Twenty Nine Million Unemployed or Underemployed, Stagnating Real Wages and Real Disposable Income, Peaking Valuations of Risk Financial Assets, World Economic Slowdown and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011, 2012, 2013

Executive Summary

I Twenty Nine Million Unemployed or Underemployed

IA1 Summary of the Employment Situation

IA2 Number of People in Job Stress

IA3 Long-term and Cyclical Comparison of Employment

IA4 Job Creation

II Stagnating Real Wages

IIA Stagnating Real Disposable Income and Consumption Expenditures

IIA1 Stagnating Real Disposable Income and Consumption Expenditures

IIA2 Financial Repression

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

Executive Summary

ESI Twenty-nine Million Unemployed or Underemployed. Table I-4 consists of data and additional calculations using the BLS household survey, illustrating the possibility that the actual rate of unemployment could be 11.5 percent and the number of people in job stress could be around 28.6 million, which is 17.6 percent of the labor force. The first column provides for 2006 the yearly average population (POP), labor force (LF), participation rate or labor force as percent of population (PART %), employment (EMP), employment population ratio (EMP/POP %), unemployment (UEM), the unemployment rate as percent of labor force (UEM/LF Rate %) and the number of people not in the labor force (NLF). All data are unadjusted or not-seasonally-adjusted (NSA). The numbers in column 2006 are averages in millions while the monthly numbers for Apr 2012, Mar 2013 and Apr 2013 are in thousands, not seasonally adjusted. The average yearly participation rate of the population in the labor force was in the range of 66.0 percent minimum to 67.1 percent maximum between 2000 and 2006 with the average of 66.4 percent (ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf). Table I-4b provides the yearly labor force participation rate from 1979 to 2013. The objective of Table I-4 is to assess how many people could have left the labor force because they do not think they can find another job. Row “LF PART 66.2 %” applies the participation rate of 2006, almost equal to the rates for 2000 to 2006, to the noninstitutional civilian population in Apr 2012 and Mar 2013 and Apr 2013 to obtain what would be the labor force of the US if the participation rate had not changed. In fact, the participation rate fell to 63.4 percent by Mar 2012 and was 63.1 percent in Mar 2013 and 63.1 percent in Apr 2013, suggesting that many people simply gave up on finding another job. Row “∆ NLF UEM” calculates the number of people not counted in the labor force because they could have given up on finding another job by subtracting from the labor force with participation rate of 66.2 percent (row “LF PART 66.2%”) the labor force estimated in the household survey (row “LF”). Total unemployed (row “Total UEM”) is obtained by adding unemployed in row “∆NLF UEM” to the unemployed of the household survey in row “UEM.” The row “Total UEM%” is the effective total unemployed “Total UEM” as percent of the effective labor force in row “LF PART 66.2%.” The results are that: (1) there are an estimated 7.567 million unemployed in Apr 2013 who are not counted because they left the labor force on their belief they could not find another job (∆NLF UEM); (2) the total number of unemployed is effectively 18.581 million (Total UEM) and not 11.014 million (UEM) of whom many have been unemployed long term; (3) the rate of unemployment is 11.5 percent (Total UEM%) and not 7.1 percent, not seasonally adjusted, or 7.5 percent seasonally adjusted; and (4) the number of people in job stress is close to 28.6 million by adding the 7.567 million leaving the labor force because they believe they could not find another job. The row “In Job Stress” in Table I-4 provides the number of people in job stress not seasonally adjusted at 28.6 million in Apr 2013, adding the total number of unemployed (“Total UEM”), plus those involuntarily in part-time jobs because they cannot find anything else (“Part Time Economic Reasons”) and the marginally attached to the labor force (“Marginally attached to LF”). The final row of Table I-4 shows that the number of people in job stress is equivalent to 17.6 percent of the labor force in Apr 2013. The employment population ratio “EMP/POP %” dropped from 62.9 percent on average in 2006 to 58.5 percent in Apr 2012, 58.2 percent in Mar 2013 and 58.6 percent in Apr 2013; and the number employed in the US fell from 147.315 million in Jul 2007 to 143.724 million in Apr 2013, by 3.591 million, or decline of 2.4 percent, while the noninstitutional population increased from 231.958 million in Jul 2007 to 245.175 million in Apr 2013, by 13.217 million or increase of 5.7 percent, using not seasonally adjusted data. What really matters for labor input in production and wellbeing is the number of people with jobs or the employment/population ratio, which has declined and does not show signs of increasing. There are several million fewer people working in 2013 than in 2006 and the number employed is not increasing while population increased 13.217 million. The number of hiring relative to the number unemployed measures the chances of becoming employed. The number of hiring in the US economy has declined by 17 million and does not show signs of increasing in an unusual recovery without hiring (http://cmpassocregulationblog.blogspot.com/2013/04/recovery-without-hiring-ten-million.html).

Table I-4, US, Population, Labor Force and Unemployment, NSA

| 2006 | Apr 2012 | Mar 2013 | Apr 2013 | |

| POP | 229 | 242,784 | 244,995 | 245,175 |

| LF | 151 | 153,905 | 154,512 | 154,739 |

| PART% | 66.2 | 63.4 | 63.1 | 63.1 |

| EMP | 144 | 141,995 | 142,698 | 143,724 |

| EMP/POP% | 62.9 | 58.5 | 58.2 | 58.6 |

| UEM | 7 | 11,910 | 11,815 | 11,014 |

| UEM/LF Rate% | 4.6 | 7.7 | 7.6 | 7.1 |

| NLF | 77 | 88,879 | 90,483 | 90,436 |

| LF PART 66.2% | 160,723 | 162,187 | 162,306 | |

| ∆NLF UEM | 6,618 | 7,675 | 7,567 | |

| Total UEM | 18,528 | 19,490 | 18,581 | |

| Total UEM% | 11.5 | 12.0 | 11.5 | |

| Part Time Economic Reasons | 7,694 | 7,734 | 7,709 | |

| Marginally Attached to LF | 2,363 | 2,326 | 2,347 | |

| In Job Stress | 28,585 | 29,550 | 28,637 | |

| People in Job Stress as % Labor Force | 17.8 | 18.2 | 17.6 |

Pop: population; LF: labor force; PART: participation; EMP: employed; UEM: unemployed; NLF: not in labor force; ∆NLF UEM: additional unemployed; Total UEM is UEM + ∆NLF UEM; Total UEM% is Total UEM as percent of LF PART 66.2%; In Job Stress = Total UEM + Part Time Economic Reasons + Marginally Attached to LF

Note: the first column for 2006 is in average millions; the remaining columns are in thousands; NSA: not seasonally adjusted

The labor force participation rate of 66.2% in 2006 is applied to current population to obtain LF PART 66.2%; ∆NLF UEM is obtained by subtracting the labor force with participation of 66.2 percent from the household survey labor force LF; Total UEM is household data unemployment plus ∆NLF UEM; and total UEM% is total UEM divided by LF PART 66.2%

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

In revealing research, Edward P. Lazear and James R. Spletzer (2012JHJul22) use the wealth of data in the valuable database and resources of the Bureau of Labor Statistics (http://www.bls.gov/data/) in providing clear thought on the nature of the current labor market of the United States. The critical issue of analysis and policy currently is whether unemployment is structural or cyclical. Structural unemployment could occur because of (1) industrial and demographic shifts; and (2) mismatches of skills and job vacancies in industries and locations. Consider the aggregate unemployment rate, Y, expressed in terms of share si of a demographic group in an industry i and unemployment rate yi of that demographic group (Lazear and Spletzer 2012JHJul22, 5-6):

Y = ∑isiyi (1)

This equation can be decomposed for analysis as (Lazear and Spletzer 2012JHJul22, 6):

∆Y = ∑i∆siy*i + ∑i∆yis*i (2)

The first term in (2) captures changes in the demographic and industrial composition of the economy ∆si multiplied by the average rate of unemployment y*i , or structural factors. The second term in (2) captures changes in the unemployment rate specific to a group, or ∆yi, multiplied by the average share of the group s*i, or cyclical factors. There are also mismatches in skills and locations relative to available job vacancies. A simple observation by Lazear and Spletzer (2012JHJul22) casts intuitive doubt on structural factors: the rate of unemployment jumped from 4.4 percent in the spring of 2007 to 10 percent in October 2009. By nature, structural factors should be permanent or occur over relative long periods. The revealing result of the exhaustive research of Lazear and Spletzer (2012JHJul22) is:

“The analysis in this paper and in others that we review do not provides any compelling evidence that there have been changes in the structure of the labor market that are capable of explaining the pattern of persistently high unemployment rates. The evidence points to primarily cyclic factors.”

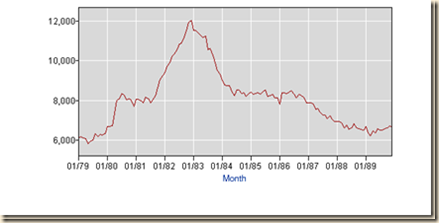

Table I-4b and Chart 12-b provide the US labor force participation rate or percentage of the labor force in population. It is not likely that simple demographic trends caused the sharp decline during the global recession and failure to recover earlier levels. The civilian labor force participation rate dropped from the peak of 66.9 percent in Jul 2006 to 63.1 percent in Apr 2013. The civilian labor force participation rate was 63.7 percent on an annual basis in 1979 and 63.4 percent in Dec 1980 and Dec 1981, reaching even 62.9 percent in both Apr and May 1979. The civilian labor force participation rate jumped with the recovery to 64.8 percent on an annual basis in 1985 and 65.9 percent in Jul 1985. Structural factors cannot explain these sudden changes vividly shown visually in the final segment of Chart 12b. Seniors would like to delay their retiring especially because of the adversities of financial repression on their savings. Labor force statistics are capturing the disillusion of potential workers of their chances in finding a job in what Lazear and Spletzer (2012JHJul22) characterize as accentuated cyclical factors.

