Financial Risks, Rules, Discretionary Authorities and Slow Productivity Growth, Twenty Seven Million Unemployed or Underemployed, Stagnating Real Wages, United States International Trade, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014

Executive Summary

I Twenty Seven Million Unemployed or Underemployed

IA1 Summary of the Employment Situation

IA2 Number of People in Job Stress

IA3 Long-term and Cyclical Comparison of Employment

IA4 Job Creation

IB Stagnating Real Wages

II Rules, Discretionary Authorities and Slow Productivity Growth

IIA United States International Trade

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

V World Economic Slowdown. Table V-1 is constructed with the database of the IMF (http://www.imf.org/external/ns/cs.aspx?id=28) to show GDP in dollars in 2012 and the growth rate of real GDP of the world and selected regional countries from 2013 to 2016. The data illustrate the concept often repeated of “two-speed recovery” of the world economy from the recession of 2007 to 2009. The IMF has changed its forecast of the world economy to 3.0 percent in 2013 but accelerating to 3.6 percent in 2014, 3.9 percent in 2015 and 3.9 percent in 2016. Slow-speed recovery occurs in the “major advanced economies” of the G7 that account for $34,543 billion of world output of $72,106 billion, or 47.9 percent, but are projected to grow at much lower rates than world output, 2.0 percent on average from 2013 to 2016 in contrast with 3.6 percent for the world as a whole. While the world would grow 15.2 percent in the four years from 2013 to 2016, the G7 as a whole would grow 8.5 percent. The difference in dollars of 2012 is rather high: growing by 15.2 percent would add around $11.0 trillion of output to the world economy, or roughly, two times the output of the economy of Japan of $5,938 billion but growing by 8.5 percent would add $6.1 trillion of output to the world, or about the output of Japan in 2012. The “two speed” concept is in reference to the growth of the 150 countries labeled as emerging and developing economies (EMDE) with joint output in 2012 of $27,080 billion, or 37.6 percent of world output. The EMDEs would grow cumulatively 21.9 percent or at the average yearly rate of 5.1 percent, contributing $5.9 trillion from 2013 to 2016 or the equivalent of somewhat less than the GDP of $8,229 billion of China in 2012. The final four countries in Table V-1 often referred as BRIC (Brazil, Russia, India, China), are large, rapidly growing emerging economies. Their combined output in 2012 adds to $14,340 billion, or 19.9 percent of world output, which is equivalent to 41.5 percent of the combined output of the major advanced economies of the G7.

Table V-1, IMF World Economic Outlook Database Projections of Real GDP Growth

| GDP USD 2012 | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | Real GDP ∆% | |

| World | 72,106 | 3.0 | 3.6 | 3.9 | 3.9 |

| G7 | 34,543 | 1.4 | 2.2 | 2.3 | 2.3 |

| Canada | 1,821 | 2.0 | 2.3 | 2.4 | 2.4 |

| France | 2,613 | 0.3 | 1.0 | 1.5 | 1.7 |

| DE | 3,428 | 0.5 | 1.7 | 1.6 | 1.4 |

| Italy | 2,014 | -1.8 | 0.6 | 1.1 | 1.3 |

| Japan | 5,938 | 1.5 | 1.4 | 1.0 | 0.7 |

| UK | 2,484 | 1.8 | 2.9 | 2.5 | 2.4 |

| US | 16,245 | 1.9 | 2.8 | 3.0 | 3.0 |

| Euro Area | 12,192 | -0.5 | 1.2 | 1.5 | 1.5 |

| DE | 3,428 | 0.5 | 1.7 | 1.6 | 1.4 |

| France | 2,613 | 0.3 | 1.0 | 1.5 | 1.7 |

| Italy | 2,014 | -1.8 | 0.6 | 1.1 | 1.3 |

| POT | 212 | -1.4 | 1.2 | 1.5 | 1.7 |

| Ireland | 211 | -0.3 | 1.7 | 2.5 | 2.5 |

| Greece | 249 | -3.9 | 0.6 | 2.9 | 3.7 |

| Spain | 1,323 | -1.2 | 0.9 | 1.0 | 1.1 |

| EMDE | 27,080 | 4.7 | 4.9 | 5.3 | 5.4 |

| Brazil | 2,248 | 2.3 | 1.8 | 2.7 | 3.0 |

| Russia | 2,004 | 1.3 | 1.3 | 2.3 | 2.5 |

| India | 1,859 | 4.4 | 5.4 | 6.4 | 6.5 |

| China | 8,229 | 7.7 | 7.5 | 7.3 | 7.0 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries); POT: Portugal

Source: IMF World Economic Outlook databank http://www.imf.org/external/ns/cs.aspx?id=28

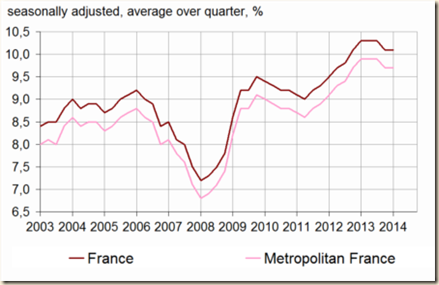

Continuing high rates of unemployment in advanced economies constitute another characteristic of the database of the WEO (http://www.imf.org/external/ns/cs.aspx?id=28). Table V-2 is constructed with the WEO database to provide rates of unemployment from 2012 to 2016 for major countries and regions. In fact, unemployment rates for 2013 in Table V-2 are high for all countries: unusually high for countries with high rates most of the time and unusually high for countries with low rates most of the time. The rates of unemployment are particularly high in 2013 for the countries with sovereign debt difficulties in Europe: 16.3 percent for Portugal (POT), 13.1 percent for Ireland, 27.3 percent for Greece, 26.4 percent for Spain and 12.2 percent for Italy, which is lower but still high. The G7 rate of unemployment is 7.1 percent. Unemployment rates are not likely to decrease substantially if slow growth persists in advanced economies.

Table V-2, IMF World Economic Outlook Database Projections of Unemployment Rate as Percent of Labor Force

| % Labor Force 2012 | % Labor Force 2013 | % Labor Force 2014 | % Labor Force 2015 | % Labor Force 2016 | |

| World | NA | NA | NA | NA | NA |

| G7 | 7.4 | 7.1 | 6.7 | 6.5 | 6.3 |

| Canada | 7.3 | 7.0 | 7.0 | 6.9 | 6.8 |

| France | 10.2 | 10.8 | 11.0 | 10.7 | 10.3 |

| DE | 5.5 | 5.3 | 5.2 | 5.2 | 5.2 |

| Italy | 10.7 | 12.2 | 12.4 | 11.9 | 11.1 |

| Japan | 4.3 | 4.0 | 3.9 | 3.9 | 3.9 |

| UK | 8.0 | 7.6 | 6.9 | 6.6 | 6.3 |

| US | 8.1 | 7.4 | 6.4 | 6.2 | 6.1 |

| Euro Area | 11.4 | 12.1 | 11.9 | 11.6 | 11.1 |

| DE | 5.5 | 5.3 | 5.2 | 5.2 | 5.2 |

| France | 10.2 | 10.8 | 11.0 | 10.7 | 10.3 |

| Italy | 10.7 | 12.2 | 12.4 | 11.9 | 11.1 |

| POT | 15.7 | 16.3 | 15.7 | 15.1 | 14.5 |

| Ireland | 14.7 | 13.1 | 11.2 | 10.5 | 10.1 |

| Greece | 24.2 | 27.3 | 26.3 | 24.4 | 21.4 |

| Spain | 25.0 | 26.4 | 25.5 | 24.9 | 24.2 |

| EMDE | NA | NA | NA | NA | NA |

| Brazil | 5.5 | 5.4 | 5.6 | 5.8 | 6.0 |

| Russia | 5.5 | 5.5 | 6.2 | 6.2 | 6.0 |

| India | NA | NA | NA | NA | NA |

| China | 4.1 | 4.1 | 4.1 | 4.1 | 4.1 |

Notes; DE: Germany; EMDE: Emerging and Developing Economies (150 countries)

Source: IMF World Economic Outlook databank http://www.imf.org/external/ns/cs.aspx?id=28

Table V-3 provides the latest available estimates of GDP for the regions and countries followed in this blog from IQ2012 to IVQ2013 available now for all countries. There are preliminary estimates for all countries for IQ2014. Growth is weak throughout most of the world.

- Japan. The GDP of Japan increased 0.9 percent in IQ2012, 3.8 percent at SAAR (seasonally adjusted annual rate) and 3.2 percent relative to a year earlier but part of the jump could be the low level a year earlier because of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan is experiencing difficulties with the overvalued yen because of worldwide capital flight originating in zero interest rates with risk aversion in an environment of softer growth of world trade. Japan’s GDP fell 0.6 percent in IIQ2012 at the seasonally adjusted annual rate (SAAR) of minus 2.2 percent, which is much lower than 3.8 percent in IQ2012. Growth of 3.2 percent in IIQ2012 in Japan relative to IIQ2011 has effects of the low level of output because of Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Japan’s GDP contracted 0.8 percent in IIIQ2012 at the SAAR of minus 3.0 percent and decreased 0.2 percent relative to a year earlier. Japan’s GDP increased 0.1 percent in IVQ2012 at the SAAR of 0.2 percent and decreased 0.3 percent relative to a year earlier. Japan grew 1.2 percent in IQ2013 at the SAAR of 4.9 percent and increased 0.1 percent relative to a year earlier. Japan’s GDP increased 0.9 percent in IIQ2013 at the SAAR of 3.5 percent and increased 1.3 percent relative to a year earlier. Japan’s GDP grew 0.3 percent in IIIQ2013 at the SAAR of 1.3 percent and increased 2.4 percent relative to a year earlier. In IVQ2013, Japan’s GDP increased 0.1 percent at the SAAR of 0.3 percent, increasing 2.5 percent relative to a year earlier. Japan’s GDP increased 1.5 percent in IQ2014 at the SAAR of 5.9 percent and increased 3.0 percent relative to a year earlier.

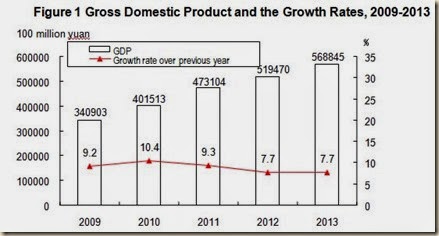

- China. China’s GDP grew 1.4 percent in IQ2012, annualizing to 5.7 percent, and 8.1 percent relative to a year earlier. The GDP of China grew at 2.1 percent in IIQ2012, which annualizes to 8.7 percent and 7.6 percent relative to a year earlier. China grew at 2.0 percent in IIIQ2012, which annualizes at 8.2 percent and 7.4 percent relative to a year earlier. In IVQ2012, China grew at 1.9 percent, which annualizes at 7.8 percent, and 7.9 percent in IVQ2012 relative to IVQ2011. In IQ2013, China grew at 1.5 percent, which annualizes at 6.1 percent and 7.7 percent relative to a year earlier. In IIQ2013, China grew at 1.8 percent, which annualizes at 7.4 percent and 7.5 percent relative to a year earlier. China grew at 2.3 percent in IIIQ2013, which annualizes at 9.5 percent and 7.8 percent relative to a year earlier. China grew at 1.7 percent in IVQ2013, which annualized to 7.0 percent and 7.7 percent relative to a year earlier. China’s GDP grew 1.4 percent in IQ2014, which annualizes to 5.7 percent, and 7.4 percent relative to a year earlier. There is decennial change in leadership in China (http://www.xinhuanet.com/english/special/18cpcnc/index.htm). Growth rates of GDP of China in a quarter relative to the same quarter a year earlier have been declining from 2011 to 2014.

