Recovery without Hiring, Loss of Full-time Jobs, Youth and Middle Age Unemployment, Risks of Steepening Yield Curve and Peaking Valuations of Risk Financial Assets, United States International Trade, Declining Real Salaries, World Economic Slowdown and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013

Executive Summary

I Recovery without Hiring

IA1 Hiring Collapse

IA2 Labor Underutilization

IA3 Ten Million Fewer Full-time Job

IA4 Youth and Middle-Age Unemployment

II United States International Trade

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

III World Financial Turbulence. Financial markets are being shocked by multiple factors including:

(1) world economic slowdown; (2) slowing growth in China with political development and slowing growth in Japan and world trade; (3) slow growth propelled by savings/investment reduction in the US with high unemployment/underemployment, falling wages, hiring collapse, contraction of real private fixed investment, decline of wealth of households over the business cycle by 5.2 percent adjusted for inflation while growing 651.8 percent adjusted for inflation from IVQ1945 to IVQ2012 and unsustainable fiscal deficit/debt threatening prosperity that can cause risk premium on Treasury debt with Himalayan interest rate hikes; and (4) the outcome of the sovereign debt crisis in Europe.

This section provides current data and analysis. Subsection IIIA Financial Risks provides analysis of the evolution of valuations of risk financial assets during the week. There are various appendixes for convenience of reference of material related to the debt crisis of the euro area. Some of this material is updated in Subsection IIIA when new data are available and then maintained in the appendixes for future reference until updated again in Subsection IIIA. Subsection IIIB Appendix on Safe Haven Currencies discusses arguments and measures of currency intervention and is available in the Appendixes section at the end of the blog comment. Subsection IIIC Appendix on Fiscal Compact provides analysis of the restructuring of the fiscal affairs of the European Union in the agreement of European leaders reached on Dec 9, 2011 and is available in the Appendixes section at the end of the blog comment. Subsection IIID Appendix on European Central Bank Large Scale Lender of Last Resort considers the policies of the European Central Bank and is available in the Appendixes section at the end of the blog comment. Appendix IIIE Euro Zone Survival Risk analyzes the threats to survival of the European Monetary Union and is available following Subsection IIIA. Subsection IIIF Appendix on Sovereign Bond Valuation provides more technical analysis and is available following Subsection IIIA. Subsection IIIG Appendix on Deficit Financing of Growth and the Debt Crisis provides analysis of proposals to finance growth with budget deficits together with experience of the economic history of Brazil and is available in the Appendixes section at the end of the blog comment.

IIIA Financial Risks. Financial turbulence, attaining unusual magnitude in recent months, characterized the expansion from the global recession since IIIQ2009. Table III-1, updated with every comment in this blog, provides beginning values on Fri Aug 2 and daily values throughout the week ending on Aug 8, 2013 of various financial assets. Section VI Valuation of Risk Financial Assets provides a set of more complete values. All data are for New York time at 5 PM. The first column provides the value on Fri Aug 2 and the percentage change in that prior week below the label of the financial risk asset. For example, the first column “Fri Aug 2, 2013”, first row “USD/EUR 1.3281 0.0 %,” provides the information that the US dollar (USD) changed 0.0 percent to USD 1.3281/EUR in the week ending on Fri Aug 2 relative to the exchange rate on Fri Jul 26. The first five asset rows provide five key exchange rates versus the dollar and the percentage cumulative appreciation (positive change or no sign) or depreciation (negative change or negative sign). Positive changes constitute appreciation of the relevant exchange rate and negative changes depreciation. Financial turbulence has been dominated by reactions to the new program for Greece (see section IB in http://cmpassocregulationblog.blogspot.com/2011/07/debt-and-financial-risk-aversion-and.html), modifications and new approach adopted in the Euro Summit of Oct 26 (European Commission 2011Oct26SS, 2011Oct26MRES), doubts on the larger countries in the euro zone with sovereign risks such as Spain and Italy but expanding into possibly France and Germany, the growth standstill recession and long-term unsustainable government debt in the US, worldwide deceleration of economic growth and continuing waves of inflation. The most important current shock is that resulting from the agreement by European leaders at their meeting on Dec 9 (European Council 2911Dec9), which is analyzed in IIIC Appendix on Fiscal Compact. European leaders reached a new agreement on Jan 30 (http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/127631.pdf) and another agreement on Jun 29, 2012 (http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/131388.pdf).

The dollar/euro rate is quoted as number of US dollars USD per one euro EUR, USD 1.3281/EUR in the first row, first column in the block for currencies in Table III-1 for Fri Aug 2, appreciating to USD 1.3258/EUR on Mon Aug 5, 2013, or by 0.2 percent. The dollar appreciated because fewer dollars, $1.3258, were required on Mon Aug 5 to buy one euro than $1.3281 on Aug 2. Table III-1 defines a country’s exchange rate as number of units of domestic currency per unit of foreign currency. USD/EUR would be the definition of the exchange rate of the US and the inverse [1/(USD/EUR)] is the definition in this convention of the rate of exchange of the euro zone, EUR/USD. A convention used throughout this blog is required to maintain consistency in characterizing movements of the exchange rate such as in Table III-1 as appreciation and depreciation. The first row for each of the currencies shows the exchange rate at 5 PM New York time, such as USD 1.3281/EUR on Aug; the second row provides the cumulative percentage appreciation or depreciation of the exchange rate from the rate on the last business day of the prior week, in this case Fri Aug 2, to the last business day of the current week, in this case Fri Aug 9, such as depreciation by 0.5 percent to USD 1.3342/EUR by Aug 2 {[(1.3342/1.3281)-1]100 = 0.0%}; and the third row provides the percentage change from the prior business day to the current business day. For example, the USD depreciated (denoted by negative sign) by 0.5 percent from the rate of USD 1.3281/EUR on Fri Aug 2 to the rate of USD 1.3342/EUR on Fri Aug 9 {[(1.3342/1.3281) – 1]100 = 0.5%} and appreciated (denoted by positive sign) by 0.3 percent from the rate of USD 1.3381 on Thu Aug 8 to USD 1.3342/EUR on Fri Aug 9 {[(1.3342/1.3381) -1]100 = -0.3%}. Other factors constant, appreciation of the dollar relative to the euro is caused by increasing risk aversion, with rising uncertainty on European sovereign risks increasing dollar-denominated assets with sales of risk financial investments. Funds move away from higher yielding risk assets to the safety of dollar-denominated assets during risk aversion and return to higher yielding risk assets during risk appetite.

III-I, Weekly Financial Risk Assets Aug 5 to Aug 9, 2013

| Fri Aug 2, 2013 | M 5 | Tue 6 | W 7 | Thu 8 | Fri 9 |

| USD/EUR 1.3281 0.0% | 1.3258 0.2% 0.2% | 1.3305 -0.2% -0.4% | 1.3337 -0.4% -0.2% | 1.3381 -0.8% -0.3% | 1.3342 -0.5% 0.3% |

| JPY/ USD 98.95 -0.7% | 98.30 0.7% 0.7% | 97.74 1.2% 0.6% | 96.34 2.6% 1.4% | 96.71 2.3% -0.4% | 96.23 2.7% 0.5% |

| CHF/ USD 0.9293 -0.1% | 0.9274 0.2% 0.2% | 0.9259 0.4% 0.2% | 0.9218 0.8% 0.4% | 0.9202 1.0% 0.2% | 0.9223 0.8% -0.2% |

| CHF/ EUR 1.2342 -0.1% | 1.2294 0.4% 0.4% | 1.2321 0.2% -0.2% | 1.2292 0.4% 0.% | 1.2313 0.2% -0.2% | 1.2304 0.3% 0.1% |

| USD/ AUD 0.8904 1.1231 -4.1% | 0.8929 1.1199 0.3% 0.3% | 0.8986 1.1128 0.9% 0.6% | 0.9000 1.1111 1.1% 0.2% | 0.9103 1.0985 2.2% 1.1% | 0.9196 1.0874 3.2% 1.0% |

| 10 Year T Note 2.597 | 2.638 | 2.638 | 2.599 | 2.589 | 2.579 |

| 2 Year T Note 0.299 | 0.303 | 0.307 | 0.303 | 0.30 | 0.30 |

| German Bond 2Y 0.15 10Y 1.65 | 2Y 0.17 10Y 1.69 | 2Y 0.17 10Y 1.70 | 2Y 0.16 10Y 1.69 | 2Y 0.16 10Y 1.69 | 2Y 0.16 10Y 1.68 |

| DJIA 15658.36 0.6% | 15612.13 -0.3% -0.3% | 15518.74 -0.9% -0.6% | 15470.67 -1.2% -0.3% | 15498.32 -1.0% 0.2% | 15425.51 -1.5% -0.5% |

| DJ Global 2277.30 1.2% | 2276.47 0.0% 0.0% | 2263.99 -0.6% -0.6% | 2252.51 -1.1% -0.5% | 2268.90 -0.4% 0.7% | 2268.48 -0.4% 0.0% |

| DJ Asia Pacific 1386.06 0.1% | 1383.11 -0.2% -0.2% | 1389.43 0.2% 0.5% | 1367.45 -1.3% -1.6% | 1370.89 -1.1% 0.3% | 1371.84 -1.0% 0.1 |

| Nikkei 14466.16 2.4% | 14258.04 -1.4% -1.4% | 14401.06 -0.5% 1.0% | 13824.94 -4.4% -4.0% | 13605.56 -5.9% -1.6% | 13615.19 -5.9% 0.1% |

