Peaking Valuations of Risk Financial Assets, United States Commercial Banks, Collapse of United States Dynamism of Income Growth and Employment Creation, World Cyclical Slow Growth and Global Recession Risk

Carlos M. Pelaez

© Carlos M. Pelaez, 2009, 2010, 2011, 2012, 2013, 2014

I Peaking Valuations of Risk Financial Assets

IB Collapse of United States Dynamism of Income Growth and Employment Creation

II United States Commercial Banks

III World Financial Turbulence

IIIA Financial Risks

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

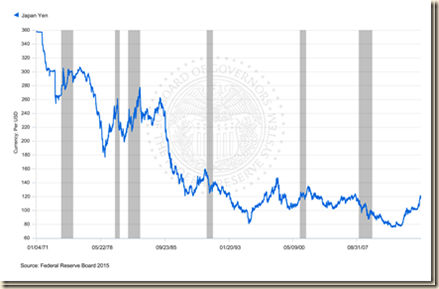

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendixes

Appendix I The Great Inflation

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIG Appendix on Deficit Financing of Growth and the Debt Crisis

IIIGA Monetary Policy with Deficit Financing of Economic Growth

IIIGB Adjustment during the Debt Crisis of the 1980s

Executive Summary

Contents of Executive Summary

ESI Financial “Irrational Exuberance,” Increasing Interest Rate Risk, Tapering Quantitative Easing, Duration Dumping, Competitive Devaluations, Steepening Yield Curve and Global Financial and Economic Risk

ESII Peaking Valuations of Risk Financial Assets

ESIII Collapse of United States Dynamism of Income Growth and Employment Creation

ESIV United States Commercial Banks Assets and Liabilities

ESV Slowing World Economic Growth

ESI “Financial “Irrational Exuberance,” Increasing Interest Rate Risk, Tapering Quantitative Easing, Duration Dumping, Steepening Yield Curve and Global Financial and Economic Risk. The International Monetary Fund (IMF) provides an international safety net for prevention and resolution of international financial crises. The IMF’s Financial Sector Assessment Program (FSAP) provides analysis of the economic and financial sectors of countries (see Pelaez and Pelaez, International Financial Architecture (2005), 101-62, Globalization and the State, Vol. II (2008), 114-23). Relating economic and financial sectors is a challenging task for both theory and measurement. The International Monetary Fund (IMF) provides an international safety net for prevention and resolution of international financial crises. The IMF’s Financial Sector Assessment Program (FSAP) provides analysis of the economic and financial sectors of countries (see Pelaez and Pelaez, International Financial Architecture (2005), 101-62, Globalization and the State, Vol. II (2008), 114-23). Relating economic and financial sectors is a challenging task for both theory and measurement. The IMF provides surveillance of the world economy with its Global Economic Outlook (WEO) (http://www.imf.org/external/ns/cs.aspx?id=29), of the world financial system with its Global Financial Stability Report (GFSR) (http://www.imf.org/external/pubs/ft/gfsr/index.htm) and of fiscal affairs with the Fiscal Monitor (http://www.imf.org/external/ns/cs.aspx?id=262). There appears to be a moment of transition in global economic and financial variables that may prove of difficult analysis and measurement. It is useful to consider a summary of global economic and financial risks, which are analyzed in detail in the comments of this blog in Section VI Valuation of Risk Financial Assets, Table VI-4.

Economic risks include the following:

- China’s Economic Growth. Cumulative growth of China’s GDP in IIIQ2014 relative to the same period in 2013 was 7.4 percent. Secondary industry accounts for 44.2 percent of cumulative GDP in IIIQ2014. In cumulative IIIQ2014, industry alone accounts for 37.4 percent of GDP and construction with the remaining 6.8 percent. Tertiary industry accounts for 46.7 percent of cumulative GDP in IIIQ2014 and primary industry for 9.0 percent. China’s growth strategy consisted of rapid increases in productivity in industry to absorb population from agriculture where incomes are lower (Pelaez and Pelaez, The Global Recession Risk (2007), 56-80). The strategy is changing to lower growth rates while improving living standards. GDP growth decelerated from 12.1 percent in IQ2010 and 11.2 percent in IIQ2010 to 7.7 percent in IQ2013, 7.5 percent in IIQ2013 and 7.8 percent in IIIQ2013. GDP grew 7.7 percent in IVQ2013 relative to a year earlier and 1.7 percent relative to IIIQ2013, which is equivalent to 7.0 percent per year. GDP grew 7.4 percent in IQ2014 relative to a year earlier and 1.5 percent in IQ2014 that is equivalent to 6.1 percent per year. GP grew 7.5 percent in IIQ2014 relative to a year earlier and 2.0 percent relative to the prior quarter, which is equivalent 8.2 percent. In IIIQ2014, GDP grew 7.3 percent relative to a year earlier and 1.9 percent relative to the prior quarter, which is 7.8 percent in annual equivalent (Section VC and earlier http://cmpassocregulationblog.blogspot.com/2014/07/financial-irrational-exuberance.htm http://cmpassocregulationblog.blogspot.com/2014/04/imf-view-world-inflation-waves-squeeze.html and earlier http://cmpassocregulationblog.blogspot.com/2014/01/capital-flows-exchange-rates-and.html and earlier http://cmpassocregulationblog.blogspot.com/2013/10/twenty-eight-million-unemployed-or.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/07/tapering-quantitative-easing-policy-and_7005.html and earlier at http://cmpassocregulationblog.blogspot.com/2013/01/recovery-without-hiring-world-inflation.html and earlier at http://cmpassocregulationblog.blogspot.com/2012/10/world-inflation-waves-stagnating-united_21.html). There is also concern about indebtedness, move to devaluation and deep policy reforms.

- United States Economic Growth, Labor Markets and Budget/Debt Quagmire. The US is growing slowly with 26.0 million in job stress, fewer 10 million full-time jobs, high youth unemployment, historically low hiring and declining/stagnating real wages. Actual GDP is about two trillion dollars lower than trend GDP.

- Economic Growth and Labor Markets in Advanced Economies. Advanced economies are growing slowly. There is still high unemployment in advanced economies.

- World Inflation Waves. Inflation continues in repetitive waves globally (http://cmpassocregulationblog.blogspot.com/2014/12/patience-on-interest-rate-increases.html and earlier http://cmpassocregulationblog.blogspot.com/2014/11/squeeze-of-economic-activity-by-carry.html and earlier http://cmpassocregulationblog.blogspot.com/2014/09/world-inflation-waves-squeeze-of.html and earlier http://cmpassocregulationblog.blogspot.com/2014/08/monetary-policy-world-inflation-waves.html). There is growing concern on capital outflows and currency depreciation of emerging markets.

A list of financial uncertainties includes:

- Euro Area Survival Risk. The resilience of the euro to fiscal and financial doubts on larger member countries is still an unknown risk.

- Foreign Exchange Wars. Exchange rate struggles continue as zero interest rates in advanced economies induce devaluation of their currencies with alternating episodes of revaluation.

- Valuation of Risk Financial Assets. Valuations of risk financial assets have reached extremely high levels in markets with lower volumes.

- Duration Trap of the Zero Bound. The yield of the US 10-year Treasury rose from 2.031 percent on Mar 9, 2012, to 2.294 percent on Mar 16, 2012. Considering a 10-year Treasury with coupon of 2.625 percent and maturity in exactly 10 years, the price would fall from 105.3512 corresponding to yield of 2.031 percent to 102.9428 corresponding to yield of 2.294 percent, for loss in a week of 2.3 percent but far more in a position with leverage of 10:1. Min Zeng, writing on “Treasurys fall, ending brutal quarter,” published on Mar 30, 2012, in the Wall Street Journal (http://professional.wsj.com/article/SB10001424052702303816504577313400029412564.html?mod=WSJ_hps_sections_markets), informs that Treasury bonds maturing in more than 20 years lost 5.52 percent in the first quarter of 2012.

- Credibility and Commitment of Central Bank Policy. There is a credibility issue of the commitment of monetary policy (Sargent and Silber 2012Mar20).

- Carry Trades. Commodity prices driven by zero interest rates have resumed their increasing path with fluctuations caused by intermittent risk aversion mixed with reallocations of portfolios of risk financial assets

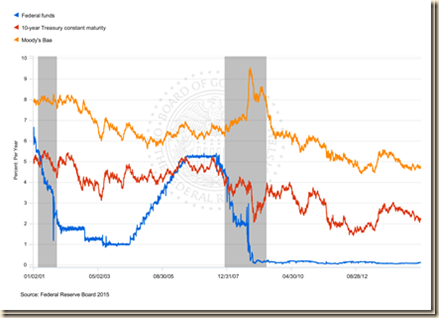

Chart VIII-1 of the Board of Governors of the Federal Reserve System provides the rate on the overnight fed funds rate and the yields of the 10-year constant maturity Treasury and the Baa seasoned corporate bond. Table VIII-3 provides the data for selected points in Chart VIII-1. There are two important economic and financial events, illustrating the ease of inducing carry trade with extremely low interest rates and the resulting financial crash and recession of abandoning extremely low interest rates.

