong evidence that recoveries have been faster after deeper recessions and recessions with financial crises, casting serious doubts on the conventional explanation of weak growth during the current expansion allegedly because of the depth of the contraction of 4.3 percent from IVQ2007 to IIQ2009 and the financial crisis. The proposition of secular stagnation should explain a long-term process of decay and not the actual abrupt collapse of the economy and labor markets currently.

Table IB-1, US, GDP, Real Disposable Personal Income, Real Disposable Income per Capita and Population in 1983-85 and 2007-2013, %

| Long-term Average ∆% per Year | GDP | Population | |

| 1929-2013 | 3.3 | 1.1 | |

| 1947-2013 | 3.2 | 1.2 | |

| 1947-1999 | 3.6 | 1.3 | |

| 2000-2013 | 1.7 | 0.9 | |

| 2000-2006 | 2.6 | 0.9 | |

| 2006-2013 | 1.0 | 0.8 | |

| 2007-2013 | 0.9 | 0.8 | |

| Long-term Average ∆% per Year | Real Disposable Income | Real Disposable Income per Capita | Population |

| 1929-2013 | 3.2 | 2.0 | 1.1 |

| 1947-1999 | 3.7 | 2.3 | 1.3 |

| 2000-2013 | 2.1 | 1.2 | 0.9 |

| 2000-2006 | 2.9 | 2.0 | 0.9 |

| 2006-2013 | 1.4 | 0.5 | 0.8 |

| 2007-2013 | 1.2 | 0.4 | 0.8 |

| Whole Cycles Average ∆% per Year | |||

| 1980-1989 | 3.5 | 2.6 | 0.9 |

| 2006-2013 | 1.4 | 0.5 | 0.8 |

| 2007-2013 | 1.2 | 0.4 | 0.8 |

| Comparison of Cycles | # Quarters | ∆% | ∆% Annual Equivalent |

| GDP | |||

| I83 to IV83 IQ83 to IQ87 IQ83 to IIQ87 I83 to III87 IQ83 to IV87 IQ83 to I88 | 4 17 18 19 20 21 | ||

| I83 to IV83 I83 to IQ87 I83 to II87 I83 to III87 I83 to IV87 I183 to I88 | 4 17 18 19 20 21 | 7.8 23.1 24.5 25.6 27.7 28.4 | 7.8 5.0 5.0 4.9 5.0 4.9 |

| RDPI | |||

| I83 to IV83 I83 to I87 I83 to III87 I83 to IV87 I83 to I88 | 4 17 19 20 21 | 5.3 19.5 20.5 22.1 23.8 | 5.3 4.3 4.0 4.1 4.2 |

| RDPI Per Capita | |||

| I83 to IV83 I83 to I87 I83 to III87 I83 to IV87 I83 to I88 | 4 17 19 20 21 | 4.4 15.1 15.5 16.7 18.2 | 4.4 3.4 3.1 3.1 3.2 |

| Whole Cycle IQ1980 to IQ1988 | |||

| GDP | 34 | 28.2 | 3.0 |

| RDPI | 34 | 31.0 | 3.2 |

| RDPI per Capita | 34 | 21.3 | 2.3 |

| Population | 34 | 8.0 | 0.9 |

| GDP | |||

| III09 to II10 III09 to III14 | 4 21 | 2.7 12.9 | 2.7 2.3 |

| RDPI | |||

| III09 to II10 III09 to III14 | 4 21 | 0.2 8.5 | 0.2 1.6 |

| RDPI per Capita | |||

| III09 to II10 III09 to III14 | 4 21 | -0.7 4.4 | -0.7 0.8 |

| Population | |||

| III09 to II010 III09 to III14 | 4 21 | 0.8 3.9 | 0.8 0.7 |

| IVQ2007 to IIIQ2014 | 28 | ||

| GDP | 28 | 8.1 | 1.1 |

| RDPI | 28 | 10.3 | 1.4 |

| RDPI per Capita | 28 | 4.7 | 0.7 |

| Population | 28 | 5.3 | 0.7 |

RDPI: Real Disposable Personal Income

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

There are seven basic facts illustrating the current economic disaster of the United States:

- GDP maintained trend growth in the entire business cycle from IQ1980 to IQ1988, including contractions and expansions. GDP is well below trend in the entire business cycle from IVQ2007 to IIIQ2014, including contractions and expansions

- Per capita real disposable income exceeded trend growth in the 1980s but is substantially below trend in IIIQ2014

- Level of employed persons increased in the 1980s but declined into IIIQ2014

- Level of full-time employed persons increased in the 1980s but declined into IIIQ2014

- Level unemployed, unemployment rate and employed part-time for economic reasons fell in the recovery from the recessions in the 1980s but not substantially in the recovery since IIIQ2009

- Wealth of households and nonprofit organizations soared in the 1980s but stagnated in real terms into IIIQ2014

- Gross private domestic investment increased sharply from IQ1980 to IQ1988 but gross private domestic investment stagnated and private fixed investment stagnated from IVQ2007 into IIIQ2014

There is a critical issue of the United States economy will be able in the future to attain again the level of activity and prosperity of projected trend growth. Growth at trend during the entire business cycles built the largest economy in the world but there may be an adverse, permanent weakness in United States economic performance and prosperity. Table IB-2 provides data for analysis of these seven basic facts. The seven blocks of Table IB-2 are separated initially after individual discussion of each one followed by the full Table IB-2.

1. Trend Growth.

i. As shown in Table IB-2, actual GDP grew cumulatively 27.8 percent from IQ1980 to IQ1988, which is relatively close to what trend growth would have been at 28.6 percent. Real GDP grew 28.2 percent from IVQ1979 to IQ1988. Rapid growth at the average annual rate of 4.9 percent per quarter during the expansion from IQ1983 to IQ1988 erased the loss of GDP of 4.6 percent during the contractions and maintained trend growth at 3.0 percent for GDP and 3.2 percent for real disposable personal income over the entire cycle.

ii. In contrast, cumulative growth from IVQ2007 to IIIQ2014 was 8.1 percent while trend growth would have been 23.0 percent. GDP in IIIQ2014 at seasonally adjusted annual rate is $16,205.6 billion as estimated by the Bureau of Economic Analysis (BEA) (http://www.bea.gov/iTable/index_nipa.cfm) and would have been $18,438.0 billion, or $2,232.4 billion higher, had the economy grown at trend over the entire business cycle as it happened during the 1980s and throughout most of US history. GDP in IIIQ2014 is 12.1 percent below trend. There is about $2.2 trillion of foregone GDP that the economy would have created as it occurred during past cyclical expansions, which explains why employment net of population growth has not rebounded to even higher than before. There would not be recovery of full employment even with growth of 3 percent per year beginning immediately because the opportunity was lost to grow faster during the expansion from IIIQ2009 to IIIQ2014 after the recession from IVQ2007 to IIQ2009. The United States has acquired a heavy social burden of unemployment and underemployment of 26.0 million people or 15.8 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2014/12/financial-risks-twenty-six-million.html) that will not diminish significantly even with return to growth of GDP of 3 percent per year because of growth of the labor force by new entrants. The ratio of the labor force of 154.871 million in Jul 2007 to the noninstitutional population of 231.958 million in Jul 2007 was 66.8 percent while the ratio of the labor force of 156.297 million in Nov 2014 to the noninstitutional population of 248.844 million in Nov 2014 was 62.8 percent. The labor force of the US in Nov 2014 corresponding to 66.8 percent of participation in the population would be 166.228 million (0.668 x 248.844. The difference between the measured labor force in Nov 2014 of 156.297 million and the labor force in Nov 2014 with participation rate of 66.8 percent (as in Jul 2007) of 166.228 million is 9.931 million. The level of the labor force in the US has stagnated and is 9.931 million lower than what it would have been had the same participation rate been maintained. Millions of people have abandoned their search for employment because they believe there are no jobs available for them. The key issue is whether the decline in participation of the population in the labor force is the result of people giving up on finding another job.Structural change in demography occurs over relatively long periods and not suddenly as shown by Edward P. Lazear and James R. Spletzer (2012JHJul22). There is an abrupt cyclical event and no evidence for secular stagnation and similar propositions.

| Period IQ1980 to IQ1988 | |

| GDP SAAR USD Billions | |

| IQ1980 | 6,524.9 |

| IQ1988 | 8,339.3 |

| ∆% IQ1980 to IQ1988 (28.2 percent from IVQ1979 $6503.9 billion) | 27.8 |

| ∆% Trend Growth IQ1980 to IQ1988 | 28.6 |

| Period IVQ2007 to IIIQ2014 | |

| GDP SAAR USD Billions | |

| IVQ2007 | 14,991.8 |

| IIIQ2014 | 16,205.6 |

| ∆% IVQ2007 to IIIQ2014 Actual | 8.1 |

| ∆% IVQ2007 to IIIQ2014 Trend Growth | 23.0 |

2. Stagnating Per Capita Real Disposable Income

i. In the entire business cycle from IQ1980 to IVQ1987, as shown in Table IB-2, growth of per capita real disposable income, or what is left per person after inflation and taxes, grew cumulatively 21.3 percent, which is close to what would have been trend growth of 18.3 percent.

ii. In contrast, in the entire business cycle from IVQ2007 to IIIQ2014, per capita real disposable income increased 4.7 percent while trend growth would have been 14.9 percent. Income available after inflation and taxes is about the same as before the contraction after 21 consecutive quarters of GDP growth at mediocre rates relative to those prevailing during historical cyclical expansions. Growth of personal income during the expansion has been tepid even with the new revisions. In IVQ2012, nominal disposable personal income grew at the SAAR of 13.8 percent and real disposable personal income at 11.8 percent (Table 2.1 http://bea.gov/iTable/index_nipa.cfm). The BEA explains as follows: “Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf pages 1-2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0113.pdf). The Bureau of Economic Analysis explains as (http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0213.pdf 2-3): “The January estimate of employee contributions for government social insurance reflected the expiration of the “payroll tax holiday,” that increased the social security contribution rate for employees and self-employed workers by 2.0 percentage points, or $114.1 billion at an annual rate. For additional information, see FAQ on “How did the expiration of the payroll tax holiday affect personal income for January 2013?” at www.bea.gov. The January estimate of employee contributions for government social insurance also reflected an increase in the monthly premiums paid by participants in the supplementary medical insurance program, in the hospital insurance provisions of the Patient Protection and Affordable Care Act, and in the social security taxable wage base.”

