Hiring Collapse, Ten Million Fewer Full-time Jobs, Youth Unemployment, World Financial Turbulence and World Economic Slowdown

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011, 2012

Executive Summary

I Hiring Collapse

IA Hiring Collapse

IB Labor Underutilization

IC Ten Million Fewer Full-time Jobs

ID Youth Unemployment

II United States Foreign Trade

III World Financial Turbulence

IIIA Financial Risks

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendix I The Great Inflation

V World Economic Slowdown. The International Monetary Fund (IMF) has revised its World Economic Outlook (WEO) to an environment of lower growth (IMF 2012WEOJan24):

“The global recovery is threatened by intensifying strains in the euro area and fragilities elsewhere. Financial conditions have deteriorated, growth prospects have dimmed, and downside risks have escalated. Global output is projected to expand by 3¼ percent in 2012—a downward revision of about ¾ percentage point relative to the September 2011 World Economic Outlook (WEO).”

The IMF (2012WEOJan24) projects growth of world output of 3.8 percent in 2011 and 3.3 percent in 2012 after 5.2 percent in 2010. Advanced economies would grow at only 1.6 percent in 2011, 1.2 percent in 2012 and 3.9 percent in 2013 after growing at 3.2 percent in 2010. Emerging and developing economies would drive the world economy, growing at 6.2 percent in 2011, 5.4 percent in 2012 and 5.9 percent in 2012 after growing at 7.3 percent in 2010. The IMF is forecasting deceleration of the world economy.

World economic slowing would be the consequence of the mild recession in the euro area in 2012 caused by “the rise in sovereign yields, the effects of bank deleveraging on the real economy and the impact of additional fiscal consolidation” (IMF 2012WEOJan24). After growing at 1.9 percent in 2010 and 1.6 percent in 2010, the economy of the euro area would contract by 0.5 percent in 2012 and grow at 0.8 percent in 2013. The United States would grow at 1.8 percent in both 2011 and 2012 and at 2.2 percent in 2013. The IMF (2012WEO Jan24) projects slow growth in 2012 of Germany at 0.3 percent and of France at 0.2 percent while Italy contracts 2.2 percent and Spain contracts 1.7 percent. While Germany would grow at 1.5 percent in 2013 and France at 1.0 percent, Italy would contract 0.6 percent and Spain 0.3 percent.

The IMF (2012WEOJan24) also projects a downside scenario, in which the critical risk “is intensification of the adverse feedback loops between sovereign and bank funding pressures in the euro area, resulting in much larger and more protracted bank deleveraging and sizable contractions in credit and output.” In this scenario, there is contraction of private investment by an extra 1.75 percentage points in relation to the projections of the WEO with euro area output contracting 4 percent relative to the base WEO projection. The environment could be complicated by failure in medium-term fiscal consolidation in the United States and Japan.

There is significant deceleration in world trade volume in the projections of the IMF (2012WEOJan24). Growth of the volume of world trade in goods and services decelerates from 12.7 percent in 2010 to 6.9 percent in 2011, 3.8 percent in 2012 and 5.4 percent in 2013. Under these projections there would be significant pressure in economies in stress such as Japan and Italy that require trade for growth. Even the stronger German economy is dependent on foreign trade. There is sharp deceleration of growth of exports of advanced economies from 12.2 percent in 2010 to 2.4 percent in 2012. Growth of exports of emerging and developing economies falls from 13.8 percent in 2010 to 6.1 percent in 2012. Another cause of concern in that oil prices in the projections fall only 4.9 percent in 2012, remaining at relatively high levels.

The JP Morgan Global Manufacturing & Services PMI™, produced by JP Morgan and Markit in association with ISM and IPFSM, rose to 54.6 in Jan from 52.7 in Dec, indicating expansion at a faster rate (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9159). This index is highly correlated with global GDP, indicating continued growth of the global economy for nearly two years and a half. The US economy drove growth in the global economy in Dec and Jan. New orders are expanding at a faster rate, increasing from 51.5 in Dec to 54.0 in Jan, suggesting further increase in business ahead. The HSBC Brazil Composite Output Index of the HSBC Brazil Services PMI™, compiled by Markit, rose from 53.2 in Dec to 53.8 in Jan (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9156). Andre Loes, Chief Economist of HSBC in Brazil, finds that the increase of the services HSBC PMI for Brazil from 54.8 in Dec to 55.0 in Jan, which is the highest level since Mar 2010, strengthen the belief that the worst period of deceleration has already occurred (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9156).

VA United States. Table USA provides the data table for the US.

Table USA, US Economic Indicators

| Consumer Price Index | Dec 12 months NSA ∆%: 3.0; ex food and energy ∆%: 2.2 Nov month ∆%: 0.0; ex food and energy ∆%: 0.1 |

| Producer Price Index | Dec 12 months NSA ∆%: 4.8; ex food and energy ∆% 3.0 |

| PCE Inflation | Dec 12 months NSA ∆%: headline 2.4; ex food and energy ∆% 1.8 |

| Employment Situation | Household Survey: Jan Unemployment Rate SA 8.3% |

| Nonfarm Hiring | Nonfarm Hiring fell from 64.9 million in 2006 to 47.2 million in 2010 or by 17.7 million |

| GDP Growth | BEA Revised National Income Accounts back to 2003 IIIQ2011 SAAR ∆%: 1.8 IVQ2011 ∆%: 2.8 Cumulative 2011 ∆%: 1.6 2011/2010 ∆%: 1.7 |

| Personal Income and Consumption | Dec month ∆% SA Real Disposable Personal Income (RDPI) 0.3 |

| Quarterly Services Report | IIIQ11/IIQII SA ∆%: |

| Employment Cost Index | IVQ2011 SA ∆%: 0.4 |

| Industrial Production | Dec month SA ∆%: 0.4 |

| Productivity and Costs | Nonfarm Business Productivity IVQ2011∆% SAAE 0.7; IVQ2011/IVQ2010 ∆% 0.5; Unit Labor Costs IVQ2011 ∆% 1.2; IVQ2011/IVQ2010 ∆%: 1.3 Blog 02/05/2012 |

| New York Fed Manufacturing Index | General Business Conditions From 8.19 Dec to Jan 13.48 |

| Philadelphia Fed Business Outlook Index | General Index from 6.8 Dec to 8.2 Jan |

| Manufacturing Shipments and Orders | Dec New Orders SA ∆%: 1.1; ex transport ∆%: 0.6 |

| Durable Goods | Dec New Orders SA ∆%: 3.0; ex transport ∆%: 2.1 |

| Sales of New Motor Vehicles | Jan 2012 913,287; Jan 2011 819,795. Jan SAAR 14.18 million, Dec SAAR 13.56, Jan 2011 SAAR 12.69 million Blog 02/05/12 |

| Sales of Merchant Wholesalers | Jan-Dec 2011/2010 ∆%: Total 13.9; Durable Goods: 12.1; Nondurable |

| Sales and Inventories of Manufacturers, Retailers and Merchant Wholesalers | Oct 11/Oct 10 NSA ∆%: Sales Total Business 9.3; Manufacturers 9.7 |

| Sales for Retail and Food Services | Jan-Dec 2011/Jan-Dec 2010 ∆%: Retail and Food Services: 7.7; Retail ∆% 7.9 |

| Value of Construction Put in Place | Dec SAAR month SA ∆%: 1.5 Dec 12 months NSA: 3.7 |

| Case-Shiller Home Prices | Nov 2011/Nov 2010 ∆% NSA: 10 Cities minus 1.3; 20 Cities: minus 1.3 |

| FHFA House Price Index Purchases Only | Nov SA ∆% 1.0; |

| New House Sales | Dec month SAAR ∆%: |

| Housing Starts and Permits | Dec Starts month SA ∆%: -4.1; Permits ∆%: -0.1 |

| Trade Balance | Balance Dec SA -$48,800 million versus Nov -$47,058 million |

| Export and Import Prices | Dec 12 months NSA ∆%: Imports 8.5; Exports 3.6 |

| Consumer Credit | Dec ∆% annual rate: 9.3 |

| Net Foreign Purchases of Long-term Treasury Securities | Nov Net Foreign Purchases of Long-term Treasury Securities: $59.8 billion Nov versus Oct -$41.0 billion |

| Treasury Budget | Fiscal Year 2012/2011 ∆%: Receipts 4.1; Outlays -3.2; Individual Income Taxes 4.9 Deficit Fiscal Year 2012 Oct-Jan $418,756 million CBO Forecast 2012FY Deficit $1.079 trillion Blog 02/05/2012 |

| Flow of Funds | IIQ2011 ∆ since 2007 Assets -$6311B Real estate -$5111B Financial -$1490 Net Worth -$5802 Blog 09/18/11 |

| Current Account Balance of Payments | IIIQ2011 -131B %GDP 2.9 Blog 12/18/11 |

Links to blog comments in Table USA: 02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or_05.html

01/29/12 http://cmpassocregulationblog.blogspot.com/2012/01/mediocre-economic-growth-financial.html

01/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

1/15/12 http://cmpassocregulationblog.blogspot.com/2012/01/recovery-without-hiring-united-states_15.html

01/08/12 http://cmpassocregulationblog.blogspot.com/2012/01/thirty-million-unemployed-or_08.html

01/01/12 http://cmpassocregulationblog.blogspot.com/2012/01/financial-risk-aversion-and-collapse-of.html

12/27/11 http://cmpassocregulationblog.blogspot.com/2011/12/slow-growth-falling-real-disposable_27.html

12/18/2011 http://cmpassocregulationblog.blogspot.com/2011/12/recovery-without-hiring-world-inflation_1721.html

12/11/2011 II http://cmpassocregulationblog.blogspot.com/2011/12/euro-zone-survival-risk-world-financial_11.html

09/18/11 http://cmpassocregulationblog.blogspot.com/2011/09/collapse-of-household-income-and-wealth.html

Sales and inventories of merchant wholesalers except manufacturers’ sales branches and offices are shown in Table VA-1 for Jan-Dec 2011 and percentage changes from the prior month and from Jan-Dec 2010. These data are volatile aggregating diverse categories of durable and nondurable goods without adjustment for price changes. Total sales for the US rose 13.9 percent in Jan-Dec 2011 relative to Jan-Dec 2010 and 1.3 percent in Dec relative to Nov. The value of total sales is quite high exceeding four trillion dollars ($4760.9 billion). Value in the breakdown is useful in identifying relative importance of individual categories. Sales of durable goods in Jan-Dec 2011 reached $2133.7 billion, or $2.1 trillion, increasing 2.4 percent in Dec relative to Nov and increasing 12.1 percent in Jan-Dec 2011 relative to Jan-Dec 2010. Sales of automotive products reached $339.7 billion in Jan-Dec 2011, decreasing 3.9 percent in the month and increasing 13.4 percent relative to a year earlier. There is strong performance of 19.4 percent in machinery and 10.1 percent in electrical products. Sales of nondurable goods rose 15.4 percent. The influence of commodity prices is revealed in the increase of 28.8 percent in farm products and 32.1 percent in petroleum products. The final three columns in Table 6 provide the value of inventories and percentage changes from the prior month and from the same month a year earlier. US total inventories of wholesalers increased 0.9 percent in Dec and increased 9.8 percent relative to a year earlier. Inventories of durable goods of $273.2 billion are 57.4 percent of total inventories of $475.9 billion and rose 10.7 percent relative to a year earlier. Automotive inventories jumped 17.2 percent relative to a year earlier. Machinery inventories of $69.4 billion rose 12.9 percent relative to a year earlier. Inventories of nondurable goods of $202.8 percent are 42.6 percent of the total and increased 8.8 percent relative to a year earlier. Inventories of farm products fell 0.3 percent in Dec relative to Nov and they declined 13.2 percent relative to a year earlier. Inventories of petroleum products increased 11.5 percent in Dec and 15.8 percent relative to a year earlier.

