Thirty Million Unemployed or Underemployed, Collapse of United States Dynamism of Income Growth and Employment Creation, Stagnating Real Wages, Peaking Valuations of Risk Financial Assets, World Economic Slowdown and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011, 2012, 2013

Executive Summary

I Thirty Million Unemployed or Underemployed

IA1 Summary of the Employment Situation

IA2 Number of People in Job Stress

IA3 Long-term and Cyclical Comparison of Employment

IA4 Job Creation

IB Collapse of United States Dynamism of Income Growth and Employment Creation

II Stagnating Real Wages

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

Sunday, March 31, 2013

Mediocre and Decelerating United States Economic Growth, Contracting Real Private Fixed Investment, Swelling Undistributed Profits, Peaking Valuations of Risk Financial Assets, World Economic Slowdown and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011, 2012, 2013

Executive Summary

I Mediocre and Decelerating United States Economic Growth

IA Mediocre and Decelerating United States Economic Growth

IA1 Contracting Real Private Fixed Investment

IA2 Swelling Undistributed Corporate Profits

IIA Stagnating Real Disposable Income and Consumption Expenditures

IIA1 Stagnating Real Disposable Income and Consumption Expenditures

IIA2 Financial Repression

IIB United States Housing Collapse

IIB1 United States New House Sales

IIB2 United States House Prices

IIB3 Factors of United States Housing Collapse

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

III World Financial Turbulence. Financial markets are being shocked by multiple factors including (1) world economic slowdown; (2) slowing growth in China with political development and slowing growth in Japan and world trade; (3) slow growth propelled by savings/investment reduction in the US with high unemployment/underemployment, falling wages, hiring collapse, contraction of real private fixed investment, decline of wealth of households over the business cycle by 8.4 percent adjusted for inflation while growing 617.2 percent adjusted for inflation from IVQ1945 to IVQ2012 and unsustainable fiscal deficit/debt threatening prosperity that can cause risk premium on Treasury debt with Himalayan interest rate hikes; and (3) the outcome of the sovereign debt crisis in Europe. This section provides current data and analysis. Subsection IIIA Financial Risks provides analysis of the evolution of valuations of risk financial assets during the week. There are various appendixes for convenience of reference of material related to the euro area debt crisis. Some of this material is updated in Subsection IIIA when new data are available and then maintained in the appendixes for future reference until updated again in Subsection IIIA. Subsection IIIB Appendix on Safe Haven Currencies discusses arguments and measures of currency intervention and is available in the Appendixes section at the end of the blog comment. Subsection IIIC Appendix on Fiscal Compact provides analysis of the restructuring of the fiscal affairs of the European Union in the agreement of European leaders reached on Dec 9, 2011 and is available in the Appendixes section at the end of the blog comment. Subsection IIID Appendix on European Central Bank Large Scale Lender of Last Resort considers the policies of the European Central Bank and is available in the Appendixes section at the end of the blog comment. Appendix IIIE Euro Zone Survival Risk analyzes the threats to survival of the European Monetary Union and is available following Subsection IIIA. Subsection IIIF Appendix on Sovereign Bond Valuation provides more technical analysis and is available following Subsection IIIA. Subsection IIIG Appendix on Deficit Financing of Growth and the Debt Crisis provides analysis of proposals to finance growth with budget deficits together with experience of the economic history of Brazil and is available in the Appendixes section at the end of the blog comment.

IIIA Financial Risks. The past half year has been characterized by financial turbulence, attaining unusual magnitude in recent months. Table III-1, updated with every comment in this blog, provides beginning values on Fri Mar 29 and daily values throughout the week ending on Apr 5, 2013 of various financial assets. Section VI Valuation of Risk Financial Assets provides a set of more complete values. All data are for New York time at 5 PM. The first column provides the value on Fri Mar 29 and the percentage change in that prior week below the label of the financial risk asset. For example, the first column “Fri Mar 29, 2013”, first row “USD/EUR 1.2818 1.3%,” provides the information that the US dollar (USD) appreciated 1.3 percent to USD 1.2818/EUR in the week ending on Fri Mar 29 relative to the exchange rate on Fri Mar 22. The first five asset rows provide five key exchange rates versus the dollar and the percentage cumulative appreciation (positive change or no sign) or depreciation (negative change or negative sign). Positive changes constitute appreciation of the relevant exchange rate and negative changes depreciation. Financial turbulence has been dominated by reactions to the new program for Greece (see section IB in http://cmpassocregulationblog.blogspot.com/2011/07/debt-and-financial-risk-aversion-and.html), modifications and new approach adopted in the Euro Summit of Oct 26 (European Commission 2011Oct26SS, 2011Oct26MRES), doubts on the larger countries in the euro zone with sovereign risks such as Spain and Italy but expanding into possibly France and Germany, the growth standstill recession and long-term unsustainable government debt in the US, worldwide deceleration of economic growth and continuing waves of inflation. The most important current shock is that resulting from the agreement by European leaders at their meeting on Dec 9 (European Council 2911Dec9), which is analyzed in IIIC Appendix on Fiscal Compact. European leaders reached a new agreement on Jan 30 (http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/127631.pdf) and another agreement on Jun 29, 2012 (http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/131388.pdf).

The dollar/euro rate is quoted as number of US dollars USD per one euro EUR, USD 1.2818/EUR in the first row, first column in the block for currencies in Table III-1 for Fri Mar 29, depreciating to USD 1.2849/EUR on Mon Apr 1, 2013, or by 0.2 percent. The dollar depreciated because more dollars, $1.2849, were required on Mon Apr 1 to buy one euro than $1.2818 on Mar 29. Table III-1 defines a country’s exchange rate as number of units of domestic currency per unit of foreign currency. USD/EUR would be the definition of the exchange rate of the US and the inverse [1/(USD/EUR)] is the definition in this convention of the rate of exchange of the euro zone, EUR/USD. A convention used throughout this blog is required to maintain consistency in characterizing movements of the exchange rate such as in Table III-1 as appreciation and depreciation. The first row for each of the currencies shows the exchange rate at 5 PM New York time, such as USD 1.2818/EUR on Mar 29; the second row provides the cumulative percentage appreciation or depreciation of the exchange rate from the rate on the last business day of the prior week, in this case Fri Mar 29, to the last business day of the current week, in this case Fri Apr 5, such as depreciation to USD 1.2995/EUR by Apr 5; and the third row provides the percentage change from the prior business day to the current business day. For example, the USD depreciated (denoted by negative sign) by 1.4 percent from the rate of USD 1.2818/EUR on Fri Mar 29 to the rate of USD 1.2995/EUR on Fri Apr 5 {[(1.2995/1.2818) – 1]100 = 1.4%} and depreciated (denoted by negative sign) by 0.5 percent from the rate of USD 1.2936 on Thu Apr 4 to USD 1.2995/EUR on Fri Apr 5 {[(1.2995/1.2936) -1]100 = 0.5%}. Other factors constant, appreciation of the dollar relative to the euro is caused by increasing risk aversion, with rising uncertainty on European sovereign risks increasing dollar-denominated assets with sales of risk financial investments. Funds move away from higher yielding risk

Table III-I, Weekly Financial Risk Assets Apr 1 to Apr 5, 2013

| Fri Mar 29, 2013 | M 1 | Tue 2 | W 3 | Thu 4 | Fri 5 |

| USD/EUR 1.2818 1.3% | 1.2849 -0.2% -0.2% | 1.2819 0.0% 0.2% | 1.2849 -0.2% -0.2% | 1.2936 -0.9% -0.7% | 1.2995 -1.4% -0.5% |

| JPY/ USD 94.22 0.3% | 93.24 1.0% 1.0% | 93.43 0.8% -0.2% | 93.05 1.2% 0.4% | 96.34 -2.3% -3.5% | 97.55 -3.5% -1.3% |

| CHF/ USD 0.9495 -0.9% | 0.9466 0.3% 0.3% | 0.9490 -0.1% -0.3% | 0.9452 0.5% 0.4% | 0.9398 1.0% 0.6% | 0.9344 1.6% 0.6% |

| CHF/ EUR 1.2169 0.4% | 1.2164 0.0% 0.0% | 1.2164 0.0% 0.0% | 1.2142 0.2% 0.2% | 1.2158 0.1% -0.1% | 1.2143 0.2% 0.1% |

| USD/ AUD 1.0419 0.9598 -0.3% | 1.0423 0.9594 0.0% 0.0% | 1.0449 0.9570 0.3% 0.3% | 1.0461 0.9559 0.4% 0.1% | 1.0435 0.9583 0.2% -0.3% | 1.0392 0.9623 -0.3% -0.4% |

| 10 Year T Note 1.847 | 1.832 | 1.862 | 1.816 | 1.761 | 1.706 |

| 2 Year T Note 0.244 | 0.238 | 0.24 | 0.228 | 0.228 | 0.228 |

| German Bond 2Y -0.02 10Y 1.29 | 2Y -0.02 10Y 1.29 | 2Y -0.01 10Y 1.31 | 2Y 0.00 10Y 1.29 | 2Y -0.01 10Y 1.24 | 2Y 0.01 10Y 1.21 |

| DJIA 14578.54 0.5% | 14572.85 0.0% 0.0% | 14662.01 0.6% 0.6% | 14550.35 -0.2% -0.8% | 14608.11 0.2% 0.4% | 14565.25 -0.1% -0.3% |