- Euro Area. GDP fell 0.1 percent in the euro area in IQ2012 and decreased 0.2 in IQ2012 relative to a year earlier. Euro area GDP contracted 0.3 percent IIQ2012 and fell 0.5 percent relative to a year earlier. In IIIQ2012, euro area GDP fell 0.2 percent and declined 0.7 percent relative to a year earlier. In IVQ2012, euro area GDP fell 0.5 percent relative to the prior quarter and fell 1.0 percent relative to a year earlier. In IQ2013, the GDP of the euro area fell 0.2 percent and decreased 1.1 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IIQ2013 and fell 0.6 percent relative to a year earlier. In IIIQ2013, euro area GDP increased 0.1 percent and fell 0.3 percent relative to a year earlier. The GDP of the euro area increased 0.3 percent in IVQ2013 and increased 0.5 percent relative to a year earlier. In IQ2014, the GDP of the euro area increased 0.2 percent and 0.9 percent relative to a year earlier.

- Germany. The GDP of Germany increased 0.7 percent in IQ2012 and 1.8 percent relative to a year earlier. In IIQ2012, Germany’s GDP decreased 0.1 percent and increased 0.6 percent relative to a year earlier but 1.1 percent relative to a year earlier when adjusted for calendar (CA) effects. In IIIQ2012, Germany’s GDP increased 0.2 percent and 0.4 percent relative to a year earlier. Germany’s GDP contracted 0.5 percent in IVQ2012 and changed 0.0 percent relative to a year earlier. In IQ2013, Germany’s GDP changed 0.0 percent and fell 1.6 percent relative to a year earlier. In IIQ2013, Germany’s GDP increased 0.7 percent and 0.9 percent relative to a year earlier. The GDP of Germany increased 0.3 percent in IIIQ2013 and 1.1 percent relative to a year earlier. In IVQ2013, Germany’s GDP increased 0.4 percent and 1.3 percent relative to a year earlier. The GDP of Germany increased 0.8 percent in IQ2014 and 2.5 percent relative to a year earlier.

- United States. Growth of US GDP in IQ2012 was 0.9 percent, at SAAR of 3.7 percent and higher by 3.3 percent relative to IQ2011. US GDP increased 0.3 percent in IIQ2012, 1.2 percent at SAAR and 2.8 percent relative to a year earlier. In IIIQ2012, US GDP grew 0.7 percent, 2.8 percent at SAAR and 3.1 percent relative to IIIQ2011. In IVQ2012, US GDP grew 0.0 percent, 0.1 percent at SAAR and 2.0 percent relative to IVQ2011. In IQ2013, US GDP grew at 1.1 percent SAAR, 0.3 percent relative to the prior quarter and 1.3 percent relative to the same quarter in 2013. In IIQ2013, US GDP grew at 2.5 percent in SAAR, 0.6 percent relative to the prior quarter and 1.6 percent relative to IIQ2012. US GDP grew at 4.1 percent in SAAR in IIIQ2013, 1.0 percent relative to the prior quarter and 2.0 percent relative to the same quarter a year earlier (http://cmpassocregulationblog.blogspot.com/2014/06/financial-instability-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html) with weak hiring (http://cmpassocregulationblog.blogspot.com/2014/05/rules-discretionary-authorities-and.html). In IVQ2013, US GDP grew 0.7 percent at 2.6 percent SAAR and 2.6 percent relative to a year earlier. In IQ2014, US GDP decreased 0.2 percent, 2.0 percent relative to a year earlier and -1.0 percent at SAAR.

- United Kingdom. In IQ2012, UK GDP changed 0.0 percent, increasing 0.6 percent relative to a year earlier. UK GDP fell 0.4 percent in IIQ2012 and increased 0.1 percent relative to a year earlier. UK GDP increased 0.8 percent in IIIQ2012 and increased 0.3 percent relative to a year earlier. UK GDP fell 0.2 percent in IVQ2012 relative to IIIQ2012 and increased 0.2 percent relative to a year earlier. UK GDP increased 0.4 percent in IQ2013 and 0.5 percent relative to a year earlier. UK GDP increased 0.8 percent in IIQ2013 and 1.7 percent relative to a year earlier. In IIIQ2013, UK GDP increased 0.8 percent and 1.8 percent relative to a year earlier. UK GDP increased 0.7 percent in IVQ2013 and 2.7 percent relative to a year earlier. In IQ2014, UK GDP increased 0.8 percent and 3.1 percent relative to a year earlier.

- Italy. Italy has experienced decline of GDP in nine consecutive quarters from IIIQ2011 to IIIQ2013. Italy’s GDP fell 1.1 percent in IQ2012 and declined 1.7 percent relative to IQ2011. Italy’s GDP fell 0.5 percent in IIQ2012 and declined 2.4 percent relative to a year earlier. In IIIQ2012, Italy’s GDP fell 0.4 percent and declined 2.6 percent relative to a year earlier. The GDP of Italy contracted 0.9 percent in IVQ2012 and fell 2.8 percent relative to a year earlier. In IQ2013, Italy’s GDP contracted 0.6 percent and fell 2.4 percent relative to a year earlier. Italy’s GDP fell 0.3 percent in IIQ2013 and 2.1 percent relative to a year earlier. The GDP of Italy decreased 0.1 percent in IIIQ2013 and declined 1.9 percent relative to a year earlier. Italy’s GDP increased 0.1 percent in IVQ2013 and decreased 0.9 percent relative to a year earlier. In IQ2014, Italy’s GDP decreased 0.1 percent and fell 0.5 percent relative to a year earlier.

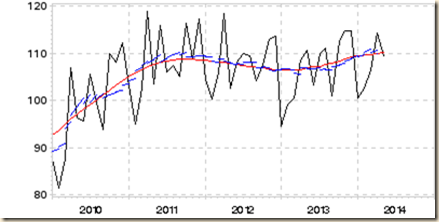

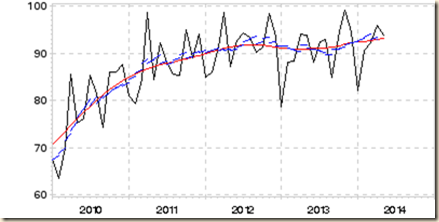

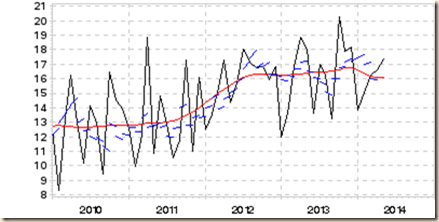

- France. France’s GDP increased 0.2 percent in IQ2012 and increased 0.6 percent relative to a year earlier. France’s GDP decreased 0.3 percent in IIQ2012 and increased 0.4 percent relative to a year earlier. In IIIQ2012, France’s GDP increased 0.3 percent and increased 0.5 percent relative to a year earlier. France’s GDP fell 0.3 percent in IVQ2012 and changed 0.0 percent relative to a year earlier. In IQ2013, France GDP changed 0.0 percent and declined 0.2 percent relative to a year earlier. The GDP of France increased 0.6 percent in IIQ2013 and 0.7 percent relative to a year earlier. France’s GDP decreased 0.1 percent in IIIQ2013 and increased 0.3 percent relative to a year earlier. The GDP of France increased 0.2 percent in IVQ2013 and 0.8 percent relative to a year earlier. In IVQ2014, France’s GDP changed 0.0 percent and increased 0.8 percent relative to a year earlier.

Table V-3, Percentage Changes of GDP Quarter on Prior Quarter and on Same Quarter Year Earlier, ∆%

| IQ2012/IVQ2011 | IQ2012/IQ2011 | |

| United States | QOQ: 0.9 SAAR: 3.7 | 3.3 |

| Japan | QOQ: 0.9 SAAR: 3.8 | 3.2 |

| China | 1.4 | 8.1 |

| Euro Area | -0.1 | -0.2 |

| Germany | 0.7 | 1.8 |

| France | 0.2 | 0.6 |

| Italy | -1.1 | -1.7 |

| United Kingdom | 0.0 | 0.6 |

| IIQ2012/IQ2012 | IIQ2012/IIQ2011 | |

| United States | QOQ: 0.3 SAAR: 1.2 | 2.8 |

| Japan | QOQ: -0.6 | 3.2 |

| China | 2.1 | 7.6 |

| Euro Area | -0.3 | -0.5 |

| Germany | -0.1 | 0.6 1.1 CA |

| France | -0.3 | 0.4 |

| Italy | -0.5 | -2.4 |

| United Kingdom | -0.4 | 0.1 |

| IIIQ2012/ IIQ2012 | IIIQ2012/ IIIQ2011 | |

| United States | QOQ: 0.7 | 3.1 |

| Japan | QOQ: –0.8 | -0.2 |

| China | 2.0 | 7.4 |

| Euro Area | -0.2 | -0.7 |

| Germany | 0.2 | 0.4 |

| France | 0.3 | 0.5 |

| Italy | -0.4 | -2.6 |

| United Kingdom | 0.8 | 0.3 |

| IVQ2012/IIIQ2012 | IVQ2012/IVQ2011 | |

| United States | QOQ: 0.0 | 2.0 |

| Japan | QOQ: 0.1 SAAR: 0.2 | -0.3 |

| China | 1.9 | 7.9 |

| Euro Area | -0.5 | -1.0 |

| Germany | -0.5 | 0.0 |

| France | -0.3 | 0.0 |

| Italy | -0.9 | -2.8 |

| United Kingdom | -0.2 | 0.2 |

| IQ2013/IVQ2012 | IQ2013/IQ2012 | |

| United States | QOQ: 0.3 | 1.3 |

| Japan | QOQ: 1.2 SAAR: 4.9 | 0.1 |

| China | 1.5 | 7.7 |

| Euro Area | -0.2 | -1.1 |

| Germany | 0.0 | -1.6 |

| France | 0.0 | -0.2 |

| Italy | -0.6 | -2.4 |

| UK | 0.4 | 0.5 |

| IIQ2013/IQ2013 | IIQ2013/IIQ2012 | |

| United States | QOQ: 0.6 SAAR: 2.5 | 1.6 |

| Japan | QOQ: 0.9 SAAR: 3.5 | 1.3 |

| China | 1.8 | 7.5 |

| Euro Area | 0.3 | -0.6 |

| Germany | 0.7 | 0.9 |

| France | 0.6 | 0.7 |

| Italy | -0.3 | -2.1 |

| UK | 0.8 | 1.7 |

| IIIQ2013/IIQ2013 | III/Q2013/ IIIQ2012 | |

| USA | QOQ: 1.0 | 2.0 |

| Japan | QOQ: 0.3 SAAR: 1.3 | 2.4 |

| China | 2.3 | 7.8 |

| Euro Area | 0.1 | -0.3 |

| Germany | 0.3 | 1.1 |

| France | -0.1 | 0.3 |

| Italy | -0.1 | -1.9 |

| UK | 0.8 | 1.8 |

| IVQ2013/IIIQ2013 | IVQ2013/IVQ2012 | |

| USA | QOQ: 0.7 SAAR: 2.6 | 2.6 |

| Japan | QOQ: 0.1 SAAR: 0.3 | 2.5 |

| China | 1.7 | 7.7 |

| Euro Area | 0.3 | 0.5 |

| Germany | 0.4 | 1.3 |

| France | 0.2 | 0.8 |

| Italy | 0.1 | -0.9 |

| UK | 0.7 | 2.7 |

| IQ2014/IVQ2013 | IQ2014/IQ2013 | |

| USA | QOQ -0.2 SAAR -1.0 | 2.0 |

| Japan | QOQ: 1.5 SAAR: 5.9 | 3.0 |

| China | 1.4 | 7.4 |

| Euro Area | 0.2 | 0.9 |

| Germany | 0.8 | 2.5 |

| France | 0.0 | 0.8 |

| Italy | -0.1 | -0.5 |

| UK | 0.8 | 3.1 |

QOQ: Quarter relative to prior quarter; SAAR: seasonally adjusted annual rate

Source: Country Statistical Agencies http://www.census.gov/aboutus/stat_int.html

Table V-4 provides two types of data: growth of exports and imports in the latest available months and in the past 12 months; and contributions of net trade (exports less imports) to growth of real GDP.