Table VA-1, US, Sales and Inventories of Merchant Wholesalers except Manufacturers’ Sales Branches and Offices, Month ∆%

| 2011 | Sales $ Billions Jan-Dec 2011 | Sales Dec ∆% SA | Sales∆% Jan/Dec 2011 from 2010 NSA | INV $ Billions Dec 2011 NSA | INV Dec ∆% | INV ∆% Dec 2011 from Dec 2010 NSA |

| US Total | 4,760.9 | 1.3 | 13.9 | 475.9 | 0.9 | 9.8 |

| Durable | 2,133.7 | 2.4 | 12.1 | 273.2 | -1.0 | 10.7 |

| Automotive | 339.7 | 3.9 | 13.4 | 45.6 | 1.0 | 17.2 |

| Prof. Equip. | 376.2 | -1.1 | 4.3 | 31.1 | -4.0 | 6.2 |

| Computer Equipment | 181.3 | 2.8 | 5.8 | 12.7 | -4.9 | 4.2 |

| Electrical | 367.2 | 0.6 | 10.1 | 41.8 | -1.4 | 11.3 |

| Machinery | 359.8 | 5.2 | 19.4 | 69.4 | -1.1 | 12.9 |

| Not Durable | 2,627.3 | 0.4 | 15.4 | 202.8 | 3.6 | 8.8 |

| Drugs | 412.6 | -0.1 | 8.2 | 35.7 | 11.4 | 5.9 |

| Apparel | 130.9 | -1.7 | 2.0 | 21.9 | 0.5 | 17.3 |

| Groceries | 582.5 | 1.9 | 11.1 | 34.1 | -0.8 | 14.0 |

| Farm Products | 259.2 | -2.6 | 28.8 | 25.8 | -0.3 | -13.2 |

| Petroleum | 711.4 | 0.6 | 32.1 | 26.1 | 11.5 | 15.8 |

Note: INV: inventories

Source: US Census Bureau

http://www2.census.gov/wholesale/pdf/mwts/currentwhl.pdf

Inventory/sales ratios of merchant wholesalers except manufacturers’ sales branches and offices are shown in Table VA-2. The total for the US has remained almost unaltered at 1.15 in Dec and 1.15 in Nov relative to 1.16 in Dec 2010. Inventory/sales ratios are higher in durable goods industries but still remain relatively stable with 1.47 in Dec 2011 relative to 1.49 in Nov 2011 and 1.50 in Dec 2010. Computer equipment operates with low inventory/sales ratios of 0.72 in Dec 2011 relative to 0.72 in Dec 2010 because of the capacity to fill orders on demand. As expected because of perishable nature, nondurable inventory/sales ratios are quite low with 0.88 in Dec 2011, which is almost equal to 0.87 in Dec 2011 and almost equal to 0.89 in Dec 2010. There are exceptions such as 1.98 in Dec 2011 in apparel that is much higher than 1.84 in Dec 2010 perhaps because of the expectation of stronger holiday sales.

Table VA-2, Inventory/Sales Ratios of Merchant Wholesalers except Manufacturers’ Sales Branches and Offices, % SA

| Dec 2011 | Nov 2011 | Dec 2010 | |

| US Total | 1.15 | 1.15 | 1.16 |

| Durable | 1.47 | 1.49 | 1.50 |

| Automotive | 1.40 | 1.42 | 1.50 |

| Prof. Equip. | 1.01 | 1.00 | 0.98 |

| Comp. Equip. | 0.72 | 0.73 | 0.72 |

| Electrical | 1.20 | 1.21 | 1.19 |

| Machinery | 2.12 | 2.21 | 2.29 |

| Not Durable | 0.87 | 0.87 | 0.88 |

| Drugs | 0.88 | 0.87 | 0.89 |

| Apparel | 1.98 | 2.05 | 1.84 |

| Groceries | 0.64 | 0.65 | 0.66 |

| Farm Products | 1.05 | 1.06 | 1.18 |

| Petroleum | 0.42 | 0.42 | 0.42 |

Sources: http://www2.census.gov/wholesale/pdf/mwts/currentwhl.pdf

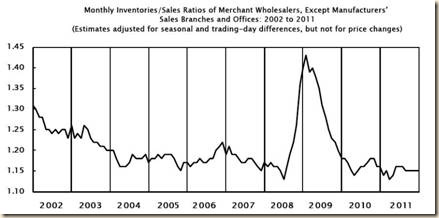

Chart VA-2 provides the chart of the US Census Bureau with inventories/sales ratios of merchant wholesalers from 2002 to 2011 seasonally adjusted. Inventory/sales ratios rise during contractions as merchants are caught with increasing inventories because of weak sales and fall during expansions as merchants attempt to fill sales with existing stocks.

Chart VA-1, US, Monthly Inventories/Sales Ratios of Merchant Wholesalers, SA, 2002-2011

Source: US Census Bureau

http://www2.census.gov/wholesale/img/mwtsbrf.jpg

The report of consumer credit outstanding of the Board of Governors of the Federal Reserve System is provided in Table VA-3. The data are in seasonally-adjusted annual rates both percentage changes and billions of dollars. Consumer credit is divided into two categories. (1) Revolving consumer credit (REV in Table VA-3) consists mainly of unsecured credit cards. (2) Non-revolving consumer credit (NREV in Table VA-3) consists of consumer loans such as car loans. In Dec 2011, revolving credit was $801 billion, or 32.1 percent of total consumer credit of $2498 billion, and non-revolving credit was $1697 billion, or 67.9 percent of total consumer credit outstanding. Consumer credit grew at relatively high rates before the recession beginning in IVQ2007 and extending to IIQ2009 as dated by the National Bureau of Economic Research or NBER (http://www.nber.org/cycles/cyclesmain.html). Percentage changes of consumer credit outstanding fell already in 2008. Rates were still negative in 2010. Contraction was sharper in revolving credit that fell at the rates of 10.1 percent in IIIQ2010, 2.6 percent in IVQ2010, 3.7 percent in IQ2011 and 2.0 percent in IIIQ2011. There was a sharp jump in consumer credit outstanding in Dec 2011: 9.3 percent total, 4.1 percent revolving and 11.8 percent non-revolving.

Table VA-3, US, Consumer Credit Outstanding, SA, Annual Rate and Billions of Dollars

| Total ∆% | REV ∆% | NRV ∆% | Total $B | REV $B | NREV $B | |

| 2011 | ||||||

| Dec | 9.3 | 4.1 | 11.8 | 2498 | 801 | 1697 |

| Nov | 9.9 | 8.4 | 10.7 | 2479 | 798 | 1681 |

| Oct | 3.3 | 1.0 | 4.4 | 2459 | 793 | 1666 |

| Sep | 3.7 | 0.7 | 5.1 | 2452 | 792 | 1659 |

| IVQ | 7.6 | 4.5 | 9.0 | 2498 | 801 | 1697 |

| IIIQ | 1.5 | -2.0 | 3.1 | 2451 | 792 | 1659 |

| IIQ | 3.5 | 1.5 | 4.5 | 2443 | 796 | 1647 |

| IQ | 2.2 | -3.7 | 5.1 | 2422 | 793 | 1629 |

| 2010 | ||||||

| IVQ | 2.5 | -2.6 | 5.0 | 2408 | 800 | 1608 |

| IIIQ | -2.1 | -10.1 | 2.1 | 2394 | 805 | 1588 |

| 2011 | 3.7 | 0.1 | 5.5 | 2498 | 801 | 1697 |

| 2010 | -1.7 | -7.5 | 1.5 | 2408 | 800 | 1608 |

| 2009 | -4.4 | -9.6 | -1.2 | 2450 | 866 | 1585 |

| 2008 | 1.6 | 1.7 | 1.5 | 2562 | 958 | 1604 |

| 2007 | 5.8 | 8.1 | 4.4 | 2523 | 942 | 1581 |

| 2006 | 4.1 | 5.0 | 3.6 | 2385 | 871 | 1514 |

Note: REV: Revolving; NREV: Non-revolving; ∆%: simple annual rate from unrounded data; Total may not add exactly because of rounding

Source: http://www.federalreserve.gov/releases/g19/current/default.htm

Chart VA-2 of the Board of Governors of the Federal Reserve System provides percentage changes of total consumer credit outstanding in the US since 1944. The shaded bars are the cyclical contraction dates of the National Bureau of Economic Research. Consumer credit is cyclical, declining during contractions as shown by negative percentage changes during economic contractions.

Chart VA-2, US, Consumer Credit Outstanding Seasonally Adjusted Annual Percentage Rate

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g19/current/default.htm

The US Treasury budget for fiscal year 2012 in the first four months of Dec, Nov and Oct 2011 and Jan 2012 is shown in Table VA-4. Receipts increased 4.1 percent in the first four months of fiscal year 2012 relative to the same four months in fiscal year 2011 or Oct-Dec 2010 and Jan 2011. Individual income taxes have grown 4.9 percent relative to the same period a year earlier. Outlays were lower by 3.2 percent relative to a year earlier. The final two rows of Table VA-4 provide the projection of the Congressional Budget Office (CBO) of the deficit for fiscal year 2012 at $1.3 trillion not very different from that in fiscal year 2011. The deficits from 2009 to 2012 exceed one trillion dollars per year, adding to $5.1 trillion in four years, which is the worst fiscal performance since World War II.

Table VA-4, US, Treasury Budget in Fiscal Year to Date Million Dollars

| Fiscal Year 2012 | Oct 2011 to Jan 2012 | Oct 2010 to Jan 2011 | ∆% |

| Receipts | 789,756 | 758,347 | 4.1 |

| Outlays | 1,138,903 | 1,177,103 | -3.2 |

| Deficit | -349,147 | -418,756 | NA |

| Individual Income Taxes | 403,794 | 384,994 | 4.9 |

| Receipts | Outlays | Deficit (-), Surplus (+) | |

| $ Billions | |||

| CBO Forecast Fiscal Year 2012 | 2,522 | 3,601 | -1,079 |

| Fiscal Year 2011 | 2,302 | 3,599 | -1,296 |

| Fiscal Year 2010 | 2,162 | 3,456 | -1,294 |

| Fiscal Year 2009 | 2,105 | 3,518 | -1,413 |

| Fiscal Year 2008 | 2,524 | 2,983 | -459 |

Source: http://www.fms.treas.gov/mts/index.html

CBO (2011AugBEO); Office of Management and Budget. 2011. Historical Tables. Budget of the US Government Fiscal Year 2011. Washington, DC: OMB; CBO. 2011JanBEO. Budget and Economic Outlook. Washington, DC, Jan.

VB. Japan. The Markit/JMMA Purchasing Managers’ Index™ (PMI™) improved for a second consecutive movement from 50.2 in Dec to 50.7 in Jan but still suggesting only marginal growth (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9077). New export business grew for the first time in eleven months with improvement in demand both internal and from abroad. Alex Hamilton, economist at Markit and author of the report finds a firmer beginning of the new quarter but with weak growth of new orders resulting from limited demand from China and Europe and valuation of the yen (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9077). Table JPY provides the country table for Japan.