| Shanghai 2029.42 0.9% | 2050.48 1.0% 1.0% | 2060.50 1.5% 0.5% | 2046.78 0.9% -0.7% | 2044.90 0.8% -0.1% | 2052.23 1.1% 0.4% |

| DAX 8406.94 2.0% | 8398.38 -0.1% -0.1% | 8299.73 -1.3% -1.2% | 8260.48 -1.7% -0.5% | 8318.32 -1.1% 0.7% | 8338.31 -0.8% 0.2% |

| DJ UBS Comm. 125.68 -0.7% | 125.02 -0.5% -0.5% | 124.28 -1.1% -0.6% | 123.73 -1.6% -0.4% | 125.02 -0.5% 1.0% | 125.57 -0.1% 0.4% |

| WTI $ B 106.85 2.1% | 106.47 -0.4% -0.4% | 105.30 -1.5% -1.1% | 104.26 -2.4% -1.0% | 103.74 -2.9% -0.5% | 106.08 -0.7% 2.3% |

| Brent $/B 108.90 1.6% | 108.62 -0.3% -0.3% | 108.21 -0.6% -0.4% | 107.38 -1.4% -0.8% | 106.73 -2.0% -0.6% | 108.21 -0.6% 1.4% |

| Gold $/OZ 1312.0 -1.6% | 1301.70 -0.8% -0.8% | 1282.5 -2.2% -1.5% | 1286.3 -2.0% 0.3% | 1311.3 -0.1% 1.9% | 1313.5 0.1% 0.2% |

Note: USD: US dollar; JPY: Japanese Yen; CHF: Swiss

Franc; AUD: Australian dollar; Comm.: commodities; OZ: ounce

Sources: http://www.bloomberg.com/markets/

http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

There is initial discussion of current and recent risk-determining events followed below by analysis of risk-measuring yields of the US and Germany and the USD/EUR rate.

First, risk determining events. Prior risk determining events are in an appendix below following Table III-1A. Current focus is on “tapering” quantitative easing by the Federal Open Market Committee (FOMC). There is sharp distinction between the two measures of unconventional monetary policy: (1) fixing of the overnight rate of fed funds at 0 to ¼ percent; and (2) outright purchase of Treasury and agency securities and mortgage-backed securities for the balance sheet of the Federal Reserve. Market are overreacting to the so-called “tapering” of outright purchases of $85 billion of securities per month for the balance sheet of the Fed. What is truly important is the fixing of the overnight fed funds at 0 to ¼ percent for which there is no end in sight as evident in the FOMC statement for Jun 19, 2013 (http://www.federalreserve.gov/newsevents/press/monetary/20130619a.htm):

“To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent” (emphasis added).

In delivering the biannual report on monetary policy (Board of Governors 2013Jul17), Chairman Bernanke (2013Jul17) advised Congress that:

“Instead, we are providing additional policy accommodation through two distinct yet complementary policy tools. The first tool is expanding the Federal Reserve's portfolio of longer-term Treasury securities and agency mortgage-backed securities (MBS); we are currently purchasing $40 billion per month in agency MBS and $45 billion per month in Treasuries. We are using asset purchases and the resulting expansion of the Federal Reserve's balance sheet primarily to increase the near-term momentum of the economy, with the specific goal of achieving a substantial improvement in the outlook for the labor market in a context of price stability. We have made some progress toward this goal, and, with inflation subdued, we intend to continue our purchases until a substantial improvement in the labor market outlook has been realized. We are relying on near-zero short-term interest rates, together with our forward guidance that rates will continue to be exceptionally low--our second tool--to help maintain a high degree of monetary accommodation for an extended period after asset purchases end, even as the economic recovery strengthens and unemployment declines toward more-normal levels. In appropriate combination, these two tools can provide the high level of policy accommodation needed to promote a stronger economic recovery with price stability.

The Committee's decisions regarding the asset purchase program (and the overall stance of monetary policy) depend on our assessment of the economic outlook and of the cumulative progress toward our objectives. Of course, economic forecasts must be revised when new information arrives and are thus necessarily provisional.”

Friedman (1953) argues there are three lags in effects of monetary policy: (1) between the need for action and recognition of the need; (2) the recognition of the need and taking of actions; and (3) taking of action and actual effects. Friedman (1953) finds that the combination of these lags with insufficient knowledge of the current and future behavior of the economy causes discretionary economic policy to increase instability of the economy or standard deviations of real income σy and prices σp. Policy attempts to circumvent the lags by policy impulses based on forecasts. We are all naïve about forecasting. Data are available with lags and revised to maintain high standards of estimation. Policy simulation models estimate economic relations with structures prevailing before simulations of policy impulses such that parameters change as discovered by Lucas (1977). Economic agents adjust their behavior in ways that cause opposite results from those intended by optimal control policy as discovered by Kydland and Prescott (1977). Advance guidance attempts to circumvent expectations by economic agents that could reverse policy impulses but is of dubious effectiveness. There is strong case for using rules instead of discretionary authorities in monetary policy (http://cmpassocregulationblog.blogspot.com/search?q=rules+versus+authorities).

The President of the European Central Bank (ECB) Mario Draghi explained the indefinite period of low policy rates during the press conference following the meeting on Jul 4, 2013 (http://www.ecb.int/press/pressconf/2013/html/is130704.en.html):

“Yes, that is why I said you haven’t listened carefully. The Governing Council has taken the unprecedented step of giving forward guidance in a rather more specific way than it ever has done in the past. In my statement, I said “The Governing Council expects the key…” – i.e. all interest rates – “…ECB interest rates to remain at present or lower levels for an extended period of time.” It is the first time that the Governing Council has said something like this. And, by the way, what Mark Carney [Governor of the Bank of England] said in London is just a coincidence.”

The statement of the meeting of the Monetary Policy Committee of the Bank of England on Jul 4, 2013, may be leading toward the same forward guidance (http://www.bankofengland.co.uk/publications/Pages/news/2013/007.aspx):

“At its meeting today, the Committee noted that the incoming data over the past couple of months had been broadly consistent with the central outlook for output growth and inflation contained in the May Report. The significant upward movement in market interest rates would, however, weigh on that outlook; in the Committee’s view, the implied rise in the expected future path of Bank Rate was not warranted by the recent developments in the domestic economy.”

A competing event is the high level of valuations of risk financial assets (http://cmpassocregulationblog.blogspot.com/2013/01/peaking-valuation-of-risk-financial.html). Matt Jarzemsky, writing on Dow industrials set record,” on Mar 5, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324156204578275560657416332.html), analyzes that the DJIA broke the closing high of 14,164.53 set on Oct 9, 2007, and subsequently also broke the intraday high of 14,198.10 reached on Oct 11, 2007. The DJIA closed at 15,425.51

on Fri Aug 2, 2013, which is higher by 8.9 percent than the value of 14,164.53 reached on Oct 9, 2007 and higher by 8.6 percent than the value of 14,198.10 reached on Oct 11, 2007. Values of risk financial are approaching or exceeding historical highs.

The key policy is maintaining fed funds rate between 0 and ¼ percent. An increase in fed funds rates could cause flight out of risk financial markets worldwide. There is no exit from this policy without major financial market repercussions. There are high costs and risks of this policy because indefinite financial repression induces carry trades with high leverage, risks and illiquidity.

Second, Risk-Measuring Yields and Exchange Rate. The ten-year government bond of Spain was quoted at 6.868 percent on Aug 10, 2012, declining to 6.447 percent on Aug 17 and 6.403 percent on Aug 24, 2012, and the ten-year government bond of Italy fell from 5.894 percent on Aug 10, 2012 to 5.709 percent on Aug 17 and 5.618 percent on Aug 24, 2012. The yield of the ten-year sovereign bond of Spain traded at 4.480 percent on Aug 9, 2013, and that of the ten-year sovereign bond of Italy at 4.187 percent (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata). Risk aversion is captured by flight of investors from risk financial assets to the government securities of the US and Germany. Diminishing aversion is captured by increase of the yield of the two- and ten-year Treasury notes and the two- and ten-year government bonds of Germany. Table III-1A provides yields of US and German governments bonds and the rate of USD/EUR. Yields of US and German government bonds decline during shocks of risk aversion and the dollar strengthens in the form of fewer dollars required to buy one euro. The yield of the US ten-year Treasury note fell from 2.202 percent on Aug 26, 2011 to 1.459 percent on Jul 20, 2012, reminiscent of experience during the Treasury-Fed accord of the 1940s that placed a ceiling on long-term Treasury debt (Hetzel and Leach 2001), while the yield of the ten-year government bond of Germany fell from 2.16 percent to 1.17 percent. In the week of Aug 9, 2013, the yield of the two-year Treasury increased to 0.30 percent and that of the ten-year Treasury decreased to 2.579 percent while the two-year bond of Germany increased to 0.16 percent and the ten-year increased to 1.68 percent; and the dollar depreciated to USD 1.3342/EUR. The zero interest rates for the monetary policy rate of the US, or fed funds rate, induce carry trades that ensure devaluation of the dollar if there is no risk aversion but the dollar appreciates in flight to safe haven during episodes of risk aversion. Unconventional monetary policy induces significant global financial instability, excessive risks and low liquidity. The ten-year Treasury yield of 2.480 is higher than consumer price inflation of 1.8 percent in the 12 months ending in Jun 2013 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and.html) and the expectation of higher inflation if risk aversion diminishes. The one-year Treasury yield of 0.114 percent is well below the 12-month consumer price inflation of 1.8 percent. Treasury securities continue to be safe haven for investors fearing risk but with concentration in shorter maturities such as the two-year Treasury. The lower part of Table III-1A provides the same flight to government securities of the US and Germany and the USD during the financial crisis and global recession and the beginning of the European debt crisis in the spring of 2010 with the USD trading at USD 1.192/EUR on Jun 7, 2010.