- Japan. Japan provides the most worrisome data (http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html and earlier http://cmpassocregulationblog.blogspot.com/2014/02/mediocre-cyclical-united-states.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-zero-interest-rates-world.html http://cmpassocregulationblog.blogspot.com/2013/11/global-financial-risk-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations_8763.html http://cmpass ocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html and earlier http://cmpassocregulationblog.blogspot.com/2013/07/duration-dumping-steepening-yield-curve.html and earlier http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and_4699.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2013/03/united-states-commercial-banks-assets.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/world-inflation-waves-united-states.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/02/thirty-one-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2012/12/mediocre-and-decelerating-united-states_24.html and earlier http://cmpassocregulationblog.blogspot.com/2012/11/contraction-of-united-states-real_25.html and for GDP http://cmpassocregulationblog.blogspot.com/2013/09/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html and earlier http://cmpassocreulationblog.blogspot.com/2013/02/recovery-without-hiring-united-states.html). In Apr 2014, Japan’s exports grew 5.1 percent in 12 months while imports increased 3.4 percent. The second part of Table V-4 shows that net trade deducted 1.3 percentage points from Japan’s growth of GDP in IIQ2012, deducted 2.2 percentage points from GDP growth in IIIQ2012 and deducted 0.5 percentage points from GDP growth in IVQ2012. Net trade added 0.4 percentage points to GDP growth in IQ2012, 1.7 percentage points in IQ2013 and 0.5 percentage points in IIQ2013. In IIIQ2013, net trade deducted 2.0 percentage points from GDP growth in Japan. Net trade ducted 2.2 percentage points from GDP growth in Japan in IVQ2013. Net trade deducted 1.1 percentage point from GDP growth of Japan in IQ2014.

- China. In Apr 2014, China exports increased 0.9 percent relative to a year earlier and imports increased 0.8 percent.

- Germany. Germany’s exports increased 3.0 percent in the month of Apr 2014 and decreased 0.2 percent in the 12 months ending in Apr 2014. Germany’s imports decreased 0.2 percent in the month of Apr and increased 0.6 percent in the 12 months ending in Apr. Net trade contributed 0.8 percentage points to growth of GDP in IQ2012, contributed 0.3 percentage points in IIQ2012, contributed 0.3 percentage points in IIIQ2012, deducted 0.5 percentage points in IVQ2012, deducted 0.3 percentage points in IQ2013 and added 0.1 percentage points in IIQ2013. Net traded deducted 0.5 percentage points from Germany’s GDP growth in IIIQ2013 and added 0.4 percentage points to GDP growth in IVQ2013. Net trade added 0.1 percentage points to GDP growth in IQ2014.

- United Kingdom. Net trade deducted 0.7 percentage points from UK value added in IQ2012, deducted 0.8 percentage points in IIQ2012, added 0.9 percentage points in IIIQ2012 and subtracted 0.4 percentage points in IVQ2012. In IQ2013, net trade added 0.5 percentage points to UK’s growth of value added and contributed 0.0 percentage points in IIQ2013. In IIIQ2013, net trade deducted 1.1 percentage points from UK growth. Net trade contributed 1.0 percentage points to UK value added in IVQ2013. Net trade contributed 0.0 percentage points to UK value added in IQ2014.

- France. France’s exports decreased 0.7 percent in Apr 2014 while imports decreased 2.9 percent. Net traded added 0.1 percentage points to France’s GDP in IIIQ2012 and 0.1 percentage points in IVQ2012. Net trade deducted 0.1 percentage points from France’s GDP growth in IQ2013 and added 0.2 percentage points in IIQ2013, deducting 0.5 percentage points in IIIQ2013. Net trade added 0.3 percentage points to France’s GDP in IVQ2013 and deducted 0.2 percentage points in IQ2014.

- United States. US exports decreased 0.2 percent in Apr 2014 and goods exports increased 2.8 percent in Jan-Apr 2014 relative to a year earlier. Net trade deducted 0.03 percentage points from GDP growth in IIIQ2012 and added 0.68 percentage points in IVQ2012. Net trade deducted 0.28 percentage points from US GDP growth in IQ2013 and deducted 0.07 percentage points in IIQ2013. Net traded added 0.14 percentage points to US GDP growth in IIIQ2013. Net trade added 0.99 percentage points to US GDP growth in IVQ2013. Net trade deducted 0.95 percentage points from US GDP growth in IQ2014. Industrial production decreased 0.6 percent in Apr 2014 after increasing 0.9 percent in Mar 2014 and increasing 1.1 percent in Feb 2014, with all data seasonally adjusted. The Federal Reserve completed its annual revision of industrial production and capacity utilization on Mar 28, 2014 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm). The report of the Board of Governors of the Federal Reserve System states (http://www.federalreserve.gov/releases/g17/Current/default.htm):

“Industrial production decreased 0.6 percent in April 2014 after having risen about 1 percent in both February and March. In April, manufacturing output fell 0.4 percent. The index had increased substantially in February and March following a decrease in January; severe weather had restrained production early in the quarter. The output of utilities dropped 5.3 percent in April, as demand for heating returned toward normal levels. The production at mines increased 1.4 percent following a gain of 2.0 percent in March. At 102.7 percent of its 2007 average, total industrial production in April was 3.5 percent above its level of a year earlier. The capacity utilization rate for total industry decreased 0.7 percentage point in April to 78.6 percent, a rate that is 1.5 percentage points below its long-run (1972–2013) average.”

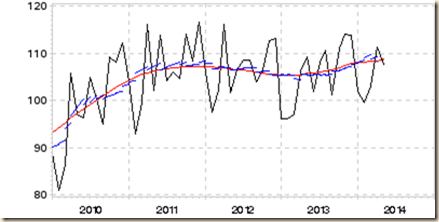

In the six months ending in Apr 2014, United States national industrial production accumulated increase of 2.0 percent at the annual equivalent rate of 4.1 percent, which is higher than growth of 3.5 percent in the 12 months ending in Apr 2014. Excluding growth of 1.1 percent in Feb 2014 (revised from 1.2 percent in the prior estimate), growth in the remaining five months from Nov to Apr 2014 accumulated to 1.0 percent or 2.2 percent annual equivalent. Industrial production fell in two of the past six months. Business equipment accumulated growth of 2.2 percent in the six months from Nov 2013 to Apr 2014 at the annual equivalent rate of 4.4 percent, which is higher than growth of 4.1 percent in the 12 months ending in Apr 2014. The Fed analyzes capacity utilization of total industry in its report (http://www.federalreserve.gov/releases/g17/Current/default.htm): “The capacity utilization rate for total industry decreased 0.7 percentage point in April to 78.6 percent, a rate that is 1.5 percentage points below its long-run (1972–2013) average.” United States industry apparently decelerated to a lower growth rate with possible acceleration in the past few months.

Manufacturing decreased 0.4 percent in Apr 2014 after increasing 0.7 percent in Mar 2014 and increasing 1.5 percent in Feb 2014 seasonally adjusted, increasing 2.5 percent not seasonally adjusted in the 12 months ending in Apr 2014. Manufacturing grew cumulatively 1.4 percent in the six months ending in Apr 2014 or at the annual equivalent rate of 2.8 percent. Excluding the increase of 1.5 percent in Feb 2014 (revised from 1.4 percent in the prior estimate), manufacturing accumulated growth of -0.1 percent from Nov 2013 to Apr 2014 or at the annual equivalent rate of -0.3 percent. Table I-2 provides a longer perspective of manufacturing in the US. There has been evident deceleration of manufacturing growth in the US from 2010 and the first three months of 2011 into more recent months as shown by 12 months rates of growth. Growth rates appeared to be increasing again closer to 5 percent in Apr-Jun 2012 but deteriorated. The rates of decline of manufacturing in 2009 are quite high with a drop of 18.2 percent in the 12 months ending in Apr 2009. Manufacturing recovered from this decline and led the recovery from the recession. Rates of growth appeared to be returning to the levels at 3 percent or higher in the annual rates before the recession but the pace of manufacturing fell steadily in the past six months with some strength at the margin. The Board of Governors of the Federal Reserve System conducted the annual revision of industrial production released on Mar 28, 2014 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm):

“The Federal Reserve has revised its index of industrial production (IP) and the related measures of capacity and capacity utilization. The annual revision for 2014 was more limited than in recent years because the source data required to extend the annual benchmark indexes of production into 2012 were mostly unavailable. Consequently, the IP indexes published with this revision are very little changed from previous estimates. Measured from fourth quarter to fourth quarter, total IP is now reported to have increased about 3 1/3 percent in each year from 2011 to 2013. Relative to the rates of change for total IP published earlier, the new rates are 1/2 percentage point higher in 2012 and little changed in any other year. Total IP still shows a peak-to-trough decline of about 17 percent for the most recent recession, and it still returned to its pre-recession peak in the fourth quarter of 2013.”

Manufacturing output fell 21.9 from the peak in Jun 2007 to the trough in Apr 2009 and increased 19.9 percent from the trough in Apr 2009 to Dec 2013. Manufacturing grew 22.3 percent from the trough in Apr 2009 to Apr 2014. Manufacturing output in Apr 2014 is 4.5 percent below the peak in Jun 2007.