| DJ Global 2111.96 -0.3% | 2101.30 -0.5% -0.5% | 2105.56 -0.3% 0.2% | 2092.51 -0.9% -0.6% | 2083.34 -1.4% -0.4% | 2079.02 -1.6% -0.2% |

| DJ Asia Pacific 1385.32 0.9% | 1370.43 -1.1% -1.1% | 1366.18 -1.4% -0.3% | 1377.52 -0.6% 0.8% | 1364.38 -1.5% -0.9% | 1364.17 -1.5% 0.0% |

| Nikkei 12397.91 0.5% | 12135.02 -2.1% -2.1% | 12003.43 -3.2% -1.1% | 12362.20 -0.3% 3.0% | 12634.54 1.9% 2.2% | 12833.64 3.5% 1.6% |

| Shanghai 2236.62 -3.9% | 2234.40 -0.1% -0.1% | 2227.74 -0.4% -0.3% | 2227.74 -0.4% 0.0% | 2225.29 -0.5% -0.1% | 2225.29 -0.5% 0.0% |

| DAX 7795.31 -1.5% | 7795.31 0.0% 0.0% | 7943.87 1.9% 1.9% | 7874.75 1.0% -0.9% | 7817.39 0.3% -0.7% | 7658.75 -1.8% -2.0% |

| DJ UBS Comm. 137.48 -0.4% | 136.36 -0.8% -0.8% | 135.52 -1.4% -0.6% | 133.93 -2.6% -1.2% | 133.64 -2.8% -0.2% | 134.08 -2.5% 0.3% |

| WTI $ B 97.23 3.6% | 96.91 -0.3% -0.3% | 96.76 -0.5% -0.2% | 94.54 -2.8% -2.3% | 93.35 -4.0% -1.3% | 93.03 -4.3% -0.3% |

| Brent $/B 110.02 2.2% | 110.94 0.8% 0.8% | 110.38 0.3% -0.5% | 107.38 -2.4% -2.7% | 106.44 -3.3% -0.9% | 104.31 -5.2% -2.0% |

| Gold $/OZ 1595.7 -0.7% | 1599.7 0.3% 0.3% | 1575.2 -1.3% -1.5% | 1557.3 -2.4% -1.1% | 1553.6 -2.6% -0.2% | 1580.6 -0.9% 1.7% |

Note: USD: US dollar; JPY: Japanese Yen; CHF: Swiss

Franc; AUD: Australian dollar; Comm.: commodities; OZ: ounce

Sources: http://www.bloomberg.com/markets/

http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

Discussion of current and recent risk-determining events is followed below by analysis of risk-measuring yields of the US and Germany and the USD/EUR rate. Financial markets in Japan and worldwide were shocked by new bold measures of “quantitative and qualitative monetary easing” by the Bank of Japan (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf). The objective of policy is to “achieve the price stability target of 2 percent in terms of the year-on-year rate of change in the consumer price index (CPI) at the earliest possible time, with a time horizon of about two years” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf). The main elements of the new policy are as follows:

- Monetary Base Control. Most central banks in the world pursue interest rates instead of monetary aggregates, injecting bank reserves to lower interest rates to desired levels. The Bank of Japan (BOJ) has shifted back to monetary aggregates, conducting money market operations with the objective of increasing base money, or monetary liabilities of the government, at the annual rate of 60 to 70 trillion yen. The BOJ estimates base money outstanding at “138 trillion yen at end-2012) and plans to increase it to “200 trillion yen at end-2012 and 270 trillion yen at end 2014” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf).

- Maturity Extension of Purchases of Japanese Government Bonds. Purchases of bonds will be extended even up to bonds with maturity of 40 years with the guideline of extending the average maturity of BOJ bond purchases from three to seven years. The BOJ estimates the current average maturity of Japanese government bonds (JGB) at around seven years. The BOJ plans to purchase about 7.5 trillion yen per month (http://www.boj.or.jp/en/announcements/release_2013/rel130404d.pdf). Takashi Nakamichi, Tatsuo Ito and Phred Dvorak, wiring on “Bank of Japan mounts bid for revival,” on Apr 4, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887323646604578401633067110420.html ), find that the limit of maturities of three years on purchases of JGBs was designed to avoid views that the BOJ would finance uncontrolled government deficits.

- Seigniorage. The BOJ is pursuing coordination with the government that will take measures to establish “sustainable fiscal structure with a view to ensuring the credibility of fiscal management” (http://www.boj.or.jp/en/announcements/release_2013/k130404a.pdf).

- Diversification of Asset Purchases. The BOJ will engage in transactions of exchange traded funds (ETF) and real estate investment trusts (REITS) and not solely on purchases of JGBs. Purchases of ETFs will be at an annual rate of increase of one trillion yen and purchases of REITS at 30 billion yen.

The European sovereign debt crisis continues to shake financial markets and the world economy. Debt resolution within the international financial architecture requires that a country be capable of borrowing on its own from the private sector. Mechanisms of debt resolution have included participation of the private sector (PSI), or “bail in,” that has been voluntary, almost coercive, agreed and outright coercive (Pelaez and Pelaez, International Financial Architecture: G7, IMF, BIS, Creditors and Debtors (2005), Chapter 4, 187-202). Private sector involvement requires losses by the private sector in bailouts of highly indebted countries. The essence of successful private sector involvement is to recover private-sector credit of the highly indebted country. Mary Watkins, writing on “Bank bailouts reshuffle risk hierarchy,” published on Mar 19, 2013, in the Financial Times (http://www.ft.com/intl/cms/s/0/7666546a-9095-11e2-a456-00144feabdc0.html#axzz2OSpbvCn8) analyzes the impact of the bailout or resolution of Cyprus banks on the hierarchy of risks of bank liabilities. Cyprus banks depend mostly on deposits with less reliance on debt, raising concerns in creditors of fixed-income debt and equity holders in banks in the euro area. Uncertainty remains as to the dimensions and structure of losses in private sector involvement or “bail in” in other rescue programs in the euro area. Alkman Granitsas, writing on “Central bank details losses at Bank of Cyprus,” on Mar 30, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887324000704578392502889560768.html), analyzes the impact of the agreement with the €10 billion agreement with IMF and the European Union on the banks of Cyprus. The recapitalization plan provides for immediate conversion of 37.5 percent of all deposits in excess of €100,000 to shares of special class of the bank. An additional 22.5 percent will be frozen without interest until the plan is completed. The overwhelming risk factor is the unsustainable Treasury deficit/debt of the United States (http://cmpassocregulationblog.blogspot.com/2013/02/united-states-unsustainable-fiscal.html). Another rising risk is division within the Federal Open Market Committee (FOMC) on risks and benefits of current policies as expressed in the minutes of the meeting held on Jan 29-30, 2013 (http://www.federalreserve.gov/monetarypolicy/files/fomcminutes20130130.pdf 13):

“However, many participants also expressed some concerns about potential costs and risks arising from further asset purchases. Several participants discussed the possible complications that additional purchases could cause for the eventual withdrawal of policy accommodation, a few mentioned the prospect of inflationary risks, and some noted that further asset purchases could foster market behavior that could undermine financial stability. Several participants noted that a very large portfolio of long-duration assets would, under certain circumstances, expose the Federal Reserve to significant capital losses when these holdings were unwound, but others pointed to offsetting factors and one noted that losses would not impede the effective operation of monetary policy.

Jon Hilsenrath and Victoria McGrane, writing on “Fed slip over how long to keep cash spigot open,” published on Feb 20, 2013 in the Wall street Journal (http://professional.wsj.com/article/SB10001424127887323511804578298121033876536.html), analyze the minutes of the Fed, comments by members of the FOMC and data showing increase in holdings of riskier debt by investors, record issuance of junk bonds, mortgage securities and corporate loans.

A competing event is the high level of valuations of risk financial assets (http://cmpassocregulationblog.blogspot.com/2013/01/peaking-valuation-of-risk-financial.html). Matt Jarzemsky, writing on Dow industrials set record,” on Mar 5, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324156204578275560657416332.html), analyzes that the DJIA broke the closing high of 14164.53 set on Oct 9, 2007, and subsequently also broke the intraday high of 14198.10 reached on Oct 11, 2007. The DJIA closed at 14565.25

on Fri Apr, 2013, which is higher by 2.8 percent than the value of 14,164.53 reached on Oct 9, 2007 and higher by 2.6 percent than the value of 14,198.10 reached on Oct 11, 2007. Values of risk financial are approaching or exceeding historical highs. Jon Hilsenrath, writing on “Jobs upturn isn’t enough to satisfy Fed,” on Mar 8, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324582804578348293647760204.html), finds that much stronger labor market conditions are required for the Fed to end quantitative easing. Unconventional monetary policy with zero interest rates and quantitative easing is quite difficult to unwind because of the adverse effects of raising interest rates on valuations of risk financial assets and home prices, including the very own valuation of the securities held outright in the Fed balance sheet. Gradual unwinding of 1 percent fed funds rates from Jun 2003 to Jun 2004 by seventeen consecutive increases of 25 percentage points from Jun 2004 to Jun 2006 to reach 5.25 percent caused default of subprime mortgages and adjustable-rate mortgages linked to the overnight fed funds rate. The zero interest rate has penalized liquidity and increased risks by inducing carry trades from zero interest rates to speculative positions in risk financial assets. There is no exit from zero interest rates without provoking another financial crash.

