Mediocre United States Economic Growth, Stagnating Real Disposable Income, Financial Repression, Swelling Undistributed Corporate Profits, Peaking Valuations of Risk Financial Assets, World Economic Slowdown and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011, 2012, 2013

Executive Summary

I Mediocre and Decelerating United States Economic Growth

IA Mediocre and Decelerating United States Economic Growth

IA1 Contracting Real Private Fixed Investment

IA2 Swelling Undistributed Corporate Profits

II Stagnating Real Disposable Income and Consumption Expenditures

IIA1 Stagnating Real Disposable Income and Consumption Expenditures

IIA2 Financial Repression

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

Executive Summary

ESI Mediocre and Decelerating United States Economic Growth. The US is experiencing the first expansion from a recession after World War II without growth, jobs (http://cmpassocregulationblog.blogspot.com/2013/05/twenty-nine-million-unemployed-or.html) and hiring (http://cmpassocregulationblog.blogspot.com/2013/05/recovery-without-hiring-collapse-of.html), unsustainable government deficit/debt (http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

http://cmpassocregulationblog.blogspot.com/2012/11/united-states-unsustainable-fiscal.html), waves of inflation (http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.html) and deteriorating terms of trade and net revenue margins in squeeze of economic activity by carry trades induced by zero interest rates

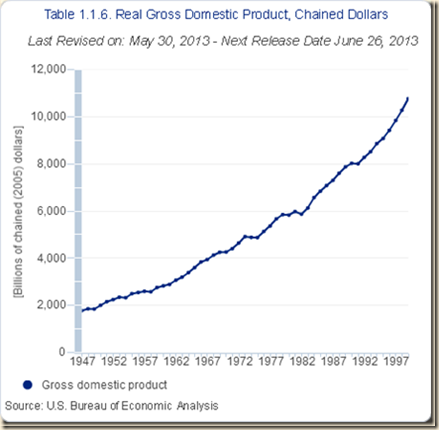

(http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.html) while valuations of risk financial assets approach historical highs. Long-term economic performance in the United States consisted of trend growth of GDP at 3 percent per year and of per capita GDP at 2 percent per year as measured for 1870 to 2010 by Robert E Lucas (2011May). The economy returned to trend growth after adverse events such as wars and recessions. The key characteristic of adversities such as recessions was much higher rates of growth in expansion periods that permitted the economy to recover output, income and employment losses that occurred during the contractions. Over the business cycle, the economy compensated the losses of contractions with higher growth in expansions to maintain trend growth of GDP of 3 percent and of GDP per capita of 2 percent. US economic growth has been at only 2.1 percent on average in the cyclical expansion in the 15 quarters from IIIQ2009 to IQ2013. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). The average of 7.8 percent in the first four quarters of major cyclical expansions is in contrast with the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 of only 3.2 percent obtained by diving GDP of $13,103.5 billion in IIIQ2010 by GDP of $12,701.0 billion in IIQ2009 {[$13.103.5/$12,701.0 -1]100 = 3.2%], or accumulating the quarter on quarter growth rates (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html). The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.7 percent and at 7.7 percent from IQ1983 to IVQ1983 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html). As a result, there are 28.6 million unemployed or underemployed in the United States for an effective unemployment rate of 17.6 percent (http://cmpassocregulationblog.blogspot.com/2013/05/twenty-nine-million-unemployed-or.html).

The economy of the US can be summarized in growth of economic activity or GDP as decelerating from mediocre growth of 2.4 percent on an annual basis in 2010 and 1.8 percent in 2011 to 2.2 percent in 2012. Calculations below show that actual growth is around 1.9 percent per year. This rate is well below 3 percent per year in trend from 1870 to 2010, which has been always recovered after events such as wars and recessions (Lucas 2011May). United States real GDP grew at the rate of 3.2 percent between 1929 and 2012 and at 3.2 percent between 1947 and 2012 (http://www.bea.gov/iTable/index_nipa.cfm see http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.html). Growth is not only mediocre but also sharply decelerating to a rhythm that is not consistent with reduction of unemployment and underemployment of 28.6 million people corresponding to 17.6 percent of the effective labor force of the United States (http://cmpassocregulationblog.blogspot.com/2013/05/twenty-nine-million-unemployed-or.html). In the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013, US real GDP grew at the seasonally-adjusted annual equivalent rates of 0.1 percent in the first quarter of 2011 (IQ2011), 2.5 percent in IIQ2011, 1.3 percent in IIIQ2011, 4.1 percent in IVQ2011, 2.0 percent in IQ2012, 1.3 percent in IIQ2012, revised 3.1 percent in IIIQ2012, 0.4 percent in IVQ2012 and revised 2.4 percent in IQ2013. The annual equivalent rate of growth of GDP for the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 is 1.9 percent, obtained as follows. Discounting 0.1 percent to one quarter is 0.025 percent {[(1.001)1/4 -1]100 = 0.025}; discounting 2.5 percent to one quarter is 0.62 percent {[(1.025)1/4 – 1]100}; discounting 1.3 percent to one quarter is 0.32 percent {[(1.013)1/4 – 1]100}; discounting 4.1 percent to one quarter is 1.0 {[(1.04)1/4 -1]100; discounting 2.0 percent to one quarter is 0.50 percent {[(1.020)1/4 -1]100); discounting 1.3 percent to one quarter is 0.32 percent {[(1.013)1/4 -1]100}; discounting 3.1 percent to one quarter is 0.77 {[(1.031)1/4 -1]100); discounting 0.4 percent to one quarter is 0.1 percent {[(1.004)1/4 – 1]100}; and discounting 2.4 percent to one quarter is 0.59 percent {[(1.024)1/4 -1}100}. Real GDP growth in the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 accumulated to 4.3 percent {[(1.00025 x 1.0062 x 1.0032 x 1.010 x 1.005 x 1.0032 x 1.0077 x 1.001 x 1.0059) - 1]100 = 4.3%}. This is equivalent to growth from IQ2011 to IQ2013 obtained by dividing the seasonally-adjusted annual rate (SAAR) of IQ2013 of $13,746.2 billion by the SAAR of IVQ2010 of $13,181.2 (http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1 and Table I-6 below) and expressing as percentage {[($13,746.2/$13,181.2) - 1]100 = 4.3%}. The growth rate in annual equivalent for the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 is 1.9 percent {[(1.00025 x 1.0062 x 1.0032 x 1.010 x 1.005 x 1.0032 x 1.0077 x 1.001 x 1.0059)4/9 -1]100 = 1.9%], or {[($13,746.2/$13,181.2)]4/9-1]100 = 1.9%} dividing the SAAR of IVQ2012 by the SAAR of IVQ2010 in Table I-6 below, obtaining the average for nine quarters and the annual average for one year of four quarters. Growth in the four quarters of 2012 accumulates to 1.7 percent {[(1.02)1/4(1.013)1/4(1.031)1/4(1.004)1/4 -1]100 = 1.7%}. This is equivalent to dividing the SAAR of $13,665.4 billion for IVQ2012 in Table I-6 by the SAAR of $13,441.0 billion in IVQ2011 except for a rounding discrepancy to obtain 1.7 percent {[($13,665.4/$13,441.0) – 1]100 = 1.7%}. The US economy is still close to a standstill especially considering the GDP report in detail.

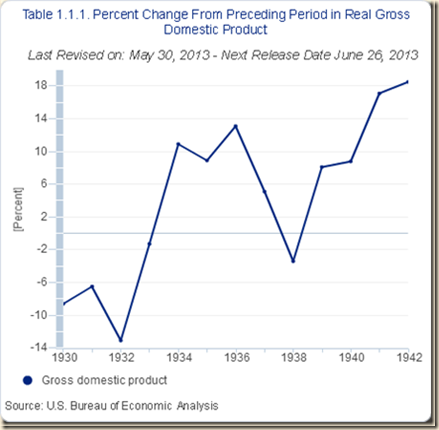

Characteristics of the four cyclical contractions are provided in Table I-4 with the first column showing the number of quarters of contraction; the second column the cumulative percentage contraction; and the final column the average quarterly rate of contraction. There were two contractions from IQ1980 to IIIQ1980 and from IIIQ1981 to IVQ1982 separated by three quarters of expansion. The drop of output combining the declines in these two contractions is 4.8 percent, which is almost equal to the decline of 4.7 percent in the contraction from IVQ2007 to IIQ2009. In contrast, during the Great Depression in the four years of 1930 to 1933, GDP in constant dollars fell 26.7 percent cumulatively and fell 45.6 percent in current dollars (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 150-2, Pelaez and Pelaez, Globalization and the State, Vol. II (2009b), 205-7). The comparison of the global recession after 2007 with the Great Depression is entirely misleading.

