Twenty Nine Million Unemployed/Underemployed, Falling Real Wages, World Financial Turbulence and World Economic Slowdown

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011

Executive Summary

I Twenty Nine Million Unemployed/Underemployed

II Falling Real Wages

III World Financial Turbulence

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendix I The Great Inflation

Executive Summary

The employment situation report of the Bureau of Labor Statistics (BLS) is rich in useful information on the state of the economy. Table 1 anticipated here from the text summarizes the report released on Oct 7. Nonfarm payroll jobs in the survey of employing establishments registered an increase in new jobs of 103,000 in Sep from 57,000 in Aug that was revised from 0. New private payroll jobs rose 137,000 in Sep, which was an improvement relative to the revised increase of 42,000 in Aug. Part of the increase in new jobs was due to the return to work of striking workers: “The increase in employment partially reflected the return to payrolls of about 45,000 telecommunications workers who had been on strike in August” (http://www.bls.gov/news.release/pdf/empsit.pdf 1). The establishment survey also provides average hourly earnings and average weekly hours worked. Average hourly earnings (AHE) without adjustment for inflation rose 1.9 percent in Sep 2011 relative to Sep 2010 and 0.2 percent relative to Aug 2011. Table 1 also provides the BLS calculation of AHEs in constant dollars, or adjusted for inflation, which fell 1.9 percent in Sep 2011 relative to Sep 2010 and fell 0.6 percent relative to Aug 2011. Average weekly hours fell from 34.2 in Aug to 34.3 in Sep. The wage bill or number of hours worked times average hourly earnings fell in real terms. The remuneration to labor is falling after adjusting for inflation. The BLS also conducts a survey of households that provides the rate of unemployment, or unemployed as percent of the labor force, which was 9.1 percent in both Sep and Aug. The rate of job creation would have to exceed around 125,000 per month of new entrants in the labor force to reduce the rate of unemployment. This blog provides with release of every employment situation report an estimate of the number in job stress, which is 29.4 million in Sep and 29.5 million in Aug. The number of people in job stress as percent of the labor force is estimated at 18.5 percent in Sep 2011 and 18.6 percent in Aug 2011. The average rate of 2.4 percent seasonally-adjusted average rates (SAAR) of economic growth in the current recovery is mediocre relative to 6.2 percent average GDP SAARs in past recoveries. As a result there are more than 29 million people unemployed, working part-time for economic reasons because they cannot find full-time employment or marginally attached to the labor force. The rate of economic growth in the first half of 2011 is equivalent to 0.8 percent for a full year. The fractured job market of the US continues to deteriorate.

A few charts illustrate the situation of the labor market of the United States. Chart 1 of the dataset of the Bureau of Labor Statistics (BLS) anticipated here from the text shows strong recovery in creation of seasonally-adjusted total nonfarm payroll jobs, including private and government jobs, in the earlier cyclical expansion from much lower drop in output in 2001 and the sharper drop and milder job creation impulse in the current cyclical recovery.

Chart 1, US, Total Nonfarm Payroll Jobs SA 2001-2011

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Chart 3 anticipated here from the text provides total nonfarm payroll job creation between 1979 and 1989 seasonally adjusted. The two contraction in 1980 and 1981 to 1982 accumulated decline of GDP of 4.8 percent that is similar to the drop of GDP of 5.1 percent from IVQ2007 to IIQ2009. Recovery of job creation was incomparably faster than during the current cyclical expansion after IIIQ2009.

Chart 3, US, Total Nonfarm Payroll Jobs SA 1979-1989

Source: US Bureau of Labor Statistics

Total private payroll job creation, excluding government jobs, seasonally-adjusted, is provided in Chart 5 anticipated here from the text for the years between 2001 and 2011. Private sector job creation is not moving as fast as required to reduce job stress of 29 million people.

Chart 5, US, Total Private Payroll Jobs SA 2001-2011

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Chart 7 anticipated here from the text shows the upward surge of total private job creation seasonally adjusted in the years 1979 to 1989. Much faster economic growth was followed with rapid private job creation.

Chart 7, US, Total Private Payroll Jobs SA 1979-1989

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

The deterioration of purchasing power of the average hourly earnings of US workers is shown by Chart 11 of the US Bureau of Labor Statistics anticipated here from the text. Chart 11 plots average hourly earnings of all US employees in constant 1982-1984 dollars with evident decline from 2010 to 2011.

Chart 11, US, Average Hourly Earnings of All Employees 1982-1984 Dollars

Source: Bureau of Labor Statistics http://www.bls.gov/data/

Chart 9 shows the decline of real disposable income during the recession followed by stagnation. The US has lost the growth impulse of prior cyclical expansions that permitted rapid hiring and elimination of unemployment. As a result, there are more than 29 million unemployed or working part-time because they cannot find full-time employment.

Chart 9, US, Real Disposable Income, 2007-2011

Source: http://www.bea.gov/national/index.htm#personal

The lack of opportunities for exiting unemployment and underemployment and for those employed the futility of the search for advancement from declining earnings constitutes a major socio-economic disaster.

I Twenty Nine Million Unemployed/Underemployed. The employment situation report of the Bureau of Labor Statistics (BLS) is rich in useful information on the state of the economy. Table 1 summarizes the report released on Oct 7. Nonfarm payroll jobs in the survey of employing establishments registered an increase in new jobs of 103,000 in Sep from 57,000 in Aug that was revised from 0. New private payroll jobs rose 137,000 in Sep, which was an improvement relative to the revised increase of 42,000 in Aug. Part of the increase in new jobs was due to the return to work of striking workers: “The increase in employment partially reflected the return to payrolls of about 45,000 telecommunications workers who had been on strike in August” (http://www.bls.gov/news.release/pdf/empsit.pdf 1). The establishment survey also provides average hourly earnings and average weekly hours worked. Average hourly earnings (AHE) without adjustment for inflation rose 1.9 percent in Sep 2011 relative to Sep 2010 and 0.2 percent relative to Aug 2011. Table 1 also provides the BLS calculation of AHEs in constant dollars, or adjusted for inflation, which fell 1.9 percent in Sep 2011 relative to Sep 2010 and fell 0.6 percent relative to Aug 2011. Average weekly hours fell from 34.2 in Aug to 34.3 in Sep. The wage bill or number of hours worked times average hourly earnings fell in real terms. The remuneration to labor is falling after adjusting for inflation. The BLS also conducts a survey of households that provides the rate of unemployment, or unemployed as percent of the labor force, which was 9.1 percent in both Sep and Aug. The rate of job creation would have to exceed around 125,000 per month of new entrants in the labor force to reduce the rate of unemployment. This blog provides with release of every employment situation report an estimate of the number in job stress, which is 29.4 million in Sep and 29.5 million in Aug. The number of people in job stress as percent of the labor force is estimated at 18.5 percent in Sep 2011 and 18.6 percent in Aug 2011. The average rate of 2.4 percent seasonally-adjusted average rates (SAAR) of economic growth in the current recovery is mediocre relative to 6.2 percent average GDP SAARs in past recoveries. As a result there are more than 29 million people unemployed, working part-time for economic reasons because they cannot find full-time employment or marginally attached to the labor force. The rate of economic growth in the first half of 2011 is equivalent to 0.8 percent for a full year. The fractured job market of the US continues to deteriorate.

Table 1, US, Summary of the Employment Situation Report SA

| Sep | Aug | |

| New Nonfarm Payroll Jobs | 103,000 | 57,000 |

| New Private Payroll Jobs | 137,000 | 42,000 |

| Average Hourly Earnings | $23.12 ∆% Sep11/Sep 10: 1.9 ∆% Sep11/Aug11: 0.2 | $23.08 ∆% Aug11/Aug 10: 1.8 ∆% Aug 11/Jul 11: –0.2 |

| Average Hourly Earnings in Constant Dollars | $10.20 ∆% Sep 11/Sep 10: –1.9% ∆% Sep 11/Aug 11: –0.6 | $10.26 ∆% Aug 11/Aug 10: –1.3 ∆% Aug 11/Jul 11: 0.0 |

| Average Weekly Hours | 34.3 | 34.2 |

| Unemployment Rate Household Survey % of Labor Force | 9.1 | 9.1 |

| Number in Job Stress Unemployed and Underemployed Blog Calculation | 29.4 million NSA | 29.5 million NSA |

| In Job Stress as % Labor Force | 18.5 | 18.6 |

Source: Tables 2, 3, 4, 8 and 9.

The Bureau of Labor Statistics (BLS) released the employment situation report on Fri Oct 7 showing an unchanged seasonally adjusted rate of unemployment, or unemployed as percent of the labor force, of 9.1 percent in Sep 2011, which is identical to 9.1 percent in Aug and Jul 2011 (http://www.bls.gov/news.release/pdf/empsit.pdf). There are two approaches to calculating the number of people in job stress. The first approach of calculating the number of people in job stress unemployed or underemployed in Table 2 is 25.8 million seasonally-adjusted in Sep, compared with 25.4 million in Aug and 25.1 million in Jul. The number in job stress unemployed or underemployed of 25.8 million in Sep is composed of 13.9 million unemployed (of whom 6.2 million, or 44.6 percent, unemployed for 27 weeks or more) compared with 13.9 million unemployed in Aug (of whom 6.0 million, or 43.2 percent, unemployed for 27 weeks or more), 9.3 million employed part-time for economic reasons in Sep (who suffered reductions in their work hours or could not find full-time employment) compared with 8.8 million in Aug and 2.5 million who were marginally attached to the labor force in Sep (who were not in the labor force but wanted and were available for work) compared with 2.6 million in Aug.

