World Inflation Waves, United States Inflation, World Financial Turbulence and World Economic Slowdown

Remembrance Earl W. Thomas and Edlow Parker

I was fortunate to meet simultaneously Earl W. Thomas and Edlow Parker in Brazil. Professor Earl W. Thomas was a distinguished scholar whose books overlap generations (http://www.amazon.com/s/ref=sr_tc_2_0?rh=i%3Astripbooks%2Ck%3AEarl+W.+Thomas&keywords=Earl+W.+Thomas&ie=UTF8&qid=1329682942&sr=1-2-ent&field-contributor_id=B001KIABF0). Earl interacted with eminent scholars Alexander N. Marchant (http://www.amazon.com/s/ref=ntt_athr_dp_sr_1?_encoding=UTF8&sort=relevancerank&search-alias=books&ie=UTF8&field-author=Alexander%20N.%20Marchant) and Alexandrino Severino (http://www.hostpublications.com/books/homenagem.html). Edlow Parker was a prominent practitioner in the field of public administration. Edlow transferred this knowledge and international professionals to many countries with significant success.

Carlos M. Pelaez

© Carlos M. Pelaez, 2010, 2011, 2012

Executive Summary

I World Inflation Waves

II United States Inflation

IIA Long-term US Inflation

IIB Current US Inflation

IIC Import Export Prices

III World Financial Turbulence

IIIA Financial Risks

IIIB Appendix on Safe Haven Currencies

IIIC Appendix on Fiscal Compact

IIID Appendix on European Central Bank Large Scale Lender of Last Resort

IIIE Appendix Euro Zone Survival Risk

IIIF Appendix on Sovereign Bond Valuation

IV Global Inflation

V World Economic Slowdown

VA United States

VB Japan

VC China

VD Euro Area

VE Germany

VF France

VG Italy

VH United Kingdom

VI Valuation of Risk Financial Assets

VII Economic Indicators

VIII Interest Rates

IX Conclusion

References

Appendix I The Great Inflation

V World Economic Slowdown. The International Monetary Fund (IMF) has revised its World Economic Outlook (WEO) to an environment of lower growth (IMF 2012WEOJan24):

“The global recovery is threatened by intensifying strains in the euro area and fragilities elsewhere. Financial conditions have deteriorated, growth prospects have dimmed, and downside risks have escalated. Global output is projected to expand by 3¼ percent in 2012—a downward revision of about ¾ percentage point relative to the September 2011 World Economic Outlook (WEO).”

The IMF (2012WEOJan24) projects growth of world output of 3.8 percent in 2011 and 3.3 percent in 2012 after 5.2 percent in 2010. Advanced economies would grow at only 1.6 percent in 2011, 1.2 percent in 2012 and 3.9 percent in 2013 after growing at 3.2 percent in 2010. Emerging and developing economies would drive the world economy, growing at 6.2 percent in 2011, 5.4 percent in 2012 and 5.9 percent in 2012 after growing at 7.3 percent in 2010. The IMF is forecasting deceleration of the world economy.

World economic slowing would be the consequence of the mild recession in the euro area in 2012 caused by “the rise in sovereign yields, the effects of bank deleveraging on the real economy and the impact of additional fiscal consolidation” (IMF 2012WEOJan24). After growing at 1.9 percent in 2010 and 1.6 percent in 2010, the economy of the euro area would contract by 0.5 percent in 2012 and grow at 0.8 percent in 2013. The United States would grow at 1.8 percent in both 2011 and 2012 and at 2.2 percent in 2013. The IMF (2012WEO Jan24) projects slow growth in 2012 of Germany at 0.3 percent and of France at 0.2 percent while Italy contracts 2.2 percent and Spain contracts 1.7 percent. While Germany would grow at 1.5 percent in 2013 and France at 1.0 percent, Italy would contract 0.6 percent and Spain 0.3 percent.

The IMF (2012WEOJan24) also projects a downside scenario, in which the critical risk “is intensification of the adverse feedback loops between sovereign and bank funding pressures in the euro area, resulting in much larger and more protracted bank deleveraging and sizable contractions in credit and output.” In this scenario, there is contraction of private investment by an extra 1.75 percentage points in relation to the projections of the WEO with euro area output contracting 4 percent relative to the base WEO projection. The environment could be complicated by failure in medium-term fiscal consolidation in the United States and Japan.

There is significant deceleration in world trade volume in the projections of the IMF (2012WEOJan24). Growth of the volume of world trade in goods and services decelerates from 12.7 percent in 2010 to 6.9 percent in 2011, 3.8 percent in 2012 and 5.4 percent in 2013. Under these projections there would be significant pressure in economies in stress such as Japan and Italy that require trade for growth. Even the stronger German economy is dependent on foreign trade. There is sharp deceleration of growth of exports of advanced economies from 12.2 percent in 2010 to 2.4 percent in 2012. Growth of exports of emerging and developing economies falls from 13.8 percent in 2010 to 6.1 percent in 2012. Another cause of concern in that oil prices in the projections fall only 4.9 percent in 2012, remaining at relatively high levels.

The JP Morgan Global Manufacturing & Services PMI™, produced by JP Morgan and Markit in association with ISM and IPFSM, rose to 54.6 in Jan from 52.7 in Dec, indicating expansion at a faster rate (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9159). This index is highly correlated with global GDP, indicating continued growth of the global economy for nearly two years and a half. The US economy drove growth in the global economy in Dec and Jan. New orders are expanding at a faster rate, increasing from 51.5 in Dec to 54.0 in Jan, suggesting further increase in business ahead. The HSBC Brazil Composite Output Index of the HSBC Brazil Services PMI™, compiled by Markit, rose from 53.2 in Dec to 53.8 in Jan (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9156). Andre Loes, Chief Economist of HSBC in Brazil, finds that the increase of the services HSBC PMI for Brazil from 54.8 in Dec to 55.0 in Jan, which is the highest level since Mar 2010, strengthen the belief that the worst period of deceleration has already occurred (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9156).

VA United States. Table USA provides the data table for the US.

Table USA, US Economic Indicators

| Consumer Price Index | Dec 12 months NSA ∆%: 3.0; ex food and energy ∆%: 2.2 Nov month ∆%: 0.0; ex food and energy ∆%: 0.1 |

| Producer Price Index | Dec 12 months NSA ∆%: 4.8; ex food and energy ∆% 3.0 |

| PCE Inflation | Dec 12 months NSA ∆%: headline 2.4; ex food and energy ∆% 1.8 |

| Employment Situation | Household Survey: Jan Unemployment Rate SA 8.3% |

| Nonfarm Hiring | Nonfarm Hiring fell from 64.9 million in 2006 to 47.2 million in 2010 or by 17.7 million |

| GDP Growth | BEA Revised National Income Accounts back to 2003 IIIQ2011 SAAR ∆%: 1.8 IVQ2011 ∆%: 2.8 Cumulative 2011 ∆%: 1.6 2011/2010 ∆%: 1.7 |

| Personal Income and Consumption | Dec month ∆% SA Real Disposable Personal Income (RDPI) 0.3 |

| Quarterly Services Report | IIIQ11/IIQII SA ∆%: |

| Employment Cost Index | IVQ2011 SA ∆%: 0.4 |

| Industrial Production | Jan month SA ∆%: 0.0 |

| Productivity and Costs | Nonfarm Business Productivity IVQ2011∆% SAAE 0.7; IVQ2011/IVQ2010 ∆% 0.5; Unit Labor Costs IVQ2011 ∆% 1.2; IVQ2011/IVQ2010 ∆%: 1.3 Blog 02/05/2012 |

| New York Fed Manufacturing Index | General Business Conditions From Jan 13.48 to Feb 19.53 |

| Philadelphia Fed Business Outlook Index | General Index from Jan 7.3 to Feb 10.2 |

| Manufacturing Shipments and Orders | Dec New Orders SA ∆%: 1.1; ex transport ∆%: 0.6 |

| Durable Goods | Dec New Orders SA ∆%: 3.0; ex transport ∆%: 2.1 |

| Sales of New Motor Vehicles | Jan 2012 913,287; Jan 2011 819,795. Jan SAAR 14.18 million, Dec SAAR 13.56, Jan 2011 SAAR 12.69 million Blog 02/05/12 |

| Sales of Merchant Wholesalers | Jan-Dec 2011/2010 ∆%: Total 13.9; Durable Goods: 12.1; Nondurable |

| Sales and Inventories of Manufacturers, Retailers and Merchant Wholesalers | Dec 11/Dec 10 NSA ∆%: Sales Total Business 7.2; Manufacturers 7.0 |

| Sales for Retail and Food Services | Jan 2012/Jan 2011 ∆%: Retail and Food Services: 5.6; Retail ∆% 5/4 |

| Value of Construction Put in Place | Dec SAAR month SA ∆%: 1.5 Dec 12 months NSA: 3.7 |

| Case-Shiller Home Prices | Nov 2011/Nov 2010 ∆% NSA: 10 Cities minus 1.3; 20 Cities: minus 1.3 |

| FHFA House Price Index Purchases Only | Nov SA ∆% 1.0; |

| New House Sales | Dec month SAAR ∆%: |

| Housing Starts and Permits | Jan Starts month SA ∆%: 1.5; Permits ∆%: 0.7 |

| Trade Balance | Balance Dec SA -$48,800 million versus Nov -$47,058 million |

| Export and Import Prices | Dec 12 months NSA ∆%: Imports 8.5; Exports 3.6 |

| Consumer Credit | Dec ∆% annual rate: 9.3 |

| Net Foreign Purchases of Long-term Treasury Securities | Nov Net Foreign Purchases of Long-term Treasury Securities: $17.9 billion Dec versus Nov $61.3 billion |

| Treasury Budget | Fiscal Year 2012/2011 ∆%: Receipts 4.1; Outlays -3.2; Individual Income Taxes 4.9 Deficit Fiscal Year 2012 Oct-Jan $418,756 million CBO Forecast 2012FY Deficit $1.079 trillion Blog 02/05/2012 |

| Flow of Funds | IIQ2011 ∆ since 2007 Assets -$6311B Real estate -$5111B Financial -$1490 Net Worth -$5802 Blog 09/18/11 |

| Current Account Balance of Payments | IIIQ2011 -131B %GDP 2.9 Blog 12/18/11 |

Links to blog comments in Table USA:

02/12/12 http://cmpassocregulationblog.blogspot.com/2012/02/hiring-collapse-ten-million-fewer-full_12.html

02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or_05.html

01/29/12 http://cmpassocregulationblog.blogspot.com/2012/01/mediocre-economic-growth-financial.html

01/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

1/15/12 http://cmpassocregulationblog.blogspot.com/2012/01/recovery-without-hiring-united-states_15.html

01/08/12 http://cmpassocregulationblog.blogspot.com/2012/01/thirty-million-unemployed-or_08.html

12/18/2011 http://cmpassocregulationblog.blogspot.com/2011/12/recovery-without-hiring-world-inflation_1721.html

12/11/2011 II http://cmpassocregulationblog.blogspot.com/2011/12/euro-zone-survival-risk-world-financial_11.html

09/18/11 http://cmpassocregulationblog.blogspot.com/2011/09/collapse-of-household-income-and-wealth.html

Industrial production was flat in Jan and increased 3.4 percent in the 12 months ending in Jan, as shown in Table VA-1. In the six months ending in Jan, industrial production grew at the annual equivalent rate of 3.4 percent. Business equipment rose 1.8 percent in Jan and grew 10.9 percent in the 12 months ending in Jan and at the annual equivalent rate of 14.9 percent in the six months ending in Jan. Capacity utilization of total industry is analyzed by the Fed in its report (http://www.federalreserve.gov/releases/g17/Current/): “The capacity utilization rate for total industry decreased to 78.5 percent, a rate 1.8 percentage points below its long-run (1972--2010) average..” Manufacturing contributed $1,229 billion to US national income of $12,643 billion without capital consumption adjustment in 2010, or 9 percent of the total, according to data of the Bureau of Economic Analysis (http://www.bea.gov/iTable/index_nipa.cfm). The increase of 0.7 percent of manufacturing in Jan was offset by declines in mining and utilities.