Table I-4, US, Number of Quarters, Cumulative Percentage Contraction and Average Percentage Annual Equivalent Rate in Cyclical Contractions

| Number of Quarters | Cumulative Percentage Contraction | Average Percentage Rate | |

| IIQ1953 to IIQ1954 | 4 | -2.5 | -0.64 |

| IIIQ1957 to IIQ1958 | 3 | -3.1 | -1.1 |

| IQ1980 to IIIQ1980 | 2 | -2.2 | -1.1 |

| IIIQ1981 to IVQ1982 | 4 | -2.6 | -0.67 |

| IVQ2007 to IIQ2009 | 6 | -4.7 | -0.80 |

Sources: Business Cycle Reference Dates; US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Table I-5 shows the extraordinary contrast between the mediocre average annual equivalent growth rate of 2.1 percent of the US economy in the fifteen quarters of the current cyclical expansion from IIIQ2009 to IQ2013 and the average of 5.7 percent in the first thirteen quarters of expansion from IQ1983 to IQ1986 and 5.3 percent in the first fifteen quarters of expansion from IQ1983 to IIIQ1986. The line “average first four quarters in four expansions” provides the average growth rate of 7.8 percent with 7.9 percent from IIIQ1954 to IIQ1955, 9.5 percent from IIIQ1958 to IIQ1959, 6.1 percent from IIIQ1975 to IIQ1976 and 7.7 percent from IQ1983 to IVQ1983. The United States missed this opportunity of high growth in the initial phase of recovery. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). Table I-5 provides an average of 7.8 percent in the first four quarters of major cyclical expansions while the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 is only 3.2 percent obtained by diving GDP of $13,103.5 billion in IIIQ2010 by GDP of $12,701.0 billion in IIQ2009 {[$13.103.5/$12,701.0 -1]100 = 3.2%], or accumulating the quarter on quarter growth rates. As a result, there are 28.6 million unemployed or underemployed in the United States for an effective unemployment rate of 17.6 percent (http://cmpassocregulationblog.blogspot.com/2013/05/twenty-nine-million-unemployed-or.html). BEA data show the US economy in standstill with annual growth of 2.4 percent in 2010 decelerating to 1.8 percent annual growth in 2011, 2.2 percent in 2012 (http://www.bea.gov/iTable/index_nipa.cfm) and cumulative 1.7 percent in the four quarters of 2012 {[(1.02)1/4(1.013)1/4(1.031)1/4(1.004)1/4 – 1]100 = 1.7%} with minor rounding discrepancy using the SSAR of $13,665.4 billion in IVQ2012 relative to the SAAR of $13,441.0 billion in IVQ2011 {[($13665.4/$13441.00-1]100 = 1.7%}. %}. The growth rate in annual equivalent for the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 is 1.9 percent {[(1.00025 x 1.0062 x 1.0032 x 1.010 x 1.005 x 1.0032 x 1.0077 x 1.001 x 1.0059)4/9 -1]100 = 1.9%], or {[($13,746.2/$13,181.2)]4/9-1]100 = 1.9%} dividing the SAAR of IVQ2012 by the SAAR of IVQ2010 in Table I-6 below, obtaining the average for nine quarters and the annual average for one year of four quarters. The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.7 percent and at 7.7 percent from IQ1983 to IVQ1983.

Table I-5, US, Number of Quarters, Cumulative Growth and Average Annual Equivalent Growth Rate in Cyclical Expansions

| Number | Cumulative Growth ∆% | Average Annual Equivalent Growth Rate | |

| IIIQ 1954 to IQ1957 | 11 | 12.6 | 4.4 |

| First Four Quarters IIIQ1954 to IIQ1955 | 4 | 7.9 | |

| IIQ1958 to IIQ1959 | 5 | 10.2 | 8.1 |

| First Four Quarters IIIQ1958 to IIQ1959 | 4 | 9.5 | |

| IIQ1975 to IVQ1976 | 8 | 9.5 | 4.6 |

| First Four Quarters IIIQ1975 to IIQ1976 | 4 | 6.1 | |

| IQ1983 to IQ1986 IQ1983 to IIIQ1986 | 13 15 | 19.6 21.3 | 5.7 5.3 |

| First Four Quarters IQ1983 to IVQ1983 | 4 | 7.7 | |

| Average First Four Quarters in Four Expansions* | 7.8 | ||

| IIIQ2009 to IQ2013 | 15 | 8.2 | 2.1 |

| First Four Quarters IIIQ2009 to IIIQ2010 | 3.2 |

*First Four Quarters: 7.9% IIIQ1954-IIQ1955; 9.6% IIIQ1958-IIQ1959; 6.1% IIIQ1975-IIQ1976; 7.7% IQ1983-IVQ1983

Sources: Business Cycle Reference Dates: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

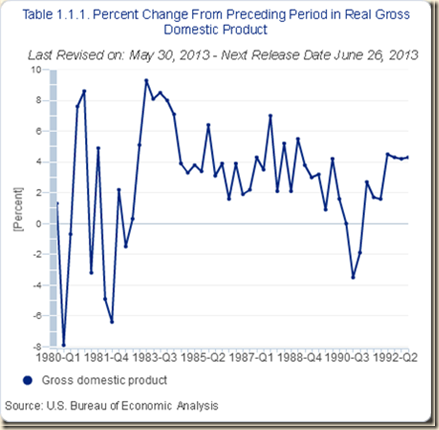

Chart I-8 shows US real quarterly GDP growth from 1980 to 1989. The economy contracted during the recession and then expanded vigorously throughout the 1980s, rapidly eliminating the unemployment caused by the contraction.

Chart I-8, US, Real GDP, 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

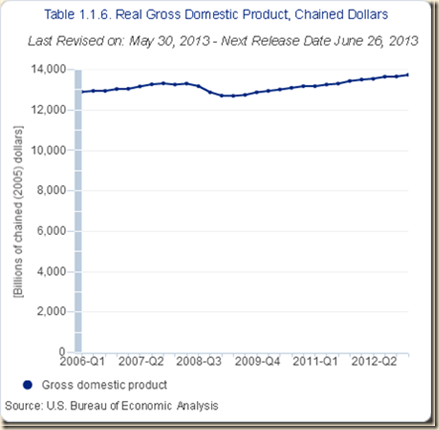

Chart I-9 shows the entirely different situation of real quarterly GDP in the US between 2007 and 2012. The economy has underperformed during the first fifteen quarters of expansion for the first time in the comparable contractions since the 1950s. The US economy is now in a perilous standstill.

Chart I-9, US, Real GDP, 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

As shown in Tables I-4 and I-5 above the loss of real GDP in the US during the contraction was 4.7 percent but the gain in the cyclical expansion has been only 8.2 percent (last row in Table I-5), using all latest revisions. As a result, the level of real GDP in IQ2013 with the second estimate and revisions is only higher by 3.2 percent than the level of real GDP in IVQ2007. Table I-6 provides in the second column real GDP in billions of chained 2005 dollars. The third column provides the percentage change of the quarter relative to IVQ2007; the fourth column provides the percentage change relative to the prior quarter; and the final fifth column provides the percentage change relative to the same quarter a year earlier. The contraction actually concentrated in two quarters: decline of 2.3 percent in IVQ2008 relative to the prior quarter and decline of 1.3 percent in IQ2009 relative to IVQ2008. The combined fall of GDP in IVQ2008 and IQ2009 was 3.6 percent {[(1-0.023) x (1-0.013) -1]100 = -3.6%}, or {[(IQ2009 $12,711.0)/(IIIQ2008 $13,186.9) – 1]100 = -3.6%}. Those two quarters coincided with the worst effects of the financial crisis. GDP fell 0.1 percent in IIQ2009 but grew 0.4 percent in IIIQ2009, which is the beginning of recovery in the cyclical dates of the NBER. Most of the recovery occurred in five successive quarters from IVQ2009 to IVQ2010 of growth of 1.0 percent in IVQ2009 and equal growth at 0.6 percent in IQ2010, IIQ2010, IIIQ2010 and IVQ2010 for cumulative growth in those five quarters of 3.4 percent, obtained by accumulating the quarterly rates {[(1.01 x 1.006 x 1.006 x 1.006 x 1.006) – 1]100 = 3.4%} or {[(IVQ2010 $13,181.2)/(IIIQ2009 $12,746.7) – 1]100 = 3.4%}. The economy lost momentum already in 2010 growing at 0.6 percent in each quarter, or annual equivalent 2.4 per cent {[(1.006)4 – 1]100 = 2.4%}, compared with annual equivalent 4.1 percent in IV2009 {[(1.01)4 – 1]100 = 4.1%}. The economy then stalled during the first half of 2011 with growth of 0.0025 percent in IQ2011 and 0.6 percent in IIQ2011 for combined annual equivalent rate of 1.2 percent {(1.00025 x 1.006)2}. The economy grew 0.3 percent in IIIQ2011 for annual equivalent growth of 1.2 percent in the first three quarters {[(1.00025 x 1.006 x 1.003)4/3 -1]100 = 1.2%}. Growth picked up in IVQ2011 with 1.0 percent relative to IIIQ2011. Growth in a quarter relative to a year earlier in Table I-6 slows from over 2.4 percent during three consecutive quarters from IIQ2010 to IVQ2010 to 1.8 percent in IQ2011, 1.9 percent in IIQ2011, 1.6 percent in IIIQ2011 and 2.0 percent in IVQ2011. As shown below, growth of 1.0 percent in IVQ2011 was partly driven by inventory accumulation. In IQ2012, GDP grew 0.5 percent relative to IVQ2011 and 2.4 percent relative to IQ2011, decelerating to 0.3 percent in IIQ2012 and 2.1 percent relative to IIQ2011 and 0.8 percent in IIIQ2012 and 2.6 percent relative to IIIQ2011 largely because of inventory accumulation and national defense expenditures. Growth was 0.1 percent in IVQ2012 with 1.7 percent relative to a year earlier but mostly because of 1.52 percentage points of inventory divestment and 1.28 percentage points of reduction of one-time national defense expenditures. Growth was 0.6 percent in IQ2013 and 1.8 percent relative to IQ2012 in large part because of burning savings to consume caused by financial repression of zero interest rates. Rates of a quarter relative to the prior quarter capture better deceleration of the economy than rates on a quarter relative to the same quarter a year earlier. The critical question for which there is not yet definitive solution is whether what lies ahead is continuing growth recession with the economy crawling and unemployment/underemployment at extremely high levels or another contraction or conventional recession. Forecasts of various sources continued to maintain high growth in 2011 without taking into consideration the continuous slowing of the economy in late 2010 and the first half of 2011. The sovereign debt crisis in the euro area is one of the common sources of doubts on the rate and direction of economic growth in the US but there is weak internal demand in the US with almost no investment and spikes of consumption driven by burning saving because of financial repression forever in the form of zero interest rates.