- The Federal Open Market Committee (FOMC) lowered the target of the fed funds rate from 7.03 percent on Jul 3, 2000, to 1.00 percent on Jun 22, 2004, in pursuit of non-existing deflation (Pelaez and Pelaez, International Financial Architecture (2005), 18-28, The Global Recession Risk (2007), 83-85). Central bank commitment to maintain the fed funds rate at 1.00 percent induced adjustable-rate mortgages (ARMS) linked to the fed funds rate. Lowering the interest rate near the zero bound in 2003-2004 caused the illusion of permanent increases in wealth or net worth in the balance sheets of borrowers and also of lending institutions, securitized banking and every financial institution and investor in the world. The discipline of calculating risks and returns was seriously impaired. The objective of monetary policy was to encourage borrowing, consumption and investment. The exaggerated stimulus resulted in a financial crisis of major proportions as the securitization that had worked for a long period was shocked with policy-induced excessive risk, imprudent credit, high leverage and low liquidity by the incentive to finance everything overnight at interest rates close to zero, from adjustable rate mortgages (ARMS) to asset-backed commercial paper of structured investment vehicles (SIV). The consequences of inflating liquidity and net worth of borrowers were a global hunt for yields to protect own investments and money under management from the zero interest rates and unattractive long-term yields of Treasuries and other securities. Monetary policy distorted the calculations of risks and returns by households, business and government by providing central bank cheap money. Short-term zero interest rates encourage financing of everything with short-dated funds, explaining the SIVs created off-balance sheet to issue short-term commercial paper with the objective of purchasing default-prone mortgages that were financed in overnight or short-dated sale and repurchase agreements (Pelaez and Pelaez, Financial Regulation after the Global Recession, 50-1, Regulation of Banks and Finance, 59-60, Globalization and the State Vol. I, 89-92, Globalization and the State Vol. II, 198-9, Government Intervention in Globalization, 62-3, International Financial Architecture, 144-9). ARMS were created to lower monthly mortgage payments by benefitting from lower short-dated reference rates. Financial institutions economized in liquidity that was penalized with near zero interest rates. There was no perception of risk because the monetary authority guaranteed a minimum or floor price of all assets by maintaining low interest rates forever or equivalent to writing an illusory put option on wealth. Subprime mortgages were part of the put on wealth by an illusory put on house prices. The housing subsidy of $221 billion per year created the impression of ever-increasing house prices. The suspension of auctions of 30-year Treasuries was designed to increase demand for mortgage-backed securities, lowering their yield, which was equivalent to lowering the costs of housing finance and refinancing. Fannie and Freddie purchased or guaranteed $1.6 trillion of nonprime mortgages and worked with leverage of 75:1 under Congress-provided charters and lax oversight. The combination of these policies resulted in high risks because of the put option on wealth by near zero interest rates, excessive leverage because of cheap rates, low liquidity by the penalty in the form of low interest rates and unsound credit decisions. The put option on wealth by monetary policy created the illusion that nothing could ever go wrong, causing the credit/dollar crisis and global recession (Pelaez and Pelaez, Financial Regulation after the Global Recession, 157-66, Regulation of Banks, and Finance, 217-27, International Financial Architecture, 15-18, The Global Recession Risk, 221-5, Globalization and the State Vol. II, 197-213, Government Intervention in Globalization, 182-4). The FOMC implemented increments of 25 basis points of the fed funds target from Jun 2004 to Jun 2006, raising the fed funds rate to 5.25 percent on Jul 3, 2006, as shown in Chart VIII-1. The gradual exit from the first round of unconventional monetary policy from 1.00 percent in Jun 2004 (http://www.federalreserve.gov/boarddocs/press/monetary/2004/20040630/default.htm) to 5.25 percent in Jun 2006 (http://www.federalreserve.gov/newsevents/press/monetary/20060629a.htm) caused the financial crisis and global recession.

- On Dec 16, 2008, the policy determining committee of the Fed decided (http://www.federalreserve.gov/newsevents/press/monetary/20081216b.htm): “The Federal Open Market Committee decided today to establish a target range for the federal funds rate of 0 to 1/4 percent.” Policymakers emphasize frequently that there are tools to exit unconventional monetary policy at the right time. At the confirmation hearing on nomination for Chair of the Board of Governors of the Federal Reserve System, Vice Chair Yellen (2013Nov14 http://www.federalreserve.gov/newsevents/testimony/yellen20131114a.htm), states that: “The Federal Reserve is using its monetary policy tools to promote a more robust recovery. A strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy tools such as asset purchases. I believe that supporting the recovery today is the surest path to returning to a more normal approach to monetary policy.” Perception of withdrawal of $2671 billion, or $2.7 trillion, of bank reserves (http://www.federalreserve.gov/releases/h41/current/h41.htm#h41tab1), would cause Himalayan increase in interest rates that would provoke another recession. There is no painless gradual or sudden exit from zero interest rates because reversal of exposures created on the commitment of zero interest rates forever.

In his classic restatement of the Keynesian demand function in terms of “liquidity preference as behavior toward risk,” James Tobin (http://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/1981/tobin-bio.html) identifies the risks of low interest rates in terms of portfolio allocation (Tobin 1958, 86):

“The assumption that investors expect on balance no change in the rate of interest has been adopted for the theoretical reasons explained in section 2.6 rather than for reasons of realism. Clearly investors do form expectations of changes in interest rates and differ from each other in their expectations. For the purposes of dynamic theory and of analysis of specific market situations, the theories of sections 2 and 3 are complementary rather than competitive. The formal apparatus of section 3 will serve just as well for a non-zero expected capital gain or loss as for a zero expected value of g. Stickiness of interest rate expectations would mean that the expected value of g is a function of the rate of interest r, going down when r goes down and rising when r goes up. In addition to the rotation of the opportunity locus due to a change in r itself, there would be a further rotation in the same direction due to the accompanying change in the expected capital gain or loss. At low interest rates expectation of capital loss may push the opportunity locus into the negative quadrant, so that the optimal position is clearly no consols, all cash. At the other extreme, expectation of capital gain at high interest rates would increase sharply the slope of the opportunity locus and the frequency of no cash, all consols positions, like that of Figure 3.3. The stickier the investor's expectations, the more sensitive his demand for cash will be to changes in the rate of interest (emphasis added).”

Tobin (1969) provides more elegant, complete analysis of portfolio allocation in a general equilibrium model. The major point is equally clear in a portfolio consisting of only cash balances and a perpetuity or consol. Let g be the capital gain, r the rate of interest on the consol and re the expected rate of interest. The rates are expressed as proportions. The price of the consol is the inverse of the interest rate, (1+re). Thus, g = [(r/re) – 1]. The critical analysis of Tobin is that at extremely low interest rates there is only expectation of interest rate increases, that is, dre>0, such that there is expectation of capital losses on the consol, dg<0. Investors move into positions combining only cash and no consols. Valuations of risk financial assets would collapse in reversal of long positions in carry trades with short exposures in a flight to cash. There is no exit from a central bank created liquidity trap without risks of financial crash and another global recession. The net worth of the economy depends on interest rates. In theory, “income is generally defined as the amount a consumer unit could consume (or believe that it could) while maintaining its wealth intact” (Friedman 1957, 10). Income, Y, is a flow that is obtained by applying a rate of return, r, to a stock of wealth, W, or Y = rW (Friedman 1957). According to a subsequent statement: “The basic idea is simply that individuals live for many years and that therefore the appropriate constraint for consumption is the long-run expected yield from wealth r*W. This yield was named permanent income: Y* = r*W” (Darby 1974, 229), where * denotes permanent. The simplified relation of income and wealth can be restated as:

W = Y/r (1)

Equation (1) shows that as r goes to zero, r→0, W grows without bound, W→∞. Unconventional monetary policy lowers interest rates to increase the present value of cash flows derived from projects of firms, creating the impression of long-term increase in net worth. An attempt to reverse unconventional monetary policy necessarily causes increases in interest rates, creating the opposite perception of declining net worth. As r→∞, W = Y/r →0. There is no exit from unconventional monetary policy without increasing interest rates with resulting pain of financial crisis and adverse effects on production, investment and employment.

