In memoriam

Antonio Castelo Branco Maciel

Global Growth Standstill Recession, Stalled Job Creation with 30 Million in Job Stress, Falling Real Wages, Stagnant Incomes and International Financial Turbulence

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011

Executive Summary

I Stalled Job Creation with 30 Million in Job Stress

II Falling Real Wages

III Stagnant Incomes

IV International Financial Turbulence

V Global Inflation

VI Global Growth Standstill Recession

VIA United States

VIB Japan

VIC China

VID Euro Area

VIE Germany

VIF France

VIG Italy

VIH UK

VII Spain

VII Valuation of Risk Financial Assets

VIII Economic Indicators

IX Interest Rates

X Conclusion

References

Appendix I: The Great Inflation and Unemployment

Executive Summary

The US is in the adverse situation of zero growth in job creation together with annual equivalent growth in the first half of 2011 of 0.7 percent. In IQ2011 the US economy grew at the seasonally-adjusted annual equivalent rate (SAAE) rate of 0.4 percent, which discounts to 0.1 percent per quarter, and in IIQ2011 the US economy grew at the SAAE rate of 1.0 percent, which discounts to 0.25 percent per quarter (http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html). Thus, growth in the first half was 1.035 {[(1.001) x (1.0025) -1]100}, which is equivalent for a full year of two semesters to only 0.7 percent {(1.0035 x 1.0035)-1]100}. In similarity with many other advanced economies, the US economy is in a standstill “growth recession.” The definition of growth recession could be a low growth rate that is insufficient to move the economy to full employment of humans together with their knowledge and skills, productive capacity and natural resources. The risk of a standstill growth recession is that the economy could contract again with nonzero probability that is unknown.

High-frequency data must be interpreted with significant caution. An unfavorable weekly or monthly report may be reversed to favorable in the near future. The employment situation of the US has not improved in the current expansion phase as in past upswing periods of the US business cycle. The main reason for weak job creation is mediocre performance in the current expansion with average GDP growth of only 2.4 percent seasonally-adjusted annual equivalent (SAAE) rate in the expansion from IIIQ2009 to IIQ2011, which is much lower than 6.2 percent SAAE rate on average in the expansion phases of four recessions. In particular, the average SAAE growth rate in the expansion from IQ1983 to IVQ1985 was 5.7 percent.

Chart 1, anticipated here from the text, shows US real quarterly GDP growth from 1980 to 1989. The economy contracted during the recession and then expanded vigorously throughout the 1980s, rapidly eliminating the unemployment caused by the contraction.

Chart 3, US, Real GDP, 1980-1989

Source: http://www.bea.gov/iTable/index_nipa.cfm

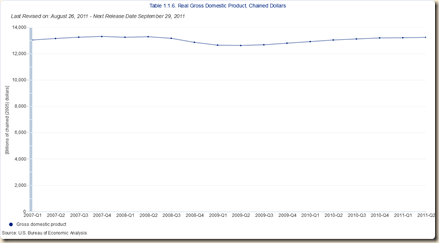

Chart 2 shows the entirely different situation of the real quarterly GDP in the US between 2007 and 2011. The economy has underperformed during the first eight quarters of expansion for the first time in the comparable contractions since the 1950s. The US economy is in a perilous standstill.

Chart 4, US, Real GDP, 2007-2011

Source: http://www.bea.gov/iTable/index_nipa.cfm

The Bureau of Labor Statistics (BLS) of the US Department of Labor provides the monthly employment situation report. This report consists of data on the US labor markets based on two types of samples: (1) the payroll survey; and (2) the household survey. There is no favorable information in the report for Aug. The first four rows in Table 1, anticipated here from the text, summarize the data in the payroll report. Growth of total nonfarm payroll jobs from Jul to Aug seasonally adjusted (SA) was 0, similar to the fed funds rate of 0 to ¼ percent and to the growth of GDP of 0.7 percent annual rate. The US has exchanged its AAA rating for 000 economic performance. Growth of nonfarm payroll jobs in Jul was 85,000, which does not absorb the new entrants in the labor force and leaves virtually unaltered the number of 30 million people in job stress. Job creation in the US is through increases in private-sector payrolls, which grew by only 17,000 in Aug and 156,000 in Jul, without alleviating job stress. The unemployment rate calculated with the data of the household survey remains at 9.1 percent in Aug, which is much higher than the “natural rate of unemployment” of around 5.2 percent.

Table 1, Summary of the Employment Situation Report SA

| Aug | Jul | |

| New Nonfarm Payroll Jobs | 0 | 85,000 |

| New Private Payroll Jobs | 17,000 | 156,000 |

| Average Hourly Earnings | $23.09 | $23.12 |

| Average Weekly Hours | 34.2 | $34.3 |

| Unemployment Rate Household Survey % of Labor Force | 9.1 | 9.1 |

| Number Unemployed and Underemployed Blog Calculation | 29.9 million NSA | 29.6 million NSA |

Source: http://www.bls.gov/news.release/pdf/empsit

The results of calculations in the text in Table 3 are that: (1) there are an estimated 4.451 million unemployed who are not counted because they left the labor force on their belief they could not find another job; (2) the total number of unemployed is effectively 18.459 million and not 14.008 million of whom many have been unemployed long term; (3) the rate of unemployment is 11.6 percent and not 9.1 percent, not seasonally adjusted, or 9.1 percent seasonally adjusted; and (4) the number of people in job stress is 29.887 million by adding the 4.451 million leaving the labor force because they believe they could not find another job, 8.738 million who work part-time because they cannot find full-time employment and 2.680 who are marginally attached to the labor force (18.459 + 8.738 + 2.680). The employment to population ratio dropped from 62.9 percent on average in 2006 to 58.8 percent in Aug 2010, 58.6 percent in Jul 2011 and 58.5 percent in Aug 2011 and the number of employed dropped from 144 million to 140 million. What really matters for labor input in production and wellbeing is the number of people with jobs or the employment/population ratio, which has declined and does not show signs of increasing. There are almost four million fewer people working in 2011 than in 2006 and the number employed is not increasing. The number of hiring relative to the number unemployed measures the chances of becoming employed. The number of hiring in the US economy has declined by 17 million and does not show signs of increasing (http://cmpassocregulationblog.blogspot.com/2011/03/slow-growth-inflation-unemployment-and.html see section IV Hiring Collapse in http://cmpassocregulationblog.blogspot.com/2011/08/world-financial-turbulence-global.html http://cmpassocregulationblog.blogspot.com/2011/06/increasing-risk-aversion-analysis-of.html).

The wage bill is the average weekly hours times the earnings per hour. Earnings per hour fell from $23.12 in Jul 2011 to $23.09 in Aug 2011 and average weekly earnings declined from $793.02 in Jul 2011 to $789.68 in Aug, 2011. The number of average weekly hours did not change from 34.2 in Aug 2010 to 34.2 in Aug 2011. The wage bill before taxes rose by 1.9 percent (1.019 times 1.000). The wage bill rose 2.6 percent in the 12 months ending in Jul, 2011 {[(wage bill in Jul 2011)/(wage bill in Jul 2010)-1 = ($23.12x34.3)/($22.61x34.2)-1]100} while CPI inflation was 3.6 percent in the 12 months ending in Jul 2011 for an inflation-adjusted wage-bill decline of 1.0 percent {[(1.026/1.036)-1]100}. Energy and food price increases are similar to a “silent tax” that is highly regressive, harming the most those with lowest incomes. There are concerns that the wage bill would deteriorate in purchasing power because of the raw materials shock in the form of increases in prices of commodities such as the 31.1 percent steady increase in the DJ-UBS Commodity Index from Jul 2, 2010 to Sep 2, 2011. The charts of four commodity price indexes by Bloomberg show steady increase since Jul 2, 2010 that was interrupted briefly only in Nov with the sovereign issues in Europe triggered by Ireland, in Mar by the earthquake and tsunami in Japan and in the beginning of May by the decline in oil prices and the sovereign risk difficulties in Europe (http://www.bloomberg.com/markets/commodities/futures/).

Inflation-adjusted average hourly earnings have been decreasing by 1.4 percent in Apr, 1.6 percent in May, 1.6 percent in Jun and 1.3 percent in Jul. A fractured labor market with falling numbers of hiring does not offer opportunities for wage and salary improvements.

The report on personal income and outlays shows reduction in the rates of growth of real or inflation-adjusted disposable income (deducting taxes) from 2.0 percent annual equivalent in IVQ2010 to 0.7 percent AE in Jan-Jul 2011 and of growth of real or inflation-adjusted personal consumption expenditures from 3.2 percent annual equivalent in IVQ2010 to 1.7 percent annual equivalent in Jan-Jul 2011. There is no evidence of trend but rather the appearance of a slowing rate of growth that is captured by GDP growth of 0.4 percent annual equivalent in IQ2011 and1.0 percent annual equivalent in IIQ2011, which accumulates to 0.35 percent in the first half of 2011 that is equivalent to 0.7 percent if repeated during two semesters for an entire year, and economic indicators in IIQ2011 and now also for Jul and Aug. There may have been a slowdown because of the interruption of the supply chain by the earthquake in Japan and sovereign turbulence in Europe but the economy was already weak before these events as shown by virtually flat real disposable income, growing at 0.7 percent annual equivalent in the first half of 2011. The 12-month rates of increase of real disposable income and real personal consumptions expenditures in the past eight months show a trend of deterioration of real disposable income from over 3 percent in the final four months of 2010 to less than 3 percent in IQ2011 and then collapsing to a range of 1.2 to 1.4 percent in May-Jul. Real personal consumption expenditure growth decelerated less sharply from close to 3 percent in IVQ 2010 to 2.3 percent in Jul and 2.0 percent in Jun.

Section VI Global Growth Standstill Recession provides the regional and country data tables for economies that contribute some three quarters of world economic output. The purchasing managers’ indexes for the US by the Institute for Supply Management and for the world by Markit show deceleration of growth commonly to conditions in 2009, weak internal demand and rapidly deteriorating export business. High-frequency indicators with a lag concur with the more current purchasing managers’ indexes.

