IIA United States Industrial Production. There is socio-economic stress in the combination of adverse events and cyclical performance:

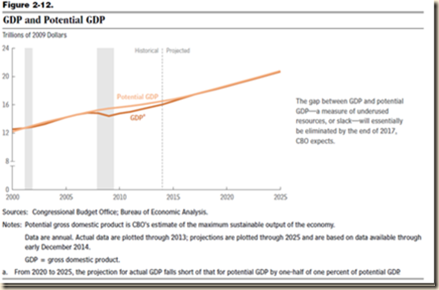

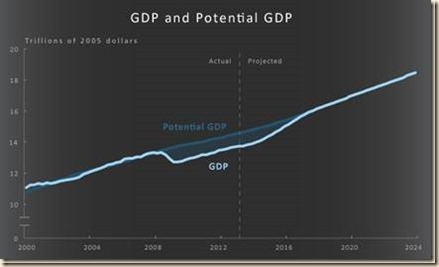

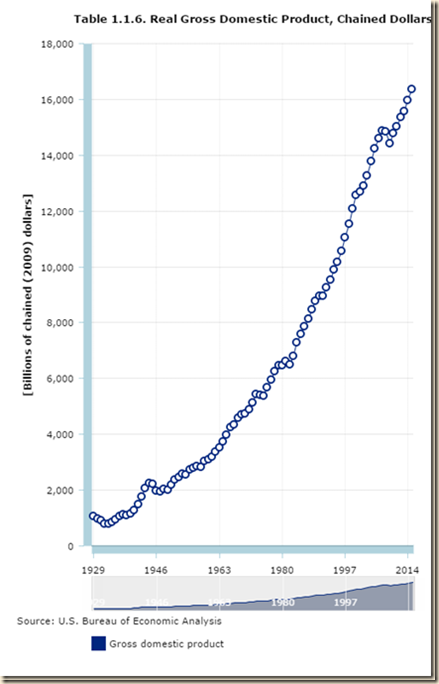

- Mediocre economic growth below potential and long-term trend, resulting in idle productive resources with GDP two trillion dollars below trend (http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/appropriate-for-fed-to-increase.html). US GDP grew at the average rate of 3.2 percent per year from 1929 to 2015, with similar performance in whole cycles of contractions and expansions, but only at 1.2 percent per year on average from 2007 to 2015. GDP in IQ2016 is 13.7 percent lower than what it would have been had it grown at trend of 3.0 percent

- Private fixed investment stagnating at increase of 6.7 percent in the entire cycle from IVQ2007 to IQ2016 (http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/appropriate-for-fed-to-increase.html)

- Twenty four million or 14.1 percent of the effective labor force unemployed or underemployed in involuntary part-time jobs with stagnating or declining real wages (http://cmpassocregulationblog.blogspot.com/2016/07/fluctuating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/fluctuating-risk-financial-assets-in.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-with-exchange-rate.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-fed-funds-rate-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/turbulence-of-financial-asset.html)

- Stagnating real disposable income per person or income per person after inflation and taxes (http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/fluctuating-risk-financial-assets-in.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/dollar-revaluation-and-decreasing.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html)

- Depressed hiring that does not afford an opportunity for reducing unemployment/underemployment and moving to better-paid jobs (http://cmpassocregulationblog.blogspot.com/2016/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/considerable-uncertainty-about-economic.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/recovery-without-hiring-ten-million.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/contraction-of-united-states-corporate.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/subdued-foreign-growth-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-volatile_17.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-policy-conundrum-recovery.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/impact-of-monetary-policy-on-exchange.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what_13.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/volatility-of-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/volatility-of-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/dollar-revaluation-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-exchange-rate-struggle-recovery.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/g20-monetary-policy-recovery-without.html)

- Productivity growth fell from 2.2 percent per year on average from 1947 to 2015 and average 2.3 percent per year from 1947 to 2007 to 1.2 percent per year on average from 2007 to 2015, deteriorating future growth and prosperity (http://cmpassocregulationblog.blogspot.com/2016/06/considerable-uncertainty-about-economic.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-fed-funds-rate-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/quite-high-equity-valuations-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-competitive-devaluation-rules.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/financial-risks-twenty-six-million.html)

- Output of manufacturing in Jun 2016 at 25.3 percent below long-term trend since 1919 and at 18.2 percent below trend since 1986 (Section II and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/04/contracting-united-states-industrial.html and earlier (http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/unconventional-monetary-policy-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/exchange-rate-and-financial-asset.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/fluctuating-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/imf-view-squeeze-of-economic-activity.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html)

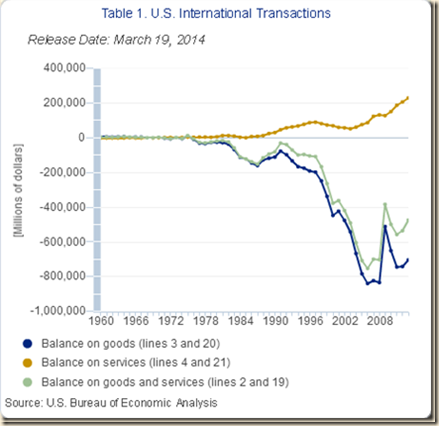

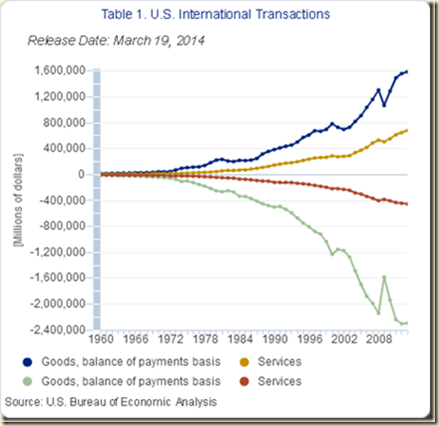

- Unsustainable government deficit/debt and balance of payments deficit (Section II and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-reducing.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/06/valuation-risks-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/02/theory-and-reality-of-cyclical-slow.html http://cmpassocregulationblog.blogspot.com/2014/03/interest-rate-risks-world-inflation.html http://cmpassocregulationblog.blogspot.com/2013/12/tapering-quantitative-easing-mediocre.html and earlier http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html)

- Worldwide waves of inflation (http://cmpassocregulationblog.blogspot.com/2016/07/oscillating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/contracting-united-states-industrial.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/uncertainty-of-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/global-decline-of-values-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/interest-rate-policy-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/irrational-exuberance-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2015/01/competitive-currency-conflicts-world.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/financial-oscillations-world-inflation.html http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html http://cmpassocregulationblog.blogspot.com/2014/07/world-inflation-waves-united-states.html)

- Deteriorating terms of trade and net revenue margins of production across countries in squeeze of economic activity by carry trades induced by zero interest rates (ES and earlier http://cmpassocregulationblog.blogspot.com/2016/06/fomc-projections-world-inflation-waves.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/most-fomc-participants-judged-that-if.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/imf-view-of-world-economy-and-finance.html and earlier) (http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-competitive.html and earlier http://cmpassocregulationblog.blogspot.com/2016/02/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/uncertainty-of-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/liftoff-of-interest-rates-with-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/interest-rate-liftoff-followed-by.html http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-quagmire-world.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-increase-on-hold-because.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/global-decline-of-values-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/07/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/global-portfolio-reallocations-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/impatience-with-monetary-policy-of.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/world-financial-turbulence-squeeze-of.html http://cmpassocregulationblog.blogspot.com/2015/01/exchange-rate-conflicts-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/imf-view-squeeze-of-economic-activity.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html)

- Financial repression of interest rates and credit affecting the most people without means and access to sophisticated financial investments with likely adverse effects on income distribution and wealth disparity (http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/twenty-four-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/04/proceeding-cautiously-in-monetary.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/twenty-five-million-unemployed-or.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/closely-monitoring-global-economic-and.html and earlier http://cmpassocregulationblog.blogspot.com/2015/12/dollar-revaluation-and-decreasing.html and earlier http://cmpassocregulationblog.blogspot.com/2015/11/dollar-revaluation-constraining.html and earlier (http://cmpassocregulationblog.blogspot.com/2015/11/live-possibility-of-interest-rates.html and earlier http://cmpassocregulationblog.blogspot.com/2015/10/labor-market-uncertainty-and-interest.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/interest-rate-policy-dependent-on-what.html and earlier http://cmpassocregulationblog.blogspot.com/2015/08/fluctuating-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/international-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/higher-volatility-of-asset-prices-at.html and earlier http://cmpassocregulationblog.blogspot.com/2015/05/dollar-devaluation-and-carry-trade.html and earlier http://cmpassocregulationblog.blogspot.com/2015/04/volatility-of-valuations-of-financial.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/global-competitive-devaluation-rules.html and earlier http://cmpassocregulationblog.blogspot.com/2015/02/job-creation-and-monetary-policy-twenty.html and earlier (http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/growth-uncertainties-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/10/world-financial-turbulence-twenty-seven.html)

- 47 million in poverty and 33 million without health insurance with family income adjusted for inflation regressing to 1996 levels (http://cmpassocregulationblog.blogspot.com/2015/10/interest-rate-policy-uncertainty-imf.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2013/09/duration-dumping-and-peaking-valuations.html)

- Net worth of households and nonprofits organizations increasing by 16.7 percent after adjusting for inflation in the entire cycle from IVQ2007 to IQ2016 when it would have grown over 28.6 percent at trend of 3.1 percent per year in real terms from IVQ1945 to IQ2016 (http://cmpassocregulationblog.blogspot.com/2016/06/of-course-considerable-uncertainty.html and earlier http://cmpassocregulationblog.blogspot.com/2016/03/monetary-policy-and-fluctuations-of_13.html and earlier http://cmpassocregulationblog.blogspot.com/2016/01/weakening-equities-and-dollar.html and earlier http://cmpassocregulationblog.blogspot.com/2015/09/monetary-policy-designed-on-measurable.html and earlier http://cmpassocregulationblog.blogspot.com/2015/06/fluctuating-financial-asset-valuations.html and earlier http://cmpassocregulationblog.blogspot.com/2015/03/dollar-revaluation-and-financial-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2014/12/valuations-of-risk-financial-assets.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/financial-volatility-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/06/financial-indecision-mediocre-cyclical.html and earlier http://cmpassocregulationblog.blogspot.com/2014/03/global-financial-risks-recovery-without.html and earlier http://cmpassocregulationblog.blogspot.com/2013/12/collapse-of-united-states-dynamism-of.html). Financial assets increased $18.3 trillion while nonfinancial assets increased $3.4 trillion with likely concentration of wealth in those with access to sophisticated financial investments. Real estate assets adjusted for inflation fell 2.7 percent.