Chart VIII-1, Fed Funds Rate and Yields of Ten-year Treasury Constant Maturity and Baa Seasoned Corporate Bond, Jan 2, 2001 to Dec 30, 2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/

Table VIII-3, Selected Data Points in Chart VIII-1, % per Year

| Fed Funds Overnight Rate | 10-Year Treasury Constant Maturity | Seasoned Baa Corporate Bond | |

| 1/2/2001 | 6.67 | 4.92 | 7.91 |

| 10/1/2002 | 1.85 | 3.72 | 7.46 |

| 7/3/2003 | 0.96 | 3.67 | 6.39 |

| 6/22/2004 | 1.00 | 4.72 | 6.77 |

| 6/28/2006 | 5.06 | 5.25 | 6.94 |

| 9/17/2008 | 2.80 | 3.41 | 7.25 |

| 10/26/2008 | 0.09 | 2.16 | 8.00 |

| 10/31/2008 | 0.22 | 4.01 | 9.54 |

| 4/6/2009 | 0.14 | 2.95 | 8.63 |

| 4/5/2010 | 0.20 | 4.01 | 6.44 |

| 2/4/2011 | 0.17 | 3.68 | 6.25 |

| 7/25/2012 | 0.15 | 1.43 | 4.73 |

| 5/1/13 | 0.14 | 1.66 | 4.48 |

| 9/5/13 | 0.08 | 2.98 | 5.53 |

| 11/21/2013 | 0.09 | 2.79 | 5.44 |

| 11/26/13 | 0.09 | 2.74 | 5.34 (11/26/13) |

| 12/5/13 | 0.09 | 2.88 | 5.47 |

| 12/11/13 | 0.09 | 2.89 | 5.42 |

| 12/18/13 | 0.09 | 2.94 | 5.36 |

| 12/26/13 | 0.08 | 3.00 | 5.37 |

| 1/1/2014 | 0.08 | 3.00 | 5.34 |

| 1/8/2014 | 0.07 | 2.97 | 5.28 |

| 1/15/2014 | 0.07 | 2.86 | 5.18 |

| 1/22/2014 | 0.07 | 2.79 | 5.11 |

| 1/30/2014 | 0.07 | 2.72 | 5.08 |

| 2/6/2014 | 0.07 | 2.73 | 5.13 |

| 2/13/2014 | 0.06 | 2.73 | 5.12 |

| 2/20/14 | 0.07 | 2.76 | 5.15 |

| 2/27/14 | 0.07 | 2.65 | 5.01 |

| 3/6/14 | 0.08 | 2.74 | 5.11 |

| 3/13/14 | 0.08 | 2.66 | 5.05 |

| 3/20/14 | 0.08 | 2.79 | 5.13 |

| 3/27/14 | 0.08 | 2.69 | 4.95 |

| 4/3/14 | 0.08 | 2.80 | 5.04 |

| 4/10/14 | 0.08 | 2.65 | 4.89 |

| 4/17/14 | 0.09 | 2.73 | 4.89 |

| 4/24/14 | 0.10 | 2.70 | 4.84 |

| 5/1/14 | 0.09 | 2.63 | 4.77 |

| 5/8/14 | 0.08 | 2.61 | 4.79 |

| 5/15/14 | 0.09 | 2.50 | 4.72 |

| 5/22/14 | 0.09 | 2.56 | 4.81 |

| 5/29/14 | 0.09 | 2.45 | 4.69 |

| 6/05/14 | 0.09 | 2.59 | 4.83 |

| 6/12/14 | 0.09 | 2.58 | 4.79 |

| 6/19/14 | 0.10 | 2.64 | 4.83 |

| 6/26/14 | 0.10 | 2.53 | 4.71 |

| 7/2/14 | 0.10 | 2.64 | 4.84 |

| 7/10/14 | 0.09 | 2.55 | 4.75 |

| 7/17/14 | 0.09 | 2.47 | 4.69 |

| 7/24/14 | 0.09 | 2.52 | 4.72 |

| 7/31/14 | 0.08 | 2.58 | 4.75 |

| 8/7/14 | 0.09 | 2.43 | 4.71 |

| 8/14/14 | 0.09 | 2.40 | 4.69 |

| 8/21/14 | 0.09 | 2.41 | 4.69 |

| 8/28/14 | 0.09 | 2.34 | 4.57 |

| 9/04/14 | 0.09 | 2.45 | 4.70 |

| 9/11/14 | 0.09 | 2.54 | 4.79 |

| 9/18/14 | 0.09 | 2.63 | 4.91 |

| 9/25/14 | 0.09 | 2.52 | 4.79 |

| 10/02/14 | 0.09 | 2.44 | 4.76 |

| 10/09/14 | 0.08 | 2.34 | 4.68 |

| 10/16/14 | 0.09 | 2.17 | 4.64 |

| 10/23/14 | 0.09 | 2.29 | 4.71 |

| 11/13/14 | 0.09 | 2.35 | 4.82 |

| 11/20/14 | 0.10 | 2.34 | 4.86 |

| 11/26/14 | 0.10 | 2.24 | 4.73 |

| 12/04/14 | 0.12 | 2.25 | 4.78 |

| 12/11/14 | 0.12 | 2.19 | 4.72 |

| 12/18/14 | 0.13 | 2.22 | 4.78 |

| 12/23/14 | 0.13 | 2.26 | 4.79 |

| 12/30/14 | 0.06 | 2.20 | 4.69 |

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/

What is truly important is the fixing of the overnight fed funds at 0 to ¼ percent for which there is no end in sight as evident in the FOMC statement for Dec 17, 2014 (http://www.federalreserve.gov/newsevents/press/monetary/20141217a.htm):

“To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy. The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program in October, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored. However, if incoming information indicates faster progress toward the Committee's employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated” (emphasis added)” (emphasis added).

How long is “considerable time”? At the press conference following the meeting on Mar 19, 2014, Chair Yellen answered a question of Jon Hilsenrath of the Wall Street Journal explaining “In particular, the Committee has endorsed the view that it anticipates that will be a considerable period after the asset purchase program ends before it will be appropriate to begin to raise rates. And of course on our present path, well, that's not utterly preset. We would be looking at next, next fall. So, I think that's important guidance” (http://www.federalreserve.gov/mediacenter/files/FOMCpresconf20140319.pdf). Many focused on “next fall,” ignoring that the path of increasing rates is not “utterly preset.”

At the press conference following the meeting on Dec 17, 2014, Chair Yellen answered a question by Jon Hilseranth of the Wall Street Journal explaining “patience” (http://www.federalreserve.gov/mediacenter/files/FOMCpresconf20141217.pdf):

“So I did say that this statement that the committee can be patient

should be interpreted as meaning that it is unlikely to begin the normalization process, for at least

the next couple of meetings. Now that doesn't point to any preset or predetermined time at which

normalization is -- will begin. There are a range of views on the committee, and it will be

dependent on how incoming data bears on the progress, the economy is making. First of all, I

want to emphasize that no meeting is completely off the table in the sense that if we do see faster

progress toward our objectives than we currently expect, then it is possible that the process of

normalization would occur sooner than we now anticipated. And of course the converse is also

true. So at this point, we think it unlikely that it will be appropriate, that we will see conditions

for at least the next couple of meetings that will make it appropriate for us to decide to begin

normalization. A number of committee participants have indicated that in their view, conditions

could be appropriate by the middle of next year. But there is no preset time.”

Chart S provides the yield of the two-year Treasury constant maturity from Mar 17, 2014, two days before the guidance of Chair Yellen on Mar 19, 2014, to Dec 30, 2014. Chart SA provides the yields of the seven-, ten- and thirty-year Treasury constant maturity in the same dates. Yields increased right after the guidance of Chair Yellen. The two-year yield remain at a higher level than before while the ten-year yield fell and increased again. There could be more immediate impact on two-year yields of an increase in the fed funds rates but the effects would spread throughout the term structure of interest rates (Cox, Ingersoll and Ross 1981, 1985, Ingersoll 1987). Yields converged toward slightly lower earlier levels in the week of Apr 24, 2014 with reallocation of portfolios of risk financial assets away from equities and into bonds and commodities. There is ongoing reshuffling of portfolios to hedge against geopolitical events and world/regional economic performance.

Chart S, US, Yield of Two-Year Treasury Constant Maturity, Mar 17 to Dec 30, 2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/

Chart SA, US, Yield of Seven-Year, Ten-Year and Thirty-Year Treasury Constant Maturity, Mar 17 to Dec 30, 2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/

At a speech on Mar 31, 2014, Chair Yellen analyzed labor market conditions as follows (http://www.federalreserve.gov/newsevents/speech/yellen20140331a.htm):

“And based on the evidence available, it is clear to me that the U.S. economy is still considerably short of the two goals assigned to the Federal Reserve by the Congress. The first of those goals is maximum sustainable employment, the highest level of employment that can be sustained while maintaining a stable inflation rate. Most of my colleagues on the Federal Open Market Committee and I estimate that the unemployment rate consistent with maximum sustainable employment is now between 5.2 percent and 5.6 percent, well below the 6.7 percent rate in February.

Let me explain what I mean by that word "slack" and why it is so important.

Slack means that there are significantly more people willing and capable of filling a job than there are jobs for them to fill. During a period of little or no slack, there still may be vacant jobs and people who want to work, but a large share of those willing to work lack the skills or are otherwise not well suited for the jobs that are available. With 6.7 percent unemployment, it might seem that there must be a lot of slack in the U.S. economy, but there are reasons why that may not be true.”

Inflation and unemployment in the period 1966 to 1985 is analyzed by Cochrane (2011Jan, 23) by means of a Phillips circuit joining points of inflation and unemployment. Chart VI-1B for Brazil in Pelaez (1986, 94-5) was reprinted in The Economist in the issue of Jan 17-23, 1987 as updated by the author. Cochrane (2011Jan, 23) argues that the Phillips circuit shows the weakness in Phillips curve correlation. The explanation is by a shift in aggregate supply, rise in inflation expectations or loss of anchoring. The case of Brazil in Chart VI-1B cannot be explained without taking into account the increase in the fed funds rate that reached 22.36 percent on Jul 22, 1981 (http://www.federalreserve.gov/releases/h15/data.htm) in the Volcker Fed that precipitated the stress on a foreign debt bloated by financing balance of payments deficits with bank loans in the 1970s. The loans were used in projects, many of state-owned enterprises with low present value in long gestation. The combination of the insolvency of the country because of debt higher than its ability of repayment and the huge government deficit with declining revenue as the economy contracted caused adverse expectations on inflation and the economy. This interpretation is consistent with the case of the 24 emerging market economies analyzed by Reinhart and Rogoff (2010GTD, 4), concluding that “higher debt levels are associated with significantly higher levels of inflation in emerging markets. Median inflation more than doubles (from less than seven percent to 16 percent) as debt rises from the low (0 to 30 percent) range to above 90 percent. Fiscal dominance is a plausible interpretation of this pattern.”