Table 2, US, People in Job Stress, Millions and % SA

| Sep | Aug | Jul | |

| Unemployed | 13.992 | 13.967 | 13.931 |

| Unemployed ≥27 weeks | 6.242 | 6.034 | 6.185 |

| Unemployed ≥27 weeks % | 44.6 | 43.2 | 44.4 |

| Part Time Economic Reasons ∆% Sep/Aug: +440 thousand | 9.270 | 8.826 | 8.396 |

| Marginally ∆% Sep/Aug: -64 thousand | 2.511 | 2.575 | 2.785 |

| Job Stress ∆% Sep/Aug: +405 thousand | 25.773 | 25.368 | 25.112 |

| Unemploy- | 9.1 | 9.1 | 9.1 |

Job Stress = Unemployed + Part Time Economic Reasons + Marginally Attached Labor Force

Source: http://www.bls.gov/news.release/pdf/empsit.pdf

In an article published by the Financial Times, Feldstein (2011Jul25) calculates 29 million Americans who are unable to find the job they desire. Comments in this blog have been providing a calculation of unemployed or underemployed in the US of around 29 million. Additional information provides deeper insight on the fractured job market of the US. Table 3 consists of data and additional calculations using the BLS household survey, illustrating the possibility that the actual rate of unemployment could be 11.6 percent and the number of people in job stress could be closer to 30 million, which is 18.5 percent of the labor force. The first column provides for 2006 the yearly average population (POP), labor force (LF), participation rate or labor force as percent of population (PART %), employment (EMP), employment population ratio (EMP/POP %), unemployment (UEM), the unemployment rate as percent of labor force (UEM/LF Rate %) and the number of people not in the labor force (NLF). The numbers in column 2006 are averages in millions while the monthly numbers for Aug 2010 and Aug and Jul 2011 are in thousands, not seasonally adjusted. The average yearly participation rate of the population in the labor force was in the range of 62.0 percent minimum to 67.1 percent maximum between 2000 and 2006 with the average of 66.4 percent (ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf). The objective of Table 3 is to assess how many people could have left the labor force because they do not think they can find another job. Row “LF PART 66.2 %” applies the participation rate of 2006, almost equal to the rates for 2000 to 2006, to the population in Sep 2010 and Aug and Sep 2011 to obtain what would be the labor force of the US if the participation rate had not changed. In fact, the participation rate fell to 64.6 percent by Sep 2010 and was 64.3 percent in Aug 2011 and 64.2 percent in Sep 2011, suggesting that many people simply gave up on finding another job. Row “∆ NLF UEM” calculates the number of people not counted in the labor force because they could have given up on finding another job by subtracting from the labor force with participation rate of 66.2 percent (row “LF PART 66.2%”) the labor force estimated in the household survey (row “LF”). Total unemployed (row “Total UEM”) is obtained by adding unemployed in row “∆NLF UEM” to the unemployed of the household survey in row “UEM.” The row “Total UEM%” is the effective total unemployed “Total UEM” as percent of the effective labor force in row “LF PART 66.2%.” The results are that: (1) there are an estimated 4.905 million unemployed who are not counted because they left the labor force on their belief they could not find another job (∆NLF UEM); (2) the total number of unemployed is effectively 18.425 million (Total UEM) and not 13.520 million (UEM) of whom many have been unemployed long term; (3) the rate of unemployment is 11.6 percent (Total UEM%) and not 8.8 percent, not seasonally adjusted, or 9.1 percent seasonally adjusted; and (4) the number of people in job stress is close to 30 million by adding the 4.905 million leaving the labor force because they believe they could not find another job. The row “In Job Stress in Table 3 provides the number of people in job stress not seasonally adjusted at 29.359 million in Sep 2011, adding the total number of unemployed (“Total UEM”), plus those involuntarily in part-time jobs because they cannot find anything else (“Part Time Economic Reasons”) and the marginally attached to the labor force (“Marginally attached to LF”). The final row of Table 3 shows that the number of people in job stress is equivalent to 18.5 percent of the labor force. The employment population ratio “EMP/POP %” dropped from 62.9 percent on average in 2006 to 58.6 percent in Sep 2010, 58.5 percent in Aug 2011 and 58.5 percent in Sep 2011 and the number employed (EMP) dropped from 144 million to 140 million. What really matters for labor input in production and wellbeing is the number of people with jobs or the employment/population ratio, which has declined and does not show signs of increasing. There are almost four million fewer people working in 2011 than in 2006 and the number employed is not increasing. The number of hiring relative to the number unemployed measures the chances of becoming employed. The number of hiring in the US economy has declined by 17 million and does not show signs of increasing (http://cmpassocregulationblog.blogspot.com/2011/09/financial-turbulence-wriston-doctrine.html http://cmpassocregulationblog.blogspot.com/2011/03/slow-growth-inflation-unemployment-and.html see section IV Hiring Collapse in http://cmpassocregulationblog.blogspot.com/2011/08/world-financial-turbulence-global.html http://cmpassocregulationblog.blogspot.com/2011/06/increasing-risk-aversion-analysis-of.html).

Table 3, US, Population, Labor Force and Unemployment, NSA

| 2006 | Sep 2010 | Aug 2011 | Sep 2011 | |

| POP | 229 | 238,322 | 239,871 | 240,071 |

| LF | 151 | 153,854 | 154,344 | 154,022 |

| PART% | 66.2 | 64.6 | 64.3 | 64.2 |

| EMP | 144 | 139,715 | 140,335 | 140,502 |

| EMP/POP% | 62.9 | 58.6 | 58.5 | 58.5 |

| UEM | 7 | 14,140 | 14,008 | 13,520 |

| UEM/LF Rate% | 4.6 | 9.2 | 9.1 | 8.8 |

| NLF | 77 | 84,468 | 85,528 | 86,049 |

| LF PART 66.2% | 157,769 | 158,795 | 158,927 | |

| ∆NLF UEM | 3,915 | 4,451 | 4,905 | |

| Total UEM | 18,055 | 18,459 | 18,425 | |

| Total UEM% | 11.4 | 11.6 | 11.6 | |

| Part Time Economic Reasons | 8,540 | 8,463 | 8,423 | |

| Marginally Attached to LF | 2,548 | 2,575 | 2,511 | |

| In Job Stress | 29,143 | 29,497 | 29,359 | |

| People in Job Stress as % Labor Force | 18.5 | 18.6 | 18.5 |

Pop: population; LF: labor force; PART: participation; EMP: employed; UEM: unemployed; NLF: not in labor force; ∆NLF UEM: additional unemployed; Total UEM is UEM + ∆NLF UEM; Total UEM% is Total UEM as percent of LF PART 66.2%; In Job Stress = Total UEM + Part Time Economic Reasons + Marginally Attached to LF

Note: the first column for 2006 is in average millions; the remaining columns are in thousands; NSA: not seasonally adjusted

The labor force participation rate of 66.2% in 2006 is applied to current population to obtain LF PART 66.2%; ∆NLF UEM is obtained by subtracting the labor force with participation of 66.2 percent from the household survey labor force LF; Total UEM is household data unemployment plus ∆NLF UEM; and total UEM% is total UEM divided by LF PART 66.2%

Sources:

ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf

http://www.bls.gov/news.release/archives/empsit_12032010.pdf

http://www.bls.gov/news.release/pdf/empsit.pdf

Total nonfarm payroll employment seasonally adjusted (SA) rose 103,000 in Aug and private payroll employment rose by 137,000. Table 4 provides the monthly change in jobs seasonally adjusted in the prior strong contraction of 1981-1982 and the recovery in 1983 into 1984 and in the contraction of 2008-2009 and in the recovery in 2009 to 2011. All revisions have been incorporated in Table 4. The data in the recovery periods are in relief to facilitate comparison. There is significant bias in the comparison. The average yearly civilian noninstitutional population was 174.2 million in 1983 and the civilian labor force 111.6 million, growing by 2009 to an average yearly civilian noninstitutional population of 235.8 million and civilian labor force of 154.1 million, that is, increasing by 35.4 percent and 38.1 percent, respectively (http://www.bls.gov/cps/cpsaat1.pdf). Total nonfarm payroll jobs in 1983 were 90.280 million, jumping to 94.530 million in 1984 while total nonfarm jobs in 2010 were 129.818 million declining from 130.807 million in 2009 (http://www.bls.gov/webapps/legacy/cesbtab1.htm ). What is striking about the data in Table 4 is that the numbers of monthly increases in jobs in 1983 are several times higher than in 2010 to 2011 even with population higher by 35.4 percent and labor force higher by 38.1 percent in 2009 relative to 1983 nearly three decades ago and total number of jobs in payrolls rose by 39.5 million in 2010 relative to 1983 or by 43.8 percent.. Growth has been mediocre in the six quarters of expansion beginning in IIIQ2009 in comparison with earlier expansions (http://cmpassocregulationblog.blogspot.com/2011/10/us-growth-standstill-at-08-percent.html http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html http://cmpassocregulationblog.blogspot.com/2011/07/growth-recession-debt-financial-risk.html http://cmpassocregulationblog.blogspot.com/2011/07/causes-of-2007-creditdollar-crisis.html http://cmpassocregulationblog.blogspot.com/2011/06/financial-risk-aversion-slow-growth.html http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html http://cmpassocregulationblog.blogspot.com/2011/05/mediocre-growth-world-inflation.html http://cmpassocregulationblog.blogspot.com/2011/03/slow-growth-inflation-unemployment-and.html http://cmpassocregulationblog.blogspot.com/2011/02/mediocre-growth-raw-materials-shock-and.html) and also in terms of what is required to reduce the job stress of at least 25 million persons but likely close to 30 million. Some of the job growth and contraction in 2010 in Table 4 is caused by the hiring and subsequent layoff of temporary workers for the 2010 census.