Industrial production increased 0.6 percent in Jun 2016 and decreased 0.3 percent in May 2016 after increasing 0.5 percent in Apr 2016, with all data seasonally adjusted, as shown in Table I-1. The Board of Governors of the Federal Reserve System conducted the annual revision of industrial production released on Apr 1, 2016 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm):

“The Federal Reserve has revised its index of industrial production (IP) and the related measures of capacity and capacity utilization.[1] Total IP is now reported to have increased about 2 1/2 percent per year, on average, from 2011 through 2014 before falling 1 1/2 percent in 2015.[2] Relative to earlier reports, the current rates of change are lower, especially for 2014 and 2015. Total IP is now estimated to have returned to its pre-recession peak in November 2014, six months later than previously estimated. Capacity for total industry is now reported to have increased about 2 percent in 2014 and 2015 after having increased only 1 percent in 2013. Compared with the previously reported estimates, the gain in 2015 is 1/2 percentage point higher, and the gain in 2013 is 1/2 percentage point lower. Industrial capacity is expected to increase 1/2 percent in 2016.”

The report of the Board of Governors of the Federal Reserve System states (http://www.federalreserve.gov/releases/g17/Current/default.htm):

“Industrial production increased 0.6 percent in June after declining 0.3 percent in May. For the second quarter as a whole, industrial production fell at an annual rate of 1.0 percent, its third consecutive quarterly decline. Manufacturing output moved up 0.4 percent in June, a gain largely due to an increase in motor vehicle assemblies. The output of manufactured goods other than motor vehicles and parts was unchanged. The index for utilities rose 2.4 percent as a result of warmer weather than is typical for June boosting demand for air conditioning. The output of mining moved up 0.2 percent for its second consecutive small monthly increase following eight straight months of decline. At 104.1 percent of its 2012 average, total industrial production in June was 0.7 percent lower than its year-earlier level. Capacity utilization for the industrial sector increased 0.5 percentage point in June to 75.4 percent, a rate that is 4.6 percentage points below its long-run (1972–2015) average.” In the six months ending in Jun 2016, United States national industrial production accumulated change of 0.1 percent at the annual equivalent rate of 0.2 percent, which is higher than decline of 0.7 percent in the 12 months ending in Jun 2016. Excluding growth of 0.6 percent in Jun 2016, growth in the remaining five months from Jan to Jun 2016 accumulated to minus 0.5 percent or minus 1.0 percent annual equivalent. Industrial production declined in three of the past six months and increased 0.5 percent in two months and 0.6 percent in another month. Industrial production expanded at annual equivalent 3.2 percent in the most recent quarter from Apr 2016 to Jun 2016 and contracted at 2.8 percent in the prior quarter Jan 2016 to Mar 2016. Business equipment accumulated change of 1.6 percent in the six months from Jan 2016 to Jun 2016, at the annual equivalent rate of 3.2 percent, which is higher than growth of minus 0.6 percent in the 12 months ending in Jun 2016. The Fed analyzes capacity utilization of total industry in its report (http://www.federalreserve.gov/releases/g17/Current/default.htm): “Capacity utilization for the industrial sector increased 0.5 percentage point in June to 75.4 percent, a rate that is 4.6 percentage points below its long-run (1972–2015) average.” United States industry apparently decelerated to a lower growth rate followed by possible acceleration and weakening growth in past months.

Table I-1, US, Industrial Production and Capacity Utilization, SA, ∆%

| Jun 16 | May 15 | Apr 15 | Mar 16 | Feb 16 | Jan 16 | Jun 16/ Jun 15 | |

| Total | 0.6 | -0.3 | 0.5 | -1.0 | -0.2 | 0.5 | -0.7 |

| Market | |||||||

| Final Products | 0.9 | -0.6 | 1.1 | -1.0 | 0.0 | 0.8 | 0.5 |

| Consumer Goods | 1.1 | -0.8 | 1.3 | -1.2 | -0.1 | 1.2 | 1.6 |

| Business Equipment | 0.7 | -0.3 | 1.1 | -0.6 | 0.5 | 0.2 | -0.6 |

| Non | -0.3 | -0.2 | 0.2 | -1.1 | 0.0 | 0.4 | -0.3 |

| Construction | -0.8 | -0.5 | 0.2 | -0.8 | -0.1 | 0.0 | 0.0 |

| Materials | 0.6 | 0.0 | -0.1 | -0.9 | -0.4 | 0.2 | -1.9 |

| Industry Groups | |||||||

| Manufacturing | 0.4 | -0.3 | 0.1 | -0.4 | 0.0 | 0.4 | 0.4 |

| Mining | 0.2 | 0.3 | -2.8 | -2.4 | -0.5 | -1.8 | -10.5 |

| Utilities | -2.4 | -0.9 | 6.2 | -4.0 | -1.1 | 3.6 | 0.5 |

| Capacity | 75.4 | 74.9 | 75.2 | 74.8 | 75.6 | 75.7 | 0.6 |

Sources: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/default.htm

Manufacturing decreased 0.4 percent in Jun 2016 after decreasing 0.3 percent in May 2016 and decreasing 0.1 percent in Apr 2016 seasonally adjusted, increasing 0.5 percent not seasonally adjusted in the 12 months ending in Jun 2016, as shown in Table I-2. Manufacturing increased cumulatively 0.2 percent in the six months ending in Jun 2016 or at the annual equivalent rate of 0.4 percent. Excluding the increase of 0.4 percent in Jun 2016, manufacturing changed minus 0.2 percent from Jan 2016 to Jun 2016 or at the annual equivalent rate of minus 0.5 percent. Table I-2 provides a longer perspective of manufacturing in the US. There has been evident deceleration of manufacturing growth in the US from 2010 and the first three months of 2011 with recovery followed by renewed deterioration in more recent months as shown by 12 months rates of growth. Growth rates appeared to be increasing again closer to 5 percent in Apr-Jun 2012 but deteriorated. The rates of decline of manufacturing in 2009 are quite high with a drop of 18.5 percent in the 12 months ending in Apr 2009. Manufacturing recovered from this decline and led the recovery from the recession. Rates of growth appeared to be returning to the levels at 3 percent or higher in the annual rates before the recession but the pace of manufacturing fell steadily with some strength at the margin. There is renewed deterioration. The Board of Governors of the Federal Reserve System conducted the annual revision of industrial production released on Apr 1, 2016 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm):

“The Federal Reserve has revised its index of industrial production (IP) and the related measures of capacity and capacity utilization.[1] Total IP is now reported to have increased about 2 1/2 percent per year, on average, from 2011 through 2014 before falling 1 1/2 percent in 2015.[2] Relative to earlier reports, the current rates of change are lower, especially for 2014 and 2015. Total IP is now estimated to have returned to its pre-recession peak in November 2014, six months later than previously estimated. Capacity for total industry is now reported to have increased about 2 percent in 2014 and 2015 after having increased only 1 percent in 2013. Compared with the previously reported estimates, the gain in 2015 is 1/2 percentage point higher, and the gain in 2013 is 1/2 percentage point lower. Industrial capacity is expected to increase 1/2 percent in 2016.”

The bottom part of Table I-2 shows decline of manufacturing by 22.3 from the peak in Jun 2007 to the trough in Apr 2009 and increase of 16.0 percent from the trough in Apr 2009 to Dec 2015. Manufacturing grew 16.0 percent from the trough in Apr 2009 to Jun 2016. Manufacturing in Jun 2016 is lower by 6.1 percent relative to the peak in Jun 2007. The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. Growth at trend in the entire cycle from IVQ2007 to IQ2016 would have accumulated to 27.6 percent. GDP in IQ2016 would be $19,129.5 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2614.9 billion than actual $16,514.6 billion. There are about two trillion dollars of GDP less than at trend, explaining the 23.7 million unemployed or underemployed equivalent to actual unemployment/underemployment of 14.1 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2016/07/fluctuating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html). US GDP in IQ2016 is 13.7 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,514.6 billion in IQ2016 or 10.2 percent at the average annual equivalent rate of 1.2 percent. Professor John H. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. Cochrane (2016May02) measures GDP growth in the US at average 3.5 percent per year from 1950 to 2000 and only at 1.76 percent per year from 2000 to 2015 with only at 2.0 percent annual equivalent in the current expansion. Cochrane (2016May02) proposes drastic changes in regulation and legal obstacles to private economic activity. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth of manufacturing at average 3.2 percent per year from Jun 1919 to Jun 2016. Growth at 3.2 percent per year would raise the NSA index of manufacturing output from 108.2316 in Dec 2007 to 141.4587 in Jun 2016. The actual index NSA in Jun 2016 is 105.6646, which is 25.3 percent below trend. Manufacturing output grew at average 2.1 percent between Dec 1986 and Dec 2015. Using trend growth of 2.1 percent per year, the index would increase to 129.1203 in Jun 2016. The output of manufacturing at 105.6646 in Jun 2016 is 18.2 percent below trend under this alternative calculation.

