Twenty Nine Million Unemployed or Underemployed, Falling Real Wages, World Financial Turbulence and Global Economic Slowdown

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011

Executive Summary

I Twenty Nine Million Unemployed or Underemployed

II Falling Real Wages

III Labor Productivity, Unit Labor Costs and Real Hourly Compensation

IV World Financial Turbulence

V Global Inflation

VI World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VII Valuation of Risk Financial Assets

VIII Economic Indicators

IX Interest Rates

X Conclusion

References

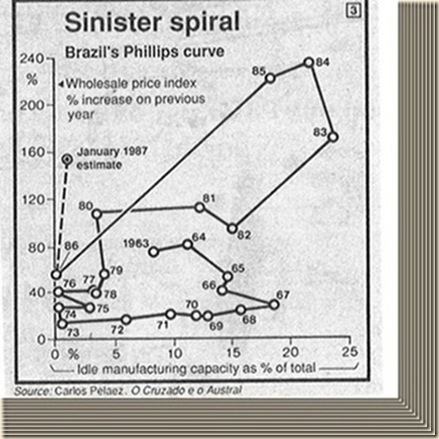

Appendix I The Great Inflation

Executive Summary

The monthly employment situation report of the Bureau of Labor Statistics (BLS) is rich in useful information on the state of the economy. Table ES1 summarizes the report released on Nov 4. Nonfarm payroll jobs in the survey of employing establishments registered an increase in Oct in total nonfarm new jobs of 80,000 and of 104,000 in private jobs. There were significant upward revisions in job creation for Sep and Aug. The earlier report provided joint nonfarm job creation in Sep and Aug of 160,000, which has now been revised to 262,000 or a gain of 102,000. Revised data for Sep and Aug show combined private job creation of 263,000 compared with 179,000 in the earlier report for a revised gain of 84,000 jobs. The establishment survey also provides average hourly earnings and average weekly hours worked. Average hourly earnings (AHE) without adjustment for inflation rose 1.8 percent in Oct 2011 relative to Oct 2010 and 0.2 percent relative to Sep 2011. Table ES1 also provides the BLS calculation of AHEs in constant dollars, or adjusted for inflation, which fell 1.8 percent in Sep 2011 relative to Sep 2010. Inflation is not yet available for Oct. Average weekly hours were 34.3 in both Oct and Sep. The wage bill or number of hours worked times average hourly earnings fell in real terms. The remuneration to labor is falling after adjusting for inflation. The BLS also conducts a survey of households that provides the rate of unemployment, or unemployed as percent of the labor force, which was 9.0 percent in Oct and 9.1 percent in Aug. The rate of job creation would have to exceed around 125,000 per month of new entrants in the labor force to reduce the rate of unemployment. This blog provides with release of every employment situation report an estimate of the number in job stress, which is 28.8 million in Oct and 29.4 million in Aug. The number of people in job stress as percent of the labor force is estimated at 18.1 percent in Oct 2011 and 18.5 percent in Aug 2011. The average rate of 2.5 percent seasonally-adjusted average rate (SAAR) of economic growth in the current recovery is mediocre relative to 6.2 percent average GDP SAARs in past recoveries (http://cmpassocregulationblog.blogspot.com/2011/10/slow-growth-driven-by-reducing-savings.html). As a result there are more than 29 million people unemployed, working part-time for economic reasons because they cannot find full-time employment or marginally attached to the labor force. The rate of economic growth in the first three quarters of 2011 is equivalent to 1.4 percent for a full year. The fractured job market of the US is not improving.

Table ES1, US, Summary of the Employment Situation Report SA

| Oct 2011 | Sep 2011 | |

| New Nonfarm Payroll Jobs | 80,000 | 158,000 |

| New Private Payroll Jobs | 104,000 | 191,000 |

| Average Hourly Earnings | $23.19 ∆% Oct11/Oct 10: 1.8 ∆% Oct 11/Sep 11: 0.2 | $23.14 ∆% Sep11/Sep 10: 1.9 ∆% Sep11/Aug11: 0.3 |

| Average Hourly Earnings in Constant Dollars | NA | $10.20 ∆% Sep 11/Sep 10: –1.8% ∆% Sep 11/Aug 11: 0.0 |

| Average Weekly Hours | 34.3 | 34.3 |

| Unemployment Rate Household Survey % of Labor Force | 9.0 | 9.1 |

| Number in Job Stress Unemployed and Underemployed Blog Calculation | 28.8 million NSA | 29.4 million NSA |

| In Job Stress as % Labor Force | 18.1 | 18.5 |

Source: Tables 2, 3, 4, 8 and 10.

The civilian labor force participation rate, or labor force as percent of population, is provided in Chart ES1 for the period from 1948 to 2011. The labor force participation rate is influenced by numerous factors such as the age of the population. There is no comparable episode in the postwar economy to the sharp collapse of the labor force participation rate in Chart ES1 during the contraction and subsequent expansion after 2007. Aging can reduce the labor force participation rate as many people retire but many may have decided to work longer as their wealth and savings have been significantly reduced. There is an important effect of many people just exiting the labor force because they belief there is no job available for them.

Chart ES1, US, Civilian Labor Force Participation Rate, 1948-2011, %

Source: US Bureau of Labor Statistics

The number of unemployed in the US jumped from 5.8 million in May 1979 to 12.1 million in Dec 1982, by 6.3 million, or 108.6 percent. The number of unemployed jumped from 6.7 million in Mar 2007 to 15.6 million in Oct 2009, by 8.9 million, or 132.8 percent. These are the two episodes with steepest increase in the level of unemployment in Chart ES2.

Chart ES2, US, Unemployed, 1948-2011, Thousands

Source: US Bureau of Labor Statistics

Chart ES3 provides the rate of unemployment of the US from 1948 to 2011. The peak of the series is 10.8 percent in both Nov and Dec 1982. The second highest rates are 10.1 percent in Oct 2009 and 9.9 percent in both Nov and Dec 2009.

Chart ES3, US, Unemployment Rate, 1948-2011

Source: US Bureau of Labor Statistics

The number unemployed for 27 weeks and over jumped from 510,000 in Dec 1978 to 2.9 million in Jun 1983, by 2.4 million, or 480 percent. The number of unemployed 27 weeks or over jumped from 1.1 million in May 2007 to 6.7 million in Jun 2010, by 5.6 million, or 509 percent. These are the two peaks in Chart ES4.

Chart ES4, US, Unemployed for 27 Weeks or More, 1948-2011, Thousands

Source: US Bureau of Labor Statistics

The employment-population ratio in Chart ES5 is an important indicator of wellbeing in labor markets, measuring the number of people with jobs. The US employment-population ratio fell from 63.4 in Dec 2006 to 58.1 in Jul 2011. There is no comparable decline during an expansion in Chart ES5.

Chart ES5, US, Employment-Population Ratio, 1948-2011

Source: US Bureau of Labor Statistics

The number of people at work part-time for economic reasons because they cannot find full-time employment is provided in Chart ES6. The number of people at work part-time for economic reasons jumped from 4.1 million in Sep 2006 to a high of 9.5 million in Sep 2010 and 9.3 million in Sep 2011, or by 5.2 million, or 127 percent. Earlier increases in the 1980s and after the tough recession of 1991 were followed by rapid decrease that is still absent in the current expansion.

Chart ES6, US, Part-Time for Economic Reasons, 1948-2011, Thousands

Source: US Bureau of Labor Statistics

There is a socio-economic disaster in the US. The economy did not grow in the early phase of expansion after the contraction at the high average rate of 6.2 percent of past contractions but rather at only 2.5 percent on average in the nine consecutive quarters of growth beginning in IIIQ2009. As a result, unemployment and underemployment have remained at extremely high levels with some 29 million people in job stress. The fractured labor market has also resulted in fewer opportunities to escape declining earnings after inflation and taxes.

I Twenty Nine Million Unemployed or Underemployed. The Bureau of Labor Statistics (BLS) of the Department of Labor released two critically important reports on US labor markets: the employment situation report (http://www.bls.gov/news.release/empsit.toc.htm) and the report on labor productivity and costs (http://www.bls.gov/lpc/). Section I Twenty Nine Million Unemployed or Underemployed analyzes employment and unemployment in the household and establishment surveys. Section II Falling Real Wages provides data and analysis on hours worked and earnings from the establishment survey. The quarterly report on labor productivity and costs is analyzed in Section III Labor Productivity, Unit Labor Costs and Real Hourly Compensation.

The monthly employment situation report of the BLS is rich in useful information on the state of the economy. Table 1 summarizes the report released on Nov 4. Nonfarm payroll jobs in the survey of employing establishments registered an increase in Oct in total nonfarm new jobs of 80,000 and of 104,000 in private jobs. There were significant upward revisions in job creation for Sep and Aug. The earlier report provided joint nonfarm job creation in Sep and Aug of 160,000, which has now been revised to 262,000 or a gain of 102,000. Revised data for Sep and Aug show combined private job creation of 263,000 compared with 179,000 in the earlier report for a revised gain of 84,000 jobs. The establishment survey also provides average hourly earnings and average weekly hours worked. Average hourly earnings (AHE) without adjustment for inflation rose 1.8 percent in Oct 2011 relative to Oct 2010 and 0.2 percent relative to Sep 2011. Table 1 also provides the BLS calculation of AHEs in constant dollars, or adjusted for inflation, which fell 1.8 percent in Sep 2011 relative to Sep 2010. Inflation is not yet available for Oct. Average weekly hours were 34.3 in both Oct and Sep. The wage bill or number of hours worked times average hourly earnings fell in real terms. The remuneration to labor is falling after adjusting for inflation. The BLS also conducts a survey of households that provides the rate of unemployment, or unemployed as percent of the labor force, which was 9.0 percent in Oct and 9.1 percent in Aug. The rate of job creation would have to exceed around 125,000 per month of new entrants in the labor force to reduce the rate of unemployment. This blog provides with release of every employment situation report an estimate of the number in job stress, which is 28.8 million in Oct and 29.4 million in Aug. The number of people in job stress as percent of the labor force is estimated at 18.1 percent in Oct 2011 and 18.5 percent in Aug 2011. The average rate of 2.5 percent seasonally-adjusted average rate (SAAR) of economic growth in the current recovery is mediocre relative to 6.2 percent average GDP SAARs in past recoveries (http://cmpassocregulationblog.blogspot.com/2011/10/slow-growth-driven-by-reducing-savings.html). As a result there are more than 29 million people unemployed, working part-time for economic reasons because they cannot find full-time employment or marginally attached to the labor force. The rate of economic growth in the first three quarters of 2011 is equivalent to 1.4 percent for a full year. The fractured job market of the US is not improving.

