Mediocre Cyclical United States Economic Growth with GDP Three Trillion Dollars below Trend in the Lost Economic Cycle of the Global Recession with Economic Growth Underperforming Below Trend Worldwide, Cyclically Stagnating Real Private Fixed Investment, United States Terms of International Trade, United States House Prices, World Cyclical Slow Growth, Government Intervention in Globalization, and Global Recession Risk

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019

I Mediocre Cyclical United States Economic Growth with GDP Three Trillion Dollars below Trend in the Lost Economic Cycle of the Global Recession with Economic Growth Underperforming Below Trend Worldwide

IA Mediocre Cyclical United States Economic Growth

IA1 Stagnating Real Private Fixed Investment

IID United States Terms of International Trade

IIA2 United States House Prices

III World Financial Turbulence

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IID. United States International Terms of Trade. Delfim Netto (1959) partly reprinted in Pelaez (1973) conducted two classical nonparametric tests (Mann 1945, Wallis and Moore 1941; see Kendall and Stuart 1968) with coffee-price data in the period of free markets from 1857 to 1906 with the following conclusions (Pelaez, 1976a, 280):

“First, the null hypothesis of no trend was accepted with high confidence; secondly, the null hypothesis of no oscillation was rejected also with high confidence. Consequently, in the nineteenth century international prices of coffee fluctuated but without long-run trend. This statistical fact refutes the extreme argument of structural weakness of the coffee trade.”

In his classic work on the theory of international trade, Jacob Viner (1937, 563) analyzed the “index of total gains from trade,” or “amount of gain per unit of trade,” denoted as T:

T= (∆Pe/∆Pi)∆Q

Where ∆Pe is the change in export prices, ∆Pi is the change in import prices and ∆Q is the change in export volume. Dorrance (1948, 52) restates “Viner’s index of total gain from trade” as:

“What should be done is to calculate an index of the value (quantity multiplied by price) of exports and the price of imports for any country whose foreign accounts are to be analysed. Then the export value index should be divided by the import price index. The result would be an index which would reflect, for the country concerned, changes in the volume of imports obtainable from its export income (i.e. changes in its "real" export income, measured in import terms). The present writer would suggest that this index be referred to as the ‘income terms of trade’ index to differentiate it from the other indexes at present used by economists.”

What really matters for an export activity especially during modernization is the purchasing value of goods that it exports in terms of prices of imports. For a primary producing country, the purchasing power of exports in acquiring new technology from the country providing imports is the critical measurement. The barter terms of trade of Brazil improved from 1857 to 1906 because international coffee prices oscillated without trend (Delfim Netto 1959) while import prices from the United Kingdom declined at the rate of 0.5 percent per year (Imlah 1958). The accurate measurement of the opportunity afforded by the coffee exporting economy was incomparably greater when considering the purchasing power in British prices of the value of coffee exports, or Dorrance’s (1948) income terms of trade.

The conventional theory that the terms of trade of Brazil deteriorated over the long term is without reality (Pelaez 1976a, 280-281):

“Moreover, physical exports of coffee by Brazil increased at the high average rate of 3.5 per cent per year. Brazil's exchange receipts from coffee-exporting in sterling increased at the average rate of 3.5 per cent per year and receipts in domestic currency at 4.5 per cent per year. Great Britain supplied nearly all the imports of the coffee economy. In the period of the free coffee market, British export prices declined at the rate of 0.5 per cent per year. Thus, the income terms of trade of the coffee economy improved at the relatively satisfactory average rate of 4.0 per cent per year. This is only a lower bound of the rate of improvement of the terms of trade. While the quality of coffee remained relatively constant, the quality of manufactured products improved significantly during the fifty-year period considered. The trade data and the non-parametric tests refute conclusively the long-run hypothesis. The valid historical fact is that the tropical export economy of Brazil experienced an opportunity of absorbing rapidly increasing quantities of manufactures from the "workshop" countries. Therefore, the coffee trade constituted a golden opportunity for modernization in nineteenth-century Brazil.”

Imlah (1958) provides decline of British export prices at 0.5 percent in the nineteenth century and there were no lost decades, depressions or unconventional monetary policies in the highly dynamic economy of England that drove the world’s growth impulse. Inflation in the United Kingdom between 1857 and 1906 is measured by the composite price index of O’Donoghue and Goulding (2004) at minus 7.0 percent or average rate of decline of 0.2 percent per year.

Simon Kuznets (1971) analyzes modern economic growth in his Lecture in Memory of Alfred Nobel:

“The major breakthroughs in the advance of human knowledge, those that constituted dominant sources of sustained growth over long periods and spread to a substantial part of the world, may be termed epochal innovations. And the changing course of economic history can perhaps be subdivided into economic epochs, each identified by the epochal innovation with the distinctive characteristics of growth that it generated. Without considering the feasibility of identifying and dating such economic epochs, we may proceed on the working assumption that modern economic growth represents such a distinct epoch - growth dating back to the late eighteenth century and limited (except in significant partial effects) to economically developed countries. These countries, so classified because they have managed to take adequate advantage of the potential of modern technology, include most of Europe, the overseas offshoots of Western Europe, and Japan—barely one quarter of world population.”

Cameron (1961) analyzes the mechanism by which the Industrial Revolution in Great Britain spread throughout Europe and Cameron (1967) analyzes the financing by banks of the Industrial Revolution in Great Britain. O’Donoghue and Goulding (2004) provide consumer price inflation in England since 1750 and MacFarlane and Mortimer-Lee (1994) analyze inflation in England over 300 years. Lucas (2004) estimates world population and production since the year 1000 with sustained growth of per capita incomes beginning to accelerate for the first time in English-speaking countries and in particular in the Industrial Revolution in Great Britain. The conventional theory is unequal distribution of the gains from trade and technical progress between the industrialized countries and developing economies (Singer 1950, 478):

“Dismissing, then, changes in productivity as a governing factor in changing terms of trade, the following explanation presents itself: the fruits of technical progress may be distributed either to producers (in the form of rising incomes) or to consumers (in the form of lower prices). In the case of manufactured commodities produced in more developed countries, the former method, i.e., distribution to producers through higher incomes, was much more important relatively to the second method, while the second method prevailed more in the case of food and raw material production in the underdeveloped countries. Generalizing, we may say -that technical progress in manufacturing industries showed in a rise in incomes while technical progress in the production of food and raw materials in underdeveloped countries showed in a fall in prices”

Temin (1997, 79) uses a Ricardian trade model to discriminate between two views on the Industrial Revolution with an older view arguing broad-based increases in productivity and a new view concentration of productivity gains in cotton manufactures and iron:

“Productivity advances in British manufacturing should have lowered their prices relative to imports. They did. Albert Imlah [1958] correctly recognized this ‘severe deterioration’ in the net barter terms of trade as a signal of British success, not distress. It is no surprise that the price of cotton manufactures fell rapidly in response to productivity growth. But even the price of woolen manufactures, which were declining as a share of British exports, fell almost as rapidly as the price of exports as a whole. It follows, therefore, that the traditional ‘old-hat’ view of the Industrial Revolution is more accurate than the new, restricted image. Other British manufactures were not inefficient and stagnant, or at least, they were not all so backward. The spirit that motivated cotton manufactures extended also to activities as varied as hardware and haberdashery, arms, and apparel.”

Phyllis Deane (1968, 96) estimates growth of United Kingdom gross national product (GNP) at around 2 percent per year for several decades in the nineteenth century. The facts that the terms of trade of Great Britain deteriorated during the period of epochal innovation and high rates of economic growth while the income terms of trade of the coffee economy of nineteenth-century Brazil improved at the average yearly rate of 4.0 percent from 1857 to 1906 disprove the hypothesis of weakness of trade as an explanation of relatively lower income and wealth. As Temin (1997) concludes, Britain did pass on lower prices and higher quality the benefits of technical innovation. Explanation of late modernization must focus on laborious historical research on institutions and economic regimes together with economic theory, data gathering and measurement instead of grand generalizations of weakness of trade and alleged neocolonial dependence (Stein and Stein 1970, 134-5):

“Great Britain, technologically and industrially advanced, became as important to the Latin American economy as to the cotton-exporting southern United States. [After Independence in the nineteenth century] Latin America fell back upon traditional export activities, utilizing the cheapest available factor of production, the land, and the dependent labor force.”

