Global Financial and Economic Risk, Recovery without Hiring, Loss of Ten Million Full-time Jobs, Youth and Middle Age Unemployment, United States International Trade, United States Services, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014

I Recovery without Hiring

IA1 Hiring Collapse

IA2 Labor Underutilization

ICA3 Ten Million Fewer Full-time Jobs

IA4 Theory and Reality of Cyclical Slow Growth Not Secular Stagnation: Youth and Middle-Age Unemployment

IIA United States International Trade

IIA1 Import and Export Prices

II United States Services

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

VC China. China estimates an index of nonmanufacturing purchasing managers based on a sample of 1200 nonmanufacturing enterprises across the country (http://www.stats.gov.cn/english/pressrelease/t20121009_402841094.htm). Table CIPMNM provides this index and components. The total index increased from 55.7 in Jan 2011 to 58.0 in Mar 2012, decreasing to 53.9 in Aug 2013. The index decreased from 56.0 in Nov 2013 to 54.6 in Dec 2013, easing to 53.4 in Jan 2014. The index moved to 53.9 in Nov 2014. The index of new orders increased from 52.2 in Jan 2012 to 54.3 in Dec 2012 but fell to 50.1 in May 2013, barely above the neutral frontier of 50.0. The index of new orders stabilized at 51.0 in Nov-Dec 2013, easing to 50.9 in Jan 2014. The index of new orders moved to 50.1 in Nov 2014.

Table CIPMNM, China, Nonmanufacturing Index of Purchasing Managers, %, Seasonally Adjusted

| Total Index | New Orders | Interm. | Subs Prices | Exp | |

| Nov 2014 | 53.9 | 50.1 | 50.6 | 47.7 | 59.7 |

| Oct | 53.8 | 51.0 | 52.0 | 48.8 | 59.9 |

| Sep | 54.0 | 49.5 | 49.8 | 47.3 | 60.9 |

| Aug | 54.4 | 50.0 | 52.2 | 48.3 | 61.2 |

| Jul | 54.2 | 50.7 | 53.4 | 49.5 | 61.5 |

| Jun | 55.0 | 50.7 | 56.0 | 50.8 | 60.4 |

| May | 55.5 | 52.7 | 54.5 | 49.0 | 60.7 |

| Apr | 54.8 | 50.8 | 52.4 | 49.4 | 61.5 |

| Mar | 54.5 | 50.8 | 52.8 | 49.5 | 61.5 |

| Feb | 55.0 | 51.4 | 52.1 | 49.0 | 59.9 |

| Jan | 53.4 | 50.9 | 54.5 | 50.1 | 58.1 |

| Dec 2013 | 54.6 | 51.0 | 56.9 | 52.0 | 58.7 |

| Nov | 56.0 | 51.0 | 54.8 | 49.5 | 61.3 |

| Oct | 56.3 | 51.6 | 56.1 | 51.4 | 60.5 |

| Sep | 55.4 | 53.4 | 56.7 | 50.6 | 60.1 |

| Aug | 53.9 | 50.9 | 57.1 | 51.2 | 62.9 |

| Jul | 54.1 | 50.3 | 58.2 | 52.4 | 63.9 |

| Jun | 53.9 | 50.3 | 55.0 | 50.6 | 61.8 |

| May | 54.3 | 50.1 | 54.4 | 50.7 | 62.9 |

| Apr | 54.5 | 50.9 | 51.1 | 47.6 | 62.5 |

| Mar | 55.6 | 52.0 | 55.3 | 50.0 | 62.4 |

| Feb | 54.5 | 51.8 | 56.2 | 51.1 | 62.7 |

| Jan | 56.2 | 53.7 | 58.2 | 50.9 | 61.4 |

| Dec 2012 | 56.1 | 54.3 | 53.8 | 50.0 | 64.6 |

| Nov | 55.6 | 53.2 | 52.5 | 48.4 | 64.6 |

| Oct | 55.5 | 51.6 | 58.1 | 50.5 | 63.4 |

| Sep | 53.7 | 51.8 | 57.5 | 51.3 | 60.9 |

| Aug | 56.3 | 52.7 | 57.6 | 51.2 | 63.2 |

| Jul | 55.6 | 53.2 | 49.7 | 48.7 | 63.9 |

| Jun | 56.7 | 53.7 | 52.1 | 48.6 | 65.5 |

| May | 55.2 | 52.5 | 53.6 | 48.5 | 65.4 |

| Apr | 56.1 | 52.7 | 57.9 | 50.3 | 66.1 |

| Mar | 58.0 | 53.5 | 60.2 | 52.0 | 66.6 |

| Feb | 57.3 | 52.7 | 59.0 | 51.2 | 63.8 |

| Jan | 55.7 | 52.2 | 58.2 | 51.1 | 65.3 |

Notes: Interm.: Intermediate; Subs: Subscription; Exp: Business Expectations

Source: National Bureau of Statistics of China

http://www.stats.gov.cn/english/

Chart CIPMNM provides China’s nonmanufacturing purchasing managers’ index. The index fell from 56.0 in Oct 2013 to 53.9 in Nov 2014.

Chart CIPMNM, China, Nonmanufacturing Index of Purchasing Managers, Seasonally Adjusted

Source: National Bureau of Statistics of China

http://www.stats.gov.cn/english/

Table CIPMMFG provides the index of purchasing managers of manufacturing seasonally adjusted of the National Bureau of Statistics of China. The general index (IPM) rose from 50.5 in Jan 2012 to 53.3 in Apr 2012, falling to 49.2 in Aug 2012, rebounding to 50.6 in Dec 2012. The index fell to 50.1 in Jun 2013, barely above the neutral frontier at 50.0, recovering to 51.4 in Nov 2013 but falling to 51.0 in Dec 2013. The index fell to 50.5 in Jan 2014 and 50.3 in Nov 2014. The index of new orders fell from 54.5 in Apr 2012 to 51.2 in Dec 2012. The index of new orders fell from 52.3 in Nov 2013 to 52.0 in Dec 2013. The index fell to 50.9 in Jan 2014 and moved to 50.9 in Nov 2014.

Table CIPMMFG, China, Manufacturing Index of Purchasing Managers, %, Seasonally Adjusted

| IPM | PI | NOI | INV | EMP | SDEL | |

| Nov 2014 | 50.3 | 52.5 | 50.9 | 47.7 | 48.2 | 50.3 |

| Oct | 50.8 | 53.1 | 51.6 | 48.4 | 48.4 | 50.1 |

| Sep | 51.1 | 53.6 | 52.2 | 48.8 | 48.2 | 50.1 |

| Aug | 51.1 | 53.2 | 52.5 | 48.6 | 48.2 | 50.0 |

| Jul | 51.7 | 54.2 | 53.6 | 49.0 | 48.3 | 50.2 |

| Jun | 51.0 | 53.0 | 52.8 | 48.0 | 48.6 | 50.5 |

| May | 50.8 | 52.8 | 52.3 | 48.0 | 48.2 | 50.3 |

| Apr | 50.4 | 52.5 | 51.2 | 48.1 | 48.3 | 50.1 |

| Mar | 50.3 | 52.7 | 50.6 | 47.8 | 48.3 | 49.8 |

| Feb | 50.2 | 52.6 | 50.5 | 47.4 | 48.0 | 49.9 |

| Jan | 50.5 | 53.0 | 50.9 | 47.8 | 48.2 | 49.8 |

| Dec 2013 | 51.0 | 53.9 | 52.0 | 47.6 | 48.7 | 50.5 |

| Nov | 51.4 | 54.5 | 52.3 | 47.8 | 49.6 | 50.6 |

| Oct | 51.4 | 54.4 | 52.5 | 48.6 | 49.2 | 50.8 |

| Sep | 51.1 | 52.9 | 52.8 | 48.5 | 49.1 | 50.8 |

| Aug | 51.0 | 52.6 | 52.4 | 48.0 | 49.3 | 50.4 |

| Jul | 50.3 | 52.4 | 50.6 | 47.6 | 49.1 | 50.1 |

| Jun | 50.1 | 52.0 | 50.4 | 47.4 | 48.7 | 50.3 |

| May | 50.8 | 53.3 | 51.8 | 47.6 | 48.8 | 50.8 |

| Apr | 50.6 | 52.6 | 51.7 | 47.5 | 49.0 | 50.8 |

| Mar | 50.9 | 52.7 | 52.3 | 47.5 | 49.8 | 51.1 |

| Feb | 50.1 | 51.2 | 50.1 | 49.5 | 47.6 | 48.3 |

| Jan | 50.4 | 51.3 | 51.6 | 50.1 | 47.8 | 50.0 |

| Dec 2012 | 50.6 | 52.0 | 51.2 | 47.3 | 49.0 | 48.8 |

| Nov | 50.6 | 52.5 | 51.2 | 47.9 | 48.7 | 49.9 |

| Oct | 50.2 | 52.1 | 50.4 | 47.3 | 49.2 | 50.1 |

| Sep | 49.8 | 51.3 | 49.8 | 47.0 | 48.9 | 49.5 |

| Aug | 49.2 | 50.9 | 48.7 | 45.1 | 49.1 | 50.0 |

| Jul | 50.1 | 51.8 | 49.0 | 48.5 | 49.5 | 49.0 |

| Jun | 50.2 | 52.0 | 49.2 | 48.2 | 49.7 | 49.1 |

| May | 50.4 | 52.9 | 49.8 | 45.1 | 50.5 | 49.0 |

| Apr | 53.3 | 57.2 | 54.5 | 48.5 | 51.0 | 49.6 |

| Mar | 53.1 | 55.2 | 55.1 | 49.5 | 51.0 | 48.9 |

| Feb | 51.0 | 53.8 | 51.0 | 48.8 | 49.5 | 50.3 |

| Jan | 50.5 | 53.6 | 50.4 | 49.7 | 47.1 | 49.7 |

IPM: Index of Purchasing Managers; PI: Production Index; NOI: New Orders Index; EMP: Employed Person Index; SDEL: Supplier Delivery Time Index

Source: National Bureau of Statistics of China

http://www.stats.gov.cn/english/

China estimates the manufacturing index of purchasing managers on the basis of a sample of 820 enterprises (http://www.stats.gov.cn/english/pressrelease/t20121009_402841094.htm). Chart CIPMMFG provides the manufacturing index of purchasing managers. The index fell to 50.1 in Jun 2013. The index decreased from 51.4 in Nov 2013 to 51.0 in Dec 2013. The index moved to 50.3 in Nov 2014.

Chart CIPMMFG, China, Manufacturing Index of Purchasing Managers, Seasonally Adjusted

Source: National Bureau of Statistics of China

http://www.stats.gov.cn/english/

Cumulative growth of China’s GDP in IIIQ2014 relative to the same period in 2013 was 7.4 percent, as shown in Table VC-GDP. Secondary industry accounts for 44.2 percent of cumulative GDP in IIIQ2014. In cumulative IIIQ2014, industry alone accounts for 37.4 percent of GDP and construction with the remaining 6.8 percent. Tertiary industry accounts for 46.7 percent of cumulative GDP in IIIQ2014 and primary industry for 9.0 percent. China’s growth strategy consisted of rapid increases in productivity in industry to absorb population from agriculture where incomes are lower (Pelaez and Pelaez, The Global Recession Risk (2007), 56-80). The strategy is shifting to lower growth rates with improvement in living standards. The bottom block of Table VC-GDP provides quarter-on-quarter growth rates of GDP and their annual equivalent. China’s GDP growth decelerated significantly from annual equivalent 10.4 percent in IIQ2011 to 7.4 percent in IVQ2011 and 5.7 percent in IQ2012, rebounding to 8.7 percent in IIQ2012, 8.2 percent in IIIQ2012 and 7.8 percent in IVQ2012. Annual equivalent growth in IQ2013 fell to 6.6 percent and to 7.3 percent in IIQ2013, rebounding to 9.5 percent in IIIQ2013. Annual equivalent growth was 7.0 percent in IVQ2013, declining to 6.1 percent in IQ2014 and increasing to 8.2 percent in IIQ2014. Annual equivalent growth slowed to 7.8 percent in IIIQ2014.