The increase was provided in the “fiscal cliff” law H.R. 8 American Taxpayer Relief Act of 2012 (http://www.gpo.gov/fdsys/pkg/BILLS-112hr8eas/pdf/BILLS-112hr8eas.pdf).

In IQ2013, personal income fell at the SAAR of minus 8.6 percent; real personal income excluding current transfer receipts at minus 11.9 percent; and real disposable personal income at minus 12.6 percent (Table 6 at http://www.bea.gov/newsreleases/national/pi/2014/pdf/pi1014.pdf). The BEA explains as follows (page 3 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf):

“The February and January changes in disposable personal income (DPI) mainly reflected the effect of special factors in January, such as the expiration of the “payroll tax holiday” and the acceleration of bonuses and personal dividends to November and to December in anticipation of changes in individual tax rates.”

In IIQ2013, personal income grew at 4.5 percent, real personal income excluding current transfer receipts at 4.6 percent and real disposable income at 3.8 percent (http://www.bea.gov/newsreleases/national/pi/2014/pdf/pi1114.pdf). In IIIQ2013, personal income grew at 3.3 percent, real personal income excluding current transfers at 1.5 percent and real disposable income at 2.0 percent (Table 6 at http://www.bea.gov/newsreleases/national/pi/2014/pdf/pi1114.pdf). In IVQ2013, personal income grew at 1.8 percent and real disposable income at 0.2 percent (Table 6 at http://www.bea.gov/newsreleases/national/pi/2014/pdf/pi1014.pdf). In IQ2014, personal income grew at 4.9 percent in nominal terms and 3.2 percent in real terms excluding current transfer receipts while nominal disposable income grew at 4.8 percent and real disposable income at 3.4 percent (http://www.bea.gov/newsreleases/national/pi/2014/pdf/pi1114.pdf). In IIQ2014, personal income grew at 4.9 percent and 2.2 percent in real terms excluding current transfers. Nominal disposable income grew at 5.5 percent and at 3.1 percent in real terms (http://www.bea.gov/newsreleases/national/pi/2014/pdf/pi1114.pdf). In IIIQ2014, personal income grew at 3.6 percent, real personal income excluding current transfers at 2.0 percent and real disposable personal income at 2.0 percent (http://www.bea.gov/newsreleases/national/pi/2014/pdf/pi1114.pdf).

| Period IQ1980 to IQ1988 |

| Real Disposable Personal Income per Capita IQ1980 Chained 2009 USD | 20,241 |

| Real Disposable Personal Income per Capita IQ1988 Chained 2009 USD | 24,543 |

| ∆% IQ1980 to IQ1988 (21.3 percent from IVQ1979 $20,230) | 21.3 |

| ∆% Trend Growth | 18.3 |

| Period IVQ2007 to IIIQ2014 |

| Real Disposable Personal Income per Capita IVQ2007 Chained 2009 USD | 35,819 |

| Real Disposable Personal Income per Capita IIIQ2014 Chained 2009 USD | 37,496 |

| ∆% IVQ2007 to IIIQ2014 | 4.7 |

| ∆% Trend Growth | 14.9 |

3. Number of Employed Persons

i. As shown in Table IB-2, the number of employed persons increased over the entire business cycle from 98.527 million not seasonally adjusted (NSA) in IQ1980 to 112.867 million NSA in IQ1988 or by 14.6 percent.

ii. In contrast, during the entire business cycle the number employed stagnated from 146.334 million in IVQ2007 to 147.666 million in IIIQ2014 or by 0.9 percent. There are 25.9 million persons unemployed or underemployed, which is 15.8 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2015/01/fluctuating-valuations-of-risk.html). The number employed in Nov 2014 was 147.666 million (NSA) or 0.351 million more people with jobs relative to the peak of 147.315 million in Jul 2007 while the civilian noninstitutional population of ages 16 years and over increased from 231.958 million in Jul 2007 to 248.844 million in Nov 2014 or by 16.886 million. The number employed increased 0.2 percent from Jul 2007 to Nov 2014 while the noninstitutional civilian population of ages of 16 years and over, or those available for work, increased 7.3 percent. The ratio of employment to population in Jul 2007 was 63.5 percent (147.315 million employment as percent of population of 231.958 million). The same ratio in Nov 2014 would result in 158.016 million jobs (0.635 multiplied by noninstitutional civilian population of 248.844 million). There are effectively 10.350 million fewer jobs in Nov 2014 than in Jul 2007, or 158.016 million minus 147.666 million. There is actually not sufficient job creation in merely absorbing new entrants in the labor force because of those dropping from job searches, worsening the stock of unemployed or underemployed in involuntary part-time jobs.

| Period IQ1980 to IQ1988 |

| Employed Millions IQ1980 NSA End of Quarter | 98.527 |

| Employed Millions IQ1988 NSA End of Quarter | 112.867 |

| ∆% Employed IQ1980 to IQ1988 | 14.6 |

| Period IVQ2007 to IIIQ2014 |

| Employed Millions IVQ2007 NSA End of Quarter | 146.334 |

| Employed Millions IIIQ2014 NSA End of Quarter | 147.666 |

| ∆% Employed IVQ2007 to IIIQ2014 | 0.9 |

4. Number of Full-Time Employed Persons

i. As shown in Table IB-2, during the entire business cycle in the 1980s, including contractions and expansion, the number of employed full-time rose from 81.280 million NSA in IQ1980 to 92.760 million NSA in IQ1988 or 14.1 percent.

ii. In contrast, during the entire current business cycle, including contraction and expansion, the number of persons employed full-time fell from 121.042 million in IVQ2007 to 119.791 million in IIIQ2014 or by minus 1.0 percent. The number with full-time jobs in Nov 2014 is 119.441 million, which is lower by 3.778 million relative to the peak of 123.219 million in Jul 2007. The magnitude of the stress in US labor markets is magnified by the increase in the civilian noninstitutional population of the United States from 231.958 million in Jul 2007 to 248.844 million in Nov 2014 or by 16.886 million (http://www.bls.gov/data/) while in the same period the number of full-time jobs fell 3.778 million. The ratio of full-time jobs of 123.219 million Jul 2007 to civilian noninstitutional population of 231.958 million was 53.1 percent. If that ratio had remained the same, there would be 132.157 million full-time jobs with population of 248.884 million in Nov 2014 (0.531 x 248.884) or 12.716 million fewer full-time jobs relative to actual 119.441 million. There appear to be around 10 million fewer full-time jobs in the US than before the global recession while population increased around 17 million. Mediocre GDP growth is the main culprit of the fractured US labor market.

4. Number of Full-time Employed Persons

| Period IQ1980 to IQ1988 |

| Employed Full-time Millions IQ1980 NSA End of Quarter | 81.280 |

| Employed Full-time Millions IQ1988 NSA End of Quarter | 92.760 |

| ∆% Full-time Employed IQ1980 to IQ1988 | 14.1 |

| Period IVQ2007 to IIIQ2014 |

| Employed Full-time Millions IVQ2007 NSA End of Quarter | 121.042 |

| Employed Full-time Millions IIIQ2014 NSA End of Quarter | 119.791 |

| ∆% Full-time Employed IVQ2007 to IIIQ2014 | -1.0 |

5. Unemployed, Unemployment Rate and Employed Part-time for Economic Reasons.

i. As shown in Table IB-2 and in the following block, in the cycle from IQ1980 to IQ1988: (a) The rate of unemployment was slightly lower at 5.9 percent in IQ1988 relative to 6.6 percent in IQ1980. (b) The number unemployed increased from 6.983 million in IQ1980 to 7.090 million in IQ1988 or 1.5 percent. (c) The number employed part-time for economic reasons increased 41.5 percent from 3.624 million in IQ1980 to 5.129 million in IQ1988.

ii. In contrast, in the economic cycle from IVQ2007 to IIIQ2014: (a) The rate of unemployment increased from 4.8 percent in IVQ2007 to 5.7 percent in IIIQ2014. (b) The number unemployed increased 21.6 percent from 7.371 million in IVQ2007 to 8.962 million in IIIQ2014. (c) The number employed part-time for economic reasons because they could not find any other job increased 41.3 percent from 4.750 million in IVQ2007 to 6.711 million in IIIQ2014. (d) U6 Total Unemployed plus all marginally attached workers plus total employed part time for economic reasons as percent of all civilian labor force plus all marginally attached workers NSA increased from 8.7 percent in IVQ2007 to 11.3 percent in IIIQ2014.