Table VA-1, US, Industrial Production and Capacity Utilization, SA, ∆%, %

| 2011 | Jan | Dec | Nov | Oct | Sep | Aug | Jan 12/ Jan 11 |

| Total | 0.0 | 1.0 | -0.3 | 0.6 | 0.2 | 0.2 | 3.4 |

| Market | |||||||

| Final Products | 0.4 | 0.9 | -0.3 | 0.5 | 0.0 | 0.6 | 3.3 |

| Consumer Goods | -0.1 | 0.8 | -0.6 | 0.2 | -0.2 | 0.4 | 0.6 |

| Business Equipment | 1.8 | 1.4 | 0.6 | 1.4 | 0.7 | 1.1 | 10.9 |

| Non | 0.2 | 1.4 | -0.7 | -0.3 | 0.4 | 0.3 | 3.0 |

| Construction | -0.4 | 3.0 | 0.2 | -0.4 | 0.1 | -0.4 | 5.3 |

| Materials | -0.4 | 1.0 | 0.4 | 0.6 | 0.2 | -0.1 | 3.5 |

| Industry Groups | |||||||

| Manufacturing | 0.7 | 1.5 | -0.2 | 0.5 | 0.4 | 0.3 | 4.5 |

| Mining | -1.8 | 0.9 | 0.7 | 1.5 | 0.0 | 1.1 | 5.8 |

| Utilities | -2.5 | -2.4 | 0.1 | -1.3 | -1.3 | -1.2 | -7.5 |

| Capacity | 78.5 | 78.6 | 77.9 | 78.0 | 77.7 | 77.6 | 1.2 |

Sources: http://www.federalreserve.gov/releases/g17/current/

Manufacturing increased 0.7 percent in Jan and 4.3 percent in 12 months. A longer perspective of manufacturing in the US is provided by Table VA-2. There has been evident deceleration of manufacturing growth in the US from 2010 and the first three months of 2011 as shown by 12 months rates of growth. The rates of decline of manufacturing in 2009 are quite high with a drop of 18.1 percent in the 12 months ending in Apr 2009. Manufacturing recovered from this decline and led the recovery from the recession. Rates of growth appear to be returning to the levels at 3 percent or higher in the annual rates before the recession.

Table VA-2, US, Monthly and 12-Month Rates of Growth of Manufacturing ∆%

| Month SA ∆% | 12 Months NSA ∆% | |

| Jan 2012 | 0.7 | 4.3 |

| Dec 2011 | 1.5 | 4.4 |

| Nov | -0.2 | 4.1 |

| Oct | 0.5 | 4.4 |

| Sep | 0.4 | 4.2 |

| Aug | 0.3 | 3.7 |

| Jul | 0.8 | 3.8 |

| Jun | 0.1 | 3.6 |

| May | 0.2 | 3.6 |

| Apr | -0.6 | 4.5 |

| Mar | 0.7 | 6.0 |

| Feb | 0.1 | 6.2 |

| Jan | 0.7 | 6.2 |

| Dec 2010 | 1.0 | 6.2 |

| Nov | 0.2 | 5.3 |

| Oct | 0.2 | 6.2 |

| Sep | 0.2 | 5.9 |

| Aug | 0.1 | 6.6 |

| Jul | 0.8 | 7.6 |

| Jun | -0.1 | 8.1 |

| May | 1.1 | 7.8 |

| Apr | 0.7 | 6.1 |

| Mar | 0.9 | 5.9 |

| Feb | 0.1 | 0.6 |

| Jan | 1.0 | 6.2 |

| Dec 2009 | 0.2 | -3.2 |

| Nov | 0.8 | -5.9 |

| Oct | -0.04 | -8.9 |

| Sep | 0.8 | -10.3 |

| Aug | 1.0 | -13.3 |

| Jul | 1.3 | -14.9 |

| Jun | -0.3 | -17.4 |

| May | -1.2 | -17.4 |

| Apr | -0.8 | -18.1 |

| Mar | -2.0 | -17.1 |

| Feb | 0.1 | -16.0 |

| Jan | -2.7 | -16.5 |

| Dec 2008 | -3.1 | -14.1 |

| Nov | -2.4 | -11.5 |

| Oct | -0.6 | -9.2 |

| Sep | -3.4 | -9.0 |

| Aug | -1.4 | -5.5 |

| Jul | -1.1 | -4.1 |

| Jun | -0.6 | -3.5 |

| May | -0.6 | -2.8 |

| Apr | -1.2 | -1.5 |

| Mar | -0.4 | -0.9 |

| Feb | -0.5 | 0.6 |

| Jan | -0.3 | 1.9 |

| Dec 2007 | 0.3 | 1.8 |

| Nov | 0.3 | 3.2 |

| Oct | -0.5 | 2.8 |

| Sep | 0.5 | 3.2 |

| Aug | -0.5 | 2.9 |

| Jul | 0.3 | 3.8 |

| Jun | 0.3 | 3.3 |

| May | -0.2 | 3.5 |

| Apr | 0.7 | 4.0 |

| Mar | 0.7 | 2.8 |

| Feb | 0.5 | 2.0 |

| Jan | -0.3 | 1.8 |

| Dec 2006 | 3.2 | |

| Dec 2005 | 1.4 | |

| Dec 2004 | 2.8 | |

| Dec 2003 | 1.7 |

Source: http://www.federalreserve.gov/releases/g17/current/table1.htm

Chart VA-1 of the Board of Governors of the Federal Reserve System provides industrial production, manufacturing and capacity since the 1970s. There was acceleration of growth of industrial production, manufacturing and capacity in the 1990s because of rapid growth of productivity in the US (see Pelaez and Pelaez, The Global Recession Risk (2007), 135-44). The slopes of the curves flatten in the 2000s. Production and capacity have not recovered to the levels before the global recession.

Chart VA-1, US, Industrial Production, Capacity and Utilization

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/current/ipg1.gif

The modern industrial revolution of Jensen (1993) is captured in Chart VA-2 of the Board of Governors of the Federal Reserve System (for the literature on M&A and corporate control see Pelaez and Pelaez, Regulation of Banks and Finance (2009a), 143-56, Globalization and the State, Vol. I (2008a), 49-59, Government Intervention in Globalization (2008c), 46-49). The slope of the curve of total industrial production accelerates in the 1990s to a much higher rate of growth than the curve excluding high-technology industries. Growth rates decelerate into the 2000s and output and capacity utilization have not recovered fully from the strong impact of the global recession. Growth in the current cyclical expansion has been more subdued than in the prior comparably deep contractions in the 1970s and 1980s. Chart VA-2 shows that the past recessions after World War II are the relevant ones for comparison with the recession after 2007 instead of common comparisons with the Great Depression. The bottom left-hand part of Chart VA-2 shows the strong growth of output of communication equipment, computers and semiconductor that continued from the 1990s into the 2000s. Output of computers and semiconductors has already surpassed the level before the global recession.

Chart VA-2, US, Industrial Production, Capacity and Utilization of High Technology Industries

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/current/ipg3.gif

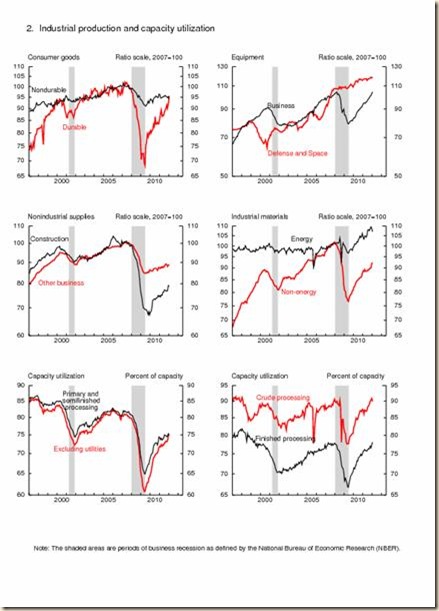

Additional detail on industrial production and capacity utilization is provided in Chart VA-3 of the Board of Governors of the Federal Reserve System. Production of consumer durable goods fell sharply during the global recession by more than 30 percent and is still around 5 percent below the level before the contraction. Output of nondurable consumer goods fell around 10 percent and is some 5 percent below the level before the contraction. Output of business equipment fell sharply during the contraction of 2001 but began rapid growth again after 2004. An important characteristic is rapid growth of output of business equipment in the cyclical expansion after sharp contraction in the global recession. Output of defense and space only suffered reduction in the rate of growth during the global recession and surged ahead of the level before the contraction. Output of construction supplies collapsed during the global recession and is well below the level before the contraction. Output of energy materials was stagnant before the contraction but has recovered sharply above the level before the contraction.

Chart VA-3, US, Industrial Production and Capacity Utilization

Source: Board of Governors of the Federal Reserve System

http://www.federalreserve.gov/releases/g17/current/ipg2.gif

The index of general business conditions of the Federal Reserve Bank of New York Empire State Manufacturing Survey shows significant improvement from minus 8.82 in Sep to 0.61 in Nov and successive jumps to solid positive growth territory of 8.19 in Dec, 13.48 in Jan and 19.53 in Feb, as shown in Table VA-3. The index had been registering negative changes in the five months from Jun to Oct. The new orders segment fell from 0.16 in Oct to minus 2.07 in Nov but rebounded to 5.99 in Dec, 13.70 in Jan and 9.73 in Feb, returning to expansion territory. There is positive reading in shipments from minus 12.88 in Sep to positive 5.33 in Oct and even higher at 9.43 in Nov with a jump to 20.06 in Dec that was consolidated with 21.69 in Jan and 22.79 in Feb. The segment of number of employees fell back into contraction territory from 3.37 in Oct to minus 3.66 in Nov but returned to expansion at 2.33 in Dec, jumping to 12.09 in Jan but falling to 3.26 in Feb. Expectations for the next six months of the general business conditions index fell from 13.04 in Sep to 6.74 in Oct at levels well below the higher expectations of 22.45 in Jun of 22.45 and 32.22 in Jul but surged to 39.02 in Nov and 50.38 in Feb. Expectations of new orders fell from 13.04 in Sep to 12.36 in Oct but jumped to 35.37 in Nov and jumped to 54.65 in Dec, consolidating at 53.85 in Jan but falling to 44.71 in Feb. Expectations of new employees surged from 0.00 in Sep to 6.74 in Oct and jumped to 14.63 in Nov, 24.42 in Dec but fell to 18.82 in Feb. The average employee workweek rose from the contraction zone at minus 2.25 in Oct to the expansion zone at 8.54 in Nov and solid expansion at 22.09 in Dec with minor decline to 17.58 in Jan and 18.82 in Feb.