Table VC-GDP, China, Quarterly Growth of GDP, Current CNY 100 Million and Inflation Adjusted ∆%

| Cumulative GDP IIIQ2014 | Value Current CNY Billion | 2014 Year-on-Year Constant Prices ∆% |

| GDP | 41,990.8 | 7.4 |

| Primary Industry | 3799.6 | 4.2 |

| Farming | 3799.6 | 4.2 |

| Secondary Industry | 18,578.7 | 7.4 |

| Industry | 15,705.7 | 7.1 |

| Construction | 2873.0 | 9.0 |

| Tertiary Industry | 19,612.5 | 7.9 |

| Transport, Storage, Post | 2337.0 | 7.0 |

| Wholesale, Retail Trades | 3893.0 | 9.7 |

| Hotel & Catering Services | 847.6 | 6.2 |

| Financial Intermediation | 2965.5 | 9.1 |

| Real Estate | 2641.4 | 2.3 |

| Other | 6928.0 | 9.0 |

| Growth in Quarter Relative to Prior Quarter | ∆% on Prior Quarter | ∆% Annual Equivalent |

| 2014 | ||

| IIIQ2014 | 1.9 | 7.8 |

| IIQ2014 | 2.0 | 8.2 |

| IQ2014 | 1.5 | 6.1 |

| 2013 | ||

| IVQ2013 | 1.7 | 7.0 |

| IIIQ2013 | 2.3 | 9.5 |

| IIQ2013 | 1.8 | 7.4 |

| IQ2013 | 1.6 | 6.6 |

| 2012 | ||

| IVQ2012 | 1.9 | 7.8 |

| IIIQ2012 | 2.0 | 8.2 |

| IIQ2012 | 2.1 | 8.7 |

| IQ2012 | 1.4 | 5.7 |

| 2011 | ||

| IVQ2011 | 1.8 | 7.4 |

| IIIQ2011 | 2.2 | 9.1 |

| IIQ2011 | 2.5 | 10.4 |

| IQ2011 | 2.3 | 9.5 |

Source: National Bureau of Statistics of China http://www.stats.gov.cn/english/

Growth of China’s GDP in IIIQ2014 relative to the same period in 2013 was 7.3 percent, as shown in Table VC-GDPA. Secondary industry accounts for 44.2 percent of GDP of which industry alone for 37.4 percent in cumulative IIIQ2014 and construction with the remaining 6.8 percent. Tertiary industry accounts for 46.7 percent of GDP in cumulative IIQ2014 and primary industry for 9.0 percent. China’s growth strategy consisted of rapid increases in productivity in industry to absorb population from agriculture where incomes are lower (Pelaez and Pelaez, The Global Recession Risk (2007), 56-80). The strategy is changing to lower growth rates while improving living standards. GDP growth decelerated from 12.1 percent in IQ2010 and 11.2 percent in IIQ2010 to 7.7 percent in IQ2013, 7.5 percent in IIQ2013 and 7.8 percent in IIIQ2013. GDP grew 7.7 percent in IVQ2013 relative to a year earlier and 1.7 percent relative to IIIQ2013, which is equivalent to 7.0 percent per year. GDP grew 7.4 percent in IQ2014 relative to a year earlier and 1.5 percent in IQ2014 that is equivalent to 6.1 percent per year. GP grew 7.5 percent in IIQ2014 relative to a year earlier and 2.0 percent relative to the prior quarter, which is equivalent 8.2 percent. In IIIQ2014, GDP grew 7.3 percent relative to a year earlier and 1.9 percent relative to the prior quarter, which is 7.8 percent in annual equivalent.

Table VC-GDPA, China, Growth Rate of GDP, ∆% Relative to a Year Earlier and ∆% Relative to Prior Quarter

| IQ 2013 | IIQ 2013 | IIIQ 2013 | IVQ 2013 | IQ 2014 | IIQ 2014 | IIIQ 2014 | ||

| GDP | 7.7 | 7.5 | 7.8 | 7.7 | 7.4 | 7.5 | 7.3 | |

| Primary Industry | 3.4 | 3.0 | 3.4 | 4.0 | 3.5 | 3.9 | 4.2 | |

| Secondary Industry | 7.8 | 7.6 | 7.8 | 7.8 | 7.3 | 7.4 | 7.4 | |

| Tertiary Industry | 8.3 | 8.3 | 8.4 | 8.3 | 7.1 | 8.0 | 7.9 | |

| GDP ∆% Relative to a Prior Quarter | 1.6 | 1.8 | 2.3 | 1.7 | 1.5 | 2.0 | 1.9 | |

| IQ 2011 | IIQ 2011 | IIIQ 2011 | IVQ 2011 | IQ 2012 | IIQ 2012 | IIIQ 2012 | IVQ 2012 | |

| GDP | 9.7 | 9.5 | 9.1 | 8.9 | 8.1 | 7.6 | 7.4 | 7.9 |

| Primary Industry | 3.5 | 3.2 | 3.8 | 4.5 | 3.8 | 4.3 | 4.2 | 4.5 |

| Secondary Industry | 11.1 | 11.0 | 10.8 | 10.6 | 9.1 | 8.3 | 8.1 | 8.1 |

| Tertiary Industry | 9.1 | 9.2 | 9.0 | 8.9 | 7.5 | 7.7 | 7.9 | 8.1 |

| GDP ∆% Relative to a Prior Quarter | 2.3 | 2.5 | 2.2 | 1.8 | 1.4 | 2.1 | 2.0 | 1.9 |

| IQ 2010 | IIQ 2010 | IIIQ 2010 | IVQ 2010 | |||||

| GDP | 12.1 | 11.2 | 10.7 | 12.1 | ||||

| Primary Industry | 3.8 | 3.6 | 4.0 | 3.8 | ||||

| Secondary Industry | 14.5 | 13.3 | 12.6 | 14.5 | ||||

| Tertiary Industry | 10.5 | 9.9 | 9.7 | 10.5 |

Source: National Bureau of Statistics of China http://www.stats.gov.cn/english/

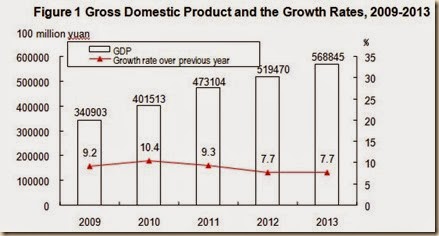

Chart VC-GDP of the National Bureau of Statistics of China provides annual value and growth rates of GDP. China’s GDP growth in 2013 is still high at 7.7 percent but at the lowest rhythm in five years.

Chart VC-GDP, China, Gross Domestic Product, Million Yuan and ∆%, 2009-2013

Source: National Bureau of Statistics of China http://www.stats.gov.cn/english/

Chart VC-FXR provides China’s foreign exchange reserves. FX reserves grew from $2399.2 billion in 2009 to $3821.3 billion in 2013 driven by high growth of China’s trade surplus.

Chart VC-FXR, China, Foreign Exchange Reserves, 2009-2013

Source: National Bureau of Statistics of China http://www.stats.gov.cn/english

Chart VC-Trade provides China’s imports and exports. Exports exceeded imports with resulting large trade balance surpluses that increased foreign exchange reserves.

Chart VC-Trade, China, Imports and Exports of Goods, 2009-2013, $100 Million US Dollars

Source: National Bureau of Statistics of China http://www.stats.gov.cn/english

The HSBC Flash China Manufacturing Purchasing Managers’ Index™ (PMI™) compiled by Markit (http://www.markiteconomics.com/Survey/PressRelease.mvc/67d6ee4cd3ee41c3b8cc48eb1e6d1bb2) is weakening. The overall Flash HSBC China Manufacturing PMI™ decreased from 50.4 in Oct to 50.4 in Nov, while the Flash HSBC China Manufacturing Output Index decreased from 50.7 in Oct to 49.5 in Nov, indicating moderate stress. Exports orders indicate expansion at slower rate. Hongbin Qu, Chief Economist, China and Co-Head of Asian Economic Research at HSBC, finds need for monetary/fiscal stimulus (http://www.markiteconomics.com/Survey/PressRelease.mvc/67d6ee4cd3ee41c3b8cc48eb1e6d1bb2). The HSBC China Services PMI™, compiled by Markit, shows the HSBC Composite Output, combining manufacturing and services, decreasing from 51.7 in Oct to 51.1 in Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/81ccf5b34a7747ab9386ee55a13b09ac). Hongbin Qu, Chief Economist, China and Co-Head of Asian Economic Research at HSBC, finds need of easing policies in consolidating growth (http://www.markiteconomics.com/Survey/PressRelease.mvc/81ccf5b34a7747ab9386ee55a13b09ac). The HSBC China Services Business Activity index increased from 52.9 in Oct to 53.0 in Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/81ccf5b34a7747ab9386ee55a13b09ac). Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC, finds that the services PMI shows sustained activity (http://www.markiteconomics.com/Survey/PressRelease.mvc/81ccf5b34a7747ab9386ee55a13b09ac). The HSBC Purchasing Managers’ Index™ (PMI™), compiled by Markit, decreased to 50.0 in Nov from 50.4 in Oct, indicating near neutral manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/3858794024174e71a8c0d88ee410a40c). New export orders slowed. Hongbin Qu, Chief Economist, China and Co-Head of Asian Economic Research at HSBC, finds weakening demand in China with possible need of monetary and fiscal policy enhancement (http://www.markiteconomics.com/Survey/PressRelease.mvc/3858794024174e71a8c0d88ee410a40c). Table CNY provides the country data table for China.

Table CNY, China, Economic Indicators

| Price Indexes for Industry | Nov 12-month ∆%: minus 2.7 Nov month ∆%: -0.5 |

| Consumer Price Index | Nov month ∆%: -0.2 Nov 12 months ∆%: 1.4 |

| Value Added of Industry | Sep month ∆%: 0.91 Jan-Sep 2014/Jan-Sep 2013 ∆%: 8.5 |

| GDP Growth Rate | Year IIIQ2014 ∆%: 7.5 First Three Quarters 2014 ∆%: 7.3 |

| Investment in Fixed Assets | Total Jan-Sep 2014 ∆%: 16.1 Real estate development: 12.5 |

| Retail Sales | Sep month ∆%: 0.85 Jan-Sep ∆%: 12.0 |

| Trade Balance | Nov balance $54.5 billion Cumulative Jan-Nov: $332.5 billion |

Links to blog comments in Table CNY:

10/26/14 http://cmpassocregulationblog.blogspot.com/2014/10/financial-oscillations-world-inflation.html

Table VC-1 provides China’s exports, imports, trade balance and 12-month percentage changes from Dec 2010 to Nov 2014. The trade surplus of China was $54.5 billion in Nov 2014 with exports growing 4.7 percent in 12 months and imports falling 6.7 percent. The trade surplus of China in Oct 2014 was $45.4 billion with exports increasing 11.6 percent in 12 months and imports 4.6 percent. The trade surplus of China in Sep 2014 was $31.0 billion with exports growing 15.3 percent relative to a year earlier and imports increasing 7.0 percent. China’s trade surplus rose to $49.8 billion in Aug 2014 with 12-month growth of exports of 9.4 percent and decline of 2.4 percent of imports in 12 months. The trade surplus of China jumped to $47.3 billion in Jul 2014 with growth of exports by 14.5 percent and decrease of imports by 1.6 percent. China’s trade surplus decreased to $31.6 billion in Jun 2014 with growth of exports of 7.2 percent and of 5.5 percent of imports. The trade surplus of China increased to $35.92 billion in May 2014 with growth of exports of 7.0 percent relative to a year earlier and decline of imports by 1.6 percent. The trade surplus of China increased to $18.45 billion in Apr 2014 with growth of exports of 0.9 percent relative to a year earlier and of imports of 0.8 percent. China had a trade surplus of $7.71 billion in Mar 2014 with exports declining 6.6 percent in 12 months and imports decreasing 11.3 percent. China had a rare trade deficit of $22.99 billion in Feb 2014 with exports decreasing 18.1 percent in 12 months while imports increased 10.1 percent. Exports increased 10.6 percent in the 12 months ending in Jan 2014 and imports 10.0 percent for trade surplus of $31.87 billion. Exports increased 4.3 percent in the 12 months ending in Dec 2013 while imports increased 8.3 percent for trade surplus of $25.64 billion. Exports surged 12.7 percent in the 12 months ending in Nov 2013 while imports increased 5.3 percent for trade surplus of $33.8 billion. Exports rebounded with growth of 5.6 percent in the 12 months ending in Oct 2013 while imports increased 7.6 percent for trade surplus of $31.11 billion. Exports fell 0.3 percent in the 12 months ending in Sep 2013 while imports increased 7.4 for reduction of the trade surplus to $15.2 billion. Markets reacted positively to China’s trade data in Aug 2013 with exports growing 7.2 percent relative to a year earlier and imports 7.0 percent for increasing trade surplus of $28.52. Exports increased 5.1 in Jul 2013 and imports 10.9 percent for trade surplus of $17.82 billion. Exports fell 3.1 percent in Jun 2013 and imports declined 0.7 percent. The trade surplus reached $27.12 billion. Exports increased 1.0 percent in May 2013 relative to a year earlier while imports fell 0.3 percent with trade surplus of $20.43 billion. Exports increased 14.7 percent in Apr 2013 relative to a year earlier and imports 16.8 percent for trade surplus of $18.16 billion. Exports increased 10.0 percent in Mar 2013 relative to a year earlier and imports increased 14.1 percent for trade deficit of $0.88 billion. Exports increased 21.8 percent in Feb 2013 relative to a year earlier and imports fell 15.2 percent for trade surplus of $15.25 billion. China’s trade growth was stronger in Jan 2013 with growth of exports of 25.0 percent in 12 months and of imports of 28.8 percent for trade surplus of $29.15 billion. China’s trade growth strengthened in Dec 2012 with growth in 12 months of exports of 14.1 percent and of imports of 6.0 percent. China’s trade growth weakened again in Nov 2012 with growth of exports of 2.9 percent and no change in imports. China’s trade growth rebounded with growth of exports in 12 months of 11.6 percent in Oct 2012 and 9.9 percent in Sep 2012 after 2.7 percent in Aug 2012 and 1.0 percent in Jul 2012 while imports grew 2.4 percent in both Sep and Oct 2012, stagnating in Nov 2012. As a result, the monthly trade surplus increased from $25.2 billion in Jul 2012 to $31.9 billion in Oct 2012, declining to $19.6 billion in Nov 2012 but increasing to $31.62 billion in Dec 2012. China’s trade growth rebounded in Oct 2012 with growth of exports of 11.6 percent in 12 months and 2.4 percent for imports and trade surplus of $31.9 billion. The number that caught attention in financial markets was growth of 1.0 percent in exports in the 12 months ending in Jul 2012. Imports were also weak, growing 4.7 percent in 12 months ending in Jul 2012. Exports increased 11.3 percent in Jun 2012 relative to a year earlier while imports grew 6.3 percent. The rate of growth of exports fell to 4.9 percent in Apr 2012 relative to a year earlier and imports increased 0.3 percent but export growth was 15.3 percent in May and imports increased 12.7 percent. China reversed the large trade deficit of USD 31.48 billion in Feb 2012 with a surplus of $5.35 billion in Mar 2012, $18.42 billion in Apr 2012, $18.7 billion in May 2012, $31.7 billion in Jun 2012, $25.2 billion in Jul 2012, $26.7 billion in Aug 2012, $27.7 billion in Sep 2012, $31.9 billion in Oct 2012 and $19.6 billion in Nov 2012. Exports fell 0.5 percent in the 12 months ending in Jan 2012 while imports fell 15.3 percent for a still sizeable trade surplus of $27.3 billion. In Feb 2012, exports increased 18.4 percent while imports jumped 39.6 percent for a sizeable deficit of $31.48 billion. There are distortions from the Lunar New Year holidays.