High volatility has become the norm in financial markets. Real Time Economics published in the Wall Street Journal on Sep 3 an article on “Number of the Week: Volatile August for Stocks” (http://blogs.wsj.com/economics/2011/09/03/number-of-the-week-volatile-august-for-stocks/). According to Real Time Economics, the daily change in the Dow Jones Industrial Average (DJIA) in the month of Aug was 1.9 percent, which does not compare with 2008, but it is still the tenth most volatile month in the past 75 years. Weak economic performance and a fractured job market are coexisting with uncertainty reflected in highly volatile valuations of risk financial assets.

I Stalled Job Creation with 30 Million in Job Stress. The US is in the adverse situation of zero growth in job creation together with annual equivalent growth in the first half of 2011 of 0.7 percent. In IQ2011 the US economy grew at the seasonally-adjusted annual equivalent rate (SAAE) rate of 0.4 percent, which discounts to 0.1 percent per quarter, and in IIQ2011 the US economy grew at the SAAE rate of 1.0 percent, which discounts to 0.25 percent per quarter (http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html). Thus, growth in the first half was 1.035 {[(1.001) x (1.0025) -1]100}, which is equivalent for a full year of two semesters to only 0.7 percent {(1.0035 x 1.0035)-1]100}. In similarity with many other advanced economies, the US economy is in a standstill “growth recession.” The definition of growth recession could be a low growth rate that is insufficient to move the economy to full employment of humans together with their knowledge and skills, productive capacity and natural resources. The risk of a standstill growth recession is that the economy could contract again with nonzero probability that is unknown.

High-frequency data must be interpreted with significant caution. An unfavorable weekly or monthly report may be reversed to favorable in the near future. The employment situation of the US has not improved in the current expansion phase as in past upswing periods of the US business cycle. The main reason for weak job creation is mediocre performance in the current expansion with average GDP growth of only 2.4 percent seasonally-adjusted annual equivalent (SAAE) rate in the expansion from IIIQ2009 to IIQ2011, which is much lower than 6.2 percent SAAE rate on average in the expansion phases of four recessions. In particular, the average SAAE growth rate in the expansion from IQ1983 to IVQ1985 was 5.7 percent.

Chart 1 shows US real quarterly GDP growth from 1980 to 1989. The economy contracted during the recession and then expanded vigorously throughout the 1980s, rapidly eliminating the unemployment caused by the contraction.

Chart 3, US, Real GDP, 1980-1989

Source: http://www.bea.gov/iTable/index_nipa.cfm

Chart 2 shows the entirely different situation of the real quarterly GDP in the US between 2007 and 2011. The economy has underperformed during the first eight quarters of expansion for the first time in the comparable contractions since the 1950s. The US economy is in a perilous standstill.

Chart 4, US, Real GDP, 2007-2011

Source: http://www.bea.gov/iTable/index_nipa.cfm

The Bureau of Labor Statistics (BLS) of the US Department of Labor provides the monthly employment situation report. This report consists of data on the US labor markets based on two types of samples: (1) the payroll survey; and (2) the household survey. There is no favorable information in the report for Aug. The first four rows in Table 1 summarize the data in the payroll report. Growth of total nonfarm payroll jobs from Jul to Aug seasonally adjusted (SA) was 0, similar to the fed funds rate of 0 to ¼ percent and to the growth of GDP of 0.7 percent annual rate. Growth of nonfarm payroll jobs in Jul was 85,000, which does not absorb the new entrants in the labor force and leaves virtually unaltered the number of 30 million people in job stress. Job creation in the US is through increases in private-sector payrolls, which grew by only 17,000 in Aug and 156,000 in Jul, without alleviating job stress. The unemployment rate calculated with the data of the household survey remains at 9.1 percent in Aug, which is much higher than the “natural rate of unemployment” of around 5.2 percent. The remainder of this section analyzes the employment situation report.

Table 1, Summary of the Employment Situation Report SA

| Aug | Jul | |

| New Nonfarm Payroll Jobs | 0 | 85,000 |

| New Private Payroll Jobs | 17,000 | 156,000 |

| Average Hourly Earnings | $23.09 | $23.12 |

| Average Weekly Hours | 34.2 | $34.3 |

| Unemployment Rate Household Survey % of Labor Force | 9.1 | 9.1 |

| Number Unemployed and Underemployed Blog Calculation | 29.9 million NSA | 29.6 million NSA |

Source: http://www.bls.gov/news.release/pdf/empsit.pdf

The Bureau of Labor Statistics (BLS) released the employment situation report on Fri Sep 2 showing an unchanged seasonally adjusted rate of unemployment, or unemployed as percent of the labor force, of 9.1 percent in Aug 2011, which is identical to 9.1 percent in Jul 2011 (http://www.bls.gov/news.release/pdf/empsit.pdf). The number of people in job stress unemployed or underemployed in Table 2 is 25.4 million in Aug, compared with 25.1 million in Jul and 25.3 million in Jun. The number in job stress unemployed or underemployed of 25.4 million in Aug is composed of 13.9 million unemployed (of whom 6.0 million, or 43.2 percent, unemployed for 27 weeks or more) compared with 13.9 million unemployed in Jul (of whom 6.2 million, or 44.4 percent, unemployed for 27 weeks or more), 8.8 million employed part-time for economic reasons (who suffered reductions in their work hours or could not find full-time employment) compared with 8.4 million in Jul and 2.6 million who were marginally attached to the labor force in Aug (who were not in the labor force but wanted and were available for work) compared with 2.8 million in Jul.

Table 2, People in Job Stress, Millions and % SA

| Aug | Jul | Jun | |

| Unemployed | 13.967 | 13.931 | 14.087 |

| Unemployed ≥27 weeks | 6.034 | 6.185 | 6.289 |

| Unemployed ≥27 weeks % | 43.2 | 44.4 | 44.6 |

| Part Time Economic Reasons | 8.826 | 8.396 | 8.552 |

| Marginally | 2.575 | 2.785 | 2.680 |

| Job Stress | 25.368 | 25.112 | 25.319 |

| Unemploy- | 9.1 | 9.1 | 9.2 |

Job Stress = Unemployed + Part Time Economic Reasons + Marginally Attached Labor Force

Source:

http://www.bls.gov/news.release/pdf/empsit.pdf

http://www.bls.gov/news.release/archives/empsit_05062011.pdf

http://www.bls.gov/news.release/archives/empsit_04012011.pdf

In an article in the Financial Times, Martin Feldstein (2011Jul25) finds that the true issue in the US is jobs. The problem is the fractured labor market. Feldstein (2011Jul25) calculates 29 million Americans who are unable to find the job they desire. Comments in this blog have been providing a calculation of unemployed or underemployed in the US of around 29 million. Additional information provides deeper insight on the fractured job market of the US. Table 3 consists of data and additional calculations using the BLS household survey, illustrating the possibility that the actual rate of unemployment could be 11.6 percent and the number of people in job stress could be closer to 30 million. The first column provides for 2006 the yearly average population (POP), labor force (LF), participation rate or labor force as percent of population (PART %), employment (EMP), employment population ratio (EMP/POP %), unemployment (UEM), the unemployment rate as percent of labor force (UEM/LF Rate %) and the number of people not in the labor force (NLF). The numbers in column 2006 are averages in millions while the monthly numbers for Aug 2010 and Aug and Jul 2011 are in thousands, not seasonally adjusted. The average yearly participation rate of the population in the labor force was in the range of 62.0 percent minimum to 67.1 percent maximum between 2000 and 2006 with the average of 66.4 percent (ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf). The objective of Table 3 is to assess how many people could have left the labor force because they do not think they can find another job. Row “LF PART 66.2 %” applies the participation rate of 2006, almost equal to the rates for 2000 to 2006, to the population in Aug 2010 and Aug and Jul 2011 to obtain what would be the labor force of the US if the participation rate had not changed. In fact, the participation rate fell to 65.0 percent by Aug 2010 and was 64.6 percent in Jul 2011 and 64.3 percent in Aug 2011, suggesting that many people simply gave up on finding another job. Row “∆ NLF UEM” calculates the number of people not counted in the labor force because they could have given up on finding another job by subtracting from the labor force with participation rate of 66.2 percent (row “LF PART 66.2%”) the labor force estimated in the household survey (row “LF”). Total unemployed (row “Total UEM”) is obtained by adding unemployed in row “∆NLF UEM” to the unemployed of the household survey in row “UEM.” The row “Total UEM%” is the effective total unemployed “Total UEM” as percent of the effective labor force in row “LF PART 66.2%.” The results are that: (1) there are an estimated 4.451 million unemployed who are not counted because they left the labor force on their belief they could not find another job (∆NLF UEM); (2) the total number of unemployed is effectively 18.459 million (Total UEM) and not 14.008 million (UEM) of whom many have been unemployed long term; (3) the rate of unemployment is 11.6 percent (Total UEM%) and not 9.1 percent, not seasonally adjusted, or 9.1 percent seasonally adjusted; and (4) the number of people in job stress is close to 30 million by adding the 4.451 million leaving the labor force because they believe they could not find another job. The last row of Table 3 provides the number of people in job stress (“In Job Stress) not seasonally adjusted at 29.877 million in Aug 2011, adding the total number of unemployed (“Total UEM”), plus those involuntarily in part-time jobs because they cannot find anything else (“Part Time Economic Reasons”) and the marginally attached to the labor force (“Marginally attached to LF”). The employment population ratio “EMP/POP %” dropped from 62.9 percent on average in 2006 to 58.8 percent in Aug 2010, 58.6 percent in Jul 2011 and 58.5 percent in Aug 2011 and the number of employed (EMP) dropped from 144 million to 140 million. What really matters for labor input in production and wellbeing is the number of people with jobs or the employment/population ratio, which has declined and does not show signs of increasing. There are almost four million fewer people working in 2011 than in 2006 and the number employed is not increasing. The number of hiring relative to the number unemployed measures the chances of becoming employed. The number of hiring in the US economy has declined by 17 million and does not show signs of increasing (http://cmpassocregulationblog.blogspot.com/2011/03/slow-growth-inflation-unemployment-and.html see section IV Hiring Collapse in http://cmpassocregulationblog.blogspot.com/2011/08/world-financial-turbulence-global.html http://cmpassocregulationblog.blogspot.com/2011/06/increasing-risk-aversion-analysis-of.html).