Table III-1A, Two- and Ten-Year Yields of Government Bonds of the US and Germany and US Dollar/EUR Exchange rate

| US 2Y | US 10Y | DE 2Y | DE 10Y | USD/ EUR | |

| 7/9/13 | 0.30 | 2.579 | 0.16 | 1.68 | 1.3342 |

| 8/2/13 | 0.299 | 2.597 | 0.15 | 1.65 | 1.3281 |

| 7/26/13 | 0.315 | 2.565 | 0.15 | 1.66 | 1.3279 |

| 7/19/13 | 0.300 | 2.480 | 0.08 | 1.52 | 1.3141 |

| 7/12/13 | 0.345 | 2.585 | 0.10 | 1.56 | 1.3068 |

| 7/5/13 | 0.397 | 2.734 | 0.11 | 1.72 | 1.2832 |

| 6/28/13 | 0.357 | 2.486 | 0.19 | 1.73 | 1.3010 |

| 6/21/13 | 0.366 | 2.542 | 0.26 | 1.72 | 1.3122 |

| 6/14/13 | 0.276 | 2.125 | 0.12 | 1.51 | 1.3345 |

| 6/7/13 | 0.304 | 2.174 | 0.18 | 1.54 | 1.3219 |

| 5/31/13 | 0.299 | 2.132 | 0.06 | 1.50 | 1.2996 |

| 5/24/13 | 0.249 | 2.009 | 0.00 | 1.43 | 1.2932 |

| 5/17/13 | 0.248 | 1.952 | -0.03 | 1.32 | 1.2837 |

| 5/10/13 | 0.239 | 1.896 | 0.05 | 1.38 | 1.2992 |

| 5/3/13 | 0.22 | 1.742 | 0.00 | 1.24 | 1.3115 |

| 4/26/13 | 0.209 | 1.663 | 0.00 | 1.21 | 1.3028 |

| 4/19/13 | 0.232 | 1.702 | 0.02 | 1.25 | 1.3052 |

| 4/12/13 | 0.228 | 1.719 | 0.02 | 1.26 | 1.3111 |

| 4/5/13 | 0.228 | 1.706 | 0.01 | 1.21 | 1.2995 |

| 3/29/13 | 0.244 | 1.847 | -0.02 | 1.29 | 1.2818 |

| 3/22/13 | 0.242 | 1.931 | 0.03 | 1.38 | 1.2988 |

| 3/15/13 | 0.246 | 1.992 | 0.05 | 1.46 | 1.3076 |

| 3/8/13 | 0.256 | 2.056 | 0.09 | 1.53 | 1.3003 |

| 3/1/13 | 0.236 | 1.842 | 0.03 | 1.41 | 1.3020 |

| 2/22/13 | 0.252 | 1.967 | 0.13 | 1.57 | 1.3190 |

| 2/15/13 | 0.268 | 2.007 | 0.19 | 1.65 | 1.3362 |

| 2/8/13 | 0.252 | 1.949 | 0.18 | 1.61 | 1.3365 |

| 2/1/13 | 0.26 | 2.024 | 0.25 | 1.67 | 1.3642 |

| 1/25/13 | 0.278 | 1.947 | 0.26 | 1.64 | 1.3459 |

| 1/18/13 | 0.252 | 1.84 | 0.18 | 1.56 | 1.3321 |

| 1/11/13 | 0.247 | 1.862 | 0.13 | 1.58 | 1.3343 |

| 1/4/13 | 0.262 | 1.898 | 0.08 | 1.54 | 1.3069 |

| 12/28/12 | 0.252 | 1.699 | -0.01 | 1.31 | 1.3218 |

| 12/21/12 | 0.272 | 1.77 | -0.01 | 1.38 | 1.3189 |

| 12/14/12 | 0.232 | 1.704 | -0.04 | 1.35 | 1.3162 |

| 12/7/12 | 0.256 | 1.625 | -0.08 | 1.30 | 1.2926 |

| 11/30/12 | 0.248 | 1.612 | 0.01 | 1.39 | 1.2987 |

| 11/23/12 | 0.273 | 1.691 | 0.00 | 1.44 | 1.2975 |

| 11/16/12 | 0.24 | 1.584 | -0.03 | 1.33 | 1.2743 |

| 11/9/12 | 0.256 | 1.614 | -0.03 | 1.35 | 1.2711 |

| 11/2/12 | 0.274 | 1.715 | 0.01 | 1.45 | 1.2838 |

| 10/26/12 | 0.299 | 1.748 | 0.05 | 1.54 | 1.2942 |

| 10/19/12 | 0.296 | 1.766 | 0.11 | 1.59 | 1.3023 |

| 10/12/12 | 0.264 | 1.663 | 0.04 | 1.45 | 1.2953 |

| 10/5/12 | 0.26 | 1.737 | 0.06 | 1.52 | 1.3036 |

| 9/28/12 | 0.236 | 1.631 | 0.02 | 1.44 | 1.2859 |

| 9/21/12 | 0.26 | 1.753 | 0.04 | 1.60 | 1.2981 |

| 9/14/12 | 0.252 | 1.863 | 0.10 | 1.71 | 1.3130 |

| 9/7/12 | 0.252 | 1.668 | 0.03 | 1.52 | 1.2816 |

| 8/31/12 | 0.225 | 1.543 | -0.03 | 1.33 | 1.2575 |

| 8/24/12 | 0.266 | 1.684 | -0.01 | 1.35 | 1.2512 |

| 8/17/12 | 0.288 | 1.814 | -0.04 | 1.50 | 1.2335 |

| 8/10/12 | 0.267 | 1.658 | -0.07 | 1.38 | 1.2290 |

| 8/3/12 | 0.242 | 1.569 | -0.02 | 1.42 | 1.2387 |

| 7/27/12 | 0.244 | 1.544 | -0.03 | 1.40 | 1.2320 |

| 7/20/12 | 0.207 | 1.459 | -0.07 | 1.17 | 1.2158 |

| 7/13/12 | 0.24 | 1.49 | -0.04 | 1.26 | 1.2248 |

| 7/6/12 | 0.272 | 1.548 | -0.01 | 1.33 | 1.2288 |

| 6/29/12 | 0.305 | 1.648 | 0.12 | 1.58 | 1.2661 |

| 6/22/12 | 0.309 | 1.676 | 0.14 | 1.58 | 1.2570 |

| 6/15/12 | 0.272 | 1.584 | 0.07 | 1.44 | 1.2640 |

| 6/8/12 | 0.268 | 1.635 | 0.04 | 1.33 | 1.2517 |

| 6/1/12 | 0.248 | 1.454 | 0.01 | 1.17 | 1.2435 |

| 5/25/12 | 0.291 | 1.738 | 0.05 | 1.37 | 1.2518 |

| 5/18/12 | 0.292 | 1.714 | 0.05 | 1.43 | 1.2780 |

| 5/11/12 | 0.248 | 1.845 | 0.09 | 1.52 | 1.2917 |

| 5/4/12 | 0.256 | 1.876 | 0.08 | 1.58 | 1.3084 |

| 4/6/12 | 0.31 | 2.058 | 0.14 | 1.74 | 1.3096 |

| 3/30/12 | 0.335 | 2.214 | 0.21 | 1.79 | 1.3340 |

| 3/2/12 | 0.29 | 1.977 | 0.16 | 1.80 | 1.3190 |

| 2/24/12 | 0.307 | 1.977 | 0.24 | 1.88 | 1.3449 |

| 1/6/12 | 0.256 | 1.957 | 0.17 | 1.85 | 1.2720 |

| 12/30/11 | 0.239 | 1.871 | 0.14 | 1.83 | 1.2944 |

| 8/26/11 | 0.20 | 2.202 | 0.65 | 2.16 | 1.450 |

| 8/19/11 | 0.192 | 2.066 | 0.65 | 2.11 | 1.4390 |

| 6/7/10 | 0.74 | 3.17 | 0.49 | 2.56 | 1.192 |

| 3/5/09 | 0.89 | 2.83 | 1.19 | 3.01 | 1.254 |

| 12/17/08 | 0.73 | 2.20 | 1.94 | 3.00 | 1.442 |

| 10/27/08 | 1.57 | 3.79 | 2.61 | 3.76 | 1.246 |

| 7/14/08 | 2.47 | 3.88 | 4.38 | 4.40 | 1.5914 |

| 6/26/03 | 1.41 | 3.55 | NA | 3.62 | 1.1423 |

Note: DE: Germany

Source:

http://www.bloomberg.com/markets/

http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

There is initial discussion of current and recent risk-determining events followed below by analysis of risk-measuring yields of the US and Germany and the USD/EUR rate.

First, risk determining events. Prior risk determining events are in an appendix below following Table III-1A. Current focus is on “tapering” quantitative easing by the Federal Open Market Committee (FOMC). There is sharp distinction between the two measures of unconventional monetary policy: (1) fixing of the overnight rate of fed funds at 0 to ¼ percent; and (2) outright purchase of Treasury and agency securities and mortgage-backed securities for the balance sheet of the Federal Reserve. Market are overreacting to the so-called “tapering” of outright purchases of $85 billion of securities per month for the balance sheet of the Fed. What is truly important is the fixing of the overnight fed funds at 0 to ¼ percent for which there is no end in sight as evident in the FOMC statement for Jun 19, 2013 (http://www.federalreserve.gov/newsevents/press/monetary/20130619a.htm):

“To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent” (emphasis added).