Table VC-1, China, Exports, Imports and Trade Balance USD Billion and ∆%

| Exports | ∆% Relative | Imports USD | ∆% Relative | Balance | |

| Nov 2014 | 211.66 | 4.7 | 157.19 | -6.7 | 54.5 |

| Oct | 206.86 | 11.6 | 161.46 | 4.6 | 45.4 |

| Sep | 213.7 | 15.3 | 182.7 | 7.0 | 31.0 |

| Aug | 208.5 | 9.4 | 158.6 | -2.4 | 49.8 |

| Jul | 212.9 | 14.5 | 165.6 | -1.6 | 47.3 |

| Jun | 186.8 | 7.2 | 155.2 | 5.5 | 31.6 |

| May | 195.47 | 7.0 | 159.55 | -1.6 | 35.92 |

| Apr | 188.54 | 0.9 | 170.09 | 0.8 | 18.45 |

| Mar | 170.11 | -6.6 | 162.40 | -11.3 | 7.71 |

| Feb | 114.09 | -18.1 | 137.08 | 10.1 | -22.99 |

| Jan | 207.13 | 10.6 | 175.26 | 10.0 | 31.87 |

| Dec 2013 | 207.74 | 4.3 | 182.10 | 8.3 | 25.64 |

| Nov | 202.20 | 12.7 | 168.40 | 5.3 | 33.8 |

| Oct | 185.41 | 5.6 | 154.30 | 7.6 | 31.11 |

| Sep | 185.64 | -0.3 | 170.44 | 7.4 | 15.21 |

| Aug | 190.61 | 7.2 | 162.09 | 7.0 | 28.52 |

| Jul | 185.99 | 5.1 | 168.17 | 10.9 | 17.82 |

| Jun | 174.32 | -3.1 | 147.19 | -0.7 | 27.12 |

| May | 182.77 | 1.0 | 162.34 | -0.3 | 20.43 |

| Apr | 187.06 | 14.7 | 168.90 | 16.8 | 18.16 |

| Mar | 182.19 | 10.0 | 183.07 | 14.1 | -0.88 |

| Feb | 139.37 | 21.8 | 124.12 | -15.2 | 15.25 |

| Jan | 187.37 | 25.0 | 158.22 | 28.8 | 29.15 |

| Dec 2012 | 199.23 | 14.1 | 167.61 | 6.0 | 31.62 |

| Nov | 179.38 | 2.9 | 159.75 | 0.0 | 19.63 |

| Oct | 175.57 | 11.6 | 143.58 | 2.4 | 31.99 |

| Sep | 186.35 | 9.9 | 158.68 | 2.4 | 27.67 |

| Aug | 177.97 | 2.7 | 151.31 | -2.6 | 26.66 |

| Jul | 176.94 | 1.0 | 151.79 | 4.7 | 25.15 |

| Jun | 180.20 | 11.3 | 148.48 | 6.3 | 31.72 |

| May | 181.14 | 15.3 | 162.44 | 12.7 | 18.70 |

| Apr | 163.25 | 4.9 | 144.83 | 0.3 | 18.42 |

| Mar | 165.66 | 8.9 | 160.31 | 5.3 | 5.35 |

| Feb | 114.47 | 18.4 | 145.95 | 39.6 | -31.48 |

| Jan | 149.94 | -0.5 | 122.66 | -15.3 | 27.28 |

| Dec 2011 | 174.72 | 13.4 | 158.20 | 11.8 | 16.52 |

| Nov | 174.46 | 13.8 | 159.94 | 22.1 | 14.53 |

| Oct | 157.49 | 15.9 | 140.46 | 28.7 | 17.03 |

| Sep | 169.67 | 17.1 | 155.16 | 20.9 | 14.51 |

| Aug | 173.32 | 24.5 | 155.56 | 30.2 | 17.76 |

| Jul | 175.13 | 20.4 | 143.64 | 22.9 | 31.48 |

| Jun | 161.98 | 17.9 | 139.71 | 19.3 | 22.27 |

| May | 157.16 | 19.4 | 144.11 | 28.4 | 13.05 |

| Apr | 155.69 | 29.9 | 144.26 | 21.8 | 11.42 |

| Mar | 152.20 | 35.8 | 152.06 | 27.3 | 0.14 |

| Feb | 96.74 | 2.4 | 104.04 | 19.4 | -7.31 |

| Jan | 150.73 | 37.7 | 144.27 | 51.0 | 6.46 |

| Dec 2010 | 154.15 | 17.9 | 141.07 | 25.6 | 13.08 |

Source: Ministry of Commerce, People’s Republic of China

http://english.mofcom.gov.cn/article/statistic/BriefStatistics/

Table VC-2 provides cumulative exports, imports and the trade balance of China together with percentage growth of exports and imports relative to a year earlier. Exports increased 5.7 percent cumulatively in Jan-Oct 2014 relative to a year earlier while imports increased 0.9 percent for cumulative trade surplus of $332.5 billion. Exports increased 5.8 percent cumulatively in Jan-Oct 2014 relative to a year while earlier while imports increased 1.8 percent for cumulative trade surplus of $277.0 billion. Exports increased 5.1 percent cumulatively in Jan-Sep 2014 relative to a year earlier while imports increased 1.3 percent for cumulative trade surplus of $231.6 billion. Exports grew 3.8 percent cumulatively in Jan-Aug 2014 relative to a year earlier while imports increased 1.6 percent for cumulative surplus of $200 billion. Exports increased 2.9 percent in the cumulative Jan-July 2014 relative to a year earlier and imports 1.1 percent for cumulative surplus of $150.6 billion. Exports increased 0.9 percent in Jan-Jun 2014 relative to a year earlier and imports increased 1.5 percent for cumulative surplus of $102.7 billion. Exports fell 0.4 percent in Jan-May 2014 relative to a year earlier while imports increased 0.8 percent for cumulative surplus of $71.11 billion. Exports fell 2.3 percent in Jan-Apr 2014 relative to the same period a year earlier and imports increased 1.5 percent for cumulative trade surplus of $35.19 billion.

Exports fell 3.4 percent in Jan-Mar 2014 relative to a year earlier while imports increased 1.6 percent for cumulative surplus of $16.74 billion. Exports fell 1.6 percent and imports increased 10.0 percent for cumulative surplus of $8.88 billion in Jan-Feb 2014. Exports increased 10.6 percent in Jan 2014 and imports 10.0 percent for cumulative surplus of $31.87 billion. Exports increased 7.9 percent in Jan-Dec 2013 relative to the same period a year earlier while imports increased 7.3 percent for cumulative surplus of $259.75 billion. Exports grew 8.3 percent in Jan-Nov 2013 relative to a year earlier while imports increased 7.1 percent for cumulative surplus of $234.15 billion. Exports grew 7.8 percent in Jan-Oct 2013 relative to a year earlier while imports grew 7.3 percent for cumulative trade surplus of $200.46 billion. Exports increased 8.0 percent in Jan-Sep 2013 relative to a year earlier while imports increased 7.3 percent for cumulative surplus of $169.36 billion. Exports increased 9.2 percent in in Jan-Aug 2013 relative to a year earlier and imports 7.3 percent for trade surplus of $154.21 billion. Exports grew 9.5 percent in Jul 2013 relative to a year earlier and imports 7.3 percent with cumulative surplus of $125.71 billion. Exports increased 10.4 percent cumulatively in Jun 2013 and imports 6.7 for cumulative surplus of $107.95 billion. Exports increased 13.5 percent in Jan-May 2013 relative to a year earlier while imports increased 8.2 percent for cumulative surplus of $80.87 billion. Exports increased 17.4 percent in Jan-Apr 2012 relative to a year earlier while imports increased 10.6 percent for cumulative surplus of $60.98 billion. Exports increased 18.4 percent in Jan-Mar 2013 relative to a year earlier while imports increased 8.4 percent for cumulative surplus of $43.07 billion. Cumulative exports in Jan-Feb 2013 grew 23.6 percent relative to a year earlier and imports 5.0 percent for trade surplus of $44.15 billion. There is strong beginning of 2013 with trade surplus of $29.15 in Jan 2013 and growth of exports of 25.0 percent and imports of 28.8 percent. The trade balance of $231.1 billion in 2012 is stronger than the trade balance of $155.14 billion in 2011. The trade balance in 2011 of $155.14 billion is lower than those from 2008 to 2010. China’s trade balance reached $231.1 billion in Jan-Dec 2012 with cumulative growth of exports of 7.9 percent and 4.3 percent of imports, which is much lower than 20.3 percent for exports and 24.9 percent for imports in 2011 and 31.3 percent for exports and 38.7 percent for imports in 2010. There is a rare cumulative deficit of $4.2 billion in Feb 2012 reversed to a small surplus in Mar 2012 and a higher surplus of $19.3 billion in Apr 2012, increasing to $37.9 billion in May, $68.9 billion in Jun 2012, $94.1 billion in Jul 2012, $120.6 billion in Aug 2012, $148.3 billion in Sep 2012, $180.24 billion in Oct 2012, $199.54 billion in Nov 2012 and $231.1 billion in Dec 2012. More observations are required to detect trends of Chinese trade.