Table VA-3, US, New York Federal Reserve Bank Empire State Manufacturing Survey Index

| Sep | Oct | Nov | Dec | Jan | Feb | |

| Current Conditions | ||||||

| General Business | -8.82 | -8.48 | 0.61 | 8.19 | 13.48 | 19.53 |

| New Orders | -8.0 | 0.16 | -2.07 | 5.99 | 13.70 | 9.73 |

| Shipments | -12.88 | 5.33 | 9.43 | 20.06 | 21.69 | 22.79 |

| Unfilled Orders | -7.61 | -4.49 | -7.32 | -15.12 | -5.49 | -7.06 |

| Inventories | -11.96 | -8.99 | -12.2 | -3.49 | 6.59 | -7.61 |

| # Employees | -5.43 | 3.37 | -3.66 | 2.33 | 12.09 | 3.26 |

| Average Employee Workweek | -2.17 | -4.49 | 2.44 | -2.33 | 6.59 | -4.71 |

| Expectations Six | ||||||

| General Business Conditions | 13.04 | 6.74 | 39.02 | 45.61 | 54.87 | 50.38 |

| New Orders | 13.04 | 12.36 | 35.37 | 54.65 | 53.85 | 44.71 |

| Shipments | 13.04 | 17.98 | 36.59 | 51.16 | 52.75 | 49.41 |

| Unfilled Orders | -6.52 | 1.12 | 6.10 | 8.14 | 5.49 | 4.71 |

| Inventories | -2.17 | -15.73 | 2.44 | 9.30 | 10.99 | 10.59 |

| # Employees | 0.00 | 6.74 | 14.63 | 24.42 | 28.57 | 29.41 |

| Average Employee Workweek | -6.52 | -2.25 | 8.54 | 22.09 | 17.58 | 18.82 |

Source: http://www.newyorkfed.org/survey/empire/empiresurvey_overview.html

The Philadelphia Business Outlook Survey in Table VA-4 provides an optimistic reading in Oct with the movement to 10.8 away from the contraction zone of minus 22.7 in Sep but fell to 3.1 in Nov and then rose to 6.8 in Dec followed by 7.3 in Jan and 10.2 in Feb. New orders were signaling increasing future activity, rising from minus 5.5 in Sep to 8.5 in Oct but declined to 3.5 in Nov to rise to 10.7 in Dec and then fall to 6.9 in Jan but recovering to 11.7 in Feb. Employment or number of workers is stronger with number of employees increasing from 5.0 in Oct to 10.6 in Nov and 11.5 in Dec, remaining at 11.6 in Jan but falling to 1.1 in Feb. The average employee workweek increased from minus 11.2 in Aug to 7.1 in Nov but fell to 2.8 in Dec and increased to 5.0 in Jan and 10.1 in Feb. Most indexes of expectations for the next six months are showing sharp increases but interruptions in Feb. The general index of expectations for the next six months rose from 28.8 in Oct to 37.7 in Nov, remaining at 40.0 in Dec but increasing to 49.0 in Jan but declining to 33.3 in Feb. Expectations of new orders rose from 28.1 in Oct to 36.9 in Nov, 44.1 in Dec and 49.7 in Jan but declined to 32.5 in Feb.

Table VA-4, FRB of Philadelphia Business Outlook Survey Diffusion Index SA

| General | New Orders | Ship-ments | # Workers | Average Work-week | |

| Current | |||||

| Feb 12 | 10.2 | 11.7 | 15.0 | 1.1 | 10.1 |

| Jan | 7.3 | 6.9 | 5.7 | 11.6 | 5.0 |

| Dec 11 | 6.8 | 10.7 | 9.1 | 11.5 | 2.8 |

| Nov | 3.1 | 3.5 | 6.0 | 10.6 | 7.1 |

| Oct | 10.8 | 8.5 | 13.6 | 5.0 | 4.2 |

| Sep | -12.7 | -5.5 | -16.6 | 7.3 | -6.2 |

| Aug | -22.7 | -22.2 | -8.9 | -0.9 | -11.2 |

| Jul | 6.2 | 0.5 | 8.2 | 9.5 | -3.9 |

| Future | |||||

| Feb 12 | 33.3 | 32.5 | 29.0 | 22.5 | 10.8 |

| Jan | 49.0 | 49.7 | 48.2 | 19.1 | 9.2 |

| Dec 11 | 40.0 | 44.1 | 36.4 | 10.8 | 4.5 |

| Nov | 37.7 | 36.9 | 35.5 | 25.2 | 4.0 |

| Oct | 28.8 | 28.1 | 29.0 | 15.5 | 8.4 |

| Sep | 25.2 | 24.6 | 27.1 | 14.0 | 6.8 |

| Aug | 6.3 | 20.6 | 18.4 | 11.2 | -0.7 |

| Jul | 25.8 | 31.2 | 26.1 | 12.9 | 6.6 |

Source: http://www.philadelphiafed.org/index.cfm

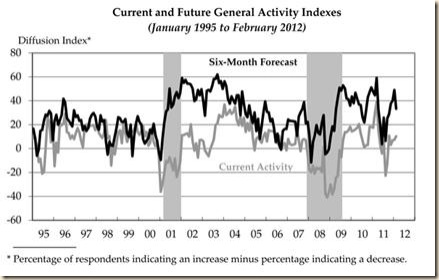

Chart VA-1 of the Federal Reserve Bank of Philadelphia is very useful, providing current and future general activity indexes from Jan 1995 to Jan 2012. The shaded areas are the recession cycle dates of the National Bureau of Economic Research (NBER) (http://www.nber.org/cycles.html). The Philadelphia Fed index dropped during the initial period of recession and then led the recovery, as industry overall. There was a second decline of the index into 2011 followed now what hopefully could be renewed strength from late 2011 into Jan 2012 but marginal weakness in Feb.

Federal Reserve Bank of Philadelphia

Chart VA-1, Federal Reserve Bank of Philadelphia Business Outlook Survey, Current and Future Activity Indexes

Source: Federal Reserve Bank of Philadelphia

http://www.philadelphiafed.org/index.cfm

Chart VA-2 of the Federal Reserve Bank of Philadelphia provides the index of new orders of the Business Outlook Survey. Strong growth in the beginning of 2011 was followed by a bump after Mar that lasted until Oct. The strength of the first quarter of 2011 has not been recovered

Chart VA-2, Federal Reserve Bank of Philadelphia Business Outlook Survey, Current New Orders Diffusion Index

Source: Federal Reserve Bank of Philadelphia

Growth rates and levels of sales in billions of dollars of manufacturers, retailers and merchant wholesalers are provided in Table VA-5. Total business sales rose 0.7 percent in Dec after 0.4 percent in Nov and were up by 7.2 percent in Dec 2011 relative to Dec 2010. Sales of manufacturers increased 0.7 percent in Dec after increasing 0.2 percent in Nov and rose 7.0 percent in the 12 months to Dec. Retailers’ sales were flat in Dec after increasing 0.3 percent in Nov and 5.6 percent in 12 months ending in Dec. Sales of merchant wholesalers rose 1.3 percent in Dec after 0.5 percent in Nov and grew 9.0 percent in 12 months. These data are not adjusted for price changes such that they reflect increases in both quantities and prices.

Table VA-5, US, Percentage Changes for Sales of Manufacturers, Retailers and Merchant Wholesalers

| Dec 2011 | Dec 11/ Nov 11 | Nov 11/ Oct 11 | Dec 11/ Dec 10 | |

| Total Business | 1,269.3 | 0.7 | 0.4 | 7.2 |

| Manufacturers | 445.5 | 0.7 | 0.2 | 7.0 |

| Retailers | 416.8 | 0.0 | 0.3 | 5.6 |

| Merchant Wholesalers | 407.0 | 1.3 | 0.5 | 9.0 |

Source: http://www.census.gov/mtis/www/data/pdf/mtis_current.pdf

Businesses added to inventories to replenish stocks in an environment of strong sales. Retailers added 0.2 percent in Dec to inventories and 0.4 percent in Nov with growth of 3.4 percent in 12 months, as shown in Table VA-6. Total business increased inventories by 0.4 percent in Dec, 0.4 percent in Nov and 7.6 percent in 12 months. Inventories sales/ratios of total business continued at a level close to 1.26 under judicious management to avoid costs and risks. Inventory/sales ratios of manufacturers and retailers are higher than for merchant wholesalers. There is stability in inventory/sales ratios in individual months and relative to a year earlier

Table VA-6, US, Percentage Changes for Inventories of Manufacturers, Retailers and Merchant Wholesalers and Inventory/Sales Ratios

| Inventory Change | Dec 11 | Dec 11/ Nov 11 ∆% SA | Nov 11/ Oct 11 ∆% SA | Dec 11/ Dec 10 ∆% NSA |

| Total Business | 1,584.2 | 0.4 | 0.3 | 7.6 |

| Manufacturers | 609.2 | 0.1 | 0.4 | 9.2 |

| Retailers | 503.3 | 0.2 | 0.4 | 3.4 |

| Merchant | 471.6 | 1.0 | 0.0 | 9.8 |

| Inventory/ | Dec 11 | Dec 2011 SA | Nov 2011 SA | Dec 2010 SA |

| Total Business | 1,584.2 | 1.26 | 1.27 | 1.28 |

| Manufacturers | 609.2 | 1.33 | 1.34 | 1.32 |

| Retailers | 503.3 | 1.32 | 1.32 | 1.35 |

| Merchant Wholesalers | 471.6 | 1.15 | 1.15 | 1.16 |

Source: http://www.census.gov/mtis/www/data/pdf/mtis_current.pdf

Inventories follow business cycles. When recession hits sales inventories pile up, declining with expansion of the economy. In a fascinating classic opus, Lloyd Meltzer (1941, 129) concludes:

“The dynamic sequences (I) through (6) were intended to show what types of behavior are possible for a system containing a sales output lag. The following conclusions seem to be the most important:

(i) An economy in which business men attempt to recoup inventory losses will always undergo cyclical fluctuations when equilibrium is disturbed, provided the economy is stable.

This is the pure inventory cycle.

(2) The assumption of stability imposes severe limitations upon the possible size of the marginal propensity to consume, particularly if the coefficient of expectation is positive.

(3) The inventory accelerator is a more powerful de-stabilizer than the ordinary acceleration principle. The difference' in stability conditions is due to the fact that the former allows for replacement demand whereas the usual analytical formulation of the latter does not. Thus, for inventories, replacement demand acts as a de-stabilizer. Whether it does so for all types of capital goods is a moot question, but I believe cases may occur in which it does not.