Summerhill (2015) contributes momentous solid facts and analysis with an ideal method combining economic theory, econometrics, international comparisons, data reconstruction and exhaustive archival research. Summerhill (2015) finds that Brazil committed to service of sovereign foreign and internal debt. Contrary to conventional wisdom, Brazil generated primary fiscal surpluses during most of the Empire until 1889 (Summerhill 2015, 37-8, Figure 2.1). Econometric tests by Summerhill (2015, 19-44) show that Brazil’s sovereign debt was sustainable. Sovereign credibility in the North-Weingast (1989) sense spread to financial development that provided the capital for modernization in England and parts of Europe (see Cameron 1961, 1967). Summerhill (2015, 3, 194-6, Figure 7.1) finds that “Brazil’s annual cost of capital in London fell from a peak of 13.9 percent in 1829 to only 5.12 percent in 1889. Average rates on secured loans in the private sector in Rio, however, remained well above 12 percent through 1850.” Financial development would have financed diversification of economic activities, increasing productivity and wages and ensuring economic growth. Brazil restricted creation of limited liability enterprises (Summerhill 2015, 151-82) that prevented raising capital with issue of stocks and corporate bonds. Cameron (1961) analyzed how the industrial revolution in England spread to France and then to the rest of Europe. The Société Générale de Crédit Mobilier of Émile and Isaac Péreire provided the “mobilization of credit” for the new economic activities (Cameron 1961). Summerhill (2015, 151-9) provides facts and analysis demonstrating that regulation prevented the creation of a similar vehicle for financing modernization by Irineu Evangelista de Souza, the legendary Visconde de Mauá. Regulation also prevented the use of negotiable bearing notes of the Caisse Générale of Jacques Lafitte (Cameron 1961, 118-9). The government also restricted establishment and independent operation of banks (Summerhill 2015, 183-214). Summerhill (2015, 198-9) measures concentration in banking that provided economic rents or a social loss. The facts and analysis of Summerhill (2015) provide convincing evidence in support of the economic theory of regulation, which postulates that regulated entities capture the process of regulation to promote their self-interest. There appears to be a case that excessively centralized government can result in regulation favoring private instead of public interests with adverse effects on economic activity. The contribution of Summerhill (2015) explains why Brazil did not benefit from trade as an engine of growth—as did regions of recent settlement in the vision of nineteenth-century trade and development of Ragnar Nurkse (1959)—partly because of restrictions on financing and incorporation. Professor Rondo E. Cameron, in his memorable A Concise Economic History of the World (Cameron 1989, 307-8), finds that “from a broad spectrum of possible forms of interaction between the financial sector and other sectors of the economy that requires its services, one can isolate three type-cases: (1) that in which the financial sector plays a positive, growth-inducing role; (2) that in which the financial sector is essentially neutral or merely permissive; and (3) that in which inadequate finance restricts or hinders industrial and commercial development.” Summerhill (2015) proves exhaustively that Brazil failed to modernize earlier because of the restrictions of an inadequate institutional financial arrangement plagued by regulatory capture for self-interest.

There is analysis of the origins of current tensions in the world economy (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), Regulation of Banks and Finance (2009b), International Financial Architecture (2005), The Global Recession Risk (2007), Globalization and the State (2008a), Globalization and the State Vol. II (2008b), Government Intervention in Globalization (2008c)).

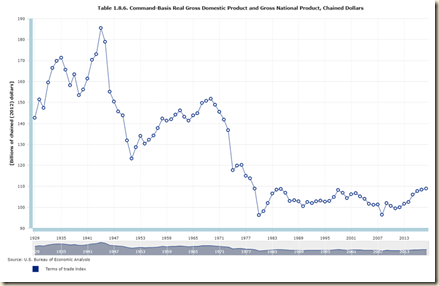

The US Bureau of Economic Analysis (BEA) measures the terms of trade index of the United States quarterly since 1947 and annually since 1929. Chart IID-1 provides the terms of trade of the US quarterly since 1947 with significant long-term deterioration from 150.474 in IQ1947 to 109.333 in IVQ2018. Significant part of the deterioration occurred from the 1960s to the 1980s followed by some recovery and then stability.

Chart IID-1, United States Terms of Trade Quarterly Index 1947-2018

Source: Bureau of Economic Analysis

Chart IID-2 provides the annual BEA index of the US terms of trade from 1929 to 2018. The index deteriorates from 142.590 in 1929 to 108.960 in 2018.

Chart IID-2 United States Terms of Trade Quarterly Index 1929-2018

Source: Bureau of Economic Analysis

The US Bureau of Labor Statistics (BLS) provides measurements of US international terms of trade. The measurement by the BLS is as follows (https://www.bls.gov/mxp/terms-of-trade.htm):

“BLS terms of trade indexes measure the change in the U.S. terms of trade with a specific country, region, or grouping over time. BLS terms of trade indexes cover the goods sector only.

To calculate the U.S. terms of trade index, take the U.S. all-export price index for a country, region, or grouping, divide by the corresponding all-import price index and then multiply the quotient by 100. Both locality indexes are based in U.S. dollars and are rounded to the tenth decimal place for calculation. The locality indexes are normalized to 100.0 at the same starting point.

TTt=(LODt/LOOt)*100,

where

TTt=Terms of Trade Index at time t

LODt=Locality of Destination Price Index at time t

LOOt=Locality of Origin Price Index at time t

The terms of trade index measures whether the U.S. terms of trade are improving or deteriorating over time compared to the country whose price indexes are the basis of the comparison. When the index rises, the terms of trade are said to improve; when the index falls, the terms of trade are said to deteriorate. The level of the index at any point in time provides a long-term comparison; when the index is above 100, the terms of trade have improved compared to the base period, and when the index is below 100, the terms of trade have deteriorated compared to the base period.”

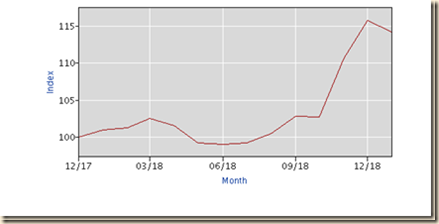

Chart IID-3 provides the BLS terms of trade of the US with Canada. The index increases from 100 in Dec 2017 to 102.8 in Sep 2018 and to 114.2 in Jan 2019.

Chart IID-3, US Terms of Trade, Monthly, All Goods, Canada, NSA, Dec 2017=100

Source: Bureau of Labor Statistics https://www.bls.gov/mxp/data.htm

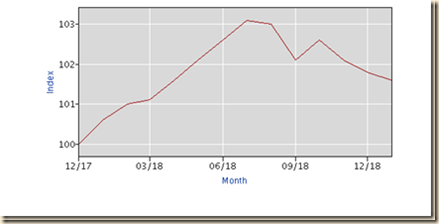

Chart IID-4 provides the BLS terms of trade of the US with the European Union. There is improvement from 100 in Dec 1947 to 102.1 in Jan 2019.

Chart IID-4, US Terms of Trade, Monthly, All Goods, European Union, NSA, Dec 2017=100

Source: Bureau of Labor Statistics https://www.bls.gov/mxp/data.htm

Chart IID-4 provides the BLS terms of trade of the US with Mexico. There is improvement from 100 in Dec 1947 to 101.6 in Jan 2019.

Chart IID-5, US Terms of Trade, Monthly, All Goods, Mexico, NSA, Dec 2017=100

Source: Bureau of Labor Statistics https://www.bls.gov/mxp/data.htm

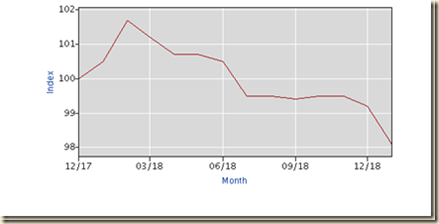

Chart IID-4 provides the BLS terms of trade of the US with China. There is deterioration from 100 in Dec 1947 to 98.3 in Jan 2019.

Chart IID-6, US Terms of Trade, Monthly, All Goods, China, NSA, Dec 2017=100

Source: Bureau of Labor Statistics https://www.bls.gov/mxp/data.htm

Chart IID-4 provides the BLS terms of trade of the US with Japan. There is deterioration from 100 in Dec 1947 to 98.1 in Jan 2019.

Chart IID-7, US Terms of Trade, Monthly, All Goods, Japan, NSA, Dec 2017=100

Source: Bureau of Labor Statistics https://www.bls.gov/mxp/data.htm

IIB2 United States House Prices. The Federal Housing Finance Agency (FHFA), which regulates Fannie Mae and Freddie Mac, provides the FHFA House Price Index (HPI) that “is calculated using home sales price information from Fannie Mae and Freddie Mac-acquired mortgages” (http://fhfa.gov/webfiles/24216/q22012hpi.pdf 1). The Federal Housing Finance Agency (FHFA), which regulates Fannie Mae and Freddie Mac, provides the FHFA House Price Index (HPI) that “is calculated using home sales price information from Fannie Mae and Freddie Mac-acquired mortgages” (http://fhfa.gov/webfiles/24216/q22012hpi.pdf 1). Table IIA2-1 provides the FHFA HPI for purchases only, which shows behavior similar to that of the Case-Shiller index but with lower magnitudes. House prices catapulted from 2000 to 2003, 2005 and 2006. From IVQ2000 to IVQ2006, the index for the US as a whole rose 55.0 percent, with 62.1 percent for New England, 72.0 percent for Middle Atlantic, 71.2 percent for South Atlantic but only by 33.1 percent for East South Central. Prices fell relative to 2014 for the US and all regions from 2006 with exception of increase of 2.6 percent for East South Central. Prices for the US increased 4.9 percent in IVQ2014 relative to IVQ2013 and 12.9 percent from IVQ2012 to IVQ2014. From IVQ2000 to IVQ2014, prices rose for the US and the four regions in Table IIA2-1.