The reading of the Phillips circuits of the 1970s by Cochrane (2011Jan, 25) is doubtful about the output gap and inflation expectations:

“So, inflation is caused by ‘tightness’ and deflation by ‘slack’ in the economy. This is not just a cause and forecasting variable, it is the cause, because given ‘slack’ we apparently do not have to worry about inflation from other sources, notwithstanding the weak correlation of [Phillips circuits]. These statements [by the Fed] do mention ‘stable inflation expectations. How does the Fed know expectations are ‘stable’ and would not come unglued once people look at deficit numbers? As I read Fed statements, almost all confidence in ‘stable’ or ‘anchored’ expectations comes from the fact that we have experienced a long period of low inflation (adaptive expectations). All these analyses ignore the stagflation experience in the 1970s, in which inflation was high even with ‘slack’ markets and little ‘demand, and ‘expectations’ moved quickly. They ignore the experience of hyperinflations and currency collapses, which happen in economies well below potential.”

Yellen (2014Aug22) states that “Historically, slack has accounted for only a small portion of the fluctuations in inflation. Indeed, unusual aspects of the current recovery may have shifted the lead-lag relationship between a tightening labor market and rising inflation pressures in either direction.”

Chart VI-1B provides the tortuous Phillips Circuit of Brazil from 1963 to 1987. There were no reliable consumer price index and unemployment data in Brazil for that period. Chart VI-1B used the more reliable indicator of inflation, the wholesale price index, and idle capacity of manufacturing as a proxy of unemployment in large urban centers.

ChVI1-B, Brazil, Phillips Circuit, 1963-1987

Source:

©Carlos Manuel Pelaez, O Cruzado e o Austral: Análise das Reformas Monetárias do Brasil e da Argentina. São Paulo: Editora Atlas, 1986, pages 94-5. Reprinted in: Brazil. Tomorrow’s Italy, The Economist, 17-23 January 1987, page 25.

The minutes of the meeting of the Federal Open Market Committee (FOMC) on Sep 16-17, 2014, reveal concern with global economic conditions (http://www.federalreserve.gov/monetarypolicy/fomcminutes20140917.htm):

“Most viewed the risks to the outlook for economic activity and the labor market as broadly balanced. However, a number of participants noted that economic growth over the medium term might be slower than they expected if foreign economic growth came in weaker than anticipated, structural productivity continued to increase only slowly, or the recovery in residential construction continued to lag.”

It is quite difficult to measure inflationary expectations because they tend to break abruptly from past inflation. There could still be an influence of past and current inflation in the calculation of future inflation by economic agents. Table VIII-1 provides inflation of the CPI. In the three months from Sep 2014 to Nov 2014, CPI inflation for all items seasonally adjusted was minus 0.8 percent in annual equivalent, obtained by calculating accumulated inflation from Sep 2014 to Nov 2014 and compounding for a full year. In the 12 months ending in Nov 2014, CPI inflation of all items not seasonally adjusted was 1.3 percent. Inflation in Nov 2014 seasonally adjusted was minus 0.3 percent relative to Oct 2014, or minus 3.5 percent annual equivalent (http://www.bls.gov/cpi/). The second row provides the same measurements for the CPI of all items excluding food and energy: 1.7 percent in 12 months and 1.6 percent in annual equivalent Sep 2014-Nov 2014. The Wall Street Journal provides the yield curve of US Treasury securities (http://professional.wsj.com/mdc/public/page/mdc_bonds.html?mod=mdc_topnav_2_3000). The shortest term is 0.018 percent for one month, 0.025 percent for three months, 0.114 percent for six months, 0.224 percent for one year, 0.681 percent for two years, 1.065 percent for three years, 1.612 percent for five years, 1.915 percent for seven years, 2.111 percent for ten years and 2.690 percent for 30 years. The Irving Fisher (1930) definition of real interest rates is approximately the difference between nominal interest rates, which are those estimated by the Wall Street Journal, and the rate of inflation expected in the term of the security, which could behave as in Table VIII-1. Inflation in Nov 2014 is low in 12 months because of the unwinding of carry trades from zero interest rates to commodity futures prices but could ignite again with subdued risk aversion. Real interest rates in the US have been negative during substantial periods in the past decade while monetary policy pursues a policy of attaining its “dual mandate” of (http://www.federalreserve.gov/aboutthefed/mission.htm):

“Conducting the nation's monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates”

Negative real rates of interest distort calculations of risk and returns from capital budgeting by firms, through lending by financial intermediaries to decisions on savings, housing and purchases of households. Inflation on near zero interest rates misallocates resources away from their most productive uses and creates uncertainty of the future path of adjustment to higher interest rates that inhibit sound decisions.

Table VIII-1, US, Consumer Price Index Percentage Change 12 Months NSA and Annual Equivalent

| ∆% 12 Months Nov 2014/Nov | ∆% Annual Equivalent Sep 2014 to Nov 2014 SA | |

| CPI All Items | 1.3 | -0.8 |

| CPI ex Food and Energy | 1.7 | 1.6 |

Source: Bureau of Labor Statistics

Professionals use a variety of techniques in measuring interest rate risk (Fabozzi, Buestow and Johnson, 2006, Chapter Nine, 183-226):

- Full valuation approach in which securities and portfolios are shocked by 50, 100, 200 and 300 basis points to measure their impact on asset values

- Stress tests requiring more complex analysis and translation of possible events with high impact even if with low probability of occurrence into effects on actual positions and capital

- Value at Risk (VaR) analysis of maximum losses that are likely in a time horizon

- Duration and convexity that are short-hand convenient measurement of changes in prices resulting from changes in yield captured by duration and convexity

- Yield volatility

Analysis of these methods is in Pelaez and Pelaez (International Financial Architecture (2005), 101-162) and Pelaez and Pelaez, Globalization and the State, Vol. (I) (2008a), 78-100). Frederick R. Macaulay (1938) introduced the concept of duration in contrast with maturity for analyzing bonds. Duration is the sensitivity of bond prices to changes in yields. In economic jargon, duration is the yield elasticity of bond price to changes in yield, or the percentage change in price after a percentage change in yield, typically expressed as the change in price resulting from change of 100 basis points in yield. The mathematical formula is the negative of the yield elasticity of the bond price or –[dB/d(1+y)]((1+y)/B), where d is the derivative operator of calculus, B the bond price, y the yield and the elasticity does not have dimension (Hallerbach 2001). The duration trap of unconventional monetary policy is that duration is higher the lower the coupon and higher the lower the yield, other things being constant. Coupons and yields are historically low because of unconventional monetary policy. Duration dumping during a rate increase may trigger the same crossfire selling of high duration positions that magnified the credit crisis. Traders reduced positions because capital losses in one segment, such as mortgage-backed securities, triggered haircuts and margin increases that reduced capital available for positioning in all segments, causing fire sales in multiple segments (Brunnermeier and Pedersen 2009; see Pelaez and Pelaez, Regulation of Banks and Finance (2008b), 217-24). Financial markets are currently experiencing fear of duration and riskier asset classes resulting from the debate within and outside the Fed on tapering quantitative easing. Table VIII-2 provides the yield curve of Treasury securities on Jan 2, 2015, Dec 31, 2013, May 1, 2013, Jan 2, 2014 and Jan 3, 2006. There is oscillating steepening of the yield curve for longer maturities, which are also the ones with highest duration. The 10-year yield increased from 1.45 percent on Jul 26, 2012 to 3.04 percent on Dec 31, 2013 and 2.12 percent on Jan 2, 2015, as measured by the United States Treasury. Assume that a bond with maturity in 10 years were issued on Dec 31, 2013, at par or price of 100 with coupon of 1.45 percent. The price of that bond would be 86.3778 with instantaneous increase of the yield to 3.04 percent for loss of 13.6 percent and far more with leverage. Assume that the yield of a bond with exactly ten years to maturity and coupon of 2.12 percent would jump instantaneously from yield of 2.12 percent on Jan 2, 2015 to 4.37 percent as occurred on Jan 3, 2006 when the economy was closer to full employment. The price of the hypothetical bond issued with coupon of 2.12 percent would drop from 100 to 81.9289 after an instantaneous increase of the yield to 4.37 percent. The price loss would be 18.1 percent. Losses absorb capital available for positioning, triggering crossfire sales in multiple asset classes (Brunnermeier and Pedersen 2009). What is the path of adjustment of zero interest rates on fed funds and artificially low bond yields? There is no painless exit from unconventional monetary policy. Chris Dieterich, writing on “Bond investors turn to cash,” on Jul 25, 2013, published in the Wall Street Journal (http://online.wsj.com/article/SB10001424127887323971204578625900935618178.html), uses data of the Investment Company Institute (http://www.ici.org/) in showing withdrawals of $43 billion in taxable mutual funds in Jun, which is the largest in history, with flows into cash investments such as $8.5 billion in the week of Jul 17 into money-market funds.