Table 1, US, Summary of the Employment Situation Report SA

| Oct 2011 | Sep 2011 | |

| New Nonfarm Payroll Jobs | 80,000 | 158,000 |

| New Private Payroll Jobs | 104,000 | 191,000 |

| Average Hourly Earnings | $23.19 ∆% Oct11/Oct 10: 1.8 ∆% Oct 11/Sep 11: 0.2 | $23.14 ∆% Sep11/Sep 10: 1.9 ∆% Sep11/Aug11: 0.3 |

| Average Hourly Earnings in Constant Dollars | NA | $10.20 ∆% Sep 11/Sep 10: –1.8% ∆% Sep 11/Aug 11: 0.0 |

| Average Weekly Hours | 34.3 | 34.3 |

| Unemployment Rate Household Survey % of Labor Force | 9.0 | 9.1 |

| Number in Job Stress Unemployed and Underemployed Blog Calculation | 28.8 million NSA | 29.4 million NSA |

| In Job Stress as % Labor Force | 18.1 | 18.5 |

Source: Tables 2, 3, 4, 8 and 10.

The BLS released the employment situation report on Fri Nov 4 showing reduction of the seasonally adjusted rate of unemployment, or unemployed as percent of the labor force, to 9.0 percent in Oct 2011, which is lower than 9.1 percent in Sep (http://www.bls.gov/news.release/pdf/empsit.pdf). There are two approaches to calculating the number of people in job stress. The first approach of calculating the number of people in job stress unemployed or underemployed in Table 2 is 25.3 million seasonally-adjusted in Oct, compared with 25.8 million in Sep and 25.4 million in Aug. The number in job stress unemployed or underemployed of 25.3 million in Oct is composed of 13.9 million unemployed (of whom 5.9 million, or 42.2 percent, unemployed for 27 weeks or more) compared with 13.9 million unemployed in Sep (of whom 6.2 million, or 44.6 percent, unemployed for 27 weeks or more), 8.9 million employed part-time for economic reasons in Oct (who suffered reductions in their work hours or could not find full-time employment) compared with 9.2 million in Aug and 2.6 million who were marginally attached to the labor force in Sep (who were not in the labor force but wanted and were available for work) compared with 2.5 million in Aug.

Table 2, US, People in Job Stress, Millions and % SA

| Oct | Sep | Aug | |

| Unemployed | 13.897 | 13.992 | 13.967 |

| Unemployed ≥27 weeks | 5.876 | 6.242 | 6.034 |

| Unemployed ≥27 weeks % | 42.2 | 44.6 | 43.2 |

| Part Time Economic Reasons ∆% Sep/Aug: +440 thousand | 8.896 | 9.270 | 8.826 |

| Marginally ∆% Sep/Aug: -64 thousand | 2.555 | 2.511 | 2.575 |

| Job Stress ∆% Sep/Aug: +405 thousand | 25.348 | 25.773 | 25.368 |

| Unemploy- | 9.0 | 9.1 | 9.1 |

Job Stress = Unemployed + Part Time Economic Reasons + Marginally Attached Labor Force

Source: http://www.bls.gov/news.release/pdf/empsit.pdf

Additional information provides deeper insight on the fractured job market of the US. Table 3 consists of data and additional calculations using the BLS household survey, illustrating the possibility that the actual rate of unemployment could be 11.6 percent and the number of people in job stress could be 29 to 30 million, which is 18.1 to 18.6 percent of the labor force. The first column provides for 2006 the yearly average population (POP), labor force (LF), participation rate or labor force as percent of population (PART %), employment (EMP), employment population ratio (EMP/POP %), unemployment (UEM), the unemployment rate as percent of labor force (UEM/LF Rate %) and the number of people not in the labor force (NLF). The numbers in column 2006 are averages in millions while the monthly numbers for Oct 2010 and Oct and Sep 2011 are in thousands, not seasonally adjusted. The average yearly participation rate of the population in the labor force was in the range of 62.0 percent minimum to 67.1 percent maximum between 2000 and 2006 with the average of 66.4 percent (ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf). The objective of Table 3 is to assess how many people could have left the labor force because they do not think they can find another job. Row “LF PART 66.2 %” applies the participation rate of 2006, almost equal to the rates for 2000 to 2006, to the population in Oct 2010 and Oct and Sep 2011 to obtain what would be the labor force of the US if the participation rate had not changed. In fact, the participation rate fell to 64.4 percent by Oct 2010 and was 64.2 percent in Sep 2011 and 64.1 percent in Oct 2011, suggesting that many people simply gave up on finding another job. Row “∆ NLF UEM” calculates the number of people not counted in the labor force because they could have given up on finding another job by subtracting from the labor force with participation rate of 66.2 percent (row “LF PART 66.2%”) the labor force estimated in the household survey (row “LF”). Total unemployed (row “Total UEM”) is obtained by adding unemployed in row “∆NLF UEM” to the unemployed of the household survey in row “UEM.” The row “Total UEM%” is the effective total unemployed “Total UEM” as percent of the effective labor force in row “LF PART 66.2%.” The results are that: (1) there are an estimated 4.970 million unemployed who are not counted because they left the labor force on their belief they could not find another job (∆NLF UEM); (2) the total number of unemployed is effectively 18.072 million (Total UEM) and not 13.102 million (UEM) of whom many have been unemployed long term; (3) the rate of unemployment is 11.6 percent (Total UEM%) and not 8.5 percent, not seasonally adjusted, or 9.0 percent seasonally adjusted; and (4) the number of people in job stress is close to 30 million by adding the 4.905 million leaving the labor force because they believe they could not find another job. The row “In Job Stress” in Table 3 provides the number of people in job stress not seasonally adjusted at 28.778 million in Sep 2011, adding the total number of unemployed (“Total UEM”), plus those involuntarily in part-time jobs because they cannot find anything else (“Part Time Economic Reasons”) and the marginally attached to the labor force (“Marginally attached to LF”). The final row of Table 3 shows that the number of people in job stress is equivalent to 18.1 percent of the labor force. The employment population ratio “EMP/POP %” dropped from 62.9 percent on average in 2006 to 58.6 percent in Oct 2010, 58.5 percent in Sep 2011 and 58.7 percent in Oct 2011 and the number employed (EMP) dropped from 144 million to 141 million. What really matters for labor input in production and wellbeing is the number of people with jobs or the employment/population ratio, which has declined and does not show signs of increasing. There are almost four million fewer people working in 2011 than in 2006 and the number employed is not increasing. The number of hiring relative to the number unemployed measures the chances of becoming employed. The number of hiring in the US economy has declined by 17 million and does not show signs of increasing (http://cmpassocregulationblog.blogspot.com/2011/10/odds-of-slowdown-or-recession-united.html http://cmpassocregulationblog.blogspot.com/2011/09/financial-turbulence-wriston-doctrine.html http://cmpassocregulationblog.blogspot.com/2011/03/slow-growth-inflation-unemployment-and.html see section IV Hiring Collapse in http://cmpassocregulationblog.blogspot.com/2011/08/world-financial-turbulence-global.html http://cmpassocregulationblog.blogspot.com/2011/06/increasing-risk-aversion-analysis-of.html).

Table 3, US, Population, Labor Force and Unemployment, NSA

| 2006 | Oct 2010 | Sep 2011 | Oct 2011 | |

| POP | 229 | 238,530 | 240,071 | 240,269 |

| LF | 151 | 153,652 | 154,022 | 154,088 |

| PART% | 66.2 | 64.4 | 64.2 | 64.1 |

| EMP | 144 | 139,749 | 140,502 | 140,987 |

| EMP/POP% | 62.9 | 58.6 | 58.5 | 58.7 |

| UEM | 7 | 13,903 | 13,520 | 13,102 |

| UEM/LF Rate% | 4.6 | 9.0 | 8.8 | 8.5 |

| NLF | 77 | 84,878 | 86,049 | 86,181 |

| LF PART 66.2% | 157,907 | 158,927 | 159,058 | |

| ∆NLF UEM | 4,255 | 4,905 | 4,970 | |

| Total UEM | 18,158 | 18,425 | 18,072 | |

| Total UEM% | 11.4 | 11.6 | 11.6 | |

| Part Time Economic Reasons | 8,279 | 8,423 | 8,151 | |

| Marginally Attached to LF | 2,602 | 2,511 | 2,555 | |

| In Job Stress | 29,039 | 29,359 | 28,778 | |

| People in Job Stress as % Labor Force | 18.4 | 18.5 | 18.1 |

Pop: population; LF: labor force; PART: participation; EMP: employed; UEM: unemployed; NLF: not in labor force; ∆NLF UEM: additional unemployed; Total UEM is UEM + ∆NLF UEM; Total UEM% is Total UEM as percent of LF PART 66.2%; In Job Stress = Total UEM + Part Time Economic Reasons + Marginally Attached to LF

Note: the first column for 2006 is in average millions; the remaining columns are in thousands; NSA: not seasonally adjusted

The labor force participation rate of 66.2% in 2006 is applied to current population to obtain LF PART 66.2%; ∆NLF UEM is obtained by subtracting the labor force with participation of 66.2 percent from the household survey labor force LF; Total UEM is household data unemployment plus ∆NLF UEM; and total UEM% is total UEM divided by LF PART 66.2%

Sources:

ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf

http://www.bls.gov/news.release/pdf/empsit.pdf

Growth and employment creation have been mediocre in the expansion beginning in Jul IIIQ2009 from the contraction between Dec IVQ2007 and Jun IIQ2009 (http://www.nber.org/cycles.html). A series of charts from the database of the Bureau of Labor Statistics (BLS) provides significant insight. Chart 1 provides the monthly employment level of the US from 1948 to 2011. The number of people employed has trebled. There are multiple contractions throughout the more than six decades but followed by resumption of the strong upward trend. The contraction after 2007 is deeper and followed by a flatter curve of job creation. Much lower average economic growth in the current expansion of 2.5 percent relative to average 6.2 percent in earlier contractions (http://cmpassocregulationblog.blogspot.com/2011/10/slow-growth-driven-by-reducing-savings.html) explains the fractured labor market.