Table JPY, Japan, Economic Indicators

| Historical GDP and CPI | 1981-2010 Real GDP Growth and CPI Inflation 1981-2010 |

| Corporate Goods Prices | Jan ∆% -0.1 |

| Consumer Price Index | Dec NSA ∆% minus 0.0 |

| Real GDP Growth | IIIQ2011 ∆%: 1.4 on IIQ2011; IIIQ2011 SAAR 5.6% |

| Employment Report | Dec Unemployed 2.75 million Change in unemployed since last year: minus 240 thousand |

| All Industry Indices | Nov month SA ∆% -1.1 Blog 01/22/12 |

| Industrial Production | Dec SA month ∆%: 4.0 |

| Machine Orders | Total Dec ∆% minus 7.2 Private ∆%: minus 22.2 |

| Tertiary Index | Nov month SA ∆% -0.8 |

| Wholesale and Retail Sales | Dec 12 months: |

| Family Income and Expenditure Survey | Dec 12 months ∆% total nominal consumption 0.3, real 0.5 Blog 02/05/12 |

| Trade Balance | Exports Dec 12 months ∆%: minus 8.0 Imports Dec 12 months ∆% +8.1 Blog 1/29/12 |

Links to blog comments in Table JPY: 02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or_05.html

01/29/12 http://cmpassocregulationblog.blogspot.com/2012/01/mediocre-economic-growth-financial.html

1/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

12/11/2011 http://cmpassocregulationblog.blogspot.com/2011/12/euro-zone-survival-risk-world-financial.html

07/31/11: http://cmpassocregulationblog.blogspot.com/2011/07/growth-recession-debt-financial-risk.html

Japan’s machinery orders in Table VB-1 fell sharply in Dec after strengthening in Nov. Total orders grew 14.7 percent in Nov but fell 7.2 percent in Dec. Private-sector orders excluding volatile orders, which are closely watched, jumped 14.7 percent in Nov but fell 22.2 percent in Dec. Orders for manufacturing increased 4.7 percent in Nov after 5.5 percent in Oct in part because of the low level after falling 17.5 percent in Sep but fell 7.1 percent in Dec. Overseas orders jumped 20.3 percent in Nov after falling 21.7 percent in Sep and increased 5.6 percent in Dec. There is significant volatility in industrial orders in advanced economies.

Table VB-1, Japan, Machinery Orders, Month ∆%, SA

| 2011 | Dec | Nov | Oct | Sep |

| Total | -7.2 | 14.7 | 3.2 | -3.7 |

| Private Sector | -22.2 | 21.5 | -9.2 | 11.6 |

| Excluding Volatile Orders | -7.1 | 14.8 | -6.9 | -8.2 |

| Mfg | -7.1 | 4.7 | 5.5 | -17.5 |

| Non Mfg ex Volatile | -6.0 | -6.2 | -7.3 | 8.5 |

| Government | 50.7 | -5.3 | 1.9 | -1.0 |

| From Overseas | 5.6 | 20.3 | 1.6 | -21.7 |

| Through Agencies | 3.0 | 0.6 | 4.0 | 15.9 |

Note: Mfg: manufacturing

Source: http://www.esri.cao.go.jp/en/stat/juchu/1112juchu-e.html

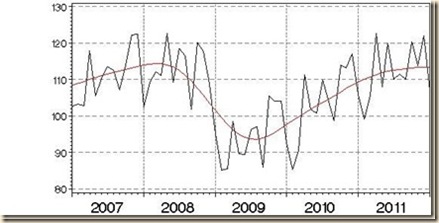

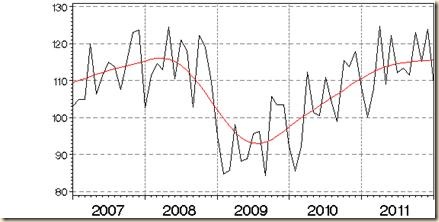

Total orders for machinery and total private-sector orders excluding volatile orders for Japan are shown in Chart VB-1 of Japan’s Economic and Social Research Institute at the Cabinet Office. The trend of private-sector orders excluding volatile orders was increasing smoothly but may be flattening or even declining now even after the jump in Nov. There could be reversal of the trend of increase in total orders. Fluctuations still prevent detecting longer term trends.

Chart VB-2, Japan, Machinery Orders

Source: Japan Economic and Social Research Institute, Cabinet Office

http://www.esri.cao.go.jp/en/stat/juchu/1112juchu-e.html

Table VB-2 provides values and percentage changes from a year earlier of Japan’s machinery orders without seasonal adjustment. Total orders of JPY 2,295,585 million are divided between JPY 1,028,849 overseas orders, or 44.8 percent of the total, and domestic orders of JPY 1,177,247, or 51.2 percent of the total, with orders through agencies of JPY 89,489 million, or 3.9 percent. Orders through agencies are not shown in the table because of the minor value. There is sharp reversal of 12-month percentage changes in Nov with increase of 11.0 percent in total orders, 8.0 percent in overseas orders, 13.5 percent in domestic orders and 12.5 percent in private orders excluding volatile items. The pace of increase declined in Dec with growth in 12 months of 0.8 percent for total orders, 12.6 percent for overseas orders, decline of 8.5 percent for domestic orders and growth of private orders excluding volatile items of 6.3 percent. There was strong impact from the global recession with total orders falling 23.3 percent in 2008, overseas orders dropping 29.4 percent and domestic orders decreasing 17.4 percent. Recovery was vigorous in 2010 with increase of total orders by 9.4 percent, overseas orders by 3.5 percent and domestic orders by 14.1 percent.

Table VB-2, Japan, Machinery Orders, 12 Months ∆% and Million Yen, Original Series

| Total | Overseas | Domestic | Private ex Volatile | |

| Value Dec 2011 | 2,295,585 | 1,028,849 | 1,177,247 | 769,303 |

| % Total | 100.0 | 44.8 | 51.3 | 33.5 |

| Value Dec 2010 | 2,277,410 | 914,067 | 1,286,616 | 723,494 |

| Value Nov 2011 | 1,857,814 | 772,051 | 994,206 | 660,717 |

| % Total | 100.0 | 41.6 | 53.6 | 35.6 |

| Value Nov 2010 | 1,673,432 | 714,663 | 876,055 | 587,441 |

| 12-month ∆% | ||||

| Dec 2011 | 0.8 | 12.6 | -8.5 | 6.3 |

| Nov 2011 | 11.0 | 8.0 | 13.5 | 12.5 |

| Oct 2011 | -6.8 | -11.9 | -1.0 | 1.8 |

| Dec 2010 | 9.4 | 3.5 | 14.1 | -0.6 |

| Dec 2009 | 1.8 | 0.4 | 3.6 | -1.9 |

| Dec 2008 | -23.3 | -29.4 | -17.4 | -24.7 |

| Dec 2007 | 1.3 | 9.8 | -4.3 | -6.4 |

| Dec 2006 | 0.8 | 0.9 | -0.1 | 0.1 |

Note: Total machinery orders = overseas + domestic demand + orders through agencies. Orders through agencies in Oct 2011 were JPY 88,919 million, or 5.4 percent of the total, and are not shown in the table. The data are the original numbers without any adjustments and differ from the seasonally-adjusted data.

Source: http://www.esri.cao.go.jp/en/stat/juchu/1112juchu-e.html

VC. China. The HSBC Purchasing Managers’ Index™ (PMI™), compiled by Markit, summarizing conditions in China’s manufacturing nearly remained flat from 48.7 in Dec to 48.8 in Jan, suggesting marginal deterioration, which now extends over three consecutive months (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9105). New orders fell marginally for a third consecutive month with moderate growth of new export business. Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC, find need of policy stimulus to ensure soft landing that could occur in the form of growth at the rate of 8 percent in IQ2012 relative to IQ2011 (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9105). The HSBC Composite Output Index for China, compiled by Markit, registered a decline from 50.8 in Dec to 49.7 in Jan, suggesting stagnation of private-sector business activity (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9153). Growth of services compensated weakness of manufacturing. Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC, finds that policy measures are required to steer the economy toward higher growth (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9153).Table CNY provides the country table for China.

Table CNY, China, Economic Indicators

| Price Indexes for Industry | Jan 12 months ∆%: 0.7 Jan month ∆%: -0.1 |

| Consumer Price Index | Jan month ∆%: 1.5 Jan 12 month ∆%: 4.5 |

| Value Added of Industry | Dec 12 month ∆%: 12.8 Jan-Dec 2011/Jan-Dec 2010 ∆%: 13.9 |

| GDP Growth Rate | Year IVQ2011 ∆%: 8.9 |

| Investment in Fixed Assets | Total Jan-Dec ∆%: 23.8 Jan-Dec ∆% real estate development: 27.9 |

| Retail Sales | Dec month ∆%: 1.41 Jan-Nov ∆%: 17.1 |

| Trade Balance | Jan balance $27.28 billion Cumulative Jan: $27.28 billion |

Links to blog comments in Table CNY:

01/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

01/15/12 http://cmpassocregulationblog.blogspot.com/2012/01/recovery-without-hiring-united-states_15.html

12/18/11 http://cmpassocregulationblog.blogspot.com/2011/12/recovery-without-hiring-world-inflation_1721.html

China’s exports and imports and their 12 months rates of growth together with the trade balance in Jan are shown in Table VC-1. The 12-month rate of growth of exports fell from 37.7 percent in Jan 2011 to minus 0.5 percent in Jan 2012. The 12-month rate of growth of imports fell from 51.0 percent in Jan 2011 to minus 15.3 percent in Jan 2012. Growth is still extremely high and in comparison with trade data for other countries. The Dow Jones Newswires informs on Oct 15 that the premier of China Wen Jiabao announced that the Chinese renminbi yuan will not be further appreciated to prevent adverse effects on exports (http://professional.wsj.com/article/SB10001424052970203914304576632790881396896.html?mod=WSJ_hp_LEFTWhatsNewsCollection). This policy has not been aggressively implemented as discussed in VI Valuation of Risk Financial Assets. The trade surplus of China increased from $6.46 billion in Jan 2011 to $27.28 billion in Jan 2012

Table VC-1, China, Exports, Imports and Trade Balance USD Billion and ∆%

| Exports | ∆% Relative | Imports USD | ∆% Relative | Balance | |

| Jan 2012 | 149.94 | -0.5 | 122.66 | -15.3 | 27.28 |

| Dec 2011 | 174.72 | 13.4 | 158.20 | 11.8 | 16.52 |

| Nov | 174.46 | 13.8 | 159.94 | 22.1 | 14.53 |

| Oct | 157.49 | 15.9 | 140.46 | 28.7 | 17.03 |

| Sep | 169.67 | 17.1 | 155.16 | 20.9 | 14.51 |

| Aug | 173.32 | 24.5 | 155.56 | 30.2 | 17.76 |

| Jul | 175.13 | 20.4 | 143.64 | 22.9 | 31.48 |

| Jun | 161.98 | 17.9 | 139.71 | 19.3 | 22.27 |

| May | 157.16 | 19.4 | 144.11 | 28.4 | 13.05 |

| Apr | 155.69 | 29.9 | 144.26 | 21.8 | 11.42 |

| Mar | 152.20 | 35.8 | 152.06 | 27.3 | 0.14 |

| Feb | 96.74 | 2.4 | 104.04 | 19.4 | -7.31 |

| Jan | 150.73 | 37.7 | 144.27 | 51.0 | 6.46 |

| Dec 2010 | 154.15 | 17.9 | 141.07 | 25.6 | 13.08 |

Source: http://english.customs.gov.cn/publish/portal191/

http://english.mofcom.gov.cn/static/column/statistic/BriefStatistics.html/1

Table VC-2 provides China’s cumulative exports and imports and their yearly growth rates together with the trade balance. China is still enjoying strong trade growth but the trade balance of $155.14 in 2011 is the weakest in three years and much lower than $183.10 billion for 2010. Exports grew at 31.3 percent in 2010 and imports at 38.7 percent with growth declining to 20.3 percent for exports and 24.9 percent for imports. It is quite difficult to separate price and quantity effects.