Table VC-2, China, Year to Date Exports, Imports and Trade Balance USD Billion and ∆%

| Exports | ∆% Relative | Imports USD | ∆% Relative | Balance | |

| Nov 2014 | 2115.7 | 5.7 | 1784.9 | 0.9 | 332.5 |

| Oct | 1904.1 | 5.8 | 1627.8 | 1.8 | 277.0 |

| Sep | 1697.2 | 5.1 | 1466.3 | 1.3 | 231.6 |

| Aug | 1483.5 | 3.8 | 1283.6 | 0.6 | 200.0 |

| Jul | 1275.0 | 2.9 | 1125.0 | 1.1 | 150.6 |

| Jun | 1062.1 | 0.9 | 959.4 | 1.5 | 102.7 |

| May | 875.32 | -0.4 | 804.21 | 0.8 | 71.11 |

| Apr | 679.85 | -2.3 | 644.66 | 1.5 | 35.19 |

| Mar | 491.31 | -3.4 | 474.57 | 1.6 | 16.74 |

| Feb | 321.23 | -1.6 | 312.35 | 10.0 | 8.88 |

| Jan | 207.13 | 10.6 | 175.26 | 10.0 | 31.87 |

| Dec 2013 | 2210.04 | 7.9 | 1950.29 | 7.3 | 259.75 |

| Nov | 2002.32 | 8.3 | 1768.17 | 7.1 | 234.15 |

| Oct | 1800.21 | 7.8 | 1599.75 | 7.3 | 200.46 |

| Sep | 1614.86 | 8.0 | 1445.50 | 7.3 | 169.36 |

| Aug | 1429.26 | 9.2 | 1275.05 | 7.3 | 154.21 |

| Jul | 1238.73 | 9.5 | 1113.02 | 7.3 | 125.71 |

| Jun | 1052.82 | 10.4 | 944.87 | 6.7 | 107.95 |

| May | 878.56 | 13.5 | 797.69 | 8.2 | 80.87 |

| Apr | 695.87 | 17.4 | 634.88 | 10.6 | 60.98 |

| Mar | 508.87 | 18.4 | 465.80 | 8.4 | 43.07 |

| Feb | 326.73 | 23.6 | 282.58 | 5.0 | 44.15 |

| Jan | 187.37 | 25.0 | 158.22 | 28.8 | 29.15 |

| Dec 2012 | 2048.93 | 7.9 | 1817.83 | 4.3 | 231.11 |

| Nov | 1849.91 | 7.3 | 1650.37 | 4.1 | 199.54 |

| Oct | 1670.90 | 7.8 | 1490.67 | 4.6 | 180.24 |

| Sep | 1495.39 | 7.4 | 1347.08 | 4.8 | 148.31 |

| Aug | 1309.11 | 7.1 | 1188.51 | 5.1 | 120.61 |

| Jul | 1131.24 | 7.8 | 1037.14 | 6.4 | 94.10 |

| Jun | 954.38 | 9.2 | 885.46 | 6.7 | 68.91 |

| May | 774.40 | 8.7 | 736.49 | 6.7 | 37.92 |

| Apr | 593.24 | 6.9 | 573.94 | 5.1 | 19.3 |

| Mar | 430.02 | 7.6 | 429.36 | 6.6 | 0.66 |

| Feb | 264.40 | 6.9 | 268.64 | 7.7 | -4.24 |

| Jan | 149.94 | -0.5 | 122.66 | -15.3 | 27.28 |

| Dec 2011 | 1,898.60 | 20.3 | 1,743.46 | 24.9 | 155.14 |

| Nov | 1,724.01 | 21.1 | 1585.61 | 26.4 | 138.40 |

| Oct | 1,549.71 | 22.0 | 1,425.68 | 26.9 | 124.03 |

| Sep | 1,392.27 | 22.7 | 1,285.17 | 26.7 | 107.10 |

| Aug | 1,222.63 | 23.6 | 1,129.90 | 27.5 | 92.73 |

| Jul | 1,049.38 | 23.4 | 973.17 | 26.9 | 76.21 |

| Jun | 874.3 | 24.0 | 829.37 | 27.6 | 44.93 |

| May | 712.37 | 25.5 | 689.41 | 29.4 | 22.96 |

| Apr | 555.30 | 27.4 | 545.02 | 29.6 | 10.28 |

| Mar | 399.64 | 26.5 | 400.66 | 32.6 | -1.02 |

| Feb | 247.47 | 21.3 | 248.36 | 36.0 | -0.89 |

| Jan | 150.7 | 37.7 | 144.27 | 51.0 | 6.46 |

| Dec 2010 | 1577.93 | 31.3 | 1394.83 | 38.7 | 183.10 |

Source: Ministry of Commerce, People’s Republic of China

http://english.mofcom.gov.cn/article/statistic/BriefStatistics/

VD Euro Area. Table VD-EUR provides yearly growth rates of the combined GDP of the members of the European Monetary Union (EMU) or euro area since 1996. Growth was very strong at 3.3 percent in 2006 and 3.0 percent in 2007. The global recession had strong impact with growth of only 0.4 percent in 2008 and decline of 4.4 percent in 2009. Recovery was at lower growth rates of 2.0 percent in 2010 and 1.6 percent in 2011. EUROSTAT estimates growth of GDP of the euro area of minus 0.7 percent in 2012 and minus 0.4 percent in 2013 but 1.1 percent in 2014 and 1.7 percent in 2015.

Table VD-EUR, Euro Area, Yearly Percentage Change of Harmonized Index of Consumer Prices, Unemployment and GDP ∆%

| Year | HICP ∆% | Unemployment | GDP ∆% |

| 1999 | 1.2 | 9.6 | 2.9 |

| 2000 | 2.2 | 8.8 | 3.8 |

| 2001 | 2.4 | 8.2 | 2.0 |

| 2002 | 2.3 | 8.5 | 0.9 |

| 2003 | 2.1 | 9.0 | 0.7 |

| 2004 | 2.2 | 9.2 | 2.2 |

| 2005 | 2.2 | 9.1 | 1.7 |

| 2006 | 2.2 | 8.4 | 3.3 |

| 2007 | 2.2 | 7.5 | 3.0 |

| 2008 | 3.3 | 7.6 | 0.4 |

| 2009 | 0.3 | 9.6 | -4.5 |

| 2010 | 1.6 | 10.1 | 1.9 |

| 2011 | 2.7 | 10.1 | 1.6 |

| 2012 | 2.5 | 11.3 | -0.7 |

| 2013* | 1.3 | 12.0 | -0.4 |

| 2014* | 1.1 | ||

| 2015* | 1.7 |

*EUROSTAT forecast Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/

http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/search_database

The GDP of the euro area in 2012 in current US dollars in the dataset of the World Economic Outlook (WEO) of the International Monetary Fund (IMF) is $12,199.1 billion or 16.9 percent of world GDP of $72,216.4 billion (http://www.imf.org/external/pubs/ft/weo/2012/02/weodata/index.aspx). The sum of the GDP of France $2613.9 billion with the GDP of Germany of $3429.5 billion, Italy of $2014.1 billion and Spain $1323.5 billion is $9381.0 billion or 76.9 percent of total euro area GDP and 13.0 percent of World GDP. The four largest economies account for slightly more than three quarters of economic activity of the euro area. Table VD-EUR1 is constructed with the dataset of EUROSTAT, providing growth rates of the euro area as a whole and of the largest four economies of Germany, France, Italy and Spain annually from 1996 to 2011 with the estimate of 2012 and forecasts for 2013, 2014 and 2015 by EUROSTAT. The impact of the global recession on the overall euro area economy and on the four largest economies was quite strong. There was sharp contraction in 2009 and growth rates have not rebounded to earlier growth with exception of Germany in 2010 and 2011.

Table VD-EUR1, Euro Area, Real GDP Growth Rate, ∆%

| Euro Area | Germany | France | Italy | Spain | |

| 2015* | 1.7 | 1.9 | 1.7 | 1.2 | 1.7 |

| 2014* | 1.1 | 1.7 | 0.9 | 0.7 | 0.5 |

| 2013* | -0.4 | 0.4 | 0.2 | -1.9 | -1.2 |

| 2012 | -0.7 | 0.7 | 0.0 | -2.4 | -1.6 |

| 2011 | 1.6 | 3.3 | 2.0 | 0.4 | 0.1 |

| 2010 | 1.9 | 4.0 | 1.7 | 1.7 | -0.2 |

| 2009 | -4.5 | -5.1 | -3.1 | -5.5 | -3.8 |

| 2008 | 0.4 | 1.1 | -0.1 | -1.2 | 0.9 |

| 2007 | 3.0 | 3.3 | 2.3 | 1.7 | 3.5 |

| 2006 | 3.3 | 3.7 | 2.5 | 2.2 | 4.1 |

| 2005 | 1.7 | 0.7 | 1.8 | 0.9 | 3.6 |

| 2004 | 2.2 | 1.2 | 2.5 | 1.7 | 3.3 |

| 2003 | 0.7 | -0.4 | 0.9 | 0.0 | 3.1 |

| 2002 | 0.9 | 0.0 | 0.9 | 0.5 | 2.7 |

| 2001 | 2.0 | 1.5 | 1.8 | 1.9 | 3.7 |

| 2000 | 3.8 | 3.1 | 3.7 | 3.7 | 5.0 |

| 1999 | 2.9 | 1.9 | 3.3 | 1.5 | 4.7 |

| 1998 | 2.8 | 1.9 | 3.4 | 1.4 | 4.5 |

| 1997 | 2.6 | 1.7 | 2.2 | 1.9 | 3.9 |

| 1996 | 1.5 | 0.8 | 1.1 | 1.1 | 2.5 |

Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/

http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/search_database

The Flash Eurozone PMI Composite Output Index of the Markit Flash Eurozone PMI®, combining activity in manufacturing and services, decreased from 52.1 in Oct to 51.4 in Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/d5ed8bd5aad54a8f97d57072f87f0aab). Chris Williamson, Chief Economist at Markit, finds that the Markit Flash Eurozone PMI index suggests GDP growth around 0.1 to 0.2 percent in IVQ2014 (http://www.markiteconomics.com/Survey/PressRelease.mvc/d5ed8bd5aad54a8f97d57072f87f0aab). The Markit Eurozone PMI® Composite Output Index, combining services and manufacturing activity with close association with GDP decreased from 52.1 in Oct to 51.1 in Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/b7b53af9b6f94a8b8c83172ba9c9bc55). Chris Williamson, Chief Economist at Markit, finds slowing growth of GDP at around 0.1 percent in IVQ2014 (http://www.markiteconomics.com/Survey/PressRelease.mvc/b7b53af9b6f94a8b8c83172ba9c9bc55). The Markit Eurozone Services Business Activity Index decreased from 52.3 in Oct to 52.1 in Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/01d8b102223d449881e2878c1544c892). The Markit Eurozone Manufacturing PMI® decreased to 50.1 in Nov from 50.6 in Oct (http://www.markiteconomics.com/Survey/PressRelease.mvc/63f18b46a2ce43ce93fe8798d9790d9e). New export orders moderated. Chris Williamson, Chief Economist at Markit, finds slowing industrial growth in the euro area with contractions in major economies (http://www.markiteconomics.com/Survey/PressRelease.mvc/63f18b46a2ce43ce93fe8798d9790d9e). Table EUR provides the data table for the euro area.

Table EUR, Euro Area Economic Indicators

| GDP | IIIQ2014 ∆% 0.2; IIIQ2014/IIIQ2013 ∆% 0.8 Blog 12/7/14 |

| Unemployment | Oct 2014: 11.5 % unemployment rate; Oct 2014: 18.347 million unemployed Blog 11/30/14 |

| HICP | Oct month ∆%: -0.1 12 months Sep ∆%: 0.4 |

| Producer Prices | Euro Zone industrial producer prices Oct ∆%: -0.4 |

| Industrial Production | Oct month ∆%: 0.1; Oct 12 months ∆%: 0.7 |

| Retail Sales | Oct month ∆%: 0.4 |

| Confidence and Economic Sentiment Indicator | Sentiment 100.8 Nov 2014 Consumer minus 11.6 Nov 2014 Blog 11/30/14 |

| Trade | Jan-Aug 2014/Jan-Aug 2013 Exports ∆%: 0.8 Aug 2014 12-month Exports ∆% -2.8 Imports ∆% -4.4 |

Links to blog comments in Table EUR:

12/7/14 http://cmpassocregulationblog.blogspot.com/2014/12/financial-risks-twenty-six-million.html

11/30/14 http://cmpassocregulationblog.blogspot.com/2014/11/valuations-of-risk-financial-assets.html

11/16/14 http://cmpassocregulationblog.blogspot.com/2014/11/fluctuating-financial-variables.html

10/19/14 http://cmpassocregulationblog.blogspot.com/2014/10/imf-view-squeeze-of-economic-activity.html

Table VD-1 provides monthly industrial production percentage changes for total production and major segments in the euro area. Total production increased 0.1 percent in Oct 2014 with increase of 0.9 percent in durable goods and decrease of 1.9 percent in energy. Capital goods decreased 0.2 percent. Nondurable goods increased 1.8 percent and intermediate goods increased 0.3 percent. Industrial production increased in all months from Dec 2012 to Jun 2013 with exception of declines of 1.1 percent in May 2013 and 0.4 percent in Mar 2013. Industrial production changed 0.0 percent in Feb 2014, increasing 0.5 percent in Sep 2014.

Table VD-1, Euro Zone, Industrial Production Month ∆%

| Total | INT | ENE | CG | DUR | NDUR | |

| Oct 2014 | 0.1 | 0.3 | -1.9 | -0.2 | 0.9 | 1.8 |

| Sep | 0.5 | -0.3 | 0.6 | 2.2 | -1.5 | -0.6 |

| Aug | -1.1 | -1.1 | 1.7 | -3.3 | -0.5 | 0.2 |

| Jul | 0.7 | 0.9 | -1.6 | 1.9 | -0.9 | 0.8 |

| Jun | -0.4 | 0.3 | -1.1 | 0.2 | 1.8 | -2.2 |

| May | -1.0 | -2.0 | 2.9 | -0.6 | -2.2 | -1.7 |

Notes: INT: Intermediate; ENE: Energy; CG: Capital Goods; DUR: Durable Consumer Goods; NDUR: Nondurable Consumer Goods

Source: EUROSTAT

http://ec.europa.eu/eurostat/data/database

Table VD-2 provides monthly and 12-month percentage changes of industrial production and major industrial categories in the euro zone. Some 12-month percentage changes in Table VD-2 are negative in the 12 months ending in Oct 2014 with exception of increase of 3.7 percent in nondurable consumer goods, 1.4 percent in capital goods and 0.2 percent in durable consumer goods. Industrial production increased 0.1 percent in the month of Oct 2014 and increased 0.7 percent in the 12 months ending in Oct 2014.