Table 3, Population, Labor Force and Unemployment, NSA

| 2006 | Aug 2010 | Jul 2011 | Aug 2011 | |

| POP | 229 | 238,099 | 239,671 | 239,871 |

| LF | 151 | 154,678 | 154,812 | 154,344 |

| PART% | 66.2 | 65.0 | 64.6 | 64.3 |

| EMP | 144 | 139,919 | 140,384 | 140,335 |

| EMP/POP% | 62.9 | 58.8 | 58.6 | 58.5 |

| UEM | 7 | 14,759 | 14,428 | 14,008 |

| UEM/LF Rate% | 4.6 | 9.5 | 9.3 | 9.1 |

| NLF | 77 | 83,421 | 84,859 | 85,528 |

| LF PART 66.2% | 157,622 | 158,662 | 158,795 | |

| ∆NLF UEM | 2,944 | 3,850 | 4,451 | |

| Total UEM | 17,703 | 18,278 | 18,459 | |

| Total UEM% | 11.2 | 11.5 | 11.6 | |

| Part Time Economic Reasons | 8,737 | 8,514 | 8,738 | |

| Marginally Attached to LF | 2,622 | 2,785 | 2,680 | |

| In Job Stress | 29,062 | 29,577 | 29,877 |

Pop: population; LF: labor force; PART: participation; EMP: employed; UEM: unemployed; NLF: not in labor force; ∆NLF UEM: additional unemployed; Total UEM is UEM + ∆NLF UEM; Total UEM% is Total UEM as percent of LF PART 66.2%; In Job Stress = Total UEM + Part Time Economic Reasons + Marginally Attached to LF

Note: the first column for 2006 is in average millions; the remaining columns are in thousands; NSA: not seasonally adjusted

The labor force participation rate of 66.2% in 2006 is applied to current population to obtain LF PART 66.2%; ∆NLF UEM is obtained by subtracting the labor force with participation of 66.2 percent from the household survey labor force LF; Total UEM is household data unemployment plus ∆NLF UEM; and total UEM% is total UEM divided by LF PART 66.2%

Sources:

ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf

http://www.bls.gov/news.release/archives/empsit_12032010.pdf

http://www.bls.gov/news.release/pdf/empsit.pdf

Total nonfarm payroll employment seasonally adjusted (SA) rose by 0 in Aug and private payroll employment rose by 17,000. Table 4 provides the monthly change in jobs seasonally adjusted in the prior strong contraction of 1981-1982 and the recovery in 1983 into 1984 and in the contraction of 2008-2009 and in the recovery in 2009 to 2011. All revisions have been incorporated in Table 4. The data in the recovery periods are in relief to facilitate comparison. There is significant bias in the comparison. The average yearly civilian noninstitutional population was 174.2 million in 1983 and the civilian labor force 111.6 million, growing by 2009 to an average yearly civilian noninstitutional population of 235.8 million and civilian labor force of 154.1 million, that is, increasing by 35.4 percent and 38.1 percent, respectively (http://www.bls.gov/cps/cpsaat1.pdf). Total nonfarm payroll jobs in 1983 were 90.280 million, jumping to 94.530 million in 1984 while total nonfarm jobs in 2010 were 129.818 million declining from 130.807 million in 2009 (http://www.bls.gov/webapps/legacy/cesbtab1.htm ). What is striking about the data in Table 4 is that the numbers of monthly increases in jobs in 1983 are several times higher than in 2010 to 2011 even with population higher by 35.4 percent and labor force higher by 38.1 percent in 2009 relative to 1983 nearly three decades ago and total number of jobs in payrolls rose by 39.5 million in 2010 relative to 1983 or by 43.8 percent.. Growth has been mediocre in the six quarters of expansion beginning in IIIQ2009 in comparison with earlier expansions (http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html http://cmpassocregulationblog.blogspot.com/2011/07/growth-recession-debt-financial-risk.html http://cmpassocregulationblog.blogspot.com/2011/07/causes-of-2007-creditdollar-crisis.html http://cmpassocregulationblog.blogspot.com/2011/06/financial-risk-aversion-slow-growth.html http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html http://cmpassocregulationblog.blogspot.com/2011/05/mediocre-growth-world-inflation.html http://cmpassocregulationblog.blogspot.com/2011/03/slow-growth-inflation-unemployment-and.html http://cmpassocregulationblog.blogspot.com/2011/02/mediocre-growth-raw-materials-shock-and.html) and also in terms of what is required to reduce the job stress of at least 25 million persons but likely close to 30 million. Some of the job growth and contraction in 2010 in Table 4 is caused by the hiring and subsequent layoff of temporary workers for the 2010 census.

Table 4, Monthly Change in Jobs, Number SA

| Month | 1981 | 1982 | 1983 | 2008 | 2009 | 2010 | Private |

| Jan | 95 | -327 | 225 | 13 | -820 | -39 | -42 |

| Feb | 67 | -6 | -78 | -83 | -726 | -35 | -21 |

| Mar | 104 | -129 | 173 | -72 | -796 | 192 | 144 |

| Apr | 74 | -281 | 276 | -185 | -660 | 277 | 229 |

| May | 10 | -45 | 277 | -233 | -386 | 458 | 48 |

| Jun | 196 | -243 | 378 | -178 | -502 | -192 | 65 |

| Jul | 112 | -343 | 418 | -231 | -300 | -49 | 93 |

| Aug | -36 | -158 | -308 | -267 | -231 | -59 | 110 |

| Sep | -87 | -181 | 1114 | -434 | -236 | -29 | 109 |

| Oct | -100 | -277 | 271 | -509 | -221 | 171 | 143 |

| Nov | -209 | 124 | 352 | -802 | -55 | 93 | 128 |

| Dec | -278 | -14 | 356 | -619 | -130 | 152 | 167 |

| 1984 | 2011 | Private | |||||

| Jan | 447 | 68 | 94 | ||||

| Feb | 479 | 235 | 261 | ||||

| Mar | 275 | 194 | 219 | ||||

| Apr | 363 | 217 | 241 | ||||

| May | 308 | 53 | 99 | ||||

| Jun | 379 | 46 | 80 | ||||

| Jul | 312 | 85 | 156 | ||||

| Aug | 241 | 0 | 17 | ||||

| Sep | 311 | ||||||

| Oct | 286 | ||||||

| Nov | 349 | ||||||

| Dec | 127 |

Source: http://data.bls.gov/PDQ/servlet/SurveyOutputServlet

http://www.bls.gov/webapps/legacy/cesbtab1.htm

http://www.bls.gov/schedule/archives/empsit_nr.htm#2010

http://www.bls.gov/news.release/pdf/empsit.pdf

Important aspects of growth of payroll jobs from Aug 2010 to Aug 2011, not seasonally adjusted (NSA), are provided in Table 5. Total nonfarm employment increased by 1,282,000, consisting of growth of total private employment by 1,744,000 and decline by 462,000 of government employment. Monthly average growth of private payroll employment has been 145,333, which is mediocre relative to 25 to 30 million in job stress, while total nonfarm employment has grown on average by only 106,833 per month. Manufacturing employment increased by 211,000 while private service providing employment grew by 1,428,000. An important feature is that jobs in temporary help services increased by 142,000. This episode of jobless recovery is characterized by part-time jobs. An important characteristic is that the losses of government jobs have been high in local government, 294,000 jobs lost, because of the higher number of employees in local government, 13.2 million relative to 4.8 million in state jobs and 2.8 million in federal jobs.

Table 5, Employees in Nonfarm Payrolls Not Seasonally Adjusted in Thousands

| Aug 2010 | Aug 2011 | Change | |

| A Total Nonfarm | 129,624 | 130,906 | 1,282 |

| B Total Private | 108,396 | 110,140 | 1,744 |

| B1 Goods Producing | 18,204 | 18,520 | 316 |

| B1a Manu-facturing | 11,646 | 11,857 | 211 |

| B2 Private service providing | 90,192 | 91,620 | 1,428 |

| B2a Temporary help services | 2,129 | 2,271 | 142 |

| C Government | 21,228 | 20,766 | -462 |

| C1 Federal | 2,949 | 2,839 | -110 |

| C2 State | 4,856 | 4,798 | -58 |

| C3 Local | 13,423 | 13,129 | -294 |

Note: A = B+C, B = B1 + B2, C=C1 + C2 + C3

Source:

http://www.bls.gov/news.release/pdf/empsit.pdf

The NBER dates recessions in the US from peaks to troughs as: IQ80 to IIIQ80, IIIQ81 to IV82 and IVQ07 to IIQ09 (http://www.nber.org/cycles/cyclesmain.html). Table 6 provides total annual level nonfarm employment in the US for the 1980s and the 2000s, which is different from 12 months comparisons. Nonfarm jobs rose by 4.853 million in 1982 to 1984, or 5.4 percent, and continued rapid growth in the rest of the decade. In contrast, nonfarm jobs are down by 7.780 million in 2010 relative to 2007 and fell by 989,000 in 2010 relative to 2009 even after six quarters of GDP growth. Monetary and fiscal stimuli have failed in increasing growth to rates required for mitigating job stress. The initial growth impulse reflects a flatter growth curve in the current expansion.