Table VC-2, China, Year to Date Exports, Imports and Trade Balance USD Billion and ∆%

| Exports | ∆% Relative | Imports USD | ∆% Relative | Balance | |

| Dec 2011 | 1,898.60 | 20.3 | 1,743.46 | 24.9 | 155.14 |

| Nov | 1,724.01 | 21.1 | 1585.61 | 26.4 | 138.40 |

| Oct | 1,549.71 | 22.0 | 1,425.68 | 26.9 | 124.03 |

| Sep | 1,392.27 | 22.7 | 1,285.17 | 26.7 | 107.10 |

| Aug | 1,222.63 | 23.6 | 1,129.90 | 27.5 | 92.73 |

| Jul | 1,049.38 | 23.4 | 973.17 | 26.9 | 76.21 |

| Jun | 874.3 | 24.0 | 829.37 | 27.6 | 44.93 |

| May | 712.37 | 25.5 | 689.41 | 29.4 | 22.96 |

| Apr | 555.30 | 27.4 | 545.02 | 29.6 | 10.28 |

| Mar | 399.64 | 26.5 | 400.66 | 32.6 | -1.02 |

| Feb | 247.47 | 21.3 | 248.36 | 36.0 | -0.89 |

| Jan | 150.7 | 37.7 | 144.27 | 51.0 | 6.46 |

| Dec 2010 | 1577.93 | 31.3 | 1394.83 | 38.7 | 183.10 |

Source: http://english.mofcom.gov.cn/static/column/statistic/BriefStatistics.html/1

VC Euro Area. The Markit Eurozone PMI® Composite Output Index rose from 48.3 in Dec to 50.4 in Jan, which is the first reading above the contraction zone at 50.0 (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9150). Chris Williamson, Chief Economist at Markit, finds that the improvement in Jan suggests stabilization after weak activity in the final four months of 2011 (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9150). The Markit Eurozone Manufacturing PMI® rose to a five-month high at 48.8 in Jan from 46.9 in Dec, still suggesting weakening business environment but at lower pace (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9078). There is significant divergence in private-sector manufacturing in the euro zone with Austria and Germany above 50 while many countries are in the contraction zone below 50. Manufacturing output in the euro zone increased in Jan, which is the first increase since Jul. Declining euro zone trade affected growth of new export orders. Chris Williamson, Chief Economist at Markit, finds encouraging performance of manufacturing that could help in preventing recession in the euro zone (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9078). Table EUR provides the country economic indicators for the euro area.

Table EUR, Euro Area Economic Indicators

| GDP | IIIQ2011 ∆% 0.2; IIIQ2011/IIIQ2010 ∆% 1.4 Blog 12/04/11 |

| Unemployment | Dec 2011: 10.4% unemployment rate Dec 2011: 16.469 million unemployed Blog 02/05/12 |

| HICP | Dec month ∆%: 0.3 12 months Dec ∆%: 2.7 |

| Producer Prices | Euro Zone industrial producer prices Dec ∆%: -0.2 |

| Industrial Production | Nov month ∆%: -0.1 |

| Industrial New Orders | Oct month ∆%: minus 1.8 Oct 12 months ∆%: 1.6 |

| Construction Output | Nov month ∆%: 0.8 |

| Retail Sales | Dec month ∆%: minus 0.4 |

| Confidence and Economic Sentiment Indicator | Sentiment 93.4 Jan 2012 down from 107 in Dec 2010 Confidence minus 20.7 Jan 2012 down from minus 11 in Dec 2010 Blog 02/05/12 |

| Trade | Jan-Nov 2011/2010 Exports ∆%: 13.1 |

| HICP, Rate of Unemployment and GDP | Historical from 1999 to 2011 Blog 1/22/12 |

Links to blog comments in Table EUR:

02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or.html

01/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

01/15/12 http://cmpassocregulationblog.blogspot.com/2012/01/recovery-without-hiring-united-states_15.html

01/08/12 http://cmpassocregulationblog.blogspot.com/2012/01/thirty-million-unemployed-or.html

12/04/11 http://cmpassocregulationblog.blogspot.com/2011/12/twenty-nine-million-in-job-stress.html

VE Germany. The Markit Germany Services Business Activity Index of the Markit Germany Services PMI® rose from 52.4 in Dec to 53.7 in Jan, for a fourth consecutive month of expansion above 50, such that the Markit Germany Composite Output Index rose from 51.3 in Dec to 53.9 in Dec (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9128), indicating expansion at a faster rate in Germany’s private-sector activity. The Markit/BME Germany Purchasing Managers’ Index® (PMI®)) improved significantly from 48.4 in Dec to the expansion territory at 51.0 in Jan, which is the first reading above 50 since Sep 2011 (The Markit/BME Germany Purchasing Managers’ Index® (PMI®)) improved). While the index is at the highest level in six month, improvement in manufacturing business is still moderate. The rate of contraction of new orders moderated in Jan but export business contracted sharply for a seventh consecutive month. Tim Moore, Senior Economist at Markit and author of the report finds improvement in manufacturing but that the decline in foreign orders influenced general decline in new orders (The Markit/BME Germany Purchasing Managers’ Index® (PMI®)) improved). Table DE provides the country data table for Germany.

Table DE, Germany, Economic Indicators

| GDP | IIIQ2011 0.5 ∆%; III/Q2011/IIIQ2010 ∆% 2.5 2011/2010: 3.0% Blog 01/15/12 |

| Consumer Price Index | Jan month SA ∆%: -0.4 |

| Producer Price Index | Dec month ∆%: -0.4 |

| Industrial Production | Mfg Dec month SA ∆%: minus 2.7 |

| Machine Orders | Dec month ∆%: 1.7 |

| Retail Sales | Dec Month ∆% minus 0.9 12 Months ∆% minus 1.4 Blog 02/05/12 |

| Employment Report | Unemployment Rate 7.3% of Labor Force |

| Trade Balance | Exports Dec 12 months NSA ∆%: 5.0 Blog 02/12/12 |

Links to blog comments in Table DE: 02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or.html

01/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

01/15/12 http://cmpassocregulationblog.blogspot.com/2012/01/recovery-without-hiring-united-states_15.html

01/08/12 http://cmpassocregulationblog.blogspot.com/2012/01/thirty-million-unemployed-or.html

The production industries index of Germany in Table VE-1 shows decline of 2.9 percent in Dec and increase of 0.8 percent in the 12 months ending in Dec. Germany’s industry suffered decline of 7.3 percent in Dec 2008 relative to Dec 2007 and decline of 2.3 percent in 2009. Recovery was vigorous with 14.2 percent in the 12 months ending in Dec 2010. The first quarter of 2011 was quite strong when the German economy outperformed the other advanced economies. The performance of Germany’s industry from 2003 to 2006 was vigorous with average rate of 5.1 percent. Data for the production industries index of Germany fluctuate sharply from month to month and also in 12-month rates.

Table VE-1, Germany, Production Industries, Month and 12-Months ∆%

| 12-Month ∆% NSA | Month ∆% Calendar SA | |

| Dec 2011 | 0.8 | -2.9 |

| Nov | 4.4 | 0.0 |

| Oct | 0.4 | 0.9 |

| Sep | 5.4 | -2.5 |

| Aug | 11.3 | -0.3 |

| Jul | 6.5 | 3.0 |

| Jun | 0.2 | -0.9 |

| May | 19.0 | 0.7 |

| Apr | 6.0 | -0.2 |

| Mar | 10.2 | 1.3 |

| Feb | 16.4 | 1.3 |

| Jan | 16.0 | 1.2 |

| Dec 2010 | 14.2 | 0.2 |

| Dec 2009 | -2.3 | -0.1 |

| Dec 2008 | -7.3 | -3.5 |

| Dec 2007 | -0.1 | 0.9 |

| Dec 2006 | 2.5 | 0.6 |

| Dec 2005 | 4.9 | 0.3 |

| Dec 2004 | 5.3 | 0.0 |

| Dec 2003 | 5.1 | 0.1 |

| Dec 2002 | 2.0 | -2.2 |

Source: Statistiche Bundesamt Deutschland

Table VE-2 provides monthly percentage changes of the German production industries index by components from May to Dec 2011. The production industries index fell 2.9 percent in Dec with negative changes in all components. Manufacturing fell 2.7 percent in Dec, declining in four of the eight months from May to Dec. The investment goods segment also fell 3.6 percent in Dec. Jul was quite strong with monthly growth of 3.0 percent for the index, 3.2 percent for manufacturing, 5.0 percent for investment goods and 14.4 percent for durable goods. It is quite difficult to analyze trends in these data. There is generalized perception that growth in the euro area slowed after the European summer.

Table VE-2, Germany, Production Industries, Industry and Components, Month ∆%

| Dec | Nov | Oct | Sep | Aug | Jul | Jun | May | |

| Production | -2.9 | 0.0 | 0.9 | -2.5 | -0.3 | 3.0 | -0.9 | 0.7 |

| Industry | -2.7 | -0.3 | 0.7 | -2.6 | -0.3 | 3.2 | -1.0 | 1.2 |

| Mfg | -2.7 | -1.0 | 0.7 | -2.6 | -0.3 | 3.3 | -1.0 | 1.3 |

| Intermediate Goods | -2.4 | -0.2 | -0.2 | -1.9 | -0.3 | 1.7 | 0.4 | 0.6 |

| Investment | -3.6 | -0.4 | 1.7 | -4.6 | 1.1 | 5.0 | -2.1 | 2.3 |

| Durable Goods | -0.9 | -2.4 | 1.6 | 0.0 | -9.7 | 14.4 | -6.3 | 0.2 |

| Nondurable Goods | -1.0 | -0.2 | -0.4 | 1.7 | -3.1 | -0.3 | -0.3 | 0.0 |

| Energy | -2.2 | -0.2 | 3.8 | -4.2 | 1.2 | -0.8 | 3.2 | -4.8 |

Seasonally Calendar Adjusted

Source: Statistiche Bundesamt Deutschland

Table VE-3 provides 12-month unadjusted percentage changes of industry and components in Germany. Although there are sharp fluctuations in the data there is suggestion of deceleration that would be expected from much higher earlier rates. The deceleration is quite evident in single-digit percentage changes in the quarter Sep to Dec relative to high double-digit percentage changes in Jan-Mar. Growth rates in the recovery from the global recession from IVQ2007 to IIQ2009 were initially very vigorous in comparison with the growth rates before the contraction that are shown in the bottom part of Table VE-3.