Table VD-2, Euro Zone, Industrial Production, Month and 12-Month ∆%

| 2014 | Oct Month ∆% | Oct 12-Month ∆% |

| Total | 0.1 | 0.7 |

| Intermediate Goods | 0.3 | -0.4 |

| Energy | -1.9 | -2.5 |

| Capital Goods | -0.2 | 1.4 |

| Durable Consumer Goods | 0.9 | 0.2 |

| Nondurable Consumer Goods | 1.8 | 3.7 |

Source: EUROSTAT

http://ec.europa.eu/eurostat/data/database

There has been significant decline in percentage changes of industrial production and major categories in 12-month rates into 2012 and 2013 with recovery in 2014, as shown in Table VD-3. Negative percentage changes moderated from the high rates in Oct-Nov 2012 with return to growth. All 12-month percentage changes are negative for the various segments of euro area industrial production from May to Aug 2013 with exception of capital goods in Jun but there is improvement in Sep to Dec 2013 and Jan 2014 with positive 12-month percentage changes for total industry. There is significant improvement in 2014 with growth of 1.9 percent in the 12 months ending in Feb with deterioration to 0.3 percent in Mar 2014 and rebound of 1.9 percent in Apr 2014. The growth rate of industrial production in 12 months slowed to 0.7 percent in May 2014 and 0.2 percent in Jun 2014. Industrial production increased 1.6 percent in the 12 months ending in Jul 2014 and fell 0.6 percent in the 12 months ending in Aug 2014. Industrial production increased 0.2 percent in the 12 months ending in Sep 2014 and 0.7 percent in the 12 months ending in Oct 2014. Output of capital goods increased 2.8 percent in the 12 months ending in Mar 2014 but only 1.2 percent in the 12 months ending in Apr 2014, increasing to 1.4 percent in the 12 months ending in May 2014. Output of capital goods grew 0.3 percent in the 12 months ending in Jun 2014 and increased 4.0 percent in the 12 months ending in Jul 2014. Output of capital goods fell 2.2 percent in the 12 months ending in Aug 2014, increasing 1.5 percent in the 12 months ending in Sep 2014 and 1.4 percent in the 12 months ending in Oct 2014. Output of intermediate goods increased 0.3 percent in the 12 months ending in Jun 2014 and 1.4 percent in the 12 months ending in Jul 2014. Output of intermediate goods fell 0.5 percent in the 12 months ending in Sep 2014 and fell 0.4 percent in the 12 months ending in Oct 2014.

Table VD-3, Euro Zone, Industrial Production 12-Month ∆%

| Total | INT | ENE | CG | DUR | NDUR | |

| Oct 2014 | 0.7 | -0.4 | -2.5 | 1.4 | 0.2 | 3.7 |

| Sep | 0.2 | -0.5 | -2.9 | 1.5 | -4.0 | 1.7 |

| Aug | -0.6 | 0.0 | -3.0 | -2.2 | -2.1 | 2.8 |

| Jul | 1.6 | 1.4 | -5.0 | 4.0 | -1.9 | 2.6 |

| Jun | 0.2 | 0.3 | -3.9 | 0.3 | -2.0 | 2.4 |

| May | 0.7 | 0.4 | -3.4 | 1.4 | -1.3 | 3.2 |

Notes: INT: Intermediate; ENE: Energy; CG: Capital Goods; DUR: Durable Consumer Goods; NDUR: Nondurable Consumer Goods

Source: EUROSTAT

http://ec.europa.eu/eurostat/data/database

VE Germany. Table VE-DE provides yearly growth rates of the German economy from 1971 to 2013, price adjusted chain-linked and price and calendar-adjusted chain-linked. Germany’s GDP fell 5.6 percent in 2009 after growing below trend at 1.1 percent in 2008. Recovery has been robust in contrast with other advanced economies. The German economy grew at 4.1 percent in 2010, 3.6 percent in 2011 and 0.4 percent in 2012. Growth decelerated to 0.1 percent in 2013.

The Federal Statistical Agency of Germany analyzes the fall and recovery of the German economy (http://www.destatis.de/jetspeed/portal/cms/Sites/destatis/Internet/EN/Content/Statistics/VolkswirtschaftlicheGesamtrechnungen/Inlandsprodukt/Aktuell,templateId=renderPrint.psml):

“The German economy again grew strongly in 2011. The price-adjusted gross domestic product (GDP) increased by 3.0% compared with the previous year. Accordingly, the catching-up process of the German economy continued during the second year after the economic crisis. In the course of 2011, the price-adjusted GDP again exceeded its pre-crisis level. The economic recovery occurred mainly in the first half of 2011. In 2009, Germany experienced the most serious post-war recession, when GDP suffered a historic decline of 5.1%. The year 2010 was characterised by a rapid economic recovery (+3.7%).”

Table VE-4 provides annual growth rates of the German economy from 1970 to 2013, price adjusted chain-linked and price and calendar-adjusted chain-linked. Germany’s GDP fell 5.6 percent in 2009 after growing below trend at 1.1 percent in 2008. Recovery has been robust in contrast with other advanced economies. The German economy grew at 4.1 percent in 2010, 3.6 percent in 2011 and 0.4 percent in 2012. Growth in 2013 was 0.1 percent.

Table VE-DE, Germany, GDP ∆% on Prior Year

| Price Adjusted Chain-Linked | Price- and Calendar-Adjusted Chain Linked | |

| Average ∆% 1991-2013 | 1.3 | |

| Average ∆% 1991-1999 | 1.5 | |

| Average ∆% 2000-2007 | 1.4 | |

| Average ∆% 2003-2007 | 2.2 | |

| Average ∆% 2007-2013 | 0.5 | |

| Average ∆% 2009-2013 | 2.0 | |

| 2013 | 0.1 | 0.2 |

| 2012 | 0.4 | 0.6 |

| 2011 | 3.6 | 3.7 |

| 2010 | 4.1 | 3.9 |

| 2009 | -5.6 | -5.6 |

| 2008 | 1.1 | 0.8 |

| 2007 | 3.3 | 3.4 |

| 2006 | 3.7 | 3.9 |

| 2005 | 0.7 | 0.9 |

| 2004 | 1.2 | 0.7 |

| 2003 | -0.7 | -0.7 |

| 2002 | 0.0 | 0.0 |

| 2001 | 1.7 | 1.8 |

| 2000 | 3.0 | 3.2 |

| 1999 | 2.0 | 1.9 |

| 1998 | 2.0 | 1.7 |

| 1997 | 1.8 | 1.9 |

| 1996 | 0.8 | 0.8 |

| 1995 | 1.7 | 1.8 |

| 1994 | 2.5 | 2.5 |

| 1993 | -1.0 | -1.0 |

| 1992 | 1.9 | 1.5 |

| 1991 | 5.1 | 5.2 |

| 1990 | 5.3 | 5.5 |

| 1989 | 3.9 | 4.0 |

| 1988 | 3.7 | 3.4 |

| 1987 | 1.4 | 1.3 |

| 1986 | 2.3 | 2.3 |

| 1985 | 2.3 | 2.3 |

| 1984 | 2.8 | 2.9 |

| 1983 | 1.6 | 1.5 |

| 1982 | -0.4 | -0.5 |

| 1981 | 0.5 | 0.6 |

| 1980 | 1.4 | 1.3 |

| 1979 | 4.2 | 4.3 |

| 1978 | 3.0 | 3.1 |

| 1977 | 3.3 | 3.5 |

| 1976 | 4.9 | 4.5 |

| 1975 | -0.9 | -0.9 |

| 1974 | 0.9 | 1.0 |

| 1973 | 4.8 | 5.0 |

| 1972 | 4.3 | 4.3 |

| 1971 | 3.1 | 3.0 |

| 1970 | NA | NA |

Source: Statistisches Bundesamt Deutschland (Destatis)

https://www.destatis.de/EN/PressServices/Press/pr/2014/02/PE14_048_811.html

https://www.destatis.de/EN/PressServices/Press/pr/2013/08/PE13_278_811.html https://www.destatis.de/EN/PressServices/Press/pr/2013/11/PE13_381_811.html

https://www.destatis.de/EN/PressServices/Press/pr/2014/01/PE14_016_811.html

https://www.destatis.de/EN/PressServices/Press/pr/2014/05/PE14_167_811.html

https://www.destatis.de/EN/PressServices/Press/pr/2014/09/PE14_306_811.html

https://www.destatis.de/EN/PressServices/Press/pr/2014/11/PE14_401_811.html

The Flash Germany Composite Output Index of the Markit Flash Germany PMI®, combining manufacturing and services, decreased from 53.9 in Oct to 52.1 in Nov. The index of manufacturing output reached 52.0 in Nov, decreasing from 52.0 in Oct, while the index of services decreased to 52.1 in Nov from 54.4 in Oct. The overall Flash Germany Manufacturing PMI® decreased from 51.4 in Oct to 50.0 in Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/f44b099a010349199847985ca7b98754). New orders in manufacturing contracted. Oliver Kolodseike, Economist at Markit, finds continuing weakness in GDP growth (http://www.markiteconomics.com/Survey/PressRelease.mvc/f44b099a010349199847985ca7b98754). The Markit Germany Composite Output Index of the Markit Germany Services PMI®, combining manufacturing and services with close association with Germany’s GDP, decreased from 53.9 in Oct to 51.7 in Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/c40864faad5c4d9ebad95744770e6389). Oliver Kolodseike, Senior Economist at Markit and author of the report, finds slow growth with risks of contraction in IVQ2014 (http://www.markiteconomics.com/Survey/PressRelease.mvc/c40864faad5c4d9ebad95744770e6389). The Germany Services Business Activity Index decreased from 54.4 in Oct to 52.1 in Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/c40864faad5c4d9ebad95744770e6389). The Markit/BME Germany Purchasing Managers’ Index® (PMI®), showing close association with Germany’s manufacturing conditions, decreased from 51.4 in Oct to 49.5 in Nov (http://www.markiteconomics.com/Survey/PressRelease.mvc/66c553dd5eeb4d8bae3c46441999bede). New export orders decreased for the first month since Jul 2013 with weakness in demand from China, the US and Europe. Oliver Kolodseike, Senior Economist at Markit and author of the report, finds weakness in manufacturing (http://www.markiteconomics.com/Survey/PressRelease.mvc/66c553dd5eeb4d8bae3c46441999bede).