Table I-6, US, Real GDP and Percentage Change Relative to IVQ2007 and Prior Quarter, Billions Chained 2005 Dollars and ∆%

| Real GDP, Billions Chained 2005 Dollars | ∆% Relative to IVQ2007 | ∆% Relative to Prior Quarter | ∆% | |

| IVQ2007 | 13,326.0 | NA | NA | 2.2 |

| IQ2008 | 13,266.8 | -0.4 | -0.4 | 1.6 |

| IIQ2008 | 13,310.5 | -0.1 | 0.3 | 1.0 |

| IIIQ2008 | 13,186.9 | -1.0 | -0.9 | -0.6 |

| IVQ2008 | 12,883.5 | -3.3 | -2.3 | -3.3 |

| IQ2009 | 12,711.0 | -4.6 | -1.3 | -4.2 |

| IIQ2009 | 12,701.0 | -4.7 | -0.1 | -4.6 |

| IIIQ2009 | 12,746.7 | -4.3 | 0.4 | -3.3 |

| IV2009 | 12,873.1 | -3.4 | 1.0 | -0.1 |

| IQ2010 | 12,947.6 | -2.8 | 0.6 | 1.9 |

| IIQ2010 | 13,019.6 | -2.3 | 0.6 | 2.5 |

| IIIQ2010 | 13,103.5 | -1.7 | 0.6 | 2.8 |

| IVQ2010 | 13,181.2 | -1.1 | 0.6 | 2.4 |

| IQ2011 | 13,183.8 | -1.1 | 0.0 | 1.8 |

| IIQ2011 | 13,264.7 | -0.5 | 0.6 | 1.9 |

| IIIQ2011 | 13,306.9 | -0.1 | 0.3 | 1.6 |

| IV2011 | 13,441.0 | 0.9 | 1.0 | 2.0 |

| IQ2012 | 13,506.4 | 1.4 | 0.5 | 2.4 |

| IIQ2012 | 13,548.5 | 1.7 | 0.3 | 2.1 |

| IIIQ2012 | 13,652.5 | 2.5 | 0.8 | 2.6 |

| IVQ2012 | 13,665.4 | 2.5 | 0.1 | 1.7 |

| IQ2013 | 13,746.2 | 3.2 | 0.6 | 1.8 |

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

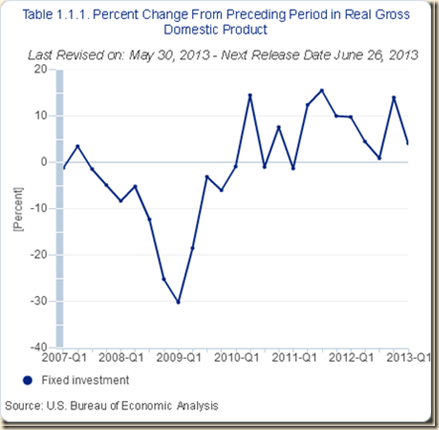

ESII Contracting Fixed Private Investment. Table IA1-2 provides real private fixed investment at seasonally adjusted annual rates from IVQ2007 to IQ2013 or for the complete economic cycle. The first column provides the quarter, the second column percentage change relative to IVQ2007, the third column the quarter percentage change in the quarter relative to the prior quarter and the final column percentage change in a quarter relative to the same quarter a year earlier. In IQ1980, gross private domestic investment in the US was $778.3 billion of 2005 dollars, growing to $965.9 billion in IVQ1985 or 24.1 percent, as shown in Table IB-2 of IB Collapse of Dynamism of United States Income Growth and Employment Creation (IX Conclusion and extended analysis at http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html). Gross private domestic investment in the US decreased 8.8 percent from $2,111.5 billion of 2005 dollars in IVQ2007 to $1,925.6 billion in IQ2013. As shown in Table IAI-2, real private fixed investment fell 8.8 percent from $2111.5 billion of 2005 dollars in IVQ2007 to $1925.6 billion in IQ2014. Growth of real private investment in Table IA1-2 is mediocre for all but four quarters from IIQ2011 to IQ2012.

Table IA1-2, US, Real Private Fixed Investment and Percentage Change Relative to IVQ2007 and Prior Quarter, Billions of Chained 2005 Dollars and ∆%

| Real PFI, Billions Chained 2005 Dollars | ∆% Relative to IVQ2007 | ∆% Relative to Prior Quarter | ∆% | |

| IVQ2007 | 2111.5 | NA | -1.2 | -1.0 |

| IQ2008 | 2066.4 | -2.1 | -2.1 | -2.9 |

| IIQ2008 | 2039.1 | -3.4 | -1.3 | -5.0 |

| IIIQ2008 | 1973.5 | -6.5 | -3.2 | -7.7 |

| IV2008 | 1835.4 | -13.1 | -7.0 | -13.1 |

| IQ2009 | 1677.3 | -20.6 | -8.6 | -18.8 |

| IIQ2009 | 1593.7 | -24.5 | -5.0 | -21.8 |

| IIIQ2009 | 1581.2 | -25.1 | -0.8 | -19.9 |

| IVQ2009 | 1556.8 | -26.3 | -1.5 | -15.2 |

| IQ2010 | 1553.1 | -26.4 | -0.2 | -7.4 |

| IIQ2010 | 1606.5 | -23.9 | 3.4 | 0.8 |

| IIIQ2010 | 1602.7 | -24.1 | -0.2 | 1.4 |

| IVQ2010 | 1632.3 | -22.7 | 1.8 | 4.8 |

| IQ2011 | 1627.0 | -22.9 | -0.3 | 4.8 |

| IIQ2011 | 1675.4 | -20.7 | 3.0 | 4.3 |

| IIIQ2011 | 1736.8 | -17.7 | 3.7 | 8.4 |

| IVQ2011 | 1778.7 | -15.8 | 2.4 | 9.0 |

| IQ2012 | 1820.6 | -13.8 | 2.4 | 11.9 |

| IIQ2012 | 1840.6 | -12.8 | 1.1 | 9.9 |

| IIIQ2012 | 1844.8 | -12.6 | 0.2 | 6.2 |

| IVQ2012 | 1906.3 | -9.7 | 3.3 | 7.2 |

| IQ2013 | 1925.6 | -8.8 | 1.0 | 5.8 |

PFI: Private Fixed Investment

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart IA1-3 provides real private fixed investment in billions of chained 2005 dollars from IV2007 to IQ2013. Real private fixed investment has not recovered, stabilizing at a level in IQ2013 that is 8.8 percent below the level in IVQ2007.

Chart IA1-3, US, Real Private Fixed Investment, Billions of Chained 2005 Dollars, IQ2007 to IQ2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IA1-4 provides real gross private domestic investment in chained dollars of 2005 from 1980 to 1986. Real gross private domestic investment climbed 24.1 percent in IVQ1985 above the level in IQ1980.

Chart IA1-4, US, Real Gross Private Domestic Investment, Billions of Chained 2005 Dollars at Seasonally Adjusted Annual Rate, 1980-1986

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IA1-5 provides real gross private domestic investment in the United States in billions of dollars of 2005 from 2006 to 2013. Gross private domestic investment reached a level in IQ2013 that was 6.9 percent lower than the level in IVQ2007 (http://www.bea.gov/iTable/index_nipa.cfm).

Chart IA1-5, US, Real Gross Private Domestic Investment, Billions of Chained 2005 Dollars at Seasonally Adjusted Annual Rate, 2007-2013

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

ESIII Swelling Undistributed Corporate Profits. Table IA1-5 provides value added of corporate business, dividends and corporate profits in billions of current dollars at seasonally adjusted annual rates (SAAR) in IVQ2007 and IQ2013 together with percentage changes. The last three rows of Table IA1-5 provide gross value added of nonfinancial corporate business, consumption of fixed capital and net value added in billions of chained 2005 dollars at SAARs. Deductions from gross value added of corporate profits down the rows of Table IA1-5 end with undistributed corporate profits. Profits after taxes with inventory valuation adjustment (IVA) and capital consumption adjustment (CCA) increased by 50.2 percent in nominal terms from IVQ2007 to IQ2013 while net dividends decreased 1.1 percent and undistributed corporate profits swelled 205 percent from $118.0 billion in IQ2007 to $359.9 billion in IQ2013 from minus $22.1 billion in current dollars in IVQ2007. The investment decision of United States corporations has been fractured in the current economic cycle in preference of cash. Gross value added of nonfinancial corporate business adjusted for inflation increased 4.2 percent from IVQ2007 to IQ2013, which is much lower than nominal increase of 12.4 percent in the same period for gross value added of total corporate business.