(4) Investment for inventory purposes cannot alter the equilibrium of income, which depends only upon the propensity to consume and the amount of non-induced investment.

(5) The apparent instability of a system containing both an accelerator and a coefficient of expectation makes further investigation of possible stabilizers highly desirable.”

Chart VA-1 shows the increase in the inventory/sales ratios during the recessions of 2001 and 2007-2009. The inventory/sales ratio fell during the expansions. The inventory/sales ratio declined to a trough in 2011, climbed and then stabilized at current levels.

Chart VA-3, Total Business Inventories/Sales Ratios 2002 to 2011

Source: US Census Bureau

http://www2.census.gov/retail/releases/historical/mtis/img/mtisbrf.gif

Retail sales increased 0.4 percent in Jan after no growth in Dec and increased 5.6 percent in the 12 months ending in Jan, as shown in Table VA-7. Excluding motor vehicles and parts, retail sales increased 0.7 percent in Jan after falling 0.5 percent in Dec and growing 5.2 percent in the 12 months ending in Jan. Sales of motor vehicles and parts fell 1.1 percent in Jan after strong growth of 2.5 percent in Dec and growth of 8.0 percent in the 12 months ending in Jan. Gasoline station sales rose 1.4 percent in fluctuating prices of gasoline, declining 2.6 percent in Dec but increasing 7.3 percent in the 12 months ending in Jan.

Table VA-7, US, Percentage Change in Monthly Sales for Retail and Food Services, ∆%

| Jan/Dec ∆% SA | Dec/Nov ∆% SA | Jan 2012 Billion Dollars NSA | 12 Months Jan 2012 from Jan 2010 ∆% NSA | |

| Retail and Food Services | 0.4 | 0.0 | 361.4 | 5.6 |

| Excluding Motor Vehicles and Parts | 0.7 | -0.5 | 298.5 | 5.2 |

| Motor Vehicles & Parts | -1.1 | 2.5 | 62.9 | 8.0 |

| Retail | 0.4 | 0.0 | 321.9 | 5.4 |

| Building Materials | 0.2 | 2.0 | 19.5 | 10.5 |

| Food and Beverage | 1.3 | -0.6 | 50.3 | 3.0 |

| Grocery | 1.3 | -0.6 | 45.8 | 2.9 |

| Health & Personal Care Stores | -0.3 | 0.3 | 22.7 | 1.0 |

| Clothing & Clothing Accessories Stores | 0.0 | 0.5 | 14.1 | 3.4 |

| Gasoline Stations | 1.4 | -2.6 | 40.9 | 7.3 |

| General Merchandise Stores | 2.0 | -0.7 | 46.9 | 4.7 |

| Food Services & Drinking Places | 0.6 | 0.4 | 39.5 | 7.2 |

Source: http://www.census.gov/retail/marts/www/marts_current.pdf

Chart VA-4 of the US Bureau of the Census shows percentage change of retails and food services sales. Sep was strong in multiple categories but the strength did not continue in Oct, Nov and Dec. Jan was stronger even with weakness in auto sales.

Chart VA-4, US, Percentage Change of Retail and Food Services Sales

Source: US Census Bureau

http://www2.census.gov/retail/releases/historical/marts/img/martsbrf.gif

Twelve-month rates of growth of US sales of retail and food services in Dec from 2000 to 2011 are shown in Table VA-8. Nominal sales have been dynamic in 2011 and 2010 after decline of 9.6 percent in 2008 and increase of only 1.9 percent in 2007. It is difficult to separate price and quantity effects in these nominal data.

Table VA-8, US, Percentage Change in 12-Month Sales for Retail and Food Services, ∆% NSA

| Dec | 12 Months ∆% |

| 2011 | 5.9 |

| 2010 | 7.5 |

| 2009 | 4.5 |

| 2008 | -9.6 |

| 2007 | 1.9 |

| 2006 | 3.1 |

| 2005 | 4.8 |

| 2004 | 8.3 |

| 2003 | 6.2 |

| 2002 | 3.2 |

| 2001 | 2.0 |

| 2000 | 0.7 |

Source: http://www.census.gov/retail/

Seasonally-adjusted annual rates (SAAR) of housing starts and permits are shown in Table VA-9. Housing starts increased 1.5 percent in Jan after declining 1.9 percent in Dec and jumping 11.8 percent in Nov. The increase of 15 percent in Sep was revised to 10.4 percent. Housing permits, indicating future activity, increased 0.7 percent in Jan after falling 1.3 percent in Dec Monthly rates in starts and permits fluctuate significantly as shown in Table VA-9.

Table VA-9, US, Housing Starts and Permits SSAR Month ∆%

| Housing | Month ∆% | Housing | Month ∆% | |

| Jan 2012 | 699 | 1.5 | 676 | 0.7 |

| Dec 2011 | 689 | -1.9 | 671 | -1.3 |

| Nov | 702 | 11.8 | 680 | 5.6 |

| Oct | 628 | -2.8 | 644 | 9.3 |

| Sep | 646 | 10.4 | 589 | -5.8 |

| Aug | 585 | -4.9 | 625 | 4.0 |

| Jul | 615 | 0.0 | 601 | -2.6 |

| Jun | 615 | 11.2 | 617 | 1.3 |

| May | 553 | 0.7 | 609 | 8.2 |

| Apr | 549 | -7.4 | 563 | -1.9 |

| Mar | 593 | 14.5 | 574 | 7.5 |

| Feb | 518 | -18.6 | 534 | -6.0 |

| Jan | 636 | 20.9 | 568 | -9.8 |

| Dec 2010 | 526 | -4.5 | 630 | -9.8 |

| Nov | 551 | 2.3 | 564 | 1.6 |

| Oct | 539 | -9.7 | 555 | -1.2 |

| Sep | 597 | -1.5 | 562 | -2.3 |

SAAR: Seasonally Adjusted Annual Rate

Source: US Census Bureau

http://www.census.gov/construction/nrc/pdf/newresconst.pdf

Housing starts and permits in Jan not-seasonally adjusted are provided in Table VA-10. Housing starts increased 14.2 percent in Jan 2011 relative to Jan 2010 and in the same period new permits fell 3.5 percent. Construction of new houses in the US remains at very depressed levels. Housing starts fell 70.0 percent in Jan 2011 relative to Jan 2006 and fell 67.8 percent relative to Jan 2005. Housing permits fell 48.6 in Jan 2006 to Jan 2011 and fell 44.6 percent from Jan 2005.

Table VA-10, US, Housing Starts and New Permits, Thousands of Units, NSA, and %

| Housing Starts | New Permits | |

| Jan 2012 | 45.9 | 76.6 |

| Jan 2011 | 40.2 | 79.4 |

| ∆% Jan 2012/Jan 2011 | 14.2 | -3.5 |

| Jan 2006 | 153.0 | 149.1 |

| ∆%/Jan 2011 | -70.0 | -48.6 |

| Jan 2005 | 142.9 | 138.2 |

| ∆%/ Jan 2012 | -67.8 | -44.6 |

Source: http://www.census.gov/construction/nrc/pdf/newresconst.pdf

http://www.census.gov/construction/nrc/pdf/newresconst_200701.pdf

http://www.census.gov/construction/nrc/pdf/newresconst_200601.pdf

Chart VA-5 of the US Census Bureau shows the sharp increase in construction of new houses from 2000 to 2006. Housing construction fell sharply through the recession, recovering from the trough around IIQ2009. The right-hand side of Chart VA-5 shows a mild downward trend or stagnation from mid 2010 to the present.

Chart VA-5, US, New Housing Units Started in the US, SAAR (Seasonally Adjusted Annual Rate)

Source: US Census Bureau

http://www.census.gov/briefrm/esbr/www/esbr020.html

A longer perspective on residential construction in the US is provided by Table VA-11 with annual data from 1960 to 2011. Housing starts fell 70.5 percent from 2005 to 2011, 61.2 percent from 2000 to 2011 and 51.3 percent relative to 1960. Housing permits fell 71.7 percent from 2005 to 2011, 61.6 percent from 2000 to 2011 and 38.8 percent from 1960 to 2011. Housing starts rose 31.8 from 2000 to 2005 while housing permits grew 35.4 percent. From 1990 to 2000 housing starts increased 31.5 percent while permits increased 43.3 percent.

Table VA-11, US, Annual New Privately Owned Housing Units Authorized by Building Permits in Permit-Issuing Places and New Privately Owned Housing Units Started, Thousands

| Starts | Permits | |

| 2011 | 609.2 | 610.7 |

| ∆% 2011/2010 | 3.8 | 1.0 |

| ∆% 2011/2005 | -70.5 | -71.7 |

| ∆% 2011/2000 | -61.2 | -61.6 |

| ∆% 2011/1960 | -51.3 | -38.8 |

| 2010 | 586.9 | 604.6 |

| ∆% 2010/2005 | -71.6 | -71.9 |

| ∆% 2010/2000 | -62.6 | -62.0 |

| ∆% 2010/1960 | -53.1 | -39.4 |

| 2009 | 554,0 | 583.0 |

| 2008 | 905.5 | 905.4 |

| 2007 | 1,355,0 | 1,398.4 |

| 2006 | 1,800.9 | 1,838.9 |

| 2005 | 2,068.3 | 2,155.3 |

| ∆% 2005/2000 | 31.8 | 35.4 |

| 2004 | 1,955.8 | 2,070.1 |

| 2003 | 1,847.7 | 1,889,2 |

| 2002 | 1,704.9 | 1,747.2 |

| 2001 | 1,602.7 | 1,1637.7 |

| 2000 | 1,568.7 | 1,592.3 |

| ∆% 2000/1990 | 31.5 | 43.3 |

| 1990 | 1,192,7 | 1,110.8 |

| 1980 | 1,292.7 | 1,190.6 |

| 1970 | 1,433.6 | 1,351.5 |

| 1960 | 1,252.2 | 997.6 |

Source: http://www.census.gov/construction/nrc/

Weakness in the housing sector is being considered as an important factor of the financial crisis, global recession and slow growth recession. Chairman Bernanke (2011Oct4JEC, 2-3) states:

“Other sectors of the economy are also contributing to the slower-than-expected rate of expansion. The housing sector has been a significant driver of recovery from most recessions in the United States since World War II. This time, however, a number of factors--including the overhang of distressed and foreclosed properties, tight credit conditions for builders and potential homebuyers, and the large number of “underwater” mortgages (on which homeowners owe more than their homes are worth)--have left the rate of new home construction at only about one-third of its average level in recent decades.”

The answer to these arguments can probably be found in the origins of the financial crisis and global recession. Let V(T) represent the value of the firm’s equity at time T and B stand for the promised debt of the firm to bondholders and assume that corporate management, elected by equity owners, is acting on the interests of equity owners. Robert C. Merton (1974, 453) states:

“On the maturity date T, the firm must either pay the promised payment of B to the debtholders or else the current equity will be valueless. Clearly, if at time T, V(T) > B, the firm should pay the bondholders because the value of equity will be V(T) – B > 0 whereas if they do not, the value of equity would be zero. If V(T) ≤ B, then the firm will not make the payment and default the firm to the bondholders because otherwise the equity holders would have to pay in additional money and the (formal) value of equity prior to such payments would be (V(T)- B) < 0.”