| Period IQ1980 to IQ1988 |

| Unemployment Rate IQ1980 NSA End of Quarter | 6.6 |

| Unemployment Rate IQ1988 NSA End of Quarter | 5.9 |

| Unemployed IQ1980 Millions End of Quarter | 6.983 |

| Unemployed IQ1988 Millions End of Quarter | 7.090 |

| ∆% | 1.5 |

| Employed Part-time Economic Reasons Millions IQ1980 End of Quarter | 3.624 |

| Employed Part-time Economic Reasons Millions IQ1988 End of Quarter | 5.129 |

| ∆% | 41.5 |

| Period IVQ2007 to IIIQ2014 |

| Unemployment Rate IVQ2007 NSA End of Quarter | 4.8 |

| Unemployment Rate IIIQ2014 NSA End of Quarter | 5.7 |

| Unemployed IVQ2007 Millions End of Quarter | 7.371 |

| Unemployed IIIQ2014 Millions End of Quarter | 8.962 |

| ∆% | 21.6 |

| Employed Part-time Economic Reasons IVQ2007 Millions End of Quarter | 4.750 |

| Employed Part-time Economic Reasons Millions IIIQ2014 End of Quarter | 6.711 |

| ∆% | 41.3 |

| U6 Total Unemployed plus all marginally attached workers plus total employed part time for economic reasons as percent of all civilian labor force plus all marginally attached workers NSA | |

| IVQ2007 | 8.7 |

| IIIQ2014 | 11.3 |

6. Wealth of Households and Nonprofit Organizations.

The comparison of net worth of households and nonprofit organizations in the entire economic cycle from IQ1980 (and from IVQ1979) to IQ1988 and from IVQ2007 to IIIQ2014 is provided in Table IIA-5. The data reveal the following facts for the cycles in the 1980s:

- IVQ1979 to IQ1988. Net worth increased 104.4 percent from IVQ1979 to IQ1988, the all items CPI index increased 51.9 percent from 76.7 in Dec 1979 to 116.5 in Mar 1988 and real net worth increased 32.6 percent.

- IQ1980 to IVQ1985. Net worth increased 65.4 percent, the all items CPI index increased 36.5 percent from 80.1 in Mar 1980 to 109.3 in Dec 1985 and real net worth increased 21.2 percent.

- IVQ1979 to IVQ1985. Net worth increased 68.8 percent, the all items CPI index increased 42.5 percent from 76.7 in Dec 1979 to 109.3 in Dec 1985 and real net worth increased 18.5 percent.

- IQ1980 to IQ1988. Net worth increased 100.2 percent, the all items CPI index increased 45.4 percent from 80.1 in Mar 1980 to 116.5 in Mar 1988 and real net worth increased 37.6 percent.

There is disastrous performance in the current economic cycle:

- IVQ2007 to IIIQ2014. Net worth increased 21.9 percent, the all items CPI increased 13.3 percent from 210.036 in Dec 2007 to 238.031 in Sep 2014 and real or inflation adjusted net worth increased 7.5 percent. Real estate assets adjusted for inflation fell 16.4 percent.

The explanation is partly in the sharp decline of wealth of households and nonprofit organizations and partly in the mediocre growth rates of the cyclical expansion beginning in IIIQ2009. Long-term economic performance in the United States consisted of trend growth of GDP at 3 percent per year and of per capita GDP at 2 percent per year as measured for 1870 to 2010 by Robert E Lucas (2011May). The economy returned to trend growth after adverse events such as wars and recessions. The key characteristic of adversities such as recessions was much higher rates of growth in expansion periods that permitted the economy to recover output, income and employment losses that occurred during the contractions. Over the business cycle, the economy compensated the losses of contractions with higher growth in expansions to maintain trend growth of GDP of 3 percent and of GDP per capita of 2 percent. The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. US economic growth has been at only 2.3 percent on average in the cyclical expansion in the 21 quarters from IIIQ2009 to IIIQ2014. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). There are new calculations using the revision of US GDP and personal income data since 1929 by the Bureau of Economic Analysis (BEA) (http://bea.gov/iTable/index_nipa.cfm) and the third estimate of GDP for IIIQ2014 (http://www.bea.gov/newsreleases/national/gdp/2014/pdf/gdp3q14_3rd.pdf). The average of 7.7 percent in the first four quarters of major cyclical expansions is in contrast with the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 of only 2.7 percent obtained by diving GDP of $14,745.9 billion in IIQ2010 by GDP of $14,355.6 billion in IIQ2009 {[$14,745.9/$14,355.6 -1]100 = 2.7%], or accumulating the quarter on quarter growth rates (http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/valuations-of-risk-financial-assets.html). The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.9 percent, 5.4 percent from IQ1983 to IIIQ1986, 5.2 percent from IQ1983 to IVQ1986, 5.0 percent from IQ1983 to IQ1987, 5.0 percent from IQ1983 to IIQ1987, 4.9 percent from IQ1983 to IIIQ1987, 5.0 percent from IQ1983 to IVQ1987, 4.9 percent from IQ1983 to IQ1988 and at 7.8 percent from IQ1983 to IVQ1983 (http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/valuations-of-risk-financial-assets.html). The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. Growth at trend in the entire cycle from IVQ2007 to IIIQ2014 would have accumulated to 23.0 percent. GDP in IIIQ2014 would be $18,438.0 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2,232.4 billion than actual $16,205.6 billion. There are about two trillion dollars of GDP less than at trend, explaining the 25.9 million unemployed or underemployed equivalent to actual unemployment of 15.7 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2015/01/fluctuating-valuations-of-risk.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/12/financial-risks-twenty-six-million.html). US GDP in IIIQ2014 is 12.1 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,205.1 billion in IIIQ2014 or 8.1 percent at the average annual equivalent rate of 1.1 percent. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. The long-term trend is growth at average 3.3 percent per year from Jan 1919 to Dec 2014. Growth at 3.3 percent per year would raise the NSA index of manufacturing output from 99.2392 in Dec 2007 to 124.5620 in Dec 2014. The actual index NSA in Dec 2014 is 101.2840, which is 18.7 percent below trend. Manufacturing output grew at average 2.4 percent between Dec 1986 and Dec 2014, raising the index at trend to 117.1610 in Dec 2014. The output of manufacturing at 101.2840 in Dec 2014 is 13.6 percent below trend under this alternative calculation.

| Period IQ1980 to IVQ1985 | |

| Net Worth of Households and Nonprofit Organizations USD Millions | |

| IVQ1979 IQ1980 | 9,047.8 9,238.6 |

| IVQ1985 IIIQ1986 IVQ1986 IQ1987 IIQ1987 IIIQ1987 IVQ1987 IQ1988 | 15,277.2 16,290.8 16,840.3 17,494.6 17,784.0 18,195.3 18,021.9 18,495.2 |

| ∆ USD Billions IVQ1985 IVQ1979 to IQ1988 IQ1980-IVQ1985 IQ1980-IIIQ1986 IQ1980-IVQ1986 IQ1980-IQ1987 IQ1980-IIQ1987 IQ1980-IIIQ1987 IQ1980-IVQ1987 IQ1980-IQ1988 | +6,229.4 ∆%68.8 R∆%18.5 +9447.4 ∆%104.4 R∆%34.6 +6,038.6 ∆%65.4 R∆%21.2 +7,052.2 ∆%76.3 R∆%28.2 +7,601.7 ∆%82.3 R∆%32.1 +8,256.0 ∆%89.4 R∆%35.3 +8,545.4 ∆%92.5 R∆%35.9 +8,956.7 ∆%96.9 R∆%37.2 +8783.3 ∆%95.1 R∆%35.4 +9256.6 ∆%100.2 R∆%37.6 |

| Period IVQ2007 to IIIQ2014 | |

| Net Worth of Households and Nonprofit Organizations USD Millions | |

| IVQ2007 | 66,753.5 |

| IIIQ2014 | 81,348.8 |

| ∆ USD Billions | +14,595.3 ∆%21.9 R∆%7.5 |

Net Worth = Assets – Liabilities. R∆% real percentage change or adjusted for CPI percentage change.