Table IA1-5, US, Value Added of Corporate Business, Corporate Profits and Dividends, IVQ2007-IQ2013

| IVQ2007 | IQ2013 | ∆% | |

| Current Billions of Dollars Seasonally Adjusted Annual Rates (SAAR) | |||

| Gross Value Added of Corporate Business | 7,975.6 | 9,103.0 | 14.1 |

| Consumption of Fixed Capital | 988.0 | 1,135.1 | 14.9 |

| Net Value Added | 6,987.6 | 7,967.8 | 14.0 |

| Compensation of Employees | 5,020.7 | 5,392.0 | 7.4 |

| Taxes on Production and Imports Less Subsidies | 659.7 | 715.7 | 8.5 |

| Net Operating Surplus | 1,307.2 | 1,860.1 | 42.3 |

| Net Interest and Misc | 202.4 | 187.6 | -7.3 |

| Business Current Transfer Payment Net | 73.1 | 122.7 | 67.8 |

| Corporate Profits with IVA and CCA Adjustments | 1,031.6 | 1,549.8 | 50.2 |

| Taxes on Corporate Income | 408.8 | 434.4 | 6.3 |

| Profits after Tax with IVA and CCA Adjustment | 622.9 | 1,115.4 | 79.1 |

| Net Dividends | 645.0 | 638.0 | -1.1 |

| Undistributed Profits with IVA and CCA Adjustment | -22.1 | 477.4 | NA |

| Billions of Chained USD 2005 SAAR | |||

| Gross Value Added of Nonfinancial Corporate Business | 6,642.5 | 6,918.7 | 4.2 |

| Consumption of Fixed Capital | 801.6 | 859.9 | 7.3 |

| Net Value Added | 5,840.9 | 6,058.7 | 3.7 |

IVA: Inventory Valuation Adjustment; CCA: Capital Consumption Adjustment

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Table IA1-6 provides comparable United States value added of corporate business, corporate profits and dividends from IQ1980 to IVQ1985. There is significant difference both in nominal and inflation-adjusted data. Profits after tax with IVA and CCA increased 140.3 percent with dividends growing 112.7 percent and undistributed profits jumping 169.7 percent. There was much higher inflation in the 1980s than in the current cycle. For example, the consumer price index for all items not seasonally adjusted increased 36.5 percent between Mar 1980 and Dec 1985 but only 9.3 percent between Dec 2007 and Dec 2012 (http://www.bls.gov/cpi/data.htm). The comparison is still valid in terms of inflation-adjusted data: gross value added of nonfinancial corporate business adjusted for inflation increased 21.2 percent between IQ1980 and IVQ1985 but only 4.2 percent between IVQ2007 and IQ2013 while net value added adjusted for inflation increased 20.6 percent between IQ1980 and IVQ1985 but only 3.7 percent between IVQ2007 and IQ2013.

Table IA1-6, US, Value Added of Corporate Business, Corporate Profits and Dividends, IQ1980-IVQ1985

| IQ1980 | IVQ1985 | ∆% | |

| Current Billions of Dollars Seasonally Adjusted Annual Rates (SAAR) | |||

| Gross Value Added of Corporate Business | 1,619.3 | 2,576.1 | 59.1 |

| Consumption of Fixed Capital | 169.9 | 278.9 | 64.2 |

| Net Value Added | 1,449.4 | 2,297.1 | 58.5 |

| Compensation of Employees | 1,090.6 | 1,667.0 | 52.9 |

| Taxes on Production and Imports Less Subsidies | 121.5 | 213.3 | 75.6 |

| Net Operating Surplus | 237.3 | 416.9 | 75.7 |

| Net Interest and Misc | 49.0 | 96.8 | 97.6 |

| Business Current Transfer Payment Net | 12.1 | 30.0 | 147.9 |

| Corporate Profits with IVA and CCA Adjustments | 176.3 | 290.0 | 64.5 |

| Taxes on Corporate Income | 97.0 | 99.7 | 2.8 |

| Profits after Tax with IVA and CCA Adjustment | 79.2 | 190.3 | 140.3 |

| Net Dividends | 40.9 | 87.0 | 112.7 |

| Undistributed Profits with IVA and CCA Adjustment | 38.3 | 103.3 | 169.7 |

| Billions of Chained USD 2005 SAAR | |||

| Gross Value Added of Nonfinancial Corporate Business | 2,642.8 | 3,203.9 | 21.2 |

| Consumption of Fixed Capital | 223.2 | 286.6 | 28.4 |

| Net Value Added | 2,419.6 | 2,917.3 | 20.6 |

IVA: Inventory Valuation Adjustment; CCA: Capital Consumption Adjustment

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart IA1-12 of the US Bureau of Economic Analysis provides quarterly corporate profits after tax and undistributed profits with IVA and CCA from 1979 to 2012. There is tightness between the series of quarterly corporate profits and undistributed profits in the 1980s with significant gap developing from 1988 and to the present with the closest approximation peaking in IVQ2005 and surrounding quarters. These gaps widened during all recessions including in 1991 and 2001 and recovered in expansions with exceptionally weak performance in the current expansion.

Chart IA1-12, US, Corporate Profits after Tax and Undistributed Profits with Inventory Valuation Adjustment and Capital Consumption Adjustment, Quarterly, 1979-2012

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Table IA1-7 provides price, costs and profit per unit of gross value added of nonfinancial domestic corporate income for IVQ2007 and IQ2013 in the upper block and for IQ1980 and IVQ1985 in the lower block. Compensation of employees or labor costs per unit of gross value added of nonfinancial domestic corporate income hardly changed from 0.667 in IVQ2007 to 0.693 in IQ2013 in a fractured labor market but increased from 0.386 in IQ1980 to 0.480 in IVQ1985 in a more vibrant labor market. Unit nonlabor costs increased mildly from 0.271 per unit of gross value added in IVQ2007 to 0.287 in IQ2013 but increased from 0.127 in IQ1980 to 0.175 in IVQ1985 in an economy closer to full employment of resources. Profits after tax with IVA and CCA per unit of gross value added of nonfinancial domestic corporate income increased from 0.076 in IVQ2007 to 0.114 in IQ2013 and from 0.025 in IQ1980 to 0.053 in IVQ1985.

Table IA1-7, US, Price, Costs and Profit per Unit of Gross Value Added of Nonfinancial Domestic Corporate Income

| IVQ2007 | IQ2013 | |

| Price per Unit of Real Gross Value Added of Nonfinancial Corporate Business | 1.056 | 1.140 |

| Compensation of Employees (Unit Labor Cost) | 0.667 | 0.693 |

| Unit Nonlabor Cost | 0.271 | 0.287 |

| Consumption of Fixed Capital | 0.128 | 0.138 |

| Taxes on Production and Imports less Subsidies plus Business Current Transfer Payments (net) | 0.103 | 0.110 |

| Net Interest and Misc. Payments | 0.040 | 0.039 |

| Corporate Profits with IVA and CCA Adjustment (Unit Profits from Current Production) | 0.118 | 0.159 |

| Taxes on Corporate Income | 0.043 | 0.045 |

| Profits after Tax with IVA and CCA Adjustment | 0.076 | 0.114 |

| IQ1980 | IVQ1985 | |

| Price per Unit of Real Gross Value Added of Nonfinancial Corporate Business | 0.566 | 0.730 |

| Compensation of Employees (Unit Labor Cost) | 0.386 | 0.480 |

| Unit Nonlabor Cost | 0.127 | 0.175 |

| Consumption of Fixed Capital | 0.060 | 0.078 |

| Taxes on Production and Imports less Subsidies plus Business Current Transfer Payments (net) | 0.047 | 0.068 |

| Net Interest and Misc. Payments | 0.020 | 0.029 |

| Corporate Profits with IVA and CCA Adjustment (Unit Profits from Current Production) | 0.054 | 0.075 |

| Taxes on Corporate Income | 0.029 | 0.022 |

| Profits after Tax with IVA and CCA Adjustment | 0.025 | 0.053 |

IVA: Inventory Valuation Adjustment; CCA: Capital Consumption Adjustment

Source: US Bureau of Economic Analysis http://www.bea.gov/iTable/index_nipa.cfm

Chart IA1-13 provides quarterly profits after tax with IVA and CCA per unit of gross value added of nonfinancial domestic corporate income from 1980 to 2013. In an environment of idle labor and other productive resources nonfinancial corporate income increased after tax profits with IVA and CCA per unit of gross value added at a faster pace in the weak economy from IVQ2007 to IQ2013 than in the vibrant expansion of the cyclical contractions of the 1980s. Part of the profits was distributed as dividends and significant part was retained as undistributed profits in the current economic cycle with frustrated investment decision.

Chart IA1-13, US, Profits after Tax with Inventory Valuation Adjustment and Capital Consumption Adjustment per Unit of Gross Value Added of Nonfinancial Domestic Corporate Income, 1980-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

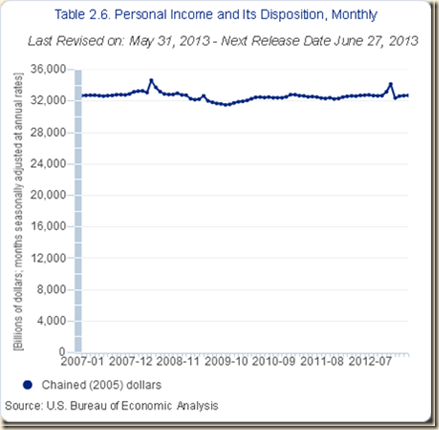

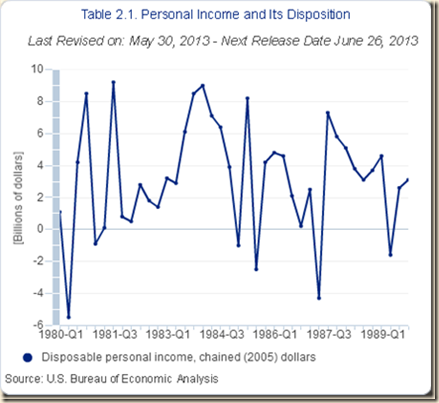

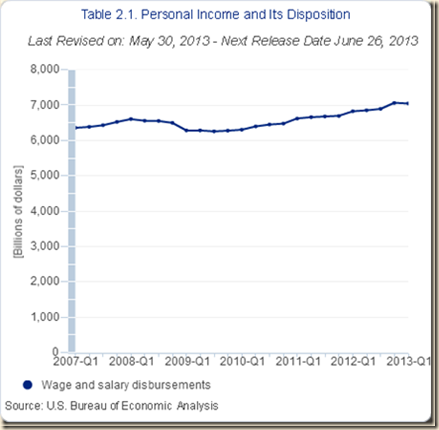

ESIV Stagnating Real Per Capita Disposable Income. Chart IIA-12 provides monthly real disposable personal income per capita from 1980 to 1989. This is the ultimate measure of wellbeing in receiving income by obtaining the value per inhabitant. The measure cannot adjust for the distribution of income. Real disposable personal income per capita grew rapidly during the expansion after 1983 and continued growing during the rest of the decade.