Chart 1, US, Employment Level, Thousands, 1948-2011

Source: US Bureau of Labor Statistics

The steep and consistent curve of growth of the US labor force is shown in Chart 2. The contraction beginning in Dec 2007 flattened the path of the US civilian labor force and is now followed by a flatter curve during the expansion.

Chart 2, US, Civilian Labor Force, 1948-2011, Thousands

Source: US Bureau of Labor Statistics

The civilian labor force participation rate, or labor force as percent of population, is provided in Chart 3 for the period from 1948 to 2011. The labor force participation rate is influenced by numerous factors such as the age of the population. There is no comparable episode in the postwar economy to the sharp collapse of the labor force participation rate in Chart 3 during the contraction and subsequent expansion after 2007. Aging can reduce the labor force participation rate as many people retire but many may have decided to work longer as their wealth and savings have been significantly reduced. There is an important effect of many people just exiting the labor force because they belief there is no job available for them.

Chart 3, US, Civilian Labor Force Participation Rate, 1948-2011, %

Source: US Bureau of Labor Statistics

The number of unemployed in the US jumped from 5.8 million in May 1979 to 12.1 million in Dec 1982, by 6.3 million, or 108.6 percent. The number of unemployed jumped from 6.7 million in Mar 2007 to 15.6 million in Oct 2009, by 8.9 million, or 132.8 percent. These are the two episodes with steepest increase in the level of unemployment in Chart 4.

Chart 4, US, Unemployed, 1948-2011, Thousands

Source: US Bureau of Labor Statistics

Chart 5 provides the rate of unemployment of the US from 1948 to 2011. The peak of the series is 10.8 percent in both Nov and Dec 1982. The second highest rates are 10.1 percent in Oct 2009 and 9.9 percent in both Nov and Dec 2009.

Chart 5, US, Unemployment Rate, 1948-2011

Source: US Bureau of Labor Statistics

The number unemployed for 27 weeks and over jumped from 510,000 in Dec 1978 to 2.9 million in Jun 1983, by 2.4 million, or 480 percent. The number of unemployed 27 weeks or over jumped from 1.1 million in May 2007 to 6.7 million in Jun 2010, by 5.6 million, or 509 percent. These are the two peaks in Chart 6.

Chart 6, US, Unemployed for 27 Weeks or More, 1948-2011, Thousands

Source: US Bureau of Labor Statistics

The employment-population ratio in Chart 7 is an important indicator of wellbeing in labor markets, measuring the number of people with jobs. The US employment-population ratio fell from 63.4 in Dec 2006 to 58.1 in Jul 2011. There is no comparable decline during an expansion in Chart 7.

Chart 7, US, Employment-Population Ratio, 1948-2011

Source: US Bureau of Labor Statistics

The number of people at work part-time for economic reasons because they cannot find full-time employment is provided in Chart 8. The number of people at work part-time for economic reasons jumped from 4.1 million in Sep 2006 to a high of 9.5 million in Sep 2010 and 9.3 million in Sep 2011, or by 5.2 million, or 127 percent. Earlier increases in the 1980s and after the tough recession of 1991 were followed by rapid decrease that is still absent in the current expansion.

Chart 8, US, Part-Time for Economic Reasons, 1948-2011, Thousands

Source: US Bureau of Labor Statistics

These eight charts confirm the view that the comparison of the current expansion should be with that in the 1980s because of similar dimensions. Chart 9 provides the level of employment in the US between 1979 and 1989. Employment surged after the contraction and grew rapidly during the decade.

Chart 9, US, Employed, Thousands, 1979-1989

Source: US Bureau of Labor Statistics

The number employed in the US fell from 146.584 million in Nov 2007 to 140.302 million in Oct 2011, by 6.282 million, or 4.3 percent. Chart 10 shows tepid recovery early in 2010 followed by near stagnation.

Chart 10, US, Employed, Thousands, 2001-2011

Source: US Bureau of Labor Statistics

There was a steady upward trend in growth of the civilian labor force between 1979 and 1989 as shown in Chart 11. There were fluctuations but strong long-term dynamism over an entire decade.

Chart 11, US, Civilian Labor Force, Thousands, 1979-1989

Source: US Bureau of Labor Statistics

The civilian labor force in Chart 12 grew steadily on an upward trend in the 2000s until it contracted together with the economy after 2007. There has not been recovery during the expansion but rather decline.

Chart 12, US, Civilian Labor Force, Thousands, 2001-2011

Source: US Bureau of Labor Statistics

The rate of participation of the labor force in population stagnated during the stagflation and conquest of inflation in the late 1970s and early 1980s, as shown in Chart 13. Recovery was vigorous during the expansion and lasted through the remainder of the decade.

Chart 13, US, Civilian Labor Force Participation Rate, 1979-1989, %

Source: US Bureau of Labor Statistics

The rate of participation in the labor force declined after the recession of 2001 and stagnated until 2007, as shown in Chart 14. The rate of participation in the labor force continued to decline both during the contraction after 2007 and the expansion after 2009.

Chart 14, US, Civilian Labor Force Participation Rate, 2001-2011, %

Source: US Bureau of Labor Statistics

The rate of unemployment peaked at 10.8 percent in Nov-Dec 1983, as shown in Chart 15. The rate of unemployment dropped sharply during the expansion after 1984 and continued to decline during the rest of the decade.

Chart 15, US, Unemployment Rate, 1979-1989, %

Source: US Bureau of Labor Statistics

The rate of unemployment in the US jumped from 4.4 percent in May 2007 to 10.1 percent in Oct 2009 and 9.9 percent in both Nov and Dec 2009, as shown in Chart 16. The rate of unemployment has fluctuated at around 9.0 percent in 2011.

Chart 16, US, Unemployment Rate, 2001-2011, %

Source: US Bureau of Labor Statistics

The employment population ratio fell from around 60 in 1979 to around 57 in 1983, as shown in Chart 17. The employment population ratio rose back to 60 in 1984 and reached 63 later in the decade.

Chart 17, US, Employment Population Ratio, 1979-1989, %

Source: US Bureau of Labor Statistics

The US employment-population ratio has fallen from 62.6 in 2006 to 58.1 in Oct 2011, as shown in Chart 18. The employment population-ratio has stagnated during the expansion.

Chart 18, US, Employment Population Ratio, 2001-2011, %

Source: US Bureau of Labor Statistics

The number unemployed for 27 weeks or over peaked in 1984 as shown in Chart 19. The number unemployed for 27 weeks or over fell sharply during the expansion and continued to decline throughout the 1980s.

Chart 19, US, Number Unemployed for 27 Weeks or More 1979-1989, Thousands

Source: US Bureau of Labor Statistics

The number unemployed for 27 weeks or over rose sharply during the contraction as shown in Chart 20. The number of unemployed for 27 weeks remained at around 6 million during the expansion compared with somewhat above 1 million before the contraction.

Chart 20, US, Number Unemployed for 27 Weeks or More, 2001-2011, Thousands

Source: US Bureau of Labor Statistics

The number of persons working part-time for economic reasons because they cannot find full-time work peaked during the contraction in 1983, as shown in Chart 21. The number of persons at work part-time for economic reasons fell sharply during the expansion and continued to fall throughout the decade.

Chart 21, US, Part-Time for Economic Reasons, 1979-1989, Thousands

Source: US Bureau of Labor Statistics

The number of people working part-time because they cannot find full-time employment rose sharply during the contraction as shown in Chart 22. The number of people working part-time because of failure to find an alternative occupation stagnated at a very high level during the expansion.

Chart 22, US, Part-Time for Economic Reasons, 2001-2011, Thousands

Source: US Bureau of Labor Statistics

Total nonfarm payroll employment seasonally adjusted (SA) rose 80,000 in Oct and private payroll employment rose by 104,000. Table 4 provides the monthly change in jobs seasonally adjusted in the prior strong contraction of 1981-1982 and the recovery in 1983 into 1984 and in the contraction of 2008-2009 and in the recovery in 2009 to 2011. All revisions have been incorporated in Table 4. The data in the recovery periods are in relief to facilitate comparison. There is significant bias in the comparison. The average yearly civilian noninstitutional population was 174.2 million in 1983 and the civilian labor force 111.6 million, growing by 2009 to an average yearly civilian noninstitutional population of 235.8 million and civilian labor force of 154.1 million, that is, increasing by 35.4 percent and 38.1 percent, respectively (http://www.bls.gov/cps/cpsaat1.pdf). Total nonfarm payroll jobs in 1983 were 90.280 million, jumping to 94.530 million in 1984 while total nonfarm jobs in 2010 were 129.818 million declining from 130.807 million in 2009 (http://www.bls.gov/webapps/legacy/cesbtab1.htm ). What is striking about the data in Table 4 is that the numbers of monthly increases in jobs in 1983 and 1984 are several times higher than in 2010 to 2011 even with population higher by 35.4 percent and labor force higher by 38.1 percent in 2009 relative to 1983 nearly three decades ago and total number of jobs in payrolls rose by 39.5 million in 2010 relative to 1983 or by 43.8 percent.. Growth has been mediocre in the nine quarters of expansion beginning in IIIQ2009 in comparison with earlier expansions (http://cmpassocregulationblog.blogspot.com/2011/10/slow-growth-driven-by-reducing-savings.html http://cmpassocregulationblog.blogspot.com/2011/10/us-growth-standstill-at-08-percent.html http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html http://cmpassocregulationblog.blogspot.com/2011/07/growth-recession-debt-financial-risk.html http://cmpassocregulationblog.blogspot.com/2011/07/causes-of-2007-creditdollar-crisis.html http://cmpassocregulationblog.blogspot.com/2011/06/financial-risk-aversion-slow-growth.html http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html http://cmpassocregulationblog.blogspot.com/2011/05/mediocre-growth-world-inflation.html http://cmpassocregulationblog.blogspot.com/2011/03/slow-growth-inflation-unemployment-and.html http://cmpassocregulationblog.blogspot.com/2011/02/mediocre-growth-raw-materials-shock-and.html) and also in terms of what is required to reduce the job stress of at least 25 million persons but likely close to 30 million. Some of the job growth and contraction in 2010 in Table 4 is caused by the hiring and subsequent layoff of temporary workers for the 2010 census.