Pelaez and Pelaez (The Global Recession Risk (2007), 208-9) apply this analysis to the US housing market in 2005-2006 concluding:

“The house market [in 2006] is probably operating with low historical levels of individual equity. There is an application of structural models [Duffie and Singleton 2003] to the individual decisions on whether or not to continue paying a mortgage. The costs of sale would include realtor and legal fees. There could be a point where the expected net sale value of the real estate may be just lower than the value of the mortgage. At that point, there would be an incentive to default. The default vulnerability of securitization is unknown.”

There are multiple important determinants of the interest rate: “aggregate wealth, the distribution of wealth among investors, expected rate of return on physical investment, taxes, government policy and inflation” (Ingersoll 1987, 405). Aggregate wealth is a major driver of interest rates (Ibid, 406). Unconventional monetary policy, with zero fed funds rates and flattening of long-term yields by quantitative easing, causes uncontrollable effects on risk taking that can have profound undesirable effects on financial stability. Excessively aggressive and exotic monetary policy is the main culprit and not the inadequacy of financial management and risk controls.

The net worth of the economy depends on interest rates. In theory, “income is generally defined as the amount a consumer unit could consume (or believe that it could) while maintaining its wealth intact” (Friedman 1957, 10). Income, Y, is a flow that is obtained by applying a rate of return, r, to a stock of wealth, W, or Y = rW (Ibid). According to a subsequent restatement: “The basic idea is simply that individuals live for many years and that therefore the appropriate constraint for consumption decisions is the long-run expected yield from wealth r*W. This yield was named permanent income: Y* = r*W” (Darby 1974, 229), where * denotes permanent. The simplified relation of income and wealth can be restated as:

W = Y/r (1)

Equation (1) shows that as r goes to zero, r →0, W grows without bound, W→∞.

Lowering the interest rate near the zero bound in 2003-2004 caused the illusion of permanent increases in wealth or net worth in the balance sheets of borrowers and also of lending institutions, securitized banking and every financial institution and investor in the world. The discipline of calculating risks and returns was seriously impaired. The objective of monetary policy was to encourage borrowing, consumption and investment but the exaggerated stimulus resulted in a financial crisis of major proportions as the securitization that had worked for a long period was shocked with policy-induced excessive risk, imprudent credit, high leverage and low liquidity by the incentive to finance everything overnight at close to zero interest rates, from adjustable rate mortgages (ARMS) to asset-backed commercial paper of structured investment vehicles (SIV).

The consequences of inflating liquidity and net worth of borrowers were a global hunt for yields to protect own investments and money under management from the zero interest rates and unattractive long-term yields of Treasuries and other securities. Monetary policy distorted the calculations of risks and returns by households, business and government by providing central bank cheap money. Short-term zero interest rates encourage financing of everything with short-dated funds, explaining the SIVs created off-balance sheet to issue short-term commercial paper to purchase default-prone mortgages that were financed in overnight or short-dated sale and repurchase agreements (Pelaez and Pelaez, Financial Regulation after the Global Recession, 50-1, Regulation of Banks and Finance, 59-60, Globalization and the State Vol. I, 89-92, Globalization and the State Vol. II, 198-9, Government Intervention in Globalization, 62-3, International Financial Architecture, 144-9). ARMS were created to lower monthly mortgage payments by benefitting from lower short-dated reference rates. Financial institutions economized in liquidity that was penalized with near zero interest rates. There was no perception of risk because the monetary authority guaranteed a minimum or floor price of all assets by maintaining low interest rates forever or equivalent to writing an illusory put option on wealth. Subprime mortgages were part of the put on wealth by an illusory put on house prices. The housing subsidy of $221 billion per year created the impression of ever increasing house prices. The suspension of auctions of 30-year Treasuries was designed to increase demand for mortgage-backed securities, lowering their yield, which was equivalent to lowering the costs of housing finance and refinancing. Fannie and Freddie purchased or guaranteed $1.6 trillion of nonprime mortgages and worked with leverage of 75:1 under Congress-provided charters and lax oversight. The combination of these policies resulted in high risks because of the put option on wealth by near zero interest rates, excessive leverage because of cheap rates, low liquidity because of the penalty in the form of low interest rates and unsound credit decisions because the put option on wealth by monetary policy created the illusion that nothing could ever go wrong, causing the credit/dollar crisis and global recession (Pelaez and Pelaez, Financial Regulation after the Global Recession, 157-66, Regulation of Banks, and Finance, 217-27, International Financial Architecture, 15-18, The Global Recession Risk, 221-5, Globalization and the State Vol. II, 197-213, Government Intervention in Globalization, 182-4).

Risk aversion channeled funds toward US long-term and short-term securities as shown in Table VA-12. Net foreign purchases of US long-term securities (row C in Table VA-12) in Nov were quite high at $61.3 billion, much higher than $8.2 billion in Oct but fell to 17.9 billion in Dec. Foreign (residents) purchases less sales of US long-term securities (row A in Table VA-12) in Dec declined $21.0 billion after strong increase of $58.0 billion in Nov. Net US (residents) purchases of long-term foreign securities (row B in Table VA-12) in Dec were $38.9 billion, much higher than $3.3 billion in Nov. In Dec,

C = A + B = -$21.0 billion + $38.9 billion = $17.9 billion

There is weakening demand in Table VA-12 in Dec in A1 private purchases by residents overseas of US long-term securities of -$11.5 billion of which increases in A11 Treasury securities $3.7 billion and A12 $16.4 billion agency securities and decrease of corporate bonds by $19.3 billion and reduction of $12.3 billion in equities. Row D shows sharp decrease in Dec in purchases of short-term dollar denominated obligations. Foreign private holdings of US Treasury bills fell $1.6 billion (row D11) with foreign official holdings decreasing $21.4 billion and the category other decreasing $16.6 billion. Risk aversion of losses in foreign securities dominates decisions to accept zero interest rates in Treasury securities with no perception of principal losses. In the case of long-term securities, investors prefer to sacrifice inflation and possible duration risk to avoid principal losses.

Table VA-12, Net Cross-Borders Flows of US Long-Term Securities, Billion Dollars, NSA

| Dec 2010 12 Months | Dec 2011 12 Months | Nov 2011 | Dec 2011 | |

| A Foreign Purchases less Sales of | 908.3 | 439.2 | 58.0 | -21.0 |

| A1 Private | 776.1 | 268.4 | 40.3 | -11.5 |

| A11 Treasury | 531.6 | 234.1 | 30.3 | 3.7 |

| A12 Agency | 146.2 | 57.6 | 11.5 | 16.4 |

| A13 Corporate Bonds | -14.0 | -44.0 | 3.5 | -19.3 |

| A14 Equities | 112.3 | 20.7 | -5.1 | -12.3 |

| A2 Official | 132.2 | 170.7 | 17.7 | -9.5 |

| A21 Treasury | 172.1 | 144.2 | 23.7 | -20.3 |

| A22 Agency | -38.2 | 23.3 | -5.3 | 10.8 |

| A23 Corporate Bonds | 0.8 | -1.2 | 1.3 | -1.4 |

| A24 Equities | -2.5 | 4.5 | -2.0 | 1.3 |

| B Net US Purchases of LT Foreign Securities | -115.3 | -123.9 | 3.3 | 38.9 |

| B1 Foreign Bonds | -54.6 | -52.7 | 2.0 | 28.1 |

| B2 Foreign Equities | -60.6 | -71.2 | 1.4 | 10.8 |

| C Net Foreign Purchases of US LT Securities | 793.0 | 315.3 | 61.3 | 17.9 |

| D Increase in Foreign Holdings of Dollar Denominated Short-term | -55.3 | -114.1 | 38.0 | -18.3 |

| D1 US Treasury Bills | -20.4 | -81.8 | 26.1 | -1.6 |

| D11 Private | 45.3 | 22.9 | 21.8 | 19.7 |

| D12 Official | -65.8 | -104.7 | 4.3 | -21.4 |

| D2 Other | -34.9 | -32.3 | 11.9 | -16.6 |

C = A + B;

A = A1 + A2

A1 = A11 + A12 + A13 + A14

A2 = A21 + A22 + A23 + A24

B = B1 + B2

D = D1 + D2

D1 = D11 + D12

Sources: http://www.treasury.gov/press-center/press-releases/Pages/tg1420.aspx

Table VA-13 provides major foreign holders of US Treasury securities. China is the largest holder with $1100.7 billion in Dec 2011, decreasing 5.1 percent from $1160.1 billion in Dec 2010. Japan increased its holdings from $882.3 billion in Dec 2010 to $1042.4 billion in Dec. The United Kingdom increased its holdings to $414.8 billion in Dec 2011 relative to $270.4 billion in Dec 2010. Caribbean banking centers increased their holdings from $168.4 billion in Dec 2010 to $174.8 billion in Dec 2011. Total foreign holdings of Treasury securities rose from $4435.6 billion in Dec 2010 to $4732.1 billion in Dec 2011, or 6.7 percent. The US continues to finance its fiscal and balance of payments deficits with foreign savings.

Table VA-13, US, Major Foreign Holders of Treasury Securities $ Billions at End of Period

| Dec 2011 | Nov 2011 | Dec 2010 | |

| Total | 4732.1 | 4750.3 | 4435.6 |

| China | 1100.7 | 1132.6 | 1160.1 |

| Japan | 1042.4 | 1038.9 | 882.3 |

| United Kingdom | 414.8 | 425.9 | 270.4 |

| Oil Exporters | 233.5 | 232.0 | 211.9 |

| Brazil | 206.9 | 206.4 | 186.1 |

| Caribbean Banking Centers | 174.8 | 185.3 | 168.4 |

| Taiwan | 149.2 | 149.6 | 155.1 |

| Switzerland | 116.2 | 113.9 | 106.8 |

| Hong Kong | 112.0 | 105.3 | 134.2 |

| Canada | 96.6 | 94.8 | 75.3 |

| Russia | 88.4 | 89.7 | 151.0 |

Source:http://www.treasury.gov/resource-center/data-chart-center/tic/Pages/ticsec2.aspx#ussecs

http://www.treasury.gov/resource-center/data-chart-center/tic/Documents/mfh.txt

VB. Japan. The Markit/JMMA Purchasing Managers’ Index™ (PMI™) improved for a second consecutive movement from 50.2 in Dec to 50.7 in Jan but still suggesting only marginal growth (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9077). New export business grew for the first time in eleven months with improvement in demand both internal and from abroad. Alex Hamilton, economist at Markit and author of the report finds a firmer beginning of the new quarter but with weak growth of new orders resulting from limited demand from China and Europe and valuation of the yen (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9077). Table JPY provides the country table for Japan.