Table I-4b, US, Labor Force Participation Rate, Percent of Labor Force in Population, NSA, 1979-2013

| Year | Jan | Feb | Mar | Apr | May | Oct | Nov | Dec | Annual |

| 1979 | 62.9 | 63.0 | 63.2 | 62.9 | 62.9 | 64.0 | 63.8 | 63.8 | 63.7 |

| 1980 | 63.3 | 63.2 | 63.2 | 63.2 | 63.5 | 63.9 | 63.7 | 63.4 | 63.8 |

| 1981 | 63.2 | 63.2 | 63.5 | 63.6 | 63.9 | 64.0 | 63.8 | 63.4 | 63.9 |

| 1982 | 63.0 | 63.2 | 63.4 | 63.3 | 63.9 | 64.1 | 64.1 | 63.8 | 64.0 |

| 1983 | 63.3 | 63.2 | 63.3 | 63.2 | 63.4 | 64.1 | 64.1 | 63.8 | 64.0 |

| 1984 | 63.3 | 63.4 | 63.6 | 63.7 | 64.3 | 64.6 | 64.4 | 64.3 | 64.4 |

| 1985 | 64.0 | 64.0 | 64.4 | 64.3 | 64.6 | 65.1 | 64.9 | 64.6 | 64.8 |

| 1986 | 64.2 | 64.4 | 64.6 | 64.6 | 65.0 | 65.5 | 65.4 | 65.0 | 65.3 |

| 1987 | 64.7 | 64.8 | 65.0 | 64.9 | 65.6 | 65.9 | 65.7 | 65.5 | 65.6 |

| 1988 | 65.1 | 65.2 | 65.2 | 65.3 | 65.5 | 66.1 | 66.2 | 65.9 | 65.9 |

| 1989 | 65.8 | 65.6 | 65.7 | 65.9 | 66.2 | 66.6 | 66.7 | 66.3 | 66.5 |

| 1990 | 66.0 | 66.0 | 66.2 | 66.1 | 66.5 | 66.5 | 66.3 | 66.1 | 66.5 |

| 1991 | 65.5 | 65.7 | 65.9 | 66.0 | 66.0 | 66.1 | 66.0 | 65.8 | 66.2 |

| 1992 | 65.7 | 65.8 | 66.0 | 66.0 | 66.4 | 66.2 | 66.2 | 66.1 | 66.4 |

| 1993 | 65.6 | 65.8 | 65.8 | 65.6 | 66.3 | 66.4 | 66.3 | 66.2 | 66.3 |

| 1994 | 66.0 | 66.2 | 66.1 | 66.0 | 66.5 | 66.8 | 66.7 | 66.5 | 66.6 |

| 1995 | 66.1 | 66.2 | 66.4 | 66.4 | 66.4 | 66.7 | 66.5 | 66.2 | 66.6 |

| 1996 | 65.8 | 66.1 | 66.4 | 66.2 | 66.7 | 67.1 | 67.0 | 66.7 | 66.8 |

| 1997 | 66.4 | 66.5 | 66.9 | 66.7 | 67.0 | 67.1 | 67.1 | 67.0 | 67.1 |

| 1998 | 66.6 | 66.7 | 67.0 | 66.6 | 67.0 | 67.1 | 67.1 | 67.0 | 67.1 |

| 1999 | 66.7 | 66.8 | 66.9 | 66.7 | 67.0 | 67.0 | 67.0 | 67.0 | 67.1 |

| 2000 | 66.8 | 67.0 | 67.1 | 67.0 | 67.0 | 66.9 | 66.9 | 67.0 | 67.1 |

| 2001 | 66.8 | 66.8 | 67.0 | 66.7 | 66.6 | 66.7 | 66.6 | 66.6 | 66.8 |

| 2002 | 66.2 | 66.6 | 66.6 | 66.4 | 66.5 | 66.6 | 66.3 | 66.2 | 66.6 |

| 2003 | 66.1 | 66.2 | 66.2 | 66.2 | 66.2 | 66.1 | 66.1 | 65.8 | 66.2 |

| 2004 | 65.7 | 65.7 | 65.8 | 65.7 | 65.8 | 66.0 | 66.1 | 65.8 | 66.0 |

| 2005 | 65.4 | 65.6 | 65.6 | 65.8 | 66.0 | 66.2 | 66.1 | 65.9 | 66.0 |

| 2006 | 65.5 | 65.7 | 65.8 | 65.8 | 66.0 | 66.4 | 66.4 | 66.3 | 66.2 |

| 2007 | 65.9 | 65.8 | 65.9 | 65.7 | 65.8 | 66.0 | 66.1 | 65.9 | 66.0 |

| 2008 | 65.7 | 65.5 | 65.7 | 65.7 | 66.0 | 66.1 | 65.8 | 65.7 | 66.0 |

| 2009 | 65.4 | 65.5 | 65.4 | 65.4 | 65.5 | 64.9 | 64.9 | 64.4 | 65.4 |

| 2010 | 64.6 | 64.6 | 64.8 | 64.9 | 64.8 | 64.4 | 64.4 | 64.1 | 64.7 |

| 2011 | 63.9 | 63.9 | 64.0 | 63.9 | 64.1 | 64.1 | 63.9 | 63.8 | 64.1 |

| 2012 | 63.4 | 63.6 | 63.6 | 63.4 | 63.8 | 63.8 | 63.5 | 63.4 | 63.7 |

| 2013 | 63.3 | 63.2 | 63.1 | 63.1 |

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Chart 12b, US, Labor Force Participation Rate, Percent of Labor Force in Population, NSA, 1979-2013

Source: Bureau of Labor Statistics

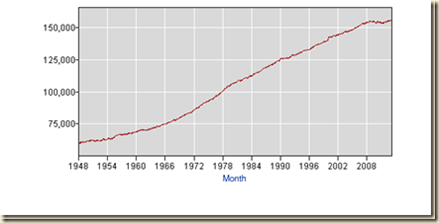

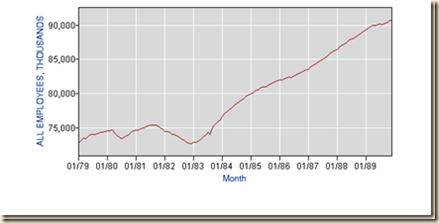

Broader perspective is provided by Chart 12c of the US Bureau of Labor Statistics. The United States civilian noninstitutional population has increased along a consistent trend since 1948 that continued through earlier recessions and the global recession from IVQ2007 to IIQ2009 and the cyclical expansion after IIIQ2009.

Chart 12c, US, Civilian Population, Thousands, NSA, 1948-2013

Sources: US Bureau of Labor Statistics

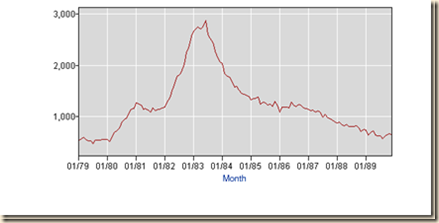

The labor force of the United States in Chart 12d has increased along a trend similar to that of the civilian noninstitutional population in Chart 12c. There is an evident stagnation of the civilian labor force in the final segment of Chart 12d during the current economic cycle. This stagnation is explained by cyclical factors similar to those analyzed by Lazear and Spletzer (2012JHJul22) that motivated an increasing population to drop out of the labor force instead of structural factors. Large segments of the potential labor force are not observed, constituting unobserved unemployment and of more permanent nature because those afflicted have been seriously discouraged from working by the lack of opportunities.