Table IIA2-1, US, FHFA House Price Index Purchases Only NSA ∆%

| United States | New England | Middle Atlantic | South Atlantic | East South Central | |

| IVQ2000 | 24.0 | 40.6 | 35.8 | 25.9 | 11.0 |

| IVQ2000 | 50.5 | 65.0 | 67.6 | 62.9 | 25.4 |

| IVQ2000 to | 55.0 | 62.1 | 72.0 | 71.2 | 33.1 |

| IVQ2005 to | -1.5 | -8.7 | -2.3 | -7.4 | 8.9 |

| IVQ2006 | -4.4 | -7.1 | -4.8 | -11.9 | 2.6 |

| IVQ2007 to | -1.9 | -5.1 | -5.0 | -8.6 | 0.7 |

| IVQ2011 to | 18.9 | 7.3 | 6.9 | 19.9 | 11.8 |

| IVQ2012 to | 12.9 | 6.8 | 5.7 | 13.8 | 8.6 |

| IVQ2013 to IVQ2014 | 4.9 | 2.5 | 2.2 | 5.1 | 4.2 |

| IVQ2000 to | 48.3 144.27 | 50.6 138.40 | 63.7 127.30 | 50.9 140.28 | 36.6 146.07 |

Source: Federal Housing Finance Agency

http://www.fhfa.gov/KeyTopics/Pages/House-Price-Index.aspx

Data of the FHFA HPI for the remaining US regions are in Table IIA2-2. Behavior is not very different from that in Table IIA2-1 with the exception of East North Central. House prices in the Pacific region doubled between 2000 and 2006. Although prices of houses declined sharply from 2005 and 2006 to 2014 with exception of West South Central and West North Central, there was still appreciation relative to 2000.

Table IIA2-2, US, FHFA House Price Index Purchases Only NSA ∆%

| West South Central | West North Central | East North Central | Mountain | Pacific | |

| IVQ2000 | 11.1 | 18.3 | 14.7 | 18.9 | 44.6 |

| IVQ2000 | 23.9 | 31.0 | 23.8 | 58.0 | 107.7 |

| IVQ2000 to IVQ2006 | 31.6 | 33.7 | 23.7 | 68.6 | 108.7 |

| IVQ2005 to | 26.6 | 4.7 | -5.4 | -2.6 | -14.7 |

| IVQ2006 | 19.1 | 2.6 | -5.4 | -8.7 | -15.1 |

| IVQ2007 to | 15.2 | 3.2 | -2.1 | -5.6 | -6.0 |

| IVQ2011 to | 18.1 | 13.5 | 14.2 | 32.9 | 37.6 |

| IVQ2012 to | 12.1 | 8.9 | 11.1 | 17.9 | 24.4 |

| IVQ2013 to IVQ2014 | 5.9 | 4.0 | 4.6 | 5.5 | 7.3 |

| IVQ2000 to IVQ2014 | 56.8 145.53 | 37.1 158.59 | 17.1 155.13 | 53.9 172.46 | 77.1 132.21 |

Source: Federal Housing Finance Agency

http://www.fhfa.gov/KeyTopics/Pages/House-Price-Index.aspx

Monthly and 12-month percentage changes of the FHFA House Price Index are in Table IIA2-3. Percentage monthly increases of the FHFA index were positive from Apr to Jul 2011 with exception of declines in May and Aug 2011 while 12-month percentage changes improved steadily from around minus 6.0 percent in Mar to May 2011 to minus 4.5 percent in Jun 2011. The FHFA house price index fell 0.6 percent in Oct 2011 and fell 3.3 percent in the 12 months ending in Oct 2011. There was significant recovery in Nov 2011 with increase in the house price index of 0.5 percent and reduction of the 12-month rate of decline to 2.4 percent. The house price index rose 0.3 percent in Dec 2011 and the 12-month percentage change improved to minus 1.4 percent. There was further improvement with revised change of minus 0.3 percent in Jan 2012 and decline of the 12-month percentage change to minus 1.3 percent. The index improved to positive change of 0.2 percent in Feb 2012 and decrease of 0.1 percent in the 12 months ending in Feb 2012. There was strong improvement in Mar 2012 with gain in prices of 0.8 percent and 1.9 percent in 12 months. The house price index of FHFA increased 0.6 percent in Apr 2012 and 2.3 percent in 12 months and improvement continued with increase of 0.7 percent in May 2012 and 3.2 percent in the 12 months ending in May 2012. Improvement consolidated with increase of 0.4 percent in Jun 2012 and 3.3 percent in 12 months. In Jul 2012, the house price index increased 0.2 percent and 3.3 percent in 12 months. Strong increase of 0.6 percent in Aug 2012 pulled the 12-month change to 4.1 percent. There was another increase of 0.5 percent in Oct 2012 and 4.9 percent in 12 months followed by increase of 0.5 percent in Nov 2012 and 4.9 percent in 12 months. The FHFA house price index increased 0.8 percent in Jan 2013 and 6.3 percent in 12 months. Improvement continued with increase of 1.0 percent in Apr 2013 and 7.1 percent in 12 months. In May 2013, the house price indexed increased 0.6 percent and 7.2 percent in 12 months. The FHFA house price index increased 0.6 percent in Jun 2013 and 7.5 percent in 12 months. In Jul 2013, the FHFA house price index increased 0.6 percent and 7.8 percent in 12 months. Improvement continued with increase of 0.3 percent in Aug 2013 and 7.5 percent in 12 months. In Sep 2013, the house price index increased 0.5 percent and 7.6 percent in 12 months. The house price index increased 0.3 percent in Oct 2013 and 7.3 percent in 12 months. In Nov 2013, the house price index increased 0.1 percent and increased 6.9 percent in 12 months. The house price index rose 0.5 percent in Dec 2013 and 6.9 percent in 12 months. Improvement continued with increase of 0.5 percent in Jan 2014 and 6.6 percent in 12 months. In Feb 2014, the house price index increased 0.5 percent and 6.5 percent in 12 months. The house price index increased 0.3 percent in Mar 2014 and 5.9 percent in 12 months. In Apr 2014, the house price index increased 0.3 percent and increased 5.5 percent in 12 months. The house price index increased 0.2 percent in May 2014 and 4.8 percent in 12 months. In Jun 2014, the house price index increased 0.5 percent and 4.7 percent in 12 months. The house price index increased 0.4 percent in Jul 2014 and 4.5 percent in 12 months. In Sep 2014, the house price index increased 0.1 percent and increased 4.2 percent in 12 months. The house price index increased 0.6 percent in Oct 2014 and 4.5 percent in 12 months. In Nov 2014, the house price index increased 0.4 percent and 4.9 percent in 12 months. The house price index increased 0.7 percent in Dec 2014 and increased 5.2 percent in 12 months. In Mar 2015, the house price index increased 0.3 percent and increased 5.2 percent in 12 months. In Apr 2015, the house price index increased 0.3 percent and 5.2 percent in 12 months. The house price index increased 0.6 percent in May 2015 and 5.5 percent in 12 months. House prices increased 0.5 percent in Jun 2015 and 5.4 percent in 12 months. The house price index increased 0.4 percent in Jul 2015 and increased 5.4 percent in 12 months. House prices increased 0.2 percent in Aug 2015 and increased 5.1 percent in 12 months. In Sep 2015, the house price index increased 0.7 percent and increased 5.8 percent in 12 months. The house price index increased 0.5 percent in Oct 2015 and increased 5.6 percent in 12 months. House prices increased 0.6 percent in Nov 2015 and increased 5.8 percent in 12 months. The house price index increased 0.4 percent in Dec 2015 and increased 5.6 percent in 12 months. House prices increased 0.6 percent in Jan 2016 and increased 6.1 percent in 12 months. The house price index increased 0.2 percent in Feb 2016 and increased 5.6 percent in 12 months. House prices increased 0.7 percent in Mar 2016 and increased 6.0 percent in 12 months. The house price index increased 0.4 percent in Apr 2016 and increased 6.0 percent in 12 months. House prices increased 0.4 percent in May 2016 and increased 5.8 percent in 12 months. The house price index increased 0.5 percent in Jun 2016 and increased 5.7 percent in 12 months. House prices increased 0.6 percent in Jul 2016 and increased 5.9 percent in 12 months. The house price index increased 0.5 percent in Aug 2016 and increased 6.2 percent in 12 months. House prices increased 0.7 percent in Sep 2016 and increased 6.3 percent in 12 months. The house price index increased 0.5 percent in Oct 2016 and increased 6.3 percent in 12 months. House prices increased 0.6 percent in Nov 2016 and increased 6.4 percent in 12 months. The house price index increased 0.4 percent in Dec 2016 and increased 6.4 percent in 12 months. House prices increased 0.2 percent in Jan 2017 and increased 5.9 percent in 12 months. In Feb 2017, the house price index increased 0.9 percent and increased 6.7 percent in 12 months. House prices increased 0.5 percent in Mar 2017 and increased 6.5 percent in 12 months. In Apr 2017, the house price index increased 0.7 percent and increased 6.9 percent in 12 months. House prices increased 0.4 percent in May 2017 and increased 6.8 percent in 12 months. The house price index increased 0.3 percent in Jun 2017 and increased 6.5 percent in 12 months. House prices increased 0.6 percent in Jul 2017 and increased 6.6 percent in 12 months. The house price index increased 0.8 percent in Aug 2017 and increased 6.9 percent in 12 months. House prices increased 0.5 percent in Sep 2017 and increased 6.7 percent in 12 months. The house price index increased 0.8 percent in Oct 2017 and increased 6.9 percent in 12 months. House prices increased 0.5 percent in Nov 2017 and increased 6.8 percent in 12 months. The house price index increased 0.5 percent in Dec 2017 and increased 6.9 percent in 12 months. The house price index increased 0.8 percent in Jan 2018 and increased 7.6 percent in 12 months. House prices increased 1.0 percent in Feb 2018 and increased 7.8 percent in 12 months. The house price index increased 0.1 percent in Mar 2018 and increased 7.3 percent in 12 months. House prices increased 0.3 percent in Apr 2018 and increased 6.9 percent in 12 months. The house price index increased 0.4 percent in May 2018 and increased 6.9 percent in 12 months ending in May 2018. House prices increased 0.4 percent in Jun 2016 and increased 6.9 percent in 12 months. The house price index increased 0.4 percent in July 2018 and increased 6.8 percent in 12 months. House prices increased 0.5 percent in Aug 2018 and increased 6.5 percent in 12 months. The house price index increased 0.3 percent in Sep 2018 and increased 6.3 percent in 12 months. House prices increased 0.4 percent in Oct 2018 and increased 5.9 percent in 12 months. The house price index increased 0.4 percent in Nov 2018 and increased 5.9 percent in 12 months. House prices increased 0.3 percent in Dec 2018 and increased 5.6 percent in 12 months.