Table 4, US, Monthly Change in Jobs, Number SA

| Month | 1981 | 1982 | 1983 | 2008 | 2009 | 2010 | Private |

| Jan | 95 | -327 | 225 | 13 | -820 | -39 | -42 |

| Feb | 67 | -6 | -78 | -83 | -726 | -35 | -21 |

| Mar | 104 | -129 | 173 | -72 | -796 | 192 | 144 |

| Apr | 74 | -281 | 276 | -185 | -660 | 277 | 229 |

| May | 10 | -45 | 277 | -233 | -386 | 458 | 48 |

| Jun | 196 | -243 | 378 | -178 | -502 | -192 | 65 |

| Jul | 112 | -343 | 418 | -231 | -300 | -49 | 93 |

| Aug | -36 | -158 | -308 | -267 | -231 | -59 | 110 |

| Sep | -87 | -181 | 1114 | -434 | -236 | -29 | 109 |

| Oct | -100 | -277 | 271 | -509 | -221 | 171 | 143 |

| Nov | -209 | 124 | 352 | -802 | -55 | 93 | 128 |

| Dec | -278 | -14 | 356 | -619 | -130 | 152 | 167 |

| 1984 | 2011 | Private | |||||

| Jan | 447 | 68 | 94 | ||||

| Feb | 479 | 235 | 261 | ||||

| Mar | 275 | 194 | 219 | ||||

| Apr | 363 | 217 | 241 | ||||

| May | 308 | 53 | 99 | ||||

| Jun | 379 | 20 | 75 | ||||

| Jul | 312 | 127 | 173 | ||||

| Aug | 241 | 57 | 42 | ||||

| Sep | 311 | 103 | 137 | ||||

| Oct | 286 | ||||||

| Nov | 349 | ||||||

| Dec | 127 |

Source: http://data.bls.gov/PDQ/servlet/SurveyOutputServlet

http://www.bls.gov/webapps/legacy/cesbtab1.htm

http://www.bls.gov/schedule/archives/empsit_nr.htm#2010

http://www.bls.gov/news.release/pdf/empsit.pdf

The following eight charts provide the comparison of job creation in the current cyclical expansion with that of recovery from a similar drop in GDP in the 1980s. Chart 1 of the dataset of the Bureau of Labor Statistics (BLS) shows strong recovery in creation of seasonally-adjusted total nonfarm payroll jobs, including private and government jobs, in the earlier cyclical expansion from much lower drop in output in 2001 and the sharper drop and milder job creation impulse in the current cyclical recovery

Chart 1, US, Total Nonfarm Payroll Jobs SA 2001-2011

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Chart 2 provides total nonfarm job creation in 2001 to 2011 without seasonal adjustment. The curve is smoothed by seasonal adjustment. The current recovery is weaker.

Chart 2, US, Total Nonfarm Payroll Jobs NSA 2001-2011

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Chart 3 provides total nonfarm payroll job creation between 1979 and 1989 seasonally adjusted. The two contraction in 1980 and 1981 to 1982 accumulated decline of GDP of 4.8 percent that is similar to the drop of GDP of 5.1 percent from IVQ2007 to IIQ2009. Recovery of job creation was incomparably faster than during the current cyclical expansion after IIIQ2009.

Chart 3, US, Total Nonfarm Payroll Jobs SA 1979-1989

Source: US Bureau of Labor Statistics

The curve of job creation without seasonal adjustment in 1979-1989 is shown in Chart 4. There are fluctuations around a sharp upward trend of recovery of employment.

Chart 4, US, Total Nonfarm Payroll Jobs NSA 1979-1989

Source: US Bureau of Labor Statistics

Total private payroll job creation, excluding government jobs, seasonally-adjusted, is provided in Chart 5 for the years between 2001 and 2011. Private sector job creation is not moving as fast as required to reduce job stress of 29 million people.

Chart 5, US, Total Private Payroll Jobs SA 2001-2011

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Total private job creation is shown in Chart 6 without seasonal adjustment in 2001-2011. The data illustrate the fact observed from hiring in the JOLTS report. The current recovery is characterized by much weaker hiring by the private sector that is the opportunity for exiting unemployment/underemployment and advancing in real income. Private sector hiring has fallen by 17 million yearly without signs of recovery.

Chart 6, US, Total Private Payroll Jobs NSA 2001-2011

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Chart 7 shows the upward surge of total private job creation seasonally adjusted in the years 1979 to 1989. Much faster economic growth was followed with rapid private job creation.

Chart 7, US, Total Private Payroll Jobs SA 1979-1989

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Finally, Chart 8 shows total private job creation not seasonally adjusted. Fluctuations occurred around a sharp upward trend of private job creation.

Chart 8, US Total Private Payroll Jobs NSA 1979-1989

Source: US Bureau of Labor Statistics http://www.bls.gov/data/

Important aspects of growth of payroll jobs from Sep 2010 to Sep 2011, not seasonally adjusted (NSA), are provided in Table 5. Total nonfarm employment increased by 1,462,000 (row A), consisting of growth of total private employment by 1,789,000 (row B) and decline by 327,000 of government employment (row C). Monthly average growth of private payroll employment has been 149,0833, which is mediocre relative to 25 to 30 million in job stress, while total nonfarm employment has grown on average by only 121,833 per month. These monthly rates of job creation are insufficient to meet the demands of new entrants in the labor force and thus perpetuate unemployment and underemployment. Manufacturing employment increased by 195,000 while private service providing employment grew by 1,459,000. The employment situation report of the Bureau of Labor Statistics informs that (http://www.bls.gov/news.release/pdf/empsit.pdf 2): “Employment in professional and business services increased by 48,000 over the month [of Sep 2011] and has grown by 897,000 since a recent low in September 2009. Employment in temporary help services edged up in September; this industry has added 53,000 jobs over the past 3 months.” An important feature is that jobs in temporary help services increased by 170,000. This episode of jobless recovery is characterized by part-time jobs and creation of jobs that are inferior to those that have been lost. Monetary and fiscal stimuli fail to increase consumption in a fractured job market. An important characteristic is that the losses of government jobs have been high in local government, 243,000 jobs lost in that past twelve months (row C3 Local), because of the higher number of employees in local government, 13.8 million relative to 5.1 million in state jobs and 2.8 million in federal jobs.

Table 5, Employees in Nonfarm Payrolls Not Seasonally Adjusted in Thousands

| Sep 2010 | Sep 2011 | Change | |

| A Total Nonfarm | 130,090 | 131,552 | 1,462 |

| B Total Private | 108,004 | 109,793 | 1,789 |

| B1 Goods Producing | 18,105 | 18,435 | 330 |

| B1a Manu-facturing | 11,628 | 11,823 | 195 |

| B2 Private service providing | 89,899 | 91,358 | 1,459 |

| B2a Professional and Business Services | 16,801 | 17,350 | 549 |

| B2b Temporary help services | 2,181 | 2,351 | 170 |

| C Government | 22,086 | 21,759 | -327 |

| C1 Federal | 2,863 | 2,827 | -36 |

| C2 State | 5,146 | 5,098 | -48 |

| C3 Local | 14,077 | 13,834 | -243 |

Note: A = B+C, B = B1 + B2, C=C1 + C2 + C3

Source:

http://www.bls.gov/news.release/pdf/empsit.pdf

The NBER dates recessions in the US from peaks to troughs as: IQ80 to IIIQ80, IIIQ81 to IV82 and IVQ07 to IIQ09 (http://www.nber.org/cycles/cyclesmain.html). Table 6 provides total annual level nonfarm employment in the US for the 1980s and the 2000s, which is different from 12 months comparisons. Nonfarm jobs rose by 4.853 million in 1982 to 1984, or 5.4 percent, and continued rapid growth in the rest of the decade. In contrast, nonfarm jobs are down by 7.780 million in 2010 relative to 2007 and fell by 989,000 in 2010 relative to 2009 even after six quarters of GDP growth. Monetary and fiscal stimuli have failed in increasing growth to rates required for mitigating job stress. The initial growth impulse reflects a flatter growth curve in the current expansion.

Table 6, Total Nonfarm Employment in Thousands

| Year | Total Nonfarm | Year | Total Nonfarm |

| 1980 | 90,528 | 2000 | 131,785 |

| 1981 | 91,289 | 2001 | 131,826 |

| 1982 | 89,677 | 2002 | 130,341 |

| 1983 | 90,280 | 2003 | 129,999 |

| 1984 | 94,530 | 2004 | 131,435 |

| 1985 | 97,511 | 2005 | 133,703 |

| 1986 | 99,474 | 2006 | 136,086 |

| 1987 | 102,088 | 2007 | 137,598 |

| 1988 | 105,345 | 2008 | 136,790 |

| 1989 | 108,014 | 2009 | 130,807 |

| 1990 | 109,487 | 2010 | 129,818 |

Source: http://www.bls.gov/webapps/legacy/cesbtab1.htm

The highest average yearly percentage of unemployed to the labor force since 1940 was 14.6 percent in 1940 followed by 9.9 percent in 1941, 8.5 percent in 1975, 9.7 percent in 1982 and 9.6 percent in 1983 (ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf). The rate of unemployment remained at high levels in the 1930s, rising from 3.2 percent in 1929 to 22.9 percent in 1932 in one estimate and 23.6 percent in another with real wages increasing by 16.4 percent (Margo 1993, 43; see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 214-5). There are alternative estimates of 17.2 percent or 9.5 percent for 1940 with real wages increasing by 44 percent. Employment declined sharply during the 1930s. The number of hours worked remained in 1939 at 29 percent below the level of 1929 (Cole and Ohanian 1999). Private hours worked fell in 1939 to 25 percent of the level in 1929. The policy of encouraging collusion through the National Industrial Recovery Act (NIRA), to maintain high prices, together with the National Labor Relations Act (NLRA), to maintain high wages, prevented the US economy from recovering employment levels until Roosevelt abandoned these policies toward the end of the 1930s (for review of the literature analyzing the Great Depression see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 198-217).