Table JPY, Japan, Economic Indicators

| Historical GDP and CPI | 1981-2010 Real GDP Growth and CPI Inflation 1981-2010 |

| Corporate Goods Prices | Jan ∆% -0.1 |

| Consumer Price Index | Dec NSA ∆% minus 0.0 |

| Real GDP Growth | IVQ2011 ∆%: -0.6 on IIIQ2011; IVQ2011 SAAR minus 2.3% |

| Employment Report | Dec Unemployed 2.75 million Change in unemployed since last year: minus 240 thousand |

| All Industry Indices | Nov month SA ∆% -1.1 Blog 01/22/12 |

| Industrial Production | Dec SA month ∆%: 4.0 |

| Machine Orders | Total Dec ∆% minus 7.2 Private ∆%: minus 22.2 |

| Tertiary Index | Dec month SA ∆% 0.6 |

| Wholesale and Retail Sales | Dec 12 months: |

| Family Income and Expenditure Survey | Dec 12 months ∆% total nominal consumption 0.3, real 0.5 Blog 02/05/12 |

| Trade Balance | Exports Dec 12 months ∆%: minus 8.0 Imports Dec 12 months ∆% +8.1 Blog 1/29/12 |

Links to blog comments in Table JPY:

02/12/12 http://cmpassocregulationblog.blogspot.com/2012/02/hiring-collapse-ten-million-fewer-full_12.html

02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or_05.html

01/29/12 http://cmpassocregulationblog.blogspot.com/2012/01/mediocre-economic-growth-financial.html

1/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

12/11/2011 http://cmpassocregulationblog.blogspot.com/2011/12/euro-zone-survival-risk-world-financial.html

07/31/11: http://cmpassocregulationblog.blogspot.com/2011/07/growth-recession-debt-financial-risk.html

Japan’s GDP fell 0.6 percent in IVQ2011 relative to IIIQ2011, seasonally adjusted, as shown in Table VB-1 that incorporates the latest revisions. IIIQ2011 GDP growth was revised upward to 1.7 percent and IQ2011 was revised downward to minus 1.8 percent. The economy of Japan had already weakened in IVQ2010 when GDP fell revised minus 0.1 percent. As in other advanced economies, Japan’s recovery from the global recession has not been robust. GDP fell in IQ2011 by 1.8 percent and fell again 0.4 percent in IIQ2011 as a result of the disruption of the tragic Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011. Recovery was robust in the first two quarters of 2010. The deepest quarterly contractions in the recession were 3.2 percent in IVQ2008 and 3.9 percent in IQ2009.

Table VB-1, Japan, Real GDP ∆% Changes from the Previous Quarter Seasonally Adjusted ∆%

| IQ | IIQ | IIIQ | IVQ | |

| 2011 | -1.8 | -0.4 | 1.7 | -0.6 |

| 2010 | 1.5 | 1.3 | 0.6 | -0.1 |

| 2009 | -3.9 | 1.8 | -0.2 | 1.8 |

| 2008 | 0.7 | -1.1 | -1.2 | -3.2 |

| 2007 | 1.0 | 0.2 | -0.4 | 0.9 |

| 2006 | 0.4 | 0.4 | -0.1 | 1.3 |

| 2005 | 0.2 | 1.3 | 0.4 | 0.2 |

| 2004 | 1.1 | -0.1 | 0.2 | -0.3 |

| 2003 | -0.5 | 1.2 | 0.4 | 1.1 |

| 2002 | -0.2 | 1.0 | 0.7 | 0.4 |

| 2001 | 0.7 | -0.2 | -1.1 | -0.1 |

| 2000 | 1.7 | 0.2 | -0.3 | 0.7 |

| 1999 | -0.8 | 0.4 | -0.1 | 0.5 |

Source: http://www.cao.go.jp/index-e.html

Table VB-2 provides contributions to real GDP at seasonally-adjusted annual rates (SAAR). The SAAR of GDP in IVQ2011 was minus 0.6 percent: 0.9 percentage points from growth of personal consumption expenditures (PC) plus 0.4 percentage points from gross fixed capital formation (GFCF) plus 0.3 percentage points from government consumption (GOVC) less net trade (exports less imports) deduction of 2.6 percentage points less 1.1 deduction of private inventory change. The SAAR of GDP in IIIQ2011 was revised to a high 7.0 percent. Net trade deducted from GDP growth in three quarters of 2011. Growth in 2011 has been driven by personal consumption expenditures.

Table VB-2, Japan, Contributions to Changes in Real GDP, Seasonally Adjusted Annual Rates (SAAR), %

| GDP | PC | GFCF | Trade | PINV | GOVC | |

| 2011 | ||||||

| I | -6.8 | -2.6 | -0.5 | -0.8 | -3.4 | 0.4 |

| II | -1.5 | 0.8 | 0.8 | -4.1 | 0.4 | 0.6 |

| III | 7.0 | 2.5 | 0.2 | 3.1 | 0.9 | 0.2 |

| IV | -2.3 | 0.7 | 0.4 | -2.6 | -1.1 | 0.3 |

| 2010 | ||||||

| I | 6.1 | 1.9 | 0.3 | 2.3 | 1.8 | -0.3 |

| II | 5.2 | 0.6 | 1.2 | 0.4 | 1.9 | 1.2 |

| III | 2.3 | 0.8 | 0.4 | -0.1 | 1.1 | 0.2 |

| IV | -0.6 | 0.3 | -1.0 | -0.4 | 0.2 | 0.3 |

| 2009 | ||||||

| I | -14.8 | -1.9 | -2.0 | -4.3 | -7.5 | 0.9 |

| II | 7.3 | 4.0 | -2.9 | 7.5 | -1.8 | 0.5 |

| III | -0.7 | 0.0 | -1.6 | 1.7 | -1.8 | 0.9 |

| IV | 7.4 | 3.3 | 0.2 | 2.8 | 0.6 | 0.4 |

| 2008 | ||||||

| I | 2.7 | 1.4 | 0.4 | 1.2 | -0.4 | 0.0 |

| II | -4.4 | -3.3 | -2.2 | 0.7 | 1.3 | -0.9 |

| III | -4.6 | -0.3 | -1.0 | -0.4 | -2.9 | -0.1 |

| IV | -12.3 | -2.9 | -4.5 | -11.3 | 5.8 | 0.4 |

| 2007 | ||||||

| I | 4.0 | 0.9 | 0.5 | 1.1 | 1.2 | 0.4 |

| II | 0.7 | 0.5 | -1.5 | 0.8 | 0.2 | 0.5 |

| III | -1.7 | -0.8 | -1.7 | 1.8 | -0.8 | -0.2 |

| IV | 3.6 | 0.2 | 0.2 | 1.5 | 1.0 | 0.6 |

Note: PC: Private Consumption; GFCF: Gross Fixed Capital Formation; PINV: Private Inventory; Trade: Net Exports; GOVC: Government Consumption

Source: http://www.cao.go.jp/index-e.html

Japan’s quarterly growth of GDP not seasonally-adjusted relative to the same quarter a year earlier is shown in Table VB-3. Contraction of GDP extended over seven quarters from IIQ2008 through IVQ2009. It was strongest in IQ2009 with output declining 9.3 percent relative to a year earlier. Yearly quarterly rates of growth of Japan were relatively high for a mature economy through the decade with the exception of the contractions in 2001 and after 2007. The Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011 caused decline of GDP in IQ2011 of 0.3 percent relative to the same quarter a year earlier and decline of 1.7 percent in IIQ2011. GDP fell 0.5 percent in IIIQ2011 relative to a year earlier and fell 1.0 percent in IVQ2011 relative to a year earlier. Japan faces the challenge of recovery from the devastation of the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011 in an environment of declining world trade and bouts of risk aversion that cause appreciation of the Japanese yen that erode the country’s competitiveness in world markets.

Table VB-3, Japan, Real GDP ∆% Changes from Same Quarter Year Earlier, NSA ∆%

| IQ | IIQ | IIIQ | IVQ | |

| 2011 | -0.3 | -1.7 | -0.5 | -1.0 |

| 2010 | 4.8 | 4.4 | 5.4 | 3.1 |

| 2009 | -9.3 | -6.6 | -5.6 | -0.5 |

| 2008 | 1.4 | -0.1 | -0.6 | -4.7 |

| 2007 | 2.8 | 2.3 | 2.0 | 1.6 |

| 2006 | 2.6 | 1.3 | 0.9 | 2.0 |

| 2005 | 0.4 | 1.4 | 1.5 | 1.9 |

| 2004 | 4.0 | 2.6 | 2.2 | 0.7 |

| 2003 | 1.7 | 1.8 | 1.5 | 1.8 |

| 2002 | -1.6 | -0.2 | 1.4 | 1.6 |

| 2001 | 1.6 | 0.9 | 0.0 | -1.0 |

| 2000 | 2.7 | 2.4 | 2.2 | 1.8 |

| 1999 | -0.3 | 0.1 | -0.1 | -0.5 |

Source: http://www.cao.go.jp/index-e.html

The tertiary activity index of Japan increased 1.4 percent in Dec and also 0.6 percent in the 12 months ending in Dec, as shown in Table VB-4. There was strong impact from the Tōhoku or Great East Earthquake and Tsunami of Mar 11, 2011 in the decline of the tertiary activity index by 5.9 percent in Mar and 3.1 percent in 12 months. The performance of the tertiary sector in the quarter Jul-Sep was weak: decline of 0.2 percent in Jul, increase of 0.1 percent in Aug and decline of 0.4 percent in Sep, after increasing 1.9 percent in Jun. The index has gained 6.7 percent in the seven nine months from Apr to Dec, erasing the loss in Mar of 5.9 percent or at the annual equivalent rate of 9.1 percent. Most of the growth occurred in the quarter from Apr to Jun with gain of 5.6 percent or at annual equivalent rate of 24.3 percent.

Table VB-4, Japan, Tertiary Activity Index, ∆%

| Month ∆% SA | 12 Months ∆% NSA | |

| Dec 2011 | 1.4 | 0.6 |

| Nov | -0.6 | -0.5 |

| Oct | 0.8 | 0.7 |

| Sep | -0.4 | 0.0 |

| Aug | 0.1 | 0.6 |

| Jul | -0.2 | -0.2 |

| Jun | 1.9 | 0.9 |

| May | 0.9 | -0.2 |

| Apr | 2.7 | -2.3 |

| Mar | -5.9 | -3.1 |

| Feb | 0.8 | 2.0 |

| Jan | -0.1 | 1.1 |

| Dec 2010 | -0.2 | 1.8 |

| Nov | 0.6 | 2.5 |

| Oct | 0.2 | 0.5 |

| Sep | -0.4 | 1.3 |

| Aug | 0.1 | 2.3 |

| Jul | 0.7 | 1.6 |

| Jun | 0.1 | 1.0 |

| May | -0.3 | 1.2 |

| Dec 2009 | -2.7 | |

| Dec 2008 | -3.3 | |

| Dec 2007 | -0.3 | |

| Dec 2006 | 0.6 | |

| Dec 2005 | 2.6 | |

| Dec 2004 | 1.6 |

Source: http://www.esri.cao.go.jp/en/sna/sokuhou/qe/main_1e.pdf

http://www.meti.go.jp/english/statistics/tyo/sanzi/index.html

Month and 12-month rates of growth of the tertiary activity index of Japan and components in Dec are provided in Table VB-5. Electricity, gas, heat supply and water increased 4.1 percent in Dec but fell 0.6 percent in the 12 months ending in Dec. Wholesale and retail trade increased 4.3 percent in the month of Dec and fell 0.2 percent in 12 months. Information and communications fell 0.5 percent in Dec and was flat in 12 months.