Table 4, US, Monthly Change in Jobs, Number SA

| Month | 1981 | 1982 | 1983 | 2008 | 2009 | 2010 | Private |

| Jan | 95 | -327 | 225 | 13 | -820 | -39 | -42 |

| Feb | 67 | -6 | -78 | -83 | -726 | -35 | -21 |

| Mar | 104 | -129 | 173 | -72 | -796 | 192 | 144 |

| Apr | 74 | -281 | 276 | -185 | -660 | 277 | 229 |

| May | 10 | -45 | 277 | -233 | -386 | 458 | 48 |

| Jun | 196 | -243 | 378 | -178 | -502 | -192 | 65 |

| Jul | 112 | -343 | 418 | -231 | -300 | -49 | 93 |

| Aug | -36 | -158 | -308 | -267 | -231 | -59 | 110 |

| Sep | -87 | -181 | 1114 | -434 | -236 | -29 | 109 |

| Oct | -100 | -277 | 271 | -509 | -221 | 171 | 143 |

| Nov | -209 | 124 | 352 | -802 | -55 | 93 | 128 |

| Dec | -278 | -14 | 356 | -619 | -130 | 152 | 167 |

| 1984 | 2011 | Private | |||||

| Jan | 447 | 68 | 94 | ||||

| Feb | 479 | 235 | 261 | ||||

| Mar | 275 | 194 | 219 | ||||

| Apr | 363 | 217 | 241 | ||||

| May | 308 | 53 | 99 | ||||

| Jun | 379 | 20 | 75 | ||||

| Jul | 312 | 127 | 173 | ||||

| Aug | 241 | 104 | 72 | ||||

| Sep | 311 | 158 | 191 | ||||

| Oct | 286 | 80 | 104 | ||||

| Nov | 349 | ||||||

| Dec | 127 |

Source: http://data.bls.gov/PDQ/servlet/SurveyOutputServlet

http://www.bls.gov/webapps/legacy/cesbtab1.htm

http://www.bls.gov/schedule/archives/empsit_nr.htm#2010

http://www.bls.gov/news.release/pdf/empsit.pdf

Charts numbered from 23 to 26 provide a comparison of payroll survey data for the contractions and expansions in the 1980s and after 2007. Chart 23 provides total nonfarm payroll jobs from 2001 to 2011. The sharp decline in total nonfarm jobs during the contraction after 2007 has been followed by initial stagnation and then tepid growth.

Chart 23, US, Total Nonfarm Payroll Jobs SA 2001-2011

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Total nonfarm payroll jobs grew rapidly during the expansion in 1983 and 1984 as shown in Chart 24. Nonfarm payroll jobs continued to grow at high rates during the remainder of the 1980s.

Chart 24, US, Total Nonfarm Payroll Jobs SA 1979-1989

Source: US Bureau of Labor Statistics

Most job creation in the US is by the private sector. Chart 25 shows the sharp destruction of jobs during the contraction after 2007. There has been growth after 2010 but insufficient to recover higher levels of employment prevailing before the contraction. At current rate, recovery of employment may spread over several years in contrast with past expansions of the business cycle in the US.

Chart 25, US, Total Private Payroll Jobs SA 2001-2011

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

In contrast, growth of private payroll jobs in the US recovered vigorously during the expansion in 1983 through 1985, as shown in Chart 26. Rapid growth of creation of private jobs continued throughout the 1980s.

Chart 26, US, Total Private Payroll Jobs SA 1979-1989

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Important aspects of growth of payroll jobs from Oct 2010 to Oct 2011, not seasonally adjusted (NSA), are provided in Table 5. Total nonfarm employment increased by 1,501,000 (row A), consisting of growth of total private employment by 1,801,000 (row B) and decline by 300,000 of government employment (row C). Monthly average growth of private payroll employment has been 150,083, which is mediocre relative to 25 to 30 million in job stress, while total nonfarm employment has grown on average by only 125,083 per month. These monthly rates of job creation are insufficient to meet the demands of new entrants in the labor force and thus perpetuate unemployment and underemployment. Manufacturing employment increased by 208,000 while private service providing employment grew by 1,456,000. The employment situation report of the Bureau of Labor Statistics informs that (http://www.bls.gov/news.release/pdf/empsit.pdf 2): “Employment in professional and business services continued to trend up in October (+32,000) and has grown by 562,000 over the past 12 months. Within the industry, there have been modest job gains in recent months in temporary help services and in management and technical consulting services.” An important feature in Table 5 is that jobs in temporary help services increased by 195,000. This episode of jobless recovery is characterized by part-time jobs and creation of jobs that are inferior to those that have been lost. Monetary and fiscal stimuli fail to increase consumption in a fractured job market. An important characteristic is that the losses of government jobs have been high in local government, 176,000 jobs lost in that past twelve months (row C3 Local), because of the higher number of employees in local government, 14.3 million relative to 5.2 million in state jobs and 2.8 million in federal jobs.

Table 5, US, Employees in Nonfarm Payrolls Not Seasonally Adjusted in Thousands

| Oct 2010 | Oct 2011 | Change | |

| A Total Nonfarm | 131,071 | 132,572 | 1,501 |

| B Total Private | 108,429 | 110,230 | 1,801 |

| B1 Goods Producing | 18,103 | 18,408 | 305 |

| B1a Manu-facturing | 11,612 | 11,820 | 208 |

| B2 Private service providing | 90,326 | 91,822 | 1,496 |

| B2a Professional and Business Services | 16,950 | 17,490 | 540 |

| B2b Temporary help services | 2,912 | 3,107 | 195 |

| C Government | 22,642 | 22,342 | -300 |

| C1 Federal | 2,850 | 2,813 | -37 |

| C2 State | 5,297 | 5,210 | -87 |

| C3 Local | 14,495 | 14,319 | -176 |

Note: A = B+C, B = B1 + B2, C=C1 + C2 + C3

Source:

http://www.bls.gov/news.release/pdf/empsit.pdf

The NBER dates recessions in the US from peaks to troughs as: IQ80 to IIIQ80, IIIQ81 to IV82 and IVQ07 to IIQ09 (http://www.nber.org/cycles/cyclesmain.html). Table 6 provides total annual level nonfarm employment in the US for the 1980s and the 2000s, which is different from 12 months comparisons. Nonfarm jobs rose by 4.853 million in 1982 to 1984, or 5.4 percent, and continued rapid growth in the rest of the decade. In contrast, nonfarm jobs are down by 7.780 million in 2010 relative to 2007 and fell by 989,000 in 2010 relative to 2009 even after six quarters of GDP growth. Monetary and fiscal stimuli have failed in increasing growth to rates required for mitigating job stress. The initial growth impulse reflects a flatter growth curve in the current expansion.

Table 6, US, Total Nonfarm Employment in Thousands

| Year | Total Nonfarm | Year | Total Nonfarm |

| 1980 | 90,528 | 2000 | 131,785 |

| 1981 | 91,289 | 2001 | 131,826 |

| 1982 | 89,677 | 2002 | 130,341 |

| 1983 | 90,280 | 2003 | 129,999 |

| 1984 | 94,530 | 2004 | 131,435 |

| 1985 | 97,511 | 2005 | 133,703 |

| 1986 | 99,474 | 2006 | 136,086 |

| 1987 | 102,088 | 2007 | 137,598 |

| 1988 | 105,345 | 2008 | 136,790 |

| 1989 | 108,014 | 2009 | 130,807 |

| 1990 | 109,487 | 2010 | 129,818 |

Source: http://www.bls.gov/webapps/legacy/cesbtab1.htm

The highest average yearly percentage of unemployed to the labor force since 1940 was 14.6 percent in 1940 followed by 9.9 percent in 1941, 8.5 percent in 1975, 9.7 percent in 1982 and 9.6 percent in 1983 (ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf). The rate of unemployment remained at high levels in the 1930s, rising from 3.2 percent in 1929 to 22.9 percent in 1932 in one estimate and 23.6 percent in another with real wages increasing by 16.4 percent (Margo 1993, 43; see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 214-5). There are alternative estimates of 17.2 percent or 9.5 percent for 1940 with real wages increasing by 44 percent. Employment declined sharply during the 1930s. The number of hours worked remained in 1939 at 29 percent below the level of 1929 (Cole and Ohanian 1999). Private hours worked fell in 1939 to 25 percent of the level in 1929. The policy of encouraging collusion through the National Industrial Recovery Act (NIRA), to maintain high prices, together with the National Labor Relations Act (NLRA), to maintain high wages, prevented the US economy from recovering employment levels until Roosevelt abandoned these policies toward the end of the 1930s (for review of the literature analyzing the Great Depression see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 198-217).

The Bureau of Labor Statistics (BLS) makes yearly revisions of its establishment survey (Harris 2011BA):

“With the release of data for January 2011, the Bureau of Labor Statistics (BLS) introduced its annual revision of national estimates of employment, hours, and earnings from the Current Employment Statistics (CES) monthly survey of nonfarm establishments. Each year, the CES survey realigns its sample-based estimates to incorporate universe counts of employment—a process known as benchmarking. Comprehensive counts of employment, or benchmarks, are derived primarily from unemployment insurance (UI) tax reports that nearly all employers are required to file with State Workforce Agencies.”

The number of not seasonally adjusted total private jobs in the US in Dec 2010 is 108.464 million, declining to 106.079 million in Jan 2011, or by 2.385 million, because of the adjustment of a different benchmark and not actual job losses. The not seasonally adjusted number of total private jobs in Dec 1984 is 80.250 million, declining to 78.704 million in Jan 1985, or by 1.546 million for the similar adjustment. Table 7 attempts to measure job losses and gains in the recessions and expansions of 1981-1985 and 2007-2011. The final ten rows provide job creation from May 1983 to May 1984 and from May 2010 to May 2011, that is, at equivalent stages of the recovery from two comparable strong recessions. The row “Change ∆%” for May 1983 to May 1984 shows an increase of total nonfarm jobs by 4.9 percent and of 5.9 percent for total private jobs. The row “Change ∆%” for May 2010 to May 2011 shows an increase of total nonfarm jobs by 0.7 percent and of 1.7 percent for total private jobs. The last two rows of Table 11 provide a calculation of the number of jobs that would have been created from May 2010 to May 2011 if the rate of job creation had been the same as from May 1983 to May 1984. If total nonfarm jobs had grown between May 2010 and May 2011 by 4.9 percent, as between May 1983 and May 1984, 6.409 million jobs would have been created in the past 12 months for a difference of 5.457 million more total nonfarm jobs relative to 0.952 million jobs actually created. If total private jobs had grown between May 2010 and May 2011 by 5.9 percent as between May 1983 and May 1984, 6.337 million private jobs would have been created for a difference of 4.539 million more total private jobs relative to 1.798 million jobs actually created.