Table I-2, US, Monthly and 12-Month Rates of Growth of Manufacturing ∆%

| Month SA ∆% | 12-Month NSA ∆% | |

| Jun 2016 | 0.4 | 0.5 |

| May | -0.3 | -0.2 |

| Apr | 0.1 | 0.7 |

| Mar | -0.4 | -0.4 |

| Feb | 0.0 | 0.9 |

| Jan | 0.4 | 0.6 |

| Dec 2015 | 0.0 | -0.4 |

| Nov | -0.3 | -0.2 |

| Oct | 0.2 | 0.9 |

| Sep | -0.2 | -0.1 |

| Aug | -0.1 | 0.8 |

| Jul | 0.7 | 0.9 |

| Jun | -0.2 | 0.3 |

| May | 0.0 | 1.1 |

| Apr | 0.2 | 1.1 |

| Mar | 0.2 | 1.1 |

| Feb | -0.4 | 1.6 |

| Jan | -0.4 | 2.9 |

| Dec 2014 | -0.2 | 2.4 |

| Nov | 0.9 | 2.4 |

| Oct | 0.0 | 1.4 |

| Sep | 0.1 | 1.5 |

| Aug | -0.4 | 1.5 |

| Jul | 0.4 | 2.2 |

| Jun | 0.4 | 1.4 |

| May | 0.2 | 1.2 |

| Apr | 0.1 | 0.8 |

| Mar | 0.7 | 1.3 |

| Feb | 1.1 | 0.0 |

| Jan | -1.1 | -0.8 |

| Dec 2013 | 0.0 | -0.1 |

| Nov | -0.1 | 0.9 |

| Oct | 0.1 | 1.7 |

| Sep | 0.1 | 1.1 |

| Aug | 0.9 | 1.3 |

| Jul | -1.0 | 0.3 |

| Jun | 0.2 | 0.8 |

| May | 0.2 | 1.0 |

| Apr | -0.3 | 1.1 |

| Mar | -0.3 | 0.8 |

| Feb | 0.5 | 0.9 |

| Jan | -0.3 | 1.1 |

| Dec 2012 | 0.7 | 2.0 |

| Nov | 0.7 | 2.0 |

| Oct | -0.3 | 0.9 |

| Sep | 0.0 | 1.8 |

| Aug | -0.2 | 2.2 |

| Jul | -0.1 | 2.5 |

| Jun | 0.2 | 3.3 |

| May | -0.4 | 3.2 |

| Apr | 0.7 | 3.6 |

| Mar | -0.6 | 2.5 |

| Feb | 0.4 | 3.9 |

| Jan | 1.0 | 3.2 |

| Dec 2011 | 0.6 | 2.7 |

| Nov | -0.4 | 2.3 |

| Oct | 0.6 | 2.5 |

| Sep | 0.3 | 2.3 |

| Aug | 0.3 | 1.9 |

| Jul | 0.6 | 2.2 |

| Jun | 0.1 | 1.8 |

| May | 0.1 | 1.6 |

| Apr | -0.6 | 2.9 |

| Mar | 0.5 | 4.5 |

| Feb | 0.1 | 5.1 |

| Jan | 0.2 | 5.2 |

| Dec 2010 | 0.4 | 5.8 |

| Nov | 0.0 | 4.9 |

| Oct | 0.1 | 6.1 |

| Sep | 0.1 | 6.4 |

| Aug | 0.2 | 7.0 |

| Jul | 0.6 | 7.5 |

| Jun | 0.0 | 9.2 |

| May | 1.5 | 8.7 |

| Apr | 0.9 | 6.9 |

| Mar | 1.2 | 4.6 |

| Feb | -0.1 | 1.2 |

| Jan | 1.1 | 1.1 |

| Dec 2009 | -0.2 | -3.4 |

| Nov | 0.9 | -6.3 |

| Oct | 0.2 | -9.3 |

| Sep | 0.8 | -10.7 |

| Aug | 1.1 | -13.7 |

| Jul | 1.4 | -15.4 |

| Jun | -0.4 | -18.0 |

| May | -1.1 | -17.9 |

| Apr | -0.8 | -18.5 |

| Mar | -1.9 | -17.4 |

| Feb | -0.2 | -16.3 |

| Jan | -3.0 | -16.6 |

| Dec 2008 | -3.4 | -14.1 |

| Nov | -2.3 | -11.4 |

| Oct | -0.6 | -8.9 |

| Sep | -3.4 | -8.7 |

| Aug | -1.2 | -5.2 |

| Jul | -1.2 | -3.7 |

| Jun | -0.5 | -3.3 |

| May | -0.5 | -2.6 |

| Apr | -1.1 | -1.3 |

| Mar | -0.3 | -0.8 |

| Feb | -0.6 | 0.8 |

| Jan | -0.4 | 2.1 |

| Dec 2007 | 0.1 | 1.8 |

| Nov | 0.5 | 3.3 |

| Oct | -0.4 | 2.7 |

| Sep | 0.4 | 2.9 |

| Aug | -0.3 | 2.7 |

| Jul | 0.1 | 3.6 |

| Jun | 0.3 | 3.1 |

| May | -0.1 | 3.3 |

| Apr | 0.7 | 3.7 |

| Mar | 0.8 | 2.6 |

| Feb | 0.4 | 1.7 |

| Jan | -0.5 | 1.3 |

| Dec 2006 | 2.8 | |

| Dec 2005 | 3.5 | |

| Dec 2004 | 4.0 | |

| Dec 2003 | 2.2 | |

| Dec 2002 | 2.3 | |

| Dec 2001 | -5.3 | |

| Dec 2000 | 0.8 | |

| Dec 1999 | 5.2 | |

| Average ∆% Dec 1986-Dec 2015 | 2.1 | |

| Average ∆% Dec 1986-Dec 2014 | 2.2 | |

| Average ∆% Dec 1986-Dec 2013 | 2.2 | |

| Average ∆% Dec 1986-Dec 1999 | 4.3 | |

| Average ∆% Dec 1999-Dec 2006 | 1.4 | |

| Average ∆% Dec 1999-Dec 2015 | 0.3 | |

| ∆% Peak 112.5837 in 06/2007 to 101.4354 in 12/2015 | -9.9 | |

| ∆% Peak 112.5837 in 06/2007 to Trough 87.4314 in 4/2009 | -22.3 | |

| ∆% Trough 87.4314 in 04/2009 to 101.4354 in 12/2015 | 16.0 | |

| ∆% Trough 87.4314 in 04/2009 to 105.6646 in 6/2016 | 2.9 | |

| ∆% Peak 112.5837 on 06/2007 to 105.6646 in 6/2016 | -6.1 |

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/default.htm

Chart I-1 of the Board of Governors of the Federal Reserve System provides industrial production, manufacturing and capacity since the 1970s. There was acceleration of growth of industrial production, manufacturing and capacity in the 1990s because of rapid growth of productivity in the US (Cobet and Wilson (2002); see Pelaez and Pelaez, The Global Recession Risk (2007), 135-44). The slopes of the curves flatten in the 2000s. Production and capacity have not recovered sufficiently above levels before the global recession, remaining like GDP below historical trend. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977).

Chart I-1, US, Industrial Production, Capacity and Utilization

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/ipg1.gif

The modern industrial revolution of Jensen (1993) is captured in Chart I-2 of the Board of Governors of the Federal Reserve System (for the literature on M&A and corporate control see Pelaez and Pelaez, Regulation of Banks and Finance (2009a), 143-56, Globalization and the State, Vol. I (2008a), 49-59, Government Intervention in Globalization (2008c), 46-49). The slope of the curve of total industrial production accelerates in the 1990s to a much higher rate of growth than the curve excluding high-technology industries. Growth rates decelerate into the 2000s and output and capacity utilization have not recovered fully from the strong impact of the global recession. Growth in the current cyclical expansion has been more subdued than in the prior comparably deep contractions in the 1970s and 1980s. Chart I-2 shows that the past recessions after World War II are the relevant ones for comparison with the recession after 2007 instead of common comparisons with the Great Depression (http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/appropriate-for-fed-to-increase.html). The bottom left-hand part of Chart II-2 shows the strong growth of output of communication equipment, computers and semiconductor that continued from the 1990s into the 2000s. Output of semiconductors has already surpassed the level before the global recession.

Chart I-2, US, Industrial Production, Capacity and Utilization of High Technology Industries

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/ipg3.gif

Additional detail on industrial production and capacity utilization is in Chart I-3 of the Board of Governors of the Federal Reserve System. Production of consumer durable goods fell sharply during the global recession by more than 30 percent and is oscillating above the level before the contraction. Output of nondurable consumer goods fell around 10 percent and is some 5 percent below the level before the contraction. Output of business equipment fell sharply during the contraction of 2001 but began rapid growth again after 2004. An important characteristic is rapid growth of output of business equipment in the cyclical expansion after sharp contraction in the global recession, stalling in the final segment. Output of defense and space only suffered reduction in the rate of growth during the global recession and surged ahead of the level before the contraction, declining in the final segment. Output of construction supplies collapsed during the global recession and is well below the level before the contraction. Output of energy materials was stagnant before the contraction but recovered sharply above the level before the contraction with recent decline.