Table VIII-2, United States, Treasury Yields

| 1/02/15 | 12/31/13 | 5/01/13 | 1/02/14 | 1/03/06 | |

| 1 M | 0.02 | 0.01 | 0.03 | 0.01 | 4.05 |

| 3 M | 0.02 | 0.07 | 0.06 | 0.07 | 4.16 |

| 6 M | 0.11 | 0.10 | 0.08 | 0.09 | 4.40 |

| 1 Y | 0.25 | 0.13 | 0.11 | 0.13 | 4.38 |

| 2 Y | 0.66 | 0.38 | 0.20 | 0.39 | 4.34 |

| 3 Y | 1.07 | 0.78 | 0.30 | 0.76 | 4.30 |

| 5 Y | 1.61 | 1.75 | 0.65 | 1.72 | 4.30 |

| 7 Y | 1.92 | 2.45 | 1.07 | 2.41 | 4.32 |

| 10 Y | 2.12 | 3.04 | 1.66 | 3.00 | 4.37 |

| 20 Y | 2.41 | 3.72 | 2.44 | 3.68 | 4.62 |

| 30 Y | 2.69 | 3.96 | 2.83 | 3.92 | NA |

M: Months; Y: Years

Source: United States Treasury

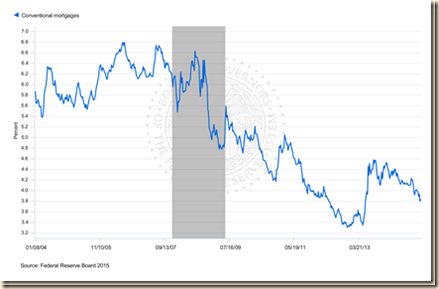

Interest rate risk is increasing in the US with amplifying fluctuations. Chart VI-13 of the Board of Governors provides the conventional mortgage rate for a fixed-rate 30-year mortgage. The rate stood at 5.87 percent on Jan 8, 2004, increasing to 6.79 percent on Jul 6, 2006. The rate bottomed at 3.35 percent on May 2, 2013. Fear of duration risk in longer maturities such as mortgage-backed securities caused continuing increases in the conventional mortgage rate that rose to 4.51 percent on Jul 11, 2013, 4.58 percent on Aug 22, 2013 and 3.83 percent on Dec 25, 2014, which is the last data point in Chart VI-13. Shayndi Raice and Nick Timiraos, writing on “Banks cut as mortgage boom ends,” on Jan 9, 2014, published in the Wall Street Journal (http://online.wsj.com/news/articles/SB10001424052702303754404579310940019239208), analyze the drop in mortgage applications to a 13-year low, as measured by the Mortgage Bankers Association. Nick Timiraos, writing on “Demand for home loans plunges,” on Apr 24, 2014, published in the Wall Street Journal (http://online.wsj.com/news/articles/SB10001424052702304788404579522051733228402?mg=reno64-wsj), analyzes data in Inside Mortgage Finance that mortgage lending of $235 billion in IQ2014 is 58 percent lower than a year earlier and 23 percent below IVQ2013. Mortgage lending collapsed to the lowest level in 14 years. In testimony before the Committee on the Budget of the US Senate on May 8, 2004, Chair Yellen provides analysis of the current economic situation and outlook (http://www.federalreserve.gov/newsevents/testimony/yellen20140507a.htm): “One cautionary note, though, is that readings on housing activity--a sector that has been recovering since 2011--have remained disappointing so far this year and will bear watching.”

Chart VI-13, US, Conventional Mortgage Rate, Jan 8, 2004 to Dec 18, 2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/update

There is a false impression of the existence of a monetary policy “science,” measurements and forecasting with which to steer the economy into “prosperity without inflation.” Market participants are remembering the Great Bond Crash of 1994 shown in Table VI-7G when monetary policy pursued nonexistent inflation, causing trillions of dollars of losses in fixed income worldwide while increasing the fed funds rate from 3 percent in Jan 1994 to 6 percent in Dec. The exercise in Table VI-7G shows a drop of the price of the 30-year bond by 18.1 percent and of the 10-year bond by 14.1 percent. CPI inflation remained almost the same and there is no valid counterfactual that inflation would have been higher without monetary policy tightening because of the long lag in effect of monetary policy on inflation (see Culbertson 1960, 1961, Friedman 1961, Batini and Nelson 2002, Romer and Romer 2004). The pursuit of nonexistent deflation during the past ten years has resulted in the largest monetary policy accommodation in history that created the 2007 financial market crash and global recession and is currently preventing smoother recovery while creating another financial crash in the future. The issue is not whether there should be a central bank and monetary policy but rather whether policy accommodation in doses from zero interest rates to trillions of dollars in the fed balance sheet endangers economic stability.

Table VI-7G, Fed Funds Rates, Thirty and Ten Year Treasury Yields and Prices, 30-Year Mortgage Rates and 12-month CPI Inflation 1994

| 1994 | FF | 30Y | 30P | 10Y | 10P | MOR | CPI |

| Jan | 3.00 | 6.29 | 100 | 5.75 | 100 | 7.06 | 2.52 |

| Feb | 3.25 | 6.49 | 97.37 | 5.97 | 98.36 | 7.15 | 2.51 |

| Mar | 3.50 | 6.91 | 92.19 | 6.48 | 94.69 | 7.68 | 2.51 |

| Apr | 3.75 | 7.27 | 88.10 | 6.97 | 91.32 | 8.32 | 2.36 |

| May | 4.25 | 7.41 | 86.59 | 7.18 | 88.93 | 8.60 | 2.29 |

| Jun | 4.25 | 7.40 | 86.69 | 7.10 | 90.45 | 8.40 | 2.49 |

| Jul | 4.25 | 7.58 | 84.81 | 7.30 | 89.14 | 8.61 | 2.77 |

| Aug | 4.75 | 7.49 | 85.74 | 7.24 | 89.53 | 8.51 | 2.69 |

| Sep | 4.75 | 7.71 | 83.49 | 7.46 | 88.10 | 8.64 | 2.96 |

| Oct | 4.75 | 7.94 | 81.23 | 7.74 | 86.33 | 8.93 | 2.61 |

| Nov | 5.50 | 8.08 | 79.90 | 7.96 | 84.96 | 9.17 | 2.67 |

| Dec | 6.00 | 7.87 | 81.91 | 7.81 | 85.89 | 9.20 | 2.67 |

Notes: FF: fed funds rate; 30Y: yield of 30-year Treasury; 30P: price of 30-year Treasury assuming coupon equal to 6.29 percent and maturity in exactly 30 years; 10Y: yield of 10-year Treasury; 10P: price of 10-year Treasury assuming coupon equal to 5.75 percent and maturity in exactly 10 years; MOR: 30-year mortgage; CPI: percent change of CPI in 12 months

Sources: yields and mortgage rates http://www.federalreserve.gov/releases/h15/data.htm CPI ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.t

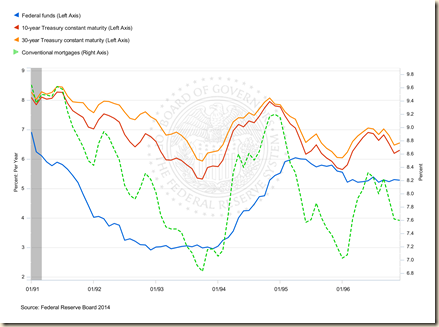

Chart VI-14 provides the overnight fed funds rate, the yield of the 10-year Treasury constant maturity bond, the yield of the 30-year constant maturity bond and the conventional mortgage rate from Jan 1991 to Dec 1996. In Jan 1991, the fed funds rate was 6.91 percent, the 10-year Treasury yield 8.09 percent, the 30-year Treasury yield 8.27 percent and the conventional mortgage rate 9.64 percent. Before monetary policy tightening in Oct 1993, the rates and yields were 2.99 percent for the fed funds, 5.33 percent for the 10-year Treasury, 5.94 for the 30-year Treasury and 6.83 percent for the conventional mortgage rate. After tightening in Nov 1994, the rates and yields were 5.29 percent for the fed funds rate, 7.96 percent for the 10-year Treasury, 8.08 percent for the 30-year Treasury and 9.17 percent for the conventional mortgage rate.

Chart VI-14, US, Overnight Fed Funds Rate, 10-Year Treasury Constant Maturity, 30-Year Treasury Constant Maturity and Conventional Mortgage Rate, Monthly, Jan 1991 to Dec 1996

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15/update/

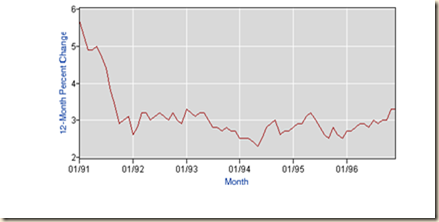

Chart VI-15 of the Bureau of Labor Statistics provides the all items consumer price index from Jan 1991 to Dec 1996. There does not appear acceleration of consumer prices requiring aggressive tightening.