Table 6, Total Nonfarm Employment in Thousands

| Year | Total Nonfarm | Year | Total Nonfarm |

| 1980 | 90,528 | 2000 | 131,785 |

| 1981 | 91,289 | 2001 | 131,826 |

| 1982 | 89,677 | 2002 | 130,341 |

| 1983 | 90,280 | 2003 | 129,999 |

| 1984 | 94,530 | 2004 | 131,435 |

| 1985 | 97,511 | 2005 | 133,703 |

| 1986 | 99,474 | 2006 | 136,086 |

| 1987 | 102,088 | 2007 | 137,598 |

| 1988 | 105,345 | 2008 | 136,790 |

| 1989 | 108,014 | 2009 | 130,807 |

| 1990 | 109,487 | 2010 | 129,818 |

Source: http://www.bls.gov/webapps/legacy/cesbtab1.htm

The highest average yearly percentage of unemployed to the labor force since 1940 was 14.6 percent in 1940 followed by 9.9 percent in 1941, 8.5 percent in 1975, 9.7 percent in 1982 and 9.6 percent in 1983 (ftp://ftp.bls.gov/pub/special.requests/lf/aa2006/pdf/cpsaat1.pdf). The rate of unemployment remained at high levels in the 1930s, rising from 3.2 percent in 1929 to 22.9 percent in 1932 in one estimate and 23.6 percent in another with real wages increasing by 16.4 percent (Margo 1993, 43; see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 214-5). There are alternative estimates of 17.2 percent or 9.5 percent for 1940 with real wages increasing by 44 percent. Employment declined sharply during the 1930s. The number of hours worked remained 29 percent in 1939 below the level of 1929 (Cole and Ohanian 1999). Private hours worked fell in 1939 to 25 percent of the level in 1929. The policy of encouraging collusion through the National Industrial Recovery Act (NIRA), to maintain high prices, together with the National Labor Relations Act (NLRA), to maintain high wages, prevented the US economy from recovering employment levels until Roosevelt abandoned these policies toward the end of the 1930s (for review of the literature analyzing the Great Depression see Pelaez and Pelaez, Regulation of Banks and Finance (2009b), 198-217).

The Bureau of Labor Statistics (BLS) makes yearly revisions of its establishment survey (Harris 2011BA):

“With the release of data for January 2011, the Bureau of Labor Statistics (BLS) introduced its annual revision of national estimates of employment, hours, and earnings from the Current Employment Statistics (CES) monthly survey of nonfarm establishments. Each year, the CES survey realigns its sample-based estimates to incorporate universe counts of employment—a process known as benchmarking. Comprehensive counts of employment, or benchmarks, are derived primarily from unemployment insurance (UI) tax reports that nearly all employers are required to file with State Workforce Agencies.”

The number of not seasonally adjusted total private jobs in the US in Dec 2010 is 108.464 million, declining to 106.079 million in Jan 2011, or by 2.385 million, because of the adjustment of a different benchmark and not actual job losses. The not seasonally adjusted number of total private jobs in Dec 1984 is 80.250 million, declining to 78.704 million in Jan 1985, or by 1.546 million for the similar adjustment. Table 7 attempts to measure job losses and gains in the recessions and expansions of 1981-1985 and 2007-2011. The final ten rows provide job creation from May 1983 to May 1984 and from May 2010 to May 2011, that is, at equivalent stages of the recovery from two comparable strong recessions. The row “Change ∆%” for May 1983 to May 1984 shows an increase of total nonfarm jobs by 4.9 percent and of 5.9 percent for total private jobs. The row “Change ∆%” for May 2010 to May 2011 shows an increase of total nonfarm jobs by 0.7 percent and of 1.7 percent for total private jobs. The last two rows of Table 11 provide a calculation of the number of jobs that would have been created from May 2010 to May 2011 if the rate of job creation had been the same as from May 1983 to May 1984. If total nonfarm jobs had grown between May 2010 and May 2011 by 4.9 percent, as between May 1983 and May 1984, 6.409 million jobs would have been created in the past 12 months for a difference of 5.457 million more total nonfarm jobs relative to 0.952 million jobs actually created. If total private jobs had grown between May 2010 and May 2011 by 5.9 percent as between May 1983 and May 1984, 6.337 million private jobs would have been created for a difference of 4.539 million more total private jobs relative to 1.798 million jobs actually created.

Table 7, Total Nonfarm and Total Private Jobs Destroyed and Subsequently Created in Two Recessions IIIQ1981-IVQ1982 and IVQ2007-IIQ2009, Thousands and Percent

| Total Nonfarm Jobs | Total Private Jobs | |

| 06/1981 # | 92,288 | 75,969 |

| 11/1982 # | 89,482 | 73,260 |

| Change # | -2,806 | -2,709 |

| Change ∆% | -3.0 | -3.6 |

| 12/1982 # | 89,383 | 73,185 |

| 05/1984 # | 94,471 | 78,049 |

| Change # | 5,088 | 4,864 |

| Change ∆% | 5.7 | 6.6 |

| 11/2007 # | 139,090 | 116,291 |

| 05/2009 # | 131,626 | 108,601 |

| Change % | -7,464 | -7,690 |

| Change ∆% | -5.4 | -6.6 |

| 12/2009 # | 130,178 | 107,338 |

| 05/2011 # | 131,753 | 108,494 |

| Change # | 1,575 | 1,156 |

| Change ∆% | 1.2 | 1.1 |

| 05/1983 # | 90,005 | 73,667 |

| 05/1984 # | 94,471 | 78,049 |

| Change # | 4,466 | 4,382 |

| Change ∆% | 4.9 | 5.9 |

| 05/2010 # | 130,801 | 107,405 |

| 05/2011 # | 131,753 | 109,203 |

| Change # | 952 | 1,798 |

| Change ∆% | 0.7 | 1.7 |

| Change # by ∆% as in 05/1984 to 05/1985 | 6,409* | 6,337** |

| Difference in Jobs that Would Have Been Created | 5,457 = | 4,539 = |

*[(130,801x1.049)-130,801] = 6,409 thousand

**[(107,405)x1.059 – 107,405] = 6,337 thousand

Source: http://data.bls.gov/pdq/SurveyOutputServlet

II Falling Real Wages. The wage bill is the average weekly hours times the earnings per hour. Table 8 provides the estimates by the BLS of earnings per hour seasonally adjusted, increasing from $22.67/hour in Aug 2010 to $23.09/hour in Aug 2011, or by 1.9 percent. There is disappointment in financial markets about the pace of wage increases because of rising food and energy costs that inhibit consumption and thus sales. Average private weekly earnings increased slightly by $14.37 from $775.31 in Aug 2010 to $789.68 in Aug 2011 or by 1.9 percent. Earnings per hour fell from $23.12 in Jul 2011 to $23.09 in Aug 2011 and average weekly earnings declined from $793.02 in Jul 2011 to $789.68 in Aug, 2011. The number of average weekly hours did not change from 34.2 in Aug 2010 to 34.2 in Aug 2011. The wage bill before taxes rose by 1.9 percent (1.019 times 1.000). The wage bill rose 2.6 percent in the 12 months ending in Jul, 2011 {[(wage bill in Jul 2011)/(wage bill in Jul 2010)-1 = ($23.12x34.3)/($22.61x34.2)-1]100} while CPI inflation was 3.6 percent in the 12 months ending in Jul 2011 for an inflation-adjusted wage-bill decline of 1.0 percent {[(1.026/1.036)-1]100}. Energy and food price increases are similar to a “silent tax” that is highly regressive, harming the most those with lowest incomes. There are concerns that the wage bill would deteriorate in purchasing power because of the raw materials shock in the form of increases in prices of commodities such as the 31.1 percent steady increase in the DJ-UBS Commodity Index from Jul 2, 2010 to Sep 2, 2011. The charts of four commodity price indexes by Bloomberg show steady increase since Jul 2, 2010 that was interrupted briefly only in Nov with the sovereign issues in Europe triggered by Ireland, in Mar by the earthquake and tsunami in Japan and in the beginning of May by the decline in oil prices and the sovereign risk difficulties in Europe (http://www.bloomberg.com/markets/commodities/futures/).

Table 8, Earnings per Hour and Average Weekly Hours SA

| Earnings per Hour | Aug 2010 | Jun 2011 | Jul 2011 | Aug 2011 |

| Total Private | $22.67 | $23.01 | $23.12 | $23.09 |

| Goods Producing | $24.14 | $24.39 | $24.46 | $24.46 |

| Service Providing | $22.32 | $22.69 | $22.81 | $22.76 |

| Average Weekly Earnings | ||||

| Total Private | $775.31 | $789.24 | $793.02 | $789.68 |

| Goods Producing | $958.36 | $973.16 | $973.51 | $973.51 |

| Service Providing | $738.79 | $753.31 | $759.57 | $753.36 |

| Average Weekly Hours | ||||

| Total Private | 34.2 | 34.3 | 34.3 | 34.2 |

| Goods Producing | 39.7 | 39.9 | 39.8 | 39.8 |

| Service Providing | 33.1 | 33.2 | 33.3 | 33.1 |

Source: http://www.bls.gov/news.release/pdf/empsit.pdf

Average hourly earnings in the first eight months of 2007, 2010 and 2011 are shown in Table 9 together with their 12-months percentage change, CPI 12 month inflation and 12-month percentage changes in CPI inflation-adjusted average hourly earnings. Nominal changes of hourly earnings in 2007 were high and compensated for CPI inflation as shown by positive changes in 12 months real or CPI inflation-adjusted average hourly earnings. In 2010 and 2011, real average hourly earnings have been falling with acceleration in Mar 2011 because of the high headline CPI inflation of 2.7 percent, accelerating in Apr to 3.2 percent and in May, Jun and Jul to 3.6 percent. Headline CPI inflation in the first six months of 2011 accumulated to an annual equivalent 3.7 percent. CPI inflation excluding food and energy accumulated to annual equivalent 2.6 percent in the first six months of 2011. As shown in Table 9, inflation-adjusted average hourly earnings have been decreasing by 1.4 percent in Apr, 1.6 percent in May, 1.6 percent in Jun and 1.3 percent in Jul. A fractured labor market with falling numbers of hiring does not offer opportunities for wage and salary improvements.