Table VE-3, Germany, Industry and Components, 12 Months ∆% Unadjusted

| IND | MFG | INTG | INVG | DG | NDG | EN | |

| 2011 | |||||||

| Dec | 0.6 | 0.7 | 2.1 | 0.1 | 0.3 | -0.6 | -14.2 |

| Nov | 5.0 | 5.2 | 4.3 | 7.2 | 1.3 | -0.4 | -7.6 |

| Oct | 1.2 | 1.3 | 0.8 | 3.5 | -3.3 | -3.2 | -8.5 |

| Sep | 6.6 | 6.6 | 6.8 | 8.9 | 3.3 | 0.3 | -9.3 |

| Aug | 12.9 | 12.7 | 11.2 | 20.2 | 4.0 | 1.4 | -5.1 |

| Jul | 8.1 | 8.3 | 6.8 | 13.0 | 7.3 | -0.3 | -9.4 |

| Jun | 1.0 | 1.0 | 1.8 | 2.0 | -10.5 | -2.1 | -6.3 |

| May | 21.4 | 21.5 | 18.0 | 28.2 | 21.6 | 13.2 | -11.7 |

| Apr | 7.5 | 7.6 | 6.2 | 11.0 | 4.8 | 2.3 | -7.5 |

| Mar | 10.7 | 10.9 | 10.2 | 14.8 | 8.5 | 1.9 | -0.3 |

| Feb | 17.0 | 17.2 | 16.3 | 22.4 | 11.0 | 6.1 | -2.9 |

| Jan | 17.1 | 17.2 | 17.0 | 23.2 | 11.2 | 4.4 | -3.0 |

| 2010 | |||||||

| Dec | 17.5 | 17.6 | 14.5 | 26.3 | 9.1 | 2.9 | 4.8 |

| Nov | 13.8 | 13.8 | 13.1 | 19.0 | 7.9 | 3.6 | 2.9 |

| Oct | 9.9 | 10.1 | 10.1 | 13.9 | 6.5 | 0.9 | 0.2 |

| Sep | 9.5 | 9.3 | 12.1 | 10.0 | 7.9 | 1.7 | -2.4 |

| Aug | 17.2 | 17.2 | 19.0 | 20.3 | 19.5 | 6.9 | -2.1 |

| Jul | 9.1 | 8.8 | 12.7 | 8.7 | 7.2 | 0.9 | -0.2 |

| Jun | 16.2 | 16.1 | 20.5 | 16.0 | 20.5 | 5.3 | -2.5 |

| May | 13.3 | 13.3 | 20.2 | 11.6 | 10.7 | 1.7 | 12.8 |

| Apr | 14.9 | 14.8 | 21.8 | 15.3 | 8.5 | 0.0 | 9.9 |

| Mar | 14.2 | 14.5 | 20.4 | 11.7 | 11.8 | 6.4 | 7.2 |

| Feb | 7.1 | 7.5 | 10.8 | 7.0 | 7.4 | -1.2 | 5.4 |

| Jan | 0.6 | 0.9 | 6.7 | -3.4 | -0.4 | -3.9 | 3.3 |

| Dec 2010 | 17.5 | 17.6 | 14.5 | 26.3 | 9.1 | 2.9 | 4.8 |

| Dec 2009 | -3.3 | -3.2 | 3.3 | -9.9 | -0.1 | 1.1 | 3.8 |

| Dec 2008 | -7.6 | -7.4 | -14.4 | -5.5 | -11.2 | 3.7 | -9.0 |

| Dec 2007 | 0.1 | -0.3 | -0.6 | 2.5 | -10.0 | -2.6 | 1.7 |

| Dec 2006 | 3.1 | 3.1 | 5.2 | 2.3 | 8.7 | -1.0 | -5.4 |

| Dec 2005 | 5.8 | 5.8 | 3.5 | 8.9 | 3.2 | 2.2 | 0.6 |

| Dec 2004 | 5.2 | 5.6 | 7.6 | 3.4 | 0.9 | 5.7 | 9.6 |

| Dec 2003 | 5.5 | 5.3 | 5.6 | 6.3 | 1.6 | 4.6 | 0.3 |

| Dec 2002 | 3.7 | 3.4 | 5.3 | 3.4 | -5.9 | 2.2 | -2.6 |

Note: IND: Industry; MFG: Manufacturing; INTG: Intermediate Goods; INVG: Investment Goods; DG: Durable Goods; NDG: Nondurable Goods; EN: Energy

Source: Statistiche Bundesamt Deutschland

Broader perspective since 2002 is provided by Chart VE-1 of the Statistiche Bundesamt Deutschland, Federal Statistical Agency of Germany. The index rises by more than one third between 2003 and 2008 with sharp fluctuations and then collapses during the global recession during 2008. Recovery has been in a steep upward trajectory that has recovered at the more recent peaks the losses during the contraction. Recovery was reversed by the drop in Dec.

Chart VE-1, Germany, Production Industries, Not Adjusted, 2005=100

Source: Statistiche Bundesamt Deutschland

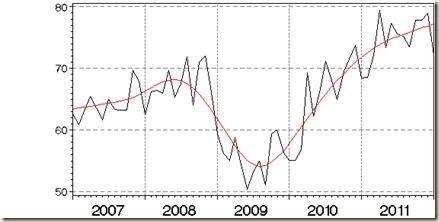

More detail is provided by Chart VE-2 of the Statistiche Bundesamt Deutschland, or Federal Statistical Agency of Germany, with the unadjusted production industries index and trend from 2007 to 2011. There could be some flattening in recent months as depicted by trend.

Chart VE-2, Germany, Production Index, Production Industries, Not Adjusted Index and Trend, 2005=100

Source: Statistiche Bundesamt Deutschland

Table VE-4 provides month and 12-month rates of growth of manufacturing in Germany in 2011. There are fluctuations in both the rates for a month and in the past 12 months. Deceleration appears in the annual equivalent rate of 10.3 percent for Jan-May but minus 5.1 percent in the annual equivalent Jun-Dec.

Table VE-4, Germany, Manufacturing Month and 12 Months ∆%

| 12 Months ∆% NSA | Month ∆% SA and Calendar Adjusted | |

| Dec 2011 | 0.7 | -2.7 |

| Nov | 5.2 | -0.3 |

| Oct | 1.3 | 0.7 |

| Sep | 6.6 | -2.6 |

| Aug | 12.7 | -0.3 |

| Jul | 8.3 | 3.3 |

| Jun | 1.0 | -1.0 |

| AE ∆% Jun-Dec | -5.1 | |

| May | 21.5 | 1.3 |

| Apr | 7.6 | 0.2 |

| Mar | 10.9 | 1.1 |

| Feb | 17.2 | 1.5 |

| Jan | 17.2 | 0.0 |

| AE ∆% Jan-May | 10.3 | |

| Dec | 17.6 | 1.4 |

AE: Annual Equivalent

Source:

Statistiche Bundesamt Deutschland

Chart VE-3 of the Statistiche Bundesamt Deutschland, or Federal Statistical Office of Germany, provides the manufacturing index of Germany from 2007 to 2011. Manufacturing was already flattening in 2007 and fell sharply in 2008 to the beginning of 2010. Manufacturing grew sharply in the initial phase of recovery but has flattened in recent months as revealed by the trend.

Chart VE-3, Germany, Manufacturing Index, Not Adjusted Index and Trend, 2005=100

Source: Statistiche Bundesamt Deutschland

Several tables and charts facilitate analysis of machinery orders in Germany. Table VE-5 reveals strong fluctuations in an evident deceleration of total orders for industry of Germany. The same behavior is observed for total, foreign and domestic orders with decline in 12-month rates from two-digit levels to single digits and some negative changes. An important aspect of Germany is that the bulk of orders is domestic or from other European countries while foreign orders have been growing rapidly. Total orders increased 1.7 percent in Dec 2011 with growth of 4.3 percent in foreign orders compensating decline of 1.4 percent in domestic orders.

Table VE-5, Germany, Volume of Orders Received in Manufacturing, Total, Domestic and Foreign, ∆%

| Total | Total | Foreign 12 M | Foreign M | Home | Home | |

| 2011 | ||||||

| Dec | 0.0 | 1.7 | -0.8 | 4.3 | 1.2 | -1.4 |

| Nov | -4.3 | -4.9 | -7.6 | -7.8 | -0.2 | -1.1 |

| Oct | 1.9 | 5.0 | 4.3 | 8.1 | -1.0 | 1.2 |

| Sep | 2.2 | -4.6 | 1.1 | -5.8 | 3.5 | -3.0 |

| Aug | 6.5 | -1.3 | 4.3 | 0.3 | 9.3 | -3.2 |

| Jul | 5.7 | -2.4 | 5.3 | -7.0 | 6.1 | 3.6 |

| Jun | 2.9 | 0.8 | 6.2 | 11.0 | -1.2 | -10.1 |

| May | 22.5 | 1.9 | 15.7 | -5.2 | 30.5 | 10.7 |

| Apr | 7.3 | 2.9 | 10.5 | 3.5 | 3.4 | 2.2 |

| Mar | 8.8 | -2.8 | 11.6 | -2.8 | 5.5 | -2.7 |

| Feb | 21.1 | 1.9 | 24.8 | 1.6 | 16.9 | 2.1 |

| Jan | 20.1 | 2.3 | 23.6 | 0.9 | 16.0 | 4.2 |

| 2010 | ||||||

| Dec | 22.2 | -2.9 | 27.3 | -3.0 | 15.8 | -2.8 |

| Nov | 21.5 | 5.0 | 26.8 | 7.6 | 15.6 | 1.8 |

| Oct | 14.1 | 1.7 | 17.7 | 1.4 | 10.4 | 2.0 |

| Sep | 13.9 | -2.8 | 16.0 | -4.9 | 11.6 | -0.2 |

| Aug | 23.5 | 3.3 | 31.9 | 6.5 | 14.4 | -0.4 |

| Jul | 14.2 | -1.9 | 21.7 | -3.4 | 6.3 | -0.3 |

| Jun | 28.5 | 3.3 | 32.0 | 5.4 | 24.3 | 0.9 |

| May | 24.4 | 0.5 | 28.9 | 1.0 | 19.9 | -0.1 |

| Apr | 29.3 | 2.6 | 33.0 | 2.7 | 25.2 | 2.4 |

| Mar | 29.4 | 5.7 | 32.3 | 6.2 | 26.4 | 5.1 |

| Feb | 23.4 | -0.7 | 27.6 | -0.7 | 18.6 | -0.8 |

| Jan | 16.7 | 4.7 | 23.6 | 4.4 | 9.7 | 5.1 |

| Dec 2009 | 9.2 | -2.1 | 10.6 | -2.4 | 7.4 | -1.7 |

| Dec 2008 | -28.2 | -7.1 | -31.5 | -9.8 | -23.7 | -3.9 |

| Dec 2007 | 7.1 | -1.5 | 9.1 | -2.4 | 4.5 | -0.4 |

| Dec 2006 | 2.9 | 0.3 | 3.4 | 0.0 | 2.2 | 0.5 |

| Dec 2005 | 4.9 | -0.9 | 10.5 | -1.6 | -1.5 | 0.0 |

| Dec 2004 | 12.7 | 6.6 | 12.9 | 8.4 | 12.7 | 4.9 |

| Dec 2003 | 10.7 | 2.4 | 16.4 | 5.4 | 5.1 | -0.8 |

| Dec 2002 | -0.2 | -3.4 | -0.8 | -6.6 | 0.2 | -0.3 |

Notes: AE: Annual Equivalent; M: Month; M: Calendar and seasonally-adjusted; 12 M: Non-adjusted

Orders for investment goods of Germany are shown in Table VE-6. Total investment goods orders increased 2.8 percent in Dec with foreign orders increasing 3.3 percent and domestic orders increasing 1.9 percent. The same behavior as for total orders is observed in the form of declining orders from all sources for total orders for investment goods. There has been evident deceleration from 2010 and early 2011 with growth rates falling from two digit levels to single digits and multiple negative changes. An important aspect of Germany’s economy shown in Tables VE-5 and VE-6 is the success in increasing the competitiveness of its economic activities as shown by rapid growth of orders for industry after the recession of 2001 in the period before the global recession beginning in late 2007.