In delivering the biannual report on monetary policy (Board of Governors 2013Jul17), Chairman Bernanke (2013Jul17) advised Congress that:

“Instead, we are providing additional policy accommodation through two distinct yet complementary policy tools. The first tool is expanding the Federal Reserve's portfolio of longer-term Treasury securities and agency mortgage-backed securities (MBS); we are currently purchasing $40 billion per month in agency MBS and $45 billion per month in Treasuries. We are using asset purchases and the resulting expansion of the Federal Reserve's balance sheet primarily to increase the near-term momentum of the economy, with the specific goal of achieving a substantial improvement in the outlook for the labor market in a context of price stability. We have made some progress toward this goal, and, with inflation subdued, we intend to continue our purchases until a substantial improvement in the labor market outlook has been realized. We are relying on near-zero short-term interest rates, together with our forward guidance that rates will continue to be exceptionally low--our second tool--to help maintain a high degree of monetary accommodation for an extended period after asset purchases end, even as the economic recovery strengthens and unemployment declines toward more-normal levels. In appropriate combination, these two tools can provide the high level of policy accommodation needed to promote a stronger economic recovery with price stability.

The Committee's decisions regarding the asset purchase program (and the overall stance of monetary policy) depend on our assessment of the economic outlook and of the cumulative progress toward our objectives. Of course, economic forecasts must be revised when new information arrives and are thus necessarily provisional.”

Friedman (1953) argues there are three lags in effects of monetary policy: (1) between the need for action and recognition of the need; (2) the recognition of the need and taking of actions; and (3) taking of action and actual effects. Friedman (1953) finds that the combination of these lags with insufficient knowledge of the current and future behavior of the economy causes discretionary economic policy to increase instability of the economy or standard deviations of real income σy and prices σp. Policy attempts to circumvent the lags by policy impulses based on forecasts. We are all naïve about forecasting. Data are available with lags and revised to maintain high standards of estimation. Policy simulation models estimate economic relations with structures prevailing before simulations of policy impulses such that parameters change as discovered by Lucas (1977). Economic agents adjust their behavior in ways that cause opposite results from those intended by optimal control policy as discovered by Kydland and Prescott (1977). Advance guidance attempts to circumvent expectations by economic agents that could reverse policy impulses but is of dubious effectiveness. There is strong case for using rules instead of discretionary authorities in monetary policy (http://cmpassocregulationblog.blogspot.com/search?q=rules+versus+authorities).

The President of the European Central Bank (ECB) Mario Draghi explained the indefinite period of low policy rates during the press conference following the meeting on Jul 4, 2013 (http://www.ecb.int/press/pressconf/2013/html/is130704.en.html):

“Yes, that is why I said you haven’t listened carefully. The Governing Council has taken the unprecedented step of giving forward guidance in a rather more specific way than it ever has done in the past. In my statement, I said “The Governing Council expects the key…” – i.e. all interest rates – “…ECB interest rates to remain at present or lower levels for an extended period of time.” It is the first time that the Governing Council has said something like this. And, by the way, what Mark Carney [Governor of the Bank of England] said in London is just a coincidence.”

The statement of the meeting of the Monetary Policy Committee of the Bank of England on Jul 4, 2013, may be leading toward the same forward guidance (http://www.bankofengland.co.uk/publications/Pages/news/2013/007.aspx):

“At its meeting today, the Committee noted that the incoming data over the past couple of months had been broadly consistent with the central outlook for output growth and inflation contained in the May Report. The significant upward movement in market interest rates would, however, weigh on that outlook; in the Committee’s view, the implied rise in the expected future path of Bank Rate was not warranted by the recent developments in the domestic economy.”

A competing event is the high level of valuations of risk financial assets (http://cmpassocregulationblog.blogspot.com/2013/01/peaking-valuation-of-risk-financial.html). Matt Jarzemsky, writing on Dow industrials set record,” on Mar 5, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324156204578275560657416332.html), analyzes that the DJIA broke the closing high of 14,164.53 set on Oct 9, 2007, and subsequently also broke the intraday high of 14,198.10 reached on Oct 11, 2007. The DJIA closed at 15,425.51

on Fri Aug 2, 2013, which is higher by 8.9 percent than the value of 14,164.53 reached on Oct 9, 2007 and higher by 8.6 percent than the value of 14,198.10 reached on Oct 11, 2007. Values of risk financial are approaching or exceeding historical highs.

The key policy is maintaining fed funds rate between 0 and ¼ percent. An increase in fed funds rates could cause flight out of risk financial markets worldwide. There is no exit from this policy without major financial market repercussions. There are high costs and risks of this policy because indefinite financial repression induces carry trades with high leverage, risks and illiquidity.

Second, Risk-Measuring Yields and Exchange Rate. The ten-year government bond of Spain was quoted at 6.868 percent on Aug 10, 2012, declining to 6.447 percent on Aug 17 and 6.403 percent on Aug 24, 2012, and the ten-year government bond of Italy fell from 5.894 percent on Aug 10, 2012 to 5.709 percent on Aug 17 and 5.618 percent on Aug 24, 2012. The yield of the ten-year sovereign bond of Spain traded at 4.480 percent on Aug 9, 2013, and that of the ten-year sovereign bond of Italy at 4.187 percent (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata). Risk aversion is captured by flight of investors from risk financial assets to the government securities of the US and Germany. Diminishing aversion is captured by increase of the yield of the two- and ten-year Treasury notes and the two- and ten-year government bonds of Germany. Table III-1A provides yields of US and German governments bonds and the rate of USD/EUR. Yields of US and German government bonds decline during shocks of risk aversion and the dollar strengthens in the form of fewer dollars required to buy one euro. The yield of the US ten-year Treasury note fell from 2.202 percent on Aug 26, 2011 to 1.459 percent on Jul 20, 2012, reminiscent of experience during the Treasury-Fed accord of the 1940s that placed a ceiling on long-term Treasury debt (Hetzel and Leach 2001), while the yield of the ten-year government bond of Germany fell from 2.16 percent to 1.17 percent. In the week of Aug 9, 2013, the yield of the two-year Treasury increased to 0.30 percent and that of the ten-year Treasury decreased to 2.579 percent while the two-year bond of Germany increased to 0.16 percent and the ten-year increased to 1.68 percent; and the dollar depreciated to USD 1.3342/EUR. The zero interest rates for the monetary policy rate of the US, or fed funds rate, induce carry trades that ensure devaluation of the dollar if there is no risk aversion but the dollar appreciates in flight to safe haven during episodes of risk aversion. Unconventional monetary policy induces significant global financial instability, excessive risks and low liquidity. The ten-year Treasury yield of 2.480 is higher than consumer price inflation of 1.8 percent in the 12 months ending in Jun 2013 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/06/paring-quantitative-easing-policy-and.html) and the expectation of higher inflation if risk aversion diminishes. The one-year Treasury yield of 0.114 percent is well below the 12-month consumer price inflation of 1.8 percent. Treasury securities continue to be safe haven for investors fearing risk but with concentration in shorter maturities such as the two-year Treasury. The lower part of Table III-1A provides the same flight to government securities of the US and Germany and the USD during the financial crisis and global recession and the beginning of the European debt crisis in the spring of 2010 with the USD trading at USD 1.192/EUR on Jun 7, 2010.

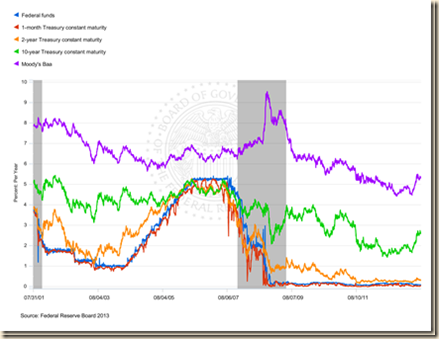

Chart III-1A of the Board of Governors of the Federal Reserve System provides the ten-year, two-year and one-month Treasury constant maturity yields together with the overnight fed funds rate, and the yield of the corporate bond with Moody’s rating of Baa. The riskier yield of the Baa corporate bond exceeds the relatively riskless yields of the Treasury securities. The beginning yields in Chart III-1A for July 31, 2001, are 3.67 percent for one month, 3.79 percent for two years, 5.07 percent for ten years, 3.82 percent for the fed funds rate and 7.85 percent for the Baa corporate bond. On July 30, 2007, yields inverted with the one month at 4.95 percent, the two-year at 4.59 percent and the ten year at 5.82 percent with the yield of the Baa corporate bond at 6.70 percent. Another interesting point is for Oct 31, 2008, with the yield of the Baa jumping to 9.54 percent and the Treasury yields declining: one month 0.12 percent, two years 1.56 percent and ten years 4.01 percent during a flight to the dollar and government securities analyzed by Cochrane and Zingales (2009). Another spike in the series is for Apr 4, 2006 with the yield of the corporate Baa bond at 8.63 and the Treasury yields of 0.12 percent for one month, 0.94 for two years and 2.95 percent for ten years. During the beginning of the flight from risk financial assets to US government securities (see Cochrane and Zingales 2009), the one-month yield was 0.07 percent, the two-year yield 1.64 percent and the ten-year yield 3.41. The combination of zero fed funds rate and quantitative easing caused sharp decline of the yields from 2008 and 2009. Yield declines have also occurred during periods of financial risk aversion, including the current one of stress of financial markets in Europe. The final point of Chart III1-A is for Aug 8, 2013, with the one-month yield at 0.05 percent, the two-year at 0.30 percent, the ten-year at 2.58 percent, the fed funds rate at 0.09 percent and the corporate Baa bond at 5.31 percent. There is an evident increase in the yields of the 10-year Treasury constant maturity and the Moody’s Baa corporate bond.