Chart IIA-12, US, Real Disposable Per Capita Income, Monthly, Seasonally Adjusted at Annual Rates, Billions of Dollars 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IIA-13 provides monthly real disposable personal per capita income from 2007 to 2013. There was initial recovery from the drop during the global recession followed by stagnation. Real per capita disposable income increased 1.4 percent from $32,703 in chained dollars of 2005 in Oct 2012 to $33,172 in Nov 2012 and 3.0 percent to $34,174 in Dec 2012 for cumulative increase of 4.5 percent from Oct 2012 to Dec 2012. Real per capita disposable income fell 5.3 percent from $34,174 in Dec 2012 to $32,378 in Jan 2013, increasing marginally 0.8 percent to $32,621 in Feb 2013 for cumulative change of minus 0.3 percent from Oct 2012 (data at http://www.bea.gov/iTable/index_nipa.cfm). This increase is shown in a jump in the final segment in Chart IIA-13 with Nov-Dec 2012, decline in Jan 2013 and recovery in Feb 2013. Real per capita disposable income increased 0.3 percent from $32,621 in Feb 2013 in chained dollars of 2005 to $32,710 in Mar 2013 for cumulative gain of 0.0 percent relative to Oct 2012. Real per capital disposable income increased to $32,729 in Apr 2013 for gain of 0.1 percent relative to Feb 2013 and 0.1 percent from Oct 2012. BEA explains as: “Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf pages 1-2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0113.pdf). The Bureau of Economic Analysis explains as (http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0213.pdf 2-3): “The January estimate of employee contributions for government social insurance reflected the expiration of the “payroll tax holiday,” that increased the social security contribution rate for employees and self-employed workers by 2.0 percentage points, or $114.1 billion at an annual rate. For additional information, see FAQ on “How did the expiration of the payroll tax holiday affect personal income for January 2013?” at www.bea.gov. The January estimate of employee contributions for government social insurance also reflected an increase in the monthly premiums paid by participants in the supplementary medical insurance program, in the hospital insurance provisions of the Patient Protection and Affordable Care Act, and in the social security taxable wage base.”

The increase was provided in the “fiscal cliff” law H.R. 8 American Taxpayer Relief Act of 2012 (http://www.gpo.gov/fdsys/pkg/BILLS-112hr8eas/pdf/BILLS-112hr8eas.pdf).

The BEA explains as follows (page 3 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf):

“The February and January changes in disposable personal income (DPI) mainly reflected the effect of special factors in January, such as the expiration of the “payroll tax holiday” and the acceleration of bonuses and personal dividends to November and to December in anticipation of changes in individual tax rates.”

Chart IIA-13, US, Real Disposable Per Capita Income, Monthly, Seasonally Adjusted at Annual Rates, Billions of Dollars 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

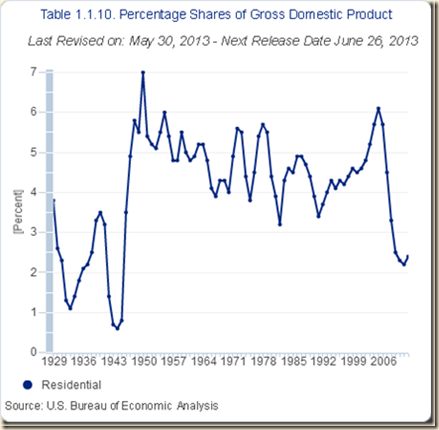

ESV Financial Repression. McKinnon (1973) and Shaw (1974) argue that legal restrictions on financial institutions can be detrimental to economic development. “Financial repression” is the term used in the economic literature for these restrictions (see Pelaez and Pelaez, Globalization and the State, Vol. II (2008b), 81-6). Interest rate ceilings on deposits and loans have been commonly used. Prohibition of payment of interest on demand deposits and ceilings on interest rates on time deposits were imposed by the Banking Act of 1933. These measures were justified by arguments that the banking panic of the 1930s was caused by competitive rates on bank deposits that led banks to engage in high-risk loans (Friedman, 1970, 18; see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 74-5). The objective of policy was to prevent unsound loans in banks. Savings and loan institutions complained of unfair competition from commercial banks that led to continuing controls with the objective of directing savings toward residential construction. Friedman (1970, 15) argues that controls were passive during periods when rates implied on demand deposit were zero or lower and when Regulation Q ceilings on time deposits were above market rates on time deposits. The Great Inflation or stagflation of the 1960s and 1970s changed the relevance of Regulation Q.

Most regulatory actions trigger compensatory measures by the private sector that result in outcomes that are different from those intended by regulation (Kydland and Prescott 1977). Banks offered services to their customers and loans at rates lower than market rates to compensate for the prohibition to pay interest on demand deposits (Friedman 1970, 24). The prohibition of interest on demand deposits was eventually lifted in recent times. In the second half of the 1960s, already in the beginning of the Great Inflation (DeLong 1997), market rates rose above the ceilings of Regulation Q because of higher inflation. Nobody desires savings allocated to time or savings deposits that pay less than expected inflation. This is a fact currently with zero interest rates and consumer price inflation of 2.0 percent in the 12 months ending in Feb 2013 (http://www.bls.gov/cpi/) but rising during waves of carry trades from zero interest rates to commodity futures exposures (http://cmpassocregulationblog.blogspot.com/2013/03/recovery-without-hiring-ten-million.html). Funding problems motivated compensatory measures by banks. Money-center banks developed the large certificate of deposit (CD) to accommodate increasing volumes of loan demand by customers. As Friedman (1970, 25) finds:

“Large negotiable CD’s were particularly hard hit by the interest rate ceiling because they are deposits of financially sophisticated individuals and institutions who have many alternatives. As already noted, they declined from a peak of $24 billion in mid-December, 1968, to less than $12 billion in early October, 1969.”

Banks created different liabilities to compensate for the decline in CDs. As Friedman (1970, 25; 1969) explains:

“The most important single replacement was almost surely ‘liabilities of US banks to foreign branches.’ Prevented from paying a market interest rate on liabilities of home offices in the United States (except to foreign official institutions that are exempt from Regulation Q), the major US banks discovered that they could do so by using the Euro-dollar market. Their European branches could accept time deposits, either on book account or as negotiable CD’s at whatever rate was required to attract them and match them on the asset side of their balance sheet with ‘due from head office.’ The head office could substitute the liability ‘due to foreign branches’ for the liability ‘due on CDs.”

Friedman (1970, 26-7) predicted the future:

“The banks have been forced into costly structural readjustments, the European banking system has been given an unnecessary competitive advantage, and London has been artificially strengthened as a financial center at the expense of New York.”

In short, Depression regulation exported the US financial system to London and offshore centers. What is vividly relevant currently from this experience is the argument by Friedman (1970, 27) that the controls affected the most people with lower incomes and wealth who were forced into accepting controlled-rates on their savings that were lower than those that would be obtained under freer markets. As Friedman (1970, 27) argues:

“These are the people who have the fewest alternative ways to invest their limited assets and are least sophisticated about the alternatives.”

Chart IIA-14 of the Bureau of Economic Analysis (BEA) provides quarterly savings as percent of disposable income or the US savings rate from 1980 to 2013. There was a long-term downward sloping trend from 12 percent in the early 1980s to less than 2 percent in 2005-2006. The savings rate then rose during the contraction and also in the expansion. In 2011 and into 2012 the savings rate declined as consumption is financed with savings in part because of the disincentive or frustration of receiving a few pennies for every $10,000 of deposits in a bank. The savings rate increased in the final segment of Chart IIA-14 in 2012 followed by another decline because of the pain of the opportunity cost of zero remuneration for hard-earned savings. Swelling realization of income in Oct-Dec 2012 in anticipation of tax increases in Jan 2012 caused the jump of the savings rate to 7.4 percent in Dec 2012. The BEA explains as: Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf). The savings rate then collapsed to 2.1 percent in Jan 2013 in part because of the decline of 5.3 percent in real disposable personal income and to 2.4 percent with increase of real disposable income by 0.7 percent in Feb 2013. The savings rate remained at 2.5 percent in Mar 2013 with increase of real disposable income by 0.3 percent and at 2.5 percent in Apr 2013 with increase of per capita real disposable income by 0.1 percent. The decline of personal income was caused by increasing contributions to government social insurance (page 1 http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0113.pdf http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0213.pdf). The objective of monetary policy is to reduce borrowing rates to induce consumption but it has collateral disincentive of reducing savings and misallocating resources away from their best uses. The zero interest rate of monetary policy is a tax on saving. This tax is highly regressive, meaning that it affects the most people with lower income or wealth and retirees. The long-term decline of savings rates in the US has created a dependence on foreign savings to finance the deficits in the federal budget and the balance of payments.