Table VE-6, Germany, Volume of Orders Received of Investment Goods Industries, Total, Foreign and Domestic, ∆%

| Total 12 M | Total M | Foreign 12 M | Foreign M | Domestic 12 M | Domestic M | |

| 2011 | ||||||

| Dec | 1.2 | 2.8 | -0.3 | 3.3 | 3.9 | 1.9 |

| Nov | -5.8 | -6.5 | -9.2 | -10.5 | -0.1 | 0.2 |

| Oct | 5.2 | 8.1 | 10.0 | 12.4 | -1.9 | 1.3 |

| Sep | 2.8 | -4.7 | 1.8 | -5.7 | 4.6 | -2.9 |

| Aug | 6.0 | -1.1 | 3.5 | 0.7 | 10.2 | -3.7 |

| Jul | 8.5 | -6.3 | 7.7 | -11.9 | 9.6 | 3.6 |

| Jun | 7.1 | 3.1 | 10.6 | 17.1 | 1.2 | -14.8 |

| May | 26.8 | 2.8 | 17.9 | -7.0 | 40.4 | 19.0 |

| Apr | 11.8 | 5.0 | 15.6 | 6.7 | 6.3 | 2.2 |

| Mar | 10.7 | -5.3 | 13.7 | -4.8 | 6.5 | -6.1 |

| Feb | 28.9 | 3.5 | 32.8 | 3.3 | 23.1 | 3.8 |

| Jan | 24.3 | 1.4 | 28.6 | 0.5 | 17.9 | 2.6 |

| 2010 | ||||||

| Dec | 27.3 | -4.6 | 31.0 | -6.1 | 21.3 | -2.1 |

| Nov | 30.1 | 8.1 | 35.9 | 12.2 | 21.5 | 2.2 |

| Oct | 20.6 | 1.7 | 23.9 | 0.3 | 16.0 | 4.0 |

| Sep | 18.1 | -3.9 | 20.4 | -6.2 | 14.6 | -0.2 |

| Aug | 29.3 | 6.8 | 42.8 | 10.4 | 12.0 | 1.4 |

| Jul | 14.1 | -4.7 | 28.4 | -6.9 | -2.3 | -1.3 |

| Jun | 33.5 | 5.6 | 41.3 | 8.8 | 22.2 | 0.7 |

| May | 25.9 | 2.0 | 35.6 | 1.8 | 13.6 | 2.5 |

| Apr | 30.1 | 2.2 | 40.1 | 3.2 | 17.4 | 0.6 |

| Mar | 26.2 | 7.5 | 33.8 | 8.6 | 16.1 | 5.7 |

| Feb | 20.3 | -1.9 | 30.3 | -1.5 | 8.1 | -2.5 |

| Jan | 16.9 | 4.6 | 29.5 | 3.3 | 2.5 | 6.6 |

| Dec 2009 | 8.1 | -1.4 | 13.6 | -1.9 | 0.5 | -0.8 |

| Dec 2008 | -32.2 | -7.6 | -36.7 | -10.7 | -24.4 | -3.1 |

| Dec 2007 | 9.6 | -0.6 | 11.6 | -2.7 | 6.3 | 2.7 |

| Dec 2006 | 3.6 | 1.8 | 3.8 | 1.9 | 3.1 | 1.9 |

| Dec 2005 | 1.9 | -2.8 | 9.8 | -3.8 | -8.5 | -1.3 |

| Dec 2004 | 19.4 | 11.2 | 18.6 | 12.2 | 20.5 | 9.8 |

| Dec 2003 | 11.7 | 2.1 | 17.2 | 5.0 | 5.4 | -1.6 |

| Dec 2002 | -2.8 | -4.3 | -3.7 | -8.1 | -1.8 | 0.2 |

Notes: AE: Annual Equivalent; M: Month; M: Calendar and seasonally-adjusted; 12 M: Non-adjusted

Chart VE-4 of the German Statistisches Bundesamt Deutschland shows the sharp upward trend of total orders in manufacturing before the global recession. There is also an obvious upward trend in the recovery from the recession with Germany’s economy being among the most dynamic in the advanced economies until the slowdown late in 2011.

Chart VE-4, Germany, Volume of Total Orders in Manufacturing, Non-Adjusted, 2005=100

Source: Statistisches Bundesamt Deutschland

Chart VE-5 of the German Statistisches Bundesamt Deutschland provides unadjusted volume of total orders in manufacturing and a trend curve. The final segment on the right could be the beginning of flattening of the trend curve but it is early to reach conclusions.

Chart VE-5, Germany, Volume of Total Orders in Manufacturing and Trend, Non-Adjusted, 2005=100

Source: Statistisches Bundesamt Deutschland

Twelve-month rates of growth Germany’s exports and imports are shown in Table VE-7. There was sharp decline in the rates in Jun and Jul to single-digit levels especially for exports. In the 12 months ending in Aug, exports rose 14.4 percent and imports 13.2 percent. In Sep, exports grew 10.5 percent relative to a year earlier and imports grew 12.0 percent. Growth rates in 12 months ending in Oct fell significantly to 3.7 percent for exports and 8.9 percent for imports. Lower prices may explain part of the decline in nominal values. Exports grew 8.3 percent in Nov and imports 6.7 percent. In Dec, exports grew 5.0 percent in 12 months and imports 5.4 percent. Growth had been much stronger in the recovery during 2010 and 2011 from the fall from 2007 to 2009. Germany’s trade grew at high rates in 2006 and 2005.

Table VE-7, Germany, Exports and Imports NSA Euro Billions and 12-Month ∆%

| Exports EURO Billions | 12- Month | Imports | 12-Month | |

| Dec 2011 | 85.1 | 5.0 | 72.1 | 5.4 |

| Nov | 94.8 | 8.2 | 78.9 | 7.0 |

| Oct | 89.2 | 3.7 | 77.9 | 8.9 |

| Sep | 95.0 | 10.5 | 77.8 | 12.0 |

| Aug | 85.1 | 14.4 | 73.5 | 13.2 |

| Jul | 85.7 | 5.3 | 75.3 | 10.0 |

| Jun | 88.1 | 3.3 | 75.6 | 6.2 |

| May | 92.0 | 20.8 | 77.4 | 17.2 |

| Apr | 84.3 | 12.1 | 73.4 | 18.1 |

| Mar | 98.2 | 14.7 | 79.4 | 14.5 |

| Feb | 84.1 | 20.1 | 72.1 | 27.1 |

| Jan | 78.6 | 24.1 | 68.5 | 24.4 |

| Dec 2010 | 81.0 | 20.0 | 68.4 | 24.3 |

| Nov | 87.6 | 21.2 | 73.7 | 30.9 |

| Oct | 86.0 | 18.7 | 71.5 | 19.1 |

| Sep | 86.0 | 21.2 | 69.5 | 17.0 |

| Aug | 74.4 | 23.8 | 64.9 | 27.1 |

| Jul | 81.4 | 15.3 | 68.4 | 24.4 |

| Jun | 85.3 | 27.5 | 71.2 | 33.9 |

| May | 76.2 | 25.6 | 66.0 | 31.2 |

| Apr | 75.2 | 16.7 | 62.2 | 14.5 |

| Mar | 85.6 | 22.0 | 69.3 | 18.0 |

| Feb | 70.0 | 9.7 | 56.8 | 3.2 |

| Jan | 63.4 | -0.3 | 55.1 | -1.9 |

| Dec 2009 | 67.5 | 1.2 | 55.0 | -7.3 |

| Dec 2008 | 66.7 | -8.6 | 59.4 | -5.0 |

| Dec 2007 | 73.0 | -0.6 | 62.5 | -0.1 |

| Dec 2006 | 73.4 | 10.2 | 62.6 | 8.5 |

| Dec 2005 | 66.6 | 11.5 | 57.7 | 18.1 |

| Dec 2004 | 59.7 | 9.2 | 48.9 | 10.8 |

| Dec 2003 | 54.7 | 7.6 | 44.1 | 3.9 |

| Dec 2002 | 50.8 | 5.5 | ||

| Dec 2001 | 48.2 | -3.7 | ||

| Dec 2000 | 50.0 |

Source: Statistiche Bundesamt Deutschland

Table VE-8 provides monthly rates of growth of exports and imports of Germany. Exports surged in Aug after weak negative growth in Jul and Jun. Exports grew again 0.8 percent in Sep but fell 2.9 percent in Oct. Exports increased 2.6 percent in Nov and fell 4.2 percent in Dec. The trade account has benefitted from declines in imports of 0.9 percent in Sep, 0.2 percent in percent in Nov and 3.9 percent in Dec.

Table VE-8, Germany, Exports and Imports Month ∆% Calendar and Seasonally Adjusted

| Exports | Imports | |

| Dec 2011 | -4.3 | -3.9 |

| Nov | 2.6 | -0.2 |

| Oct | -2.9 | 0.1 |

| Sep | 0.8 | -0.9 |

| Aug | 3.2 | 0.0 |

| Jul | -1.0 | 0.5 |

| Jun | -0.5 | -0.3 |

| May | 2.9 | 3.0 |

| Apr | -4.0 | -1.9 |

| Mar | 5.5 | 2.6 |

| Feb | 2.5 | 3.2 |

| Jan | 0.3 | 3.6 |

| Dec 2010 | -1.1 | -2.6 |

Source: Statistiche Bundesamt Deutschland

Chart VE-6 of the Statistisches Bundesamt Deutschland shows exports and trend of German exports. Growth has been with fluctuations around a strong upward trend.

Chart VE-6, Germany, Exports Original Value and Trend 2007-2011

Source: Statistisches Bundesamt Deutschland

Chart VE-7 of the Statistisches Bundesamt Deutschland provides German imports and trend. Imports also fell sharply and have been recovering with fluctuations around a strong upward trend that could be flattening

Chart VE-7, Germany, Imports Original Value and Trend 2007-2011

Source: Statistisches Bundesamt Deutschland

Chart VE-8 of the Statistisches Bundesamt Deutschland shows the trade balance of Germany since 2007. There was sharp decline during the global recession and fluctuations around a mild upward trend during the recovery with stabilization followed by stronger trend in recent months.

Chart VE-8, Germany, Trade Balance Original and Trend 2007-2011

Source:

Statistisches Bundesamt Deutschland

There is extremely important information in Table VE-9 for the current sovereign risk crisis in the euro zone. Table VE-9 provides the structure of regional and country relations of Germany’s exports and imports with newly available data for Dec. German exports to other European Union members are 47.4 percent of total exports in Dec and 59.2 percent in Jan-Dec. Exports to the euro area are 31.8 percent in Dec and 39.7 percent in Jan-Dec. Exports to third countries are 44.3 percent of the total in Dec and 40.8 percent in Jan-Dec. There is similar distribution for imports. Economic performance in Germany is closely related to its high competitiveness in world markets. Weakness in the euro zone and the European Union in general could affect the German economy. This may be the major reason for choosing the “fiscal abuse” of the European Central Bank considered by Buiter (2011Oct31) over the breakdown of the euro zone. There is a tough analytical, empirical and forecasting doubt of growth and trade in the euro zone and the world with or without maintenance of the European Monetary Union (EMU) or euro zone. Germany could benefit from depreciation of the euro because of its high share in exports to countries not in the euro zone but breakdown of the euro zone raises doubts on the region’s economic growth that could affect German exports to other member states.

Table VE-9, Germany, Structure of Exports and Imports by Region, € Billions and ∆%

| Dec 2011 | 12 Months | Jan-Dec | Jan-Dec 2011/ | |

| Total | 85.1 | 5.0 | 1,060.1 | 11.4 |

| A. EU | 47.4 % 55.7 | -1.6 | 627.3 % 59.2 | 9.9 |

| Euro Area | 31.8 % 37.4 | -3.3 | 420.9 % 39.7 | 8.6 |

| Non-euro Area | 15.5 % 18.2 | 2.2 | 206.4 % 19.5 | 12.6 |

| B. Third Countries | 37.7 % 44.3 | 14.7 | 432.8 % 40.8 | 13.6 |

| Total Imports | 72.1 | 5.4 | 902.0 | 13.2 |

| C. EU Members | 45.9 % 63.7 | 5.1 | 572.6 % 63.5 | 13.8 |

| Euro Area | 31.9 % 44.2 | 3.5 | 401.5 % 44.5 | 12.9 |

| Non-euro Area | 14.0 % 19.4 | 8.8 | 171.1 % 18.9 | 16.1 |

| D. Third Countries | 26.2 % 36.3 | 6.1 | 329.4 % 36.5 | 12.0 |

Notes: Total Exports = A+B; Total Imports = C+D

VF France. The Markit France Services Activity Index of the Markit France Services PMI® rose from 50.3 in Dec to 52.3 in Jan such that the Markit France Composite Output Index increased from stability at 50 in Dec to growth at 51.2 in Jan, which is a high in five months (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9154). The pace of deterioration of manufacturing business slowed with the Markit Purchasing Managers’ Index® (PMI®)) fell slightly from 48.9 in Dec to 48.5 in Jan, suggesting modest deterioration of business conditions (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9104). There were additional declines in new orders and output in Jan. There was only marginal decline in foreign new orders. Jack Kennedy, Senior Economist at Markit and author of the France Manufacturing PMI®, finds challenging conditions with special weakness in domestic demand (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9104). Table FR provides the country data table for France.