7. Gross Private Domestic Investment.

i. The comparison of gross private domestic investment in the entire economic cycles from IQ1980 to IQ1988 and from IVQ2007 to IIIQ2014 is in the following block and in Table IB-2. Gross private domestic investment increased from $951.6 billion in IQ1980 to $1,194.4 billion in IQ1988 or by 25.5 percent.

ii In the current cycle, gross private domestic investment increased from $2,605.2 billion in IVQ2007 to $2,750.8 billion in IIIQ2014, or 5.6 percent. Private fixed investment edged from $2,586.3 billion in IVQ2007 to $2,643.3 billion in IIIQ2014, or increase by 2.2 percent.

| Period IQ1980 to IQ1988 | |

| Gross Private Domestic Investment USD 2009 Billions | |

| IQ1980 | 951.6 |

| IQ1988 | 1,194.4 |

| ∆% | 25.5 |

| Period IVQ2007 to IIIQ2014 | |

| Gross Private Domestic Investment USD Billions | |

| IVQ2007 | 2,605.2 |

| IIIQ2014 | 2,750.8 |

| ∆% | 5.6 |

| Private Fixed Investment USD 2009 Billions | |

| IVQ2007 | 2,586.3 |

| IIIQ2014 | 2,643.3 |

| ∆% | 2.2 |

Table IB-2, US, GDP and Real Disposable Personal Income per Capita Actual and Trend Growth and Employment, 1980-1985 and 2007-2012, SAAR USD Billions, Millions of Persons and ∆%

| Period IQ1980 to IQ1988 | |

| GDP SAAR USD Billions | |

| IQ1980 | 6,524.9 |

| IQ1988 | 8,339.3 |

| ∆% IQ1980 to IQ1988 (28.2 percent from IVQ1979 $6503.9 billion) | 27.8 |

| ∆% Trend Growth IQ1980 to IQ1988 | 28.6 |

| Real Disposable Personal Income per Capita IQ1980 Chained 2009 USD | 20,241 |

| Real Disposable Personal Income per Capita IQ1988 Chained 2009 USD | 24,543 |

| ∆% IQ1980 to IQ1988 (21.3 percent from IVQ1979 $20,230 billion) | 21.3 |

| ∆% Trend Growth | 18.3 |

| Employed Millions IQ1980 NSA End of Quarter | 98.527 |

| Employed Millions IQ1988 NSA End of Quarter | 112.867 |

| ∆% Employed IQ1980 to IQ1988 | 14.6 |

| Employed Full-time Millions IQ1980 NSA End of Quarter | 81.280 |

| Employed Full-time Millions IQ1988 NSA End of Quarter | 92.760 |

| ∆% Full-time Employed IQ1980 to IQ1988 | 14.1 |

| Unemployment Rate IQ1980 NSA End of Quarter | 6.6 |

| Unemployment Rate IQ1988 NSA End of Quarter | 5.9 |

| Unemployed IQ1980 Millions NSA End of Quarter | 6.983 |

| Unemployed IQ1988 Millions NSA End of Quarter | 7.090 |

| ∆% | 1.5 |

| Employed Part-time Economic Reasons IQ1980 Millions NSA End of Quarter | 3.624 |

| Employed Part-time Economic Reasons Millions IQ1988 NSA End of Quarter | 5.129 |

| ∆% | 41.5 |

| Net Worth of Households and Nonprofit Organizations USD Billions | |

| IVQ1979 | 9,047.8 |

| IQ1988 | 18,495.2 |

| ∆ USD Billions | +9,447.4 |

| ∆% CPI Adjusted | 34.6 |

| Gross Private Domestic Investment USD 2009 Billions | |

| IQ1980 | 951.6 |

| IQ1988 | 1194.4 |

| ∆% | 25.5 |

| Period IVQ2007 to IIIQ2014 | |

| GDP SAAR USD Billions | |

| IVQ2007 | 14,991.8 |

| IIIQ2014 | 16,205.6 |

| ∆% IVQ2007 to IIIQ2014 | 8.1 |

| ∆% IVQ2007 to IIIQ2014 Trend Growth | 23.0 |

| Real Disposable Personal Income per Capita IVQ2007 Chained 2009 USD | 35,819 |

| Real Disposable Personal Income per Capita IIIQ2014 Chained 2009 USD | 37,496 |

| ∆% IVQ2007 to IIIQ2014 | 4.7 |

| ∆% Trend Growth | 14.9 |

| Employed Millions IVQ2007 NSA End of Quarter | 146.334 |

| Employed Millions IIIQ2014 NSA End of Quarter | 147.666 |

| ∆% Employed IVQ2007 to IIIQ2014 | 0.9 |

| Employed Full-time Millions IVQ2007 NSA End of Quarter | 121.042 |

| Employed Full-time Millions IIIQ2014 NSA End of Quarter | 119.791 |

| ∆% Full-time Employed IVQ2007 to IIIQ2014 | -1.0 |

| Unemployment Rate IVQ2007 NSA End of Quarter | 4.8 |

| Unemployment Rate IIIQ2014 NSA End of Quarter | 5.7 |

| Unemployed IVQ2007 Millions NSA End of Quarter | 7.371 |

| Unemployed IIIQ2014 Millions NSA End of Quarter | 8.962 |

| ∆% | 21.6 |

| Employed Part-time Economic Reasons IVQ2007 Millions NSA End of Quarter | 4.750 |

| Employed Part-time Economic Reasons Millions IIIQ2014 NSA End of Quarter | 6.711 |

| ∆% | 41.3 |

| U6 Total Unemployed plus all marginally attached workers plus total employed part time for economic reasons as percent of all civilian labor force plus all marginally attached workers NSA | |

| IVQ2007 | 8.7 |

| IIIQ2014 | 11.3 |

| Net Worth of Households and Nonprofit Organizations USD Billions | |

| IVQ2007 | 66,753.5 |

| IIIQ2014 | 81,348.8 |

| ∆ USD Billions | 14,595.3 ∆%21.9 R∆%7.5 |

| Gross Private Domestic Investment USD Billions | |

| IVQ2007 | 2,605.2 |

| IIIQ2014 | 2,750.8 |

| ∆% | 5.6 |

| Private Fixed Investment USD 2009 Billions | |

| IVQ2007 | 2,586.3 |

| IIIQ2014 | 2,643.3 |

| ∆% | 2.2 |

Note: GDP trend growth used is 3.0 percent per year and GDP per capita is 2.0 percent per year as estimated by Lucas (2011May) on data from 1870 to 2010.

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm US Bureau of Labor Statistics http://www.bls.gov/data/. Board of Governors of the Federal Reserve System. 2014. Flow of funds, balance sheets and integrated macroeconomic accounts: third quarter 2014. Washington, DC, Federal Reserve System, Dec 11.

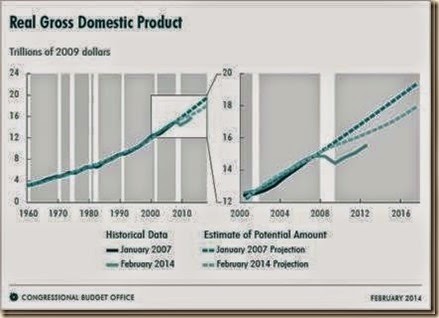

The Congressional Budget Office (CBO 2014BEOFeb4) estimates potential GDP, potential labor force and potential labor productivity provided in Table IB-3. The CBO estimates average rate of growth of potential GDP from 1950 to 2012 at 3.3 percent per year. The projected path is significantly lower at 2.1 percent per year from 2013 to 2024. The legacy of the economic cycle expansion from IIIQ2009 to IIIQ2014 is GDP growth at 2.3 percent on average is in contrast with 4.9 percent on average in the expansion from IQ1983 to IQ1988 (http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html). Subpar economic growth may perpetuate unemployment and underemployment estimated at 25.9 million or 15.8 percent of the effective labor force in Dec 2014 (http://cmpassocregulationblog.blogspot.com/2015/01/fluctuating-valuations-of-risk.html) with much lower hiring than in the period before the current cycle (http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html).

Table IB-3, US, Congressional Budget Office History and Projections of Potential GDP of US Overall Economy, ∆%

| Potential GDP | Potential Labor Force | Potential Labor Productivity* | |

| Average Annual ∆% | |||

| 1950-1973 | 3.9 | 1.6 | 2.3 |

| 1974-1981 | 3.2 | 2.5 | 0.8 |

| 1982-1990 | 3.2 | 1.6 | 1.6 |

| 1991-2001 | 3.2 | 1.3 | 1.9 |

| 2002-2012 | 2.2 | 0.8 | 1.4 |

| 2007-2012 | 1.7 | 0.6 | 1.1 |

| Total 1950-2012 | 3.3 | 1.5 | 1.8 |

| Projected Average Annual ∆% | |||

| 2013-2018 | 2.1 | 0.6 | 1.5 |

| 2019-2024 | 2.1 | 0.5 | 1.6 |

| 2013-2024 | 2.1 | 0.5 | 1.6 |

*Ratio of potential GDP to potential labor force

Source: CBO (2014BEOFeb4), CBO, Key assumptions in projecting potential GDP—February 2014 baseline. Washington, DC, Congressional Budget Office, Feb 4, 2014.

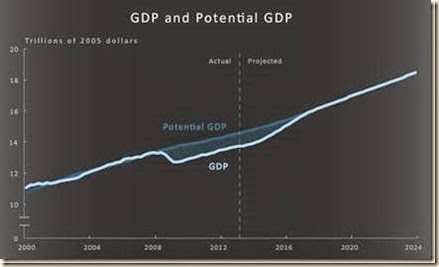

Chart IB-1 of the Congressional Budget Office (CBO 2013BEOFeb5) provides actual and potential GDP of the United States from 2000 to 2011 and projected to 2024. Lucas (2011May) estimates trend of United States real GDP of 3.0 percent from 1870 to 2010 and 2.2 percent for per capita GDP. The United States successfully returned to trend growth of GDP by higher rates of growth during cyclical expansion as analyzed by Bordo (2012Sep27, 2012Oct21) and Bordo and Haubrich (2012DR). Growth in expansions following deeper contractions and financial crises was much higher in agreement with the plucking model of Friedman (1964, 1988). The unusual weakness of growth at 2.3 percent on average from IIIQ2009 to IIIQ2014 during the current economic expansion in contrast with 4.9 percent on average in the cyclical expansion from IQ1983 to IQ1988 (http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html) cannot be explained by the contraction of 4.3 percent of GDP from IVQ2007 to IIQ2009 and the financial crisis. Weakness of growth in the expansion is perpetuating unemployment and underemployment of 26.0 million or 15.8 percent of the labor force as estimated for Dec 2014 (http://cmpassocregulationblog.blogspot.com/2015/01/fluctuating-valuations-of-risk.html). There is no exit from unemployment/underemployment and stagnating real wages because of the collapse of hiring (http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html). The US economy and labor markets collapsed without recovery. Abrupt collapse of economic conditions can be explained only with cyclic factors (Lazear and Spletzer 2012Jul22) and not by secular stagnation (Hansen 1938, 1939, 1941 with early dissent by Simons 1942).