An important risk event is the reduction of growth prospects in the euro zone discussed by European Central Bank President Mario Draghi in “Introductory statement to the press conference,” on Dec 6, 2012 (http://www.ecb.int/press/pressconf/2012/html/is121206.en.html):

“This assessment is reflected in the December 2012 Eurosystem staff macroeconomic projections for the euro area, which foresee annual real GDP growth in a range between -0.6% and -0.4% for 2012, between -0.9% and 0.3% for 2013 and between 0.2% and 2.2% for 2014. Compared with the September 2012 ECB staff macroeconomic projections, the ranges for 2012 and 2013 have been revised downwards.

The Governing Council continues to see downside risks to the economic outlook for the euro area. These are mainly related to uncertainties about the resolution of sovereign debt and governance issues in the euro area, geopolitical issues and fiscal policy decisions in the United States possibly dampening sentiment for longer than currently assumed and delaying further the recovery of private investment, employment and consumption.”

Reuters, writing on “Bundesbank cuts German growth forecast,” on Dec 7, 2012, published in the Financial Times (http://www.ft.com/intl/cms/s/0/8e845114-4045-11e2-8f90-00144feabdc0.html#axzz2EMQxzs3u), informs that the central bank of Germany, Deutsche Bundesbank reduced its forecast of growth for the economy of Germany to 0.7 percent in 2012 from an earlier forecast of 1.0 percent in Jun and to 0.4 percent in 2012 from an earlier forecast of 1.6 percent while the forecast for 2014 is at 1.9 percent.

The major risk event during earlier weeks was sharp decline of sovereign yields with the yield on the ten-year bond of Spain falling to 5.309 percent and that of the ten-year bond of Italy falling to 4.473 percent on Fri Nov 30, 2012 and 5.366 percent for the ten-year of Spain and 4.527 percent for the ten-year of Italy on Fri Nov 14, 2012 (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata). Vanessa Mock and Frances Robinson, writing on “EU approves Spanish bank’s restructuring plans,” on Nov 28, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887323751104578146520774638316.html?mod=WSJ_hp_LEFTWhatsNewsCollection), inform that the European Union regulators approved restructuring of four Spanish banks (Bankia, NCG Banco, Catalunya Banc and Banco de Valencia), which helped to calm sovereign debt markets. Harriet Torry and James Angelo, writing on “Germany approves Greek aid,” on Nov 30, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887323751104578150532603095790.html?mod=WSJ_hp_LEFTWhatsNewsCollection), inform that the German parliament approved the plan to provide Greece a tranche of €44 billion in promised financial support, which is subject to sustainability analysis of the bond repurchase program later in Dec 2012. A hurdle for sustainability of repurchasing debt is that Greece’s sovereign bonds have appreciated significantly from around 24 percent for the bond maturing in 21 years and 20 percent for the bond maturing in 31 years in Aug 2012 to around 17 percent for the 21-year maturity and 15 percent for the 31-year maturing in Nov 2012. Declining years are equivalent to increasing prices, making the repurchase more expensive. Debt repurchase is intended to reduce bonds in circulation, turning Greek debt more manageable. Ben McLannahan, writing on “Japan unveils $11bn stimulus package,” on Nov 30, 2012, published in the Financial Times (http://www.ft.com/intl/cms/s/0/adc0569a-3aa5-11e2-baac-00144feabdc0.html#axzz2DibFFquN

), informs that the cabinet in Japan approved another stimulus program of $11 billion, which is twice larger than another stimulus plan in late Oct and close to elections in Dec. Henry Sender, writing on “Tokyo faces weak yen and high bond yields,” published on Nov 29, 2012 in the Financial Times (http://www.ft.com/intl/cms/s/0/9a7178d0-393d-11e2-afa8-00144feabdc0.html#axzz2DibFFquN), analyzes concerns of regulators on duration of bond holdings in an environment of likelihood of increasing yields and yen depreciation.

First, Risk-Determining Events. The European Council statement on Nov 23, 2012 asked the President of the European Commission “to continue the work and pursue consultations in the coming weeks to find a consensus among the 27 over the Union’s Multiannual Financial Framework for the period 2014-2020” (http://www.consilium.europa.eu/uedocs/cms_Data/docs/pressdata/en/ec/133723.pdf) Discussions will continue in the effort to reach agreement on a budget: “A European budget is important for the cohesion of the Union and for jobs and growth in all our countries” (http://www.consilium.europa.eu/uedocs/cms_Data/docs/pressdata/en/ec/133723.pdf). There is disagreement between the group of countries requiring financial assistance and those providing bailout funds. Gabrielle Steinhauser and Costas Paris, writing on “Greek bond rally puts buyback in doubt,” on Nov 23, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887324352004578136362599130992.html?mg=reno64-wsj) find a new hurdle in rising prices of Greek sovereign debt that may make more difficult buybacks of debt held by investors. European finance ministers continue their efforts to reach an agreement for Greece that meets with approval of the European Central Bank and the IMF. The European Council (2012Oct19 http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/133004.pdf ) reached conclusions on strengthening the euro area and providing unified financial supervision:

“The European Council called for work to proceed on the proposals on the Single Supervisory Mechanism as a matter of priority with the objective of agreeing on the legislative framework by 1st January 2013 and agreed on a number of orientations to that end. It also took note of issues relating to the integrated budgetary and economic policy frameworks and democratic legitimacy and accountability which should be further explored. It agreed that the process towards deeper economic and monetary union should build on the EU's institutional and legal framework and be characterised by openness and transparency towards non-euro area Member States and respect for the integrity of the Single Market. It looked forward to a specific and time-bound roadmap to be presented at its December 2012 meeting, so that it can move ahead on all essential building blocks on which a genuine EMU should be based.”

Buiter (2012Oct15) finds that resolution of the euro crisis requires full banking union together with restructuring the sovereign debt of at least four and possibly total seven European countries. The Bank of Spain released new data on doubtful debtors in Spain’s credit institutions (http://www.bde.es/bde/en/secciones/prensa/Agenda/Datos_de_credit_a6cd708c59cf931.html). In 2006, the value of doubtful credits reached €10,859 million or 0.7 percent of total credit of €1,508,626 million. In Aug 2012, doubtful credit reached €178,579 million or 10.5 percent of total credit of €1,698,714 million.

There are three critical factors influencing world financial markets. (1) Spain could request formal bailout from the European Stability Mechanism (ESM) that may also affect Italy’s international borrowing. David Roman and Jonathan House, writing on “Spain risks backlash with budget plan,” on Sep 27, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390443916104578021692765950384.html?mod=WSJ_hp_LEFTWhatsNewsCollection) analyze Spain’s proposal of reducing government expenditures by €13 billion, or around $16.7 billion, increasing taxes in 2013, establishing limits on early retirement and cutting the deficit by €65 billion through 2014. Banco de España, Bank of Spain, contracted consulting company Oliver Wyman to conduct rigorous stress tests of the resilience of its banking system. (Stress tests and their use are analyzed by Pelaez and Pelaez Globalization and the State Vol. I (2008b), 95-100, International Financial Architecture (2005) 112-6, 123-4, 130-3).) The results are available from Banco de España (http://www.bde.es/bde/en/secciones/prensa/infointeres/reestructuracion/ http://www.bde.es/f/webbde/SSICOM/20120928/informe_ow280912e.pdf). The assumptions of the adverse scenario used by Oliver Wyman are quite tough for the three-year period from 2012 to 2014: “6.5 percent cumulative decline of GDP, unemployment rising to 27.2 percent and further declines of 25 percent of house prices and 60 percent of land prices (http://www.bde.es/f/webbde/SSICOM/20120928/informe_ow280912e.pdf). Fourteen banks were stress tested with capital needs estimates of seven banks totaling €59.3 billion. The three largest banks of Spain, Banco Santander (http://www.santander.com/csgs/Satellite/CFWCSancomQP01/es_ES/Corporativo.html), BBVA (http://www.bbva.com/TLBB/tlbb/jsp/ing/home/index.jsp) and Caixabank (http://www.caixabank.com/index_en.html), with 43 percent of exposure under analysis, have excess capital of €37 billion in the adverse scenario in contradiction with theories that large, international banks are necessarily riskier. Jonathan House, writing on “Spain expects wider deficit on bank aid,” on Sep 30, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390444138104578028484168511130.html?mod=WSJPRO_hpp_LEFTTopStories), analyzes the 2013 budget plan of Spain that will increase the deficit of 7.4 percent of GDP in 2012, which is above the target of 6.3 percent under commitment with the European Union. The ratio of debt to GDP will increase to 85.3 percent in 2012 and 90.5 percent in 2013 while the 27 members of the European Union have an average debt/GDP ratio of 83 percent at the end of IIQ2012. (2) Symmetric inflation targets appear to have been abandoned in favor of a self-imposed single jobs mandate of easing monetary policy even after the economy grows again at or close to potential output. Monetary easing by unconventional measures is now apparently open ended in perpetuity as provided in the statement of the meeting of the Federal Open Market Committee (FOMC) on Sep 13, 2012 (http://www.federalreserve.gov/newsevents/press/monetary/20120913a.htm):

“To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.”

In fact, it is evident to the public that this policy will be abandoned if inflation costs rise. There is the concern of the production and employment costs of controlling future inflation.