Table 7, US, Total Nonfarm and Total Private Jobs Destroyed and Subsequently Created in Two Recessions IIIQ1981-IVQ1982 and IVQ2007-IIQ2009, Thousands and Percent

| Total Nonfarm Jobs | Total Private Jobs | |

| 06/1981 # | 92,288 | 75,969 |

| 11/1982 # | 89,482 | 73,260 |

| Change # | -2,806 | -2,709 |

| Change ∆% | -3.0 | -3.6 |

| 12/1982 # | 89,383 | 73,185 |

| 05/1984 # | 94,471 | 78,049 |

| Change # | 5,088 | 4,864 |

| Change ∆% | 5.7 | 6.6 |

| 11/2007 # | 139,090 | 116,291 |

| 05/2009 # | 131,626 | 108,601 |

| Change % | -7,464 | -7,690 |

| Change ∆% | -5.4 | -6.6 |

| 12/2009 # | 130,178 | 107,338 |

| 05/2011 # | 131,753 | 108,494 |

| Change # | 1,575 | 1,156 |

| Change ∆% | 1.2 | 1.1 |

| 05/1983 # | 90,005 | 73,667 |

| 05/1984 # | 94,471 | 78,049 |

| Change # | 4,466 | 4,382 |

| Change ∆% | 4.9 | 5.9 |

| 05/2010 # | 130,801 | 107,405 |

| 05/2011 # | 131,753 | 109,203 |

| Change # | 952 | 1,798 |

| Change ∆% | 0.7 | 1.7 |

| Change # by ∆% as in 05/1984 to 05/1985 | 6,409* | 6,337** |

| Difference in Jobs that Would Have Been Created | 5,457 = | 4,539 = |

*[(130,801x1.049)-130,801] = 6,409 thousand

**[(107,405)x1.059 – 107,405] = 6,337 thousand

Source: http://data.bls.gov/pdq/SurveyOutputServlet

II Falling Real Wages. The wage bill is the product of average weekly hours times the earnings per hour. Table 8 provides the estimates by the BLS of earnings per hour seasonally adjusted, increasing from $22.77/hour in Oct 2010 to $23.19/hour in Oct 2011, or by 1.8 percent. There has been disappointment in valuation of stocks about the pace of wage increases because of rising food and energy costs that inhibit consumption and thus sales and similar concern about growth of consumption that accounts for 70 percent of GDP. Growth of consumption by decreasing savings may not be lasting and sound for personal finances (http://cmpassocregulationblog.blogspot.com/2011/10/slow-growth-driven-by-reducing-savings.html). Average private weekly earnings increased slightly by $14.41 from $781.01 in Oct 2010 to $795.42 in Oct 2011 or by 1.8 percent. The inflation-adjusted wage bill can only be calculated for Sep, which is the most recent month for which there are estimates of the consumer price index. Earnings per hour rose from $22.70 in Sep 2010 to $23.14 in Sep 2011 or by 1.9 percent (http://www.bls.gov/data/; see Table 10 below). Average weekly hours increased from 34.2 in Sep 2010 to 34.3 in Sep 2011 or by 0.3 percent (http://www.bls.gov/data/; see Table 9 below). The wage bill rose 2.2 percent in the 12 months ending in Sep, 2011:

{[(wage bill in Sep 2011)/(wage bill in Sep 2010)]-1}100 =

{[($23.14x34.3)/($22.70x34.2)]-1]}100

= {[($793.70/$$776.34)]-1}100 = 2.2%

CPI inflation was 3.9 percent in the 12 months ending in Aug 2011 (http://www.bls.gov/news.release/cpi.nr0.htm) for an inflation-adjusted wage-bill decline of 1.6 percent :{[(1.022/1.039)-1]100}. Energy and food price increases are similar to a “silent tax” that is highly regressive, harming the most those with lowest incomes. There are concerns that the wage bill would deteriorate in purchasing power because of renewed raw materials shock in the form of increases in prices of commodities such as the 31.1 percent steady increase in the DJ-UBS Commodity Index from Jul 2, 2010 to Sep 2, 2011. The charts of four commodity price indexes by Bloomberg show steady increase since Jul 2, 2010 that was interrupted briefly only in Nov 2010 with the sovereign issues in Europe triggered by Ireland, in Mar by the earthquake and tsunami in Japan and in the beginning of May by the decline in oil prices and sovereign risk difficulties in Europe (http://www.bloomberg.com/markets/commodities/futures/). Renewed risk aversion because of the sovereign risks in Europe has reduced the rate of increase of the DJ UBS commodity index to 20.6 percent on Nov 4, 2011, relative to Jul 2, 2010.

Table 8, US, Earnings per Hour and Average Weekly Hours SA

| Earnings per Hour | Oct 2010 | Aug 2011 | Sep 2011 | Oct 2011 |

| Total Private | $22.77 | $23.08 | $23.14 | $23.19 |

| Goods Producing | $24.20 | $24.45 | $24.52 | $24.58 |

| Service Providing | $22.43 | $22.76 | $22.81 | $22.86 |

| Average Weekly Earnings | ||||

| Total Private | $781.01 | $789.34 | $793.70 | $795.42 |

| Goods Producing | $963.16 | $973.11 | $978.35 | $983.20 |

| Service Providing | $744.68 | $753.36 | $757.29 | $758.95 |

| Average Weekly Hours | ||||

| Total Private | 34.3 | 34.2 | 34.3 | 34.3 |

| Goods Producing | 39.8 | 39.8 | 39.9 | 40.0 |

| Service Providing | 33.2 | 33.1 | 33.2 | 33.2 |

Source: http://www.bls.gov/news.release/pdf/empsit.pdf

Table 9 provides average weekly hours of all employees in the US from 2006 to 2011. Average weekly hours fell from 34.7 in Jun 2007 to 33.7 in Jun 2009, which was the last month of the contraction. Average weekly hours rose to 34.3 in Oct 2011.

Table 9, US, Average Weekly Hours of All Employees 2006-2011

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct |

| 2006 | 34.4 | 34.5 | 34.5 | 34.6 | 34.5 | 34.5 | 34.5 | 34.6 | ||

| 2007 | 34.4 | 34.6 | 34.6 | 34.6 | 34.6 | 34.7 | 34.6 | 34.5 | 34.6 | 34.5 |

| 2008 | 34.5 | 34.6 | 34.6 | 34.5 | 34.5 | 34.6 | 34.5 | 34.5 | 34.4 | 34.4 |

| 2009 | 34.1 | 34.1 | 34.0 | 33.9 | 33.8 | 33.7 | 33.8 | 33.9 | 33.9 | 33.8 |

| 2010 | 34.0 | 34.0 | 34.1 | 34.1 | 34.2 | 34.1 | 34.2 | 34.2 | 34.2 | 34.3 |

| 2011 | 34.2 | 34.3 | 34.3 | 34.4 | 34.4 | 34.3 | 34.3 | 34.2 | 34.3 | 34.3 |

Source: US Bureau of Labor Statistics

http://data.bls.gov/cgi-bin/surveymost?bls

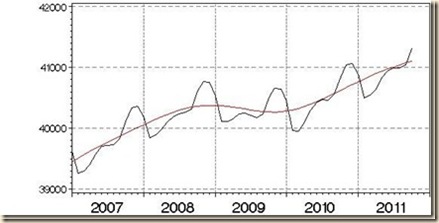

Chart 27 provides average weekly hours monthly from Mar 2006 to Oct 2011. Average weekly hours remained relatively stable in the period before the contraction and fell sharply during the contraction as business could not support lower production with the same labor input. Average weekly hours rose rapidly during the expansion but have stabilized at a level below that prevailing before the contraction.

Chart 27, US, Average Weekly Hours of All Employees 2006-2011

Source: US Bureau of Labor Statistics

http://data.bls.gov/cgi-bin/surveymost?bls

Calculations with BLS data of inflation-adjusted average hourly earnings are shown in Table 10. The final column of Table 9 (“12 Month Real ∆%”) provides inflation-adjusted average hourly earnings of all employees in the US. Average hourly earnings rose above inflation throughout the first nine months of 2007 just before the global recession that began in the final quarter of 2007 when average hourly earnings lost to inflation. In contrast, average hourly earnings of all US workers have risen less than inflation in five months in 2010 and in all but one month in 2011 and the loss has accelerated to 1.9 percent in Sep 2011, which is the most recent month for which there are consumer price index data.

Table 10, US, Average Hourly Earnings Nominal and Inflation Adjusted, Dollars and % NSA

| AHE ALL | 12 Month | ∆% 12 Month CPI | 12 Month | |

| 2007 | ||||

| Jan* | $20.70* | 4.2* | 2.1 | 2.1* |

| Feb* | $20.79* | 4.1* | 2.4 | 1.7* |

| Mar | $20.78 | 3.6 | 2.8 | 0.8 |

| Apr | $20.85 | 3.5 | 2.6 | 0.7 |

| May | $20.89 | 3.8 | 2.7 | 1.1 |

| Jun | $21.00 | 3.8 | 2.7 | 1.1 |

| Jul | $21.04 | 3.7 | 2.4 | 1.3 |

| Aug | $21.03 | 3.5 | 1.9 | 1.6 |

| Sep | $21.12 | 3.5 | 2.8 | 0.7 |

| Oct | $21.11 | 3.1 | 3.5 | -0.4 |

| Nov | $21.17 | 3.3 | 4.3 | -0.9 |

| Dec | $21.27 | 3.4 | 4.1 | -0.7 |

| 2010 | ||||

| Jan | $22.44 | 1.9 | 2.6 | -0.7 |

| Feb | $22.48 | 1.9 | 2.1 | -0.2 |

| Mar | $22.48 | 1.8 | 2.3 | -0.5 |

| Apr | $22.52 | 1.8 | 2.2 | -0.4 |

| May | $22.57 | 1.9 | 2.0 | -0.1 |

| Jun | $22.57 | 1.8 | 1.1 | 0.7 |

| Jul | $22.61 | 1.8 | 1.2 | 0.6 |

| Aug | $22.67 | 1.8 | 1.1 | 0.7 |

| Sep | $22.70 | 1.7 | 1.1 | 0.6 |

| Oct | $22.77 | 1.9 | 1.2 | 0.7 |

| Nov | $22.76 | 1.7 | 1.1 | 0.6 |

| Dec | $22.77 | 1.7 | 1.5 | 0.2 |

| 2011 | ||||

| Jan | $22.86 | 1.9 | 1.6 | 0.3 |

| Feb | $22.88 | 1.8 | 2.1 | -0.3 |

| Mar | $22.89 | 1.8 | 2.7 | -0.9 |

| Apr | $22.93 | 1.8 | 3.2 | -1.4 |

| May | $23.02 | 1.9 | 3.6 | -1.6 |

| Jun | $23.01 | 1.9 | 3.6 | -1.6 |

| Jul | $23.12 | 2.3 | 3.6 | -1.3 |

| Aug | $23.08 | 1.8 | 3.8 | -1.9 |

| Sep | $23.14 | 1.9 | 3.9 | -1.9 |

| Oct | $23.19 | 1.8 |

Note: AHE ALL: average hourly earnings of all employees; CPI: consumer price index; Real: adjusted by CPI inflation; NA: not available

*AHE of production and nonsupervisory employees because of unavailability of data for all employees

Source: http://data.bls.gov/cgi-bin/surveymost?bls

ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

Average hourly earnings of all US employees in the US in constant dollars of 1982-1984 from the dataset of the US Bureau of Labor Statistics (BLS) are provided in Table 11. Average hourly earnings fell 1.8 percent after adjusting for inflation in the 12 months ending in Sep 2011. Table 11 confirms the trend of deterioration of purchasing power of average hourly earnings in 2011. Those who still work bring back home a paycheck that buys fewer goods than a year earlier.