Chart III-1A, US, Ten-Year, Two-Year and One-Month Treasury Constant Maturity Yields, Overnight Fed Funds Rate and Yield of Moody’s Baa Corporate Bond, Jul 31, 2001-Aug 8, 2013

Note: US Recessions in shaded areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/

Alexandra Scaggs, writing on “Tepid profits, roaring stocks,” on May 16, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887323398204578487460105747412.html), analyzes stabilization of earnings growth: 70 percent of 458 reporting companies in the S&P 500 stock index reported earnings above forecasts but sales fell 0.2 percent relative to forecasts of increase of 0.5 percent. Paul Vigna, writing on “Earnings are a margin story but for how long,” on May 17, 2013, published in the Wall Street Journal (http://blogs.wsj.com/moneybeat/2013/05/17/earnings-are-a-margin-story-but-for-how-long/), analyzes that corporate profits increase with stagnating sales while companies manage costs tightly. More than 90 percent of S&P components reported moderate increase of earnings of 3.7 percent in IQ2013 relative to IQ2012 with decline of sales of 0.2 percent. Earnings and sales have been in declining trend. In IVQ2009, growth of earnings reached 104 percent and sales jumped 13 percent. Net margins reached 8.92 percent in IQ2013, which is almost the same at 8.95 percent in IIIQ2006. Operating margins are 9.58 percent. There is concern by market participants that reversion of margins to the mean could exert pressure on earnings unless there is more accelerated growth of sales. Vigna (op. cit.) finds sales growth limited by weak economic growth. Kate Linebaugh, writing on “Falling revenue dings stocks,” on Oct 20, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390444592704578066933466076070.html?mod=WSJPRO_hpp_LEFTTopStories), identifies a key financial vulnerability: falling revenues across markets for United States reporting companies. Global economic slowdown is reducing corporate sales and squeezing corporate strategies. Linebaugh quotes data from Thomson Reuters that 100 companies of the S&P 500 index have reported declining revenue only 1 percent higher in Jun-Sep 2012 relative to Jun-Sep 2011 but about 60 percent of the companies are reporting lower sales than expected by analysts with expectation that revenue for the S&P 500 will be lower in Jun-Sep 2012 for the entities represented in the index. Results of US companies are likely repeated worldwide. Future company cash flows derive from investment projects. Real private fixed investment fell from $2,111.5 billion in IVQ2007 to $1920.4 billion in IQ2013 or by 9.1 percent compared with growth of 24.1 percent of gross private domestic investment from IQ1980 to IVQ1985 (http://cmpassocregulationblog.blogspot.com/2013/06/tapering-quantitative-easing-policy-and.html). Undistributed profits of US corporations swelled 306.9 percent from $118.0 billion IQ2007 to $480.2 billion in IQ2013 and changed signs from minus $22.1 billion in IVQ2007 (http://cmpassocregulationblog.blogspot.com/2013/06/tapering-quantitative-easing-policy-and.html). Corporate profits with inventory valuation and capital consumption adjustment fell $27.8 billion relative to IVQ2012 (http://www.bea.gov/newsreleases/national/gdp/2013/pdf/gdp1q13_3rd.pdf), from $2013.0 billion in IVQ2012 to $1985.2 billion in IQ2013 at the quarterly rate of minus 1.4 percent. Uncertainty originating in fiscal, regulatory and monetary policy causes wide swings in expectations and decisions by the private sector with adverse effects on investment, real economic activity and employment. The investment decision of US business is fractured. The basic valuation equation that is also used in capital budgeting postulates that the value of stocks or of an investment project is given by:

Where Rτ is expected revenue in the time horizon from τ =1 to T; Cτ denotes costs; and ρ is an appropriate rate of discount. In words, the value today of a stock or investment project is the net revenue, or revenue less costs, in the investment period from τ =1 to T discounted to the present by an appropriate rate of discount. In the current weak economy, revenues have been increasing more slowly than anticipated in investment plans. An increase in interest rates would affect discount rates used in calculations of present value, resulting in frustration of investment decisions. If V represents value of the stock or investment project, as ρ → ∞, meaning that interest rates increase without bound, then V → 0, or

declines.

There was mixed performance in equity indexes with several indexes in Table III-1 decreasing in the week ending on Aug 9, 2013, after wide swings caused by reallocations of investment portfolios worldwide. Stagnating revenues, corporate cash hoarding and declining investment are causing reevaluation of discounted net earnings with deteriorating views on the world economy and United States fiscal sustainability but investors have been driving indexes higher. DJIA decreased 0.5 percent on Aug 9, decreasing 1.5 percent in the week. Germany’s Dax increased 0.2 percent on Fri Aug 9 and decreased 0.8 percent in the week. Dow Global changed 0.0 percent on Aug 9 and decreased 0.4 percent in the week. Japan’s Nikkei Average increased 0.1 percent on Fri Aug 9 and decreased 5.9 percent in the week as the yen continues oscillating but relatively weaker and the stock market gains in expectations of fiscal stimulus by a new administration and monetary stimulus by a new board of the Bank of Japan. Dow Asia Pacific TSM increased 0.1 percent on Aug 9 and decreased 1.0 percent in the week. Shanghai Composite that decreased 0.2 percent on Mar 8 and decreased 1.7 percent in the week of Mar 8, falling below 2000 to close at 1980.13 on Fri Nov 30 but closing at 2052.23 on Fri Aug 9 for increase of 0.4 percent and increase of 1.1 percent in the week of Aug 9. There is evident trend of deceleration of the world economy that could affect corporate revenue and equity valuations, causing oscillation in equity markets with increases during favorable risk appetite.

Commodities were mixed in the week of Aug 9, 2013. The DJ UBS Commodities Index increased 0.4 percent on Fri Aug 9 and decreased 0.1 percent in the week, as shown in Table III-1. WTI decreased 0.7 percent in the week of Aug 9 while Brent decreased 0.6 percent in the week. Gold increased 0.2 percent on Fri Aug 9 and increased 0.1 percent in the week.

Table III-2 provides an update of the consolidated financial statement of the Eurosystem. The balance sheet has swollen with the long-term refinancing operations (LTROs). Line 5 “Lending to Euro Area Credit Institutions Related to Monetary Policy” increased from €546,747 million on Dec 31, 2010, to €879,130 million on Dec 28, 2011 and €804,920 million on Aug 2, 2013 with some repayment of loans already occurring. The sum of line 5 and line 7 (“Securities of Euro Area Residents Denominated in Euro”) has reached €1,405,632 million in the statement of Aug 2, 2013, with marginal reduction. There is high credit risk in these transactions with capital of only €90,418 million as analyzed by Cochrane (2012Aug31).

Table III-2, Consolidated Financial Statement of the Eurosystem, Million EUR

| Dec 31, 2010 | Dec 28, 2011 | Aug 2, 2013 | |

| 1 Gold and other Receivables | 367,402 | 419,822 | 319,968 |

| 2 Claims on Non Euro Area Residents Denominated in Foreign Currency | 223,995 | 236,826 | 247,320 |

| 3 Claims on Euro Area Residents Denominated in Foreign Currency | 26,941 | 95,355 | 25,825 |

| 4 Claims on Non-Euro Area Residents Denominated in Euro | 22,592 | 25,982 | 21,660 |

| 5 Lending to Euro Area Credit Institutions Related to Monetary Policy Operations Denominated in Euro | 546,747 | 879,130 | 804,920 |

| 6 Other Claims on Euro Area Credit Institutions Denominated in Euro | 45,654 | 94,989 | 86,813 |

| 7 Securities of Euro Area Residents Denominated in Euro | 457,427 | 610,629 | 600,712 |

| 8 General Government Debt Denominated in Euro | 34,954 | 33,928 | 28,356 |

| 9 Other Assets | 278,719 | 336,574 | 255,517 |

| TOTAL ASSETS | 2,004, 432 | 2,733,235 | 2,391,090 |

| Memo Items | |||

| Sum of 5 and 7 | 1,004,174 | 1,489,759 | 1,405,632 |

| Capital and Reserves | 78,143 | 81,481 | 90,418 |

Source: European Central Bank

http://www.ecb.int/press/pr/wfs/2011/html/fs110105.en.html

http://www.ecb.int/press/pr/wfs/2011/html/fs111228.en.html

http://www.ecb.int/press/pr/wfs/2013/html/fs130806.en.html

IIIE Appendix Euro Zone Survival Risk. Resolution of the European sovereign debt crisis with survival of the euro area would require success in the restructuring of Italy. That success would be assured with growth of the Italian economy. A critical problem is that the common euro currency prevents Italy from devaluing the exchange to parity or the exchange rate that would permit export growth to promote internal economic activity, which could generate fiscal revenues for primary fiscal surpluses that ensure creditworthiness. Professors Ricardo Caballero and Francesco Giavazzi (2012Jan15) find that the resolution of the European sovereign crisis with survival of the euro area would require success in the restructuring of Italy. Growth of the Italian economy would ensure that success. A critical problem is that the common euro currency prevents Italy from devaluing the exchange rate to parity or the exchange rate that would permit export growth to promote internal economic activity, which could generate fiscal revenues for primary fiscal surpluses that ensure creditworthiness. Fiscal consolidation and restructuring are important but of long-term gestation. Immediate growth of the Italian economy would consolidate the resolution of the sovereign debt crisis. Caballero and Giavazzi (2012Jan15) argue that 55 percent of the exports of Italy are to countries outside the euro area such that devaluation of 15 percent would be effective in increasing export revenue. Newly available data in Table III-3 providing Italy’s trade with regions and countries supports the argument of Caballero and Giavazzi (2012Jan15). Italy’s exports to the European Monetary Union (EMU), or euro area, are only 40.5 percent of the total in Jan-Jun 2013. Exports to the non-European Union area with share of 46.3 percent in Italy’s total exports are growing at 3.0 percent in Jan-Jun 2013 relative to Jan-Jun 2012 while those to EMU are growing at minus 4.1 percent.