Chart VI-15, US, Consumer Price Index All Items, Jan 1991 to Dec 1996

Source: Bureau of Labor Statistics

http://www.bls.gov/cpi/data.htm

Chart IV-16 of the Bureau of Labor Statistics provides 12-month percentage changes of the all items consumer price index from Jan 1991 to Dec 1996. Inflation collapsed during the recession from Jul 1990 (III) and Mar 1991 (I) and the end of the Kuwait War on Feb 25, 1991 that stabilized world oil markets. CPI inflation remained almost the same and there is no valid counterfactual that inflation would have been higher without monetary policy tightening because of the long lag in effect of monetary policy on inflation (see Culbertson 1960, 1961, Friedman 1961, Batini and Nelson 2002, Romer and Romer 2004). Policy tightening had adverse collateral effects in the form of emerging market crises in Mexico and Argentina and fixed income markets worldwide.

Chart VI-16, US, Consumer Price Index All Items, Twelve-Month Percentage Change, Jan 1991 to Dec 1996

Source: Bureau of Labor Statistics

http://www.bls.gov/cpi/data.htm

Table VI-2 extracts four rows of Table VI-1 with the Dollar/EUR (USD/EUR) exchange rate and Chinese Yuan/Dollar (CNY/USD) exchange rate that reveal pursuit of exchange rate policies resulting from monetary policy in the US and capital control/exchange rate policy in China. The ultimate intentions are the same: promoting internal economic activity at the expense of the rest of the world. The easy money policy of the US was deliberately or not but effectively to devalue the dollar from USD 1.1423/EUR on Jun 26, 2003 to USD 1.5914/EUR on Jul 14, 2008, or by 39.3 percent. The flight into dollar assets after the global recession caused revaluation to USD 1.192/EUR on Jun 7, 2010, or by 25.1 percent. After the temporary interruption of the sovereign risk issues in Europe from Apr to Jul, 2010, shown in Table VI-4 below, the dollar has devalued again to USD 1.2003 EUR on Jan 2, 2015 or by 0.7 percent {[(1.20031.192)-1]100 = 2.2%}. Yellen (2011AS, 6) admits that Fed monetary policy results in dollar devaluation with the objective of increasing net exports, which was the policy that Joan Robinson (1947) labeled as “beggar-my-neighbor” remedies for unemployment. Risk aversion erodes devaluation of the dollar. China fixed the CNY to the dollar for a long period at a highly undervalued level of around CNY 8.2765/USD subsequently revaluing to CNY 6.8211/USD until Jun 7, 2010, or by 17.6 percent. After fixing again the CNY to the dollar, China revalued to CNY 6.2063/USD on Fri Jan 2, 2015, or by an additional 9.0 percent, for cumulative revaluation of 25.0 percent. The final row of Table VI-2 shows: devaluation of 0.6 percent in the week of Dec 12, 2014; devaluation of 0.6 percent in the week of Dec 19, 2014; devaluation of 0.1 percent in the week of Dec 26, 2014; and revaluation of 0.3 percent in the week of Jan 2, 2015. There could be reversal of revaluation to devalue the Yuan.

Table VI-2, Dollar/Euro (USD/EUR) Exchange Rate and Chinese Yuan/Dollar (CNY/USD) Exchange Rate

| USD/EUR | 12/26/03 | 7/14/08 | 6/07/10 | 1/02/15 |

| Rate | 1.1423 | 1.5914 | 1.192 | 1.2003 |

| CNY/USD | 01/03 | 07/21 | 7/15 | 1/02/ 2015 |

| Rate | 8.2765 | 8.2765 | 6.8211 | 6.2063 |

| Weekly Rates | 12/12/2014 | 12/19/2014 | 12/26/2014 | 1/02/ 2015 |

| CNY/USD | 6.1852 | 6.2226 | 6.2276 | 6.2063 |

| ∆% from Earlier Week* | -0.6 | -0.6 | -0.1 | 0.3 |

*Negative sign is depreciation; positive sign is appreciation

Source: http://professional.wsj.com/mdc/public/page/mdc_currencies.html?mod=mdc_topnav_2_3000

Professor Edward P Lazear (2013Jan7), writing on “Chinese ‘currency manipulation’ is not the problem,” on Jan 7, 2013, published in the Wall Street Journal (http://professional.wsj.com/article/SB10001424127887323320404578213203581231448.html), provides clear thought on the role of the yuan in trade between China and the United States and trade between China and Europe. There is conventional wisdom that Chinese exchange rate policy causes the loss of manufacturing jobs in the United States, which is shown by Lazear (2013Jan7) to be erroneous. The fact is that manipulation of the CNY/USD rate by China has only minor effects on US employment. Lazear (2013Jan7) shows that the movement of monthly exports of China to its major trading partners, United States and Europe, since 1995 cannot be explained by the fixing of the CNY/USD rate by China. The period is quite useful because it includes rapid growth before 2007, contraction until 2009 and weak subsequent expansion. Chart VI-1 of the Board of Governors of the Federal Reserve System provides the CNY/USD exchange rate from Jan 3, 1995 to Dec 24, 2014 together with US recession dates in shaded areas. China fixed the CNY/USD rate for a long period as shown in the horizontal segment from 1995 to 2005. There was systematic revaluation of 17.6 percent from CNY 8.2765 on Jul 21, 2005 to CNY 6.8211 on Jul 15, 2008. China fixed the CNY/USD rate until Jun 7, 2010, to avoid adverse effects on its economy from the global recession, which is shown as a horizontal segment from 2009 until mid 2010. China then continued the policy of appreciation of the CNY relative to the USD with oscillations until the beginning of 2012 when the rate began to move sideways followed by a final upward slope of devaluation that is measured in Table VI-2A but virtually disappeared in the rate of CNY 6.3589/USD on Aug 17, 2012 and was nearly unchanged at CNY 6.3558/USD on Aug 24, 2012. China then appreciated 0.2 percent in the week of Dec 21, 2012, to CNY 6.2352/USD for cumulative 1.9 percent revaluation from Oct 28, 2011 and left the rate virtually unchanged at CNY 6.2316/USD on Jan 11, 2013, appreciating to CNY 6.2148/USD on Dec 24, 2014, which is the last data point in Chart VI-1. Revaluation of the CNY relative to the USD by 25.0 percent by Jan 2, 2015 has not reduced the trade surplus of China but reversal of the policy of revaluation could result in international confrontation. The interruption with upward slope in the final segment on the right of Chart VI-I is measured as virtually stability in Table VI-2A followed with decrease or revaluation and subsequent increase or devaluation. The final segment shows decline or revaluation with another upward move or devaluation. Linglin Wei, writing on “China intervenes to lower yuan,” on Feb 26, 2014, published in the Wall Street Journal (http://online.wsj.com/news/articles/SB10001424052702304071004579406810684766716?KEYWORDS=china+yuan&mg=reno64-wsj), finds from informed sources that the central bank of China conducted the ongoing devaluation of the yuan with the objective of driving out arbitrageurs to widen the band of fluctuation. There is concern if the policy of revaluation is changing to devaluation.

Chart VI-1, Chinese Yuan (CNY) per US Dollar (USD), Business Days, Jan 3, 1995-Dec 24, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

Chart VI-1A provides the daily CNY/USD rate from Jan 5, 1981 to Dec 24, 2014. The exchange rate was CNY 1.5418/USD on Jan 5, 1981. There is sharp cumulative depreciation of 107.8 percent to CNY 3.2031 by Jul 2, 1986, continuing to CNY 5.8145/USD on Dec 29, 1993 for cumulative 277.1 percent since Jan 5, 1981. China then devalued sharply to CNY 8.7117/USD on Jan 7, 1994 for 49.8 percent relative to Dec 29, 1993 and cumulative 465.0 percent relative to Jan 5, 1981. China then fixed the rate at CNY 8.2765/USD until Jul 21, 2005 and revalued as analyzed in Chart VI-1. The final data point in Chart VI-1A is CNY 6.2148/USD on Dec 24, 2014. To be sure, China fixed the exchange rate after substantial prior devaluation. It is unlikely that the devaluation could have been effective after many years of fixing the exchange rate with high inflation and multiple changes in the world economy. The argument of Lazear (2013Jan7) is still valid in view of the lack of association between monthly exports of China to the US and Europe since 1995 and the exchange rate of China.