Chart IB-1, US, Congressional Budget Office, Actual and Projections of Potential GDP, 2000-2024, Trillions of Dollars

Source: Congressional Budget Office, CBO (2013BEOFeb5). The last year in common in both projections is 2017. The revision lowers potential output in 2017 by 7.3 percent relative to the projection in 2007.

Chart IB-2 provides differences in the projections of potential output by the CBO in 2007 and more recently on Feb 4, 2014, which the CBO explains in CBO (2014Feb28).

Chart IB-2, Congressional Budget Office, Revisions of Potential GDP

Source: Congressional Budget Office, 2014Feb 28. Revisions to CBO’s Projection of Potential Output since 2007. Washington, DC, CBO, Feb 28, 2014.

Chart IB-3 provides actual and projected potential GDP from 2000 to 2024. The gap between actual and potential GDP disappears at the end of 2017 (CBO2014Feb4). GDP increases in the projection at 2.5 percent per year.

Chart IB-3, Congressional Budget Office, GDP and Potential GDP

Source: CBO (2013BEOFeb5), CBO, Key assumptions in projecting potential GDP—February 2014 baseline. Washington, DC, Congressional Budget Office, Feb 4, 2014.

References

Abraham, Katharine G., John C. Haltiwanger, Kristin Sandusky and James Spletzer. 2009. Exploring differences in employment between household and establishment data. Cambridge, MA, National Bureau of Economic Research, Mar 2009.

Allen, William R. 1993. Irving Fisher and the 100 percent reserve proposal. Journal of Law and Economics 36 (2, Oct): 703-17.

Andrés, Javier, J. David López-Salido and Edward Nelson. 2004. Tobin’s imperfect asset substitution in optimizing equilibrium. Journal of Money, Credit and Banking 36 (4, Aug): 665-90.

Asso, Pier Francesco, George A. Kahn and Robert Leeson. 2007. The Taylor Rule and the transformation of monetary policy. Kansas City: Federal Reserve Bank of Kansas City RWP 07-II, Dec.

Asso, Pier Francesco, George A. Kahn and Robert Leeson. 2010. The Taylor Rule and the practice of central banking. Kansas City: Federal Reserve Bank of Kansas City, RWP 10-05, Feb.

Atkeson, Andrew and Patrick J. Kehoe. 1998. Paths of development for early- and late-bloomers in a dynamic Heckscher-Ohlin world. Minneapolis, Federal Reserve Bank of Minneapolis, Staff Report No. 256, Oct.

Atkeson, Andrew and Patrick J. Kehoe. 2004. Deflation and depression: is there an empirical link. American Economic Review 94 (2, May): 99-103.

Bagehot, Walter. 1873. Lombard Street, 14th edn. London: Kegan, Paul & Co, 1917.

Ball, Laurence and N. Gregory Mankiw. 2002. The NAIRU in theory and practice. Journal of Economic Perspectives 16 (4, Autumn): 115-36.

Bank of Japan. 2012Feb14APP. Amendment to “Principal Terms and Conditions for the Asset Purchase Program.” Tokyo, Bank of Japan, Feb 14 http://www.boj.or.jp/en/announcements/release_2012/rel120214a.pdf

Bank of Japan. 2012Feb14PSG. The price stability goal in the medium to long term. Tokyo, Bank of Japan, Feb 14 http://www.boj.or.jp/en/announcements/release_2012/k120214b.pdf

Bank of Japan. 2012Feb14EME. Enhancement of monetary easing. Tokyo, Bank of Japan, Feb 14 http://www.boj.or.jp/en/announcements/release_2012/k120214a.pdf

Barbosa, Fernando de Holanda. 1987. Domestic and international sources of Brazilian inflation: 1947-80. In Luigi L. Pasinetti and P.J. Lloyd, eds. Structural change, economic interdependence and world development. Basingstoke: Palgrave Macmillan.

Barro, Robert J. and David B. Gordon. 1983a. Rules, discretion and reputation in a model of monetary policy. Journal of Monetary Economics 12 (1): 101-121.

Barro, Robert J. and David B. Gordon. 1983b. A positive theory of monetary policy in a natural rate model. Journal of Political Economy 91 (4, Aug): 589-610.

Barsky, Robert B. and Lutz Kilian. 2004. Oil and the macroeconomy since the 1970s. Journal of Economic Perspectives 18 (4, Autumn): 115-34.

Barth, James R., Gerard Caprio, Jr. and Ross Levine. 2006. Rethinking bank regulation. Cambridge: Cambridge University Press.

Basel Committee on Banking Supervision. 2011Jun. Basel II: a global regulatory framework for more resilient banks and banking systems. Basel, Switzerland: BIS, Jun 2011 http://www.bis.org/publ/bcbs189.pdf

Batini, Nicoletta and Edward Nelson. 2002. The lag from monetary policy actions to inflation: Friedman revisited. London, Bank of England, External MPC Unit Discussion Paper No. 6, Jan.

Beim, David O. 2011Oct9. Can the euro be saved? New York City, Columbia University, Oct 9 http://www1.gsb.columbia.edu/mygsb/faculty/research/pubfiles/5573/Can%20the%20Euro%20be%20Saved.pdf

Benhabib, Jess and Mark M. Spiegel. 2009. Moderate inflation and the deflation-depression link. 2009. Journal of Money, Credit and Banking 41 (4, Jun): 787-798.

Benston, George J. and George G. Kaufman. 1997. The FDICA after five years. Journal of Economic Perspectives 11 (3, Summer, 1997): 139-58.

Bernanke, Ben S. 2002. Deflation: making sure “it” doesn’t happen here. Washington, DC, National Economists Club, Nov 21 http://www.federalreserve.gov/boarddocs/speeches/2002/20021121/default.htm

Bernanke, Ben S. 2000. Japanese monetary policy: a case of self-induced paralysis? In Ryoichi Mikitani and Adam S. Posen, Japan’s financial crisis and its parallels to US experience. Washington, DC, Institute for International Economics, Special Report 13, Sep 2000.

Bernanke, Ben S. 2002. Deflation: making sure “it” doesn’t happen here. Washington, DC, Before the National Economists Club, Nov 21 http://www.federalreserve.gov/boarddocs/speeches/2002/20021121/default.htm

Bernanke, Ben S. 2003. A perspective on inflation targeting. Business Economics 38 (3, Jul): 7–15.

Bernanke, Ben S. 2003JPY. Some thoughts on monetary policy in Japan. Tokyo, Before the Japan Society of Monetary Economics, May 31 http://www.federalreserve.gov/boarddocs/speeches/2003/20030531/default.htm

Bernanke, Ben S. 2009SL. The crisis and the policy response. London, London School of Economics, Stamp Lecture, Jan 13 http://www.federalreserve.gov/newsevents/speech/bernanke20090113a.htm

Bernanke, Ben S. 2010WP. What the Fed did and why: supporting the recovery and sustaining price stability. Washington Post, Nov 4. http://www.washingtonpost.com/wp-dyn/content/article/2010/11/03/AR2010110307372_pf.html

Bernanke, Ben S. 2011Oct4JEC. Statement. Washington, DC, Joint Economic Committee, US Congress, Oct 4 http://www.federalreserve.gov/newsevents/testimony/bernanke20111004a.pdf

Bernanke, Ben S. 2012Apr25. Transcript of Chairman Bernanke’s press conference April 25, 2012. Washington, DC, Board of Governors of the Federal Reserve System, Apr 25 http://www.federalreserve.gov/mediacenter/files/FOMCpresconf20120425.pdf

Bernanke, Ben S. 2012Aug22. Letter to The Honorable Darrell E. Issa. Washington, DC, Board of Governors of the Federal Reserve System, Aug 22 http://online.wsj.com/public/resources/documents/Bernankeletter0812.pdf

Bernanke, Ben S. 2012Oct14IMF. US monetary policy and international implications. Tokyo, Japan, Challenges of the Global Financial System: Risks and Governance under Evolving Globalization, High-level Seminar sponsored by Bank of Japan-International Monetary Fund, Oct 14 http://www.federalreserve.gov/newsevents/speech/bernanke20121014a.htm

Bernanke, Ben S. 2012JHAug31. Monetary policy since the onset of the crisis. Jackson Hole, WY, Federal Reserve Bank of Kansas City Economic Symposium, Aug 31 http://www.federalreserve.gov/newsevents/speech/bernanke20120831a.htm

Bernanke, Ben S. 2012Nov20. The economic recovery and economic policy. New York City, NY, Economic Club, Nov 20 http://www.federalreserve.gov/newsevents/speech/bernanke20121120a.htm

Bernanke, Ben S. 2013Mar25. Monetary policy and the global economy. London, Bank of England and London School of Economics, Mar 25 http://www.federalreserve.gov/newsevents/speech/bernanke20130325a.htm

Bernanke, Ben S. 2013Jul17. Statement on semiannual monetary policy report to the Congress. Washington, DC, Jul 17, US House of Representatives, Jul 18, US Senate http://www.federalreserve.gov/newsevents/testimony/bernanke20130717a.htm

Bernanke, Ben S. and Frederic S. Mishkin. 1997. Inflation targeting: a new framework for monetary policy? Journal of Economic Perspectives 11 (2, Spring): 97–116.