(2) The European Central Bank (ECB) approved a new program of bond purchases under the name “Outright Monetary Transactions” (OMT). The ECB will purchase sovereign bonds of euro zone member countries that have a program of conditionality under the European Financial Stability Facility (EFSF) that is converting into the European Stability Mechanism (ESM). These programs provide enhancing the solvency of member countries in a transition period of structural reforms and fiscal adjustment. The purchase of bonds by the ECB would maintain debt costs of sovereigns at sufficiently low levels to permit adjustment under the EFSF/ESM programs. Purchases of bonds are not limited quantitatively with discretion by the ECB as to how much is necessary to support countries with adjustment programs. Another feature of the OMT of the ECB is sterilization of bond purchases: funds injected to pay for the bonds would be withdrawn or sterilized by ECB transactions. The statement by the European Central Bank on the program of OTM is as follows (http://www.ecb.int/press/pr/date/2012/html/pr120906_1.en.html):

“6 September 2012 - Technical features of Outright Monetary Transactions

As announced on 2 August 2012, the Governing Council of the European Central Bank (ECB) has today taken decisions on a number of technical features regarding the Eurosystem’s outright transactions in secondary sovereign bond markets that aim at safeguarding an appropriate monetary policy transmission and the singleness of the monetary policy. These will be known as Outright Monetary Transactions (OMTs) and will be conducted within the following framework:

Conditionality

A necessary condition for Outright Monetary Transactions is strict and effective conditionality attached to an appropriate European Financial Stability Facility/European Stability Mechanism (EFSF/ESM) programme. Such programmes can take the form of a full EFSF/ESM macroeconomic adjustment programme or a precautionary programme (Enhanced Conditions Credit Line), provided that they include the possibility of EFSF/ESM primary market purchases. The involvement of the IMF shall also be sought for the design of the country-specific conditionality and the monitoring of such a programme.

The Governing Council will consider Outright Monetary Transactions to the extent that they are warranted from a monetary policy perspective as long as programme conditionality is fully respected, and terminate them once their objectives are achieved or when there is non-compliance with the macroeconomic adjustment or precautionary programme.

Following a thorough assessment, the Governing Council will decide on the start, continuation and suspension of Outright Monetary Transactions in full discretion and acting in accordance with its monetary policy mandate.

Coverage

Outright Monetary Transactions will be considered for future cases of EFSF/ESM macroeconomic adjustment programmes or precautionary programmes as specified above. They may also be considered for Member States currently under a macroeconomic adjustment programme when they will be regaining bond market access.

Transactions will be focused on the shorter part of the yield curve, and in particular on sovereign bonds with a maturity of between one and three years.

No ex ante quantitative limits are set on the size of Outright Monetary Transactions.

Creditor treatment

The Eurosystem intends to clarify in the legal act concerning Outright Monetary Transactions that it accepts the same (pari passu) treatment as private or other creditors with respect to bonds issued by euro area countries and purchased by the Eurosystem through Outright Monetary Transactions, in accordance with the terms of such bonds.

Sterilisation

The liquidity created through Outright Monetary Transactions will be fully sterilised.

Transparency

Aggregate Outright Monetary Transaction holdings and their market values will be published on a weekly basis. Publication of the average duration of Outright Monetary Transaction holdings and the breakdown by country will take place on a monthly basis.

Securities Markets Programme

Following today’s decision on Outright Monetary Transactions, the Securities Markets Programme (SMP) is herewith terminated. The liquidity injected through the SMP will continue to be absorbed as in the past, and the existing securities in the SMP portfolio will be held to maturity.”

Jon Hilsenrath, writing on “Fed sets stage for stimulus,” on Aug 31, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390443864204577623220212805132.html?mod=WSJ_hp_LEFTWhatsNewsCollection), analyzes the essay presented by Chairman Bernanke at the Jackson Hole meeting of central bankers, as defending past stimulus with unconventional measures of monetary policy that could be used to reduce extremely high unemployment. Chairman Bernanke (2012JHAug31, 18-9) does support further unconventional monetary policy impulses if required by economic conditions (http://www.federalreserve.gov/newsevents/speech/bernanke20120831a.htm):

“Over the past five years, the Federal Reserve has acted to support economic growth and foster job creation, and it is important to achieve further progress, particularly in the labor market. Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.”

Professor John H Cochrane (2012Aug31), at the University of Chicago Booth School of Business, writing on “The Federal Reserve: from central bank to central planner,” on Aug 31, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390444812704577609384030304936.html?mod=WSJ_hps_sections_opinion), analyzes that the departure of central banks from open market operations into purchase of assets with risks to taxpayers and direct allocation of credit subject to political influence has caused them to abandon their political independence and accountability. Cochrane (2012Aug31) finds a return to the proposition of Milton Friedman in the 1960s that central banks can cause inflation and macroeconomic instability.

Mario Draghi (2012Aug29), President of the European Central Bank, also reiterated the need of exceptional and unconventional central bank policies (http://www.ecb.int/press/key/date/2012/html/sp120829.en.html):

“Yet it should be understood that fulfilling our mandate sometimes requires us to go beyond standard monetary policy tools. When markets are fragmented or influenced by irrational fears, our monetary policy signals do not reach citizens evenly across the euro area. We have to fix such blockages to ensure a single monetary policy and therefore price stability for all euro area citizens. This may at times require exceptional measures. But this is our responsibility as the central bank of the euro area as a whole.

The ECB is not a political institution. But it is committed to its responsibilities as an institution of the European Union. As such, we never lose sight of our mission to guarantee a strong and stable currency. The banknotes that we issue bear the European flag and are a powerful symbol of European identity.”

Buiter (2011Oct31) analyzes that the European Financial Stability Fund (EFSF) would need a “bigger bazooka” to bail out euro members in difficulties that could possibly be provided by the ECB. Buiter (2012Oct15) finds that resolution of the euro crisis requires full banking union together with restructuring the sovereign debt of at least four and possibly total seven European countries. Table III-7 in IIIE Appendix Euro Zone Survival Risk below provides the combined GDP in 2012 of the highly indebted euro zone members estimated in the latest World Economic Outlook of the IMF at $4167 billion or 33.1 percent of total euro zone GDP of $12,586 billion. Using the WEO of the IMF, Table III-8 in IIIE Appendix Euro Zone Survival Risk below provides debt of the highly indebted euro zone members at $3927.8 billion in 2012 that increases to $5809.9 billion when adding Germany’s debt, corresponding to 167.0 percent of Germany’s GDP. There are additional sources of debt in bailing out banks. The dimensions of the problem may require more firepower than a bazooka perhaps that of the largest conventional bomb of all times of 44,000 pounds experimentally detonated only once by the US in 1948 (http://www.airpower.au.af.mil/airchronicles/aureview/1967/mar-apr/coker.html).

Second, Risk-Measuring Yields and Exchange Rate. The ten-year government bond of Spain was quoted at 6.868 percent on Aug 10, 2012, declining to 6.447 percent on Aug 17 and 6.403 percent on Aug 24, 2012, and the ten-year government bond of Italy fell from 5.894 percent on Aug 10, 2012 to 5.709 percent on Aug 17 and 5.618 percent on Aug 24, 2012. The yield of the ten-year sovereign bond of Spain traded at 4.767 percent on Apr 5, 2013 and that of the ten-year sovereign bond of Italy at 4.322 percent (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata). Risk aversion is captured by flight of investors from risk financial assets to the government securities of the US and Germany. Diminishing aversion is captured by increase of the yield of the two- and ten-year Treasury notes and the two- and ten-year government bonds of Germany. Table III-1A provides yields of US and German governments bonds and the rate of USD/EUR. Yields of US and German government bonds decline during shocks of risk aversion and the dollar strengthens in the form of fewer dollars required to buy one euro. The yield of the US ten-year Treasury note fell from 2.202 percent on Aug 26, 2011 to 1.459 percent on Jul 20, 2012, reminiscent of experience during the Treasury-Fed accord of the 1940s that placed a ceiling on long-term Treasury debt (Hetzel and Leach 2001), while the yield of the ten-year government bond of Germany fell from 2.16 percent to 1.17 percent. In the week of Apr 5, 2013, the yield of the two-year Treasury stabilized 0.228 percent and that of the ten-year Treasury decreased to 1.706 percent while the two-year bond of Germany stabilized at 0.01 percent and the ten-year decreased to 1.21 percent; and the dollar depreciated to USD 1.2995/EUR. The zero interest rates for the monetary policy rate of the US, or fed funds rate, carry trades ensure devaluation of the dollar if there is no risk aversion but the dollar appreciates in flight to safe haven during episodes of risk aversion. Unconventional monetary policy induces significant global financial instability, excessive risks and low liquidity. The ten-year Treasury yield is about equal to consumer price inflation of 2.0 percent in the 12 months ending in Feb 2013 (http://cmpassocregulationblog.blogspot.com/2013/03/recovery-without-hiring-ten-million.html) and the expectation of higher inflation if risk aversion diminishes. Treasury securities continue to be safe haven for investors fearing risk but with concentration in shorter maturities such as the two-year Treasury. The lower part of Table III-1A provides the same flight to government securities of the US and Germany and the USD during the financial crisis and global recession and the beginning of the European debt crisis in the spring of 2010 with the USD trading at USD 1.192/EUR on Jun 7, 2010.