Table FR, France, Economic Indicators

| CPI | Dec month ∆% 0.4 |

| PPI | Dec month ∆%: -0.1 Blog 02/05/12 |

| GDP Growth | IIIQ2011/IIQ2011 ∆%: 0.3 |

| Industrial Production | Dec/Nov SA ∆%: |

| Industrial New Orders | Mfg Nov ∆% 1.0 YOY ∆% 2.8 Blog 01/22/12 |

| Consumer Spending | Dec Manufactured Goods |

| Employment | IIIQ2011 Unemployed 2.631 million |

| Trade Balance | Dec Exports ∆%: month minus 2.7, 12 months 7.2 Dec Imports ∆%: month minus 0.4, 12 months 5.3 Blog 02/12/12 |

| Confidence Indicators | Historical averages 100 Dec: France 91 Mfg Business Climate 91 Retail Trade 89 Services 92 Building 100 Household 81 Blog 1/29/12 |

Links to blog comments in Table FR:

02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or.html

01/29 http://cmpassocregulationblog.blogspot.com/2012/01/mediocre-economic-growth-financial.html

01/15/12 http://cmpassocregulationblog.blogspot.com/2012/01/recovery-without-hiring-united-states_15.html

01/08/12 http://cmpassocregulationblog.blogspot.com/2012/01/thirty-million-unemployed-or.html

12/27/11 http://cmpassocregulationblog.blogspot.com/2011/12/slow-growth-falling-real-disposable_27.html

12/04/11 http://cmpassocregulationblog.blogspot.com/2011/12/twenty-nine-million-in-job-stress.html

France’s industrial production by segments is provided in Table VF-1. Total industry fell 1.4 percent in Dec after increasing 1.1 percent in Nov and manufacturing fell 1.4 percent in Dec after increasing 1.4 percent in Nov. Construction fell 2.0 percent in Dec after increasing 1.7 percent in Nov. Mining fell 1.3 percent in Dec and declined 0.7 percent in Nov. There were declines for all categories in the quarter. Industry rose 0.6 percent relative to the same quarter a year earlier and manufacturing grew 2.1 percent while mining fell 8.5 percent.

Table VF-1, France, Industrial Production ∆%

| Dec/Nov | Nov/Oct | QOQ | YOY | |

| Industry | -1.4 | 1.1 | -0.8 | 0.6 |

| Manufacturing | -1.4 | 1.4 | -0.5 | 2.1 |

| Mining, Mining, Energy, Water, Waste Mgt | -1.3 | -0.7 | -2.9 | -8.5 |

| Construction | -2.0 | 1.7 | -0.7 | 3.1 |

Note: QOQ: quarter on quarter; YOY:most recent quarter on the same quarter a year earlier

Source: Institut National de la Statistique et des Études Économiques

http://www.insee.fr/en/themes/info-rapide.asp?id=10&date=20120210

Table VF-2 provides longer historical perspective of manufacturing in France. The decline of 1.4 percent in Dec corresponded to increase of 0.8 percent in 12 months. There is similar strength earlier in the recovery in 2010 and early 2011 with less strong performance in the latter part of 2011. Manufacturing fell 12.7 percent in 2008 during the global contraction and an additional 2.8 percent in 2009.

Table VF-2, France, Manufacturing, Month and 12-Month ∆%

| Month ∆% | 12-Month ∆% | |

| Dec 2011 | -1.4 | 0.8 |

| Nov | 1.4 | 2.6 |

| Oct | 0.3 | 2.8 |

| Sep | -2.0 | 1.8 |

| Aug | 0.3 | 4.7 |

| Jul | 1.8 | 3.9 |

| Jun | -2.0 | 3.2 |

| May | 1.2 | 4.1 |

| Apr | -0.3 | 3.4 |

| Mar | -0.9 | 4.4 |

| Feb | 0.6 | 7.1 |

| Jan | 1.9 | 6.6 |

| Dec 2010 | 0.4 | 5.0 |

| Dec 2009 | -2.8 | |

| Dec 2008 | -12.7 | |

| Dec 2007 | -0.2 | |

| Dec 2006 | 2.4 | |

| Dec 2005 | -0.1 | |

| Dec 2004 | 1.5 | |

| Dec 2003 | 0.3 | |

| Dec 2002 | -0.5 | |

| Dec 2001 | -4.8 | |

| Dec 2000 | 5.1 | |

| Average ∆% 1990-2000 | 1.5 |

Source:

Institut National de la Statistique et des Études Économiques

http://www.insee.fr/en/themes/info-rapide.asp?id=10&date=20120210

Chart VF-1 of France’s Institut National de la Statistique et des Études Économiques shows indices of manufacturing in France from 2007 to 2011. Manufacturing, which is CZ in Chart VF-1, fell deeply in 2008 and part of 2009. All curves of industrial indices tend to flatten recently with oscillations.

Chart VF-1, France, Industrial Production Indices 2007-2011

Legend : CZ : Manufacturing - (C1) : Manufacture of food products and beverages - (C3) : Electrical and electronic equipment; machine equipment - (C4) : Manufacture of transport equipment - (C5) : Other manufacturing

Source: Institut National de la Statistique et des Études Économiques

France has been running a trade deficit fluctuating around €6,000 million, as shown in Table VF-3. Exports fell 2.7 percent in Dec while imports increased 5.3 percent, resulting in increase of the trade deficit from €4140 million in Nov to €4993 million in Dec.

Table VF-3, France, Exports, Imports and Trade Balance, € Millions

| Exports | Imports | Trade Balance | |

| Dec 2011 | 36,458 | 41,451 | -4,993 |

| Nov | 37,460 | 41,600 | -4,140 |

| Oct | 36,049 | 41,796 | -5,747 |

| Sep | 35,953 | 42,053 | -6,100 |

| Aug | 37,719 | 42,362 | -4,643 |

| Jul | 35,134 | 41,592 | -6,458 |

| Jun | 34,863 | 40,067 | -5,204 |

| May | 34,846 | 41,487 | -6,641 |

| Apr | 34,561 | 41,493 | -6,932 |

| Mar | 35,098 | 41,214 | -6,116 |

| Feb | 34,786 | 41,165 | -6,379 |

| Jan | 34,380 | 40,869 | -6,489 |

| Dec 2010 | 34,023 | 39,380 | -5,357 |

Source: http://lekiosque.finances.gouv.fr/AppChiffre/nationales/surcadre_nationales.asp?TF=revue

Month and 12-month rates of growth of exports and imports of France are provided in Table VF-4. Exports fell 2.7 percent in Dec and grew 7.2 percent in 12 months. Imports fell 0.4 percent in Dec and grew 5.3 percent in 12 months. Growth of exports and imports has fluctuated in 2011 as a result of price surges of commodities and raw materials.

Table VF-4, France, Exports and Imports, Month and 12-Month ∆%

| Exports | Exports | Imports | Imports 12-Month ∆% | |

| Dec 2011 | -2.7 | 7.2 | -0.4 | 5.3 |

| Nov | 3.9 | 8.1 | -0.5 | 5.2 |

| Oct | 0.3 | 9.1 | -0.6 | 14.9 |

| Sep | -4.7 | 8.3 | -0.7 | 10.9 |

| Aug | 7.4 | 11.2 | 1.9 | 9.1 |

| Jul | 0.8 | 2.3 | 3.8 | 9.6 |

| Jun | 0.3 | 3.8 | -3.1 | 7.9 |

| May | 0.8 | 15.4 | 0.0 | 16.2 |

| Apr | -1.5 | 7.7 | 0.7 | 14.3 |

| Mar | 0.9 | 11.4 | 0.1 | 14.6 |

| Feb | 1.2 | 14.0 | 0.7 | 21.6 |

| Jan | 1.0 | 13.8 | 3.8 | 20.1 |

| Dec 2011 | 7.2 | 5.3 | ||

| Dec 2010 | 14.6 | 15.1 | ||

| Dec 2009 | -9.9 | -2.2 | ||

| Dec 2008 | -7.3 | -11.3 | ||

| Dec 2007 | 6.1 | 8.4 | ||

| Dec 2006 | 7.4 | 6.9 | ||

| Dec 2005 | 11.0 | 14.8 | ||

| Dec 2004 | -3.6 | 5.9 | ||

| Dec 2003 | 7.1 | 1.6 |

Source: http://lekiosque.finances.gouv.fr/AppChiffre/nationales/surcadre_nationales.asp?TF=revue

Table VF-5 provides exports, imports and the trade balance of France from 2002 to 2011. The trade balance deteriorated sharply from deficit of €44,935 million in 2009 to deficit of €69,592 million in 2011. The rate of import growth of 11.7 percent in 2011 exceeded that rate of export growth of 8.6 percent.

Table VF-5, France, Cumulative Exports, Imports and Trade Balance, € Millions and ∆%, 2002-2011

| Exports | ∆% | Imports | ∆% | Balance | |

| 2011 | 428,802 | 8.6 | 498,394 | 11.7 | -69,592 |

| 2010 | 394,760 | 14.0 | 446,287 | 14.1 | -51,527 |

| 2009 | 346,248 | -17.1 | 391,183 | -17.4 | -44,935 |

| 2008 | 417,634 | 2.7 | 473,853 | 5.5 | -56,219 |

| 2007 | 406,487 | 3.0 | 448,981 | 5.8 | -42,494 |

| 2006 | 394,621 | 9.5 | 424,549 | 10.4 | -29,928 |

| 2005 | 360,376 | 4.4 | 384,588 | 9.6 | -24,212 |

| 2004 | 345,256 | 5.4 | 350,996 | 7.0 | -5,740 |

| 2003 | 327,653 | -1.7 | 327,884 | -0.6 | -231 |

| 2002 | 333,423 | NA | 329,875 | nA | 3,548 |

Source: http://lekiosque.finances.gouv.fr/AppChiffre/nationales/surcadre_nationales.asp?TF=revue

VG Italy. The Markit/ADACI Business Activity Index of the Markit/ADACI Italy Services PMI® increased from 44.5 in Dec to 44.8 in Jan, indicating sharp contraction in services output in Italy (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9146). Italy’s Markit/ADACI Purchasing Managers’ Index® (PMI®)) improved further from 44.3 in Dec to 46.8 in Jan but still showing significant deterioration of business conditions for Italian manufacturers (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9093). Improvement originated in slower rhythm of decline of new orders and manufacturing product but new orders have declined during eight months. An important finding in the survey is that the declining euro relative to the dollar resulted in success of Italian entities in obtaining new business in the US. Phil Smith, Economist at Markit and author of the report, finds improvement of Italian manufacturing in moving away from contraction but with still weakening new orders (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9093). Table IT provides the country data table for Italy.