Chart 12d, US, Labor Force, Thousands, NSA, 1948-2013

Sources: US Bureau of Labor Statistics

ESII Insufficient Job Creation. What is striking about the data in Table I-8 is that the numbers of monthly increases in jobs in 1983 and 1984 are several times higher than in 2010 to 2011 even with population higher by 35.4 percent and lab Total nonfarm payroll employment seasonally adjusted (SA) increased 165,000 in Apr 2013 and private payroll employment rose 176,000. The average number of nonfarm jobs created in Jan-Apr 2012 was 224,750 while the average number of nonfarm jobs created in Jan-Apr 2013 was 195,750, or decline by 12.9 percent. The average number of private jobs created in the US in Jan-Apr 2012 was 229,000 while the average in Jan-Apr 2013 was 203,250, or decline by 11.2 percent. The US labor force increased from 153.617 million in 2011 to 154.975 million in 2012 by 1.358 million or 113,167 per month. The average increase of nonfarm jobs in the four months from Jan to Mar 2013 was 195,750, which is a rate of job creation inadequate to reduce significantly unemployment and underemployment in the United States because of 113,167 new entrants in the labor force per month with 28.6 million unemployed or underemployed. The difference between the average increase of 203,250 new private nonfarm jobs per month in the US from Jan to Mar 2013 and the 113,167 average monthly increase in the labor force from 2011 to 2012 is 90,083 monthly new jobs net of absorption of new entrants in the labor force. There are 28.6 million in job stress in the US currently. The provision of 90,083 new jobs per month net of absorption of new entrants in the labor force would require 318 months to provide jobs for the unemployed and underemployed (28.637 million divided by 90,083) or 26.5 years (318 divided by 12). The civilian labor force of the US in Apr 2013 not seasonally adjusted stood at 154.739 million with 11.014 million unemployed or effectively 18.581 million unemployed in this blog’s calculation by inferring those who are not searching because they believe there is no job for them for effective labor force of 162.306 million. Reduction of one million unemployed at the current rate of job creation without adding more unemployment requires 0.9 years (1 million divided by product of 90,083 by 12, which is 1,080,996). Reduction of the rate of unemployment to 5 percent of the labor force would be equivalent to unemployment of only 7.737 million (0.05 times labor force of 154.739 million) for new net job creation of 3.277 million (11.014 million unemployed minus 7.737 million unemployed at rate of 5 percent) that at the current rate would take 3.0 years (3.277 million divided by 1.080996). Under the calculation in this blog there are 18.581 million unemployed by including those who ceased searching because they believe there is no job for them and effective labor force of 162.306 million. Reduction of the rate of unemployment to 5 percent of the labor force would require creating 11.381 million jobs net of labor force growth that at the current rate would take 9.7 years (18.581 million minus 0.05(162.306 million) or 10.466 million divided by 1.080996, using LF PART 66.2% and Total UEM in Table I-4). These calculations assume that there are no more recessions, defying United States economic history with periodic contractions of economic activity when unemployment increases sharply. The number employed in the US fell from 147.315 million in Jul 2007 to 143.724 million in Apr 2013, by 3.591 million, or decline of 2.4 percent, while the noninstitutional population increased from 231.958 million in Jul 2007 to 245.175 million in Apr 2013, by 13.217 million or increase of 5.7 percent, using not seasonally adjusted data. There is actually not sufficient job creation in merely absorbing new entrants in the labor force because of those dropping from job searches, worsening the stock of unemployed or underemployed in involuntary part-time jobs. or force higher by 38.1 percent in 2009 relative to 1983 nearly three decades ago and total number of jobs in payrolls rose by 39.5 million in 2010 relative to 1983 or by 43.8 percent. The contraction after 2007 is deeper and followed by a flatter curve of job creation. Economic growth is much lower in the current expansion at 2.1 percent (http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html). The average growth rate of 7.8 percent in the first four quarters of cyclical expansion is derived from 7.9 percent from IIIQ1954 to IIQ1955, 9.6 percent from IIIQ1958 to IIQ1959, 6.1 percent from IIIQ1975 to IIQ1986 and 7.7 percent from IQ1983 to IVQ1983. The United States missed this opportunity of high growth in the initial phase of recovery. Boskin (2010Sep) measures that the US economy grew at 6.2 percent in the first four quarters and 4.5 percent in the first 12 quarters after the trough in the second quarter of 1975; and at 7.7 percent in the first four quarters and 5.8 percent in the first 12 quarters after the trough in the first quarter of 1983 (Professor Michael J. Boskin, Summer of Discontent, Wall Street Journal, Sep 2, 2010 http://professional.wsj.com/article/SB10001424052748703882304575465462926649950.html). The average of 7.8 percent in the first four quarters of major cyclical expansions is in contrast with the rate of growth in the first four quarters of the expansion from IIIQ2009 to IIQ2010 of only 3.2 percent obtained by diving GDP of $13,103.5 billion in IIIQ2010 by GDP of $12,701.0 billion in IIQ2009 {[$13.103.5/$12,701.0 -1]100 = 3.2%], or accumulating the quarter on quarter growth rates (http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html). BEA data show the US economy in standstill with annual growth of 2.4 percent in 2010 decelerating to 1.8 percent annual growth in 2011, 2.2 percent in 2012 (http://www.bea.gov/iTable/index_nipa.cfm) and cumulative 1.7 percent in the four quarters of 2012 {[(1.02)1/4(1.013)1/4(1.031)1/4(1.004)1/4 – 1]100 = 1.7%} with minor rounding discrepancy using the SSAR of $13,665.4 billion in IVQ2012 relative to the SAAR of $13,441.0 billion in IVQ2011 {[($13665.4/$13441.00-1]100 = 1.7%}. %}. The growth rate in annual equivalent for the four quarters of 2011, the four quarters of 2012 and the first quarter of 2013 is 1.9 percent {[(1.00025 x 1.0062 x 1.0032 x 1.010 x 1.005 x 1.0032 x 1.0077 x 1.001 x 1.0062)4/9 -1]100 = 1.9%], or {[($13,750.1/$13,181.2)]4/9-1]100 = 1.9%} dividing the SAAR of IVQ2012 by the SAAR of IVQ2010 in Table I-6 below, obtaining the average for nine quarters and the annual average for one year of four quarters. The expansion from IQ1983 to IVQ1985 was at the average annual growth rate of 5.7 percent and at 7.7 percent from IQ1983 to IVQ1983 (http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states_28.html).

Table I-8, US, Monthly Change in Jobs, Number SA

| Month | 1981 | 1982 | 1983 | 2008 | 2009 | 2010 | Private |

| Jan | 95 | -327 | 225 | 14 | -794 | -13 | -17 |

| Feb | 67 | -6 | -78 | -85 | -695 | -40 | -26 |

| Mar | 104 | -129 | 173 | -79 | -830 | 154 | 111 |

| Apr | 74 | -281 | 276 | -215 | -704 | 229 | 170 |

| May | 10 | -45 | 277 | -186 | -352 | 521 | 102 |

| Jun | 196 | -243 | 378 | -169 | -472 | -130 | 94 |

| Jul | 112 | -343 | 418 | -216 | -351 | -86 | 103 |

| Aug | -36 | -158 | -308 | -270 | -210 | -37 | 129 |

| Sep | -87 | -181 | 1114 | -459 | -233 | -43 | 113 |

| Oct | -100 | -277 | 271 | -472 | -170 | 228 | 188 |

| Nov | -209 | -124 | 352 | -775 | -21 | 144 | 154 |

| Dec | -278 | -14 | 356 | -705 | -220 | 95 | 114 |

| 1984 | 2011 | Private | |||||

| Jan | 447 | 69 | 80 | ||||

| Feb | 479 | 196 | 243 | ||||

| Mar | 275 | 205 | 223 | ||||

| Apr | 363 | 304 | 303 | ||||

| May | 308 | 115 | 183 | ||||

| Jun | 379 | 209 | 177 | ||||

| Jul | 312 | 78 | 206 | ||||

| Aug | 241 | 132 | 129 | ||||

| Sep | 311 | 225 | 256 | ||||

| Oct | 286 | 166 | 174 | ||||

| Nov | 349 | 174 | 197 | ||||

| Dec | 127 | 230 | 249 | ||||

| 1985 | 2012 | Private | |||||

| Jan | 266 | 311 | 323 | ||||

| Feb | 124 | 271 | 265 | ||||

| Mar | 346 | 205 | 208 | ||||

| Apr | 195 | 112 | 120 | ||||

| May | 274 | 125 | 152 | ||||

| Jun | 145 | 87 | 78 | ||||

| Jul | 189 | 153 | 177 | ||||

| Aug | 193 | 165 | 131 | ||||

| Sep | 204 | 138 | 118 | ||||

| Oct | 187 | 160 | 217 | ||||

| Nov | 209 | 247 | 256 | ||||

| Dec | 168 | 219 | 224 | ||||

| 1985 | 2013 | Private | |||||

| Jan | 123 | 148 | 164 | ||||

| Feb | 107 | 332 | 319 | ||||

| Mar | 93 | 138 | 154 | ||||

| Apr | 188 | 165 | 176 | ||||

| May | 125 | ||||||

| Jun | -93 | ||||||

| Jul | 318 | ||||||

| Aug | 113 | ||||||

| Sep | 346 | ||||||

| Oct | 187 | ||||||

| Nov | 186 | ||||||

| Dec | 204 |

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

ESIII Stagnating Real Wages. Average hourly earnings of all US employees in the US in constant dollars of 1982-1984 from the dataset of the US Bureau of Labor Statistics (BLS) are provided in Table II-4. Average hourly earnings fell 0.5 percent after adjusting for inflation in the 12 months ending in Mar 2012 and gained 0.6 percent in the 12 months ending in Apr 2011 but then lost 0.6 percent in the 12 months ending in May 2012 with a gain of 0.3 percent in the 12 months ending in Jun 2012 and 1.0 percent in Jul 2012 followed by 0.1 percent in Aug 2012 and 0.7 percent in Sep 2012. Average hourly earnings adjusted by inflation fell 1.2 percent in the 12 months ending in Oct 2012. Average hourly earnings adjusted by inflation increased 0.1 percent in the 12 months ending in Nov 2012 and 1.1 percent in the 12 months ending in Dec 2012 but fell 0.2 percent in the 12 months ending in Jan 2013 and stagnated with gain of 0.1 percent in the 12 months ending in Feb 2013. Average hourly earnings adjusted for inflation increased 0.4 percent in the 12 months ending in Mar 2013. Table II-4 confirms the trend of deterioration of purchasing power of average hourly earnings in 2011 and into 2012 with 12-month percentage declines in three of the first four months of 2012 (-1.1 percent in Jan, -1.1 percent in Feb and -0.5 percent in Mar), declines of 0.6 percent in May and 1.2 percent in Oct and increase in five (0.6 percent in Apr, 0.3 percent in Jun, 1.0 percent in Jul, 0.7 percent in Sep and 1.1 percent in Dec) and stagnation in two (0.1 percent in Aug and 0.1 percent in Nov). Average hourly earnings adjusted for inflation fell 0.2 percent in the 12 months ending in Jan 2013, stagnated with gain of 0.1 percent in the 12 months ending in Feb 2013 and gained 0.4 percent in the 12 months ending Mar 2013. Annual data are revealing: -0.7 percent in 2008 during carry trades into commodity futures in a global recession, 3.2 percent in 2009 with reversal of carry trades, no change in 2010 and 2012 and decline by 1.1 percent in 2011. Annual average hourly earnings of all employees in the United States adjusted for inflation increased 1.4 percent from 2007 to 2012 at the yearly average rate of 0.3 percent (from $10.11 in 2007 to $10.25 in 2012 in dollars of 1982-1984 using data in http://www.bls.gov/data/). Those who still work bring back home a paycheck that buys fewer goods than a year earlier and savings in bank deposits do not pay anything because of financial repression (Section IIA2 and earlier http://cmpassocregulationblog.blogspot.com/2013/04/mediocre-and-decelerating-united-states.html).