Chart IIA-14, US, Personal Savings as a Percentage of Disposable Personal Income, Quarterly, 1980-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IIA-15 of the US Bureau of Economic Analysis provides personal savings as percent of personal disposable income, or savings ratio, from Jan 2007 to Mar 2013. The uncertainties caused by the global recession resulted in sharp increase in the savings ratio that peaked at 8.3 percent in May 2008 (http://www.bea.gov/iTable/index_nipa.cfm). The second highest ratio occurred at 6.7 percent in May 2009. There was another rising trend until 5.8 percent in Jun 2010 and then steady downward trend until trough of 3.2 percent in Nov 2011. This was followed by an upward trend with 4.1 percent in Jun 2012 but decline to 3.7 percent in Aug 2012, 3.3 percent in Sep 2012, 3.7 percent in Oct and increase to 4.7 percent in Nov 2012 followed by jump to 7.4 percent in Dec 2012. Swelling realization of income in Oct-Dec 2012 in anticipation of tax increases in Jan 2012 caused the jump of the savings rate to 7.4 percent in Dec 2012. The BEA explains as: Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf). There was a reverse effect in Jan 2013 with decline of the savings rate to 2.1 percent. Real disposable personal income fell 5.2 percent and real disposable per capita income fell from $34,174 in Dec 2012 to $32,378 in Jan 2013 or by 5.3 percent, which is explained by the Bureau of Economic Analysis as follows (page 3 http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0213.pdf):

“Contributions for government social insurance -- a subtraction in calculating personal income --increased $6.4 billion in February, compared with an increase of $126.8 billion in January. The

January estimate reflected increases in both employer and employee contributions forgovernment social insurance. The January estimate of employee contributions for government social insurance reflected the expiration of the “payroll tax holiday,” that increased the social security contribution rate for employees and self-employed workers by 2.0 percentage points, or $114.1 billion at an annual rate. For additional information, see FAQ on “How did the expiration of the payroll tax holiday affect personal income for January 2013?” at www.bea.gov. The January estimate of employee contributions for government social insurance also reflected an increase in the monthly premiums paid by participants in the supplementary medical insurance program, in the hospital insurance provisions of the Patient Protection and Affordable Care Act, and in the social security taxable wage base; together, these changes added $12.9 billion to January. Employer contributions were boosted $5.9 billion in January, which reflected increases in the social security taxable wage base (from $110,100 to $113,700), in the tax rates paid by employers to state unemployment insurance, and in employer contributions for the federal unemployment tax and for pension guaranty. The total contribution of special factors to the January change in contributions for government social insurance was $132.9billion.”

Consumption was maintained by burning savings because of the drain of decline of real disposable personal income by 5.2 percent and 5.3 percent in per capita terms. The savings rate rose to 2.4 percent in Feb 2013 with increase of real per capita income by 0.8 percent and remained at 2.5 percent in Mar 2013 with further increase of real per capita disposable income by 0.3 percent. The savings ratio remained at 2.5 percent in Apr 2013 with increase of real per capita disposable income by 0.1 percent. Permanent manipulation of the entire spectrum of interest rates with monetary policy measures distorts the compass of resource allocation with inferior outcomes of future growth, employment and prosperity and dubious redistribution of income and wealth worsening the most the personal welfare of people without vast capital and financial relations to manage their savings.

Chart IIA-15, US, Personal Savings as a Percentage of Disposable Income, Monthly 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

ESVI Global Financial and Economic Risk. The International Monetary Fund (IMF) provides an international safety net for prevention and resolution of international financial crises. The IMF’s Financial Sector Assessment Program (FSAP) provides analysis of the economic and financial sectors of countries (see Pelaez and Pelaez, International Financial Architecture (2005), 101-62, Globalization and the State, Vol. II (2008), 114-23). Relating economic and financial sectors is a challenging task both for theory and measurement. The IMF (2012WEOOct) provides surveillance of the world economy with its Global Economic Outlook (WEO) (http://www.imf.org/external/pubs/ft/weo/2012/02/index.htm), of the world financial system with its Global Financial Stability Report (GFSR) (IMF 2012GFSROct) (http://www.imf.org/external/pubs/ft/gfsr/2012/02/index.htm) and of fiscal affairs with the Fiscal Monitor (IMF 2012FMOct) (http://www.imf.org/external/pubs/ft/fm/2012/02/fmindex.htm). There appears to be a moment of transition in global economic and financial variables that may prove of difficult analysis and measurement. It is useful to consider a summary of global economic and financial risks, which are analyzed in detail in the comments of this blog in Section VI Valuation of Risk Financial Assets, Table VI-4.

Economic risks include the following:

- China’s Economic Growth. China is lowering its growth target to 7.5 percent per year. China’s GDP growth decelerated significantly from annual equivalent 9.9 percent in IIQ2011 to 7.4 percent in IVQ2011 and 6.6 percent in IQ2012, rebounding to 7.8 percent in IIQ2012, 8.7 percent in IIIQ2012 and 8.2 percent in IVQ2012. Annual equivalent growth in IQ2013 fell to 6.6 percent. (See Subsection VC and earlier at http://cmpassocregulationblog.blogspot.com/2013/01/recovery-without-hiring-world-inflation.html and earlier at http://cmpassocregulationblog.blogspot.com/2012/10/world-inflation-waves-stagnating-united_21.html).

- United States Economic Growth, Labor Markets and Budget/Debt Quagmire. The US is growing slowly with 28.6 million in job stress, fewer 10 million full-time jobs, high youth unemployment, historically low hiring and declining real wages.

- Economic Growth and Labor Markets in Advanced Economies. Advanced economies are growing slowly. There is still high unemployment in advanced economies.

- World Inflation Waves. Inflation continues in repetitive waves globally (http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.htmland earlier http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html).

A list of financial uncertainties includes:

- Euro Area Survival Risk. The resilience of the euro to fiscal and financial doubts on larger member countries is still an unknown risk.

- Foreign Exchange Wars. Exchange rate struggles continue as zero interest rates in advanced economies induce devaluation of their currencies.

- Valuation of Risk Financial Assets. Valuations of risk financial assets have reached extremely high levels in markets with lower volumes.

- Duration Trap of the Zero Bound. The yield of the US 10-year Treasury rose from 2.031 percent on Mar 9, 2012, to 2.294 percent on Mar 16, 2012. Considering a 10-year Treasury with coupon of 2.625 percent and maturity in exactly 10 years, the price would fall from 105.3512 corresponding to yield of 2.031 percent to 102.9428 corresponding to yield of 2.294 percent, for loss in a week of 2.3 percent but far more in a position with leverage of 10:1. Min Zeng, writing on “Treasurys fall, ending brutal quarter,” published on Mar 30, 2012, in the Wall Street Journal (http://professional.wsj.com/article/SB10001424052702303816504577313400029412564.html?mod=WSJ_hps_sections_markets), informs that Treasury bonds maturing in more than 20 years lost 5.52 percent in the first quarter of 2012.

- Credibility and Commitment of Central Bank Policy. There is a credibility issue of the commitment of monetary policy (Sargent and Silber 2012Mar20).

- Carry Trades. Commodity prices driven by zero interest rates have resumed their increasing path with fluctuations caused by intermittent risk aversion

A competing event is the high level of valuations of risk financial assets (http://cmpassocregulationblog.blogspot.com/2013/01/peaking-valuation-of-risk-financial.html). Matt Jarzemsky, writing on Dow industrials set record,” on Mar 5, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324156204578275560657416332.html), analyzes that the DJIA broke the closing high of 14,164.53 set on Oct 9, 2007, and subsequently also broke the intraday high of 14,198.10 reached on Oct 11, 2007. The DJIA closed at 15,115.57

on Fri May 31, 2013, which is higher by 6.7 percent than the value of 14,164.53 reached on Oct 9, 2007 and higher by 6.5 percent than the value of 14,198.10 reached on Oct 11, 2007. Values of risk financial are approaching or exceeding historical highs.

The carry trade from zero interest rates to leveraged positions in risk financial assets had proved strongest for commodity exposures but US equities have regained leadership. The DJIA has increased 56.0 percent since the trough of the sovereign debt crisis in Europe on Jul 2, 2010 to May 31, 2013, S&P 500 has gained 59.5 percent and DAX 47.2 percent. Before the current round of risk aversion, almost all assets in the column “∆% Trough to 5/31/13” had double digit gains relative to the trough around Jul 2, 2010 followed by negative performance but now some valuations of equity indexes show varying behavior: China’s Shanghai Composite is 3.5 percent below the trough; Japan’s Nikkei Average is 56.1 percent above the trough; DJ Asia Pacific TSM is 20.9 percent above the trough; Dow Global is 28.3 percent above the trough; STOXX 50 of 50 blue-chip European equities (http://www.stoxx.com/indices/index_information.html?symbol=sx5E) is 19.4 percent above the trough; and NYSE Financial Index is 36.1 percent above the trough. DJ UBS Commodities is 5.4 percent above the trough. DAX index of German equities (http://www.bloomberg.com/quote/DAX:IND) is 47.2 percent above the trough. Japan’s Nikkei Average is 56.1 percent above the trough on Aug 31, 2010 and 20.9 percent above the peak on Apr 5, 2010. The Nikkei Average closed at 13,774.54