Chart VI-1A, Chinese Yuan (CNY) per US Dollar (USD), Business Days, Jan 5, 1981-Dec 24, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

Chart VI-1B provides finer details with the rate of Chinese Yuan (CNY) to the US Dollar (USD) from Oct 28, 2011 to Dec 24, 2014. There have been alternations of revaluation and devaluation. The initial data point is CNY 6.5370 on Oct 28, 2011. There is an episode of devaluation from CNY 6.2790 on Apr 30, 2012 to CNY 6.3879 on Jul 25, 2012, or devaluation of 1.4 percent. Another devaluation is from CNY 6.0402/USD on Jan 14, 2014 to CNY 6.2148 on Dec 24, 2014, or devaluation of 2.9 percent. The United States Treasury estimates US government debt held by private investors at $9829 billion in Sep 2014. China’s holding of US Treasury securities of $1253 billion in Oct 2014 represent 12.7 percent of US government marketable interest-bearing debt held by private investors (http://www.fiscal.treasury.gov/fsreports/rpt/treasBulletin/treasBulletin_home.htm). Min Zeng, writing on “China plays a big role as US Treasury yields fall,” on Jul 16, 2004, published in the Wall Street Journal (http://online.wsj.com/articles/china-plays-a-big-role-as-u-s-treasury-yields-fall-1405545034?tesla=y&mg=reno64-wsj), finds that acceleration in purchases of US Treasury securities by China has been an important factor in the decline of Treasury yields in 2014. Japan increased its holdings from $1174.4 billion in Oct 2013 to $1222.4 billion in Oct 2014 or 4.1 percent. The combined holdings of China and Japan in Oct 2014 add to $2475 billion, which is equivalent to 25.2 percent of US government marketable interest-bearing securities held by investors of $9829 billion in Jun 2014 (http://www.fms.treas.gov/bulletin/index.html). Total foreign holdings of Treasury securities rose from $5655.1 billion in Oct 2013 to $6058.9 billion in Oct 2014, or 7.1 percent. The US continues to finance its fiscal and balance of payments deficits with foreign savings (see Pelaez and Pelaez, The Global Recession Risk (2007)). A point of saturation of holdings of US Treasury debt may be reached as foreign holders evaluate the threat of reduction of principal by dollar devaluation and reduction of prices by increases in yield, including possibly risk premium. Shultz et al (2012) find that the Fed financed three-quarters of the US deficit in fiscal year 2011, with foreign governments financing significant part of the remainder of the US deficit while the Fed owns one in six dollars of US national debt. Concentrations of debt in few holders are perilous because of sudden exodus in fear of devaluation and yield increases and the limit of refinancing old debt and placing new debt. In their classic work on “unpleasant monetarist arithmetic,” Sargent and Wallace (1981, 2) consider a regime of domination of monetary policy by fiscal policy (emphasis added):

“Imagine that fiscal policy dominates monetary policy. The fiscal authority independently sets its budgets, announcing all current and future deficits and surpluses and thus determining the amount of revenue that must be raised through bond sales and seignorage. Under this second coordination scheme, the monetary authority faces the constraints imposed by the demand for government bonds, for it must try to finance with seignorage any discrepancy between the revenue demanded by the fiscal authority and the amount of bonds that can be sold to the public. Suppose that the demand for government bonds implies an interest rate on bonds greater than the economy’s rate of growth. Then if the fiscal authority runs deficits, the monetary authority is unable to control either the growth rate of the monetary base or inflation forever. If the principal and interest due on these additional bonds are raised by selling still more bonds, so as to continue to hold down the growth of base money, then, because the interest rate on bonds is greater than the economy’s growth rate, the real stock of bonds will growth faster than the size of the economy. This cannot go on forever, since the demand for bonds places an upper limit on the stock of bonds relative to the size of the economy. Once that limit is reached, the principal and interest due on the bonds already sold to fight inflation must be financed, at least in part, by seignorage, requiring the creation of additional base money.”

Chart VI-1B, Chinese Yuan (CNY) per US Dollar (US), Business Days, Oct 28, 2011-Dec 24, 2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

There are major ongoing and unresolved realignments of exchange rates in the international financial system as countries and regions seek parities that can optimize their productive structures. Seeking exchange rate parity or exchange rate optimizing internal economic activities is complex in a world of unconventional monetary policy of zero interest rates and even negative nominal interest rates of government obligations such as negative yields for the two-year government bond of Germany. Regulation, trade and devaluation conflicts should have been expected from a global recession (Pelaez and Pelaez (2007), The Global Recession Risk, Pelaez and Pelaez, Government Intervention in Globalization: Regulation, Trade and Devaluation Wars (2008a)): “There are significant grounds for concern on the basis of this experience. International economic cooperation and the international financial framework can collapse during extreme events. It is unlikely that there will be a repetition of the disaster of the Great Depression. However, a milder contraction can trigger regulatory, trade and exchange wars” (Pelaez and Pelaez, Government Intervention in Globalization: Regulation, Trade and Devaluation Wars (2008c), 181). Chart VI-2 of the Board of Governors of the Federal Reserve System provides the key exchange rate of US dollars (USD) per euro (EUR) from Jan 4, 1999 to Dec 24, 2014. US recession dates are in shaded areas. The rate on Jan 4, 1999 was USD 1.1812/EUR, declining to USD 0.8279/EUR on Oct 25, 2000, or appreciation of the USD by 29.9 percent. The rate depreciated 21.9 percent to USD 1.0098/EUR on Jul 22, 2002. There was sharp devaluation of the USD of 34.9 percent to USD 1.3625/EUR on Dec 27, 2004 largely because of the 1 percent interest rate between Jun 2003 and Jun 2004 together with a form of quantitative easing by suspension of auctions of the 30-year Treasury, which was equivalent to withdrawing supply from markets. Another depreciation of 17.5 percent took the rate to USD 1.6010/EUR on Apr 22, 2008, already inside the shaded area of the global recession. The flight to the USD and obligations of the US Treasury appreciated the dollar by 22.3 percent to USD 1.2446/EUR on Oct 27, 2008. In the return of the carry trade after stress tests showed sound US bank balance sheets, the rate depreciated 21.2 percent to USD 1.5085/EUR on Nov 25, 2009. The sovereign debt crisis of Europe in the spring of 2010 caused sharp appreciation of 20.7 percent to USD 1.1959/EUR on Jun 6, 2010. Renewed risk appetite depreciated the rate 24.4 percent to USD 1.4875/EUR on May 3, 2011. The rate depreciated 1.9 percent to USD 1.2188/EUR on Dec 24, 2014, which is the last point in Chart VI-2. The data in Table VI-6 is obtained from closing dates in New York published by the Wall Street Journal (http://professional.wsj.com/mdc/public/page/marketsdata.html?mod=WSJ_PRO_hps_marketdata).

Chart VI-2, US Dollars (USD) per Euro (EUR), Jan 4, 1999 to Dec 24, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

Chart VI-3 provides three indexes of the US Dollars (USD) from Jan 4, 1995 to Dec 24, 2014.

Chart VI-3A provides the overnight fed funds rate and yields of the three-month constant maturity Treasury bill, the ten-year constant maturity Treasury note and Moody’s Baa bond from Jan 4, 1995 to Dec 30, 2014. The first phase from 1995 to 2001 shows sharp trend of appreciation of the USD while interest rates remained at relatively high levels. The dollar revalued partly because of the emerging market crises that provoked inflows of financial investment into the US and partly because of a deliberate strong dollar policy. DeLong and Eichengreen (2001, 4-5) argue:

“That context was an economic and political strategy that emphasized private investment as the engine for U.S. economic growth. Both components of this term, "private" and "investment," had implications for the administration’s international economic strategy. From the point of view of investment, it was important that international events not pressure on the Federal Reserve to raise interest rates, since this would have curtailed capital formation and vitiated the effects of the administration’s signature achievement: deficit reduction. A strong dollar -- or rather a dollar that was not expected to weaken -- was a key component of a policy which aimed at keeping the Fed comfortable with low interest rates. In addition, it was important to create a demand for the goods and services generated by this additional productive capacity. To the extent that this demand resided abroad, administration officials saw it as important that the process of increasing international integration, of both trade and finance, move forward for the interest of economic development in emerging markets and therefore in support of U.S. economic growth.”

The process of integration consisted of restructuring “international financial architecture” (Pelaez and Pelaez, International Financial Architecture: G7, IMF, BIS, Debtors and Creditors (2005)). Policy concerns subsequently shifted to the external imbalances, or current account deficits, and internal imbalances, or government deficits (Pelaez and Pelaez, The Global Recession Risk: Dollar Devaluation and the World Economy (2007)). Fed policy consisted of lowering the policy rate or fed funds rate, which is close to the marginal cost of funding of banks, toward zero during the past decade. Near zero interest rates induce carry trades of selling dollar debt (borrowing), shorting the USD and investing in risk financial assets. Without risk aversion, near zero interest rates cause devaluation of the dollar. Chart VI-3 shows the weakening USD between the recession of 2001 and the contraction after IVQ2007. There was a flight to dollar assets and especially obligations of the US government after Sep 2008. Cochrane and Zingales (2009) show that flight was coincident with proposals of TARP (Troubled Asset Relief Program) to withdraw “toxic assets” in US banks (see Pelaez and Pelaez, Financial Regulation after the Global Recession (2009a) and Regulation of Banks and Finance (2009b)). There are shocks to globalization in the form of regulation, trade and devaluation wars and breakdown of international cooperation (Pelaez and Pelaez, Globalization and the State: Vol. I (2008a), Globalization and the State: Vol. II (2008b) and Government Intervention in Globalization: Regulation, Trade and Devaluation Wars (2008c)). As evident in Chart VI-3A, there is no exit from near zero interest rates without a financial crisis and economic contraction, verified by the increase of interest rates from 1 percent in Jun 2004 to 5.25 percent in Jun 2006. The Federal Open Market Committee (FOMC) lowered the target of the fed funds rate from 7.03 percent on Jul 3, 2000, to 1.00 percent on Jun 22, 2004, in pursuit of non-existing deflation (Pelaez and Pelaez, International Financial Architecture (2005), 18-28, The Global Recession Risk (2007), 83-85). The FOMC implemented increments of 25 basis points of the fed funds target from Jun 2004 to Jun 2006, raising the fed funds rate to 5.25 percent on Jul 3, 2006, as shown in Chart VI-3A. The gradual exit from the first round of unconventional monetary policy from 1.00 percent in Jun 2004 (http://www.federalreserve.gov/boarddocs/press/monetary/2004/20040630/default.htm) to 5.25 percent in Jun 2006 (http://www.federalreserve.gov/newsevents/press/monetary/20060629a.htm) caused the financial crisis and global recession. There are conflicts on exchange rate movements among central banks. There is concern of declining inflation in the euro area and appreciation of the euro. On Jun 5, 2014, the European Central Bank introduced cuts in interest rates and a negative rate paid on deposits of banks (http://www.ecb.europa.eu/press/pr/date/2014/html/pr140605.en.html):

“5 June 2014 - Monetary policy decisions

At today’s meeting the Governing Council of the ECB took the following monetary policy decisions:

- The interest rate on the main refinancing operations of the Eurosystem will be decreased by 10 basis points to 0.15%, starting from the operation to be settled on 11 June 2014.