Table III-3, Italy, Exports and Imports by Regions and Countries, % Share and 12-Month ∆%

| Jun 2013 | Exports | ∆% Jan-Jun 2013/ Jan-Jun 2012 | Imports | ∆% Jan-Jun 2013/ Jan-Jun 2012 |

| EU | 53.7 | -3.1 | 52.9 | -3.0 |

| EMU 17 | 40.5 | -4.1 | 42.7 | -3.1 |

| France | 11.1 | -3.1 | 8.3 | -6.2 |

| Germany | 12.5 | -4.5 | 14.6 | -7.4 |

| Spain | 4.7 | -8.0 | 4.4 | -3.0 |

| UK | 4.9 | 1.0 | 2.5 | -1.4 |

| Non EU | 46.3 | 3.0 | 47.1 | -11.3 |

| Europe non EU | 13.9 | 0.0 | 11.3 | 6.9 |

| USA | 6.8 | -2.3 | 3.3 | -18.6 |

| China | 2.3 | 6.7 | 6.5 | -10.4 |

| OPEC | 5.7 | 10.5 | 10.8 | -27.4 |

| Total | 100.0 | -0.4 | 100.0 | -7.0 |

Notes: EU: European Union; EMU: European Monetary Union (euro zone)

Source: Istituto Nazionale di Statistica http://www.istat.it/it/archivio/97574

Table III-4 provides Italy’s trade balance by regions and countries. Italy had trade deficit of €356 million with the 17 countries of the euro zone (EMU 17) in Jun 2013 and cumulative deficit of €2393 million in Jan-Jun 2013. Depreciation to parity could permit greater competitiveness in improving the trade surplus of 3752 million in Jan-Jun 2013 with Europe non European Union, the trade surplus of €7593 million with the US and trade surplus with non-European Union of €8020 million in Jan-Jun 2013. There is significant rigidity in the trade deficits in Jan-Jun 2013 of €6726 million with China and €3998 million with members of the Organization of Petroleum Exporting Countries (OPEC). Higher exports could drive economic growth in the economy of Italy that would permit less onerous adjustment of the country’s fiscal imbalances, raising the country’s credit rating.

Table III-4, Italy, Trade Balance by Regions and Countries, Millions of Euro

| Regions and Countries | Trade Balance Jun 2013 Millions of Euro | Trade Balance Cumulative Jan-Jun 2013 Millions of Euro |

| EU | 1,124 | 4,268 |

| EMU 17 | -356 | -2,393 |

| France | 1,080 | 6,207 |

| Germany | -391 | -2,437 |

| Spain | 22 | 391 |

| UK | 1,070 | 4,671 |

| Non EU | 2,494 | 8,020 |

| Europe non EU | 1,066 | 3,752 |

| USA | 1,333 | 7,593 |

| China | -906 | -6,726 |

| OPEC | -315 | -3,998 |

| Total | 3,618 | 12,288 |

Notes: EU: European Union; EMU: European Monetary Union (euro zone)

Source: Istituto Nazionale di Statistica http://www.istat.it/it/archivio/97574

Growth rates of Italy’s trade and major products are in Table III-5 for the period Jan-Jun 2013 relative to Jan-Jun 2012. Growth rates of cumulative imports relative to a year earlier are negative for energy with minus 17.4 percent and minus 11.3 percent for durable goods. The higher rate of growth of exports of minus 0.4 percent in Jan-Jun 2013/Jan-Jun 2012 relative to imports of minus 7.0 percent may reflect weak demand in Italy with GDP declining during eight consecutive quarters from IIIQ2011 through IIQ2013 together with softening commodity prices.

Table III-5, Italy, Exports and Imports % Share of Products in Total and ∆%

| Exports | Exports | Imports | Imports | |

| Consumer | 29.3 | 6.2 | 25.6 | 0.1 |

| Durable | 5.8 | 0.8 | 2.9 | -11.3 |

| Non-Durable | 23.5 | 7.5 | 22.7 | 1.6 |

| Capital Goods | 31.6 | 0.7 | 19.5 | -7.7 |

| Inter- | 33.6 | -3.9 | 32.6 | -4.7 |

| Energy | 5.5 | -18.7 | 22.3 | -17.4 |

| Total ex Energy | 94.5 | 0.6 | 77.7 | -4.0 |

| Total | 100.0 | -0.4 | 100.0 | -7.0 |

Note: % Share for 2012 total trade.

Source: Istituto Nazionale di Statistica http://www.istat.it/it/archivio/97574

Table III-6 provides Italy’s trade balance by product categories in Jun 2013 and cumulative Jan-Jun 2013. Italy’s trade balance excluding energy generated surplus of €8285 million in Jun 2013 and €39,687 million cumulative in Jan-Jun 2013 but the energy trade balance created deficit of €4667 million in Jun 2013 and cumulative €27,399 million in Jan-Jun 2013. The overall surplus in Jun 2013 was €3618 million with cumulative surplus of €12,288 million in Jan-Jun 2013. Italy has significant competitiveness in various economic activities in contrast with some other countries with debt difficulties.

Table III-6, Italy, Trade Balance by Product Categories, € Millions

| Jun 2013 | Cumulative Jan-Jun 2013 | |

| Consumer Goods | 2,017 | 10,262 |

| Durable | 1,155 | 6,323 |

| Nondurable | 862 | 3,939 |

| Capital Goods | 5,419 | 26,173 |

| Intermediate Goods | 849 | 3,252 |

| Energy | -4,667 | -27,399 |

| Total ex Energy | 8,285 | 39,687 |

| Total | 3,618 | 12,288 |

Source: Istituto Nazionale di Statistica http://www.istat.it/it/archivio/97574

Brazil faced in the debt crisis of 1982 a more complex policy mix. Between 1977 and 1983, Brazil’s terms of trade, export prices relative to import prices, deteriorated 47 percent and 36 percent excluding oil (Pelaez 1987, 176-79; Pelaez 1986, 37-66; see Pelaez and Pelaez, The Global Recession Risk (2007), 178-87). Brazil had accumulated unsustainable foreign debt by borrowing to finance balance of payments deficits during the 1970s. Foreign lending virtually stopped. The German mark devalued strongly relative to the dollar such that Brazil’s products lost competitiveness in Germany and in multiple markets in competition with Germany. The resolution of the crisis was devaluation of the Brazilian currency by 30 percent relative to the dollar and subsequent maintenance of parity by monthly devaluation equal to inflation and indexing that resulted in financial stability by parity in external and internal interest rates avoiding capital flight. With a combination of declining imports, domestic import substitution and export growth, Brazil followed rapid growth in the US and grew out of the crisis with surprising GDP growth of 4.5 percent in 1984.

The euro zone faces a critical survival risk because several of its members may default on their sovereign obligations if not bailed out by the other members. The valuation equation of bonds is essential to understanding the stability of the euro area. An explanation is provided in this paragraph and readers interested in technical details are referred to the Subsection IIIF Appendix on Sovereign Bond Valuation. Contrary to the Wriston doctrine, investing in sovereign obligations is a credit decision. The value of a bond today is equal to the discounted value of future obligations of interest and principal until maturity. On Dec 30, 2011, the yield of the 2-year bond of the government of Greece was quoted around 100 percent. In contrast, the 2-year US Treasury note traded at 0.239 percent and the 10-year at 2.871 percent while the comparable 2-year government bond of Germany traded at 0.14 percent and the 10-year government bond of Germany traded at 1.83 percent. There is no need for sovereign ratings: the perceptions of investors are of relatively higher probability of default by Greece, defying Wriston (1982), and nil probability of default of the US Treasury and the German government. The essence of the sovereign credit decision is whether the sovereign will be able to finance new debt and refinance existing debt without interrupting service of interest and principal. Prices of sovereign bonds incorporate multiple anticipations such as inflation and liquidity premiums of long-term relative to short-term debt but also risk premiums on whether the sovereign’s debt can be managed as it increases without bound. The austerity measures of Italy are designed to increase the primary surplus, or government revenues less expenditures excluding interest, to ensure investors that Italy will have the fiscal strength to manage its debt exceeding 100 percent of GDP, which is the third largest in the world after the US and Japan. Appendix IIIE links the expectations on the primary surplus to the real current value of government monetary and fiscal obligations. As Blanchard (2011SepWEO) analyzes, fiscal consolidation to increase the primary surplus is facilitated by growth of the economy. Italy and the other indebted sovereigns in Europe face the dual challenge of increasing primary surpluses while maintaining growth of the economy (for the experience of Brazil in the debt crisis of 1982 see Pelaez 1986, 1987).