on Fri May 31, 2013 (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata), which is 34.3 percent higher than 10,254.43 on Mar 11, 2011, on the date of the Tōhoku or Great East Japan Earthquake/tsunami. Global risk aversion erased the earlier gains of the Nikkei. The dollar depreciated by 9.0 percent relative to the euro and even higher before the new bout of sovereign risk issues in Europe. The column “∆% week to 5/31/13” in Table VI-4 shows increase of 0.5 percent for China’s Shanghai Composite in the week. DJ Asia Pacific decreased 2.3 percent. NYSE Financial decreased 0.5 percent in the week. DJ UBS Commodities decreased 0.9 percent. Dow Global decreased 1.0 percent in the week of May 31, 2013. The DJIA decreased 1.2 percent and S&P 500 decreased 1.1 percent. DAX of Germany increased 0.5 percent. STOXX 50 decreased 1.3 percent. The USD depreciated 0.5 percent. There are still high uncertainties on European sovereign risks and banking soundness, US and world growth slowdown and China’s growth tradeoffs. Sovereign problems in the “periphery” of Europe and fears of slower growth in Asia and the US cause risk aversion with trading caution instead of more aggressive risk exposures. There is a fundamental change in Table VI-4 from the relatively upward trend with oscillations since the sovereign risk event of Apr-Jul 2010. Performance is best assessed in the column “∆% Peak to 5/31/13” that provides the percentage change from the peak in Apr 2010 before the sovereign risk event to May 31, 2013. Most risk financial assets had gained not only relative to the trough as shown in column “∆% Trough to 5/31/13” but also relative to the peak in column “∆% Peak to 5/31/13.” There are now several equity indexes above the peak in Table VI-4: DJIA 34.9 percent, S&P 500 34.0 percent, DAX 31.8 percent, Dow Global 4.7 percent, DJ Asia Pacific 5.8 percent, NYSE Financial Index (http://www.nyse.com/about/listed/nykid.shtml) 8.4 percent, Nikkei Average 20.9 percent and STOXX 50 1.1 percent. There is only one equity index below the peak: Shanghai Composite by 27.3 percent. DJ UBS Commodities Index is now 9.9 percent below the peak. The US dollar strengthened 14.1 percent relative to the peak. The factors of risk aversion have adversely affected the performance of risk financial assets. The performance relative to the peak in Apr 2010 is more important than the performance relative to the trough around early Jul 2010 because improvement could signal that conditions have returned to normal levels before European sovereign doubts in Apr 2010. Alexandra Scaggs, writing on “Tepid profits, roaring stocks,” on May 16, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887323398204578487460105747412.html), analyzes stabilization of earnings growth: 70 percent of 458 reporting companies in the S&P 500 stock index reported earnings above forecasts but sales fell 0.2 percent relative to forecasts of increase of 0.5 percent. Paul Vigna, writing on “Earnings are a margin story but for how long,” on May 17, 2013, published in the Wall Street Journal (http://blogs.wsj.com/moneybeat/2013/05/17/earnings-are-a-margin-story-but-for-how-long/), analyzes that corporate profits increase with stagnating sales while companies manage costs tightly. More than 90 percent of S&P components reported moderate increase of earnings of 3.7 percent in IQ2013 relative to IQ2012 with decline of sales of 0.2 percent. Earnings and sales have been in declining trend. In IVQ2009, growth of earnings reached 104 percent and sales jumped 13 percent. Net margins reached 8.92 percent in IQ2013, which is almost the same at 8.95 percent in IIIQ2006. Operating margins are 9.58 percent. There is concern by market participants that reversion of margins to the mean could exert pressure on earnings unless there is more accelerated growth of sales. Vigna (op. cit.) finds sales growth limited by weak economic growth. Kate Linebaugh, writing on “Falling revenue dings stocks,” on Oct 20, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390444592704578066933466076070.html?mod=WSJPRO_hpp_LEFTTopStories), identifies a key financial vulnerability: falling revenues across markets for United States reporting companies. Global economic slowdown is reducing corporate sales and squeezing corporate strategies. Linebaugh quotes data from Thomson Reuters that 100 companies of the S&P 500 index have reported declining revenue only 1 percent higher in Jun-Sep 2012 relative to Jun-Sep 2011 but about 60 percent of the companies are reporting lower sales than expected by analysts with expectation that revenue for the S&P 500 will be lower in Jun-Sep 2012 for the entities represented in the index. Results of US companies are likely repeated worldwide. It may be quite painful to exit QE→∞ or use of the balance sheet of the central together with zero interest rates forever. The basic valuation equation that is also used in capital budgeting postulates that the value of stocks or of an investment project is given by:

Where Rτ is expected revenue in the time horizon from τ =1 to T; Cτ denotes costs; and ρ is an appropriate rate of discount. In words, the value today of a stock or investment project is the net revenue, or revenue less costs, in the investment period from τ =1 to T discounted to the present by an appropriate rate of discount. In the current weak economy, revenues have been increasing more slowly than anticipated in investment plans. An increase in interest rates would affect discount rates used in calculations of present value, resulting in frustration of investment decisions. If V represents value of the stock or investment project, as ρ → ∞, meaning that interest rates increase without bound, then V → 0, or

declines. Equally, decline in expected revenue from the stock or project, Rτ, causes decline in valuation. An intriguing issue is the difference in performance of valuations of risk financial assets and economic growth and employment. Paul A. Samuelson (http://www.nobelprize.org/nobel_prizes/economics/laureates/1970/samuelson-bio.html) popularized the view of the elusive relation between stock markets and economic activity in an often-quoted phrase “the stock market has predicted nine of the last five recessions.” In the presence of zero interest rates forever, valuations of risk financial assets are likely to differ from the performance of the overall economy. The interrelations of financial and economic variables prove difficult to analyze and measure.

Table VI-4, Stock Indexes, Commodities, Dollar and 10-Year Treasury

| Peak | Trough | ∆% to Trough | ∆% Peak to 5/31/ /13 | ∆% Week 5/31/13 | ∆% Trough to 5/31/ 13 | |

| DJIA | 4/26/ | 7/2/10 | -13.6 | 34.9 | -1.2 | 56.0 |

| S&P 500 | 4/23/ | 7/20/ | -16.0 | 34.0 | -1.1 | 59.5 |

| NYSE Finance | 4/15/ | 7/2/10 | -20.3 | 8.4 | -0.5 | 36.1 |

| Dow Global | 4/15/ | 7/2/10 | -18.4 | 4.7 | -1.0 | 28.3 |

| Asia Pacific | 4/15/ | 7/2/10 | -12.5 | 5.8 | -2.3 | 20.9 |

| Japan Nikkei Aver. | 4/05/ | 8/31/ | -22.5 | 20.9 | -5.7 | 56.1 |

| China Shang. | 4/15/ | 7/02 | -24.7 | -27.3 | 0.5 | -3.5 |

| STOXX 50 | 4/15/10 | 7/2/10 | -15.3 | 1.1 | -1.3 | 19.4 |

| DAX | 4/26/ | 5/25/ | -10.5 | 31.8 | 0.5 | 47.2 |

| Dollar | 11/25 2009 | 6/7 | 21.2 | 14.1 | -0.5 | -9.0 |

| DJ UBS Comm. | 1/6/ | 7/2/10 | -14.5 | -9.9 | -0.9 | 5.4 |

| 10-Year T Note | 4/5/ | 4/6/10 | 3.986 | 2.132 |

T: trough; Dollar: positive sign appreciation relative to euro (less dollars paid per euro), negative sign depreciation relative to euro (more dollars paid per euro)

Source: http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

IA Mediocre and Decelerating United States Economic Growth. The US is experiencing the first expansion from a recession after World War II without growth, jobs (http://cmpassocregulationblog.blogspot.com/2013/05/twenty-nine-million-unemployed-or.html) and hiring (http://cmpassocregulationblog.blogspot.com/2013/05/recovery-without-hiring-collapse-of.html), unsustainable government deficit/debt (http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html

http://cmpassocregulationblog.blogspot.com/2012/11/united-states-unsustainable-fiscal.html), waves of inflation (http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.html) and deteriorating terms of trade and net revenue margins in squeeze of economic activity by carry trades induced by zero interest rates

(http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.html) while valuations of risk financial assets approach historical highs. Long-term economic performance in the United States consisted of trend growth of GDP at 3 percent per year and of per capita GDP at 2 percent per year as measured for 1870 to 2010 by Robert E Lucas (2011May). The economy returned to trend growth after adverse events such as wars and recessions. The key characteristic of adversities such as recessions was much higher rates of growth in expansion periods that permitted the economy to recover output, income and employment losses that occurred during the contractions. Over the business cycle, the economy compensated the losses of contractions with higher growth in expansions to maintain trend growth of GDP of 3 percent and of GDP per capita of 2 percent. US economic growth has been at only 2.1 percent on average in the cyclical expansion in the 15 quarters from IIIQ2009 to IQ2013. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). The average of 7.8 percent in the first four quarters of major cyclical expansions is in contrast with the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 of only 3.2 percent obtained by diving GDP of $13,103.5 billion in IIIQ2010 by GDP of $12,701.0 billion in IIQ2009 {[$13.103.5/$12,701.0 -1]100 = 3.2%], or accumulating the quarter on quarter growth rates (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html). The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.7 percent and at 7.7 percent from IQ1983 to IVQ1983 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html). As a result, there are 28.6 million unemployed or underemployed in the United States for an effective unemployment rate of 17.6 percent (http://cmpassocregulationblog.blogspot.com/2013/05/twenty-nine-million-unemployed-or.html).