Table 9, Average Hourly Earnings Nominal and Inflation Adjusted, Dollars and % NSA

| AHE ALL | 12 Month | ∆% 12 Month CPI | 12 Month | |

| 2007 | ||||

| Jan* | $20.70* | 4.2* | 2.1 | 2.1* |

| Feb* | $20.79* | 4.1* | 2.4 | 1.7* |

| Mar | $20.78 | 3.6 | 2.8 | 0.8 |

| Apr | $20.85 | 3.5 | 2.6 | 0.7 |

| May | $20.89 | 3.8 | 2.7 | 1.1 |

| Jun | $21.00 | 3.8 | 2.7 | 1.1 |

| Jul | $21.04 | 3.7 | 2.4 | 1.3 |

| Aug | $21.03 | 3.5 | 1.9 | 1.6 |

| 2010 | ||||

| Jan | $22.44 | 1.9 | 2.6 | -0.7 |

| Feb | $22.48 | 1.9 | 2.1 | -0.2 |

| Mar | $22.48 | 1.8 | 2.3 | -0.5 |

| Apr | $22.52 | 1.8 | 2.2 | -0.4 |

| May | $22.57 | 1.9 | 2.0 | -0.1 |

| Jun | $22.57 | 1.8 | 1.1 | 0.7 |

| Jul | $22.61 | 1.8 | 1.2 | 0.6 |

| Aug | $22.67 | 1.8 | 1.1 | 0.7 |

| 2011 | ||||

| Jan | $22.86 | 1.9 | 1.6 | 0.3 |

| Feb | $22.88 | 1.8 | 2.1 | -0.3 |

| Mar | $22.89 | 1.8 | 2.7 | -0.9 |

| Apr | $22.93 | 1.8 | 3.2 | -1.4 |

| May | $23.02 | 1.9 | 3.6 | -1.6 |

| Jun | $23.01 | 1.9 | 3.6 | -1.6 |

| Jul | $23.12 | 2.3 | 3.6 | -1.3 |

| Aug | $23.09 | 1.8 |

Note: AHE ALL: average hourly earnings of all employees; CPI: consumer price index; Real: adjusted by CPI inflation; NA: not available

*AHE of production and nonsupervisory employees because of unavailability of data for all employees

Source: http://data.bls.gov/cgi-bin/surveymost?bls

ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

III Stagnant Incomes. The data on personal income and consumption have been revised back to 2003 as it the case of the national accounts (GDP revisions are covered in http://cmpassocregulationblog.blogspot.com/2011/07/growth-recession-debt-financial-risk.html). All revisions are incorporated in this subsection. There are two types of very valuable information on income, consumption and prices in Table 10, showing monthly, and annual equivalent percentage changes, seasonally adjusted, of current dollar or nominal personal income (NPI), current dollars or nominal disposable personal income (NDPI), real or constant chained (2005) dollars DPI (RDPI), current dollars nominal personal consumption expenditures (NPCE) and constant or chained (2005) dollars PCE. First, the difference between NDPI and RDPI (NDPI/RDPI) and NPCE and RPCE (NPCE/RPCE) indicates inflation. Let the rate of inflation be π, the percentage change in nominal value NV and the change in real value rv. Then:

(1+π)(1+rv) = (1+NV) (1)

Thus, if we know (1+NV) and (1+rv), simple rearrangement provides (1+π):

(1+π) = (1+NV)/(1+rv) (2)

The growing gap between NDPI/RDPI and NPCE/RPCE is inflation and accelerating from the final quarter of 2010 to the first seven months of 2011 but a declining rate since the drop in commodity prices beginning in May. The gap becomes more evident in the cumulative percentages Jan-Jul 2011 and IVQ2010 and their annual equivalents Jan-Jul 2011 AE and IVQ2010 AE. The gap of NDPI/RDPI in Jan-Jul 2011 in Table 10 is 2.4 percent (1.031/1.007), which is much higher than in IVQ2010 of 2.5 percent (1.045/1.02). The gap NPCE/RPCE in Jan-Jun 2011 in Table 10 is 3.1 percent (1.039/1.008), which is much higher than 2.5 percent (1.045/1.02) in IVQ2010. Inflation in the deflator of personal income and outlays is moving toward 3 percent per year. That is, the government is benefitting from a tax known as the inflation tax. By issuing money through its central bank the government buys goods and services. In a situation of sizeable deficits and inflation, the government gains by purchasing before effects of issuing money that causes increases in prices (see http://cmpassocregulationblog.blogspot.com/2011/05/global-inflation-seigniorage-monetary.html http://cmpassocregulationblog.blogspot.com/2011/05/global-inflation-seigniorage-financial.html Pelaez and Pelaez, International Financial Architecture (2005), 201-12). This is a hidden but actually felt contribution of monetary accommodation to financing bloated government expenditures. The new inflation tax argument is not by increases in inflation resulting from increasing monetary aggregates but by the rise in valuations of assets such as commodities induced through the carry trade of near zero interest rates.

Table 10, Percentage Change from Prior Month Seasonally Adjusted of Personal Income, Disposable Income and Personal Consumption Expenditures %

| NPI | NDPI | RDPI | NPCE | RPCE | |

| 2011 | |||||

| Jul | 0.3 | 0.3 | -0.1 | 0.8 | 0.5 |

| Jun | 0.2 | 0.2 | 0.3 | -0.1 | 0.0 |

| May | 0.3 | 0.2 | 0.1 | 0.1 | 0.0 |

| Apr | 0.4 | 0.4 | 0.1 | 0.2 | -0.1 |

| Mar | 0.5 | 0.4 | 0.0 | 0.6 | 0.2 |

| Feb | 0.6 | 0.1 | 0.1 | 0.8 | 0.4 |

| Jan | 1.2 | 0.2 | 0.0 | 0.4 | 0.0 |

| Jan- Jul 2011 | 3.6 | 1.8 | 0.4 | 2.8 | 1.0 |

| Jan- Jul 2011 A | 6.2 | 3.1 | 0.7 | 4.9 | 1.7 |

| 2010 | |||||

| Dec | 0.5 | 0.5 | 0.2 | 0.4 | 0.1 |

| Nov | 0.1 | 0.1 | 0.0 | 0.4 | 0.3 |

| Oct | 0.5 | 0.5 | 0.3 | 0.6 | 0.4 |

| IVQ10 | 1.1 | 1.1 | 0.5 | 1.4 | 0.8 |

| IVQ010 | 4.5 | 4.5 | 2.0 | 5.7 | 3.2 |

Notes: NPI: current dollars personal income; NDPI: current dollars disposable personal income; RDPI: chained (2005) dollars DPI; NPCE: current dollars personal consumption expenditures; RPCE: chained (2005) dollars PCE; A: annual equivalent; IVQ2010: fourth quarter 2010; A: annual equivalent

Percentage change month to month seasonally adjusted

Source: http://www.bea.gov/newsreleases/national/pi/2011/pdf/pi0711.pdf

Second, while division in quarters is arbitrary, Table 10 shows reduction in the rates of growth of RDPI from 2.0 percent AE in IVQ2010 to 0.7 percent AE in Jan-Jul 2011 and of growth of RPCE from 3.2 percent AE in IVQ2010 to 1.7 percent AE in Jan-Jul 2011. There is no evidence of trend but rather the appearance of a slowing rate of growth that is captured by GDP growth of 0.4 percent annual equivalent in IQ2011 and1.0 percent annual equivalent in IIQ2011, which is equivalent to 0.35 percent in the first half of 2011 that is equivalent to 0.7 percent if repeated during two semesters for an entire year, and economic indicators in IIQ2011 and now also for Jul and Aug. There may have been a slowdown because of the interruption of the supply chain by the earthquake in Japan and sovereign turbulence in Europe but the economy was already weak as shown by virtually flat real disposable income, growing at 0.7 percent annual equivalent that is equal to annual equivalent GDP growth in the first half of 2011.

Further information on income and consumption is provided by Table 11. The 12-month rates of increase of RDPI and RPCE in the past eight months show a trend of deterioration of RDPI from over 3 percent in the final four months of 2010 to less than 3 percent in IQ2011 and then collapsing to a range of 1.2 to 1.4 percent in May-Jul. RPCE growth decelerated less sharply from close to 3 percent in IVQ 2010 to 2.3 percent in Jul and 2.0 percent in Jun. Market participants have been concerned with data in Tables 11 and 12 showing more subdued growth of RPCE. Growth rates of personal income and consumption have weakened. Goods and especially durable goods have been driving growth of PCE as shown by the much higher 12-months rates of growth of real goods PCE (RPCEG) and durable goods real PCE (RPCEGD) than services real PCE (RPCES). The faster expansion of industry in the economy is derived from growth of consumption of goods and in particular of consumer durable goods while growth of consumption of services is much more moderate. The 12 months rates of growth of RPCEGD have fallen from more than 10 percent in Sep 2010 to Feb 2011 to the range of 7.0 to 7.7 percent in the quarter May-Jul. RPEC growth rates have fallen from over 5 percent late in 2010 and early Jan-Feb 2011 to the range of 3.5 to 4.0 percent in the quarter May-Jul.

Table 11, Real Disposable Personal Income and Real Personal Consumption Expenditures Percentage Change from the Same Month a Year Earlier %

| RDPI | RPCE | RPCEG | RPCEGD | RPCES | |

| 2011 | |||||

| Jul | 1.2 | 2.3 | 3.8 | 7.0 | 1.6 |

| Jun | 1.4 | 2.0 | 3.5 | 6.5 | 1.2 |

| May | 1.3 | 2.1 | 4.0 | 7.7 | 1.2 |

| Apr | 1.8 | 2.4 | 4.7 | 9.2 | 1.4 |

| Mar | 2.4 | 2.6 | 4.5 | 9.3 | 1.7 |

| Feb | 2.7 | 2.9 | 5.9 | 12.8 | 1.4 |

| Jan | 2.8 | 2.9 | 5.8 | 12.0 | 1.5 |

| 2010 | |||||

| Dec | 3.2 | 2.8 | 5.4 | 10.2 | 1.6 |

| Nov | 3.6 | 3.2 | 5.9 | 10.2 | 1.9 |

| Oct | 3.8 | 2.9 | 6.1 | 12.2 | 1.3 |

| Sep | 3.1 | 2.7 | 5.6 | 10.5 | 1.4 |

Notes: RDPI: real disposable personal income; RPCE: real personal consumption expenditures (PCE); RPCEG: real PCE goods; RPCEGD: RPCEG durable goods; RPCES: RPCE services

Numbers are percentage changes from the same month a year earlier

Source: http://www.bea.gov/newsreleases/national/pi/2011/pdf/pi0711.pdf

Personal income and its disposition are shown in Table 12. An important adversity is shown in Table 12 in the form of sharp deceleration in the growth of wages and salaries to $8.9 billion in Jun relative to May compared with more than $20 billion in the monthly changes in wages and salaries in Mar to Jul. Monthly increases in wages and salaries have been declining from $55.4 billion in Jan 2011 relative to Dec 2010, $20.7 billion in May relative to Apr and recovery to $24.2 billion in Jul relative to Jun.