Table VB-5, Japan, Tertiary Index and Components, Month and 12-Month Percentage Changes ∆%

| Dec 2011 | Weight | 12 Months ∆% NSA | Month ∆% SA |

| Tertiary Index | 10,000.0 | 0.6 | 1.4 |

| Electricity, Gas, Heat Supply & Water | 372.9 | -0.6 | 4.1 |

| Information & Communications | 951.2 | 0.0 | -0.5 |

| Wholesale & Retail Trade | 2,641.2 | -0.2 | 4.3 |

| Finance & Insurance | 971.1 | -0.3 | 0.0 |

| Real Estate & Goods Rental & Leasing | 903.4 | -0.5 | 0.6 |

| Scientific Research, Professional & Technical Services | 551.3 | 2.3 | 3.5 |

| Accommodations, Eating, Drinking | 496.0 | 3.2 | 1.2 |

| Living-Related, Personal, Amusement Services | 552.7 | 2.4 | 1.4 |

| Learning Support | 116.9 | 0.0 | -0.1 |

| Medical, Health Care, Welfare | 921,1 | 2.3 | 1.6 |

| Miscellaneous ex Government | 626.7 | 3.1 | -0.1 |

Source:

http://www.esri.cao.go.jp/en/sna/sokuhou/qe/main_1e.pdf

http://www.meti.go.jp/english/statistics/tyo/sanzi/index.html

VC. China. The HSBC Purchasing Managers’ Index™ (PMI™), compiled by Markit, summarizing conditions in China’s manufacturing nearly remained flat from 48.7 in Dec to 48.8 in Jan, suggesting marginal deterioration, which now extends over three consecutive months (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9105). New orders fell marginally for a third consecutive month with moderate growth of new export business. Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC, find need of policy stimulus to ensure soft landing that could occur in the form of growth at the rate of 8 percent in IQ2012 relative to IQ2011 (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9105). The HSBC Composite Output Index for China, compiled by Markit, registered a decline from 50.8 in Dec to 49.7 in Jan, suggesting stagnation of private-sector business activity (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9153). Growth of services compensated weakness of manufacturing. Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC, finds that policy measures are required to steer the economy toward higher growth (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9153).Table CNY provides the country table for China.

Table CNY, China, Economic Indicators

| Price Indexes for Industry | Jan 12 months ∆%: 0.7 Jan month ∆%: -0.1 |

| Consumer Price Index | Jan month ∆%: 1.5 Jan 12 month ∆%: 4.5 |

| Value Added of Industry | Dec 12 month ∆%: 12.8 Jan-Dec 2011/Jan-Dec 2010 ∆%: 13.9 |

| GDP Growth Rate | Year IVQ2011 ∆%: 8.9 |

| Investment in Fixed Assets | Total Jan-Dec ∆%: 23.8 Jan-Dec ∆% real estate development: 27.9 |

| Retail Sales | Dec month ∆%: 1.41 Jan-Nov ∆%: 17.1 |

| Trade Balance | Jan balance $27.28 billion Cumulative Jan: $27.28 billion |

Links to blog comments in Table CNY:

02/12/11 http://cmpassocregulationblog.blogspot.com/2012/02/hiring-collapse-ten-million-fewer-full_12.html

01/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

01/15/12 http://cmpassocregulationblog.blogspot.com/2012/01/recovery-without-hiring-united-states_15.html

Table EUR, Euro Area Economic Indicators

| GDP | IVQ2011 ∆% minus 0.3; IVQ2011/IVQ2010 ∆% 0.7 Blog 02/019/12 |

| Unemployment | Dec 2011: 10.4% unemployment rate Dec 2011: 16.469 million unemployed Blog 02/05/12 |

| HICP | Dec month ∆%: 0.3 12 months Dec ∆%: 2.7 |

| Producer Prices | Euro Zone industrial producer prices Dec ∆%: -0.2 |

| Industrial Production | Dec month ∆%: -1.1 |

| Industrial New Orders | Oct month ∆%: minus 1.8 Oct 12 months ∆%: 1.6 |

| Construction Output | Dec month ∆%: 0.3 |

| Retail Sales | Dec month ∆%: minus 0.4 |

| Confidence and Economic Sentiment Indicator | Sentiment 93.4 Jan 2012 down from 107 in Dec 2010 Confidence minus 20.7 Jan 2012 down from minus 11 in Dec 2010 Blog 02/05/12 |

| Trade | Jan-Dec 2011/2010 Exports ∆%: 12.7 |

| HICP, Rate of Unemployment and GDP | Historical from 1999 to 2011 Blog 1/22/12 |

Links to blog comments in Table EUR:

02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or.html

01/22/12 http://cmpassocregulationblog.blogspot.com/2012/01/world-inflation-waves-united-states.html

01/15/12 http://cmpassocregulationblog.blogspot.com/2012/01/recovery-without-hiring-united-states_15.html

01/08/12 http://cmpassocregulationblog.blogspot.com/2012/01/thirty-million-unemployed-or.html

Table VD-1 provides the yearly growth rates of the combined GDP of the members of the European Monetary Union (EMU) or euro area since 1996. Growth was very strong at 3.3 percent in 2006 and 3.0 percent in 2007. The global recession has strong impact with growth of only 0.4 percent in 2008 and decline of 4.3 percent in 2009. Recovery was at lower growth rates of 1.9 percent in 2010 and 1.5 percent in 2011. EUROSTAT forecasts growth of GDP of the euro area of 0.5 percent in 2012.

Table VD-1, Euro Area, Real GDP Growth Rate

| Year | ∆% |

| 2013 EUROSTAT Forecast | 1.3 |

| 2012 EUROSTAT Forecast | 0.5 |

| 2011 | 1.5 |

| 2010 | 1.9 |

| 2009 | -4.3 |

| 2008 | 0.4 |

| 2007 | 3.0 |

| 2006 | 3.3 |

| 2005 | 1.7 |

| 2004 | 2.2 |

| 2003 | 0.7 |

| 2002 | 0.9 |

| 2001 | 2.0 |

| 2000 | 3.8 |

| 1999 | 2.9 |

| 1998 | 2.8 |

| 1997 | 2.6 |

| 1996 | 1.5 |

Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/tgm/table.do?tab=table&init=1&plugin=1&language=en&pcode=tsieb020

Table VD-2 provides GDP growth in IVQ2011 and relative to the same quarter a year earlier for the euro zone, European Union, Japan and the US. Both the euro zone and the European Union experienced decline of GDP of 0.3 percent in IVQ2011 and meager growth of 0.7 percent and 0.9 percent, respectively, relative to IVQ2010. Growth in IVQ2011 was weak worldwide with somewhat stronger performance by the US but still insufficient to reduce unemployment and underemployment (http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or.html).

Table VD-2, Euro Zone, European Union, Japan and USA, Real GDP Growth

| ∆% IVQ2011/ IIIQ2011 | ∆% IVQ2011/ IVQ2010 | |

| Euro Zone | -0.3 | 0.7 |

| European Union | -0.3 | 0.9 |

| Germany | -0.2 | 2.0 |

| France | 0.2 | 1.4 |

| Netherlands | -0.7 | 0.7 |

| Finland | 0.0 | 1.2 |

| Belgium | -0.2 | 0.9 |

| Portugal | -1.3 | -2.7 |

| Ireland | NA | NA |

| Italy | -0.7 | -0.5 |

| Greece | -7.0 | |

| Spain | -0.3 | 0.3 |

| United Kingdom | -0.2 | 0.8 |

| Japan | -0.6 | -1.0 |

| USA | 0.7 | 1.6 |

Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/2-15022012-AP/EN/2-15022012-AP-EN.PDF

Chart VD-3 of EUROSTAT provides growth rates for the euro zone and European Union. There are significant differences in growth experience. Countries in need of fiscal adjustment are growing slowly or contracting.

Chart VD-3, Euro Zone, European Union, Real GDP Growth ∆% on Previous Year

Source: EUROSTAT

Table VD-3 provides quarterly growth of real GDP in the euro area and European Union. The upper panel provides growth in the quarter relative to the prior quarter. Growth started strong in IQ2011 with 0.8 percent for the euro area and 0.7 percent for the European Union. Performance deteriorated during the year with decline of 0.3 percent in IVQ2011 for both the euro area and the European Union. The lower panel provides growth in a quarter relative to the same quarter a year earlier. Growth was quite strong in IQ2011 with 2.4 percent for both the euro area and European Union. Growth in IVQ2011 relative to IVQ2011 was meager with 0.7 percent for the euro area and 0.9 percent for the European Union with marginal decline of 0.3 percent in the quarter.

Table VD-3, Euro Area and European Union, Growth of Real GDP

| IQ2011 | IIQ2011 | IIIQ2011 | IVQ2011 | |

| ∆% from Prior Quarter | ||||

| EA 17 | 0.8 | 0.2 | 0.1 | -0.3 |

| EU 27 | 0.7 | 0.2 | 0.3 | -0.3 |

| ∆% from Same Quarter Year Earlier | ||||

| EA 17 | 2.4 | 1.6 | 1.3 | 0.7 |

| EA 27 | 2.4 | 1.7 | 1.4 | 0.9 |

Notes: EA: Euro Area; EU: European Union

Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/2-15022012-AP/EN/2-15022012-AP-EN.PDF

The decline of industrial production by 2.0 percent in Sep interrupted growth of industrial production in the euro zone of 0.8 percent in Jul and 1.1 percent in Aug, as shown in Table VD-4. Production fell cumulatively 3.5 percent in Sep-Dec or at the annual equivalent rate of decline of 10.0 percent. All segments of industrial production fell in Oct with exception of rebound of durable goods by 0.2 percent after four consecutive months of decline and flat growth of nondurable goods also after multiple months of decline. Industrial production is highly volatile in larger economies in the euro zone.

Table VD-4, Euro Zone, Industrial Production Month ∆%

| 2011 | Total | INT | ENE | CG | DUR | NDUR |

| Dec | -1.1 | -0.7 | -2.0 | -0.8 | 0.2 | 0.0 |

| Nov | 0.0 | 0.5 | -0.2 | 0.2 | -0.5 | -0.8 |

| Oct | -0.3 | -0.9 | -0.6 | 0.8 | -1.1 | 0.4 |

| Sep | -2.1 | -2.2 | -1.8 | -4.0 | -3.5 | -1.3 |

| Aug | 1.1 | 1.4 | 1.0 | 2.2 | -0.2 | 1.5 |

| Jul | 0.8 | 0.5 | 0.2 | 2.9 | 3.4 | -0.7 |

| Jun | -0.7 | -0.8 | 1.1 | -1.5 | -2.6 | -0.7 |

| May | 0.1 | -0.2 | 0.2 | 1.1 | -0.6 | -0.1 |

| Apr | 0.3 | 0.0 | -3.7 | 0.7 | 1.0 | 0.4 |

| Mar | 0.0 | 0.0 | -0.3 | -0.6 | 0.0 | 0.4 |

| Feb | 0.5 | 0.5 | -1.3 | 2.2 | 0.9 | 0.9 |

| Jan | 0.1 | 2.3 | -4.7 | -1.8 | 1.1 | -0.1 |

Notes: INT: Intermediate; ENE: Energy; CG: Capital Goods; DUR: Durable Consumer Goods; NDUR: Nondurable Consumer Goods

Source: Eurostat

http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/4-14022012-AP/EN/4-14022012-AP-EN.PDF

Table VD-5 provides 12-month percentage changes of industrial production and major industrial categories in the euro zone. Industrial production decreased 2.2 percent in the 12 months ending in Dec. There is only positive 12-month growth of 0.8 percent for capital goods.