- The interest rate on the marginal lending facility will be decreased by 35 basis points to 0.40%, with effect from 11 June 2014.

- The interest rate on the deposit facility will be decreased by 10 basis points to -0.10%, with effect from 11 June 2014. A separate press release to be published at 3.30 p.m. CET today will provide details on the implementation of the negative deposit facility rate.”

The ECB also introduced new measures of monetary policy on Jun 5, 2014 (http://www.ecb.europa.eu/press/pr/date/2014/html/pr140605_2.en.html):

“5 June 2014 - ECB announces monetary policy measures to enhance the functioning of the monetary policy transmission mechanism

In pursuing its price stability mandate, the Governing Council of the ECB has today announced measures to enhance the functioning of the monetary policy transmission mechanism by supporting lending to the real economy. In particular, the Governing Council has decided:

- To conduct a series of targeted longer-term refinancing operations (TLTROs) aimed at improving bank lending to the euro area non-financial private sector [1], excluding loans to households for house purchase, over a window of two years.

- To intensify preparatory work related to outright purchases of asset-backed securities (ABS).”

The President of the European Central Bank (ECB) Mario Draghi analyzed the measures at a press conference (http://www.ecb.europa.eu/press/pressconf/2014/html/is140605.en.html). At the press conference following the meeting of the ECB on Jul 3, 2014, Mario Draghi stated (http://www.ecb.europa.eu/press/pressconf/2014/html/is140703.en.html): “In fact, as I said, interest rates will stay low for an extended period of time, and the Governing Council is unanimous in its commitment to use also nonstandard, unconventional measures to cope with the risk of a too-prolonged period of time of low inflation.”

The President of the ECB Mario Draghi analyzed unemployment in the euro area and the policy response policy in a speech at the Jackson Hole meeting of central bankers on Aug 22, 2014 (http://www.ecb.europa.eu/press/key/date/2014/html/sp140822.en.html):

“We have already seen exchange rate movements that should support both aggregate demand and inflation, which we expect to be sustained by the diverging expected paths of policy in the US and the euro area (Figure 7). We will launch our first Targeted Long-Term Refinancing Operation in September, which has so far garnered significant interest from banks. And our preparation for outright purchases in asset-backed security (ABS) markets is fast moving forward and we expect that it should contribute to further credit easing. Indeed, such outright purchases would meaningfully contribute to diversifying the channels for us to generate liquidity.”

On Sep 4, 2014, the European Central Bank lowered policy rates (http://www.ecb.europa.eu/press/pr/date/2014/html/pr140904.en.html):

“4 September 2014 - Monetary policy decisions

At today’s meeting the Governing Council of the ECB took the following monetary policy decisions:

- The interest rate on the main refinancing operations of the Eurosystem will be decreased by 10 basis points to 0.05%, starting from the operation to be settled on 10 September 2014.

- The interest rate on the marginal lending facility will be decreased by 10 basis points to 0.30%, with effect from 10 September 2014.

- The interest rate on the deposit facility will be decreased by 10 basis points to -0.20%, with effect from 10 September 2014.”

The President of the European Central Bank announced on Sep 4, 2014, the decision to expand the balance sheet by purchases of asset-backed securities (ABS) in a new ABS Purchase Program (ABSPP) and covered bonds (http://www.ecb.europa.eu/press/pressconf/2014/html/is140904.en.html):

“Based on our regular economic and monetary analyses, the Governing Council decided today to lower the interest rate on the main refinancing operations of the Eurosystem by 10 basis points to 0.05% and the rate on the marginal lending facility by 10 basis points to 0.30%. The rate on the deposit facility was lowered by 10 basis points to -0.20%. In addition, the Governing Council decided to start purchasing non-financial private sector assets. The Eurosystem will purchase a broad portfolio of simple and transparent asset-backed securities (ABSs) with underlying assets consisting of claims against the euro area non-financial private sector under an ABS purchase programme (ABSPP). This reflects the role of the ABS market in facilitating new credit flows to the economy and follows the intensification of preparatory work on this matter, as decided by the Governing Council in June. In parallel, the Eurosystem will also purchase a broad portfolio of euro-denominated covered bonds issued by MFIs domiciled in the euro area under a new covered bond purchase programme (CBPP3). Interventions under these programmes will start in October 2014. The detailed modalities of these programmes will be announced after the Governing Council meeting of 2 October 2014. The newly decided measures, together with the targeted longer-term refinancing operations which will be conducted in two weeks, will have a sizeable impact on our balance sheet.”

At the Thirtieth Meeting of the International Monetary and Financial Committee of the IMF (IMFC), the President of the European Central Bank (ECB), Mario Draghi stated (http://www.ecb.europa.eu/press/key/date/2014/html/sp141010.en.html):

“Our monetary policy continues to aim at firmly anchoring medium to long-term inflation expectations, in line with our objective of maintaining inflation rates below, but close to, 2% over the medium term. In this context, we have taken both conventional and unconventional measures that will contribute to a return of inflation rates to levels closer to our aim. Our unconventional measures, more specifically our TLTROs (Targeted Longer-Term Refinancing Operations) and our new purchase programmes for ABSs and covered bonds, will further enhance the functioning of our monetary policy transmission mechanism and facilitate credit provision to the real economy. Should it become necessary to further address risks of too prolonged a period of low inflation, the ECB’s Governing Council is unanimous in its commitment to using additional unconventional instruments within its mandate.”

In a speech on “Monetary Policy in the Euro Area,” on Nov 21, 2014, the President of the European Central Bank, Mario Draghi, advised of the determination to bring inflation back to normal levels by aggressive holding of securities in the balance sheet (http://www.ecb.europa.eu/press/key/date/2014/html/sp141121.en.html):

“In short, there is a combination of policies that will work to bring growth and inflation back on a sound path, and we all have to meet our responsibilities in achieving that. For our part, we will continue to meet our responsibility – we will do what we must to raise inflation and inflation expectations as fast as possible, as our price stability mandate requires of us.

If on its current trajectory our policy is not effective enough to achieve this, or further risks to the inflation outlook materialise, we would step up the pressure and broaden even more the channels through which we intervene, by altering accordingly the size, pace and composition of our purchases.”

In the Introductory Statement to the press conference on Dec 4,2014, the President of the European Central Bank Mario Draghi advised that (http://www.ecb.europa.eu/press/pressconf/2014/html/is141204.en.html):

“In this context, early next year the Governing Council will reassess the monetary stimulus achieved, the expansion of the balance sheet and the outlook for price developments. We will also evaluate the broader impact of recent oil price developments on medium-term inflation trends in the euro area. Should it become necessary to further address risks of too prolonged a period of low inflation, the Governing Council remains unanimous in its commitment to using additional unconventional instruments within its mandate. This would imply altering early next year the size, pace and composition of our measures.”

Chart VI-3, US Dollar Currency Indexes, Jan 4, 1995-Dec 26, 2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm

Chart VI-3A, US, Overnight Fed Funds Rate, Yield of Three-Month Treasury Constant Maturity, Yield of Ten-Year Treasury Constant Maturity and Yield of Moody’s Baa Bond, Jan 4, 1995 to Dec 30, 2014

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/h15

Carry trades induced by zero interest rates increase capital flows into emerging markets that appreciate exchange rates. Portfolio reallocations away from emerging markets depreciate their exchange rates in reversals of capital flows. Chart VI-4A provides the exchange rate of the Mexican peso (MXN) per US dollar from Nov 8, 1993 to Dec 24, 2014. The first data point in Chart VI-4A is MXN 3.1520 on Nov 8, 1993. The rate devalued to 11.9760 on Nov 14, 1995 during emerging market crises in the 1990s and the increase of interest rates in the US in 1994 that stressed world financial markets (Pelaez and Pelaez, International Financial Architecture 2005, The Global Recession Risk 2007, 147-77). The MXN depreciated sharply to MXN 15.4060/USD on Mar 2, 2009, during the global recession. The rate moved to MXN 11.5050/USD on May 2, 2011, during the sovereign debt crisis in the euro area. The rate depreciated to 11.9760 on May 9, 2013. The final data point is MXN 14.7460/USD on Dec 24, 2014.

Chart VI-4A, Mexican Peso (MXN) per US Dollar (USD), Nov 8, 1993 to Dec 24, 2014

Note: US Recessions in Shaded Areas

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/H10/default.htm