Table II-4, US, Average Hourly Earnings of All Employees NSA in Constant Dollars of 1982-1984

| Year | Jan | Feb | Mar | Apr | May | Nov | Dec |

| 2006 | 10.05 | 10.11 | 9.92 | 10.15 | 10.21 | ||

| 2007 | 10.23 | 10.22 | 10.14 | 10.18 | 10.02 | 10.05 | 10.17 |

| 2008 | 10.11 | 10.12 | 10.11 | 10.00 | 9.91 | 10.37 | 10.47 |

| 2009 | 10.48 | 10.50 | 10.47 | 10.40 | 10.32 | 10.40 | 10.38 |

| 2010 | 10.41 | 10.43 | 10.35 | 10.35 | 10.38 | 10.38 | 10.40 |

| 2011 | 10.53 | 10.41 | 10.26 | 10.22 | 10.22 | 10.25 | 10.30 |

| 2012 | 10.41 | 10.30 | 10.21 | 10.28 | 10.16 | 10.26 | 10.41 |

| ∆% 12 M 2012 | -1.1 | -1.1 | -0.5 | 0.6 | -0.6 | 0.1 | 1.1 |

| 2013 | 10.39 | 10.31 | 10.25 | ||||

| ∆% 12 M 2013 | -0.2 | 0.1 | 0.4 |

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Chart II-2 of the US Bureau of Labor Statistics plots average hourly earnings of all US employees in constant 1982-1984 dollars with evident decline from annual earnings of $10.36 in 2009 and 2010 to $10.25 in 2011 and 2012 or loss of 1.1 percent (data in http://www.bls.gov/data/).

Chart II-2, US, Average Hourly Earnings of All Employees in Constant Dollars of 1982-1984, SA 2006-2013

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

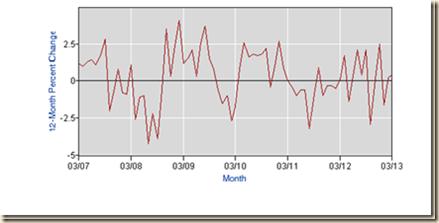

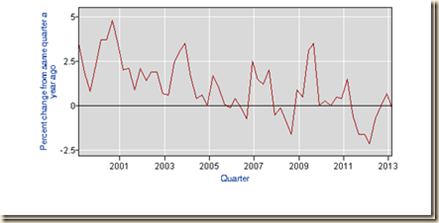

Chart II-3 provides 12-month percentage changes of average hourly earnings of all employees in constant dollars of 1982-1984, that is, adjusted for inflation. There was sharp contraction of inflation-adjusted average hourly earnings of US employees during parts of 2007 and 2008. Rates of change in 12 months became positive in parts of 2009 and 2010 but then became negative again in 2011 and then into 2012 with temporary increase in Apr 2012 that was reversed in May with another gain in Jun and Jul 2012 followed by stagnation in Aug 2012 and marginal gain in Sep 2012 with sharp decline in Oct 2012, stagnation in Nov 2012, increase in Dec 2012 and renewed decrease in Jan 2013 with near stagnation in Feb 2013 followed by mild increase in Mar 2013.

Chart II-3, Average Hourly Earnings of All Employees NSA 12-Month Percent Change, 1982-1984 Dollars, NSA 2007-2013

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

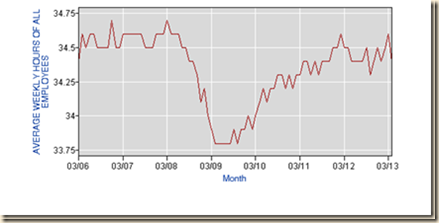

Average weekly earnings of all US employees in the US in constant dollars of 1982-1984 from the dataset of the US Bureau of Labor Statistics (BLS) are provided in Table II-5. Average weekly earnings fell 3.2 percent after adjusting for inflation in the 12 months ending in Aug 2011, decreased 0.9 percent in the 12 months ending in Sep 2011, increased 0.9 percent in the 12 months ending in Oct 2011, fell 1.0 percent in the 12 months ending in Nov 2011 and 0.3 in the 12 months ending in Dec 2011, declining 0.3 percent in the 12 months ending in Jan 2012 and 0.5 percent in the 12 months ending in Feb 2012. Average weekly earnings in constant dollars were virtually flat in Mar 2012 relative to Mar 2011, increasing 0.1 percent. Average weekly earnings in constant dollars increased 1.7 percent in Apr 2012 relative to Apr 2011 but fell 1.4 percent in May 2012 relative to May 2011, increasing 0.3 percent in the 12 months ending in Jun and 2.1 percent in Jul 2012. Real weekly earnings increased 0.4 percent in the 12 months ending in Aug 2012 and 2.1 percent in the 12 months ending in Sep 2012. Real weekly earnings fell 2.9 percent in the 12 months ending in Oct 2012 and increased 0.1 percent in the 12 months ending in Nov 2012 and 2.5 percent in the 12 months ending in Dec 2012. Real weekly earnings fell 1.6 percent in the 12 months ending in Jan 2013 and virtually stagnated with gain of 0.2 percent in the 12 months ending in Feb 2013, increasing 0.4 percent in the 12 months ending in Mar 2013. Table II-5 confirms the trend of deterioration of purchasing power of average weekly earnings in 2011 and into 2012 with oscillations according to carry trades causing world inflation waves (http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html). On an annual basis, average weekly earnings in constant 1982-1984 dollars increased from $349.78 in 2007 to $353.66 in 2012, by 1.1 percent or at the average rate of 0.2 percent per year (data in http://www.bls.gov/data/). Annual average weekly earnings in constant dollars of $353.50 in 2010 were virtually unchanged at $353.66 in 2012. Those who still work bring back home a paycheck that buys fewer high-quality goods than a year earlier. The fractured US job market does not provide an opportunity for advancement as in past booms following recessions (http://cmpassocregulationblog.blogspot.com/2013/04/recovery-without-hiring-ten-million.html).

Table II-5, US, Average Weekly Earnings of All Employees in Constant Dollars of 1982-1984, NSA 2007-2013

| Year | Jan | Feb | Mar | Apr | Nov | Dec |

| 2006 | 343.71 | 349.95 | 349.12 | 353.37 | ||

| 2007 | 348.72 | 349.40 | 347.76 | 353.41 | 346.85 | 356.11 |

| 2008 | 345.92 | 346.21 | 351.70 | 344.13 | 358.83 | 357.17 |

| 2009 | 354.10 | 360.31 | 355.81 | 349.33 | 356.59 | 351.95 |

| 2010 | 350.71 | 350.51 | 349.76 | 351.99 | 355.12 | 355.61 |

| 2011 | 360.29 | 353.81 | 349.90 | 350.62 | 351.44 | 354.41 |

| 2012 | 359.06 | 352.12 | 350.19 | 356.68 | 351.91 | 363.13 |

| ∆% 12 M 2012 | -0.3 | -0.5 | 0.1 | 1.7 | 0.1 | 2.5 |

| 2013 | 353.17 | 352.66 | 351.59 | |||

| ∆% 12 M 2013 | -1.6 | 0.2 | 0.4 |

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Chart II-4 provides average weekly earnings of all employees in constant dollars of 1982-1984. The same pattern emerges of sharp decline during the contraction, followed by recovery in the expansion and continuing fall with oscillations caused by carry trades from zero interest rates into commodity futures from 2010 to 2011 and into 2012 and 2013.

Chart II-4, US, Average Weekly Earnings of All Employees in Constant Dollars of 1982-1984, SA 2006-2013

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Chart II-5 provides 12-month percentage changes of average weekly earnings of all employees in the US in constant dollars of 1982-1984. There is the same pattern of contraction during the global recession in 2008 and then again trend of deterioration in the recovery without hiring and inflation waves in 2011 and 2012.

Chart II-5, US, Average Weekly Earnings of All Employees NSA in Constant Dollars of 1982-1984 12-Month Percent Change, NSA 2007-2013

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

ESIV Stagnating Real Disposable Income Per Capita. Chart IIA-3 provides personal income in the US between 1980 and 1989. These data are not adjusted for inflation that was still high in the 1980s in the exit from the Great Inflation of the 1960s and 1970s. Personal income grew steadily during the 1980s after recovery from two recessions from Jan IQ1980 to Jul IIIQ1980 and from Jul IIIQ1981 to Nov IVQ1982 (http://www.nber.org/cycles.html) with combined drop of GDP by 4.8 percent.