Much of the analysis and concern over the euro zone centers on the lack of credibility of the debt of a few countries while there is credibility of the debt of the euro zone as a whole. In practice, there is convergence in valuations and concerns toward the fact that there may not be credibility of the euro zone as a whole. The fluctuations of financial risk assets of members of the euro zone move together with risk aversion toward the countries with lack of debt credibility. This movement raises the need to consider analytically sovereign debt valuation of the euro zone as a whole in the essential analysis of whether the single-currency will survive without major changes.

Welfare economics considers the desirability of alternative states, which in this case would be evaluating the “value” of Germany (1) within and (2) outside the euro zone. Is the sum of the wealth of euro zone countries outside of the euro zone higher than the wealth of these countries maintaining the euro zone? On the choice of indicator of welfare, Hicks (1975, 324) argues:

“Partly as a result of the Keynesian revolution, but more (perhaps) because of statistical labours that were initially quite independent of it, the Social Product has now come right back into its old place. Modern economics—especially modern applied economics—is centered upon the Social Product, the Wealth of Nations, as it was in the days of Smith and Ricardo, but as it was not in the time that came between. So if modern theory is to be effective, if it is to deal with the questions which we in our time want to have answered, the size and growth of the Social Product are among the chief things with which it must concern itself. It is of course the objective Social Product on which attention must be fixed. We have indexes of production; we do not have—it is clear we cannot have—an Index of Welfare.”

If the burden of the debt of the euro zone falls on Germany and France or only on Germany, is the wealth of Germany and France or only Germany higher after breakup of the euro zone or if maintaining the euro zone? In practice, political realities will determine the decision through elections.

The prospects of survival of the euro zone are dire. Table III-7 is constructed with IMF World Economic Outlook database (http://www.imf.org/external/pubs/ft/weo/2013/01/weodata/index.aspx) for GDP in USD billions, primary net lending/borrowing as percent of GDP and general government debt as percent of GDP for selected regions and countries in 2013.

Table III-7, World and Selected Regional and Country GDP and Fiscal Situation

| GDP 2013 | Primary Net Lending Borrowing | General Government Net Debt | |

| World | 74,172 | ||

| Euro Zone | 12,752 | -0.04 | 73.9 |

| Portugal | 218 | -1.4 | 115.0 |

| Ireland | 222 | -3.2 | 106.2 |

| Greece | 244 | -- | 155.4 |

| Spain | 1,388 | -3.5 | 79.1 |

| Major Advanced Economies G7 | 34,068 | -3.8 | 91.5 |

| United States | 16,238 | -4.6 | 89.0 |

| UK | 2,423 | -5.0 | 86.1 |

| Germany | 3,598 | 1.8 | 54.1 |

| France | 2,739 | -1.4 | 86.5 |

| Japan | 5,150 | -9.0 | 143.4 |

| Canada | 1,844 | -2.4 | 35.9 |

| Italy | 2,076 | 2.7 | 102.3 |

| China | 9,020 | -2.1* | 21.3** |

*Net Lending/borrowing**Gross Debt

Source: IMF World Economic Outlook databank http://www.imf.org/external/pubs/ft/weo/2013/01/weodata/index.aspx

The data in Table III-7 are used for some very simple calculations in Table III-8. The column “Net Debt USD Billions” in Table III-8 is generated by applying the percentage in Table III-7 column “General Government Net Debt % GDP 2013” to the column “GDP USD Billions.” The total debt of France and Germany in 2013 is $4315.7 billion, as shown in row “B+C” in column “Net Debt USD Billions” The sum of the debt of Italy, Spain, Portugal, Greece and Ireland is $4087.3 billion, adding rows D+E+F+G+H in column “Net Debt USD billions.” There is some simple “unpleasant bond arithmetic” in the two final columns of Table III-8. Suppose the entire debt burdens of the five countries with probability of default were to be guaranteed by France and Germany, which de facto would be required by continuing the euro zone. The sum of the total debt of these five countries and the debt of France and Germany is shown in column “Debt as % of Germany plus France GDP” to reach $8403.0 billion, which would be equivalent to 132.6 percent of their combined GDP in 2013. Under this arrangement, the entire debt of the euro zone including debt of France and Germany would not have nil probability of default. The final column provides “Debt as % of Germany GDP” that would exceed 233.5 percent if including debt of France and 167.7 percent of German GDP if excluding French debt. The unpleasant bond arithmetic illustrates that there is a limit as to how far Germany and France can go in bailing out the countries with unsustainable sovereign debt without incurring severe pains of their own such as downgrades of their sovereign credit ratings. A central bank is not typically engaged in direct credit because of remembrance of inflation and abuse in the past. There is also a limit to operations of the European Central Bank in doubtful credit obligations. Wriston (1982) would prove to be wrong again that countries do not bankrupt but would have a consolation prize that similar to LBOs the sum of the individual values of euro zone members outside the current agreement exceeds the value of the whole euro zone. Internal rescues of French and German banks may be less costly than bailing out other euro zone countries so that they do not default on French and German banks.

Table III-8, Guarantees of Debt of Sovereigns in Euro Area as Percent of GDP of Germany and France, USD Billions and %

| Net Debt USD Billions | Debt as % of Germany Plus France GDP | Debt as % of Germany GDP | |

| A Euro Area | 9,423.7 | ||

| B Germany | 1,946.5 | $8403.0 as % of $3598 =233.5% $6033.8 as % of $3598 =167.7% | |

| C France | 2,369.2 | ||

| B+C | 4,315.7 | GDP $6,337.0 Total Debt $8403.0 Debt/GDP: 132.6% | |

| D Italy | 2,123.7 | ||

| E Spain | 1,097.9 | ||

| F Portugal | 250.7 | ||

| G Greece | 379.2 | ||

| H Ireland | 235.8 | ||

| Subtotal D+E+F+G+H | 4,087.3 |

Source: calculation with IMF data IMF World Economic Outlook databank http://www.imf.org/external/pubs/ft/weo/2013/01/weodata/index.aspx

There is extremely important information in Table VE-9 for the current sovereign risk crisis in the euro zone. Table III-9 provides the structure of regional and country relations of Germany’s exports and imports with newly available data for Jun 2013. German exports to other European Union (EU) members are 57.8 percent of total exports in Jun 2013 and 57.3 percent in cumulative Jan-Jun 2013. Exports to the euro area are 37.7 percent in Jun and 37.4 percent cumulative in Jan-Jun. Exports to third countries are 42.2 percent of the total in Jun and 42.7 percent cumulative in Jan-Jun. There is similar distribution for imports. Exports to non-euro countries are increasing 2.2 percent in the 12 months ending in Jun 2013, increasing 1.1 percent cumulative in Jan-Jun 2013 while exports to the euro area are decreasing 1.4 percent in the 12 months ending in Jun 2013 and decreasing 3.1 percent cumulative in Jan-Jun 2013. Exports to third countries, accounting for 42.2 percent of the total in Jun 2013, are decreasing 4.6 percent in the 12 months ending in Jun 2013 and increasing 1.0 percent cumulative in Jan-Jun 2013, accounting for 42.7 percent of the cumulative total in Jan-Jun 2013. Price competitiveness through devaluation could improve export performance and growth. Economic performance in Germany is closely related to its high competitiveness in world markets. Weakness in the euro zone and the European Union in general could affect the German economy. This may be the major reason for choosing the “fiscal abuse” of the European Central Bank considered by Buiter (2011Oct31) over the breakdown of the euro zone. There is a tough analytical, empirical and forecasting doubt of growth and trade in the euro zone and the world with or without maintenance of the European Monetary Union (EMU) or euro zone. Germany could benefit from depreciation of the euro because of high share in its exports to countries not in the euro zone but breakdown of the euro zone raises doubts on the region’s economic growth that could affect German exports to other member states.

Table III-9, Germany, Structure of Exports and Imports by Region, € Billions and ∆%

| Jun 2013 | Jun 12-Month | Cumulative Jan-Jun 2012 € Billions | Cumulative Jan-Jun 2013/ | |

| Total | 92.8 | -2.1 | 547.4 | -0.6 |

| A. EU | 53.6 % 57.8 | -0.1 | 313.7 % 57.3 | -1.7 |

| Euro Area | 35.0 % 37.7 | -1.4 | 205.0 % 37.4 | -3.1 |

| Non-euro Area | 18.6 % 20.0 | 2.2 | 108.7 % 19.9 | 1.1 |

| B. Third Countries | 39.2 % 42.2 | -4.6 | 233.7 % 42.7 | 1.0 |

| Total Imports | 75.9 | -1.2 | 449.7 | -1.6 |

| C. EU Members | 49.1 % 64.7 | -0.3 | 291.0 % 64.7 | 0.1 |

| Euro Area | 34.8 % 45.8 | -0.5 | 203.5 % 45.3 | -0.8 |

| Non-euro Area | 14.3 % 18.8 | 0.0 | 87.4 % 19.4 | 2.1 |

| D. Third Countries | 26.7 % 35.2 | -2.7 | 158.7 % 35.3 | -4.6 |

Notes: Total Exports = A+B; Total Imports = C+D

Source: Statistisches Bundesamt Deutschland

https://www.destatis.de/EN/PressServices/Press/pr/2013/08/PE13_262_

IIIF Appendix on Sovereign Bond Valuation. There are two approaches to government finance and their implications: (1) simple unpleasant monetarist arithmetic; and (2) simple unpleasant fiscal arithmetic. Both approaches illustrate how sovereign debt can be perceived riskier under profligacy.