The Bureau of Labor Statistics (BLS) makes yearly revisions of its establishment survey (Harris 2011BA):

“With the release of data for January 2011, the Bureau of Labor Statistics (BLS) introduced its annual revision of national estimates of employment, hours, and earnings from the Current Employment Statistics (CES) monthly survey of nonfarm establishments. Each year, the CES survey realigns its sample-based estimates to incorporate universe counts of employment—a process known as benchmarking. Comprehensive counts of employment, or benchmarks, are derived primarily from unemployment insurance (UI) tax reports that nearly all employers are required to file with State Workforce Agencies.”

The number of not seasonally adjusted total private jobs in the US in Dec 2010 is 108.464 million, declining to 106.079 million in Jan 2011, or by 2.385 million, because of the adjustment of a different benchmark and not actual job losses. The not seasonally adjusted number of total private jobs in Dec 1984 is 80.250 million, declining to 78.704 million in Jan 1985, or by 1.546 million for the similar adjustment. Table 7 attempts to measure job losses and gains in the recessions and expansions of 1981-1985 and 2007-2011. The final ten rows provide job creation from May 1983 to May 1984 and from May 2010 to May 2011, that is, at equivalent stages of the recovery from two comparable strong recessions. The row “Change ∆%” for May 1983 to May 1984 shows an increase of total nonfarm jobs by 4.9 percent and of 5.9 percent for total private jobs. The row “Change ∆%” for May 2010 to May 2011 shows an increase of total nonfarm jobs by 0.7 percent and of 1.7 percent for total private jobs. The last two rows of Table 11 provide a calculation of the number of jobs that would have been created from May 2010 to May 2011 if the rate of job creation had been the same as from May 1983 to May 1984. If total nonfarm jobs had grown between May 2010 and May 2011 by 4.9 percent, as between May 1983 and May 1984, 6.409 million jobs would have been created in the past 12 months for a difference of 5.457 million more total nonfarm jobs relative to 0.952 million jobs actually created. If total private jobs had grown between May 2010 and May 2011 by 5.9 percent as between May 1983 and May 1984, 6.337 million private jobs would have been created for a difference of 4.539 million more total private jobs relative to 1.798 million jobs actually created.

Table 7, Total Nonfarm and Total Private Jobs Destroyed and Subsequently Created in Two Recessions IIIQ1981-IVQ1982 and IVQ2007-IIQ2009, Thousands and Percent

| Total Nonfarm Jobs | Total Private Jobs | |

| 06/1981 # | 92,288 | 75,969 |

| 11/1982 # | 89,482 | 73,260 |

| Change # | -2,806 | -2,709 |

| Change ∆% | -3.0 | -3.6 |

| 12/1982 # | 89,383 | 73,185 |

| 05/1984 # | 94,471 | 78,049 |

| Change # | 5,088 | 4,864 |

| Change ∆% | 5.7 | 6.6 |

| 11/2007 # | 139,090 | 116,291 |

| 05/2009 # | 131,626 | 108,601 |

| Change % | -7,464 | -7,690 |

| Change ∆% | -5.4 | -6.6 |

| 12/2009 # | 130,178 | 107,338 |

| 05/2011 # | 131,753 | 108,494 |

| Change # | 1,575 | 1,156 |

| Change ∆% | 1.2 | 1.1 |

| 05/1983 # | 90,005 | 73,667 |

| 05/1984 # | 94,471 | 78,049 |

| Change # | 4,466 | 4,382 |

| Change ∆% | 4.9 | 5.9 |

| 05/2010 # | 130,801 | 107,405 |

| 05/2011 # | 131,753 | 109,203 |

| Change # | 952 | 1,798 |

| Change ∆% | 0.7 | 1.7 |

| Change # by ∆% as in 05/1984 to 05/1985 | 6,409* | 6,337** |

| Difference in Jobs that Would Have Been Created | 5,457 = | 4,539 = |

*[(130,801x1.049)-130,801] = 6,409 thousand

**[(107,405)x1.059 – 107,405] = 6,337 thousand

Source: http://data.bls.gov/pdq/SurveyOutputServlet

II Falling Real Wages. The wage bill is the average weekly hours times the earnings per hour. Table 8 provides the estimates by the BLS of earnings per hour seasonally adjusted, increasing from $22.70/hour in Sep 2010 to $23.12/hour in Sep 2011, or by 1.9 percent. There is disappointment in valuation of stocks about the pace of wage increases because of rising food and energy costs that inhibit consumption and thus sales and similar concern about growth of consumption that accounts for 70 percent of GDP. Average private weekly earnings increased slightly by $16.68 from $776.34 in Sep 2010 to $793.02 in Sep 2011 or by 2.1 percent. The inflation-adjusted wage bill can only be calculated for Aug, which is the most recent month for which there are estimates of the consumer price index. Earnings per hour rose from $22.67 in Aug 2010 to $23.08 in Aug 2011 or by 1.8 percent (http://www.bls.gov/data/) and were equal in Sep 2011 at $23.12; average weekly earnings declined from $793.02 in Jul 2011 to $789.34 in Aug, 2011 and were equal at $793.02 in Sep 2011. The number of average weekly hours was unchanged from 34.2 in Aug 2010 to 34.2 in Aug 2011 or by 0.0 percent (http://www.bls.gov/data/). The wage bill rose 1.99 percent in the 12 months ending in Aug, 2011:

{[(wage bill in Aug 2011)/(wage bill in Aug 2010)-1]100 = [($23.12x34.2)/($22.67x34.2)-1]100

= [($790.70/$$775.31)-1]100} = 1.99%

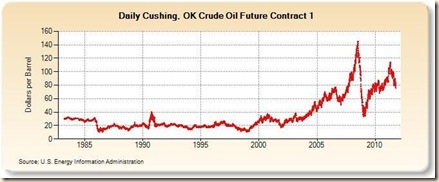

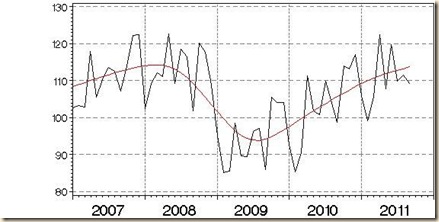

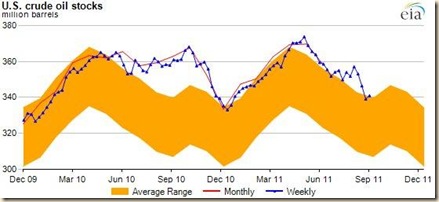

CPI inflation was 3.8 percent in the 12 months ending in Aug 2011 (http://www.bls.gov/news.release/cpi.nr0.htm) for an inflation-adjusted wage-bill decline of 1.7 percent :{[(1.0199/1.038)-1]100}. Energy and food price increases are similar to a “silent tax” that is highly regressive, harming the most those with lowest incomes. There are concerns that the wage bill would deteriorate in purchasing power because of renewed raw materials shock in the form of increases in prices of commodities such as the 31.1 percent steady increase in the DJ-UBS Commodity Index from Jul 2, 2010 to Sep 2, 2011. The charts of four commodity price indexes by Bloomberg show steady increase since Jul 2, 2010 that was interrupted briefly only in Nov with the sovereign issues in Europe triggered by Ireland, in Mar by the earthquake and tsunami in Japan and in the beginning of May by the decline in oil prices and the sovereign risk difficulties in Europe (http://www.bloomberg.com/markets/commodities/futures/).

Table 8, Earnings per Hour and Average Weekly Hours SA

| Earnings per Hour | Sep 2010 | Jul 2011 | Aug 2011 | Sep 2011 |

| Total Private | $22.70 | $23.12 | $23.08 | $23.12 |

| Goods Producing | $24.15 | $24.45 | $24.43 | $24.46 |

| Service Providing | $22.36 | $22.80 | $22.76 | $22.80 |

| Average Weekly Earnings | ||||

| Total Private | $776.34 | $793.02 | $789.34 | $793.02 |

| Goods Producing | $958.76 | $973.11 | $972.31 | $975.95 |

| Service Providing | $740.12 | $759.24 | $753.36 | $756.96 |

| Average Weekly Hours | ||||

| Total Private | 34.2 | 34.3 | 34.2 | 34.3 |

| Goods Producing | 39.7 | 39.8 | 39.8 | 39.9 |

| Service Providing | 33.1 | 33.3 | 33.1 | 33.2 |

Source: http://www.bls.gov/news.release/pdf/empsit.pdf

Chart 9 provides average weekly hours of all employees from 2006 to 2011 seasonally adjusted. The data are in current dollar, that is, without adjusting for inflation, which is provided below. Average weekly hours in nominal or current dollars collapsed during the global recession, rose sharply in the early phase of recovery and now are trendless or stagnated.

Chart 9, US, Average Weekly Hours of All Employees 2006-2011 SA

Source: Bureau of Labor Statistics

Chart 10 provides average weekly earnings of all employees in the US. There is an upward trend throughout the months from 2006 to 2011 with perhaps flattening in the last few months.

Chart 10, US, Average Weekly Earnings of All Employees, SA 2006-2011

Source: Bureau of Labor Statistics

Calculations with BLS data of inflation-adjusted average hourly earnings are shown in Table 9. The final column of Table 9 (“12 Month Real ∆%”) provides inflation-adjusted average hourly earnings of all employees in the US. Average hourly earnings rose above inflation throughout the first eight months of 2007 just before the global recession that began in the final quarter of 2007. In contrast, average hourly earnings of all US workers have risen less than inflation in most months in 2010 and 2011 and the loss has accelerated to 1.9 percent in Aug 2011, which is the most recent month for which there are consumer price index data.