Table 11, US, Average Hourly Earnings of All Employees in Constant Dollars of 1982-1984

| Year | Apr | May | Jun | Jul | Aug | Sep |

| 2006 | 10.04 | 10.00 | 10.02 | 10.00 | 9.97 | 10.06 |

| 2007 | 10.12 | 10.10 | 10.14 | 10.13 | 10.13 | 10.13 |

| 2008 | 10.01 | 10.00 | 9.95 | 9.88 | 9.93 | 9.96 |

| 2009 | 10.40 | 10.39 | 10.34 | 10.34 | 10.33 | 10.33 |

| 2010 | 10.35 | 10.39 | 10.41 | 10.39 | 10.40 | 10.39 |

| 2011 | 10.22 | 10.24 | 10.26 | 10.26 | 10.20 | 10.20 |

| ∆% 20011 | -1.3 | -1.4 | -1.4 | -1.3 | -1.9 | -1.8 |

Source: US Bureau of Labor Statistics

http://data.bls.gov/cgi-bin/surveymost?bls

The deterioration of purchasing power of the average hourly earnings of US workers is shown by Chart 28 of the US Bureau of Labor Statistics. Chart 28 plots average hourly earnings of all US employees in constant 1982-1984 dollars with evident decline from 2010 to 2011.

Chart 28, US, Average Hourly Earnings of All Employees in Constant Dollars of 1982-1984

Source: US Bureau of Labor Statistics

http://data.bls.gov/cgi-bin/surveymost?bls

Average hourly earnings of all US employees in the US in constant dollars of 1982-1984 from the dataset of the US Bureau of Labor Statistics (BLS) are provided in Table 11. Average hourly earnings fell 1.8 percent after adjusting for inflation in the 12 months ending in Sep 2011. Table 11 confirms the trend of deterioration of purchasing power of average hourly earnings in 2011. Those who still work bring back home a paycheck that buys fewer goods than a year earlier.

Table 11, US, Average Weekly Earnings of All Employees in Constant Dollars of 1982-1984

| Year | Apr | May | Jun | Jul | Aug | Sep |

| 2006 | 346.38 | 345.00 | 346.86 | 344.83 | 343.82 | 347.21 |

| 2007 | 350.18 | 349.49 | 351.75 | 350.57 | 349.34 | 350.54 |

| 2008 | 345.45 | 344.83 | 344.35 | 341.01 | 342.67 | 342.66 |

| 2009 | 352.54 | 351.20 | 348.43 | 349.52 | 350.14 | 350.21 |

| 2010 | 352.87 | 355.19 | 354.89 | 355.32 | 355.54 | 355.42 |

| 2011 | 351.46 | 352.26 | 351.86 | 351.79 | 348.85 | 349.72 |

| ∆% 20011 | -0.4 | -0.8 | -0.9 | -1.0 | -1.9 | -1.6 |

Source: US Bureau of Labor Statistics

http://data.bls.gov/cgi-bin/surveymost?bls

Chart 29 provides average weekly earnings of all employees in constant dollars of 1982-1984. The same pattern emerges of sharp decline during the contraction, followed by recovery in the expansion and continuing fall from 2010 to 2011.

Chart 29, US, Average Weekly Earnings of All Employees in Constant Dollars of 1982-1984

Source: US Bureau of Labor Statistics

http://data.bls.gov/cgi-bin/surveymost?bls

III Labor Productivity, Unit Labor Costs and Real Hourly Compensation. The Bureau of Labor Statistics (BLS) of the Department of Labor provides the quarterly report on productivity and costs. The operational definition of productivity used is (http://www.bls.gov/news.release/pdf/prod2.pdf 1): “Labor productivity, or output per hour, is calculated by dividing an index of real output by an index of hours worked of all persons, including employees, proprietors, and unpaid family workers.” The BLS has revised the estimates for productivity and unit costs. Table 13 provides the data for nonfarm business sector productivity and unit labor costs for the first three quarters of 2011 in seasonally adjusted annual equivalent (SAAE) rate and the percentage change from the same quarter a year earlier. Reflecting increases in output of 3.8 percent and of 0.6 percent in hours worked, nonfarm business sector labor productivity rose at a high SAAE rate of 3.1 percent in IIIQ2011, as shown in column 2 “IIIQ2011 SAEE.” The increase of labor productivity from IIIQ2010 to IIIQ2011 was 1.1 percent, reflecting increases in output of 2.5 percent and of hours worked of 1.4 percent, as shown in column 3 “IIIQ2011 YoY.” The BLS defines unit labor costs as (http://www.bls.gov/news.release/pdf/prod2.pdf 1): “BLS defines unit labor costs as the ratio of hourly compensation to labor productivity; increases in hourly compensation tend to increase unit labor costs and increases in output per hour tend to reduce them.” Unit labor costs fell at 2.4 percent in IIIQ2011 and fell 1.4 percent in IIIQ2011 relative to IIIQ2010. Hourly compensation in IIIQ2011 SAAE rose at 0.6 percent, which deflating by the estimated consumer price increase SAAE rate in IIIQ2011 results in a decline of real hourly compensation by 2.4 percent. Unit labor costs and real hourly compensation are declining.

Table 13, US, Nonfarm Business Sector Productivity and Costs %

| IIIQ | IIIQ | IIQ 2011 SAAE | IIQ 2011 YoY | IQ 2011 SAAE | IQ 2011 YoY | |

| Produc-tivity | 3.1 | 1.1 | -0.1 | 0.9 | -0.6 | 1.2 |

| Output | 3.8 | 2.5 | 1.8 | 2.5 | 0.9 | 3.2 |

| Hours | 0.6 | 1.4 | 2.0 | 1.6 | 1.5 | 1.9 |

| Hourly | 0.6 | 2.3 | 2.7 | 2.7 | 5.6 | 2.6 |

| Real Hourly Comp. | -2.4 | -1.4 | -1.3 | -0.7 | 0.3 | 0.4 |

| Unit Labor Costs | -2.4 | 1.2 | 2.8 | 1.8 | 6.2 | 1.4 |

| Unit Nonlabor Payments | 9.1 | 3.6 | 2.5 | 1.9 | -3.1 | 2.0 |

| Implicit Price Deflator | 2.2 | 2.2 | 2.7 | 1.8 | 2.2 | 1.7 |

Notes: SAAE: seasonally adjusted annual equivalent; Comp.: compensation; YoY: Quarter on Same Quarter Year Earlier

Source: http://www.bls.gov/news.release/pdf/prod2.pdf

The revised increases in productivity in Table 14 of 4.1 percent in the 2010 annual average and 2.3 percent in the 2009 annual average were facilitated by reductions in hours worked of 0.1 percent in 2010 and 7.2 percent in 2009. The contraction period and the recovery period have been characterized by savings of labor inputs. The report on productivity and costs confirms a weak economy in IIQ2011 and losses in real hourly compensation of labor with likely adverse effects on consumption. The GDP report with growth of only 1.3 percent at SAAE rate in IIQ2011 or 0.32 percent in the quarter is consistent with these data. The economy improved in IIIQ2011 with GDP growth at the SAAE rate of 2.5 percent significantly because of consumption resulting from reducing savings (http://cmpassocregulationblog.blogspot.com/2011/10/slow-growth-driven-by-reducing-savings.html). Increase in hours used at the SAAE rate of 0.6 percent with increase in output by 3.8 resulted in an increase in nonfarm business productivity of 3.1 percent.