Table V-4, Growth of Trade and Contributions of Net Trade to GDP Growth, ∆% and % Points

| Exports | Exports 12 M ∆% | Imports | Imports 12 M ∆% | |

| USA | -0.2 Apr | 2.8 Jan-Apr | 1.2 Apr | 2.8 Jan-Apr |

| Japan | Apr 2014 5.1 Mar 2014 1.8 Feb 2014 9.5 Jan 2014 9.5 Dec 2013 15.3 Nov 2013 18.4 Oct 2013 18.6 Sep 2013 11.5 Aug 2013 14.7 Jul 2013 12.2 Jun 2013 7.4 May 2013 10.1 Apr 2013 3.8 Mar 2013 1.1 Feb 2013 -2.9 Jan 2013 6.4 Dec -5.8 Nov -4.1 Oct -6.5 Sep -10.3 Aug -5.8 Jul -8.1 | Apr 2013 3.4 Mar 2014 18.1 Feb 2014 9.0 Jan 2014 25.0 Dec 2013 24.7 Nov 2013 21.1 Oct 2013 26.1 Sep 2013 16.5 Aug 2013 16.0 Jul 2013 19.6 Jun 2013 11.8 May 2013 10.0 Apr 2013 9.4 Mar 2013 5.5 Feb 2013 7.3 Jan 2013 7.3 Dec 1.9 Nov 0.8 Oct -1.6 Sep 4.1 Aug -5.4 Jul 2.1 | ||

| China | 2014 0.9 Apr -6.6 Mar -18.1 Feb 10.6 Jan 2013 4.3 Dec 12.7 Nov 5.6 Oct -0.3 Sep 7.2 Aug 5.1 Jul -3.1 Jun 1.0 May 14.7 Apr 10.0 Mar 21.8 Feb 25.0 Jan | 2014 0.8 Apr -11.3 Mar 10.1 Feb 10.0 Jan 2013 8.3 Dec 5.3 Nov 7.6 Oct 7.4 Sep 7.0 Aug 10.9 Jul -0.7 Jun -0.3 May 16.8 Apr 14.1 Mar -15.2 Feb 28.8 Jan | ||

| Euro Area | -0.7 12-M Mar | 1.0 Jan-Mar | 2.5 12-M Mar | -0.1 Jan-Mar |

| Germany | 3.0 Apr CSA | -0.2 Apr | 0.1 Apr CSA | 0.6 Apr |

| France Mar | -0.7 | -6.4 | -2.9 | -5.5 |

| Italy Mar | -0.8 | 1.2 | -1.0 | -1.3 |

| UK | -2.9 Apr | -2.9 Feb-Apr 14 /Feb-Apr 13 | 0.6 Apr | -3.7 Feb-Apr 14 13/Feb-Apr 13 |

| Net Trade % Points GDP Growth | % Points | |||

| USA | IQ2014 -0.95 IVQ2013 0.99 IIIQ2013 0.14 IIQ2013 -0.07 IQ2013 -0.28 IVQ2012 +0.68 IIIQ2012 -0.03 IIQ2012 +0.10 IQ2012 +0.44 | |||

| Japan | 0.4 IQ2012 -1.3 IIQ2012 -2.2 IIIQ2012 -0.5 IVQ2012 1.7 IQ2013 0.5 IIQ2013 -2.0 IIIQ2013 -2.2 IVQ2013 -1.1 IQ2014 | |||

| Germany | IQ2012 0.8 IIQ2012 0.4 IIIQ2012 0.3 IVQ2012 -0.5 IQ2013 -0.3 IIQ2013 0.1 IIIQ2013 -0.5 IVQ2013 0.4 IQ2014 0.1 | |||

| France | 0.1 IIIQ2012 0.1 IVQ2012 -0.1 IQ2013 0.2 IIQ2013 -0.5 IIIQ2013 0.3 IVQ2013 -0.2 IQ2014 | |||

| UK | -0.7 IQ2012 -0.8 IIQ2012 +0.9 IIIQ2012 -0.4 IVQ2012 0.5 IQ2013 0.0 IIQ2013 -1.1 IIIQ2013 1.0 IVQ2013 0.0 IQ2014 |

Sources: Country Statistical Agencies http://www.census.gov/foreign-trade/ http://www.bea.gov/iTable/index_nipa.cfm

The geographical breakdown of exports and imports of Japan with selected regions and countries is provided in Table V-5 for Apr 2014. The share of Asia in Japan’s trade is more than one-half for 53.8 percent of exports and 45.2 percent of imports. Within Asia, exports to China are 18.0 percent of total exports and imports from China 22.6 percent of total imports. While exports to China increased 9.8 percent in the 12 months ending in Apr 2014, imports from China increased 7.8 percent. The largest export market for Japan in Apr 2014 is the US with share of 18.5 percent of total exports, which is close to that of China, and share of imports from the US of 8.4 percent in total imports. Japan’s exports to the US grew 1.9 percent in the 12 months ending in Apr 2014 and imports from the US grew 6.9 percent. Western Europe has share of 10.7 percent in Japan’s exports and of 10.3 percent in imports. Rates of growth of exports of Japan in Apr 2014 are 1.9 percent for exports to the US, minus 5.9 percent for exports to Brazil and 17.6 percent for exports to Germany. Comparisons relative to 2011 may have some bias because of the effects of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Deceleration of growth in China and the US and threat of recession in Europe can reduce world trade and economic activity. Growth rates of imports in the 12 months ending in Apr 2014 are positive for all trading partners except for declines from Canada and the Middle East. Imports from Asia increased 7.6 percent in the 12 months ending in Apr 2014 while imports from China increased 7.8 percent. Data are in millions of yen, which may have effects of recent depreciation of the yen relative to the United States dollar (USD).

Table V-5, Japan, Value and 12-Month Percentage Changes of Exports and Imports by Regions and Countries, ∆% and Millions of Yen

| Apr 2014 | Exports | 12 months ∆% | Imports Millions Yen | 12 months ∆% |

| Total | 6,069,221 | 5.1 | 6,878,077 | 3.4 |

| Asia | 3,263,128 | 3.6 | 3,109,642 | 7.6 |

| China | 1,095,389 | 9.8 | 1,556,390 | 7.8 |

| USA | 1,122,903 | 1.9 | 575,427 | 6.9 |

| Canada | 76,087 | 12.0 | 92,453 | -18.4 |

| Brazil | 44,568 | -5.9 | 73,187 | 5.0 |

| Mexico | 98,272 | 19.7 | 37,125 | 9.5 |

| Western Europe | 649,304 | 14.4 | 710,007 | 10.1 |

| Germany | 169,365 | 17.6 | 189,736 | 7.8 |

| France | 54,689 | -7.3 | 96,321 | 1.0 |

| UK | 91,072 | 10.2 | 66,436 | 30.4 |

| Middle East | 246,455 | 25.6 | 1,249,425 | -6.9 |

| Australia | 132,306 | -10.0 | 426,071 | 7.4 |

Source: Japan, Ministry of Finance http://www.customs.go.jp/toukei/info/index_e.htm

World trade projections of the IMF are in Table V-6. There is increasing growth of the volume of world trade of goods and services from 3.0 percent in 2013 to 5.3 percent in 2015 and 5.7 percent on average from 2016 to 2019. World trade would be slower for advanced economies while emerging and developing economies (EMDE) experience faster growth. World economic slowdown would be more challenging with lower growth of world trade.

Table V-6, IMF, Projections of World Trade, USD Billions, USD/Barrel and Annual ∆%

| 2013 | 2014 | 2015 | Average ∆% 2016-2019 | |

| World Trade Volume (Goods and Services) | 3.0 | 4.3 | 5.3 | 5.7 |

| Exports Goods & Services | 3.1 | 4.5 | 5.3 | 5.7 |

| Imports Goods & Services | 2.9 | 4.2 | 5.2 | 5.7 |

| World Trade Value of Exports Goods & Services USD Billion | 23,083 | 23,990 | 25,123 | Average ∆% 2006-2015 20,390 |

| Value of Exports of Goods USD Billion | 18,591 | 19,281 | 20,132 | Average ∆% 2006-2015 16,396 |

| Average Oil Price USD/Barrel | 104.07 | 104.17 | 97.92 | Average ∆% 2006-2015 88.84 |

| Average Annual ∆% Export Unit Value of Manufactures | -1.1 | -0.3 | -0.4 | Average ∆% 2006-2015 1.4 |

| Exports of Goods & Services | 2013 | 2014 | 2015 | Average ∆% 2016-2019 |

| Euro Area | 1.4 | 3.4 | 4.2 | 4.7 |

| EMDE | 4.4 | 5.0 | 6.2 | 6.2 |

| G7 | 1.4 | 3.9 | 4.5 | 4.9 |

| Imports Goods & Services | ||||

| Euro Area | 0.3 | 2.8 | 3.5 | 4.7 |

| EMDE | 5.6 | 5.2 | 6.3 | 6.4 |

| G7 | 1.1 | 3.2 | 4.2 | 4.9 |

| Terms of Trade of Goods & Services | ||||

| Euro Area | -0.3 | -0.2 | -0.7 | -0.1 |

| EMDE | 0.7 | -0.4 | -0.6 | -0.4 |

| G7 | 0.7 | -0.044 | 0.3 | 0.0 |

| Terms of Trade of Goods | ||||

| Euro Area | 0.8 | -0.044 | 0.1 | -0.2 |

| EMDE | -0.6 | -0.9 | -0.9 | -0.8 |

| G7 | -0.1 | -0.3 | -0.9 | -0.7 |

Notes: Commodity Price Index includes Fuel and Non-fuel Prices; Commodity Industrial Inputs Price includes agricultural raw materials and metal prices; Oil price is average of WTI, Brent and Dubai

Source: International Monetary Fund World Economic Outlook databank

http://www.imf.org/external/ns/cs.aspx?id=28

The JP Morgan Global All-Industry Output Index of the JP Morgan Manufacturing and Services PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, with high association with world GDP, increased to 54.3 in May from 52.8 in Apr, indicating expansion at faster rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/e4a3e6a323e44c3f9d5a30c1d2c99a59). This index has remained above the contraction territory of 50.0 during 58 consecutive months. The employment index increased from 51.2 in Apr to 51.7 in May with input prices rising at faster rate, new orders increasing at faster rate and output increasing at faster rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/e4a3e6a323e44c3f9d5a30c1d2c99a59). David Hensley, Director of Global Economics Coordination at JP Morgan finds possible higher growth in the second half of the year (http://www.markiteconomics.com/Survey/PressRelease.mvc/e4a3e6a323e44c3f9d5a30c1d2c99a59). The JP Morgan Global Manufacturing PMI™, produced by JP Morgan and Markit in association with ISM and IFPSM, increased at 52.2 in May from 51.9 in Apr (http://www.markiteconomics.com/Survey/PressRelease.mvc/fe712f3189ef4f73910514ced33c78d1). New export orders expanded for the eleventh consecutive month (http://www.markiteconomics.com/Survey/PressRelease.mvc/fe712f3189ef4f73910514ced33c78d1). David Hensley, Director of Global Economic Coordination at JP Morgan finds improvement of the index with possibly higher growth in the second half of 2014 (http://www.markiteconomics.com/Survey/PressRelease.mvc/fe712f3189ef4f73910514ced33c78d1). The HSBC Brazil Composite Output Index, compiled by Markit, decreased from 49.9 in Apr to 49.8 in May, indicating unchanged activity of Brazil’s private sector (http://www.markiteconomics.com/Survey/PressRelease.mvc/1b1eac66368b4c93b0488de12835096a). The HSBC Brazil Services Business Activity index, compiled by Markit, increased from 50.4 in Apr to 50.6 in May, indicating expanding services activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/1b1eac66368b4c93b0488de12835096a). André Loes, Chief Economist, Brazil, at HSBC, finds risks of slowing economic activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/1b1eac66368b4c93b0488de12835096a). The HSBC Brazil Purchasing Managers’ IndexTM (PMI™) decreased marginally from 49.3 in Apr to 48.8 in May, indicating moderate deterioration in manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/3b3a43fb381f4a8bb8f3f6b86953a877). André Loes, Chief Economist, Brazil at HSBC, finds weakening industrial activity in Brazil (http://www.markiteconomics.com/Survey/PressRelease.mvc/3b3a43fb381f4a8bb8f3f6b86953a877).