Table 12, Personal Income and its Disposition, Seasonally Adjusted at Annual Rates $ Billions

| Personal | Wages & | Personal | DPI | Savings | |

| Jul | 13,067.3 | 6,695.4 | 1,410.6 | 11,656.7 | 5.0 |

| Jun | 13,024.9 | 6,671.2 | 1,400.7 | 11,624.2 | 5.5 |

| Change Jul/Jun | 42.4 | 24.2 | 9.9 | 32.5 | |

| May | 12,997.2 | 6,662.3 | 1,395.6 | 11,601.6 | 5.2 |

| Change | 27.7 | 8.9 | 5.1 | 22.6 | |

| Apr | 12,962.5 | 6,641.6 | 1,387.2 | 11,575.3 | 5.1 |

| Change | 34.7 | 20.7 | 8.4 | 26.3 | |

| Mar | 12,909.7 | 6,614.8 | 1,377.7 | 11,532.1 | 4.9 |

| Change | 52.8 | 26.8 | 9.5 | 43.2 | |

| Feb | 12,850.6 | 6,582.9 | 1,367.1 | 11,483.5 | 5.0 |

| Change | 59.1 | 31.9 | 10.6 | 48.6 | |

| Jan | 12,780.3 | 6,536.8 | 1,352.8 | 11,427.5 | 5.2 |

| Change | 70.3 | 46.1 | 14.3 | 56.0 | |

| Dec | 12,625.0 | 6,481.4 | 1,247.6 | 11,377.3 | 5.2 |

| Change | 155.3 | 55.4 | 105.2 | 50.2 |

Source: http://www.bea.gov/newsreleases/national/pi/2011/pdf/pi0711.pdf

IV International Financial Turbulence. The past three months have been characterized by financial turbulence, attaining unusual magnitude in the past month. Table 13, updated with every comment in this blog, provides beginning values on Aug 29 and daily values throughout the week ending on Fr Sep 2 of several financial variables. Section VI Valuation of Risk Financial Assets provides a set of more complete values. All data are for New York time at 5 PM. The first column provides the value on Fri Aug 26 and the percentage change in that prior week below the label of the financial risk asset. The first five rows provide five key exchange rates versus the dollar and the percentage cumulative appreciation (positive change or no sign) or depreciation (negative change or negative sign). Positive changes constitute appreciation of the relevant exchange rate and negative changes depreciation. Financial turbulence has been dominated by reactions to the new program for Greece (see section IB in http://cmpassocregulationblog.blogspot.com/2011/07/debt-and-financial-risk-aversion-and.html), doubts on the larger countries in the euro zone with sovereign risks such as Spain and Italy, the growth standstill recession and long-term unsustainable government debt in the US, worldwide deceleration of economic growth and continuing inflation. The dollar/euro rate is quoted as number of dollars USD per one euro EUR, USD 1.450/EUR in the first row, column 1 in the block for currencies in Table 13 for Fri Aug 26, depreciating to USD 1.4524/EUR on Mon Aug 29, or by 0.2 percent. Table 13 defines a country’s exchange rate as number of units of domestic currency per unit of foreign currency. USD/EUR would be the definition of the exchange rate of the US and the inverse [1/(USD/EUR)] is the definition in this convention of the rate of exchange of the euro zone, EUR/USD. A convention is required to maintain consistency in characterizing movements of the exchange rate in Table 13 as appreciation and depreciation. The first row for each of the currencies shows the exchange rate at 5 PM New York time, such as USD 1.4524/EUR on Aug 29; the second row provides the cumulative percentage appreciation or depreciation of the exchange rate from the rate on the last business day of the prior week, in this case Fri Aug 26, to the last business day of the current week, in this case Fri Sep 2, such as appreciation of 2.0 percent for the dollar to USD 1.4206/EUR by Sep 2; and the third row provides the percentage change from the prior business day to the current business day. For example, the USD appreciated (positive sign) by 2.0 percent from the rate of USD 1.450/EUR on Fri Aug 26 to the rate of USD 1.4206 on Fri Sep 2 {[1.4206/1.450 – 1]100 = -2.0%} and appreciated by 0.4 percent from the rate of USD 1.4269 on Thu Sep 1 to USD 1.4206 on Fri Sep 2 {[1.4206/1.4269 -1]100 = -0.4%}. The dollar appreciated during the week because more dollars $1.450 were required to buy one euro on Fri Aug 26 than $1.4206 required to buy one euro on Fri Sep

Table 13, Weekly Financial Risk Assets Aug 29 to Sep 2, 2011

| Fr Aug 26 | M 29 | Tu 30 | W 31 | Th 1 | Fr 2 |

| USD/ 1.450 -0.8% | 1.4524 -0.2% -0.2% | 1.4442 0.6% 0.7% | 1.4372 0.9% 0.3% | 1.4269 1.6% 0.7% | 1.4206 2.0% 0.4% |

| JPY/ 76.65 0.2% | 76.86 -0.3% -0.3% | 76.6665 0.0% 0.3% | 76.6130 0.0% 0.0% | 76.9010 -0.3% -0.3% | 76.79 -0.2% 0.1% |

| CHF/ 0.811 -3.2% | 0.8158 -0.6% -0.6% | 0.8203 -1.1% -0.5% | 0.8058 0.6% 1.8% | 0.7952 1.9% 1.3% | 0.783 3.4% 1.5% |

| CHF/EUR -3.4% | 1.1849 -1.3% -1.3% | 1.1847 -1.3% 0.0% | 1.1582 1.0% 2.2% | 1.1346 3.0% 2.0% | 1.1197 4.3% 1.3% |

| USD/ 1.057 0.9461 1.5% | 1.0676 0.9367 1.0% 1.0% | 1.0684 0.9360 1.1% 0.1% | 1.0692 0.9353 1.1% 0.0% | 1.0737 0.9314 1.6% 0.5% | 1.064 0.9398 0.7% -0.9% |

| 10 Year 2.202 | 2.26 | 2.18 | 2.23 | 2.13 | 1.992 |

| 2 Year T Note | 0.34 | 0.20 | 0.20 | 0.18 | 0.20 |

| German Bond 2Y 0.65 10Y 2.16 | 2Y 0.74 10Y 2.23 | 2Y 0.66 10Y 2.15 | 2Y 0.72 10Y 2.22 | 2Y 0.64 10Y 2.14 | 2Y 0.52 10Y 2.01 |

| DJIA 11284.54 4.3% |

2.3% 2.3% |

2.4% 0.2% |

2.9% 0.5% |

1.9% -1.0% |

-0.4% -2.2% |

| DJ Global 1838.41. 2.8% |

2.4% 2.4% |

2.9% 0.5% |

4.3% 1.3% |

3.6% -0.7% |

1.1% -2.4% |

| DJ Asia Pacific 1240.15 0.4% |

1.4% 1.4% |

1.8% 1.3% |

3.8% 1.1% |

4.1% 0.3% |

3.2% -0.9% |

| Nikkei 0.9% |

0.6% 0.6% |

1.8% 1.2% |

1.8% 0.0% |

2.9% 1.2% |

1.7% -1.2% |

| Shanghai 2612.19 3.1% |

-1.4% -1.4% |

-1.7% -0.4% |

-1.7% 0.0% |

-2.1% -0.4% |

-3.2% -1.1% |

| DAX 1.0 |

2.4% 2.4% |

1.9% -0.5% |

4.5% 2.5% |

3.5% -0.9% |

0.02% -3.4% |

| DJ UBS Comm. 161.140 1.3% | 161.41 0.2% 0.2% | 163.43 1.4% 1.2% | 164.430 2.0% 0.6% | 162.91 1.1% -0.9% | 162.51 0.9% -0.2% |

| WTI $ B 3.4% | 87.540 2.4% 2.4% | 88.720 3.8% 1.3% | 88.880 4.0% 0.2% | 88.750 3.9% -0.1% | 86.450 1.2% -2.6% |

| Brent $/B 111.040 1.9% | 111.88 0.8% 0.8% | 113.96 2.6% 1.9% | 114.630 3.2% 0.6% | 114.060 2.7% -0.5% | 112.30 1.1% -1.5% |

| Gold $/B 1826.80 -1.5% | 1792.0 -1.9% -1.9% | 1841.9 0.8% 2.8% | 1827.90 0.1% -0.7% | 1827.60 0.0% -0.1% | 1876.90 2.7% 2.7% |

Note: USD: US dollar; JPY: Japanese Yen; CHF: Swiss

Franc; AUD: Australian dollar; Comm.: commodities; B: barrel; OZ: ounce

Sources:

http://www.bloomberg.com/markets/

http://professional.wsj.com/mdc/page/marketsdata.html?mod=WSJ_hps_marketdata

The week was dominated by three events.