Table VD-5, Euro Zone, Industrial Production 12-Month ∆%

| 2011 | Dec Month ∆% | Dec 12-Month ∆% |

| Total | -1.1 | -2.0 |

| Intermediate Goods | -0.7 | -0.5 |

| Energy | -2.0 | -11.9 |

| Capital Goods | -0.8 | 0.8 |

| Durable Consumer Goods | 0.2 | -3.9 |

| Nondurable Consumer Goods | 0.0 | -0.8 |

Source: Eurostat

http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/4-14022012-AP/EN/4-14022012-AP-EN.PDF

There has been significant decline in percentage changes of industrial production and major categories in 12-month rates throughout 2011 as shown in Table VD-6. The 12-month rate of growth in Feb of 7.8 percent has fallen to minus 2.0 percent in Dec. Trend is difficult to identify because of significant volatility. Capital goods were growing at 15.1 percent in the 12 months ending in Feb and only at 0.8 percent in the 12 months ending in Dec.

Table VD-6, Euro Zone, Industrial Production 12-Month ∆%

| 2011 | Total | INT | ENE | CG | DUR | NDUR |

| Dec | -2.0 | -0.5 | -11.9 | 0.8 | -3.9 | -0.8 |

| Nov | 0.1 | -0.2 | -6.4 | 4.8 | -3.1 | -1.3 |

| Oct | 1.0 | 0.4 | -5.0 | 4.9 | -3.1 | 0.8 |

| Sep | 2.2 | 2.2 | -3.4 | 6.0 | -1.0 | 0.4 |

| Aug | 6.0 | 5.4 | -2.1 | 13.1 | 3.0 | 2.8 |

| Jul | 4.3 | 4.2 | -4.1 | 11.8 | 4.2 | -0.7 |

| Jun | 2.8 | 3.1 | -3.7 | 7.0 | -2.7 | 0.9 |

| May | 4.3 | 4.5 | -7.2 | 10.7 | 1.2 | 2.7 |

| Apr | 5.4 | 5.5 | -5.3 | 10.5 | 4.8 | 3.7 |

| Mar | 5.7 | 7.5 | -2.1 | 11.5 | 2.5 | 0.7 |

| Feb | 7.8 | 10.0 | -2.8 | 15.1 | 3.5 | 2.6 |

| Jan | 6.2 | 9.5 | -1.9 | 13.0 | 2.0 | 0.5 |

Notes: INT: Intermediate; ENE: Energy; CG: Capital Goods; DUR: Durable Consumer Goods; NDUR: Nondurable Consumer Goods

Source: Eurostat

http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/4-14022012-AP/EN/4-14022012-AP-EN.PDF

Blanchard (2011WEOSep) analyzes the difficulty of fiscal consolidation efforts during periods of weak economic growth. Table VD-7 provides percentage changes of euro zone industrial production in the months of Dec and Nov and in the 12 months ending in Dec and Nov for members of the euro zone and the UK that is a member of the European Union but not of the common currency and central bank under the European Monetary Union (EMU). Industrial production in the 12 months ending in Dec grew in a few economies: 0.9 percent in Germany, 1.1 percent in France and 3.8 percent in Belgium. Industrial production is contracting in 12 months in Dec in the GIIPS (Greece, Ireland, Italy, Portugal and Spain) countries that are attempting to improve expectations in their fiscal affairs—Greece -8.3 percent, Italy -4.1 percent, Portugal -3.2 percent, Spain -7.0 percent and Ireland -7.3 percent.

Table VD-7, Euro Zone, Industrial Production, Month and 12-Month ∆%

| 2011 | Month ∆% Dec | Month ∆% Nov | 12 Months ∆% Dec | 12 Months ∆% Nov |

| Euro Zone | -1.1 | 0.0 | -2.0 | 0.1 |

| Germany | -2.7 | -0.3 | -2.6 | 0.9 |

| France | -1.3 | 1.1 | -2.2 | 1.1 |

| Netherlands | -1.3 | -1.5 | -6.6 | -5.3 |

| Finland | 2.6 | 1.0 | 1.5 | -2.3 |

| Belgium | NA | 1.9 | NA | 3.8 |

| Portugal | -1.6 | -2.3 | -8.9 | -3.2 |

| Ireland | 2.5 | -12.7 | -5.2 | -7.3 |

| Italy | 1.4 | 0.3 | -1.7 | -4.1 |

| Greece | -2.4 | 1.0 | -12.4 | -8.3 |

| Spain | 0.9 | -1.0 | -3.7 | -7.0 |

| UK | 0.5 | -0.5 | -2.7 | -3.7 |

Source: Eurostat

http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/4-14022012-AP/EN/4-14022012-AP-EN.PDF

Euro zone trade growth continues to be strong as shown in Table VD-8. Exports grew at 12.7 percent and imports at 12.2 percent in Jan-Dec 2011 relative to Jan-Dec 2010. The 12-month rates of growth of exports were 9.3 percent in Dec and 10.1 percent in Nov, which are higher than 0.8 percent for imports in Dec and 3.9 percent in Nov. At the margin, rates of growth of trade are declining in part because of moderation of commodity prices.

Table VD-8, Euro Zone, Exports, Imports and Trade Balance, Billions of Euros and Percent, NSA

| Exports | Imports | |

| Jan-Dec 2011 | 1733.1 | 1740.8 |

| Jan-Dec 2010 | 1537.3 | 1552.0 |

| ∆% | 12.7 | 12.2 |

| Dec 2011 | 147.4 | 137.7 |

| Dec 2010 | 134.9 | 136.6 |

| ∆% | 9.3 | 0.8 |

| Nov 2011 | 155.4 | 149.1 |

| Nov 2010 | 141.2 | 143.5 |

| ∆% | 10.1 | 3.9 |

| Trade Balance | Jan-Dec 2011 | Jan-Dec 2010 |

| € Billions | -7.7 | -14.7 |

Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/6-15022012-BP/EN/6-15022012-BP-EN.PDF

The structure of trade of the euro zone in Jan-Nov 2011 is provided in Table VD-9. Data are still not available for trade structure for Dec. Manufactured exports grew 11.6 percent in Jan-Nov 2011 relative to Jan-Nov 2010 while imports grew 8.1 percent. The trade surplus in manufactured products was lower than the trade deficit in primary products in both Jan-Nov 2011 and Jan-Nov 2010.

Table VD-9, Euro Zone, Structure of Exports, Imports and Trade Balance, € Billions, ∆%

| Primary | Manufactured | Other | Total | |

| Exports | ||||

| Jan-Nov 2011 € B | 239.0 | 1302.0 | 44.6 | 1585.7 |

| Jan-Nov 2010 € B | 195.3 | 1166.3 | 40.8 | 1402.4 |

| ∆% | 22.4 | 11.6 | 9.3 | 13.1 |

| Imports | ||||

| Jan-Nov 2011 € B | 564.2 | 1011.9 | 27.1 | 1603.1 |

| Jan-Nov 2010 € B | 453.1 | 935.8 | 26.5 | 1415.4 |

| ∆% | 24.5 | 8.1 | 2.3 | 13.3 |

| Trade Balance € B | ||||

| Jan-Nov 2011 | -325.1 | 290.2 | 17.5 | -17.4 |

| Jan-Nov 2010 | -257.7 | 230.4 | 14.3 | -13.0 |

Source: EUROSTAT

http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/6-15022012-BP/EN/6-15022012-BP-EN.PDF

Construction is weak throughout most advanced economies. Growth of euro zone construction output in Table VD-10 has fluctuated with alternation of negative change. Jul is the only strong month with monthly percentage increase of 1.2 percent and 2.5 percent in 12 months. Percentage changes were negative from Jul to Oct. In Oct, construction output fell 1.4 percent and fell 2.5 percent in 12 months. Construction rebounded in Nov with increase of 0.2 percent in the month and 0.4 percent in 12 months. In Dec, construction output increased again by 0.3 percent and was higher by 7.8 percent relative to a year earlier

Table VD-10, Euro Zone, Construction Output ∆%

| Month ∆% | 12-Month ∆% | |

| Dec 2011 | 0.3 | 7.8 |

| Nov | 0.2 | 0.4 |

| Oct | -1.1 | -2.5 |

| Sep | -1.4 | 0.5 |

| Aug | -0.1 | 2.2 |

| Jul | 1.2 | 2.5 |

Source: http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/4-17022012-AP/EN/4-17022012-AP-EN.PDF

VE Germany. The Markit Germany Services Business Activity Index of the Markit Germany Services PMI® rose from 52.4 in Dec to 53.7 in Jan, for a fourth consecutive month of expansion above 50, such that the Markit Germany Composite Output Index rose from 51.3 in Dec to 53.9 in Dec (http://www.markiteconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9128), indicating expansion at a faster rate in Germany’s private-sector activity. The Markit/BME Germany Purchasing Managers’ Index® (PMI®)) improved significantly from 48.4 in Dec to the expansion territory at 51.0 in Jan, which is the first reading above 50 since Sep 2011 (The Markit/BME Germany Purchasing Managers’ Index® (PMI®)) improved). While the index is at the highest level in six month, improvement in manufacturing business is still moderate. The rate of contraction of new orders moderated in Jan but export business contracted sharply for a seventh consecutive month. Tim Moore, Senior Economist at Markit and author of the report finds improvement in manufacturing but that the decline in foreign orders influenced general decline in new orders (The Markit/BME Germany Purchasing Managers’ Index® (PMI®)) improved). Table DE provides the country data table for Germany.

Table DE, Germany, Economic Indicators

| GDP | IVQ2011 -0.2 ∆%; IV/Q2011/IVQ2010 ∆% 1.5 2011/2010: 3.0% Blog 02/19/12 GDP ∆% 1992-2011 Blog 02/19/12 |

| Consumer Price Index | Jan month SA ∆%: -0.4 |

| Producer Price Index | Jan month ∆%: 0.6 |

| Industrial Production | Mfg Dec month SA ∆%: minus 2.7 |

| Machine Orders | Dec month ∆%: 1.7 |

| Retail Sales | Dec Month ∆% minus 0.9 12 Months ∆% minus 1.4 Blog 02/05/12 |

| Employment Report | Unemployment Rate 7.3% of Labor Force |

| Trade Balance | Exports Dec 12 months NSA ∆%: 5.0 Blog 02/12/12 |

Links to blog comments in Table DE:

02/12/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or_05.html

02/05/12 http://cmpassocregulationblog.blogspot.com/2012/02/thirty-one-million-unemployed-or.html