Table DE, Germany, Economic Indicators

| GDP | IIIQ2014 0.1 ∆%; III/Q2014/IIIQ2013 ∆% 1.2 2013/2012: 0.1% GDP ∆% 1970-2013 Blog 8/26/12 5/27/12 11/25/12 2/24/13 5/19/13 5/26/13 8/18/13 8/25/13 11/17/13 11/24/13 1/26/14 2/16/14 3/2/14 5/18/14 5/25/14 8/17/14 9/7/14 11/16/14 11/30/14 |

| Consumer Price Index | Nov month NSA ∆%: 0.0 |

| Producer Price Index | Oct month ∆%: -0.2 NSA, minus 0.1 CSA |

| Industrial Production | MFG Oct month CSA ∆%: 0.2 |

| Machine Orders | MFG Oct month ∆%: 2.5 |

| Retail Sales | Oct Month ∆% 1.9 12-Month ∆% 1.7 Blog 11/30/14 |

| Employment Report | Unemployment Rate SA Oct 4.9% |

| Trade Balance | Exports Oct 12-month NSA ∆%: 4.9 Blog 12/14/14 |

Links to blog comments in Table DE:

11/30/14 http://cmpassocregulationblog.blogspot.com/2014/11/valuations-of-risk-financial-assets.html

11/23/14 http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html

11/16/14 http://cmpassocregulationblog.blogspot.com/2014/11/fluctuating-financial-variables.html

9/7/14 http://cmpassocregulationblog.blogspot.com/2014/09/competitive-monetary-policy-and.html

8/17/2014 http://cmpassocregulationblog.blogspot.com/2014/08/weakening-world-economic-growth.html

5/25/14 http://cmpassocregulationblog.blogspot.com/2014/05/united-states-commercial-banks-assets.html

5/18/14 http://cmpassocregulationblog.blogspot.com/2014/05/world-inflation-waves-squeeze-of.html

3/2/14 http://cmpassocregulationblog.blogspot.com/2014/03/financial-risks-slow-cyclical-united.html

2/16/14 http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html

1/26/14 http://cmpassocregulationblog.blogspot.com/2014/01/capital-flows-exchange-rates-and.html

11/24/13 http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-zero-interest-rates-world.html

11/17/13 http://cmpassocregulationblog.blogspot.com/2013/11/risks-of-unwinding-monetary-policy.html

8/25/13 http://cmpassocregulationblog.blogspot.com/2013/08/interest-rate-risks-duration-dumping.html

8/18/13 http://cmpassocregulationblog.blogspot.com/2013/08/duration-dumping-and-peaking-valuations.html

There is significantly stronger performance of production in Germany with wide monthly fluctuations. The production industries index of Germany in Table VE-1 shows increase of 0.2 percent in Dec 2012 and decrease of 9.4 percent in the 12 months ending in Dec 2012. The index decreased 0.5 percent in Jan 2013 and 1.3 percent in 12 months and increased 0.7 percent in Feb 2013, declining 4.9 percent in 12 months. In Mar 2013, the production index of Germany increased 0.9 percent and fell 8.5 percent in 12 months. The production index jumped 0.9 percent in Apr 2013 and 7.5 percent in 12 months. In May 2013, the production index fell 1.1 percent and 4.4 percent in 12 months. The production index of Germany increased 1.9 percent in Jun 2013 and fell 0.4 percent in 12 months. In Jul 2013, the production industries index fell 1.3 percent and increased 1.9 percent in 12 months. The production industries index increased 2.1 percent in Aug 2013 and fell 2.8 percent in 12 months. In Sep 2013, the production index fell 0.8 percent and increased 4.2 percent in 12 months. In Oct 2013, the production index of Germany fell 0.7 percent and increased 1.3 percent in 12 months. The index of production industries increased 1.8 percent in Nov 2013 and 0.4 percent in 12 months. The index of production industries increased 0.1 percent in Dec 2013 and increased 5.9 percent in 12 months. The production industries index increased 0.5 percent in Jan 2014 and 3.3 percent in 12 months. In Feb 2014, the production industries index increased 0.3 percent and 5.8 percent in 12 months. The production industries index fell 0.7 percent in Mar 2014 and increased 4.7 percent relative to a year earlier. The production industries index of Germany changed 0.0 percent in Apr 2014 and fell 1.6 percent in 12 months. The production index fell 1.4 percent in May 2014, increasing 3.9 percent in 12 months. The production index of Germany increased 0.5 percent in Jun 2014 and fell 2.3 percent in 12 months. In Jul 2014, the production industries index of Germany increased 1.0 percent and 2.7 percent in 12 months. The production index of Germany fell 2.3 percent in Aug 2014 and decreased 5.0 percent in 12 months. The production index of Germany increased 1.1 percent in Oct 2014 and 3.6 percent in 12 months. In Oct 2014, the production index of Germany increased 0.2 percent and 0.8 percent in 12 months. Germany’s production industries suffered decline of 7.3 percent in Dec 2008 relative to Dec 2007 and decline of 2.3 percent in 2009. Recovery was vigorous with 17.1 percent in the 12 months ending in Dec 2010. The first quarter of 2011 was quite strong when the German economy outperformed the other advanced economies. The performance of Germany’s production industries from 2002 to 2006 was vigorous with average rate of 4.5 percent. Data for the production industries index of Germany fluctuate sharply from month to month and in 12-month rates.

Table VE-1, Germany, Production Industries, Month and 12-Month ∆%

| 12-Month ∆% NSA | Month ∆% Calendar SA | |

| Oct 2014 | 0.8 | 0.2 |

| Sep | 3.6 | 1.1 |

| Aug | -5.0 | -2.3 |

| Jul | 2.7 | 1.0 |

| Jun | -2.3 | 0.5 |

| May | 3.9 | -1.4 |

| Apr | -1.6 | 0.0 |

| Mar | 4.7 | -0.7 |

| Feb | 5.8 | 0.3 |

| Jan | 3.3 | 0.5 |

| Dec 2013 | 5.9 | 0.1 |

| Nov | 0.4 | 1.8 |

| Oct | 1.3 | -0.7 |

| Sep | 4.2 | -0.8 |

| Aug | -2.8 | 2.1 |

| Jul | 1.9 | -1.3 |

| Jun | -0.4 | 1.9 |

| May | -4.4 | -1.1 |

| Apr | 7.5 | 0.9 |

| Mar | -8.5 | 0.9 |

| Feb | -4.9 | 0.7 |

| Jan | -1.3 | -0.5 |

| Dec 2012 | -9.4 | 0.2 |

| Nov | -2.9 | -0.7 |

| Oct | 4.1 | -1.3 |

| Sep | -6.7 | -1.2 |

| Aug | -0.6 | 0.0 |

| Jul | 2.4 | 0.8 |

| Jun | 4.2 | -0.9 |

| May | -6.3 | 1.6 |

| Apr | -0.6 | -2.1 |

| Mar | -0.1 | 2.2 |

| Feb | 2.4 | -0.5 |

| Jan | 4.8 | 0.9 |

| Dec 2011 | 2.0 | -1.8 |

| Nov | 3.9 | -0.3 |

| Oct | 0.1 | 1.3 |

| Sep | 4.5 | -1.8 |

| Aug | 10.2 | -0.5 |

| Jul | 5.8 | 2.9 |

| Jun | -0.8 | -1.6 |

| May | 18.2 | 0.8 |

| Apr | 5.3 | 0.2 |

| Mar | 9.8 | 0.5 |

| Feb | 15.8 | 1.2 |

| Jan | 15.1 | 1.2 |

| Dec 2010 | 17.1 | |

| Dec 2009 | -2.3 | |

| Dec 2008 | -7.3 | |

| Dec 2007 | -0.1 | |

| Dec 2006 | 2.5 | |

| Dec 2005 | 4.9 | |

| Dec 2004 | 5.3 | |

| Dec 2003 | 5.1 | |

| Dec 2002 | 2.0 | |

| Dec 2001 | -8.8 | |

| Dec 2000 | 0.2 | |

| Dec 1999 | 6.4 | |

| Average ∆% per Year | ||

| Dec 1995 to Dec 2013 | 1.5 | |

| Dec 1995 to Dec 2000 | 2.7 | |

| Dec 1995 to Dec 2006 | 2.2 | |

| Dec 2002 to Dec 2006 | 4.5 |

Source: Statistiche Bundesamt Deutschland (Destatis)

https://www.destatis.de/EN/FactsFigures/Indicators/ShortTermIndicators/ShortTermIndicators.html

Table VE-2 provides monthly percentage changes of the German production industries index by components from Mar to Oct 2014. The index increased 0.2 percent in Oct 2014 with decrease of 0.4 percent in capital goods and decrease of 1.1 percent in energy. There was increase of 0.2 percent in manufacturing and increase of 0.8 percent in intermediate goods. The index increased 1.1 percent in Sep 2014 with increases in all segments except decline of 1.7 percent in nondurable goods. The index decreased 2.3 percent in Aug 2014 with all segments declining with exception of increases of 0.7 percent for nondurable goods and 4.0 percent for energy.

Table VE-2, Germany, Production Industries, Industry and Components, Month ∆%

| Oct 2014 | Sep | Aug | Jul | Jun | May | Apr | Mar | |

| Production | 0.2 | 1.1 | -2.3 | 1.0 | 0.5 | -1.4 | 0.0 | -0.7 |

| Industry | 0.2 | 1.3 | -3.2 | 1.6 | 0.4 | -1.3 | 0.1 | -0.4 |

| Mfg | 0.2 | 1.2 | -3.1 | 1.6 | 0.3 | -1.4 | 0.2 | -0.4 |

| Intermediate Goods | 0.8 | 0.0 | -1.5 | 0.8 | 0.3 | -2.3 | 0.7 | -0.7 |

| Capital | -0.4 | 3.4 | -5.8 | 3.1 | -0.2 | 0.4 | -0.6 | -0.3 |

| Durable Goods | 0.6 | 0.0 | -3.4 | -0.4 | 2.2 | -1.1 | -2.1 | 0.9 |

| Nondurable Goods | 0.5 | -1.7 | 0.7 | -0.1 | 1.8 | -3.8 | 1.7 | 0.3 |

| Energy | -1.1 | 2.7 | 4.0 | -4.6 | 0.1 | 0.5 | -0.2 | 1.3 |

Seasonally Calendar Adjusted

Source: Source: Statistisches Bundesamt Deutschland

https://www.destatis.de/EN/FactsFigures/Indicators/ShortTermIndicators/ShortTermIndicators.html

Table VE-3 provides 12-month unadjusted percentage changes of industry and components in Germany. There were percentage declines of 12-month rates in the production index of Germany and all segments in the four months from Dec 2012 to Mar 2013 with exception of nondurables in Jan 2013 and energy in Jan and Mar 2013. There is sharp recovery in Apr 2013 with growth of manufacturing by 7.9 percent and capital goods by 11.1 percent. All segments show declines in 12 months in May 2013. There are increases in the 12 months ending in Jun of 1.2 percent in capital goods and 2.8 percent in durable goods. All segments increased in Jul 2013. All segments fell in Aug 2013 with sharp declines. There is strong recovery in Sep with high rates of increase. Many segments increased in the 12 months ending in Oct 2013 with 1.7 percent growth in manufacturing and 2.0 percent in capital goods. Most segments increased in Nov 2013 with 1.1 percent in manufacturing and 1.9 percent in capital goods. All segments increased in Dec 2013 with exception of energy. Most segments increased in Jan 2014 with exception of declines for durable goods and energy. All segments increased in Feb 2014 with exception of energy. All segments increased in Mar 2014 with exception of energy. All segments decreased in Apr 2014 with exception of intermediate goods and nondurable goods. All segments increased in May 2014 with exception of energy. All segments fell in Jun 2014 with exception of nondurable goods. All segments increased in Jul 2014 with exception of energy and durable goods. All segments declined in the 12 months ending in Aug 2014. All segments increased in the 12 months ending in Sep 2014 with exception of energy. All segments increased in the 12 months ending in Oct 2014 with exception of energy. All Percentage declines in 12 months are quite sharp in Dec 2012 with many percentage changes negative around two-digits. Although there are sharp fluctuations in the data, there is suggestion of deceleration that would be expected from much higher earlier rates. The deceleration is quite evident in single-digit percentage changes from Sep 2011 to Dec 2012 relative to high double-digit percentage changes in Jan-Mar 2011. There are multiple negative 12-month percentage changes across many segments. Growth rates in the recovery from the global recession from IVQ2007 to IIQ2009 were initially very vigorous in comparison with the growth rates before the contraction that are shown in the bottom part of Table VE-3.