Table IIA2-3, US, FHFA House Price Index Purchases Only SA. Month and NSA 12-Month ∆%

| Month ∆% SA | 12 Month ∆% NSA | |||

| 12/1/2018 | 0.3 | 5.6 | ||

| 11/1/2018 | 0.4 | 5.9 | ||

| 10/1/2018 | 0.4 | 5.9 | ||

| 9/1/2018 | 0.3 | 6.3 | ||

| 8/1/2018 | 0.5 | 6.5 | ||

| 7/1/2018 | 0.4 | 6.8 | ||

| 6/1/2018 | 0.4 | 6.9 | ||

| 5/1/2018 | 0.4 | 6.9 | ||

| 4/1/2018 | 0.3 | 6.9 | ||

| 3/1/2018 | 0.1 | 7.3 | ||

| 2/1/2018 | 1.0 | 7.8 | ||

| 1/1/2018 | 0.8 | 7.6 | ||

| 12/1/2017 | 0.5 | 6.9 | ||

| 11/1/2017 | 0.5 | 6.8 | ||

| 10/1/2017 | 0.8 | 6.9 | ||

| 9/1/2017 | 0.5 | 6.7 | ||

| 8/1/2017 | 0.8 | 6.9 | ||

| 7/1/2017 | 0.6 | 6.6 | ||

| 6/1/2017 | 0.3 | 6.5 | ||

| 5/1/2017 | 0.4 | 6.8 | ||

| 4/1/2017 | 0.7 | 6.9 | ||

| 3/1/2017 | 0.5 | 6.5 | ||

| 2/1/2017 | 0.9 | 6.7 | ||

| 1/1/2017 | 0.2 | 5.9 | ||

| 12/1/2016 | 0.4 | 6.4 | ||

| 11/1/2016 | 0.6 | 6.4 | ||

| 10/1/2016 | 0.5 | 6.3 | ||

| 9/1/2016 | 0.7 | 6.3 | ||

| 8/1/2016 | 0.5 | 6.2 | ||

| 7/1/2016 | 0.6 | 5.9 | ||

| 6/1/2016 | 0.5 | 5.7 | ||

| 5/1/2016 | 0.4 | 5.8 | ||

| 4/1/2016 | 0.4 | 6.0 | ||

| 3/1/2016 | 0.7 | 6.0 | ||

| 2/1/2016 | 0.2 | 5.6 | ||

| 1/1/2016 | 0.6 | 6.1 | ||

| 12/1/2015 | 0.4 | 5.6 | ||

| 11/1/2015 | 0.6 | 5.8 | ||

| 10/1/2015 | 0.5 | 5.6 | ||

| 9/1/2015 | 0.7 | 5.8 | ||

| 8/1/2015 | 0.2 | 5.1 | ||

| 7/1/2015 | 0.4 | 5.4 | ||

| 6/1/2015 | 0.5 | 5.4 | ||

| 5/1/2015 | 0.6 | 5.5 | ||

| 4/1/2015 | 0.3 | 5.2 | ||

| 3/1/2015 | 0.3 | 5.2 | ||

| 2/1/2015 | 0.8 | 5.1 | ||

| 1/1/2015 | 0.1 | 4.8 | ||

| 12/1/2014 | 0.7 | 5.2 | ||

| 11/1/2014 | 0.4 | 4.9 | ||

| 10/1/2014 | 0.6 | 4.5 | ||

| 9/1/2014 | 0.1 | 4.2 | ||

| 8/1/2014 | 0.5 | 4.6 | ||

| 7/1/2014 | 0.4 | 4.5 | ||

| 6/1/2014 | 0.5 | 4.7 | ||

| 5/1/2014 | 0.2 | 4.8 | ||

| 4/1/2014 | 0.3 | 5.5 | ||

| 3/1/2014 | 0.3 | 5.9 | ||

| 2/1/2014 | 0.5 | 6.5 | ||

| 1/1/2014 | 0.5 | 6.6 | ||

| 12/1/2013 | 0.5 | 6.9 | ||

| 11/1/2013 | 0.1 | 6.9 | ||

| 10/1/2013 | 0.3 | 7.3 | ||

| 9/1/2013 | 0.5 | 7.6 | ||

| 8/1/2013 | 0.3 | 7.5 | ||

| 7/1/2013 | 0.6 | 7.8 | ||

| 6/1/2013 | 0.6 | 7.5 | ||

| 5/1/2013 | 0.8 | 7.2 | ||

| 4/1/2013 | 0.6 | 7.1 | ||

| 3/1/2013 | 1.0 | 7.1 | ||

| 2/1/2013 | 0.6 | 6.8 | ||

| 1/1/2013 | 0.8 | 6.3 | ||

| 12/1/2012 | 0.5 | 5.2 | ||

| 11/1/2012 | 0.5 | 4.9 | ||

| 10/1/2012 | 0.5 | 4.9 | ||

| 9/1/2012 | 0.4 | 3.8 | ||

| 8/1/2012 | 0.6 | 4.1 | ||

| 7/1/2012 | 0.2 | 3.3 | ||

| 6/1/2012 | 0.4 | 3.3 | ||

| 5/1/2012 | 0.7 | 3.2 | ||

| 4/1/2012 | 0.6 | 2.3 | ||

| 3/1/2012 | 0.8 | 1.9 | ||

| 2/1/2012 | 0.2 | -0.1 | ||

| 1/1/2012 | -0.3 | -1.3 | ||

| 12/1/2011 | 0.3 | -1.4 | ||

| 11/1/2011 | 0.5 | -2.4 | ||

| 10/1/2011 | -0.6 | -3.3 | ||

| 9/1/2011 | 0.6 | -2.5 | ||

| 8/1/2011 | -0.3 | -4.0 | ||

| 7/1/2011 | 0.3 | -3.6 | ||

| 6/1/2011 | 0.4 | -4.5 | ||

| 5/1/2011 | -0.2 | -5.9 | ||

| 4/1/2011 | 0.2 | -5.8 | ||

| 3/1/2011 | -1.0 | -5.9 | ||

| 2/1/2011 | -1.0 | -5.2 | ||

| 1/1/2011 | -0.4 | -4.5 | ||

| 12/1/2010 | -0.8 | -3.9 | ||

| 12/1/2009 | -1.0 | -2.0 | ||

| 12/1/2008 | -0.3 | -10.4 | ||

| 12/1/2007 | -0.5 | -3.4 | ||

| 12/1/2006 | 0.1 | 2.4 | ||

| 12/1/2005 | 0.6 | 9.8 | ||

| 12/1/2004 | 0.9 | 10.2 | ||

| 12/1/2003 | 0.9 | 8.0 | ||

| 12/1/2002 | 0.7 | 7.8 | ||

| 12/1/2001 | 0.6 | 6.7 | ||

| 12/1/2000 | 0.6 | 7.1 | ||

| 12/1/1999 | 0.5 | 6.1 | ||

| 12/1/1998 | 0.4 | 5.9 | ||

| 12/1/1997 | 0.3 | 3.4 | ||

| 12/1/1996 | 0.3 | 2.7 | ||

| 12/1/1995 | 0.4 | 3.0 | ||

| 12/1/1994 | 0.0 | 2.5 | ||

| 12/1/1993 | 0.5 | 3.1 | ||

| 12/1/1992 | -0.1 | 2.4 |

Source: Federal Housing Finance Agency

The bottom part of Table IIA2-3 provides 12-month percentage changes of the FHFA house price index since 1992 when data become available for 1991. Table IIA2-4 provides percentage changes and average rates of percent change per year for various periods. Between 1992 and 2018, the FHFA house price index increased 157.9 percent at the yearly average rate of 3.7 percent. In the period 1992-2000, the FHFA house price index increased 39.2 percent at the average yearly rate of 4.2 percent. The average yearly rate of price increase accelerated to 7.5 percent in the period 2000-2003, 8.5 percent in 2000-2005 and 7.4 percent in 2000-2006. At the margin, the average rate jumped to 10.0 percent in 2003-2005 and 7.4 percent in 2003-2006. House prices measured by the FHFA house price index increased 20.5 percent at the average yearly rate of 1.6 percent between 2006 and 2018 and 23.3 percent between 2005 and 2018 at the average yearly rate of 1.6 percent.

| Dec | ∆% | Average ∆% per Year |

| 1992-2018 | 157.9 | 3.7 |

| 1992-2000 | 39.2 | 4.2 |

| 2000-2003 | 24.2 | 7.5 |

| 2000-2005 | 50.2 | 8.5 |

| 2003-2005 | 21.0 | 10.0 |

| 2005-2018 | 23.3 | 1.6 |

| 2000-2006 | 53.8 | 7.4 |

| 2003-2006 | 23.8 | 7.4 |

| 2006-2018 | 20.5 | 1.6 |

Source: Federal Housing Finance Agency

The explanation of the sharp contraction of household wealth can probably be found in the origins of the financial crisis and global recession. Let V(T) represent the value of the firm’s equity at time T and B stand for the promised debt of the firm to bondholders and assume that corporate management, elected by equity owners, is acting on the interests of equity owners. Robert C. Merton (1974, 453) states:

“On the maturity date T, the firm must either pay the promised payment of B to the debtholders or else the current equity will be valueless. Clearly, if at time T, V(T) > B, the firm should pay the bondholders because the value of equity will be V(T) – B > 0 whereas if they do not, the value of equity would be zero. If V(T) ≤ B, then the firm will not make the payment and default the firm to the bondholders because otherwise the equity holders would have to pay in additional money and the (formal) value of equity prior to such payments would be (V(T)- B) < 0.”