VA United States. The Markit Flash US Manufacturing Purchasing Managers’ Index™ (PMI™) seasonally adjusted increased to 56.2 in May from 55.4 in Apr (http://www.markiteconomics.com/Survey/PressRelease.mvc/1132ab4261d34b5a9194a1c5aed2ddad). New export orders registered 51.5 in May, decreasing from 51.7 in Apr, indicating expansion at a slower rate. Chris Williamson, Chief Economist at Markit, finds that manufacturing hiring is growing with creation of about 15,000 to 20,000 jobs per month and output increasing at the fastest pace in more than three years (http://www.markiteconomics.com/Survey/PressRelease.mvc/1132ab4261d34b5a9194a1c5aed2ddad). The Markit Flash US Services PMI™ Business Activity Index increased from 55.0 in Apr to 58.4 in May (http://www.markiteconomics.com/Survey/PressRelease.mvc/772f9f410a674dc28ef47cfce6cc9ab1). Tim Moore, Senior Economist at Markit, finds that the surveys are consistent with stronger growth in IIQ2014 (http://www.markiteconomics.com/Survey/PressRelease.mvc/772f9f410a674dc28ef47cfce6cc9ab1). The Markit US Composite PMI™ Output Index of Manufacturing and Services increased to 58.4 in May from 55.6 in Apr (http://www.markiteconomics.com/Survey/PressRelease.mvc/79ce2aae785c47a4b99b1233d757b169). The Markit US Services PMI™ Business Activity Index increased from 55.0 in Apr to 58.1 in May (http://www.markiteconomics.com/Survey/PressRelease.mvc/79ce2aae785c47a4b99b1233d757b169). Chris Williamson, Chief Economist at Markit, finds the indexes consistent with US growth at annual rate of 3.0 percent in IIQ2014 (http://www.markiteconomics.com/Survey/PressRelease.mvc/79ce2aae785c47a4b99b1233d757b169). The Markit US Manufacturing Purchasing Managers’ Index™ (PMI™) increased to 56.4 in May from 55.4 in Apr, which indicates expansion at faster rate (http://www.markiteconomics.com/Survey/PressRelease.mvc/4de925caab7141c9ab46942a017cba27). The index of new exports orders increased from 51.7 in Apr to 52.2 in May while total new orders decreased from 58.9 in Apr to 58.8 in May. Chris Williamson, Chief Economist at Markit, finds that the index suggests output growth at the fastest pace since the Global Recession (http://www.markiteconomics.com/Survey/PressRelease.mvc/4de925caab7141c9ab46942a017cba27). The purchasing managers’ index (PMI) of the Institute for Supply Management (ISM) Report on Business® increased 0.5 percentage points from 54.9 in Apr to 55.4 in May, which indicates growth at a faster rate (http://www.ism.ws/ISMReport/MfgROB.cfm?navItemNumber=12942). The index of new orders increased 1.8 percentage points from 55.1 in Apr to 56.9 in May. The index of exports decreased 0.5 percentage point from 57.0 in Apr to 56.5 in May, growing at a slower rate. The Non-Manufacturing ISM Report on Business® PMI increased 1.1 percentage points from 55.2 in Apr to 56.3 in May, indicating growth of business activity/production during 58 consecutive months, while the index of new orders increased 2.3 percentage points from 58.2 in Apr to 60.5 in May (http://www.ism.ws/ISMReport/NonMfgROB.cfm?navItemNumber=12943). Table USA provides the country economic indicators for the US.

Table USA, US Economic Indicators

| Consumer Price Index | Apr 12 months NSA ∆%: 2.0; ex food and energy ∆%: 1.8 Apr month SA ∆%: 0.3; ex food and energy ∆%: 0.2 |

| Producer Price Index | Finished Goods Apr 12-month NSA ∆%: 3.1; ex food and energy ∆% 1.7 Final Demand Apr 12-month NSA ∆%: 2.1; ex food and energy ∆% 1.9 |

| PCE Inflation | Apr 12-month NSA ∆%: headline 1.6; ex food and energy ∆% 1.4 |

| Employment Situation | Household Survey: May Unemployment Rate SA 6.3% |

| Nonfarm Hiring | Nonfarm Hiring fell from 63.3 million in 2006 to 54.2 million in 2013 or by 9.1 million |

| GDP Growth | BEA Revised National Income Accounts IIQ2012/IIQ2011 2.8 IIIQ2012/IIIQ2011 3.1 IVQ2012/IVQ2011 2.0 IQ2013/IQ2012 1.3 IIQ2013/IIQ2012 1.6 IIIQ2013/IIIQ2012 2.0 IVQ2013/IVQ2012 2.6 IQ2014/IQ2013 2.0 IQ2012 SAAR 3.7 IIQ2012 SAAR 1.2 IIIQ2012 SAAR 2.8 IVQ2012 SAAR 0.1 IQ2013 SAAR 1.1 IIQ2013 SAAR 2.5 IIIQ2013 SAAR 4.1 IVQ2013 SAAR 2.6 IQ2014 SAAR -1.0 |

| Real Private Fixed Investment | SAAR IQ2014 minus 2.3 ∆% IVQ2007 to IQ2014: minus 3.5% Blog 6/1/14 |

| Corporate Profits | IQ2014 SAAR: Corporate Profits -9.8; Undistributed Profits -19.0 Blog 6/1/14 |

| Personal Income and Consumption | Apr month ∆% SA Real Disposable Personal Income (RDPI) SA ∆% 0.2 |

| Quarterly Services Report | IVQ13/IVQ12 NSA ∆%: Financial & Insurance 5.6 |

| Employment Cost Index | Compensation Private IQ2014 SA ∆%: 0.3 |

| Industrial Production | Apr month SA ∆%: -0.6 Manufacturing Apr SA ∆% minus 0.4 Apr 12 months SA ∆% 2.9, NSA 2.5 |

| Productivity and Costs | Nonfarm Business Productivity IQ2014∆% SAAE -3.2; IQ2014/IQ2013 ∆% 1.0; Unit Labor Costs SAAE IQ2014 ∆% 5.7; IQ2014/IQ2013 ∆%: 1.2 Blog 6/8/2014 |

| New York Fed Manufacturing Index | General Business Conditions From Apr 1.29 to May 19.01 |

| Philadelphia Fed Business Outlook Index | General Index from Apr 16.6 to May 15.4 |

| Manufacturing Shipments and Orders | New Orders SA Apr ∆% 0.7 Ex Transport 0.5 Jan-Apr NSA New Orders ∆% 2.8 Ex transport 1.9 |

| Durable Goods | Apr New Orders SA ∆%: 0.8; ex transport ∆%: 0.1 |

| Sales of New Motor Vehicles | Jan-Apr 2014 5,134,255; Jan-Apr 2013 4,980,081. Apr 14 SAAR 16.04 million, Mar 14 SAAR 16.40 million, Apr 2013 SAAR 15.19 million Blog 5/4/14 |

| Sales of Merchant Wholesalers | Jan-Mar 2014/Jan-Mar 2013 NSA ∆%: Total 4.3; Durable Goods: 3.5; Nondurable |

| Sales and Inventories of Manufacturers, Retailers and Merchant Wholesalers | Mar 14 12-M NSA ∆%: Sales Total Business 3.9; Manufacturers 2.7 |

| Sales for Retail and Food Services | Jan-Apr 2014/Jan-Apr 2013 ∆%: Retail and Food Services 3.0; Retail ∆% 1.9 |

| Value of Construction Put in Place | Apr SAAR month SA ∆%: 0.2 Apr 12-month NSA: 8.1 |

| Case-Shiller Home Prices | Mar 2014/Mar 2013 ∆% NSA: 10 Cities 12.6; 20 Cities: 12.4 |

| FHFA House Price Index Purchases Only | Mar SA ∆% 0.7; |

| New House Sales | Apr 2014 month SAAR ∆%: 6.4 |

| Housing Starts and Permits | Apr Starts month SA ∆% 13.2; Permits ∆%: 8.0 |

| Trade Balance | Balance Apr SA -$47,236 million versus Mar -$44,176 million |

| Export and Import Prices | Apr 12-month NSA ∆%: Imports -0.3; Exports 0.1 |

| Consumer Credit | Mar ∆% annual rate: Total 6.7; Revolving 1.6; Nonrevolving 8.7 |

| Net Foreign Purchases of Long-term Treasury Securities | Mar Net Foreign Purchases of Long-term US Securities: $4.0 billion |

| Treasury Budget | Fiscal Year 2014/2013 ∆% Apr: Receipts 8.2; Outlays minus 2.4; Individual Income Taxes 3.5 Deficit Fiscal Year 2012 $1,087 billion Deficit Fiscal Year 2013 $680 billion Blog 5/18/2014 |

| CBO Budget and Economic Outlook | 2012 Deficit $1087 B 6.8% GDP Debt 11,281 B 70.1% GDP 2013 Deficit $680 B, 4.1% GDP Debt 11,982 B 72.1% GDP Blog 8/26/12 11/18/12 2/10/13 9/22/13 2/16/14 |

| Commercial Banks Assets and Liabilities | Apr 2014 SAAR ∆%: Securities 3.7 Loans 8.3 Cash Assets 2.2 Deposits 9.3 Blog 5/25/14 |

| Flow of Funds | IVQ2013 ∆ since 2007 Assets +$12,272.6 BN Nonfinancial -$729.2 BN Real estate -$1380.6 BN Financial +13,001.7 BN Net Worth +$12,910.9 BN Blog 3/16/14 |

| Current Account Balance of Payments | IVQ2013 -83,739 MM %GDP 2.2 Blog 3/23/14 |

Links to blog comments in Table USA:

6/1/14 http://cmpassocregulationblog.blogspot.com/2014/06/financial-instability-mediocre-cyclical.html

5/25/14 http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html

5/18/14 http://cmpassocregulationblog.blogspot.com/2014/05/world-inflation-waves-squeeze-of.html

5/11/14 http://cmpassocregulationblog.blogspot.com/2014/05/rules-discretionary-authorities-and.html

5/4/2014 http://cmpassocregulationblog.blogspot.com/2014/05/financial-volatility-mediocre-cyclical.html

3/23/14 http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html

3/16/2014 http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

9/22/13 http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html

2/10/13 http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

Motor vehicle sales and production in the US have been in long-term structural change. Table VA-1 provides the data on new motor vehicle sales and domestic car production in the US from 1990 to 2010. New motor vehicle sales grew from 14,137 thousand in 1990 to the peak of 17,806 thousand in 2000 or 29.5 percent. In that same period, domestic car production fell from 6,231 thousand in 1990 to 5,542 thousand in 2000 or -11.1 percent. New motor vehicle sales fell from 17,445 thousand in 2005 to 11,772 in 2010 or 32.5 percent while domestic car production fell from 4,321 thousand in 2005 to 2,840 thousand in 2010 or 34.3 percent. In May 2014, light vehicle sales accumulated to 6,742,948, which is higher by 5.0 percent relative to 6,424,707 a year earlier (http://motorintelligence.com/m_frameset.html). The seasonally adjusted annual rate of light vehicle sales in the US reached 16.77 million in May 2014, higher than 16.04 million in Apr 2014 and higher than 15.48 million in May 2013 (http://motorintelligence.com/m_frameset.html).