1. Greece. Two types of doubts developed during the week on the execution of the Greek rescue program.

i. Finland collateral. James G. Neuger and Sandrine Rastello, writing on Sep 2 on “IMF said to oppose push for Greek Collateral,” published by Bloomberg (http://www.bloomberg.com/news/print/2011-09-02/imf-said-to-oppose-push-for-greek-collateral.html), analyze the demands by Finland of €1 billion cash collateral from Greece as a condition to participate in the second rescue program of €109 billion. Neuger and Rastello obtained information from parties involved in the negotiation that the IMF opposes the Finnish collateral because it would undermine the priority status of the IMF as creditor and would also violate the rights of bondholders. The collateral issue would not jeopardize disbursement of the €8 billion tranche of the first rescue program later in Sep but raises doubts about the execution of the second bailout program that is required because of doubts of the capacity of Greece in funding in international financial markets

ii. Suspension of Official Lenders’ Conversations. Alex Barker, Kerin Hope and Ralph Atkins, writing on Sep 2 on “Lenders suspend Greek bail-out talks,” published in the Financial Times (http://www.ft.com/intl/cms/s/0/7d8aa766-d541-11e0-bd7e-00144feab49a.html#axzz1Wt3oVgji), analyze the suspension by the official lenders of conversations on the Greek execution of the rescue program. The official lenders are the European Union, IMF and European Central Bank. The conversations center on the release of the €8 billion tranche of the first rescue package that is due in Sep. The issue is the gap of €1.2 billion in Greece’s 2011 budget and allegations of inadequate implementation of agreed structural reforms, plans of privatization and enhanced tax collection. Barker, Hope and Atkins quote an increase by 4 basis points of Greek two-year bonds to 37.10 percent, subsequently surpassing 38.00 percent, and a rise in yields of Italian 10-year bonds to 5.25 percent and of Spanish bonds to 5.10 percent. If the European Union and the IMF decide not to release the €8 billion tranche, Greece could be forced into default with repercussions on other countries through exposures to Greek risk by investors and banks

2. World Economy. The release of purchasing managers’ indexes for many countries consolidated the view of deceleration of growth in the world economy to perilous standstill that is close to the point of contraction

3. US Employment. The two above factors combined with the release of the employment situation report of the US showing zero creation of new jobs, falling real wages and high levels of unemployment and underemployment affecting 30 million people

The two major safe-haven currencies, Japanese yen and Swiss franc, remained at very strong levels, undermining the competitiveness of Japanese and Swiss products in foreign markets and relative to imports in domestic markets. The JPY/USD rate remained in a strong range of JPY 76.6130/USD to JPY 76.9010/USD during the week, as shown in Table 13. The Swiss franc appreciated by 3.4 percent versus the dollar to CHF 0.783/USD on Fr Sep 2 and by 4.3 percent versus the euro to CHF 1.1197/EUR. Currency interventions have failed to prevent appreciation in the rounds of risk aversion in international financial markets. The Australian dollar appreciated as much as 1.6 percent by Thu Sep 1 but lost 0.9 percent on Fri Sep 2 and ended stronger by 0.7 percent.

US Treasury securities and German government bonds continue to be used as safe-havens in the flight from risk financial assets. The yield of the US 10-year note dropped from 2.202 percent on Fr Aug 26 to 1.992 percent on Fr Sep 2 (see Table 13). Nick Baker and Rita Nazareth, writing on Sep 2 on “Stocks tumble as 10-year yield nears record low,” published by Bloomberg (http://www.bloomberg.com/news/print/2011-09-02/asia-stocks-end-six-day-rise-as-u-s-futures-drop-franc-climbs-oil-falls.html), find that the yield of 1.99 percent is only four basis points higher than the record low for the yield of the 10-year Treasury note. Zero interest rates and record-low bond yields do not encourage economic recovery in an environment of significant uncertainty. The 2-year Treasury note yield remains virtually fixed at 0.20 percent. Similar yield declines occurred with German government bonds. The 2-year government bond of Germany fell from 0.65 percent on Fr Aug 26 to 0.52 percent on Sep 2 while the 10-year yield collapsed from 2.23 percent on Fr Aug 26 to 2.01 percent on Fr Sep 2.

The early part of the week centered on the possibility of further monetary easing measures as proposed by some participants in the Federal Open Market Committee (FOMC) meeting on Aug 9 as revealed by the minutes released on Aug 30 (http://www.federalreserve.gov/newsevents/press/monetary/fomcminutes20110809.pdf 7):

“Participants discussed the range of policy tools available to promote a stronger economic recovery should the Committee judge that providing additional monetary accommodation was warranted. Reinforcing the Committee’s forward guidance about the likely path of monetary policy was seen as a possible way to reduce interest rates and provide greater support to the economic expansion; a few participants emphasized that guidance focusing solely on the state of the economy would be preferable to guidance that named specific spans of time or calendar dates. Some participants noted that additional asset purchases could be used to provide more accommodation by lowering longer-term interest rates. Others suggested that increasing the average maturity of the System’s portfolio—perhaps by selling securities with relatively short remaining maturities and purchasing securities with relatively long remaining maturities—could have a similar effect on longer-term interest rates. Such an approach would not boost the size of the Federal Reserve’s balance sheet and the quantity of reserve balances. A few participants noted that a reduction in the interest rate paid on excess reserve balances could also be helpful in easing financial conditions. In contrast, some participants judged that none of the tools available to the Committee would likely do much to promote a faster economic recovery, either because the headwinds that the economy faced would unwind only gradually and that process could not be accelerated with monetary policy or because recent events had significantly lowered the path of potential output. Consequently, these participants thought that providing additional stimulus at this time would risk boosting inflation without providing a significant gain in output or employment. Participants noted that devoting additional time to discussion of the possible costs and benefits of various potential tools would be useful, and they agreed that the September meeting should be extended to two days in order to provide more time.”

Statements and minutes of central banks are subject to various types of interpretations. Finance professionals are focusing on the two-day FOMC meeting on Sep 21-22 for possible new monetary policy impulses that could affect risk financial assets (http://www.federalreserve.gov/monetarypolicy/fomccalendars.htm#9662). Another important policy event is the address to Congress by the President on Sep 8 (http://www.whitehouse.gov/the-press-office/2011/08/31/statement-press-secretary-presidents-speech-joint-session-congress):

“The President is focused on the urgent need to create jobs and grow our economy, so he welcomes the opportunity to address a Joint Session of Congress on Thursday, September 8th and challenge our nation's leaders to start focusing 100% of their attention on doing whatever they can to help the American people.”

Equity markets in Table 13 registered strong gains in the week until the release of weak manufacturing economic data on Sep 1 followed by the adverse employment situation report on Sep 2. The indexes shown in Table 13 gained during the week with the exception of decline by 0.4 percent in the DJIA and 3.2 percent by the Shanghai Composite. DAX ended flat with sharp drop of 3.4 percent on Fr Sep 2.

Oil prices were surging during the week until hit by the mood on Fr Sep 2, with WTI gaining 1.2 percent on fears of the new Gulf of Mexico hurricane and Brent advancing 1.1 percent but dropping significant part of much stronger gains during the week. Gold underperformed during the week but jumped 2.7 percent on Fr Sep 2 on the hopes of hedge by investors.

V Global Inflation. There is inflation everywhere in the world economy, with slow growth and persistently high unemployment in advanced economies. Table 14 updated with every post, provides the latest annual data for GDP, consumer price index (CPI) inflation, producer price index (PPI) inflation and unemployment (UNE) for the advanced economies, China and the highly-indebted European countries with sovereign risk issues. The table now includes the Netherlands and Finland that with Germany make up the set of northern countries in the euro zone that hold key votes in the enhancement of the mechanism for solution of the sovereign risk issues (http://www.ft.com/cms/s/0/55eaf350-4a8b-11e0-82ab-00144feab49a.html#axzz1G67TzFqs). Newly available data on inflation is considered below in this section. The data in Table 14 for the euro zone and its members is updated from information provided by Eurostat but individual country information is provided in this section as soon as available, following Table 14. Data for other countries in Table 14 is also updated with reports from their statistical agencies. Economic data for major regions and countries is considered in Section Global Growth Standstill Recession following individual country and regional data tables.

Table 14, GDP Growth, Inflation and Unemployment in Selected Countries, Percentage Annual Rates

| GDP | CPI | PPI | UNE | |

| US | 2.9 | 3.6 | 7.0 | 9.1 |

| Japan | -0.7*** | 0.2 | 2.5 | 4.6 |

| China | 9.6 | 6.5 | 7.5 | |

| UK | 1.8 | 4.5* | 5.9* output | 7.7 |

| Euro Zone | 1.7 | 2.5 | 6.1 | 10.0 |

| Germany | 2.8 | 2.6 | 5.7 | 6.1 |

| France | 1.6 | 2.1 | 6.1 | 9.9 |

| Nether-lands | 1.5 | 2.9 | 8.2 | 4.3 |

| Finland | 3.7 | 3.7 | 7.3 | 7.9 |

| Belgium | 2.5 | 4.0 | 8.4 | 7.5 |

| Portugal | -0.9 | 3.0 | 5.7 | 12.3 |

| Ireland | -1.0 | 1.0 | 5.0 | 14.5 |

| Italy | 0.8 | 2.1 | 4.9 | 8.0 |

| Greece | -4.8 | 2.1 | 8.7 | 15.1 |

| Spain | 0.7 | 3.0 | 7.4 | 21.2 |

Notes: GDP: rate of growth of GDP; CPI: change in consumer price inflation; PPI: producer price inflation; UNE: rate of unemployment; all rates relative to year earlier

*Office for National Statistics

PPI http://www.statistics.gov.uk/pdfdir/ppi0811.pdf

CPI http://www.statistics.gov.uk/pdfdir/cpi0611.pdf

** Excluding food, beverage, tobacco and petroleum

http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/4-04042011-AP/EN/4-04042011-AP-EN.PDF

***Change from IQ2011 relative to IQ2010 http://www.esri.cao.go.jp/jp/sna/sokuhou/kekka/gaiyou/main_1.pdf

Source: EUROSTAT; country statistical sources http://www.census.gov/aboutus/stat_int.html