Pelaez and Pelaez (The Global Recession Risk (2007), 208-9) apply this analysis to the US housing market in 2005-2006 concluding:

“The house market [in 2006] is probably operating with low historical levels of individual equity. There is an application of structural models [Duffie and Singleton 2003] to the individual decisions on whether or not to continue paying a mortgage. The costs of sale would include realtor and legal fees. There could be a point where the expected net sale value of the real estate may be just lower than the value of the mortgage. At that point, there would be an incentive to default. The default vulnerability of securitization is unknown.”

There are multiple important determinants of the interest rate: “aggregate wealth, the distribution of wealth among investors, expected rate of return on physical investment, taxes, government policy and inflation” (Ingersoll 1987, 405). Aggregate wealth is a major driver of interest rates (Ibid, 406). Unconventional monetary policy, with zero fed funds rates and flattening of long-term yields by quantitative easing, causes uncontrollable effects on risk taking that can have profound undesirable effects on financial stability. Excessively aggressive and exotic monetary policy is the main culprit and not the inadequacy of financial management and risk controls.

The net worth of the economy depends on interest rates. In theory, “income is generally defined as the amount a consumer unit could consume (or believe that it could) while maintaining its wealth intact” (Friedman 1957, 10). Income, Y, is a flow that is obtained by applying a rate of return, r, to a stock of wealth, W, or Y = rW (Ibid). According to a subsequent restatement: “The basic idea is simply that individuals live for many years and that therefore the appropriate constraint for consumption decisions is the long-run expected yield from wealth r*W. This yield was named permanent income: Y* = r*W” (Darby 1974, 229), where * denotes permanent. The simplified relation of income and wealth can be restated as:

W = Y/r (1)

Equation (1) shows that as r goes to zero, r →0, W grows without bound, W→∞.

Lowering the interest rate near the zero bound in 2003-2004 caused the illusion of permanent increases in wealth or net worth in the balance sheets of borrowers and also of lending institutions, securitized banking and every financial institution and investor in the world. The discipline of calculating risks and returns was seriously impaired. The objective of monetary policy was to encourage borrowing, consumption and investment but the exaggerated stimulus resulted in a financial crisis of major proportions as the securitization that had worked for a long period was shocked with policy-induced excessive risk, imprudent credit, high leverage and low liquidity by the incentive to finance everything overnight at close to zero interest rates, from adjustable rate mortgages (ARMS) to asset-backed commercial paper of structured investment vehicles (SIV).

The consequences of inflating liquidity and net worth of borrowers were a global hunt for yields to protect own investments and money under management from the zero interest rates and unattractive long-term yields of Treasuries and other securities. Monetary policy distorted the calculations of risks and returns by households, business and government by providing central bank cheap money. Short-term zero interest rates encourage financing of everything with short-dated funds, explaining the SIVs created off-balance sheet to issue short-term commercial paper to purchase default-prone mortgages that were financed in overnight or short-dated sale and repurchase agreements (Pelaez and Pelaez, Financial Regulation after the Global Recession, 50-1, Regulation of Banks and Finance, 59-60, Globalization and the State Vol. I, 89-92, Globalization and the State Vol. II, 198-9, Government Intervention in Globalization, 62-3, International Financial Architecture, 144-9). ARMS were created to lower monthly mortgage payments by benefitting from lower short-dated reference rates. Financial institutions economized in liquidity that was penalized with near zero interest rates. There was no perception of risk because the monetary authority guaranteed a minimum or floor price of all assets by maintaining low interest rates forever or equivalent to writing an illusory put option on wealth. Subprime mortgages were part of the put on wealth by an illusory put on house prices. The housing subsidy of $221 billion per year created the impression of ever increasing house prices. The suspension of auctions of 30-year Treasuries was designed to increase demand for mortgage-backed securities, lowering their yield, which was equivalent to lowering the costs of housing finance and refinancing. Fannie and Freddie purchased or guaranteed $1.6 trillion of nonprime mortgages and worked with leverage of 75:1 under Congress-provided charters and lax oversight. The combination of these policies resulted in high risks because of the put option on wealth by near zero interest rates, excessive leverage because of cheap rates, low liquidity because of the penalty in the form of low interest rates and unsound credit decisions because the put option on wealth by monetary policy created the illusion that nothing could ever go wrong, causing the credit/dollar crisis and global recession (Pelaez and Pelaez, Financial Regulation after the Global Recession, 157-66, Regulation of Banks, and Finance, 217-27, International Financial Architecture, 15-18, The Global Recession Risk, 221-5, Globalization and the State Vol. II, 197-213, Government Intervention in Globalization, 182-4).

There are significant elements of the theory of bank financial fragility of Diamond and Dybvig (1983) and Diamond and Rajan (2000, 2001a, 2001b) that help to explain the financial fragility of banks during the credit/dollar crisis (see also Diamond 2007). The theory of Diamond and Dybvig (1983) as exposed by Diamond (2007) is that banks funding with demand deposits have a mismatch of liquidity (see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 58-66). A run occurs when too many depositors attempt to withdraw cash at the same time. All that is needed is an expectation of failure of the bank. Three important functions of banks are providing evaluation, monitoring and liquidity transformation. Banks invest in human capital to evaluate projects of borrowers in deciding if they merit credit. The evaluation function reduces adverse selection or financing projects with low present value. Banks also provide important monitoring services of following the implementation of projects, avoiding moral hazard that funds be used for, say, real estate speculation instead of the original project of factory construction. The transformation function of banks involves both assets and liabilities of bank balance sheets. Banks convert an illiquid asset or loan for a project with cash flows in the distant future into a liquid liability in the form of demand deposits that can be withdrawn immediately.

In the theory of banking of Diamond and Rajan (2000, 2001a, 2001b), the bank creates liquidity by tying human assets to capital. The collection skills of the relationship banker convert an illiquid project of an entrepreneur into liquid demand deposits that are immediately available for withdrawal. The deposit/capital structure is fragile because of the threat of bank runs. In these days of online banking, the run on Washington Mutual was through withdrawals online. A bank run can be triggered by the decline of the value of bank assets below the value of demand deposits.

Pelaez and Pelaez (Regulation of Banks and Finance 2009b, 60, 64-5) find immediate application of the theories of banking of Diamond, Dybvig and Rajan to the credit/dollar crisis after 2007. It is a credit crisis because the main issue was the deterioration of the credit portfolios of securitized banks as a result of default of subprime mortgages. It is a dollar crisis because of the weakening dollar resulting from relatively low interest rate policies of the US. It caused systemic effects that converted into a global recession not only because of the huge weight of the US economy in the world economy but also because the credit crisis transferred to the UK and Europe. Management skills or human capital of banks are illustrated by the financial engineering of complex products. The increasing importance of human relative to inanimate capital (Rajan and Zingales 2000) is revolutionizing the theory of the firm (Zingales 2000) and corporate governance (Rajan and Zingales 2001). Finance is one of the most important examples of this transformation. Profits were derived from the charter in the original banking institution. Pricing and structuring financial instruments was revolutionized with option pricing formulas developed by Black and Scholes (1973) and Merton (1973, 1974, 1998) that permitted the development of complex products with fair pricing. The successful financial company must attract and retain finance professionals who have invested in human capital, which is a sunk cost to them and not of the institution where they work.

The complex financial products created for securitized banking with high investments in human capital are based on houses, which are as illiquid as the projects of entrepreneurs in the theory of banking. The liquidity fragility of the securitized bank is equivalent to that of the commercial bank in the theory of banking (Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 65). Banks created off-balance sheet structured investment vehicles (SIV) that issued commercial paper receiving AAA rating because of letters of liquidity guarantee by the banks. The commercial paper was converted into liquidity by its use as collateral in SRPs at the lowest rates and minimal haircuts because of the AAA rating of the guarantor bank. In the theory of banking, default can be triggered when the value of assets is perceived as lower than the value of the deposits. Commercial paper issued by SIVs, securitized mortgages and derivatives all obtained SRP liquidity on the basis of illiquid home mortgage loans at the bottom of the pyramid. The run on the securitized bank had a clear origin (Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 65):

“The increasing default of mortgages resulted in an increase in counterparty risk. Banks were hit by the liquidity demands of their counterparties. The liquidity shock extended to many segments of the financial markets—interbank loans, asset-backed commercial paper (ABCP), high-yield bonds and many others—when counterparties preferred lower returns of highly liquid safe havens, such as Treasury securities, than the risk of having to sell the collateral in SRPs at deep discounts or holding an illiquid asset. The price of an illiquid asset is near zero.”