Table III-1A, Two- and Ten-Year Yields of Government Bonds of the US and Germany and US Dollar/EUR Exchange rate

| US 2Y | US 10Y | DE 2Y | DE 10Y | USD/ EUR | |

| 4/5/13 | 0.228 | 1.706 | 0.01 | 1.21 | 1.2995 |

| 3/29/13 | 0.244 | 1.847 | -0.02 | 1.29 | 1.2818 |

| 3/22/13 | 0.242 | 1.931 | 0.03 | 1.38 | 1.2988 |

| 3/15/13 | 0.246 | 1.992 | 0.05 | 1.46 | 1.3076 |

| 3/8/13 | 0.256 | 2.056 | 0.09 | 1.53 | 1.3003 |

| 3/1/13 | 0.236 | 1.842 | 0.03 | 1.41 | 1.3020 |

| 2/22/13 | 0.252 | 1.967 | 0.13 | 1.57 | 1.3190 |

| 2/15/13 | 0.268 | 2.007 | 0.19 | 1.65 | 1.3362 |

| 2/8/13 | 0.252 | 1.949 | 0.18 | 1.61 | 1.3365 |

| 2/1/13 | 0.26 | 2.024 | 0.25 | 1.67 | 1.3642 |

| 1/25/13 | 0.278 | 1.947 | 0.26 | 1.64 | 1.3459 |

| 1/18/13 | 0.252 | 1.84 | 0.18 | 1.56 | 1.3321 |

| 1/11/13 | 0.247 | 1.862 | 0.13 | 1.58 | 1.3343 |

| 1/4/13 | 0.262 | 1.898 | 0.08 | 1.54 | 1.3069 |

| 12/28/12 | 0.252 | 1.699 | -0.01 | 1.31 | 1.3218 |

| 12/21/12 | 0.272 | 1.77 | -0.01 | 1.38 | 1.3189 |

| 12/14/12 | 0.232 | 1.704 | -0.04 | 1.35 | 1.3162 |

| 12/7/12 | 0.256 | 1.625 | -0.08 | 1.30 | 1.2926 |

| 11/30/12 | 0.248 | 1.612 | 0.01 | 1.39 | 1.2987 |

| 11/23/12 | 0.273 | 1.691 | 0.00 | 1.44 | 1.2975 |

| 11/16/12 | 0.24 | 1.584 | -0.03 | 1.33 | 1.2743 |

| 11/9/12 | 0.256 | 1.614 | -0.03 | 1.35 | 1.2711 |

| 11/2/12 | 0.274 | 1.715 | 0.01 | 1.45 | 1.2838 |

| 10/26/12 | 0.299 | 1.748 | 0.05 | 1.54 | 1.2942 |

| 10/19/12 | 0.296 | 1.766 | 0.11 | 1.59 | 1.3023 |

| 10/12/12 | 0.264 | 1.663 | 0.04 | 1.45 | 1.2953 |

| 10/5/12 | 0.26 | 1.737 | 0.06 | 1.52 | 1.3036 |

| 9/28/12 | 0.236 | 1.631 | 0.02 | 1.44 | 1.2859 |

| 9/21/12 | 0.26 | 1.753 | 0.04 | 1.60 | 1.2981 |

| 9/14/12 | 0.252 | 1.863 | 0.10 | 1.71 | 1.3130 |

| 9/7/12 | 0.252 | 1.668 | 0.03 | 1.52 | 1.2816 |

| 8/31/12 | 0.225 | 1.543 | -0.03 | 1.33 | 1.2575 |

| 8/24/12 | 0.266 | 1.684 | -0.01 | 1.35 | 1.2512 |

| 8/17/12 | 0.288 | 1.814 | -0.04 | 1.50 | 1.2335 |

| 8/10/12 | 0.267 | 1.658 | -0.07 | 1.38 | 1.2290 |

| 8/3/12 | 0.242 | 1.569 | -0.02 | 1.42 | 1.2387 |

| 7/27/12 | 0.244 | 1.544 | -0.03 | 1.40 | 1.2320 |

| 7/20/12 | 0.207 | 1.459 | -0.07 | 1.17 | 1.2158 |

| 7/13/12 | 0.24 | 1.49 | -0.04 | 1.26 | 1.2248 |

| 7/6/12 | 0.272 | 1.548 | -0.01 | 1.33 | 1.2288 |

| 6/29/12 | 0.305 | 1.648 | 0.12 | 1.58 | 1.2661 |

| 6/22/12 | 0.309 | 1.676 | 0.14 | 1.58 | 1.2570 |

| 6/15/12 | 0.272 | 1.584 | 0.07 | 1.44 | 1.2640 |

| 6/8/12 | 0.268 | 1.635 | 0.04 | 1.33 | 1.2517 |

| 6/1/12 | 0.248 | 1.454 | 0.01 | 1.17 | 1.2435 |

| 5/25/12 | 0.291 | 1.738 | 0.05 | 1.37 | 1.2518 |

| 5/18/12 | 0.292 | 1.714 | 0.05 | 1.43 | 1.2780 |

| 5/11/12 | 0.248 | 1.845 | 0.09 | 1.52 | 1.2917 |

| 5/4/12 | 0.256 | 1.876 | 0.08 | 1.58 | 1.3084 |

| 4/6/12 | 0.31 | 2.058 | 0.14 | 1.74 | 1.3096 |

| 3/30/12 | 0.335 | 2.214 | 0.21 | 1.79 | 1.3340 |

| 3/2/12 | 0.29 | 1.977 | 0.16 | 1.80 | 1.3190 |

| 2/24/12 | 0.307 | 1.977 | 0.24 | 1.88 | 1.3449 |

| 1/6/12 | 0.256 | 1.957 | 0.17 | 1.85 | 1.2720 |

| 12/30/11 | 0.239 | 1.871 | 0.14 | 1.83 | 1.2944 |

| 8/26/11 | 0.20 | 2.202 | 0.65 | 2.16 | 1.450 |

| 8/19/11 | 0.192 | 2.066 | 0.65 | 2.11 | 1.4390 |

| 6/7/10 | 0.74 | 3.17 | 0.49 | 2.56 | 1.192 |

| 3/5/09 | 0.89 | 2.83 | 1.19 | 3.01 | 1.254 |

| 12/17/08 | 0.73 | 2.20 | 1.94 | 3.00 | 1.442 |

| 10/27/08 | 1.57 | 3.79 | 2.61 | 3.76 | 1.246 |

| 7/14/08 | 2.47 | 3.88 | 4.38 | 4.40 | 1.5914 |

| 6/26/03 | 1.41 | 3.55 | NA | 3.62 | 1.1423 |

Note: DE: Germany

Source:

http://www.bloomberg.com/markets/

http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

http://www.federalreserve.gov/releases/h15/data.htm

http://www.ecb.int/stats/money/long/html/index.en.html

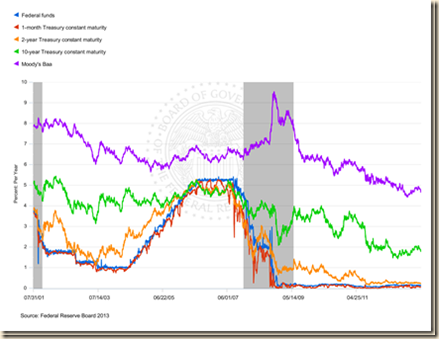

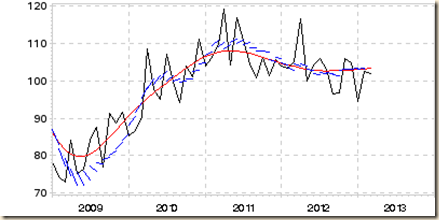

Chart III-1A of the Board of Governors of the Federal Reserve System provides the ten-year, two-year and one-month Treasury constant maturity yields together with the overnight fed funds rate and the yield of the corporate bond with Moody’s rating of Baa. The riskier yield of the Baa corporate bond exceeds the relatively riskless yields of the Treasury securities. The beginning yields in Chart III-1A for July 31, 2001, are 3.67 percent for one month, 3.79 percent for two years, 5.07 percent for ten years, 3.82 percent for the fed funds rate and 7.85 percent for the Baa corporate bond. On July 30, 2007, yields inverted with the one month at 4.95 percent, the two-year at 4.59 percent and the ten year at 5.82 percent with the yield of the Baa corporate bond at 6.70 percent. Another interesting point is for Oct 31, 2008, with the yield of the Baa jumping to 9.54 percent and the Treasury yields declining: one month 0.12 percent, two years 1.56 percent and ten years 4.01 percent during a flight to the dollar and government securities analyzed by Cochrane and Zingales (2009). Another spike in the series is for Apr 4, 2006 with the yield of the corporate Baa bond at 8.63 and the Treasury yields of 0.12 percent for one month, 0.94 for two years and 2.95 percent for ten years. During the beginning of the flight from risk financial assets to US government securities (see Cochrane and Zingales 2009), the one-month yield was 0.07 percent, the two-year yield 1.64 percent and the ten-year yield 3.41. The combination of zero fed funds rate and quantitative easing caused sharp decline of the yields from 2008 and 2009. Yield declines have also occurred during periods of financial risk aversion, including the current one of stress of financial markets in Europe. The final point of Chart III1-A is for Apr 4, 2013, with the one-month yield at 0.07 percent, the two-year at 0.22 percent, the ten-year at 1.78 percent, the fed funds rate at 0.14 percent and the corporate Baa bond at 4.66 percent.