Table VA-1, US, New Motor Vehicle Sales and Car Production, Thousand Units

| New Motor Vehicle Sales | New Car Sales and Leases | New Truck Sales and Leases | Domestic Car Production | |

| 1990 | 14,137 | 9,300 | 4,837 | 6,231 |

| 1991 | 12,725 | 8,589 | 4,136 | 5,454 |

| 1992 | 13,093 | 8,215 | 4,878 | 5,979 |

| 1993 | 14,172 | 8,518 | 5,654 | 5,979 |

| 1994 | 15,397 | 8,990 | 6,407 | 6,614 |

| 1995 | 15,106 | 8,536 | 6,470 | 6,340 |

| 1996 | 15,449 | 8,527 | 6,922 | 6,081 |

| 1997 | 15,490 | 8,273 | 7,218 | 5,934 |

| 1998 | 15,958 | 8,142 | 7,816 | 5,554 |

| 1999 | 17,401 | 8,697 | 8,704 | 5,638 |

| 2000 | 17,806 | 8,852 | 8,954 | 5,542 |

| 2001 | 17,468 | 8,422 | 9,046 | 4,878 |

| 2002 | 17,144 | 8,109 | 9,036 | 5,019 |

| 2003 | 16,968 | 7,611 | 9,357 | 4,510 |

| 2004 | 17,298 | 7,545 | 9,753 | 4,230 |

| 2005 | 17,445 | 7,720 | 9,725 | 4,321 |

| 2006 | 17,049 | 7,821 | 9,228 | 4,367 |

| 2007 | 16,460 | 7,618 | 8,683 | 3,924 |

| 2008 | 13,494 | 6,814 | 6.680 | 3,777 |

| 2009 | 10,601 | 5,456 | 5,154 | 2,247 |

| 2010 | 11,772 | 5,729 | 6,044 | 2,840 |

Source: US Census Bureau

http://www.census.gov/compendia/statab/cats/wholesale_retail_trade/motor_vehicle_sales.html

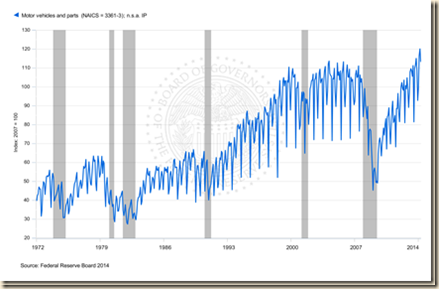

Chart VA-1 of the Board of Governors of the Federal Reserve provides output of motor vehicles and parts in the United States from 1972 to 2014. Output virtually stagnated since the late 1990s.

Chart VA-1, US, Motor Vehicles and Parts Output, 1972-2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/default.htm

Manufacturers’ shipments increased 0.3 percent in Apr 2014 and 0.4 percent in Mar 2014 after increasing 1.0 percent in Feb 2014. New orders increased 0.7 percent in Apr 2014, after increasing 1.5 percent in Mar 2014 and increasing 1.7 percent in Feb 2014, as shown in Table VA-2. These data are very volatile. Volatility is illustrated by increase of 2642.2 percent of new orders of nondefense aircraft in Sep 2012 following decline by 97.2 percent in Aug. New orders excluding transportation equipment increased 0.5 percent in Apr 2014 after increasing 0.8 percent in Mar 2014 and increasing 0.8 percent in Feb 2014. Capital goods new orders, indicating investment, increased 3.0 percent in Apr 2014 after increasing 10.5 percent in Mar 2014 and decreasing 0.6 percent in Feb 2014. New orders of nondefense capital goods decreased 1.0 percent in Apr 2014 after increasing 9.7 percent in Mar 2014 and decreasing 1.8 percent in Feb 2014. Excluding more volatile aircraft, capital goods orders decreased 1.2 percent in Apr 2014 after increasing 4.7 percent in Mar 2014 and increasing 0.1 percent in Feb 2014.

Table VA-2, US, Value of Manufacturers’ Shipments and New Orders, SA, Month ∆%

| Apr 2014 | Mar 2013 ∆% | Feb 2013 | |

| Total | |||

| S | 0.3 | 0.4 | 1.0 |

| NO | 0.7 | 1.5 | 1.7 |

| Excluding | |||

| S | 0.5 | 0.3 | 0.8 |

| NO | 0.5 | 0.8 | 0.8 |

| Excluding | |||

| S | 0.4 | 0.3 | 1.1 |

| NO | -0.1 | 1.1 | 1.5 |

| Durable Goods | |||

| S | -0.1 | 1.4 | 1.1 |

| NO | 0.6 | 3.7 | 2.6 |

| Machinery | |||

| S | -1.2 | 3.0 | 2.3 |

| NO | -2.8 | 4.3 | 0.1 |

| Computers & Electronic Products | |||

| S | 0.6 | 1.2 | -1.2 |

| NO | -1.3 | 7.2 | -0.2 |

| Computers | |||

| S | 3.9 | 0.5 | -1.1 |

| NO | -13.2 | 7.3 | 70.7 |

| Transport | |||

| S | -0.8 | 1.0 | 2.3 |

| NO | 1.4 | 5.2 | 6.9 |

| Automobiles | |||

| S | -5.7 | -6.5 | 5.6 |

| Motor Vehicles | |||

| S | -0.3 | 0.0 | 4.7 |

| NO | -0.2 | 0.5 | 4.2 |

| Nondefense | |||

| S | -0.9 | 4.0 | -4.8 |

| NO | -7.9 | 12.3 | 11.4 |

| Capital Goods | |||

| S | -0.4 | 2.3 | 0.3 |

| NO | 3.0 | 10.5 | -0.6 |

| Nondefense Capital Goods | |||

| S | -0.6 | 2.5 | 0.6 |

| NO | -1.0 | 9.7 | -1.8 |

| Capital Goods ex Aircraft | |||

| S | -0.4 | 2.2 | 0.8 |

| NO | -1.2 | 4.7 | 0.1 |

| Nondurable Goods | |||

| S | 0.7 | -0.5 | 0.9 |

| NO | 0.7 | -0.5 | 0.9 |

Note: Mfg: manufacturing; S: shipments; NO: new orders; Transport: transportation

Source: US Census Bureau

http://www.census.gov/manufacturing/m3/

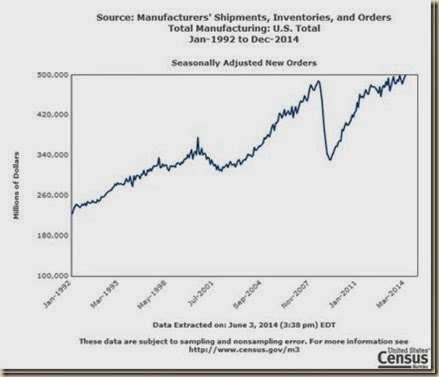

Chart VA-2 of the US Census Bureau provides new orders of manufacturers from Apr 2013 to Mar 2014. There is significant volatility that prevents discerning clear trends.

Chart VA-2, US, Manufacturers’ New Orders 2013-2014 Seasonally Adjusted, Month ∆%

Source: US Census Bureau

http://www.census.gov/briefrm/esbr/www/esbr022.html

Chart VA-3 of the US Census Bureau provides total value of manufacturers’ new orders, seasonally adjusted, from 1992 to 2014. Seasonal adjustment reduces sharp oscillations. The series dropped nearly vertically during the global recession but rose along a path even steeper than in the high-growth period before the recession. The final segment suggests deceleration but similar segments occurred in earlier periods followed with continuing growth and stability currently.

Chart VA-3, US, Value of Total Manufacturers’ New Orders, Seasonally Adjusted, 1992-2014

Source: US Census Bureau

http://www.census.gov/manufacturing/m3/

Additional perspective on manufacturers’ shipments and new orders is provided by Table VA-3. Values are cumulative millions of dollars in Jan-Apr 2014 not seasonally adjusted (NSA). Shipments of all manufacturing industries in Jan-Apr 2014 total $1935.2 billion and new orders total $1933.7 billion, growing respectively by 2.3 percent and 2.8 percent relative to the same period in 2013. Excluding transportation equipment, shipments grew 2.0 percent and new orders increased 1.9 percent. Excluding defense, shipments grew 2.4 percent and new orders grew 2.5 percent. Durable goods shipments reached $921.6 billion in Jan-Apr 2014, or 47.6 percent of the total, growing by 3.9 percent, and new orders $920.1 billion, or 47.6 percent of the total, growing by 4.9 percent. Important information in Table VA-3 is the large share of nondurable goods with shipments of $1013.6 billion or 52.4 percent of the total, growing by 0.9 percent. Capital goods have relatively high value of $329.1 billion for shipments, growing 3.9 percent, and new orders $345.8 billion, increasing 4.6 percent, which could be an indicator of future investment. Excluding aircraft, capital goods shipments reached $262.7 billion, growing 3.0 percent, and new orders $279.9 billion, increasing 3.1 percent. There is no suggestion in these data that the US economy is close to recession but manufacturing accounts for 11.0 percent of US national income in IVQ2013. These data are not adjusted for inflation.

Table VA-3, US, Value of Manufacturers’ Shipments and New Orders, NSA, Millions of Dollars

| Jan-Apr 2014 | Shipments | ∆% 2013/ | New Orders | ∆% 2013/ |

| Total | 1,935,202 | 2.3 | 1,933,703 | 2.8 |

| Excluding Transport | 1,664,224 | 2.0 | 1,656,336 | 1.9 |

| Excluding Defense | 1,890,051 | 2.4 | 1,888,648 | 2.5 |

| Durable Goods | 921,636 | 3.9 | 920,137 | 4.9 |

| Machinery | 139,826 | 3.5 | 149,255 | 7.0 |

| Computers & Electronic Products | 110,749 | 4.8 | 84,096 | 4.3 |

| Computers | 1,577 | -23.3 | 1,357 | -40.6 |

| Transport Equipment | 270,978 | 4.1 | 277,367 | 8.5 |

| Automobiles | 36,321 | -14.4 | ||

| Motor Vehicles | 82,499 | 8.1 | 82,842 | 8.3 |

| Nondefense Aircraft | 43,746 | 15.5 | 49,148 | 14.3 |

| Capital Goods | 329,091 | 3.9 | 345,838 | 4.6 |

| Nondefense Capital Goods | 292,250 | 4.6 | 308,469 | 2.9 |

| Capital Goods ex Aircraft | 262,667 | 3.0 | 279,925 | 3.1 |

| Nondurable Goods | 1,013,566 | 0.9 | 1,013,566 | 0.9 |

| Food Products | 256,761 | 5.7 | ||

| Petroleum Refineries | 266,763 | -1.8 | ||

| Chemical Products | 251,540 | -1.0 |

Note: Transport: transportation Source: US Census Bureau

Source: US Census Bureau

http://www.census.gov/manufacturing/m3/

Chart VA-4 of the US Census Bureau provides value of manufacturer’s new orders not seasonally adjusted from Jan 1992 to Apr 2014. Fluctuations are evident, which are smoothed by seasonal adjustment in the above Chart VA-3. The series drops nearly vertically during the global contraction and then resumes growth in a steep upward trend, flattening recently.