Chart IIA-3, US, Personal Income, Billion Dollars, Quarterly Seasonally Adjusted at Annual Rates, 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

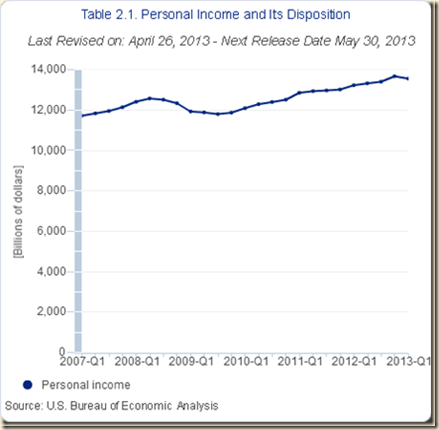

A different evolution of personal income is shown in Chart IB-4. Personal income also fell during the recession from Dec IVQ2007 to Jun IIQ2009 (http://www.nber.org/cycles.html). Growth of personal income during the expansion has been tepid even with the new revisions. In IVQ2012, nominal disposable personal income grew at the SAAR of 8.1 percent and real disposable personal income at 6.2 percent (http://www.bea.gov/iTable/index_nipa.cfm), which the BEA explains as: “Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf pages 1-2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0113.pdf). The Bureau of Economic Analysis explains as (http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0213.pdf 2-3): “The January estimate of employee contributions for government social insurance reflected the expiration of the “payroll tax holiday,” that increased the social security contribution rate for employees and self-employed workers by 2.0 percentage points, or $114.1 billion at an annual rate. For additional information, see FAQ on “How did the expiration of the payroll tax holiday affect personal income for January 2013?” at www.bea.gov. The January estimate of employee contributions for government social insurance also reflected an increase in the monthly premiums paid by participants in the supplementary medical insurance program, in the hospital insurance provisions of the Patient Protection and Affordable Care Act, and in the social security taxable wage base.”

The increase was provided in the “fiscal cliff” law H.R. 8 American Taxpayer Relief Act of 2012 (http://www.gpo.gov/fdsys/pkg/BILLS-112hr8eas/pdf/BILLS-112hr8eas.pdf).

In IQ2013, personal income fell at the SAAR of minus 3.2 percent; real personal income excluding current transfer receipts at minus 5.8 percent; and real disposable personal income at minus 5.3 percent (Table 5 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf). The BEA explains as follows (page 3 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf):

“The February and January changes in disposable personal income (DPI) mainly reflected the effect of special factors in January, such as the expiration of the “payroll tax holiday” and the acceleration of bonuses and personal dividends to November and to December in anticipation of changes in individual tax rates.”

Chart IIA-4, US, Personal Income, Current Billions of Dollars, Quarterly Seasonally Adjusted at Annual Rates, 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

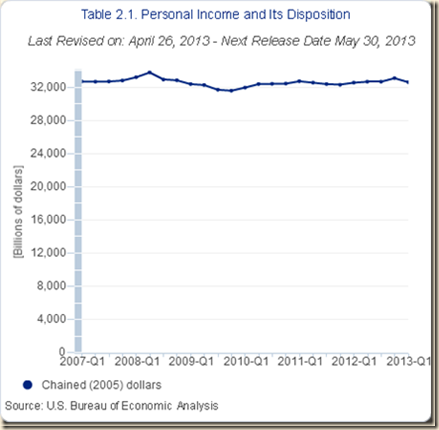

Real or inflation-adjusted disposable personal income is provided in Chart IIA-5 from 1980 to 1989. Real disposable income after allowing for taxes and inflation grew steadily at high rates during the entire decade.

Chart IIA-5, US, Real Disposable Income, Billions of Chained 2005 Dollars, Quarterly Seasonally Adjusted at Annual Rates 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

In IQ2013, personal income fell at the SAAR of minus 3.2 percent; real personal income excluding current transfer receipts at minus 5.8 percent; and real disposable personal income at minus 5.3 percent (Table 5 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf). The BEA explains as follows (page 3 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf):

“The February and January changes in disposable personal income (DPI) mainly reflected the effect of special factors in January, such as the expiration of the “payroll tax holiday” and the acceleration of bonuses and personal dividends to November and to December in anticipation of changes in individual tax rates.”

Chart IIA-6, US, Real Disposable Income, Billions of Chained 2005 Dollars, Seasonally Adjusted at Annual Rates, 2007-2013

http://www.bea.gov/iTable/index_nipa.cfm

Chart IIA-7 provides percentage quarterly changes in real disposable income from the preceding period at seasonally adjusted annual rates from 1980 to 1989. Rates of changes were high during the decade with few negative changes.

Chart IIA-7, US, Real Disposable Income Percentage Change from Preceding Period at Quarterly Seasonally-Adjusted Annual Rates, 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IIA-8 provides percentage quarterly changes in real disposable income from the preceding period at seasonally-adjusted annual rates from 2007 to 2012. There has been a period of positive rates followed by decline of rates and then negative and low rates in 2011. Recovery in 2012 has not reproduced the dynamism of the brief early phase of expansion. In IVQ2012, nominal disposable personal income grew at the SAAR of 7.9 percent and real disposable personal income at 6.2 percent, which the BEA explains as: Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf). In IQ2013, personal income fell at the SAAR of minus 3.2 percent; real personal income excluding current transfer receipts at minus 5.8 percent; and real disposable personal income at minus 5.3 percent (Table 5 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf). The BEA explains as follows (page 3 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf):

“The February and January changes in disposable personal income (DPI) mainly reflected the effect of special factors in January, such as the expiration of the “payroll tax holiday” and the acceleration of bonuses and personal dividends to November and to December in anticipation of changes in individual tax rates.”

Chart, IIA-8, US, Real Disposable Income, Percentage Change from Preceding Period at Seasonally-Adjusted Annual Rates, 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

In the latest available report, the Bureau of Economic Analysis (BEA) estimates US personal income in Mar 2013 at the seasonally adjusted annual rate of $13,630.4 billion, as shown in Table IIA-3 above (see Table 1 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf). The major portion of personal income is compensation of employees of $8,763.9 billion, or 64.3 percent of the total. Wage and salary disbursements are $7,039.2 billion, of which $5,831.7 billion by private industries and supplements to wages and salaries of $1,724.7 billion (employer contributions to pension and insurance funds are $1,195.3 billion and contributions to social insurance are $529.4 billion). In Dec 1985, US personal income was $3,596.4 billion at SAAR (http://www.bea.gov/iTable/index_nipa.cfm). Compensation of employees was $2,498.5 billion, or 69.5 percent of the total. Wage and salary disbursement were $2.056.3 billion of which $1671.0 billion by private industries. Supplements to wages and salaries were $442.2 billion with employer contributions to pension and insurance funds of $289.4 billion and $152.9 billion to government social insurance. Chart IIA-9 provides US wage and salary disbursement by private industries in the 1980s. Growth was robust after the interruption of the recessions.

Chart IIA-9, US, Wage and Salary Disbursement, Private Industries, Quarterly, Seasonally Adjusted at Annual Rates Billions of Dollars, 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IIA-10 shows US wage and salary disbursement of private industries from 2007 to 2012. There is a drop during the contraction followed by initial recovery in 2010 and then the current much weaker relative performance in 2011, 2012 and 2013.

Chart IIA-10, US, Wage and Salary Disbursement, Private Industries, Quarterly, Seasonally Adjusted at Annual Rates, Billions of Dollars 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IIA-11 provides finer detail with monthly wage and salary disbursement of private industries from 2007 to 2013. There is decline during the contraction and a period of mild recovery followed by stagnation and recent recovery that is weaker than in earlier expansion periods of the business cycle. There is decline of 0.6 percent in Jan 2013 because of the higher contributions to government social insurance followed by recovery of 0.7 percent in Feb 2013 and 0.2 percent in Mar 2013.

Chart IIA-11, US, Wage and Salary Disbursement, Private Industries, Monthly, Seasonally Adjusted at Annual Rates, Billions of Dollars 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IIA-12 provides monthly real disposable personal income per capita from 1980 to 1989. This is the ultimate measure of wellbeing in receiving income by obtaining the value per inhabitant. The measure cannot adjust for the distribution of income. Real disposable personal income per capita grew rapidly during the expansion after 1983 and continued growing during the rest of the decade.