Chart I-3, US, Industrial Production and Capacity Utilization

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/ipg2.gif

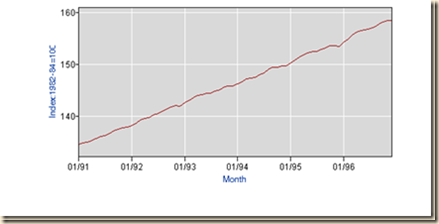

United States manufacturing output from 1919 to 2016 on a monthly basis is in Chart I-4 of the Board of Governors of the Federal Reserve System. The second industrial revolution of Jensen (1993) is quite evident in the acceleration of the rate of growth of output given by the sharper slope in the 1980s and 1990s. Growth was robust after the shallow recession of 2001 but dropped sharply during the global recession after IVQ2007. Manufacturing output recovered sharply but has not reached earlier levels and is losing momentum at the margin. Current output is well below extrapolation of trend. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth of manufacturing at average 3.2 percent per year from Jun 1919 to Jun 2016. Growth at 3.2 percent per year would raise the NSA index of manufacturing output from 108.2316 in Dec 2007 to 141.4587 in Jun 2016. The actual index NSA in Jun 2016 is 105.6646, which is 25.3 percent below trend. Manufacturing output grew at average 2.1 percent between Dec 1986 and Dec 2015. Using trend growth of 2.1 percent per year, the index would increase to 129.1203 in Jun 2016. The output of manufacturing at 105.6646 in Jun 2016 is 18.2 percent below trend under this alternative calculation.

Chart I-4, US, Manufacturing Output, 1919-2016

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/default.htm

Manufacturing jobs not seasonally adjusted decreased 33,000 from Jun 2015 to Jun 2016 or at the average monthly rate of minus 2750. There are effects of the weaker economy and international trade together with the yearly adjustment of labor statistics. Industrial production increased 0.6 percent in Jun 2016 and decreased 0.3 percent in May 2016 after increasing 0.5 percent in Apr 2016, with all data seasonally adjusted. The Board of Governors of the Federal Reserve System conducted the annual revision of industrial production released on Apr 1, 2016 (http://www.federalreserve.gov/releases/g17/revisions/Current/DefaultRev.htm):

“The Federal Reserve has revised its index of industrial production (IP) and the related measures of capacity and capacity utilization.[1] Total IP is now reported to have increased about 2 1/2 percent per year, on average, from 2011 through 2014 before falling 1 1/2 percent in 2015.[2] Relative to earlier reports, the current rates of change are lower, especially for 2014 and 2015. Total IP is now estimated to have returned to its pre-recession peak in November 2014, six months later than previously estimated. Capacity for total industry is now reported to have increased about 2 percent in 2014 and 2015 after having increased only 1 percent in 2013. Compared with the previously reported estimates, the gain in 2015 is 1/2 percentage point higher, and the gain in 2013 is 1/2 percentage point lower. Industrial capacity is expected to increase 1/2 percent in 2016.”

Manufacturing fell 22.3 from the peak in Jun 2007 to the trough in Apr 2009 and increased 16.0 percent from the trough in Apr 2009 to Dec 2015. Manufacturing in Jun 2016 is lower by 6.1 percent relative to the peak in Jun 2007. The US maintained growth at 3.0 percent on average over entire cycles with expansions at higher rates compensating for contractions. Growth at trend in the entire cycle from IVQ2007 to IQ2016 would have accumulated to 27.6 percent. GDP in IQ2016 would be $19,129.5 billion (in constant dollars of 2009) if the US had grown at trend, which is higher by $2614.9 billion than actual $16,514.6 billion. There are about two trillion dollars of GDP less than at trend, explaining the 23.7 million unemployed or underemployed equivalent to actual unemployment/underemployment of 14.1 percent of the effective labor force (http://cmpassocregulationblog.blogspot.com/2016/07/fluctuating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html). US GDP in IQ2016 is 13.7 percent lower than at trend. US GDP grew from $14,991.8 billion in IVQ2007 in constant dollars to $16,514.6 billion in IQ2016 or 10.2 percent at the average annual equivalent rate of 1.2 percent. Professor John H. Cochrane (2014Jul2) estimates US GDP at more than 10 percent below trend. Cochrane (2016May02) measures GDP growth in the US at average 3.5 percent per year from 1950 to 2000 and only at 1.76 percent per year from 2000 to 2015 with only at 2.0 percent annual equivalent in the current expansion. Cochrane (2016May02) proposes drastic changes in regulation and legal obstacles to private economic activity. The US missed the opportunity to grow at higher rates during the expansion and it is difficult to catch up because growth rates in the final periods of expansions tend to decline. The US missed the opportunity for recovery of output and employment always afforded in the first four quarters of expansion from recessions. Zero interest rates and quantitative easing were not required or present in successful cyclical expansions and in secular economic growth at 3.0 percent per year and 2.0 percent per capita as measured by Lucas (2011May). There is cyclical uncommonly slow growth in the US instead of allegations of secular stagnation. There is similar behavior in manufacturing. There is classic research on analyzing deviations of output from trend (see for example Schumpeter 1939, Hicks 1950, Lucas 1975, Sargent and Sims 1977). The long-term trend is growth of manufacturing at average 3.2 percent per year from Jun 1919 to Jun 2016. Growth at 3.2 percent per year would raise the NSA index of manufacturing output from 108.2316 in Dec 2007 to 141.4587 in Jun 2016. The actual index NSA in Jun 2016 is 105.6646, which is 25.3 percent below trend. Manufacturing output grew at average 2.1 percent between Dec 1986 and Dec 2015. Using trend growth of 2.1 percent per year, the index would increase to 129.1203 in Jun 2016. The output of manufacturing at 105.6646 in Jun 2016 is 18.2 percent below trend under this alternative calculation.

Table I-13 provides national income by industry without capital consumption adjustment (WCCA). “Private industries” or economic activities have share of 87.6 percent in IQ2016. Most of US national income is in the form of services. In Jun 2016, there were 145.239 million nonfarm jobs NSA in the US, according to estimates of the establishment survey of the Bureau of Labor Statistics (BLS) (http://www.bls.gov/news.release/empsit.nr0.htm Table B-1). Total private jobs of 123.191 million NSA in Jun 2016 accounted for 84.8 percent of total nonfarm jobs of 145.239 million, of which 12.374 million, or 10.0 percent of total private jobs and 8.5 percent of total nonfarm jobs, were in manufacturing. Private service-providing jobs were 103.275 million NSA in Jun 2016, or 71.1 percent of total nonfarm jobs and 83.8 percent of total private-sector jobs. Manufacturing has share of 10.8 percent in US national income in IQ2016 and durable goods 6.3 percent, as shown in Table I-13. Most income in the US originates in services. Subsidies and similar measures designed to increase manufacturing jobs will not increase economic growth and employment and may actually reduce growth by diverting resources away from currently employment-creating activities because of the drain of taxation.

Table I-13, US, National Income without Capital Consumption Adjustment by Industry, Seasonally Adjusted Annual Rates, Billions of Dollars, % of Total

| SAAR | % Total | SAAR IQ2016 | % Total | |

| National Income WCCA | 15,949.3 | 100.0 | 16,047.3 | 100.0 |

| Domestic Industries | 15,756.7 | 98.8 | 15,893.5 | 99.0 |

| Private Industries | 13,940.7 | 87.4 | 14,062.9 | 87.6 |

| Agriculture | 156.2 | 1.0 | 146.6 | 0.9 |

| Mining | 239.6 | 1.5 | 233.4 | 1.5 |

| Utilities | 178.9 | 1.1 | 178.8 | 1.1 |

| Construction | 755.0 | 4.7 | 767.7 | 4.8 |

| Manufacturing | 1733.7 | 10.9 | 1730.7 | 10.8 |

| Durable Goods | 1015.8 | 6.4 | 1013.8 | 6.3 |

| Nondurable Goods | 718.0 | 4.5 | 716.9 | 4.5 |

| Wholesale Trade | 972.5 | 6.1 | 976.7 | 6.1 |

| Retail Trade | 1096.6 | 6.9 | 1104.0 | 6.9 |

| Transportation & WH | 527.7 | 3.3 | 522.9 | 3.3 |

| Information | 609.7 | 3.8 | 617.4 | 3.8 |

| Finance, Insurance, RE | 2779.1 | 17.4 | 2843.6 | 17.7 |

| Professional & Business Services | 2159.8 | 13.5 | 2170.6 | 13.5 |

| Education, Health Care | 1596.3 | 10.0 | 1621.8 | 10.1 |

| Arts, Entertainment | 675.8 | 4.2 | 683.8 | 4.3 |

| Other Services | 459.7 | 2.9 | 465.0 | 2.9 |

| Government | 1816.0 | 11.4 | 1830.6 | 11.4 |

| Rest of the World | 192.7 | 1.2 | 153.9 | 1.0 |

Notes: SSAR: Seasonally-Adjusted Annual Rate; WCCA: Without Capital Consumption Adjustment by Industry; WH: Warehousing; RE, includes rental and leasing: Real Estate; Art, Entertainment includes recreation, accommodation and food services; BS: business services

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Motor vehicle sales and production in the US have been in long-term structural change. Table VA-1 provides the data on new motor vehicle sales and domestic car production in the US from 1990 to 2010. New motor vehicle sales grew from 14,137 thousand in 1990 to the peak of 17,806 thousand in 2000 or 29.5 percent. In that same period, domestic car production fell from 6,231 thousand in 1990 to 5,542 thousand in 2000 or -11.1 percent. New motor vehicle sales fell from 17,445 thousand in 2005 to 11,772 in 2010 or 32.5 percent while domestic car production fell from 4,321 thousand in 2005 to 2,840 thousand in 2010 or 34.3 percent. In Jun 2016, light vehicle sales accumulated to 8,645,016 million, which is higher by 1.5 percent relative to 8,521,260 a year earlier (http://motorintelligence.com/m_frameset.html). The seasonally adjusted annual rate of light vehicle sales in the US reached 16.66 million in Jun 2016, lower than 17.45 million in May 2016 and lower than 17.00 million in Jun 2015 (http://motorintelligence.com/m_frameset.html).