Chart VA-4, US, Value of Total Manufacturers’ New Orders, Not Seasonally Adjusted, 1992-2014

Source: US Census Bureau

http://www.census.gov/manufacturing/m3/

Construction spending at seasonally adjusted annualized rate (SAAR) reached $953.5 billion in Apr 2013, which was higher by 0.2 percent than in the prior month of Mar 2014, as shown in Table VA-4. Residential investment, with $382.9 billion accounting for 40.2 percent of total value of construction, changed 0.0 percent in Apr and nonresidential investment, with $570.6 billion accounting for 59.8 percent of the total, increased 0.4 percent. Public construction increased 0.8 percent while private construction changed 0.0 percent. Data in Table VA-4 show that nonresidential construction at $570.6 billion is much higher in value than residential construction at $382.9 billion while total private construction at $686.5 billion is much higher than public construction at $267.0 billion, all in SAAR. Residential and nonresidential construction contributed positively to growth of GDP in the US in all quarters in 2012. Nonresidential investment deducted 0.57 percentage points from GDP growth in IQ2013 while residential construction added 0.34 percentage points. Nonresidential construction added 0.56 percentage points to GDP growth in IIQ2013 with residential construction adding 0.40 percentage points. Nonresidential construction added 0.58 percentage points to GDP growth in IIIQ2013 while residential construction added 0.31 percentage points. Nonresidential construction added 0.68 percentage points to GDP growth in IVQ2013 while residential construction deducted 0.26 percentage points. In 2012, residential construction added 0.32 percentage points to GDP growth and added 0.01 percentage points in 2011. Residential construction added 0.33 percentage points to GDP growth in 2013. Nonresidential construction added 0.85 percentage points to GDP growth in 2012 and 0.84 percentage points in 2011. Nonresidential construction added 0.33 percentage points to GDP growth in 2013. In IQ2014, residential construction deducted 0.20 percentage points from GDP growth and nonresidential construction deducted 0.16 percentage points (http://cmpassocregulationblog.blogspot.com/2014/06/financial-instability-mediocre-cyclical.html).

Table VA-4, Construction Put in Place in the United States Seasonally Adjusted Annual Rate Million Dollars and Month and 12-Month ∆%

| Apr 2014 | Apr 2014 SAAR $ Millions | Month ∆% | 12-Month ∆% |

| Total | 953,548 | 0.2 | 8.6 |

| Residential | 382,942 | 0.0 | 16.3 |

| Nonresidential | 570,606 | 0.4 | 3.9 |

| Total Private | 686,542 | 0.0 | 11.7 |

| Private Residential | 378,520 | 0.1 | 17.2 |

| New Single Family | 189,551 | 1.3 | 14.5 |

| New Multi-Family | 40,388 | 2.7 | 31.2 |

| Private Nonresidential | 308,022 | -0.1 | 5.6 |

| Total Public | 267,006 | 0.8 | 1.2 |

| Public Residential | 4,421 | -6.0 | -29.3 |

| Public Nonresidential | 262,584 | 1.0 | 2.0 |

SAAR: seasonally adjusted annual rate; B: billions

Source: US Census Bureau http://www.census.gov/construction/c30/c30index.html

Further information on construction spending is provided in Table VA-5. The original monthly estimates not-seasonally adjusted (NSA) and their 12-month rates of change are provided in the first two columns while the SAARs and their monthly changes are provided in the final two columns. There has been improvement in construction in the US. There are only five declines in the monthly rate from Dec 2011 to Apr 2014. Growth in 12 months fell from 9.5 percent in Dec 2012 to 4.9 percent in Dec 2013, rebounding 8.1 percent in Apr 2014.

Table VA-5, US, Value and Percentage Change in Value of Construction Put in Place, Dollars Millions and ∆%

| Value NSA | 12-Month ∆% NSA | Value | Month ∆% SA* | |

| Apr 2014 | 76,263 | 8.1 | 953,548 | 0.2 |

| Mar | 70,248 | 9.7 | 951,582 | 0.6 |

| Feb | 63,348 | 8.6 | 946,109 | 0.4 |

| Jan | 64,511 | 9.1 | 942,494 | -0.4 |

| Dec 2013 | 71,502 | 4.9 | 946,712 | 2.0 |

| Nov | 77,931 | 1.1 | 928,312 | 0.6 |

| Oct | 85,193 | 4.5 | 922,898 | 0.7 |

| Sep | 85,383 | 5.7 | 916,520 | 1.4 |

| Aug | 85,677 | 4.9 | 903,786 | 0.1 |

| Jul | 83,104 | 5.3 | 902,854 | 0.6 |

| Jun | 81,722 | 4.9 | 897,113 | 0.1 |

| May | 77,327 | 7.0 | 896,134 | 2.0 |

| Apr | 70,535 | 6.5 | 878,396 | 1.1 |

| Mar | 64,036 | 5.3 | 869,164 | -0.1 |

| Feb | 58,395 | 4.3 | 869,909 | 0.8 |

| Jan | 59,143 | 6.2 | 863,136 | -2.3 |

| Dec 2012 | 68,136 | 9.5 | 883,550 | 0.1 |

| Nov | 77,091 | 12.0 | 882,685 | 2.3 |

| Oct | 81,520 | 9.8 | 863,065 | -1.2 |

| Sep | 80,812 | 7.2 | 873,259 | 2.2 |

| Aug | 81,712 | 6.0 | 854,048 | -0.3 |

| Jul | 78,897 | 9.4 | 856,348 | 0.1 |

| Jun | 77,876 | 6.9 | 855,779 | 1.3 |

| May | 72,240 | 9.8 | 844,709 | 1.4 |

| Apr | 66,223 | 7.8 | 833,243 | 0.8 |

| Mar | 60,796 | 7.5 | 826,641 | 0.4 |

| Feb | 55,981 | 10.8 | 823,331 | 0.7 |

| Jan | 55,671 | 9.3 | 817,616 | 0.0 |

| Dec 2011 | 62,242 | 3.4 | 817,569 | 1.0 |

SAAR: Seasonally Adjusted Annual Rate

Source: US Census Bureau http://www.census.gov/construction/c30/c30index.html

The sharp contraction of the value of construction in the US is revealed by Table VA-6. Construction spending in Jan-Apr 2014, not seasonally adjusted, reached $274.5billion, which is higher by 8.9 percent than $252.1 billion in the same period in 2013. The depth of the contraction is shown by the decline of construction spending from $350.7 billion in Jan-Apr 2006 to $274.5 billion in the same period in 2014, or decline by minus 21.7 percent. The decline in inflation-adjusted terms is much higher. The all-items not seasonally adjusted CPI (consumer price index) increased from 201.5 in Apr 2006 to 237.072 in Apr 2014 (http://www.bls.gov/cpi/data.htm) or by 17.7 percent. The comparable decline from Jan-Apr 2005 to Jan-Apr 2014 is minus 11.6 percent. Construction spending in Jan-Apr 2014 increased by 8.7 percent relative to the same period in 2003. Construction spending is lower by 2.0 percent in Jan-Feb 2014 relative to the same period in 2009. Construction has been weaker than the economy as a whole.

Table VA-6, US, Value of Construction Put in Place in the United States, Not Seasonally Adjusted, $ Millions and ∆%

| Jan-Apr 2014 $ MM | 274,460 |

| Jan-Apr 2013 | 252,109 |

| ∆% to 2014 | 8.9 |

| Jan-Apr 2012 $ MM | 238,671 |

| ∆% to 2014 | 15.0 |

| Jan-Apr 2011 $ MM | 219,489 |

| ∆% to 2014 | 25.0 |

| Jan-Apr 2010 $MM | 236,255 |

| ∆% to 2014 | 16.2 |

| Jan-Apr 2009 | 280,051 |

| ∆% to 2014 | -2.0 |

| Jan-Apr 2006 $ MM | 350,715 |

| ∆% to 2014 | -21.7 |

| Jan-Apr 2005 $ MM | 310,352 |

| ∆% to 2014 | -11.6 |

| Jan-Apr 2003 $ MM | 252,447 |

| ∆% to 2014 | 8.7 |

Source: US Census Bureau http://www.census.gov/construction/c30/c30index.html

Chart VA-5 of the US Census Bureau provides value of construction spending in the US not seasonally adjusted from 2002 to 2014. There are wide oscillations requiring seasonal adjustment to compare adjacent data. There was sharp decline during the global recession followed in recent periods by a stationary series that may be moving upward again with vacillation in the final segment.

Chart VA-5, Value of Construction Spending not Seasonally Adjusted, Millions of Dollars, 2002-2014

Source: US Census Bureau http://www.census.gov/construction/c30/c30index.html

Monthly construction spending in the US in Jan-Apr and Nov-Dec not seasonally adjusted is shown in Table VA-7 for the years between 2002 and 2014. The value of $76.3 billion in Apr 2014 is higher by 8.1 percent than $70.5billion in Apr 2013. Construction fell by 20.0 percent from the peak of $95.3 billion in Apr 2006 to $76.3 billion in Apr 2014. The data are not adjusted for inflation or changes in quality.

Table VA-7, US, Value of Construction Spending Not Seasonally Adjusted, Millions of Dollars

| Year | Jan | Feb | Mar | Apr | Nov | Dec |

| 2002 | 59,516 | 58,588 | 63,782 | 69,504 | 71,362 | 63,984 |

| 2003 | 59,877 | 58,526 | 64,506 | 69,638 | 77,915 | 71,050 |

| 2004 | 64,934 | 64,138 | 73,238 | 78,354 | 86,394 | 77,733 |

| 2005 | 71,474 | 72,048 | 81,345 | 85,485 | 97,549 | 88,172 |

| 2006 | 81,058 | 81,478 | 92,855 | 95,324 | 95,339 | 86,436 |

| 2007 | 79,406 | 79,177 | 88,905 | 93,375 | 94,822 | 84,218 |

| 2008 | 77,349 | 77,227 | 82,779 | 87,743 | 86,067 | 76,645 |

| 2009 | 66,944 | 66,296 | 71,624 | 75,187 | 71,906 | 64,098 |

| 2010 | 55,586 | 54,019 | 60,228 | 66,422 | 68,019 | 60,202 |

| 2011 | 50,955 | 50,544 | 56,536 | 61,454 | 68,809 | 62,242 |

| 2012 | 55,671 | 55,981 | 60,796 | 66,223 | 77,091 | 68,136 |

| 2013 | 59,143 | 58,395 | 64,036 | 70,535 | 77,931 | 71,502 |

| 2014 | 64,511 | 63,438 | 70,248 | 76,263 | NA | NA |

Source: US Census Bureau http://www.census.gov/construction/c30/c30index.html

Chart VA-6 of the US Census Bureau shows SAARs of construction spending for the US since 1993. Construction spending surged in nearly vertical slope after the stimulus of 2003 combining near zero interest rates together with other housing subsidies and subsequent slow adjustment in 17 doses of increases by 25 basis points between Jun 2004 and Jun 2006. Construction spending collapsed after subprime mortgages defaulted with the fed funds rate increasing from 1.00 percent in Jun 2004 to 5.25 percent in Jun 2006. Subprime mortgages were programmed for refinancing in two years after increases in homeowner equity in the assumption that fed funds rates would remain low forever or increase in small increments (Gorton 2009EFM see http://cmpassocregulationblog.blogspot.com/2011/07/causes-of-2007-creditdollar-crisis.html). Price declines of houses or even uncertainty prevented refinancing of subprime mortgages that defaulted, causing the financial crisis that eventually triggered the global recession. Chart VA-9 shows a trend of increase in the final segment but it is difficult to assess if it is sustainable.