Table 9, US, Average Hourly Earnings Nominal and Inflation Adjusted, Dollars and % NSA

| AHE ALL | 12 Month | ∆% 12 Month CPI | 12 Month | |

| 2007 | ||||

| Jan* | $20.70* | 4.2* | 2.1 | 2.1* |

| Feb* | $20.79* | 4.1* | 2.4 | 1.7* |

| Mar | $20.78 | 3.6 | 2.8 | 0.8 |

| Apr | $20.85 | 3.5 | 2.6 | 0.7 |

| May | $20.89 | 3.8 | 2.7 | 1.1 |

| Jun | $21.00 | 3.8 | 2.7 | 1.1 |

| Jul | $21.04 | 3.7 | 2.4 | 1.3 |

| Aug | $21.03 | 3.5 | 1.9 | 1.6 |

| 2010 | ||||

| Jan | $22.44 | 1.9 | 2.6 | -0.7 |

| Feb | $22.48 | 1.9 | 2.1 | -0.2 |

| Mar | $22.48 | 1.8 | 2.3 | -0.5 |

| Apr | $22.52 | 1.8 | 2.2 | -0.4 |

| May | $22.57 | 1.9 | 2.0 | -0.1 |

| Jun | $22.57 | 1.8 | 1.1 | 0.7 |

| Jul | $22.61 | 1.8 | 1.2 | 0.6 |

| Aug | $22.67 | 1.8 | 1.1 | 0.7 |

| 2011 | ||||

| Jan | $22.86 | 1.9 | 1.6 | 0.3 |

| Feb | $22.88 | 1.8 | 2.1 | -0.3 |

| Mar | $22.89 | 1.8 | 2.7 | -0.9 |

| Apr | $22.93 | 1.8 | 3.2 | -1.4 |

| May | $23.02 | 1.9 | 3.6 | -1.6 |

| Jun | $23.01 | 1.9 | 3.6 | -1.6 |

| Jul | $23.12 | 2.3 | 3.6 | -1.3 |

| Aug | $23.08 | 1.8 | 3.8 | -1.9 |

| Sep | $23.12 | 1.9 |

Note: AHE ALL: average hourly earnings of all employees; CPI: consumer price index; Real: adjusted by CPI inflation; NA: not available

*AHE of production and nonsupervisory employees because of unavailability of data for all employees

Source: http://data.bls.gov/cgi-bin/surveymost?bls

ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

Average hourly earnings of all US employees in the US in constant dollars of 1982-1984 from the dataset of the US Bureau of Labor Statistics (BLS) are provided in Table 10. Average hourly earnings fell 1.9 percent after adjusting for inflation in the 12 months ending in Aug 2011. Table 10 confirms the trend of deterioration of purchasing power of average hourly earnings in 2011. Those who still work bring back home a paycheck that buys fewer goods than a year earlier.

Table 10, US, Average Hourly Earnings of All Employees 1982-1984 Dollars

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug |

| 2006 | 10.04 | 10.04 | 10.00 | 10.02 | 10.00 | 9.97 | ||

| 2007 | 10.13 | 10.12 | 10.12 | 10.12 | 10.10 | 10.14 | 10.13 | 10.13 |

| 2008 | 10.02 | 10.01 | 10.03 | 10.01 | 10.00 | 9.95 | 9.88 | 9.93 |

| 2009 | 10.39 | 10.37 | 10.39 | 10.40 | 10.39 | 10.34 | 10.34 | 10.33 |

| 2010 | 10.32 | 10.33 | 10.33 | 10.35 | 10.39 | 10.41 | 10.39 | 10.40 |

| 2011 | 10.34 | 10.29 | 10.24 | 10.22 | 10.24 | 10.26 | 10.26 | 10.20 |

| ∆% 20011 /2010 | 0.2 | 0.6 | -0.8 | -1.3 | -1.4 | -1.4 | -1.3 | -1.9 |

Source: Bureau of Labor Statistics

The deterioration of purchasing power of the average hourly earnings of US workers is shown by Chart 11 of the US Bureau of Labor Statistics. Chart 11 plots average hourly earnings of all US employees in constant 1982-1984 dollars with evident decline from 2010 to 2011.

Chart 11, US, Average Hourly Earnings of All Employees 1982-1984 Dollars

Source: Bureau of Labor Statistics http://www.bls.gov/data/

III World Financial Turbulence. The past three months have been characterized by financial turbulence, attaining unusual magnitude in the past month. Table 11, updated with every comment in this blog, provides beginning values on Oct 3 and daily values throughout the week ending on Fr Oct 7 of several financial assets. Section VI Valuation of Risk Financial Assets provides a set of more complete values. All data are for New York time at 5 PM. The first column provides the value on Fri Sep 30 and the percentage change in that prior week below the label of the financial risk asset. The first five asset rows provide five key exchange rates versus the dollar and the percentage cumulative appreciation (positive change or no sign) or depreciation (negative change or negative sign). Positive changes constitute appreciation of the relevant exchange rate and negative changes depreciation. Financial turbulence has been dominated by reactions to the new program for Greece (see section IB in http://cmpassocregulationblog.blogspot.com/2011/07/debt-and-financial-risk-aversion-and.html), doubts on the larger countries in the euro zone with sovereign risks such as Spain and Italy, the growth standstill recession and long-term unsustainable government debt in the US, worldwide deceleration of economic growth and continuing inflation. The dollar/euro rate is quoted as number of US dollars USD per one euro EUR, USD 1.3392/EUR in the first row, first column in the block for currencies in Table 15 for Fri Oct 3, appreciating to USD 1.3185/EUR on Mon Oct 3, or by 1.5 percent. Table 11 defines a country’s exchange rate as number of units of domestic currency per unit of foreign currency. USD/EUR would be the definition of the exchange rate of the US and the inverse [1/(USD/EUR)] is the definition in this convention of the rate of exchange of the euro zone, EUR/USD. A convention is required to maintain consistency in characterizing movements of the exchange rate in Table 11 as appreciation and depreciation. The first row for each of the currencies shows the exchange rate at 5 PM New York time, such as USD 1.3185/EUR on Oct 3; the second row provides the cumulative percentage appreciation or depreciation of the exchange rate from the rate on the last business day of the prior week, in this case Fri Sep 30, to the last business day of the current week, in this case Fri Oct 7, such as appreciation of 0.1 percent for the dollar to USD 1.338/EUR by Oct 7; and the third row provides the percentage change from the prior business day to the current business day. For example, the USD appreciated (negative sign) by 0.1 percent from the rate of USD 1.3392/EUR on Fri Sep 30 to the rate of USD 1.338/EUR on Fri Oct 7 {[1.338/1.3392 – 1]100 = -0.1%} and appreciated by 0.4 percent from the rate of USD 1.344 on Thu Oct 6 to USD 1.338/EUR on Fri Oct 7 {[1.338/1.344 -1]100 = -0.4%}. The dollar appreciated during the week because fewer dollars, $1.338, were required to buy one euro on Fri Oct 7 than $1.3392 required to buy one euro on Fri Sep 30. The appreciation of the dollar in the week was caused by risk aversion with risk financial investments being sold in exchange for dollar-denominated assets.

Table 11, Weekly Financial Risk Assets Oct 3 to Oct 7, 2011

| Sep 30, 2011 | M 3 | Tu 4 | W 5 | Th 6 | Fr 7 |

| USD/ 1.3392 0.8% | 1.3185 1.5% 1.5% | 1.3346 0.3% -1.2% | 1.3345 0.3% 0.0% | 1.344 -0.4% -0.7% | 1.338 0.1% 0.4% |

| JPY/ 77.04 -0.6% | 76.6455 0.5% 0.5% | 76.901 0.2% -0.3% | 76.7795 0.3% 0.1% | 76.711 0.4% 0.1% | 76.709 0.4% 0.0% |

| CHF/ 0.908 -0.9% | 0.9204 -1.4% -1.4% | 0.9178 -1.1% 0.3% | 0.9231 -1.7% -0.6% | 0.92 -1.3% 0.3% | 0.915 -0.8% 0.5% |

| CHF/EUR 0.7% | 1.2135 -0.1% -0.1% | 1.2249 -0.9% -0.9% | 1.2319 -1.4% -0.6% | 1.2369 -1.9% -0.4% | 1.2420 -2.3% -0.4% |

| USD/ 0.966 1.0352 -1.2% | 0.9537 1.0485 -1.3% -1.3% | 0.9581 1.0437 -0.8% 0.5% | 0.9651 1.0362 -0.1% 0.7% | 0.975 1.0256 0.9% 1.0% | 0.977 1.0235 1.1% 0.2% |

| 10 Year 1.912 | 1.755 | 1.833 | 1.884 | 1.995 | 2.078 |

| 2 Year T Note | 0.228 | 0.248 | 0.252 | 0.268 | 0.292 |

| German Bond 2Y 0.55 10Y 1.89 | 2Y 0.50 10Y 1.82 | 2Y 0.46 10Y 1.73 | 2Y 0.50 10Y 1.84 | 2Y 0.61 10Y 1.94 | 2Y 0.60 10Y 2.00 |

| DJIA 10913.38 1.3% | -2.4% -2.4% | -0.9% 1.4% | 0.2% 1.2% | 1.9% 1.7% | 1.7% -0.2% |

| DJ Global 1725.68 1.5% | -2.9% -2.9% | -3.3% -0.4% | -1.3% 2.1% | 1.5% 2.8% | 1.8% 0.3% |

| DJ Asia Pacific 1164.97 0.9% | -2.5% -2.5% | -4.5% -2.1% | -4.9% -0.4% | -2.2% 2.8% | -0.4% 1.9% |

| Nikkei 1.6% | -1.8% -1.8% | -2.8% -1.1% | -3.6% -0.9% | -2.0% 1.7% | -1.1% 0.9% |

| Shanghai 2359.22 -3.0% | NA | NA | NA | NA | NA |

| DAX 5.9% | -2.3% -2.3% | -5.2% -2.9% | -0.5% 4.9% | 2.6% 3.2% | 3.2% 0.5% |

| DJ UBS Comm. 140.2 -2.0 | 140.30 0.1% 0.1% | 138.35 -1.3% -1.4% | 140.4 0.1% 1.5% | 142.79 1.8% 1.7% | 141.8 1.1% -0.7% |

| WTI $ B -1.9% | 76.65 -2.6% -2.6% | 77.59 -1.4 -1.2% | 79.76 1.4% 2.8% | 82.27 4.6% 3.1% | 82.98 5.5% 0.9% |

| Brent $/B 102.28 -1.6% | 100.93 -1.3% -1.3% | 101.55 -0.7% 0.6% | 102.73 0.4% 1.2% | 104.95 2.6% 2.2% | 106.02 3.6% 1.0% |

| Gold $/OZ 1622.4 -0.2% | 1655.0 2.0% 2.0% | 1621.0 -0.1% -2.1% | 1642.2 1.2% 1.3% | 1628.1 0.3% -0.9% | 1640.6 1.1% 0.8% |