Gorton and Metrick (2010H, 507) provide a revealing quote to the work in 1908 of Edwin R. A. Seligman, professor of political economy at Columbia University, founding member of the American Economic Association and one of its presidents and successful advocate of progressive income taxation. The intention of the quote is to bring forth the important argument that financial crises are explained in terms of “confidence” but as Professor Seligman states in reference to historical banking crises in the US, the important task is to explain what caused the lack of confidence. It is instructive to repeat the more extended quote of Seligman (1908, xi) on the explanations of banking crises:

“The current explanations may be divided into two categories. Of these the first includes what might be termed the superficial theories. Thus it is commonly stated that the outbreak of a crisis is due to lack of confidence,--as if the lack of confidence was not in itself the very thing which needs to be explained. Of still slighter value is the attempt to associate a crisis with some particular governmental policy, or with some action of a country’s executive. Such puerile interpretations have commonly been confined to countries like the United States, where the political passions of democracy have had the fullest way. Thus the crisis of 1893 was ascribed by the Republicans to the impending Democratic tariff of 1894; and the crisis of 1907 has by some been termed the ‘[Theodore] Roosevelt panic,” utterly oblivious of the fact that from the time of President Jackson, who was held responsible for the troubles of 1837, every successive crisis had had its presidential scapegoat, and has been followed by a political revulsion. Opposed to these popular, but wholly unfounded interpretations, is the second class of explanations, which seek to burrow beneath the surface and to discover the more occult and fundamental causes of the periodicity of crises.”

Scholars ignore superficial explanations in the effort to seek good and truth. The problem of economic analysis of the credit/dollar crisis is the lack of a structural model with which to attempt empirical determination of causes (Gorton and Metrick 2010SB). There would still be doubts even with a well-specified structural model because samples of economic events do not typically permit separating causes and effects. There is also confusion is separating the why of the crisis and how it started and propagated, all of which are extremely important.

In true heritage of the principles of Seligman (1908), Gorton (2009EFM) discovers a prime causal driver of the credit/dollar crisis. The objective of subprime and Alt-A mortgages was to facilitate loans to populations with modest means so that they could acquire a home. These borrowers would not receive credit because of (1) lack of funds for down payments; (2) low credit rating and information; (3) lack of information on income; and (4) errors or lack of other information. Subprime mortgage “engineering” was based on the belief that both lender and borrower could benefit from increases in house prices over the short run. The initial mortgage would be refinanced in two or three years depending on the increase of the price of the house. According to Gorton (2009EFM, 13, 16):

“The outstanding amounts of Subprime and Alt-A [mortgages] combined amounted to about one quarter of the $6 trillion mortgage market in 2004-2007Q1. Over the period 2000-2007, the outstanding amount of agency mortgages doubled, but subprime grew 800%! Issuance in 2005 and 2006 of Subprime and Alt-A mortgages was almost 30% of the mortgage market. Since 2000 the Subprime and Alt-A segments of the market grew at the expense of the Agency (i.e., the government sponsored entities of Fannie Mae and Freddie Mac) share, which fell from almost 80% (by outstanding or issuance) to about half by issuance and 67% by outstanding amount. The lender’s option to rollover the mortgage after an initial period is implicit in the subprime mortgage. The key design features of a subprime mortgage are: (1) it is short term, making refinancing important; (2) there is a step-up mortgage rate that applies at the end of the first period, creating a strong incentive to refinance; and (3) there is a prepayment penalty, creating an incentive not to refinance early.”

The prime objective of successive administrations in the US during the past 20 years and actually since the times of Roosevelt in the 1930s has been to provide “affordable” financing for the “American dream” of home ownership. The US housing finance system is mixed with public, public/private and purely private entities. The Federal Home Loan Bank (FHLB) system was established by Congress in 1932 that also created the Federal Housing Administration in 1934 with the objective of insuring homes against default. In 1938, the government created the Federal National Mortgage Association, or Fannie Mae, to foster a market for FHA-insured mortgages. Government-insured mortgages were transferred from Fannie Mae to the Government National Mortgage Association, or Ginnie Mae, to permit Fannie Mae to become a publicly-owned company. Securitization of mortgages began in 1970 with the government charter to the Federal Home Loan Mortgage Corporation, or Freddie Mac, with the objective of bundling mortgages created by thrift institutions that would be marketed as bonds with guarantees by Freddie Mac (see Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 42-8). In the third quarter of 2008, total mortgages in the US were $12,057 billion of which 43.5 percent, or $5423 billion, were retained or guaranteed by Fannie Mae and Freddie Mac (Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a), 45). In 1990, Fannie Mae and Freddie Mac had a share of only 25.4 percent of total mortgages in the US. Mortgages in the US increased from $6922 billion in 2002 to $12,088 billion in 2007, or by 74.6 percent, while the retained or guaranteed portfolio of Fannie and Freddie rose from $3180 billion in 2002 to $4934 billion in 2007, or by 55.2 percent.

According to Pinto (2008) in testimony to Congress:

“There are approximately 25 million subprime and Alt-A loans outstanding, with an unpaid principal amount of over $4.5 trillion, about half of them held or guaranteed by Fannie and Freddie. Their high risk activities were allowed to operate at 75:1 leverage ratio. While they may deny it, there can be no doubt that Fannie and Freddie now own or guarantee $1.6 trillion in subprime, Alt-A and other default prone loans and securities. This comprises over 1/3 of their risk portfolios and amounts to 34% of all the subprime loans and 60% of all Alt-A loans outstanding. These 10.5 million unsustainable, nonprime loans are experiencing a default rate 8 times the level of the GSEs’ 20 million traditional quality loans. The GSEs will be responsible for a large percentage of an estimated 8.8 million foreclosures expected over the next 4 years, accounting for the failure of about 1 in 6 home mortgages. Fannie and Freddie have subprimed America.”

In perceptive analysis of growth and macroeconomics in the past six decades, Rajan (2012FA) argues that “the West can’t borrow and spend its way to recovery.” The Keynesian paradigm is not applicable in current conditions. Advanced economies in the West could be divided into those that reformed regulatory structures to encourage productivity and others that retained older structures. In the period from 1950 to 2000, Cobet and Wilson (2002) find that US productivity, measured as output/hour, grew at the average yearly rate of 2.9 percent while Japan grew at 6.3 percent and Germany at 4.7 percent (see Pelaez and Pelaez, The Global Recession Risk (2007), 135-44). In the period from 1995 to 2000, output/hour grew at the average yearly rate of 4.6 percent in the US but at lower rates of 3.9 percent in Japan and 2.6 percent in the US. Rajan (2012FA) argues that the differential in productivity growth was accomplished by deregulation in the US at the end of the 1970s and during the 1980s. In contrast, Europe did not engage in reform with the exception of Germany in the early 2000s that empowered the German economy with significant productivity advantage. At the same time, technology and globalization increased relative remunerations in highly-skilled, educated workers relative to those without skills for the new economy. It was then politically appealing to improve the fortunes of those left behind by the technological revolution by means of increasing cheap credit. As Rajan (2012FA) argues:

“In 1992, Congress passed the Federal Housing Enterprises Financial Safety and Soundness Act, partly to gain more control over Fannie Mae and Freddie Mac, the giant private mortgage agencies, and partly to promote affordable homeownership for low-income groups. Such policies helped money flow to lower-middle-class households and raised their spending—so much so that consumption inequality rose much less than income inequality in the years before the crisis. These policies were also politically popular. Unlike when it came to an expansion in government welfare transfers, few groups opposed expanding credit to the lower-middle class—not the politicians who wanted more growth and happy constituents, not the bankers and brokers who profited from the mortgage fees, not the borrowers who could now buy their dream houses with virtually no money down, and not the laissez-faire bank regulators who thought they could pick up the pieces if the housing market collapsed. The Federal Reserve abetted these shortsighted policies. In 2001, in response to the dot-com bust, the Fed cut short-term interest rates to the bone. Even though the overstretched corporations that were meant to be stimulated were not interested in investing, artificially low interest rates acted as a tremendous subsidy to the parts of the economy that relied on debt, such as housing and finance. This led to an expansion in housing construction (and related services, such as real estate brokerage and mortgage lending), which created jobs, especially for the unskilled. Progressive economists applauded this process, arguing that the housing boom would lift the economy out of the doldrums. But the Fed-supported bubble proved unsustainable. Many construction workers have lost their jobs and are now in deeper trouble than before, having also borrowed to buy unaffordable houses. Bankers obviously deserve a large share of the blame for the crisis. Some of the financial sector’s activities were clearly predatory, if not outright criminal. But the role that the politically induced expansion of credit played cannot be ignored; it is the main reason the usual checks and balances on financial risk taking broke down.”

In fact, Raghuram G. Rajan (2005) anticipated low liquidity in financial markets resulting from low interest rates before the financial crisis that caused distortions of risk/return decisions provoking the credit/dollar crisis and global recession from IVQ2007 to IIQ2009. Near zero interest rates of unconventional monetary policy induced excessive risks and low liquidity in financial decisions that were critical as a cause of the credit/dollar crisis after 2007. Rajan (2012FA) argues that it is not feasible to return to the employment and income levels before the credit/dollar crisis because of the bloated construction sector, financial system and government budgets.