Table 14, US, Revised Nonfarm Business Sector Productivity and Costs Annual Average ∆% Annual Average

| 2010 | 2009 | 2008 | |

| Productivity | 4.1 | 2.3 | 0.6 |

| Output | 4.0 | -5.1 | -1.5 |

| Hours | -0.1 | -7.2 | -2.1 |

| Hourly | 2.1 | 1.6 | 3.4 |

| Real Hourly Comp. | 0.4 | 2.0 | -0.4 |

| Unit Labor Costs | -2.0 | -0.7 | 2.8 |

| Unit Nonlabor Payments | 5.7 | 3.8 | |

| Implicit Price Deflator | 1.1 | 1.1 |

Notes: SAAE: seasonally adjusted annual equivalent; Comp.: compensation

Source: http://www.bls.gov/news.release/pdf/prod2.pdf

Productivity jumped in the recovery after the recession from Mar IQ2001 to Nov IVQ2001 (http://www.nber.org/cycles.html). Table 15 provides quarter on quarter and annual percentage changes in nonfarm business output per hour, or productivity, from 2001 to 2011. The annual average jumped from 2.9 percent in 2001 to 4.6 percent in 2002. Nonfarm business productivity increased at the SAAE rate of 8.8 percent in the first quarter after the recession in IQ2002. Productivity increases decline later in the expansion period. Productivity increases were mediocre during the recession from Dec IVQ2007 to Jun IIQ2009 (http://www.nber.org/cycles.html) and increased during the first phase of expansion

Table 15, US, Nonfarm Business Output per Hour, Percent Change from Prior Quarter at Annual Rate, 2001-2011

| Year | Qtr1 | Qtr2 | Qtr3 | Qtr4 | Annual |

| 2001 | -1.3 | 7.4 | 2.5 | 5.8 | 2.9 |

| 2002 | 8.8 | 0.5 | 3.8 | -0.2 | 4.6 |

| 2003 | 3.7 | 5.5 | 9.5 | 1.5 | 3.7 |

| 2004 | 0.6 | 3.3 | 0.7 | 0.5 | 2.6 |

| 2005 | 4.2 | -0.8 | 3.1 | -0.2 | 1.6 |

| 2006 | 2.5 | 0.4 | -2.2 | 2.7 | 0.9 |

| 2007 | -0.1 | 3.3 | 4.7 | 2.1 | 1.5 |

| 2008 | -2.4 | 2.2 | -0.7 | -3.4 | 0.6 |

| 2009 | 1.3 | 8.0 | 6.5 | 5.5 | 2.3 |

| 2010 | 4.6 | 1.2 | 2.1 | 2.2 | 4.1 |

| 2011 | -0.6 | -0.1 | 3.1 |

Source: US Bureau of Labor Statistics

http://www.bls.gov/lpc/home.htm

Chart 30 of the Bureau of Labor Statistics (BLS) provides SAAE rates of nonfarm business productivity from 2001 to 2011. There is a clear pattern in both episodes of economic cycles in 2001 and 2007 of rapid expansion of productivity in the transition from contraction to expansion followed by more subdued productivity expansion. Part of the explanation is the reduction in labor utilization resulting from adjustment of business to the sudden shock of collapse of sales.

Chart 30, US, Nonfarm Business Output per Hour, Percent Change from Prior Quarter at Annual Rate, 2001-2011

Source: US Bureau of Labor Statistics

http://www.bls.gov/lpc/home.htm

Percentage changes from prior quarter at SAAE rates and annual average percentage changes of nonfarm business unit labor costs are provided in Table 16. Unit labor costs fell during the contractions with continuing negative percentage changes in the early phases of the recovery. Weak labor markets partly explain the decline in unit labor costs. As the economy moves toward full employment, labor markets tighten with increase in unit labor costs. The expansion beginning in IIIQ2009 has been characterized by high unemployment and underemployment. Table 16 shows continuing subdued unit labor costs.

Table 16, US, Nonfarm Business Unit Labor Costs, Percent Change from Prior Quarter at Annual Rate 2001-2011

| Year | Qtr1 | Qtr2 | Qtr3 | Qtr4 | Annual |

| 2001 | 10.9 | -5.8 | -1.1 | -1.7 | 1.5 |

| 2002 | -4.1 | 3.4 | -1.6 | 2.2 | -1.3 |

| 2003 | 2.8 | 1.4 | -3.5 | 1.8 | 1.0 |

| 2004 | -2.5 | 2.4 | 5.8 | 2.7 | 0.7 |

| 2005 | -1.0 | 3.5 | 2.6 | 2.6 | 2.3 |

| 2006 | 2.9 | 1.3 | 3.6 | 6.8 | 2.8 |

| 2007 | 4.0 | -1.9 | -1.9 | 4.4 | 2.4 |

| 2008 | 8.7 | -3.5 | 4.3 | 5.7 | 2.8 |

| 2009 | -4.0 | -1.2 | -3.9 | -4.1 | -0.7 |

| 2010 | -3.1 | 1.4 | -0.2 | -1.6 | -2.0 |

| 2011 | 6.2 | 2.8 | -2.4 |

Source: US Bureau of Labor Statistics

http://www.bls.gov/lpc/home.htm

Chart 31 provides percentage changes quarter on quarter at SAAE rates of nonfarm business unit labor costs. With the exception of a jump of 6.2 percent in IQ2011, 2.8 percent in IIQ2011 and 1.4 percent in IIQ2010, changes in nonfarm business unit labor costs have been negative.

Chart 31, US, Nonfarm Business Unit Labor Costs, Percent Change from Prior Quarter at Annual Rate 2001-2011

Source: US Bureau of Labor Statistics

http://www.bls.gov/lpc/home.htm

Table 17 provides percentage change from prior quarter at annual rates for nonfarm business real hourly worker compensation. The expansion after the contraction of 2001 was followed by strong recovery of real hourly compensation.

Table 17, Nonfarm Business Real Hourly Compensation, Percent Change from Prior Quarter at Annual Rate 2001-2011

| Year | Qtr1 | Qtr2 | Qtr3 | Qtr4 | Annual |

| 2001 | 5.4 | -1.5 | 0.2 | 4.5 | 1.6 |

| 2002 | 2.8 | 0.6 | 0.0 | -0.6 | 1.5 |

| 2003 | 2.4 | 7.7 | 2.5 | 1.8 | 2.4 |

| 2004 | -5.2 | 2.6 | 3.7 | -1.1 | 0.6 |

| 2005 | 1.3 | -0.1 | -0.3 | -1.3 | 0.6 |

| 2006 | 3.1 | -1.8 | -2.6 | 11.6 | 0.5 |

| 2007 | 0.0 | -3.3 | 0.2 | 1.6 | 1.1 |

| 2008 | 1.4 | -6.3 | -2.7 | 12.5 | -0.4 |

| 2009 | -0.4 | 4.7 | -1.3 | -1.5 | 2.0 |

| 2010 | 0.2 | 3.1 | 0.4 | -2.1 | 0.4 |

| 2011 | 0.3 | -1.3 | -2.4 |

Source: US Bureau of Labor Statistics

http://www.bls.gov/lpc/home.htm

Chart 32 provides percentage change from prior quarter at annual rate of nonfarm business real hourly compensation from 2001 to 2011. There are significant fluctuations in quarterly percentage changes oscillating between positive and negative. There is not a clear pattern in the two contractions in the 2000s.

Chart 32, Nonfarm Business Real Hourly Compensation, Percent Change from Prior Quarter at Annual Rate 2001-2011

Source: US Bureau of Labor Statistics

http://www.bls.gov/lpc/home.htm

Chart 33 provides percentage change from prior quarter at annual rate for nonfarm business output per hour from 1947 to 2011. The average would be represented by a horizontal line above zero. There is an increase in the rate of improvement of productivity in the 1990s that was not continued into the 2000s.

Chart 33, US, Nonfarm Business Output per Hour, Percent Change from Prior Quarter at Annual Rate 1947-2011

Source: US Bureau of Labor Statistics http://www.bls.gov/lpc/home.htm

Chart 34 provides percentage changes from prior quarter at annual rate for US nonfarm business unit labor costs from 1947 to 2011. The most remarkable period is the 1970s in which stagflation occurred in fluctuating but high positive percentage changes of unit labor costs. There was significant moderation of increases in unit labor costs in the 1980s. Fluctuation has characterized the 2000s.

Chart 34, US, Nonfarm Business Unit Labor Costs, Percent Change from Prior Quarter at Annual Rate 1947-2011

Source: US bureau of Labor Statistics

http://www.bls.gov/lpc/home.htm

Chart 35 provides percentage changes from the prior quarter at annual rate of nonfarm business real hourly compensation from 1947 to 2011. Negative changes have occurred more frequently in the 2000s than during the Great Inflation of the 1970s.

Chart 35, US, Nonfarm Business Real Hourly Compensation, Percent Change from Prior Quarter at Annual Rate 1947-2011

Source: US Bureau of Labor Statistics

http://www.bls.gov/lpc/home.htm

IV World Financial Turbulence. The past three months have been characterized by financial turbulence, attaining unusual magnitude in the past few weeks. Table 18, updated with every comment in this blog, provides beginning values on Oct 31 and daily values throughout the week ending on Fr Nov 4 of several financial assets. Section VII Valuation of Risk Financial Assets provides a set of more complete values. All data are for New York time at 5 PM. The first column provides the value on Fri Oct 28 and the percentage change in that prior week below the label of the financial risk asset. The first five asset rows provide five key exchange rates versus the dollar and the percentage cumulative appreciation (positive change or no sign) or depreciation (negative change or negative sign). Positive changes constitute appreciation of the relevant exchange rate and negative changes depreciation. Financial turbulence has been dominated by reactions to the new program for Greece (see section IB in http://cmpassocregulationblog.blogspot.com/2011/07/debt-and-financial-risk-aversion-and.html), modifications and new approach adopted in the Euro Summit of Oct 26 (European Commission 2011Oct26SS, 2011Oct26MRES), doubts on the larger countries in the euro zone with sovereign risks such as Spain and Italy, the growth standstill recession and long-term unsustainable government debt in the US, worldwide deceleration of economic growth and continuing inflation. The dollar/euro rate is quoted as number of US dollars USD per one euro EUR, USD 1.415/EUR in the first row, first column in the block for currencies in Table 18 for Fri Oct 28, appreciating to USD 1.3843/EUR on Mon Oct 31, or by 2.2 percent. Table 18 defines a country’s exchange rate as number of units of domestic currency per unit of foreign currency. USD/EUR would be the definition of the exchange rate of the US and the inverse [1/(USD/EUR)] is the definition in this convention of the rate of exchange of the euro zone, EUR/USD. A convention is required to maintain consistency in characterizing movements of the exchange rate in Table 18 as appreciation and depreciation. The first row for each of the currencies shows the exchange rate at 5 PM New York time, such as USD 1.3843/EUR on Oct 31; the second row provides the cumulative percentage appreciation or depreciation of the exchange rate from the rate on the last business day of the prior week, in this case Fri Oct 28, to the last business day of the current week, in this case Fri Nov 4, such as appreciation of 2.5 percent for the dollar to USD 1.379/EUR by Nov 4; and the third row provides the percentage change from the prior business day to the current business day. For example, the USD appreciated (positive sign) by 2.5 percent from the rate of USD 1.415/EUR on Fri Oct 28 to the rate of USD 1.379/EUR on Fri Nov 4 {[(1.379/1.415) – 1]100 = -2.5%} and appreciated by 0.2 percent from the rate of USD 1.3822 on Thu Nov 3 to USD 1.379/EUR on Fri Nov 4 {[(1.379/1.3822) -1]100 = -0.2%}. The dollar appreciated during the week because fewer dollars, $1.379, were required to buy one euro on Fri Nov 4 than $1.415 required to buy one euro on Fri Oct 28. The depreciation of the dollar in the week was caused by increasing risk aversion, largely resulting with the uncertainty on European sovereign risks, with purchases of risk financial investments by reduction of dollar-denominated assets.