First, Unpleasant Monetarist Arithmetic. Fiscal policy is described by Sargent and Wallace (1981, 3, equation 1) as a time sequence of D(t), t = 1, 2,…t, …, where D is real government expenditures, excluding interest on government debt, less real tax receipts. D(t) is the real deficit excluding real interest payments measured in real time t goods. Monetary policy is described by a time sequence of H(t), t=1,2,…t, …, with H(t) being the stock of base money at time t. In order to simplify analysis, all government debt is considered as being only for one time period, in the form of a one-period bond B(t), issued at time t-1 and maturing at time t. Denote by R(t-1) the real rate of interest on the one-period bond B(t) between t-1 and t. The measurement of B(t-1) is in terms of t-1 goods and [1+R(t-1)] “is measured in time t goods per unit of time t-1 goods” (Sargent and Wallace 1981, 3). Thus, B(t-1)[1+R(t-1)] brings B(t-1) to maturing time t. B(t) represents borrowing by the government from the private sector from t to t+1 in terms of time t goods. The price level at t is denoted by p(t). The budget constraint of Sargent and Wallace (1981, 3, equation 1) is:

D(t) = {[H(t) – H(t-1)]/p(t)} + {B(t) – B(t-1)[1 + R(t-1)]} (1)

Equation (1) states that the government finances its real deficits into two portions. The first portion, {[H(t) – H(t-1)]/p(t)}, is seigniorage, or “printing money.” The second part,

{B(t) – B(t-1)[1 + R(t-1)]}, is borrowing from the public by issue of interest-bearing securities. Denote population at time t by N(t) and growing by assumption at the constant rate of n, such that:

N(t+1) = (1+n)N(t), n>-1 (2)

The per capita form of the budget constraint is obtained by dividing (1) by N(t) and rearranging:

B(t)/N(t) = {[1+R(t-1)]/(1+n)}x[B(t-1)/N(t-1)]+[D(t)/N(t)] – {[H(t)-H(t-1)]/[N(t)p(t)]} (3)

On the basis of the assumptions of equal constant rate of growth of population and real income, n, constant real rate of return on government securities exceeding growth of economic activity and quantity theory equation of demand for base money, Sargent and Wallace (1981) find that “tighter current monetary policy implies higher future inflation” under fiscal policy dominance of monetary policy. That is, the monetary authority does not permanently influence inflation, lowering inflation now with tighter policy but experiencing higher inflation in the future.

Second, Unpleasant Fiscal Arithmetic. The tool of analysis of Cochrane (2011Jan, 27, equation (16)) is the government debt valuation equation:

(Mt + Bt)/Pt = Et∫(1/Rt, t+τ)st+τdτ (4)

Equation (4) expresses the monetary, Mt, and debt, Bt, liabilities of the government, divided by the price level, Pt, in terms of the expected value discounted by the ex-post rate on government debt, Rt, t+τ, of the future primary surpluses st+τ, which are equal to Tt+τ – Gt+τ or difference between taxes, T, and government expenditures, G. Cochrane (2010A) provides the link to a web appendix demonstrating that it is possible to discount by the ex post Rt, t+τ. The second equation of Cochrane (2011Jan, 5) is:

MtV(it, ·) = PtYt (5)

Conventional analysis of monetary policy contends that fiscal authorities simply adjust primary surpluses, s, to sanction the price level determined by the monetary authority through equation (5), which deprives the debt valuation equation (4) of any role in price level determination. The simple explanation is (Cochrane 2011Jan, 5):

“We are here to think about what happens when [4] exerts more force on the price level. This change may happen by force, when debt, deficits and distorting taxes become large so the Treasury is unable or refuses to follow. Then [4] determines the price level; monetary policy must follow the fiscal lead and ‘passively’ adjust M to satisfy [5]. This change may also happen by choice; monetary policies may be deliberately passive, in which case there is nothing for the Treasury to follow and [4] determines the price level.”

An intuitive interpretation by Cochrane (2011Jan 4) is that when the current real value of government debt exceeds expected future surpluses, economic agents unload government debt to purchase private assets and goods, resulting in inflation. If the risk premium on government debt declines, government debt becomes more valuable, causing a deflationary effect. If the risk premium on government debt increases, government debt becomes less valuable, causing an inflationary effect.

There are multiple conclusions by Cochrane (2011Jan) on the debt/dollar crisis and Global recession, among which the following three:

(1) The flight to quality that magnified the recession was not from goods into money but from private-sector securities into government debt because of the risk premium on private-sector securities; monetary policy consisted of providing liquidity in private-sector markets suffering stress

(2) Increases in liquidity by open-market operations with short-term securities have no impact; quantitative easing can affect the timing but not the rate of inflation; and purchase of private debt can reverse part of the flight to quality

(3) The debt valuation equation has a similar role as the expectation shifting the Phillips curve such that a fiscal inflation can generate stagflation effects similar to those occurring from a loss of anchoring expectations.

IV Global Inflation. There is inflation everywhere in the world economy, with slow growth and persistently high unemployment in advanced economies. Table IV-1, updated with every blog comment, provides the latest annual data for GDP, consumer price index (CPI) inflation, producer price index (PPI) inflation and unemployment (UNE) for the advanced economies, China and the highly indebted European countries with sovereign risk issues. The table now includes the Netherlands and Finland that with Germany make up the set of northern countries in the euro zone that hold key votes in the enhancement of the mechanism for solution of sovereign risk issues (Peter Spiegel and Quentin Peel, “Europe: Northern Exposures,” Financial Times, Mar 9, 2011 http://www.ft.com/intl/cms/s/0/55eaf350-4a8b-11e0-82ab-00144feab49a.html#axzz1gAlaswcW). Newly available data on inflation is considered below in this section. Data in Table IV-1 for the euro zone and its members are updated from information provided by Eurostat but individual country information is provided in this section as soon as available, following Table IV-1. Data for other countries in Table IV-1 are also updated with reports from their statistical agencies. Economic data for major regions and countries is considered in Section V World Economic Slowdown following with individual country and regional data tables.

Table IV-1, GDP Growth, Inflation and Unemployment in Selected Countries, Percentage Annual Rates

| GDP | CPI | PPI | UNE | |

| US | 1.6 | 1.8 | 2.5 | 7.6 |

| Japan | 0.4 | 0.2 | 1.2 | 3.9 |

| China | 7.5 | 2.7 | -2.3 | |

| UK | 1.4 | 2.9* CPIH 2.7 | 2.0 output | 7.8 |

| Euro Zone | -1.1 | 1.6 | 0.3 | 12.1 |

| Germany | -0.3 | 1.9 | 0.6 | 5.3 |

| France | -0.4 | 1.0 | 0.2 | 10.4 |

| Nether-lands | -1.4 | 3.2 | -0.2 | 6.6 |

| Finland | -2.2 | 2.3 | 1.7 | 8.4 |

| Belgium | -0.6 | 1.5 | 0.9 | 8.6 |

| Portugal | -4.0 | 1.2 | 1.4 | 17.6 |

| Ireland | NA | 0.7 | 1.8 | 13.6 |

| Italy | -2.4 | 1.4 | -0.7 | 12.2 |

| Greece | -5.6 | -0.3 | 0.8 | NA |

| Spain | -2.0 | 2.2 | 1.3 | 26.9 |

Notes: GDP: rate of growth of GDP; CPI: change in consumer price inflation; PPI: producer price inflation; UNE: rate of unemployment; all rates relative to year earlier

*Office for National Statistics http://www.ons.gov.uk/ons/rel/cpi/consumer-price-indices/june-2013/index.html **Core

Source: EUROSTAT http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/; country statistical sources http://www.census.gov/aboutus/stat_int.html

Table IV-1 shows the simultaneous occurrence of low growth, inflation and unemployment in advanced economies. The US grew at 1.4 percent in IIQ2013 relative to IIQ2012 (Table 8 in http://www.bea.gov/newsreleases/national/gdp/2013/pdf/gdp2q13_adv.pdf http://cmpassocregulationblog.blogspot.com/2013/08/risks-of-steepening-yield-curve-and.html and earlier http://cmpassocregulationblog.blogspot.com/2013/06/tapering-quantitative-easing-policy-and.html). Japan’s GDP grew 0.1 percent in IQ2013 relative to IQ2012 and 0.2 percent relative to a year earlier. Japan’s grew at the seasonally adjusted annual rate (SAAR) of 4.1 percent in IQQ2013 (http://cmpassocregulationblog.blogspot.com/2013/06/recovery-without-hiring-seven-million.html and earlier http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.html). The UK grew at 0.6 percent in IIQ2013 relative to IQ2013 and GDP increased 1.4 percent in IIQ2013 relative to IIQ2012 (http://cmpassocregulationblog.blogspot.com/2013/07/duration-dumping-steepening-yield-curve.html and earlier http://cmpassocregulationblog.blogspot.com/2013/07/twenty-nine-million-unemployed-or.html). The Euro Zone grew at minus 0.3 percent in IQ2013 and minus 1.1 percent in IQ2013 relative to IQ2012 (http://cmpassocregulationblog.blogspot.com/2013/07/twenty-nine-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2013/06/twenty-eight-million-unemployed-or.html). These are stagnating or “growth recession” rates, which are positive or about nil growth rates with some contractions that are insufficient to recover employment. The rates of unemployment are quite high: 7.4 percent in the US but 17.4 percent for unemployment/underemployment or job stress of 28.3 million (http://cmpassocregulationblog.blogspot.com/2013/08/risks-of-steepening-yield-curve-and.html