Table VA-1, US, New Motor Vehicle Sales and Car Production, Thousand Units

| New Motor Vehicle Sales | New Car Sales and Leases | New Truck Sales and Leases | Domestic Car Production | |

| 1990 | 14,137 | 9,300 | 4,837 | 6,231 |

| 1991 | 12,725 | 8,589 | 4,136 | 5,454 |

| 1992 | 13,093 | 8,215 | 4,878 | 5,979 |

| 1993 | 14,172 | 8,518 | 5,654 | 5,979 |

| 1994 | 15,397 | 8,990 | 6,407 | 6,614 |

| 1995 | 15,106 | 8,536 | 6,470 | 6,340 |

| 1996 | 15,449 | 8,527 | 6,922 | 6,081 |

| 1997 | 15,490 | 8,273 | 7,218 | 5,934 |

| 1998 | 15,958 | 8,142 | 7,816 | 5,554 |

| 1999 | 17,401 | 8,697 | 8,704 | 5,638 |

| 2000 | 17,806 | 8,852 | 8,954 | 5,542 |

| 2001 | 17,468 | 8,422 | 9,046 | 4,878 |

| 2002 | 17,144 | 8,109 | 9,036 | 5,019 |

| 2003 | 16,968 | 7,611 | 9,357 | 4,510 |

| 2004 | 17,298 | 7,545 | 9,753 | 4,230 |

| 2005 | 17,445 | 7,720 | 9,725 | 4,321 |

| 2006 | 17,049 | 7,821 | 9,228 | 4,367 |

| 2007 | 16,460 | 7,618 | 8,683 | 3,924 |

| 2008 | 13,494 | 6,814 | 6.680 | 3,777 |

| 2009 | 10,601 | 5,456 | 5,154 | 2,247 |

| 2010 | 11,772 | 5,729 | 6,044 | 2,840 |

Source: US Census Bureau

http://www.census.gov/compendia/statab/cats/wholesale_retail_trade/motor_vehicle_sales.html

Chart I-5 of the Board of Governors of the Federal Reserve provides output of motor vehicles and parts in the United States from 1972 to 2016. Output virtually stagnated since the late 1990s.

Chart 1-5, US, Motor Vehicles and Parts Output, 1972-2016

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/default.htm

Chart I-6 of the Board of Governors of the Federal Reserve System provides output of computers and electronic products in the United States from 1972 to 2016. Output accelerated sharply in the 1990s and 2000s and surpassed the level before the global recession beginning in IVQ2007.

Chart I-6, US, Output of Computers and Electronic Products, 1972-2016

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/default.htm

Chart I-7 of the Board of Governors of the Federal Reserve System shows that output of durable manufacturing accelerated in the 1980s and 1990s with slower growth in the 2000s perhaps because processes matured. Growth was robust after the major drop during the global recession but appears to vacillate in the final segment.

Chart I-7, US, Output of Durable Manufacturing, 1972-2016

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/default.htm

Chart I-8 of the Board of Governors of the Federal Reserve System provides output of aerospace and miscellaneous transportation equipment from 1972 to 2016. There is long-term upward trend with oscillations around the trend and cycles of large amplitude.

Chart I-8, US, Output of Aerospace and Miscellaneous Transportation Equipment, 1972-2016

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/Current/default.htm

The Empire State Manufacturing Survey Index in Table VA-1 provides continuing deterioration that started in Jun 2012 well before Hurricane Sandy in Oct 2012. The current general index has been in negative contraction territory from minus 2.41 in Aug 2012 to minus 9.31 in Jan 2013 and minus 2.20 in May 2013. The current general index changed to 0.55 in Jul 2016. The index of current orders has also been in negative contraction territory from minus 2.85 in Aug 2012 to minus 10.62 in Jan 2013 and minus 6.11 in Jun 2013. The index of current new orders changed to minus 1.82 in Jul 2016. Number of workers and hours worked have registered negative or declining readings since Sep 2012 with minus 4.4 for number of workers in Jul 2016 and weakness of minus 5.59 for average workweek. There is improvement in the general index for the next six months at 29.24 in Jul 2016 and new orders at 29.05.

Table VA-1, US, New York Federal Reserve Bank Empire State Manufacturing Survey Index SA

| Current | New Orders | Shipments | Number of Workers | Average Workweek | |

| Sep-11 | -4.23 | -4.52 | -6.92 | -5.43 | -2.17 |

| Oct-11 | -5.37 | 1.94 | 3.36 | 3.37 | -4.49 |

| Nov-11 | 4.62 | 0.79 | 12.44 | -3.66 | 2.44 |

| Dec-11 | 11.77 | 9.36 | 23.44 | 2.33 | -2.33 |

| Jan-12 | 10.34 | 8.67 | 18.11 | 12.09 | 6.59 |

| Feb-12 | 16.62 | 6.26 | 17.73 | 11.76 | 7.06 |

| Mar-12 | 16.12 | 5.52 | 15.64 | 13.58 | 18.52 |

| Apr-12 | 8.33 | 6.26 | 6.42 | 19.28 | 6.02 |

| May-12 | 13.52 | 7.34 | 21 | 20.48 | 12.05 |

| Jun-12 | 2.74 | 2.93 | 11.44 | 12.37 | 3.09 |

| Jul-12 | 2.94 | -3.98 | 8.68 | 18.52 | 0 |

| Aug-12 | -2.41 | -2.85 | 7.49 | 16.47 | 3.53 |

| Sep-12 | -6.7 | -10.59 | 4.67 | 4.26 | -1.06 |

| Oct-12 | -3.87 | -6.56 | -3.97 | -1.08 | -4.3 |

| Nov-12 | -1.13 | 5.11 | 15.98 | -14.61 | -7.87 |

| Dec-12 | -5.59 | -0.96 | 11.34 | -9.68 | -10.75 |

| Jan-13 | -9.31 | -10.62 | -4.72 | -4.3 | -5.38 |

| Feb-13 | 7.62 | 11.18 | 10.51 | 8.08 | -4.04 |

| Mar-13 | 6.45 | 6.8 | 7.84 | 3.23 | 0 |

| Apr-13 | 5.12 | 3.83 | 3.48 | 6.82 | 5.68 |

| May-13 | -2.2 | -2.96 | -2.85 | 5.68 | -1.14 |

| Jun-13 | 6.22 | -6.11 | -6.56 | 0 | -11.29 |

| Jul-13 | 4.89 | 1.96 | 4.86 | 3.26 | -7.61 |

| Aug-13 | 10.34 | 2.58 | 2.92 | 10.84 | 4.82 |

| Sep-13 | 7.67 | 2.24 | 13.24 | 7.53 | 1.08 |

| Oct-13 | 4.71 | 8.63 | 18.18 | 3.61 | 3.61 |

| Nov-13 | 1.77 | -3.29 | 0.97 | 0 | -5.26 |

| Dec-13 | 3.3 | -0.48 | 6.7 | 0 | -10.84 |

| Jan-14 | 10.52 | 8.06 | 14.14 | 12.2 | 1.22 |

| Feb-14 | 4.41 | 0.89 | 2.57 | 11.25 | 3.75 |

| Mar-14 | 5.16 | 4.42 | 7.19 | 5.88 | 4.71 |

| Apr-14 | 4.67 | -0.04 | 7.03 | 8.16 | 2.04 |

| May-14 | 16.23 | 8.01 | 14.91 | 20.88 | 2.2 |

| Jun-14 | 18.13 | 15.85 | 13.64 | 10.75 | 9.68 |

| Jul-14 | 20.42 | 16.52 | 18.71 | 17.05 | 2.27 |

| Aug-14 | 17.21 | 15.31 | 23.04 | 13.64 | 7.95 |

| Sep-14 | 29.17 | 16.72 | 23.97 | 3.26 | 3.26 |

| Oct-14 | 7.85 | 0.41 | 7.15 | 10.23 | -1.14 |

| Nov-14 | 11.47 | 9.39 | 11.01 | 8.51 | -7.45 |

| Dec-14 | -2.61 | -0.6 | 1.7 | 8.33 | -11.46 |

| Jan-15 | 9.69 | 5.53 | 10.17 | 13.68 | -8.42 |

| Feb-15 | 7.71 | 1.55 | 14.07 | 10.11 | -1.12 |

| Mar-15 | 6.22 | -1.42 | 8.66 | 18.56 | 5.15 |

| Apr-15 | 0.57 | -4.37 | 14.53 | 9.57 | -4.26 |

| May-15 | 2.22 | 1.52 | 12.99 | 5.21 | -2.08 |

| Jun-15 | -2.05 | -3.02 | 9.97 | 8.65 | 3.85 |

| Jul-15 | 0.94 | -5.18 | 5.22 | 3.19 | 4.26 |

| Aug-15 | -12.79 | -14.57 | -12.65 | 1.82 | -1.82 |

| Sep-15 | -12.86 | -12.52 | -8.07 | -6.19 | -10.31 |

| Oct-15 | -11.41 | -16.98 | -8.79 | -8.49 | -7.55 |

| Nov-15 | -10.06 | -11.75 | -3.03 | -7.27 | -14.55 |

| Dec-15 | -6.21 | -6.18 | 4.62 | -16.16 | -27.27 |

| Jan-16 | -19.37 | -23.54 | -14.39 | -13 | -6 |

| Feb-16 | -16.64 | -11.63 | -11.56 | -0.99 | -5.94 |

| Mar-16 | 0.62 | 9.57 | 13.88 | -1.98 | 1.98 |

| Apr-16 | 9.56 | 11.14 | 10.17 | 1.92 | 1.92 |

| May-16 | -9.02 | -5.54 | -1.94 | 2.08 | -8.33 |

| Jun-16 | 6.01 | 10.9 | 9.32 | 0.00 | -5.1 |

| Jul-16 | 0.55 | -1.82 | 0.7 | -4.4 | -5.49 |

| Six Months | General Index | New Orders | Shipments | Number of Workers | Average Workweek |