Chart VA-6, US, Construction Expenditures SAAR 1993-2014

Source: US Census Bureau

http://www.census.gov/briefrm/esbr/www/esbr050.html

Construction spending at SAARs in the four months Jan-Apr and Dec is shown in Table VA-8 for the years between 2002 and 2014. There is a peak in 2005 to 2007 with subsequent collapse of SAARs and rebound in 2012-2014.

Table VA-8, US, Value of Construction Spending SAAR Millions of Dollars

| Year | Jan | Feb | Mar | Apr | Dec |

| 2002 | 858,654 | 862,338 | 844,551 | 858,240 | 855,921 |

| 2003 | 863,855 | 859,225 | 851,132 | 859,459 | 948,491 |

| 2004 | 938,826 | 938,656 | 960,946 | 967,761 | 1,037,684 |

| 2005 | 1,036,187 | 1,056,492 | 1,065,262 | 1,058,365 | 1,178,305 |

| 2006 | 1,183,861 | 1,199,767 | 1,213,270 | 1,183,485 | 1,153,491 |

| 2007 | 1,149,899 | 1,156,008 | 1,167,402 | 1,159,124 | 1,108,958 |

| 2008 | 1,106,047 | 1,092,331 | 1,094,910 | 1,091,142 | 993,515 |

| 2009 | 962,704 | 959,907 | 954,984 | 929,593 | 832,565 |

| 2010 | 816,132 | 795,808 | 805,985 | 824,008 | 779,895 |

| 2011 | 757,039 | 754,169 | 763,058 | 772,204 | 817,569 |

| 2012 | 817,616 | 823,331 | 826,641 | 833,243 | 883,550 |

| 2013 | 863,136 | 869,909 | 869,164 | 878,396 | 946,712 |

| 2014 | 942,494 | 946,109 | 951,582 | 953,548 | NA |

Source: US Census Bureau http://www.census.gov/construction/c30/c30index.html

Chart VA-7 of the US Census Bureau provides SAARs of value of construction from 2002 to 2014. There is clear acceleration after 2003 when fed funds rates were fixed at 1.0 percent from Jun 2003 until Jun 2004. Construction peaked in 2005-2006, stabilizing in 2007 at a lower level and then collapsed in a nearly vertical drop until 2011 with increases into 2012 and marginal drop in Jan 2013 followed by increase in Feb 2013 and decline in Mar 2013 followed by continuing increase in Apr-May 2013. Construction stabilized in Jun 2013 and increased in Jul-Aug 2013. Construction declined in Sep 2013 and increased in Oct-Dec 2013 and Feb-Apr 2014.

Chart VA-7, US, Construction Expenditures SAAR 2002-2014

Source: US Census Bureau

http://www.census.gov/construction/c30/c30index.html

Chart VA-8 of the US Census Bureau provides monthly residential construction in the US not seasonally adjusted from 2002 to 2014. There was steep increase until 2006 followed by sharp contraction. The series stabilized at the bottom and increased in the final segment with subsequent stability.

Chart VA-8, US, Residential Construction, Not Seasonally Adjusted, Millions of Dollars, 2002-2014

Source: US Census Bureau http://www.census.gov/construction/c30/c30index.html

Chart VA-9 of the US Census Bureau provides monthly nonresidential construction in the US not seasonally adjusted. There is similar acceleration until 2006 followed by milder contraction than for residential construction. The final segment appears stationary.

Chart VA-9, US, Nonresidential Construction, Not Seasonally Adjusted, Millions of Dollars, 2002-2014

http://www.census.gov/construction/c30/c30index.html

Annual available data for the value of construction put in place in the US between 1993 and 2013 are provided in Table VA-9. Data from 1993 to 2001 are available for public and private construction with breakdown in residential and nonresidential only for private construction. Data beginning in 2002 provide aggregate residential and nonresidential values. Total construction value put in place in the US increased 85.2 percent between 1993 and 2013 but most of the growth, 65.3 percent, was concentrated in 1993 to 2000 with increase of 12.0 percent between 2000 and 2013. Total value of construction increased 6.1 percent between 2002 and 2013 with value of nonresidential construction increasing 26.0 percent while value of residential construction fell 16.1 percent. Value of total construction fell 18.6 percent between 2005 and 2013, with value of residential construction declining 45.4 percent while value of nonresidential construction rose 15.5 percent. Value of total construction fell 23.0 percent between 2006 and 2013, with value of nonresidential construction increasing 2.7 percent while value of residential construction fell 45.6 percent. In 2002, nonresidential construction had share of 52.6 percent in total construction while the share of residential construction was 47.4 percent. In 2013, the share of nonresidential construction in total value rose to 62.5 percent while that of residential construction fell to 37.5 percent.

Table VA-9, Annual Value of Construction Put in Place 1993-2013, Millions of Dollars and ∆%

| Total | Private Nonresidential | Private Residential | |

| 1993 | 485,548 | 150,006 | 208,180 |

| 1994 | 531,892 | 160,438 | 241,033 |

| 1995 | 548,666 | 180,534 | 228,121 |

| 1996 | 599,693 | 195,523 | 257,495 |

| 1997 | 631,853 | 213,720 | 264,696 |

| 1998 | 688,515 | 237,394 | 296,343 |

| 1999 | 744,551 | 249,167 | 326,302 |

| 2000 | 802,756 | 275,293 | 346,138 |

| 2001 | 840,249 | 273,922 | 364,414 |

| Total | Total Nonresidential | Total Residential | |

| 2002 | 847,874 | 445,914 | 401,960 |

| 2003 | 891,497 | 440,246 | 451,251 |

| 2004 | 991,356 | 452,948 | 538,408 |

| 2005 | 1,104,136 | 486,629 | 617,507 |

| 2006 | 1,167,222 | 547,408 | 619,814 |

| 2007 | 1,152,351 | 651,883 | 500,468 |

| 2008 | 1,067,564 | 709,818 | 357,746 |

| 2009 | 903,201 | 649,273 | 253,928 |

| 2010 | 804,561 | 555,449 | 249,112 |

| 2011 | 788,014 | 535,357 | 252,657 |

| 2012 | 856,953 | 570,429 | 286,524 |

| 2013 | 899,949 | 562,113 | 337,836 |

| ∆% 1993-2013 | 85.2 | ||

| ∆% 1993-2000 | 65.3 | ||

| ∆% 2000-2013 | 12.0 | ||

| ∆% 2002-2013 | 6.1 | 26.0 | -16.1 |

| ∆% 2005-2013 | -18.6 | 15.5 | -45.4 |

| ∆% 2006-2013 | -23.0 | 2.7 | -45.6 |

Source: US Census Bureau http://www.census.gov/construction/c30/c30index.html

VB Japan. The GDP of Japan grew at 1.0 percent per year on average from 1991 to 2002, with the GDP implicit deflator falling at 0.8 percent per year on average. The average growth rate of Japan’s GDP was 4 percent per year on average from the middle of the 1970s to 1992 (Ito 2004). Low growth in Japan in the 1990s is commonly labeled as “the lost decade” (see Pelaez and Pelaez, The Global Recession Risk (2007), 81-115). Table VB-GDP provides yearly growth rates of Japan’s GDP from 1995 to 2013. Growth weakened from 2.7 per cent in 1995 and 1996 to contractions of 1.5 percent in 1999 and 0.4 percent in 2001 and growth rates below 2 percent with exception of 2.3 percent in 2003. Japan’s GDP contracted sharply by 3.7 percent in 2006 and 2.0 percent in 2009. As in most advanced economies, growth was robust at 3.4 percent in 2010 but mediocre at 0.3 percent in 2011 and 0.7 percent in 2013. Japan’s GDP grew 2.3 percent in 2013.

Table VB-GDP, Japan, Yearly Percentage Change of GDP ∆%

| Calendar Year | ∆% |

| 1995 | 2.7 |

| 1996 | 2.7 |

| 1997 | 0.1 |

| 1998 | -1.5 |

| 1999 | 0.5 |

| 2000 | 2.0 |

| 2001 | -0.4 |

| 2002 | 1.1 |

| 2003 | 2.3 |

| 2004 | 1.5 |

| 2005 | 1.9 |

| 2006 | 1.8 |

| 2007 | 1.8 |

| 2008 | -3.7 |

| 2009 | -2.0 |

| 2010 | 3.4 |

| 2011 | 0.3 |

| 2012 | 0.7 |

| 2013 | 2.3 |

Source: Source: Japan Economic and Social Research Institute, Cabinet Office

http://www.esri.cao.go.jp/index-e.html

http://www.esri.cao.go.jp/en/sna/sokuhou/sokuhou_top.html

Table VB-BOJF provides the forecasts of economic activity and inflation in Japan by the majority of members of the Policy Board of the Bank of Japan, which is part of their Outlook for Economic Activity and Prices (https://www.boj.or.jp/en/mopo/outlook/gor1404b.pdf). For fiscal 2013, the forecast is of growth of GDP between 2.2 and 2.3 percent, with the all items CPI less fresh food of 0.8 percent (https://www.boj.or.jp/en/mopo/outlook/gor1404b.pdf). The critical difference is forecast of the CPI excluding fresh food of 3.0 to 3.5 percent in 2014, 1.9 to 2.8 percent in 2015 and 2.0 to 3.0 in 2016. Consumer price inflation in Japan excluding fresh food was 0.3 percent in Mar 2013 and 1.3 percent in 12 months (http://www.stat.go.jp/english/data/cpi/1581.htm). The new monetary policy of the Bank of Japan aims to increase inflation to 2 percent. These forecasts are biannual in Apr and Oct. The Cabinet Office, Ministry of Finance and Bank of Japan released on Jan 22, 2013, a “Joint Statement of the Government and the Bank of Japan on Overcoming Deflation and Achieving Sustainable Economic Growth” (http://www.boj.or.jp/en/announcements/release_2013/k130122c.pdf) with the important change of increasing the inflation target of monetary policy from 1 percent to 2 percent:

“The Bank of Japan conducts monetary policy based on the principle that the policy shall be aimed at achieving price stability, thereby contributing to the sound development of the national economy, and is responsible for maintaining financial system stability. The Bank aims to achieve price stability on a sustainable basis, given that there are various factors that affect prices in the short run.

The Bank recognizes that the inflation rate consistent with price stability on a sustainable basis will rise as efforts by a wide range of entities toward strengthening competitiveness and growth potential of Japan's economy make progress. Based on this recognition, the Bank sets the price stability target at 2 percent in terms of the year-on-year rate of change in the consumer price index.

Under the price stability target specified above, the Bank will pursue monetary easing and aim to achieve this target at the earliest possible time. Taking into consideration that it will take considerable time before the effects of monetary policy permeate the economy, the Bank will ascertain whether there is any significant risk to the sustainability of economic growth, including from the accumulation of financial imbalances.”