Note: USD: US dollar; JPY: Japanese Yen; CHF: Swiss

Franc; AUD: Australian dollar; Comm.: commodities; OZ: ounce

Source:

http://www.bloomberg.com/markets/

http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

There was again turbulence in financial assets with flight from risk exposures to safe havens and return to risk financial assets during the week of Oct 7. Risk aversion is present in the appreciation of the USD by 0.1 percent and the continuing strength of the Japanese yen that appreciated 0.4 percent in the week. Exchange rate controls by the Swiss National Bank (SNB) fixing the rate at a minimum of CHF 1.20/EUR (http://www.snb.ch/en/mmr/reference/pre_20110906/source/pre_20110906.en.pdf) prevented flight of capital into the Swiss franc that depreciated 2.3 percent relative to the euro and 0.8 percent relative to the dollar. Another symptom of risk aversion is the depreciation of the Australian dollar by 1.3 percent in unwinding carry trades on Mon Oct 3 but appreciation by 1.1 percent by Fri Oct 7. .

Risk aversion is also captured by decline of the yield of the 10-year Treasury note to 1.912 percent on Sep 30, increasing to 2.078 percent by Fri Oct 7 but still at a level well below consumer price inflation of 3.8 percent in the 12 months ending in Aug (http://www.bls.gov/cpi/). Investors are willing to sacrifice yield relative to inflation in defensive actions to avoid turbulence in valuations of risk financial assets. During the financial panic of Sep 2008, funds moved away from risk exposures to government securities. A similar risk aversion phenomenon occurs in Europe with low levels of the yield of the 10-year government bond on Fri Oct 7 at 0.60 percent for the two-year maturity and 2.00 percent for the 10-year maturity while the flash euro zone CPI inflation for Sep is at 3.0 percent (http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/2-30092011-AP/EN/2-30092011-AP-EN.PDF). Safety overrides inflation-adjusted yield.

There were gains in equity indexes in Europe and the US in Table 11 in the week of Fri Oct 7. The Dow Asia Pacific dropped 0.4 percent and the Nikkei Average fell 0.9 percent in the week even after solid increases on Oct 7. The gains in Oct 6 and Oct 7 were driven by optimism of a solution to the European sovereign risk dilemma by means of recapitalization of banks.

Commodities roughly tracked other risk financial assets. All three indexes commodity prices in Table 11 rose in the week of Oct 7 and the DJ UBS Commodity Index rose 1.1 percent in the week. In the absence of risk aversion, risk financial assets tend to increase in value because of the carry trade from zero interest rates. Exposures are reduced because of risk aversion, causing collapse of valuations of risk financial assets.

There are three factors dominating valuations of risk financial assets that are systematically discussed in this blog.

1. Euro zone survival risk. The fundamental issue of sovereign risks in the euro zone is whether the group of countries with euro as common currency and unified monetary policy through the European Central Bank will (i) continue to exist; (ii) downsize to a limited number of countries with the same currency; or (iii) revert to the prior system of individual national currencies.

2. United States Growth, Employment and Fiscal Soundness. Recent posts of this blog analyze the mediocre rate of growth of the US in contrast with V-shaped recovery in all expansions following recessions since World War II, deterioration of social and economic indicators, unemployment and underemployment of 30 million, decline of yearly hiring by 17 million, falling real wages and unsustainable central government or Treasury debt (http://cmpassocregulationblog.blogspot.com/2011/10/us-growth-standstill-at-08-percent.html http://cmpassocregulationblog.blogspot.com/2011/09/collapse-of-household-income-and-wealth.html http://cmpassocregulationblog.blogspot.com/2011/09/global-growth-standstill-recession.html http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html).

3. World Economic Slowdown. Careful, detailed analysis of the slowdown of the world economy is provided in Section V World Economic Slowdown. Data and analysis are provided for regions and countries that jointly account for about three quarters of world output.

The issue of rescuing sovereigns in difficulty is increasingly becoming the issue of survival of the euro. Cochrane (2011Sep28), writing in the Wall Street Journal on Sep 28, argues, contrary to official doctrine and rescue efforts, that survival of the euro requires allowing sovereigns to default and maintaining the European Central Bank (ECB) isolated from the defaults. The practical problem in the bailouts of sovereign is that the bailout fund has been approved for €440 billion while several trillion euro are required if there are difficulties with the larger sovereigns such as Italy and Spain. A proposal consists of leveraging by using the €440 billion to borrow the trillions of dollars of euro. Davies (2011Sep28) finds two options for the borrowing, both involving “other people’s money.” (1) The rescue fund would receive loans from the ECB; and (2) the rescue fund would receive loans from sovereign wealth funds of emerging markets with large reserves. Cochrane (2011Sep28) argues correctly, as it occurred with credit-risk transfer products, that the risk does not disappear but is just merely transferred. The risk would end up with the lenders such as the ECB and would deteriorate the reserves of emerging markets. Cochrane (2011Sep28) finds resemblance with the purchase of bonds before the financial crisis to increase leverage while writing CDS (credit default swaps). The ECB would find significant deterioration of its already high subprime collateral. Davies (2011Sep28) finds that the ECB would become a gigantic collateralized debt obligation (CDO). The bailout fund would issue notes for the more than one trillion euro required in the bailout that would be insured by the €440 billion, increasing the possibility of raising the loans because of the AAA rating of a few core sovereigns, in particular, Germany. The trillions of euro loans from the ECB or emerging markets could be used to acquire subprime sovereign debt and recapitalize European banks that also own some of that debt. The credit risk would be transferred almost entirely to Germany and its taxpayers who effectively guarantee the loans. Germany would be faced with the same issue as unsustainable reparations from World War II only in that in this case Germany did not provoke a war (see the classic treatment by Keynes (1929, 1929R and Ohlin 1929; see also Samuelson 1952, Johnson 1975, Darity and Frank 2003 and Lane and Milessi-Ferretti 2004).

An important article published in the Financial Times (http://www.ft.com/intl/cms/s/0/04993d2a-ef6f-11e0-941e-00144feab49a.html#axzz1a01qPYQ3 ) on Oct 5 by several authors (Patrick Jenkins, Alex Barker, Peter Spiegel, Gerrit Wiesmann and Hugh Carnegy with additional work by George Parker and Joshua Chaffin) revealed discussion at a meeting of the European Banking Authority (EBA) (http://www.eba.europa.eu/). Provisions for major write downs of European sovereign debt could cause reduction of capital in European banks by €200 billion. The meeting discussed using market values in valuation of sovereign debt held by banks. The EBA would be discussing mechanisms for forcing banks to recapitalize in accordance with loss of value of sovereign debt holdings. One possibility would be the write down of Greece’s bonds. In another article published in the Financial Times (http://www.ft.com/intl/cms/s/0/573452fe-f0ff-11e0-b56f-00144feab49a.html#axzz1aHrBA6Tq) on Oct 8, on “Merkel and Sarkozy hold talks on crisis,” Quentin Peel and Hugh Carnegy analyze talks on Oct 9 by the heads of state of Germany and France, Angela Merkel and Nicolas Sarkozy, on the financial crisis in the euro zone and how to finance the probable recapitalization of banks because of losses in holdings of sovereign debt. Quentin Peel, writing on Oct 9 on “Merkel and Sarkozy set euro deadline,” published in the Financial Times (http://www.ft.com/intl/cms/s/0/c3beacac-f29a-11e0-931e-00144feab49a.html#axzz1aHrBA6Tq) informs that France and Germany have set a deadline before the meeting of European leaders at the end of Oct to solve the euro zone financial crisis, including bank recapitalization. There no details on bank recapitalization that faces tough political opposition.