| Sep-11 | 22.6 | 23.32 | 22.05 | 0.00 | -6.52 |

| Oct-11 | 14.64 | 19.81 | 23.48 | 6.74 | -2.25 |

| Nov-11 | 35.31 | 30.4 | 32.92 | 14.63 | 8.54 |

| Dec-11 | 46.17 | 43.52 | 40.6 | 24.42 | 22.09 |

| Jan-12 | 51.25 | 44.1 | 44.09 | 28.57 | 17.58 |

| Feb-12 | 46.26 | 38.25 | 41.46 | 29.41 | 18.82 |

| Mar-12 | 44.07 | 38.7 | 40.22 | 32.1 | 20.99 |

| Apr-12 | 40.06 | 38.13 | 37.99 | 27.71 | 10.84 |

| May-12 | 32.45 | 31.43 | 25.89 | 12.05 | 8.43 |

| Jun-12 | 28.36 | 28.99 | 24.27 | 16.49 | 2.06 |

| Jul-12 | 23.83 | 20.93 | 22.49 | 6.17 | -4.94 |

| Aug-12 | 17.46 | 13.63 | 21.59 | 3.53 | -8.24 |

| Sep-12 | 27.07 | 27.77 | 22.41 | 8.51 | 2.13 |

| Oct-12 | 20.5 | 22.93 | 18.45 | 0 | -11.83 |

| Nov-12 | 17.98 | 15.54 | 26.03 | -1.12 | 0 |

| Dec-12 | 19.93 | 19.41 | 22.39 | 10.75 | 5.38 |

| Jan-13 | 21.77 | 22.92 | 24.31 | 7.53 | 3.23 |

| Feb-13 | 31.87 | 27.73 | 27.68 | 15.15 | 11.11 |

| Mar-13 | 35.2 | 34.39 | 40.01 | 19.35 | 2.15 |

| Apr-13 | 30.02 | 35.29 | 36.22 | 25 | 7.95 |

| May-13 | 26.25 | 29.45 | 25.66 | 11.36 | 1.14 |

| Jun-13 | 28.69 | 23.2 | 23.06 | 1.61 | -9.68 |

| Jul-13 | 33.13 | 31.96 | 35.11 | 1.09 | -1.09 |

| Aug-13 | 34.44 | 29.61 | 30.82 | 8.43 | -6.02 |

| Sep-13 | 40.35 | 37.99 | 36.94 | 4.3 | -2.15 |

| Oct-13 | 41.53 | 37.49 | 33.89 | 7.23 | 2.41 |

| Nov-13 | 37.81 | 39.83 | 37.79 | 22.37 | -3.95 |

| Dec-13 | 37.92 | 28.17 | 31.85 | 9.64 | 1.2 |

| Jan-14 | 36.29 | 36.66 | 30.14 | 20.73 | 9.76 |

| Feb-14 | 39.98 | 45.05 | 43.58 | 25 | 7.5 |

| Mar-14 | 35.23 | 37.94 | 35.36 | 17.65 | 9.41 |

| Apr-14 | 37.82 | 34.03 | 37.94 | 22.45 | 1.02 |

| May-14 | 43.09 | 37.48 | 34.94 | 17.58 | -3.3 |

| Jun-14 | 42.46 | 45.18 | 46.42 | 20.43 | 0 |

| Jul-14 | 29.41 | 25.84 | 25.55 | 17.05 | -4.55 |

| Aug-14 | 44.58 | 49.22 | 54.17 | 22.73 | 0 |

| Sep-14 | 46.7 | 45.58 | 46.5 | 14.13 | 5.43 |

| Oct-14 | 42.48 | 42.97 | 42.98 | 12.5 | -2.27 |

| Nov-14 | 47.44 | 48.02 | 45.33 | 24.47 | 8.51 |

| Dec-14 | 37.19 | 36.27 | 36.24 | 20.83 | 12.5 |

| Jan-15 | 47.23 | 39.91 | 39.56 | 31.58 | 11.58 |

| Feb-15 | 27.58 | 30.73 | 31.59 | 24.72 | 1.12 |

| Mar-15 | 31.01 | 28.1 | 28.71 | 28.87 | 3.09 |

| Apr-15 | 36.24 | 33.27 | 31.7 | 22.34 | -1.06 |

| May-15 | 30.5 | 33.68 | 31.43 | 16.67 | -1.04 |

| Jun-15 | 27.68 | 28.04 | 25.2 | 13.46 | 0 |

| Jul-15 | 27.87 | 31.55 | 25.81 | 9.57 | -3.19 |

| Aug-15 | 31.49 | 29.32 | 32.12 | 3.64 | 1.82 |

| Sep-15 | 23.53 | 23.76 | 24.76 | 7.22 | -9.28 |

| Oct-15 | 23.34 | 24.05 | 24.65 | 10.38 | 0.94 |

| Nov-15 | 22.4 | 21.16 | 22.13 | 16.36 | 5.45 |

| Dec-15 | 35.65 | 25.37 | 32.34 | 15.15 | 10.1 |

| Jan-16 | 9.51 | 12.18 | 16.97 | 4 | 11 |

| Feb-16 | 14.48 | 22.15 | 23.82 | 16.83 | 0 |

| Mar-16 | 25.52 | 38.96 | 33.33 | 12.87 | 4.95 |

| Apr-16 | 29.4 | 36.55 | 37.18 | 13.46 | 10.58 |

| May-16 | 28.48 | 22.43 | 24.37 | 10.42 | 5.21 |

| Jun-16 | 34.84 | 38.24 | 29.13 | -2.04 | 2.04 |

| Jul-16 | 29.24 | 29.05 | 29.84 | 1.1 | -6.59 |

Source: Federal Reserve Bank of New York

http://www.ny.frb.org/survey/empire/empiresurvey_overview.html

Chart VA-1 of the Federal Reserve Bank of New York provides indexes of current and expected economic activity. There were multiple contractions in current activity after the global recession shown in shade. Current activity is weakening relative to strong recovery in the initial expansion in 2010 and 2011.

Chart VA-1, US, US, Federal Reserve Bank of New York, Diffusion Index of Current and Expected Activity, Seasonally Adjusted

Source: Federal Reserve Bank of New York

http://www.ny.frb.org/survey/empire/empiresurvey_overview.html

Table VA-1 shows improvement after prior deterioration followed by current soft improvement of the Business Outlook Survey of the Federal Reserve Bank of Philadelphia. The general index moved out of contraction at 4.7 in Feb 2013 to contraction at minus 2.9 in Jul 2016. New orders moved from minus 0.2 in Feb 2013 to 11.8 in Jul 2016. Expectations for the next six months are brighter with the general index at 33.7 in Jul 2016 and the index of new orders at 29.2.

Table VA-2, US, Federal Reserve Bank of Philadelphia Business Outlook Survey, SA

| Current General Index | Current New Orders | Current Shipments | Future General Index | Future New Orders | Future Shipments | |