Table IIA-1 shows the euphoria of prices during the housing boom and the subsequent decline. House prices rose 95.4 percent in the 10-city composite of the Case-Shiller home price index, 81.0 percent in the 20-city composite and 65.6 percent in the US national home price index between Dec 2000 and Dec 2005. Prices rose around 100 percent from Dec 2000 to Dec 2006, increasing 95.8 percent for the 10-city composite, 82.2 percent for the 20-city composite and 68.4 percent in the US national index. House prices rose 37.6 percent between Dec 2003 and Dec 2005 for the 10-city composite, 34.2 percent for the 20-city composite and 29.0 percent for the US national propelled by low fed funds rates of 1.0 percent between Jul 2003 and Jun 2004. Fed funds rates increased by 0.25 basis points at every meeting of the Federal Open Market Committee (FOMC) from Jun 2004 until Jun 2006, reaching 5.25 percent. Simultaneously, the suspension of auctions of the 30-year Treasury bond caused decline of yields of mortgage-backed securities with intended decrease in mortgage rates. Similarly, between Dec 2003 and Dec 2006, the 10-city index gained 37.9 percent; the 20-city index increased 35.1 percent; and the US national 31.2 percent. House prices have increased from Dec 2006 to Dec 2018 by 1.9 percent for the 10-city composite, increasing 4.4 percent for the 20-city composite and increasing 12.1 percent for the US national. Measuring house prices is quite difficult because of the lack of homogeneity that is typical of standardized commodities. In the 12 months ending in Dec 2018, house prices increased 3.8 percent in the 10-city composite, increasing 4.2 percent in the 20-city composite and 4.7 percent in the US national. Table IIA-1 also shows that house prices increased 99.6 percent between Dec 2000 and Dec 2018 for the 10-city composite, increasing 90.9 percent for the 20-city composite and 88.8 percent for the US national. House prices are close to the lowest level since peaks during the boom before the financial crisis and global recession. The 10-city composite increased 0.1 percent from the peak in Jun 2006 to Dec 2018 and the 20-city composite increased 3.1 percent from the peak in Jul 2006 to Dec 2018. The US national increased 11.3 percent in Dec 2018 from the peak of the 10-city composite in Jun 2006 and increased 11.2 percent from the peak of the 20-city composite in Jul 2006. The final part of Table II-2 provides average annual percentage rates of growth of the house price indexes of Standard & Poor’s Case-Shiller. The average annual growth rate between Dec 1987 and Dec 2018 for the 10-city composite was 3.9 percent and 3.6 percent for the US national. Data for the 20-city composite are available only beginning in Jan 2000. House prices accelerated in the 1990s with the average rate of the 10-city composite of 5.0 percent between Dec 1992 and Dec 2000 while the average rate for the period Dec 1987 to Dec 2000 was 3.8 percent. The average rate for the US national was 3.6 percent from Dec 1987 to Dec 2018 and 3.6 percent from Dec 1987 to Dec 2000. Although the global recession affecting the US between IVQ2007 (Dec) and IIQ2009 (Jun) caused decline of house prices of slightly above 30 percent, the average annual growth rate of the 10-city composite between Dec 2000 and Dec 2018 was 3.9 percent while the rate of the 20-city composite was 3.7 percent and 3.6 percent for the US national.

Table IIA-1, US, Percentage Changes of Standard & Poor’s Case-Shiller Home Price Indices, Not Seasonally Adjusted, ∆%

| 10-City Composite | 20-City Composite | US National | |

| ∆% Dec 2000 to Dec 2003 | 42.0 | 34.9 | 28.3 |

| ∆% Dec 2000 to Dec 2005 | 95.4 | 81.0 | 65.6 |

| ∆% Dec 2003 to Dec 2005 | 37.6 | 34.2 | 29.0 |

| ∆% Dec 2000 to Dec 2006 | 95.8 | 82.2 | 68.4 |

| ∆% Dec 2003 to Dec 2006 | 37.9 | 35.1 | 31.2 |

| ∆% Dec 2005 to Dec 2018 | 2.1 | 5.4 | 14.0 |

| ∆% Dec 2006 to Dec 2018 | 1.9 | 4.7 | 12.1 |

| ∆% Dec 2009 to Dec 2018 | 43.3 | 46.0 | 40.0 |

| ∆% Dec 2010 to Dec 2018 | 45.2 | 49.6 | 46.0 |

| ∆% Dec 2011 to Dec 2018 | 51.5 | 55.9 | 51.9 |

| ∆% Dec 2012 to Dec 2018 | 42.9 | 45.8 | 42.7 |

| ∆% Dec 2013 to Dec 2018 | 25.8 | 28.6 | 28.9 |

| ∆% Dec 2014 to Dec 2018 | 20.8 | 23.2 | 23.3 |

| ∆% Dec 2015 to Dec 2018 | 15.1 | 16.7 | 17.2 |

| ∆% Dec 2016 to Dec 2018 | 10.0 | 10.7 | 11.3 |

| ∆% Dec 2017 to Dec 2018 | 3.8 | 4.2 | 4.7 |

| ∆% Dec 2000 to Dec 2018 | 99.6 | 90.9 | 88.8 |

| ∆% Peak Jun 2006 Dec 2018 | 0.1 | 11.3 | |

| ∆% Peak Jul 2006 to Dec 2018 | 3.1 | 11.2 | |

| Average ∆% Dec 1987-Dec 2018 | 3.9 | NA | 3.6 |

| Average ∆% Dec 1987-Dec 2000 | 3.8 | NA | 3.6 |

| Average ∆% Dec 1992-Dec 2000 | 5.0 | NA | 4.5 |

| Average ∆% Dec 2000-Dec 2018 | 3.9 | 3.7 | 3.6 |

Source: https://us.spindices.com/index-family/real-estate/sp-corelogic-case-shiller

Price increases measured by the Case-Shiller house price indices show in data for Dec 2018 that “the rate of home price increases across the U.S. has continued to slow” (https://www.spice-indices.com/idpfiles/spice-assets/resources/public/documents/880361_cshomeprice-release-0226.pdf?force_download=true ). Monthly house prices increased sharply from Feb 2013 to Jan 2014 for both the 10- and 20-city composites, as shown in Table IIA-2. In Jan 2013, the seasonally adjusted 10-city composite increased 0.8 percent and the 20-city increased 0.8 percent while the 10-city not seasonally adjusted changed 0.0 percent and the 20-city changed 0.0 percent. House prices increased at high monthly percentage rates from Feb to Nov 2013. House prices seasonally adjusted declined in most months for both the 10-city and 20-city Case-Shiller composites from Dec 2010 to Jan 2012, as shown in Table IIA-2. The most important seasonal factor in house prices is school changes for wealthier homeowners with more expensive houses. Without seasonal adjustment, house prices fell from Dec 2010 throughout Mar 2011 and then increased in every month from Apr to Aug 2011 but fell in every month from Sep 2011 to Feb 2012. The not seasonally adjusted index registers decline in Mar 2012 of 0.1 percent for the 10-city composite and is flat for the 20-city composite. Not seasonally adjusted house prices increased 1.4 percent in Apr 2012 and at high monthly percentage rates until Sep 2012. House prices not seasonally adjusted stalled from Oct 2012 to Jan 2013 and surged from Feb to Sep 2013, decelerating in Oct 2013-Feb 2014. House prices grew at fast rates in Mar 2014. The 10-city NSA index changed minus 0.2 percent in Dec 2018 and the 20-city changed minus 0.2 percent. The 10-city SA increased 0.2 percent in Dec 2018 and the 20-city composite SA increased 0.2 percent. Declining house prices cause multiple adverse effects of which two are quite evident. (1) There is a disincentive to buy houses in continuing price declines. (2) More mortgages could be losing fair market value relative to mortgage debt. Another possibility is a wealth effect that consumers restrain purchases because of the decline of their net worth in houses.

Table IIA-2, US, Monthly Percentage Change of S&P Corelogic Case-Shiller Home Price Indices, Seasonally Adjusted and Not Seasonally Adjusted, ∆%

| 10 City Composite SA | 10 City Composite NSA | 20 City Composite SA | 20 City Composite NSA | ||||