Table VE-3, Germany, Industry and Components, 12-Month ∆% Unadjusted

| IND | MFG | INTG | CG | DG | NDG | EN | |

| 2014 | |||||||

| Oct | 1.1 | 1.2 | -0.1 | 2.6 | 0.8 | 0.6 | -3.2 |

| Sep | 4.3 | 4.3 | 3.0 | 5.8 | 1.2 | 3.8 | -3.0 |

| Aug | -4.9 | -4.8 | -2.6 | -8.2 | -6.4 | -0.7 | -5.9 |

| Jul | 4.5 | 4.4 | 1.8 | 8.0 | -0.5 | 2.2 | -9.6 |

| Jun | -1.8 | -2.0 | -1.5 | -2.4 | -6.3 | 0.6 | -5.8 |

| May | 4.8 | 4.7 | 2.7 | 7.5 | 6.6 | 1.9 | -2.4 |

| Apr | -1.1 | -0.8 | 0.9 | -3.3 | -4.2 | 1.8 | -6.7 |

| Mar | 5.3 | 5.2 | 5.0 | 5.8 | 4.9 | 4.8 | -9.0 |

| Feb | 5.9 | 5.9 | 6.5 | 5.9 | 4.4 | 4.7 | -5.2 |

| Jan | 3.4 | 3.3 | 2.4 | 5.5 | -1.4 | 1.3 | -2.3 |

| 2013 | |||||||

| Dec | 6.2 | 6.1 | 7.1 | 6.4 | 5.2 | 4.2 | -0.1 |

| Nov | 1.1 | 1.1 | 0.6 | 1.9 | -0.4 | 0.5 | -1.6 |

| Oct | 1.8 | 1.7 | 2.3 | 2.0 | -0.4 | 0.0 | -0.3 |

| Sep | 4.7 | 4.6 | 4.0 | 5.8 | 6.1 | 2.5 | 0.8 |

| Aug | -2.9 | -3.0 | -4.0 | -1.8 | -7.5 | -2.4 | -3.1 |

| Jul | 1.6 | 1.6 | 2.1 | 0.5 | 4.1 | 3.5 | 0.7 |

| Jun | -0.1 | 0.0 | -1.6 | 1.2 | 2.8 | -1.1 | -1.6 |

| May | -4.5 | -4.4 | -3.6 | -5.9 | -10.2 | -0.9 | -4.6 |

| Apr | 8.1 | 7.9 | 4.3 | 11.1 | 9.3 | 8.9 | 0.4 |

| Mar | -8.4 | -8.3 | -7.3 | -9.6 | -9.0 | -7.0 | 2.4 |

| Feb | -5.1 | -5.2 | -5.7 | -5.4 | -6.1 | -2.3 | -8.9 |

| Jan | -1.2 | -1.1 | -1.3 | -2.7 | -2.8 | 3.8 | 0.1 |

| 2012 | |||||||

| Dec | -9.6 | -9.4 | -11.8 | -8.5 | -12.5 | -7.0 | -2.4 |

| Nov | -3.1 | -3.1 | -3.9 | -2.7 | -7.6 | -1.2 | 0.7 |

| Oct | 3.9 | 3.8 | 2.8 | 4.0 | 0.7 | 7.0 | 3.2 |

| Sep | -7.6 | -7.5 | -8.8 | -7.1 | -11.2 | -5.2 | 4.0 |

| Aug | -1.1 | -1.0 | -3.2 | 0.3 | 0.4 | 0.7 | 4.5 |

| Jul | 2.0 | 2.0 | 0.3 | 4.6 | -2.4 | -0.7 | 2.2 |

| Jun | 3.8 | 3.7 | 1.9 | 6.5 | 7.2 | 0.3 | 6.7 |

| May | -7.0 | -6.8 | -7.5 | -6.1 | -10.6 | -7.7 | 4.0 |

| Apr | -1.1 | -1.1 | -2.0 | 1.9 | -5.3 | -5.9 | 3.7 |

| Mar | -0.5 | -0.4 | -3.1 | 2.8 | -6.2 | -2.3 | -0.8 |

| Feb | 3.2 | 3.3 | 0.9 | 7.3 | -0.1 | -2.3 | 5.9 |

| Jan | 5.6 | 5.6 | 3.0 | 10.4 | 4.7 | 0.1 | -3.3 |

| 2011 | |||||||

| Dec | 1.5 | 1.4 | 1.8 | 1.3 | 0.2 | 1.4 | -9.2 |

| Nov | 4.6 | 4.5 | 2.9 | 8.1 | 2.3 | -1.0 | -5.8 |

| Oct | 0.6 | 0.7 | -0.3 | 3.2 | -2.3 | -3.4 | -6.1 |

| Sep | 5.7 | 5.7 | 4.6 | 9.2 | 3.4 | -0.8 | -6.1 |

| Aug | 12.4 | 12.2 | 9.3 | 20.4 | 4.8 | 1.4 | -3.0 |

| Jul | 7.9 | 7.8 | 5.0 | 13.7 | 6.8 | 0.1 | -5.7 |

| Jun | 0.5 | 0.5 | 0.2 | 2.3 | -10.2 | -2.1 | -4.7 |

| May | 21.5 | 21.2 | 17.9 | 28.3 | 20.8 | 12.8 | -7.3 |

| Apr | 7.5 | 7.5 | 6.1 | 11.1 | 4.6 | 1.6 | -5.5 |

| Mar | 11.2 | 11.2 | 10.8 | 15.0 | 8.6 | 2.0 | 2.8 |

| Feb | 17.3 | 17.1 | 16.3 | 23.1 | 10.1 | 6.3 | -0.4 |

| Jan | 17.2 | 16.9 | 17.5 | 23.1 | 9.9 | 3.6 | -2.6 |

| 2010 | |||||||

| Dec | 17.6 | 17.6 | 14.8 | 25.9 | 8.5 | 1.7 | 2.6 |

| Nov | 13.9 | 13.9 | 12.9 | 19.2 | 7.7 | 3.9 | 3.5 |

| Oct | 9.9 | 9.9 | 9.7 | 14.0 | 6.3 | 0.8 | 2.5 |

| Sep | 9.8 | 9.5 | 12.2 | 10.1 | 8.3 | 2.6 | 2.1 |

| Aug | 16.9 | 17.0 | 19.3 | 19.9 | 18.3 | 6.9 | 1.3 |

| Jul | 9.0 | 8.9 | 13.2 | 8.7 | 7.4 | 0.8 | 1.9 |

| Jun | 16.4 | 16.2 | 20.8 | 16.1 | 19.7 | 5.1 | -2.8 |

| May | 13.1 | 13.3 | 20.0 | 12.0 | 11.2 | 1.4 | 11.1 |

| Apr | 14.9 | 14.9 | 21.7 | 15.5 | 8.8 | 0.2 | 9.4 |

| Mar | 14.3 | 14.5 | 20.4 | 12.3 | 11.8 | 5.8 | 4.2 |

| Feb | 6.8 | 7.4 | 10.6 | 6.5 | 7.9 | -1.0 | 3.7 |

| Jan | 0.4 | 0.9 | 6.3 | -3.8 | 0.8 | -3.0 | 0.8 |

| Dec 2010 | 17.6 | 17.6 | 14.8 | 25.9 | 8.5 | 1.7 | 2.6 |

| Dec 2009 | -3.2 | -3.1 | 3.3 | -9.9 | -0.1 | 1.1 | 3.7 |

| Dec 2008 | -7.6 | -7.4 | -14.3 | -5.4 | -11.2 | 3.7 | -9.0 |

| Dec 2007 | 0.0 | -0.3 | -0.6 | 2.5 | -10.0 | -2.7 | 1.6 |

| Dec 2006 | 3.2 | 3.1 | 5.2 | 2.3 | 8.6 | -0.9 | -5.3 |

| Dec 2005 | 5.8 | 5.9 | 3.5 | 9.0 | 3.2 | 2.1 | 0.6 |

| Dec 2004 | 5.3 | 5.5 | 7.7 | 3.4 | 0.8 | 5.7 | 9.6 |

| Dec 2003 | 5.5 | 5.3 | 5.5 | 6.4 | 1.7 | 4.4 | 0.3 |

| Dec 2002 | 3.7 | 3.3 | 5.4 | 3.4 | -5.9 | 2.3 | -2.6 |

Note: IND: Industry; MFG: Manufacturing; INTG: Intermediate Goods; CG: Capital Goods; DG: Durable Goods; NDG: Nondurable Goods; EN: Energy

Source: Statistisches Bundesamt Deutschland (Destatis

https://www.destatis.de/EN/FactsFigures/Indicators/ShortTermIndicators/ShortTermIndicators.html

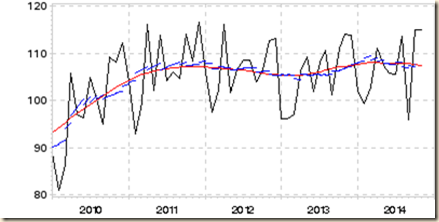

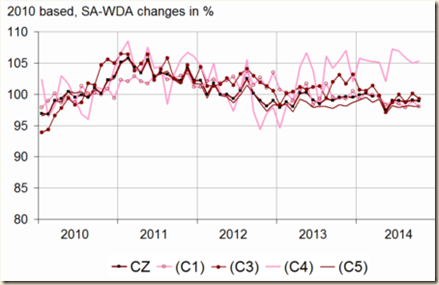

Broader perspective since 2005 is provided by Chart VE-1 of the Statistisches Bundesamt Deutschland, Federal Statistical Agency of Germany. The index of production industries not seasonally adjusted rises by more than one third between 2003 and 2008 with sharp fluctuations and then collapses during the global recession in 2008. Recovery has been in a steep upward trajectory that has recovered at the more recent peaks the losses during the contraction. Recovery stalled recently with increase at the margin.

Chart VE-1, Germany, Production Industries, Not Adjusted, 2010=100

Source: Statistiche Bundesamt Deutschland

https://www.destatis.de/EN/FactsFigures/Indicators/ShortTermIndicators/ShortTermIndicators.html

More detail is provided by Chart VE-2 of the Statistiche Bundesamt Deutschland, or Federal Statistical Agency of Germany, with the unadjusted production industries index and trend from 2010 to 2014. There could be some flattening in recent months probably leading into stagnation, mild downturn and recent recovery as depicted by trend. There is weakness in the current segment with stability/decline followed with increase/stability.

Chart VE-2, Germany, Production Industries, Not Adjusted, 2010=100

Source: Statistiche Bundesamt Deutschland

https://www.destatis.de/EN/FactsFigures/Indicators/ShortTermIndicators/ShortTermIndicators.html

Table VE-4 provides month and 12-month rates of growth of manufacturing in Germany from Dec 2010 to Oct 2014. There are fluctuations in both monthly rates and in the past 12 months. In Jan 2013, manufacturing fell 1.1 percent and decreased 1.1 percent in 12 months. Manufacturing increased 1.0 percent in Feb 2013, declining 5.2 percent in 12 months. In Mar 2013, manufacturing increased 0.9 percent but fell 8.3 percent in 12 months. There is strong recovery in Apr 2013 with growth of 0.5 percent and 7.9 percent in 12 months. Manufacturing fell 0.9 percent in May 2013 and declined 4.4 percent in 12 months. Recovery is strong in Jun 2013 with growth of 1.9 percent in the month but change of 0.0 percent in 12 months. Manufacturing fell 1.8 percent in Jul 2013 and increased 1.6 percent in 12 months. In Aug 2013, manufacturing increased 2.7 percent and fell 3.0 percent in 12 months. Manufacturing fell 1.1 percent in Sep 2013 and increased 4.6 percent in 12 months. Manufacturing increased 2.3 percent in Nov 2013 and 1.1 percent in 12 months. In Dec 2013, manufacturing increased 0.1 percent and increased 6.1 percent in 12 months. Manufacturing changed 0.0 percent in Jan 2014, increasing 3.3 percent in 12 months. In Feb 2014, manufacturing increased 0.5 percent and 5.9 percent in 12 months. Manufacturing fell 0.4 percent in Mar 2014 and increased 5.2 percent in 12 months. Manufacturing increased 0.2 percent in Apr 2014 and fell 0.8 percent in 12 months. Manufacturing fell 1.4 percent in May, increasing 4.7 percent in 12 months. Manufacturing increased 0.3 percent in Jun 2014 and fell 2.0 percent in 12 months. In Jul 2014, manufacturing jumped 1.6 percent and increased 4.4 percent in 12 months. Manufacturing fell 3.1 percent in Aug 2014 and declined 4.8 percent in 12 months. Manufacturing increased 1.2 percent in Sep 2014 and 1.2 percent in 12 months. In Oct 2014, manufacturing increased 0.2 percent and 1.2 percent in 12 months.

Table VE-4, Germany, Manufacturing Month and 12-Month ∆%

| 12-Month ∆% NSA | Month ∆% SA and Calendar Adjusted | |

| Oct 2014 | 1.2 | 0.2 |

| Sep | 4.3 | 1.2 |

| Aug | -4.8 | -3.1 |

| Jul | 4.4 | 1.6 |

| Jun | -2.0 | 0.3 |

| May | 4.7 | -1.4 |

| Apr | -0.8 | 0.2 |

| Mar | 5.2 | -0.4 |

| Feb | 5.9 | 0.5 |

| Jan | 3.3 | 0.0 |

| Dec 2013 | 6.1 | 0.1 |

| Nov | 1.1 | 2.3 |

| Oct | 1.7 | -0.6 |

| Sep | 4.6 | -1.1 |

| Aug | -3.0 | 2.7 |

| Jul | 1.6 | -1.8 |

| Jun | 0.0 | 1.9 |

| May | -4.4 | -0.9 |

| Apr | 7.9 | 0.5 |

| Mar | -8.3 | 0.9 |

| Feb | -5.2 | 1.0 |

| Jan | -1.1 | -1.1 |

| Dec 2012 | -9.4 | 1.0 |

| Nov | -3.1 | -0.6 |

| Oct | 3.8 | -1.4 |

| Sep | -7.5 | -1.6 |

| Aug | -1.0 | 0.1 |

| Jul | 2.0 | 1.2 |

| Jun | 3.7 | -1.3 |

| May | -6.8 | 2.1 |

| Apr | -1.1 | -1.9 |

| Mar | -0.4 | 1.0 |

| Feb | 3.3 | 0.2 |

| Jan | 5.6 | 0.7 |

| Dec 2011 | 1.4 | -1.6 |

| Nov | 4.5 | -0.7 |

| Oct | 0.7 | 1.1 |

| Sep | 5.7 | -1.9 |

| Aug | 12.2 | -0.5 |

| Jul | 7.8 | 3.2 |

| Jun | 0.5 | -1.7 |

| May | 21.2 | 1.1 |

| Apr | 7.5 | 0.6 |

| Mar | 11.2 | 0.6 |

| Feb | 17.1 | 1.4 |

| Jan | 16.9 | 0.0 |

| Dec 2010 | 17.6 | 1.3 |

Source: Statistisches Bundesamt Deutschland (Destatis)

https://www.destatis.de/EN/FactsFigures/Indicators/ShortTermIndicators/ShortTermIndicators.html

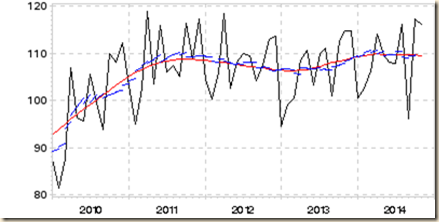

Chart VE-3 of the Statistisches Bundesamt Deutschland, or Federal Statistical Office of Germany, provides the manufacturing index of Germany from 2010 to 2014. Manufacturing was already flattening in 2007 and fell sharply in 2008 to the beginning of 2010. Manufacturing grew sharply in the initial phase of recovery but has flattened in recent months as revealed by the trend that may be turning downwardly.