Stagflation is still an unknown event but the risk is sufficiently high to be worthy of consideration (see http://cmpassocregulationblog.blogspot.com/2011/06/risk-aversion-and-stagflation.html). The analysis of stagflation also permits the identification of important policy issues in solving vulnerabilities that have high impact on global financial risks. There are six key interrelated vulnerabilities in the world economy that have been causing global financial turbulence: (1) sovereign risk issues in Europe resulting from countries in need of fiscal consolidation and enhancement of their sovereign risk ratings (see Section IV International Financial Turbulence in this post, section III in http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html http://cmpassocregulationblog.blogspot.com/2011/08/world-financial-turbulence-global.html http://cmpassocregulationblog.blogspot.com/2011/08/global-growth-recession-25-to-30.html section II in http://cmpassocregulationblog.blogspot.com/2011/08/global-growth-recession-25-to-30.html http://cmpassocregulationblog.blogspot.com/2011/07/twenty-five-to-thirty-million.html http://cmpassocregulationblog.blogspot.com/2011/06/risk-aversion-and-stagflation.html and Section I Increasing Risk Aversion in http://cmpassocregulationblog.blogspot.com/2011/06/increasing-risk-aversion-analysis-of.html and section IV in http://cmpassocregulationblog.blogspot.com/2011/04/budget-quagmire-fed-commodities_10.html); (2) the tradeoff of growth and inflation in China; (3) slow growth (see http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html http://cmpassocregulationblog.blogspot.com/2011/08/global-growth-recession-25-to-30.html http://cmpassocregulationblog.blogspot.com/2011/07/growth-recession-debt-financial-risk.html http://cmpassocregulationblog.blogspot.com/2011/06/financial-risk-aversion-slow-growth.html http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html http://cmpassocregulationblog.blogspot.com/2011/05/mediocre-growth-world-inflation.html http://cmpassocregulationblog.blogspot.com/2011_03_01_archive.html http://cmpassocregulationblog.blogspot.com/2011/02/mediocre-growth-raw-materials-shock-and.html), weak hiring (see Section IV United States Economic Uncertainty in http://cmpassocregulationblog.blogspot.com/2011/08/world-financial-turbulence-global.html and section III Hiring Collapse in http://cmpassocregulationblog.blogspot.com/2011/04/fed-commodities-price-shocks-global.html ) and continuing job stress of 24 to 30 million people in the US and stagnant wages in a fractured job market (see section I Stalled Job Creation with 30 Million in Job Stress in this post, http://cmpassocregulationblog.blogspot.com/2011/07/twenty-five-to-thirty-million.html http://cmpassocregulationblog.blogspot.com/2011/05/job-stress-of-24-to-30-million-falling.html http://cmpassocregulationblog.blogspot.com/2011/04/twenty-four-to-thirty-million-in-job_03.html http://cmpassocregulationblog.blogspot.com/2011/03/unemployment-and-undermployment.html); (4) the timing, dose, impact and instruments of normalizing monetary and fiscal policies (see II Budget/Debt Quagmire in http://cmpassocregulationblog.blogspot.com/2011/08/united-states-gdp-growth-standstill.html http://cmpassocregulationblog.blogspot.com/2011/03/is-there-second-act-of-us-great.html http://cmpassocregulationblog.blogspot.com/2011/03/global-financial-risks-and-fed.html http://cmpassocregulationblog.blogspot.com/2011/02/policy-inflation-growth-unemployment.html) in advanced and emerging economies; (5) the earthquake and tsunami affecting Japan that is having repercussions throughout the world economy because of Japan’s share of about 9 percent in world output, role as entry point for business in Asia, key supplier of advanced components and other inputs as well as major role in finance and multiple economic activities (http://professional.wsj.com/article/SB10001424052748704461304576216950927404360.html?mod=WSJ_business_AsiaNewsBucket&mg=reno-wsj); and (6) the geopolitical events in the Middle East.

Table 15 provides the forecasts of the Federal Reserve Board Members and Federal Reserve Bank Presidents for the FOMC meeting in Jun. Inflation by the price index of personal consumption expenditures (PCE) was forecast for 2011 in the Apr meeting of the FOMC between 2.1 to 2.8 percent. Table 15 shows that the interval has narrowed to PCE (personal consumption expenditures) headline inflation of between 2.3 and 2.5 percent. The FOMC focuses on core PCE inflation, which excludes food and energy. The Apr forecast of core PCE inflation was an interval between 1.3 and 1.6 percent. Table 15 shows the revision of this forecast in Jun to a higher interval between 1.5 and 1.8 percent.

Table 15, Forecasts of PCE Inflation and Core PCE Inflation by the FOMC, %

| PCE Inflation | Core PCE Inflation | |

| 2011 | 2.3 to 2.5 | 1.5 to 1.8 |

| 2012 | 1.5 to 2.0 | 1.4 to 2.0 |

| 2013 | 1.5 to 2.0 | 1.4 to 2.0 |

| Longer Run | 1.7 to 2.0 |

Source: http://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20110622.pdf

The discussion of the FOMC on the statement of the Aug 9 meeting, revealed in the FOMC minutes released on Aug 30 (http://www.federalreserve.gov/newsevents/press/monetary/fomcminutes20110809.pdf 8), provides some information on the view of the members of the committee:

“The Committee agreed to keep the target range for the federal funds rate at 0 to ¼ percent and to state that economic conditions are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013. That anticipated path for the federal funds rate was viewed both as appropriate in light of most members’ outlook for the economy and as generally consistent with some prescriptions for monetary policy based on historical and model-based analysis. In choosing to phrase the outlook for policy in terms of a time horizon, members also considered conditioning the outlook for the level of the federal funds rate on explicit numerical values for the unemployment rate or the inflation rate. Some members argued that doing so would establish greater clarity regarding the Committee’s intentions and its likely reaction to future economic developments, while others raised questions about how an appropriate numerical value might be chosen. No such references were included in the statement for this meeting. One member expressed concern that the use of a specific date in the forward guidance would be seen by the public as an unconditional commitment, and it could undermine Committee credibility if a change in timing subsequently became appropriate.

Most members, however, agreed that stating a conditional expectation for the level of the federal funds rate through mid-2013 provided useful guidance to the public, with some noting that such an indication did not remove the Committee’s flexibility to adjust the policy rate earlier or later if economic conditions do not evolve as the Committee currently expects.”

The 12-month rates of increase of PCE price indexes are shown in Table 16. These data are released at the end of the month in the BEA report on personal income and outlays (http://www.bea.gov/newsreleases/national/pi/2011/pdf/pi0711.pdf) while the CPI and PPI are released in mid month. Headline 12-month PCE inflation (PCE) has accelerated from the range between 1.2 percent and 1.5 percent in Aug-Dec 2010 to 2.3 percent in Apr, 2.6 percent in May and also Jun and 2.8 percent in Jul 2011. Monetary policy uses PCE inflation excluding food and energy (PCEX), at 1.6 percent in Jul, on the basis of research showing that current PCEX is a better indicator of headline PCE a year ahead than current headline PCE inflation (http://cmpassocregulationblog.blogspot.com/2011/04/fed-commodities-price-shocks-global.html http://cmpassocregulationblog.blogspot.com/2011/06/unemployment-and-underemployment-of-24.html http://cmpassocregulationblog.blogspot.com/2011/05/slowing-growth-global-inflation-great.html). The explanation is that commodity price shocks are “mean reverting,” returning to their long-term means after spiking during shortages caused by climatic factors, geopolitical events and the like. Inflation of PCE goods (PCEG) has accelerated sharply reaching 4.7 percent in Jul from 1 percent or less in Aug-Dec, in spite of 12-month negative inflation of PCE durable goods (PCEG-D) while PCE services inflation (PCES) has remained around 1.6 percent. The last two columns of Table 16 show PCE food inflation (PCEF) and PCE energy inflation (PCEE) that have been rising sharply, especially for energy. Monetary policy expects these increases to revert with its indicator PCEX returning to levels that are acceptable for continuing monetary accommodation.

Table 16, Percentage Change in 12 Months of Prices of Personal Consumption Expenditures ∆%

| PCE | PCEG | PCEG | PCES | PCEX | PCEF | PCEE | |

| 2011 | |||||||

| Jul | 2.8 | 4.7 | -0.2 | 1.8 | 1.6 | 4.3 | 20.1 |

| Jun | 2.6 | 4.5 | -0.5 | 1.6 | 1.4 | 3.9 | 20.8 |

| May | 2.6 | 4.4 | -1.0 | 1.6 | 1.3 | 3.6 | 21.9 |

| Apr | 2.3 | 3.9 | -1.4 | 1.6 | 1.2 | 3.3 | 19.8 |

| Mar | 2.0 | 3.0 | -1.8 | 1.5 | 1.0 | 3.1 | 16.5 |

| Feb | 1.8 | 2.1 | -1.8 | 1.6 | 1.1 | 2.4 | 11.9 |

| Jan | 1.5 | 1.2 | -2.3 | 1.6 | 1.0 | 1.8 | 7.9 |

| 2010 | |||||||

| Dec | 1.4 | 1.0 | -2.5 | 1.5 | 0.9 | 1.3 | 8.3 |

| Nov | 1.2 | 0.4 | -2.4 | 1.5 | 1.0 | 1.3 | 4.1 |

| Oct | 1.3 | 0.6 | -2.1 | 1.6 | 1.0 | 1.3 | 6.3 |

| Sep | 1.4 | 0.4 | -1.7 | 1.9 | 1.2 | 1.3 | 4.1 |

| Aug | 1.5 | 0.4 | -1.4 | 1.9 | 1.4 | 0.7 | 3.8 |

Notes: percentage changes in price index relative to the same month a year earlier of PCE: personal consumption expenditures; PCEG: PCE goods; PCEG-D: PCE durable goods; PCES: PCE services; PCEX: PCE excluding food and energy; PCEF: PCE food; PCEE: PCE energy goods and services

Source: http://www.bea.gov/newsreleases/national/pi/2011/pdf/pi0711.pdf

The role of devil’s advocate is played by data in Table 17. Headline PCE inflation (PCE) has jumped to 1.7 percent cumulative in the first seven months of 2011, which is equivalent to 2.9 percent annual, with PCEG jumping to 3.2 percent cumulative and 5.6 percent annual equivalent, PCEG-D rising 0.7 percent cumulative or 1.2 percent annual, and PCES rising to 1.4 percent cumulative and 2.4 percent annual. All these headline inflation data are much higher in the first seven months of 2011 than in Sep-Dec 2010. PCEX, used in monetary policy, rose to 1.0 percent cumulative or 2.0 percent annual in the first seven months of 2011 compared with only 0.5 percent cumulative and 1.5 percent annual equivalent in Sep-Dec 2010. PCEF has increased by 3.7 percent cumulative, which is equivalent in a full year to 6.3 percent. PCEE has risen to 10.9 percent cumulative or 19.4 percent annual equivalent with decline by 1.2 percent in May and decline by 4.5 percent in Jun.

Table 17, Monthly and Jan-Jun PCE Inflation and Annual Equivalent Jan-Jul 2011 and Sep-Dec 2010 ∆%

| PCE | PCEG | PCEG | PCES | PCEX | PCEF | PCEE | |

| 2011 | |||||||

| Jan-Jul 2011 | 1.7 | 3.2 | 0.7 | 1.4 | 1.4 | 3.7 | 10.9 |