| Jan-11 | 16.4 | 21.2 | 11.3 | 43.9 | 36.1 | 38.2 |

| Feb-11 | 29.1 | 20.8 | 24.2 | 41.9 | 38.8 | 43.8 |

| Mar-11 | 36.6 | 35.0 | 28.9 | 57.0 | 55.5 | 54.8 |

| Apr-11 | 13.2 | 14.4 | 21.2 | 35.7 | 31 | 36.4 |

| May-11 | 6.2 | 8.3 | 9.5 | 26.2 | 25.1 | 28.7 |

| Jun-11 | -0.3 | -5.1 | 7.6 | 8.3 | 8.4 | 8.4 |

| Jul-11 | 6.8 | 3.4 | 7.3 | 28.5 | 32.2 | 27.4 |

| Aug-11 | -19.6 | -18.3 | -2.7 | 12.9 | 26.5 | 23.9 |

| Sep-11 | -11.2 | -7.1 | -9.9 | 17.9 | 19.6 | 21.4 |

| Oct-11 | 6.0 | 5.0 | 8.5 | 26.1 | 28.5 | 29.6 |

| Nov-11 | 3.9 | 1.0 | 6.6 | 36.2 | 36.2 | 33.7 |

| Dec-11 | 2.4 | 4.4 | 5.3 | 33.8 | 38.6 | 32.1 |

| Jan-12 | 7.4 | 11.7 | 5.1 | 44.3 | 43.8 | 43.9 |

| Feb-12 | 10.8 | 12.1 | 8.4 | 30.3 | 32.4 | 28.3 |

| Mar-12 | 9.2 | 2.0 | 2.2 | 30.6 | 37.3 | 31.2 |

| Apr-12 | 6.1 | 1.6 | -2.9 | 39.9 | 42.7 | 34.9 |

| May-12 | -0.6 | 2.3 | 9.2 | 24.7 | 35.4 | 30.7 |

| Jun-12 | -12.4 | -17.7 | -11.2 | 25.1 | 33.7 | 36.5 |

| Jul-12 | -13.1 | -4.0 | -10.8 | 21.3 | 25.5 | 18.7 |

| Aug-12 | -2.8 | -0.2 | -3 | 20.6 | 25.3 | 18.6 |

| Sep-12 | -0.7 | -0.7 | -13.8 | 31.2 | 42.7 | 34.3 |

| Oct-12 | -1.5 | -5.1 | -7.3 | 16.8 | 20.6 | 20.7 |

| Nov-12 | -10.9 | -8.1 | -6.5 | 16.3 | 22.6 | 23.8 |

| Dec-12 | 2.1 | 2.2 | 12 | 23.1 | 29.2 | 28.5 |

| Jan-13 | -1.2 | -1.1 | 2 | 29.6 | 32.1 | 36.7 |

| Feb-13 | -4.7 | -0.2 | 1.7 | 32.3 | 39.3 | 33.9 |

| Mar-13 | 3.3 | 4.1 | 8.1 | 35.8 | 38.8 | 34.8 |

| Apr-13 | 1.5 | 1.9 | 5.3 | 31.2 | 35.5 | 34.4 |

| May-13 | 0.6 | -3.5 | -0.1 | 38.9 | 42.1 | 38.6 |

| Jun-13 | 12.8 | 11.3 | 7.3 | 36.2 | 38.4 | 38.1 |

| Jul-13 | 14.7 | 7.2 | 8.6 | 40.9 | 51.5 | 42.9 |

| Aug-13 | 7.5 | 6.8 | 2 | 39.6 | 38.8 | 41 |

| Sep-13 | 19.9 | 17.9 | 17.5 | 48.1 | 51.1 | 47.2 |

| Oct-13 | 12.7 | 22.1 | 16.2 | 54.2 | 60.9 | 51.4 |

| Nov-13 | 3.5 | 8.4 | 5.1 | 41.5 | 45.9 | 40.6 |

| Dec-13 | 3 | 11 | 8.2 | 43 | 45.6 | 41.8 |

| Jan-14 | 15.9 | 8.7 | 15.5 | 38.7 | 40.9 | 37.1 |

| Feb-14 | 3.6 | 3.5 | -6.8 | 44.7 | 39.8 | 42.4 |

| Mar-14 | 15 | 12.5 | 15.7 | 43.3 | 40.3 | 47.7 |

| Apr-14 | 18.3 | 18.7 | 24.8 | 40.6 | 41.2 | 41.6 |

| May-14 | 19.3 | 15 | 20.1 | 42.2 | 42.5 | 43.6 |

| Jun-14 | 14.3 | 9.8 | 13.7 | 50.9 | 51.9 | 44.9 |

| Jul-14 | 19 | 28.8 | 25.7 | 52.3 | 46.5 | 49.3 |

| Aug-14 | 21.4 | 12.8 | 13.9 | 63.2 | 51.7 | 61.2 |

| Sep-14 | 21.3 | 12.4 | 15.6 | 45.6 | 44 | 49.7 |

| Oct-14 | 17.1 | 15.1 | 15.8 | 48.5 | 48.2 | 49.8 |

| Nov-14 | 33.6 | 29.1 | 29 | 49.5 | 44.3 | 47.1 |

| Dec-14 | 20.5 | 12.8 | 10.4 | 50.9 | 46.5 | 47.7 |

| Jan-15 | 14.1 | 11.1 | -1.3 | 54.9 | 46.9 | 44.7 |

| Feb-15 | 13 | 7.7 | 8.2 | 36.3 | 46.2 | 43.4 |

| Mar-15 | 10.7 | 9.4 | 3.3 | 39.3 | 40.6 | 39 |

| Apr-15 | 10.8 | 6 | 3.4 | 41.8 | 37.8 | 40.3 |

| May-15 | 8.1 | 5.5 | 5.2 | 35.5 | 35 | 34.4 |

| Jun-15 | 8.1 | 9.6 | 9.3 | 38.9 | 42 | 52.2 |

| Jul-15 | 0.7 | 3.1 | -0.8 | 38.2 | 40.7 | 43.1 |

| Aug-15 | 3.4 | 2.5 | 11 | 37.6 | 40.5 | 32.3 |

| Sep-15 | -3.6 | 8.6 | 9.3 | 36.8 | 40.3 | 37.2 |

| Oct-15 | -5.9 | -9.3 | -5.3 | 31.4 | 35.4 | 34.5 |

| Nov-15 | -5.7 | -7.8 | -3.6 | 36.9 | 44.9 | 40.1 |

| Dec-15 | -10.2 | -11.1 | -2.1 | 24.1 | 34.5 | 36.6 |

| Jan-16 | -3.5 | -1.4 | 9.6 | 19.1 | 21.1 | 22 |

| Feb-16 | -2.8 | -5.3 | 2.5 | 17.3 | 19.8 | 20.2 |

| Mar-16 | 12.4 | 15.7 | 22.1 | 28.8 | 38.8 | 34.2 |

| Apr-16 | -1.6 | 0 | -10.8 | 42.2 | 48.7 | 41 |

| May-16 | -1.8 | -1.9 | -0.5 | 36.1 | 39.9 | 37.9 |

| Jun-16 | 4.7 | -3 | -2.1 | 29.8 | 29.9 | 32.2 |

| Jul-16 | -2.9 | 11.8 | 6.3 | 33.7 | 29.2 | 27.2 |

Source: Federal Reserve Bank of Philadelphia

http://www.philadelphiafed.org/index.cfm

Chart VA-2 of the Federal Reserve Bank of Philadelphia is very useful, providing current and future general activity indexes from Jan 2006 to May 2016. The shaded areas are the recession cycle dates of the National Bureau of Economic Research (NBER) (http://www.nber.org/cycles.html). The Philadelphia Fed index dropped during the initial period of recession and then led the recovery, as industry overall. There was a second decline of the index into 2011 followed now by what appeared as renewed strength from late 2011 into Jan 2012. There is decline to negative territory of the current activity index in Nov 2012 and return to positive territory in Dec 2012 with decline of current conditions into contraction in Jan-Feb 2013 and rebound to mild expansion in Mar-Apr 2013. The index of current activity moved into expansion in Jun-Oct 2013 with weakness in Nov-Dec 2013, improving in Jan 2014. There is renewed deterioration in Feb 2014 with rebound in Apr-Sep 2014 and mild deterioration in Oct 2014 followed by improvement in Nov 2014. The index deteriorated in Jan-Feb 2015, stabilizing in Mar-May 2015 and improving in Jun 2015. The index deteriorated in Jul 2015, improved in Aug 2015 and deteriorated in Sep-Oct 2015. The index shows contraction in Nov 2015 to Feb 2016 with recovery in Mar 2016. There is deterioration in Apr-May 2016 with improvement in Jun 2016 and deterioration in Jul 2016.

Chart VA-2, Federal Reserve Bank of Philadelphia Business Outlook Survey, Current and Future Activity Indexes

Source: Federal Reserve Bank of Philadelphia

http://www.philadelphiafed.org/index.cfm

The index of current new orders of the Business Outlook Survey of the Federal Reserve Bank of Philadelphia in Chart VA-2 illustrates the weakness of the cyclical expansion. The index weakened in 2006 and 2007 and then fell sharply into contraction during the global recession. There have been twelve readings into contraction from Jan 2012 to May 2013 and generally weak readings with some exceptions. The index of new orders moved into expansion in Jun-Oct 2013 with moderation in Nov-Dec 2013 and into Jan 2014. The index fell into contraction in Feb 2014, recovering in Mar-Apr 2014 but weaker reading in May 2014. There is marked improvement in Jun-Jul 2014 with slowing in Aug-Oct 2014 followed by acceleration in Nov 2014. New orders deteriorated in Jan-Apr 2015, improving in May-Jun 2015. New orders deteriorated in Jul-Aug 2015 and improved in Sep 2015. New orders deteriorated in Oct-2015 to Dec 2015, contracting at slower pace in Jan 2016. There is sharper contraction in Feb 2016 and an upward jump in Mar 2016 followed by deterioration in Apr-Jun 2016. New orders improved in Jul 2016.

Chart VA-3, Federal Reserve Bank of Philadelphia Business Outlook Survey, Current New Orders Diffusion Index SA

Source: Federal Reserve Bank of Philadelphia

http://www.philadelphiafed.org/index.cfm

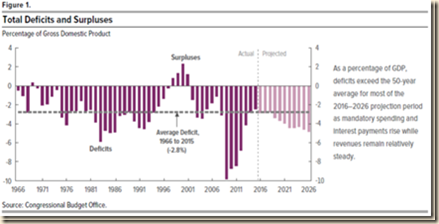

IIA Unresolved US Balance of Payments Deficits and Fiscal Imbalance Threatening Risk Premium on Treasury Securities. Table IIA1-1 of the CBO (2012NovMBR, 2013BEOFeb5, 2013HBDFFeb5, 2013MEFFeb5, 2013Aug12, CBO, Feb 2014, CBO, Apr 2014, CBO, Jan 2015 https://www.cbo.gov/about/products/budget_economic_data#3) shows the significant worsening of United States fiscal affairs from 2007-2008 to 2009-2012 with marginal improvement in 2013-2015 but with much higher debt relative to GDP. The deficit of $1.1 trillion in fiscal year 2012 was the fourth consecutive federal deficit exceeding one trillion dollars. All four deficits are the highest in share of GDP since 1946 (CBO 2012MBR, 2013HBDFeb5, 2013Aug12, 2013AugHBD, CBO, Jan 2015 https://www.cbo.gov/about/products/budget_economic_data#3).