The economy of the US can be summarized in growth of economic activity or GDP as decelerating from mediocre growth of 2.4 percent on an annual basis in 2010 and 1.8 percent in 2011 to 2.2 percent in 2012. Calculations below show that actual growth is around 1.9 percent per year. This rate is well below 3 percent per year in trend from 1870 to 2010, which has been always recovered after events such as wars and recessions (Lucas 2011May). United States real GDP grew at the rate of 3.2 percent between 1929 and 2012 and at 3.2 percent between 1947 and 2012 (http://www.bea.gov/iTable/index_nipa.cfm see http://cmpassocregulationblog.blogspot.com/2013/05/word-inflation-waves-squeeze-of.html). Growth is not only mediocre but also sharply decelerating to a rhythm that is not consistent with reduction of unemployment and underemployment of 28.6 million people corresponding to 17.6 percent of the effective labor force of the United States (http://cmpassocregulationblog.blogspot.com/2013/05/twenty-nine-million-unemployed-or.html). In the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013, US real GDP grew at the seasonally-adjusted annual equivalent rates of 0.1 percent in the first quarter of 2011 (IQ2011), 2.5 percent in IIQ2011, 1.3 percent in IIIQ2011, 4.1 percent in IVQ2011, 2.0 percent in IQ2012, 1.3 percent in IIQ2012, revised 3.1 percent in IIIQ2012, 0.4 percent in IVQ2012 and revised 2.4 percent in IQ2013. The annual equivalent rate of growth of GDP for the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 is 1.9 percent, obtained as follows. Discounting 0.1 percent to one quarter is 0.025 percent {[(1.001)1/4 -1]100 = 0.025}; discounting 2.5 percent to one quarter is 0.62 percent {[(1.025)1/4 – 1]100}; discounting 1.3 percent to one quarter is 0.32 percent {[(1.013)1/4 – 1]100}; discounting 4.1 percent to one quarter is 1.0 {[(1.04)1/4 -1]100; discounting 2.0 percent to one quarter is 0.50 percent {[(1.020)1/4 -1]100); discounting 1.3 percent to one quarter is 0.32 percent {[(1.013)1/4 -1]100}; discounting 3.1 percent to one quarter is 0.77 {[(1.031)1/4 -1]100); discounting 0.4 percent to one quarter is 0.1 percent {[(1.004)1/4 – 1]100}; and discounting 2.4 percent to one quarter is 0.59 percent {[(1.024)1/4 -1}100}. Real GDP growth in the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 accumulated to 4.3 percent {[(1.00025 x 1.0062 x 1.0032 x 1.010 x 1.005 x 1.0032 x 1.0077 x 1.001 x 1.0059) - 1]100 = 4.3%}. This is equivalent to growth from IQ2011 to IQ2013 obtained by dividing the seasonally-adjusted annual rate (SAAR) of IQ2013 of $13,746.2 billion by the SAAR of IVQ2010 of $13,181.2 (http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1 and Table I-6 below) and expressing as percentage {[($13,746.2/$13,181.2) - 1]100 = 4.3%}. The growth rate in annual equivalent for the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 is 1.9 percent {[(1.00025 x 1.0062 x 1.0032 x 1.010 x 1.005 x 1.0032 x 1.0077 x 1.001 x 1.0059)4/9 -1]100 = 1.9%], or {[($13,746.2/$13,181.2)]4/9-1]100 = 1.9%} dividing the SAAR of IVQ2012 by the SAAR of IVQ2010 in Table I-6 below, obtaining the average for nine quarters and the annual average for one year of four quarters. Growth in the four quarters of 2012 accumulates to 1.7 percent {[(1.02)1/4(1.013)1/4(1.031)1/4(1.004)1/4 -1]100 = 1.7%}. This is equivalent to dividing the SAAR of $13,665.4 billion for IVQ2012 in Table I-6 by the SAAR of $13,441.0 billion in IVQ2011 except for a rounding discrepancy to obtain 1.7 percent {[($13,665.4/$13,441.0) – 1]100 = 1.7%}. The US economy is still close to a standstill especially considering the GDP report in detail.

The objective of this section is analyzing US economic growth in the current cyclical expansion. There is initial discussion of the conventional explanation of the current recovery as being weak because of the depth of the contraction and the financial crisis and brief discussion of the concept of “slow-growth recession.” Analysis that is more complete is in IB Collapse of United States Dynamism of Income Growth and Employment Creation, which is updated with release of more information on the United States economic cycle (IX Conclusion and extended analysis at http://cmpassocregulationblog.blogspot.com/2013/05/united-states-commercial-banks-assets.html). The bulk of the section consists of comparison of the current growth experience of the US with earlier expansions after past deep contractions and consideration of recent performance.

This blog has analyzed systematically the weakness of the United States recovery in the current business cycle from IIIQ2009 to the present in comparison with the recovery from the two recessions in the 1980s from IQ1983 to IVQ1985. US economic growth has been at only 2.1 percent on average in the cyclical expansion in the 15 quarters from IIIQ2009 to IQ2013. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). The average of 7.8 percent in the first four quarters of major cyclical expansions is in contrast with the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 of only 3.2 percent obtained by diving GDP of $13,103.5 billion in IIIQ2010 by GDP of $12,701.0 billion in IIQ2009 {[$13.103.5/$12,701.0 -1]100 = 3.2%], or accumulating the quarter on quarter growth rates (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html). The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.7 percent and at 7.7 percent from IQ1983 to IVQ1983 (Section I and earlier http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html). As a result, there are 28.6 million unemployed or underemployed in the United States for an effective unemployment rate of 17.6 percent (http://cmpassocregulationblog.blogspot.com/2013/05/twenty-nine-million-unemployed-or.html).

The conventional explanation is that the recession from IVQ2007 (Dec) to IIQ2009 (Jun) was so profound that it caused subsequent weak recovery and that historically growth after recessions with financial crises has been weaker. Michael D. Bordo (2012Sep27) and Bordo and Haubrich (2012DR) provide evidence contradicting the conventional explanation: recovery is much stronger on average after profound contractions and also much stronger after recessions with financial crises than after recessions without financial crises. Insistence on the conventional explanation prevents finding policies that can accelerate growth, employment and prosperity.

A monumental effort of data gathering, calculation and analysis by Carmen M. Reinhart and Kenneth Rogoff is highly relevant to banking crises, financial crash, debt crises and economic growth (Reinhart 2010CB; Reinhart and Rogoff 2011AF, 2011Jul14, 2011EJ, 2011CEPR, 2010FCDC, 2010GTD, 2009TD, 2009AFC, 2008TDPV; see also Reinhart and Reinhart 2011Feb, 2010AF and Reinhart and Sbrancia 2011). See http://cmpassocregulationblog.blogspot.com/2011/07/debt-and-financial-risk-aversion-and.html The dataset of Reinhart and Rogoff (2010GTD, 1) is quite unique in breadth of countries and over time periods:

“Our results incorporate data on 44 countries spanning about 200 years. Taken together, the data incorporate over 3,700 annual observations covering a wide range of political systems, institutions, exchange rate and monetary arrangements and historic circumstances. We also employ more recent data on external debt, including debt owed by government and by private entities.”

Reinhart and Rogoff (2010GTD, 2011CEPR) classify the dataset of 2317 observations into 20 advanced economies and 24 emerging market economies. In each of the advanced and emerging categories, the data for countries is divided into buckets according to the ratio of gross central government debt to GDP: below 30, 30 to 60, 60 to 90 and higher than 90 (Reinhart and Rogoff 2010GTD, Table 1, 4). Median and average yearly percentage growth rates of GDP are calculated for each of the buckets for advanced economies. There does not appear to be any relation for debt/GDP ratios below 90. The highest growth rates are for debt/GDP ratios below 30: 3.7 percent for the average and 3.9 for the median. Growth is significantly lower for debt/GDP ratios above 90: 1.7 for the average and 1.9 percent for the median. GDP growth rates for the intermediate buckets are in a range around 3 percent: the highest 3.4 percent average is for the bucket 60 to 90 and 3.1 percent median for 30 to 60. There is even sharper contrast for the United States: 4.0 percent growth for debt/GDP ratio below 30; 3.4 percent growth for debt/GDP ratio of 30 to 60; 3.3 percent growth for debt/GDP ratio of 60 to 90; and minus 1.8 percent, contraction, of GDP for debt/GDP ratio above 90.

For the five countries with systemic financial crises—Iceland, Ireland, UK, Spain and the US—real average debt levels have increased by 75 percent between 2007 and 2009 (Reinhart and Rogoff 2010GTD, Figure 1). The cumulative increase in public debt in the three years after systemic banking crisis in a group of episodes after World War II is 86 percent (Reinhart and Rogoff 2011CEPR, Figure 2, 10).

An important concept is “this time is different syndrome,” which “is rooted in the firmly-held belief that financial crises are something that happens to other people in other countries at other times; crises do not happen here and now to us” (Reinhart and Rogoff 2010FCDC, 9). There is both an arrogance and ignorance in “this time is different” syndrome, as explained by Reinhart and Rogoff (2010FCDC, 34):

“The ignorance, of course, stems from the belief that financial crises happen to other people at other time in other places. Outside a small number of experts, few people fully appreciate the universality of financial crises. The arrogance is of those who believe they have figured out how to do things better and smarter so that the boom can long continue without a crisis.”

There is sober warning by Reinhart and Rogoff (2011CEPR, 42) on the basis of the momentous effort of their scholarly data gathering, calculation and analysis:

“Despite considerable deleveraging by the private financial sector, total debt remains near its historic high in 2008. Total public sector debt during the first quarter of 2010 is 117 percent of GDP. It has only been higher during a one-year sting at 119 percent in 1945. Perhaps soaring US debt levels will not prove to be a drag on growth in the decades to come. However, if history is any guide, that is a risky proposition and over-reliance on US exceptionalism may only be one more example of the “This Time is Different” syndrome.”