Bernanke, Ben S. and Vincent R. Reinhart. 2004. Conducting monetary policy at very low short-term interest rates. American Economic Review 94 (2): 85-90.

Black, Fischer and Myron Scholes. 1973. The pricing of options and corporate liabilities. Journal of Political Economy 81 (May/June): 637-54.

Blanchard, Olivier. 2011WEOSep. Foreword to IMF 2011WEOSep: XIII-XIV.

Blanchard, Olivier. 2012WEOApr. Foreword to IMF 2012WEOApr: XIII-XIV

Blanchard, Olivier and Lawrence F. Katz. 1997. What we know and do not know about the natural rate of unemployment. Journal of Economic Perspectives 11 (1, Winter): 51-72.

Blinder, Alan S. 2000. Monetary policy at the zero lower bound: balancing the risks. Journal of Money, Credit and Banking 32 (4, Nov): 1093-1099.

Blinder, Alan S. and Mark Zandi. 2010Jul27. How the Great Recession was brought to an end. Princeton, NJ, http://www.princeton.edu/~blinder/End-of-Great-Recession.pdf

Board of Governors of the Federal Reserve System. 2012Dec6. Flow of funds accounts of the United States. Washington, DC, Federal Reserve System, Dec 6 http://www.federalreserve.gov/releases/z1/default.htm

Board of Governors of the Federal Reserve System. 2017Jul17. Monetary policy report. Washington, DC, Board of Governors of the Federal Reserve, Jul 17 http://www.federalreserve.gov/monetarypolicy/mpr_default.htm

Bordo, Michael D. 2012Sep27. Financial recessions don’t lead to weak recoveries. Wall Street Journal, Sep 27 http://professional.wsj.com/article/SB10000872396390444506004577613122591922992.html

Bordo, Michael E. 2012Oct21. Why this US recovery is weaker. Bloomberg View, Oct 21 http://www.bloomberg.com/news/2012-10-21/why-this-u-s-recovery-is-weaker.html

Bordo, Michael D. and Hugh Rockoff. 2011. The influence of Irving Fisher on Milton Friedman’s monetary economics. Denver, CO, AEA Session on Irving Fisher and Modern Economics: 100 years after the Purchasing Power of Money, Jan 8 www.aeaweb.org/aea/2011conference/program/retrieve.php?pdfid

Bordo, Michael D, Ehsan Choudhri and Anna J. Schwartz. 1995. Could stable money have averted the Great Contraction. Economic Inquiry 33 (3, Jul): 484-505.

Bordo, Michael D. and Harold James. 2001. The Adam Klug Memorial Lecture: Haberler versus Nurkse: the case for floating exchange rates as an alternative to Bretton Woods? Cambridge, MA: NBER, WP 8545, Oct.

Bordo, Michael D. and Jopseh G. Haubrich. 2012DR. Deep recessions, fast recoveries, and financial crises: evidence from the American record. Cleveland, OH, Federal Reserve Bank of Cleveland, WP 12/14 http://www.clevelandfed.org/research/workpaper/2012/wp1214.pdf

Bordo, Michael D. and Peter Rousseau. 2006. Legal political factors and the historical evolution of the finance-growth link. NBER Working Paper No. 12035. Cambridge, MA, National Bureau of Economic Research, Feb. Earlier presented at CPRN/ONB Workshop on International Financial Integration: The Role of Intermediaries, Vienna, 30 Sep-1Oct 2005.

Boskin, Michael J. 2010Sep. Summer of economic discontent. Wall Street Journal, Sep 2 http://online.wsj.com/article/SB10001424052748703882304575465462926649950.html?KEYWORDS=michael+boskin

Bricker, Jesse, Arthur B. Kennickell, Kevin B. Moore and John Sabelhaus. 2012. Changes in US family finances from 2007 to 2010: evidence from the Survey of Consumer Finances. Federal Reserve Bulletin 98 (2, Jun): 2-80 http://www.federalreserve.gov/pubs/bulletin/2012/PDF/scf12.pdf

Brunner, Karl and Allan H. Meltzer. 1973. Mr. Hicks and the “monetarists.” Economica NS 40 (157, Feb): 44-59.

Brunnermeier, Markus K. and Lasse Hege Pedersen. 2009. Market liquidity and funding liquidity. Review of Financial Studies 22 (6): 2201-38.

Buiter, Willem. 2011Oct31. EFSF needs bigger bazooka to maximize its firepower. Financial Times, Oct 31 http://www.ft.com/intl/cms/s/0/c4886f7a-03d3-11e1-bbc5-00144feabdc0.html#axzz1cMoq63R5

Buiter, Willem. 2012Oct15. Only big debt restructuring can save euro. Financial Times, Oct 15 http://www.ft.com/intl/cms/s/0/edd92eee-12de-11e2-aa9c-00144feabdc0.html#axzz29OP0k8cX

Buiter, Willem. 2014Feb4. The Fed’s bad manners risk offending foreigners. Financial Times, Feb 4 http://www.ft.com/intl/cms/s/0/fbb09572-8d8d-11e3-9dbb-00144feab7de.html#axzz2suwrwkFs

Brunner, Karl and Allan H. Meltzer. 1973. Mr. Hicks and the “monetarists.” Economica NS 40 (157, Feb): 44-59.

Burdekin, Richard C. 2005. US pressure on China’s currency: Milton Friedman and the silver episode revisited. Claremont McKenna College, Nov 2005 http://www.claremontmckenna.edu/rdschool/papers/2005-07.pdf

Bureau of Labor Statistics. 2011Feb11. Overview of seasonal adjustment of the current employment statistics program. Washington, Feb 11, 2011 http://www.bls.gov/ces/cessa_oview.pdf

Bureau of Labor Statistics. 2012Feb3. Seasonal adjustment files and documentation. Washington, BLD, Feb 3 http://www.bls.gov/web/empsit/cesseasadj.htm

Caballero, Ricardo and Francsco Giavazzi. 2012Jan15. Parity may be euro’s last chance. Bloomberg, Jan 15 http://www.bloomberg.com/news/2012-01-16/dollar-parity-may-be-euro-salvation-commentary-by-caballero-and-giavazzi.html

Cagan, Phillip. 1965. Determinants and effects of changes in the stock of money, 1875-1960. New York: Columbia University Press.

Calomiris, Charles C. and Gary B. Gorton. 1991. The origins of banking panics: models, facts and bank regulation. In R. Glenn Hubbard, ed. Financial markets and financial crises. Chicago: University of Chicago Press.

Calomiris, Charles W. and Stephen H. Haber. 2014. Fragile by design: the political origins of banking crises and scarce credit. Princeton: Princeton University Press http://press.princeton.edu/titles/10177.html

Cameron, Rondo E. 1961. France and the economic development of Europe 1800-1914: conquests of peace and seeds of war. Princeton: Princeton University Press.

Cameron, Rondo E. 1967. Banking in the early stages of industrialization. Oxford: Oxford University Press.

Cameron, Rondo E. 1972. Banking and economic development. Oxford: Oxford University Press.

Cameron, Rondo E. 1989. A concise economic history of the world: from Paleolithic times to the present. New York and Oxford: Oxford University Press.

Cameron, Rondo E., V.I. Bovkyn, Richard Sylla, Mira Wilkins, Boris Anan’ich, and A. A. Fursenko, eds. 1992. International Banking 1870-1914. Oxford: Oxford University Press.

CBO. 2011JunLTBO. CBO’s long-term budget outlook. Washington, DC, Congressional Budget Office, Jun http://www.cbo.gov/ftpdocs/122xx/doc12212/06-21-Long-Term_Budget_Outlook.pdf

CBO. 2012JanBEO. The budget and economic outlook: fiscal years 2012 to 2022. Washington, DC: Congressional Budget Office, Jan http://www.cbo.gov/ftpdocs/126xx/doc12699/01-31-2012_Outlook.pdf

CBO. 2012Jan31. Historical budget data. Washington, DC, Jan 31.