Table IAI-1, US, Budget Fiscal Year Totals, Billions of Dollars and % GDP

| 2007 | 2008 | 2009 | 2010 | 2011 | |

| Receipts | 2568 | 2524 | 2105 | 2163 | 2303 |

| Outlays | 2729 | 2983 | 3518 | 3457 | 3603 |

| Deficit | -161 | -459 | 1413 | 1294 | 1300 |

| % GDP | -1.1 | -3.1 | -9.8 | -8.7 | -8.5 |

| 2012 | 2013 | 2014 | 2015 | |

| Receipts | 2450 | 2775 | 3021 | 3250 |

| Outlays | 3537 | 3455 | 3506 | 3688 |

| Deficit | 1087 | 680 | -485 | -438 |

| % GDP | -6.8 | -4.1 | -2.8 | -2.5 |

Source: https://www.cbo.gov/about/products/budget_economic_data#2 CBO (2012NovMBR), CBO (2013BEOFeb5), CBO (2013HBDFeb5), CBO (2013Aug12). CBO, Historical Budget Data—February 2014, Washington, DC, Congressional Budget Office, Feb. CBO, Historical Budget Data—April 2014, Washington DC, Congressional Budget Office, Apr 14. CBO, Historical budget data—August 2014 release. Washington, DC, Congressional Budget Office, Aug 27. CBO, Monthly budget review: summary of fiscal year 2014. Washington, DC, Congressional Budget Office, Nov 10, 2014. CBO, Historical Budget Data, January 2015 Baseline from Budget and economic outlook: 2015 to 2025. Washington, DC, CBO, Jan 26. CBO. 2015. An update to the budget and economic outlook: 2015 to 2025. Washington, DC, CBO, Aug 25.

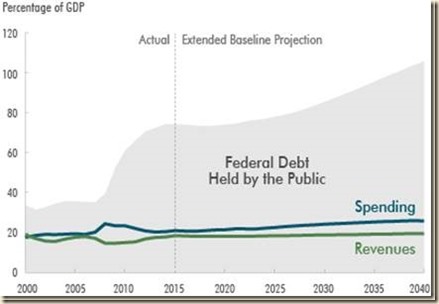

Table IIAI-2 provides additional information required for understanding the deficit/debt situation of the United States. The table is divided into four parts: Treasury budget in the 2016 fiscal year beginning on Oct 1, 2015 and ending on Sep 30, 2016; federal fiscal data for the years from 2009 to 2015; federal fiscal data for the years from 2005 to 2008; and Treasury debt held by the public from 2005 to 2015. Receipts increased 0.9 percent in the cumulative fiscal year 2016 ending in Jun 2016 relative to the cumulative in fiscal year 2015. Individual income taxes increased 0.4 percent relative to the same fiscal period a year earlier. Outlays increased 3.9 percent relative to a year earlier. There are also receipts, outlays, deficit and debt for fiscal years 2013, 2014 and 2015. Total revenues of the US from 2009 to 2012 accumulate to $9021 billion, or $9.0 trillion, while expenditures or outlays accumulate to $14,115 billion, or $14.1 trillion, with the deficit accumulating to $5094 billion, or $5.1 trillion. Revenues decreased 6.5 percent from $9653 billion in the four years from 2005 to 2008 to $9021 billion in the years from 2009 to 2012. Decreasing revenues were caused by the global recession from IVQ2007 (Dec) to IIQ2009 (Jun) and also by growth of only 2.1 percent on average in the cyclical expansion from IIIQ2009 to IQ2016. In contrast, the expansion from IQ1983 to IIIQ1989 was at the average annual growth rate of 4.7 percent and at 7.8 percent from IQ1983 to IVQ1983 (http://cmpassocregulationblog.blogspot.com/2016/07/financial-asset-values-rebound-from.html and earlier http://cmpassocregulationblog.blogspot.com/2016/05/appropriate-for-fed-to-increase.html). Because of mediocre GDP growth, there are 23.7 million unemployed or underemployed in the United States for an effective unemployment/underemployment rate of 14.1 percent (http://cmpassocregulationblog.blogspot.com/2016/07/fluctuating-valuations-of-risk.html and earlier http://cmpassocregulationblog.blogspot.com/2016/06/financial-turbulence-twenty-four.html). Weakness of growth and employment creation is analyzed in II Collapse of United States Dynamism of Income Growth and Employment Creation (Section II and earlier http://cmpassocregulationblog.blogspot.com/2016/05/recovery-without-hiring-ten-million.html). In contrast with the decline of revenue, outlays or expenditures increased 30.2 percent from $10,839 billion, or $10.8 trillion, in the four years from 2005 to 2008, to $14,115 billion, or $14.1 trillion, in the four years from 2009 to 2012. Increase in expenditures by 30.2 percent while revenue declined by 6.5 percent caused the increase in the federal deficit from $1186 billion in 2005-2008 to $5094 billion in 2009-2012. Federal revenue was 14.9 percent of GDP on average in the years from 2009 to 2012, which is well below 17.4 percent of GDP on average from 1966 to 2015. Federal outlays were 23.3 percent of GDP on average from 2009 to 2012, which is well above 20.2 percent of GDP on average from 1966 to 2015. The lower part of Table IIA1-2 shows that debt held by the public swelled from $5803 billion in 2008 to $13,117 billion in 2015, by $7314 billion or 126.0 percent. Debt held by the public as percent of GDP or economic activity jumped from 39.3 percent in 2008 to 73.6 percent in 2016, which is well above the average of 39.0 percent from 1966 to 2015. The United States faces tough adjustment because growth is unlikely to recover, creating limits on what can be obtained by increasing revenues, while continuing stress of social programs restricts what can be obtained by reducing expenditures.

Table IIA1-2, US, Treasury Budget in Fiscal Year to Date Million Dollars

| Jun | Fiscal Year 2016 | Fiscal Year 2015 | ∆% |

| Receipts | 2,468,827 | 2,446,920 | 0.9 |

| Outlays | 2,869,674 | 2,763,281 | 3.9 |

| Deficit | -400,847 | -316,361 | |

| Individual Income Tax | 1,171,623 | 1,167,500 | 0.4 |

| Corporation Income Tax | 223,388 | 255,453 | -12.6 |

| Social Insurance | 616,441 | 588,659 | 4.7 |

| Receipts | Outlays | Deficit (-), Surplus (+) | |

| $ Billions | |||

| Fiscal Year 2015 | 3,250 | 3,688 | -438 |

| % GDP | 18.2 | 20.7 | 2.5 |

| Fiscal Year 2014 | 3,021 | 3,506 | -485 |

| % GDP | 17.6 | 20.4 | 2.8 |

| Fiscal Year 2013 | 2,775 | 3,455 | -680 |

| % GDP | 16.8 | 20.9 | -4.1 |

| Fiscal Year 2012 | 2,450 | 3,537 | -1,087 |

| % GDP | 15.3 | 22.1 | -6.8 |

| Fiscal Year 2011 | 2,303 | 3,603 | -1,300 |

| % GDP | 15.0 | 23.4 | -8.5 |

| Fiscal Year 2010 | 2,163 | 3,457 | -1,294 |

| % GDP | 14.6 | 23.4 | -8.7 |

| Fiscal Year 2009 | 2,105 | 3,518 | -1,413 |

| % GDP | 14.6 | 24.4 | -9.8 |

| Total 2009-2012 | 9,021 | 14,115 | -5,094 |

| Average % GDP 2009-2012 | 14.9 | 23.3 | -8.5 |

| Fiscal Year 2008 | 2,524 | 2,983 | -459 |

| % GDP | 17.1 | 20.2 | -3.1 |

| Fiscal Year 2007 | 2,568 | 2,729 | -161 |

| % GDP | 17.9 | 19.1 | -1.1 |

| Fiscal Year 2006 | 2,407 | 2,655 | -248 |

| % GDP | 17.6 | 19.4 | -1.8 |

| Fiscal Year 2005 | 2,154 | 2,472 | -318 |

| % GDP | 16.7 | 19.2 | -2.5 |

| Total 2005-2008 | 9,653 | 10,839 | -1,186 |

| Average % GDP 2005-2008 | 17.3 | 19.5 | -2.1 |

| Debt Held by the Public | Billions of Dollars | Percent of GDP | |

| 2005 | 4,592 | 35.6 | |

| 2006 | 4,829 | 35.3 | |

| 2007 | 5,035 | 35.2 | |

| 2008 | 5,803 | 39.3 | |

| 2009 | 7,545 | 52.3 | |

| 2010 | 9,019 | 60.9 | |

| 2011 | 10,128 | 65.9 | |

| 2012 | 11,281 | 70.4 | |

| 2013 | 11,983 | 72.6 | |

| 2014 | 12,780 | 74.4 | |

| 2015 | 13,117 | 73.6 |

Source: http://www.fiscal.treasury.gov/fsreports/rpt/mthTreasStmt/mthTreasStmt_home.htm

CBO (2012NovMBR). CBO (2011AugBEO); Office of Management and Budget 2011. Historical Tables. Budget of the US Government Fiscal Year 2011. Washington, DC: OMB; CBO. 2011JanBEO. Budget and Economic Outlook. Washington, DC, Jan. CBO. 2012AugBEO. Budget and Economic Outlook. Washington, DC, Aug 22. CBO. 2012Jan31. Historical budget data. Washington, DC, Jan 31. CBO. 2012NovCDR. Choices for deficit reduction. Washington, DC. Nov. CBO. 2013HBDFeb5. Historical budget data—February 2013 baseline projections. Washington, DC, Congressional Budget Office, Feb 5. CBO. 2013HBDFeb5. Historical budget data—February 2013 baseline projections. Washington, DC, Congressional Budget Office, Feb 5. CBO (2013Aug12). 2013AugHBD. Historical budget data—August 2013. Washington, DC, Congressional Budget Office, Aug. CBO, Historical Budget Data—February 2014, Washington, DC, Congressional Budget Office, Feb. CBO, Historical budget data—April 2014 release. Washington, DC, Congressional Budget Office, Apr. Congressional Budget Office, August 2014 baseline: an update to the budget and economic outlook: 2014 to 2024. Washington, DC, CBO, Aug 27, 2014. CBO, Monthly budget review: summary of fiscal year 2014. Washington, DC, Congressional Budget Office, Nov 10, 2014. CBO, The budget and economic outlook: 2015 to 2025. Washington, DC, Congressional Budget Office, Jan 26, 2015. https://www.cbo.gov/about/products/budget_economic_data#3 https://www.cbo.gov/about/products/budget_economic_data#2