Chart IIA-12, US, Real Disposable Per Capita Income, Monthly, Seasonally Adjusted at Annual Rates, Billions of Dollars 1980-1989

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

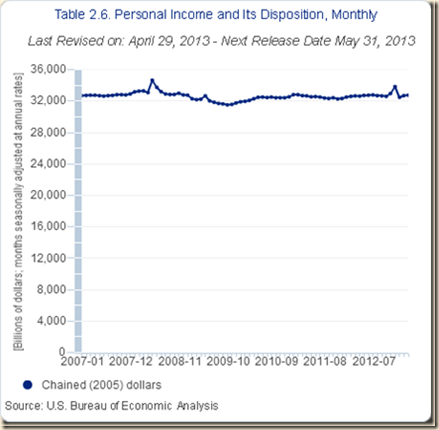

Chart IIA-13 provides monthly real disposable personal per capita income from 2007 to 2013. There was initial recovery from the drop during the global recession followed by stagnation. Real per capita disposable income increased 1.1 percent from $32,602 in chained dollars of 2005 in Oct 2012 to $32,967 in Nov 2012 and 2.7 percent to $33,846 in Dec 2012 for cumulative increase of 3.8 percent from Oct 2012 to Dec 2012. Real per capita disposable income fell 4.1 percent from $33,846 in Dec 2012 to $32,467 in Jan 2013, increasing marginally 0.7 percent to $32,686 in Feb 2013 for cumulative change of 0.3 percent from Oct 2012 (data at http://www.bea.gov/iTable/index_nipa.cfm). This increase is shown in a jump in the final segment in Chart IIA-13 with Nov-Dec 2012, decline in Jan 2013 and recovery in Feb 2013. Real per capita disposable income increased 0.2 percent from $32,686 in Feb 2013 in chained dollars of 2005 to $32,767 in Mar 2013 for cumulative gain of 0.5 percent relative to Oct 2012. BEA explains as: “Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf pages 1-2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0113.pdf). The Bureau of Economic Analysis explains as (http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0213.pdf 2-3): “The January estimate of employee contributions for government social insurance reflected the expiration of the “payroll tax holiday,” that increased the social security contribution rate for employees and self-employed workers by 2.0 percentage points, or $114.1 billion at an annual rate. For additional information, see FAQ on “How did the expiration of the payroll tax holiday affect personal income for January 2013?” at www.bea.gov. The January estimate of employee contributions for government social insurance also reflected an increase in the monthly premiums paid by participants in the supplementary medical insurance program, in the hospital insurance provisions of the Patient Protection and Affordable Care Act, and in the social security taxable wage base.”

The increase was provided in the “fiscal cliff” law H.R. 8 American Taxpayer Relief Act of 2012 (http://www.gpo.gov/fdsys/pkg/BILLS-112hr8eas/pdf/BILLS-112hr8eas.pdf).

The BEA explains as follows (page 3 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0313.pdf):

“The February and January changes in disposable personal income (DPI) mainly reflected the effect of special factors in January, such as the expiration of the “payroll tax holiday” and the acceleration of bonuses and personal dividends to November and to December in anticipation of changes in individual tax rates.”

Chart IIA-13, US, Real Disposable Per Capita Income, Monthly, Seasonally Adjusted at Annual Rates, Billions of Dollars 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

ESV Financial Repression. McKinnon (1973) and Shaw (1974) argue that legal restrictions on financial institutions can be detrimental to economic development. “Financial repression” is the term used in the economic literature for these restrictions (see Pelaez and Pelaez, Globalization and the State, Vol. II (2008b), 81-6). Interest rate ceilings on deposits and loans have been commonly used. Prohibition of payment of interest on demand deposits and ceilings on interest rates on time deposits were imposed by the Banking Act of 1933. These measures were justified by arguments that the banking panic of the 1930s was caused by competitive rates on bank deposits that led banks to engage in high-risk loans (Friedman, 1970, 18; see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 74-5). The objective of policy was to prevent unsound loans in banks. Savings and loan institutions complained of unfair competition from commercial banks that led to continuing controls with the objective of directing savings toward residential construction. Friedman (1970, 15) argues that controls were passive during periods when rates implied on demand deposit were zero or lower and when Regulation Q ceilings on time deposits were above market rates on time deposits. The Great Inflation or stagflation of the 1960s and 1970s changed the relevance of Regulation Q.

Most regulatory actions trigger compensatory measures by the private sector that result in outcomes that are different from those intended by regulation (Kydland and Prescott 1977). Banks offered services to their customers and loans at rates lower than market rates to compensate for the prohibition to pay interest on demand deposits (Friedman 1970, 24). The prohibition of interest on demand deposits was eventually lifted in recent times. In the second half of the 1960s, already in the beginning of the Great Inflation (DeLong 1997), market rates rose above the ceilings of Regulation Q because of higher inflation. Nobody desires savings allocated to time or savings deposits that pay less than expected inflation. This is a fact currently with zero interest rates and consumer price inflation of 2.0 percent in the 12 months ending in Feb 2013 (http://www.bls.gov/cpi/) but rising during waves of carry trades from zero interest rates to commodity futures exposures (http://cmpassocregulationblog.blogspot.com/2013/03/recovery-without-hiring-ten-million.html). Funding problems motivated compensatory measures by banks. Money-center banks developed the large certificate of deposit (CD) to accommodate increasing volumes of loan demand by customers. As Friedman (1970, 25) finds:

“Large negotiable CD’s were particularly hard hit by the interest rate ceiling because they are deposits of financially sophisticated individuals and institutions who have many alternatives. As already noted, they declined from a peak of $24 billion in mid-December, 1968, to less than $12 billion in early October, 1969.”

Banks created different liabilities to compensate for the decline in CDs. As Friedman (1970, 25; 1969) explains:

“The most important single replacement was almost surely ‘liabilities of US banks to foreign branches.’ Prevented from paying a market interest rate on liabilities of home offices in the United States (except to foreign official institutions that are exempt from Regulation Q), the major US banks discovered that they could do so by using the Euro-dollar market. Their European branches could accept time deposits, either on book account or as negotiable CD’s at whatever rate was required to attract them and match them on the asset side of their balance sheet with ‘due from head office.’ The head office could substitute the liability ‘due to foreign branches’ for the liability ‘due on CDs.”

Friedman (1970, 26-7) predicted the future:

“The banks have been forced into costly structural readjustments, the European banking system has been given an unnecessary competitive advantage, and London has been artificially strengthened as a financial center at the expense of New York.”

In short, Depression regulation exported the US financial system to London and offshore centers. What is vividly relevant currently from this experience is the argument by Friedman (1970, 27) that the controls affected the most people with lower incomes and wealth who were forced into accepting controlled-rates on their savings that were lower than those that would be obtained under freer markets. As Friedman (1970, 27) argues:

“These are the people who have the fewest alternative ways to invest their limited assets and are least sophisticated about the alternatives.”

Chart IIA-14 of the Bureau of Economic Analysis (BEA) provides quarterly savings as percent of disposable income or the US savings rate from 1980 to 2012. There was a long-term downward sloping trend from 12 percent in the early 1980s to less than 2 percent in 2005-2006. The savings rate then rose during the contraction and also in the expansion. In 2011 and into 2012 the savings rate declined as consumption is financed with savings in part because of the disincentive or frustration of receiving a few pennies for every $10,000 of deposits in a bank. The savings rate increased in the final segment of Chart IIA-14 in 2012 followed by another decline because of the pain of the opportunity cost of zero remuneration for hard-earned savings. Swelling realization of income in Oct-Dec 2012 in anticipation of tax increases in Jan 2012 caused the jump of the savings rate to 6.5 percent in Dec 2012. The BEA explains as: Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf). The savings rate then collapsed to 2.3 percent in Jan 2013 in part because of the decline of 4.0 percent in real disposable personal income and to 2.7 percent with increase of real disposable income by 0.7 percent in Feb 2013. The savings rate remained at 2.7 percent in Mar 2013 with increase of real disposable income by 0.3 percent. The decline of personal income was caused by increasing contributions to government social insurance (page 1 http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0113.pdf http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0213.pdf). The objective of monetary policy is to reduce borrowing rates to induce consumption but it has collateral disincentive of reducing savings and misallocating resources away from their best uses. The zero interest rate of monetary policy is a tax on saving. This tax is highly regressive, meaning that it affects the most people with lower income or wealth and retirees. The long-term decline of savings rates in the US has created a dependence on foreign savings to finance the deficits in the federal budget and the balance of payments.

Chart IIA-14, US, Personal Savings as a Percentage of Disposable Personal Income, Quarterly, 1980-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

Chart IIA-15 of the US Bureau of Economic Analysis provides personal savings as percent of personal disposable income, or savings ratio, from Jan 2007 to Mar 2013. The uncertainties caused by the global recession resulted in sharp increase in the savings ratio that peaked at 8.3 percent in May 2008 (http://www.bea.gov/iTable/index_nipa.cfm). The second highest ratio occurred at 6.7 percent in May 2009. There was another rising trend until 5.8 percent in Jun 2010 and then steady downward trend until trough of 3.2 percent in Nov 2011, which was followed by an upward trend with 4.1 percent in Jun 2012 but decline to 3.7 percent in Aug 2012, 3.3 percent in Sep 2012, 3.4 percent in Oct and increase to 4.1 percent in Nov 2012 followed by jump to 6.5 percent in Dec 2012. Swelling realization of income in Oct-Dec 2012 in anticipation of tax increases in Jan 2012 caused the jump of the savings rate to 6.5 percent in Dec 2012. The BEA explains as: Personal income in November and December was boosted by accelerated and special dividend payments to persons and by accelerated bonus payments and other irregular pay in private wages and salaries in anticipation of changes in individual income tax rates. Personal income in December was also boosted by lump-sum social security benefit payments” (page 2 at http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi1212.pdf). There was a reverse effect in Jan 2013 with decline of the savings rate to 2.3 percent. Real disposable personal income fell 4.0 percent and real disposable per capita income fell from $33,846 in Dec 2012 to $32,467 in Jan 2013 or by 4.1 percent, which is explained by the Bureau of Economic Analysis as follows (page 3 http://www.bea.gov/newsreleases/national/pi/2013/pdf/pi0213.pdf):

“Contributions for government social insurance -- a subtraction in calculating personal income --increased $6.4 billion in February, compared with an increase of $126.8 billion in January. The

January estimate reflected increases in both employer and employee contributions for government social insurance. The January estimate of employee contributions for government social insurance reflected the expiration of the “payroll tax holiday,” that increased the social security contribution rate for employees and self-employed workers by 2.0 percentage points, or $114.1 billion at an annual rate. For additional information, see FAQ on “How did the expiration of the payroll tax holiday affect personal income for January 2013?” at www.bea.gov. The January estimate of employee contributions for government social insurance also reflected an increase in the monthly premiums paid by participants in the supplementary medical insurance program, in the hospital insurance provisions of the Patient Protection and Affordable Care Act, and in the social security taxable wage base; together, these changes added $12.9 billion to January. Employer contributions were boosted $5.9 billion in January, which reflected increases in the social security taxable wage base (from $110,100 to $113,700), in the tax rates paid by employers to state unemployment insurance, and in employer contributions for the federal unemployment tax and for pension guaranty. The total contribution of special factors to the January change in contributions for government social insurance was $132.9billion.”