CBO. 2012MarBEO. Updated budget projections: fiscal years 2012 to 2022. Washington, DC: Congressional Budget Office, Mar http://www.cbo.gov/sites/default/files/cbofiles/attachments/March2012Baseline.pdf

CBO. 2012LTBO. The 2012 long-term budget outlook. Washington, DC: Congressional Budget Office, Jun http://www.cbo.gov/sites/default/files/cbofiles/attachments/06-05-Long-Term_Budget_Outlook.pdf

CBO. 2012AugBEO. An update to the budget and economic outlook: fiscal years 2012 to 2022. Washington, DC, Congressional Budget Office, Aug http://www.cbo.gov/publication/43539

CBO. 2012NovMBR. Monthly budget review fiscal year 2012. Washington, DC, Congressional Budget Office, Nov 7 http://www.cbo.gov/publication/43698

CBO. 2012NovCDR. Choices for deficit reduction. Washington, DC, Congressional Budget Office http://www.cbo.gov/publication/43692

CBO. 2012NovEEP. Economic effects of policies contributing to fiscal tightening in 2013. Washington, DC, Congressional Budget Office, Nov http://www.cbo.gov/publication/43694

CBO. 2013BEOFeb5. The budget and economic outlook: fiscal years 2013 to 2023. Washington, DC, Congressional Budget Office http://www.cbo.gov/publication/43907

CBO. 2013HBDFeb5. Historical budget data—February 2013 baseline projections. Washington, DC, Congressional Budget Office http://www.cbo.gov/publication/43904

CBO. 2013MEFeb5. Macroeconomic effects of alternative budget paths. Washington, DC, Congressional Budget Office, Feb 5 http://www.cbo.gov/publication/43769

CBO (2013Aug12). 2013AugHBD. Historical budget data—August 2013. Washington, DC, Congressional Budget Office, Aug 12 http://www.cbo.gov/publication/44507

CBO (2013Aug12Av). Kim Kowaleski and Amber Marcellino. Updated historical budget data. CBO, Aug 12 http://www.cbo.gov/publication/44508

CBO (2013Sep11). 2013Sep11. CBO’s baseline budget projections updated. Washington, DC, Congressional Budget Office, Sep 11 http://www.cbo.gov/publication/44574

CBO (2013Sep17). The 2013 long-term budget outlook. Washington, DC, Congressional Budget Office, Sep 17 http://www.cbo.gov/publication/44521

Chung, Hess, Jean-Philippe Laforte, David Reifschneider and John C. Williams. 2011. Have we underestimated the likelihood and severity of zero lower bound events? San Francisco, FRBSF, WP 2011-01 http://www.frbsf.org/publications/economics/papers/2011/wp11-01bk.pdf

Cline, William. 2001. The role of the private sector in resolving financial crises in emerging markets. Cambridge, MA, NBER, Jun.

Cline, William. 2002. Private sector involvement: definition, measurement and implementation. London, Bank of England Conference, Jul-23-4.

Cobet, Aaron E. and Gregory A. Wilson. 2002. Comparing 50 years of labor productivity in US and foreign manufacturing. Monthly Labor Review (Jun): 51-65.

Cochrane, John A. 2010A. The government debt valuation equation. An appendix to “Understanding policy.” http://faculty.chicagobooth.edu/john.cochrane/research/Papers/

Cochrane, John H. 2011Jan. Understanding policy in the great recession: some unpleasant fiscal arithmetic. European Economic Review 55 (1, Jan): 2-30.

Cochrane, John H. 2012Aug31. The Federal Reserve: from central bank to central planner. Wall Street Journal, Aug 31 http://professional.wsj.com/article/SB10000872396390444812704577609384030304936.html?mod=WSJ_hps_sections_opinion

Cochrane, John H. 2014Jul2. The failure of macroeconomics. Wall Street Journal, Jul 2. http://online.wsj.com/articles/john-cochrane-new-keynesian-macroeconomic-models-dont-support-more-stimulus-spending-1404342631?KEYWORDS=john+h+cochrane

Cochrane, John H. and Luigi Zingales. 2009. Lehman and the financial crisis. Wall Street Journal, Sep 15.

Cohen, Morris Raphael and Ernest Nagel. 1934. An introduction to logic and scientific method. New York: Harcourt, Brace and Company.

Cole, Harold L. and Lee E. Ohanian. 1999. The Great Depression in the United States from a neoclassical perspective. Federal Reserve Bank of Minneapolis Quarterly Review 23 (1, Winter): 2-24.

Cole, Harold L. and Narayana Kocherlakota. 1998. Zero nominal interest rates: why they are good and how to get them. Federal Reserve Bank of Minneapolis Quarterly Review 22 (2, Spring): 2-10.

Cooley, Thomas F. and Lee E. Ohanian. 2010. FDR and the lessons of the Depression. Wall Street Journal, Aug 27 http://online.wsj.com/news/articles/SB10001424052748703461504575443402028756986?KEYWORDS=Thomas+Cooley

Contador, Cláudio R. and Haddad, Cláudio L. 1975. Produto real, moeda e preços. Revista Brasileira de Estatística 36(143, jul/set): 407-40.

Cox, John C., Jonathan E. Ingersoll, Jr. and Stephen A. Ross. 1981. A re-examination of traditional hypotheses about the term structure of interest rates. Journal of Finance 36 (4, Sep): 769-99.

Cox, John C., Jonathan E. Ingersoll, Jr. and Stephen A. Ross. 1985. A theory of the term structure of interest rates. Econometrica 53 (2, Mar): 385-407.

Culbertson, John M. 1957. The term structure of interest rates. Quarterly Journal of Economics 71 (4, Nov): 485-517.

Culbertson, J. M. 1960. Friedman on the lag in effect of monetary policy. Journal of Political Economy 68 (6, Dec): 617-21.

Culbertson, J. M. 1961. The lag in effect of monetary policy: reply. Journal of Political Economy 69 (5, Oct): 467-77.

Culbertson, John M. 1963. The term structure of interest rates: reply. Quarterly Journal of Economics 77 (4, Nov): 691-6.

D’Amico Stefania and Thomas B. King. 2010. Flow and stock effects of large-sale Treasury purchases. Washington, DC, Federal Reserve board, Sep.

Darby, Michael R. Darby. 1974. The permanent income theory of consumption—a restatement. Quarterly Journal of Economics (88, 2): 228-50.

Deane, Phyllis. 1968. New estimates of gross national product for the United Kingdom 1830-1914. Review of Income and Wealth 14 (2, Jun): 95-112.

Delfim Netto, Antonio. 1959. O problema do café no Brasil. São Paulo: Faculdade de Economia e Administração da Universidade de São Paulo. Partly reprinted in Pelaez (1973).

De Long, J. Bradford. 1997. America’s peacetime inflation: the 1970s. In Christina D. Romer and David H. Romer, eds. Reducing inflation: motivation and strategy. Chicago: University of Chicago Press, 1997.

DeLong, J. Bradford and Barry Eichengreen. 2001Jul. Between meltdown and moral hazard: the international monetary and financial policies of the Clinton Administration. Cambridge, MA, Conference on the Economic Policies of the Clinton Administration, Kennedy School of Government, Jun 26-29 http://eml.berkeley.edu/~eichengr/research/clintonfinancialpolicies9.pdf

DeNavas-Walt, Carmen, Bernadette D. Proctor and Jessica C. Smith. 2012Sep. Income, poverty and health insurance coverage in the United States: 2011. Washington, DC, US Census Bureau http://www.census.gov/prod/2012pubs/p60-243.pdf

DeNavas-Walt, Carmen, Bernadette D. Proctor and Jessica C. Smith. 2013. Income, poverty, and health insurance coverage in the United States: 2012. Washington, DC: US Census Bureau, Current Population Reports, P60-245, US Government Printing Office http://www.census.gov/prod/2013pubs/p60-245.pdf

DeNavas-Walt, Carmen and Bernadette D. Proctor. 2014. Income and poverty in the United States: 2013. Washington, DC: US Census Bureau, Current Population Reports P60-249, US Government Printing Office, Sep 18.

Doh, Taeyoung. 2010. The efficacy of large-scale asset purchases at the zero lower bound. Federal Reserve Bank of Kansas City Economic Review Second Quarter 2010: 5-34 http://www.kansascityfed.org/Publicat/EconRev/PDF/10q2Doh.pdf

Dorrance, G. S. 1948. The income terms of trade. Review of Economic Studies 16 (1, 1948-1949): 50-6.

Draghi, Mario. 2011Dec1. Introductory statement by Mario Draghi, President of the ECB. Brussels, Hearing before the Plenary of the European Parliament, Dec 1 http://www.ecb.int/press/key/date/2011/html/sp111201.en.html

Draghi, Mario. 2011Dec8. Introductory statement to the press conference. Frankfurt am Main, ECB, Dec 8 http://www.ecb.int/press/pressconf/2011/html/is111208.en.html

Draghi, Mario. 2012May26. Speech by Mario Draghi, President of the European Central Bank. London, Global Investment Conference, Jul 26 http://www.ecb.int/press/key/date/2012/html/sp120726.en.html

Draghi, Mario. 2012Aug29. The future of the euro: stability through change. Frankfurt am Main, ECB, published in Die Zeit, 29 Aug 2012 http://www.ecb.int/press/key/date/2012/html/sp120829.en.html

Duffie, Darell and Kenneth J. Singleton. 2003. Credit risk: pricing, measurement and management. Princeton: Princeton University Press.