Chart III-1A, US, Ten-Year, Two-Year and One-Month Treasury Constant Maturity Yields, Overnight Fed Funds Rate and Yield of Moody’s Baa Corporate Bond, Jul 31, 2001-Apr 4, 2013

Note: US Recessions in shaded areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/update/

Kate Linebaugh, writing on “Falling revenue dings stocks,” on Oct 20, 2012, published in the Wall Street Journal (http://professional.wsj.com/article/SB10000872396390444592704578066933466076070.html?mod=WSJPRO_hpp_LEFTTopStories), identifies a key financial vulnerability: falling revenues across markets for United States reporting companies. Global economic slowdown is reducing corporate sales and squeezing corporate strategies. Linebaugh quotes data from Thomson Reuters that 100 companies of the S&P 500 index have reported declining revenue only 1 percent higher in Jun-Sep 2012 relative to Jun-Sep 2011 but about 60 percent of the companies are reporting lower sales than expected by analysts with expectation that revenue for the S&P 500 will be lower in Jun-Sep 2012 for the entities represented in the index. Results of US companies are likely repeated worldwide. The basic valuation equation that is also used in capital budgeting postulates that the value of stocks or of an investment project is given by:

Where Rτ is expected revenue in the time horizon from τ =1 to T; Cτ denotes costs; and ρ is an appropriate rate of discount. In words, the value today of a stock or investment project is the net revenue, or revenue less costs, in the investment period from τ =1 to T discounted to the present by an appropriate rate of discount. In the current weak economy, revenues have been increasing more slowly than anticipated in investment plans. An increase in interest rates would affect discount rates used in calculations of present value, resulting in frustration of investment decisions. If V represents value of the stock or investment project, as ρ → ∞, meaning that interest rates increase without bound, then V → 0, or

declines.

There was mostly weak performance in equity indexes with many indexes declining in Table III-1 in the week ending on Apr 5, 2013. Stagnating revenues are causing reevaluation of discounted net earnings with deteriorating views on the world economy and United States fiscal sustainability but investors have been driving indexes higher. DJIA decreased 0.3 percent on Apr 5, decreasing 0.1 percent in the week. Germany’s Dax decreased 2.0 percent on Fri Apr 5 and decreased 1.8 percent in the week. Dow Global decreased 0.2 percent on Apr 5 and decreased 1.6 percent in the week. Japan’s Nikkei Average increased 1.6 percent on Fri Apr 5 and increased 3.5 percent in the week as the yen continues to be oscillating but relatively weaker and the stock market gains in expectations of fiscal stimulus by a new administration and monetary stimulus by a new board of the Bank of Japan. Dow Asia Pacific TSM changed 0.0 percent on Apr 5 and decreased 1.5 percent in the week while Shanghai Composite that decreased 0.2 percent on Mar 8 and decreased 1.7 percent in the week of Mar 8, falling below 2000 to close at 1980.13 on Fri Nov 30 but closing at 2225.29 on Thu Apr 5 for loss of 0.0 percent and loss of 0.5 percent in the week of Apr 5. There is evident trend of deceleration of the world economy that could affect corporate revenue and equity valuations, causing oscillation in equity markets with increases during favorable risk appetite.

Commodities were mostly weaker in the week of Apr 5, 2013. The DJ UBS Commodities Index increased 0.5 percent on Fri Apr 5 and decreased 2.5 percent in the week, as shown in Table III-1. WTI decreased 4.3 percent in the week of Apr 5 while Brent decreased 5.2 percent in the week. Gold increased 1.7 percent on Fri Apr 5 and decreased 0.9 percent in the week.

Table III-2 provides an update of the consolidated financial statement of the Eurosystem. The balance sheet has swollen with the long-term refinancing operations (LTROs). Line 5 “Lending to Euro Area Credit Institutions Related to Monetary Policy” increased from €546,747 million on Dec 31, 2010, to €879,130 million on Dec 28, 2011 and €903,619 million on Mar 29, 2013 with some repayment of loans already occurring. The sum of line 5 and line 7 (“Securities of Euro Area Residents Denominated in Euro”) has increased to €1,521,683 million in the statement of Mar 29, 2013, with marginal reduction. There is high credit risk in these transactions with capital of only €88,227 million as analyzed by Cochrane (2012Aug31).

Table III-2, Consolidated Financial Statement of the Eurosystem, Million EUR

| Dec 31, 2010 | Dec 28, 2011 | Mar 29, 2013 | |

| 1 Gold and other Receivables | 367,402 | 419,822 | 435,316 |

| 2 Claims on Non Euro Area Residents Denominated in Foreign Currency | 223,995 | 236,826 | 254,369 |

| 3 Claims on Euro Area Residents Denominated in Foreign Currency | 26,941 | 95,355 | 31,563 |

| 4 Claims on Non-Euro Area Residents Denominated in Euro | 22,592 | 25,982 | 22,101 |

| 5 Lending to Euro Area Credit Institutions Related to Monetary Policy Operations Denominated in Euro | 546,747 | 879,130 | 903,619 |

| 6 Other Claims on Euro Area Credit Institutions Denominated in Euro | 45,654 | 94,989 | 88,538 |

| 7 Securities of Euro Area Residents Denominated in Euro | 457,427 | 610,629 | 618,064 |

| 8 General Government Debt Denominated in Euro | 34,954 | 33,928 | 29,894 |

| 9 Other Assets | 278,719 | 336,574 | 264,663 |

| TOTAL ASSETS | 2,004, 432 | 2,733,235 | 2,648,126 |

| Memo Items | |||

| Sum of 5 and 7 | 1,004,174 | 1,489,759 | 1,521,683 |

| Capital and Reserves | 78,143 | 85,748 | 88,917 |

Source: European Central Bank

http://www.ecb.int/press/pr/wfs/2011/html/fs110105.en.html

http://www.ecb.int/press/pr/wfs/2011/html/fs111228.en.html

http://www.ecb.int/press/pr/wfs/2013/html/fs130404.en.html

IIIE Appendix Euro Zone survival risk. Professors Ricardo Caballero and Francesco Giavazzi (2012Jan15) find that the resolution of the European sovereign crisis with survival of the euro area would require success in the restructuring of Italy. That success would be assured with growth of the Italian economy. A critical problem is that the common euro currency prevents Italy from devaluing the exchange rate to parity or the exchange rate that would permit export growth to promote internal economic activity, which could generate fiscal revenues for primary fiscal surplus that ensure creditworthiness. Fiscal consolidation and restructuring are important but of long-term gestation. Immediate growth of the Italian economy would consolidate the resolution of the sovereign debt crisis. Professors Ricardo Caballero and Francesco Giavazzi (2012Jan15) find that the resolution of the European sovereign crisis with survival of the euro area would require success in the restructuring of Italy. That success would be assured with growth of the Italian economy. A critical problem is that the common euro currency prevents Italy from devaluing the exchange rate to parity or the exchange rate that would permit export growth to promote internal economic activity, which could generate fiscal revenues for primary fiscal surplus that ensure creditworthiness. Fiscal consolidation and restructuring are important but of long-term gestation. Immediate growth of the Italian economy would consolidate the resolution of the sovereign debt crisis. Caballero and Giavazzi (2012Jan15) argue that 55 percent of the exports of Italy are to countries outside the euro area such that devaluation of 15 percent would be effective in increasing export revenue. Newly available data in Table III-3 providing Italy’s trade with regions and countries supports the argument of Caballero and Giavazzi (2012Jan15). Italy’s exports to the European Monetary Union (EMU), or euro area, are only 40.5 percent of the total. Exports to the non-European Union area with share of 46.3 percent in Italy’s total exports are growing at 17.6 percent in Jan 2013 relative to Jan 2012 while those to EMU are growing at 1.7 percent.

Table III-3, Italy, Exports and Imports by Regions and Countries, % Share and 12-Month ∆%

| Jan 2013 | Exports | ∆% Jan- 2013/ Jan 2012 | Imports | Imports |

| EU | 53.7 | 2.6 | 52.9 | 2.4 |

| EMU 17 | 40.5 | 1.7 | 42.7 | 3.3 |

| France | 11.1 | 4.0 | 8.3 | 0.0 |

| Germany | 12.5 | 0.3 | 14.6 | -4.4 |

| Spain | 4.7 | -8.6 | 4.4 | 2.3 |

| UK | 4.9 | 8.1 | 2.5 | 5.9 |

| Non EU | 46.3 | 17.6 | 47.1 | -5.6 |

| Europe non EU | 13.9 | 10.7 | 11.3 | 19.9 |

| USA | 6.8 | 19.7 | 3.3 | -16.9 |

| China | 2.3 | 24.6 | 6.5 | -2.8 |

| OPEC | 5.7 | 26.1 | 10.8 | -19.6 |

| Total | 100.0 | 8.7 | 100.0 | -1.8 |

Notes: EU: European Union; EMU: European Monetary Union (euro zone)

Source: Istituto Nazionale di Statistica http://www.istat.it/it/archivio/85204

Table III-4 provides Italy’s trade balance by regions and countries. Italy had trade surplus of €663 million with the 17 countries of the euro zone (EMU 17) in Jan 2013 and cumulative surplus of €663 million in Jan 2013. Depreciation to parity could permit greater competitiveness in improving the trade deficit of €193 million in Jan 2013 with Europe non-European Union and the trade surplus of €762 million with the US and trade with non-European Union of €2281 million in Jan 2013. There is significant rigidity in the trade deficits in Jan of €1619 million with China and €1143 million with members of the Organization of Petroleum Exporting Countries (OPEC). Higher exports could drive economic growth in the economy of Italy that would permit less onerous adjustment of the country’s fiscal imbalances, raising the country’s credit rating.