Consumption was maintained by burning savings because of the drain of decline of real disposable personal income by 4.0 percent and 4.1 percent in per capita terms. The savings rate rose to 2.7 percent in Feb 2013 with increase of real per capita income by 0.7 percent and remained at 2.7 percent in Mar 2013 with further increase of real per capita disposable income by 0.2 percent. Permanent manipulation of the entire spectrum of interest rates with monetary policy measures distorts the compass of resource allocation with inferior outcomes of future growth, employment and prosperity and dubious redistribution of income and wealth worsening the most the personal welfare of people without vast capital and financial relations to manage their savings.

Chart IIA-15, US, Personal Savings as a Percentage of Disposable Income, Monthly 2007-2013

Source: US Bureau of Economic Analysis

http://www.bea.gov/iTable/index_nipa.cfm

ESVI Stagnating United States Labor Productivity. The Bureau of Labor Statistics (BLS) of the Department of Labor provides the quarterly report on productivity and costs. The operational definition of productivity used by the BLS is (http://www.bls.gov/news.release/pdf/prod2.pdf 1): “Labor productivity, or output per hour, is calculated by dividing an index of real output by an index of hours worked of all persons, including employees, proprietors, and unpaid family workers.” The BLS has revised the estimates for productivity and unit costs. Table VA-1 provides revised data for nonfarm business sector productivity and unit labor costs for IQ2013 and the final two quarters of 2012 in seasonally adjusted annual equivalent (SAAE) rate and the percentage change from the same quarter a year earlier. Reflecting increases in output of 2.5 percent and of 1.8 percent in hours worked, nonfarm business sector labor productivity increased at a SAAE rate of 0.7 percent in IQ2013, as shown in column 2 “IQ2013 SAEE.” The increase of labor productivity from IQ2012 to IQ2013 was 0.9 percent, reflecting increases in output of 2.5 percent and of hours worked of 1.5 percent, as shown in column 3 “IQ2013 YoY.” Hours worked increased from 1.6 percent in IIIQ2012 in SAAE to 2.4 percent in IVQ2012 and 1.8 percent in IQ2013 while output growth fell from 4.7 percent in IIIQ2011 to 0.7 percent in IVQ2012 and 2.5 percent in IQ2013. The BLS defines unit labor costs as (http://www.bls.gov/news.release/pdf/prod2.pdf 1): “BLS defines unit labor costs as the ratio of hourly compensation to labor productivity; increases in hourly compensation tend to increase unit labor costs and increases in output per hour tend to reduce them.” Unit labor costs increased at the SAAE rate of 0.5 percent in IQ2013 and rose 0.6 percent in IQ2013 relative to IQ2012. Hourly compensation increased at the SAAE rate of 1.2 percent in IQ2013, which deflating by the estimated consumer price increase SAAE rate in IQ2013 results in decrease of real hourly compensation at 0.3 percent. Real hourly compensation decreased 0.1 percent in IQ2013 relative to IQ2012.

Table VA-1, US, Nonfarm Business Sector Productivity and Costs %

| IQ 2013 SAAE | IQ 2013 YoY | IVQ 2012 SAAE | IVQ 2012 YoY | IIIQ | IIIQ | |

| Productivity | 0.7 | 0.9 | -1.7 | 0.6 | 3.1 | 1.6 |

| Output | 2.5 | 2.5 | 0.7 | 2.5 | 4.7 | 3.7 |

| Hours | 1.8 | 1.5 | 2.4 | 1.9 | 1.6 | 2.1 |

| Hourly | 1.2 | 1.6 | 2.7 | 2.7 | 1.2 | 1.7 |

| Real Hourly Comp. | -0.3 | -0.1 | 0.4 | 0.7 | -0.9 | 0.0 |

| Unit Labor Costs | 0.5 | 0.6 | 4.4 | 2.0 | -1.9 | 0.1 |

| Unit Nonlabor Payments | 0.7 | 2.2 | -5.3 | 1.0 | 9.3 | 3.6 |

| Implicit Price Deflator | 0.6 | 1.3 | 0.2 | 1.6 | 2.7 | 1.6 |

Notes: SAAE: seasonally adjusted annual equivalent; Comp.: compensation; YoY: Quarter on Same Quarter Year Earlier

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/

In 2012, productivity increased 0.7 percent in the annual average, as shown in Table VA-2. Increases in productivity were 0.6 percent in 2011, 3.1 percent in 2010 and 2.9 percent in 2008. Savings of labor inputs have characterized the contraction period and the recovery period. Real hourly compensation fell 0.6 percent in 2012 and 0.6 percent in 2011, interrupting increases of 0.4 percent in 2010 and 1.8 percent in 2009. Unit labor costs fell 1.5 percent in 2009 and 1.0 percent in 2010 but increased 2.0 percent in 2011 and 0.7 percent in 2012.

Table VA-2, US, Revised Nonfarm Business Sector Productivity and Costs Annual Average, ∆% Annual Average

| 2012 ∆% | 2011 ∆% | 2010 ∆% | 2009 ∆% | 2008 ∆% | 2007 ∆% | |

| Productivity | 0.7 | 0.6 | 3.1 | 2.9 | 0.6 | 1.5 |

| Real Hourly Compensation | -0.6 | -0.6 | 0.4 | 1.8 | -0.4 | 1.1 |

| Unit Labor Costs | 0.7 | 2.0 | -1.0 | -1.5 | 2.8 | 2.4 |

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/

Productivity jumped in the recovery after the recession from Mar IQ2001 to Nov IVQ2001 (http://www.nber.org/cycles.html). Table VA-3 provides quarter on quarter and annual percentage changes in nonfarm business output per hour, or productivity, from 1999 to 2012. The annual average jumped from 3.0 percent in 2001 to 4.5 percent in 2002. Nonfarm business productivity increased at the SAAE rate of 8.9 percent in the first quarter after the recession in IQ2002. Productivity increases decline later in the expansion period. Productivity increases were mediocre during the recession from Dec IVQ2007 to Sep IIIQ2009 (http://www.nber.org/cycles.html) and increased during the first phase of expansion from IIQ2009 to IQ2010, trended lower and collapsed in 2011 and 2012 with sporadic jumps and declines in five out of eight quarters. Productivity increased at 0.7 percent in IQ2013.

Table VA-3, US, Nonfarm Business Output per Hour, Percent Change from Prior Quarter at Annual Rate, 1999-2012

| Year | Qtr1 | Qtr2 | Qtr3 | Qtr4 | Annual |

| 1999 | 4.0 | 0.3 | 3.4 | 7.0 | 3.3 |

| 2000 | -1.4 | 9.1 | 0.1 | 4.2 | 3.4 |

| 2001 | -1.1 | 7.4 | 2.2 | 5.8 | 3.0 |

| 2002 | 8.9 | 0.2 | 3.9 | -0.1 | 4.5 |

| 2003 | 3.5 | 5.6 | 9.6 | 1.4 | 3.7 |

| 2004 | 0.7 | 3.4 | 0.3 | 1.0 | 2.7 |

| 2005 | 4.3 | -0.9 | 3.0 | -0.1 | 1.7 |

| 2006 | 2.9 | 0.2 | -2.4 | 2.8 | 0.9 |

| 2007 | -0.2 | 3.3 | 4.7 | 2.0 | 1.5 |

| 2008 | -2.5 | 2.4 | -1.0 | -3.4 | 0.6 |

| 2009 | 5.8 | 6.5 | 5.2 | 4.8 | 2.9 |

| 2010 | 3.1 | -0.5 | 3.2 | 1.7 | 3.1 |

| 2011 | -1.3 | 0.6 | -0.1 | 2.3 | 0.6 |

| 2012 | -0.7 | 1.7 | 3.1 | -1.7 | 0.7 |

| 2013 | 0.7 |

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/

Chart VA-1 of the Bureau of Labor Statistics (BLS) provides SAAE rates of nonfarm business productivity from 1999 to 2012. There is a clear pattern in both episodes of economic cycles in 2001 and 2007 of rapid expansion of productivity in the transition from contraction to expansion followed by more subdued productivity expansion. Part of the explanation is the reduction in labor utilization resulting from adjustment of business to the sudden shock of collapse of revenue. Productivity rose briefly in the expansion after 2009 but then collapsed and moved to negative change with some positive changes recently at lower rates.

Chart VA-1, US, Nonfarm Business Output per Hour, Percent Change from Prior Quarter at Annual Rate, 1999-2013

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/

Chart VA-6 provides percentage changes in a quarter relative to the same quarter a year earlier for nonfarm business real hourly compensation. Labor compensation eroded sharply during the recession with brief recovery in 2010 and another fall until recently.