Eggertsson, Gauti B. and Paul Krugman. 2010. Debt, deleveraging and the liquidity trap: A Fisher-Minsky-Koo approach. Princeton, Princeton University, Nov 16 http://www.princeton.edu/~pkrugman/debt_deleveraging_ge_pk.pdf

European Council. 2011Dec9. Statements by the euro area heads of state or government. Brussels, European Union, Dec 9 http://www.consilium.europa.eu/uedocs/cms_Data/docs/pressdata/en/ec/126658.pdf

European Council. 2012Oct19. Conclusions. Brussels, European Union, Oct 19 http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/133004.pdf

DeNavas-Walt, Carmen, Bernadette D. Proctor and Jessica C. Smith. 2012Sep. Income, poverty and health insurance coverage in the United States: 2011. Washington, DC, US Census Bureau, US Government Printing Office, Sep http://www.census.gov/prod/2012pubs/p60-243.pdf

Diamond, DouglasW. 1984. Financial intermediation and delegated monitoring. Review of Economic Studies 51: 393-414.

Diamond, Douglas W. 1996. Financial intermediation as delegated monitoring: a simple example. Economic Quarterly Federal Reserve Bank of Richmond 82 (3): 51-66.

Diamond, Douglas W. and Philip H. Dybvig. 1983. Bank runs, deposit insurance and liquidity. Journal of Political Economy 91 (3, Jun): 401-49.

Diamond, Douglas W. and Philip H. Dybvig. 1986. Banking theory, deposit insurance and bank regulation. Journal of Business 59 (1, Jan): 55-68.

Diamond, Douglas W. and Raghuram G. Rajan. 2000. A theory of bank capital. Journal of Finance 55 (6, Dec): 2431-65.

Diamond, Douglas W. and Raghuram G. Rajan. 2001a. Banks and liquidity. American Economic Review 91 (2, May): 422-5.

Diamond, Douglas W. and Raghuram G. Rajan. 2001b. Liquidity Risk, liquidity creation and financial fragility: a theory of banking. Journal of Political Economy 109 (2, Apr): 287-327.

Dornbusch, Rudiger. 1976. Expectations and exchange rate dynamics. Journal of Political Economy 84 (6, Dec): 1161-76.

Draghi, Mario. 2011Dec15. The euro, monetary stability and the design of a fiscal compact. Berlin, Dec 15 http://www.ecb.int/press/key/date/2011/html/sp111215.en.html

Draghi, Mario. 2012May3. Introductory statement to the press conference. Barcelona, May 3 http://www.ecb.int/press/pressconf/2012/html/is120503.en.html

Draghi, Mario. 2012Jun15. President’s address at the 14th ECB and its Watchers Conference. Frankfurt am Main, European Central Bank, Jun 15 http://www.ecb.int/press/key/date/2012/html/sp120615.en.html

Economides, Nicholas, Yannis Ioannides, Emmanuel Petrakis, Christopher Pissarides and Thanasis Stengos. 2012. What’s at stake in the Greek vote. Wall Street Journal, Jun 14 http://professional.wsj.com/article/SB10001424052702303822204577466541312448940.html?mod=WSJ_hps_sections_opinion

Eichengreen, Barry and Jeffrey Sachs. 1985. Exchange rates and economic recovery in the 1930s. Journal of Economic History 45 (4, Dec): 925-46.

Eggertson, Gauti B. and Michael Woodford. 2003. The zero bound on interest rates and optimal monetary policy. Brookings Papers on Economic Activity I (2003): 139-211.

European Central Bank. 2011MBDec. Editorial. Monthly Bulletin December 2011, 5-9 http://www.ecb.int/pub/pdf/mobu/mb201112en.pdf

European Commission. 2011Oct26SS. Euro summit statement. Brussels, European Commission, Oct 26 http://ec.europa.eu/news/economy/111027_en.htm

European Commission. 2011Oct26MRES. Main results of Euro Summit. Brussels, European Commission, Oct 26 http://www.consilium.europa.eu/uedocs/cms_Data/docs/pressdata/en/ec/125645.pdf

European Council. 2011Dec9. Statements by the euro area heads of state or government. Brussels, European Union, Dec 9 http://www.consilium.europa.eu/uedocs/cms_Data/docs/pressdata/en/ec/126658.pdf

Evans, Charles. 2010. Monetary policy in a low-inflation environment: developing a state-contingent price-level target. Boston, Federal Reserve Bank of Boston’s 55th Economic Conference, Oct 16 http://chicagofed.org/webpages/publications/speeches/2010/10_16_boston_speech.cfm#_ftn1

Evans, Charles. 2012Aug27. Some thoughts on global risks and monetary policy. Hong Kong, China, Market News International Seminar, Aug 27 http://www.chicagofed.org/webpages/publications/speeches/2012/08_27_12_hongkong.cfm

Evans, Charles. 2012Nov27. Monetary policy in challenging times. Toronto, Canada, Howe Institute, Nov 27

http://www.chicagofed.org/webpages/publications/speeches/2012/11_27_12_cdhowe.cfm

Fabozi, Frank J., Gerald W. Buestow, Jr., and Robert R. Johnson. Measuring interest rate risk. In Frank J. Fabozzi, ed. The handbook of fixed income securities, 7th Edition. New York, McGraw, 2006.

Fama, Eugene F. 1970. Efficient capital markets: a review of theory and empirical work. Journal of Finance 25 (2): 383-417.

Fama, Eugene F. and Robert R. Bliss. 1987. The information in long-maturity forward rates. American Economic Review 77 (4, Sep): 680-92.

Fisher, Irving. 1930. The theory of interest. New York: The Macmillan Company http://www.econlib.org/library/YPDBooks/Fisher/fshToI19.html

Fisher, Irving. 1933. The debt-deflation theory of great depressions. Econometrica 1(4): 337-57.

Fisher, Irving. 100% Money. 1936. New York: Adelphi Company.

Fishlow, Albert. 1965. American railroads and the transformation of the ante-bellum economy. Cambridge, MA: Harvard University Press.

Feldstein, Martin. 2012Mar19. Obama’s tax hikes threaten a new US recession. Financial Times, Mar 19 http://www.ft.com/intl/cms/s/0/0d0e7acc-6f7d-11e1-9c57-00144feab49a.html#axzz1pexRlsiQ

Fleming, J. Marcus. 1962. Domestic financial policies under fixed and under floating exchange rates. IMF Staff Papers 9: 369-79.

Fogel, Robert W. 1964. Railroads and American economic growth: essays in econometric history. Cambridge, MA: Harvard University Press.

Fogel, Robert W. and Stanley Engerman. 1974. Time on the cross. Boston: Little Brown.

Forbes, Kristin J. 2012JHAug9. The big “C”: identifying and mitigating contagion. Jackson Hole, WY, Federal Reserve Bank of Kansas City Symposium, Aug 31 http://www.kansascityfed.org/publicat/sympos/2012/kf.pdf

Friedman, Milton. 1953. The effects of a full-employment policy on economic stability: a formal analysis. In Milton Friedman, Essays on positive economics. Chicago: University of Chicago Press.

Friedman, Milton. 1953b. The case for flexible exchange rates. In Milton Friedman, Essays on positive economics. Chicago: University of Chicago Press: 157-203.

Friedman, Milton. 1957. A Theory of the Consumption Function. Princeton: Princeton University Press.

Friedman, Milton. 1961. The lag in effect of monetary policy. Journal of Political Economy 69 (5, Oct): 447-66.

Friedman, Milton. 1964. The monetary studies of the National Bureau. In The National Bureau enters its forty-fifth year. New York, NY: National Bureau of Economic Research, Inc., Forty-Fourth Annual Report: 7-25 http://www.nber.org/chapters/c4453.pdf

Friedman, Milton. 1968. The role of monetary policy. American Economic Review 58 (1, Mar): 1-17.

Friedman, Milton. 1969. The optimum quantity of money. In Milton Friedman, The optimum quantity of money and other essays. Chicago: Aldine, 1969.

Friedman, Milton. 1970. Controls on interest rates paid by banks. Journal of Money, Credit and Banking 2 (1, Feb): 15-32.

Friedman, Milton. 1982. Monetary policy: theory and practice. Journal of Money, Credit and Banking 14 (1, Feb): 98-118.

Friedman, Milton. 1988. The “plucking model” of business fluctuations revisited. Palo Alto, CA, The Hoover Institution, Stanford University, Working Papers in Economics E-88-48, Dec 1988.

Friedman, Milton. 1989. Bimetalism revisited. Palo Alto, CA, The Hoover Institution, Stanford University, Working Papers in Economics E-89-24. Aug 1989.

Friedman, Milton. Franklin D. Roosevelt, Silver and China. Journal of Political Economy 100 (1, Feb): 62-83.

Friedman, Milton and Anna Jacobson Schwartz. 1963. A monetary history of the United States, 1867-1960. Princeton: Princeton University Press.

Friedman, Milton and Anna Jacobson Schwartz. 1970. Monetary statistics of the United States: estimates, sources, and methods. New York: Columbia University Press.

FOMC. 2006Dec12. Meeting of the Federal Open Market Committee December 12, 2006. Washington, DC, Federal Reserve, Dec 12 http://www.federalreserve.gov/monetarypolicy/files/FOMC20061212meeting.pdf

Gagnon, Joseph, Matthew Raskin, Julie Remache and Brian Sack. 2010. Large-scale asset purchases by the Federal Reserve: did they work. New York, FRBNY Staff Report no. 441, Mar http://data.newyorkfed.org/research/staff_reports/sr441.pdf

Georgescu-Rogen, Nicholas. 1960. Economic theory and agrarian economics. Oxford Economic Papers New Series 12 (1, Feb): 1-40.

Gorton, Gary. 2009EFM. The subprime panic. European Financial Management 15 (1): 10-46.