Chart VE-3, Germany, Production Index, Manufacturing, Not Adjusted Index and Trend, 2010=100

Source: Statistiche Bundesamt Deutschland https://www.destatis.de/EN/FactsFigures/Indicators/ShortTermIndicators/ShortTermIndicators.html

Table VE-5 provides month and 12-month rates of growth of new orders of manufacturing in Germany from Jan 2010 to Oct 2014. There are fluctuations in both monthly rates and in the past 12 months. Table VE-5 reveals strong fluctuations in an evident deceleration of total orders for industry of Germany with recent oscillating improvement. Total orders for manufacturing increased 2.5 percent in Oct 2014 and increased 2.5 percent in 12 months. There is the same behavior for total, foreign and domestic orders with decline in 12-month rates from two-digit levels to single digits and negative changes. An important aspect of Germany is that the bulk of orders is domestic or from other European countries while foreign orders have been growing rapidly. There is weakening world trade affecting export economies. As in other countries, data on orders for manufacturing are highly volatile. Most 12-month percentage changes from Jan 2012 to Sep 2012 in Table VE-5 are negative largely because of the unusual strength of the Germany economy in the beginning of 2011 but more recently because of slowing world economy in 2012-2014.

Table VE-5, Germany, Volume of Orders Received in Manufacturing, Total, Domestic and Foreign, ∆%

| Total | Total | Foreign 12 M | Foreign M | Home | Home | |

| 2014 | ||||||

| Oct | 2.4 | 2.5 | 2.2 | 0.6 | 2.5 | 5.3 |

| Sep | 2.1 | 1.1 | 4.1 | 4.0 | -0.4 | -2.6 |

| Aug | -2.1 | -4.2 | -0.1 | -6.5 | -4.5 | -1.0 |

| Jul | 5.9 | 4.8 | 9.3 | 7.6 | 1.5 | 1.1 |

| Jun | -4.0 | -2.4 | -5.0 | -3.2 | -2.4 | -1.4 |

| May | 7.7 | -1.2 | 7.6 | -0.5 | 7.8 | -2.0 |

| Apr | 3.7 | 2.7 | 4.6 | 4.2 | 2.5 | 0.8 |

| Mar | 3.2 | -2.3 | 2.5 | -3.9 | 4.2 | -0.3 |

| Feb | 7.6 | 0.7 | 9.3 | 0.5 | 5.6 | 1.1 |

| Jan | 5.8 | 0.0 | 8.2 | -1.6 | 2.9 | 2.2 |

| 2013 | ||||||

| Dec | 8.4 | 0.0 | 10.7 | 1.9 | 5.0 | -2.4 |

| Nov | 4.5 | 0.7 | 6.0 | -0.3 | 2.5 | 2.2 |

| Oct | 3.7 | -0.4 | 4.1 | 0.2 | 3.1 | -1.1 |

| Sep | 11.2 | 2.6 | 13.7 | 5.0 | 8.0 | -0.4 |

| Aug | 0.0 | 0.6 | -0.9 | -0.4 | 1.0 | 1.8 |

| Jul | 5.1 | -2.9 | 5.5 | -4.8 | 4.8 | -0.3 |

| Jun | 4.8 | 5.1 | 7.9 | 6.1 | 0.7 | 3.9 |

| May | -3.6 | -0.3 | -1.6 | 0.6 | -6.2 | -1.5 |

| Apr | 5.9 | -2.5 | 7.6 | -2.1 | 3.6 | -2.8 |

| Mar | -5.6 | 2.5 | -4.4 | 3.0 | -7.2 | 1.8 |

| Feb | -2.7 | 1.5 | -1.5 | 1.8 | -4.2 | 1.1 |

| Jan | 0.3 | -1.1 | 1.9 | -2.5 | -1.7 | 0.9 |

| 2012 | ||||||

| Dec | -9.1 | 1.6 | -6.7 | 2.3 | -12.6 | 0.6 |

| Nov | -0.9 | -3.0 | 2.4 | -4.7 | -5.1 | -0.6 |

| Oct | 4.5 | 4.2 | 7.0 | 7.2 | 1.3 | 0.3 |

| Sep | -8.9 | -2.3 | -6.6 | -3.9 | -11.7 | -0.4 |

| Aug | -4.4 | -0.5 | -2.1 | 0.4 | -7.1 | -1.6 |

| Jul | -1.6 | 0.4 | 0.6 | 0.6 | -4.2 | 0.2 |

| Jun | -4.5 | -1.9 | -6.4 | -1.9 | -1.7 | -2.0 |

| May | -11.0 | 1.0 | -3.7 | 2.3 | -18.8 | -0.6 |

| Apr | -3.9 | -2.0 | -4.4 | -3.2 | -3.1 | -0.5 |

| Mar | -2.2 | 2.6 | -1.2 | 3.6 | -3.3 | 1.4 |

| Feb | -4.3 | 0.6 | -4.7 | 1.8 | -3.8 | -0.9 |

| Jan | -2.6 | -2.3 | -4.6 | -3.8 | -0.2 | -0.4 |

| 2011 | ||||||

| Dec | 0.0 | 2.6 | -0.3 | 4.7 | 0.5 | 0.0 |

| Nov | -4.8 | -3.3 | -8.2 | -5.3 | -0.3 | -0.7 |

| Oct | 0.1 | 2.0 | 2.1 | 3.9 | -2.1 | -0.2 |

| Sep | 2.2 | -3.6 | 1.9 | -4.9 | 2.6 | -2.2 |

| Aug | 7.1 | -0.6 | 5.2 | 0.6 | 9.4 | -2.0 |

| Jul | 4.9 | -2.3 | 4.6 | -6.3 | 5.4 | 2.9 |

| Jun | 3.5 | -0.2 | 7.8 | 9.4 | -2.0 | -10.6 |

| May | 23.1 | 2.8 | 16.0 | -4.0 | 31.8 | 11.3 |

| Apr | 6.7 | 1.6 | 9.6 | 2.1 | 3.0 | 1.1 |

| Mar | 9.8 | -2.9 | 12.3 | -2.9 | 6.9 | -3.0 |

| Feb | 21.5 | 0.9 | 24.1 | 0.5 | 18.4 | 1.6 |

| Jan | 22.5 | 3.8 | 26.1 | 3.6 | 18.2 | 4.0 |

| 2010 | ||||||

| Dec | 21.8 | -2.7 | 26.8 | -3.9 | 15.4 | -1.1 |

| Nov | 21.4 | 5.2 | 27.1 | 8.5 | 15.0 | 1.2 |

| Oct | 14.2 | 0.9 | 18.2 | 0.8 | 10.0 | 0.9 |

| Sep | 13.9 | -1.6 | 15.6 | -4.0 | 11.9 | 1.6 |

| Aug | 22.2 | 2.6 | 29.7 | 4.7 | 14.5 | 0.0 |

| Jul | 14.1 | -1.0 | 21.4 | -1.0 | 6.4 | -0.9 |

| Jun | 27.6 | 2.7 | 30.6 | 3.5 | 24.2 | 1.8 |

| May | 24.8 | 0.1 | 29.6 | 0.9 | 19.4 | -0.9 |

| Apr | 29.9 | 2.9 | 34.0 | 3.0 | 25.7 | 3.0 |

| Mar | 29.4 | 5.0 | 32.9 | 5.1 | 25.8 | 4.9 |

| Feb | 24.0 | 0.0 | 28.7 | 0.6 | 18.6 | -0.7 |

| Jan | 17.0 | 3.8 | 23.8 | 4.3 | 9.8 | 3.1 |

| Dec 2009 | 9.1 | -1.7 | 10.5 | -2.6 | 7.3 | -0.5 |

| Dec 2008 | -28.3 | -6.7 | -31.5 | -9.5 | -23.7 | -2.9 |

| Dec 2007 | 7.1 | -0.9 | 9.1 | -2.0 | 4.4 | 0.2 |

| Dec 2006 | 2.8 | 0.8 | 3.4 | 0.5 | 2.2 | 1.1 |

| Dec 2005 | 5.0 | -0.5 | 10.4 | -1.1 | -1.4 | 0.3 |

| Dec 2004 | 12.7 | 6.5 | 13.0 | 8.5 | 12.7 | 4.9 |

| Dec 2003 | 10.7 | 2.4 | 16.4 | 5.4 | 5.1 | -0.8 |

| Dec 2002 | -0.2 | -3.4 | -0.8 | -6.6 | 0.2 | -0.3 |

| Average ∆% 2003-2007 | 7.6 | 10.4 | 4.5 | |||

| Average ∆% 2003-2012 | 2.3 | 3.9 | 0.3 |

Notes: AE: Annual Equivalent; M: Month; M: Calendar and seasonally adjusted; 12 M: Non-adjusted Source: Statistisches Bundesamt Deutschland

https://www.destatis.de/EN/FactsFigures/Indicators/ShortTermIndicators/ShortTermIndicators.html

Orders for capital goods of Germany are shown in Table VE-6. Total capital goods orders increased 3.0 percent in Oct 2014 and increased 4.4 percent in 12 months. Domestic orders increased 8.6 percent in Oct and foreign orders decreased 0.1 percent. There has been deceleration from 2010 and early 2011 with growth rates falling from two digit levels to single digits, and multiple negative changes with recent improvement. An important aspect of Germany’s economy shown in Tables VE-5 and VE-6 is the success in increasing the competitiveness of its economic activities as shown by rapid growth of orders for industry after the recession of 2001 in the period before the global recession beginning in late 2007. Germany adopted fiscal and labor market reforms to increase productivity.

Table VE-6, Germany, Volume of Orders Received of Capital Goods Industries, Total, Foreign and Domestic, ∆%

| Total 12 M | Total M | Foreign 12 M | Foreign M | Domestic 12 M | Domestic M | |

| 2014 | ||||||

| Oct | 4.4 | 3.0 | 3.2 | -0.1 | 6.5 | 8.6 |

| Sep | 1.1 | 1.4 | 2.4 | 4.0 | -1.2 | -3.1 |

| Aug | -2.4 | -6.6 | -0.3 | -9.6 | -5.7 | -1.0 |

| Jul | 8.8 | 9.2 | 12.6 | 12.6 | 2.3 | 3.3 |

| Jun | -7.6 | -5.1 | -9.0 | -6.3 | -4.7 | -3.0 |

| May | 10.1 | -0.2 | 10.0 | 1.1 | 10.5 | -2.4 |

| Apr | 5.4 | 3.7 | 6.4 | 5.7 | 3.6 | 0.4 |

| Mar | 3.2 | -2.9 | 1.2 | -5.0 | 6.5 | 0.7 |

| Feb | 7.4 | 0.5 | 9.0 | 0.0 | 4.7 | 1.4 |

| Jan | 7.0 | -1.2 | 9.4 | -3.8 | 3.2 | 3.9 |

| 2013 | ||||||

| Dec | 10.7 | 1.2 | 14.8 | 4.9 | 3.2 | -5.2 |

| Nov | 6.8 | 2.2 | 7.4 | 1.5 | 5.3 | 3.6 |

| Oct | 2.7 | -2.9 | 2.1 | -3.1 | 3.3 | -2.5 |

| Sep | 14.6 | 3.6 | 17.1 | 6.7 | 10.3 | -1.5 |

| Aug | 3.1 | 0.9 | 1.5 | -0.7 | 5.7 | 3.8 |

| Jul | 6.3 | -5.3 | 7.3 | -7.5 | 5.0 | -1.4 |

| Jun | 9.1 | 9.2 | 13.5 | 10.1 | 1.8 | 7.5 |

| May | -3.1 | -0.4 | -0.4 | 1.4 | -7.8 | -3.3 |

| Apr | 6.0 | -2.8 | 7.3 | -3.4 | 3.7 | -2.0 |