Table IT, Italy, Economic Indicators

| Consumer Price Index | Jan month ∆%: 0.3 |

| Producer Price Index | Dec month ∆%: 0.1 Blog 02/05/12 |

| GDP Growth | IIIQ2011/IIIQ2010 SA ∆%: 0.2 |

| Labor Report | Dec 2011 Participation rate 62.5% Employment ratio 56.9% Unemployment rate 8.9% Blog 02/05/12 |

| Industrial Production | Dec month ∆%: 1.4 |

| Retail Sales | Nov month ∆%: minus 1.8 Nov 12 months ∆%: minus 0.3 Blog 01/29/12 |

| Business Confidence | Mfg Jan 92.1, Sep 94.4 Construction Jan 82.2, Sep 79.0 Blog 02/05/12 |

| Consumer Confidence | Consumer Confidence Jan 91.6, Dec 96.1 Economy Jan 75.3, Dec 77.1 Blog 01/29/12 |

| Trade Balance | Balance Nov SA -€1417 million versus Oct -€1946 |

Links to blog comments in Table IT:

02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or.html

01/29/12 http://cmpassocregulationblog.blogspot.com/2012/01/mediocre-economic-growth-financial.html

1/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

12/27/11 http://cmpassocregulationblog.blogspot.com/2011/12/slow-growth-falling-real-disposable_27.html

Italy’s industrial production increased 1.4 percent in Dec but is lower by 1.7 percent relative to a year earlier. Industrial production increased 0.3 percent in Nov but fell 4.1 percent in 12 months, as shown in Table VG-1. Industrial production fell 18.8 percent in 2009 after falling 3.2 percent in 2008.

Table VG-1, Italy, Industrial Production ∆%

| Month ∆% SA | 12 Months ∆% Calendar Adjusted | |

| Dec 2011 | 1.4 | -1.7 |

| Nov | 0.3 | -4.1 |

| Oct | -0.8 | -4.0 |

| Sep | -4.7 | -2.7 |

| Aug | 3.6 | 4.7 |

| Jul | -0.6 | -1.1 |

| Jun | -0.7 | 0.1 |

| May | -0.8 | 1.8 |

| Apr | 0.8 | 3.9 |

| Mar | 0.4 | 3.5 |

| Feb | 1.1 | 2.4 |

| Jan | -1.7 | 0.4 |

| Dec 2010 | -0.6 | 6.3 |

| Nov | 0.8 | 5.2 |

| Oct | 0.1 | 3.8 |

| Sep | 0.3 | 5.5 |

| Aug | -0.4 | 11.0 |

| Jul | 0.5 | 7.0 |

| Jun | 0.9 | 9.6 |

| May | 1.1 | 8.4 |

| Apr | 0.7 | 9.1 |

| Mar | -0.3 | 7.8 |

| Feb | -0.5 | 4.2 |

| Jan | 3.7 | 0.7 |

| Dec 2009 | -1.3 | -6.6 |

| Year | ||

| 2011 | 0.0 | |

| 2010 | 6.4 | |

| 2009 | -18.8 | |

| 2008 | -3.2 |

Source: Istituto Nazionale di Statistica

http://www.istat.it/it/archivio/53027

Month and 12-month rates of growth of Italy’s industrial production and major categories are provided in Table VG-2 for Dec 2011. The 12-month rates of change are all negative and relatively high. Total industrial production increased 1.4 percent in Dec but fell 1.7 percent relative to a year earlier. In the month of Dec, consumer goods increased 1.8 percent, durable goods 3.0 percent and nondurable goods 1.6 percent.

Table VG-2, Italy, Industrial Production Rate of Change ∆%

| Dec 2011 | Month ∆% | 12-Month ∆% |

| Total | 1.4 | -1.7 |

| Consumer Goods | 1.8 | -0.8 |

| Durable | 3.0 | -4.7 |

| Nondurable | 1.6 | -0.1 |

| Capital Goods | 3.6 | 3.2 |

| Intermediate Goods | 0.0 | -3.6 |

| Energy | -2.0 | -10.3 |

Source:

Istituto Nazionale di Statistica

http://www.istat.it/it/archivio/53027

VH United Kingdom. The Markit/CIPS UK Services PMI® rose from 54.0 in Dec to 56.0 in Jan (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9155). Chris Williamson, Chief Economist at Markit, finds strength in services, manufacturing and construction, constituting significant improvement over IVQ2011 (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9155). Table UK provides the country data table for the UK.

Table UK, UK Economic Indicators

| CPI | Dec month ∆%: 0.4 |

| Output/Input Prices | Output Prices: |

| GDP Growth | IVQ2011 prior quarter ∆% minus 0.2; year earlier same quarter ∆%: 0.8 |

| Industrial Production | Dec 2011/Dec 2010 NSA ∆%: Industrial Production minus 3.3; Manufacturing 0.8 |

| Retail Sales | Dec month SA ∆%: +0.6 |

| Labor Market | Sep/Nov Unemployment Rate: 8.4%; Claimant Count 5%; Earnings Growth 1.9% |

| Trade Balance | Balance Dec minus ₤1109 million |

Links to blog comments in Table UK:

01/29/12 http://cmpassocregulationblog.blogspot.com/2012/01/mediocre-economic-growth-financial.html

01/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

01/15/12 http://cmpassocregulationblog.blogspot.com/2012/01/recovery-without-hiring-united-states_15.html

12/27/11 http://cmpassocregulationblog.blogspot.com/2011/12/slow-growth-falling-real-disposable_27.html

Table VH-1, UK, Output of the Production Industries, Chain Volume Indices of Gross Value Added, 12-Month ∆%

| PROD | MNG | MFG | ENGY | CON | CON | CAP | |

| 2011 | |||||||

| Dec | -3.3 | -14.6 | 0.8 | -15.4 | -4.6 | 0.1 | 5.7 |

| Nov | -3.6 | -15.0 | -1.0 | -12.7 | 0.1 | -0.8 | 4.1 |

| Oct | -2.7 | -14.1 | -0.3 | -11.6 | -1.5 | -1.3 | 4.8 |

| Sep | -2.0 | -18.3 | 1.0 | -12.1 | -1.4 | 0.0 | 6.4 |

| Aug | -1.5 | -16.0 | 0.9 | -9.9 | -1.7 | 1.6 | 4.0 |

| Jul | -1.4 | -17.3 | 2.0 | -11.4 | 1.4 | 3.1 | 4.4 |

| Jun | -0.7 | -16.8 | 2.9 | -10.3 | 6.6 | 2.3 | 7.5 |

| May | -1.7 | -22.8 | 3.4 | -14.6 | 2.2 | 3.4 | 6.3 |

| Apr | -2.0 | -16.5 | 1.9 | -12.5 | 1.3 | 3.7 | 4.4 |

| Mar | -0.8 | -16.6 | 2.9 | -11.4 | 1.3 | 0.3 | 8.6 |

| Feb | 1.2 | -12.7 | 4.7 | -8.7 | 0.8 | 0.5 | 10.6 |

| Jan | 3.1 | -5.0 | 5.8 | -4.6 | 4.3 | -0.5 | 10.6 |

| 2010 | |||||||

| Dec | 3.3 | -4.8 | 4.3 | 0.8 | -4.6 | 3.1 | 8.0 |

| Nov | 2.7 | -6.2 | 5.1 | -3.1 | -9.4 | 1.2 | 9.5 |

| Oct | 2.7 | -6.2 | 5.3 | -3.1 | -9.5 | 4.2 | 7.3 |

| Sep | 3.7 | 2.9 | 5.2 | 1.2 | -9.0 | 2.1 | 9.7 |

| Aug | 3.8 | 0.3 | 6.2 | -1.1 | 0.2 | 3.5 | 12.7 |

| Jul | 1.6 | -8.9 | 5.0 | -7.1 | -1.4 | -0.9 | 12.7 |

| Jun | 1.2 | -9.5 | 3.9 | -6.6 | -6.2 | 0.5 | 9.6 |

| May | 2.5 | -1.0 | 3.5 | -1.4 | -2.6 | -3.3 | 12.2 |

| Apr | 0.9 | -5.9 | 2.1 | -3.6 | -3.7 | -6.3 | 10.1 |

| Mar | 2.2 | -1.4 | 3.2 | -0.9 | 0.2 | -1.7 | 9.2 |

| Feb | -0.6 | -8.4 | 1.0 | -5.9 | -1.5 | -2.7 | 7.4 |

| Jan | -1.6 | -8.7 | -0.4 | -5.1 | -3.5 | -1.4 | 4.9 |

| 2011/ 2010 | -1.3 | -15.5 | 2.1 | -11.3 | 0.7 | 1.0 | 6.4 |

| 2010/ | 1.9 | -4.9 | 3.7 | -3.1 | -4.3 | -0.2 | 9.4 |

| 2009/ 2008 | -9.0 | -9.0 | -9.6 | -6.2 | -7.5 | -0.8 | -10.7 |

| 2008/ 2007 | -2.8 | -6.5 | -2.6 | -2.9 | -5.6 | -1.9 | -3.0 |

| 2007/ | 0.5 | -2.5 | 0.8 | -1.2 | 1.0 | -1.7 | 2.5 |

| 2006/ 2005 | -- | -7.6 | 1.7 | -5.4 | 0.3 | 0.7 | 2.9 |

Notes: PROD IND: Production Industries; MNG: Mining; MFG: Manufacturing; ENGY: Energy; CON DUR: Consumer Durables; CONS NDUR: Consumer Nondurables; CAP: Capital Goods

Source: http://www.ons.gov.uk/ons/rel/iop/index-of-production/december-2011/index.html

Percentage changes in the production industries and major components in the latest month relative to the prior month are shown in Table VH-2. Manufacturing fell in all months from Jun to Nov with the exception of no growth in Sep. In Dec, manufacturing grew 1.0 percent. Growth was stronger in the first five months to May with the exception of decline by 1.3 percent in Apr. Output of consumer durables has fallen sharply in Jul-Dec by cumulative 5.9 percent with growth only in Nov by 1.0 percent. Output of capital goods fell 0.8 percent in Jul and then another 0.2 percent in Aug but grew strongly by 2.0 percent in Sep but declined slightly by 1.0 percent in Oct, increasing 1.3 percent in Nov and 0.9 percent in Dec.

Table VH-2, UK, Output of the Production Industries, Chained Volume Indices of Gross Value Added, Latest Month on Previous Month ∆%

| PROD | MNG | MFG | ENGY | CON | CON | CAP | |

| 2011 | |||||||

| Dec | 0.5 | -2.1 | 1.0 | -1.1 | -1.0 | 1.2 | 0.9 |

| Nov | -0.5 | -1.8 | -0.1 | -1.4 | 1.0 | -0.3 | 1.3 |

| Oct | -1.1 | 0.0 | -0.9 | -1.8 | -0.1 | -0.6 | -1.0 |

| Sep | -0.2 | -1.6 | 0.0 | -1.2 | -2.7 | -2.1 | 2.0 |

| Aug | 0.2 | 2.7 | -0.4 | 1.9 | -1.9 | 0.3 | -0.2 |

| Jul | -0.4 | -0.5 | -0.2 | -1.4 | -2.2 | -0.2 | -0.8 |

| Jun | 0.2 | 1.0 | -0.3 | 1.3 | 0.1 | 0.5 | -0.1 |

| May | 0.8 | -5.4 | 1.7 | -1.3 | 0.9 | 0.6 | 2.8 |

| Apr | -1.7 | -1.1 | -1.3 | -2.3 | -1.0 | 0.3 | -3.3 |

| Mar | 0.2 | -0.8 | 0.4 | -0.5 | 0.5 | 1.3 | 0.9 |

| Feb | -1.3 | -8.2 | 0.1 | -5.6 | -1.4 | 0.2 | 1.4 |

| Jan | 0.1 | 2.4 | 0.9 | -3.1 | 3.3 | -1.1 | 2.0 |

| 2010 | |||||||

| Dec | 0.2 | -2.5 | -0.7 | 2.1 | 3.9 | 0.2 | -0.6 |

Notes: PROD IND: Production Industries; MNG: Mining; MFG: Manufacturing; ENGY: Electricity, Gas and Water Supply; CON DUR: Consumer Durables; CONS NDUR: Consumer Nondurables; CAP: Capital Goods

Source: http://www.ons.gov.uk/ons/rel/iop/index-of-production/december-2011/index.html