Table 18, Weekly Financial Risk Assets Oct 31 to Nov 4, 2011

| Oct 28, 2011 | M 31 | Tu 1 | W 2 | Th 3 | Fr 4 |

| USD/ 1.415 -1.9% | 1.3843 2.2% 2.2% | 1.3701 3.2% 1.1% | 1.3741 2.9% -0.3% | 1.3822 2.3% -0.6% | 1.379 2.5% 0.2% |

| JPY/ 75.812 0.6% | 78.1902 -3.1% -3.1% | 78.3217 -3.3% -0.2% | 78.0440 -2.9% 0.4% | 78.0065 -2.9% 0.0% | 78.2125 -3.2% -0.3% |

| CHF/ 0.8862 -0.4% | 0.8774 1.0% 1.0% | 0.8869 -0.1% -1.1% | 0.8841 0.2% 0.3% | 0.8782 0.9% 0.7% | 0.888 -0.2% -1.1% |

| CHF/EUR 1.2207 0.5% | 1.2147 0.5% 0.5% | 1.2151 0.5% 0.0% | 1.2149 0.5% 0.0% | 1.2139 0.6% 0.1% | 1.2204 0.0% -0.5% |

| USD/ 1.0710 0.9337 3.1% | 1.0535 0.9492 -1.7% -1.7% | 1.0344 0.9667 -3.5% -1.8% | 1.0339 0.9672 -3.6% -0.1% | 1.0427 0.9591 -2.7% 0.8% | 1.037 0.9643 -3.3% -0.6% |

| 10 Year 2.326 | 2.125 | 1.98 | 1.99 | 2.08 | 2.066 |

| 2 Year T Note 0.293 | 0.250 | 0.23 | 0.23 | 0.24 | 0.234 |

| Germany Bond 2Y 0.60 10Y 2.18 | 2Y 0.54 10Y 2.02 | 2Y 0.41 10Y 1.77 | 2Y 0.42 10Y 1.83 | 2Y 0.40 10Y 1.91 | 2Y 0.40 10Y 1.82 |

| DJIA 12231.11 3.6% | -2.3% -2.3% | -4.7% -2.5% | -3.2% 1.5% | -1.5% 1.8% | -2.0% -0.5% |

| DJ Global 1964.49 6.4% | -3.4% -3.4% | -7.1% -3.9% | -6.1% 1.1% | -5.0% 1.1% | -5.3% -0.3% |

| DJ Asia Pacific 1274.32 7.1% | -2.3% -2.3% | -4.4% -2.1% | -4.8% -0.5% | -5.5% -0.6% | -3.5% 2.1% |

| Nikkei 9050.47 4.3% | -0.7% -0.7% | -2.4% -1.7% | -4.5% -2.2% | -4.5% -2.2% | -2.8% 1.9% |

| Shanghai 2473.41 6.7% | -0.2% -0.2% | -0.1% 0.1% | 1.2% 1.4% | 1.4% 0.2% | 2.2% 0.8% |

| DAX 6346.19 6.3% | -2.5% -2.5% | -8.0% -5.7% | -6.1% 2.0% | -3.4% 2.9% | -5.9% -2.5% |

| DJ UBS Commodities 150.87 4.1% | -0.9% -0.9% | -2.4% -1.5% | -2.2% 0.2% | -0.9% 1.3% | -0.9% 0.0% |

| WTI $ B 93.46 6.9% | 92.67 -0.8% -0.8% | 91.46 -2.1% -1.3% | 92.41 -1.1% 1.0% | 93.96 0.5% 1.7% | 94.53 1.1% 0.6% |

| Brent $/B 110.01 0.4% | 109.34 -0.6% -0.6% | 108.9 -1.0% -0.4% | 109.25 -0.7% 0.3% | 110.83 0.7% 1.4% | 112.32 2.1% 1.3% |

| Gold $/OZ 1747.2 6.8% | 1720.4 -1.5% -1.5% | 1721.4 -1.5% 0.1% | 1736.8 -0.6% 0.9% | 1758.7 0.7% 1.3% | 1756.7 0.5% -0.1% |

Note: USD: US dollar; JPY: Japanese Yen; CHF: Swiss

Franc; AUD: Australian dollar; Comm.: commodities; OZ: ounce

Source: http://www.bloomberg.com/markets/

http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

Risk aversion returned in the week of Nov 4 because of the uncertainties on rapidly moving political development in Greece and lack of substantive measures at the G20 meeting. Most currency movements in Table 18 reflect risk aversion. The dollar appreciated 2.5 percent relative to the euro. Safe-haven currencies, such as the Swiss franc (CHF) and the Japanese yen (JPY) were again under threat of appreciation. A characteristic of the global recession would be struggle for maintaining competitiveness by policies of regulation, trade and devaluation (Pelaez and Pelaez, Government Intervention in Globalization: Regulation, Trade and Devaluation War (2008c)). Appreciation of the exchange rate causes two major effects on Japan.

1. Trade. Consider an example with actual data (Pelaez and Pelaez, Government Intervention in Globalization: Regulation, Trade and Devaluation Wars (2008c), 70-72). The yen traded at JPY 117.69/USD on Apr 2, 2007 and at JPY 102.77/USD on Apr 2, 2008, or appreciation of 12.7 percent. This meant that an export of JPY 10,000 to the US sold at USD 84.97 on Apr 2, 2007 [(JPY 10,000)/(USD 117.69/USD)], rising to USD 97.30 on Apr 2, 2008 [(JPY 10,000)/(JPY 102.77)]. If the goods sold by Japan were invoiced worldwide in dollars, Japanese’s companies would suffer a reduction in profit margins of 12.7 percent required to maintain the same dollar price. An export at cost of JPY 10,000 would only bring JPY 8,732 when converted at JPY 102.77 to maintain the price of USD 84.97 (USD 84.97 x JPY 102.77/USD). If profit margins were already tight, Japan would be uncompetitive and lose revenue and market share. The pain of Japan from dollar devaluation is illustrated by Table 56 in the Oct 30 comment of this blog (http://cmpassocregulationblog.blogspot.com/2011/10/slow-growth-driven-by-reducing-savings.html): The yen traded at JPY 110.19/USD on Aug 18, 2008 and at JPY 75.812/USD on Oct 28, 2011, for cumulative appreciation of 31.2 percent. Cumulative appreciation from Sep 15, 2010 (JPY 83.07/USD) to Oct 28, 2011 (JPY 75.812) was 31.2 percent.

2. Foreign Earnings and Investment. Consider the case of a Japanese company receiving earnings from investment overseas. Accounting the earnings and investment in the books in Japan would also result in a loss of 12.7 percent. Accounting would show fewer yen for investment and earnings overseas.

There is a point of explosion of patience with dollar devaluation and domestic currency appreciation. Andrew Monahan, writing on “Japan intervenes on yen to cap sharp rise,” on Oct 31, 2011, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424052970204528204577009152325076454.html?mod=WSJPRO_hpp_MIDDLETopStories), analyzes the intervention of the Bank of Japan, at request of the Ministry of Finance, on Oct 31, 2011. Traders consulted by Monahan estimate that the Bank of Japan sold JPY 7 trillion, about $92.31 billion, against the dollar, exceeding the JPY 4.5 trillion on Aug 4, 2011. The intervention caused an increase of the yen rate to JPY 79.55/USD relative to earlier trading at a low of JPY 75.31/USD. The yen depreciated 3.1 percent on Oct 31 to JPY 78.1902/USD, as shown in Table 18. Historically, interventions in yen currency markets have been unsuccessful (Pelaez and Pelaez, The Global Recession Risk (2007), 107-109). Interventions are even more difficult currently with daily trading of some $4 trillion in world currency markets.

Exchange rate controls by the Swiss National Bank (SNB) fixing the rate at a minimum of CHF 1.20/EUR (http://www.snb.ch/en/mmr/reference/pre_20110906/source/pre_20110906.en.pdf) has prevented flight of capital into the Swiss franc. The Swiss franc depreciated 0.2 percent relative to the USD but remained unchanged to the euro also suggesting remaining aversion on European risk. Risk aversion is evident in the depreciation of the Australian dollar by cumulative 3.3 percent on Fr Nov 4. Risk appetite would be revealed by carry trades from zero interest rates in the US and Japan into high yielding currencies such as in Australia with appreciation of the Australian dollar (see Pelaez and Pelaez, Globalization and the State, Vol. II (2008b), 202-4, Pelaez and Pelaez, Government Intervention in Globalization (2008c), 70-4).

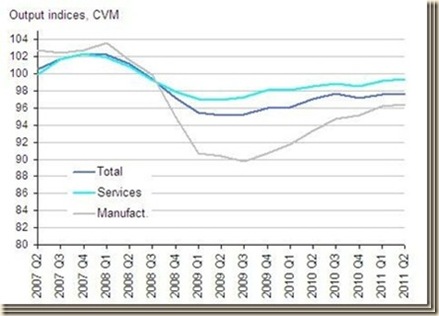

Risk aversion is captured by flight of investors from risk financial assets to the government securities of the US and Germany. Increasing risk aversion is captured by decrease of the yield of the 10-year Treasury note from 2.326 percent on Oct 28 to 2.066 percent on Fri Nov 4. The 10-year Treasury yield is still at a level well below consumer price inflation of 3.9 percent in the 12 months ending in Sep and 0.3 percent in Sep relative to Aug (http://www.bls.gov/cpi/). Treasury securities continue to be safe haven for investors fearing risk but with concentration in shorter maturities such as the two-year Treasury with declining yield of 0.234 percent on Nov 4 from 0.293 percent on Oct 28. Investors are willing to sacrifice yield relative to inflation in defensive actions to avoid turbulence in valuations of risk financial assets but may be managing duration more carefully. During the financial panic of Sep 2008, funds moved away from risk exposures to government securities. A similar risk aversion phenomenon occurs in Europe with lower levels of the yield of the 10-year government bond of Germany on Fri Nov 4 at 0.40 percent for the two-year maturity from 0.60 percent on Fri Oct 28 and 1.82 percent percent for the 10-year maturity on Fri Nov 4 from 2.18 percent on Fri Oct 28 while the final estimate of euro zone CPI inflation for Sep is at 3.0 percent (http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/2-14102011-BP/EN/2-14102011-BP-EN.PDF). Safety overrides inflation-adjusted yield but there could be duration aversion.