Rating agencies have been quite active in downgrades of European sovereign risks. On Oct 4, Moody’s Investors Services (2011Oct4IGB) downgraded the ratings of Italy’s government bonds to A2 with negative outlook from Aa2 but affirmed the Prime-1 rating of short-term debt. The reasons for the downgrade were: (1) risks of long-term funding of European sovereigns; (2) risks of weak economic growth because of internal slow growth and also global weakening growth; and (3) risks of implementation of government fiscal consolidation. On Oct 7, Moody’s Investor Services (2011Oct7) placed Belgium’s Aa1 ratings on local and foreign government bonds on review for “possible downgrade, while affirming its short-term ratings at Prime-1.” The reasons for the review of ratings are: (1) weakness in long-term sovereign funding markets; (2) risks of government debt in a weak growth environment; and (3) impact of bank support measures on the already weak government balance sheets. On Oct 7, Fitch Ratings (2011Oct7) downgraded the long-term rating of Spain foreign and local debt from ‘AA+’ to ‘AA-‘ and affirmed negative rating outlook. Spain’s short-term rating was affirmed at ‘F1+.’ The reason for the downgrade is a combination of deepening euro area financial crisis, regional budget weakness and doubts on medium term growth of Spain. Fitch Ratings also downgraded Italy long-term foreign and local currency debt from ‘AA-‘to ‘A+’ and maintained the outlook as negative. In an article published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424052970203388804576616772677159568.html?mod=WSJ_hp_LEFTWhatsNewsCollection) on Oct 8 on “Spain and Italy hit by downgrades,” Stephen Fidler, William Horobin and Matthew Dalton analyze the downgrades and relate them to the discussion on bank recapitalization. The meeting in Berlin of prime ministers Angela Merkel and Nicolas Sarkozy on Oct 9 and the summit of European leaders on Oct 17 and 18 may develop a hierarchy on how to proceed with bank recapitalization.

The Wriston “doctrine” on sovereign lending was predicated on the argument that countries do not bankrupt (Wriston 1982). Another Wriston idea was that the old Citibank should be more valuable dead than alive: if Citibank followed the model of the old Merrill Lynch and sold the individual components or franchises the value would be higher than that of the unbroken Citibank. There was a rise in leveraged buy outs (LBO) in the 1980s that has been extensively analyzed in academic literature (see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 159-66). The debt crisis of the 1980s and many other episodes in history actually proved that a country can bankrupt and that many countries can bankrupt simultaneously.

Welfare economics considers the desirability of alternative states, which in this case would be evaluating the “value” of Germany (1) within and (2) outside the euro zone. Is the sum of the wealth of euro zone countries outside of the euro zone higher than the wealth of these countries maintaining the euro zone? On the choice of indicator of welfare, Hicks (1975, 324) argues:

“Partly as a result of the Keynesian revolution, but more (perhaps) because of statistical labours that were initially quite independent of it, the Social Product has now come right back into its old place. Modern economics—especially modern applied economics—is centered upon the Social Product, the Wealth of Nations, as it was in the days of Smith and Ricardo, but as it was not in the time that came between. So if modern theory is to be effective, if it is to deal with the questions which we in our time want to have answered, the size and growth of the Social Product are among the chief things with which it must concern itself. It is of course the objective Social Product on which attention must be fixed. We have indexes of production; we do not have—it is clear we cannot have—an Index of Welfare.”

If the burden of the debt of the euro zone falls on Germany and France or only on Germany, is the wealth of Germany and France or only Germany higher after breakup of the euro zone or if maintaining the euro zone? In practice, political realities will determine the decision through elections.

The euro zone faces a critical survival risk because several of its members may default on their sovereign obligations if not bailed out by a few of the other members. Contrary to the Wriston doctrine, investing in sovereign obligations is a credit decision. The value of a bond today is equal to the discounted value of future obligations of interest and principal until maturity. On Oct 7, the yield of the 2-year bond of the government of Greece was quoted above 56 percent and the 10-year bond yield traded at over 24 percent. In contrast, the 2-year US Treasury note traded at 0.292 percent and the 10-year at 2.078 percent while the comparable 2-year government bond of Germany traded at 0.60 percent and the 10-year government bond of Germany traded at 2.0 percent (see Table 11). There is no need for sovereign ratings: the perceptions of investors are of relatively higher probability of default by Greece, defying Wriston (1982), and nil probability of default of the US Treasury and the German government. The essence of the sovereign credit decision is whether the sovereign will be able to finance new debt and refinance existing debt without interrupting service of interest and principal. Prices of sovereign bonds incorporate multiple anticipations such as inflation and liquidity premiums of long-term relative to short-term debt but also risk premiums on whether the sovereign’s debt can be managed as it increases without bound or close to the maximum desired by investors.

Much of the analysis and concern over the euro zone centers on the default risk of the debt of a few countries while there is little if any risk of default of the debt of the euro zone as a whole. In practice, there is convergence in valuations and concerns toward the fact that there may not be survival of the euro zone as a whole. The fluctuations of financial risk assets of members of the euro zone move together with risk aversion toward the countries with nil default probability. This movement raises the need to consider analytically sovereign debt valuation of the euro zone as a whole in the essential analysis of whether the single-currency will (or should) survive without major changes.

The prospects of survival of the euro zone are dire. Table 12 is constructed with IMF World Economic Outlook database released during the prior week for GDP in USD billions, primary net lending/borrowing as percent of GDP and general government debt as percent of GDP for selected regions and countries in 2010.

Table 12, World and Selected Regional and Country GDP and Fiscal Situation

| GDP 2010 | Primary Net Lending Borrowing | General Government Net Debt | |

| World | 62,911.2 | ||

| Euro Zone | 12,167.8 | -3.6 | 65.9 |

| Portugal | 229.2 | -6.3 | 88.7 |

| Ireland | 206.9 | -28.9 | 78.0 |

| Greece | 305.4 | -4.9 | 142.8 |

| Spain | 1,409.9 | -7.8 | 48.8 |

| Major Advanced Economies G7 | 31,716.9 | -6.5 | 76.5 |

| United States | 14,526.6 | -8.4 | 68.3 |

| UK | 2,250.2 | -7.7 | 67.7 |

| Germany | 3,286.5 | -1.2 | 57.6 |

| France | 2,562.7 | -4.9 | 76.5 |

| Japan | 5,458.8 | -8.1 | 117.2 |

| Canada | 1,577.0 | -4.9 | 32.2 |

| Italy | 2,055.1 | -0.3 | 99.4 |

| China | 5,878.3 | -2.3 | 33.8* |

| Cyprus | 23.2 | -5.3 | 61.6 |

*Gross Debt

Source: http://www.imf.org/external/pubs/ft/weo/2011/01/weodata/index.aspx

The data in Table 12 are used for some very simple calculations in Table 13. The column “Net Debt USD Billions” in Table 13 is generated by applying the percentage in Table 12 column “General Government Net Debt % GDP 2010” to the column “GDP USD Billions.” The total debt of France and Germany in 2010 is $3853.5 billion, as shown in row “B+C” in column “Net Debt USD Billions” The sum of the debt of Italy, Spain, Portugal, Greece and Ireland is $3531.6 billion. There is some simple “unpleasant bond arithmetic” in the two final columns of Table 12. Suppose the entire debt burdens of the five countries with probability of default were to be guaranteed by France and Germany, which de facto would be required by continuing the euro zone. The sum of the total debt of these five countries and the debt of France and Germany is shown in column “Debt as % of Germany plus France GDP” to reach $7385.1 billion, which would be equivalent to 126.3 percent of their combined GDP in 2010. Under this arrangement the entire debt of the euro zone including debt of France and Germany would not have nil probability of default. The final column provides “Debt as % of Germany GDP” that would exceed 224 percent if including debt of France and 165 percent of German GDP if excluding French debt. The unpleasant bond arithmetic illustrates that there is a limit as to how far Germany and France can go in bailing out the countries with unsustainable sovereign debt without incurring severe pains of their own such as downgrades of their sovereign credit ratings. A central bank is not typically engaged in direct credit because of remembrance of inflation and abuse in the past. There is also a limit to operations of the European Central Bank in doubtful credit obligations. Wriston (1982) would prove to be wrong again that countries do not bankrupt but would have a consolation prize that similar to LBOs the sum of the individual values of euro zone members outside the current agreement exceeds the value of the whole. Internal rescues of French and German banks may be less costly than bailing out other euro zone countries so that they do not default on French and German banks.

Table 13, Guarantees of Debt of Sovereigns in Euro Area as Percent of GDP of Germany and France, USD Billions and %

| Net Debt USD Billions | Debt as % of Germany Plus France GDP | Debt as % of Germany GDP | |

| A Euro Area | 8,018.6 | ||

| B Germany | 1,893.0 | $7385.1 as % of $3286.5 =224.7% $5424.6 as % of $3286.5 =165.1% | |

| C France | 1,960.5 | ||

| B+C | 3,853.5 | GDP $5849.2 Total Debt $7385.1 Debt/GDP: 126.3% | |

| D Italy | 2,042.8 | ||

| E Spain | 688.0 | ||

| F Portugal | 203.3 | ||

| G Greece | 436.1 | ||

| H Ireland | 161.4 | ||

| Subtotal D+E+F+G+H | 3,531.6 |

Source: calculation with IMF data http://www.imf.org/external/pubs/ft/weo/2011/01/weodata/index.aspx

IV Global Inflation. There is inflation everywhere in the world economy, with slow growth and persistently high unemployment in advanced economies. Table 14 updated with every post, provides the latest annual data for GDP, consumer price index (CPI) inflation, producer price index (PPI) inflation and unemployment (UNE) for the advanced economies, China and the highly-indebted European countries with sovereign risk issues. The table now includes the Netherlands and Finland that with Germany make up the set of northern countries in the euro zone that hold key votes in the enhancement of the mechanism for solution of the sovereign risk issues (http://www.ft.com/cms/s/0/55eaf350-4a8b-11e0-82ab-00144feab49a.html#axzz1G67TzFqs). Newly available data on inflation is considered below in this section. The data in Table 14 for the euro zone and its members is updated from information provided by Eurostat but individual country information is provided in this section as soon as available, following Table 14. Data for other countries in Table 14 is also updated with reports from their statistical agencies. Economic data for major regions and countries is considered in Section V World Economic Slowdown following individual country and regional data tables.