| December 2018 | 0.2 | -0.2 | 0.2 | -0.2 | |||

| November 2018 | 0.2 | -0.2 | 0.3 | -0.1 | |||

| October 2018 | 0.4 | 0.0 | 0.4 | 0.0 | |||

| September 2018 | 0.6 | 0.0 | 0.7 | 0.0 | |||

| August 2018 | -0.1 | 0.1 | -0.2 | 0.0 | |||

| July 2018 | 0.1 | 0.3 | 0.1 | 0.3 | |||

| June 2018 | 0.2 | 0.5 | 0.2 | 0.6 | |||

| May 2018 | 0.1 | 0.6 | 0.2 | 0.7 | |||

| April 2018 | -0.3 | 0.7 | -0.2 | 0.9 | |||

| March 2018 | 0.7 | 0.9 | 0.8 | 1.0 | |||

| February 2018 | 0.8 | 0.7 | 0.9 | 0.7 | |||

| January 2018 | 0.6 | 0.3 | 0.7 | 0.3 | |||

| December 2017 | 0.6 | 0.2 | 0.6 | 0.2 | |||

| November 2017 | 0.7 | 0.3 | 0.7 | 0.2 | |||

| October 2017 | 0.6 | 0.2 | 0.6 | 0.2 | |||

| September 2017 | 1.0 | 0.4 | 1.1 | 0.3 | |||

| August 2017 | 0.2 | 0.4 | 0.1 | 0.4 | |||

| July 2017 | 0.5 | 0.8 | 0.5 | 0.7 | |||

| June 2017 | 0.3 | 0.7 | 0.3 | 0.7 | |||

| May 2017 | 0.3 | 0.8 | 0.3 | 0.9 | |||

| April 2017 | -0.2 | 0.8 | -0.1 | 1.0 | |||

| March 2017 | 0.7 | 0.8 | 0.7 | 1.0 | |||

| February 2017 | 0.4 | 0.3 | 0.6 | 0.4 | |||

| January 2017 | 0.7 | 0.3 | 0.6 | 0.2 | |||

| December 2016 | 0.7 | 0.2 | 0.7 | 0.2 | |||

| November 2016 | 0.6 | 0.2 | 0.7 | 0.2 | |||

| October 2016 | 0.4 | -0.1 | 0.5 | 0.0 | |||

| September 2016 | 0.6 | 0.0 | 0.7 | 0.1 | |||

| August 2016 | 0.2 | 0.3 | 0.1 | 0.3 | |||

| July 2016 | 0.3 | 0.5 | 0.3 | 0.6 | |||

| June 2016 | 0.2 | 0.7 | 0.3 | 0.8 | |||

| May 2016 | 0.2 | 0.8 | 0.2 | 0.9 | |||

| April 2016 | 0.1 | 1.0 | 0.1 | 1.1 | |||

| March 2016 | 0.7 | 0.9 | 0.7 | 1.0 | |||

| February 2016 | 0.4 | 0.2 | 0.4 | 0.2 | |||

| January 2016 | 0.4 | -0.1 | 0.5 | 0.0 | |||

| December 2015 | 0.4 | -0.1 | 0.5 | 0.0 | |||

| November 2015 | 0.5 | 0.0 | 0.6 | 0.0 | |||

| October 2015 | 0.5 | -0.1 | 0.6 | 0.0 | |||

| September 2015 | 0.6 | 0.1 | 0.7 | 0.1 | |||

| August 2015 | 0.2 | 0.2 | 0.1 | 0.3 | |||

| July 2015 | 0.2 | 0.6 | 0.3 | 0.7 | |||

| June 2015 | 0.2 | 0.9 | 0.3 | 1.0 | |||

| May 2015 | 0.3 | 1.0 | 0.3 | 1.1 | |||

| April 2015 | 0.2 | 1.1 | 0.2 | 1.1 | |||

| March 2015 | 0.5 | 0.8 | 0.6 | 0.9 | |||

| February 2015 | 0.8 | 0.5 | 0.8 | 0.5 | |||

| January 2015 | 0.4 | -0.1 | 0.5 | -0.1 | |||

| December 2014 | 0.6 | 0.0 | 0.6 | 0.0 | |||

| November 2014 | 0.4 | -0.3 | 0.4 | -0.2 | |||

| October 2014 | 0.5 | -0.1 | 0.5 | -0.1 | |||

| September 2014 | 0.3 | -0.1 | 0.4 | -0.1 | |||

| August 2014 | 0.1 | 0.2 | 0.1 | 0.2 | |||

| July 2014 | 0.1 | 0.6 | 0.1 | 0.6 | |||

| June 2014 | 0.2 | 1.0 | 0.2 | 1.0 | |||

| May 2014 | 0.1 | 1.1 | 0.2 | 1.1 | |||

| April 2014 | 0.3 | 1.1 | 0.3 | 1.2 | |||

| March 2014 | 0.5 | 0.8 | 0.5 | 0.9 | |||

| February 2014 | 0.4 | 0.0 | 0.4 | 0.0 | |||

| January 2014 | 0.6 | -0.1 | 0.6 | -0.1 | |||

| December 2013 | 0.5 | -0.1 | 0.5 | -0.1 | |||

| November 2013 | 0.7 | 0.0 | 0.7 | -0.1 | |||

| October 2013 | 0.9 | 0.2 | 0.9 | 0.2 | |||

| September 2013 | 1.1 | 0.7 | 1.1 | 0.7 | |||

| August 2013 | 1.2 | 1.3 | 1.2 | 1.3 | |||

| July 2013 | 1.2 | 1.9 | 1.1 | 1.8 | |||

| June 2013 | 1.2 | 2.2 | 1.2 | 2.2 | |||

| May 2013 | 1.4 | 2.5 | 1.4 | 2.5 | |||

| April 2013 | 1.9 | 2.6 | 1.9 | 2.6 | |||

| March 2013 | 1.0 | 1.3 | 1.0 | 1.3 | |||

| February 2013 | 0.9 | 0.3 | 0.9 | 0.2 | |||

| January 2013 | 0.8 | 0.0 | 0.8 | 0.0 | |||

| December 2012 | 0.9 | 0.2 | 0.9 | 0.2 | |||

| November 2012 | 0.6 | -0.3 | 0.7 | -0.2 | |||

| October 2012 | 0.6 | -0.2 | 0.7 | -0.1 | |||

| September 2012 | 0.6 | 0.3 | 0.6 | 0.3 | |||

| August 2012 | 0.6 | 0.8 | 0.7 | 0.9 | |||

| July 2012 | 0.6 | 1.5 | 0.7 | 1.6 | |||

| June 2012 | 1.0 | 2.1 | 1.1 | 2.3 | |||

| May 2012 | 1.0 | 2.2 | 1.1 | 2.4 | |||

| April 2012 | 0.8 | 1.4 | 0.9 | 1.4 | |||

| March 2012 | -0.2 | -0.1 | -0.3 | 0.0 | |||

| February 2012 | -0.2 | -0.9 | -0.1 | -0.8 | |||

| January 2012 | -0.3 | -1.1 | -0.2 | -1.0 | |||

| December 2011 | -0.5 | -1.2 | -0.4 | -1.1 | |||

| November 2011 | -0.6 | -1.4 | -0.5 | -1.3 | |||

| October 2011 | -0.5 | -1.3 | -0.5 | -1.4 | |||

| September 2011 | -0.3 | -0.6 | -0.4 | -0.7 | |||

| August 2011 | -0.2 | 0.1 | -0.2 | 0.1 | |||

| July 2011 | 0.0 | 0.9 | 0.0 | 1.0 | |||

| June 2011 | -0.1 | 1.0 | 0.0 | 1.2 | |||

| May 2011 | -0.2 | 1.0 | -0.2 | 1.0 | |||

| April 2011 | 0.1 | 0.6 | 0.2 | 0.6 | |||

| March 2011 | -0.9 | -1.0 | -1.1 | -1.0 | |||

| February 2011 | -0.5 | -1.3 | -0.4 | -1.2 | |||

| January 2011 | -0.3 | -1.1 | -0.3 | -1.1 | |||

| December 2010 | -0.2 | -0.9 | -0.2 | -1.0 |

Source: https://us.spindices.com/index-family/real-estate/sp-corelogic-case-shiller

Table IIA-4 summarizes the brutal drops in assets and net worth of US households and nonprofit organizations from 2007 to 2008 and 2009. Total assets fell $9.6 trillion or 11.6 percent from 2007 to 2008 and $8.1 trillion or 9.8 percent to 2009. Net worth fell $9.5 trillion from 2007 to 2008 or 13.9 percent and $7.9 trillion to 2009 or 11.6 percent. Subsidies to housing prolonged over decades together with interest rates at 1.0 percent from Jun 2003 to Jun 2004 inflated valuations of real estate and risk financial assets such as equities. The increase of fed funds rates by 25 basis points until 5.25 percent in Jun 2006 reversed carry trades through exotic vehicles such as subprime adjustable rate mortgages (ARM) and world financial markets. Short-term zero interest rates encourage financing of everything with short-dated funds, explaining the SIVs created off-balance sheet to issue short-term commercial paper to purchase default-prone mortgages that were financed in overnight or short-dated sale and repurchase agreements (Pelaez and Pelaez, Financial Regulation after the Global Recession, 50-1, Regulation of Banks and Finance, 59-60, Globalization and the State Vol. I, 89-92, Globalization and the State Vol. II, 198-9, Government Intervention in Globalization, 62-3, International Financial Architecture, 144-9).

Table IIA-4, Difference of Balance Sheet of Households and Nonprofit Organizations, Billions of Dollars from 2007 to 2008 and 2009

| 2007 | 2008 | Change to 2008 | 2009 | Change to 2009 | |

| A | 82,929.2 | 73,344.8 | -9,584.4 | 74,800.4 | -8,128.8 |

| Non | 27,989.1 | 24,354.7 | -3,634.4 | 23,456.0 | -4,533.1 |

| RE | 23,192.4 | 19,435.0 | -3,757.4 | 18,519.5 | -4,672.9 |

| FIN | 54,940.1 | 48,990.1 | -5,950.0 | 51,344.4 | -3,595.7 |

| LIAB | 14,522.0 | 14,436.4 | -85.6 | 14,310.4 | -211.6 |

| NW | 68,407.2 | 58,908.4 | -9,498.8 | 60,490.0 | -7,917.2 |

A: Assets; Non FIN: Nonfinancial Assets; RE: Real Estate; FIN: Financial Assets; LIAB: Liabilities; NW: Net Worth

Source: Board of Governors of the Federal Reserve System. 2018. Flow of funds, balance sheets and integrated macroeconomic accounts: second quarter 2018. Washington, DC, Federal Reserve System, Sep 20. https://www.federalreserve.gov/releases/z1/current/default.htm

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019.

No comments:

Post a Comment