Table III-4, Italy, Trade Balance by Regions and Countries, Millions of Euro

| Regions and Countries | Trade Balance Jan 2013 Millions of Euro | Trade Balance Cumulative Jan 2013 Millions of Euro |

| EU | 663 | 663 |

| EMU 17 | -296 | -296 |

| France | 1,002 | 1,002 |

| Germany | -246 | -246 |

| Spain | 156 | 156 |

| UK | 702 | 702 |

| Non EU | -2,281 | -2,281 |

| Europe non EU | -193 | -193 |

| USA | 762 | 762 |

| China | -1,619 | -1,619 |

| OPEC | -1,435 | -1,1435 |

| Total | -1,619 | -1,619 |

Notes: EU: European Union; EMU: European Monetary Union (euro zone)

Source: Istituto Nazionale di Statistica http://www.istat.it/it/archivio/85204

Growth rates of Italy’s trade and major products are provided in Table III-5 for the period Jan 2013 relative to Jan 2012. Growth rates in 12 months of imports are negative for energy with minus 14.9 percent, minus 14.4 percent for durable goods, minus 5.0 percent for exports and minus 1.8 percent for total imports. The higher rate of growth of exports of 8.7 percent in Jan 2013/Jan 2012 relative to imports of minus 1.8 percent may reflect weak demand in Italy with GDP declining during six consecutive quarters from IIIQ2011 through IVQ2012 together with softening commodity prices.

Table III-5, Italy, Exports and Imports % Share of Products in Total and ∆%

| Exports | Exports | Imports | Imports | |

| Consumer | 29.3 | 15.2 | 25.6 | 5.2 |

| Durable | 5.8 | 14.5 | 2.9 | -14.4 |

| Non | 23.5 | 15.3 | 22.7 | 7.7 |

| Capital Goods | 31.6 | 11.7 | 19.5 | -5.0 |

| Inter- | 33.6 | 6.9 | 32.6 | 5.5 |

| Energy | 5.5 | -23.8 | 22.3 | -14.9 |

| Total ex Energy | 94.5 | 11.0 | 77.7 | 2.7 |

| Total | 100.0 | 8.7 | 100.0 | -1.8 |

Note: % Share for Jan-Nov 2012.

Source: Istituto Nazionale di Statistica http://www.istat.it/it/archivio/85204

Table III-6 provides Italy’s trade balance by product categories in Jan 2013 and cumulative Jan 2013. Italy’s trade balance excluding energy generated surplus of €3844 million in Jan 2013 and €3844 million cumulative in Jan 2013 but the energy trade balance created deficit of €5463 million in Jan 2013 and cumulative €63844 million in Jan 2013. The overall deficit in Jan 2013 was €1618 million with cumulative deficit of €1618 million in Jan 2013. Italy has significant competitiveness in various economic activities in contrast with some other countries with debt difficulties.

Table III-6, Italy, Trade Balance by Product Categories, € Millions

| Jan 2013 | Cumulative Jan 2013 | |

| Consumer Goods | 996 | 996 |

| Durable | 802 | 802 |

| Nondurable | 194 | 194 |

| Capital Goods | 3,065 | 3,065 |

| Intermediate Goods | -217 | -217 |

| Energy | -5,463 | -5,463 |

| Total ex Energy | 3,844 | 3,844 |

| Total | -1,619 | -1,619 |

Source: Istituto Nazionale di Statistica http://www.istat.it/it/archivio/85204

Brazil faced in the debt crisis of 1982 a more complex policy mix. Between 1977 and 1983, Brazil’s terms of trade, export prices relative to import prices, deteriorated 47 percent and 36 percent excluding oil (Pelaez 1987, 176-79; Pelaez 1986, 37-66; see Pelaez and Pelaez, The Global Recession Risk (2007), 178-87). Brazil had accumulated unsustainable foreign debt by borrowing to finance balance of payments deficits during the 1970s. Foreign lending virtually stopped. The German mark devalued strongly relative to the dollar such that Brazil’s products lost competitiveness in Germany and in multiple markets in competition with Germany. The resolution of the crisis was devaluation of the Brazilian currency by 30 percent relative to the dollar and subsequent maintenance of parity by monthly devaluation equal to inflation and indexing that resulted in financial stability by parity in external and internal interest rates avoiding capital flight. With a combination of declining imports, domestic import substitution and export growth, Brazil followed rapid growth in the US and grew out of the crisis with surprising GDP growth of 4.5 percent in 1984.

The euro zone faces a critical survival risk because several of its members may default on their sovereign obligations if not bailed out by the other members. The valuation equation of bonds is essential to understanding the stability of the euro area. An explanation is provided in this paragraph and readers interested in technical details are referred to the Subsection IIIF Appendix on Sovereign Bond Valuation. Contrary to the Wriston doctrine, investing in sovereign obligations is a credit decision. The value of a bond today is equal to the discounted value of future obligations of interest and principal until maturity. On Dec 30 the yield of the 2-year bond of the government of Greece was quoted around 100 percent. In contrast, the 2-year US Treasury note traded at 0.239 percent and the 10-year at 2.871 percent while the comparable 2-year government bond of Germany traded at 0.14 percent and the 10-year government bond of Germany traded at 1.83 percent. There is no need for sovereign ratings: the perceptions of investors are of relatively higher probability of default by Greece, defying Wriston (1982), and nil probability of default of the US Treasury and the German government. The essence of the sovereign credit decision is whether the sovereign will be able to finance new debt and refinance existing debt without interrupting service of interest and principal. Prices of sovereign bonds incorporate multiple anticipations such as inflation and liquidity premiums of long-term relative to short-term debt but also risk premiums on whether the sovereign’s debt can be managed as it increases without bound. The austerity measures of Italy are designed to increase the primary surplus, or government revenues less expenditures excluding interest, to ensure investors that Italy will have the fiscal strength to manage its debt of 120 percent of GDP, which is the third largest in the world after the US and Japan. Appendix IIIE links the expectations on the primary surplus to the real current value of government monetary and fiscal obligations. As Blanchard (2011SepWEO) analyzes, fiscal consolidation to increase the primary surplus is facilitated by growth of the economy. Italy and the other indebted sovereigns in Europe face the dual challenge of increasing primary surpluses while maintaining growth of the economy (for the experience of Brazil in the debt crisis of 1982 see Pelaez 1986, 1987).

Much of the analysis and concern over the euro zone centers on the lack of credibility of the debt of a few countries while there is credibility of the debt of the euro zone as a whole. In practice, there is convergence in valuations and concerns toward the fact that there may not be credibility of the euro zone as a whole. The fluctuations of financial risk assets of members of the euro zone move together with risk aversion toward the countries with lack of debt credibility. This movement raises the need to consider analytically sovereign debt valuation of the euro zone as a whole in the essential analysis of whether the single-currency will survive without major changes.

Welfare economics considers the desirability of alternative states, which in this case would be evaluating the “value” of Germany (1) within and (2) outside the euro zone. Is the sum of the wealth of euro zone countries outside of the euro zone higher than the wealth of these countries maintaining the euro zone? On the choice of indicator of welfare, Hicks (1975, 324) argues:

“Partly as a result of the Keynesian revolution, but more (perhaps) because of statistical labours that were initially quite independent of it, the Social Product has now come right back into its old place. Modern economics—especially modern applied economics—is centered upon the Social Product, the Wealth of Nations, as it was in the days of Smith and Ricardo, but as it was not in the time that came between. So if modern theory is to be effective, if it is to deal with the questions which we in our time want to have answered, the size and growth of the Social Product are among the chief things with which it must concern itself. It is of course the objective Social Product on which attention must be fixed. We have indexes of production; we do not have—it is clear we cannot have—an Index of Welfare.”

If the burden of the debt of the euro zone falls on Germany and France or only on Germany, is the wealth of Germany and France or only Germany higher after breakup of the euro zone or if maintaining the euro zone? In practice, political realities will determine the decision through elections.

The prospects of survival of the euro zone are dire. Table III-7 is constructed with IMF World Economic Outlook database (http://www.imf.org/external/datamapper/index.php?db=WEO) for GDP in USD billions, primary net lending/borrowing as percent of GDP and general government debt as percent of GDP for selected regions and countries in 2010.