Chart VA-6, US, Nonfarm Business Real Hourly Compensation, Percent Change Same Quarter a Year Earlier 1999-2013

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/

Rapid increase of US labor productivity in the 1990s is shown in Chart VA-7 with the index of nonfarm business labor productivity from 1947 to 2012. The rate of productivity increase continued in the early part of the 2000s but then softened and fell during the global recession.

Chart VA-7, US, Nonfarm Business Labor Productivity, Output per Hour, 1947-2012, Index 2005=100

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/

Unit labor costs increased sharply during the Great Inflation from the late 1960s to 1981 as shown by sharper slope in Chart VA-8. Unit labor costs continued to increase but at a lower rate.

Chart VA-8, US, Nonfarm Business, Unit Labor Costs, 1947-2012, Index 2005=100

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/

Real hourly compensation increased at relatively high rates after 1947 to the early 1970s but reached a plateau that lasted until the early 1990s, as shown in Chart VA-9. There were rapid increases until the global recession.

Chart VA-9, US, Nonfarm Business, Real Hourly Compensation, 1947-2012, Index 2005=100

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/

ESVII Stagnating United States Private Sector Wages and Salaries. There is different behavior of 12 months percentage rates of private-sector wages and salaries in Chart VA-14. Rates fell in the first part of the decade and then rose into 2007. Rates of change in 12 months of wages and salaries in the private sector fell during the global contraction to barely above 1 percent and have not rebounded sufficiently while inflation has returned in waves.

Chart VA-14, US, ECI, Wages and Salaries, Private Industry, 12 Months Percent Change, 2001-2013

Source: US Bureau of Labor Statistics

Chart VA-15 provides 12-month percentage rates of change of the consumer price index of the US. Inflation has risen sharply into 2011 with 3.0 percent in the 12 months ending in Dec while wage and salary increases in the private sector have risen by 1.6 percent in the 12 months ending in Dec. Wages and salaries rose 1.9 percent in the 12 months ending in Mar while inflation was 2.7 percent in the 12 months ending in Mar. Wage and salaries of the private sector increased 1.8 percent in the 12 months ending in Jun, which is almost equal to inflation of 1.7 percent. Wages and salaries increased 1.7 percent in the 12 months ending in Sep 2012 while inflation was 2.0 percent. Wages and salaries increased 1.7 percent in Dec 2012 while inflation was 1.7 percent. Wages and salaries increased 1.6 percent in the 12 months ending in Mar 2013 while inflation was 1.5 percent.

Chart VA-15, US, Consumer Price Index, 12-Month Percentage Change, NSA, 2001-2013

Source: US Bureau of Labor Statistics

ESVIII Global Financial and Economic Risk. The International Monetary Fund (IMF) provides an international safety net for prevention and resolution of international financial crises. The IMF’s Financial Sector Assessment Program (FSAP) provides analysis of the economic and financial sectors of countries (see Pelaez and Pelaez, International Financial Architecture (2005), 101-62, Globalization and the State, Vol. II (2008), 114-23). Relating economic and financial sectors is a challenging task both for theory and measurement. The IMF (2012WEOOct) provides surveillance of the world economy with its Global Economic Outlook (WEO) (http://www.imf.org/external/pubs/ft/weo/2012/02/index.htm), of the world financial system with its Global Financial Stability Report (GFSR) (IMF 2012GFSROct) (http://www.imf.org/external/pubs/ft/gfsr/2012/02/index.htm) and of fiscal affairs with the Fiscal Monitor (IMF 2012FMOct) (http://www.imf.org/external/pubs/ft/fm/2012/02/fmindex.htm). There appears to be a moment of transition in global economic and financial variables that may prove of difficult analysis and measurement. It is useful to consider a summary of global economic and financial risks, which are analyzed in detail in the comments of this blog in Section VI Valuation of Risk Financial Assets, Table VI-4.

Economic risks include the following:

- China’s Economic Growth. China is lowering its growth target to 7.5 percent per year. China’s GDP growth decelerated significantly from annual equivalent 9.9 percent in IIQ2011 to 7.4 percent in IVQ2011 and 6.6 percent in IQ2012, rebounding to 7.8 percent in IIQ2012, 8.7 percent in IIIQ2012 and 8.2 percent in IVQ2012. Annual equivalent growth in IQ2013 fell to 6.6 percent. (See Subsection VC and earlier at http://cmpassocregulationblog.blogspot.com/2013/01/recovery-without-hiring-world-inflation.html and earlier at http://cmpassocregulationblog.blogspot.com/2012/10/world-inflation-waves-stagnating-united_21.html).

- United States Economic Growth, Labor Markets and Budget/Debt Quagmire. The US is growing slowly with 28.6 million in job stress, fewer 10 million full-time jobs, high youth unemployment, historically low hiring and declining real wages.

- Economic Growth and Labor Markets in Advanced Economies. Advanced economies are growing slowly. There is still high unemployment in advanced economies.

- World Inflation Waves. Inflation continues in repetitive waves globally (http://cmpassocregulationblog.blogspot.com/2013/04/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2013/03/recovery-without-hiring-ten-million.html ).

A list of financial uncertainties includes:

- Euro Area Survival Risk. The resilience of the euro to fiscal and financial doubts on larger member countries is still an unknown risk.

- Foreign Exchange Wars. Exchange rate struggles continue as zero interest rates in advanced economies induce devaluation of their currencies.

- Valuation of Risk Financial Assets. Valuations of risk financial assets have reached extremely high levels in markets with lower volumes.

- Duration Trap of the Zero Bound. The yield of the US 10-year Treasury rose from 2.031 percent on Mar 9, 2012, to 2.294 percent on Mar 16, 2012. Considering a 10-year Treasury with coupon of 2.625 percent and maturity in exactly 10 years, the price would fall from 105.3512 corresponding to yield of 2.031 percent to 102.9428 corresponding to yield of 2.294 percent, for loss in a week of 2.3 percent but far more in a position with leverage of 10:1. Min Zeng, writing on “Treasurys fall, ending brutal quarter,” published on Mar 30, 2012, in the Wall Street Journal (http://professional.wsj.com/article/SB10001424052702303816504577313400029412564.html?mod=WSJ_hps_sections_markets), informs that Treasury bonds maturing in more than 20 years lost 5.52 percent in the first quarter of 2012.

- Credibility and Commitment of Central Bank Policy. There is a credibility issue of the commitment of monetary policy (Sargent and Silber 2012Mar20).

- Carry Trades. Commodity prices driven by zero interest rates have resumed their increasing path with fluctuations caused by intermittent risk aversion

Matt Jarzemsky, writing on Dow industrials set record,” on Mar 5, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324156204578275560657416332.html), analyzes that the DJIA broke the closing high of 14164.53 set on Oct 9, 2007, and subsequently also broke the intraday high of 14,198.10 reached on Oct 11, 2007. The DJIA closed at 14973.96

on Fri May 3, 2013, which is higher by 5.7 percent than the value of 14,164.53 reached on Oct 9, 2007 and higher by 5.5 percent than the value of 14,198.10 reached on Oct 11, 2007. Values of risk financial are approaching or exceeding historical highs.

Jon Hilsenrath, writing on “Jobs upturn isn’t enough to satisfy Fed,” on Mar 8, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324582804578348293647760204.html), finds that much stronger labor market conditions are required for the Fed to end quantitative easing. Unconventional monetary policy with zero interest rates and quantitative easing is quite difficult to unwind because of the adverse effects of raising interest rates on valuations of risk financial assets and home prices, including the very own valuation of the securities held outright in the Fed balance sheet. Gradual unwinding of 1 percent fed funds rates from Jun 2003 to Jun 2004 by seventeen consecutive increases of 25 percentage points from Jun 2004 to Jun 2006 to reach 5.25 percent caused default of subprime mortgages and adjustable-rate mortgages linked to the overnight fed funds rate. The zero interest rate has penalized liquidity and increased risks by inducing carry trades from zero interest rates to speculative positions in risk financial assets. There is no exit from zero interest rates without provoking another financial crash.

The carry trade from zero interest rates to leveraged positions in risk financial assets had proved strongest for commodity exposures but US equities have regained leadership. The DJIA has increased 54.6 percent since the trough of the sovereign debt crisis in Europe on Jul 2, 2010 to May 3, 2013, S&P 500 has gained 57.9 percent and DAX 43.2 percent. Before the current round of risk aversion, almost all assets in the column “∆% Trough to 5/3/13” had double digit gains relative to the trough around Jul 2, 2010 followed by negative performance but now some valuations of equity indexes show varying behavior: China’s Shanghai Composite is 7.4 percent below the trough; Japan’s Nikkei Average is 55.2 percent above the trough; DJ Asia Pacific TSM is 25.0 percent above the trough; Dow Global is 28.6 percent above the trough; STOXX 50 of 50 blue-chip European equities (http://www.stoxx.com/indices/index_information.html?symbol=sx5E) is 20.5 percent above the trough; and NYSE Financial Index is 35.2 percent above the trough. DJ UBS Commodities is 7.4 percent above the trough. DAX index of German equities (http://www.bloomberg.com/quote/DAX:IND) is 43.2 percent above the trough. Japan’s Nikkei Average is 55.2 percent above the trough on Aug 31, 2010 and 20.2 percent above the peak on Apr 5, 2010. The Nikkei Average closed at 13694.04