Table 14, GDP Growth, Inflation and Unemployment in Selected Countries, Percentage Annual Rates

| GDP | CPI | PPI | UNE | |

| US | 2.9 | 3.8 | 6.5 | 9.1 |

| Japan | -1.1 | 0.2 | 2.6 | 4.4 |

| China | 9.6 | 6.2 | 7.3 | |

| UK | 1.8 | 4.5* | 6.3* output | 7.7 |

| Euro Zone | 1.6 | 3.0 | 5.9 | 10.0 |

| Germany | 2.8 | 2.5 | 5.4 | 6.0 |

| France | 1.6 | 2.4 | 6.3 | 9.9 |

| Nether-lands | 1.5 | 2.8 | 7.7 | 4.4 |

| Finland | 2.7 | 3.5 | 7.5 | 7.8 |

| Belgium | 2.5 | 3.4 | 7.1 | 6.8 |

| Portugal | -0.9 | 2.8 | 5.5 | 12.3 |

| Ireland | -1.0 | 1.0 | 4.7 | 14.6 |

| Italy | 0.8 | 2.3 | 4.8 | 7.9 |

| Greece | -4.8 | 1.4 | 7.4 | 15.1 |

| Spain | 0.7 | 2.7 | 7.1 | 21.2 |

Notes: GDP: rate of growth of GDP; CPI: change in consumer price inflation; PPI: producer price inflation; UNE: rate of unemployment; all rates relative to year earlier

*Office for National Statistics

PPI http://www.ons.gov.uk/ons/dcp171778_233900.pdf

CPI http://www.statistics.gov.uk/pdfdir/cpi0611.pdf

** Excluding food, beverage, tobacco and petroleum

Source: EUROSTAT; country statistical sources http://www.census.gov/aboutus/stat_int.html

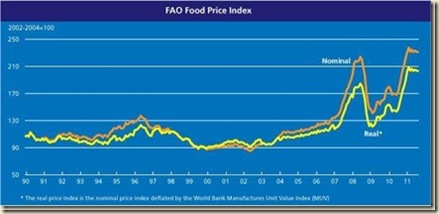

Stagflation is still an unknown event but the risk is sufficiently high to be worthy of consideration (see http://cmpassocregulationblog.blogspot.com/2011/06/risk-aversion-and-stagflation.html). The analysis of stagflation also permits the identification of important policy issues in solving vulnerabilities that have high impact on global financial risks. There are six key interrelated vulnerabilities in the world economy that have been causing global financial turbulence: (1) sovereign risk issues in Europe resulting from countries in need of fiscal consolidation and enhancement of their sovereign risk ratings (see Section III World Financial Turbulence in this post, http://cmpassocregulationblog.blogspot.com/2011/10/us-growth-standstill-at-08-percent.html http://cmpassocregulationblog.blogspot.com/2011/09/imf-view-of-world-economy-and-finance.html http://cmpassocregulationblog.blogspot.com/2011/09/collapse-of-household-income-and-wealth.html http://cmpassocregulationblog.blogspot.com/2011/09/financial-turbulence-wriston-doctrine.html http://cmpassocregulationblog.blogspot.com/2011/09/global-growth-standstill-recession.html http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html http://cmpassocregulationblog.blogspot.com/2011/08/world-financial-turbulence-global.html http://cmpassocregulationblog.blogspot.com/2011/08/global-growth-recession-25-to-30.html section II in http://cmpassocregulationblog.blogspot.com/2011/08/global-growth-recession-25-to-30.html http://cmpassocregulationblog.blogspot.com/2011/07/twenty-five-to-thirty-million.html http://cmpassocregulationblog.blogspot.com/2011/06/risk-aversion-and-stagflation.html and Section I Increasing Risk Aversion in http://cmpassocregulationblog.blogspot.com/2011/06/increasing-risk-aversion-analysis-of.html and section IV in http://cmpassocregulationblog.blogspot.com/2011/04/budget-quagmire-fed-commodities_10.html); (2) the tradeoff of growth and inflation in China; (3) slow growth (see http://cmpassocregulationblog.blogspot.com/2011/10/us-growth-standstill-at-08-percent.html http://cmpassocregulationblog.blogspot.com/2011/09/global-growth-standstill-recession.html http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html http://cmpassocregulationblog.blogspot.com/2011/08/global-growth-recession-25-to-30.html http://cmpassocregulationblog.blogspot.com/2011/07/growth-recession-debt-financial-risk.html http://cmpassocregulationblog.blogspot.com/2011/06/financial-risk-aversion-slow-growth.html http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html http://cmpassocregulationblog.blogspot.com/2011/05/mediocre-growth-world-inflation.html http://cmpassocregulationblog.blogspot.com/2011_03_01_archive.html http://cmpassocregulationblog.blogspot.com/2011/02/mediocre-growth-raw-materials-shock-and.html), weak hiring (see Section III Hiring Collapse in http://cmpassocregulationblog.blogspot.com/2011/09/financial-turbulence-wriston-doctrine.html http://cmpassocregulationblog.blogspot.com/2011/08/world-financial-turbulence-global.html and section III Hiring Collapse in http://cmpassocregulationblog.blogspot.com/2011/04/fed-commodities-price-shocks-global.html ) and continuing job stress of 24 to 30 million people in the US and stagnant wages in a fractured job market (see Section I Twenty Nine Million Unemployed/Underemployed http://cmpassocregulationblog.blogspot.com/2011/09/global-growth-standstill-recession.html http://cmpassocregulationblog.blogspot.com/2011/07/twenty-five-to-thirty-million.html http://cmpassocregulationblog.blogspot.com/2011/05/job-stress-of-24-to-30-million-falling.html http://cmpassocregulationblog.blogspot.com/2011/04/twenty-four-to-thirty-million-in-job_03.html http://cmpassocregulationblog.blogspot.com/2011/03/unemployment-and-undermployment.html); (4) the timing, dose, impact and instruments of normalizing monetary and fiscal policies (see II Budget/Debt Quagmire in http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html http://cmpassocregulationblog.blogspot.com/2011/03/is-there-second-act-of-us-great.html http://cmpassocregulationblog.blogspot.com/2011/03/global-financial-risks-and-fed.html http://cmpassocregulationblog.blogspot.com/2011/02/policy-inflation-growth-unemployment.html) in advanced and emerging economies; (5) the earthquake and tsunami affecting Japan that is having repercussions throughout the world economy because of Japan’s share of about 9 percent in world output, role as entry point for business in Asia, key supplier of advanced components and other inputs as well as major role in finance and multiple economic activities (http://professional.wsj.com/article/SB10001424052748704461304576216950927404360.html?mod=WSJ_business_AsiaNewsBucket&mg=reno-wsj); and (6) the geopolitical events in the Middle East.

Table 15 provides the forecasts of the Federal Reserve Board Members and Federal Reserve Bank Presidents for the FOMC meeting in Jun. There are lags in effect of monetary policy (Batini and Nelson 2002, Culbertson 1960, 1961, Friedman 1961, Romer and Romer 2004). Central banks forecast inflation in the effort to program monetary policy to attain effects at the correct timing of need by taking into account lags in effects of policy (Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 99-116). Inflation by the price index of personal consumption expenditures (PCE) was forecast for 2011 in the Apr meeting of the FOMC between 2.1 to 2.8 percent. Table 12 shows that the interval has narrowed to PCE (personal consumption expenditures) headline inflation of between 2.3 and 2.5 percent. The FOMC focuses on core PCE inflation, which excludes food and energy. The Apr forecast of core PCE inflation was an interval between 1.3 and 1.6 percent. Table 15 shows the revision of this forecast in Jun to a higher interval between 1.5 and 1.8 percent. A new forecast with significant changes will be provided in Nov.

Table 15, Forecasts of PCE Inflation and Core PCE Inflation by the FOMC, %

| PCE Inflation | Core PCE Inflation | |

| 2011 | 2.3 to 2.5 | 1.5 to 1.8 |

| 2012 | 1.5 to 2.0 | 1.4 to 2.0 |

| 2013 | 1.5 to 2.0 | 1.4 to 2.0 |

| Longer Run | 1.7 to 2.0 |

Source: http://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20110622.pdf

In testimony to the Joint Economic Committee of the US Congress, Chairman Bernanke (2011Oct4, 6) provides more current evaluation of the inflation outlook:

“As the FOMC anticipated, however, inflation has begun to moderate as these transitory influences wane. In particular, the prices of oil and many other commodities have either leveled off or have come down from their highs, and the step-up in automobile production has started to reduce pressures on the prices of cars and light trucks. Importantly, the higher rate of inflation experienced so far this year does not appear to have become ingrained in the economy. Longer-term inflation expectations have remained stable according to surveys of households and economic forecasters, and the five-year-forward measure of inflation compensation derived from yields on nominal and inflation-protected Treasury securities suggests that inflation expectations among investors may have moved lower recently. In addition to the stability of longer-term inflation expectations, the substantial amount of resource slack in U.S. labor and product markets should continue to restrain inflationary pressures.”

The measures taken by the Federal Open Market Committee (FOMC) are described by Chairman Bernanke (2011Oct4, 6-7) as follows:

“In view of the deterioration in the economic outlook over the summer and the subdued inflation picture over the medium run, the FOMC has taken several steps recently to provide additional policy accommodation. At the August meeting, the Committee provided greater clarity about its outlook for the level of short-term interest rates by noting that economic conditions were likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013. And at our meeting in September, the Committee announced that it intends to increase the average maturity of the securities in the Federal Reserve’s portfolio. Specifically, it intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less, leaving the size of our balance sheet approximately unchanged. This maturity extension program should put downward pressure on longer-term interest rates and help make broader financial conditions more supportive of economic growth than they would otherwise have been. The Committee also announced in September that it will begin reinvesting principal payments on its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities rather than in longer-term Treasury securities. By helping to support mortgage markets, this action too should contribute to a stronger economic recovery.”

Three distinguished economists have analyzed current monetary policy from different perspectives. These contributions are considered in turn.