Table III-7, World and Selected Regional and Country GDP and Fiscal Situation

| GDP 2012 | Primary Net Lending Borrowing | General Government Net Debt | |

| World | 71,277 | ||

| Euro Zone | 12,065 | -0.5 | 73.4 |

| Portugal | 211 | -0.7 | 110.9 |

| Ireland | 205 | -4.4 | 103.0 |

| Greece | 255 | -1.7 | 170.7 |

| Spain | 1,340 | -4.5 | 78.6 |

| Major Advanced Economies G7 | 33,769 | -5.1 | 89.0 |

| United States | 15,653 | -6.5 | 83.8 |

| UK | 2,434 | -5.6 | 83.7 |

| Germany | 3,367 | 1.4 | 58.4 |

| France | 2,580 | -2.2 | 83.7 |

| Japan | 5,984 | -9.1 | 135.4 |

| Canada | 1,770 | -3.2 | 35.8 |

| Italy | 1,980 | 2.6 | 103.1 |

| China | 8,250 | -1.3* | 22.2** |

*Net Lending/borrowing**Gross Debt

Source: IMF World Economic Outlook databank http://www.imf.org/external/datamapper/index.php?db=WEO

The data in Table III-7 are used for some very simple calculations in Table III-8. The column “Net Debt USD Billions” in Table III-8 is generated by applying the percentage in Table III-7 column “General Government Net Debt % GDP 2010” to the column “GDP USD Billions.” The total debt of France and Germany in 2012 is $4155.8 billion, as shown in row “B+C” in column “Net Debt USD Billions” The sum of the debt of Italy, Spain, Portugal, Greece and Ireland is $3975.1 billion, adding rows D+E+F+G+H in column “Net Debt USD billions.” There is some simple “unpleasant bond arithmetic” in the two final columns of Table III-8. Suppose the entire debt burdens of the five countries with probability of default were to be guaranteed by France and Germany, which de facto would be required by continuing the euro zone. The sum of the total debt of these five countries and the debt of France and Germany is shown in column “Debt as % of Germany plus France GDP” to reach $8130.8 billion, which would be equivalent to 136.7 percent of their combined GDP in 2012. Under this arrangement the entire debt of the euro zone including debt of France and Germany would not have nil probability of default. The final column provides “Debt as % of Germany GDP” that would exceed 241.5 percent if including debt of France and 177.4 percent of German GDP if excluding French debt. The unpleasant bond arithmetic illustrates that there is a limit as to how far Germany and France can go in bailing out the countries with unsustainable sovereign debt without incurring severe pains of their own such as downgrades of their sovereign credit ratings. A central bank is not typically engaged in direct credit because of remembrance of inflation and abuse in the past. There is also a limit to operations of the European Central Bank in doubtful credit obligations. Wriston (1982) would prove to be wrong again that countries do not bankrupt but would have a consolation prize that similar to LBOs the sum of the individual values of euro zone members outside the current agreement exceeds the value of the whole euro zone. Internal rescues of French and German banks may be less costly than bailing out other euro zone countries so that they do not default on French and German banks.

Table III-8, Guarantees of Debt of Sovereigns in Euro Area as Percent of GDP of Germany and France, USD Billions and %

| Net Debt USD Billions | Debt as % of Germany Plus France GDP | Debt as % of Germany GDP | |

| A Euro Area | 8,855.7 | ||

| B Germany | 1,996.3 | $8130.9 as % of $3367 =241.5% $5971.4 as % of $3367 =177.4% | |

| C France | 2,159.5 | ||

| B+C | 4,155.8 | GDP $5,947.0 Total Debt $8130.9 Debt/GDP: 136.7% | |

| D Italy | 2,041.4 | ||

| E Spain | 1,053.2 | ||

| F Portugal | 234.0 | ||

| G Greece | 435.3 | ||

| H Ireland | 211.2 | ||

| Subtotal D+E+F+G+H | 3,975.1 |

Source: calculation with IMF data http://www.imf.org/external/datamapper/index.php?db=WEO

There is extremely important information in Table III-9 for the current sovereign risk crisis in the euro zone. Table III-9 provides the structure of regional and country relations of Germany’s exports and imports with newly available data for Jan 2013. German exports to other European Union (EU) members are 58.7 percent of total exports in Jan 2013 and 58.7 percent in cumulative Jan 2013. Exports to the euro area are 38.7 percent in Jan and 38.7 percent cumulative in Jan. Exports to third countries are 41.3 percent of the total in Jan and 41.3 percent cumulative in Jan. There is similar distribution for imports. Exports to non-euro countries are increasing 5.5 percent in Jan 2013 and increasing 5.5 percent cumulative in Jan 2013 while exports to the euro area are increasing 0.4 percent in Jan and increasing 0.4 percent cumulative in Jan 2013. Exports to third countries, accounting for 44.3 percent of the total in Jan 2013, are increasing 4.5 percent in Jan and increasing 4.5 percent cumulative in Jan, accounting for 41.3 percent of the cumulative total in Jan 2013. Price competitiveness through devaluation could improve export performance and growth. Economic performance in Germany is closely related to its high competitiveness in world markets. Weakness in the euro zone and the European Union in general could affect the German economy. This may be the major reason for choosing the “fiscal abuse” of the European Central Bank considered by Buiter (2011Oct31) over the breakdown of the euro zone. There is a tough analytical, empirical and forecasting doubt of growth and trade in the euro zone and the world with or without maintenance of the European Monetary Union (EMU) or euro zone. Germany could benefit from depreciation of the euro because of high share in its exports to countries not in the euro zone but breakdown of the euro zone raises doubts on the region’s economic growth that could affect German exports to other member states.

Table III-9, Germany, Structure of Exports and Imports by Region, € Billions and ∆%

| Jan 2013 | Jan 12-Month | Cumulative Jan 2012 € Billions | Cumulative Jan 2013/ | |

| Total | 88.6 | 3.1 | 88.6 | 3.1 |

| A. EU | 52.0 % 58.7 | 2.1 | 52.0 % 58.7 | 2.1 |

| Euro Area | 34.3 % 38.7 | 0.4 | 34.3 % 38.7 | 0.4 |

| Non-euro Area | 17.7 % 20.0 | 5.5 | 17.7 % 20.0 | 5.5 |

| B. Third Countries | 36.6 % 41.3 | 4.5 | 36.6 % 41.3 | 4.5 |

| Total Imports | 74.9 | 2.9 | 74.9 | 2.9 |

| C. EU Members | 46.9 % 62.6 | 4.6 | 46.9 % 62.6 | 4.6 |

| Euro Area | 32.3 % 43.1 | 2.8 | 32.3 % 43.1 | 2.8 |

| Non-euro Area | 14.6 % 19.5 | 8.7 | 14.6 % 19.5 | 8.7 |

| D. Third Countries | 28.0 % 37.4 | 0.2 | 28.0 % 37.4 | 0.2 |

Notes: Total Exports = A+B; Total Imports = C+D

Source:

Statistisches Bundesamt Deutschland https://www.destatis.de/EN/PressServices/Press/pr/2013/03/PE13_094_51.html

IIIF Appendix on Sovereign Bond Valuation. There are two approaches to government finance and their implications: (1) simple unpleasant monetarist arithmetic; and (2) simple unpleasant fiscal arithmetic. Both approaches illustrate how sovereign debt can be perceived riskier under profligacy.

First, Unpleasant Monetarist Arithmetic. Fiscal policy is described by Sargent and Wallace (1981, 3, equation 1) as a time sequence of D(t), t = 1, 2,…t, …, where D is real government expenditures, excluding interest on government debt, less real tax receipts. D(t) is the real deficit excluding real interest payments measured in real time t goods. Monetary policy is described by a time sequence of H(t), t=1,2,…t, …, with H(t) being the stock of base money at time t. In order to simplify analysis, all government debt is considered as being only for one time period, in the form of a one-period bond B(t), issued at time t-1 and maturing at time t. Denote by R(t-1) the real rate of interest on the one-period bond B(t) between t-1 and t. The measurement of B(t-1) is in terms of t-1 goods and [1+R(t-1)] “is measured in time t goods per unit of time t-1 goods” (Sargent and Wallace 1981, 3). Thus, B(t-1)[1+R(t-1)] brings B(t-1) to maturing time t. B(t) represents borrowing by the government from the private sector from t to t+1 in terms of time t goods. The price level at t is denoted by p(t). The budget constraint of Sargent and Wallace (1981, 3, equation 1) is:

D(t) = {[H(t) – H(t-1)]/p(t)} + {B(t) – B(t-1)[1 + R(t-1)]} (1)

Equation (1) states that the government finances its real deficits into two portions. The first portion, {[H(t) – H(t-1)]/p(t)}, is seigniorage, or “printing money.” The second part,

{B(t) – B(t-1)[1 + R(t-1)]}, is borrowing from the public by issue of interest-bearing securities. Denote population at time t by N(t) and growing by assumption at the constant rate of n, such that:

N(t+1) = (1+n)N(t), n>-1 (2)

The per capita form of the budget constraint is obtained by dividing (1) by N(t) and rearranging:

B(t)/N(t) = {[1+R(t-1)]/(1+n)}x[B(t-1)/N(t-1)]+[D(t)/N(t)] – {[H(t)-H(t-1)]/[N(t)p(t)]} (3)

On the basis of the assumptions of equal constant rate of growth of population and real income, n, constant real rate of return on government securities exceeding growth of economic activity and quantity theory equation of demand for base money, Sargent and Wallace (1981) find that “tighter current monetary policy implies higher future inflation” under fiscal policy dominance of monetary policy. That is, the monetary authority does not permanently influence inflation, lowering inflation now with tighter policy but experiencing higher inflation in the future.

Second, Unpleasant Fiscal Arithmetic. The tool of analysis of Cochrane (2011Jan, 27, equation (16)) is the government debt valuation equation:

(Mt + Bt)/Pt = Et∫(1/Rt, t+τ)st+τdτ (4)